Exhibit 99.2

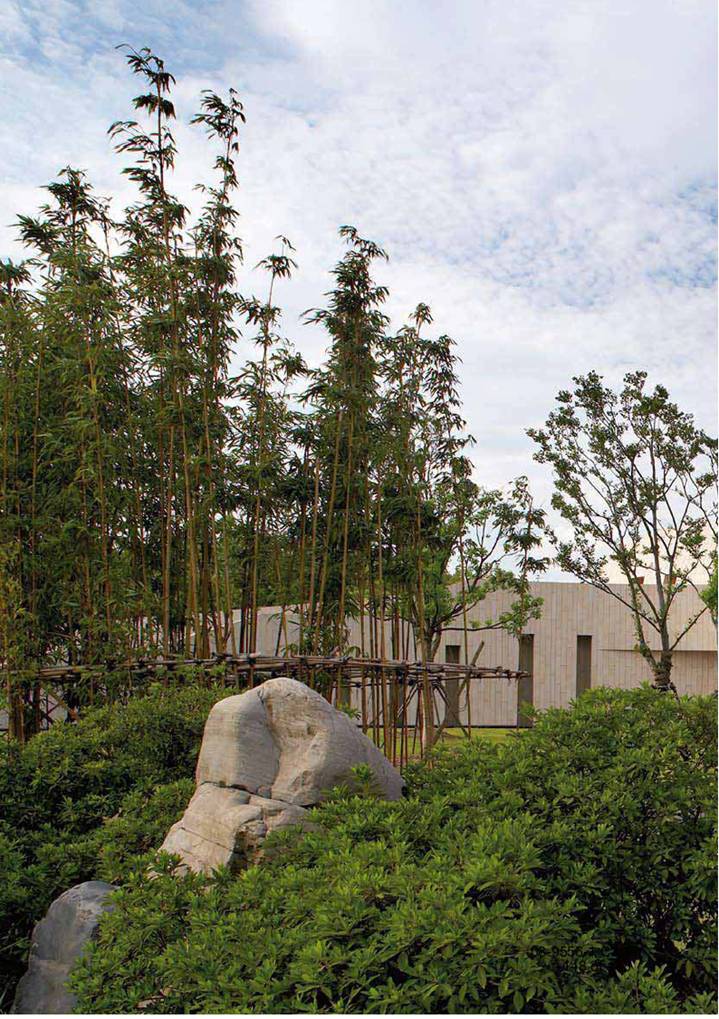

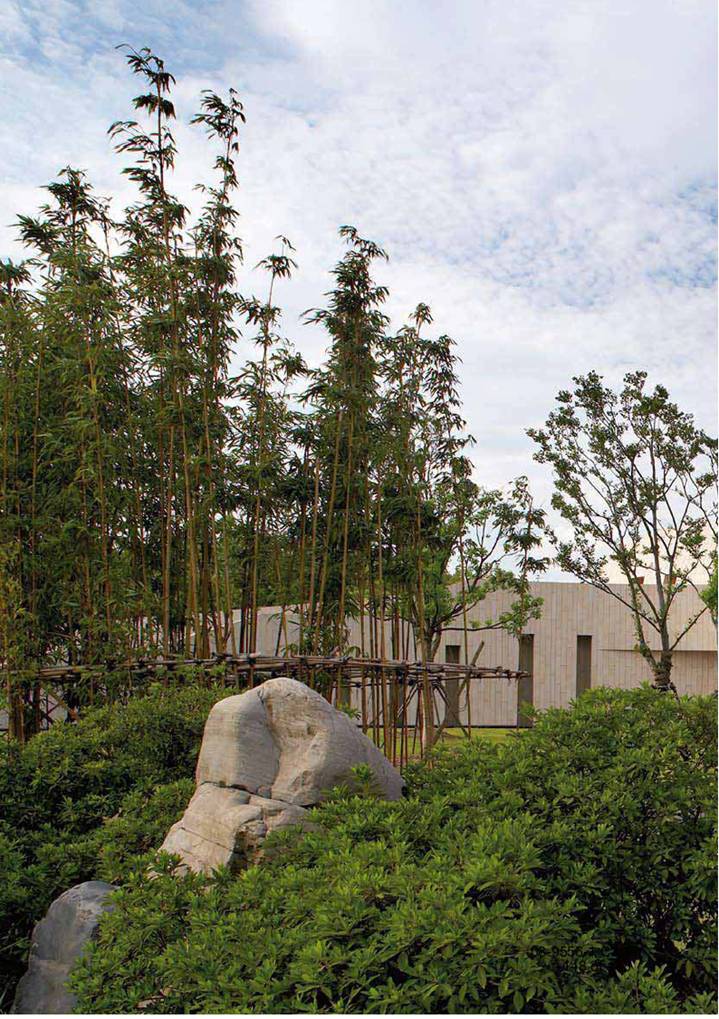

Photo cover: New Jiang Wan Cultural Center

Nestled in the city’s last wetland preserve, Shanghai’s latest and most comprehensive urban development, New Jiangwan Town, is a model for a sustainable community for the 21st Century. In its heart is a new cultural center, designed to showcase the area’s environmental sensitivity and celebrate the vibrant and evolving community. The center was designed by RTKL.

ARCADIS NV

Nieuwe Stationsstraat 10, 6811 KS, Arnhem, The Netherlands

P.O. Box 33, 6800 LE, Arnhem, The Netherlands

Tel +31 26 3778911

Fax +31 26 4438381

E-mail ir@arcadis.nl

Internet www.arcadis-global.com

Chamber of Commerce Arnhem, The Netherlands Trade registry no. 09051284

VAT: NL 0062.93.700.B.01

For other company addresses see page 146 of this report.

Safe Harbor Provision

Except for the historical information contained herein, the statements in this report are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to differ materially from forecasted results. Those risks include, among others, risks associated with possible changes in environmental legislation, changes in investment flow for infrastructure, changes in the investment climate for buildings, and more generally, risks related to the Company’s ability to acquire and execute projects. These and other risks are described in the Report by the Executive Board and in ARCADIS’ filings with the Securities and Exchange Commission (SEC) over the last 12 months, copies of which are available from the SEC, upon request from the Company, or on the Company’s website.

Table of contents

Highlights 2007 | 4 |

Selected financial data | 5 |

The ARCADIS Share | 6 |

Position in the market | 10 |

Mission and Profile | 12 |

Brief overview of | |

Company activities | |

Introduction | 14 |

Report by the Executive Board | 17 |

Vision and strategy | 17 |

Results and financing | 27 |

Developments by business line | 34 |

· Infrastructure | 34 |

· Environment | 38 |

· Buildings | 42 |

Developments by region | 46 |

· The Netherlands | 46 |

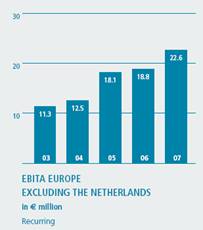

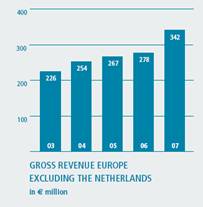

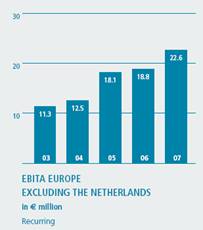

· Europe excluding the Netherlands | 47 |

· United States | 48 |

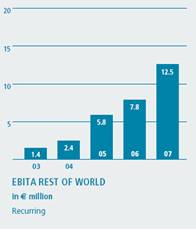

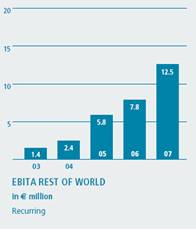

· Rest of the world | 49 |

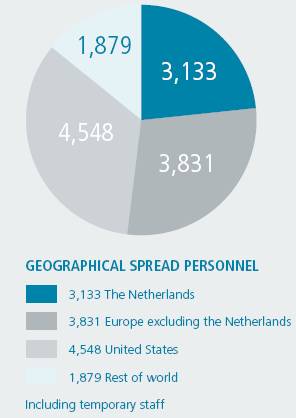

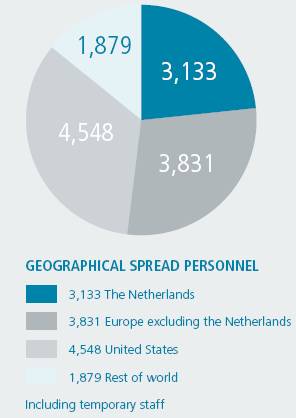

Human Resources Management | 50 |

Risk management | 53 |

Sustainable business conduct | 57 |

Outlook 2008 | 63 |

Report by the Supervisory Board | 65 |

Information on members of the Supervisory and Executive Boards | 72 |

Remuneration Report | 75 |

Corporate Governance | 81 |

Financial Statements 2007 | 87 |

Consolidated balance sheet | 88 |

Consolidated statement of income | 89 |

Consolidated statement of cash flows | 90 |

Consolidated statement of changes in equity | 91 |

Notes to the consolidated financial statements | 92 |

Company balance sheet | 132 |

Company statement of income | 133 |

Notes to the Company balance sheet | 133 |

Notes to the Company statement of income | 137 |

Other information | 139 |

Auditor’s report | 140 |

Ten-year summary | 142 |

Other financial data | 144 |

Company addresses | 145 |

Geographical distribution/ Organization structure | 146 |

3

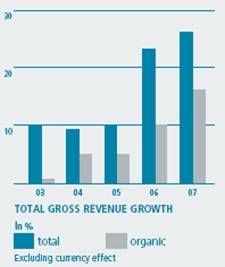

Highlights 2007

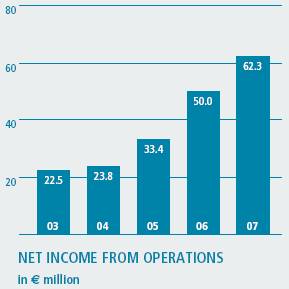

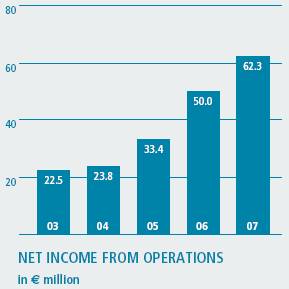

Net income from operations

25% higher (before amortization and non-operational items)

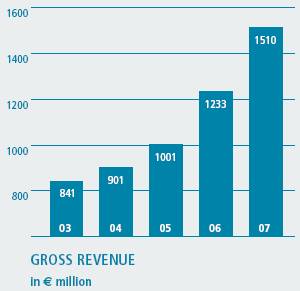

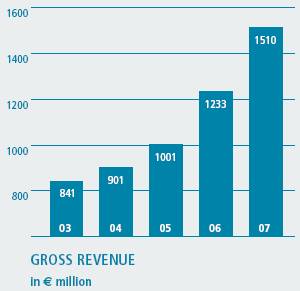

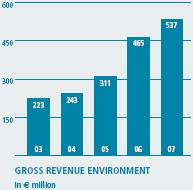

Gross revenue

rose 22% to € 1.5 billion

Organic growth

at record level of 16% and strong across business lines and geographies

Margin improves further

to 10.5%, well beyond the goal of 10%

Environment shows exceptional organic growth

at 22%, mainly coming from the United States where we gained market share

Infrastructure market strong

with organic growth of 13%, mainly from the Netherlands and Brazil

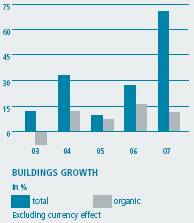

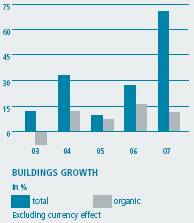

Strong expansion in Buildings

with 71% growth, mainly through acquisitions, but also good organic growth of 11%

Milestone acquisition of RTKL

puts ARCADIS on the world map in architecture and high end urban planning

Seven new acquisitions

add in total € 192 million in gross revenue and almost 1500 new colleagues

Breakthrough contract in water management for New Orleans

of (maximum) US$ 150 million establishes global reputation in this field

Strategy sharpened

growth goal increased to 15% of which at least half organic

Divisional structure introduced in operating companies

to be better aligned with key clients and markets across geographies

NASDAQ listing ended

because of low trading volumes and relatively high costs

4

Selected financial data

Amounts in millions of euros unless otherwise stated

Revenue | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

Gross revenue | | 1,510 | | 1,233 | | 1,001 | | 901 | | 841 | |

Net revenue | | 1,004 | | 837 | | 703 | | 633 | | 595 | |

Operating results | | | | | | | | | | | |

EBITA | | 107.2 | | 78.8 | | 60.4 | | 35.9 | | 36.0 | |

EBITA recurring | | 105.9 | | 78.8 | | 57.3 | | 39.1 | | 36.0 | |

Operating income | | 95.0 | | 70.5 | | 54.4 | | 35.5 | | 34.9 | |

Associates | | (0.8 | ) | (0.5 | ) | 1.4 | | 2.4 | | 2.6 | |

Net income from operations(1) | | 62.3 | | 50.0 | | 33.4 | | 23.8 | | 22.5 | |

Net income | | 54.9 | | 44.9 | | 33.4 | | 22.2 | | 21.4 | |

Return on average invested capital (in %) | | 20.1 | | 20.3 | | 20.6 | | 17.2 | | 15.9 | |

Capital employed | | | | | | | | | | | |

Balance sheet total | | 921.7 | | 736.5 | | 650.1 | | 442.3 | | 347.3 | |

Total long-term capital employed | | 428.9 | | 366.2 | | 346.3 | | 197.9 | | 193.8 | |

Total equity | | 199.2 | | 200.7 | | 188.1 | | 145.4 | | 144.1 | |

Total equity as % of balance sheet total | | 22 | | 27 | | 29 | | 33 | | 41 | |

Interest coverage ratio | | 14 | | 17 | | 17 | | 10 | | 13 | |

Net debt to EBITDA ratio | | 1.0 | | 0.4 | | 0.6 | | (0.1 | ) | 0.1 | |

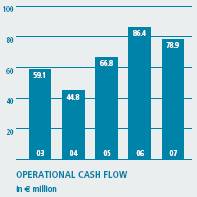

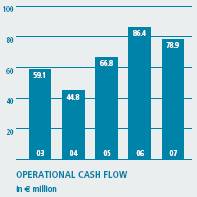

Net cash provided by operating activities | | 78.9 | | 86.4 | | 66.8 | | 44.8 | | 59.1 | |

| | | | | | | | | | | |

Total shares outstanding at December 31 (in thousands) | | 20,167 | | 20,305 | | 20,270 | | 20,299 | | 20,017 | |

| | | | | | | | | | | |

Data per share (in euros) | | | | | | | | | | | |

Net income from operations | | 3.06 | | 2.47 | | 1.65 | | 1.18 | | 1.13 | |

Net income | | 2.70 | | 2.22 | | 1.65 | | 1.10 | | 1.07 | |

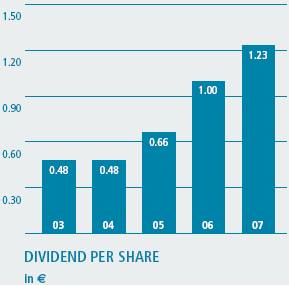

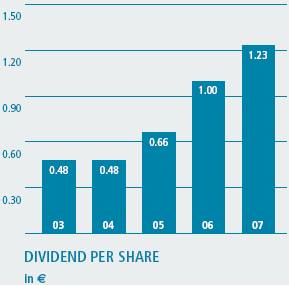

Dividend proposal | | 1.23 | | 1.00 | | 0.66 | | 0.48 | | 0.48 | |

Shareholders’ equity | | 9.09 | | 9.15 | | 8.53 | | 6.61 | | 6.68 | |

Personnel(2) | | | | | | | | | | | |

Average number of contract employees | | 11,304 | | 9,685 | | 9,208 | | 9,419 | | 8,827 | |

Average number of employees total(3) | | 12,408 | | 10,728 | | 10,043 | | 9,972 | | 9,203 | |

Total number of employees at December 31(3) | | 13,391 | | 11,533 | | 10,101 | | 10,474 | | 9,724 | |

(1) Net income excluding amortization and non-recurring items

(2) The headcount includes the total number of employees of proportionally consolidated companies

(3) Including temporary staff

The 2003 financial data are not adjusted to comply with the International Financial Reporting Standards (IFRS).

5

The ARCADIS share

Stock exchange listings

ARCADIS shares are listed at Euronext Amsterdam under the symbol ARCAD. The shares are no longer listed at the NASDAQ Stock Exchange, since the delisting became effective on June 7, 2007. The decision to delist was based on the relatively low trading volume of ARCADIS shares on the NASDAQ and the fact that the costs associated with a NASDAQ listing and the reporting requirements of the U.S. Securities and Exchange Commission outweigh the benefits of such a listing. The Company remains committed to the U.S. market and to U.S. shareholders. After the NASDAQ delisting, U.S. shareholders are able to trade ARCADIS shares in the United States in the over-the-counter (OTC) market under the symbol ARCAY. ARCADIS has offered to cover conversion fees and expenses for a period of 6 months following delisting for those shareholders who decided to convert their shares from New York registry shares to shares that are eligible for trading on the Euronext. As a result of delisting from the NASDAQ, the Company expects the liquidity of share trading in the U.S. to be reduced substantially, allowing for deregistration with the Securities and Exchange Commission on or about June 8, 2008.

On the Euronext Amsterdam exchange, two liquidity providers are active in the ARCADIS share: ABN AMRO Bank and Rabo Securities. As of March 4, 2008, the ARCADIS share is part of the Amsterdam Midkap Index® (AMX) of the Euronext.

Investor Relations

ARCADIS has an active investor relations (IR) policy aimed at keeping existing and potential shareholders well informed about the strategy and recent developments in the Company. ARCADIS follows a quarterly reporting cycle for its financials and, in addition, informs the market through press releases on important developments and positioning project wins. Twice a year, at the presentation of the annual and semiannual results, ARCADIS organizes a financial press conference and an analyst meeting, which are broadcast live over the internet. At the presentation of the first and third quarter results, a conference call is held for financial analysts, also accessible through a live audio link through the ARCADIS website.

6

Annual General Meeting of Shareholders

The Annual General Meeting of Shareholders (GMS) is scheduled for May 7, 2008 at 2:00 p.m. and will be held at the Company headquarters in the Rijntoren building in Arnhem, the Netherlands. The agenda for this meeting will be available on April 7, 2008 upon request from the Company and/or can be found on the Company’s website.

Dividend

It is proposed that the 2007 cash dividend be € 1.23 per share, compared to € 1.00 for 2006. This equals 40% of net income from operations. ARCADIS’ dividend policy is to pay an annual dividend ranging from 30% to 40% of net income from operations.

Historical development of the number of outstanding shares

| | | | Issuance of | | | | | | | |

| | | | new shares | | | | | | At | |

| | | | related to | | | | | | December | |

| | At January 1 | | options | | Repurchase | | Reissuance | | 31 | |

2003 | | 19,996,674 | | 133,703 | | 112,972 | | — | | 20,017,405 | |

2004 | | 20,017,405 | | 215,238 | | 11,900 | | 78,000 | | 20,298,743 | |

2005 | | 20,298,743 | | — | | 332,046 | | 303,239 | | 20,269,936 | |

2006 | | 20,269,936 | | — | | 494,838 | | 529,890 | | 20,304,988 | |

2007 | | 20,304,988 | | — | | 350,000 | | 212,197 | | 20,167,185 | |

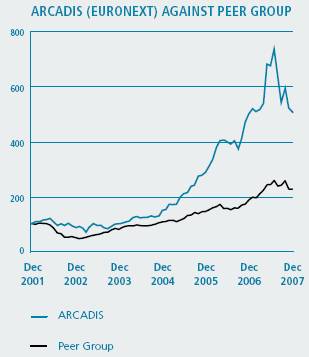

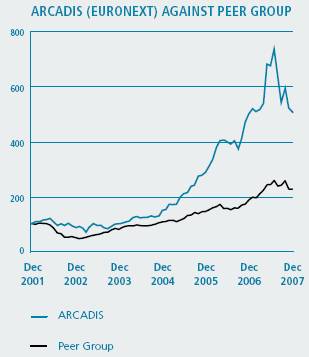

Share price development

On the first trading day of 2007, the share price on the Euronext Amsterdam exchange closed at € 46.81, while at the end of the year, it closed at € 47.30, only a slight increase. In mid-July, the stock price reached an all time high of € 70.00 on the back of strong Company performance and a positive newsflow. After that date, market sentiment turned away from small cap stocks primarily under influence of the subprime crisis. Despite continued solid Company performance and the acquisition of RTKL Inc., ARCADIS stock development was negatively influenced by this subprime effect, probably also as a result of the Company’s exposure to the U.S. market. In 2007, the Amsterdam Smallcap Index (AScX) of which ARCADIS was a part in 2007, decreased 6% during the same period.

7

Closing prices per share on Euronext Amsterdam NV

In € | | High | | Low | | Year-end | |

2003 | | 10.50 | | 6.41 | | 9.34 | |

2004 | | 13.75 | | 9.40 | | 13.70 | |

2005 | | 27.18 | | 13.08 | | 26.80 | |

2006 | | 46.70 | | 26.60 | | 46.70 | |

2007 | | 68.85 | | 42.92 | | 47.30 | |

Liquidity increased further

The liquidity of ARCADIS shares saw a 15% increase. The average daily trading volume on Euronext Amsterdam in 2007 was 69,231 shares, compared to 60,122 shares per day in 2006. In combination with a higher average share price, the total trading volume expressed in euros in 2007 was enough to propel ARCADIS into the Amsterdam Midkap Index®, after having spent only two years in the Amsterdam Smallcap Index (AScX).

Data per share in €

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003(2) | | 2002(2) | | 2001(2) | |

Net income from operations | | 3.06 | | 2.47 | | 1.65 | | 1.18 | | 1.13 | | 1.23 | | 1.14 | |

Net income | | 2.70 | | 2.22 | | 1.65 | | 1.10 | | 1.07 | | 1.23 | | 1.24 | |

Dividend | | 1.23 | (1) | 1.00 | | 0.66 | | 0.48 | | 0.48 | | 0.48 | | 0.44 | |

Shareholder’s equity | | 9.09 | | 9.15 | | 8.53 | | 6.61 | | 6.68 | | 6.64 | | 6.59 | |

(1) Proposed dividend

(2) Not adjusted for IFRS

Peer group

To benchmark its performance, ARCADIS has selected a group of peer companies. This group consists of international, public companies in the consulting and engineering business with activities and a size comparable to ARCADIS. This peer group includes the following companies: Grontmij (Euronext Exchange); Atkins (London Stock Exchange); Pöyry (Helsinki Stock Exchange); TRC Companies (New York Stock Exchange); Tetra Tech (NASDAQ Stock Market); URS Corporation (New York Stock Exchange); Sweco (The Nordic Exchange); Alten (Euronext Paris); WSP (London Stock Exchange).

8

“The total trading volume was enough to propel ARCADIS into the Amsterdam Midkap Index®”

Ownership information

Under the Disclosure of Major Holdings in Listed Companies Act, we received the following notifications of the status of capital interest:

Stichting Lovinklaan | | 20.2% (in the Company register year-end 2007) |

Vereniging KNHM | | 5.2% (in the Company register year-end 2007) |

Fortis NV | | 6.1% (situation end 2007) |

Delta Deelnemingen Fonds | | 5.2% (situation end 2007) |

Reach Capital | | 5.8% (notification 2007) |

Delta Lloyd | | 5.5% (notification 2008) |

Financial calendar 2008 (tentative)

May 7 | | First quarter 2008, conference call and live web cast |

May 7 | | Annual General Meeting of Shareholders |

May 9 | | Ex-dividend quotation |

May 23 | | Dividend payment date |

August 7 | | Second quarter 2008, Press conference, analyst meeting and live web cast |

November 12 | | Third quarter 2008, conference call and live web cast |

9

Position in the market

Clients

ARCADIS works for a broad range of clients from the public and private sectors.

· Infrastructure: numerous government entities, such as municipalities, provinces, states, water boards, national governments or management organizations for railroads and roads. Also work for utility companies, project developers, contractors or other companies and for consortia in public-private partnership (PPP) projects.

· Environment: primarily companies (oil and gas, chemical industry, transportation, etc.), of which many multinationals. Also work for governments at different levels, such as the U.S. Department of Defense.

· Buildings: primarily real estate owners, managers or operators: companies, developers, banks, hotel operators, etc. and semi-public institutions such as hospitals and schools. But also governments, for urban planning or institutional real estate – such as museums or work for governments as regulators.

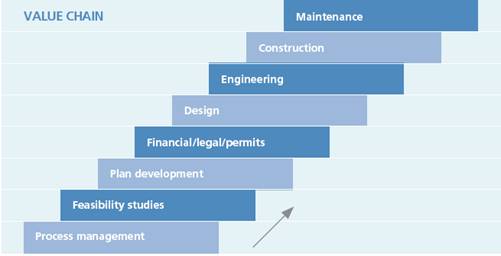

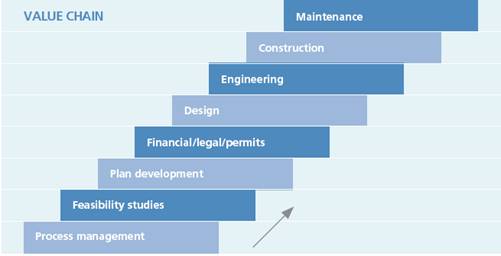

Active in the entire value chain

ARCADIS provides services in the entire value chain: consultancy, planning, design, engineering and management services based on the knowledge and experience of highly educated professionals. The focus lies in providing services with higher added value. The key is an

10

early involvement in projects based on solid client relationships. In the contracting phase of projects, we perform construction management services. In turnkey projects, the execution is primarily outsourced. For the management and maintenance phase, we provide facility management services in which the execution is outsourced.

Competitive position

Many markets in which we operate have a local character. To compete effectively with the many small and larger players, solid client relationships and a thorough knowledge of local conditions are key. That is why ARCADIS wants to belong in local markets to the top five, and in the United States, to the top ten. In most European countries where we operate and in Brazil and Chile, we have a top five position. In the United States, we are currently in the top 20.

In larger projects and in sectors of the environmental and buildings markets, the competition is more international. In environment, ARCADIS is positioned in the global top three, and in environmental services for private-sector firms, we are number one. Only a limited number of companies can internationally deliver environmental services to multinationals. ARCADIS has a similar competitive advantage in the buildings market for international developers or investors.

Top ten in the world*

1 | | | URS | | United States | |

2 | | | AECOM | | United States | |

3 | | | Altran Technologies | | France | |

4 | | | CH2M HILL | | United States | |

5 | | | Atkins | | United Kingdom | |

6 | | | SNC-Lavalin Group | | Canada | |

7 | | | Parsons Corporation | | United States | |

8 | | | Parsons Brinckerhoff | | United States | |

9 | | | ARCADIS | | The Netherlands | |

10 | | | Fugro | | The Netherlands | |

Top three in Europe*

1 | | | Altran Technologies | | France | |

2 | | | Atkins | | United Kingdom | |

3 | | | ARCADIS | | The Netherlands | |

*) Source: Swedish Federation of Consulting Engineers and Architects (STD), November 2007

11

Mission

Our mission as consultants, designers, planners, engineers and project managers is to contribute to the quality of life by creating places of distinction and providing sustainable solutions that improve the built and natural environments and by doing so produce exceptional value for our clients, employees and shareholders.

Profile

ARCADIS is an international company that delivers consulting, architectural design, planning, engineering and management services for infrastructure, environment and buildings. Our proficient and dedicated professionals are focused on improving mobility, enhancing sustainability and raising the quality of life in every project we do around the world. We define our success by both surpassing our clients’ expectations and making a positive, significant and lasting impact on the environments, people and places we touch.

ARCADIS ranks third in Europe and ninth in the world. Because of our home market positions in Europe, the United States and South America we combine a deep knowledge of the local conditions where we work with fresh global perspectives for unique, integrated solutions. From feasibility studies through implementation and maintenance, ARCADIS is all about balance: of the creative and the functional, of possibility and reality, of the local and global, of present needs and future legacy. ARCADIS imagines the results - and re-shapes the future.

12

Brief overview of company activities

At ARCADIS, we divide our services into three distinct segments in an effort to distinguish our lines of business. That said, in today’s complex world, we are increasingly exploring the benefits of working across these segments and across geographies, to improve the human condition by establishing a balance between the natural and built environment.

Infrastructure

High-quality infrastructure provides more than simply railroads, highways, bridges and waterways; it helps to improve mobility, facilitate modes of travel and communication, and generate sources of commerce. ARCADIS provides consultancy, design and construction management for rural and urban infrastructure. Whether we are developing utilities for rail safety, designing tunnels, creating water management systems, or constructing wind energy parks, we operate with one key mission in mind: Create the foundations for healthier places to live and work.

Environment

ARCADIS has long led the industry in environmental services, delivering projects that protect the Earth’s resources while meeting our clients’ economic objectives. Ranging from soil and groundwater contamination investigations to consultancy on corporate energy and waste management issues, our services support environmental policy for companies and governments, reflect environmental impact assessments and uphold environmental management and environmental legislation. Our environmental segment is driven by our corporate mission to leave the Earth better than we found it.

Buildings

ARCADIS approaches the planning, design, development and maintenance of buildings with the understanding that we are providing legacies for our clients. Every office, hospital, residential building, school, museum, stadium and railway station plays a key role in a larger urban design scheme that contributes to quality of life and sends a message about our clients’ mission. We deliver world-class architecture, full-cycle project and program management, cost management and facility management services that create value and help our clients achieve their business objectives. Ultimately, we aim to balance function and aesthetics with environment and social stewardship, creating iconic buildings that withstand the test of time.

13

The Executive Board

From left to right Michiel Jaski - Ben van der Klift - Harrie Noy (Chief Executive Officer) - Friedrich Schneider

14

Introduction

ARCADIS had a magnificent year in 2007, scoring record results, reaching unprecedented organic growth levels and completing a milestone acquisition in our history. We are truly on our way to fulfilling the goal of becoming a global leader in the markets in which we compete.

Gross revenue surpassed € 1.5 billion; net revenue € 1.0 billion and EBITA € 100 million. We did well across the breadth of our activities, scoring double-digit growth in all business lines and regions. We improved margins to a level that exceeds our 10% goal. We capitalized well on favorable market conditions thanks to our strong local network, the synergies created by our entrepreneurial people and our leading positions. We are the pre-eminent provider of environmental services to private industry globally. We have strongly increased our visibility and skills in the water market. And we became a leading global player in architectural design and urban planning through the strategic acquisition of RTKL.

Our goal in recent years has been to be active higher in the value chain and divest businesses that yield insufficient returns. By acquiring companies with better returns and focusing on existing activities with higher added value, we have structurally raised margins.

We are an attractive employer, offering many opportunities to people who are up to a challenge. Our leading professionals do groundbreaking work in some of the world’s most difficult projects: projects that touch the heart of communities, find the right balance between economy and ecology and integrate sustainability in our designs and activities.

ARCADIS has arrived at a breakthrough point. We introduced a revised strategy titled ‘Building Global Leadership’, with the sharpened ambition to reach leading positions in each of the three business lines in which we operate. We raised our overall growth goal to 15%, at least half of which should be generated organically.

We are positive about 2008 as markets offer room for growth. More multinational clients look for international service providers with global solutions – we are ready to help them. Our client-focused approach helps us to continue to gain market share. Our strong environmental capabilities, rail and water design skills, extensive project and program management experience and expertise in architecture and urban planning provide an excellent basis for further expansion of our company.

Growth through acquisitions remains high on the agenda. Our focus is on strengthening our home market positions, aspiring toward a top ten position in the United States and top five positions in other markets, while simultaneously strengthening business lines to fulfill our global ambitions. In addition, we seek to expand in Asia/India which offer strong growth prospects.

We are proud of the achievements of our company in 2007 and share this pride with the 13,000 people who actually produced this success – our employees. We truly value and want to thank them for their contributions, enthusiasm and dedication. That, together with the trust of our clients and shareholders, is the basis for the continued success of our company.

On behalf of the Executive Board,

Harrie L.J. Noy,

Chief Executive Officer

15

Report by the Executive Board

Vision and strategy

The ARCADIS vision

ARCADIS has created one of the strongest transnational firms of professionals who work across segments and geographies to deliver real-life solutions to the complex challenges of today’s infrastructure, environment and buildings. Today, we stand at a crucial point: business is stronger than ever; we have grown rapidly but thoughtfully; and we’re in a position now, more than ever, to truly leverage our knowledge to deliver real value-added services to our clients across the globe.

We are, as ever, steadfastly committed to challenging our clients to think beyond today’s reality and delivering on that promise. At the same time, we never lose sight of the larger responsibility: to the earth, to respond to and improve the human condition, to produce strong and viable cities, to support business and commerce, to serve the world today and well into the future.

The following key elements of ARCADIS’ vision drive our long-term strategy:

Focus on three business lines: infrastructure, environment and buildings. This offers the opportunity to provide clients integrated business solutions through one-stop shopping. A broad range of disciplines with expertise and experience at the international level also allows us to capitalize on new market trends and grow through innovation.

16

Global network based on strong home market positions. Our global network enables us to leverage expertise across the globe and provide services to multinational clients that increasingly are looking for service providers who can deliver services of consistent quality globally. Because client relationships and solid understanding of local conditions are essential in our business, we aim for strong home market positions as the basis for our global network. Our goal is to build these positions in Europe, the United States, South America and Asia and to be ranked in the top five of our industry in the countries in which we are active, except for the United States where the goal is to be in the top ten.

One firm concept. ARCADIS operates as one firm around the globe, with a brand that reflects our mission and is recognizable for quality and reliability. Internal collaboration to meet client demands is part of our culture. By leveraging client relationships and exchanging knowledge, we create synergy that provides maximum benefit to our clients.

Employees are the key to our success. Their capabilities, entrepreneurship, results focus and commitment are the basis for the combination of thinking and acting that distinguishes ARCADIS (Imagine the result). Engaging, coaching and developing employees, therefore, play an important role in our company policy.

Attracting, retaining and developing talented people, together with delivering added value to clients, are the basis for profitable growth. That’s how we create value for shareholders who on that basis want to invest in our company. This is the best guarantee for continuity, which is in the interest of all stakeholders.

“Engaging, coaching and developing employees play an important role in our company policy.”

17

Market trends

Market conditions for ARCADIS are strongly influenced by investments of governments, private-sector corporations and institutions. Although these investments partly depend on economic cycles, in the longer run, our markets offer ample opportunities for growth as demand for our services is increasing.

Societal issues drive demand for our services

ARCADIS’ work involves the physical conditions for human life, the built and natural environments. Issues include:

Quality of life. Quality standards for the human habitat are increasing, with the emphasis on sustainability and livability of the built environment and the quality of nature and landscape.

Mobility is an issue in all countries in which ARCADIS is active. Poor accessibility causes constraints for economic development and is experienced by the public as a serious restriction on freedom of movement. Therefore governments are evaluating ways to accelerate investment programs for roads and public transportation.

Urbanization means investments in residential areas, industrial sites, commercial properties and other facilities. Deteriorated inner city areas need revitalization, requiring large investments in redevelopment programs, including remediation.

Sustainability. This rapidly growing issue for both governments and private-sector companies is about preserving the quality of life for future generations. As a consequence everything has to be evaluated on its potential impact on the environment. This drives growth in the environmental market but also influences our work in infrastructure and buildings (e.g. “green buildings”).

Climate change is going faster and stronger than initially expected and is having serious consequences especially in delta areas where more than 50% of the world’s population lives. This issue will greatly impact our work in all three of our business lines – from determining ways to reduce greenhouse gases to limiting the potential consequences of flood events through water management and flood protection.

18

Water. The lack of clean, safe, potable water leads to a growing demand for water supply and treatment facilities.

In most of these areas, ARCADIS is well positioned to capitalize on the growing demand for services.

Changing client needs create opportunities

ARCADIS works for a broad range of clients, from governments to the private sector. Our clients’ needs are changing and include:

Globalization of industry. International companies increasingly seek service providers who can provide services internationally. Many of these companies have vendor reduction programs in place to limit the number of service providers to safeguard quality standards across their operations and increase efficiency.

Outsourcing and privatization. More and more, companies are focusing on their core business, while non-core functions such as facility management or environmental activities are outsourced. A comparable trend is apparent in government, where the focus shifts to policy making while the implementation is left to companies like ARCADIS.

Private financing of public facilities. To finance the growing need for investments in public facilities, many governments seek private investors to expedite programs, often in the form of PPP. This leads to overall market growth because investments no longer depend solely on government budgets.

Supply-chain integration. Clients are increasingly looking for an integrated seamless construction process: design/build, DBFO - Design, Build, Finance and Operate, or similar approaches. A consortium of private-sector companies develops, designs and builds a project and provides the financing and operations management.

Risk participation. An increasing number of clients are asking us to share in project risks. In these instances, our fee is dependent on our performance. ARCADIS has internal procedures to control the related risks (see page 53 of this report).

Many of these changing client needs are favorable to ARCADIS as more work is outsourced to the market. In addition, we are capable of serving multinational clients internationally; only a limited number of competitors

19

have this capability. New types of contracts require a broad, multidisciplinary service offering and good risk management. ARCADIS is able to leverage the experience with such contracts and gain advantage on competitors.

Strategic positioning

Major shift in portfolio accomplished

In mid-2000, we changed our strategy by introducing value creation for shareholders as an important goal in an effort to improve our long-term position. By focusing on three service areas and on our home markets in Europe and North and South America, we intended to increase growth levels, as well as margins. Since then, approximately € 190 million in gross revenue have been divested, predominantly non-core activities with lower margins, while more than € 650 million in gross revenue have been added through acquisitions of companies providing services with higher added value, higher margins and more growth potential. The revised strategy has paid off. In the period 2003 – 2007, gross revenue has shown a compound average growth rate of more than 15%, while margins improved from 6.0% in 2003 to 10.5% in 2007.

Acquisition of RTKL in 2007 milestone for ARCADIS

In July 2007, we acquired RTKL, one of the world’s leading design and planning firms, with some 1.050 professionals, about $200 million in revenues and offices across the United States, in Europe (London, Madrid) and China (Shanghai). RTKL provides architectural design, master planning and specialized engineering services and has a well-diversified international portfolio of award-winning work across the commercial, health, workplace and civic markets in some 50 countries. RTKL joined ARCADIS to be able to build a global design and planning practice (faster) and to offer their clients an integrated service package.

The company will not be integrated into our existing operations, but will operate separately.

The merger with RTKL fits very well in our strategic goals. It is the next step in expanding the buildings business with high added-value services, which allows us to build a leadership position in this segment and to participate more in large property investments across the world. Together, we offer a full range of services: planning, design, program and cost management, property consulting and specialized engineering, separately or as an integrated package. RTKL’s world class brand, based on consistent quality and high profile projects, will substantially enhance ARCADIS’ reputation and visibility.

20

Strategic positioning improved strongly

As a result of the shift in portfolio and our strong focus, ARCADIS is now positioned as a premier international professional services firm, providing high added-value services with strong growth potential. The acquisition in 2005 of Blasland, Bouck and Lee (BBL) in the United States brought ARCADIS into a leading position in the global environmental market. In the infrastructure market, we have a recognizable position with several specialties at the international level, including water management. In the buildings market, a transition has taken place to services with higher added value, first management services and in 2007, with the acquisition of RTKL, high-level architectural design and planning services.

ARCADIS is positioned in the top five in our industry in many European countries and in Brazil. However, in the United Kingdom and the United States, we have yet to achieve our desired position. In Asia, our position is still modest. We have proven that we are able to generate substantial synergies through internal cooperation. Our name awareness has increased, and we have a solid reputation in the labor market; however, significant progress is still possible in both these areas. Despite major investments in acquisitions, our financial position is healthy with ample room for further expansion.

SWOT analysis shows ARCADIS’ strong position

The SWOT analysis for ARCADIS as a whole is presented below.

Strengths | | Weaknesses |

Home market positions in Europe, the United States and South America | | Limited position in Asia |

| | |

Focus on three business lines with growth potential | | Relatively high fixed costs, labor-intensive services |

| | |

Extensive client list with multinationals Stable cash flow and healthy balance sheet | | Visibility outside the Netherlands |

Opportunities | | Threats |

Synergy based on expertise and client relationships | | Shortage in labor market |

| | |

Climate change and sustainability push demand | | Rapid market decline caused by credit crisis |

| | |

Outsourcing by companies and privatization by governments | | Weakening of U.S. dollar (translation risk) |

| | |

Further expansion through acquisitions | | |

21

2008 – 2011 Strategy :

Building Global Leadership

As we update our strategy every two to three years, a new strategy review process was started during 2007, which culminated in the revised strategy Building Global Leadership. Each of the three markets in which ARCADIS is active was evaluated. With the help of key business staff, market attractiveness of different activities, as well as ARCADIS’ competitive position, was analyzed. This resulted in a revised overall ambition for the company, including adjusted financial goals.

ARCADIS’ overall ambition

ARCADIS aims for a leadership position in its three business lines — Infrastructure, Environment and Buildings. For each business line, a more specific ambition has been developed consistent with the overall company goal. But leadership goes beyond the ambitions for the business lines. It also entails:

Superior growth and profitability. In relative terms, we want to be in the upper quartile of our peer group.

Employer of choice. We can only be leading when we are able to attract and retain the best people. Therefore, we aim to be positioned as employer of choice, with an international and inspiring workplace where innovation and teamwork offer clients the best achievable solutions and where talent is provided optimal opportunities for growth.

Leading in sustainability in the sector. Sustainability is part of our mission and is (therefore) at the heart of our business. Being a leader in this regard not only has a positive impact on our market position, but also helps to attract and retain good people.

Key elements in achieving our ambition

We have identified three key elements for achieving our ambition of being a leading company globally:

Client focus. To deliver services to clients across boundaries, client focus is essential. Through systematic account management, we aim to build long-term relationships with select multinational and key national/local clients who appreciate the value-added services we provide. Cross-selling services and satisfying client’s previously unmet needs will help them realize their goals.

22

“We want the full extent of our knowledge and capabilities to be available to our clients.”

Seamless delivery. Our ability to seamlessly deliver services of consistently high quality in different countries is critical in serving multinational clients and leveraging our expertise across geographies.

One firm based on strong local positions. On the one hand, we need strong local positions to maintain and build relationships with clients; on the other hand, we want the full extent of our knowledge and capabilities to be available to our clients, based on a culture of internal collaboration and resource sharing.

What it takes to realize our goals

For each of the business lines, tailored strategies have been developed to achieve our goals. (More information regarding these strategies is provided in the section on business lines.) In addition, the revised strategy includes:

Continued focus on higher added-value services

This focus has greatly contributed to our improved margins over the past years and will continue, also through the outsourcing or off-shoring of lower added-value activities.

Aligning the organization to meet changed needs

To successfully implement the strategy, the organization will be adjusted by introducing a division-type structure in each of the operating companies, reflecting the three business lines. In the United States and the Netherlands, this has already been completed, and the other countries will follow in 2008. In addition, Global Business Line Teams (GBLT) have been established for each business line, bringing together global leadership and operating company leadership. These teams will drive the global business line strategy. For Environment, coordinating client development and delivering global seamless service will be the focus; for Infrastructure, sharing and developing technical knowledge and expertise for business development; and for Buildings, developing synergies in the business line and further developing a global delivery platform for project management.

Strengthening of supporting processes

People are critical to the successful implementation of our strategy. Therefore, the Human Resource Management function has been enhanced. To facilitate seamless delivery and the one firm concept, knowledge management will be further strengthened, additionally by completing the required IT infrastructure. In addition, initiatives will be developed to create greater brand visibility and recognition, based on

23

sharpening our positioning by including the strength of the RTKL brand. A global sustainability program will be introduced that will confirm our commitment to improving the environment and help differentiate our brand even further.

Acquisitions remain high on the priority list

To achieve our strategic goals, we will continue with acquisitions. Priorities are driven by building and expanding home market positions and by the strategy for each of the business lines. With respect to home markets, we want to further strengthen our position in the United States and the United Kingdom and expand in select European countries, as well as in Asia and India. In Infrastructure, we look for acquisitions to build a stronger position in the United States and to expand in public transportation and water. In Environment, strengthening in Europe and Brazil and adding specialized services are the main goals, while in Buildings, expanding project management services in the United States, France and the Middle East and growing RTKL’s premier design and planning practice are high on the list. We are specifically looking for larger acquisitions to fulfill multiple goals simultaneously.

In addition to strategic fit, reputation of the company and quality of management are important criteria. Financially, we aim for acquisitions that are earnings accretive, have margins compatible with ARCADIS’ goals and are value enhancing with a return on investment of 15% or more.

Financial goals

Growth goal raised to 15%

Given ARCADIS’ improved growth profile as a result of the portfolio change, the attractiveness of market conditions over a longer term and the strength of our market positions, we have increased our growth target for both revenue and earnings per share to 15% (excluding currency impacts).

“We have increased our growth target for both revenue and earnings per share.”

24

This results in the following financial goals for the mid- to long-term (three years):

· Gross revenue: average annual growth of 15% (was 10%), at least half of which is organic.

· Operational margin: at least 10% (was 10%) (EBITA as a percentage of net revenue).

· Earnings per share: average annual growth of 15% (was 10%) (based on net income from operations and present financing structure).

· Return on invested capital of 15% (was 15%). This is net income from operations, excluding interest charges, as a percentage of shareholders’ equity plus net interest-bearing debt, calculated as an average over four quarters.

These goals exclude the impact of currency exchange rate differences. Net income from operations is before amortization and non-recurring items like book gains. Goodwill has been capitalized on the balance sheet since 2001; as of 2004, the figures are based on IFRS.

Reaching our goals also depends on market conditions. Targets for organic growth and margin for each of the business lines are specified in the section on business lines.

Currency risks in the business are generally hedged. Because the currency translation risk has no effect on the business, this risk is not hedged.

Performance in comparison to financial goals

Below are the results of previous years compared to the goals, excluding currency impacts.

In % | | Goal(1) | | 2003(2) | | 2004 | | 2005 | | 2006 | | 2007 | |

Gross revenue | | 15 | | 10 | | 9 | (3) | 10 | | 23 | | 26 | |

- Organic | | 7.5 | | 1 | | 5 | | 5 | | 10 | | 16 | |

- Acquisitions | | 7.5 | | 9 | | 4 | | 5 | | 13 | | 10 | |

Operational margin | | 10 | | 6.0 | | 6.2 | (4) | 8.2 | | 9.4 | | 10.5 | (4) |

Earnings per share | | 15 | | (4 | ) | 9 | | 40 | | 50 | | 28 | |

Return on invested capital | | 15 | | 15.9 | | 17.2 | | 20.6 | | 20.3 | | 20.1 | |

(1) As from 2008

(2) Figures based on NL-GAAP

(3) Excluding book profit on sales

(4) Excluding non-recurring items

25

Results and financing

Excellent performance leads to record year

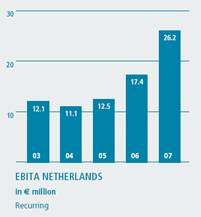

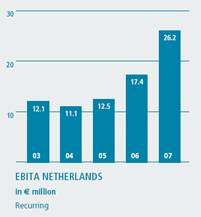

In 2007, ARCADIS continued its excellent performance with another record year. Gross revenue rose 22% to € 1.5 billion. At 16%, organic growth was very strong, demonstrating we successfully capitalized on favorable market conditions. Net income from operations (before amortization and non-operational items) was 25% higher at € 62.3 million. Per share, this is € 3.06 against € 2.47 in 2006. This excellent result is attributable to high organic growth, a continued improvement of margins and a strong contribution from acquisitions. Performance was strong across the board. All three business lines produced increased margins and organic growth well above our targets. Geographically, all regions contributed to the improved profits, with a particularly strong performance in the Netherlands, Brazil and the United States.

Dividend € 1.23 per share

ARCADIS proposes to raise its cash dividend to € 1.23 per share from the € 1.00 per share distributed last year. This represents 40% of net income from operations. The dividend policy is aimed at a payout ratio of 30% to 40% of net income from operations and is designed to provide shareholders with an attractive dividend yield, while providing the Company sufficient resources to finance growth through, among other things, acquisitions.

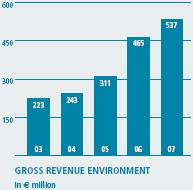

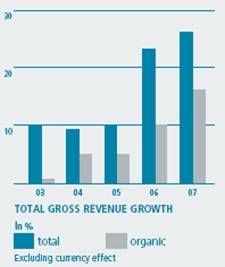

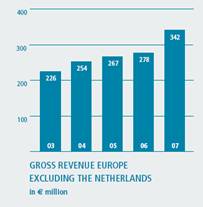

Strong growth in gross revenue

Gross revenue increased 22% to € 1,510 million (2006: € 1,233 million). The 10% acquisition growth was mainly the result of the acquisitions of PinnacleOne and more significantly RTKL, both in the United States, as well as various smaller acquisitions, partially offset by the divestment of

26

Euroconsult. The currency impact was more substantial than in previous years at a negative 4%, primarily the result of a decline in the U.S. dollar. At 16%, organic growth was well above our goal of 5%. Almost all countries showed double-digit organic growth, with the largest contributions coming from the Netherlands, the United States and Brazil.

Net revenue up by 20%

Net revenue, the portion of revenue produced by ARCADIS’ staff, grew by 20% and for the first time surpassed one billion euros: € 1.004 million (2006: € 837 million). On balance, the contribution from acquisitions and divestments was 12%; the currency effect was a negative 3%, while organic growth totaled a very strong 11%. This is lower than the organic growth in gross revenue due to high levels of subcontracting in turnkey hydropower projects in Brazil and in several large remediation contracts in the U.S. environmental market.

Geographical mix relatively stable

Despite the strong growth in the United States, both through acquisitions and organically, the share of total revenue coming from the U.S. only slightly increased because of a substantial negative currency effect of 10%. So on balance, 43% of gross revenue came from U.S. operations (2006: 42%); the Netherlands contributed 25% (2006: 26%); other European countries, 23% (2006: 23%); and Rest of World, 9% (2006: 9%). So, roughly half of revenue was generated in Europe and the other half in the United States and Rest of World (mainly Brazil).

More balanced portfolio

The acquisitions of PinnacleOne and especially RTKL boosted revenue in the buildings business line, which represented 23% of total 2007 sales (2006: 17%). Partially the result of divestments, the relative position of infrastructure declined to 41% (2006: 45%). Strong organic growth in environment was partially offset by the decline in the U.S. dollar, resulting in a total revenue share for environment of 36% (2006: 38%).

Favorable development of cost

Personnel cost increased by 19% to € 693 million (2006: € 581 million), while other operational cost rose 16% to € 185 million (2006: € 160 million). The organic increase of personnel cost and other operational cost totaled 10.4% and 10.8%, respectively. This is lower than the organic growth in net revenue of 11.0%. The difference is the result of productivity and efficiency improvements.

27

“Positive impact from acquisitions on the margin; in the ongoing business the margin also improved.”

Relative decline in depreciation

Depreciation (excluding amortization) rose 15% to € 20.4 million (2006: € 17.7 million) through a combination of strong organic growth and expansion through acquisitions. As a percentage of net revenue, depreciation decreased slightly from 2.1% in 2006 to 2.0% in 2007.

Higher amortization of identifiable intangible assets

Under IFRS, identifiable intangible assets related to acquisitions must be separated from goodwill and amortized separately. For ARCADIS, this primarily relates to the profit included in the backlog of acquired companies. These assets are amortized over their economic lifetime (on average one to two years). In 2007, amortization increased 48% to € 12.2 million (2006: € 8.3 million), mainly because of the acquisition of RTKL.

Strong increase in operating income and EBITA

Operating income increased 35% to € 95.0 million (2006: € 70.5 million). ARCADIS uses EBITA (operating income before amortization) and recurring EBITA (excluding non-operational items) to measure the financial performance of operations. For 2006 and 2007, these measures have been determined as follows:

In € millions | | 2007 | | 2006 | |

Operating income reported | | 95.0 | | 70.5 | |

Amortization | | 12.2 | | 8.3 | |

EBITA | | 107.2 | | 78.8 | |

Book gain from sale of assets | | (1.4 | ) | — | |

U.K. Sharesave plan | | 0.1 | | — | |

Recurring EBITA | | 105.9 | | 78.8 | |

Included from sale of carbon credits | | 2.6 | | 0.6 | |

In France, an office building was sold, resulting in a book gain of € 1.4 million. Since September 2007, our U.K. staff have been able to participate in the employee stock purchase program. Although this program is totally funded by the Lovinklaan Foundation, the U.K.-specific structure of the program requires under IFRS the (imaginary) costs to be taken on the company’s accounts. In recurring EBITA, this has been taken out as a non-operational item.

EBITA increased by 36%. On a recurring basis, the increase was 34%, resulting in a recurring EBITA of € 105.9 million (2006: € 78.8 million). The currency effect was a negative 4%, while acquisitions contributed 20%, considerably higher than the contribution to net revenue (12%).

28

This demonstrates the positive impact of the acquisitions and divestments on the margin. Organically, recurring EBITA increased 18%, also more than net revenue (11%), indicating that the margin also improved in the ongoing business. In EBITA, an amount of € 2.6 million (2006: € 0.6 million) is included related to the sale of carbon credits in Brazil. Excluding the contribution of carbon credits, organic growth in EBITA was 16%.

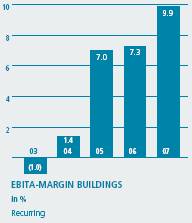

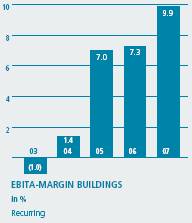

Further improvement of margins

The margin (EBITA as % of net revenue) improved further to 10.7%, on a recurring basis to 10.5% (2006: 9.4%), clearly demonstrating that ARCADIS operates higher in the value chain with activities that create more added value. With the 2007 margin, we have achieved the 10% target that was introduced in 2006. The margin improved in all three business lines, to a level at or above target, driven by higher productivity and efficiency, divestments of low-margin business, and acquisitions of higher margin companies.

Financing charges higher as a result of acquisitions

On balance, financing charges totaled € 8.6 million, € 5.1 million more than the € 3.5 million in 2006. The currency and interest rate risks on loans are (partially) hedged using financial derivatives. This had a negative impact on financing charges of € 0.5 million, while this impact in 2006 was a positive € 1.1 million. Excluding this impact, financing charges increased to € 8.1 million compared to € 4.6 million in 2006, primarily the result of investments in acquisitions. In addition, the 2006 figure was positively impacted by a one-off interest gain of € 0.5 million.

Tax rate increased

The effective tax rate came out to a normal level of 32.8%, compared to the 30.2% in 2006, which was rather low due to one-off impacts. In addition, taxes were higher because of shifts in the geographical distribution of taxable income and the fact that, as of 2007, option costs in the Netherlands are no longer tax deductible.

Negative contribution from associated companies

The loss in associated companies of € 0.8 million, compared to a loss of € 0.5 million in 2006, was the result of a few Brazilian energy projects that experienced start-up problems and delays in contract renewals. These are not expected to be issues in 2008.

Strong increase in minority interest

Minority interest, the part of profits that flows back to the co-owners of the less-than-100%-owned ARCADIS companies, increased strongly to

29

€ 2.6 million (2006: € 1.5 million). This was mainly the result of positive developments in Brazil, where ARCADIS owns 50.01% of ARCADIS Logos shares.

Strong gains in net income and net income from operations

Net income totaled € 54.9 million, or € 2.70 per share, compared to the € 44.9 million, or € 2.22 per share, in 2006. Net income from operations (before amortization and non-operational items) was € 62.3 million, 25% more than the € 50.0 million that was realized in 2006. Per share, this equals € 3.06 compared to € 2.47 in 2006.

Solid cash flow

Net income plus depreciation and amortization totaled € 87 million (2006: € 71 million). As a result of slightly higher working capital needs caused by the strong organic growth and, more importantly, higher tax-related cash outflows, cash flow from operational activities declined slightly to € 79 million (2006: € 86 million).

Investment levels higher as a result of increased acquisition activity Investments in (in)tangible assets (excluding acquisitions) were € 33 million (2006: € 19 million). The increase is mainly the result of investments in Brazilian energy projects and office renovations. Other investments, related to communications and computer equipment and office furniture, increased to facilitate growth. The sale of property in France, the United States and the Netherlands resulted in a cash inflow of € 14 million.

In 2007, the following companies were acquired:

Name | | Country | | Staff | | Gross revenue | | Consolidated as of | |

| | | | | | in € million | | | |

BFB | | The Netherlands | | 65 | | 6 | | January 2007 | |

HL-S | | Germany | | 20 | | 2 | | January 2007 | |

Aeolus | | Belgium | | 30 | | 3 | | April 2007 | |

Alkyon | | The Netherlands | | 45 | | 5 | | July 2007 | |

RTKL | | United States | | 1,050 | | 144 | | July 2007 | |

APS | | United Kingdom | | 70 | | 13 | | Mid-August 2007 | |

Vectra | | United Kingdom | | 110 | | 15 | | Mid-November 2007 | |

Idesol | | Chile | | 70 | | 4 | | Mid-November 2007 | |

Total acquisitions | | | | 1,460 | | 192 | | | |

The background of these acquisitions is discussed in the business line sections. The investments in new acquisitions, the expansion of our interest in some consolidated companies and after-payments for earlier acquisitions

30

totaled € 103 million (after deduction of cash at closing), of which € 18 million represents deferred payments, resulting in a cash outflow of € 85 million. Goodwill acquired amounted to € 85 million and identifiable intangible assets to € 15 million. In addition, € 13 million (2006: € 7 million) was invested in associated companies and other financial non-current assets, which included an investment in a Brazilian hydropower project. The sale of our interest in Euroconsult and some smaller consolidated companies resulted in a cash outflow of € 2 million, while the divestment of non-consolidated entities, including the interest in a Brazilian energy project, resulted in a cash inflow of € 4 million.

Number of shares remains nearly unchanged

The number of outstanding shares remained almost unchanged at 20.2 million (2006: 20.3 million). To cover obligations related to option plans, 350,000 shares were repurchased, while 212,197 previously repurchased shares were used for the exercising of options. No new share capital was issued. The average number of outstanding shares (used to calculate net income per share) was 20.3 million (2006: 20.2 million). For more information on the number of outstanding shares and options and on share purchase plans, please refer to Note 17 of the financial statements.

Balance sheet remains healthy

The balance sheet total rose to € 922 million (2006: € 736 million), the result of organic growth in activities (€ 39 million), acquisitions (€ 176 million) and currency effects (negative € 29 million).

Goodwill increased to € 210 million (2006: € 139 million) as a result of the balance of acquisitions and currency effects. Identifiable intangible assets were € 12 million (2006: € 10 million). As of 2004, goodwill is no longer amortized but subject to an impairment test once a year. In 2007, this test determined that no goodwill loss had occurred, emphasizing the continued value of the cash-generating units.

Despite the strong organic growth, net working capital (work in progress plus accounts receivables minus accounts payable) decreased slightly by € 7 million. As a percentage of gross revenue (measured at the fourth quarter level times four), net working capital again declined from 12.5% in 2006 to 11.9% in 2007.

Cash and cash equivalents totaled € 93 million (€ 2006: € 101 million). Net debt (cash and cash equivalents minus interest-bearing debt) increased to € 134 million (2006: € 45 million), primarily the result of the investments in

31

new acquisitions, which were financed with debt. Interest-bearing debt also includes the after-payment obligations to former shareholders of acquired companies, totaling € 40 million (2006: € 22 million).

At year-end 2007, € 234 million in short-term credit and guarantee facilities was available (2006: € 196 million), of which € 50 million was used. In addition, banks issued project bonds for € 62 million (2006: € 41 million). Long-term debt rose to € 165 million (2006: € 119 million), while short-term debt increased to € 62 million (2006: € 27 million), of which € 27 million was the result of acquisition-related after-payments payable in 2008.

Shareholders’ equity was € 188 million, almost level with the € 189 million at year-end 2006. The table below details the change:

In € million | | Effect | |

Net income over the book-year 2007 | | 54.9 | |

Dividend payment over the book-year 2006 | | (20.4 | ) |

Currency exchange rate differences | | (22.2 | ) |

Exercising of options | | 2.2 | |

Temporary purchase of shares to cover option plan obligations | | (19.8 | ) |

Option costs | | 4.2 | |

Fiscal effects related to options plans | | (0.1 | ) |

Total change | | (1.2 | ) |

The balance sheet ratios remained strong. The net debt to equity ratio at year-end 2007 was 0.7 (2006: 0.2); the net debt to EBITDA ratio was 1.0 (2006: 0.4); and the interest coverage ratio was 14 (2006: 17).

“The balance sheet ratios remained strong with net debt to equity at 0.7 and net debt to EBITDA at 1.0.”

32

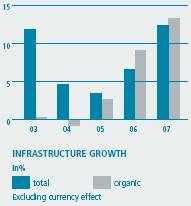

Developments by business line Infrastructure

This business line involves activities for designing the physical living environment. Themes include Living and Working (land development for residential, work and recreational areas, urban and rural planning); Mobility (traffic management, highways, railroads, waterways, bridges and tunnels); Water (water management, water quality and hydraulic engineering) and Energy (hydropower plants, biogas installations). This segment contributed 41% to 2007 revenues (2006: 45%).

Building on local strength with specialties at the international level

The infrastructure market is predominantly a local market with national, regional or local governments as the principal customers, as well as developers, contractors and other companies, such as mining firms or utilities. Understanding local conditions and clients, including their organizations and goals, is critical for success in this market. Therefore, ARCADIS has built strong local positions that allow us to anticipate developments, deliver tailor-made solutions and leverage our global expertise to clients at the local level. Strong local positions also create visibility and brand recognition, which is helpful in marketing and important in attracting high-quality staff. In rail infrastructure, water management and large transportation corridors, including bridges and tunnels, ARCADIS has specialist expertise that can be leveraged internationally.

33

Following is the SWOT analysis for infrastructure:

Strengths | | Weaknesses |

Strong local positions and broad service offering | | Insufficient recognition internationally |

| | |

Specialist in rail, water management and large transportation corridors, including bridges and tunnels | | Reputation in water limited to water management |

Opportunities | | Threats |

Major investments in (public) transportation | | Sudden reductions in government spending |

| | |

Climate change pushes water management in delta areas | | Increasing competition based on price |

| | |

Increase in public-private partnership projects | | |

| | |

Privatization by governments | | |

Recognized global infrastructure player based on local strength

This is the ambition for infrastructure as has been defined in our revised strategy. It means:

• Building leadership positions in rail, water management and large transportation corridors (including bridges and tunnels) by focusing on knowledge exchange and development through our newly established Global Knowledge Networks. The focus for each of these activities is different. For rail, the focus is on the Netherlands, the United Kingdom, France and Poland; for water-related services, on the United States and Europe; and for large transportation corridors, on large, multidisciplinary projects, including design-build or PPP schemes.

• Growing select mining accounts, especially in South America and the United States, by leveraging the relationships we have with major clients.

• Continue expanding our strong home market positions through organic growth, as well as acquisitions.

The goal for organic growth is 6%; the target margin is 8% to 9%.

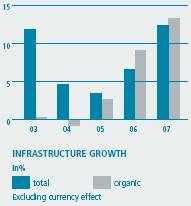

Strong organic growth; margin improved further

Gross revenue grew 10%. The currency impact was a negative 2%. Acquisitions and divestments produced on balance a decline of 1%, due to the divestment of Euroconsult, active in the donor-funded market. At 13%, organic growth increased considerably compared to 2006 (9%). Net revenue growth totaled 9%, organically 9% as well. The lower organic growth in net revenue resulted from high levels of subcontracting, especially caused by turnkey projects in Brazil. The margin rose to 8.8% (2006: 8.4%), mainly from enhanced profitability in the Netherlands.

34

Positioned as a leader in water management

2007 began with an excellent start when the ARCADIS-led joint venture with Bioengineering Group won a contract valued at a maximum of $150 million for flood protection services in New Orleans. Later, a similar contract for a maximum $50 million followed from the same client, the U.S. Army Corps of Engineers. Both contract wins were based on our strong local presence in the United States, combined with our Dutch experience and reputation in water management. In addition, we also won water projects in Florida and Louisiana, as well as California.

As a consequence of climate change, the water management market is expected to grow significantly. The 2007 project wins clearly demonstrate ARCADIS’ leadership position in this market. To further expand our capabilities, we acquired Alkyon, a Netherlands-based specialist in water management, providing high-level consultancy services for coastal and river management, flood protection and harbor and delta development. With Alkyon’s extensive international experience, we are even better positioned to capitalize on the growing demand for water management services.

Strong growth in Dutch infrastructure market

Organic growth was well above 10%, demonstrating that ARCADIS did very well in this market. In rail engineering, we benefited from large investments in upgrading existing railway systems. The government policy favoring a PPP approach for all major infrastructure projects positively impacts the market. In 2007, the consortium with ARCADIS as design and engineering partner was selected as the preferred bidder for the renovation and extension of the Coentunnel, the first big DBFO infrastructure project under the new program (contract value almost € 500 million). Increased outsourcing by the Ministry of Public Works provided us two large framework contracts for consultancy and engineering services.

Market in other European countries improved

After some slowdown in 2006, growth in Belgium was again strong. Market conditions in France remained positive, allowing for stable growth. Although in Germany, public investments in infrastructure are increasing, the market is still highly competitive. In Poland, the delay in project execution is gradually disappearing, resulting in solid revenue growth, while in the Czech Republic, our activities continued to grow.

Mining and energy drive growth in South America

Both in Brazil and Chile, our infrastructure practice did very well. Strong demand for raw materials boosts investments by mining companies and contributes to favorable economic conditions that support government

35

“In many countries there is an urgent need to improve and expand infrastructure.”

infrastructure spending. In Chile, our position was further strengthened with the acquisition of Idesol, active in mining projects, from feasibility studies, conceptual design and engineering to construction management.

In Brazil, we are also involved in the rapidly growing market for energy projects. ARCADIS Logos works on several small and larger hydropower projects, which are usually developed together with other partners based on a DBFO approach. In 2007, construction began on Retiro Baixo, a midsized hydropower project in which ARCADIS Logos holds 25%. After the successful completion of a biogas installation at the Bandeirantes Landfill, a similar project was finished at the São João Landfill, also near São Paulo, and a concession for a third project at the Gramacho Landfill near Rio de Janeiro was won.

Decline in U.S. land development compensated by water and transportation

Our U.S. land development practice suffered severely from the housing market crisis, resulting in a revenue decline of 22%. In the fourth quarter, revenue was down almost 50% compared to a year ago. Meanwhile, capacity has been adjusted to the lower revenue levels. In water and transportation, we grew 10% (combined), resulting in a slight organic growth for our total U.S. infrastructure business.

Outlook

In many countries, there is an urgent need to improve and expand infrastructure, both roads/highways and public transportation. Government investments provide a stable basis in this market, while private financing is used to accelerate infrastructure development programs. In the Netherlands, we expect continued growth on the back of a solid economy, a continuous flow of PPP projects, ongoing investments in rail and road infrastructure, a good municipal market and government outsourcing. Also in other European countries, the outlook is favorable. In Belgium and France, we can benefit from large investments, partly through PPP projects. European funds will continue to positively impact infrastructure investments in Central Europe.

The U.S. land development practice now represents less than 1% of our global revenue, and we expect a continued downward trend, especially on a year-to-year basis. As transportation budgets are allocated for a longer period, that market is expected to be stable. Concerns about climate change will drive the water market, especially in water management. Although growth in Brazil and Chile might be lower compared to the very high levels in 2007, market conditions in these countries are expected to remain positive, allowing for solid growth.

36

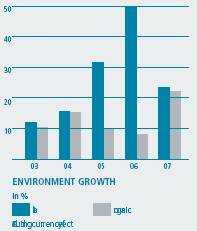

Developments by business line Environment

This business line represents 36% of revenue (2006: 38%) and focuses on sustainability. The largest activity involves the cleanup of legacy issues related to land, air and water pollution. We also assist clients with environmental assessments, site closures and reuse, product stewardship issues, climate change mitigation – including carbon footprint minimization, energy efficiency and renewable energy – and health and safety issues and provide services for noise abatement, solid waste disposal and the preservation of nature and landscape.

ARCADIS has strong positions in environment

A large part of the environmental market involves legacy issues related to soil and groundwater contamination. In that market, ARCADIS is globally positioned in the top 3. In environmental services to private-sector companies, we are the leading company in the world. Our competitive strength is based on our global network, allowing us to serve multinational clients internationally; our advanced, cost-effective remediation technology; our GRiP® program for guaranteed solutions; and our health and safety culture. Our strong client base positions us well to expand our services related to sustainability and climate change.

37

Following is the SWOT analysis for environment:

Strengths | | Weaknesses |

International footprint with home-country strength | | Developing position in Asia and the Middle East |

| | |

Strong client base and client-focused approach | | Gaps in our network where we need to rely on strategic partners |

| | |

Cost-effective remediation technology and GRiP® | | Visibility outside the Netherlands |

| | |

Health and safety culture | | |

Opportunities | | Threats |

Vendor reduction by multinational clients who look for global service providers | | Economic decline: less environmental spending |

| | |

Redevelopment of contaminated industrial sites | | Reduction in environmental spending by the U.S. Department of Defense |

Services related to climate change and sustainability | | |

Global leadership in environment

Our goal is to expand our position as the world’s single leading provider of environmental services to private-sector clients. We plan to achieve this by:

• A clear, relentless focus on multinational and key national clients, who will largely be private-sector clients but will also include important public-sector clients.

• Truly operating as one firm, sharing clients and knowledge across borders while seamlessly delivering an increasing array of services.

• Expanding services especially in strategic environmental consultancy and D4 (Deactivation, Decommissioning, Decontamination, Demolition) services, with a continued investment in our site evaluation and remediation capabilities.

• Strengthening our geographic presence in Europe and Brazil while expanding into Asia.

• Continued development and sharing of innovative technologies.

• Leveraging our strength in Environment into other business lines.

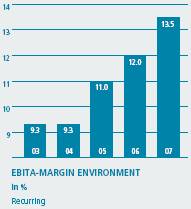

The goal for organic growth is 12%; the target margin is 12% to 13%.

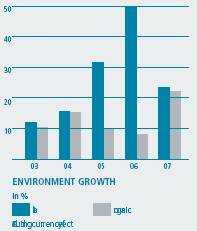

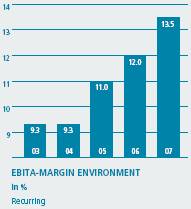

Excellent organic growth; margin increased further

2007 has been a breakout year for our environmental business, with a 22% organic growth. Acquisitions contributed 1%. Offsetting this were negative currency effects of 8%, resulting in gross revenue growth of 16%. Net revenue grew 9%, organically by 14%. The difference between gross and net revenue growth stems from several large U.S. remediation contracts with substantial subcontracting. The strongest performance was in our U.S. operations, with a 23% organic growth. In other parts of the world, organic

38

growth was also positive and especially strong in Poland, the United Kingdom, Brazil and Chile. Margin improved to 13.5% (2006: 12.0%); excluding the impact of carbon credits, the margin was at 12.7% (2006: 11.8%).

Niche acquisitions strengthen our position

Acquisition growth was minimal in 2007 as we focused successfully on integrating the acquisitions of the past several years. Two smaller firms were added: in Belgium, Aeolus, a niche player in environmental impact assessments; and in the United Kingdom, Vectra, a specialist in health, safety, risk management and other environmental consultancy services for clients in the oil, gas and nuclear industries and in transportation.

Multinational client focus pays off

A growing number of companies take environmental issues and corporate stewardship seriously and want to control them at the highest levels in their organizations. Generally, these clients select suppliers who can help them across their operations to meet their long-term goals. Many have vendor reduction programs in place for consistent quality and efficiency gains. With our client-focused approach, we focus on those multinational and key national clients who match our value proposition. This approach has been very successful. In 2007, the growth rate of the 60 global accounts in our Multinational Clients Program was almost 30%.

Gaining market share, especially in the United States

With our 2007 level of organic growth, we are outpacing our competitors and gaining market share, especially in the United States. To integrate BBL within our U.S. organization, we introduced early in 2007 a client-focused business model with a very positive impact on staff utilization and revenue synergy. BBL took advantage of ARCADIS’ advanced remediation technology and cross selling of services in their remedial implementation group, while ARCADIS benefited from BBL’s client-focused process and health and safety culture.

The GRiP® market was tempered by delays in development of complex projects in the private market, while the U.S. Army released few guaranteed cleanup contracts. As a consequence, GRiP® backlog decreased to $230 million (2006: $290 million). Order intake in traditional contracts was strong, but with lower levels of subcontracting. As a result, U.S. backlog in gross revenue remained relatively stable, but backlog in net revenue increased by 16% compared to the end of 2006.

Product stewardship opportunities abound

ARCADIS advises companies about the human health, environmental and sustainability aspects of their products and services, stemming from significant regulatory drivers such as the REACH and GHS programs. Proprietary tools and systems and providing seamless global product stewardship services have enabled us to more than double our revenue in this practice, finishing 2007 with more than 70 staff globally engaged in this service offering.

39

“Climate concerns will further enhance sustainability as important driver in the global environmental market.”

Deal making drives due diligence work

Mergers and acquisitions require assessments of environmental liabilities. In 2007, ARCADIS provided environmental due diligence services to more than 100 clients in 33 countries at approximately 800 locations ranging from chemical plants and refineries to warehouses.

Climate change offers new opportunities

Influenced by the Kyoto Protocol and the internal sustainability programs of our clients, our activities related to assessing carbon footprints and sustainability issues were significant. In Brazil, we are involved in projects that use methane gas from two large landfills near Sao Paulo for power production. More than 80% of the carbon credits from landfill projects in the world come from these two landfills.

Acquisition of LFR further strengthens our position

At the end of January 2008, we acquired LFR Inc., a U.S. environmental firm with more than 480 staff in 34 offices nationwide, producing a 2007 gross revenue of $127 million (net revenue $63 million). Through this acquisition, we establish a more substantial presence in California, a premier environmental market, while adding capabilities in geotechnical services and air pollution. Similarly to BBL, we expect to benefit from cross selling services both nationally and internationally and from operational synergies over time.

Outlook