UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x | ||

Filed by a Party other than the Registrant ¨ | ||

| Check the appropriate box: | ||

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

¨ Soliciting Material Pursuant to §240.14a-11 (c) or §240.14a-12 | ||

CENTER TRUST, INC.

(Name of Person(s) Filing Proxy Statement if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notes:

CENTER TRUST, INC.

3500 Sepulveda Boulevard

Manhattan Beach, California 90266

May 21, 2002

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Center Trust, Inc. to be held on June 26, 2002, at 1:00 p.m. local time, at The Marriott Manhattan Beach, Terrace Ballroom B, located at 1400 Parkview Avenue, Manhattan Beach, California, for the following purposes:

(1) to elect two directors to our Board of Directors;

(2) to approve an amendment to our Second Amended and Restated 1993 Stock Option and Incentive Plan (the “Plan”) to (a) increase the number of shares available for grants under the Plan, (b) extend the period of time during which incentive stock options may be granted under the Plan and (c) provide that the per share exercise price of options granted under the Plan will not be less than 85% of the fair market value of our common stock on the date of grant; and

(3) to transact any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof.

I hope that you will be able to attend the meeting in person. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE URGE YOU TO SIGN, DATE, AND RETURN THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE OR VOTE BY TELEPHONE IN ACCORDANCE WITH THE INSTRUCTIONS SET FORTH ON THE ENCLOSED PROXY CARD. This will not prevent you from voting in person but will assure that your vote is counted if you are unable to attend the meeting. Your shares will be voted at the meeting as instructed in your proxy, if given.

I look forward to seeing you at the Annual Meeting.

| Sincerely, | ||

| ||

Edward D. Fox | ||

Chairman of the Board and Chief Executive Officer |

CENTER TRUST, INC.

3500 Sepulveda Boulevard

Manhattan Beach, California 90266

Notice of Annual Meeting of Stockholders

To Be Held on June 26, 2002

Notice is hereby given that the Annual Meeting of Stockholders of Center Trust, Inc. will be held at The Marriott Manhattan Beach, Terrace Ballroom B, located at 1400 Parkview Avenue, Manhattan Beach, California, on Wednesday, June 26, 2002, at 1:00 p.m., for the following purposes:

(1) to elect two directors to serve until the 2005 Annual Meeting of Stockholders and until each of their respective successors is elected and has qualified;

(2) to approve an amendment to our Second Amended and Restated 1993 Stock Option and Incentive Plan (the “Plan”) to (a) increase the number of shares available for grants under the Plan, (b) extend the period of time during which incentive stock options may be granted under the Plan and (c) provide that the per share exercise price of options granted under the Plan will not be less than 85% of the fair market value of our common stock on the date of grant; and

(3) to transact any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof.

Our Board of Directors has fixed the close of business on May 17, 2002 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements thereof.

To ensure that you are represented at the Annual Meeting, the Company requests that you sign and date the enclosed proxy card as promptly as possible and return it in the enclosed envelope. If you attend the Annual Meeting and vote your shares in person or file with the Secretary of the Company an instrument revoking your proxy or a duly executed proxy bearing a later date, your proxy will not be used. If you prefer, you may vote your shares over the telephone (toll-free from the United States or Canada) by following the enclosed telephone voting instructions. The voting procedures are designed to authenticate each stockholder by use of a control number, to allow stockholders to vote their shares, and to confirm that their instructions have been properly recorded. You may still attend the Annual Meeting if you vote by proxy or by telephone.

All stockholders are cordially invited to attend the Annual Meeting.

By Order of the Board of Directors,

Edward A. Stokx

Secretary

Manhattan Beach, California

May 21, 2002

CENTER TRUST, INC.

PROXY STATEMENT

for

ANNUAL MEETING OF STOCKHOLDERS

June 26, 2002

This Proxy Statement is provided to the stockholders of Center Trust, Inc., a Maryland corporation, in connection with the solicitation of proxies to be voted at our Annual Meeting of Stockholders to be held on Wednesday, June 26, 2002 at 1:00 p.m. Proxies will be used for the following purposes: (1) to elect two directors to serve until our 2005 Annual Meeting of Stockholders and until each of their respective successors is elected and has qualified; (2) to approve an amendment to our Second Amended and Restated 1993 Stock Option and Incentive Plan (the “Plan”) to (a) increase the number of shares available for grants under the Plan, (b) extend the period of time during which incentive stock options may be granted under the Plan and (c) provide that the per share exercise price of options granted under the Plan will not be less than 85% of the fair market value of our common stock on the date of grant; and (3) to transact any other business that properly comes before the Annual Meeting. The approximate date on which this Proxy Statement and accompanying form of proxy will first be sent to our stockholders is May 24, 2002.

This solicitation is made on behalf of our Board of Directors. Costs of the solicitation will be paid by the Company. Our directors, officers and employees and those of our affiliates may also solicit proxies by telephone, e-mail, fax or personal interview. We have retained the services of Corporate Investor Communications, Inc., for a fee estimated at $4,500 plus out-of-pocket expenses, to assist in the solicitation of proxies. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material to stockholders.

Holders of record of our common stock, par value $.01 per share, as of the close of business on May 17, 2002 are entitled to receive notice of, and to vote at, the Annual Meeting. The outstanding common stock is the only class of securities of the Company entitled to vote at the Annual Meeting, and each share of common stock entitles its holder to one vote. Stockholders are not permitted to cumulate their shares for the purpose of electing directors or otherwise. At the close of business on May 17, 2002, 27,856,455 shares of our common stock were issued and outstanding.

Unless contrary instructions are indicated on the proxy, all shares represented by valid proxies received in time to be voted at the Annual Meeting (and not revoked before they are voted) will be voted “FOR” the nominees named below for election as directors and the amendment to the Plan. If any other business properly comes before the Annual Meeting and is submitted to a vote of stockholders, then proxies received by the Board of Directors will be voted in accordance with the best judgment of the designated proxy holders. A stockholder may revoke his or her proxy at any time before exercise by delivering to the Secretary of the Company a written notice of such revocation, by filing with the Secretary of the Company a duly executed proxy bearing a later date, or by voting in person at the Annual Meeting.

Shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee which are represented at the Annual Meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum. Directors will be elected and the amendment to the Plan will be approved by a favorable vote of a majority of the votes cast at the Annual Meeting, providing that a quorum is present. Accordingly, abstentions and broker non-votes will have no effect on the result of the election of directors.

Our principal executive offices are located at 3500 Sepulveda Boulevard, Manhattan Beach, California 90266 and our telephone number is (310) 546-4520.

1

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of nine members divided into three classes serving staggered terms of three years each. Although the current terms of three members of the Board expire in 2002, the Board has nominated only two persons for election to the Board at the Annual Meeting, leaving the third position vacant following the Annual Meeting. Since our bylaws provide for the existence of eleven members on the Board, there will be three vacant positions on the Board immediately following the Annual Meeting. Proxies cannot be voted for more than two persons, which is the number of persons nominated for director. Pursuant to our articles of incorporation and our bylaws, the term of office of one class of directors expires each year and at each annual meeting the successors of the class whose term is expiring in that year are elected to hold office for a term of three years and until their successors are elected and have qualified.

The current terms of Christine Garvey, Stuart J.S. Gulland and Douglas N. Wells expire in 2002. The Board has nominated Messrs. Gulland and Wells for re-election to the Board to serve until our 2005 Annual Meeting of Stockholders, and until each of their respective successors is elected and has qualified to serve. Ms. Garvey has elected not to stand for re-election.

In the absence of instructions to the contrary, the persons named as proxy holders in the accompanying proxy intend to vote in favor of the election of the two nominees designated below, each of whom is currently a director of the Company. The Board of Directors expects that each of the nominees will be available to serve as a director, but if any nominee should become unavailable for election, it is intended that the shares represented by the proxy will be voted for a substitute nominee who would be designated by the Board of Directors.

Under our bylaws, someone other than the Board may nominate a person for election as a director at the Annual Meeting only if the person making the nomination has first delivered a timely notice to the Secretary of the Company. To be timely, a stockholder’s notice must be delivered to the Secretary of the Company at our principal executive offices not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from such anniversary date, notice must be delivered not earlier than the 90th day prior to such annual meeting and not later than the later of the 60th day prior to such annual meeting or the tenth day following the day on which public announcement of the annual meeting date was first made. A notice of nomination must set forth certain information required under our bylaws.

Nominees for Election as Director

Name | Age | Present Position With The Company | Director Since | |||

| Stuart J.S. Gulland | 40 | President, Chief Operating Officer and Director | 1998 | |||

| Douglas N. Wells | 37 | Director | 2000 |

Stuart J.S. Gulland has served as a director of the Company since April 1998. Mr. Gulland has served as the Company’s President since May 2002 and its Chief Operating Officer since May 2000, and has entered into an employment agreement with the Company providing for his employment until December 31, 2003. Prior to May 2000 he served as the Company’s Chief Financial Officer. He joined the Company in April 1995. Previously, Mr. Gulland specialized in real estate with Deloitte & Touche, the international accounting and consulting firm. Mr. Gulland is a Certified Public Accountant and a Chartered Accountant. He is also a member of the Urban Land Institute and the International Council of Shopping Centers.

2

Douglas N. Wells has served as a director of the Company since June 2000. Mr. Wells is a Principal of Lazard Frères Real Estate Investors, L.L.C. (“LFREI”). Prior to joining LFREI in 1997, he served as a Vice President of ARES Realty Capital, Inc., a wholly owned subsidiary of The Mutual Life Insurance Company of New York (“MONY”), from 1993 to 1997. At ARES, he was responsible for advising MONY and other institutional clients on real estate investments in the western United States and Canada. Prior to that, Mr. Wells was with Shelter Corporation of Canada, Ltd., a developer, owner and manager of multi-family apartment, office and retail properties in Canada and the United States. Mr. Wells is a member of the Partnership Committees of DP Operating Partnership, L.P. and The Rubenstein Company, L.P.

Directors Continuing in Office

Name | Age | Director Since | Term Expires | |||

| Robert T. Barnum | 56 | 1997 | 2003 | |||

| Fred L. Riedman | 71 | 1994 | 2003 | |||

| Mark S. Ticotin | 53 | 1999 | 2003 | |||

| R. Bruce Andrews | 61 | 1994 | 2004 | |||

| Edward D. Fox | 54 | 1997 | 2004 | |||

| Sandra A. Lamb | 57 | 2000 | 2004 |

Robert T. Barnumhas served as a director of the Company since August 1997. Mr. Barnum is a private investor and an advisor to private equity funds, including Texas Pacific Group. He was the President and Chief Operating Officer of American Savings Bank from 1989 until its sale in 1997. Mr. Barnum served as the Chief Financial Officer of First Nationwide from 1984 to 1988 and the Krupp Companies, a major national real estate and financial services firm, from 1982 to 1984. He was a director of Harborside Healthcare until its sale in 1998 and a director of National Reinsurance until its sale to General Reinsurance in 1996. He is currently a director of Westcorp, a publicly-held thrift holding company and Berkshire Mortgage, a privately-held commercial mortgage banking company.

Fred L. Riedman has served as a director of the Company since February 1994. Mr. Riedman has been a private investor since he retired from his position as a partner with the law firm of Riedman, Dalessi & Dybens in 1998, where he had been a partner since 1965. Mr. Riedman is a trustee of the California Museum Foundation. Mr. Riedman has served on the board of directors of the Aquarium of the Pacific at Long Beach, California since 1995.

Mark S. Ticotinhas served as a director of the Company since October 1999. Mr. Ticotin is a Managing Principal of Lazard Frères Real Estate Investors, L.L.C. (“LFREI”) and is the Chief Executive Officer and a director of Atria, Inc. and Kapson Senior Quarters Corp. Before joining LFREI, he was Senior Executive Vice President of Simon Property Group, Inc. (“SPG”), a publicly traded real estate investment trust after SPG merged with Corporate Property Investors (“CPI”) in September 1998. Mr. Ticotin had been President and Chief Operating Officer of CPI when it merged with SPG. The portfolios of CPI and SPG consisted primarily of regional shopping centers. From 1988 to 1997, Mr. Ticotin was Senior Vice President of CPI and responsible for its leasing, legal and marketing departments. Prior to joining CPI in 1983, he was an attorney with the law firm of Cravath, Swaine & Moore. Mr. Ticotin also serves as a director of Konover Property Trust, Inc. and is a member of the Membership Committee of In Town Holding Company, L.L.C.

R. Bruce Andrews has served as a director of the Company since February 1994. Mr. Andrews has been the President and Chief Executive Officer of Nationwide Health Properties, a REIT specializing in health care properties, since September 1989. He served as Chief Financial Officer, Chief Operating Officer and a director of American Medical International, Inc., an operator of health care facilities, from 1970 to 1986.

Edward D. Foxhas served as a director of the Company since August 1997 and also serves as the Company’s Chief Executive Officer. Until May 2002, Mr. Fox also served as President of the Company. Mr. Fox

3

has entered into an employment agreement with the Company providing for his employment until December 31, 2004. Prior to joining the Company, Mr. Fox was founding and managing Partner of CommonWealth Pacific, LLC, a major developer, owner and strategic advisor for office and mixed use properties in the western United States. He was a Senior Partner and the President of Maguire Thomas Partners from 1981 to 1995. Prior to that, Mr. Fox was with Arthur Andersen, the international accounting and consulting firm, where he specialized in real estate.

Sandra A. Lambhas served as a director of the Company since June 2000. Ms. Lamb is a Director of Lazard Frères & Co., LLC, a private investment bank and global financial services firm. Ms. Lamb joined Lazard in 1983 and is a member of its Banking Department in New York City. She advises clients on mergers and acquisitions, corporate financial matters and complex financial restructurings. Prior to joining Lazard, Ms. Lamb was an officer at an institutional investor specializing in private placement investments. Ms. Lamb also serves on the board of directors of the Fortress Group, Inc.

Directors Barnum, Fox, Lamb, Ticotin and Wells were each originally designated for nomination to the Board by Prometheus Western Retail, LLC (“Prometheus”) pursuant to a stockholders agreement between Prometheus, certain of its affiliates and the Company whereby the Company agreed to support the nomination and election of such nominees. Although Messrs. Barnum and Fox were previously designated for nomination by Prometheus, they no longer serve as designees of Prometheus.

Board Meetings; Committees and Compensation

Certain significant actions of the Company, including transactions involving a change of control of the Company, amendments to the Company’s articles of incorporation or bylaws or the issuance of securities or rights with certain special voting or other rights, require the approval of a minimum of one more than a majority of all directors.

The Board of Directors met six times during the year ended December 31, 2001. The Board of Directors has an Audit Committee, an Executive Committee, a Compensation Committee, a Nominating Committee and an Acquisition/Disposition Committee.

Audit Committee. Messrs. Barnum (Chairman) and Andrews and Ms. Garvey currently serve on the Audit Committee. Since Ms. Garvey is not standing for re-election to the Board at this Annual Meeting, she is expected to be replaced on the audit committee by Ms. Lamb. The Audit Committee was established to make recommendations concerning the engagement of independent auditors, review with the independent auditors the plans and results of the audit engagement, approve professional services provided by the independent auditors, review the independence of the independent auditors, consider the range of audit and non-audit fees and review the adequacy of the Company’s internal accounting controls. No member of the Audit Committee is an employee of the Company. The Audit Committee operates pursuant to a written charter adopted by the Board of Directors. During 2001 the Audit Committee held a total of four meetings.

Executive Committee. Messrs. Fox, Gulland, Riedman and Ticotin currently serve on the Executive Committee. Subject to the Company’s conflict of interest policies and certain other limitations, the Executive Committee has been granted the authority to acquire and dispose of real property and the power to authorize, on behalf of the full Board of Directors, the execution of certain contracts and agreements. The Executive Committee held no meetings in 2001.

Compensation Committee. Messrs. Andrews (Chairman), Barnum and Riedman currently serve on the Compensation Committee. The Compensation Committee determines compensation for the Company’s executive officers and administers grants of stock options and restricted stock pursuant to our Second Amended and Restated 1993 Stock Option and Incentive Plan. The Compensation Committee held three meetings in 2001.

4

Nominating Committee. Messrs. Fox, Riedman and Ticotin currently serve on the Nominating Committee. The Nominating Committee was established to review the qualifications of candidates for Board membership, to review the status of a director when his or her principal position and/or primary affiliation changes, to recommend to the Board of Directors candidates for election by stockholders at annual meetings, to recommend candidates to fill vacancies in directorships, to recommend to the Board of Directors the removal of a director, if in the Company’s best interests, and to make recommendations to the Board of Directors concerning selection, tenure, retirement and composition of the Board of Directors. The Nominating Committee considers nominees recommended by stockholders. Detailed resumes of business experience and personal data of potential nominees may be submitted to the Secretary of the Company. The Nominating Committee held no meetings in 2001.

Acquisition/Disposition Committee. Messrs. Fox and Wells currently serve on the Acquisition/Disposition Committee. The Acquisition/Disposition Committee was established to review the Company’s short-term and long-term plans regarding real estate acquisitions and dispositions, to review and approve certain proposed real estate acquisitions and dispositions and to make recommendations to the Board of Directors regarding other proposed real estate transactions. The Acquisition/Disposition Committee held no meetings in 2001.

The Company pays its non-employee directors (the “Independent Directors”) an annual fee of $20,000. In addition, the Company pays the Independent Directors fees of $1,000 for attendance at each meeting of the Board of Directors and $500 for attendance at each committee meeting. For the fiscal year ended December 31, 2001, the Company elected to pay the Independent Directors their director fees in stock in lieu of cash. The number of shares paid to each Independent Director was based on the cash fees that would have been paid to such director for such period with the number of shares payable based on 85% of the average stock price during such period of $4.41 per share. Pursuant to this formula, each of directors Barnum, Riedman, Garvey and Andrews were paid 7,078, 7,345, 5,876 and 7,879 shares of our common stock, respectively, in lieu of cash fees for the 2001 fiscal year. Directors Lamb, Ticotin and Wells have each agreed to waive their rights to receive compensation as a director during this period. Each Independent Director is also reimbursed for expenses incurred in attending meetings (including committee meetings). Directors who also serve as officers of the Company are not paid any director fees. Pursuant to our Second Amended and Restated 1993 Stock Option and Incentive Plan, upon initial election to the Board of Directors, each Independent Director of the Company receives an initial grant of options to purchase 5,000 shares of our common stock having an exercise price equal to the fair market value on the date of grant, and thereafter on each January 1st during the term of the Stock Option and Incentive Plan, each then serving Independent Director automatically receives a grant of options to purchase 2,500 shares of our common stock at an exercise price equal to the fair market value on the date of grant.

Required Vote for Approval and Recommendation of the Board of Directors

Assuming a quorum is present, the affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve the election of directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR APPROVAL OF THE ELECTION OF DIRECTORS. PROPERLY EXECUTED PROXIES WILL BE VOTED FOR THE ELECTION OF DIRECTORS UNLESS STOCKHOLDERS DESIGNATE OTHERWISE.

5

PROPOSAL NO. 2

APPROVAL OF AN AMENDMENT TO THE SECOND AMENDED AND RESTATED 1993

STOCK OPTION AND INCENTIVE PLAN

The Board of Directors has, subject to stockholder approval, adopted an amendment (the “Plan Amendment”) to the Company’s Second Amended and Restated 1993 Stock Option and Incentive Plan (the “Plan”) to (i) increase the maximum number of shares available for grants under the Plan by 450,000 shares of the Company’s common stock, par value $.01 per share (“Common Stock”), (ii) provide that incentive stock options may be granted under the Plan until the tenth anniversary of the date on which the Board adopted the Plan Amendment and (iii) provide that the per share exercise price of options granted under the Plan will not be less than 85% of the fair market value of our Common Stock on the date of grant. The Plan Amendment, which is described below and a form of which is attached as an exhibit hereto, is effective as of May 21, 2002, subject to stockholder approval. If the Plan Amendment is not approved by stockholders, the Plan shall continue in effect as it existed immediately prior to the adoption of the Plan Amendment. The Board and the Compensation Committee recommend the approval by the stockholders of the Plan Amendment.

The principal purposes of the Plan are (a) to provide incentives for officers, key employees and directors of the Company and its subsidiaries through granting of options and restricted stock, thereby providing them with incentive to further the Company’s development and financial success, and (b) to enable the Company and its subsidiaries to obtain and retain the services of directors and key employees considered essential to the long range success of the Company. Because Mr. Fox agreed to receive his salary in 2001 and his salary and bonus in 2000, 1999 and 1998 in the form of stock granted under the Plan in lieu of cash compensation, a larger portion of the shares available for grant under the Plan have been used than expected over this period. From 1999 through 2001, the Company issued 388,499 shares of our stock under the Plan to Mr. Fox in lieu of his salary and bonus. The Board and the Compensation Committee believe that the Plan Amendment, which increases the number of shares available for grants under the Plan and provides for the continued granting of incentive stock options under the Plan, will enable the Company to continue to provide performance incentives to eligible participants to the benefit of the Company and its stockholders.

Summary of the Plan and the Plan Amendment

The following summary of the Plan, which incorporates the changes made pursuant to the Plan Amendment, is qualified in its entirety by reference to the Plan itself, which may be obtained by making a written request to the Company’s Secretary, and the Plan Amendment, which appears as an exhibit to this Proxy Statement.

General. The Plan consists of three plans: (i) one for the benefit of the officers and key employees of the Company and its subsidiaries; (ii) one for the benefit of Independent Directors; and (iii) one for the benefit of the officers and key employees of CT Operating Partnership, L.P. (the “Operating Partnership”) and its subsidiaries.

The approximate number of individuals in each class eligible to participate in the Plan is as follows: (a) three officers and other employees of the Company and its subsidiaries (except the Operating Partnership); (b) 67 officers and other employees of the Operating Partnership and its subsidiaries; and (c) six Independent Directors.

The Plan Amendment, if approved by the stockholders, would (i) increase the number of shares authorized upon exercise of options or as restricted stock awards by 450,000 to 3,200,000; (ii) extend the period of time during which incentive stock options may be granted under the Plan to the tenth anniversary of the date on which the Board adopted the Plan Amendment; and (iii) provide that the per share exercise price of options granted under the Plan will not be less than 85% of the fair market value of our Common Stock on the date of grant. If the Plan Amendment is approved by the stockholders, the Plan, as amended, would constitute a new plan for purposes of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), thus permitting the

6

continued granting of incentive stock options under the Plan. The Plan Amendment also contains certain other minor changes to the Plan relating to administrative and accounting matters.

Administration of the Plan. The Plan is administered by the Compensation Committee, or another committee of the Board appointed to administer the Plan (such committee is hereinafter referred to as the “Committee”). The Committee interprets the Plan and the options and restricted stock thereunder, adopts such rules for the administration, interpretation and application of the Plan as are consistent therewith and interprets, amends or revokes any such rules. The Board conducts the general administration of the Plan with respect to awards granted to Independent Directors. In addition, the Board, in its absolute discretion, may at any time exercise any and all rights or duties of the Committee under the Plan except with respect to matters which under Rule 16b-3 or Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), or any regulations or rules issued thereunder, are required to be determined in the sole and absolute discretion of the Committee.

The Committee selects from among the eligible employees the individuals to whom options and restricted stock are to be granted and determines the number, terms and conditions of shares to be subject thereto, consistent with the Plan. The Board selects which Independent Directors will receive restricted stock and determines the number, terms and conditions of shares to be subject thereto, consistent with the Plan.

Awards to Employees. Subject to certain award and ownership limits, officers and other employees of the Company, the Operating Partnership or any of their respective subsidiaries who are determined by the Committee to be key employees are eligible to receive options and restricted stock grants under the Plan. Options granted to employees of the Company or its subsidiaries (other than the Operating Partnership) may be either nonqualified stock options (“NQSOs”) or incentive stock options (“ISOs”). If the Plan Amendment is approved by the stockholders, the Plan, as amended, would constitute a new plan for purposes of Section 422 of the Code, thus permitting the continued granting of ISOs under the Plan.

The maximum number of shares which may be subject to options granted to any individual in any one-year period cannot exceed 500,000.

NQSOs will provide for the right to purchase Common Stock at a specified price which, unless intended to qualify as performance-based compensation for purposes of Section 162(m) of the Code, may be less than fair market value on the date of grant (but not less than 85% of fair market value). NQSOs may be granted for any term specified by the Committee.

ISOs will be designed to comply with the applicable provisions of the Code but may be subsequently modified to disqualify them from treatment as an ISO. The exercise price of an ISO shall equal at least 100% of fair market value of Common Stock on the grant date;provided, however, in the case of an ISO granted to an individual then owning (within the meaning of Section 424(d) of the Code) more than 10% of the total combined voting power of all classes of the Company’s stock (or the stock of any subsidiary or any parent corporation of the Company), the price per share must be at least 110% of the fair market value of such share on the date the option is granted. The term of ISOs shall not be more than ten years from the date granted, or five years from such date if the ISO is granted to an individual then owning more than 10% of the total combined voting power described in the preceding sentence.

Options usually will become exercisable (in the discretion of the Committee) in one or more installments after the grant date. Unless the Committee otherwise provides, no option held by an employee subject to Section 16 of the Securities Exchange Act of 1934, as amended (“Section 16”), may be exercised during the first six months and one day after such option is granted. The Committee may accelerate the time at which options granted to employees become exercisable.

Restricted stock may be sold to eligible employees at various prices (but not below par value unless otherwise permitted by applicable state law) and may be made subject to such restrictions as may be determined

7

by the Committee. Unless the Committee otherwise provides, no share of restricted stock granted to a person subject to Section 16 shall be sold, assigned or otherwise transferred until at least six months and one day have elapsed from the date on which the restricted stock was issued. Restricted stock, typically, may be repurchased by the Company immediately upon a restricted stockholder’s termination of employment at the original purchase price if the conditions or restrictions are not then met. In addition, unless provided otherwise by the Committee, if no consideration was paid by the restricted stockholder upon issuance, a restricted stockholder’s rights in unvested restricted stock shall lapse upon termination of employment. In general, restricted stock may not be sold, or otherwise transferred or hypothecated, until restrictions are removed or expire. Unless otherwise provided by the Committee, purchasers of restricted stock, unlike recipients of options, will have voting rights and will receive dividends prior to the time when the restrictions lapse, subject to the restrictions in his or her restricted stock agreement, except that in the discretion of the Committee, any extraordinary distributions with respect to the Common Stock shall be subject to the restrictions applicable to the restricted stock.

Awards to Independent Directors. All options granted to Independent Directors are NQSOs. Subject to certain award and ownership limits, each Independent Director of the Company automatically receives an option to purchase 5,000 shares of Common Stock on the date of his or her election to the Board; and on January 1 of each year during the term of the Plan, automatically receives an option to purchase 2,500 shares of Common Stock.

The exercise price of options granted to Independent Directors equals 100% of the fair market value of a share of Common Stock on the date the option is granted, except for options granted shortly after the initial public offering of the Common Stock of the Company.

The term of options granted to Independent Directors is ten years from the date the option is granted, and options granted to Independent Directors become exercisable in cumulative annual installments of 25% on each of the first, second, third and fourth anniversaries of the date of option grant, without variation or acceleration except as described below with respect to certain corporate transactions.

Restricted stock may be sold to Independent Directors at various prices (but not below par value unless otherwise permitted by applicable state law) and may be made subject to such restrictions as may be determined by the Board. Unless the Board otherwise provides, no share of restricted stock granted to an Independent Director shall be sold, assigned or otherwise transferred until at least six months and one day have elapsed from the date on which the restricted stock was issued. Restricted stock, typically, may be repurchased by the Company immediately upon a restricted stockholder’s termination of employment or termination as a director at the original purchase price if the conditions or restrictions are not then met. In addition, unless provided otherwise by the Board, if no consideration were paid by the Independent Director upon issuance, a restricted stockholder’s rights in unvested restricted stock shall lapse upon termination as a director. In general, restricted stock may not be sold, or otherwise transferred or hypothecated, until restrictions are removed or expire. Unless otherwise provided by the Board, purchasers of restricted stock, unlike recipients of options, will have voting rights and will receive dividends prior to the time when the restrictions lapse, subject to the restrictions in his or her restricted stock agreement, except that in the discretion of the Board, any extraordinary distributions with respect to the Common Stock shall be subject to the restrictions applicable to the restricted stock.

Consideration. Except as the Committee (or the Board, in the case of awards to Independent Directors) may otherwise provide, in consideration of the granting of a stock option or restricted stock, the employee or Independent Director must agree in the written award agreement to remain in the employ of, or to continue as a director for, the Company, or the Operating Partnership, or a subsidiary thereof, for at least one year (or such shorter period as may be fixed in the agreement or by actions of the Committee or the Board following the grant) after the award is granted (or until the next annual meeting of the stockholders of the Company, in the case of an Independent Director).

Exercise of Options. Options may be exercised by compliance with certain prescribed procedures. The option price must be paid in cash unless the Committee (or the Board, in the case of options granted to

8

Independent Directors) in its discretion allows payment through delivery of shares of Common Stock with a fair market value on the date of delivery equal to the aggregate option price or (subject to certain timing requirements if the option was granted prior to November 19, 1996) through the surrender of shares issuable upon exercise of the option. In addition, in the case of options granted to employees, the Committee may allow a delay in payment for up to thirty days or through the delivery of other property or by a combination of these methods. The Committee may make loans to employees in connection with the exercise or receipt of options or the issuance of restricted stock.

No option granted to any Independent Director may be exercised to any extent by anyone after the first to occur of the following events: (i) ten years from the date of option grant, or (ii) three months from the date of termination of directorship (for any reason other than death or disability), or (iii) one year from the date of such Independent Director’s death or disability. The Committee shall provide, in the terms of each individual option granted to an employee, when such option expires and becomes unexercisable and, except as limited by the Code and the regulations and rulings thereunder with respect to ISOs, the Committee may expand the term of any option granted to an employee.

Acceleration and Termination Upon Corporate Events and Transactions. Subject to certain limitations, in the event of certain corporate transactions set forth in the Plan or any unusual or nonrecurring transactions or events affecting the Company, or of changes in applicable laws, regulations, or accounting principles, the Committee (or the Board, in the case of awards granted to Independent Directors) may take certain actions set forth in the Plan whenever it determines that such action is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan or with respect to any option, or restricted stock, to facilitate such transactions or events or to give effect to such changes in laws, regulations or principles.

Amendment and Termination. Generally, the Plan can be amended, modified, suspended or terminated by the Board or the Committee. However, without approval of the Company’s stockholders given within twelve months before or after the action by the Committee or the Board, no action of the Committee or the Board may increase the limits imposed on the maximum number of shares which may be issued under the Plan or, subject to certain exceptions, modify any award limits, and no action of the Committee or the Board may be taken that would otherwise require stockholder approval as a matter of applicable law, regulation or rule. No termination date is specified for the Plan, but no ISO may be granted under the Plan after the first to occur of the following events: (a) the expiration of ten years from the date the Plan Amendment was adopted by the Board; or (b) the expiration of ten years from the date the Plan Amendment is approved by the Company’s stockholders.

Federal Income Tax Consequences

The following discussion is a general summary of the material U.S. federal income tax consequences to U.S. participants in the Plan, and is intended for general information only. The discussion is based on the Code, regulations thereunder, rulings and decisions now in effect, all of which are subject to change. Alternative minimum tax and state and local income taxes are not discussed, and may vary depending on individual circumstances and from locality to locality. Depending on the interaction of Section 83(a) of the Code with the provisions of Rule 16b-3 which apply to the Plan at the time of the grant of options and restricted stock, the tax consequences to persons subject to Section 16 may be different from the general consequences described below.

Section 162(m). Under Section 162(m) of the Code, income tax deductions of publicly-traded companies may be limited to the extent total annual compensation for certain executive officers exceeds $1 million (less the amount of any “excess parachute payments” as defined in Section 280G of the Code) in any one year. However, under Section 162(m), the deduction limit does not apply to certain “qualified performance-based compensation” established by an independent compensation committee which is adequately disclosed to, and approved by, stockholders. In particular, stock options will satisfy the performance-based exception if the awards are made by a qualifying compensation committee under a plan that has been approved by the Company’s stockholders, the

9

plan sets the maximum number of shares that can be granted to any particular employee within a specified period and the compensation is based solely on an increase in the stock price after the grant date (i.e. the option exercise price is equal to or greater than the fair market value of the stock subject to the award on the grant date). Restricted stock granted under the Plan will not qualify as “qualified performance-based compensation” for purposes of Section 162(m) unless such restricted stock vests upon preestablished objective performance goals, the material terms of which are disclosed to and approved by the stockholders of the Company. Thus, the Company expects that restricted stock granted under the Plan will not constitute “qualified performance-based compensation” for purposes of Section 162(m).

It is the practice of the Committee to attempt to have all compensation treated as tax-deductible compensation wherever, in the judgment of the Committee, to do so would be consistent with the objectives of the compensation plan under which the compensation is paid. Accordingly, the Board of Directors is asking stockholders to approve the Plan Amendment in compliance with requirements of Section 162(m). In general, the Company intends to comply with other requirements of the performance-based compensation exclusion under Section 162(m) with respect to option grants, including option pricing requirements and requirements governing the administration of the Plan, so that, upon stockholder approval of the Plan Amendment, the deductibility of compensation paid to top executives pursuant to options issued thereunder is not expected to be disallowed.

Nonqualified Stock Options. For federal income tax purposes, the recipient of NQSOs granted under the Plan will not have taxable income upon the grant of the option, nor will the Company then be entitled to any deduction. Generally, upon exercise of NQSOs the optionee will realize ordinary income, in an amount equal to the difference between the option exercise price and the fair market value of the stock at the date of exercise. Subject to the deductibility limits of Section 162(m), upon exercise of a NQSO by an employee of the Company or a Company subsidiary or by an Independent Director, the Company will be entitled to a deduction in an amount equal to such difference. An optionee’s basis for the stock for purposes of determining his gain or loss on his subsequent disposition of the shares generally will be the fair market value of the stock on the date of exercise of the NQSO.

The tax consequences resulting from the exercise of a NQSO through delivery of already-owned Company shares are not completely certain. In published rulings, the Internal Revenue Service has taken the position that, to the extent an equivalent value of shares is acquired, the optionee will recognize no gain and the employee’s basis in the stock acquired upon such exercise is equal to the employee’s basis in the surrendered shares, that any additional shares acquired upon such exercise are compensation to the employee taxable under the rules described above and that the employee’s basis in any such additional shares is their then-fair market value.

Incentive Stock Options. There is no taxable income to an optionee when an ISO is granted to him or when that option is exercised;provided, however, that upon exercise the optionee’s alternative minimum taxable income will generally include an amount equal to the difference between the option exercise price and the fair market value at the time of exercise. Gain realized by an optionee upon sale of stock issued on exercise of an ISO is taxable at capital gains rates, and no tax deduction is available to the Company, unless the optionee disposes of the shares within two years after the date of grant of the option or within one year after the date the shares were transferred to the optionee. In such event, the difference between the option exercise price and the fair market value of the shares on the date of the option’s exercise will be taxed at ordinary income rates, and, subject to the deductibility limits of Section 162(m), the Company will be entitled to a deduction to the extent the employee must recognize ordinary income. An ISO exercised more than three months after an optionee’s termination of employment, other than by reason of death or disability, will be taxed as a NQSO, with the optionee deemed to have received income upon such exercise taxable at ordinary income rates. Subject to the deductibility limits of Section 162(m), the Company will be entitled to a tax deduction equal to the ordinary income, if any, realized by the optionee.

The tax consequences resulting from the exercise of an ISO through delivery of already-owned shares of Common stock are not completely certain. In published rulings and proposed regulations, the Internal Revenue

10

Service has taken the position that generally the employee will recognize no income upon such stock-for-stock exercise, that, to the extent an equivalent number of shares is acquired, the employee’s basis in the shares acquired upon such exercise is equal to the employee’s basis in the surrendered shares increased by any compensation income recognized by the employee, that the employee’s basis in any additional shares acquired upon such exercise is zero and that any sale or other disposition of the acquired shares within the one- or two-year period described above will be viewed first as a disposition of the shares with the lowest basis.

Restricted Stock. An employee or Independent Director to whom restricted stock is issued will not have taxable income upon issuance and the Company will not then be entitled to a deduction. However, when restrictions on shares of restricted stock lapse, such that the shares are no longer subject to repurchase by the Company, the grantee will realize ordinary income and, subject to the deductibility limits of Section 162(m), the Company will be entitled to a deduction in an amount equal to the fair market value of the shares at the date such restrictions lapse, less the purchase price therefor. Grantees of restricted stock may not make an election under Section 83(b) of the Code.

Plan Benefits

It is expected that options and/or restricted stock will be granted in the future to Named Executive Officers, as defined below, and employees of the Company, the Operating Partnership and their subsidiaries, including officers who are not Named Executive Officers. Future awards granted to these individuals under the Plan will be made at the discretion of the Committee in accordance with the terms of the Plan. Therefore, the benefits and amounts that will be received by these individuals under the Plan are not presently determinable.

Except for an annual grant of 2,500 stock options to each of our non-employee directors, the Company did not grant any stock options under the Plan in 2001. However, certain of the Named Executive Officers and other executive officers of the Company received grants of restricted stock under the Plan in 2001. The amounts of these grants to the Named Executive Officers are reflected in the Summary Compensation Table under “Executive Compensation.” For fiscal year 2000, and prior years, stock option and/or restricted stock awards were granted to the current Named Executive Officers and then-current Named Executive Officers, as well as to other employees of the Company, the Operating Partnership and their subsidiaries, including officers who were not Named Executive Officers. Certain information relating to prior awards under the Plan is set forth below.

Each January 1st during the term of the Plan, each then serving non-employee director automatically receives a grant of options to purchase 2,500 shares of our Common Stock at an exercise price equal to the fair market value on the date of grant. Because future awards of restricted stock may be made to directors at the discretion of the Board, the restricted stock benefits or amounts that will be received by non-employee directors under the Plan are not presently determinable. Since October 1998, the Board has elected to pay non-employee directors their fees in stock in lieu of cash. In 2001, non-employee directors received a total of 28,178 shares of restricted stock in lieu of cash fees.

As of December 31, 2001, the aggregate number of options and shares of restricted stock received by each of the following individuals and groups of individuals under the Plan since its adoption and since the inception of their applicable employment or association with the Company are as follows:

(1) Edward D. Fox, Chief Executive Officer and Chairman of the Board, had received 883,499 shares of restricted stock, with an aggregate fair market value of $6,499,451 at the time of grant (as of December 31, 2001, vesting of 225,000 shares is subject to certain performance criteria).

(2) Stuart J.S. Gulland, President and Chief Operating Officer, had received (i) non-qualified stock options to purchase 100,950 shares, with a weighted average exercise price of $14.69 per share, (ii) 182,297 shares of restricted stock, with an aggregate fair market value of $1,384,037 at the time of grant (as of December 31, 2001, vesting of 70,000 shares is subject to certain performance criteria) and (iii) incentive stock options to purchase 41,550 shares, with a weighted average exercise price of $17.48 per share.

11

(3) Joseph F. Paggi, Jr. Senior Vice President, Assets, has received 29,119 shares of restricted stock, with an aggregate fair market value of $285,394 at the time of grant.

(4) Edward A. Stokx, Chief Financial Officer and Secretary, had received (i) non-qualified stock options to purchase 109,084 shares, with a weighted average exercise price of $10.87 per share, (ii) 2,871 shares of restricted stock, with an aggregate fair market value of $11,915 at the time of grant, and (iii) incentive stock options to purchase 40,916 shares, with a weighted average exercise price of $13.78 per share.

(5) all current executive officers, including those listed above, as a group had received, in the aggregate, (i) options to purchase 457,500 shares, with a weighted average exercise price of $12.42 per share, and (ii) 1,097,786 shares of restricted stock, with an aggregate fair market value of $8,180,797 at the time of grant.

(6) all current directors who are not officers as a group had received, in the aggregate, (i) options to purchase 73,400 shares, with a weighted average exercise price of $11.54 per share, and (ii) 71,259 shares of restricted stock, with an aggregate fair market value of $396,808 at the time of grant.

(7) all current employees, other than current executive officers, had received, in the aggregate, options to purchase 55,442 shares, with a weighted average exercise price of $12.17 per share.

On December 31, 2001, the closing price of a share of the Company’s Common Stock on the New York Stock Exchange was $4.25.

Equity Compensation Plan Information

The following table provides information, as of December 31, 2001, about our Common Stock that may be issued upon the exercise of options, warrants and rights under our existing Second Amended and Restated 1993 Stock Option and Incentive Plan, which is our only equity compensation plan:

Equity Compensation Plan Information | |||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column of this chart) | ||||

| Equity compensation plans approved by security holders | 723,842 | $ | 12.27 | 588,562 | |||

| Equity compensation plans not approved by security holders | N/A | N/A | N/A | ||||

| Total | 723,842 | $ | 12.27 | 588,562 | |||

Required Vote for Approval and Recommendation of the Board of Directors

Assuming a quorum is present, the affirmative vote of a majority of votes cast at the Annual Meeting is required to approve the Plan Amendment.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR APPROVAL OF THE PLAN AMENDMENT. PROPERLY EXECUTED PROXIES WILL BE VOTED FOR THE PLAN AMENDMENT UNLESS STOCKHOLDERS DESIGNATE OTHERWISE.

12

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of April 25, 2002 regarding beneficial ownership of the common stock of the Company by (1) each person known by the Company to be the beneficial owner of 5% or more of the Company’s common stock, (2) each director the Company, (3) the Chief Executive Officer and the other Named Executive Officers of the Company and (4) the Company’s executive officers and directors as a group.

Shares Beneficially Owned | ||||||

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(a) | Percent of Class | ||||

| Prometheus Western Retail, LLC | 15,666,666 | (b) | 56.7 | % | ||

| 30 Rockefeller Plaza | ||||||

| New York, NY 10020 | ||||||

| First Manhattan Co. | 1,868,005 | (c) | 6.8 | % | ||

| 437 Madison Avenue | ||||||

| New York, NY 10022 | ||||||

| Edward D. Fox | 883,599 | (d) | 3.2 | % | ||

| Stuart J.S. Gulland | 324,797 | (e) | 1.2 | % | ||

| R. Bruce Andrews | 49,392 | (f) | * | |||

| Robert T. Barnum | 64,536 | (g) | * | |||

| Sandra A. Lamb | — | * | ||||

| Joseph Paggi | 29,119 | * | ||||

| Fred L. Riedman | 43,335 | (h) | * | |||

| Edward A. Stokx | 120,537 | (i) | * | |||

| Mark S. Ticotin(j) | — | * | ||||

| Douglas N. Wells(j) | — | * | ||||

| All Directors and Executive Officers as a group (10 persons) | 1,526,903 | (d)(e)(f)(g) | 5.5 | % | ||

| (h | )(i) | |||||

| * | Less than 1% |

| (a) | For purposes of this Proxy Statement, beneficial ownership of securities is defined in accordance with the rules of the Securities and Exchange Commission and means generally the power to vote or exercise investment discretion with respect to securities, regardless of any economic interests therein. Except as otherwise indicated, the Company believes that the beneficial owners of shares of our common stock listed in this table have sole investment and voting power with respect to such shares, subject to community property laws where applicable. |

| (b) | Based on a Schedule 13D filed by Prometheus Western Retail, LLC (“PWR LLC”) with the Securities and Exchange Commission on May 17, 2002. Represents 15,666,666 shares of common stock directly owned by PWR LLC. Prometheus Western Retail Trust (“PWRT”) is the sole member of PWR LLC. LF Strategic Realty Investors L.P. (“LFSRI”) is the owner of 100% of the common shares of PWRT. Lazard Frères Real Estate Investors L.L.C. (“LFREI”) is the managing member of LFSRI and Lazard Frères & Co. LLC (“LAZARD”) is the managing member of LFREI. As a result of such relationships, PWRT, LFSRI, LFREI and Lazard may be deemed to indirectly beneficially own the shares of common stock owned by PWR LLC. Each of LFREI and Lazard disclaims beneficial ownership of such shares of common stock. |

13

| (c) | Based on information set forth in a Schedule 13G filed by the stockholder on February 15, 2002. In the Schedule 13G, the stockholder indicates sole voting power with respect to 17,700 of such shares, shared voting power with respect to 1,789,605 of such shares, sole dispositive power with respect to 17,700 of such shares and shared dispositive power with respect to 1,850,305 of such shares. |

| (d) | Includes restricted stock received per the terms of Mr. Fox’s employment contract in lieu of cash compensation since the inception of his employment with the Company, as well as restricted stock received as long-term incentive compensation. Included in the shares owned are 225,000 shares of restricted stock which are subject to both time and performance vesting requirements. |

| (e) | Includes restricted stock received per the terms of executive’s employment contract. Included in the shares owned are 70,000 shares of restricted stock which are subject to both time and performance vesting requirements. Includes options to purchase 142,500 shares of which will vest within 60 days of April 25, 2002. |

| (f) | Includes options to purchase 19,950 shares which will vest within 60 days of April 25, 2002. |

| (g) | Includes options to purchase 9,750 shares which will vest within 60 days of April 25, 2002. |

| (h) | Includes options to purchase 19,950 shares which will vest within 60 days of April 25, 2002. |

| (i) | Includes options to purchase 116,666 shares which will vest within 60 days of April 25, 2002. |

| (j) | Mr. Ticotin is a Managing Principal of LFREI and Mr. Wells is a Principal of LFREI. Mr. Ticotin and Mr. Wells may be deemed to indirectly beneficially own all of the shares of common stock which LFREI indirectly beneficially owns. See footnote (b). Mr. Ticotin and Mr. Wells disclaim beneficial ownership of all such shares of common stock except to the extent of any pecuniary interest they may possess by virtue of their positions with LFREI. |

14

EXECUTIVE OFFICERS

The following table sets forth the names, ages and positions of each of our executive officers.

Name | Age | Position | ||

| Edward D. Fox | 54 | Chairman of the Board and Chief Executive Officer | ||

| Stuart J.S. Gulland | 40 | Director, President and Chief Operating Officer | ||

| Joseph F. Paggi, Jr. | 64 | Senior Vice President, Assets | ||

| Edward A. Stokx | 36 | Chief Financial Officer and Secretary |

In addition to Messrs. Fox and Gulland, whose biographies appear above, the following persons are executive officers of the Company:

Joseph F. Paggi, Jr., Senior Vice President, Assets, joined the Company in April 1998 and has entered into an employment agreement with the Company providing for employment until July 31, 2002. From 1993 to 1998 he was Senior Vice President for Blatteis Realty Co., a 75 year-old firm specializing in retail properties nationally. From 1989 to 1998 Mr. Paggi served as a consultant for Waterfront Renaissance Associates, owner/developer of Philly Walk, and as a retail development consultant to Playa Capital Company, LLC, the successor to Maguire Thomas Partners for the development of Playa Vista, a 1,300 acre mixed-use project near Marina Del Rey, California. Mr. Paggi was a national retail consultant for Maguire Thomas Partners from 1988 to 1993. He is a graduate of UCLA and Loyola University School of Law.

Edward A. Stokx, Chief Financial Officer and Secretary joined the Company in October 1997 and has entered into an employment agreement with the Company providing for his employment until December 31, 2002. Mr. Stokx previously served as Senior Vice President, Finance of the Company. Prior to joining the Company, Mr. Stokx was a Senior Manager with Deloitte & Touche LLP where he focused on serving the real estate industry. In his capacity with Deloitte & Touche LLP, Mr. Stokx’s association with the Company dates back to its formation in 1993. Mr. Stokx is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants and the California Society of Public Accountants. Mr. Stokx is a graduate of Loyola Marymount University.

15

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain compensation information for the fiscal years ended December 31, 2001, 2000 and 1999 with respect to the Company’s Chief Executive Officer and three other executive officers of the Company (the “Named Executive Officers”).

Long Term Compensation | ||||||||||||||||

Annual Compensation | Restricted Stock Awards ($)(b) | Securities Underlying Options (#)(c) | All Other Compensation ($) | |||||||||||||

Name and Principal Position | Year | Salary ($)(a) | Bonus ($) | |||||||||||||

| Edward D. Fox | 2001 | 387,049 | 0 | (d) | 249,000 | (e) | 0 | 352,941 | (d) | |||||||

| Chief Executive Officer and | 2000 | 0 | (d) | 0 | (d) | 414,844 | (e) | 0 | 802,955 | (d) | ||||||

| Chairman of the Board | 1999 | 0 | (d) | 0 | (d) | 483,600 | (e) | 0 | 779,043 | (d) | ||||||

| 2,784,375 | (f) | |||||||||||||||

| Stuart J.S. Gulland | 2001 | 251,913 | 187,500 | 124,500 | (g) | 0 | 44,119 | (h) | ||||||||

| President and Chief Operating | 2000 | 244,070 | 221,325 | 206,229 | (g) | 0 | 0 | |||||||||

| Officer | 1999 | 265,114 | 124,255 | 214,931 | (g) | 0 | 0 | |||||||||

| 1,093,600 | (i) | |||||||||||||||

| Joseph F. Paggi, Jr. | 2001 | 160,084 | 62,500 | 0 | 75,000 | (j) | ||||||||||

| Senior Vice President, Assets | 2000 | 207,583 | 50,000 | 0 | 0 | 0 | ||||||||||

| 1999 | 211,894 | 73,032 | 546,800 | (j) | 0 | 0 | ||||||||||

| Edward A. Stokx | 2001 | 161,963 | 50,625 | 0 | 0 | 11,915 | (k) | |||||||||

| Chief Financial Officer and | 2000 | 151,264 | 72,009 | 0 | 0 | 0 | ||||||||||

| Secretary | 1999 | 125,596 | 45,000 | 0 | 100,000 | 0 | ||||||||||

| (a) | Includes accrued vacation paid out and allowance for automobile expenses. |

| (b) | Represents restricted stock granted under our Stock Option and Incentive Plan. The value of the restricted stock is calculated by multiplying the closing market price of our common stock on the date of each grant by the number of shares awarded. |

| (c) | Represents options to purchase shares of our common stock granted under our Stock Option and Incentive Plan. The 1999 options vest over a three-year period and have an exercise price of $10.00. See “—Aggregated Option Exercises and Fiscal Year-End Option Value Table.” |

| (d) | In lieu of cash compensation, Mr. Fox elected to receive his salary and bonus in 2000 and 1999 in the form of stock. In 2001, Mr. Fox’s salary was paid in cash while his bonus was paid in the form of stock. When receiving stock in-lieu-of cash, Mr. Fox’s salary and bonus were converted at 85% of the average common stock price during each calendar quarter. The value of the restricted stock is calculated by multiplying the closing market price of our common stock on the date of each grant by the number of shares awarded. In 1999, Mr. Fox received stock valued at $421,088 in lieu of a cash salary and stock valued at $357,955 in lieu of a cash bonus. In 2000, Mr. Fox received stock valued at $368,179 in lieu of a cash salary and stock valued at $434,776 in lieu of a cash bonus. In 2001, Mr. Fox received stock valued at $352,941 in lieu of a cash bonus. As of April 25, 2002, the value of all vested stock received by Mr. Fox, including stock received in lieu of salary and bonus as well as restricted stock awards, since the inception of his employment in 1998 was $3,655,224, based on the closing price of our common stock on such date of $5.55. |

| (e) | Represents the value of 60,000, 75,000 and 75,000 shares of restricted stock vested for each of the periods ended December 31, 2001, 2000 and 1999, respectively. |

| (f) | Represents the value of 225,000 shares of restricted stock granted during 1999. Mr. Fox was granted 225,000 shares of restricted stock effective January 31, 1999, subject to both time and performance based vesting requirements. As the time component is satisfied, the Company refreshes Mr. Fox’s unvested shares of restricted stock by granting him an additional 18,750 shares per calendar quarter, up to a maximum of |

16

| 300,000 unvested shares. The performance component is satisfied at the discretion of the Board based on Mr. Fox’s successful achievement of certain defined objectives as set forth by the Board. In any given year, a maximum of 75,000 shares may fully vest. Based on the closing price of our common stock on April 25, 2002 of $5.55, the value of the aggregate shares of unvested restricted stock held by Mr. Fox was equal to $1,248,750. |

| (g) | Represents the value of 30,000, 33,333 and 33,333 shares of restricted stock vested for the periods ended December 31, 2001, 2000 and 1999, respectively. |

| (h) | Represents the value of 10,631 shares of restricted stock granted and vested for the period ended December 31, 2001. |

| (i) | Represents the value of 100,000 shares of restricted stock granted effective January 1, 1999. The vesting of such shares is subject to certain performance requirements as determined by the Board. In any given year, a maximum of 33,333 shares may fully vest. Upon vesting of 33,333 shares in both 2000 and 1999, additional unvested shares equal to the number of shares vested during the period were granted to Mr. Gulland. As of December 31, 2001, addition unvested shares had not been granted. As of December 31, 2001, Mr. Gulland had 70,000 shares of unvested stock. Based on the closing price of our common stock on April 25, 2002 of $5.55, the value of the aggregate shares of unvested restricted stock held by Mr. Gulland was equal to $388,500. |

| (j) | Represents the value of 50,000 shares of restricted stock granted effective January 1, 1999. As of December 31, 2001, 16,667 shares had vested as a result of meeting certain performance requirements. During 2001, the Company modified its employment agreement with Mr. Paggi. In exchange for changes made to certain provisions of the agreement, including but not limited to, salary and severance provisions, the Company made a one-time payment of $75,000 to Mr. Paggi. In addition, the 33,333 shares of unvested restricted stock grants were canceled. |

| (k) | Represents the value of 2,871 shares of restricted stock granted and vested for the period ended December 31, 2001. |

Aggregated Option Exercises and Fiscal Year-End Option Value Table

The following table provides information related to the 2001 fiscal year-end value and number of unexercised options held by each of the Named Executive Officers. During the fiscal year ended December 31, 2001, none of the Named Executive Officers exercised any options to purchase shares of our common stock.

Name | Number of Unexercised Options at Fiscal-Year End Exercisable/Unexercisable (#)(a) | Value of Unexercised In-the-Money Options at Fiscal-Year End Exercisable/Unexercisable ($)(a) | ||

| Edward D. Fox | 0/0 | 0/0 | ||

| Stuart J.S. Gulland | 142,500/0 | 0/0 | ||

| Joseph F. Paggi, Jr. | 0/0 | 0/0 | ||

| Edward A. Stokx | 116,666/33,334 | 0/0 |

| (a) | On December 31, 2001, the closing market price of our common stock on the New York Stock Exchange was $4.25. At that time, the exercise price for all options held by Named Executive Officers was at or above $10.00. |

Employment and Change-In-Control Agreements

We have entered into an employment agreement with Edward D. Fox, providing for his employment for a rolling three year term unless either party gives written notice to the other party at least 90 days prior to the end of a given year that it does not desire to continue to extend the term with a one-year severance component. Thus, although the agreement currently provides for Mr. Fox’s employment until December 2004, unless either party properly notifies the other that it does not wish to extend the term, the term will continue to extend an additional year at the end of each year. The agreement provides for annual compensation of $375,000; a discretionary bonus

17

in an amount to be determined by the Board based on the performance of Mr. Fox and the Company; and a grant of 225,000 shares of restricted stock in 1999, subject to both a time and performance based vesting component, as long term incentive compensation. From the inception of his employment until December 31, 2000, Mr. Fox elected to receive his annual compensation and bonus in restricted stock of the Company on a quarterly basis and based on a price calculated at 85% of the average stock price for the prior calendar quarter. The 225,000 shares of restricted stock granted to Mr. Fox in 1999 as long-term incentive compensation are subject to both a time and performance based vesting component. As the time component is satisfied, the Company refreshes Mr. Fox’s unvested shares of restricted stock by granting him up to an additional 18,750 shares of restricted stock per calendar quarter to a maximum of 300,000 unvested shares. A maximum of 75,000 shares may vest in a given year subject to the achievement of certain performance criteria as set forth by the Board. The employment agreement also provided for the cancellation of 300,000 stock options issued to Mr. Fox pursuant to his prior employment agreement. Restricted stock issued to Mr. Fox pursuant to his employment agreement, including issuances in lieu of annual compensation and bonus, has been and is expected to continue to be issued under the Plan. Subsequent to December 31, 2001, the Compensation Committee and Mr. Fox have agreed in principle to a modification of Mr. Fox’s current employment contract. Under the proposed terms of the agreement, Mr. Fox’s compensation will be substantially reduced over time as he will focus his efforts primarily on the business development and strategic direction of the Company. Once the terms of the agreement are finalized, the parties are expected to execute a revised employment contract.

We have entered into an employment agreement with Stuart J.S. Gulland providing for his employment for a rolling two year term unless either party gives written notice to the other party at least 90 days prior to the end of a given year that it does not desire to continue to extend the term. Thus, although the agreement currently provides for Mr. Gulland’s employment until December 31, 2003, unless either party properly notifies the other that it does not wish to extend the term, the term will continue to extend an additional year at the end of each year. The agreement provides for an annual salary of $250,000 and an annual bonus in an amount to be determined by the Board of Directors. In addition, pursuant to the employment agreement, the Company granted Mr. Gulland 100,000 shares of restricted stock of the Company in 1999, subject primarily to the achievement of certain performance criteria as set by the Board. The employment agreement also provided for the cancellation of 100,000 stock options issued to Mr. Gulland pursuant to his prior employment agreement. The restricted stock issued to Mr. Gulland pursuant to his employment agreement was issued under the Plan. In connection with his appointment as President of the Company in May 2002, the Compensation Committee and Mr. Gulland have agreed in principle to a modification of Mr. Gulland’s current employment contract. Once the terms of the agreement are finalized, the parties are expected to execute a revised employment contract.

We have entered into an employment agreement with Joseph F. Paggi, Jr. providing for his employment as Senior Vice President of Assets. The agreement provides for a rolling one year term unless either party gives written notice to the other party at least 60 days prior to the end of a given year that it does not desire to continue to extend the term. Thus, although the agreement currently provides for Mr. Paggi’s employment until July 31, 2002, unless either party properly notifies the other that it does not wish to extend the term, the term will continue to extend an additional year at the end of each year. The agreement provides for an annual salary of $105,000 and an annual bonus in an amount to be determined by the Board of Directors. In consideration of certain changes to the terms of Mr. Paggi’s employment agreement, the Company made a one-time payment of $75,000 to Mr. Paggi in 2001.

We have entered into an employment agreement with Edward A. Stokx providing for his employment for a rolling one year term unless either party gives written notice to the other party at least 90 days prior to the end of a given year that it does not desire to continue to extend the term. Thus, although the agreement currently provides for Mr. Stokx’s employment until December 31, 2002, unless either party properly notifies the other that it does not wish to extend the term, the term will continue to extend an additional year at the end of each year. The agreement provides for an annual salary of $150,000 and an annual bonus in an amount to be determined by the Board of Directors. In addition, pursuant to the employment agreement, the Company granted Mr. Stokx options to purchase 50,000 shares of our common stock in 1998 and 100,000 shares of our common

18

stock in 1999, subject to vesting requirements under the Plan. The stock options granted to Mr. Stokx pursuant to his employment agreement were granted under the Plan. In connection with his appointment as Chief Financial Officer of the Company in May 2002, the Compensation Committee and Mr. Stokx have agreed in principle to a modification of Mr. Stokx’s current employment contract. Once the terms of the agreement are finalized, the parties are expected to execute a revised employment contract.

The bylaws of the Company provide for indemnification of the officers, directors, employees and agents of the Company pursuant to the Maryland General Corporation Law. The Maryland General Corporation Law permits the indemnification of any officer, director, employee or agent of the Company against expenses and liabilities in any action arising out of such person’s activities on behalf of the Company, if such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Company or in a manner he had no reasonable cause to believe was unlawful.

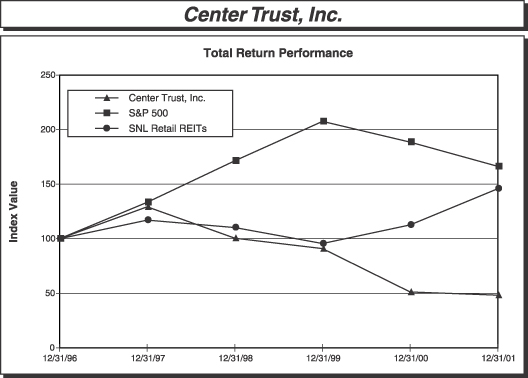

Stock Performance Graph

The graph below compares the cumulative total return of the Company, the S&P 500 Index and the SNL Retail REIT Index(*) from December 31, 1996 to December 31, 2001. The comparison assumes $100 was invested on December 31, 1996 in our common stock and each of the foregoing indices and assumes reinvestment of dividends before consideration of income taxes.

Period Ending | ||||||||||||

12/31/96 | 12/31/97 | 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | |||||||

| Center Trust | 100.00 | 129.28 | 100.59 | 90.92 | 51.15 | 48.25 | ||||||

| S&P 500 Total Return | 100.00 | 133.37 | 171.44 | 207.52 | 188.62 | 166.22 | ||||||

| SNL Retail REITs | 100.00 | 117.09 | 110.26 | 95.49 | 112.69 | 145.92 | ||||||

| * | The SNL Retail REIT Index is a peer group index comprised of the following companies: Acadia Realty Trust, Aegis Realty, Inc., Agree Realty Corporation, Alexander’s, Inc., Atlantic Realty Trust, Burnham Pacific |

19