Exhibit 99.1

Overview

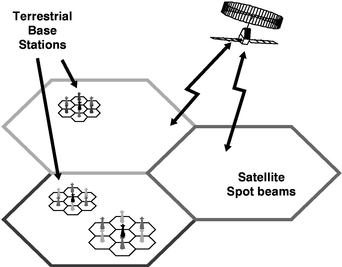

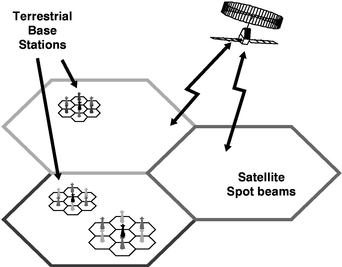

We are developing an integrated satellite and terrestrial communications network to provide ubiquitous wireless broadband services, including Internet access and voice services, in the United States and Canada. Using an all-Internet Protocol ("IP"), open architecture, we believe our network will provide significant advantages over existing wireless networks. Such potential advantages include higher data speeds, lower costs per bit and flexibility to support a range of custom IP applications and services. Our current business plan envisions a "carrier's carrier" wholesale model whereby our strategic partners and other wholesale customers can use our network to provide differentiated broadband services to their subscribers. We believe our planned open network, in contrast to legacy networks currently operated by incumbent providers, will allow distribution and other strategic partners to have open network access to create a variety of custom applications and services for consumers.

We currently offer a range of mobile satellite communications services ("MSS") using two geostationary satellites ("GEOs") that support the delivery of data, voice, fax and dispatch radio services. We are licensed by the United States and Canadian governments to operate in the L-band spectrum which we have coordinated for use. We currently have coordinated approximately 30 MHz of spectrum throughout the United States and Canada. Our United States and Canadian spectrum footprint covers a total population of nearly 330 million. In operating our next generation integrated network, we plan to allocate the use of spectrum between satellite and terrestrial service. Our spectrum occupies a portion of the 1.5 - 1.6 GHz frequency band (the "L-band") and is positioned between the frequencies used today by terrestrial wireless providers in the United States and Canada. We were the first MSS provider to receive a license to operate an Ancillary Terrestrial Component ("ATC") network from the Federal Communications Commission ("FCC"). We were a major proponent of the FCC's February 2003 and February 2005 ATC and ATC Reconsideration Orders, both of which were adopted on a bipartisan, 5-0 basis. These ATC licenses permit the use of our L-band satellite frequencies in the operation of an advanced, integrated network capable of providing wireless broadband on a fixed, portable and fully mobile basis.

With access to approximately 30 MHz of spectrum that is conducive for mobile and fixed broadband wireless services, we believe we are well positioned to support an extensive wireless business plan. We believe access to this amount of spectrum provides us with the ability to pursue a network architecture using a choice of third generation ("3G") and fourth generation ("4G") wireless air interfaces, including such technologies as WiMAX, Code-Division Multiple Access-Evolution Data Optimized ("CDMA-EVDO"), WideBand "CDMA" ("WCDMA") and Flash Orthogonal Frequency Division Multiplexing ("Flash-OFDM"). We believe our next generation integrated network will create the opportunity to use our United States and Canadian nationwide spectrum, in its current configuration, to establish a strong position within the wireless industry.

Market Opportunity

We believe that the changing dynamics of the telecommunications industry have created a compelling market opportunity for our planned next generation integrated network. Increased competition, industry consolidation, wireless substitution for wireline services and the general convergence of media and telecommunications have led major service providers to attempt to offer consumers a bundle of four communications services: video, broadband data, voice and mobile wireless services. However, incumbent wireless providers may be constrained by certain factors, such as their spectrum positions and legacy second generation ("2G") and 3G circuit-switched network architectures, as the demand for an advanced bundle has increased. Wireless carriers may also be pursuing different market strategies based upon their existing networks and customers rather than offering new services like those we plan to provide using next generation integrated technology. New technologies are

1

emerging to deliver advanced broadband wireless services and applications to a potentially wide range of devices at price points we believe will be lower than those offered by incumbents' legacy networks. We anticipate that our United States and Canadian nationwide spectrum holdings and strategy to deploy a wireless, all-IP network will allow us, through wholesale customers, to provide superior connectivity to an array of devices, satisfy the evolving needs of the industry and capture a greater percentage of the consumer's total spending on communications services. We believe the potential market opportunity includes participation from large enterprises that have limited access to the wireless services business (potentially including content companies, video service providers, web services firms, consumer electronics companies, enterprise service providers, device and chipset vendors and Internet service providers) which have large, loyal customer bases and are exploring opportunities to incorporate broadband wireless connectivity to differentiate and expand their core service offerings.

Key Strengths

We believe that the following competitive strengths position us to be a leader in the next generation wireless communications market:

- •

- High-Quality, United States and Canadian Nationwide Spectrum. We are licensed by the United States and Canada to operate in the L-band spectrum which we have coordinated for use. We currently have coordinated approximately 30 MHz of spectrum throughout the United States and Canada. We believe this amount of spectrum provides us with the ability to pursue a variety of advanced broadband air interfaces. We also believe our spectrum has strong propagation characteristics required for a large mobile operation.

- •

- Advanced and High Capacity Network Design. We believe our planned all-IP design will capitalize on modern network architecture and components to deliver greater capacity, more efficiently and at a lower variable cost than existing legacy networks. We expect to use an advanced air interface and package substantially more services and communications traffic within the same broadband architecture using the anticipated efficiencies of an all-IP design. We believe the ubiquitous coverage, interoperability and network redundancy that we intend to provide through the satellite component of our system is critical for reliability-sensitive markets such as public safety and homeland security. This capability is particularly timely given renewed focus on a reliable communications backbone for natural disasters such as Hurricane Katrina as well as other emergencies.

- •

- "Carrier's Carrier" Wholesale Business Model. We believe our wholesale approach will allow us to avoid a portion of the significant up-front subscriber acquisition costs, as well as other customer support costs related to a retail business model. We believe our partners will have the ability to develop and deploy superior and differentiated services and promotional offerings due to the planned open network and systems architecture, as well as the potential ability to choose from an expanded selection of end user devices as a result of fewer network restrictions. We believe that with partner distribution, our business model will be able to scale at a substantially faster pace than if we sold services directly to end-users.

2

- •

- Scalable, Build-As-You-Go Capital Plan. With regard to our terrestrial network, we plan to control our rate of capital expenditures based on our success rates and strategic partners. Our plan to develop the terrestrial component of our next generation integrated network includes a flexible approach to adding capacity for specific markets and/or services as demand warrants.

- •

- Differentiated Intellectual Property. Our intellectual property portfolio has been developed over 15 years and includes over 100 filed patent applications representing over 4,000 claims. We believe our patents cover elements we expect to be important to the development of any ATC network, including space segment design, frequency reuse and allocation, satellite beam forming and network management.

- •

- Time to Market. As a pioneer in the development of ATC, we were the first MSS operator to be granted an ATC license and as such are well positioned to be the first to utilize the full benefits of "transparency," which refers to the use of integrated satellite and terrestrial technology on standard wireless devices that are substantially similar to current PCS/cellular devices in terms of aesthetics, cost, form factor and functionality within terrestrial applications. Given recent advances in air interface technology, we believe we are also well positioned as a "last mover" to build an advanced and state-of-the-art 4G network that leapfrogs the incumbents' legacy 2G and 3G circuit-switched networks.

- •

- Management and Sponsorship. Our management team and investors have extensive backgrounds in telecommunications-related ventures. Our investors include BCE Inc., Columbia Capital, Motient Corporation ("Motient"), SkyTerra Communications, Inc. (an affiliate of Apollo Advisors L.P.), and Spectrum Equity. Certain of our executives and directors, led by Founder and Chairman Gary Parsons and Chief Executive Officer Alex Good, have previously served as founding partners and/or senior managers at leading telecommunications companies and have significant experience in wireless communications and spectrum license regulation. Several members of our management team and our limited partners were founding members of and/or are investors in XM Satellite Radio Holdings, Inc. or Sirius Satellite Radio Inc.

Our Spectrum

We are licensed in the United States and Canada to operate in the L-band spectrum which we have coordinated for use. We currently have coordinated approximately 30 MHz of spectrum throughout the United States and Canada for satellite service, which we plan to reuse to provide terrestrial service. Assuming a covered population of 330 million persons ("POPs"), this equates to approximately 10 billion MHz-POPs. The following are beneficial characteristics of our spectrum:

- •

- Broad geographic coverage. Our spectrum provides the opportunity to launch services throughout the United States and Canada, which differentiates our spectrum from other terrestrial wireless spectrum that has been auctioned or is expected to be auctioned in regional or local licenses, such as the Advanced Wireless Services ("AWS") and 700 MHz spectrum bands. Costs associated with clearing the 700 MHz and AWS spectrum could be substantial, and the process for clearing incumbent users from these bands could be complicated.

- •

- Cost-effective build-out relating to propagation characteristics of L-band. We believe the radio propagation characteristics of the L-band spectrum, located at 1.5 - 1.6 GHz, will enable us to deploy a terrestrial network at lower initial costs than would be incurred by companies operating in higher frequency spectrum bands, since fewer towers will be required for a comparable wireless footprint. We further believe that due to L-band radio propagation characteristics, we will incur lower operating expenses compared to existing PCS operators.

3

- •

- FCC approval to operate an integrated satellite and terrestrial network. We have received an authorization from the FCC, after an industry-defining rule-making, to operate an ATC network that would utilize our spectrum for terrestrial wireless services integrated with MSS. MSV was the first company to receive an FCC license for this purpose. We expect the additional frequency reuse, and resulting greater capacity of the terrestrial component of our integrated network, will provide us the economies of scale to offer affordable consumer services. We expect our satellites will give our next generation integrated network the ability to provide ubiquitous coverage within our satellite footprints in the United States and Canada, subject to the limitations of any satellite signal to penetrate inside buildings, an option not available to traditional terrestrial wireless companies. We believe the importance of satellite-enabled ubiquity and redundancy has become evident in recent natural disasters and national emergencies. Users of our network will have access to the satellite component of the network with the ease and availability and through the same types of devices as they enjoy with cellular wireless communications today.

- •

- Flexibility in choice of air-interface technology. The FCC has given us authority to use Global System for Mobile Communications ("GSM"), CDMA and WCDMA air interfaces. We have applied for and expect to receive authority to use WiMAX and Flash-OFDM air interfaces. We plan to select an air interface for our next generation integrated network in the future.

- •

- L-band spectrum assignment and potential rebanding. We operate today, and plan to operate our next generation integrated network, on blocks of spectrum of various sizes that are not completely contiguous. We believe our current spectrum contiguity is sufficient to support our next generation business plan, which contemplates use of one of a variety of broadband wireless air interfaces. Our existing plan does not assume or include the benefits of rebanding through the exchange of selected frequency channels among L-band operators, but we believe that rebanding, or a cooperative arrangement with other L-band operators with respect to our L-band spectrum use, could: (1) increase spectrum efficiency, (2) reduce our capital expenditures, (3) lower our operating expenses and (4) permit the expansion of our business plan to support higher broadband data rates and a larger number of broadband wireless subscribers.

Business Model

We are an operating company today with approximately 200,000 units in service and approximately $29 million in annual revenue. We provide switched and packet data service and sell bulk capacity to service provider partners through two nearly identical GEOs. Consistent with our strategy to deploy an integrated ATC network, in January 2006 we entered into a contract with Boeing Satellite Systems, Inc. ("Boeing") for the design and construction of our next generation satellites, which are expected to launch commencing in 2009. We believe our next generation satellites are designed to be powerful enough to enable subscribers to use transparent wireless devices.

We are also currently in the planning phase of our terrestrial network. We currently expect to start the build-out of the terrestrial network in several markets in 2007 and complete additional market build-outs in the future until we achieve a top 50 market footprint in the United States and Canada. We believe the success-based nature of our network deployment mitigates risk for our potential strategic partners and investors. As we reach scale and sell services to additional wholesale partners, we plan to extend our network footprint incrementally to offer nomadic, portable and fully mobile services.

Partnership Opportunities

We believe our strategy of offering wholesale broadband wireless services will enable us to partner with a range of media and communications service providers, including established

4

telecommunications companies, video service providers, satellite radio operators, Internet service providers, web application portals, consumer electronics companies, content providers and other mobile virtual network operators ("MVNOs"). We believe that our all-IP open architecture will offer an attractive platform for partnering with existing communications service providers and potential strategic partners attempting to enter the wireless space.

We believe new entrants seeking a broadband wireless solution will benefit from our approach. Historically, companies seeking to offer broadband wireless services may have been hindered by the systems of the incumbent wireless carriers, which limit the ability of third parties to control the service offering, customer experience and potential economics. In contrast, our distribution partners will have the ability to develop and deploy differentiated services and promotional offerings due to the open architecture of our planned network.

Our planned integrated architecture also offers the differentiation and increased coverage of a powerful satellite system, which creates additional partnership and distribution opportunities in a number of large coverage sensitive, vertical market segments, such as public safety, homeland security, rural users, fleet management and consumer telematics.

5

Summary Consolidated Financial Data

In the following table, we provide you with our summary historical consolidated financial and operating data for the periods indicated. The historical consolidated financial data for the fiscal years ended December 31, 2003, 2004 and 2005, respectively, are derived from our consolidated financial statements.

| | Year Ended December 31,

| |

|---|

| | 2003

| | 2004

| | 2005

| |

|---|

| | (Dollar amounts in thousands)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | |

| Total revenue | | $ | 27,124 | | $ | 29,007 | | $ | 29,381 | |

| Total operating expenses(1) | | | 44,128 | | | 55,762 | | | 68,534 | |

| Loss from continuing operations before other income (expense) | | | (17,004 | ) | | (26,755 | ) | | (39,153 | ) |

| Net loss(2) | | | (28,000 | ) | | (33,455 | ) | | (40,955 | ) |

| Balance Sheet Data (at end of period indicated): | | | | | | | | | | |

| Cash and cash equivalents(3) | | $ | 3,982 | | $ | 129,124 | | $ | 59,925 | |

| Restricted cash(4) | | | 74 | | | 75 | | | 6,264 | |

| Investments | | | — | | | — | | | 52,278 | |

| Total assets | | | 130,819 | | | 246,223 | | | 216,784 | |

| Working capital | | | 306 | | | 128,105 | | | 107,995 | |

| Accrued interest, net of current portion(3) | | | 16,725 | | | — | | | — | |

| Long-term deferred revenue, net of current portion | | | 20,866 | | | 20,690 | | | 23,243 | |

| Vendor note payable, net of current portion | | | 916 | | | 696 | | | 470 | |

| Notes payable to investors(3) | | | 82,925 | | | — | | | — | |

| Total partners' equity (deficit) | | | (984 | ) | | 212,964 | | | 181,260 | |

| Other Data: | | | | | | | | | | |

| Net cash provided by (used in) operating activities | | | 457 | | | (30,206 | ) | | (12,048 | ) |

| Net cash used in investing activities | | | (4,532 | ) | | (4,636 | ) | | (58,706 | ) |

| Net cash provided by financing activities | | | 2,125 | | | 160,267 | | | 323 | |

- (1)

- Total operating expenses include next generation expenses related to the development and deployment of our next generation integrated network of $4,268, $8,593, and $18,516 for the years ended December 31, 2003, 2004, and 2005, respectively. Total operating expenses include depreciation and amortization of $17,928, $18,439 and $16,109 for the years ended December 31, 2003, 2004 and 2005, respectively. Total operating expenses include non-cash compensation expenses related to options, excluding such expenses included in next generation expenses, of $0, $267 and $6,680 for the years ended December 31, 2003, 2004 and 2005, respectively.

- (2)

- Net loss includes losses from discontinued operations of TerreStar Networks Inc., a former subsidiary which was spun-off in May 2005, of $4,328, $1,939, and $9,553 for the years ended December 31, 2003, 2004, and 2005, respectively. Additionally, net loss for the year ended December 31, 2005 includes $724 related to cumulative effect of change in accounting principle upon the adoption of Financial Accounting Standards Board Interpretation No. 46, "Accounting for Variable Interest Entities."

- (3)

- In November 2004, the Company received $145,000 in cash proceeds from two of its existing limited partners in exchange for the issuance of 4,923,599 units of limited partnership interest. Concurrently with this transaction, the Company paid approximately $18,209 of accrued interest, in cash, on outstanding notes held by its limited partners, and exchanged or converted approximately $80,554 of principal amount and $4,368 of additional accrued interest on such outstanding notes into an aggregate of 9,911,234 units of limited partnership interest, which represented

6

approximately 50% of the units outstanding prior to this transaction. See note 5 of notes to the consolidated financial statements included herein.

- (4)

- In accordance with the requirements of the FCC, the Company secured a five-year, $3,000 bond for each orbital location. The bonds are fully collateralized by a $3,000 letter of credit for each bond, secured by cash on deposit, which is reflected as restricted cash. The restricted cash as of December 31, 2003 and 2004 relates to amounts retained from the purchase of the satellite business in 2001, which was restricted to pay Motient's rent obligation to the Company for the lease of office space in the Company's headquarters and to ensure the provision of certain services to the Company by Motient under a transition services agreement.

7

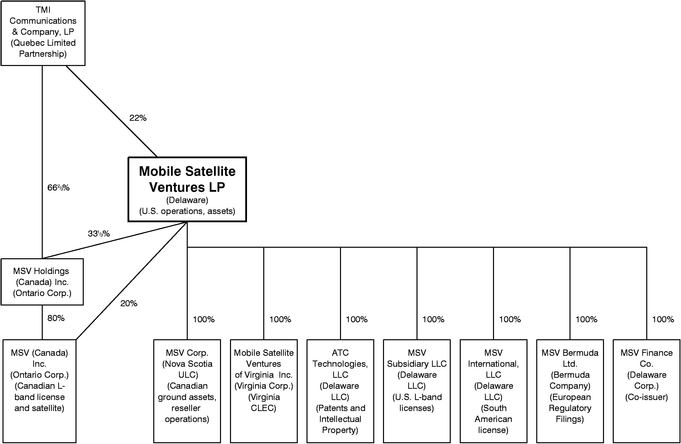

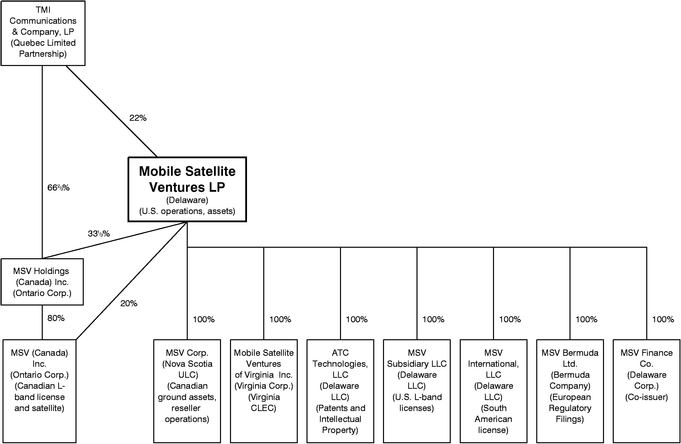

Company Structure

The following reflects our current company structure and the principal operational function of each of our subsidiaries as well as MSV Canada, which is jointly owned with TMI Communications & Company, Limited Partnership ("TMI"):

8

RISK FACTORS

Risks Associated with our Next Generation Business Plan

We need substantial further financing to develop and construct our next generation integrated network, but such financing might not be available.

We estimate that the total cost to develop and construct the two satellite components of our integrated network in the United States and Canada, including the costs of the satellites, their launch, launch insurance and associated ground segment will be approximately $1.1 billion. This estimate does not include approximately $250 million to construct a spare satellite that would not be launched ("ground spare") but is required by our FCC authorization.

In addition, we will require significant funds to construct the terrestrial component of our network. We plan to pursue a top 50 market terrestrial footprint, and we expect that each market could require between $20 million and $60 million to establish terrestrial coverage. We estimate that the total cost to deploy the terrestrial portion of the network could range between $500 million and $2.6 billion, depending on the choice of air interface technology, the number of markets deployed, the scope of the terrestrial build within each market and the targeted service offering (limited mobile, portable or fully mobile).

Our plan for a South American satellite, for which we have also contracted with Boeing, may cause us to incur additional expenditures of approximately $540 million, depending upon how such a plan is pursued. See the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources."

Our costs could be greater than our current estimates. For example, if we elect to defer payments under our satellite construction contract, and/or if we exercise certain options to buy additional satellites or other equipment or services, our cost for the satellite component of our network will increase, possibly significantly. The cost to build the terrestrial component of our network could be greater, perhaps significantly, than our current estimates, depending on changing costs of supplies, market conditions, and other factors over which we have no control.

Our projections assume that a portion of the remaining costs associated with constructing the satellite and terrestrial components of our next generation integrated network will be borne in part by one or more technology and strategic partners. If we are not able to enter into agreements with third parties to cover such costs, or if such funding sources are not able to cover such costs, our funding requirements will be significantly greater than we currently anticipate. We have not yet entered into any such agreements and cannot assure you if and when we will enter into such agreements.

In addition to financing from technology and strategic partners, we plan to raise future funds by selling debt and equity securities, and by obtaining loans or other credit lines from banks or other financial institutions. The type, timing and terms of financing we may select will depend upon our cash needs, the availability of other financing sources, the prevailing conditions in the financial markets and the restrictions contained in any future indebtedness. We cannot assure you that we will be able to find any such sources at any given time on favorable terms, if at all. If we fail to obtain any necessary financing on a timely basis, then each of the following could occur:

- •

- our satellite construction, launch, or other events necessary to conduct our business could be materially delayed, or their costs could materially increase;

- •

- we could default on our commitments to our satellite construction or launch contractors, creditors or other third parties, leading to termination of construction or inability to launch our satellites; and

9

- •

- we may not be able to launch our next generation integrated network as planned, and may have to discontinue operations or seek a purchaser for our business or assets.

As a result of these factors, we could lose our FCC or Industry Canada licenses or our international rights if we fail to achieve required performance milestones.

If we are successful in raising additional financing, we anticipate that a significant portion of future financing will consist of debt securities. As a result, we will be more highly leveraged. If additional funds are raised through the incurrence of indebtedness, we may incur significant interest charges, and become subject to various restrictions and covenants that could limit our ability to respond to market conditions, provide for unanticipated capital investments or take advantage of business opportunities.

The market for our service is new and unproven and the success of our next generation business will depend on market acceptance.

Other than satellite radio, we are not aware of any integrated (i.e. combined satellite and terrestrial) wireless service in commercial operation. Neither we, nor any other company, has developed an integrated next generation network. Our business plan contemplates that a significant portion of our revenues will be derived from strategic partners. To date, we have not entered into any strategic partnerships with respect to distribution of our next generation integrated network. As a result, we can estimate only with a partial level of certainty the potential demand for such services and the degree to which we will meet that demand. Furthermore, there may not be sufficient demand to enable us, or additional costs that do not allow us, to earn sufficient revenues, achieve sufficient cash flow or record a profit. Among other things, end user acceptance of our next generation integrated service will depend upon:

- •

- whether we provide integrated wireless services consistent with market demand;

- •

- the relative attractiveness of our service offerings to our anticipated partners;

- •

- the cost and availability of user equipment whose form factor is little different from standard wireless devices, but incorporates the new technology required to operate on our network;

- •

- federal, state, local and international regulations affecting the operation of satellite networks and wireless systems;

- •

- whether competitors develop new and alternative next generation technologies; and

- •

- general and local economic conditions.

If we cannot gain market acceptance for our planned products and services, our business will be significantly harmed. We have made, and will continue to make, significant capital investments to generate demand for our services. Accordingly, any material miscalculation with respect to our operating strategy or business plan will harm our business.

We will depend on one or more third parties to incorporate our technology into their consumer offerings, and such third parties may not be successful or effective in their use of our technology.

We have adopted a wholesale "carrier's carrier" business model and do not have plans to manufacture or sell end-user devices to consumers. The success of our network will depend on partnerships with third parties that incorporate our technology into their service and product offerings. In particular, we will not ourselves produce transparent wireless handsets for sale to wireless consumers but instead will need to identify and work with our partners and customers to apply our technology to standard wireless handsets and devices that they in turn market. If our partners are not successful in incorporating our technology or marketing devices compatible with our network, our revenues would be less than expected, and our business would suffer.

10

We will depend on one or more third party contractors to construct the terrestrial base station component of our next generation integrated network.

We currently plan to contract with one or more third parties to construct the terrestrial component of our next generation integrated network. Our success in implementing our next generation integrated network and penetrating our targeted vertical markets will depend, to a large extent, on the efforts of these third party partners. The development and rollout of the terrestrial network by these third parties may be subject to unforeseen delays, cost overruns, regulatory changes, engineering and technological changes and other factors, some of which may be outside of our control. If we are not able to enter into partnering relationships and construct the terrestrial component of our next generation integrated network, we may not be able to implement our business plan.

Failure to develop and supply terminals to customers in a timely manner will delay our revenues.

We will rely on third party manufacturers and their distributors to manufacture and distribute transparent devices. Transparent devices are not yet available, and we and third party vendors may be unable to develop and produce enough affordable transparent devices in a timely manner to permit the widespread introduction of our service. If we, our customers and our manufacturers fail to develop devices that are completely transparent for timely commercial sale at affordable prices, the launch of our next generation service would be delayed, our revenues would be less than expected, and our business would suffer.

Our integrated wireless network will depend on the development and integration of complex technologies in a satellite configuration that might not work.

Our next generation integrated network will require new applications of existing technology, complex integration of different technologies and the development of new technologies. We will have to integrate a number of sophisticated satellite and other wireless technologies that typically have not been integrated in the past, and some of which are not yet fully developed, before we can begin offering our next generation service. In order for our service to be received by traditional consumer devices, additional components and software will need to be added to such devices to adjust for the L-band frequencies as well as satellite communications. Although we intend to test the components of the next generation integrated network, we cannot ultimately confirm the ability of the system to function until we have actually deployed a substantial portion of our next generation integrated network. For example, our ground-based beam formation capabilities and the size of the reflectors on our next generation satellites cannot be fully tested until our next generation satellites are launched. Hardware or software errors in space or on the ground may limit or delay our next generation service, and therefore reduce anticipated revenues and the viability of our services. There could also be delays in the planned development, integration and operation of the components of our next generation integrated network. If the technological integration of our next generation integrated network is not completed in a timely and effective manner, our business would be harmed.

In our next generation integrated network, we will seek to develop and deploy network management techniques so that mobile devices used on our network will be able to seamlessly transition between satellite mode and terrestrial mode. We intend to develop such techniques primarily by adapting existing techniques used in PCS/cellular systems and digital/analog systems. However, such techniques have not been deployed before in a combined satellite/terrestrial system, and there can be no assurances that we will be successful in developing such techniques or deploying them in our next generation integrated network in a cost effective or timely manner. If we are not able to develop or deploy such techniques, mobile devices used on our network may not be able to seamlessly transition between satellite and terrestrial modes, and this may make our next generation integrated network less attractive to potential partners and end-user customers.

11

Our next generation satellites are subject to possible construction and delivery delays, the occurrence of which could materially and adversely affect our business.

Our next generation satellites are subject to possible construction and delivery delays. The manufacture of such satellites is technically complex, and delays could result from a variety of causes, including failure of third-party vendors to perform as anticipated and changes in the technical specifications of the satellite. There can be no assurance that delivery of our next generation satellites will be timely, which may hinder the introduction of our planned next generation integrated network. Any delay could also make it more difficult for us to secure desired distribution partnerships.

During any period of delay, we would continue to have significant cash requirements that could materially increase the aggregate amount of funding we need. We may not be able to obtain additional financing on favorable terms, or at all, during periods of delay. A delay could also require rescheduling of the anticipated launch date, and another launch slot may not be available within a reasonable period of time. In addition, a delay in satellite system operations could also result in revocation of our frequency and orbital slot authorizations and our international rights.

Our satellites could be damaged or destroyed during launch or deployment, fail to achieve their designated orbital location after launch or experience significant launch delays.

A percentage of satellites never become operational because of, among other factors, launch failure, satellite destruction or damage during launch, improper orbital placement and/or the failure of antennas to fully deploy. Launch failure rates vary depending on the particular launch vehicle and contractor. Even launch vehicles with good track records experience some launch failures, and there can be no assurance that we will be able to launch our satellites on vehicles with higher success rates. If one or more of our launches or deployments fail, we will suffer significant delays that will be damaging to our business, we will incur significant additional costs associated with the failed launches, and our revenue generating activities will be delayed. We cannot assure you that our satellite launches or deployments will be successful. The deployment of large antennas, such as the antennas on our next generation satellites, which are larger than most commercial satellites, pose additional risks during deployment. Even if launched into orbit, a satellite may fail to enter into its designated orbital location, or we may use more fuel than planned to place a satellite into its orbital location and, as a result, may reduce the overall useful life of the satellite.

Satellites have a limited useful life and premature failure of our satellites could damage our business.

During and after their launch, all satellites are subject to equipment failures, malfunctions and other problems. If one of our satellites were to fail prematurely, it likely would affect the quality of our service, substantially delay the commencement or interrupt the continuation of our service and harm our business and could impact our licenses. This harm to our business would continue until we either extended service to our customers on another satellite or built and launched additional satellites. Each of our MSAT-1 and MSAT-2 satellites has in the past experienced malfunctions and neither operate at full capacity. Our satellites could experience future malfunctions at any time, which could damage our ability to serve our customers, harm our reputation in the marketplace, reduce the expected useful life of the satellites and possibly adversely affect our government approvals. There can be no assurance that our existing satellites will remain operational until such time as we launch our next generation satellites. Any gap could have a material adverse effect on our business and could result in the loss of licenses.

Our ability to generate revenue depends on the lives of our existing and next generation satellites. Each satellite has a limited useful life. A number of factors could decrease the useful lives of our satellites to less than what is currently expected, including, without limitation:

- •

- defects in construction;

- •

- faster than expected degradation of solar panels;

12

- •

- durability of component parts;

- •

- loss of fuel on board;

- •

- higher than anticipated use of fuel to maintain the satellite's orbital location or higher than anticipated use of fuel during orbit raising following launch;

- •

- random failure of satellite components that are not protected by back-up units;

- •

- electromagnetic storms; and

- •

- collisions with other objects in space.

Damage to our satellites may not be fully covered by insurance.

We intend to purchase launch and in-orbit insurance policies for our next generation satellites from global space insurance underwriters. Although the indenture will generally require customary launch and full in-orbit insurance, there are limitations to such requirement. If certain material adverse changes in market conditions for full in-orbit insurance were to make it commercially unreasonable for us to maintain full in-orbit insurance, we could forego such insurance. Other adverse changes in insurance market conditions may substantially increase the premiums we will have to pay for such insurance or may preclude us from fully insuring our loss. In addition, if our in-orbit insurance lapses, the indenture will allow up to 120 days for replacement insurance to be put in place. If the launch of our next generation satellite system is a total or partial failure, our insurance may not fully cover our losses, and these failures may also cause insurers to include additional exclusions in our insurance policies when they come up for renewal. There can be no assurance that additional financing will be available to construct, launch and insure a replacement satellite or, if available, will be available on terms favorable to us. We do not expect to buy insurance to cover, and would not have protection against, business interruption, loss of business or similar losses. Also, any insurance we obtain will likely contain certain customary exclusions and material change conditions that would limit our coverage. We do not have insurance with respect to our existing satellites.

Delays in deployment of our terrestrial network due to limited tower availability, local zoning approvals or adequate telecommunications transport capacity would delay our revenues.

Our business strategy includes the deployment of a terrestrial network. Tower sites and authorizations in some desirable areas may be very costly and time intensive to obtain. If we are unable to obtain tower space, local zoning approvals or adequate telecommunications transport capacity to develop our network in a timely fashion, the launch of our next generation integrated network would be delayed, our revenues would be less than expected and our business would suffer.

Our planned terrestrial network or other ground facilities could be damaged by natural catastrophes or man-made disasters.

Since our planned terrestrial network will be attached to buildings, towers and other structures around the country, an earthquake, tornado, flood or other catastrophic event or other man-made disaster or vandalism could damage our network, interrupt our service and harm our business in the affected area. We will not have replacement or redundant facilities that can be used to assume the functions of our terrestrial network in the event of a catastrophic event. Any damage to our terrestrial network would likely result in degradation of our service for some subscribers and could result in complete loss of service in some affected areas. Temporary disruptions could also damage our reputation and the demand for our services.

13

We may be unable to achieve our business and financial objectives because the communications industry is highly competitive.

In seeking market acceptance for our next generation services, we will encounter competition from many sources, including:

- •

- existing satellite services from other operators;

- •

- conventional terrestrial wireless services;

- •

- traditional wireline voice and high-speed data offerings;

- •

- terrestrial land-mobile and fixed services; and

- •

- next generation integrated services that may be offered in the future by other networks operating in the S-band, L-band or Big Low Earth Orbiting ("LEO") band.

The communications industry includes major domestic and international companies, many of which have financial, technical, marketing, sales, distribution and other resources substantially greater than we do and which provide a wider range of services than will be provided by us. While we believe our services will be complementary to terrestrial wireless services, we may be adversely affected by competition from companies that provide services using existing wireless technologies.

We may also face competition from companies using new technologies and new integrated networks in the future. For instance, the FCC has authorized ICO Global Communications ("ICO") and TMI to use radio frequencies for mobile satellite services within the S-band. TMI has agreed to transfer its S-band authorizations to TerreStar. Although these potential competitors currently have no operations in this band, they are planning to launch integrated networks similar to those envisioned by us. Through our subsidiary, ATC Technologies LLC, we have also granted TerreStar a license to use our intellectual property for the development of its network. TMI/TerreStar have announced plans to launch a S-band satellite in 2007, in advance of the launches of our satellites. Failure to offer next generation integrated services that compete effectively with potential competitors such as TMI/TerreStar would have an adverse impact on our revenues, profitability and liquidity. We will also face competition with respect to entering into strategic partnerships.

We and our partners must continue to identify, develop and market innovative products or enhance existing products on a timely basis to maintain our profit margins and our competitive position.

Our future growth may depend on our ability to gauge the direction of commercial and technological progress in key markets and on our ability to fund and successfully develop and market products in our markets. Our competitors may have access to technologies not available to us, which may enable them to provide communications services of greater interest to end users, or at a more competitive cost. We may not be able to develop new products or technology, either alone or with third parties, or license any additional necessary intellectual property rights from third parties on a commercially competitive basis. The satellite and wireless industries are both characterized by rapid technological change, frequent new product innovations, changes in customer requirements and expectations and evolving industry standards. If we or our partners are unable to keep pace with these changes, our business may be unsuccessful. Products using new technologies, or emerging industry standards, could make our technologies obsolete. If we or our partners fail to keep pace with the evolving technological innovations in our markets on a competitive basis, our financial condition and results of operation could be adversely affected.

An economic downturn in the United States and Canada or changes in consumer spending could negatively affect our results of operations.

We expect that the primary customer base for our next generation integrated network will be composed of the customers of our distribution partners and customers within certain vertical markets (for example, public safety, fleet management and consumer telematics). In the event that the United

14

States and Canada experience an economic downturn and spending by end customers drops, our business may be negatively affected.

Demand for the services we plan to offer may not grow or be accepted generally, or in particular geographic markets, for particular types of services, or during particular time periods. A lack of demand could adversely affect our ability to sell our services, enter into strategic partnerships or develop and successfully market new services. In addition, demand patterns shift over time, and consumer preferences may not favor the services we plan to offer.

We may not be able to protect our proprietary information and intellectual property rights, which could limit the growth of our business and impact our ability to compete.

As of March 1, 2006, we have filed more than 100 patent applications (each application being filed in the United States and in several countries abroad), acquired 13 patents and two pending patent applications from Celsat related to the provision of next generation integrated network services, and have been issued 9 patents covering the fundamental principles of our next generation integrated technology. There is no assurance that the patents for which we have applied will be issued or, if issued, will be sufficient to fully protect our technology. In addition, there can be no assurance that any patents issued or licensed to us will not be challenged, invalidated or circumvented. Litigation to defend and enforce our intellectual property rights could result in substantial costs and diversion of resources and could have a material adverse effect on our financial condition and results of operations, regardless of the final outcome of such litigation. Despite our efforts to safeguard and maintain our proprietary rights, there can be no assurance that we will be successful in doing so or that our competitors will not independently develop or patent technologies equivalent or superior to our technologies. We believe that third parties may infringe upon our intellectual property now and in the future.

We also rely upon unpatented proprietary technology and other trade secrets. While it is our policy to enter into confidentiality agreements with our employees and third parties to protect our proprietary expertise and other trade secrets, these agreements may not be enforceable, or, even if legally enforceable, we may not have adequate remedies for breaches of such agreements. The failure of our patents or confidentiality agreements to protect our proprietary technology or trade secrets could result in significantly lower revenues, reduced profit margins or loss of market share.

We may be unable to determine when third parties are using our intellectual property rights without our authorization. The undetected or unremedied use of our intellectual property rights or the legitimate development or acquisition of intellectual property similar to ours by third parties could reduce or eliminate any competitive advantage we have as a result of our intellectual property, adversely affecting our financial condition and results of operations. If we must take legal action to protect, defend or enforce our intellectual property rights, any suits or proceedings could result in significant costs and diversion of our resources and our management's attention, and we may not prevail in any such suits or proceedings. A failure to protect, defend or enforce our intellectual property rights could have an adverse effect on our business, financial condition and results of operations.

Third parties may claim that our products or services infringe their intellectual property rights, which may cause us to pay unexpected litigation costs or damages, or prevent us from making, using, or selling our products.

Other parties may have patents or pending patent applications relating to integrated wireless technology that may later mature into patents. Such parties may bring suit against us for patent or other infringement of intellectual property rights. Although we do not intend to, we may infringe on the intellectual property rights of others. If our products or services are found to infringe or otherwise violate the intellectual property rights of others, we may need to obtain licenses from those parties or

15

substantially re-engineer our products or processes in order to avoid infringement. We may not be able to obtain the necessary licenses on commercially reasonable terms, if at all, or be able to re-engineer our products successfully. Moreover, if we are found by a court of law to infringe or otherwise violate the intellectual property rights of others, we could be required to pay substantial damages or be enjoined from making, using, or selling the infringing products or technology. We also could be enjoined from making, using, or selling the allegedly infringing products or technology, pending the final outcome of the suit.

Our business could be harmed if we cannot attract and retain key personnel.

Our success depends, in large part, upon the continuing contributions of our key technical, marketing, sales and management personnel. We generally do not enter into employment agreements with our employees for fixed terms, and do not maintain "key-man" insurance on any of our employees. The loss of the services of several key employees within a short period of time could harm our business and our future prospects. Our future success will also depend on our ability to attract and retain additional management and technical personnel required in connection with the growth and development of our business. Competition for such personnel is intense, and if we fail to retain or attract such personnel our business could suffer. We have entered into arrangements with certain executives which provide for payments upon a change of control, as defined in those agreements. Our Chief Executive Officer has such an agreement which currently would provide payments to him if he chooses to leave the Company for any reason. See the section entitled "Management—Employment Agreements."

Regulatory Risks

We may not be able to coordinate successfully with other L-band satellite system operators to access and use the full approximately 30 MHz of L-band spectrum.

We are required to coordinate the use of our satellites as part of the satellite registration process of the International Telecommunication Union ("ITU"). With respect to the primary frequencies used by commercial GEOs, the ITU rules grant rights to member states (which are the national governments party to the ITU treaty) on a "first-in-time, first-in-right" basis and set forth a process for protecting earlier-registered satellite systems from interference from later-registered satellite systems. To comply with these rules, we must coordinate the operation of our satellites with other satellites. The coordination process may require us to modify our proposed coverage areas, or satellite design or transmission plans, in order to eliminate or minimize interference with other satellites or ground-based facilities. In addition, while the ITU's rules require later-in-time systems to coordinate their operations with us, we cannot guarantee that other operators will conduct their operations so as to avoid transmitting any signals that would cause harmful interference to the signals that we, or our customers, transmit.

Since our system became operational in 1996, our spectrum access in North America has been governed by a multi-lateral agreement referred to as the Mexico City Memorandum of Understanding ("Mexico City MoU") and by bilateral agreements. There are five national administrations, the United States, Canada, Mexico, Russia and the United Kingdom that are party to the Mexico City MoU. We operate under the auspices of the United States and Canada. Accordingly, we must coordinate with operators and their administrations to operate in the L-band and to reconfigure the L-band. Operators might not cooperate in these coordination procedures. Since 1999, there has been no new spectrum sharing agreement among the satellite system operators represented by the five administrations. We have not completed coordination of our new satellites. International coordination could result in an increase or decrease in the amount of spectrum available to the Company. See the section entitled "Business—Regulatory—L-band Coordination."

16

Moreover, the initial international frequency coordination of our system was done for narrowband services and air interfaces. Newer broadband services and air interfaces can take advantage of larger blocks of contiguous spectrum. While some of our L-band spectrum is already in sufficiently large contiguous blocks to permit the offering of such new formats, we are engaged in negotiations with other operators to reconfigure the L-band spectrum to maximize and enhance the usability of such spectrum services. Other operators, however, could seek to delay such efforts to reconfigure the L-band to maximize and enhance the use of the band for the provision of new services, including ATC services. For example Inmarsat recently announced its intention to pursue an MSS/ATC system in the L-band, yet Inmarsat has vigorously opposed our ATC application. The failure to reconfigure the L-band into larger blocks of contiguous spectrum will prevent us from maximizing the efficiency and capacity of our next generation integrated network.

Moreover, we cannot guarantee that the ITU will not change its rules in the future in a way that could limit or preclude our use of some or all of our existing or future orbital locations or frequencies.

We may not be able to secure the return of certain spectrum we loaned to Inmarsat PLC ("Inmarsat").

In 1999 and 2003, and consistent with the Mexico City MoU, we loaned approximately 3 MHz of L-band spectrum to Inmarsat for its temporary use. We have initiated steps with the FCC and Industry Canada to confirm our rights to the spectrum but there can be no guarantee that Inmarsat will comply with this effort. If the loaned spectrum is not returned before the deployment of the ATC network, there could be a negative impact on service levels and the numbers of users our spectrum could support. As such, over time it could impact our business plan.

Our service may cause or be subject to interference.

As a satellite provider, we are required to provide our satellite and ATC service without causing harmful interference to most other spectrum users and we must accept some interference from certain other spectrum users. While we view this as remote, this requirement may potentially hinder the satellite portion of the operation of our system and may, in certain cases, subject our users to a degradation in service quality. Moreover, Inmarsat currently operates satellites that have not been coordinated with ours and, thus, may interfere with our satellites. We are working to minimize the risk of interference, but there is no guarantee we will be successful. See the section entitled "Business—Regulatory—Technical Requirements."

The ultimate resolution of pending FCC proceedings could materially affect our ability to develop and offer ATC services and have a material adverse effect on our next generation business plans.

Inmarsat has challenged two FCC orders that may impact our ability to maximize the efficiency of our ATC in the L-band, including the 2004 ATC decision granting our ATC license and the 2005 decision establishing revised rules for ATC. Inmarsat has objected to our pending 2005 application for a modified ATC license to take advantage of the new ATC rules. Inmarsat has consistently asked the FCC to impose technical restrictions on our ATC service. These challenges remain pending at the FCC. If these challenges are decided unfavorably to us, it may impede or preclude our ability to deploy and operate our proposed next generation integrated network.

17

We need additional regulatory approvals before we can operate ATC.

We have pending an application at the FCC to modify our ATC authorization to provide us additional flexibility, including authority for ATC deployments based on Frequency Division Duplex ("FDD") and Time Division Duplex ("TDD") using OFDM and OFDMA air interfaces such as WiMax and Flash-OFDM. Inmarsat has challenged certain elements of the modification application, including the request for authority to deploy TDD-based air interfaces. In addition, we will need further regulatory approvals before we can operate ATC, including a blanket license for our user terminals and FCC certification of our user terminals and base stations. MSV will also need to construct a satellite as a ground spare or receive a waiver from the FCC of its ground spare requirement. We intend to request such a waiver based on our plan to use MSV-1 and MSV-2 as in-orbit spares for each other. Any difficulty in obtaining these approvals or such a waiver may delay the commencement of operation of our new system. We do not yet have authority from Industry Canada to operate ATC in Canada. We can provide no assurance if or when we will obtain any of these approvals.

A 2002 decision could be construed to limit a portion of our operations to using no more than 20 MHz of L-band spectrum.

In a 2002 decision, the FCC granted our subsidiary, Mobile Satellite Ventures Subsidiary LLC ("MSV Sub"), a license to use up to 20 MHz of L-band spectrum on MSAT-2. That decision also states that spectrum acquired under a future merger between Motient and TMI would be included within the 20 MHz limit. We filed a petition for clarification and partial reconsideration of that decision because MSV had already been established pursuant to an FCC order in 2001 that had authorized MSV to use TMI's spectrum without imposing such spectrum limitations. MSV has coordinated less than 20 MHz of L-band spectrum for the United States satellites. We believe that, even if we were limited to 20 MHz of spectrum on the United States satellites, we would continue to be able to use all the coordinated spectrum (approximately 30 MHz) on our Canadian satellite and on our integrated network, as well as up to 20 MHz of coordinated spectrum on the United States satellite. We cannot be sure how or when the FCC will dispose of our petition, but subsequent FCC decisions suggest that spectrum licensed to MSV Canada is not included within the 20 MHz limit. If the FCC decides adversely to us, our United States licensed L-band satellites (MSAT-2 and MSV-1) could be limited to a maximum of 20 MHz, which could reduce our ability to offer certain new satellite services. See the sections entitled "Business—Regulatory—L-band Service Links" and "—101° WL Replacement Satellite."

Failure to comply with FCC and Industry Canada rules and regulations could damage our business.

FCC and Industry Canada rules and regulations, and the terms of our satellite authorizations and our ATC license from the FCC, require us to meet certain conditions, such as satellite construction and launch milestones, maintenance of satellite coverage of all fifty states, Puerto Rico, and the United States Virgin Islands and the provision of an integrated service offering. Non-compliance by us with these or other conditions, including other FCC or Industry Canada gating criteria, could result in fines, additional license conditions, license revocation, or other adverse FCC or Industry Canada actions. See the section entitled "Business—Regulatory."

If the supply of available mobile licensed spectrum increases, the value of our spectrum assets may decrease.

The FCC or Industry Canada could allocate large amounts of additional mobile licensed spectrum that could be used to compete with us, or that could decrease the perceived market value of our wireless capacity. The FCC, for example, recently scheduled an auction of 90 MHz of spectrum in the 1.7/2.1 GHz range for June 2006. Additional spectrum auctions may be scheduled in the future. In addition, incremental allocations of spectrum may make it easier for new competitors to enter the

18

market, and could further diminish the value of our spectrum assets. See the section entitled "Business—Our Spectrum."

Technical challenges or regulatory requirements may limit the attractiveness of our spectrum for providing mobile services.

We believe our L-band spectrum with ATC capability will be attractive to potential partners if our spectrum is at least functionally equivalent to PCS/cellular spectrum. The FCC and Industry Canada require us to provide substantial satellite service throughout the United States and Canada. This requirement may limit the availability of some of our spectrum for terrestrial service in some markets at some times. In addition, we must give priority and pre-emptive access to certain other users of the L-band, for example, for safety-related transmissions in the Global Maritime Distress and Safety System and the Aeronautical Mobile Satellite (Route) Service. PCS/cellular spectrum is not constrained by any such requirement. If we are not able to develop technology that allows our partners to use our spectrum in a manner comparable to PCS/cellular operators, we may not be successful in entering into partnership arrangements. See the section entitled "Business—Regulatory—Priority and Preemptive Access."

Our ability to offer a primarily fixed service may be limited by the policies of the FCC.

The FCC has permitted us to provide fixed services on a non-interference basis, which means that such operations are not permitted to cause interference to various other users of the band and are not permitted to claim protection from such other users. The FCC also has required our fixed services to be offered on an "incidental or ancillary" basis, conditions which the FCC has not defined in this context.

We may face difficulties in obtaining regulatory approvals for provision of telecommunications services, and we may face changes in regulation, each of which could adversely affect our operations.

The provision of telecommunications services is highly regulated. We may be required to obtain additional approvals from national and local authorities in connection with the services that we currently provide or wish to provide in the future, including in connection with services associated with our next generation integrated network. As a provider of communications services in the United States and Canada, we are subject to the regulatory authority of both the United States and Canada. Violations of laws or regulations may result in various sanctions including fines, loss of authorizations and the denial of applications for new authorizations or for the renewal of existing authorizations

Moreover, we may be required to obtain additional approvals from national and local regulatory authorities in connection with the services that we currently provide or wish to provide in the future. From time to time, governmental entities may impose new conditions on our authorizations which could have an effect on our ability to generate revenue and conduct our current and next generation business as currently planned. For example, from time to time, the United States federal government has considered whether to impose fees on the use of frequencies such as the ones we use to provide our service. If we are required to pay such fees, we may be subject to substantially increased costs.

Export control and embargo laws may preclude us from obtaining necessary satellites, parts or data or providing certain services in the future.

United States companies and companies located in the United States must comply with United States export control laws in connection with any information, products, or materials that they provide to us relating to satellites, associated equipment and data and with the provision of related services. If these entities cannot or do not obtain the necessary export or re-export authorizations from the United

19

States government, we must obtain such authorizations ourselves. It is possible that, in the future, they and we may not be able to obtain and maintain the necessary authorizations, or existing authorizations could be revoked.

If our manufacturers and we cannot obtain and maintain the necessary authorizations, this failure could adversely affect our ability to:

- •

- procure new United States-manufactured satellites;

- •

- control our existing satellites;

- •

- acquire launch services;

- •

- obtain insurance and pursue our rights under insurance policies; or

- •

- conduct our satellite-related operations.

In addition, if we do not properly manage our internal compliance processes and were to violate United States export laws, the terms of an export authorization, or embargo laws, the violation could make it more difficult, or even impossible, to maintain or obtain licenses and could result in civil or criminal penalties.

Our contractual relationship with potential partners that may operate ATC facilities in our next generation integrated network must comply with FCC and Industry Canada rules that require ATC to be integrated with the satellite service and require us, as the license holder, to control ATC operations.

We must ensure compliance with the ATC rules of the FCC and Industry Canada. This may require agreements with some partners that provide for a degree of control by us in the operation of their business that may be difficult to negotiate.

In addition, the Communications Act and the FCC's rules require us to maintain legal as well as actual control over the spectrum for which we are licensed. Our ability to enter into partnering arrangements may be limited by the requirement that we maintain de facto control of the spectrum for which we are licensed. If we are found to have relinquished control without approval from the FCC, we may be subject to fines, forfeitures, or revocation of our licenses.

20

Rules relating to Canadian ownership and control of MSV Canada are subject to interpretation and change.

MSV Canada is subject to foreign ownership restrictions imposed by theTelecommunications Act (Canada) and theRadiocommunication Act (Canada) and regulations made pursuant to the these Acts. Although we believe that MSV Canada is in compliance with the relevant legislation, there can be no assurance that a future determination by Industry Canada or the Canadian Radio-television and Telecommunications Commission, or events beyond our control, will not result in MSV Canada ceasing to comply with the relevant legislation. If such a development were to occur, the ability of MSV Canada to operate as a Canadian carrier under theTelecommunications Act (Canada) or to maintain, renew or secure its Industry Canada authorizations could be jeopardized and our business could be materially adversely affected.

21

SELECTED CONSOLIDATED FINANCIAL DATA

The following selected financial data are derived from the consolidated financial statements of Mobile Satellite Ventures LP. The data should be read in conjunction with the consolidated financial statements, related notes, and other financial information included herein.

| | Year Ended December 31,

| |

|---|

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

| |

|---|

| | (Dollar amounts in thousands)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | |

Total revenue |

|

$ |

2,095 |

|

$ |

24,854 |

|

$ |

27,124 |

|

$ |

29,007 |

|

$ |

29,381 |

|

| Total operating expenses(1) | | | 18,251 | | | 43,984 | | | 44,128 | | | 55,762 | | | 68,534 | |

| Loss from continuing operations before other income (expense) | | | (16,156 | ) | | (19,130 | ) | | (17,004 | ) | | (26,755 | ) | | (39,153 | ) |

| Net loss(2) | | | (16,524 | ) | | (26,167 | ) | | (28,000 | ) | | (33,455 | ) | | (40,955 | ) |

Balance Sheet Data

(at end of period indicated): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents(3) |

|

$ |

3,629 |

|

$ |

5,582 |

|

$ |

3,982 |

|

$ |

129,124 |

|

$ |

59,925 |

|

| Restricted cash(4) | | | 4,008 | | | 653 | | | 74 | | | 75 | | | 6,264 | |

| Investments | | | — | | | — | | | — | | | — | | | 52,278 | |

| Total assets | | | 162,664 | | | 144,295 | | | 130,819 | | | 246,223 | | | 216,784 | |

| Current liabilities | | | 11,999 | | | 10,555 | | | 10,372 | | | 11,873 | | | 11,811 | |

| Accrued interest, net of current portion(3) | | | 768 | | | 9,340 | | | 16,275 | | | — | | | — | |

| Long-term deferred revenue, net of current portion | | | 18,970 | | | 16,634 | | | 20,866 | | | 20,690 | | | 23,243 | |

| Vendor note payable, net of current portion | | | — | | | — | | | 916 | | | 696 | | | 470 | |

| Notes payable to investors(3) | | | 81,500 | | | 84,500 | | | 82,925 | | | — | | | — | |

| Total partners' equity (deficit) | | | 49,427 | | | 23,266 | | | (984 | ) | | 212,964 | | | 181,260 | |

Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by operating activities | | | (625 | ) | | (162 | ) | | 457 | | | (30,206 | ) | | (12,048 | ) |

| Net cash used in investing activities | | | (51,802 | ) | | (4,040 | ) | | (4,532 | ) | | (4,636 | ) | | (58,706 | ) |

| Net cash provided by financing activities | | | 55,000 | | | 3,000 | | | 2,125 | | | 160,267 | | | 323 | |

| Ratio of earnings to fixed charges (unaudited) | | | — | (5) | | — | (5) | | — | (5) | | — | (5) | | — | (5) |

- (1)

- Total operating expenses include next generation expenses related to the development and deployment of our next generation integrated network of $271, $1,622, $4,268, $8,593, and $18,516 for the years ended December 31, 2001, 2002, 2003, 2004, and 2005 respectively. Total operating expenses include depreciation and amortization of $6,640, $18,235, $17,928, $18,439 and $16,109 for the years ended December 31, 2001, 2002, 2003, 2004 and 2005, respectively. Total operating expenses include non-cash compensation expenses related to options, excluding such expenses included in next generation expenses, of $40, $0, $0, $267 and $6,680 for the years ended December 31, 2001, 2002, 2003, 2004 and 2005, respectively.

- (2)

- Net loss includes losses from discontinued operations of TerreStar, a former subsidiary established in February 2002, which was spun-off in May 2005 of $1,668, $4,328, $1,939, and $9,553 for the years ended December 31, 2002, 2003, 2004, and 2005 respectively. Additionally, net loss for the year ended December 31, 2005 includes $724 related to the cumulative effect of change in accounting principle upon the adoption of Financial Accounting Standards Board Interpretation No. 46, "Accounting for Variable Interest Entities" in 2005.

22

- (3)

- In November 2004, the Company received $145,000 in cash proceeds from two of its existing limited partners in exchange for the issuance of 4,923,599 units of limited partnership interest. Concurrently with this transaction, the Company paid approximately $18,209 of accrued interest, in cash, on outstanding notes held by its limited partners, and exchanged or converted approximately $80,554 of principal amount and $4,368 of additional accrued interest on such outstanding notes into an aggregate of 9,911,234 units of limited partnership interest, which represented approximately 50% of the units outstanding prior to such transaction. See note 5 of notes to the consolidated financial statements included herein.

- (4)

- In accordance with the requirements of the FCC, the Company secured a five-year, $3,000 bond for each orbit location. The bonds are fully collateralized by a $3,000 letter of credit for each bond, secured by cash on deposit, which is reflected as restricted cash. The restricted cash as of December 31, 2001, 2002, 2003, and 2004 relates to amounts retained from the purchase of the satellite business in 2001, which was restricted to pay Motient's rent obligation to the Company for the lease of office space in the Company's headquarters and to ensure the provision of certain services to the Company by Motient under a transition services agreement.

- (5)

- For the years ended December 31, 2001, 2002, 2003, 2004 and 2005 earnings were insufficient to cover fixed charges by approximately $16,525, $24,500, $23,672, $31,516 and $32,126, respectively.

23

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read together with our consolidated financial statements and the related notes thereto. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in those forward-looking statements. See the section entitled "Risk Factors" for a discussion of certain of the uncertainties, risks and assumptions associated with these statements.

Overview

We are developing an integrated satellite and terrestrial communications network to provide ubiquitous wireless broadband services, including Internet access and voice services, in the United States and Canada. Using an all-IP, open architecture, we believe our network will provide significant advantages over existing wireless networks. Such potential advantages include higher data speeds, lower costs per bit and flexibility to support a range of custom IP applications and services. Our current business plan envisions a "carrier's carrier" wholesale model whereby our strategic partners and other wholesale customers can use our network to provide differentiated broadband services to their subscribers. We believe our planned open network, in contrast to legacy networks currently operated by incumbent providers, will allow distribution and other strategic partners to have open network access and create a wide variety of custom applications and services for consumers.

We currently offer a range of MSS using two GEOs that support the delivery of data, voice, fax and dispatch radio services. We are licensed by the United States and Canadian governments to operate in the L-band spectrum which we have coordinated for use. We currently have coordinated approximately 30 MHz of spectrum throughout the United States and Canada. In operating our next generation integrated network, we plan to allocate the use of spectrum between satellite and terrestrial service. Our spectrum footprint covers a total population of nearly 330 million. Our spectrum occupies a portion of the L-band and is positioned between the frequencies used today by terrestrial wireless providers in the United States and Canada. We were the first MSS provider to receive a license to operate an ATC network from the FCC. We were a major proponent of the FCC's February 2003 and February 2005 ATC and ATC Reconsideration Orders, both of which were adopted on a bipartisan, 5-0 basis. These ATC licenses permit the use of our L-band satellite frequencies in the operation of an advanced, integrated network capable of providing wireless broadband on a fixed, portable and fully mobile basis.

Current Business

We currently provide switched and packet data service to approximately 30,000 units in service through a retail sales channel that includes a direct sales force, dealers and resellers. Many of these users are federal, state and local agencies involved in public safety and security that depend on our system for redundant and ubiquitous wireless services during daily operations and in the case of emergencies.

In addition to offering managed services to our core direct customer base, we also sell bulk capacity on a wholesale basis to service provider partners for special purpose networks. We provide service to approximately 170,000 more units in service through these indirect channels. A majority of these indirect users access our network for fleet management and asset tracking services through companies including Geologic Solutions, Inc., Wireless Matrix Corporation, Transcore Holdings, Inc. and SkyBitz, Inc.

24

We provide service in the United States and Canada using two nearly identical GEOs. The first satellite is located at 101° WL. The second satellite, formerly owned by TMI and now owned by MSV Canada, is located at 106.5° WL.

Financings