Exhibit 99.2

| Imagine the result |

Shape the future. Push boundaries. Develop.

A global network of business professionals creating benefits for communities and companies everywhere.

We drive progress by making complexity simple.

We give life to ideas.

Your success is our commitment.

Imagine the result.

ARCADIS NV

Nieuwe Stationsstraat 10, 6811 KS Arnhem, The Netherlands

P.O. Box 33, 6800 LE Arnhem, The Netherlands

Tel +31 26 3778911

Fax +31 26 4438381

E-mail ir@arcadis.nl

Internet www.arcadis-global.com

Chamber of Commerce Arnhem, The Netherlands Trade registry no. 09051284

BTW: NL 0062.93.700.B.01

For other company addresses see page 136 of this report.

Table of contents

2 | | Highlights 2006 |

3 | | Selected financial data |

4 | | The ARCADIS share |

7 | | Position in the market |

8 | | Mission and Profile |

9 | | Brief overview of Company activities |

10 | | Introduction |

14 | | Report by the Executive Board |

14 | | Vision and strategy |

24 | | Results and financing |

32 | | Developments by service area |

32 | | · Infrastructure |

36 | | · Environment |

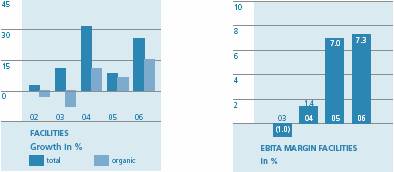

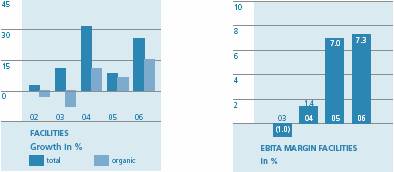

40 | | · Facilities |

44 | | Developments by region |

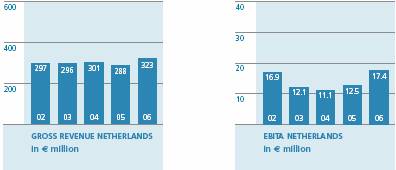

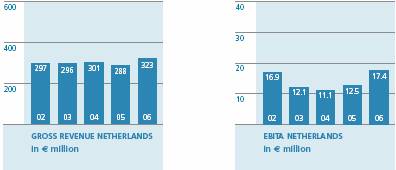

44 | | · The Netherlands |

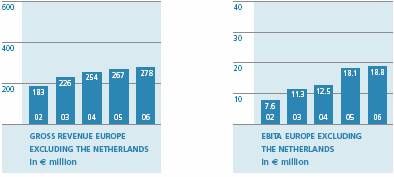

45 | | · Europe excluding the Netherlands |

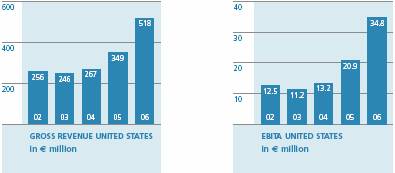

46 | | · United States |

47 | | · Rest of world |

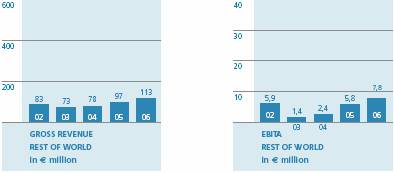

48 | | Human Resources Management |

50 | | Risk management |

52 | | Sustainable business conduct |

57 | | Outlook 2007 |

60 | | Report by the Supervisory Board |

65 | | Supervisory Board |

66 | | Executive Board, Staff Directors and Senior Management Committee |

70 | | Remuneration Report |

78 | | Corporate Governance |

85 | | Financial Statements 2006 |

86 | | Consolidated balance sheet |

87 | | Consolidated statement of income |

88 | | Consolidated cash flow statement |

89 | | Consolidated statement of changes in equity |

90 | | Valuation principles |

97 | | Notes to the consolidated financial statements |

98 | | Notes to the consolidated balance sheet |

116 | | Notes to the consolidated statement of income |

122 | | Company balance sheet |

123 | | Company statement of income |

123 | | Notes to the Company balance sheet |

128 | | Notes to the Company statement of income |

131 | | Other information |

132 | | Auditor’s report |

133 | | Other financial data |

134 | | Ten-year summary |

136 | | Company addresses |

137 | | Geographical spread / Organization structure |

139 | | Glossary |

This is a true and correct translation of the Dutch Annual Report 2006 of ARCADIS NV. If different interpretations regarding the contents arise, the Dutch version will prevail.

Safe Harbor Provision

Except for the historical information contained herein, the statements in this report are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to differ materially from forecasted results. Those risks include, among others, risks associated with possible changes in environmental legislation, changes in investment flow for infrastructure, changes in the investment climate for buildings, and more generally, risks related to the Company’s ability to acquire and execute projects. These and other risks are described in this annual report on page 50 and in ARCADIS’ filings with the Securities and Exchange Commission (SEC) over the last 12 months, copies of which are available from the SEC, upon request from the Company, or on the Company’s website.

1

Highlights 2006

Highlights 2006

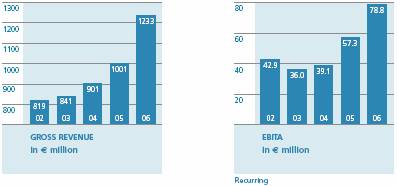

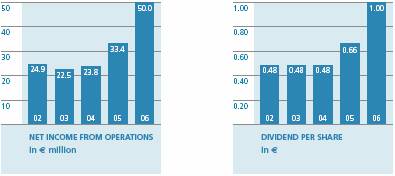

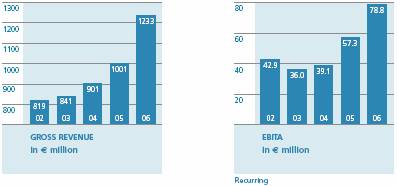

Net income from operations _50% higher (before amortization and non-recurring items)

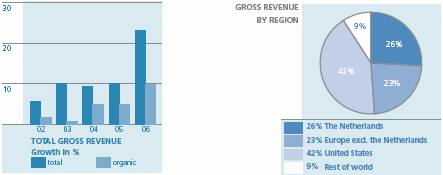

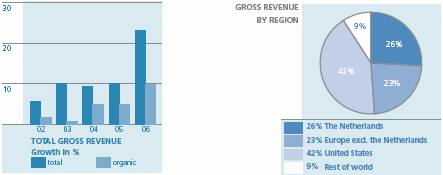

Gross revenue_rose 23% to € 1.2 billion

Organic growth_at 10%, double our goal

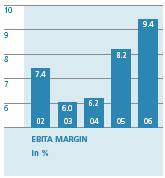

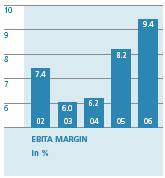

Margin improves further_to 9.4%, taking us an important step closer to our new goal of 10%

Solid contribution from acquisitions_BBL and AYH acquired in 2005 contribute strongly to profit increase

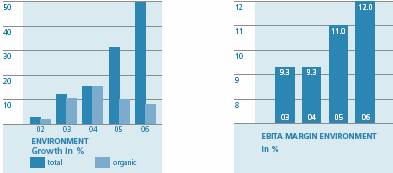

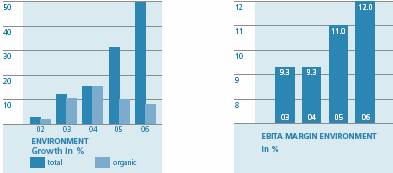

Environment main growth market_with a growth of 50%, of which 8% was organic, mainly from the United States

Infrastructure organic growth to 9%_the result of market recovery in the Netherlands and continued growth in the United States and Brazil

New initiative in facilities_the launch of ARCADIS’ Worldwide Project Consulting, aimed at international real estate investors

Dutch market shows strong recovery_which, combined with earlier restructurings, leads to strong profit improvement

Integration of BBL is progressing well_cooperation is yielding more synergy than expected

Six new acquisitions_add over € 50 million in revenue and strengthen our portfolio and position in home markets

Control framework for financial reporting improved_related to the American Sarbanes-Oxley Act.

2

Selected financial data

Selected financial data

Revenue | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

Gross revenue | | 1,233 | | 1,001 | | 901 | | 841 | | 819 | |

Net revenue | | 837 | | 703 | | 633 | | 595 | | 578 | |

Operating results | | | | | | | | | | | |

EBITA | | 78.8 | | 60.4 | | 35.9 | | 36.0 | | 42.9 | |

EBITA recurring | | 78.8 | | 57.3 | | 39.1 | | 36.0 | | 42.9 | |

Operating income | | 70.5 | | 54.4 | | 35.5 | | 34.9 | | 42.7 | |

Associates | | (0.5 | ) | 1.4 | | 2.4 | | 2.6 | | 0.7 | |

Net income from operations(1) | | 50.0 | | 33.4 | | 23.8 | | 22.5 | | 24.9 | |

Net income | | 44.9 | | 33.4 | | 22.2 | | 21.4 | | 24.7 | |

Return on average invested capital | | 20.3 | % | 20.6 | % | 17.2 | % | 15.9 | % | 18.8 | % |

Capital employed | | | | | | | | | | | |

Balance sheet total | | 736.5 | | 650.1 | | 442.3 | | 347.3 | | 343.8 | |

Total long-term capital employed | | 366.2 | | 346.3 | | 197.9 | | 193.8 | | 182.9 | |

Total equity | | 200.7 | | 188.1 | | 145.4 | | 144.1 | | 141.8 | |

Total equity as % of balance sheet total | | 27 | % | 29 | % | 33 | % | 41 | % | 41 | % |

Interest coverage ratio | | 17 | | 17 | | 10 | | 13 | | 19 | |

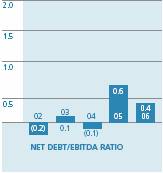

Net debt to EBITDA ratio | | 0.4 | | 0.6 | | (0.1 | ) | 0.1 | | (0.2 | ) |

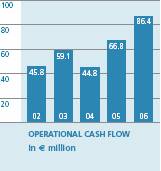

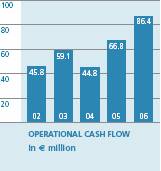

Net cash provided by operating activities | | 86.4 | | 66.8 | | 44.8 | | 59.1 | | 45.8 | |

| | | | | | | | | | | |

Total shares outstanding at December 31 (in thousands) | | 20,234 | | 20,270 | | 20,299 | | 20,017 | | 19,997 | |

| | | | | | | | | | | |

Data per share of € 0.05 (in euros) | | | | | | | | | | | |

Net income from operations | | 2.47 | | 1.65 | | 1.18 | | 1.13 | | 1.23 | |

Net income | | 2.22 | | 1.65 | | 1.10 | | 1.07 | | 1.23 | |

Dividend proposal | | 1.00 | | 0.66 | | 0.48 | | 0.48 | | 0.48 | |

Shareholders’ equity | | 9.34 | | 8.53 | | 6.61 | | 6.68 | | 6.64 | |

Personnel(2) | | | | | | | | | | | |

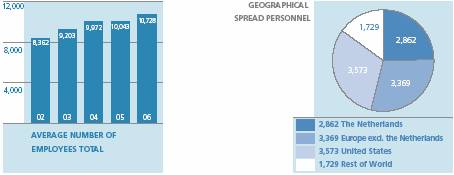

Average number of contract employees | | 9,685 | | 9,208 | | 9,419 | | 8,827 | | 8,020 | |

Average number of employees total | | 10,728 | | 10,043 | | 9,972 | | 9,203 | | 8,362 | |

Total number of employees at December 31 | | 11,533 | | 10,101 | | 10,474 | | 9,724 | | 8,704 | |

(1) Net income excluding amortization and non-recurring items

(2) The headcount includes the total number of employees of proportionally consolidated companies

Amounts in millions of euros unless otherwise stated

The 2003 and prior financial data are not adjusted to comply with the International Financial Reporting Standards (IFRS).

3

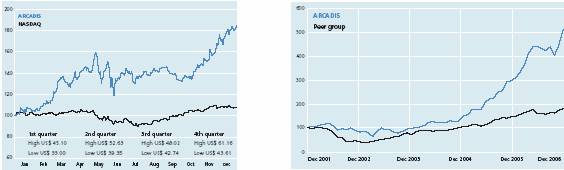

The ARCADIS share

The ARCADIS share

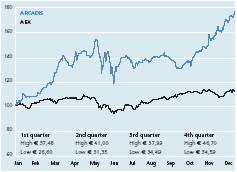

Stock exchange listings

ARCADIS shares are listed on the Euronext Amsterdam under the symbol ARCAD and on the U.S. NASDAQ Stock Market currently under the symbol ARCAF (in 2007, the symbol will be changed to ARCA). On the Euronext Amsterdam exchange, two liquidity providers are active in the ARCADIS share: ABN AMRO Bank and Rabo Securities. Since 2006, the ARCADIS share has been part of the Amsterdam Small Cap Index (AScX) of Euronext.

An active Investor Relations policy

ARCADIS has an active investor relations (IR) policy aimed at keeping existing and potential shareholders – institutional as well as private – well informed about the strategy and recent developments in the Company. ARCADIS follows a quarterly reporting cycle for its financials and, in addition, informs the market through press releases on important developments and positioning project wins. Twice a year, at the presentation of the annual and semi-annual results, ARCADIS organizes a financial press conference and an analyst meeting, which are broadcast live over the internet. At the presentation of the first and third quarter results, a conference call is held for financial analysts, also accessible through a live audio webcast.

Recognition for financial communication

Investors (private as well as institutional), financial analysts and representatives of the financial media are positive about ARCADIS’ IR work according to a study conducted by the independent research firm Rematch. ARCADIS was chosen for the fifth consecutive time as the second best small-cap firm for delivering IR programs. The Company was also – for the second consecutive year – nominated for the prestigious Sijthoff award for financial reporting. The ARCADIS website was evaluated for this award by Jungle Rating. Of the fifty stock exchange-listed company websites evaluated, ARCADIS was the best small-cap firm, scoring higher than a considerable number of AEX index firms and all the mid-cap companies.

Historical development of the number of outstanding shares of ARCADIS

| | | | Issuance | | | | | | | | | |

| | | | of new shares | | Stock | | | | | | | |

| | At | | related to | | purchase | | | | | | At | |

| | January 1 | | options | | plans | | Repurchase | | Reissuance | | December 31 | |

2002 | | 20,284,441 | | 7,993 | | 4,240 | | 300,000 | | — | | 19,996,674 | |

2003 | | 19,996,674 | | 133,703 | | — | | 112,972 | | — | | 20,017,405 | |

2004 | | 20,017,405 | | 215,238 | | — | | 11,900 | | 78,000 | | 20,298,743 | |

2005 | | 20,298,743 | | — | | — | | 332,046 | | 303,239 | | 20,269,936 | |

2006 | | 20,269,936 | | — | | — | | 494,838 | | 529,890 | | 20,304,988 | |

4

Annual General Meeting of Shareholders

The Annual General Meeting of Shareholders is scheduled for May 16, 2007 at 2:00 p.m. and will be held at the Company headquarters in the Rijntoren building in Arnhem, the Netherlands. The agenda for this meeting will be available on April 16, 2007 upon request from the Company and/or can be found on the Company’s website.

Dividend

It is proposed that the 2006 cash dividend be € 1.00 per share, compared to € 0.66 for 2005. This equals more than 40% of net income from operations. ARCADIS’ dividend policy is to recommend payment of an annual dividend ranging from 30% to 40% of net income from operations.

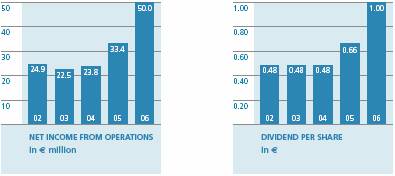

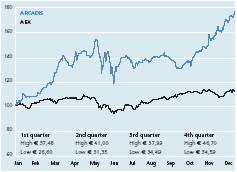

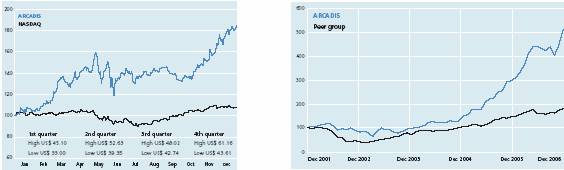

Share price development

On the first trading day of 2006, the share price on the Euronext was € 26.80, while the year closed at € 46.70, an increase of 74%. In 2006, the Dutch AEX index increased 13%.

In 2006, the ARCADIS share opened on the NASDAQ at a price of $31.600 and closed year-end 2006 at $61.160, an increase of 94%. On the NASDAQ, the index rose 10% in 2006.

Price per share on Euronext

In € | | High | | Low | | Close | |

2002 | | 11.19 | | 7.94 | | 7.94 | |

2003 | | 10.50 | | 6.41 | | 9.34 | |

2004 | | 13.75 | | 9.40 | | 13.70 | |

2005 | | 27.18 | | 13.08 | | 26.80 | |

2006 | | 46.70 | | 26.60 | | 46.70 | |

Price per share on NASDAQ

In US$ | | High | | Low | | Close | |

2002 | | 10.350 | | 8.000 | | 8.380 | |

2003 | | 12.600 | | 7.000 | | 11.800 | |

2004 | | 18.700 | | 11.650 | | 18.418 | |

2005 | | 32.300 | | 16.780 | | 31.600 | |

2006 | | 61.160 | | 33.000 | | 61.160 | |

Liquidity

The liquidity of ARCADIS shares saw a further improvement in 2006, making the share profile more attractive for institutional investors. The average daily trading volume on the Euronext in 2006 was 60,122 shares, almost double the volume of 31,395 shares per day in 2005. On the NASDAQ, liquidity in the average daily volume in ARCADIS shares in 2006 was 4,683, compared to an average 7,300 shares per day in 2005.

Data per share in €

| | 2006 | | 2005 | | 2004 | | 2003(2) | | 2002(2) | | 2001(2) | |

Net income from operations | | 2.47 | | 1.65 | | 1.18 | | 1.13 | | 1.23 | | 1.14 | |

Net income | | 2.22 | | 1.65 | | 1.10 | | 1.07 | | 1.23 | | 1.24 | |

Dividend | | 1.00 | (1) | 0.66 | | 0.48 | | 0.48 | | 0.48 | | 0.44 | |

Shareholder’s equity | | 9.34 | | 8.53 | | 6.61 | | 6.68 | | 6.64 | | 6.59 | |

(1) Proposed dividend

(2) Not adjusted for IFRS

5

Peer group

To benchmark its performance, ARCADIS has selected a group of peer companies. This group consists of international, public companies in the consulting and engineering business with activities and a size comparable to ARCADIS. This peer group includes the following companies:

Grontmij, Euronext Exchange; Atkins, London Stock Exchange; Pöyry, Helsinki Stock Exchange; TRC Companies, New York Stock Exchange; Tetra Tech, NASDAQ Stock Market; URS Corporation, New York Stock Exchange; Sweco, The Nordic Exchange; Alten, Euronext Paris; WSP, London Stock Exchange.

Ownership information

Under the Disclosure of Major Holdings in Listed Companies Act, we received the following notifications of the status of capital interest:

· Stichting Lovinklaan 20.2% (in the Company register year-end 2006)

· Vereniging KNHM 5.2% (in the Company register year-end 2006)

· Fortis NV 6.1% (situation end 2006)

· Delta Deelnemingen Fonds 5.3% (situation end 2006)

Financial calendar (tentative)

May 8, 2007_First quarter 2007, Conference call-live webcast

May 16, 2007_Annual General Meeting of Shareholders

May 18, 2007_Ex-dividend quotation

May 30, 2007_Dividend payment date

August 8, 2007_Second quarter 2007, Press conference (morning), Financial analyst meeting (afternoon)-both live webcast

November 15, 2007_Third quarter 2007, Conference call-live webcast

Contact information

For general information about ARCADIS, please visit our website. Or you may call or email Investor Relations:

Joost Slooten, phone: +31 26 377 8604; email: j.slooten@arcadis.nl

after business hours +31 6 27061880 (also press contact);

Evelien Hamelink, phone: +31 26 377 8337; email: e.a.hamelink@arcadis.nl

Registrar and common stock transfer agent

Euronext Amsterdam: ABN AMRO Bank, Amsterdam, the Netherlands

NASDAQ Stock Market: Bank of New York; New York, New York; United States

6

Position in the market

Top ten in the world

1 | | URS | | United States |

2 | | Atkins | | United Kingdom |

3 | | AECOM | | United States |

4 | | Jacobs | | United States |

5 | | Fluor | | United States |

6 | | CH2M HILL | | United States |

7 | | Fugro | | The Netherlands |

8 | | ARCADIS | | The Netherlands |

9 | | Tetra Tech | | United States |

10 | | Parsons | | United States |

Top three in Europe

1 | | Atkins | | United Kingdom |

2 | | Fugro | | The Netherlands |

3 | | ARCADIS | | The Netherlands |

Position in the market

Clients

ARCADIS works for a broad range of clients from the public and private sectors.

Infrastructure market: numerous government entities, such as municipalities, provinces, states, water boards, national governments or (privatized) managers of infrastructure such as railroad and road management administrations. Also includes work for utility companies, project developers, contractors or other companies and consortia in Public-Private Partnership projects.

Environmental market: primarily companies (oil and gas, chemical industry, transportation, etc.), many multinationals. Also includes work for governments at different levels, such as the U.S. Department of Defense.

Facilities market: primarily real estate owners, managers or operators of: companies, developers, banks, hotel operators, etc. and semi-public institutions such as hospitals and schools. Also includes work for governments as owners or regulators of real estate.

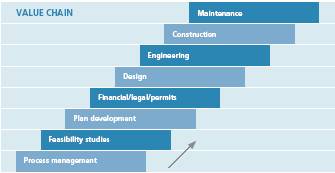

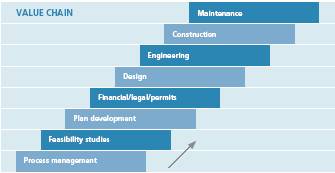

Active in the entire value chain

ARCADIS provides services in the entire value chain. Services include consultancy, engineering and management services based on the knowledge and experience of highly educated professionals. The focus lies in providing services with higher added value. The key is an early involvement in projects based on solid client relationships. In the contracting phase of projects, we perform construction management services. In turnkey projects, the execution is primarily outsourced to third parties. For the management and maintenance phase, we provide facility management services in which the execution is outsourced.

Competitive position

An important element of the markets in which we operate is the local character. To compete effectively with the many small and larger players in these markets, solid client relationships and a thorough knowledge of local conditions are essential. That is why ARCADIS strives to belong to the top five in local markets, and in the United States to the top ten. In most European countries where we are active and in Brazil and Chile, we have a top ten position. In the United States, we are currently in the top 20.

In larger projects and in sectors of the environmental and facilities markets, the competition is more international in nature. In the environmental market, ARCADIS is positioned in the global top three, and in environmental services for private-sector firms, we are number one. The number of companies that can deliver environmental services for multinationals is limited. ARCADIS has a similar advantage when it comes to the facilities market for international real estate investors.

Globally, ARCADIS is positioned in the top ten, and in Europe, in the top three in our field.

7

Mission and Profile

Mission

We strive to contribute to the sustainable quality of the built and natural environments and, in the process, create value for our clients, employees and shareholders.

Profile

ARCADIS is an international company that delivers consulting, engineering and project management services for infrastructure, environment and facilities. Focused on mobility, sustainability and quality of life. Companies and governments benefit daily from the proficiency, professionalism and dedication of our people. We are committed to their success.

We understand the challenges of our clients, and we truly deliver value. We do this through feasibility studies, consultancy, design, engineering, project and process management, implementation and maintenance. We have strong home market positions in Europe, the United States and South America and a close-knit network of offices. This local presence, combined with specialist expertise and international experience, enables us to offer tailormade integrated solutions. Creative yet practical and feasible solutions. Think and act. We have a clear vision of developments in society and work with our clients to redefine the realities of today. To be prepared for the future. ARCADIS looks ahead. Imagines. Develops. Delivers results.

8

Brief overview of Company activities

Brief overview of Company activities

Infrastructure_ARCADIS improves mobility. Consults, designs and manages the construction of infrastructure: railroads, highways, airports, harbors, waterways, dikes and retention ponds. In rail: utilities for safety, signaling, communications and energy supply. Specialist in bridges and tunnels. In small power plants, wind energy and hydropower plants. For municipalities: industrial parks and residential areas, renovation and restoration programs. In rural areas: water management, landscape reconstruction and recreational projects.

Environment_ARCADIS is a world leader in environmental services. Consults on environmental policy for companies and governments, conducts environmental impact assessments and supports in environmental management and legislation. Investigates soil and groundwater contamination, develops cost-effective remedial solutions and completes these remediation projects. Advises corporations on waste management issues and on the reduction of energy and water usage. Activities in the area of waste management, ecology and nature development.

Facilities_ARCADIS develops and maintains buildings. Offices, stores and commercial properties. Also hospitals, schools, museums, prisons, stadiums or railway stations. Alleviating our client’s worries through excellent project and program management, from identifying requirements through the final operational phase. Cost management: providing services that create value and help clients achieve their business objectives of staying within budget cost-effectively. Complete facility management: providing our clients with more time to focus on their core activities.

9

Introduction

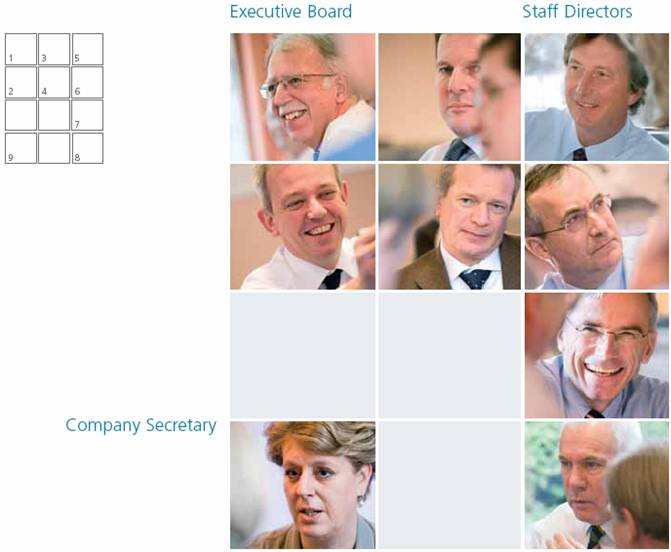

Executive Board_Harrie Noy-CEO, Ben van der Klift-CFO, Friedrich Schneider, Michiel Jaski (from left to right)

10

Introduction

ARCADIS again has had an excellent year, with results to be proud of. Net income from operations rose 50% to record levels. Organic growth at 10% was twice the level of our goal. Margins improved to 9.4%, taking a major step toward our goal of 10%.

A solid performance was realized across the board. In all service areas, growth was at or above our goal, while margins improved. Geographically, the United States, the Netherlands and the United Kingdom were the primary contributors to the increased profit. BBL and AYH, acquired in 2005, performed beyond expectations. With BBL, we achieved a great deal of revenue synergy. AYH initiated the ARCADIS Worldwide Project Consulting effort to service international real estate investors and users.

The striking results demonstrate the success of our strategy aimed at activities with higher added value and more growth potential. Leveraging internal cooperation and synergy to capitalize on market opportunities gives us a competitive edge, as was demonstrated with the award of a $150 million framework contract for water management in New Orleans, won through the combination of our strong U.S. presence and our Dutch water expertise.

The portfolio changes in recent years have improved ARCADIS’ position. We are now market leader in the global environmental market for private-sector firms. In infrastructure, we have strong local positions and rail, bridges, tunnels and water expertise at the international level. In facilities we made a transition to services higher in the value chain.

ARCADIS is stronger than ever. The outlook for 2007 continues to be positive. We will continue on the selected course. The market offers plenty of opportunities. Awareness of sustainability and the environment is rapidly growing. Climate change requires top level water management expertise. Private funding for PPP increases the speed with which infrastructure problems are solved. Investments in facilities grow as a result of the favorable economy. An increasing number of internationally active clients want service providers who are active in multiple countries and provide a consistent level of quality.

Organic growth remains an important priority. We achieve this by strengthening our client focus and through internal cooperation aimed at providing added value to our clients. In addition, acquisitions are high on the priority list again. Here we focus on strengthening in the United States and the United Kingdom, expanding our presence in Asia and adding services higher in the value chain. Our goal is to be a unified company with a leading global position, a preferred supplier for multinationals, an employer of choice for talented employees, an attractive brand, and a top performer.

These goals can only be achieved through the drive and entrepreneurship of our employees. We greatly appreciate their dedication, and the enthusiasm with which they deliver their contribution. That, together with the trust of our clients and shareholders, determines the success of our company.

On behalf of the Executive Board,

Harrie L.J. Noy, Chief Executive Officer

11

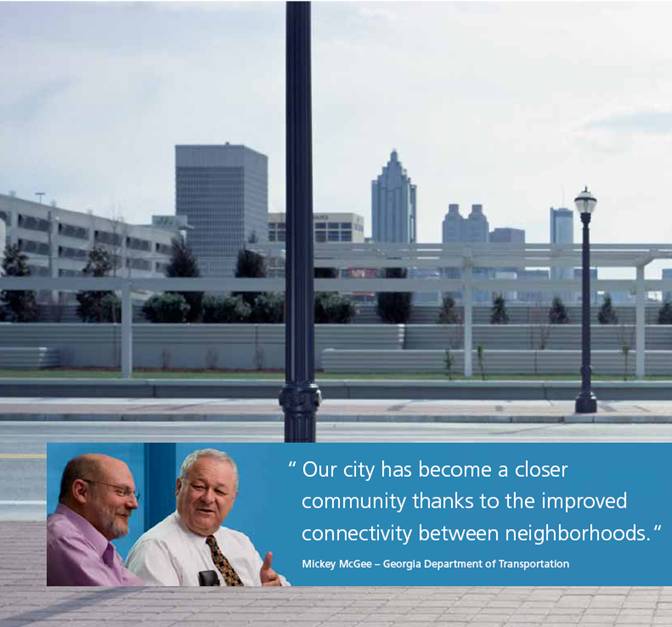

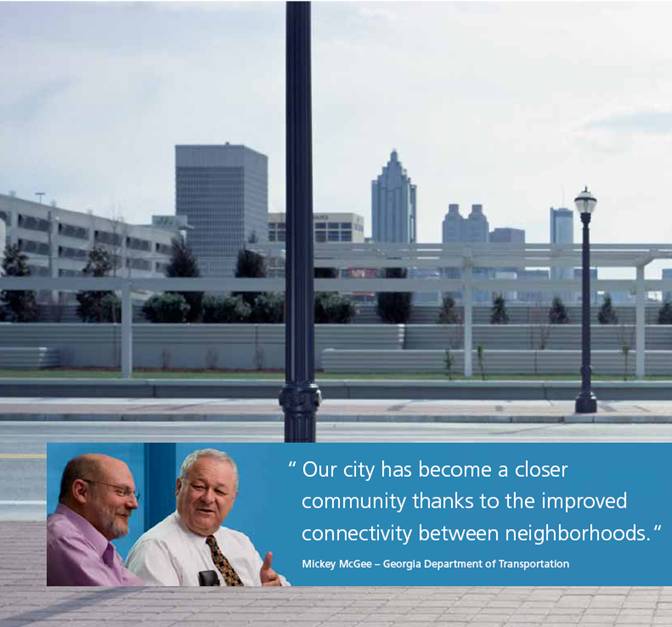

ARCADIS was honored with a design award for the Atlanta 5th Street Bridge replacement project. The project was recognized for its outstanding bridge and structural design. It was the first design-build project led by Georgia Department of Transportation in the Atlanta metro area.

12

Connectivity

Connectivity – Many cities face similar problems. Highways cut through the urban landscape, isolating neighborhoods. The city becomes a collection of small towns. Here, connectivity is the key. Reconnecting communities to the center. Providing easier and better access. Making urban life more attractive.

Mickey McGee (l) – Metropolitan Atlanta District Construction Engineer - Georgia Department of Transportation

Frank Danchetz (r) – Business Practice Director, Transportation Design - ARCADIS

McGee – The 5th Street Bridge in Atlanta is about as wide as it is long and reconnects neighborhoods that were once isolated from downtown Atlanta.

Danchetz – The bridge provides a vital link between the main Georgia Tech campus on the west side of I-75/85 and Technology Square in midtown Atlanta. It features cars and trolley lanes and also wider pedestrian sidewalks and green amenities for student activities.

McGee – The elevated park makes the freeway less obvious as it blocks the view of and reduces the noise from the highway traffic below. It really contributes to the aesthetics of the setting.

Danchetz – What’s more, the bridge improves connectivity and reduces traffic congestion as it encourages more pedestrians to walk between the central campus and Technology Square. Additionally, a trolley runs between Midtown and the campus every five minutes.

McGee – The bridge has transformed Midtown into a dynamic live-learn-work-play community. Projects like these pave the way to transform Atlanta and reconnect neighborhoods into a community setting.

13

Report by the Executive Board

Report by the Executive Board_Vision and strategy

The ARCADIS vision

Push boundaries. Innovate. Deliver consistent quality. With a focus on client needs. To help them realize their goals. With a feel for local conditions and a clear vision for the future. Proactive and engaged. Proposing sustainable solutions. In infrastructure, environment and facilities. That is ARCADIS’ ambition. Doing business for the world of tomorrow. By offering services that contribute to the quality of the human habitat. Project management, consulting and engineering services. For companies and governments. Worldwide.

Following are the key elements of ARCADIS’ vision:

Client focus We work hard to understand our clients’ goals and provide solutions that help them realize those goals.

Strong home market positions ARCADIS ‘lives’ from the trust that clients have in the quality of our services. Maintaining close client relationships and adeptness in understanding local conditions are essential. This requires strong home market positions and close-knit office networks in the countries in which we are active.

Multinational clients These clients have an increasing need for service providers such as ARCADIS who can deliver services of consistent quality in a multitude of countries. Our international presence eminently qualifies us to fulfill this need.

One-stop shopping Clients want integrated total business solutions for their problems. By offering a broad range of services with specialist expertise and experience at the international level, we can provide clients unique integrated solutions.

One firm concept ARCADIS operates as one firm around the globe. This makes us recognizable to clients everywhere. Internal synergy and cooperation are important priorities that allow us to offer our clients nothing but the best.

Employees are the key to our success Their knowledge, entrepreneurship, results focus and involvement are the basis for the combination of thinking and acting that distinguishes ARCADIS (Imagine the result). Coaching and developing employees therefore plays an important role in company policy.

14

Market trends

Market conditions for ARCADIS are strongly influenced by the investments of governments and corporations. These investments in part depend on economic cycles. But in the longer run, demand for our services is increasing, and our markets offer clear growth opportunities. This results from current themes in society, as well as changes in client needs.

WuGuang PDL Company in China

Fast and safe connections

China is investing heavily in rail infrastructure through an expansion program that envisions about 7,456 miles of high-speed rail lines. ARCADIS is assisting China on one of its first high-speed railway lines between Wuhan and Guangzhou by providing construction management and quality control during the construction of a 155-mile section of the high-speed railway line to ensure that the rail line meets international standards.

15

Municipality of Enschede in the Netherlands

Revitalizing communities sustainably

With its small green courtyards, Pathmos in Enschede is a typical example of a 1920s garden neighborhood. Over the years, however, it has deteriorated and the area has become one of increased social conflicts. In 2001, revitalization of the neighborhood began. From the onset, ARCADIS – as a consultant to the municipality and the housing corporation – has been involved with the revitalization and been the point of contact for residents. Working closely with the residents, public areas were developed with a focus on improving the living environment. A school with a nursery, bathhouse and cultural center was completed around a major square. Lighting and green amenities such as the restoration of a pond and rose garden in the central park were given special attention. Through recycling of old material and sustainable water management, the redevelopment was completed in a responsible way. Residents are extremely pleased with the improvements, and for the first time in years, there is a waiting list for rental houses in the quarter.

Current themes in society

ARCADIS’ work involves the design and realization of the natural and built environment. Therefore, current themes in society have a large impact on the demand for our services. Themes include:

Quality of life Demand for high-quality human habitat is on the rise. The emphasis lies on the sustainability and liveability of the built environment and the quality of nature and rural areas.

Mobility In many countries, this is an issue, necessitating investments in roads and public transportation, as well as increasing numbers of alternative financing options such as public-private partnerships (PPP).

Urbanization Investments in living areas, commercial properties and other facilities are increasing as inner cities deteriorate and require redevelopment. Large investments are needed in buildings, as well as infrastructure.

Sustainability Earth and the processes and activities that take place on it must be designed in a sustainable way, so that the quality of life is also guaranteed for future generations. This is a driver for growth in the environmental market.

Water Lack of clean, safe, potable water supplies leads to a growing demand in water supply and treatment facilities. In addition, flood protection measures create growth.

Climate change Happening faster and with greater force than expected, changing climates present serious consequences: sea levels rise, precipitation patterns change, etc. These changes create increased demand for environmental services to reduce carbon dioxide (CO2) emissions and also focus more attention on flood protection.

16

In many of these areas — infrastructure, the design of living areas and commercial properties, environmental services and water management — ARCADIS is well positioned to benefit from the growing demand for services. In other areas — water quality and urban planning — further strengthening or broadening of our capabilities is needed.

Changing client needs

ARCADIS works for a broad range of clients, from governments to the private sector.

The needs of these clients are changing and involve:

Globalization of industry International companies increasingly seek service providers who can provide strong service offerings internationally. In part, this is intensified by regulations requiring companies to valuate their liabilities according to unified standards (SOX).

Outsourcing and privatization More and more, companies are concentrating on core activities. Non-core functions such as facility management or environmental activities are outsourced. A comparable trend is apparent in government, where the focus is on policy making while implementation of policy is left to companies like ARCADIS.

Private investment in public services. This trend in many countries is often in the form of PPP. Private investment leads to overall market growth because investments no longer depend solely on government budgets.

Supply-chain integration Many clients want an integrated construction process with no delays between preparation and execution. Design/build or DBFO —Design, Build, Finance and Operate — offers this continuity. A consortium of private-sector companies develops, designs and builds projects, providing financing and operations management also.

Risk participation An increasing number of clients are asking us to share in project risk. Our fee then is determined by the added value we deliver — a common component in DBFO projects. ARCADIS has internal procedures to control these risks (see page 50 of this report).

Many of these changing client needs are favorable to ARCADIS as more work is outsourced to the market. In addition, we are capable of serving multinational clients internationally. Worldwide, there are only a few companies with comparable skills. Finally, many new client needs require a broad, multidisciplinary service offering and good risk management. ARCADIS can export our experience in one country to other countries and with that take the lead in certain markets.

17

Goals

Together with its vision, ARCADIS has selected seven goals that direct its strategy:

Value creation for shareholders. This means investing in employees and services, to deliver more added value for clients. This results in profitable growth, which is the basis for value creation.

Leading positions in infrastructure, environment and facilities. This offers the opportunity to provide clients integrated business solutions. A broad scope of disciplines also allows us to capitalize on new market trends and to grow through innovation.

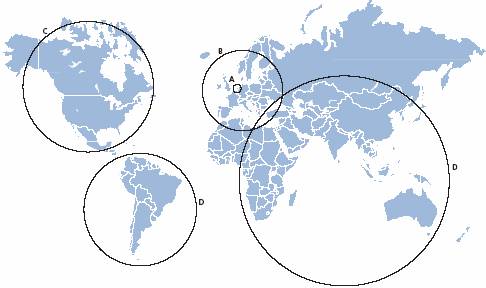

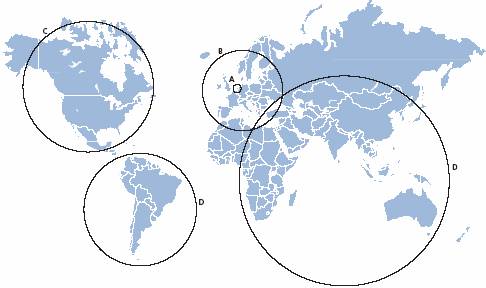

Home market positions in Europe, the United States, South America and Asia. In the countries in which we are active, we strive to be positioned in the top 5, and in the United States to be positioned in the top 10, in our industry.

Global leadership in services for multinational clients, specifically in environmental and management services.

One seamless company, where internal cooperation is part of the culture directed at creating synergy. With a brand that is recognizable around the globe for quality and reliability.

Employer of choice with an international and inspiring workplace where innovation and teamwork offer clients the best achievable solutions and where talent is provided maximum opportunities for growth.

A healthy financial position with enough strength to grow through acquisitions.

Strategic progress

Profitable growth in home markets

In mid-2000, value creation for shareholders became a leading element in our strategy in an effort to improve the Company’s long-term position. Since then, the ARCADIS strategy has been aimed at the realization of the goals mentioned above. Profitable growth in home markets in Europe and North and South America are key to that process as are organic growth, margin improvement and expansion of activities through acquisitions. In recent years, organic growth has increased, and margins have improved considerably. Acquisitions and divestments have led to a strong change in the portfolio. From 2000 to 2005, approximately € 150 million in gross revenue was divested. These divestments were predominantly non-core activities with lower margins. They were replaced with more than € 400 million in gross revenue in consultancy and management services with higher added value, higher margins and more growth potential.

18

Recurring

Strategic positioning strongly improved

The portfolio changes have strongly improved ARCADIS’ strategic positioning.

The acquisition in 2005 of BBL in the United States brought ARCADIS into the top 3 in the global environmental market, and we are now the global market leader in environmental services to companies. In the infrastructure market, we have a recognizable position with several specialties at the international level. In the facilities market, a transition was completed to higher value management services. Meanwhile, ARCADIS has a top 5 position in many European countries and Brazil. Even though our activities in the United Kingdom have expanded considerably, and our presence in the United States has doubled since 2000, we still have not reached our desired position in those markets. In Asia, our position is still modest. Internal cooperation has improved considerably. ARCADIS’ name awareness has increased considerably, and in the labor market, ARCADIS has a solid reputation. Nevertheless, in both of these areas, significant progress can still be made. Despite investments in acquisitions, our financial position is very healthy with ample room for further expansion.

Considerable value creation

Thanks to the contribution of many within ARCADIS, developments in recent years have led to a considerable creation of value. The market capitalization of the Company rose from € 173 million at year-end 2000 to € 945 million at year-end 2006.

Good progress in 2006

In 2006, considerable progress was achieved in realizing our strategic goals.

Integration of BBL is progressing well The integration of BBL – acquired as of October 1, 2005 – within our existing U.S. organization, was a main priority in 2006. The basis for this integration is BBL’s successful client-focused business model. As of January 1, 2007, organizational changes have been implemented, targeting enhanced efficiency, increased marketing power, and greater synergy in both the U.S. and internationally. A logical next step will be the introduction of a divisional structure that offers opportunity for the planned future expansion of our position in the United States.

Strong organic growth and higher margin At 10%, organic growth was much higher than our goal of 5%. The margin improved further to 9.4%, a clear demonstration that ARCADIS is now active higher in the value chain with activities that create more added value.

Strong growth with multinational clients BBL’s objective to serve their clients outside the United States drove their decision to join ARCADIS. ARCADIS’ Multinational Clients (MNC) program makes it possible to serve global companies in multiple countries with consistent quality, directed through an account management program. The BBL acquisition has increased the gross revenue in the MNC program to € 171 million. The organic growth amounted to 15%.

19

PKP Polskie Linie Kolejowe in Poland

Improved connectivity

Poland will invest heavily in rail infrastructure in the coming years. In central Poland, ARCADIS is providing project management and supervision services for the modernization of a 37- mile railway track between Skierniewice and Lodz. The track is part of the 79-mile railway line between Warsaw and Lodz, two Polish urban areas having more than 3 million inhabitants. The modernization will lead to increased speed for passenger trains from 87 to 99 miles per hour, which will considerably lower the travel time for passengers. The comfort of passengers is also taken into account. A great deal of attention will be paid to safety and the elimination of noise and vibrations.

Transnational Growth Platforms formed These initiatives were introduced in 2006 based on our revised 2005 strategy. The Transnational Growth Platforms (TGPs) are horizontal business lines that target the creation of additional growth across operating company borders. More information is provided in the sections on market developments by service area.

Strengthening portfolio and home markets through acquisitions Even though the 2006 priority was the integration of already acquired companies, considerable expansion through acquisitions was achieved in 2006 and includes:

| | | | | | Gross revenue | | Consolidated | |

Name | | Country | | Staff | | in € million | | as of | |

In Situ Technieken | | The Netherlands | | 10 | | 1.5 | | 4/1/2006 | |

Dresdner Grundwasser Consulting | | Germany | | 20 | | 1.5 | | 7/1/2006 | |

Berkeley Consulting | | United Kingdom | | 100 | | 10 | | 8/1/2006 | |

ECOLAS | | Belgium | | 60 | | 6 | | 10/1/2006 | |

BCT | | Belgium | | 65 | | 6 | | 10/1/2006 | |

PinnacleOne | | United States | | 230 | | 28 | | 11/1/2006 | |

Total | | | | 485 | | 53 | | | |

In Situ Technieken strengthens our position in soil remediation. The company has a technology that in certain soils leads to quicker and more cost-effective results. In Germany, Dresdner Grundwasser Consulting was added, specializing in water management and wastewater treatment. Through the acquisition of Berkeley Consulting in England — active in project management, construction management and conflict resolution — AYH was able to expand its client base to the public sector. In Belgium, the acquisition of ECOLAS strengthened our position in the European environmental market, while the acquisition of the engineering company BCT expands the activities in the Walloon region of Belgium. The acquisition of PinnacleOne considerably strengthens our position in project and program management in the United States. This acquisition fits into the ARCADIS Worldwide Project Consulting initiative, aimed at serving international real estate investors globally.

20

Strategy

The 2005 revised strategy titled Choices for growth, generally continues the 2000 strategy, which was aimed at profitable growth in home markets. For each of the three markets in which ARCADIS is active, a strategic goal was formulated based on a portfolio analysis that listed both the attractiveness of the market and ARCADIS’ competitive position for each of our different activities. In addition, SWOT analyses were completed for service areas and ARCADIS as a whole. The latter is as follows.

Strengths | | Weaknesses |

Strong home market positions in Europe, the United States and South America | | Limited position in Asia

Labor intensive services: high fixed costs |

Focus on three service areas with growth potential | | Visibility outside the Netherlands |

Extensive client list with multinationals | | |

Stable cash flow and healthy balance sheet | | |

Opportunities | | Threats |

Synergy based on expertise and client contacts | | Shortage in labor market |

Growth of investments in Central Europe and Asia | | Rapid market decline |

Outsourcing (companies) and privatization (governments) | | Weakening of U.S. dollar (conversion risk) |

Further expansion through acquisitions | | |

The three service area goals are listed elsewhere in this report.

The strategy for ARCADIS as a whole consists of the following core elements:

Strengthening of organic growth through:

· Expansion of local positions in home markets. ARCADIS’ strong home market positions offer excellent opportunities to capitalize on the changes offered by local markets, thus using ARCADIS’ global knowledge and experience. Through strong positions in Poland and the Czech Republic, we can benefit from the considerable investments of European funds in Central Europe.

· Application of Transnational Growth Platforms. Through this initiative, we aim to generate additional growth in areas where the market is attractive and ARCADIS has strength – in rail, tunnels and bridges, environment and project and program management.

· Leveraging of good relationships with multinational clients to further expand our services to these clients through cross selling.

· Combining of knowledge and experience into new products to benefit from certain market developments (e.g., facility management in response to the outsourcing of building maintenance activities by companies).

Focus on activities with higher added value The sooner ARCADIS becomes involved in a project, the higher the added value it can create. Management services and front-end consultancy therefore have a higher added value. This is also true for alternative contract types such as the Guaranteed Remediation Program (GRiP®), RECLAIMSM or

21

Koch Industries worldwide

Superior environmental consultancy for an industry leader

With a presence in some 60 countries in a variety of industries, Koch Industries is the largest privately held company in the United States. Koch companies strive to be industry leaders in environmental stewardship and health and safety performance, focusing on the creation of long-term value for customers and society. ARCADIS’ relationship with Koch Industries began more than 10 years ago with the successful execution of a single environmental project in the U.S. Thanks to ARCADIS’ client-focused strategy, shared values and a strong global geographical match, the relationship expanded into hundreds of projects worldwide. ARCADIS provides Koch with superior environmental consultancy including remediation and environmental compliance support.

DBFO projects. ARCADIS’ strategy is aimed at growing these types of activities, while outsourcing lower added value services such as detailed engineering. This policy should lead to improved margins.

Expansion through acquisitions aimed at:

· Further strengthening home markets, particularly in the United States and the United Kingdom.

· Strengthening the portfolio, beginning with expanding services higher in the value chain — management services, broadening of environmental services, planning services, rail activities and water.

· Developing a position in Asia.

Acquisitions must have a good strategic fit, while the target company has to have a solid reputation and strong management. Financial criteria include positive contribution to earnings per share, a margin compatible with ARCADIS’ goals and a return on investment of 15% or more.

Enhance name awareness through a proactive public relations and communications policy, publications in trade magazines, and lectures at trade fairs. In 2007, an investment will be made to strengthen this discipline, particularly in the United States.

Active Human Resources policy This policy is aimed at attracting, compelling and retaining talented employees, as competition is predominantly won in the labor market. For more information on this policy, please see the section on Human Resources Management.

Financial goals

Margin target raised to 10%

In 2005, the margin target of 8% that was established in 2000 was reached. From 2000 to 2005, the margin improved by almost 40%: from 6.0% in 1999 to 8.2% in 2005. Portfolio changes and a focus on activities with higher added value pushed the

22

margin structurally higher. This was the basis for reevaluating the margin targets. An internal and external benchmark was completed as part of this reevaluation, leading to a new margin target of 10% (EBITA as a percentage of net revenue). The service areas have the following margin targets:

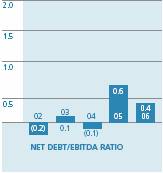

Infrastructure | | 8% - 9 | % |

Environment | | 12% - 13 | % |

Facilities | | 10% - 11 | % |

Total | | 10 | % |

The Company will reevaluate its margin targets when structural changes take place in the portfolio (e.g., as a result of the addition of newly acquired companies). To meet the targets, the policy remains aimed on productivity improvements and activities with higher added value. Reaching these targets also depends on market conditions.

Other goals

The other financial goals for the mid to long term (3 years) remain unchanged:

· Gross revenue: average annual growth of 10% or more, half of which is organic.

· Operational margin: 10% (EBITA as a percentage of net revenue).

· Earnings per share: average annual growth of 10% or more (based on net income from operations).

· Return on invested capital of 15% or more. This is net income from operations, excluding interest charges, compared to shareholders’ equity plus net interest-bearing debt, calculated as an average over four quarters.

The goals listed above exclude the effects of currency exchange rate differences. Net income from operations is before amortization and non-recurring items like book gains. Goodwill is capitalized on the balance sheet as of 2001; as of 2004, the figures are based on IFRS.

Currency risks in the business are generally hedged. Because the translation risk has no effect on the business, this risk is not hedged.

Performance in comparison to financial goals

Below are the results of previous years compared to the above goals, excluding currency effects.

| | Goal | | 2001 | | 2002 | | 2003 | | 2004(3) | | 2005(3) | | 2006(3) | |

Gross revenue | | 10 | % | 3 | % | 6 | % | 10 | % | 9 | %(1) | 10 | % | 23 | % |

·Organic | | 5 | % | 3 | % | 2 | % | 1 | % | 5 | % | 5 | % | 10 | % |

·Acquisitions | | 5 | % | 0 | % | 4 | % | 9 | % | 4 | % | 5 | % | 13 | % |

Operational margin | | 10 | % | 6.9 | % | 7.4 | % | 6.0 | % | 6.2 | %(2) | 8.2 | % | 9.4 | % |

Earnings per share | | 10 | % | 10 | % | 11 | % | (4 | )% | 9 | % | 40 | % | 50 | % |

Return on invested capital | | 15 | % | 17.6 | % | 18.8 | % | 15.9 | % | 17.2 | % | 20.6 | % | 20.3 | % |

(1) Excluding book profit on sales

(2) Excluding non-recurring items

(3) Figures based on IFRS

23

Excluding currency effect

Results and Financing

Record year 2006 was another record year for ARCADIS. Gross revenue rose 23% to € 1.2 billion. At 10%, organic growth was especially strong. Net income from operations (before amortization and non-operational items) rose 50% to € 50.0 million. Per share, this is € 2.47 against € 1.65 in 2005. This excellent result is attributable to strong growth in our service areas, continued margin improvement and a solid contribution from acquisitions. Across the board, performance was good. In all three service areas, organic growth was on or above target, while margins improved. Geographically, the profit gains were primarily strong in the Netherlands, the United States and the United Kingdom.

Dividend € 1.00 per share ARCADIS proposes to raise its cash dividend to € 1.00 per share from the € 0.66 per share distributed over 2005, an increase of over 50%. This represents more than 40% of net income from operations. The Company’s dividend policy is aimed at a payout ratio of 30% to 40% of net income from operations and is designed to provide shareholders with an attractive dividend yield, while providing the Company sufficient resources to finance growth through, among other things, acquisitions.

Strong growth in gross revenue Gross revenue increased 23% to € 1.233 billion (2005: € 1.001 billion). On balance, 14% of this increase came from acquisitions and divestments. The acquisitions in 2005 of AYH in the United Kingdom and BBL in the United States contributed significantly, while the sale in mid-2005 of our 50% participation in a Spanish firm had the largest negative effect. The currency effect was limited. Organic growth was at 10%, well over our 5% goal. The largest contribution to growth came from the Netherlands, the United States and Brazil, while France and United Kingdom also saw solid growth.

Net revenue increases 19% Net revenue, the portion of revenue produced by ARCADIS’ staff, grew by 19% to € 837 million (2005: € 703 million). On balance, the contribution from acquisitions and divestments was 13%; the currency effect was almost zero. Organic growth totaled 6%, which is less than the growth in gross revenue, among other things the result of the commencement in 2006 of the DSM/Sabic facility management contract that includes a large subcontractor component.

24

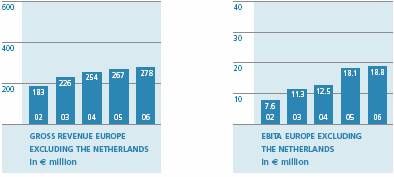

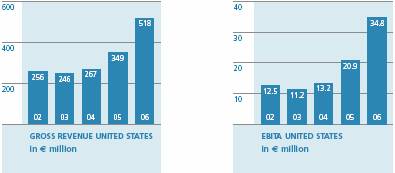

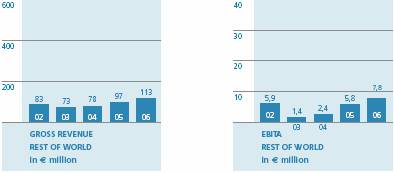

Geographical mix shifts As a result of vigorous expansion through acquisitions, the U.S. share of total revenue grew. In 2006, 42% of gross revenue was generated from operations in the United States (2005: 35%); the Netherlands contributed 26% (2005: 29%); Europe excluding the Netherlands, 23% (2005: 26%); and Rest of World, 9% (2005: 10%). Therefore, approximately half of the gross revenue is generated from European operations and the other half from operations in the United States and Rest of World.

Red Bull in United Kingdom

Realizing an exceptional office

Red Bull’s striking new office was a tremendous project to manage. The exciting design led to many cost and health and safety conundrums for AYH. It required careful and innovative planning and a creative project approach. To get from one floor to another, Red Bull workers can enjoy an exhilarating ride down a fiberglass slide or take a floating staircase. The award-winning open office promotes interaction and is unlike any office in London.

25

Umicore in Belgium

Cost-effective remediation solutions

The Umicore-plant in Balen has been operational for more than a century. Historical production activities have resulted in heavy metals contamination (zinc and cadmium). Part of the contamination plume extends beneath an adjacent neighborhood. In addition, the plant is built atop the largest drinking water supply in Flanders. To prevent further seepage of the contamination into the ground and to contain the groundwater contamination at the site boundaries, Umicore retained ARCADIS to evaluate various remediation options and determine the most appropriate remedy. Simulation models were used to predict the effects of the various remediation techniques on the fate and transport of groundwater contamination. Hydrological isolation was determined to be a cost-effective solution, preventing further migration of the contaminated groundwater.

Environment revenue increases As a result of the acquisitions in 2005 of BBL and Greystone, environment’s share of total revenue grew to 38% (2005: 31%). Partially the result of divestments in 2005, infrastructure declined to 45% (2005: 53%). Facilities totaled 17% (2005: 16%) as a result of acquisitions in that service area, remaining relatively stable.

Development of cost Operational cost (staff cost and other operational cost) increased by 18% to € 741 million (2005: € 628 million). The effect of acquisitions and divestments was 12.3%. Organically, the increase was 5.8%. This is lower than the increase in net revenue of 6.3%. The difference is the result of efficiency improvements.

Personnel cost increased by 20% to € 581 million (2005: € 485 million) while the other operational costs increased 12% to € 160 million (2005: € 143 million). Costs include € 5.4 million for external costs related to the Sarbanes Oxley Act (SOX 404) compliance and for the integration of BBL. This relates to temporary extra staff hires, consultants and auditor costs. Both operations also required a lot of time from ARCADIS’ own staff.

Relative decline in depreciation Depreciation (excluding amortization) rose 16% to € 17.7 million (2005: € 15.2 million), primarily the result of expansion through acquisitions. As a percentage of net revenue, depreciation decreased slightly from 2.2% in 2005 to 2.1% in 2006.

Amortization of identifiable intangible assets higher Under IFRS, identifiable intangible assets related to acquisitions must be separated from goodwill and amortized separately. For ARCADIS, this generally relates to the profit in the acquired company’s backlog. These assets are amortized over their economic lifetime (on average one to two years). In 2006, the amortization increased to € 8.3 million (2005: € 6.0 million) as a result of completed acquisitions.

26

Strong increase in operating income and EBITA Operating income rose 30% to € 70.5 million (2005: € 54.4 million). Of this amount, € 0.6 million is related to the sale of carbon credits in Brazil.

EBITA (operating income before amortization) and recurring EBITA are often used to measure the financial performance of operations. In 2005 and 2006, these measures developed as follows:

In € millions | | 2006 | | 2005 | |

Operating income reported | | 70.5 | | 54.4 | |

Amortization | | 8.3 | | 6.0 | |

EBITA | | 78.8 | | 60.4 | |

Book gain from divestments | | — | | 2.5 | |

Non-operation pension gain | | — | | 0.6 | |

Recurring EBITA | | 78.8 | | 57.3 | |

EBITA rose 31%. On a recurring basis, the gain was 38%, totaling € 78.8 million (2005: € 57.3 million). The currency effect was zero. The contribution from acquisitions and divestments was 24%, considerably higher than the contribution to net revenue (14%). This clearly demonstrates the positive effect of the acquisitions and divestments on the margin. Organically, EBITA increased 14%, also more than net revenue (6%). Thus, the margin also improved organically.

Financing charges higher as a result of acquisitions On balance, financing charges rose to € 3.5 million, an increase of € 1.7 million compared to the € 1.8 million in 2005. This increase is mainly the result of investments in acquisitions, which are financed with loans. Using financial derivatives, currency and interest rate risks on these loans are hedged. On balance, this effect on financing charges was a positive € 1.1 million (2005: positive € 1.7 million). Excluding this effect, financing charges were € 4.6 million (2005: € 3.6 million). This includes a non-recurring interest gain of € 0.5 million.

In 2006, group financing for the majority of the operating companies was introduced, optimizing the financing structure. This also has a positive effect on financing charges.

Tax rate lower The effective tax rate of 30.2% was lower than the 32.2% in 2005. A reduction in the Dutch corporate tax rate that became effective on January 1, 2007 has a favorable effect on the tax rate resulting in a lowering of the deferred tax reserve by € 1.0 million, which was added to the 2006 net income.

27

Negative contribution from associated companies A loss of € 0.5 million was realized from associated companies in 2006. In 2005, the contribution was € 1.4 million. The decline is the result of delays in project awards and new sales contracts for a number of energy projects in Brazil.

Strong decline in minority interest Minority interest – that part of the profit that flows back to the co-owners of the less-than-100%-owned ARCADIS companies – declined considerably to € 1.5 million (2005: € 3.2 million). To a large extent, this was the result of developments in Brazil, where ARCADIS owns 50.01% of the shares of ARCADIS Logos. The profit from our own activities rose strongly, but this was insufficient to offset the decline resulting from non-consolidated energy projects. In addition, results declined in other companies in which ARCADIS does not have a 100% ownership (e.g., in Poland and the Czech Republic), while elsewhere interests were expanded (the United Kingdom and Germany) or divested (Spain).

Strong gains in net income and net income from operations Net income was € 44.9 million, or € 2.22 per share, against € 33.4 million, or € 1.65 per share in 2005. Net income from operations (before amortization and non-operational items) was € 50.0 million, 50% more than the € 33.4 million in 2005. Per share, this is € 2.47 against € 1.65 in 2005.

Solid cash flow Net income plus depreciation and amortization totaled € 71 million (2005: € 55 million). Cash flow from operational activities increased considerably to € 86 million (2005: € 67 million). After subtracting replacement investments, a free cash flow remained of more than € 68 million (2005: € 52 million).

Investment levels lower as a result of fewer acquisitions Investments in intangible fixed assets, excluding acquisitions, were € 18 million (2005: € 15 million) - equivalent to the level of depreciation. The investments primarily relate to communications and computer equipment, as well as office furniture.

An amount of € 53 million (2005: € 121 million) was invested in new acquisitions or expansion efforts in consolidated companies, of which € 30 million relates to goodwill and € 11 million to identifiable intangible assets. In addition, € 7 million was invested in associated companies and other financial fixed assets (2005: € 6 million).

28

Number of shares remains nearly unchanged The number of outstanding shares at year-end 2006 was 20.3 million, almost equal to the number at year-end 2005. To cover obligations related to option plans, approximately 495,000 shares were repurchased, while approximately 530,000 shares that had been purchased earlier were used for the exercising of options by employees. No new shares were issued. The average number of outstanding shares (used to calculate net income per share) was 20.2 million (2005: 20.3 million). For more information on the number of outstanding shares, please refer to page 109 of this report. For more information about options and share purchase plans, please refer to page 105 of this report.

Lufthansa in Germany

Concept for an attractive working environment

ARCADIS Homola played a key role in the realization of Lufthansa’s new Aviation Center in Frankfurt, assisting them in developing long-term architectural concepts, which ultimately lead to this open, healthy and attractive working environment for Lufthansa’s administration staff. The exceptional building structure required close cooperation between the project management teams of ARCADIS and Lufthansa throughout all construction phases.

29

Samarco in Brazil

Management partner in booming business

The mining market in Brazil is booming as a result of global demand for raw materials. Thanks to our extensive experience in the project management of major projects in Brazil, ARCADIS is well equipped to manage the country’s most significant new mining projects. ARCADIS is currently providing overall project management services to CVRD’s subsidiary Samarco for the construction of a new pelletizing plant and an iron ore beneficiation plant at the mine. The two units will be linked by a 249-mile iron ore pipeline that passes through 25 cities. The municipalities will profit from these new activities through increased tax revenue. What’s more, Samarco – known as a socially responsible company – has invested in the development of local educational and cultural centers.

Balance sheet remains healthy The balance sheet total rose to € 736 million at year-end 2006 (2005: € 650 million) - the result of organic growth of activities (€ 54 million), acquisitions (€ 60 million) and currency effects (negative € 28 million).

Goodwill increased to € 139 million (2005: € 116 million) as a result of the balance of acquisitions and currency effects. Identifiable intangible assets at year-end 2006 were € 10 million (2005: € 8 million). As of 2004, goodwill is no longer amortized but subject to an impairment test once a year. In 2006, this test determined that no goodwill loss had occurred.

Influenced by the strong organic growth, working capital, consisting of work in progress plus accounts receivables minus accounts payable, increased slightly by € 6 million. As a percentage of gross revenue (measured at the level of the fourth quarter times four), working capital declined from 12.7% in 2005 to 12.5% in 2006.

Cash and cash equivalents at year-end 2006 were € 101 million (€ 2005: € 74 million). Net debt (cash and cash equivalents minus interest-bearing debt) at year-end 2006 was € 45 million (2005: € 52 million). As a result of the favorable cash flow, the net debt improved despite the investments in new acquisitions. Interest-bearing debt also includes the after-payment obligations to former shareholders of acquired companies, totaling € 21 million.

30

At year-end 2006, € 196 million in short-term credit facilities was available (2005: € 182 million). At the balance sheet date, € 22 million of these facilities were used. In addition, banks have pledged project bonds for € 41 million (2005: € 40 million). At year-end 2006, ARCADIS had € 119 million in long-term debt (2005: € 116 million). Current liabilities rose from € 304 million in 2005 to € 370 million in 2006. Of this increase, € 23 million was a result of shorter billing cycles.

Shareholders’ equity rose € 12.7 million to € 188.9 million at year-end 2006 as follows:

In € million | | Effect | |

Net income over the book-year 2006 | | 44.9 | |

Dividend payment over the book-year 2005 | | (13.4 | ) |

Currency exchange rate differences | | (14.1 | ) |

Exercising of options | | 4.6 | |

Temporary purchase of shares to cover option plan obligations | | (17.6 | ) |

Option costs | | 1.8 | |

Fiscal effects related to options plans | | 6.4 | |

The balance sheet ratios remained strong. The net debt to equity ratio at year-end 2006 was 0.2 (2005: 0.3). The net debt to EBITDA ratio was 0.4 (2005: 0.6). The interest coverage ratio remained unchanged at 17.

31

Developments by service area_Infrastructure

This segment is comprised of all ARCADIS activities that are focused on designing physical living environments. Themes include Living and Working (planning for living, working and recreational areas, as well as urban and rural environments); Mobility (traffic management, highway, railroad and waterway connections, bridges and tunnels); Water (water management, water quality and hydraulic engineering); and Energy (hydropower plants, biogas installations). This segment contributed 45% of ARCADIS’ total 2006 revenue (2005: 53%).

Strong local positions with specialties at the international level In the infrastructure market, government entities are our principal customers. Additionally, we work for developers, construction companies or other corporations. In this market, ARCADIS has strong local positions, with a solid knowledge and understanding of local conditions and long-term client relationships. This allows us to react early to developments, deliver tailor-made services and leverage our global expertise and experience to clients at the local level. In rail infrastructure, bridges and tunnels, as well as water management, ARCADIS has specialist expertise and experience that can be applied internationally.

Following is the SWOT analysis for infrastructure:

Strengths | | Weaknesses |

Strong local positions and broad service offerings | | Limited recognition in large projects |

Specialization in rail infrastructure (including rail systems), bridges and tunnels, water management | | Limited master planning experience for front-end project involvement |

| | Limited reputation in the water market (water quality) |

Opportunities | | Threats |

Privatization by governments, more PPP projects | | Sudden reductions in government investment |

Major investments in rail and subway networks | | Increases in competition based on price |

Increased focus on water management in delta areas | | |

Infrastructure market goals The following infrastructure goals have been set:

· Further expansion and growth of strong local positions;

· A recognizable market leadership position in rail infrastructure;

· The application of our unique expertise in bridges and tunnels;

· An organic growth of 4 to 6% per year; a margin of 8 to 9%.

Strong local positions make us an attractive partner in PPP projects. We are also able to benefit from the trend among government clients to outsource more work to the private sector. For rail and bridges and tunnels, we have developed Transnational Growth Platforms to more fully capitalize on market opportunities. We are striving to further strengthen our master planning capabilities for earlier entry into projects, thereby avoiding competing solely on price. We are also focusing on expanding our position in the water market in 2007.

32

Excluding currency effect

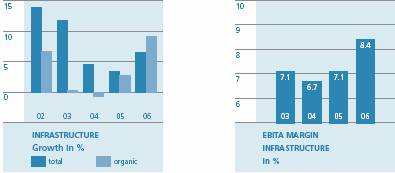

Strong organic growth; improved margin Activities grew 7%. The effect of acquisitions and divestments on balance was a negative 3%, specifically as a result of the divestment of our Spanish holdings mid-2005. The currency effect was 1%. The 9% organic growth is a strong improvement over prior years. This can be attributed to favorable market conditions in the Netherlands, the United States and Brazil. The margin rose to 8.4% (2005: 7.1%), mainly as a result of enhanced profitability in the Netherlands.

The Dutch market recovery was stronger and quicker than expected, resulting in 10% growth. In the United States, the land development market softened, but this was more than compensated for by growth in water and transportation. On balance, organic growth totaled over 15%. In Brazil, investment in both the private and public sectors remained strong, continuing the healthy growth there.

Flemish Ministry in Belgium

Let the traffic flow

Traffic jams are a structural issue on the Brussels beltway. Fast-moving commuter traffic converges onto this beltway merging with lower speed local traffic that frequently uses the numerous approaches and exits. ARCADIS proposed to split the beltway so that each traffic flow could move unimpeded. A continuous beltway will provide access to the highways, while a parallel road will serve local traffic.

33

Toulouse District in France

Providing better access

Beneath the central business center of southwest France, ARCADIS is working on an impressive project. In the densely populated city center of Toulouse, the subway network will undergo a 9-mile north-south extension, with 20 station stops. ARCADIS prepared the detailed design for many of the stations, controlled the tunnel design and provided consulting services for the tunnel boring. ARCADIS applied various tunneling techniques based on the geotechnical conditions. Construction beneath the famous Canal du Midi – a Unesco World Heritage listed site – required an innovative approach. When completed, the new subway line will cross the existing east-west subway line in the heart of the city center, providing access for travel in all directions.

Poland lagged behind expectations. Despite a large number of new project awards, increasing the backlog, delays plagued projects in the first half of the year. In France, market conditions remained positive, allowing for stable growth. In Belgium, several large projects are in a transition to a subsequent phase, resulting in a temporary flat organic growth. Even though gross revenue in Germany declined, signals indicate market improvement. In the fourth quarter, we won a large project management assignment from Deutsche Bahn. In the donor-financed market, gross revenue declined.

Breakthrough of Public-Private Partnership initiatives In 2006, the number of PPP initiatives grew strongly, a trend seen in many countries where ARCADIS is active. With more frequency, the design, construction, operation and financing components of large projects are being offered in an integrated approach. The advantage is twofold: financing is not burdening government budgets at a single time, and private-sector parties are increasing efficiency by integrating activities and applying life cycle concepts. Institutional investors are very interested in these initiatives because of the stable cash flow. These initiatives also offer opportunities for ARCADIS: as an advisor to the government or as a partner in a consortium that develops the project. ARCADIS serves as an advisor on the Zuidas project in Amsterdam, a large area development in which the infrastructure is constructed underground. This project is partially financed by the projected future value of the developed real estate. As a partner in a consortium, we primarily contribute our knowledge and understanding of local conditions and our expertise in developing creative solutions. Additionally, we are willing to share risks that are offset by the profit potential.

Building a leadership position in rail To benefit from the strong growth in the rail market, a Rail Business Team was assembled in 2006 to further penetrate the international market. Focusing on the Netherlands, France, Poland, the United Kingdom and China, services include modernizing rail systems and expanding high-speed rail networks and regular rail systems. In the Netherlands, Asset Rail, a joint venture with Imtech and Dura Vermeer, was awarded its first project for the maintenance and management of a section of rail track. In China, we were awarded a construction management project for a 153-mile section of a high-speed-railway between Wuhan and Hwadu, and in Poland, we were awarded a program management contract for

34

updating a 40-mile section of railway between Warsaw and Lodz. In France, we contributed expertise on the high-speed railway line between Paris and Strasbourg. In 2006, we obtained the certification to work on the British rail systems.

Bundled expertise in bridges and tunnels Our center of excellence for bridges is housed in France, while our tunnel expertise resides in a network of specialists located in several countries. In 2006, the center of excellence for bridges, which previously designed the Millau Bridge in France and the Lange Wapper Bridge in Antwerp, Belgium, won the French engineering award for the design of the sixth bridge over the Seine River in Rouen. The spectacular “butterfly” construction of this lift bridge attracted significant attention. In the Netherlands, the longest ecoduct in the world and the longest wooden bicycle bridge in the Netherlands were completed. In the Czech Republic, we conducted work on several large tunnel projects, while in Toulouse, France, we conducted work on the tunnel that expands the tram and subway network. Our work on the Detroit Upper Rouge Tunnel has provided us a solid position in the growing U.S. tunneling market.

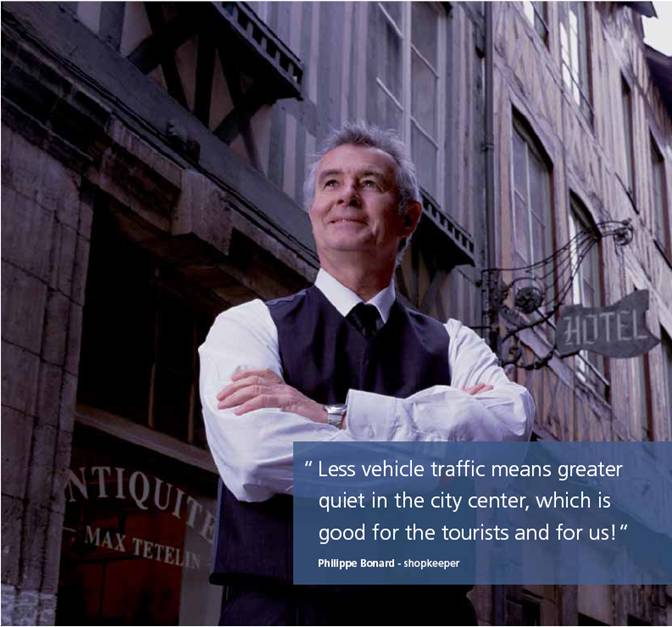

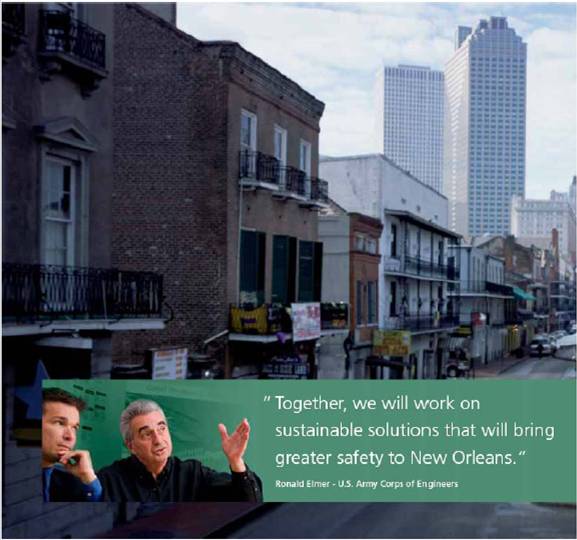

Water is a growth market In the Netherlands, ARCADIS has extensive experience in the water market, among other things, developed while designing the river dike improvements for the Deltaplan Dutch rivers in the middle of the nineties. In early January 2007, ARCADIS in a joint venture with Bioengineering Group won an Indefinite Delivery Indefinite Quantity contract, having a maximum value of $150 million, from the U.S. Army Corps of Engineers for services to provide solutions for hurricane protection for New Orleans and the surrounding Gulf Coast. Our local presence combined with our Dutch water expertise and reputation won us the project. This assignment will generate significant work in the future and strengthens our position in this growth market.

Outlook The positive trend in the Dutch market is expected to continue, in part as a result of favorable economic conditions. Although rail renewal projects are seeing some delays, we are continuing to be awarded PPP projects, and the government is continuing to outsource additional work. In the municipal market, demand for integrated land development is rising. In other European countries, the outlook is also positive. In Belgium and France, large investments are being made in the form of PPP projects. In the United Kingdom, ARCADIS can contribute to the renewal of rail infrastructure. After a series of project delays in Poland, European investments offer good prospects for Poland, the Czech Republic and Romania.

In the United States, the large U.S. Army Corps of Engineers’ contract for water management services for New Orleans and the surrounding Gulf Coast will provide opportunities for additional growth in these activities. The federal investment program (SAFETEA) continues to have a positive effect on the transportation market. In that market, we are also seeing an increase in the number of PPP projects. The market for land development is not expected to improve until the second half of 2007. Market conditions in Brazil are expected to remain favorable. In Chile, further growth is also anticipated in 2007, particularly in mining-related activities.

35

Developments by service area_Environment

This service area - 38% of revenue (2005: 31%) – relates to the theme of Sustainability: ensuring that the earth remains livable for future generations. Activities are aimed at improving and maintaining air, soil, groundwater and surface-water quality, as well as nature and ecology projects. Also included in this service area are projects related to climate change, product stewardship, noise abatement, solid waste disposal and health and safety.

ARCADIS is a market leader in environment With the acquisition of the American firm Blasland, Bouck & Lee (BBL) in 2005, ARCADIS holds market leadership positions in the global environmental market. A considerable portion of this market relates to investigation and remediation of soil and groundwater contamination, as well as contaminated sediments. In this market, ARCADIS is positioned in the global top 3. With its strong international presence, ARCADIS already was a large service provider to the private sector, and together with BBL, we are the leading company in the world in this sector.

Following is the SWOT analysis for environment:

Strengths | | Weaknesses |

International network for services to multinational clients | | Limited position in Asia |