May 2007

Safe Harbor

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

This presentation includes “forward looking statements. ” All statements other than statements of historical facts included in this presentation regarding the prospects of our industry and our prospects, plans, financial position and business strategy, may constitute forward looking statements. These statements are based on the beliefs and assumptions of our management and on the information currently available to our management at the time of such statements. Forward looking statements generally can be identified by the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions that indicate future events and trends. Although we believe that the expectations reflected in these forward -looking statements are reasonable, these expectations may not prove to be correct. Important factors that could cause actual results to differ materially from our expectations are disclosed in the preliminary offering memorandum. All subsequent written and oral forward - -looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements included in this document. Factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected include, but are not limited to, our ability to obtain financing, obtain and maintain regulatory approvals, generate sufficient cash flows, develop our universal chipset architecture, achieve market acceptance for our services, develop our network and generate technological innovations.

The forward -looking statements in this presentation are made only as of the date of this presentation. We undertake no obligation to update or revise the forward -looking statements, whether as a result of new information, future events or otherwise.

| 2 |

MarketOpportunity and Business

Overview

| 3 |

TerreStar/MotientOverview

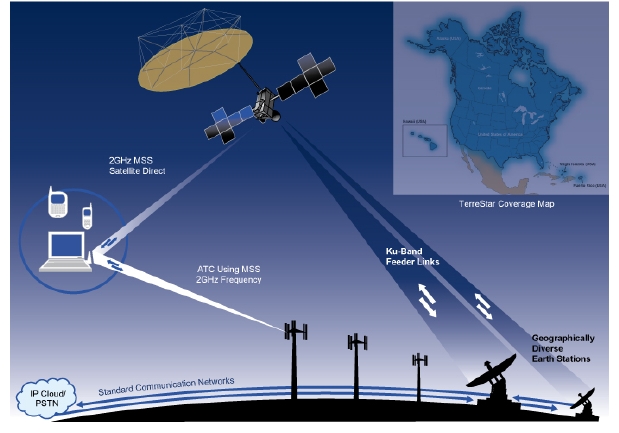

l | TerreStar plans to develop, build and operate an all IP-based integrated satellite and ancillary terrestrial component (“ATC”) mobile communications network |

| |

| | - - | TerreStar has rights to use 20 MHz of ATC eligible MSS S-band spectrum |

| |

| | - - | The network will provide seamless, ubiquitous mobile communication services throughout the U.S. and Canada |

|

| l | TerreStar plans to address growing government, enterprise and consumer demand for wireless mobile voice and data services |

| |

| | - - | Focus on government’s need for reliable emergency communications system |

| |

| | - - | Market the services on a wholesale basis as a “carrier’s carrier” |

|

| l | Motient Corporation (Ticker: “MNCP”) ownership of TerreStar is approximately 86% |

| |

| | - - | Motient also beneficially owns 44.4 million shares of SkyTerra |

| |

| | - - | In February 2007, TerreStar issued $500 Senior Secured PIK Notes to fund satellite, network construction and operations |

| |

| | - - | New management teams and Boards at Motient and TerreStar in place |

| |

| 4 |

TerreStar’sStrategy

l | Secure The License |

| |

| | - - | “Smart” Build |

| |

| | - - | FCC Milestones |

|

| l | De-Risk the Business |

| |

| | - - | Management |

| |

| | - - | Technology |

| |

| | - - | Vendors |

| |

| | - - | Prudent Capital Plan |

|

| l | Pre-Subscribe the Service |

|

| l | Broaden Exit/Partner Opportunities |

| |

| 5 |

Key Highlights

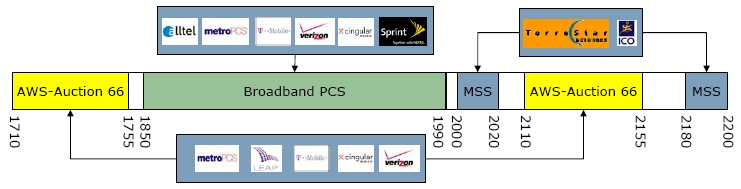

20 MHz of Spectrum | - ATC eligible S-band spectrum in the 2 GHz range in U.S. and Canada

- Adjacent to PCS spectrum used by national wireless carriers

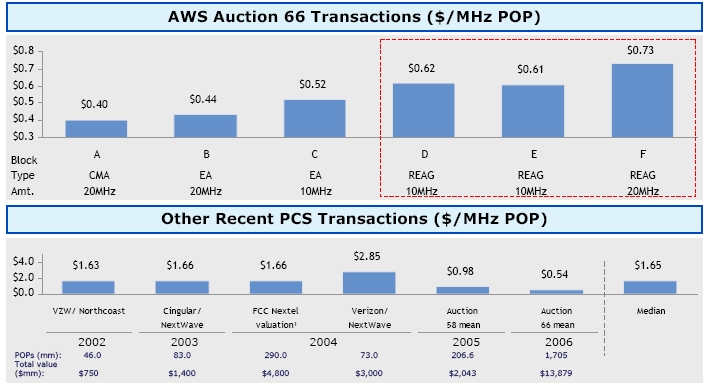

- Significant underlying value based on recent FCC AWS Auction 66

|

Advanced Network & Technology | - All IP-enabled next generation network

- Seamlessly integrated satellite and terrestrial system

- Prioritization of service capability in case of disaster or emergencies

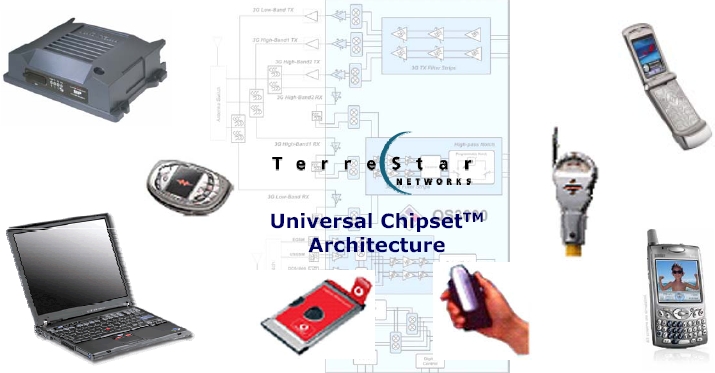

- Universal chipsetTM architecture

|

Strong

Strategic Relationships | - Cooperative Research and Development Agreement with U.S. federal government in place

- Vendor relationships for construction and launch of satellite, buildout of ground segment, and development of universal chipsetTM architecture

|

Large Market Opportunity | - High demand for wireless services – $163B¹ revenue opportunity by 2010

- Governments’ heightened focus on public safety and Homeland Security

- Enterprises expanding wireless applications to improve operations

|

Scalable Business Model | - Wholesale / “carrier’s carrier” operating strategy

- Buildout in several key markets based on customer demand

|

1 Based on IDCResearch, March 2006

| 6 |

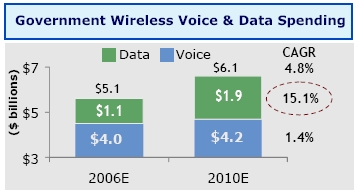

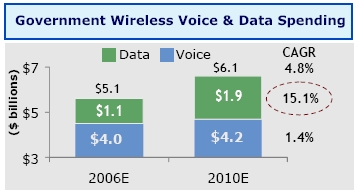

EmergencyPreparedness will Drive

GovernmentDemand

- Spurred by 9/11 and Hurricane Katrina, government at all levels is investing significantly in improving communications systems

- Need for uninterrupted, interoperable network connectivity during emergencies

- “…cellular and wireless technology as a whole is increasingly more applicable and critical to our operations.” Louisiana Homeland Security & Emergency Preparedness

|  |

| Source: In-Stat Telecom Trends and Expenditures: U.S. Government Nov 2006 |

|

Source: Frost and Sullivan, 2005 |

TerreStar will seek agovernmentanchortenant for

itsnetwork

| 7 |

Agreement in Place with FederalGovernment

l | Cooperative Research and Development Agreement (“CRADA”) signed between U.S. Defense Information Systems Agency (“DISA”) and TerreStar in October 2006 to develop a North American emergency response communications network |

| |

| l | Positions TerreStar as a collaborator with the government to develop required services and become the only qualified provider to a variety of public safety and defense users |

| |

| | - - | 2-year agreement |

| |

| | - - | Third-party participation by mutual agreement only |

| |

| | - - | Information exchanged is classified, proprietary and FOIA exempt |

| |

| | - - | Authorized security clearances for 15 personnel |

| |

| l | CRADA intended to provide government requirements upon which procurement will be based |

| |

| | - - | Ensure continuity of government communications in event of a disaster |

| |

| | - - | Provide backup platform for command and control of federal, state and local officials |

| |

“Both collaborators expect … to eventually develop

products that will mutually benefit the Government

and the collaborator”

| 8 |

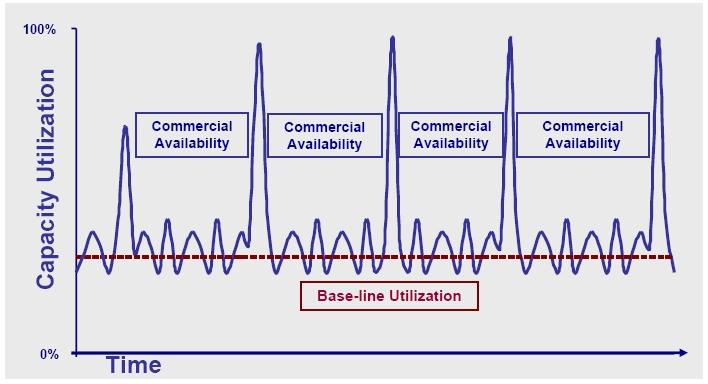

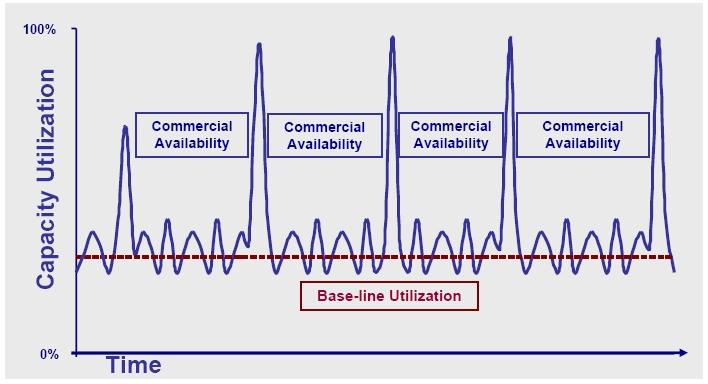

Illustrative“Take-or-Pay”Model forGovernmentService

Government contract would de-risk business model and enable

the offering of wholesale services on a competitive basis

| 9 |

Significant CommercialMarketOpportunity

Telematics

and Logistics | - Provide a wide range of functions to numerous industries, including Auto, Retail, Manufacturing and Machine-to-Machine communications

- Enhance efficiency of operations, logistics and distribution networks

- Developing consumer telematics and security solutions with ADT

|

Serving the Underserved | - Provide wireless access to RLECs to deliver new wireless services to the 40 million US households deemed underserved

- Potential for bundled mobile and fixed wireless alternatives

|

Wireless Service Providers | - Extending service capability of incumbent service providers

- Address coverage and network constraints

- New network alternative for MVNOs

|

Internet/ Media Companies | - Provide platform to deliver mobile video and data services

- Increasing usage of data-intensive applications (video games, mobile)

- Additional source of advertising revenue

|

Corporate Networks | - Provide backup support for corporate networks

- Secured high-speed wireless communications such as VPN

- Increasing wireless usage due to mobile workforces

|

| 10 |

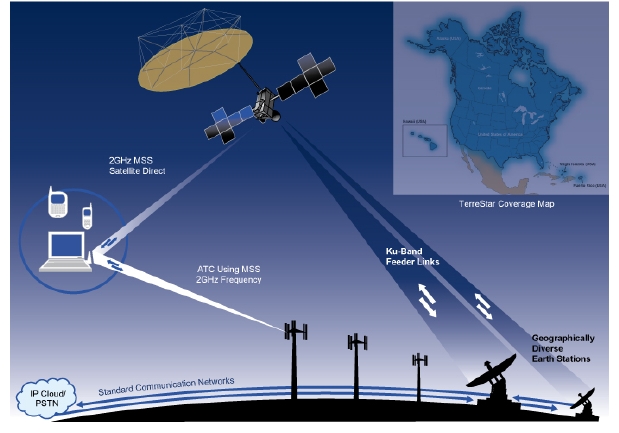

All-IP Enabled Seamlessly -Integrated Satellite

and Terrestrial Network

| 11 |

SignificantProgress inNetwork Development

|

| l | TerreStar-1 to be launched on Arianespace vehicle |

| | | |

| | - | Most powerful two-way commercial communications geostationary satellite |

| | | |

| | - | Beam coverage: continental United States, Canada, Puerto Rico, Hawaii and Alaska |

| | | |

| | - | Capable of generating approximately 500 simultaneous spot beams |

| | | |

| l | TerreStar-2 (spare) construction underway |

| | | |

| l | 2 satellite gateways being developed by Loral / Hughes |

| | | |

| l | ATC portfolio – global IP license |

| 12 |

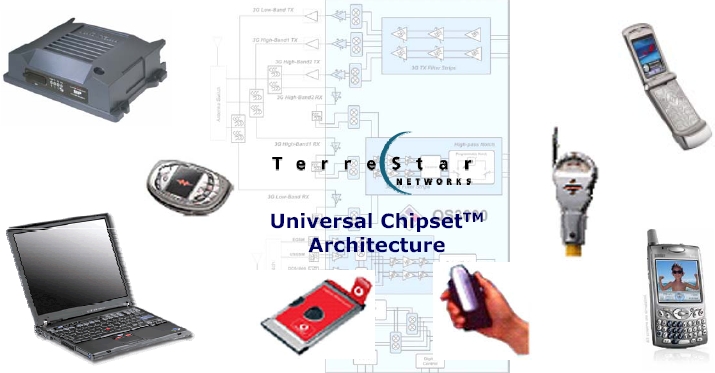

AttractiveMobile Unit FormFactor

TerreStar’stechnology will allowclients toenjoycomparable

handset formfactors tothose used in thewirelessindustry

| 13 |

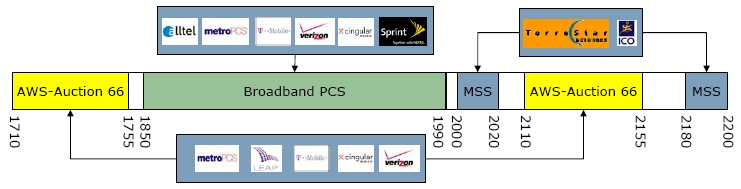

AttractiveSpectrumPosition

Two contiguous and cleared 10 MHz blocks in 2 GHz MSS S-band

All ATC-eligible

Ubiquitous coverage in U.S. and Canada

Adjacent to PCS and AWS operators

Significant underlying value

MobileWirelessSpectrumFrequencies(MHz)

| 14 |

U.S. andCanadianRegulatory Timeline

Event | | Requirements | | Timeline | | Comments |

| | | | | | | |

| |

| Two 10 MHz Blocks of Spectrum Reservation Awarded | | Completed | | 12/05 | | Subject to launch and operational capability of satellite |

| |

| |

| Two 10 MHz Blocks of Spectrum Reservation Perfected | | Launch TerreStar-1 | | 09/08* | | Satellite must be launchedinto assigned orbital location |

| | | | | | | |

| | | Entire System Operational | | 11/08 | | Demonstrates system functionality |

| |

| |

| Application for ATCauthorization | | Order TerreStar-2 | | Completed 08/06 | | Gating item for ATCauthorization |

| |

| | | ATC ApplicationSubmitted | | 1stHalf 2007 | | Provides ability to operateintegrated satellite andterrestrial network |

| |

| | | ATC Approval Granted | | 2ndHalf 2008 | | Gating criteria include: |

| | | | | | | •Full U.S. coverage, including Alaska, and Hawaii |

| | | | | | | •Spare satellite |

| | | | | | | •Integrated ground/satellite system |

| |

*Subject to FCC approval. Current FCC milestone is 11/07.

| 15 |

FinancingOverview

| 16 |

Corporate Structure

| 17 |

Balance Sheet Summary

| ($ millions) |

March 31, 2007 |

| | | |

| Cash and Cash Equivalents | $ | 343 |

| Escrow for TerreStar-1 construction | | 13 |

| Total Cash | $ | 356 |

| |

| Senior Secured PIK notes due 2014 | | 500 |

| Accrued Interest | | 9 |

| Total Debt | $ | 509 |

| |

| Preferred Equity | | 409 |

| Common Equity | | 355 |

| Total Stockholders' Equity | $ | 764 |

| |

| Total Capitalization | $ | 1,273 |

| 18 |

Funding Requirements

$ millions | April - December 2007 |

Satellite construction TerreStar 2 (Loral) | $ | 85 |

GBBF earth stations (Loral/Hughes) | | 15 |

Satellite ground network, handset and terrestrial | | 60-80 |

Operating and R&D expenses | | 100 |

|

Total | $ | 260-280 |

Additional

Near-Term CapitalResources | Liquidity from SKYT shares Vendor financing capacity Potential equity/debt offerings

|

2008 and

Beyond | Remaining TerreStar 1 launch and insurance costs of $80-90M;

handset/chipset development and TerreStar 2 construction $40-60M per market for buildout of ATC network; initial strategy is

to launch in several key markets

|

| 19 |

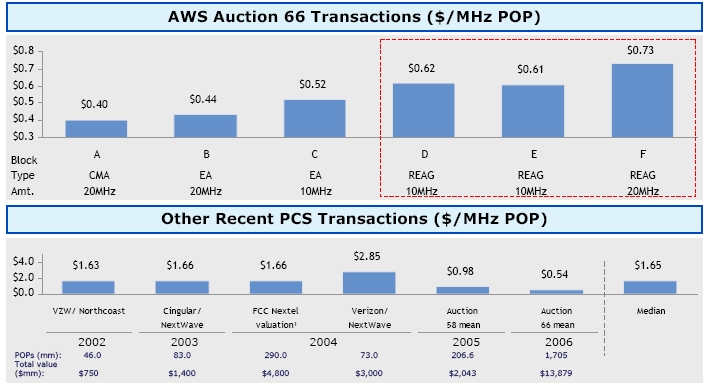

SubstantialUnderlyingSpectrumValue

Implied spectrum value of over $4 billion²

based on AWS-Auction 66 REAG market values

Source: WallStreetResearch

1Based on FCC determined value of $4.8 billion. Assumes 290 million US POPs

2Based on $0.65/MHz POP of average D, E, and F Auction 66 REAG values, 330 million POPs, and 20 MHz of spectrum

| 20 |

Key Highlights

20 MHz of ATC eligible S-band spectrum in U.S. and Canada

Large government and commercial markets opportunity

Advanced next generation network and technology

Strong strategic relationships

Scalable business model

| 21 |