UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | |

| Investment Company Act file number: | | 811-08076 |

| | |

| Exact name of registrant as specified in charter: | | The Emerging Markets Telecommunications Fund, Inc. |

| | |

| Address of principal executive offices: | | 1735 Market Street, 32nd Floor Philadelphia, PA 19103 |

| | |

| Name and address of agent for service: | | Ms. Andrea Melia Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 |

| | |

| Registrant’s telephone number, including area code: | | 866-839-5205 |

| | |

| Date of fiscal year end: | | October 31 |

| | |

| Date of reporting period: | | October 31, 2009 |

Item 1. Reports to Stockholders.

THE EMERGING MARKETS TELECOMMUNICATIONS

FUND, INC.

ANNUAL REPORT

OCTOBER 31, 2009

ETF-AR-1009

LETTER TO SHAREHOLDERS

Dear Valued Shareholder,

On behalf of our global associates, I would like to introduce you to Aberdeen Asset Management PLC ("Aberdeen"). On December 31, 2008, Aberdeen signed an agreement to purchase parts of the asset management business of Credit Suisse, including the part that managed The Emerging Markets Telecommunications Fund, Inc. (the "Fund"). The closing of this transaction occurred on June 30, 2009.

Aberdeen is the parent company of an asset management group managing assets for both institutional and retail clients from offices throughout the world. Over the past 25 years, Aberdeen has grown to become a global asset manager managing over $213 billion in assets principally on behalf of leading national and corporate pension funds, central banks and other financial institutions from 27 offices located around the world. Aberdeen has been managing registered closed-end funds since 2000 and with the closing of the Credit Suisse transaction now manages or serves as the sub-adviser to 11 North American registered closed-end funds, coupled with 17 U.K. registered closed-end funds. As part of our ongoing commitment to provide additional, timely information to investors, including Fund performance and investment strategy, I would like to highlight the new monthly factsheets which are posted on the Fund website (www.aberdeenETF.com). If you have any questions in relation to this information or suggestions on how to improve it further please either call us at 1-866-839-5205 or email InvestorRelations@aberdeen-asset.com. We would be delighted to hear from you.

Clarity And Consistency Remain Key

This Annual Report for the Fund covers the activities for the twelve month period ended October 31, 2009. This period has encompassed particularly difficult times in world stock markets, with many of the world's financial institutions demonstrating significant weaknesses in both processes and products. There was a consequent weakening in financial confidence around the world and unprecedented levels of government intervention in support of the financial markets.

Aberdeen Asset Management Investment Services Limited, the Investment Manager, is committed to its established clear and consistent investment process across the globe. The commitment to completing thorough research for each investment is considered particularly important by us in this environment.

Share Price Performance

The Fund's share price increased 25.99% over the twelve months, from $12.66 on October 31, 2008 to $15.95 on October 30, 2009. The Fund's share price on October 30, 2009 represented a discount of 11.63% to the NAV per share of $18.05 on that date, compared with a discount of 17.42% to the NAV per share of $15.33 on October 31, 2008. As of December 18, 2009, the share price was $16.47, representing a discount of 10.9% to the NAV per share of $18.49.

Market Commentary

There were a number of key market regulatory, competitive and technological developments in the sector during the year. Wide variations in market penetration and growth rates existed across markets but emerging market wireless revenue growth remain attractive compared to developed countries with revenue growth in the high single digits, versus revenue growth of less than 1% annually. Average revenue per user continues to fall as penetration rates increase. However, in

LETTER TO SHAREHOLDERS (CONTINUED)

the major markets such as China and India, annual subscriber growth remains strong at 18% and 50%, together with wireless penetration levels of 51% and 34% respectively. Market consolidation will continue to be a prominent theme within the sector.

Looking Ahead

The expansion of network coverage in rural areas and the growth in data services, facilitated by better devices, new applications, the roll-out of 3G networks and pricing are key growth drivers. There are a number of promising value-added service applications emerging. For example, operators are looking to develop money transfer and payment systems such as MPESA, developed by Safaricom and Vodafone for the Kenyan market, and the industry is continuing to search for other value-added applications, for example, in the field of healthcare. The surge in smartphones is also driving data growth with penetration of these devices approaching 10% in some emerging markets despite the general lack of handset subsidies.

Fixed-line development has been stunted in many emerging markets as a result of rapid wireless growth for voice and broadband services. However, as the market for mobile technology begins to mature, operators are increasingly turning attention to pursuing 'total communications' strategies. Operators with attractive fixed-line service propositions may be able to prosper by providing faster sustainable bandwidth services to deliver value-added services such as pay-TV. Finally, mergers appear to be intensifying within the sector, illustrated by Vivendi's recent bid for GVT, a Brazilian fixed-line operator.

Investor Relations Information

For information about the Fund, daily updates of share price, NAV and details of distributions, visit the website at www.aberdeenETF.com. Please contact Aberdeen with additional queries by:

• calling toll free at1-866-839-5205 in the United States, or

• emailing InvestorRelations@aberdeen-asset.com.

For information about the Aberdeen Group, visit the Aberdeen website at www.aberdeen-asset.com.

Finally, included within this report is a postage paid reply card which would register you into the Aberdeen enhanced email service. Following receipt of the completed form, updated investment information relating to the closed-end fund complex would be circulated to your attention.

Yours sincerely,

Christian Pittard

President

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

PORTFOLIO SUMMARY

OCTOBER 31, 2009 (UNAUDITED)

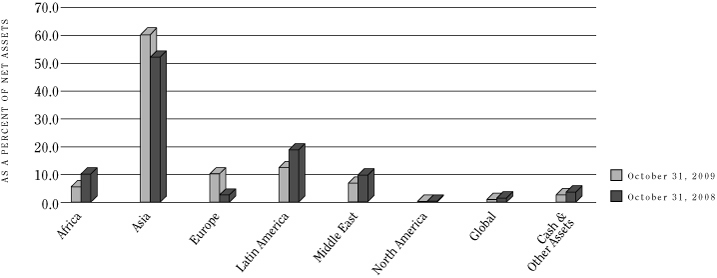

GEOGRAPHIC ASSET BREAKDOWN

SUMMARY OF SECURITIES BY COUNTRY/REGION

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

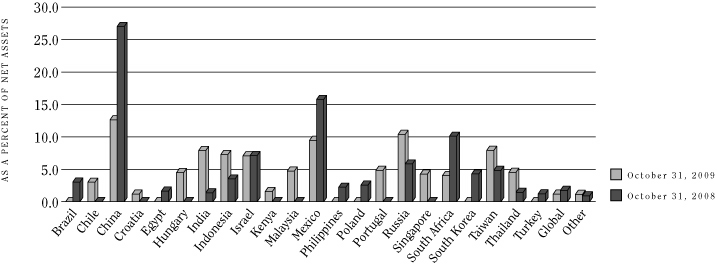

PORTFOLIO SUMMARY (CONTINUED)

OCTOBER 31, 2009 (UNAUDITED)

TOP 10 HOLDINGS, BY ISSUER

| | | Holding | | Sector | | Country | | Percent of Net Assets | |

| | 1. | | | China Mobile Ltd. | | Wireless Telecommunication Services | | China | | | 12.6 | | |

| | 2. | | | América Móvil S.A.B. de C.V., Series L | | Wireless Telecommunication Services | | Mexico | | | 9.4 | | |

| | 3. | | | Taiwan Mobile Co., Ltd. | | Wireless Telecommunication Services | | Taiwan | | | 7.9 | | |

| | 4. | | | Bharti Airtel Ltd. | | Wireless Telecommunication Services | | India | | | 7.9 | | |

| | 5. | | | Vimpel-Communications | | Wireless Telecommunication Services | | Russia | | | 5.5 | | |

| | 6. | | | Mobile Telesystems OJSC | | Wireless Telecommunication Services | | Russia | | | 4.9 | | |

| | 7. | | | Portugal Telecom SGPS S.A. | | Diversified Telecommunication Services | | Portugal | | | 4.8 | | |

| | 8. | | | Digi.Com BHD | | Wireless Telecommunication Services | | Malaysia | | | 4.7 | | |

| | 9. | | | Bezeq Israeli Telecommunication Corp. Ltd. | | Diversified Telecommunication Services | | Israel | | | 4.7 | | |

| | 10. | | | Advanced Info Service Public Co., Ltd. | | Wireless Telecommunication Services | | Thailand | | | 4.5 | | |

AVERAGE ANNUAL RETURNS

OCTOBER 31, 2009

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Net Asset Value (NAV) | | | 21.35 | % | | | 1.58 | % | | | 13.23 | % | | | 5.34 | % |

| Market Value | | | 29.52 | % | | | 0.87 | % | | | 14.02 | % | | | 6.73 | % |

During the fiscal year, Credit Suisse waived fees and/or reimbursed expenses, without which performance would be lower. Aberdeen Asset Management Investment Services Limited may waive fees and/or reimburse expenses, but has made no determination to do so. Without such waivers and/or reimbursed expenses, performance would be lower. Waivers and/or reimbursements are subject to change and may be discontinued at any time. Returns represent past performance. Total investment return at net asset value is based on changes in the net asset value of fund shares and assumes reinvestment of dividends and distributions, if any. Total investment return at market value is based on changes in the market price at which the fund's shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the fund's dividend reinvestment program. Because the fund's shares trade in the stock market based on investor demand, the fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on share price and NAV. Past performance is no guarantee of future results. The current performance of the fund may be lower or higher than the figures shown. The fund's yield, return and market price and NAV will fluctuate. Performance information current to the most recent month-end is available by calling 866-839-5205.

The annualized gross expense ratio is 1.43%.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

SCHEDULE OF INVESTMENTS

OCTOBER 31, 2009

| Description | | No. of Shares | | Value |

| EQUITY OR EQUITY-LINKED SECURITIES-97.16% |

EQUITY OR EQUITY-LINKED SECURITIES OF TELECOMMUNICATION COMPANIES IN EMERGING COUNTRIES-96.65% |

| ASIA-0.37% |

| VENTURE CAPITAL-0.37% |

TVG Asian Communications Fund II, L.P.#†‡ (Cost $886,646) | | | 3,622,118 | * | | $ | 549,091 | |

| CHILE-3.00% |

| DIVERSIFIED TELECOMMUNICATION SERVICES-3.00% |

Empresa Nacional de Telecomunicaciones S.A. (Cost $4,214,099) | | | 335,132 | | | | 4,449,938 | |

| CHINA-12.64% |

| WIRELESS TELECOMMUNICATION SERVICES-12.64% |

| China Mobile Ltd.†† | | | 1,880,172 | | | | 17,625,424 | |

| China Mobile Ltd., ADR | | | 23,920 | | | | 1,117,782 | |

| | | | 18,743,206 | |

TOTAL CHINA (Cost $23,550,968) | | | 18,743,206 | |

| CROATIA-1.16% |

| DIVERSIFIED TELECOMMUNICATION SERVICES-1.16% |

Hrvatske Telekomunikacije dd†† (Cost $1,715,679) | | | 31,438 | | | | 1,716,633 | |

| HUNGARY-4.46% |

| DIVERSIFIED TELECOMMUNICATION SERVICES-4.46% |

Magyar Telekom Telecommunications PLC†† (Cost $6,451,686) | | | 1,530,000 | | | | 6,623,355 | |

| INDIA-7.87% |

| WIRELESS TELECOMMUNICATION SERVICES-7.87% |

Bharti Airtel Ltd.†† (Cost $16,128,759) | | | 1,889,920 | | | | 11,668,475 | |

| Description | | No. of Shares | | Value |

| INDONESIA-7.25% |

| DIVERSIFIED TELECOMMUNICATION SERVICES-4.47% |

PT Telekomunikasi Indonesia Tbk†† | | | 7,699,954 | | | $ | 6,630,540 | |

| WIRELESS TELECOMMUNICATION SERVICES-2.78% |

| PT Indosat Tbk†† | | | 7,756,356 | | | | 4,120,017 | |

TOTAL INDONESIA (Cost $10,036,060) | | | 10,750,557 | |

| ISRAEL-7.06% |

| DIVERSIFIED TELECOMMUNICATION SERVICES-4.73% |

Bezeq Israeli Telecommunication Corp. Ltd.†† | | | 3,132,772 | | | | 7,010,614 | |

| VENTURE CAPITAL-2.33% |

| BPA Israel Ventures LLC#†‡ | | | 1,674,587 | * | | | 572,275 | |

Concord Ventures Fund II, L.P†‡ | | | 4,000,000 | * | | | 694,476 | |

Giza GE Venture Fund III L.P.†‡ | | | 2,750,000 | * | | | 604,918 | |

K.T. Concord Venture Fund L.P.†‡ | | | 2,000,000 | * | | | 95,928 | |

| Neurone Ventures II, L.P.#†‡ | | | 686,184 | * | | | 189,789 | |

SVE Star Ventures Enterprises GmbH & Co. No. IX KG†‡ | | | 2,001,470 | * | | | 643,292 | |

Walden-Israel Ventures III, L.P.#†‡ | | | 1,249,188 | * | | | 657,297 | |

| | | | 3,457,975 | |

TOTAL ISRAEL (Cost $15,623,023) | | | 10,468,589 | |

| KENYA-1.51% |

| WIRELESS TELECOMMUNICATION SERVICES-1.51% |

Safaricom Ltd.†† (Cost $2,156,775) | | | 41,722,300 | | | | 2,234,396 | |

See accompanying notes to financial statements.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

SCHEDULE OF INVESTMENTS (CONTINUED)

OCTOBER 31, 2009

| Description | | No. of Shares | | Value |

| LATIN AMERICA-0.20% |

| VENTURE CAPITAL-0.20% |

JPMorgan Latin America Capital Partners L.P.#†‡ (Cost $666,719) | | | 2,286,227 | * | | $ | 300,570 | |

| MALAYSIA-4.73% |

| WIRELESS TELECOMMUNICATION SERVICES-4.73% |

Digi.Com BHD†† (Cost $6,798,740) | | | 1,100,000 | | | | 7,024,202 | |

| MEXICO-9.45% |

| WIRELESS TELECOMMUNICATION SERVICES-9.45% |

América Móvil S.A.B. de C.V., Series L, ADR (Cost $5,895,100) | | | 317,498 | | | | 14,011,187 | |

| PORTUGAL-4.82% |

| DIVERSIFIED TELECOMMUNICATION SERVICES-4.82% |

Portugal Telecom SGPS S.A.†† (Cost $6,462,769) | | | 624,000 | | | | 7,151,058 | |

| RUSSIA-10.35% |

| WIRELESS TELECOMMUNICATION SERVICES-10.35% |

| Mobile Telesystems OJSC | | | 1,007,000 | | | | 7,159,770 | |

| Vimpel-Communications, ADR† | | | 456,759 | | | | 8,189,689 | |

| | | | 15,349,459 | |

TOTAL RUSSIA (Cost $12,187,865) | | | 15,349,459 | |

| SINGAPORE-4.24% |

| DIVERSIFIED TELECOMMUNICATION SERVICES-4.24% |

Singapore Telecommunications Ltd.†† (Cost $6,711,795) | | | 3,030,000 | | | | 6,296,888 | |

| Description | | No. of Shares | | Value |

| SOUTH AFRICA-3.99% |

| WIRELESS TELECOMMUNICATION SERVICES-3.99% |

MTN Group Ltd.†† (Cost $5,066,586) | | | 398,791 | | | $ | 5,924,797 | |

| TAIWAN-7.88% |

| WIRELESS TELECOMMUNICATION SERVICES-7.88% |

Taiwan Mobile Co., Ltd.†† (Cost $10,568,932) | | | 6,538,340 | | | | 11,693,487 | |

| THAILAND-4.52% |

| WIRELESS TELECOMMUNICATION SERVICES-4.52% |

Advanced Info Service Public Co., Ltd. (Cost $7,102,902) | | | 2,596,765 | | | | 6,700,703 | |

| GLOBAL-1.15% |

| VENTURE CAPITAL-1.15% |

Emerging Markets Ventures I, L.P.#†‡ | | | 7,248,829 | * | | | 873,774 | |

| Telesoft Partners II QP, L.P.#†‡ | | | 2,280,000 | * | | | 826,203 | |

| Telesoft Partners L.P.†‡ | | | 1,250,000 | * | | | 0 | |

TOTAL GLOBAL (Cost $4,114,762) | | | 1,699,977 | |

TOTAL EMERGING COUNTRIES (Cost $146,339,865) | | | 143,356,568 | |

| EQUITY SECURITIES OF TELECOMMUNICATION COMPANIES IN DEVELOPED COUNTRIES-0.51% |

| UNITED STATES-0.51% |

| VENTURE CAPITAL-0.51% |

Technology Crossover Ventures IV, L.P.#†‡ (Cost $612,003) | | | 1,937,800 | * | | | 760,755 | |

See accompanying notes to financial statements.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

SCHEDULE OF INVESTMENTS (CONTINUED)

OCTOBER 31, 2009

| Description | | No. of Shares | | Value |

EQUITY SECURITIES OF COMPANIES PROVIDING OTHER ESSENTIAL SERVICES IN THE DEVELOPMENT OF AN EMERGING COUNTRY'S INFRASTRUCTURE-0.00% |

| ARGENTINA-0.00% |

| VENTURE CAPITAL-0.00% |

Exxel Capital Partners V, L.P.†‡ (Cost $380,481) | | | 1,897,761 | * | | $ | 0 | |

TOTAL EQUITY OR EQUITY-LINKED SECURITIES-97.16% (Cost $147,332,349) | | | 144,117,323 | |

| | | Principal Amount (000's) | | |

| SHORT-TERM INVESTMENT-2.05% |

| UNITED KINGDOM-2.05% |

Citibank London, overnight deposit, 0.03%, 11/02/09 (Cost $3,045,000) | | $ | 3,045 | | | | 3,045,000 | |

TOTAL INVESTMENTS-99.21% (Cost $150,377,349) | | | 147,162,323 | |

| CASH AND OTHER ASSETS, LESS LIABILITIES-0.79% | | | 1,166,175 | |

| NET ASSETS-100.00% | | $ | 148,328,498 | |

† Non-income producing security.

†† Security was fair valued as of October 31, 2009. Security is valued at fair value as determined in good faith by, or under the direction of, the Board of Directors, under procedures established by the Board of Directors. (See Note B and H).

‡ Restricted security, not readily marketable. (See Note H).

# As of October 31, 2009, the aggregate amount of open commitments for the Fund is $2,739,674. (See Note H).

* Represents contributed capital.

ADR American Depositary Receipts.

See accompanying notes to financial statements.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

OCTOBER 31, 2009

| ASSETS |

| Investments, at value (Cost $150,377,349) (Notes B, E, G) | | $ | 147,162,323 | |

| Cash (including $2,862,373 of foreign currencies with a cost of $2,793,900) | | | 2,862,767 | |

| Receivables: |

| Dividends | | | 661,422 | |

| Prepaid expenses | | | 27,480 | |

| Total Assets | | | 150,713,992 | |

| LIABILITIES |

| Payables: |

| Investments purchased | | | 2,015,396 | |

| Investment advisory fees (Note C) | | | 170,106 | |

| Directors' fees | | | 51,748 | |

| Other accrued expenses | | | 148,244 | |

| Total Liabilities | | | 2,385,494 | |

| NET ASSETS (applicable to 8,246,665 shares of common stock outstanding) (Note D) | | $ | 148,328,498 | |

| NET ASSETS CONSIST OF |

| Capital stock, $0.001 par value; 8,246,665 shares issued and outstanding (100,000,000 shares authorized) | | $ | 8,247 | |

| Paid-in capital | | | 157,833,749 | |

| Undistributed net investment income | | | 3,208,742 | |

| Accumulated net realized loss on investments and foreign currency related transactions | | | (9,575,259 | ) |

| Net unrealized depreciation in value of investments and translation of other assets and liabilities denominated in foreign currencies | | | (3,146,981 | ) |

| Net assets applicable to shares outstanding | | $ | 148,328,498 | |

| NET ASSET VALUE PER SHARE (based on 8,246,665 shares issued and outstanding) | | $ | 17.99 | |

| MARKET PRICE PER SHARE | | $ | 15.95 | |

See accompanying notes to financial statements.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

STATEMENT OF OPERATIONS

FOR THE FISCAL YEAR ENDED OCTOBER 31, 2009

| INVESTMENT INCOME |

| Income (Note B) : |

| Dividends | | $ | 5,770,510 | |

| Interest | | | 1,475 | |

| Less: Foreign taxes withheld | | | (582,433 | ) |

| Total Investment Income | | | 5,189,552 | |

| Expenses: |

| Investment advisory fees (Note C) | | | 1,434,962 | |

| Custodian fees | | | 155,195 | |

| Directors' fees | | | 117,467 | |

| Accounting fees (Note C) | | | 77,932 | |

| Audit and tax fees | | | 60,997 | |

| Legal fees | | | 40,237 | |

| Shareholder servicing fees | | | 21,504 | |

| Insurance fees | | | 19,440 | |

| Stock exchange listing fees | | | 1,453 | |

| Printing fees (Note C) | | | 874 | |

| Miscellaneous fees | | | 16,319 | |

| Total Expenses | | | 1,946,380 | |

| Less: Fee waivers (Note C) | | | (62,244 | ) |

| Net Expenses | | | 1,884,136 | |

| Net Investment Income | | | 3,305,416 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND

FOREIGN CURRENCY RELATED TRANSACTIONS |

| Net realized gain from: |

| Investments | | | 9,459,517 | |

| Foreign currency related transactions | | | 398,988 | |

Net change in unrealized appreciation in value of investments and translation of other assets and liabilities denominated in foreign currencies | | | 12,487,235 | |

| Net realized and unrealized gain on investments and foreign currency related transactions | | | 22,345,740 | |

| NET INCREASE IN NET ASSET RESULTING FROM OPERATIONS | | $ | 25,651,156 | |

See accompanying notes to financial statements.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Years Ended October 31, |

| | | 2009 | | 2008 |

| INCREASE/(DECREASE) IN NET ASSETS |

| Operations: |

| Net investment income | | $ | 3,305,416 | | | $ | 3,602,350 | |

| Net realized gain on investments and foreign currency related transactions | | | 9,858,505 | | | | 20,330,510 | |

Net change in unrealized appreciation/(depreciation) in value of investments and translation of other assets and liabilities denominated in foreign currencies | | | 12,487,235 | | | | (145,616,728 | ) |

| Net increase/(decrease) in net assets resulting from operations | | | 25,651,156 | | | | (121,683,868 | ) |

| Dividends and distributions to shareholders: |

| Net investment income | | | (2,968,015 | ) | | | (94,353 | ) |

| Total dividends and distributions to shareholders | | | (2,968,015 | ) | | | (94,353 | ) |

| Capital share transactions: |

Cost of 0 and 306,439 shares purchased under the share repurchase program (Note I) | | | — | | | | (6,459,493 | ) |

Issuance of 2,180 and 780 shares through the directors compensation plan (Note C) | | | 35,299 | | | | 17,683 | |

| Total capital share transactions | | | 35,299 | | | | (6,441,810 | ) |

| Total increase/(decrease) in net assets | | | 22,718,440 | | | | (128,220,031 | ) |

| NET ASSETS |

| Beginning of year | | | 125,610,058 | | | | 253,830,089 | |

| End of year* | | $ | 148,328,498 | | | $ | 125,610,058 | |

| | | | | | | | | |

* Includes undistributed net investment income of $3,208,742 and $2,938,901, respectively.

See accompanying notes to financial statements.

This page intentionally left blank.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

FINANCIAL HIGHLIGHTS§

Contained below is per share operating performance data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for each period indicated. This information has been derived from information provided in the financial statements and market price data for the Fund's shares.

| | | For the Fiscal Years Ended October 31, | | For the Eleven Months Ended October 31, |

| | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004§§ |

| PER SHARE OPERATING PERFORMANCE |

| Net asset value, beginning of period | | $ | 15.24 | | | $ | 29.69 | | | $ | 17.67 | | | $ | 12.72 | | | $ | 9.95 | | | $ | 8.17 | |

| Net investment income/(loss) | | | 0.40 | † | | | 0.43 | † | | | 0.01 | † | | | 0.01 | † | | | 0.02 | † | | | 0.01 | † |

| Net realized and unrealized gain/(loss) on investments and foreign currency related transactions | | | 2.71 | | | | (14.98 | ) | | | 12.02 | * | | | 4.93 | | | | 2.74 | | | | 1.70 | |

Net increase/(decrease) in net assets resulting from operations | | | 3.11 | | | | (14.55 | ) | | | 12.03 | | | | 4.94 | | | | 2.76 | | | | 1.71 | |

| Dividends and distributions to shareholders: |

| Net investment income | | | (0.36 | ) | | | (0.01 | ) | | | (0.02 | ) | | | — | | | | — | | | | — | |

Net realized gains on investments and foreign currency related transactions | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total dividends and distributions to shareholders | | | (0.36 | ) | | | (0.01 | ) | | | (0.02 | ) | | | — | | | | — | | | | — | |

Anti-dilutive impact due to capital shares tendered or repurchased | | | — | | | | 0.11 | | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.07 | |

| Net asset value, end of period | | $ | 17.99 | | | $ | 15.24 | | | $ | 29.69 | | | $ | 17.67 | | | $ | 12.72 | | | $ | 9.95 | |

| Market value, end of period | | $ | 15.95 | | | $ | 12.66 | | | $ | 28.08 | | | $ | 16.00 | | | $ | 10.91 | | | $ | 8.52 | |

| Total investment return (a) | | | 29.52 | % | | | (54.89 | )% | | | 75.68 | % | | | 46.65 | % | | | 28.05 | % | | | 24.38 | % |

| RATIOS/SUPPLEMENTAL DATA |

| Net assets, end of period (000 omitted) | | $ | 148,328 | | | $ | 125,610 | | | $ | 253,830 | | | $ | 152,045 | | | $ | 109,823 | | | $ | 86,351 | |

| Ratio of expenses to average net assets (b) | | | 1.43 | % | | | 1.37 | % | | | 1.50 | % | | | 1.62 | % | | | 1.93 | % | | | 1.81 | %(c) |

| Ratio of expenses to average net assets, excluding taxes | | | 1.43 | % | | | 1.37 | % | | | 1.50 | % | | | 1.60 | % | | | 1.92 | % | | | 1.81 | %(c) |

| Ratio of net investment income/(loss) to average net assets | | | 2.51 | % | | | 1.75 | % | | | 0.03 | % | | | 0.09 | % | | | 0.15 | % | | | 0.13 | %(c) |

| Portfolio turnover rate | | | 90.65 | % | | | 34.07 | % | | | 26.47 | % | | | 39.79 | % | | | 80.95 | % | | | 71.57 | % |

§ Per share amounts prior to November 3, 2000 have been restated to reflect a conversion factor of 0.9994 for shares issued in connection with the merger of The Emerging Markets Infrastructure Fund, Inc. and The Emerging Markets Telecommunications Fund, Inc.

§§ On August 9, 2004, the Fund's Board of Directors approved a change in the Fund's fiscal year-end from November 30 to October 31. The financial highlights for 2004 represent the eleven-month period beginning on December 1, 2003 and ending October 31, 2004.

† Based on average shares outstanding.

* The investment adviser fully reimbursed the Fund for a loss on a transaction not meeting the Fund's investment guidelines, which otherwise would have reduced the amount by $0.04 (Note C).

†† Based on shares outstanding on November 21, 2001 (prior to the 2001 tender offer) and November 30, 2001.

††† Based on shares outstanding on November 6, 2002 (prior to the 2002 tender offer) and November 30, 2002.

(a) Total investment return at market value is based on the changes in market price of a share during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund's dividend reinvestment program.

(b) Ratios shown are inclusive of Brazilian transaction, Indian capital gains and Chilean repatriation taxes, if any.

(c) Annualized.

See accompanying notes to financial statements.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

FINANCIAL HIGHLIGHTS§

| | | For the Fiscal Years Ended November 30, | | For the Six Months Ended November 30, | | For the Fiscal Year Ended May 31, |

| | | 2003 | | 2002 | | 2001 | | 2000 | | 2000 |

| PER SHARE OPERATING PERFORMANCE |

| Net asset value, beginning of period | | $ | 7.30 | | | $ | 8.42 | | | $ | 10.35 | | | $ | 18.36 | | | $ | 12.13 | |

| Net investment income/(loss) | | | (0.10 | )† | | | (0.15) | ††† | | | (0.12 | )†† | | | (0.14 | )† | | | (0.20 | )† |

Net realized and unrealized gain/(loss) on investments and foreign currency related transactions | | | 0.97 | | | | (1.03 | ) | | | (1.88 | ) | | | (4.78 | ) | | | 6.14 | |

Net increase/(decrease) in net assets resulting from operations | | | 0.87 | | | | (1.18 | ) | | | (2.00 | ) | | | (4.92 | ) | | | 5.94 | |

| Dividends and distributions to shareholders: |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Net realized gains on investments and foreign currency related transactions | | | — | | | | — | | | | — | | | | (3.09 | ) | | | — | |

| Total dividends and distributions to shareholders | | | — | | | | — | | | | — | | | | (3.09 | ) | | | — | |

Anti-dilutive impact due to capital shares tendered or repurchased | | | — | | | | 0.06 | | | | 0.07 | | | | — | | | | 0.29 | |

| Net asset value, end of period | | $ | 8.17 | | | $ | 7.30 | | | $ | 8.42 | | | $ | 10.35 | | | $ | 18.36 | |

| Market value, end of period | | $ | 6.85 | | | $ | 6.22 | | | $ | 6.88 | | | $ | 7.688 | | | $ | 13.508 | |

| Total investment return (a) | | | 10.13 | % | | | (9.59 | )% | | | (10.50 | )% | | | (28.46 | )% | | | 37.58 | % |

| RATIOS/SUPPLEMENTAL DATA |

| Net assets, end of period (000 omitted) | | $ | 74,899 | | | $ | 66,937 | | | $ | 90,771 | | | $ | 131,325 | | | $ | 130,300 | |

| Ratio of expenses to average net assets (b) | | | 1.77 | % | | | 1.90 | % | | | 1.76 | % | | | 1.91 | %(c) | | | 2.24 | % |

| Ratio of expenses to average net assets, excluding taxes | | | 1.77 | % | | | 1.77 | % | | | 1.74 | % | | | 1.91 | %(c) | | | 2.04 | % |

| Ratio of net investment income/(loss) to average net assets | | | (1.33 | )% | | | (1.89 | )% | | | (1.18 | )% | | | (1.50 | )%(c) | | | (1.15 | )% |

| Portfolio turnover rate | | | 120.31 | % | | | 94.89 | % | | | 82.16 | % | | | 51.72 | % | | | 113.75 | % |

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS

OCTOBER 31, 2009

NOTE A. ORGANIZATION

The Emerging Markets Telecommunications Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management investment company.

NOTE B. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Security Valuation: The net asset value of the Fund is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. Equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation. Valuation Time is as of the close of regular trading of the "exchange", (usually 4:00 pm Eastern Standard Time). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest ask quotation in the case of a short sale of securities. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Debt obligations that will mature in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that this method would not represent fair value. Investments in mutual funds are valued at the mutual fund's closing net asset value per share on the day of valuation.

Securities and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Fund's Valuation Time, but after the close of the securities' primary market, are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. The Fund may utilize a service provided by an independent third party which has been approved by the Board of Directors to fair value certain securities. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. The Fund's estimate of fair value assumes a willing buyer and a willing seller neither acting under the compulsion to buy or sell. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could differ from the prices originally paid by the Fund or the current carrying values, and the difference could be material.

The Fund adopted ASC 820, Fair Value Measurements and Disclosures ("ASC 820"), effective November 1, 2008. In accordance with ASC 820, fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. ASC 820 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity.

Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments, information provided by the General Partner or investee companies such as publicly traded prices, financial statements, capital statements, recent transactions, and general market conditions).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2009 in valuing the Fund's investments carried at value:

| Investments, at value | | Quoted Prices in Active Markets for Identical Investments (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Balance as of 10/31/2009 |

| Diversified Telecommunication Services | | $ | 4,449,938 | | | $ | 35,429,088 | | | $ | — | | | $ | 39,879,026 | |

| Venture Capital | | | — | | | | — | | | | 6,768,368 | | | | 6,768,368 | |

| Wireless Telecommunication Services | | | 37,179,131 | | | | 60,290,798 | | | | — | | | | 97,469,929 | |

| Short-Term Investments | | | — | | | | 3,045,000 | | | | — | | | | 3,045,000 | |

| Total | | $ | 41,629,069 | | | $ | 98,764,886 | | | $ | 6,768,368 | | | $ | 147,162,323 | |

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

| Investments, at value | | Balance as of 10/31/2008 | | Accrued discounts/ premiums | | Realized gain/(loss) | | Change in unrealized appreciation/ (depreciation) | | Net purchases (sales) | | Net transfers in and/or out of Level 3 | | Balance as of 10/31/2009 |

| Venture Capital | | $ | 9,290,520 | | | $ | — | | | $ | (683,942 | ) | | $ | (1,784,346 | ) | | $ | (53,864 | ) | | $ | — | | | $ | 6,768,368 | |

| Total | | $ | 9,290,520 | | | $ | — | | | $ | (683,942 | ) | | $ | (1,784,346 | ) | | $ | (53,864 | ) | | $ | — | | | $ | 6,768,368 | |

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

Short-Term Investment: The Fund sweeps available cash into a short-term time deposit available through Brown Brothers Harriman & Co., the Fund's custodian. The short-term time deposit is a variable rate account classified as a short-term investment.

Investment Transactions and Investment Income: Investment transactions are accounted for on a trade date basis. The cost of investments sold is determined by use of the specific identification method for both financial reporting and U.S. income tax purposes. Interest income is accrued as earned; dividend income is recorded on the ex-dividend date.

Taxes: No provision is made for federal taxes as it is the Fund's intention to continue to qualify for and elect the tax treatment applicable to regulated investment companies under the Internal Revenue Code of 1986, as amended, and to make the requisite distributions to its shareholders, which will be sufficient to relieve it from federal income and excise taxes.

The Fund is subject to the provisions of ASC 740 Income Taxes ("ASC 740"). The Fund has reviewed its current tax positions and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Services.

Under certain circumstances the Fund may be subject to a maximum of 36% Israeli capital gains tax on gains derived from the sale of certain Israeli investments. For the fiscal year ended October 31, 2009, the Fund did not incur such expense.

The Fund may be subject to a 16% Indian capital gains tax on gains derived from the sale of certain Indian investments. For the year ended October 31, 2009, the Fund did not incur such expense.

Brazil imposes a Contribução Provisoria sobre Movimentaçãoes Financieras ("CPMF") tax that applies to foreign exchange transactions related to dividends carried out by financial institutions. The tax rate is 0.38%. For the year ended October 31, 2009, the Fund did not incur such expense.

Foreign Currency Translations: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(I) market value of investment securities, assets and liabilities at the valuation date rate of exchange; and

(II) purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of gains and losses on investments in equity securities which is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are treated as ordinary income for U.S. federal income tax purposes.

Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

of net unrealized appreciation/depreciation in value of investments, and translation of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received.

Distributions of Income and Gains: The Fund distributes at least annually to shareholders substantially all of its net investment income and net realized short-term capital gains, if any. The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses, including capital loss carryovers, if any. An additional distribution maybe made to the extent necessary to avoid the payment of a 4% U.S. federal excise tax. Dividends and distributions to shareholders are recorded by the Fund on the ex-dividend date.

The character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for U.S. income tax purposes due to U.S. generally accepted accounting principles/tax differences in the character of income and expense recognition.

Partnership Accounting Policy: The Fund records its pro-rata share of the income/(loss) and capital gains/(losses) allocated from the underlying partnerships and adjusts the cost of the underlying partnerships accordingly. These amounts are included in the Fund's Statement of Operations.

Other: Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales of securities by foreign investors. In addition, if there is deterioration in a country's balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad. Amounts repatriated prior to the end of specified periods may be subject to taxes as imposed by a foreign country.

The emerging countries' securities markets are substantially smaller, less liquid and more volatile than the major securities markets in the United States. A high proportion of the securities of many companies in emerging countries may be held by a limited number of persons, which may limit the number of securities available for investment by the Fund. The limited liquidity of emerging country securities markets may also affect the Fund's ability to acquire or dispose of securities at the price and time it wishes to do so.

The Fund is sector concentrated and therefore invests a high percentage of its assets in the telecommunications sector. As a result, the financial, economic, business and political developments in a particular sector of the market, positive or negative, have a greater impact on the Fund's net asset value and will cause its shares to fluctuate more than if the Fund did not concentrate its investments in a particular sector. Under normal market conditions, it will invest not less than 80% of its net assets in a group of related industries within the telecommunications sector of the market.

The Fund, subject to local investment limitations, may invest up to 25% of its assets (at the time of commitment) in illiquid equity securities, including securities of private equity funds (whether in corporate or partnership form) that invest primarily in the emerging markets. When investing through another investment fund, the Fund will bear its proportionate

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

share of the expenses incurred by that fund, including management fees. Such securities are expected to be illiquid which may involve a high degree of business and financial risk and may result in substantial losses Because of the current absence of any liquid trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Further, companies whose securities are not publicly traded may not be subject to the disclosures and other investor protection requirements applicable to companies whose securities are publicly traded.

The Fund may enter into repurchase agreements ("repos") on U.S. Government securities with primary government securities dealers recognized by the Federal Reserve Bank of New York and member banks of the Federal Reserve System and on securities issued by the governments of foreign countries, their instrumentalities and with creditworthy parties in accordance with established procedures. Repos are contracts under which the buyer of a security simultaneously buys and commits to resell the security to the seller at an agreed upon price and date. Repos are deposited with the Fund's custodian and, pursuant to the terms of the repurchase agreement, the collateral must have an aggregate market value greater than or equal to the repurchase price plus accrued interest at all times. If the value of the underlying securities fall below the value of the repurchase price plus accrued interest, the Fund will require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults on its repurchase obligation, the Fund maintains the right to sell the underlying securities at market value and may claim any resulting loss against the seller; collectability of such claims may be limited. At October 31, 2009, the Fund had no such agreements.

NOTE C. AGREEMENTS

Effective July 1, 2009, Aberdeen Asset Management Investment Services Limited ("AAMISL") serves as the Fund's investment adviser with respect to all investments. The adviser is a direct wholly-owned subsidiary of Aberdeen Asset Management PLC. AAMISL receives as compensation for its advisory services from the Fund, an annual fee, calculated weekly and paid quarterly, equal to 1.25% of the first $100 million of the Fund's average weekly market value or net assets (whichever is lower), 1.125% of the next $100 million and 1.00% of amounts in excess of $200 million. For the period July 1, 2009 to October 31, 2009, AAMISL earned $559,242 for advisory services.

Prior to July, 1, 2009, Credit Suisse Asset Management, LLC ("Credit Suisse"), served as the Fund's investment adviser. For its services, Credit Suisse received a fee identical to the current fee paid to AAMISL. For the period November 1, 2008 to June 30, 2009, Credit Suisse earned $875,720 for advisory services, of which Credit Suisse waived $62,244. Prior to July 1, 2009, Credit Suisse Asset Management Limited ("Credit Suisse Ltd. U.K.") an affiliate of Credit Suisse, served as the Fund's sub investment adviser. Credit Suisse Ltd. U.K.'s sub-investment advisory fee was paid by Credit Suisse out of Credit Suisse's net investment advisory fee and was not paid by the Fund.

Brown Brothers Harriman & Co. ("BBH & Co.") serves as the Fund's U.S. administrator. For the fiscal year ended October 31, 2009, BBH & Co. earned $77,932 for administrative and fund accounting services.

Merrill Corporation ("Merrill"), an affiliate of Credit Suisse, the previous investment adviser, has been engaged by the Fund to provide certain financial printing services. For the fiscal year ended October 31, 2009, Merrill was paid $6,967 for its services to the Fund.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

The Independent Directors receive fifty percent (50%) of their annual retainer in the form of shares. Beginning in 2008, the independent Directors can elect to receive up to 100% of their annual retainer in shares of the fund. During the fiscal year ended October 31, 2009, 2,180 shares were issued through the Directors compensation plan. Directors as a group own less than 1% of the Fund's outstanding shares.

NOTE D. CAPITAL STOCK

The authorized capital stock of the Fund is 100,000,000 shares of common stock, $0.001 par value. As of October 31, 2009 the Fund held 8,246,665 shares outstanding.

NOTE E. INVESTMENT IN SECURITIES

For the fiscal year ended October 31, 2009, purchases and sales of securities, other than short-term investments, were $117,412,202 and $115,309,752, respectively.

NOTE F. CREDIT FACILITY

Prior to July 1, 2009, the Fund, together with other funds/portfolios advised by Credit Suisse (collectively, the "Participating Funds"), participated in a $50 million committed, unsecured, line of credit facility ("Credit Facility") with State Street Bank and Trust Company for temporary or emergency purposes. Under the terms of the Credit Facility, the Participating Funds paid an aggregate commitment fee on the average unused amount of the Credit Facility, which was allocated among the Participating Funds in such manner as was determined by the governing Boards of the Participating Funds. In addition, the Participating Funds paid interest on borrowings at either the Overnight Federal Funds rate or the Overnight LIBOR rate plus a spread. For the period ended June 30, 2009, the Fund had no borrowings under the Credit Facility. This arrangement ceased effective July 1, 2009.

NOTE G. FEDERAL INCOME TAXES

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

For the fiscal year ended October 31, 2009 the Fund paid $2,968,015 in distributions, classified as ordinary income. For the fiscal year ended October 31, 2008 the Fund paid $94,353 in distributions, classified as ordinary income.

The tax basis of components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences. These differences are primarily due to losses deferred on wash sales and timing differences due to partnership investments. At October 31, 2009, the components of distributable earnings on a tax basis, for the Fund were as follows:

| Undistributed ordinary income | | $ | 3,209,004 | |

| Accumulated net realized loss | | | (14,988,493 | ) |

| Unrealized appreciation | | | 2,265,991 | |

| Total distributable earnings | | $ | (9,513,498 | ) |

At October 31, 2009, the Fund had a capital loss carry forward for U.S. federal income tax purposes of $14,988,493. Capital loss carry forwards of $9,342,732 and $5,645,761 expire 2010 and 2011, respectively. It is uncertain whether the Fund will be able to realize the benefits before they expire. During the fiscal year ended October 31, 2009, the Fund utilized capital loss carry forwards of $8,020,268.

At October 31, 2009, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

unrealized appreciation from investments were $144,964,115, $23,045,214, $(20,847,006) and $2,198,208, respectively.

At October 31, 2009, the Fund reclassified $67,560 from undistributed net investment income to accumulated net realized loss on investments and foreign currency related transactions. These permanent differences are due to differing book/tax treatments of foreign currency transactions and partnership investments. Net assets were not affected by these reclassifications.

NOTE H. RESTRICTED SECURITIES

Certain of the Fund's investments are restricted as to resale and are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors in the absence of readily ascertainable market values.

| Security | Acquisition Date(s) | | Cost | | Fair Value At 10/31/09 | | Percent of Net Assets | | Distributions Received | | Open Commitments |

| BPA Israel Ventures LLC | 10/05/00 – 12/09/05 | | $ | 1,160,483 | | | $ | 572,275 | | | | 0.39 | | | $ | 97,293 | | | $ | 625,413 | |

| Concord Ventures Fund II, L.P. | 03/29/00 – 12/15/06 | | | 2,633,194 | | | | 694,476 | | | | 0.47 | | | | 258,608 | | | | — | |

| Emerging Markets Ventures I, L.P. | 01/22/98 – 01/10/06 | | | 2,790,776 | | | | 873,774 | | | | 0.59 | | | | 7,129,731 | | | | 851,172 | |

| Exxel Capital Partners V, L.P. | 05/11/98 – 12/03/98 | | | 380,481 | | | | 0 | | | | 0.00 | | | | 205,185 | | | | — | |

| Giza GE Venture Fund III, L.P. | 01/31/00 – 11/23/06 | | | 1,812,299 | | | | 604,918 | | | | 0.41 | | | | 724,175 | | | | — | |

JPMorgan Latin America Capital Partners L.P. | 04/10/00 – 03/20/08 | | | 666,719 | | | | 300,570 | | | | 0.20 | | | | 2,290,424 | | | | 502,195 | |

| K.T. Concord Venture Fund L.P. | 12/08/97 – 09/29/00 | | | 1,260,856 | | | | 95,928 | | | | 0.06 | | | | 1,320,492 | | | | — | |

| Neurone Ventures II, L.P. | 11/24/00 – 02/24/09 | | | 193,007 | | | | 189,789 | | | | 0.13 | | | | 297,649 | | | | 75,000 | |

SVE Star Ventures Enterprises GmbH & Co. No. IX KG | 12/21/00 – 08/12/08 | | | 1,624,685 | | | | 643,292 | | | | 0.43 | | | | 380,279 | | | | — | |

Technology Crossover Ventures IV, L.P. | 03/08/00 – 03/30/09 | | | 612,003 | | | | 760,755 | | | | 0.51 | | | | 1,614,017 | | | | 62,200 | |

| Telesoft Partners L.P. | 07/22/97 – 06/07/01 | | | 158,405 | | | | 0 | | | | 0.00 | | | | 7,203,101 | | | | — | |

| Telesoft Partners II QP, L.P. | 07/14/00 – 06/12/08 | | | 1,165,581 | | | | 826,203 | | | | 0.56 | | | | 1,109,561 | | | | 120,000 | |

TVG Asian Communications Fund II, L.P. | 06/07/00 – 10/27/05 | | | 886,646 | | | | 549,091 | | | | 0.37 | | | | 3,514,709 | | | | 377,882 | |

| Walden-Israel Ventures III, L.P. | 02/23/01 – 09/18/08 | | | 759,916 | | | | 657,297 | | | | 0.44 | | | | 942,976 | | | | 125,812 | |

| Total | | | $ | 16,105,051 | | | $ | 6,768,368 | | | | 4.56 | | | $ | 27,088,200 | | | $ | 2,739,674 | |

The Fund may incur certain costs in connection with the disposition of the above securities.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

NOTE I. SHARE REPURCHASE PROGRAM/

SELF-TENDER POLICY

Share Repurchase Program: The Board of Directors of the Fund, at a meeting held on November 21, 2003, authorized management to make open market purchases from time to time in an amount up to 10% of the Fund's outstanding shares whenever the Fund's shares are trading at a discount to net asset value of 15% or more. Open market purchases may also be made within the discretion of management if the discount is less than 15%. In May 2007, the Fund's Board of Directors approved a reduction of the threshold that would trigger potential share repurchases from 15% to 12%. Also in May 2007, the Fund's Board approved that open market purchases can also be made within the discretion of management where the discount is less than 12%. The Board has instructed management to report repurchase activity to it regularly, and to post the number of shares repurchased on the Fund's website on a monthly basis. For the fiscal year ended October 31, 2008, the Fund repurchased 306,439 of its shares for a total cost of $6,459,493 at a weighted discount of 12.36% from its net asset value. As of October 31, 2008 the repurchase of this original amount had been completed.

Self-Tender Policy: In April 2009, the Board authorized a tender offer to purchase 10% of the Fund's outstanding common shares at a price of 98% of the Fund's net asset value on the date the tender offer expires, provided the common shares of the Fund have traded at a volume weighted average discount to net asset value of greater than 10% during a 90-day measurement period. The measurement period commenced in August 2009 through October 31, 2009; as of October 31, 2009 the volume weighted average discount to net asset value was under 10%, and therefore a tender offer was not initiated.

NOTE J. CONTINGENCIES

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

NOTE K. RECENT ACCOUNTING PRONOUNCEMENTS

In June 2009, the FASB issued Accounting Standard Codification 105-10, "The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles—a replacement of FASB Statement No. 162" ("ASC 105-10, formerly "SFAS 168"). ASC 105-10 replaces SFAS No. 162, "The Hierarchy of Generally Accepted Accounting Principles" and establishes the "FASB Accounting Standards Codification" ("Codification") as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with U.S. GAAP. All guidance contained in the Codification carries an equal level of authority. On the effective date of ASC 105-10, the Codification will supersede all then-existing non-SEC accounting and reporting standards. All other non-grandfathered non-SEC accounting literature not included in the Codification will become nonauthoritative. ASC 105-10 is effective for financial statements issued for interim and annual periods ending after September 15, 2009. Management has evaluated this new statement and the financial statements and notes to financial statements have been updated to reflect how the Funds' reference GAAP.

THE EMERGING MARKETS TELECOMMUNICATIONS FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

OCTOBER 31, 2009

NOTE L. SUBSEQUENT EVENTS

In accordance with the provisions set forth in ASC 855 "Subsequent Events", management has evaluated the possibility of subsequent events existing in the Fund's financial statements through December 24, 2009.

Effective November 1, 2009, the Board of Directors have approved the reinitiation of its share repurchase program, which authorizes management to make open market purchases from time to time in an amount up to 10% of the Fund's outstanding shares. Such purchases may be made when the Fund's shares are trading at a discount to net asset value of 12% or more. Open market purchases may also be made at the discretion of management if the discount to net asset value is less than 12%.

On November 13, 2009, the Fund entered into a credit facility along with other Funds advised by Aberdeen (The Chile Fund, The Indonesia Fund, The First Israel Fund, The Latin America Equity Fund, collectively, the "Funds"). The Funds agreed to a $10 million committed revolving credit facility with Brown Brothers Harriman & Co. for temporary or emergency purposes. Under the terms of the credit facility, the Funds will pay an aggregate commitment fee on the average unused amount of the credit facility. In addition, the Funds will pay interest on borrowings at the Overnight LIBOR rate plus a spread

Subsequent to October 31, 2009, the Fund declared a distribution of 12.42 cents per share payable on Jan 15, 2010 shareholders of record on Dec 22, 2009.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

of The Emerging Markets Telecommunications Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations, of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Emerging Markets Telecommunications Fund, Inc. (the "Fund") at October 31, 2009, the results of its operations for the year then ended and the changes in its net assets and financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at October 31, 2009 by correspondence with the custodian, brokers, and private equity issuers, provides a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

December 24, 2009

RESULTS OF ANNUAL MEETING OF SHAREHOLDERS (UNAUDITED)

On May 8, 2009, the Annual Meeting of Shareholders of the Fund (the "Meeting") was held and the following matter was voted upon:

(1) To re-elect two directors to the Board of Directors of the Fund:

| Name of Director | | For | | Withheld |

| Walter Eberstadt | | | 6,668,916 | | | | 145,353 | |

| Steven N. Rappaport | | | 6,629,010 | | | | 185,259 | |

In addition to the directors elected at the Meeting, Enrique R. Arzac, James J. Cattano, Martin M. Torino, continued as directors of the Fund.

RESULTS OF SPECIAL MEETING OF SHAREHOLDERS (UNAUDITED)

On May 8, 2009, a Special Meeting of Shareholders of the Fund was held and the following matter was voted upon:

(1) To approve a new advisory agreement with Aberdeen Asset Management Investment Services Limited:

| For | | Against | | Abstain |

| | 5,321,642 | | | | 263,797 | | | | 56,343 | |

TAX INFORMATION (UNAUDITED)

For the fiscal year ended October 31, 2009, the Fund designates approximately $2,968,015, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue code, as qualified dividend income eligible for reduced tax rates. These lower rates range from 5% to 15% depending on an individual's tax bracket. If the Fund pays a distribution during calendar year 2009, complete information will be reported in conjunction with Form 1099-DIV.

The Fund has made an election under Section 853 to pass through foreign taxes paid by the Fund to its shareholders. The amount of foreign taxes that were passed through to shareholders for the year ended October 31, 2009, was $575,601. The amount of foreign source income was $5,779,713. Shareholders should refer to their Form 1099-DIV to determine the amount includable on their respective tax returns for 2009.

INFORMATION CONCERNING DIRECTORS AND OFFICERS (UNAUDITED)

Name, Address (Year of Birth) | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Fund Complex Overseen by Director | | Other Directorships Held by Director | |

| Independent Directors | |

| |

Enrique R. Arzac c/o Aberdeen Asset Management Att: US Legal 1735 Market Street, 32nd Fl Philadelphia, PA 19103 (1941) | | Director; Chairman of the Board; Nominating Committee Chairman and Audit Committee Member | | Since 1996; Chairman since 2005; current term ends at the 2010 annual meeting | | Professor of Finance and Economics, Graduate School of Business, Columbia University since 1971 | | | 5 | | | Director of Epoch Holding Corporation (an Investment management and investment advisory services company); Director of The Adams Express Company (a closed-end investment company); Director of Petroleum and Resources Corporation (a closed-end investment company) | |

| |

James J. Cattano c/o Aberdeen Asset Management Att: US Legal 1735 Market Street, 32nd Fl Philadelphia, PA 19103 (1943) | | Director; Nominating Committee Member and Audit Committee Chairman | | Since 1993; current term ends at the 2010 annual meeting | | President, Primary Resources Inc. (an international trading and manufacturing company specializing in the sale of agricultural commodities throughout Latin American markets) since October 1996 | | | 5 | | | None | |

| |

Walter Eberstadt c/o Aberdeen Asset Management Att: US Legal 1735 Market Street, 32nd Fl Philadelphia, PA 19103 (1921) | | Director; Nominating and Audit Committee Member | | Since 2005; current term ends at the 2009 annual meeting | | Limited Managing Director in Lazard Freres & Co. since 1969 | | | 1 | | | None | |

| |

Steven N. Rappaport c/o Aberdeen Asset Management Att: US Legal 1735 Market Street, 32nd Fl Philadelphia, PA 19103 (1948) | | Director; Nominating and Audit Committee Member | | Since 2006; current term ends at the 2009 annual meeting | | Partner of Lehigh Court, LLC and RZ Capital (private investment firms) since July 2002 | | | 5 | | | Director of iCAD, Inc. (Surgical & Medical Instruments & Apparatus); Director of Presstek, Inc. (digital imaging technologies company); Director of Wood Resources, LLC (a plywood manufacturing company) | |

| |

INFORMATION CONCERNING DIRECTORS AND OFFICERS (UNAUDITED) (CONTINUED)

Name, Address (Year of Birth) | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Fund Complex Overseen by Director | | Other Directorships Held by Director | |

| Independent Directors—(continued) | |

| |

Martin M. Torino c/o Aberdeen Asset Management Att: US Legal 1735 Market Street, 32nd Fl Philadelphia, PA 19103 (1949) | | Director; Nominating and Audit Committee Member | | Since 1993; current term ends at the 2011 annual meeting | | Chief Executive Officer and Director of Celsur Logistica S.A. (Logistics) since 2002 | | | 3 | | | None | |

| |

Gregory Hazlett c/o Aberdeen Asset Management Att: US Legal 1735 Market Street, 32nd Fl Philadelphia, PA 19103 (1965) | | Director | | Since October 2009; Current term ends at the 2012 annual meeting. | | Strategic Advisor, Keywise Capital Management (Hong Kong), Sept 2009-Present Executive Consultant, FS Associates, Jan 2008-Present Chief Investment Officer, Children's Hospital of Philadelphia, Dec 2005-Dec 2007 Managing Director, Howard Hughes Medical Institute, Jun 1998-Mar 2005 | | | 1 | | | Director, Vietnam Lotus Fund Director, City of Rockville Retirement Fund, Director; Vietnam Emerging Equity Fund Limited, India Capital Institutional Fund, Siguler Guff BRIC Opportunities Fund, MAC Japan Fund, Korea Growth Opportunities Fund, Lazard Emerging World Investors Fund | |

| |

INFORMATION CONCERNING DIRECTORS AND OFFICERS (UNAUDITED) (CONTINUED)

Name, Address (Year of Birth) | | Position(s) Held with Fund | | Length of Time Served | | Principal Occupation(s) During Past Five Years | |

| Officers | |

| |

Christian Pittard c/o Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1973) | | President | | Since July 2009 | | Currently, Group Development Director, Collective Funds for Aberdeen Asset Management Limited. Mr. Pittard served as Head of North American funds based in the U.S. from 2005 to 2007. Prior to that, Mr. Pittard was a Managing Director of Aberdeen's business in Jersey, Channel Islands having joined Aberdeen in 1998. | |

| |

Vincent McDevitt Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1966) | | Chief Compliance Officer | | Since July 2009 | | Currently, CCO-Registered Funds for Aberdeen Asset Management Inc. Mr. McDevitt joined the Aberdeen Asset Management Inc. in January 2008. He has ten years experience in the investment securities industry. Formerly with ING Clarion Real Estate Securities LP, Turner Investment Partners, Inc., and the Vanguard Group. | |

| |

Alan Goodson Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1974) | | Vice President | | Since July 2009 | | Currently, Head of US Collective Funds for Aberdeen Asset Management Inc. Previously, Mr. Goodson was Head of Product Management for Aberdeen's US collective investment vehicles and serves as vice president and secretary for Aberdeen's registered investment companies in the US and Canada. Mr. Goodson joined Aberdeen from PricewaterhouseCoopers in 2000 and relocated to Aberdeen's Philadelphia office in 2005. | |

| |

Megan Kennedy Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1974) | | Vice President and Secretary | | Since July 2009 | | Currently, Head of Product Management for Aberdeen Asset Management Inc. Ms. Kennedy joined Aberdeen Asset Management Inc. in 2005 as a Senior Fund Administrator. Ms. Kennedy was promoted to Assistant Treasurer Collective Funds/North American Mutual Funds in February 2008 and promoted to Treasurer Collective Funds/North American Mutual Funds in July 2008. Prior to joining Aberdeen Asset Management Inc., Ms. Kennedy was a Private Equity Manager with PFPC (2002-2005). | |

| |

Andrea Melia Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1969) | �� | Treasurer and Chief Financial Officer | | Since July 2009 | | Currently, Head of Fund Accounting for Aberdeen Asset Management Inc. Ms. Melia joined Aberdeen Asset Management Inc. in September 2009. Prior to joining Aberdeen, Ms. Melia was Director of fund administration and accounting oversight for Princeton Administrators LLC, a division of BlackRock Inc. and had worked with Princeton Administrators since 1992. | |

| |

William Baltrus Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1967) | | Vice President | | Vice President | | Currently, Head of Mutual Fund Administration for Aberdeen Asset Management Inc. Prior to joining Aberdeen Asset Management Inc. in November 2007, he was Vice President of Administration for Nationwide Funds Group from 2000-2007. | |

| |

INFORMATION CONCERNING DIRECTORS AND OFFICERS (UNAUDITED) (CONTINUED)

Name, Address (Year of Birth) | | Position(s) Held with Fund | | Served | | Principal Occupation(s) During Past Five Years | |

| Officers—(continued) | |

| |

Joanne Irvine c/o Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1968) | | Vice President | | Since July 2009 | | Currently, Head of Emerging Markets Ex. Asia on the global emerging markets equities team in London. Ms. Irvine joined Aberdeen in 1996 in a group development role. | |

| |

Devan Kaloo c/o Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1972) | | Vice President | | Since July 2009 | | Currently, serves as Head of Global Emerging Markets. Mr. Kaloo joined Aberdeen in 2000 on the Asian portfolio team before becoming responsible for the Asian ex Japan region as well as regional portfolios within emerging market mandates and technology stocks. | |

| |

Jennifer Nichols Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1978) | | Vice President | | Since July 2009 | | Currently, Head of Legal US, Vice President and Secretary of Aberdeen Asset Management Inc. Ms. Nichols joined Aberdeen Asset Management Inc. in October 2006. Prior to that, Ms. Nichols was an associate attorney in the Financial Services Group of Pepper Hamilton LLP (law firm) (2003-2006). Ms. Nichols graduated in 2003 with a J.D. from the University of Virginia School of Law. | |

| |

Lucia Sitar Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1971) | | Vice President | | Since July 2009 | | Currently, U.S. Counsel for Aberdeen Asset Management Inc. Ms. Sitar joined Aberdeen Asset Management Inc. in July 2007. Prior to that, Ms. Sitar was an associate attorney in the Investment Management Group of Stradley Ronan Stevens & Young LIP (law firm) (2000-2007). | |

| |

Tim Sullivan Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1961) | | Vice President | | Since July 2009 | | Currently, Head of Product Development and Vice President of Aberdeen Asset Management Inc. Mr. Sullivan joined Aberdeen Asset Management Inc. in 2000. | |

| |

Hugh Young c/o Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 (1958) | | Vice President | | Since July 2009 | | Currently, a member of the Executive Management Committee of Aberdeen Asset Management PLC. He has been Managing Director of Aberdeen Asset Management Asia Limited since 1991. | |

| |

ADVISORY AGREEMENT APPROVAL DISCLOSURE (UNAUDITED)

The Board of Directors (the "Board") of The Emerging Markets Telecommunications Fund, Inc. (the "Fund"), including a majority of the Directors who have no direct or indirect interest in the investment advisory agreement and are not "interested persons" of the Fund, as defined in the Investment Company Act of 1940 (the "Independent Directors"), is required to approve and review annually the terms of the Fund's investment advisory agreement. During the period covered by this report, the Board approved an investment advisory agreement with Aberdeen Asset Management Asia Limited (the "Adviser"). This agreement is referred to as the "New Agreement."

The Board's consideration and approval of the New Agreement was prompted by Credit Suisse's announcement in December 2008 that it had signed an agreement to sell part of its asset management business (the "Sold Businesses") to Aberdeen PLC (the "Proposed Transaction"), which pursuant to Section 15 of the Investment Company Act of 1940, would cause the Fund's then-existing investment advisory agreement to terminate automatically (the "Termination"). As a result, from January through March 2009, the Board held a series of meetings to consider alternatives available for the Fund in light of the Termination. At these meetings, the Board invited representatives of Credit Suisse and Aberdeen PLC to provide information regarding the Termination and its impact on the advisory and other service-provider relationships of the Fund. The Board also met with senior executives, investment professionals and compliance personnel of both Credit Suisse and Aberdeen PLC and their investment advisory subsidiaries. Throughout this period, the Independent Directors, directly and through their counsel, also requested, received and evaluated extensive information about the Adviser and its capacity and resources to manage the Fund. The Independent Directors also considered other options for the Fund, including engaging a consultant to solicit and evaluate proposals from other asset management firms and restructuring or liquidating the Fund.

After a detailed review of all information received and extensive deliberations, the Fund's Board unanimously approved the New Agreement. The New Agreement was approved by a majority of the Fund's Independent Directors.

In approving the new investment advisory agreement, the Board considered all factors they believed relevant in exercising its business judgment, including:

(i) the reputation, financial strength and resources of Aberdeen PLC and the Adviser;

(ii) that Aberdeen PLC is a global and independent organization with an exclusive focus on asset management;

(iii) Aberdeen PLC's commitment, as personally communicated by its most senior executive officers, to continuing and expanding its asset management business in general and its U.S.-registered closed-end fund business in particular;

(iv) Aberdeen PLC's representation that, if the Adviser were approved as the Fund's investment adviser, there would be no diminution in the nature, quality and extent of services provided to the Fund and its shareholders, including administrative, regulatory and compliance services;

(v) the qualifications and experience of portfolio management personnel of the Adviser who would be responsible for managing the Fund's investments, including the Fund's illiquid investments, and the Adviser's team-based investment philosophy and process;

(vi) Aberdeen PLC's regulatory and compliance history in general and in connection with servicing existing U.S.-registered closed-end funds in particular;

ADVISORY AGREEMENT APPROVAL DISCLOSURE (UNAUDITED) (CONTINUED)

(vii) that the investment objective and policies of the Fund will not change following the Termination;

(viii) that any repositioning of the Fund's portfolio to transition them to the Adviser's investment style (with trading activity expected to be minimal in the short term for the Fund) would be done in a manner that minimizes transaction costs and mitigates adverse tax consequences;

(ix) that the Adviser's emerging markets equity strategy has outperformed the relevant benchmark index over various periods;

(x) that the Adviser has no present intention to propose any immediate changes to any of the Fund's third-party service providers;

(xi) that, at its November 2008 meeting, the Board performed a full annual review of the then-existing advisory agreements as required by the 1940 Act and had re-approved the agreement, concluding, among other things, that the advisory fee rate charged by Credit Suisse Asset Management, LLC ("CSAM") was not excessive;

(xii) that the Fund's advisory fees rate would remain at the same level under the New Agreement;

(xiii) that expenses that were absorbed by CSAM as the Fund's adviser would be absorbed by the Adviser;

(xiv) that the terms and conditions of the New Agreement are similar to those of the existing agreement;

(xv) that Credit Suisse and Aberdeen PLC, and not the Fund, would bear all costs of meetings, preparation of materials and solicitation in connection with obtaining approvals of the New Agreement; and

(xvi) that the Adviser has committed to refrain from imposing or seeking to impose, for a period of two years after the closing of Proposed Transaction, any "unfair burden" (as defined in the 1940 Act) on the Fund.