UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

ORTHOVITA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ORTHOVITA, INC.

45 GREAT VALLEY PARKWAY

MALVERN, PENNSYLVANIA 19355

NOTICE OF 2005 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON July 25, 2005

DEAR ORTHOVITA, INC. SHAREHOLDERS:

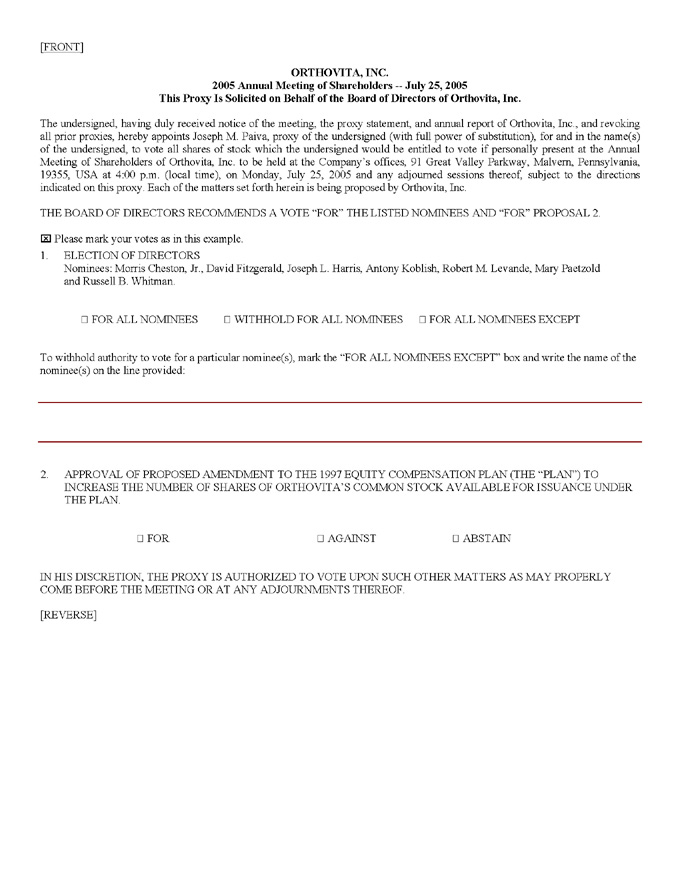

The annual meeting of ORTHOVITA, INC. will be held at Orthovita’s offices, 91 Great Valley Parkway, Malvern, Pennsylvania, 19355, on July 25, 2005 at 4:00 p.m., local time, for the following purposes:

| 1. | To elect seven directors to hold office until the next Annual Meeting of Shareholders or until their respective successors have been elected or appointed; |

| 2. | To vote on a proposed amendment to the 1997 Equity Compensation Plan to increase the number of shares of Orthovita’s Common Stock available for issuance under the Plan from 7,350,000 shares to 9,350,000 shares; and |

| 3. | To act upon such other matters as may properly come before the meeting. |

Holders of Orthovita’s common stock of record at the close of business on April 28, 2005 are entitled to receive this notice and to vote at the meeting and any adjournments.

|

By Order of the Board of Directors, |

JOSEPH M. PAIVA |

Corporate Secretary |

Malvern, Pennsylvania, USA

April 28, 2005

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT

YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN, DATE AND RETURN THE

ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE OR VOTE BY TELEPHONE

OR VIA THE INTERNET.

ORTHOVITA, INC.

45 GREAT VALLEY PARKWAY

MALVERN, PENNSYLVANIA 19355

PROXY STATEMENT

QUESTIONS AND ANSWERS

| 1. | Q: WHO IS SOLICITING MY VOTE? |

A: This proxy solicitation is being made on behalf of the Board of Directors of Orthovita, Inc. (“Orthovita”) for use at the 2005 Annual Meeting of Shareholders.

| | |

| A: | | • The election of seven directors to serve on Orthovita’s Board of Directors for the ensuing year; |

| | | • An amendment to the 1997 Equity Compensation Plan to increase the number of shares of Orthovita’s Common Stock available for issuance pursuant to grants thereunder from 7,350,000 shares to 9,350,000 shares; and |

| | | • Any other matter that may properly come before the meeting. |

| 3. | Q: HOW DOES THE BOARD RECOMMEND I VOTE ON THE PROPOSALS? |

A: The Board recommends a vote FOR each of the nominees named in this proxy statement and FOR the proposed amendment to the Orthovita, Inc. 1997 Equity Compensation Plan.

| 4. | Q: WHO IS ENTITLED TO VOTE? |

A: Only stockholders of record on April 28, 2005, the record date for the Annual Meeting, will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

A: There are three ways to vote – by telephone from the U.S. or Canada, by Internet OR by mail.

| | (1) | To vote by telephone, follow the “VOTE BY TELEPHONE” instructions on the proxy card. The proxy card has your unique and confidential control number at the bottom of the page. |

| | (2) | To vote online via the Internet, follow the “VOTE BY INTERNET” instructions on the proxy card. The proxy card has your unique and confidential control number. You must access the Company’s Transfer Agent’s website directly to vote your shares. Do not discard your login number and password, since it will be needed if you choose to revoke your vote at a later time (see 6. (d) below). |

| | (3) | To vote by mail, complete, sign, date and return the proxy card in the prepaid envelope. |

| 6. | Q: CAN I REVOKE MY PROXY? |

Yes. You have the right to revoke your proxy, whether voted by telephone, by Internet or by mail at any time before the meeting by:

| | (a) | notifying the Corporate Secretary, Joseph M. Paiva, at the address shown on the Notice of the Annual Meeting; |

| | (c) | returning a later dated proxy card, OR; |

| | (d) | voting via the Internet at a later date. |

1

Proxies that are voted in accordance with these instructions and are received by Orthovita prior to the meeting will be voted in accordance with the instructions contained thereon. If you return your signed proxy card but do not mark the boxes showing how you wish to vote and the executed proxy is not revoked, your shares will be voted FOR the proposal to elect the nominees to serve on the Board and will be voted FOR the proposal to amend the Orthovita, Inc. 1997 Equity Compensation Plan.

| 7. | Q: WHO WILL COUNT THE VOTES? |

A: The Company’s transfer agent, StockTrans, will serve as judge of election for the Annual Meeting. Representatives of StockTrans will count the votes.

| 8. | Q: IS MY VOTE CONFIDENTIAL? |

A: Proxy cards, ballots and voting tabulations that identify individual shareholders are mailed or returned directly to the Transfer Agent, and handled in a manner that protects your voting privacy. Your vote will not be disclosed except: (1) as needed to permit the Transfer Agent to tabulate and certify the vote; and (2) as required by law. Additionally, all comments written on the proxy card or elsewhere will be forwarded to management. Your identity will be kept confidential unless you ask that your name be disclosed.

| 9. | Q: HOW MANY SHARES CAN VOTE? |

A: As of the record date of the Annual Meeting, the Company had outstanding 47,177,940 shares of Common Stock. A holder of outstanding shares of Common Stock on the record date is entitled to one vote on each matter to be considered.

| 10. | Q: WHAT IS A “QUORUM”? |

A: There must be a quorum for the meeting to be held. The presence at the Annual Meeting, by person or by proxy, of shareholders representing a majority of the votes represented by the Common Stock is necessary to constitute a quorum for the transaction of business. If you submit a properly executed proxy card, even if you abstain from voting, you will be considered part of the quorum. A WITHHELD vote will also be counted for purposes of determining whether a quorum is present.

| 11. | Q: WHAT ARE THE VOTING REQUIREMENTS TO APPROVE A PROPOSAL? |

A: Assuming a quorum is present, nominees for director must receive a plurality of the votes cast to be elected. This means that the seven candidates receiving the highest number of votes will be elected. The proposal to amend the Orthovita, Inc. 1997 Equity Compensation Plan must receive more than 50% of the votes cast to be approved. You may abstain from voting on the proposal to amend the Orthovita, Inc. 1997 Equity Compensation Plan or withhold votes with regard to the election of directors. Neither abstentions nor withheld votes will have any effect on the outcome of the vote, but both abstentions and withheld votes will be counted for the purposes of determining whether a quorum is present.

| 12. | Q: WHAT ARE BROKER NON-VOTES? |

A: A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular matter because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Broker non-votes have no effect on a vote. However, if a broker or other nominee has the authority to vote on any matter considered at the meeting, other than a procedural matter, and submits a proxy with respect to that matter, the shares subject to the vote will be deemed to be present for the purposes of determining whether a quorum is present

| 13. | Q: WHO CAN ATTEND THE ANNUAL MEETING? |

A: All shareholders of record as of April 28, 2005 may attend.

| 14. | Q: HOW WILL VOTING ON ANY OTHER BUSINESS BE CONDUCTED? |

A: We do not know of any business to be considered at the 2005 Annual Meeting other than consideration of the proposals described in this proxy statement. If any other business is presented at the Annual Meeting, your signed proxy card gives authority to Joseph M. Paiva, Chief Financial Officer and Secretary, to vote on such matters at his discretion.

2

| 15. | Q: HOW WILL PROXIES BE SOLICITED? |

A: In addition to solicitation by mail, arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries to send proxy materials to beneficial owners, and we will, upon request, reimburse them for their reasonable expenses in doing so. To the extent necessary in order to ensure sufficient representation at the meeting, we may request, in person, by telephone or telecopy, the return of proxy cards. This solicitation may be made by the Company’s directors, officers or regular employees. The Company may also employ an outside firm to assist in the solicitation of proxies at the Company’s expense. The Company will pay the cost of solicitation of proxies.

| 16. | Q: WHO ARE THE LARGEST PRINCIPAL SHAREHOLDERS? |

A: See “SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT” beginning on page 4 of this proxy statement for the largest principal shareholders as of April 25, 2005.

| 17. | Q: CAN A SHAREHOLDER RECOMMEND A NOMINEE OR NOMINEES TO BE DIRECTORS OF ORTHOVITA? |

A: As a shareholder, you may recommend any person as a nominee for director by writing to the Nominating Committee of the Board of Directors, c/o Orthovita, Inc., 45 Great Valley Parkway, Malvern, PA 19355. Recommendations must be received by January 1, 2006 for the 2006 Annual Meeting. The recommendation must indicate the following:

| | • | | the name, residence and business address of the nominating shareholder. |

| | • | | a representation that the shareholder is a record holder of the stock or holds the stock through a broker. |

| | • | | the number of shares held by the recommending shareholder. |

| | • | | a representation that the shareholder intends to appear in person or by proxy at the meeting of the shareholders to nominate the individual(s) if the nominations are to be made at a shareholder meeting. |

| | • | | information regarding each nominee that would be required to be included in a proxy statement. |

| | • | | a description of any arrangement or understanding between the shareholder and each and every nominee. |

| | • | | the written consent of each nominee to serve as a director, if elected. |

| 18. | Q: WHEN WAS THIS PROXY STATEMENT MAILED TO SHAREHOLDERS? |

A: This proxy statement and accompanying form of proxy were first mailed to shareholders on or about May 13, 2005.

3

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to Orthovita regarding the beneficial ownership of the Common Stock as of April 25, 2005 (except as specified below) by (1) all beneficial owners of 5% or more of the Common Stock; (2) each director and nominee for election as director; (3) each executive officer named in the Summary Compensation Table included elsewhere in this proxy statement; and (4) all executive officers, directors and nominees of Orthovita as a group. The number of shares beneficially owned by each person is determined under the rules of the Securities and Exchange Commission (“SEC”) and the information is not necessarily indicative of beneficial ownership for any other purpose.

| | | | | | |

Name and Address

| | Total Number

of Shares

Beneficially

Owned(1) (2)

| | | Ownership

Percent of

Total(3)

| |

Angiotech Pharmaceuticals, Inc. 1618 Station Street Vancouver, British Columbia V6A 1B6 Canada | | 5,681,818 | | | 12.0 | % |

| | |

Samuel D. Isaly OrbiMed Advisors LLC OrbiMed Capital LLC c/o OrbiMed Advisors, LLC 767 Third Avenue, 30th floor New York, NY 10017 | | 3,150,000 | (4) | | 6.7 | % |

| | |

Antony Koblish | | 257,800 | (5) | | * | |

Erik M. Erbe, Ph.D. | | 229,500 | (6) | | * | |

Joseph M. Paiva | | 185,000 | (7) | | * | |

Maarten Persenaire | | 152,250 | (8) | | * | |

David J. McIlhenny | | 149,500 | (9) | | * | |

David Fitzgerald | | 86,563 | (10) | | * | |

Robert M. Levande | | 79,780 | (11) | | * | |

Mary Paetzold | | 69,687 | (12) | | * | |

Morris Cheston, Jr. | | 50,780 | (13) | | * | |

Russell B. Whitman | | 45,313 | (14) | | * | |

Christopher H. Smith | | 37,500 | (15) | | * | |

Joseph Harris | | 25,000 | (16) | | * | |

Directors and executive officers as a group (12 persons) | | 1,368,312 | | | 2.9 | % |

4

| (1) | This table is based on information supplied by officers, directors and principal shareholders of Orthovita and on any Schedules 13D or 13G filed with the SEC. On that basis, Orthovita believes that each of the shareholders named in this table has sole voting and dispositive power with respect to the shares indicated as beneficially owned except as otherwise indicated in the footnotes to this table. |

| (2) | The total number of shares beneficially owned includes shares that can be acquired upon the exercise of stock options currently exercisable or within sixty days of April 25, 2005. |

| (3) | Applicable percentage of ownership is based on 47,177,940 shares of common stock outstanding on April 25, 2005. Beneficial ownership is determined in accordance with rules of the Securities and Exchange Commission and means voting or investment power with respect to securities. Shares of common stock issuable upon the exercise of stock options or warrants exercisable currently, or within 60 days of April 25, 2005, are deemed outstanding and to be beneficially owned by the person holding such option for purposes of computing such person’s percentage ownership, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| (4) | The information in this note is based solely on information contained in Amendment No. 1 to Schedule 13G, filed with the SEC on February 14, 2005 by Samuel D. Isaly (“Isaly”). OrbiMed Advisors LLC, OrbiMed Capital LLC, OrbiMed Advisors LLC and OrbiMed Capital LLC are registered investment advisers. OrbiMed Capital LLC holds 2,111,000 shares on behalf of Caduceus Private Investments LLC; OrbiMed Advisors LLC holds 1,039,000 shares on behalf of UBS Juniper Crossover Fund LLC (996,000 shares) and OrbiMed Associates LLC (43,000 shares). Isaly is President of OrbiMed Advisors LLC, Managing Member of OrbiMed Capital LLC, and a control person of both entities. Isaly, OrbiMed Advisors LLC and OrbiMed Capital LLC share power to direct the vote and to direct the disposition of all of the 3,150,000 shares. |

| (5) | Includes 255,500 shares underlying stock options. |

| (6) | Includes 229,500 shares underlying stock options. |

| (7) | Includes 183,000 shares underlying stock options. |

| (8) | Includes 146,750 shares underlying stock options. |

| (9) | Includes 149,500 shares underlying stock options. |

| (10) | Includes 86,563 shares underlying stock options. |

| (11) | Includes 74,375 shares underlying stock options. |

| (12) | Includes 69,687 shares underlying stock options. |

| (13) | Includes 44,375 shares underlying stock options. |

| (14) | Includes 45,313 shares underlying stock options. |

| (15) | Includes 37,500 shares underlying stock options. |

| (16) | Includes 25,000 shares underlying stock options. |

5

ELECTION OF DIRECTORS

At the Annual Meeting, seven directors will be elected to hold office until the next Annual Meeting of Shareholders or until their successors have been duly elected and qualified. All of the nominees served on the Board in 2004, except for Mr. Joseph Harris who was appointed to the Board in April 2005 to fill the vacancy on the Board created by the increase in the number of directors from six to seven.

The Board of Directors believes that the nominees will be able to serve as directors, if elected. If any nominee is unable to stand for re-election, proxies will be voted for the election of such other person as the Board of Directors may recommend, unless the Board reduces the number of directors.

Set forth below is certain information concerning the nominees for election as directors:

NOMINEES FOR THE BOARD OF DIRECTORS

| | | | |

Name and Length of Service as Director

| | Age

| | Principal Occupation and Certain Directorships

|

Morris Cheston, Jr. Director since May 2001 | | 67 | | Mr. Cheston has been a partner in the law firm of Ballard Spahr Andrews & Ingersoll, LLP since 1971. Mr. Cheston is active in numerous civic and charitable organizations including currently serving as the Chairman, Board of Managers of Pennsylvania Hospital and a Trustee, and a Member of the Executive Committee of the University of Pennsylvania Health System. Mr. Cheston received a Bachelor of Arts degree from Princeton University and his Juris Doctor from Harvard Law School. |

| | |

David Fitzgerald Director since December 2002 | | 71 | | From October 1970 until his retirement in January 1996, Mr. Fitzgerald served in several capacities as President and CEO of Howmedica, Inc., Executive Vice President of Pfizer Hospital Products Group, and Vice President of Pfizer, Inc. He is currently a Director at LifeCell Corporation, a publicly traded tissue implant company, and Arthrocare Corp., a publicly traded developer of a technology platform for soft tissue surgical procedures. Mr. Fitzgerald has a Bachelor of Science degree from American International College and a Master of Business Administration degree from New York University. |

| | |

Joseph L. Harris Director since April 2005 | | 58 | | Mr. Harris has been a partner and fund manager of Trillium Lakefront Partners, III, a technology venture capital fund since May 2004. From October 2002 until May 2004, Mr. Harris was a consultant to Trillium Group structuring Trillium Lakefront Partners, III. From 2000 to October 2002, Mr. Harris was Senior Vice President of Corporate Development for Cantel Medical Corp, and from 1996 to 2000, he served as Senior Vice President and Director of Corporate Strategy and Development for SmithKline Beecham, currently Glaxo SmithKline. From 1986 to 1996, Mr. Harris served as Managing Director of Business Development for Eastman Kodak Company. Prior to 1986, Mr. Harris practiced as a certified public accountant with Coopers & Lybrand and as an attorney with the MacKenzie Law Firm. He currently serves on the Board of Diomed, Inc. a publicly traded medical device company. Mr. Harris holds a Bachelor of Science degree in accounting, a Master of Business Administration degree in finance and a Juris Doctor from Syracuse University. |

| | |

Antony Koblish Director since April 2002 | | 39 | | Mr. Koblish has served as President and Chief Executive Officer of Orthovita since April 2002, after serving as Senior Vice President of Commercial Operations since June 2001. From January 1999 to June 2001, Mr. Koblish managed Orthovita’s Worldwide Marketing division. Prior to 1999, Mr. Koblish served as Director of Marketing and Product Development, Reconstructive Specialty Group of Howmedica, Inc., a subsidiary of Pfizer, Inc. Mr. Koblish earned a Bachelor of Science degree in Mechanical Engineering from Worcester Polytechnic Institute and a Master of Science degree in Engineering, Mechanical Engineering and Applied Mechanics from the University of Pennsylvania. |

6

| | | | |

Name and Length of Service as Director

| | Age

| | Principal Occupation and Certain Directorships

|

Robert M. Levande Director since May 2000 | | 56 | | Mr. Levande has been Managing Director at MDB Capital Group LLC since May 2003. He served as Managing Director at Gilford Securities, Inc., an investment firm, from April 2002 to April 2003. In addition, he founded and has served as president of the Palantir Group, Inc., a private consulting firm specializing in providing strategic advice to entrepreneurs in the medical technology industry since January 1999. From 1972 to 1998, Mr. Levande served in various managerial positions with Pfizer Inc. including Vice President – Business Analysis & Development of its Medical Technology Group (1996 to 1998) and Senior Vice President of Howmedica Inc. (1987-1996). Mr. Levande received his Bachelor of Science degree from the Wharton School of Finance and Commerce of the University of Pennsylvania and his Master of Business Administration degree from Columbia University. |

| | |

Mary Paetzold Director since February 2003 | | 55 | | Ms. Paetzold is a retired CPA with over 30 years of experience with public and private companies. From 1994 through February 2000, Ms. Paetzold served as Vice President, chief financial officer, and director (1996-1997) of Ecogen, Inc., a publicly traded agricultural biotechnology company. From 1973 through 1994, Ms. Paetzold practiced with KPMG Peat Marwick, LLP, serving as a partner from 1984 until 1994. Ms. Paetzold currently serves as a director and chairman of the audit committee for Immunomedics, Inc., a publicly traded biotechnology company. Ms. Paetzold has a Bachelor of Arts in Mathematics from Montclair State University. |

| | |

Russell B. Whitman Director since October 2003 | | 60 | | From 1996 to 2000, Mr. Whitman served as President and CEO of Matrix Biotechnologies, a development stage company engaged in the development of medical implants for articular cartilage repair. From 1987 through 1995, Mr. Whitman served as CEO of Curative Technologies, Inc. before becoming Chairman in 1990. From 1969 through 1987, Mr. Whitman was employed by Pfizer, Inc. in a variety of management positions, most recently as Senior Vice President for Pfizer’s Hospital Products Group. Mr. Whitman was previously Chairman and a Board member of the New York Biotechnology Association and a member of the Board of Trustees of the Long Island High Technology Incubator. Mr. Whitman earned a Bachelor of Science degree in Chemistry from St. Lawrence University and a Master of Business Administration degree from the Wharton Graduate School of the University of Pennsylvania. |

7

CORPORATE GOVERNANCE

Corporate Governance Guidelines and Other Corporate Governance Documents

Orthovita’s Corporate Governance Guidelines, which include guidelines for determining director independence and other matters relating to Orthovita’s corporate governance, is available on Orthovita’s website. In addition, Orthovita’s other corporate governance documents, including the Charter of the Audit Committee, the Charter of the Nominating and Corporate Governance Committee, the Charter of the Compensation Committee and Orthovita’s Code of Conduct, are also available on Orthovita’s website. Shareholders may access these documents on the Company Profile—Corporate Governance page of Orthovita’s website at www.orthovita.com

Orthovita’s website is not part of this proxy statement and references to Orthovita’s website address are intended to be inactive textual references only.

Board Independence

The Board of Directors has determined that Morris Cheston, Jr., David Fitzgerald, Joseph Harris, Robert M. Levande, Mary Paetzold and Russell B. Whitman are each an independent director within the meaning of the rules of the Nasdaq Stock Market, Inc. In addition, the Board has determined that each of the members of the Audit Committee and the Compensation Committee is also independent within the meaning of the rules of the Nasdaq Stock Market, Inc., including additional rules relating to Audit Committee members.

Executive Sessions of Independent Directors

The independent directors meet at regularly scheduled meetings without the presence of management directors and other directors who are not independent.

Board of Directors and Board Committees

The Board of Directors held nine meetings during 2004. It is the Board’s policy that directors should attend Orthovita’s annual meeting of shareholders absent exceptional cause. All Board members attended the 2004 annual meeting.

The Board has a standing Audit Committee, Compensation Committee and a Nominating and Corporate Governance Committee. These committees, their principal functions and their respective memberships are described below.

Audit Committee

The Audit Committee provides oversight of the quality and integrity of Orthovita’s financial statements, internal controls and financial reporting process. In addition, the Audit Committee oversees Orthovita’s process to manage business and financial risks and compliance with legal, ethical and regulatory requirements. The Audit Committee meets at least quarterly with management and outside independent registered public accountants to discuss Orthovita’s financial statements and earnings press releases prior to any public release or filing of the information, reviews the performance and independence of our independent registered public accountants, selects Orthovita’s independent registered public accountants and pre-approves all audit, tax and non-audit services rendered by Orthovita’s independent registered public accountants.

The current members of the Audit Committee are Mary Paetzold, who serves as Chairperson, Morris Cheston, Jr. and Robert M. Levande. Each of the members of the Audit Committee is independent as defined by the Nasdaq listing standards currently in effect and as defined by the Securities and Exchange Commission (“SEC”).

The Board has determined that Mary Paetzold qualifies as an “audit committee financial expert” as that term is defined in SEC regulations, and, therefore, Ms. Paetzold qualifies as a financially sophisticated audit committee member as required by The Nasdaq Stock Market, Inc.’s Corporate Governance Rules.

The Audit Committee held eleven meetings during the year ended December 31, 2004.

8

Compensation Committee

The Compensation Committee is responsible for reviewing Orthovita’s compensation philosophy and the adequacy of compensation plans and programs for directors, executive officers and other Company employees. In addition, the Compensation Committee reviews compensation arrangements and incentive goals for executive officers and oversees the administration of Orthovita’s compensation plans. The Compensation Committee reviews the performance of executive officers and awards incentive compensation and adjusts compensation arrangements as appropriate based upon performance.

The current members of the Compensation Committee are Russell B. Whitman, who serves as Chairperson, and David Fitzgerald. Each of the members of the Compensation Committee is independent as defined by Nasdaq listing standards currently in effect and those approved by the SEC on November 4, 2003.

The Compensation Committee held four meetings during the year ended December 31, 2004.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the “Governance Committee”) assists the Board in fulfilling its responsibilities regarding the oversight of the composition of the Board and other corporate governance matters. Among its other duties, the Governance Committee advises the Board regarding the operations of the Board and recommends to the Board the director nominees for election as director at the next annual meeting of shareholders, as well as individuals to fill vacancies on the Board. In addition, the Governance Committee recommends to the Board the responsibilities, structure, operation and membership of each Board committee. The Governance Committee oversees the Board’s annual evaluation of its performance and the performance of other Board committees. In addition, the Governance Committee develops and recommends to the Board corporate governance guidelines for Orthovita and periodically reviews such guidelines.

The current members of the Governance Committee are Morris Cheston, Jr., who serves as Chairperson, David Fitzgerald, and Russell Whitman. Each of the members of the Governance Committee is independent as defined by Nasdaq listing standards currently in effect and those approved by the SEC on November 4, 2003.

The Governance Committee held one meeting during the year ended December 31, 2004.

Consideration of Director Candidates

The Governance Committee considers candidates for Board membership. Because the Board believes that its members should ideally reflect a mix of experience and other qualifications, there is no rigid formula. In evaluating potential candidates, however, the Governance Committee will consider, among others things, the degree to which a potential candidate fulfills a current Board need (e.g., the need for an audit committee financial expert), as well as the candidate’s ability and commitment to understand Orthovita and its industry and to devote the time necessary to fulfill the role of director (including without limitation regularly attending and participating in meetings of the Board and its Committees). In consideration potential candidates, the Governance Committee should consider the overall competency of the Board in the following areas: (i) industry knowledge; (ii) accounting and finance (iii) business judgment; (iv) management; (v) leadership; (vi) business strategy; (vii) crisis management, and (viii) corporate governance.

As described above under “Questions and Answers - Can a Shareholder Recommend a Nominee or Nominees to be Directors of Orthovita?”, the Governance Committee will consider Board candidates recommended by shareholders in accordance with the procedures described. The Governance Committee’s process for identifying and evaluating candidates is the same with respect to candidates recommended by members of the Board, management, shareholders or others.

Shareholders also have the right to nominate director candidates themselves without any prior review or recommendation by the Governance Committee or the Board of Directors, by following the procedures set forth under our bylaws as described at “Shareholder Proposals” in this Proxy Statement. A copy of these bylaw provisions can be obtained by writing to Investor Relations, Orthovita Inc., 45 Great Valley Parkway, Malvern, Pennsylvania, 19355.

Communications with the Board

Shareholders or interested persons may send communications to the Board of Directors in writing, addressed to the full Board of Directors or a specific committee of the Board of Directors, c/o Investor Relations, Orthovita Inc., 45 Great Valley Parkway, Malvern, PA 19355, telephone 610-640-1775 or email to: investorrelations@orthovita.com. All written communications so addressed will be promptly forwarded by Investor Relations to the specified individual directors, or, if applicable, to all the members of the Board as deemed appropriate. You can report your concerns to the Board of Directors, the independent directors or the Audit Committee anonymously or confidentially.

9

Code of Conduct

Orthovita has a Code of Conduct applicable to all of its officers, other employees and directors. Among other things, the Code of Conduct encourages a culture of honesty, accountability and mutual respect, to provide guidance to recognize and deal with ethical issues and to provide mechanisms to report unethical conduct. The Code of Conduct provides for the prompt internal reporting of violations of the Code of Conduct to an appropriate person identified in the Code of Conduct and contains provisions regarding accountability for adherence to the Code of Conduct. We intend to satisfy the disclosure requirements regarding any amendment to, or waiver from, a provision of our Code of Conduct by disclosing such matters in the Investors section of our website.

Directors’ Compensation

Employee directors do not receive any additional compensation for service on the Board or its committees. Directors receive cash reimbursement for travel expenses to the Board meetings, and Orthovita pays the liability insurance on behalf of the Company’s directors.

Directors who are not employees of Orthovita received the following compensation for the period June 12, 2003 through December 31, 2004:

Effective June 12, 2003 through December 31, 2004:

| | | | | | |

Cash Compensation

| | Non-qualified Stock Options: Initial Grant

| | Non-qualified Stock Options: Annual Grant

| | Restricted Stock or Non- qualified Stock Options: Annual Remuneration

|

None | | Options to purchase 25,000 shares of Common Stock upon election to the Board. The exercise price per share is equal to the market price of the Company’s Common Stock on the date elected to the Board. The options are fully vested upon grant and expire after ten years. | | Options to purchase 10,000 shares of our Common Stock. The exercise price per share is equal to the market price of the Company’s Common Stock on the date of the Annual Meeting of Shareholders. One-half of the shares underlying the options granted vest upon grant and 25% of the underlying shares vest for each of the following two years. | | $15,000 annual remuneration paid in the form of fully-vested non-qualified stock option grant. The restricted stock is valued based upon the market price of the Company’s Common Stock on the date of the Annual Meeting of Shareholders. |

In addition, the following non-qualified stock options were granted each calendar year:

| | | | |

| Non-qualified stock options per calendar year | | | | |

| | |

Board chairperson | | 10,000 | | |

Audit Committee chairperson | | 7,500 | | |

Non-chairperson Audit Committee member | | 5,000 | | |

Non-chairperson Compensation Committee member | | 2,500 | | |

Non-qualified stock options issued to non-employee directors are granted at the then current market price of Orthovita’s Common Stock on the date of grant, and the non-qualified stock options vest 50% on date of grant and 25% for each of the following two years.

10

Effective January 1, 2005, directors who are not employees of Orthovita began receiving the following compensation:

Effective January 1, 2005:

| | | | | | |

Cash Compensation

| | Non-qualified Stock Options: Initial Grant

| | Non-qualified Stock Options: Annual Grant

| | Restricted Stock or Non- qualified Stock Options: Annual Remuneration

|

| Annual retainers and in-person meeting fees paid for service on the Board and its committees as set forth below. | | Options to purchase 25,000 shares of Common Stock upon election to the Board. The exercise price per share is equal to the market price of the Company’s Common Stock on the date elected to the Board. The options are fully vested upon grant and expire after ten years. | | Options to purchase 10,000 shares of our Common Stock. The exercise price per share is equal to the market price of the Company’s Common Stock on the date of the Annual Meeting of Shareholders. One-half of the shares underlying the options granted vest upon grant and 25% of the underlying shares vest for each of the following two years. | | $15,000 annual remuneration paid in the form of restricted stock, which vests the earlier of (i) five year cliff; (ii) change in control of the Company, as defined; or (iii) when the non-employee director no longer serves on the Company’s Board of Directors. The restricted stock is valued based upon the market price of the Company’s Common Stock on the date of the Annual Meeting of Shareholders. |

| | | | | | | |

Annual Retainers

| | In-Person Meeting Fees

|

All board members | | $ | 9,000 | | Chairperson of Board meeting | | $1,500 |

Board chairperson | | | 4,500 | | Non-chairperson of Board meeting | | 1,000 |

Audit Committee chairperson | | | 7,500 | | Audit Committee meeting | | 1,500 |

Compensation Committee chairperson | | | 3,000 | | Compensation Committee meeting | | 1,000 |

| Nominating and Corporate Governance Committee chairperson | | | 2,000 | | Nominating and Corporate Governance Committee meeting | | 1,000 |

Non-chairperson Audit Committee member | | | 3,000 | | | | |

| Other non-chairperson Committee member (each committee) | | | 1,500 | | | | |

11

Executive Officers of Orthovita

The names, business experience and ages of Orthovita’s executive officers are listed below:

| | | | |

Name

| | Business Experience

| | Age

|

Antony Koblish | | Mr. Koblish has served as President and Chief Executive Officer of Orthovita since April 2002, after serving as Senior Vice President of Commercial Operations since June 2001. From January 1999 to June 2001, Mr. Koblish managed Orthovita’s Worldwide Marketing division. Prior to 1999, Mr. Koblish served as Director of Marketing and Product Development, Reconstructive Specialty Group of Howmedica, Inc., a subsidiary of Pfizer, Inc. Mr. Koblish earned a Bachelor of Science degree in Mechanical Engineering from Worcester Polytechnic Institute and a Master of Science degree in Engineering, Mechanical Engineering and Applied Mechanics from the University of Pennsylvania. | | 39 |

| | |

Erik M. Erbe, Ph.D. | | Dr. Erbe has been Chief Science Officer since April 2002. From May 1995 to April 2002, he served as Orthovita’s Vice President, Research and Development of Orthovita. Prior to that time, Dr. Erbe was the Senior Product Development Engineer of 3M’s Dental Products Division and Ceramic Technology Center from 1991 to 1995. Dr. Erbe received his Ph.D. in Ceramic Engineering and Glass Science from the University of Missouri at Rolla. | | 40 |

| | |

Maarten Persenaire, M.D. | | Dr. Persenaire has served as Orthovita’s Chief Medical Officer since April 1999. Prior to joining Orthovita, Dr. Persenaire served in several positions at AcroMed Corporation, a DePuy-Johnson & Johnson company, most recently as Vice President of Clinical Affairs. Dr. Persenaire received his medical degree from the Groningen State University in The Netherlands in 1982 and served his internship and residency in Internal Medicine and Surgery at the Greertruiden Hospital, The Netherlands, 1983. | | 48 |

| | |

Joseph M. Paiva | | Mr. Paiva has been Orthovita’s Chief Financial Officer since December 1997. Previously, Mr. Paiva was the Controller of Cephalon, Inc., an international biopharmaceutical company, from December 1995 to December 1997. Mr. Paiva received a Bachelor of Science degree in Accounting from Fairleigh Dickinson University in New Jersey and a Master of Business Administration degree from Rutgers University in New Jersey. Mr. Paiva is a Certified Public Accountant. | | 49 |

| | |

David J. McIlhenny | | Mr. McIlhenny has been Orthovita’s Senior Vice President, Operations since December 2002. From January 1996 to December 2002, Mr. McIlhenny was Vice President of Quality Assurance and Regulatory Affairs and Vice President of Quality Systems and Operations Support and Director of Manufacturing and Quality Control. From 1991 to 1995, Mr. McIlhenny was Director of Operations and Engineering at Surgical Laser Technology, a company that developed, manufactured and marketed regulatory approved medical lasers and disposable fiber optic laser delivery systems. Mr. McIlhenny received a Bachelor of Science degree in Civil Engineering from The Pennsylvania State University, a Bachelor of Science degree in Mechanical Engineering from Drexel University and a Master of Business Administration degree from Old Dominion University. | | 70 |

| | |

Christopher H. Smith | | Mr. Smith joined Orthovita in February 2004 as Vice President, Sales. From 1999 to 2004, Mr. Smith was a group director at Medtronic Neurologic Technologies, a division of Medtronic, Inc. From 1992 to 1999, Mr. Smith founded and was president of ThoroughMed Inc., a spine, neurosurgery and biomaterials distributor agency based in New York. ThoroughMed was acquired by Medtronic in 1999 and incorporated into Medtronic’s Neurologic Technologies sales division. | | 44 |

12

EXECUTIVE COMPENSATION: REPORT OF THE COMPENSATION COMMITTEE

Compensation Philosophy. The Compensation Committee of the Board of Directors’ (the “Compensation Committee”) philosophy is to promote the achievement of Orthovita’s annual and long-term performance objectives as set by the CEO and approved by the Board, to ensure that the executive officers’ interests are aligned with the success of Orthovita, and provide compensation opportunities that will attract, retain, and motivate superior executive personnel. This philosophy contemplates that the compensation of each executive officer should be influenced significantly by the executive officer’s performance, measured by both financial and non-financial performance, the executive officer’s overall level of experience, as well as other subjective factors. The Compensation Committee attempts to create a balanced compensation package by combining components based upon the achievement of long-term strategic value for shareholders with components based upon the execution of shorter-term tactical goals. The Compensation Committee believes that it has instituted a management compensation plan which:

| | • | | Attracts and retains talented management; |

| | • | | Provides both short-term and long-term incentives; |

| | • | | Focuses performance on the achievements of Orthovita’s objectives; and |

| | • | | Is consistent with shareholder interests. |

Compensation Methodology. The Compensation Committee develops and implements compensation policies, plans and programs which seek to enhance shareholder value of Orthovita by closely aligning the financial interests of Orthovita’s senior management with those of its shareholders. In order to determine appropriate compensation for the CEO and other executive officers, the Compensation Committee reviews the compensation plans for similar companies in our industry.

The Compensation Committee’s compensation program for senior management is comprised of the following:

Base salary. The annual base salary is designed to compensate executives for their sustained performance and level of responsibility and is established by the Compensation Committee’s subjective evaluation of the executive’s performance and experience. The Compensation Committee approves all salary increases for executive officers and presents their recommendation to the Board for approval.

Annual performance bonus. An annual discretionary cash bonus program is established in order to promote the achievement of Orthovita’s annual performance objectives. Company and individual objectives and milestones are established by the Board early each year, and are weighted for targets such as progress in sales, cash flow, research and development, clinical activities, and financing activities. Based upon achievement of these objectives, bonus amounts for each executive are recommended to the Compensation Committee by the CEO. At the end of each year, the Compensation Committee, in consultation with the CEO, determines the degree to which each Company objective has been achieved and the performance bonus to be awarded to the executive. The bonus awards are then submitted to the Board by the Compensation Committee for approval.

Long-term incentive compensation. The Compensation Committee recommends to the entire Board, the number of incentive stock option grants, restricted stock awards or other grants under the 1997 Equity Compensation Plan, if any, to be granted to each executive. These grants are based on the Compensation Committee’s subjective view of the executive’s ability to enhance the financial and operational performance of the Company; the executive’s past performance; and the expectation of the executive’s future performance and contributions. All stock options are granted with an exercise price equal to the closing market price of Orthovita’s Common Stock on the date of grant or award.

13

The CEO’s compensation for fiscal year 2004 included an annual base salary of $236,250 and a bonus of $106,313, which was paid in March 2005. In addition Orthovita granted Mr. Koblish options to purchase 300,000 shares of Orthovita’s Common Stock in May 2004. Orthovita granted stock options based upon a subjective evaluation of the CEO’s overall performance. The Compensation Committee awarded these stock options to Mr. Koblish based upon the Board’s conclusion that Orthovita achieved 90% of its objectives including product sales growth in excess of 50%. Mr. Koblish also was granted option to purchase 5,000 shares of Orthovita’s Common Stock in September 2004 upon attaining five years of employment with Orthovita.

Certain provisions of the Internal Revenue Code provide generally that publicly held corporations may not deduct compensation for its chief executive officer or each of other specified executive officers to the extent that such compensation exceeds $1 million for the executive. It is not expected that these provisions will adversely affect Orthovita based on its current compensatory structure. In this regard, base salary and bonus levels are expected to remain well below the $1 million limitation in the foreseeable future. In addition, Orthovita’s 1997 Equity Compensation Plan is designed to preserve, to the extent otherwise available, the deductibility of income realized upon the exercise of stock options under the plan regardless of whether such income, together with salary, bonus and other compensation, exceeds $1 million.

|

Respectfully submitted, |

Russell B. Whitman, Chairperson |

David Fitzgerald |

April 28, 2005 |

14

SUMMARY COMPENSATION TABLE

The following table sets forth information regarding compensation paid by Orthovita with respect to Orthovita’s Chief Executive Officer during 2004 and Orthovita’s four other most highly compensated executive officers (“Named Executive Officers”).

| | | | | | | | | | | |

Executive Officer Principal Position

| | Year

| | Annual Compensation

| | Long-Term Incentive

Compensation

| |

| | | Salary ($)

| | Bonus ($)

| | Securities

Underlying

Options (#)

| | All Other Compensation ($)

| |

Antony Koblish, Chief Executive Officer (1) | | 2004

2003

2002 | | 236,250

225,000

209,600 | | 106,313

120,319

— | | 305,000

200,000

178,000 | | 18,689

17,825

14,808 | (2)

|

| | | | | |

Erik M. Erbe, Ph.D., Chief Science Officer | | 2004

2003

2002 | | 195,930

186,600

183,270 | | 26,451

65,077

— | | 230,000

110,000

80,000 | | 14,479

14,515

14,203 | (3)

|

| | | | | |

Maarten Persenaire, M.D., Chief Medical Officer | | 2004

2003

2002 | | 195,834

186,500

186,500 | | 58,162

65,045

— | | 115,000

110,000

63,000 | | 15,365

14,453

15,803 | (4)

|

| | | | | |

Joseph M. Paiva, Chief Financial Officer | | 2004

2003

2002 | | 194,250

185,000

181,525 | | 61,189

73,120

— | | 120,000

120,000

81,000 | | 15,598

14,860

14,382 | (5)

|

| | | | | |

David J. McIlhenny, Senior Vice President, Operations | | 2004

2003

2002 | | 173,250

165,000

148,615 | | 46,778

57,544

— | | 110,000

110,000

71,000 | | 19,381

20,605

20,868 | (6)

|

| (1) | Mr. Koblish has been Chief Executive Officer since April 23, 2002. See “Executive Compensation: Report of the Compensation Committee” for details of the 2004 securities underlying options granted during 2004. |

| (2) | Includes $2,939 for life and disability insurance premiums, $9,600 for an automobile allowance, and $6,150 in matching contributions made by Orthovita under its 401(k) plan. |

| (3) | Includes $2,129 for life and disability insurance premiums, $7,200 for an automobile allowance, and $6,150 in matching contributions made by Orthovita under its 401(k) plan. |

| (4) | Includes $2,015 for life and disability insurance premiums, $7,200 for an automobile allowance, and $6,150 in matching contributions made by Orthovita under its 401(k) plan. |

| (5) | Includes $2,248 for life and disability insurance premiums, $7,200 for an automobile allowance, and $6,150 in matching contributions made by Orthovita under its 401(k) plan. |

| (6) | Includes $6,665 for life and disability insurance premiums, $7,200 for an automobile allowance, and $6,150 in matching contributions made by Orthovita under its 401(k) plan. |

15

OPTION GRANTS IN FISCAL 2004. The following table presents information concerning the options granted under the 1997 Equity Compensation Plan to Named Executive Officers during 2004.

| | | | | | | | | | | | | | | | | |

| | | OPTION GRANTS IN LAST FISCAL YEAR

|

Name

| | Number of

Securities

Underlying

Options

Granted

| | | Percent of

Total Options

Granted to

Employees in

Fiscal Year

| | | Exercise

Price ($/share)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for

Option Term(4)

|

| | | | | | 5% Annual

Growth Rate

| | 10% Annual

Growth Rate

|

Antony Koblish | | 300,000

5,000 | (1)

(2) | | 12.9 | % | | $

| 4.45

4.51 | | May 4, 2014

September 1, 2014 | | $ | 2,211,306 | | $ | 3,521,135 |

| | | | | | |

Erik M. Erbe | | 130,000

100,000 | (1)

(3) | | 9.7 | % | |

| 4.45

5.00 | | May 4, 2014

June 4, 2014 | | $ | 1,756,763 | | $ | 2,797,351 |

| | | | | | |

Maarten Persenaire | | 110,000

5,000 | (1)

(2) | | 4.9 | % | |

| 4.45

4.51 | | May 4, 2014

September 1, 2014 | | $ | 834,075 | | $ | 1,328,126 |

| | | | | | |

Joseph M. Paiva | | 120,000 | (1) | | 5.1 | % | | | 4.45 | | May 4, 2014 | | $ | 869,830 | | $ | 1,385,058 |

| | | | | | |

David J. McIlhenny | | 110,000 | (1) | | 4.6 | % | | | 4.45 | | May 4, 2014 | | $ | 797,344 | | $ | 1,269,637 |

| (1) | Options granted have an exercise price per share equal to the closing price of Orthovita’s Common Stock on the date of grant and have a ten-year term. Options vest as follows: |

One-half vest 25% on each of the first four anniversaries of the date of grant; and

One-half vest on the fifth anniversary of the date of grant. However, vesting will be accelerated for these options to the extent of achievement of Board approved goals. To the extent vesting is accelerated, these options will vest as one-half upon a determination of the Board that the goal(s) have been achieved and one-half six months thereafter.

| (2) | Options granted have an exercise price per share equal to the closing price of Orthovita’s Common Stock on the date of grant and have a ten-year term. Options vest as to 25% of the underlying shares on each of the first four anniversaries of the date of grant. |

| (3) | Options granted have an exercise price per share equal to the closing price of Orthovita’s Common Stock on the date of grant and have a ten-year term. Options vest as follows: |

25% on date of grant;

37.5% upon achievement of goals as measured by the Compensation Committee; and

37.% upon achievement of additional goals as measured by the Compensation Committee.

| (4) | In accordance with SEC regulations, these columns show gains that could accrue for the respective options assuming that the market price of the Common Stock appreciates in value from the date of grant over a period of ten years (except as noted below) at an annualized rate of 5% and 10%, respectively. Actual gains, if any, on stock option exercises are dependent on the future performance of Orthovita Common Stock and overall market conditions. These amounts are not intended to forecast possible future increases, if any, in the market price of Orthovita’s Common Stock. |

16

AGGREGATED OPTION EXERCISES AND YEAR-END VALUES. The following table presents information about shares acquired upon the exercise of option and the number and value of options held by the Named Executive Officers at December 31, 2004.

| | | | | | | | | | | | | | | |

| | | AGGREGATED OPTION EXERCISES IN THE LAST FISCAL YEAR AND YEAR-END VALUES

|

| | | Shares

Acquired on

Exercise

| | Value

Realized (2)

| | Number of Securities

Underlying Unexercised

Options at December 31, 2004

| | Value of Unexercised In-the-Money Options at December 31, 2004(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Antony Koblish | | — | | | — | | 209,750 | | 543,250 | | $ | 213,540 | | $ | 303,880 |

Erik M. Erbe, Ph.D. | | 80,000 | | $ | 85,350 | | 208,500 | | 323,500 | | $ | 36,375 | | $ | 131,175 |

Maarten Persenaire | | — | | | — | | 134,750 | | 228,250 | | $ | 88,665 | | $ | 127,305 |

Joseph M. Paiva | | — | | | — | | 183,000 | | 232,500 | | $ | 113,515 | | $ | 129,675 |

David J. McIlhenny | | — | | | — | | 134,250 | | 227,750 | | $ | 99,918 | | $ | 132,473 |

| (1) | Based upon the difference between (i) the closing price of our Common Stock on the Nasdaq National Market on December 31, 2004 ($4.19 per share) and (ii) the exercise price of unexercised in-the-money options. |

| (2) | Based upon the difference between (i) the closing market price of our Common Stock on the Nasdaq National Market on the date of exercise and (ii) the exercise price of the options. |

17

EQUITY COMPENSATION PLAN INFORMATION

AS OF DECEMBER 31, 2004

The following table provides information on Orthovita’s equity compensation plans as of December 31, 2004. All of Orthovita’s equity compensation plans have been approved by Orthovita’s shareholders.

| | | | | | | |

Plan Category

| | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

| | (b) Weighted- Average Exercise Price of Outstanding Options, Warrants and Rights

| | (c) Number of Securities Remaining Available for Future Issuance Under Compensation Plans (excluding securities reflected in column (a))

|

Equity Compensation Plans Approved by Shareholders | | 6,587,878 | | $ | 3.85 | | 510,908 |

| | | |

Equity Compensation Plans Not Approved by Shareholders | | — | | | — | | — |

| | | |

Total | | 6,587,878 | | $ | 3.85 | | 510,908 |

18

EMPLOYMENT AND CHANGE OF CONTROL AGREEMENTS

In May 2002, Orthovita entered into employment agreements with each of Messrs. Koblish and Paiva and Dr. Erbe. Mr. Koblish’s agreement provides for his employment as the Company’s Chief Executive Officer and President at an annual salary of $236,250 plus an automobile allowance of $800 per month. Mr. Paiva’s agreement provides for employment as the Company’s Chief Financial Officer at an annual salary of $194,250 plus an automobile allowance of $600 per month. Dr. Erbe’s agreement provides for employment as the Company’s Chief Science Officer at an annual salary of $195,930 plus an automobile allowance of $600 per month. Each of the employment agreements with Messrs. Koblish, Paiva and Dr. Erbe provisions relating to the reimbursement of certain business expenses, participation in employee benefit plans, including health, disability and 401(k), generally available to the other executive officers of Orthovita, life insurance of $500,000, and confidentiality and non-competition provisions. Each of the agreements with Messrs. Koblish, Paiva and Dr. Erbe provides for automatic one-year renewal unless cancelled by Orthovita prior to the expiration of the year. In addition, each of the agreements contains the following severance benefits and change of control provisions. If the executive officer is terminated without “cause” (as defined in the respective employment agreement) or suffers a “constructive termination without cause,” Orthovita or its successor entity will: (i) pay up to eighteen months of salary (in the case of Messrs. Koblish and Paiva) or twenty-four months of salary (in the case of Dr. Erbe) severance benefit; (ii) for a period of eighteen months (in the case of Messrs. Koblish and Paiva) or twenty-four months (in the case of Dr. Erbe) following each termination or constructive termination without cause, continue health insurance coverage; and (iii) pay for unused vacation time. In addition, one hundred percent of any stock option, restricted stock or other stock grants or awards made to the executive officer that have not yet become exercisable or vested shall become exercisable or vested.

The receipt of the eighteen month (as to Messrs. Koblish and Paiva) or twenty-four month (as to Dr. Erbe) salary continuation severance payment described above is conditioned upon the executive executing a release in favor of Orthovita. If the executive does not execute and deliver the release, he will be entitled to the amount of his base salary for the remainder of the term of his employment agreement.

The severance benefit will end or be decreased if the executive begins comparable employment elsewhere, subject to certain conditions.

In addition, upon the occurrence of a change of control of Orthovita, one hundred percent (100%) of any stock option, restricted stock or other stock grants or awards made to the executive officer that have not yet become exercisable or vested shall become exercisable or vested.

Under each of the employment agreements, a “change of control” is defined generally as meaning the acquisition by a person of securities having more than 50% of the voting power of Orthovita’s outstanding securities; a sale or other disposition of substantially all of Orthovita’s assets; a liquidation or dissolution of Orthovita; any transaction as a result of which the shareholders of Orthovita do not beneficially own at least 50% of the voting power of the surviving company in the election of directors; or a change in the composition of the Board as a result of which incumbent Board members constitute less than a majority of the Board. A “constructive termination without cause” means the executive officer’s resignation following a reduction in the officer’s compensation, a material diminution in the officer’s duties and responsibilities, assignment of duties and responsibilities that are materially inconsistent with the duties and responsibilities held by the officer on the date of the agreement or that materially impair his ability to function in his then current position, or the failure of Orthovita to comply with any of the material terms of the agreement, other than with respect to a decrease in the officer’s compensation, notice and an opportunity to cure.

19

In addition, Orthovita has entered into change of control agreements with its other Executive Officers and Vice Presidents that provide for the following severance benefits:

| | • | | If within one year after a Change of Control of Orthovita (as defined in Orthovita’s 1997 Equity Compensation Plan), (a) Orthovita terminates the executive’s employment for any reason other than “Cause” (as defined in Orthovita’s 1997 Equity Compensation Plan), disability or death, or (b) the executive voluntarily terminates employment with Orthovita on account of a “Constructive Termination” (as defined below), the executive will receive payments equivalent to his base salary, as in effect immediately prior to the termination of employment, for a minimum of six months but not to exceed twelve months, as described below. |

| | • | | A “Constructive Termination” is a termination of employment at the executive’s initiative after the occurrence of any of the following events without their consent within one year after a Change of Control of Orthovita: (a) a material diminution in his duties, responsibilities, authority or status, (b) a reduction in any amount of his annual base salary, or (c) the assignment to him of duties or responsibilities which are materially inconsistent with the duties, responsibilities, authority, or status of his position prior to the Change of Control or materially impair his ability to function in his then current position. |

| | • | | Payment of the base salary will continue until the earlier of: (a) the commencement of “Comparable Employment” (as defined below), or (b) the first anniversary of termination of employment with Orthovita. Each executive’s entitlement to receive the payments described above will depend upon such executive’s execution of Orthovita’s standard separation of employment and general release at the time of termination of employment. |

| | • | | “Comparable Employment” means that new employment with another employer after the executive’s termination that (i) pays a salary that is no less than 75% of his base salary on the termination date and (ii) requires performance of the same or similar skill levels as when employed by Orthovita. |

| | • | | If an executive officer is eligible to receive severance benefits under the terms of a written employment agreement, severance agreement or offer letter, he will receive the benefits from either the Change of Control Agreement or the Employment Agreement, depending on which arrangement provides the higher level of benefits. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During the year ended December 31, 2004, Orthovita sold 5,681,818 shares of the Company’s Common Stock to Angiotech Pharmaceutical, Inc. (“Angiotech”) for net proceeds of $24,024,375. As a result, Angiotech holds approximately 12.0% of Orthovita’s outstanding shares of Common Stock. Orthovita also entered into an agreement with Cohesion Technologies, Inc., a wholly-owned subsidiary of Angiotech, to distribute, market and sell CoStasis® (re-branded as VITAGEL Surgical Hemostat), a composite liquid hemostat, and the CELLPAKER® plasma collection system, used together with VITAGEL, to surgical customers throughout North America, with an option to expand the territory to include the European Union and the rest of the world. Under the agreement, Orthovita has the obligation to purchase the products and make royalty payments to Angiotech based on the net sales of such products. During the year ended December 31, 2004, Orthovita paid $86,143 in royalty payments to Angiotech.

20

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is comprised of three independent directors and operates under a written charter adopted by the Board of Directors. The Audit Committee selects Orthovita’s Independent Registered Public Accountants.

As described more fully in its charter, the primary purpose of the Audit Committee is to provide oversight of the quality and integrity of Orthovita’s financial statements, internal controls and financial reporting process, and Orthovita’s process to manage business and financial risks and compliance with legal, ethical and regulatory requirements. In addition, the Audit Committee interacts directly with and evaluates the performance of the independent registered public accountants, including determining whether to engage or dismiss the independent registered public accountants and to determine compensation of the independent registered public accountants and monitor the independent registered public accountant’s qualifications and independence.

Management is responsible for the preparation, presentation and integrity of the financial statements, and evaluation of and assessment of the effectiveness of the Orthovita’s internal control over financial reporting. KPMG LLP, Orthovita’s independent registered public accountants, is responsible for performing an independent audit of the consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States). In addition, KPMG LLP expresses an opinion on Management’s assessment of internal control over financial reporting and expresses an opinion on internal control over financial reporting. The Audit Committee’s responsibility is to monitor and oversee this process.

The Audit Committee has reviewed and discussed the audited consolidated financial statements with Management. In addition, the Audit Committee has reviewed Management’s assessment of the effectiveness of Orthovita’s internal control over financial reporting. Management represented to the Audit Committee that Orthovita’s consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles. The Audit Committee has discussed with the independent registered public accountants (i) the audited consolidated financial statements; (ii) their opinion regarding the financial statements and their opinion regarding management’s assessment and evaluation of internal control over financial reporting pursuant to Public Company Accounting Oversight Board Standard No. 2 and (iii) the matters required to be discussed in accordance Auditing Standards, as amended, “Communications with Audit Committees.”

Orthovita’s independent registered public accountants also provided the Committee with the written disclosures and letter required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the Committee discussed with the independent registered public accountants that firm’s independence.

Based on the review and discussion described above, the Committee recommended that the Board of Directors include the audited consolidated financial statements in Orthovita’s annual report on Form 10-K for the year ended December 31, 2004.

|

Respectfully submitted, |

Mary Paetzold, Chairperson |

Morris Cheston |

Robert M. Levande |

April 28, 2005 |

21

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has selected KPMG LLP as the independent registered public accountants to examine the consolidated financial statements of Orthovita for 2005. A representative of KPMG LLP will be present at the meeting and will have an opportunity to make a statement if he or she desires to do so and will also be available to respond to appropriate questions raised at the meeting.

The following table sets forth the aggregate fees incurred by us for the following periods relating to Orthovita’s independent registered public accountants, KPMG LLP:

| | | | | | |

| | | Year Ended December 31

|

| | | 2004

| | 2003

|

Audit Fees | | $ | 434,000 | | $ | 112,000 |

Audit Related Fees | | | 68,000 | | | 11,500 |

Tax Fees | | | 6,500 | | | 25,625 |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

| | | $ | 508,500 | | $ | 149,125 |

| | |

|

| |

|

|

Audit Fees are fees paid to KPMG LLP for professional services for the audit of Orthovita’s consolidated financial statements included in the Company’s Form 10-K and review of financial statements included in the Company’s Form 10-Qs, and for services that are normally provided by the independent registered public accountants in connection with regulatory filings or engagements. In 2004, Audit Fees also include professional services rendered for the audit of Management’s assessment of internal controls over financial reporting and the audit of Orthovita’s internal control over financial reporting ($294,000 in the aggregate). Audit Related Fees included fees for issuance of consents to various registration statements under the Securities Act of 1933 filed by Orthovita, as well as for consultation on financial accounting and reporting matters in connection with these registration statements. Tax Fees are for tax compliance services provided by KPMG LLP.

Pre-approval Policies and Procedures

All audit, tax and non-audit services to be performed by Orthovita’s independent registered public accountants must be approved in advance by the Audit Committee. As permitted by the SEC’s rules, the Audit Committee has adopted policies and procedures for giving such approval. The Audit Committee policy is to allow the Audit Committee Chairperson pre-approve any audit, tax or all other non-audit services up to $5,000 in aggregate fees and report such fees to the Committee at the next meeting. All services over $5,000 related to the Audit Fees, Audit-Related Fees, Tax Fees or All Other Fees described above were pre-approved by the Audit Committee pursuant to the pre-approval provisions set forth in applicable rules of the SEC.

22

PROPOSAL TO AMEND AND RESTATE THE 1997 EQUITY COMPENSATION PLAN

The Board has proposed to amend and restate Section 3(a) of the Company’s 1997 Equity Compensation Plan (the “Plan”). The effect of the amendment will be to increase the aggregate number of shares of Common Stock of Orthovita that may be issued under the Plan from 7,350,000 shares of Common Stock to 9,350,000 shares of Common Stock. This is an increase to the Plan of 2,000,000 shares of Common Stock.

The following table presents information concerning the number of options granted during 2004, and their respective dollar value, under the Plan.

1997 Equity Compensation Plan

| | | | | |

Name and Position

| | Dollar Value ($)

| | Number of Options

|

Antony Koblish, Chief Executive Officer | | $ | 1,357,550 | | 305,000 |

Erik M. Erbe, Ph.D., Chief Science Officer | | | 1,078,500 | | 230,000 |

Maarten Persenaire, M.D., Chief Medical Officer | | | 512,050 | | 115,000 |

Joseph M. Paiva, Chief Financial Officer | | | 534,000 | | 120,000 |

David J. McIlhenny, Senior Vice President, Operations | | | 489,500 | | 110,000 |

Executive Group | | | 3,971,600 | | 880,000 |

Non-Executive Director Group | | | 1,402,363 | | 334,250 |

Non-Executive Officer Employee Group | | | 3,386,350 | | 790,000 |

Non-Employee Consultant Group | | | 1,053,217 | | 257,283 |

Purpose and Effect of the Proposed Amendment and Restatement

The Plan currently has 7,350,000 shares of Common Stock reserved for issuance, and as of April 25, 2005, the Plan had 470,633 shares of Common Stock available for issuance. The Plan is intended to encourage participants to contribute to Orthovita’s long-term growth, to align their interests with the Company’s shareholders’ interests and to aid the Company in attracting and retaining officers, employees, consultants and directors of outstanding ability. The Board of Directors believes it is in Orthovita’s best interest to increase the number of shares of Common Stock authorized under the Plan to 9,350,000, in order to be able to make additional awards under the Plan.

Description of the Plan

Except as described below, the Plan is administered by a committee (the “Compensation Committee”), consisting of two or more outside directors, as defined under section 162(m) of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). These “outside directors” are to be non-employee directors, as defined in Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All grants made to non-employee directors are subject to the approval of the Compensation Committee.

23

Employees may receive incentive stock options, nonqualified stock options, restricted stock or stock appreciation rights (“SARs”) under the Plan. Non-employee directors and consultants may receive non-qualified stock options, restricted stock or SARs. The maximum number of shares that may be subject to grants under the Plan to any individual during any calendar year is 500,000 shares.

If and to the extent options or SARs granted under the Plan terminate, expire, or are cancelled, forfeited, exchanged or surrendered without having been exercised, or if any shares of restricted stock are forfeited, the shares subject to such grants shall again be available for purposes of the Plan.

For the period November 2001 through February 22, 2005, the Compensation Committee recommended to the Board of Directors for approval all grants made to Orthovita’s executive officers, directors and consultants. The Board had created a one-person committee of the board and delegated to that committee the authority to make grants under the Plan to employees of Orthovita and its subsidiaries who are not subject to the restrictions of section 16(b) of the Exchange Act and who are not expected to be subject to the limitations of section 162(m) of the Internal Revenue Code. Under the terms of this delegation specified by the Board, the one-person committee was not to make annual grants that exceeded an aggregate of 50,000 shares of Common Stock per employee. The Board also could prescribe other limitations and conditions on this committee’s ability to make grants under the Plan. Antony Koblish, Chief Executive Officer, was the director who served on the one-person committee. Effective February 22, 2005, the Compensation Committee recommends for Board approval all options to be granted to vice-presidents and more senior officers and the Compensation Committee pre-approves all other stock options granted.

If there is any change in the number or kind of shares of Common Stock outstanding by reason of a stock dividend, spinoff, stock split, recapitalization, merger, consolidation or other extraordinary or unusual event, the maximum number of shares available for grants, the maximum number of shares that any individual may be granted in any year, the number of shares covered by outstanding grants, the kind of shares issued under the Plan, and the price per share or the applicable market value of grants may be appropriately adjusted by the committee.

The Plan provides for grants of non-qualified stock options, restricted stock or SARs to non-employee directors. The Board, as authorized under the Plan, has approved an initial grant of 25,000 fully vested non-qualified stock options upon election to the Board, an annual grant of 10,000 non-qualified stock options per calendar year, and a $15,000 annual remuneration to non-employee directors, which is to be paid in the form of a restricted stock grant or a fully vested non-qualified stock option grant. Non-qualified stock options issued to non-employee directors are granted at the then current market price of Orthovita’s Common Stock on the date of grant. In addition, non-qualified stock options, which are not fully vested at the date of grant, vest 50% on date of grant and 25% for each of the following two years. Effective January 1, 2005, annual remuneration to non-employee directors will be paid in the form of restricted stock which vests the earlier of (i) five year cliff; (ii) change in control of the Company, as defined; or (iii) when the non-employee director no longer serves on the Company’s Board of Directors.

The Board, as authorized under the Plan, had approved an annual grant to the Board Chairperson of 10,000 non-qualified stock options per calendar year, an annual grant to the Audit Committee Chairperson of 7,500 non-qualified stock options per calendar year, an annual grant to each Audit Committee Member of 5,000 non-qualified stock options per calendar year, and an annual grant to each Compensation Committee Member of 2,500 non-qualified stock options per calendar year. Effective January 1, 2005, the Board has approved cash compensation for service on the Board and its committees instead of the issuance of non-qualified stock options.

The committee determines the term of each stock option, which cannot exceed ten years from the date of grant. However, an incentive stock option granted to a 10% shareholder may not have a term longer than five years from the date of grant. The grantee may pay the exercise price (i) in cash, (ii) with the consent of the committee, by tendering shares of Common Stock owned by the grantee, (iii) through a broker-assisted exercise in accordance with applicable law, or (iv) by a combination of the foregoing. Options may be exercised while the grantee is an employee, consultant or member of the Board or within a specified time after termination of employment or service.

The committee may make restricted stock awards to key employees, consultants or, with Board approval, non-employee directors as it deems appropriate. The committee will establish the amount and terms of each restricted stock grant.