Searchable text section of graphics shown above

Exhibit 99.1

2005 Business Activity

• FSA surpassed $1 billion in PV originations for first time

– U.S. municipal business - largest share of PV premiums

– U.S. asset-backed business - constrained by tight credit spreads

– International business - solid performance led by public infrastructure business

– Financial Products — growth in GICs and Structured Products

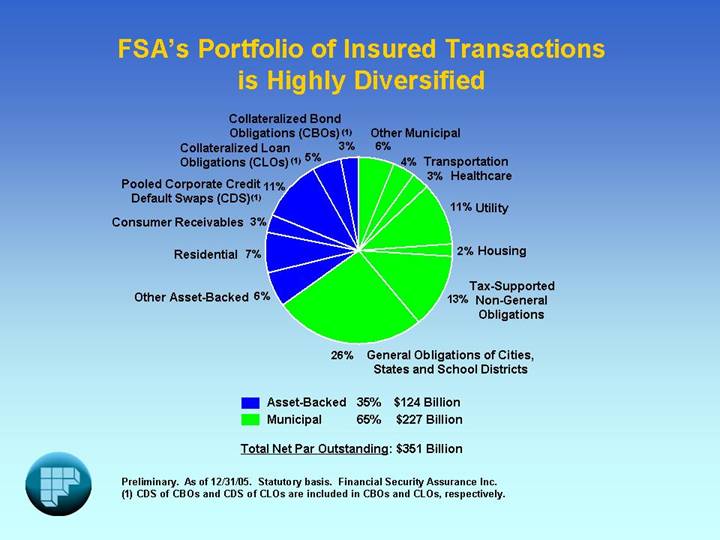

FSA’s Portfolio of Insured Transactions

is Highly Diversified

[PIE CHART]

[LOGO] | Preliminary. As of 12/31/05. Statutory basis. Financial Security Assurance Inc. |

| (1) CDS of CBOs and CDS of CLOs are included in CBOs and CLOs, respectively. |

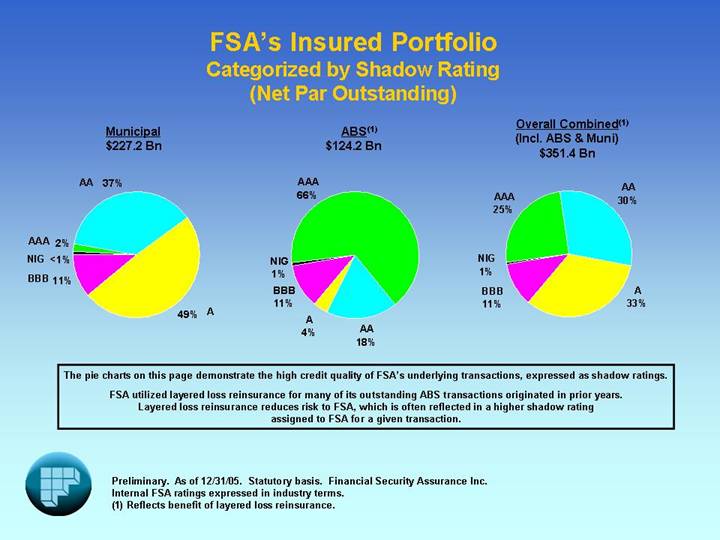

FSA’s Insured Portfolio

Categorized by Shadow Rating

(Net Par Outstanding)

Municipal | | ABS(1) | | Overall Combined(1) |

| | | | (Incl. ABS & Muni) |

$227.2 Bn | | $124.2 Bn | | $351.4 Bn |

| | | | |

| | | | |

[PIE CHART] | | [PIE CHART] | | [PIE CHART] |

The pie charts on this page demonstrate the high credit quality of FSA’s underlying transactions, expressed as shadow ratings.

FSA utilized layered loss reinsurance for many of its outstanding ABS transactions originated in prior years.

Layered loss reinsurance reduces risk to FSA, which is often reflected in a higher shadow rating

assigned to FSA for a given transaction.

| Preliminary. As of 12/31/05. Statutory basis. Financial Security Assurance Inc. |

[LOGO] | Internal FSA ratings expressed in industry terms. |

| (1) Reflects benefit of layered loss reinsurance. |

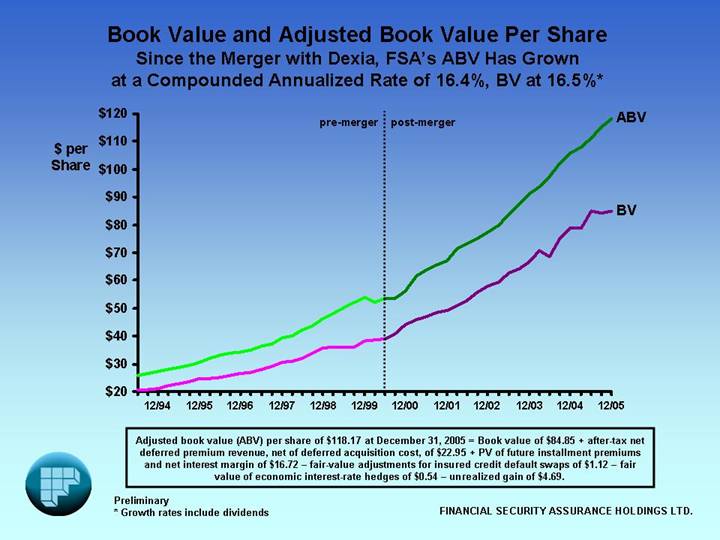

Book Value and Adjusted Book Value Per Share

Since the Merger with Dexia, FSA’s ABV Has Grown

at a Compounded Annualized Rate of 16.4%, BV at 16.5%*

[LINE GRAPH]

Adjusted book value (ABV) per share of $118.17 at December 31, 2005 = Book value of $84.85 + after-tax net

deferred premium revenue, net of deferred acquisition cost, of $22.95 + PV of future installment premiums

and net interest margin of $16.72 — fair-value adjustments for insured credit default swaps of $1.12 — fair

value of economic interest-rate hedges of $0.54 — unrealized gain of $4.69.

| | |

[LOGO] | Preliminary | |

| * Growth rates include dividends | FINANCIAL SECURITY ASSURANCE HOLDINGS LTD. |

NON-GAAP MEASURES

This presentation includes measures that are promulgated in accordance with accounting principles generally accepted in the United States of America (GAAP measures) and measures not so promulgated (non-GAAP measures). This presentation is meant to be read in conjunction with the most recent Annual Report on Form 10-K for Financial Security Assurance Holdings Ltd. (the Company), which contains, for non-GAAP measures, a presentation of and reconciliation to the most comparable GAAP measures.

This presentation contains information about the non-GAAP measures “operating earnings” and “adjusted book value.” The Company defines operating earnings as net income before the effects of fair-value adjustments for

(1) FSA-insured investment-grade credit default swaps (CDS) that are required to be marked to fair value under GAAP accounting principles and

(2) “economic interest rate hedges”, defined as interest rate derivatives that are intended to hedge fixed rate assets and liabilities but do not meet the criteria necessary to receive hedge accounting treatment under GAAP accounting principles.

The Company views insured CDS risks as comparable to other insured risks and enters into such non-cancelable contracts fully intending to hold them to maturity. Management believes it is probable that the financial impact of the fair-value adjustments for the insured CDS will disappear over the finite terms of the exposures. Periodic unrealized gains and losses related to interest-rate hedges arise in both the financial guaranty and financial products business segments, caused primarily by the one-sided mark-to-market derivative valuations prescribed by SFAS 133 for derivatives that do not qualify for “hedge treatment” under GAAP. Under the Company’s definition of operating earnings, the economic effect of these hedges is recognized, which, for interest-rate swaps, generally results in any cash paid or received being recognized ratably as an expense or revenue over the hedged item’s life. Management therefore considers operating earnings a key measure of normal operating results.

Management defines the non-GAAP measure, “adjusted book value” (ABV), as GAAP book value

plus the after-tax effect of:

(1) unearned premium revenues, net of amounts ceded to reinsurers

(2) the present value of future installment premiums, net of amounts ceded to reinsurers

(3) the present value of future net interest margin from the Company’s Financial Products operations

less the after-tax effect of

(1) the deferred costs of acquiring policies

(2) fair-value adjustments for insured CDS.

(3) fair value of economic interest rate hedges

(4) unrealized gains on investments

Management believes that the intrinsic value of the Company comprises not only book value, but also the estimated present value of future income from business it has already originated. Such future income is substantial because premiums are earned over the life of each insured transaction. For this reason, management considers ABV, which captures these forms of deferred income, to be an operating measure of the intrinsic value of the Company.

This presentation also contains certain other non-GAAP measures, such as total claims-paying resources, which are based on statutory accounting principles applicable to insurance companies. Management uses such measures because the measures are required by regulators or used by rating agencies to assess the capital adequacy of the Company.

FORWARD-LOOKING STATEMENTS

The Company relies on the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. This safe harbor requires that the Company specify important factors that could cause actual results to differ materially from those contained in forward-looking statements made by or on behalf of the Company. Accordingly, forward-looking statements by the Company and its affiliates are qualified by reference to the following cautionary statements.

In its filings with the SEC, reports to shareholders, press releases and other written and oral communications, the Company from time to time makes forward-looking statements. Such forward-looking statements include, but are not limited to, (1) projections of revenues, income (or loss), earnings (or loss) per share, dividends, market share or other financial forecasts; (2) statements of plans, objectives or goals of the Company or its management, including those related to growth in adjusted book value or return on equity; and (3) expected losses on, and adequacy of loss reserves for, insured transactions. Words such as “believes,” “anticipates,” “expects,” “intends” and “plans” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

The Company cautions that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in forward-looking statements made by the Company. These factors include:

• changes in capital requirements or other criteria of securities rating agencies applicable to financial guaranty insurers in general or to FSA specifically

• competitive forces, including the conduct of other financial guaranty insurers in general

• changes in domestic or foreign laws or regulations applicable to the Company, its competitors or its clients

• changes in accounting principles or practices that may result in a decline in securitization transactions or impact the Company’s reported financial results

• an economic downturn or other economic conditions (such as a rising interest rate environment) adversely affecting transactions insured by FSA or its investment portfolio

• inadequacy of reserves established by the Company for losses and loss adjustment expenses

• temporary or permanent disruptions in cash flow on FSA-insured structured transactions attributable to legal challenges to such structures

• downgrade or default of one or more of FSA’s reinsurers

• the amount and nature of business opportunities that may be presented to the Company

• market conditions, including the credit quality and market pricing of securities issued

• capacity limitations that may impair investor appetite for FSA-insured obligations

• market spreads and pricing on insured credit default swap exposures, which may result in gain or loss due to mark-to-market accounting requirements

• prepayment speeds on FSA-insured asset-backed securities and other factors that may influence the amount of installment premiums paid to FSA

• changes in the value or performance of strategic investments made by the Company

• other factors, most of which are beyond the Company’s control.

The Company cautions that the foregoing list of important factors is not exhaustive. In any event, such forward-looking statements made by the Company speak only as of the date on which they are made, and the Company does not undertake any obligation to update or revise such statements as a result of new information, future events or otherwise.