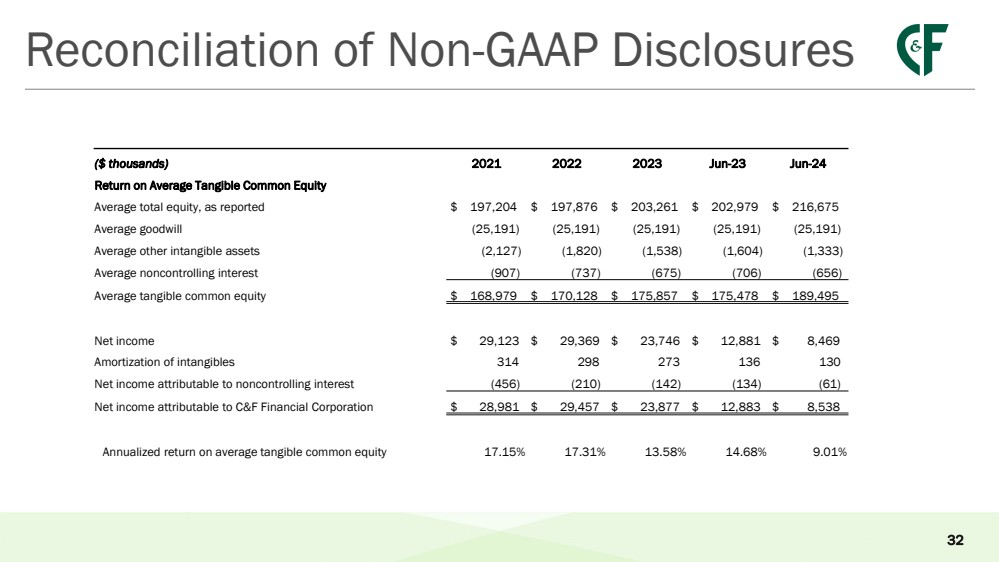

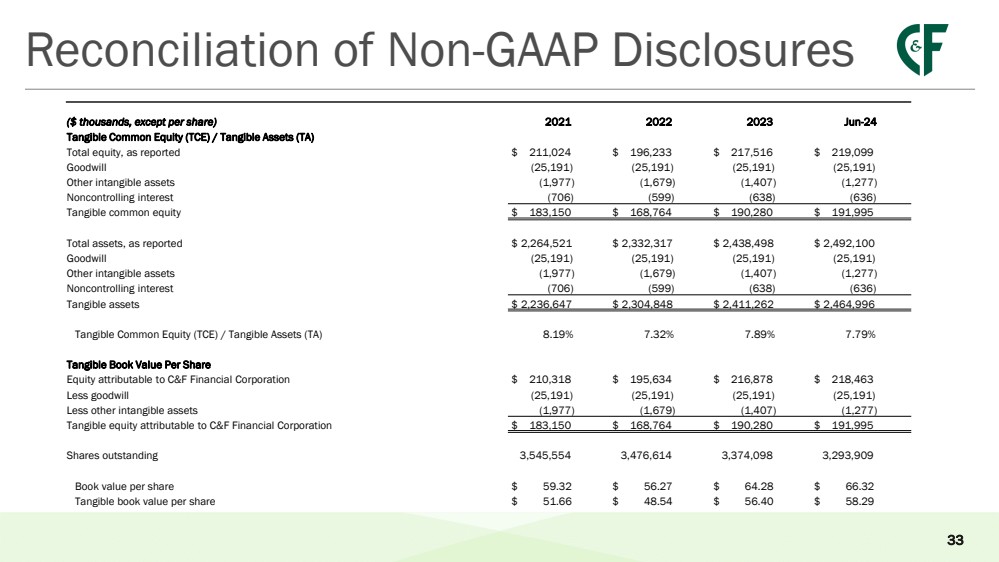

| Cautionary Statements Forward-Looking Statements. Certain statements in this presentation may constitute “forward-looking statements” within the meaning of federal securities laws. These forward-looking statements are based on the beliefs of the Corporation’s management, as well as assumptions made by, and information currently available to, the Corporation’s management, and reflect management’s current views with respect to certain events that could have an impact on the Corporation’s future financial performance. These forward-looking statements relate to expectations concerning matters that are not historical fact, may express “belief,” “intention,” “expectation,” “potential” and similar expressions, and may use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “may,” “might,” “will,” “intend,” “target,” “should,” “could,” or similar expressions. These statements are inherently uncertain, and there can be no assurance that the underlying assumptions will prove to be accurate. Actual results could differ materially from those anticipated or implied by such statements. Factors that could have a material adverse effect on the operations and future prospects of the Corporation include, but are not limited to, changes in: (1) interest rates, such as volatility in short-term interest rates or yields on U.S. Treasury bonds, increases in interest rates following actions by the Federal Reserve and increases or volatility in mortgage interest rates, (2) general business conditions, as well as conditions within the financial markets, (3) general economic conditions, including unemployment levels, inflation rates, supply chain disruptions and slowdowns in economic growth, (4) general market conditions, including disruptions due to pandemics or significant health hazards, severe weather conditions, natural disasters, terrorist activities, financial crises, political crises, war and other military conflicts (including the ongoing military conflicts between Russia and Ukraine and in the Middle East) or other major events, or the prospect of these events, (5) average loan yields and average costs of interest-bearing deposits, (6) financial services industry conditions, including bank failures or concerns involving liquidity, (7) labor market conditions, including attracting, hiring, training, motivating and retaining qualified employees, (8) the legislative/regulatory climate, regulatory initiatives with respect to financial institutions, products and services, the Consumer Financial Protection Bureau (the CFPB) and the regulatory and enforcement activities of the CFPB, (9) monetary and fiscal policies of the U.S. Government, including policies of the FDIC, U.S. Department of the Treasury and the Board of Governors of the Federal Reserve System (the Federal Reserve Board), and the effect of these policies on interest rates and business in our markets, (10) demand for financial services in the Corporation’s market areas, (11) the value of securities held in the Corporation’s investment portfolios, (12) the quality or composition of the loan portfolios and the value of the collateral securing those loans, (13) the inventory level, demand and fluctuations in the pricing of used automobiles, including sales prices of repossessed vehicles, (14) the level of automobile loan delinquencies or defaults and our ability to repossess automobiles securing delinquent automobile finance installment contracts, (15) the level of net charge-offs on loans and the adequacy of our allowance for credit losses, (16) the level of indemnification losses related to mortgage loans sold, (17) demand for loan products, (18) deposit flows, (19) the strength of the Corporation’s counterparties, (20) the availability of lines of credit from the FHLB and other counterparties, (21) the soundness of other financial institutions and any indirect exposure related to the closings of other financial institutions and their impact on the broader market through other customers, suppliers and partners, or that the conditions which resulted in the liquidity concerns experienced by closed financial institutions may also adversely impact, directly or indirectly, other financial institutions and market participants with which the Corporation has commercial or deposit relationships, (22) competition from both banks and non-banks, including competition in the non-prime automobile finance markets and marine and recreational vehicle finance markets, (23) services provided by , or the level of the Corporation’s reliance upon third parties for key services, (24) the commercial and residential real estate markets, including changes in property values, (25) the demand for residential mortgages and conditions in the secondary residential mortgage loan markets, (26) the Corporation’s technology initiatives and other strategic initiatives, (27) the Corporation’s branch expansions and consolidations plans, (28) cyber threats, attacks or events, (29) C&F Bank’s product offerings, and (30) accounting principles, policies and guidelines, and elections by the Corporation thereunder, including, for example, our adoption of the CECL methodology and the potential volatility in the Corporation’s operating results due to the application of the CECL methodology . These risks and uncertainties should be considered in evaluating the forward-looking statements contained herein, and readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation. For additional information on risk factors that could affect the forward-looking statements contained herein, see the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2023 and other reports filed with the SEC. The Corporation undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Use of Certain Non-GAAP Financial Measures. The accounting and reporting policies of the Corporation conform to GAAP in the United States and prevailing practices in the banking industry. However, certain non-GAAP measures are used by management to supplement the evaluation of the Corporation’s financial condition and performance. These include return on average tangible common equity (ROATCE), tangible common equity to tangible assets (TCE/TA), and tangible book value per share. A reconciliation of the non-GAAP financial measures used by the Corporation to evaluate and measure the Corporation’s financial condition and performance to the most directly comparable GAAP financial measures is presented in an appendix. No Offer or Solicitation This presentation does not constitute an offer to sell or a solicitation to buy any securities. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. About C&F Financial Corporation. Additional information regarding the Corporation’s products and services, as well as access to its filings with the SEC, are available on the Corporation’s website at http://www.cffc.com. 2 |