BlackLining Demo���� BlackLining Demo���� BlackLining Demo���� Annual Report 2024

In our 100th year at StoneX, we celebrated the many efforts and achievements that have shaped our company, while also sharpening our focus on intentional execution and a renewed sense of purpose. We aligned our vision across core and ancillary businesses, ensuring that every part of the organization is moving toward our strategic goals. As we relentlessly pursue these objectives, we’ve positioned StoneX for even greater success in 2025 and beyond.

3 44 Corporate statements 46 Office locations 48 Officers & directors 44 Corporate governance 51 Financial statements 50 Appendix StoneX Headquarters The Helmsley Building | New York, New York 04 Our vision 05 Performance highlights 06 Key metrics 08 Chairman’s letter 11 Financial summary 04 12 Performance in 2024 Strategy report 12 Chief Executive’s letter 26 StoneX ecosystem 28 Commercial segment 32 Institutional segment 36 Self-Directed/Retail segment 40 Payments segment Contents

StoneX | Annual Report 2024 4 A member of the Fortune 100, StoneX Group Inc. (NASDAQ: SNEX) is an institutional-grade financial services firm that connects world-leading companies, organizations, and investors to global markets with ease. Our vision is to be the leading financial services firm, built on a foundation of unwavering commitment to our clients by providing exceptional service, unmatched local expertise, and seamless global access and execution. We strive to set the standard for trust and excellence in every market we serve, as we continue to grow and solidify our reputation globally. Our vision By the numbers 75+ securities markets 4,500+ employees 40+ derivatives exchanges 70+ offices $4.6T volume traded 20+ countries 54K+ institutional, commercial & payments clients 215M listed derivative contracts traded 4

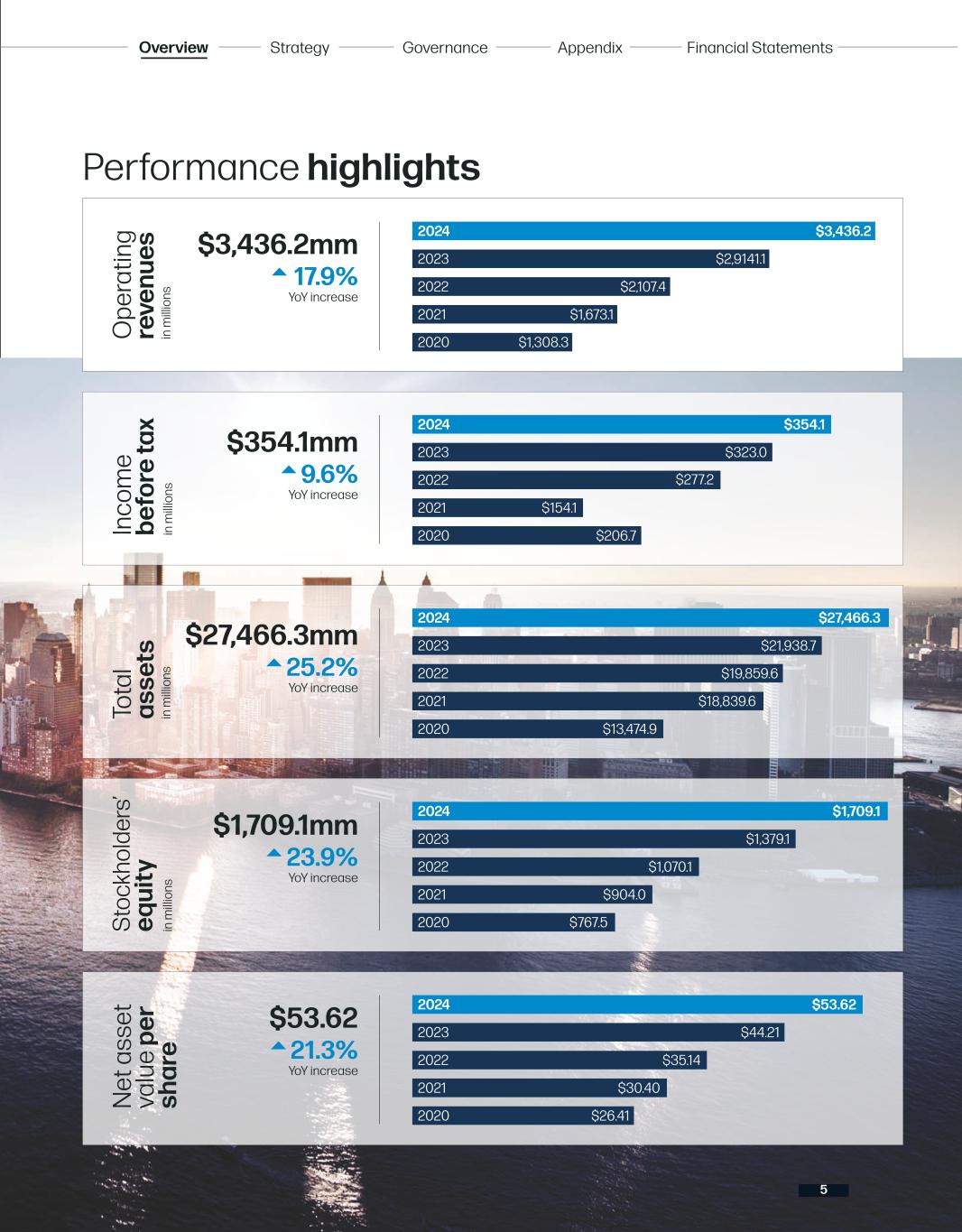

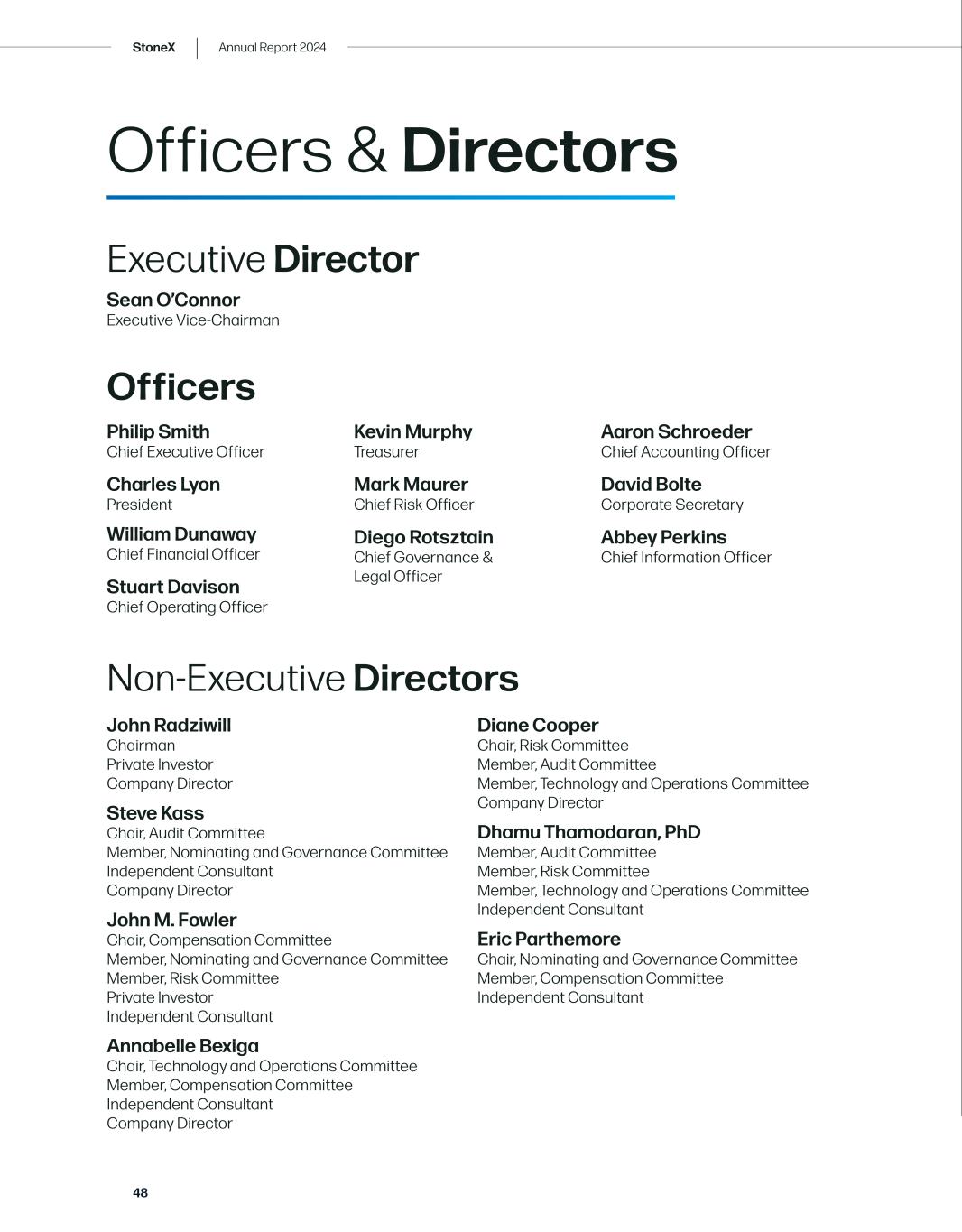

5 Overview Strategy Governance Financial StatementsAppendix Performance highlights 5 in m illi on s $3,436.2mm YoY increase 17.9% 2024 $3,436.2 O pe ra tin g re ve nu es 2023 $2,9141.1 2022 $2,107.4 2021 $1,673.1 2020 $1,308.3 2024 $354.1 2023 $323.0 2022 $277.2 2021 $154.1 2020 $206.7 2024 $27,466.3 2023 $21,938.7 2022 $19,859.6 2021 $18,839.6 2020 $13,474.9 2024 $1,709.1 2023 $1,379.1 2022 $1,070.1 2021 $904.0 2020 $767.5 2024 $53.62 2023 $44.21 2022 $35.14 2021 $30.40 2020 $26.41 in m illi on s In co m e be fo re ta x $27,466.3mm YoY increase 25.2% in m illi on s To ta l as se ts $1,709.1mm YoY increase 23.9% in m illi on s St oc kh ol de rs ’ eq ui ty $53.62 YoY increase 21.3% N et a ss et va lu e pe r sh ar e $354.1mm YoY increase 9.6%

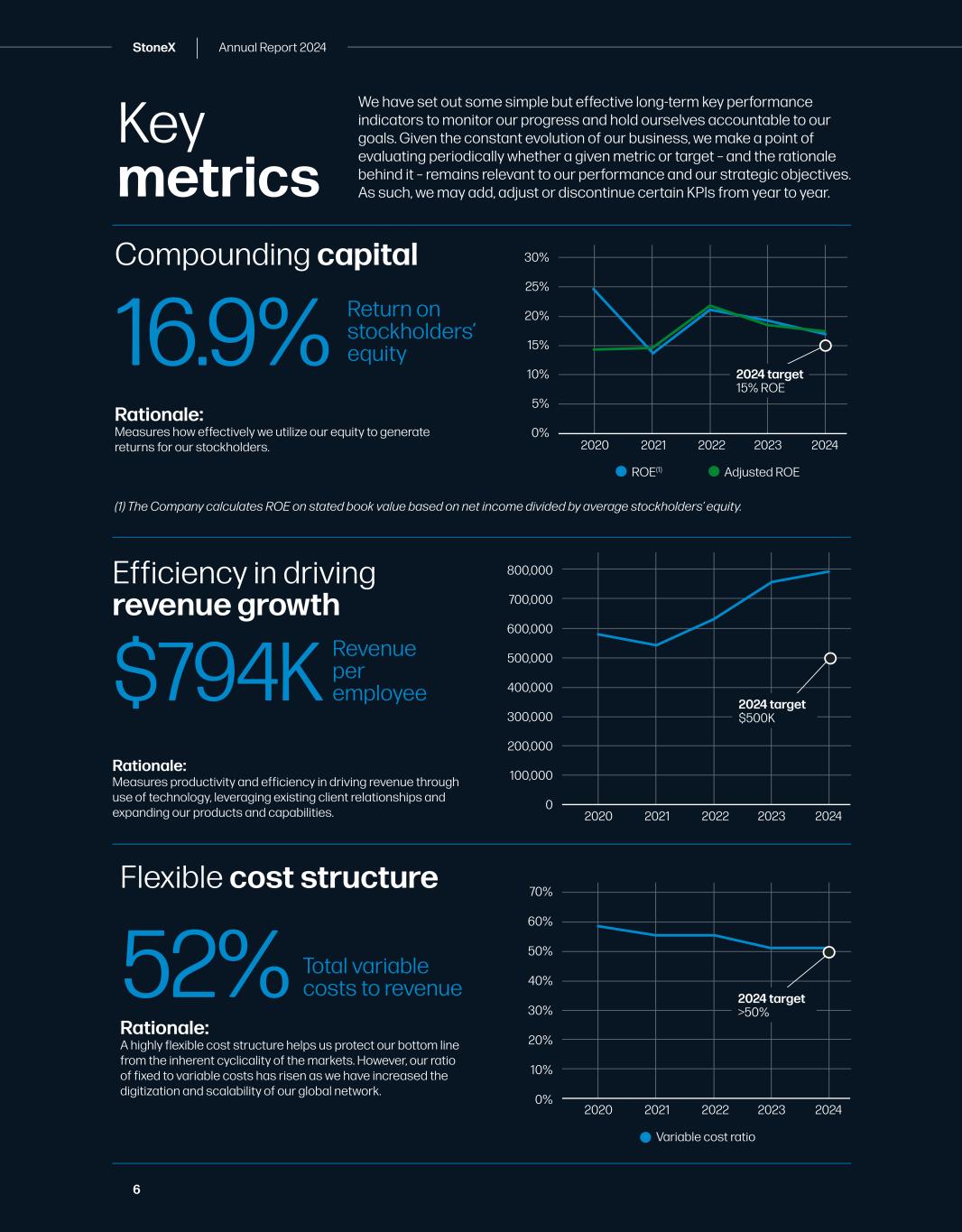

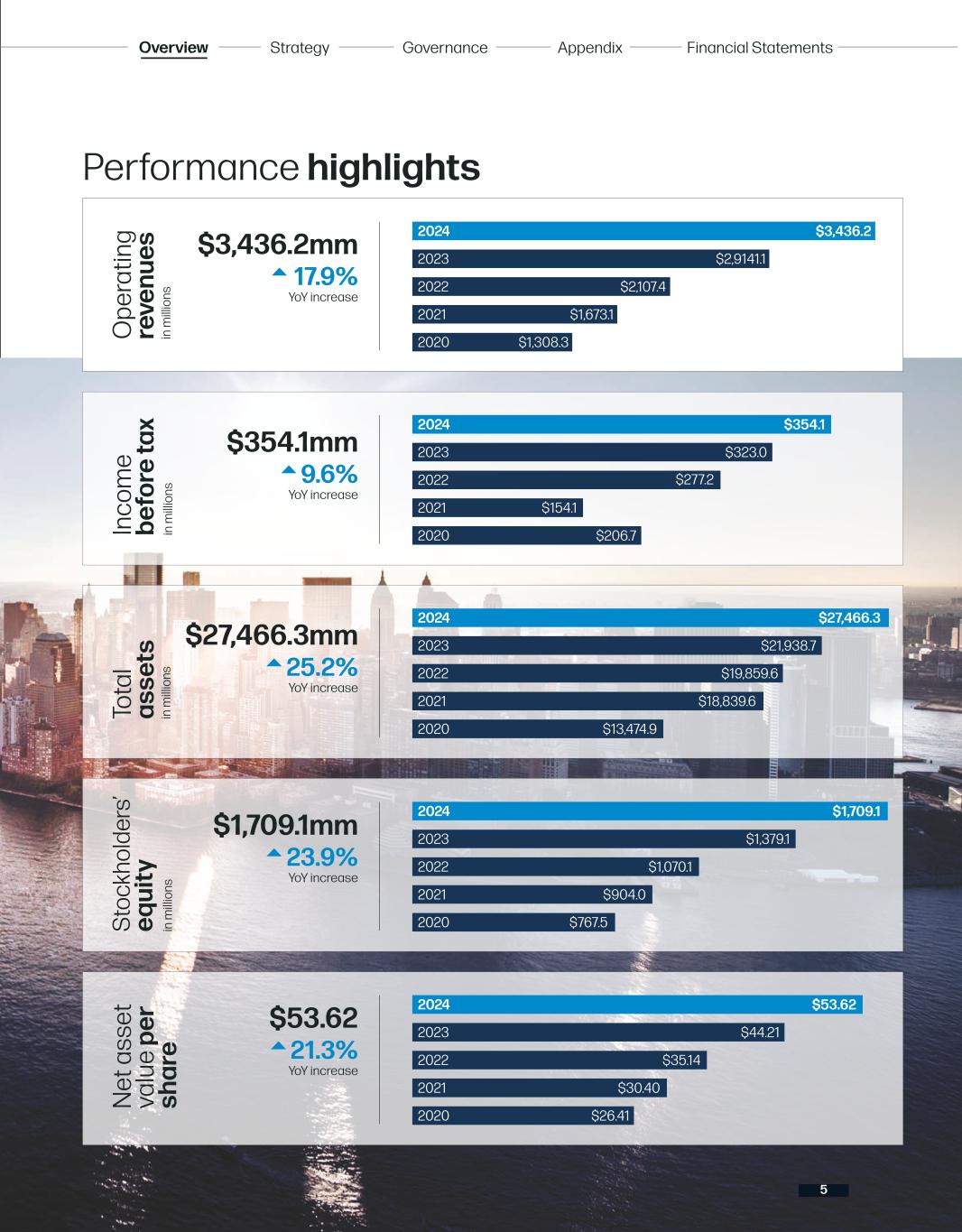

StoneX | Annual Report 2024 6 We have set out some simple but effective long-term key performance indicators to monitor our progress and hold ourselves accountable to our goals. Given the constant evolution of our business, we make a point of evaluating periodically whether a given metric or target – and the rationale behind it – remains relevant to our performance and our strategic objectives. As such, we may add, adjust or discontinue certain KPIs from year to year. Key metrics Compounding capital Efficiency in driving revenue growth Rationale: Measures productivity and efficiency in driving revenue through use of technology, leveraging existing client relationships and expanding our products and capabilities. (1) The Company calculates ROE on stated book value based on net income divided by average stockholders’ equity. Return on stockholders’ equity Revenue per employee 16.9% $794K 2020 2021 2022 2023 2024 0% 5% 10% 15% 25% 30% 20% ROE(1) Adjusted ROE 2024 target 15% ROE Flexible cost structure Rationale: A highly flexible cost structure helps us protect our bottom line from the inherent cyclicality of the markets. However, our ratio of fixed to variable costs has risen as we have increased the digitization and scalability of our global network. Total variable costs to revenue52% 2020 2021 2022 2023 2024 0% 10% 20% 30% 50% 60% 70% 40% Variable cost ratio 2020 2021 2022 2023 2024 100,000 0 200,000 300,000 400,000 600,000 700,000 800,000 500,000 Rationale: Measures how effectively we utilize our equity to generate returns for our stockholders. 2024 target $500K 2024 target >50%

7 Strategy Governance Financial StatementsAppendix Risk metrics (bad debt expense)1 Rationale: Calibrates our risk tolerance to avoid out-sized losses which may impede our ability to function normally: ensures that bad debt expense is proportional to our annual operating revenue and earnings. (1) Bad debt excludes impairments of $5.7 million in fiscal 2020. Bad debt to operating revenue0.0% As a % of operating revenue 2020 2021 2022 2023 2024 $0 $2.0 $4.0 $6.0 $10.0 $12.0 $14.0 $16.0 $18.0 $8.0 0.0 0.2 0.4 0.6 1.0 1.2 0.8 Bad debt, excluding impairment (in millions) (%) Compensation ratio Rationale: Ensures that overall compensation cost is proportional to the return shareholders require for supporting the costs, capital and risks associated with our platform. Total comp to operating revenue27.4% 2020 2021 2022 2023 2024 0% 5% 10% 15% 25% 30% 35% 40% 45% 20% Compensation to operating revenue Overview 2024 target Less than 1% 2024 target Less than 40%

StoneX | Annual Report 2024 8 In a year that tested the resilience of financial companies globally, StoneX delivered exceptional results, achieving revenue targets and demonstrating the strength of our evolving business model. Despite declining volatility and interest rates, which typically pose challenges for StoneX, we have grown our trading volumes and achieved in excess of our 15% ROE target by attracting new clients, effectively managing costs and expanding our product and geographical range. This adaptability, irrespective of market conditions, reflects the fundamental strength of our business model that has guided us to achieve a 32% revenue CAGR for the last 21 years. Chairman’s letter StoneX’s success is also reflected in our strong stock market performance, which shows recognition by the investment community of our continuing growth and increasing importance in the financial services industry. The value proposition is clear: our stock rose nearly 27% year-over-year, while still trading at less than half the earnings multiple of the S&P 500 (a 13.03 PE ratio vs 30.52). Our performance underscores the significant potential for value creation, as more investors recognize our consistent execution and growing market presence as a leading financial services franchise. The financial markets are undergoing fundamental structural changes which create significant opportunities for StoneX. Regulatory requirements, including the Basel regime, have imposed stricter capital constraints on the trading activities of larger banks and raised regulatory costs for smaller players, forcing many out of the market. StoneX is uniquely positioned to capitalize on these changes, leveraging this environment to onboard a record number of Commercial/ Institutional clients in Q3 2024. Simultaneously, the rise of off-exchange trading is reshaping public markets. Major financial platforms have been increasingly executing trades internally, reducing reliance on public exchanges. This model enhances efficiency, lowers transaction costs, and improves control over trading processes. With our strategic focus on internalization, StoneX is extremely well- positioned to be a key player in this evolving financial ecosystem, laying the groundwork for future growth. Our internalization strategy is proving particularly transformative for the business - by designing our trading platforms to aggregate trading and internalize spreads, we’ve created a virtuous cycle: best pricing for clients, reduced hedging costs for our business, and maximized revenue opportunities as spreads are internal. Our diverse product and geographical base make internalization possible, raising the probability of offsetting trades and driving substantial revenue capture and margin increase. 8

9 Strategy Governance Financial StatementsAppendixOverview As a business, we have established comprehensive capabilities across every aspect of a financial transaction – from execution to clearance and settlement while creating natural spreads and hedges through our product diversity. Our total addressable market (TAM) is enormous and presents an extraordinary growth opportunity; currently, we are leaving ample room to develop across all our business units. I’d like to also highlight one of our business units that significantly outperformed this year. Our acquisition of Gain Capital Holdings, Inc. has evolved to become a cornerstone of our growth strategy, delivering a 19% increase in Self-Directed/Retail segment operating revenues year-over-year despite less than favorable market conditions. The acquisition has exceeded our expectations as we benefited significantly from both internalization of spreads and product diversification. But we must be mindful of ongoing macroeconomic challenges. As our company has grown to over 70 offices and 4,500+ employees, we cannot simply keep our nose to the grindstone and ignore the broader market impacts. Interest rates, volatility, and upcoming electoral changes add uncertainty to our business at every turn. The ever-growing U.S. deficit and elevated stock market valuations relative to U.S. GDP warrant careful consideration. I remain confident in our disciplined approach to market exposure, and applaud our risk controls during critical moments, such as the unprecedented volatility in cocoa futures prices earlier this year. The financial markets are undergoing fundamental structural changes which create significant opportunities for StoneX. 9

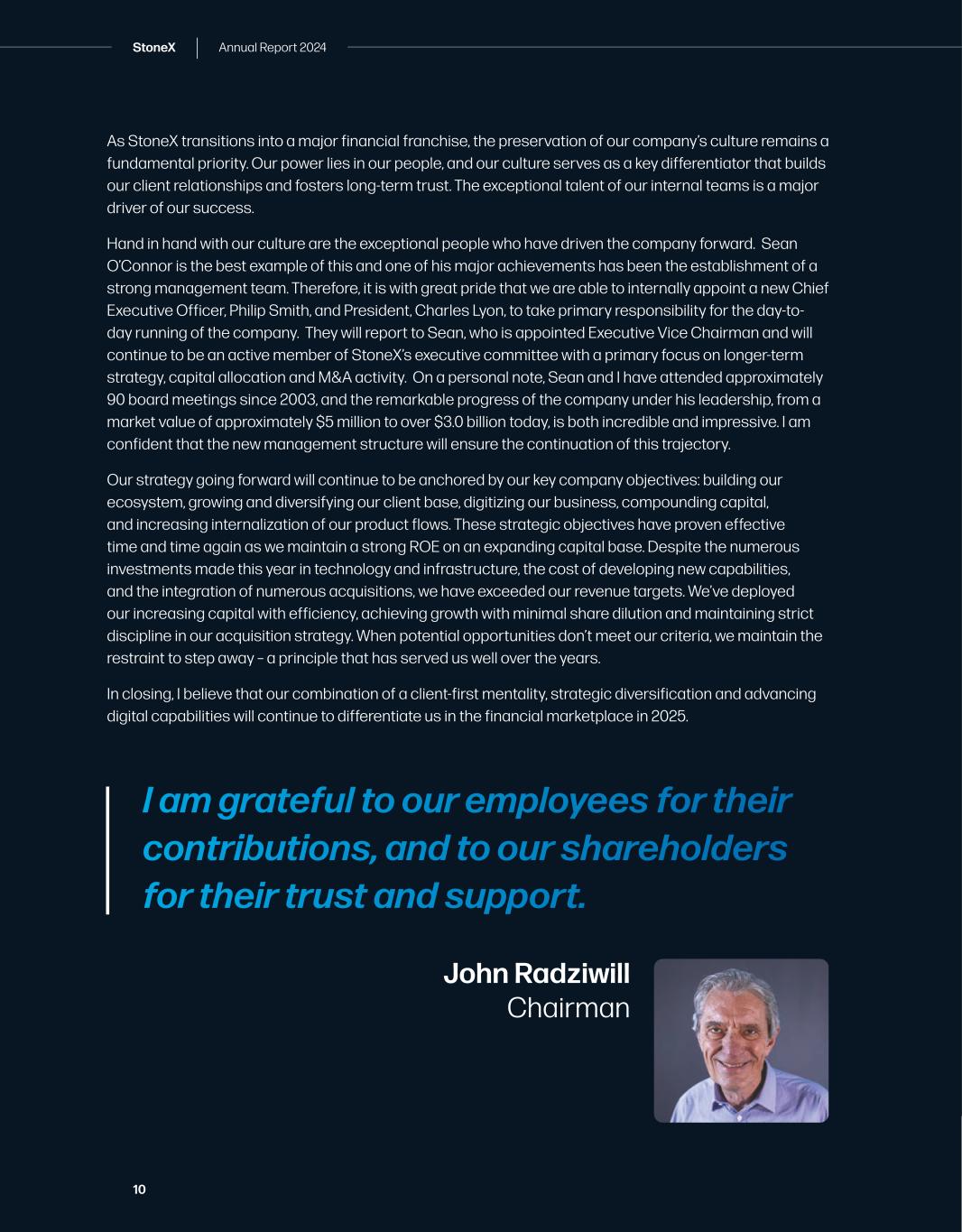

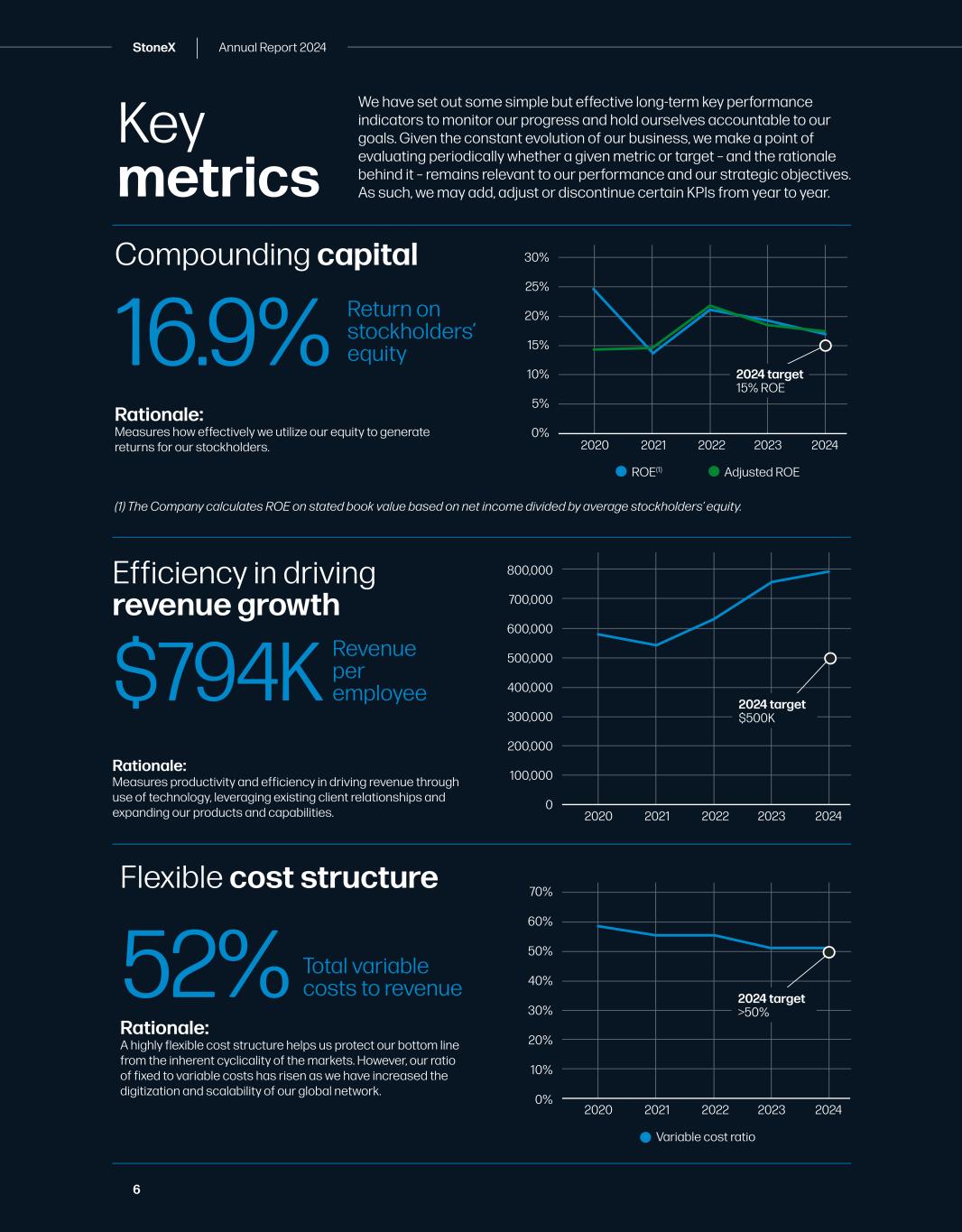

StoneX | Annual Report 2024 10 John Radziwill Chairman I am grateful to our employees for their contributions, and to our shareholders for their trust and support. As StoneX transitions into a major financial franchise, the preservation of our company’s culture remains a fundamental priority. Our power lies in our people, and our culture serves as a key differentiator that builds our client relationships and fosters long-term trust. The exceptional talent of our internal teams is a major driver of our success. Hand in hand with our culture are the exceptional people who have driven the company forward. Sean O’Connor is the best example of this and one of his major achievements has been the establishment of a strong management team. Therefore, it is with great pride that we are able to internally appoint a new Chief Executive Officer, Philip Smith, and President, Charles Lyon, to take primary responsibility for the day-to- day running of the company. They will report to Sean, who is appointed Executive Vice Chairman and will continue to be an active member of StoneX’s executive committee with a primary focus on longer-term strategy, capital allocation and M&A activity. On a personal note, Sean and I have attended approximately 90 board meetings since 2003, and the remarkable progress of the company under his leadership, from a market value of approximately $5 million to over $3.0 billion today, is both incredible and impressive. I am confident that the new management structure will ensure the continuation of this trajectory. Our strategy going forward will continue to be anchored by our key company objectives: building our ecosystem, growing and diversifying our client base, digitizing our business, compounding capital, and increasing internalization of our product flows. These strategic objectives have proven effective time and time again as we maintain a strong ROE on an expanding capital base. Despite the numerous investments made this year in technology and infrastructure, the cost of developing new capabilities, and the integration of numerous acquisitions, we have exceeded our revenue targets. We’ve deployed our increasing capital with efficiency, achieving growth with minimal share dilution and maintaining strict discipline in our acquisition strategy. When potential opportunities don’t meet our criteria, we maintain the restraint to step away – a principle that has served us well over the years. In closing, I believe that our combination of a client-first mentality, strategic diversification and advancing digital capabilities will continue to differentiate us in the financial marketplace in 2025.

11 Overview Strategy Governance Financial StatementsAppendix in USD millions (except share and per share amounts) Transaction-based clearing expenses Introducing broker commissions Interest expense Interest expense on corporate funding Operating revenues Net operating revenues Net income Earnings per share(1) Selected balance sheet information Other data Weighted-average number of common shares outstanding(1) Total compensation and other expenses Compensation and other expenses: Gain on acquisitions and other gains, net Income tax expense Basic Diluted Basic Diluted Total assets Payable to lenders under loans Senior secured borrowings, net Stockholders’ equity Return on average stockholders’ equity Employees, end of period Compensation and benefits as a percentage of operating revenues Financial summary 2024 20222023 2021 2020 $3,436.2 1,767.2 $260.8 1,421.9 1,475.9 $207.1 1,205.1 $2,914.1 1,621.0 $238.5 1,323.4 1,150.0 868.0 $116.3 $169.6 999.3 743.2 $2,107.4 $1,673.1 $1,308.3 271.7 160.5 49.6 41.3 222.5 113.8 80.4 23.6 291.2 160.1 135.5 44.7 271.8 161.6 802.2 57.5 319.3 166.2 1,115.7 67.8 942.4 79.1 69.7 73.4 49.0 52.6 28.4 8.5 53.1 0.6 65.1 8.8 354.1 93.3 $8.24 $7.96 30,539,237 31,625,029 794.8 66.2 54.3 52.4 36.1 55.3 16.9 8.3 44.4 15.8 60.6 6.4 277.2 70.1 $6.85 $6.67 29,355,605 30,101,311 868.6 74.0 57.0 61.6 40.4 54.0 24.8 9.1 51.0 16.5 66.4 25.4 323.0 84.5 $7.71 $7.45 29,936,000 30,929,011 679.1 58.8 40.9 46.0 34.2 33.3 4.5 9.3 36.5 10.4 46.3 518.7 46.3 30.2 28.4 23.5 12.2 8.9 7.0 19.7 18.7 29.6 3.4 154.1 37.8 81.9 206.7 37.1 $3.93 $3.82 $5.86 $5.74 28,695,965 29,517,253 28,236,492 28,770,719 $18,839.6 $248.6 $507.0 $904.0 13.9% 3,242 40.6% $19,859.6 $485.1 $339.1 $1,070.1 21.0% 3,615 37.7% $21,938.7 $341.0 $342.1 $1,379.1 19.5% 4,137 29.8% $27,466.3 $338.8 $543.1 $1,709.1 $13,474.9 $268.1 $515.5 $767.5 24.9% 2,950 39.6% 1Subsequent to September 30, 2023, we completed a 3-for-2 split of our common stock, effected as a stock dividend. All share amounts and per share amounts have been retroactively adjusted for the stock split. 16.9% 4,556 27.4% Income before tax Compensation and benefits Trading systems and market information Professional fees Non-trading technology and support Occupancy and equipment rental Selling and marketing Travel and business development Communications Depreciation and amortization Bad debts, net of recoveries and impairments Other

StoneX | Annual Report 2024 12 Shareholder equity $1,709.1 | CAGR 28% Market value $2,609.9 | CAGR 29% Operating revenue $3,436.2 | CAGR 32% Our track record 2002 - 2024 (in USD mm) StoneX has achieved a strong compound annual growth rate (CAGR), driven by strategic expansion across asset classes and increased market share in equities, commodities, foreign exchange, and fixed income. This consistent growth highlights StoneX’s ability to adapt to client needs and capitalize on market opportunities, reinforcing its position as a resilient and integrated global financial services provider. Chief Executive’s letter Introduction As we reflect on a milestone year at StoneX, I want to extend my gratitude for your confidence and continued support. Fiscal Year 2024 was marked by the highest earnings and operating revenues in our history—achievements made even more significant as they were accomplished despite diminished volatility and an overall challenging market environment. These results underscore the strength of our business model, the dedication of our employees, and the trust of our clients. As we celebrate our centennial year, we are also laying the groundwork for future success. With strategic realignments to our offerings, we are positioning StoneX to thrive and continue to deliver exceptional value to our shareholders.

13 Overview Strategy Governance Financial StatementsAppendixt Record financial performance Fiscal 2024 was a record year for StoneX, with operating revenues reaching $3.4 billion, an 18% increase from the prior year, driven by strong client activity and increased volumes across nearly all segments. Net income grew 9% to a record $260.8 million, and diluted earnings per share (EPS) rose 7% to $7.96. Our return on equity (ROE) of 16.9% exceeded our 15% target, reflecting our disciplined capital allocation and resilient approach to challenging market environments. These results, capped by a very strong fourth quarter, underscore our success in deepening client engagement and expanding market penetration and provide solid momentum as we enter Fiscal 2025. As proud as we are of these results, we believe the true measure of our approach’s success lies in our long-term performance. Over the past 21 years, we have grown stockholder equity, operating revenue, and market capitalization at nearly 30% compound annual growth rates. This track record, which we believe is unmatched in the industry, enables us to continue delivering sustained value regardless of market conditions.

StoneX | Annual Report 2024 14 Over the past 21 years, we have grown stockholder equity, operating revenue, and market capitalization at a nearly 30% compound annual growth rate. Our continued financial performance is powered by four drivers: market opportunities and industry consolidation that enable us to expand our client footprint and grow volumes over time, market volatility which drives our revenue capture, the impact of interest rates on our client float, and finally, our ability to control costs and drive operational leverage. The market environment remains favorable for client acquisition, with larger banks increasingly focused on servicing only their biggest clients as capital pressures from Basel III mount. Meanwhile, consolidation continues at the lower end of the market. Together, these trends create meaningful opportunities for expansion in our addressable market, a dynamic which I expect will continue for some time. In this environment where the market structure is changing and being reformatted, our comprehensive financial ecosystem becomes a key determinate for winning new clients. Our unique ability to provide efficient execution, as well as post-trade clearing, custody and financing services across all asset classes make us a financial counterparty of choice for these clients. This is validated by record levels of client onboarding, including an all-time high in the third quarter, as well as increased cross-selling revenue as our clients leverage our unique and growing ecosystem. Our success in this regard is best demonstrated by client volumes across our various products. As shown in the table below, we increased volumes across nearly all our products, an even more impressive result given the reduced volatility environment. Listed derivatives and securities were standout performers, with volumes up 34% and 36%, respectively. The lower volatility impacted revenue capture across nearly all of our products with the exception of FX/CFDs which saw a 32% increase. We are committed to delivering ‘best execution’ for our clients across all our products, which means we primarily operate as a ‘price taker’ in terms of revenue capture the market affords to us. This lower volatility environment reduced our revenue capture from 5-15% compared to the prior year, significantly offsetting the positive impact of client volume increases. In many markets though, volatility seems to have reached its lowest points and we are unlikely to see further erosion in revenue capture. Going forward, volume growth should now translate more linearly into revenue growth for each of our products. Of course, any increase in revenue capture due to heightened volatility would further amplify the impact of greater client volumes on revenue realized. Since the onset of the COVID-19 pandemic, interest has been a tailwind for our business, driven not only by the Federal Reserve’s rate hikes but also by a substantial growth in client float. Over the last three years, our expanded client base and higher margin requirements, driven by increased market volatility, have led to this expansion. We have now seen this cycle peak, and although our interest and fees earned on client balances still increased 12% over the prior year, we now face headwinds from declining interest rates and lower margin requirements due to suppressed volatility. Fortunately, the majority of our float earns a net interest margin which is unaffected by lower interest rates – unless we return to zero rates, which I view as highly unlikely. The impact of reduced rates may be further offset as the rate trajectory now appears flatter than initially anticipated, and the ongoing growth of our client base can result in increased client float. 14

15 Overview Strategy Governance Financial StatementsAppendixt 15 Our significant growth and product expansion over the last three years have led to higher operational costs. Additionally, as we continue to digitize our business, we have made substantial investments in technology and talent, resulting in costs that are incurred ahead of revenue. Consequently, expenses have increased nearly in line with net revenue, with limited operational leverage realized. Overall, costs increased by 8% for the year, which is considerably lower than in the previous two years and slightly below the 9% growth rate of our net operating revenues. We believe our overall costs, including investments, should moderate as a percentage of revenue, assuming all else remains equal. We have heightened our focus on cost management and ensuring that our infrastructure is more digital and scalable to drive operational leverage and margin expansion as we continue to grow revenues. We expect to see tangible benefits from our technology investments, which will fuel revenue growth, create operational scalability, and ultimately drive margins. Fiscal Year 2024 Product Results & Key Metrics Listed Derivatives $469.6mm | Up 13% OTC Derivatives $209.9mm | Down 10% Physical Contracts $217.9mm | Down 11% Securities $1,442.7mm | Up 36% Payments $205.1mm | Down 2% FX/CFDs(3) $316.1mm | Up 21% Interest / Fees Earned on Client Balances $432.1mm | Up 12% Operating Revenue(4) by Product Key Operating Metrics Contracts (‘000s) Contracts (‘000s) Contracts (‘000s) ADV(3) (USDmm) ADV (USDmm) ADV (USDmm) Listed Derivatives, Client Equity(1) Figures presented are annual; FY2024 percentage changes reflect full year figures ending September 30, 2024 vs full year ending September 30, 2023. Key metrics presented do not account for all Operating Revenue generated (1) Listed Derivatives Client Equity balance pertains to client assets in our futures and options business on which we retain a share of interest earnings (2) Money Market Fund / FDIC Sweep balance pertains to client assets in our correspondent securities clearing business on which we retain a share of fee income (3) Contracts For Difference (“CFD”), Average Daily Volume (“ADV”) and Rate Per Million (“RPM”) (4) Operating Revenue represents gross revenue less cost of sales of physical commodities (5) The calculation of Securities RPM represents the RPM after excluding interest income associated with our equities activities and deducting the interest expense associated with our fixed income activities from operating revenues 214,811 | Up 34% $2.09 | Down 14% 3,538 | No change $59.62 | Down 9% $7,156 | Up 36% $256 | Down 15% $69 | Up 3% $11,693 | Down 5% $10,813 | Down 9% $115 | Up 32% $6,206mm | Down 13% $1,017mm | Down 24% N/A N/A Rate per Contract Rate per Contract Rate per Contract RPM(3)(5) RPM RPM MMF/FDIC Sweep Balances(2)

StoneX | Annual Report 2024 16 1 Progress on our strategic initiatives At StoneX, we continue to employ the same fundamental strategy that has remained as relevant today as it was 20 years ago. At StoneX, our ecosystem is the foundation for long-term growth. By integrating a diverse suite of products, services, and advanced technologies, we connect clients to global financial markets, providing seamless access to essential tools and solutions. Our strategy focuses on delivering scalable, innovative, and client-focused solutions, backed by investments in talent and technology to continually enhance our capabilities. These investments, though incurring upfront costs, are crucial for building long-term value and expanding our market reach. As our ecosystem grows, we expect to achieve operational leverage, improve margins, and strengthen our position as a leading financial services provider. By staying committed to focused execution, we ensure that every action we take is aligned with our core goals and delivers measurable impact. Our approach to innovation keeps us at the forefront of industry advancements, while client-centricity drives us to consistently meet and exceed the evolving needs of those we serve. Ecosystem optimization 2 3 StoneX is client-centric, focused on expanding our footprint into new markets and increasing market share with existing clients. We aim to serve new segments and channels, leveraging our capabilities to tap into a large, underpenetrated market, while enhancing our ecosystem to strengthen our value proposition for both new and existing clients. Over the past decade, we have significantly expanded our client footprint, aided by a favorable industry environment. We believe that our unique global financial ecosystem positions us to be the counterparty of choice, placing us in a strong position to capture market share. In 2024, we leveraged our extensive marketing assets, particularly in digital, to aggressively grow the StoneX brand and enhance market visibility. Central to our strategy is building a comprehensive financial ecosystem that meets the diverse needs of our clients, with cross-selling becoming deeply embedded in our culture and actively tracked. This approach has proven successful, as evidenced by the sustained high level of new account onboarding, culminating in an all-time quarterly record in Q3, which highlights our ability to continually attract and serve new clients. We continue to strengthen our global presence with strategic investments in key markets. In the EU, we’ve expanded our Frankfurt office post-Brexit, enabling us to better serve our existing clients while reaching new ones who may be underserved in the current environment. Alongside this, we’ve enhanced our regulatory standing in Germany with a full BaFin license and an upgraded EEX membership. In Asia, we’ve expanded our product capabilities in Singapore, adding expertise in fixed income, prime services and clearing, foreign exchange, and commodities, which positions us for deeper market penetration in the region. These efforts, along with the broadening of our licensing to support a wider range of payments and securities offerings, are gaining momentum in an underrepresented yet highly promising market. Market expansion

17 Overview Strategy Governance Financial StatementsAppendixt Finally, our business is underpinned by capital, and we need to support our growth with internally generated capital, accessing capital markets when appropriate, and approach acquisitions in a disciplined manner. We prioritize ROE and capital compounding as key metrics of success. Over the past decade, we have more than tripled our shareholders’ funds, acquired over 15 businesses, and expanded our client footprint, largely financed through retained earnings and the power of compounding. Achieving our ROE target remains a critical goal, and as we continue to digitize our platform and scale our operations, we expect improvements in both margins and ROE. Our strategy also involves selectively engaging with capital markets, ensuring any additional capital raised is appropriately priced. This was demonstrated by our successful refinancing of senior secured notes from the GAIN acquisition, where we upsized the deal from $350 million to $550 million and extended the duration of our capital stack at a significantly lower yield spread. This approach strengthens our financial position and supports long- term growth. Compounding capital 3 4StoneX is actively embracing digitization to drive growth, scalability, and efficiency across its operations. By leveraging technology, we are enhancing client engagement, expanding our addressable market, and improving margin expansion. Our trading platforms are increasingly digital, allowing us to aggregate trades, internalize spreads, and improve revenue capture, particularly in our self-directed/retail business. We have made significant strides in risk management through real- time data aggregation and monitoring, which strengthens our ability to manage risk across the organization. A major focus is to make it easier for clients to start doing business with us by streamlining onboarding and monitoring processes through a global technology solution that simplifies workflows, harmonizes data, and provides self-service options. This initiative is already underway and is expected to significantly enhance operational efficiency. Additionally, we’re focusing on using ‘best cost locations’ for support, allowing us to manage costs more effectively. To further enhance scalability, we’ve developed a centralized data lake to integrate client and transactional data, and introduced a global StoneX ID for seamless data matching. Looking ahead, we plan to centralize all market data into a hub, dramatically reducing data costs. These initiatives collectively position StoneX to achieve greater digital transformation, expanding our capabilities and improving margins as we scale globally. Digital transformation

StoneX | Annual Report 2024 1818 StoneX organizes its business around client needs, segmenting by client type to align with their product preferences and delivery methods. This ranges from high-touch, consultative services for commercial clients managing price risks and supply chains, to low-touch digital platforms for retail and self-directed clients trading a wide array of products. Our key business segments Visit our Segment Overview section to learn more Commercial overview | Page 30 Institutional overview | Page 34 Self-Directed/Retail overview | Page 38 Payments overview | Page 42 Our unique, expansive financial ecosystem and global footprint enable us to serve a diverse range of clients—from commercial entities to institutional investors, hedge funds, active traders, financial institutions, NGOs, charities and individual investors. Despite their varied profiles, all clients share the need for access to financial markets, whether for risk management, investment, or trading. This diversity strengthens our resilient business model and creates opportunities for growth through internalizing risk and driving operational efficiency. $871.9mm | Up 1% $1,962.1mm | Up 30% $395.0mm | Up 19% $209.6mm | Down 1% $387.7mm | Down 1% $266.0mm | Up 22% $119.3mm | Up 160% $112.6mm | Up 3% Operating revenue Segment income Commercial Institutional Self-Directed/Retail Payments

19 Overview Strategy Governance Financial StatementsAppendixt Commercial Our commercial segment reported operating revenues of $871.9 million, roughly in line with Fiscal Year 2023. Stronger results from listed derivatives, up 14% year-over-year, and interest income were offset by lower revenues from OTC derivatives and physical commodities. 2024 marked significant expansion in the commercial segment overall. In January, StoneX became Abaxx Exchange’s first clearing and trading member, providing clients access to physically deliverable futures contracts for LNG, nickel sulphate, and carbon. We also joined the Montreal Exchange (TMX), expanding our expertise in listed products including fixed income. Additionally, we continue to evaluate other potential trading venues to expand our capabilities and better serve our clients. In October, StoneX Metals Limited completed its acquisition of JBR’s precious metal recovery and refinery business, strengthening our market-leading metals offering by integrating a key part of the supply chain and addressing growing global demand for recycled silver. The newly established StoneX Specialty Coffee team brings decades of green coffee expertise and a powerful network spanning over 20 countries, further enhancing our commercial capabilities. Our electronic metals trading platform, PMX, has become a market-leading execution venue, achieving a record daily notional trading volume of over $3.6 billion. We are also very active on Bloomberg FXGO, where we were ranked #1 overall for all metals-related products. Our StoneHedge offering has achieved critical mass and is now the go-to solution for large grain elevators in the Midwest. This platform has doubled its volumes for the third straight year, now with over 620 locations and 900 traders. It is a prime example of using technology to add value to our large commercial clients and embed ourselves as a long-term partner in their business. We are now looking to expand this offering to include other commodity products and more jurisdictions. We have expanded our capabilities in physical commodities to provide comprehensive services, including risk management and logistics. Our acquisition of CDI, a physical cotton brokerage business based in Brazil and Switzerland, has almost doubled its gross revenues in its first year, validating the integration of hedging services with the sale of physical commodities and related logistics. We are now offering this bundled service to coffee producers in Brazil, with promising early results, and plan to expand this approach to other products and regions. During the year, we established an office in GIFT City in Gujarat, India, to facilitate trading of precious metals into the strategically important Indian market. We also became the first international trading and self-clearing entity on the local Indian International Bullion Exchange (IIBX), positioning ourselves for broader access to other products and capabilities across the subcontinent. 19

StoneX | Annual Report 2024 20 Institutional Our institutional segment delivered strong results in Fiscal Year 2024, with operating revenues rising 30% year-over-year to $1,962 million. This growth was driven by strong performance in equity market- making, derivatives, and interest income. In equities, we expanded our electronic market-making platform for domestic NMS equities, achieving a record 118 billion shares traded. Key drivers of our global growth include StoneX’s network of localized expertise and a comprehensive trading and execution platform, enabling us to expand into new markets while strengthening our presence in existing ones. Notably, StoneX Financial Pty Ltd became a direct clearing and trading member of the Australian Securities Exchange (ASX), granting clients access to the Australian derivatives market, while StoneX Financial (Canada) Inc. achieved Approved Participant status on the Montreal Exchange (TMX), expanding access to institutional-grade products globally. Our prime services offering, essential for hedge funds, has evolved into a global multi-asset execution and custody platform, supporting activity across all segments. In 2024, we expanded our reach in the UK with repo financing and securities lending, while continuing to invest in technology for trading, regulatory reporting, and back-office operations. The global prime business grew by more than 20%, fueled in part by growth in the ETF space, where we provide tailored custody and execution solutions. Our outsourced services business, which has become a core part of our prime offerings, continues to grow and has received industry recognition, including awards for Best Outsourced Solution from Hedge Fund Magazine and HedgeWeek. Additionally, we expanded into credit and sell-side outsourced trading, introducing two new approaches to the industry. To strengthen our presence in the emerging regulated crypto market, we made key hires for StoneX Digital in the U.S. and established the infrastructure to become a digital asset custodian in Ireland, where we have received regulatory approval. Similarly, we continue to make progress in the growing carbon trading market, with an expanding client base and revenue stream. Our fixed income offering continues to expand, broadening both our credit capabilities and global reach. As part of this growth, we recently announced our intention to acquire Octo Finances, a leading fixed-income trading firm based in Paris, pending regulatory approval. This acquisition will enhance our offerings in bonds, convertible securities, and credit research while providing greater access to the EU institutional market. Additionally, we are leveraging technological advancements to deliver resilient, low-latency solutions that address the evolving needs of institutional clients and developing innovative platforms like LoanMatch, designed to bring greater transparency and liquidity to the loan market.

21 Overview Strategy Governance Financial StatementsAppendixt Self-Directed/Retail Our self-directed segment delivered exceptional results in 2024, with operating revenues increasing 19% to $395.0 million and segment income rising by 160%, reflecting the operational leverage in our self-directed platforms. Even with challenging market conditions, lower trading volumes were offset by record-breaking new client acquisition, improved revenue capture, better internalization of spreads, and product diversification, resulting in operating revenue rising 19%, further emphasizing the strength of this segment. We evolved our retail segment to “self-directed” with the goal of integrating the full suite of StoneX products and services into our retail digital platform. This initiative, powered by our digital marketing team, will expand our addressable market for StoneX products globally. The self-directed platform enables us to offer a curated set of products to clients, allowing for efficient digital marketing, onboarding, servicing, and trade execution. We’ve made meaningful progress on this multi-year project, already delivering impactful results. Our flagship FOREX.com platform reinforced its position as the number one forex broker in the U.S. through an innovative partnership with Kalshi, a CFTC-regulated exchange. This collaboration allows trading on the outcome of future events, further enhancing our technology-driven solutions for self- directed clients. On the agricultural side, StoneX Plus has gained momentum, reaching over 300 active clients, including many large enough for high-touch relationships. With a proven, scalable product, we can now digitally market to hundreds of thousands of farmers globally, providing risk management advice and hedging capabilities without the constraints of traditional high-touch models. 21

StoneX | Annual Report 2024 22 1 22 Payments The payments business remained relatively flat in 2024, with operating revenues of $209.6 million reflecting the impact of tighter FX spreads in key payment corridors. Despite challenging market conditions, we made a significant investment to enhance our infrastructure in order to better serve an expanding network of banks and financial institutions. We are finalizing the rework of our global payments system architecture, with most clients migrated to our new cloud-based system, delivering significantly higher STP rates on payments. Our internally built XPay system enables payments-at-scale and eliminates costly vendor-based solutions, improving efficiency, scalability, and the ability to meet diverse client needs globally. These upgrades provide secure, reliable, and real-time payment capabilities, strengthening our position as a trusted partner in the global payments ecosystem. Additionally, StoneX was one of the first financial organizations to enable Swift’s new pre-validation service for cross-border payments, enhancing transaction speed and improving straight-through- processing for a more seamless client experience.

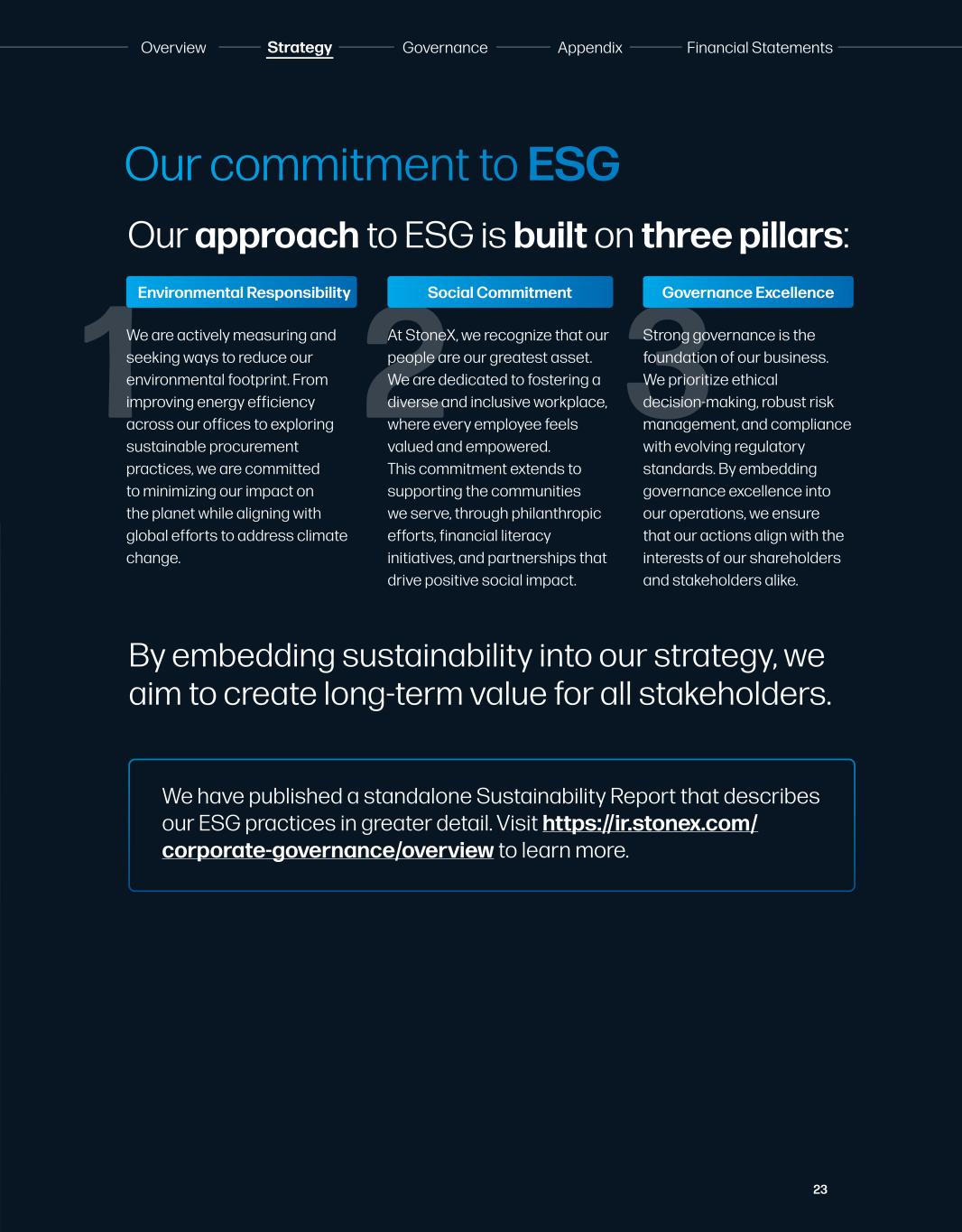

23 Overview Strategy Governance Financial StatementsAppendix 1 2 3 Our commitment to ESG We are actively measuring and seeking ways to reduce our environmental footprint. From improving energy efficiency across our offices to exploring sustainable procurement practices, we are committed to minimizing our impact on the planet while aligning with global efforts to address climate change. At StoneX, we recognize that our people are our greatest asset. We are dedicated to fostering a diverse and inclusive workplace, where every employee feels valued and empowered. This commitment extends to supporting the communities we serve, through philanthropic efforts, financial literacy initiatives, and partnerships that drive positive social impact. Strong governance is the foundation of our business. We prioritize ethical decision-making, robust risk management, and compliance with evolving regulatory standards. By embedding governance excellence into our operations, we ensure that our actions align with the interests of our shareholders and stakeholders alike. Environmental Responsibility Social Commitment Governance Excellence Our approach to ESG is built on three pillars: By embedding sustainability into our strategy, we aim to create long-term value for all stakeholders. We have published a standalone Sustainability Report that describes our ESG practices in greater detail. Visit https://ir.stonex.com/ corporate-governance/overview to learn more. t

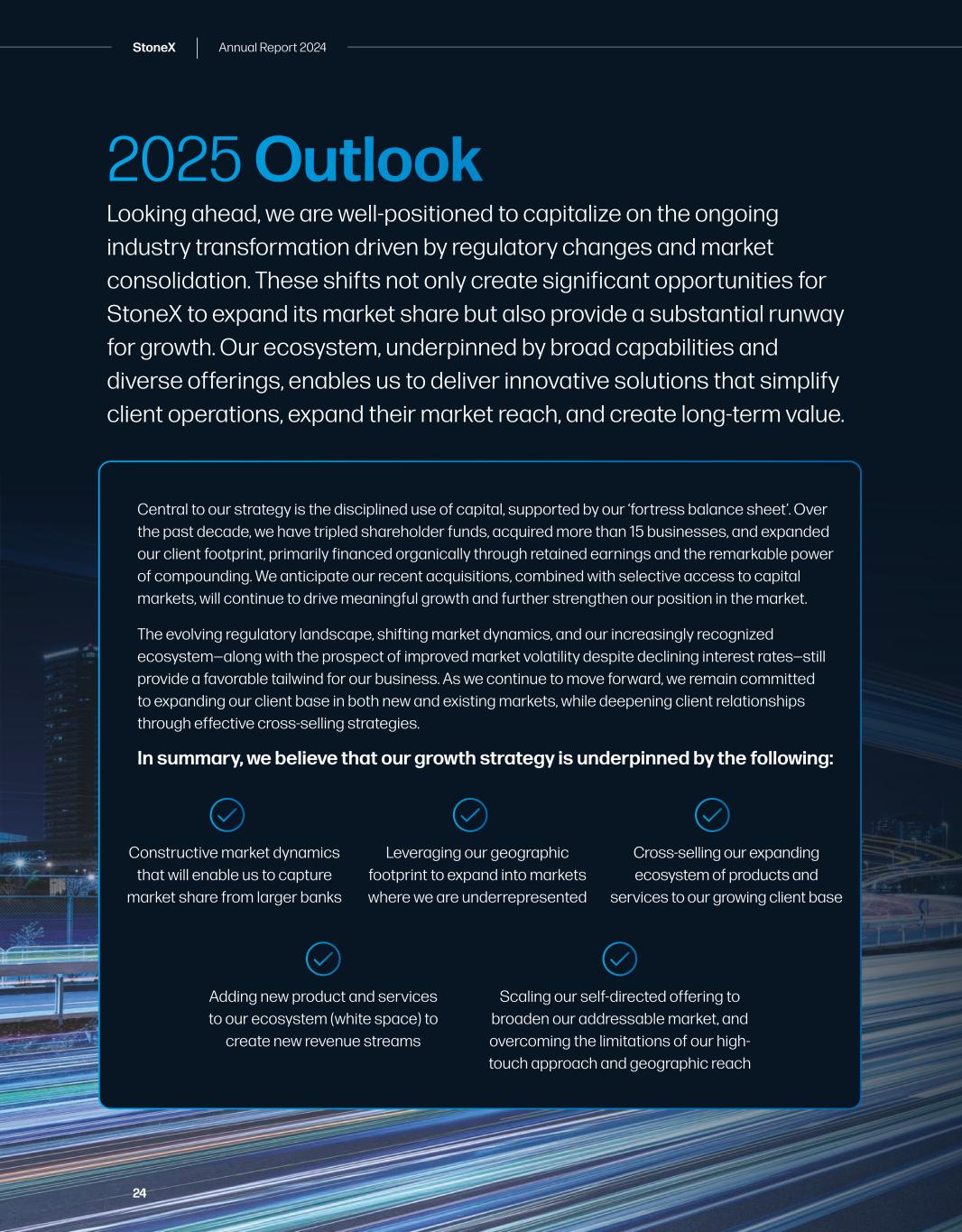

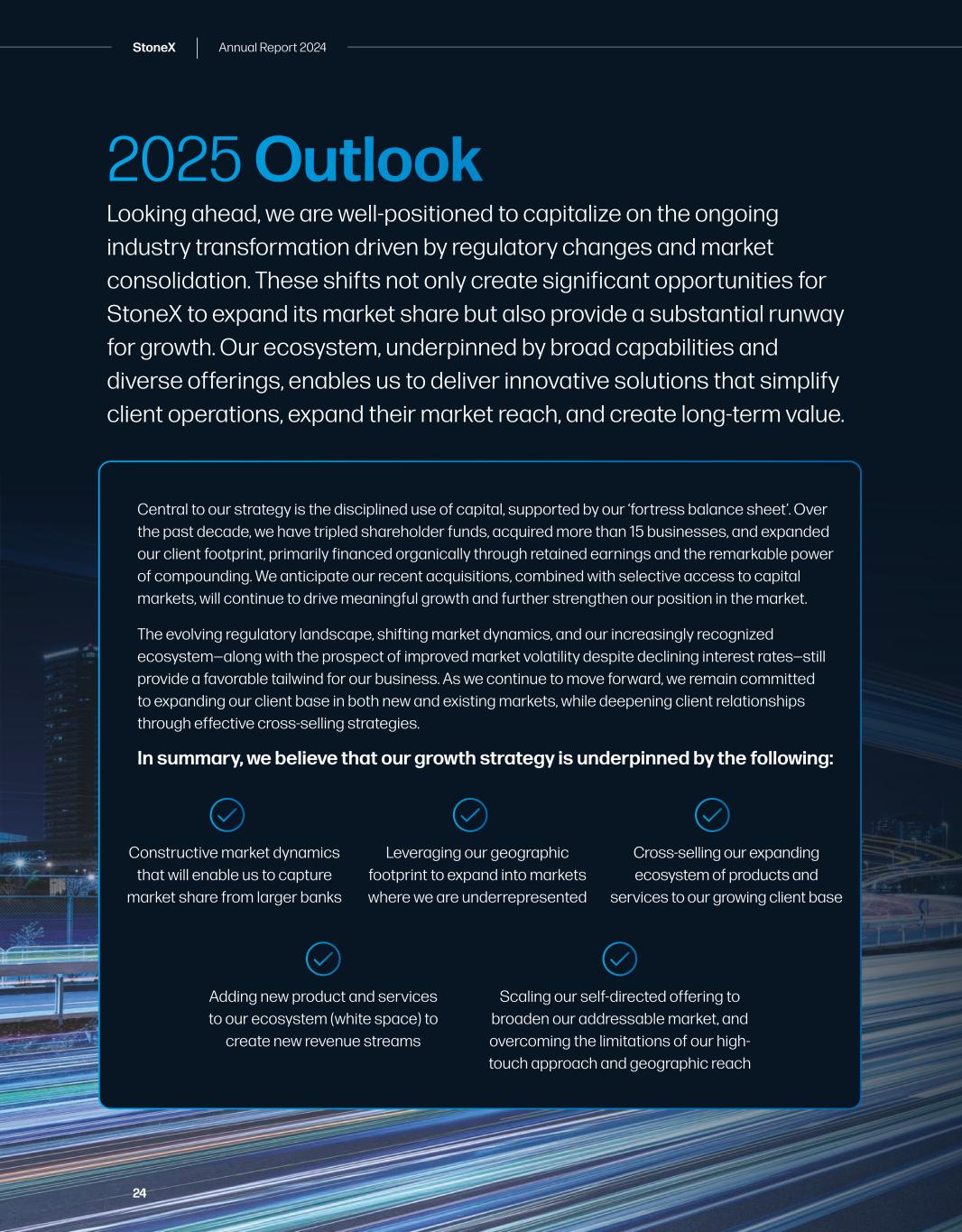

StoneX | Annual Report 2024 2424 2025 Outlook Looking ahead, we are well-positioned to capitalize on the ongoing industry transformation driven by regulatory changes and market consolidation. These shifts not only create significant opportunities for StoneX to expand its market share but also provide a substantial runway for growth. Our ecosystem, underpinned by broad capabilities and diverse offerings, enables us to deliver innovative solutions that simplify client operations, expand their market reach, and create long-term value. Central to our strategy is the disciplined use of capital, supported by our ‘fortress balance sheet’. Over the past decade, we have tripled shareholder funds, acquired more than 15 businesses, and expanded our client footprint, primarily financed organically through retained earnings and the remarkable power of compounding. We anticipate our recent acquisitions, combined with selective access to capital markets, will continue to drive meaningful growth and further strengthen our position in the market. The evolving regulatory landscape, shifting market dynamics, and our increasingly recognized ecosystem—along with the prospect of improved market volatility despite declining interest rates—still provide a favorable tailwind for our business. As we continue to move forward, we remain committed to expanding our client base in both new and existing markets, while deepening client relationships through effective cross-selling strategies. In summary, we believe that our growth strategy is underpinned by the following: Constructive market dynamics that will enable us to capture market share from larger banks Leveraging our geographic footprint to expand into markets where we are underrepresented Adding new product and services to our ecosystem (white space) to create new revenue streams Cross-selling our expanding ecosystem of products and services to our growing client base Scaling our self-directed offering to broaden our addressable market, and overcoming the limitations of our high- touch approach and geographic reach

25 Overview Strategy Governance Financial StatementsAppendixt Over the past decade, we have tripled shareholder funds, acquired more than 15 businesses, and significantly expanded our client footprint. Thank you for being part of the StoneX journey. It has been 22 years since I founded StoneX and became CEO. From humble beginnings—just 10 people and less than $10 million in equity—we have grown into a thriving financial franchise with over 4,500 employees and over $3 billion in revenue and market value. This remarkable achievement is a testament to the incredible team at StoneX, whose hard work has made this journey possible and provided me with an experience beyond my wildest dreams. Leading this company has been an enormous privilege, and one for which I am deeply grateful. However, it has become time to transition of management to the next generation of exceptionally capable leaders. As such, I am thrilled that Philip Smith and Charles Lyon have taken on the day-to-day leadership of StoneX as CEO andPresident, respectively. I have transitioned to the role of Executive Vice Chairman, remaining a full-time employee and member of the executive committee with a focus on longer-term strategy, capital allocation and M&A activity, Philip, Charles, andI have worked together for over 20 years, and I have complete confidence in their ability to build on our track record of success. On behalf of the executive team, I want to thank our clients, employees, and shareholders for their unwavering support. As we mark the 100th anniversary of Saul Stone & Company, we honor the entrepreneurial spirit that laid the foundation for the company we are today. With a strong legacy and a clear vision for the future, StoneX is ready to seize emerging opportunities as a leading global financial franchise. Closing remarks Sean O’Connor Chief Executive Officer

Exchanges OTC markets The StoneX global ecosystem Clients we serve Client strategy The StoneX diversified client strategy is central to our growth, enabling us to serve a global client base across segments, services, and products. We maintain a targeted approach by focusing on the underserved middle market, often overlooked by larger banks. This allows us to deliver full-service financial solutions tailored to their needs, building durable relationships and opening opportunities for cross-selling into complementary products. Financial marketplace • Agricultural producers • Energy and resource extractors • Manufacturers and processors • Merchants and market intermediaries • Global traders and distributors • Industrial consumers • Asset managers • Mutual funds • ETFs • Hedge funds • Banks and depositories • Pension funds • Corporates • Insurance companies • Sovereigns • Government agencies • Municipalities • Specialized investment firms • Educational institutions • IDOs and NGOs • HNW families and individuals • Individual investors • Private wealth and advisory clients Commercial Institutional Self-Directed/Retail Payments 26 StoneX | Annual Report 2024

27 Overview Strategy Governance Financial StatementsAppendixt ECNsATNs Vertically integrated ecosystem Our core services StoneX provides critical expertise and service in virtually every part of the financial services ecosystem. Providing multi-asset execution, hedging, clearing and settlement, custody, and financing. By integrating every critical financial service within a single platform—from custody and trading to advisory—StoneX enables seamless access and efficient execution across asset classes. Global market access via digital platforms Risk management and hedging Strategic advisory and capital services Global execution, clearing and custody Liquidity provider and market-maker

StoneX | Annual Report 2024 28 Commercial segment The StoneX commercial segment serves commodity clients worldwide, spanning the entire supply chain from pre-production planning and risk management to final consumption with a view to better manage margins and profitability. Our division primarily focuses on providing comprehensive trading, hedging, and risk management solutions tailored to the unique needs of clients in agriculture, energy, and metals markets. We work with a diverse range of customers, from producers and processors to industrial consumers, helping them navigate and manage commodity price volatility, currency fluctuations, logistics and other market risks. Primary services and markets Market Intelligence By aggregating and analyzing data from both internal and external sources, we provide actionable market insights and decision-making tools. What sets us apart is our unmatched network of client relationships and a global team of over 350 commodity professionals, which enables us to offer unparalleled breadth and depth. Revenue is generated through subscription or consulting agreements. Financial market and FX data Supply chain and logistics data Fundamental analysis Technical analysis Production data Inventory data Listed and OTC derivatives Derivatives market-making FX hedging products Interest rate hedging Tailored OTC swaps Physical commodities Embedded price protection in physicals contracts Trade Advisory & Execution Our team of commodity professionals, with deep market expertise and access to exchange-traded and OTC derivatives, helps companies analyze risks and determine the most effective hedging strategies to manage margins. Revenue is generated through consulting agreements, trade commissions and spreads on OTC products. Producers Merchandisers & Processors Consumers Energy Metals Agriculture Supply Chain Management StoneX acts as a principal to manage supply chains on behalf of our clients. We purchase, transport, store, and sell commodities, providing commodity marketing, procurement, pricing services, and logistics across all modes of transportation and storage. Revenue is generated through buy/sell spreads after costs. Transportation & logistics Inventory management Trade administration & pricing

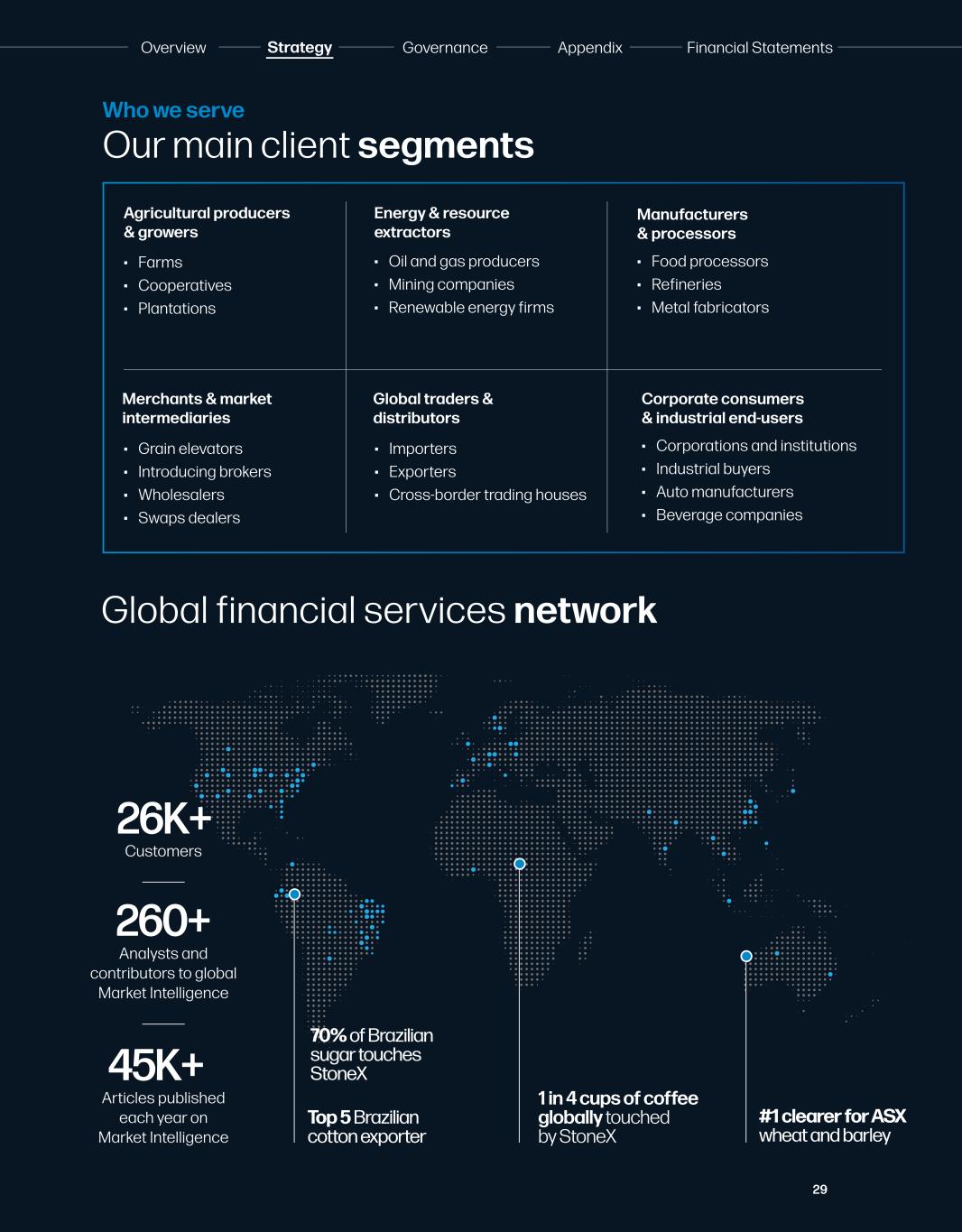

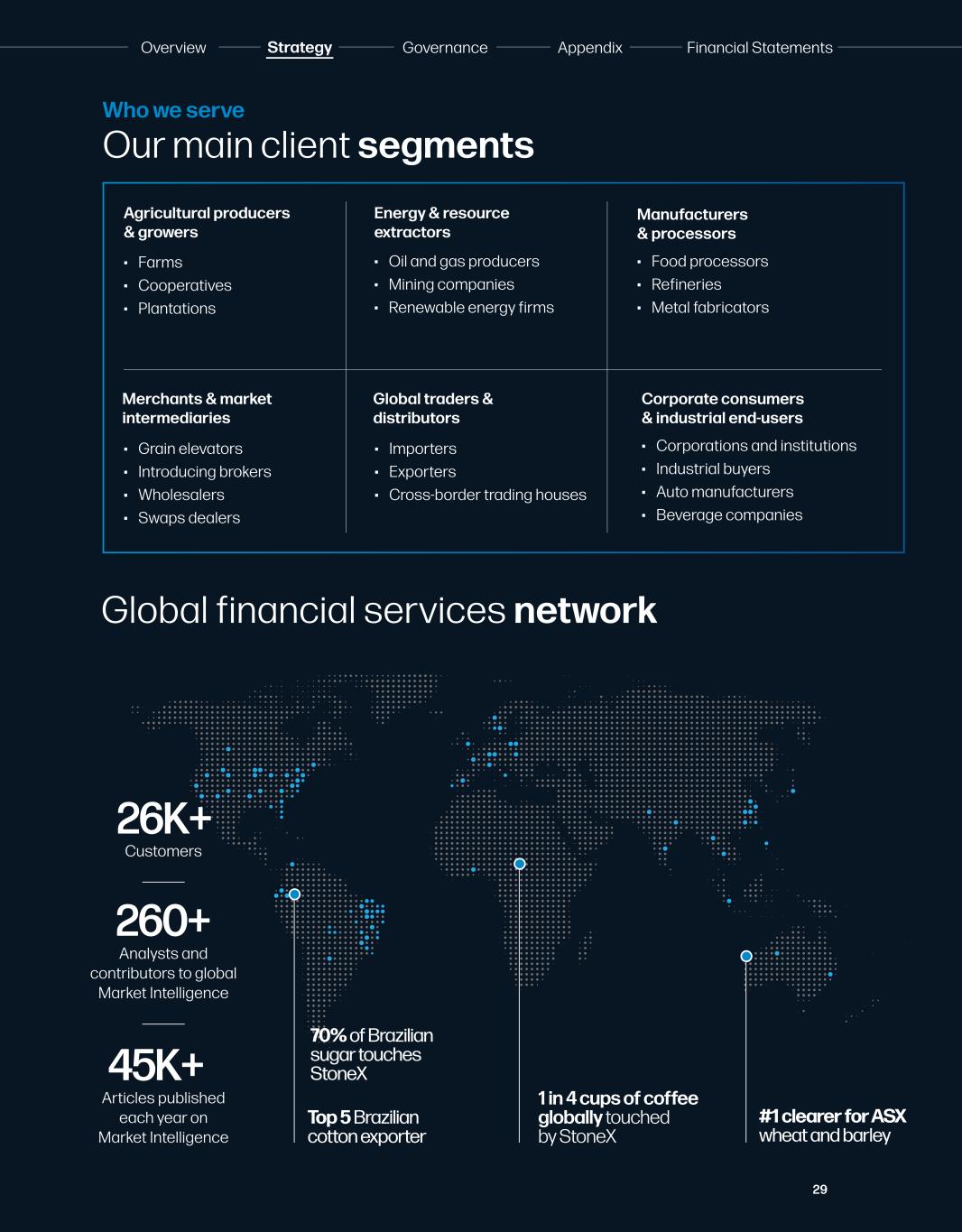

29 Overview Strategy Governance Financial StatementsAppendixt Our main client segments Who we serve Agricultural producers & growers • Farms • Cooperatives • Plantations Merchants & market intermediaries • Grain elevators • Introducing brokers • Wholesalers • Swaps dealers Global traders & distributors • Importers • Exporters • Cross-border trading houses Manufacturers & processors • Food processors • Refineries • Metal fabricators Corporate consumers & industrial end-users • Corporations and institutions • Industrial buyers • Auto manufacturers • Beverage companies Energy & resource extractors • Oil and gas producers • Mining companies • Renewable energy firms 1 in 4 cups of coffee globally touched by StoneX #1 clearer for ASX wheat and barley Top 5 Brazilian cotton exporter 45K+ Articles published each year on Market Intelligence 260+ Analysts and contributors to global Market Intelligence 26K+ Customers Global financial services network 70% of Brazilian sugar touches StoneX

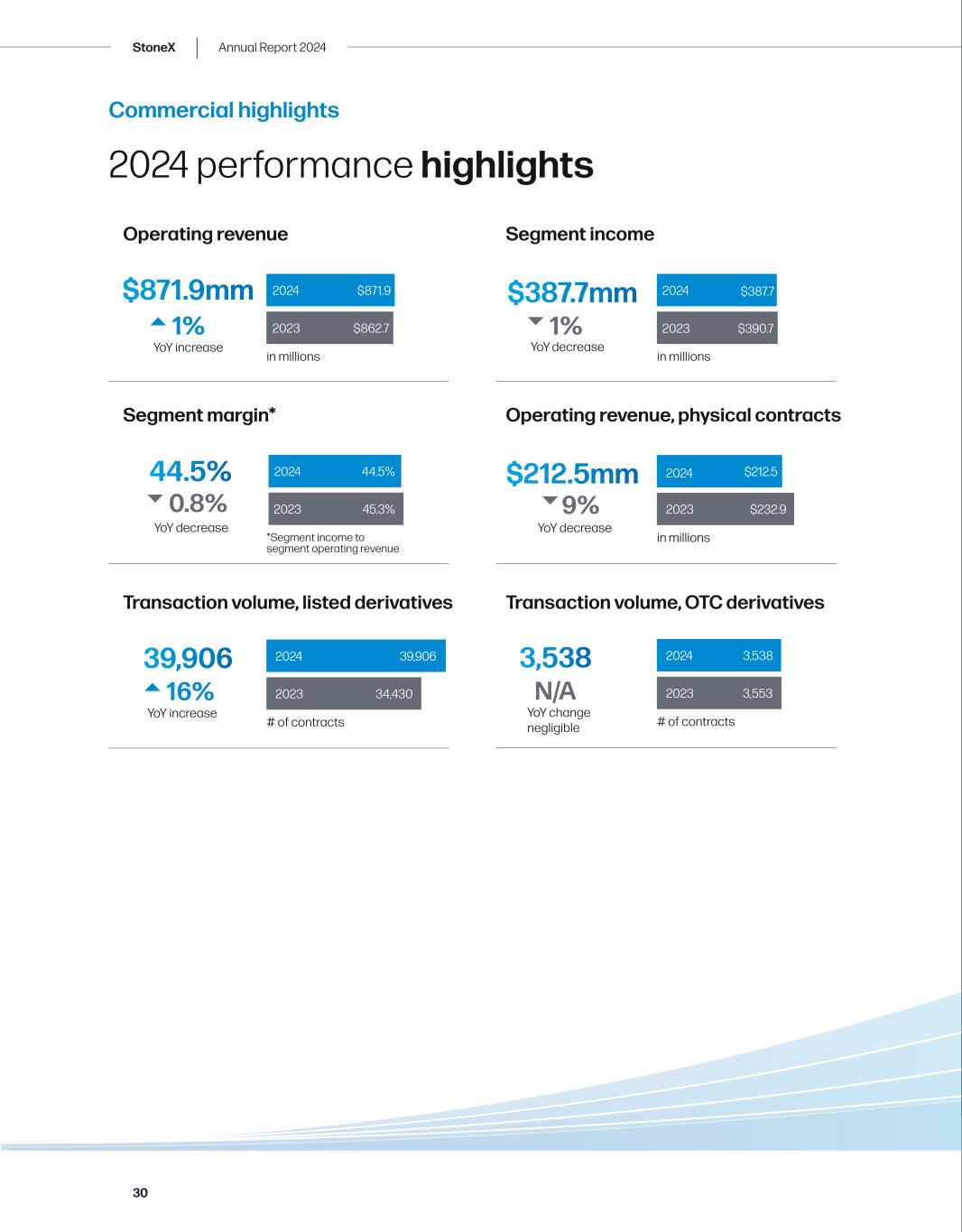

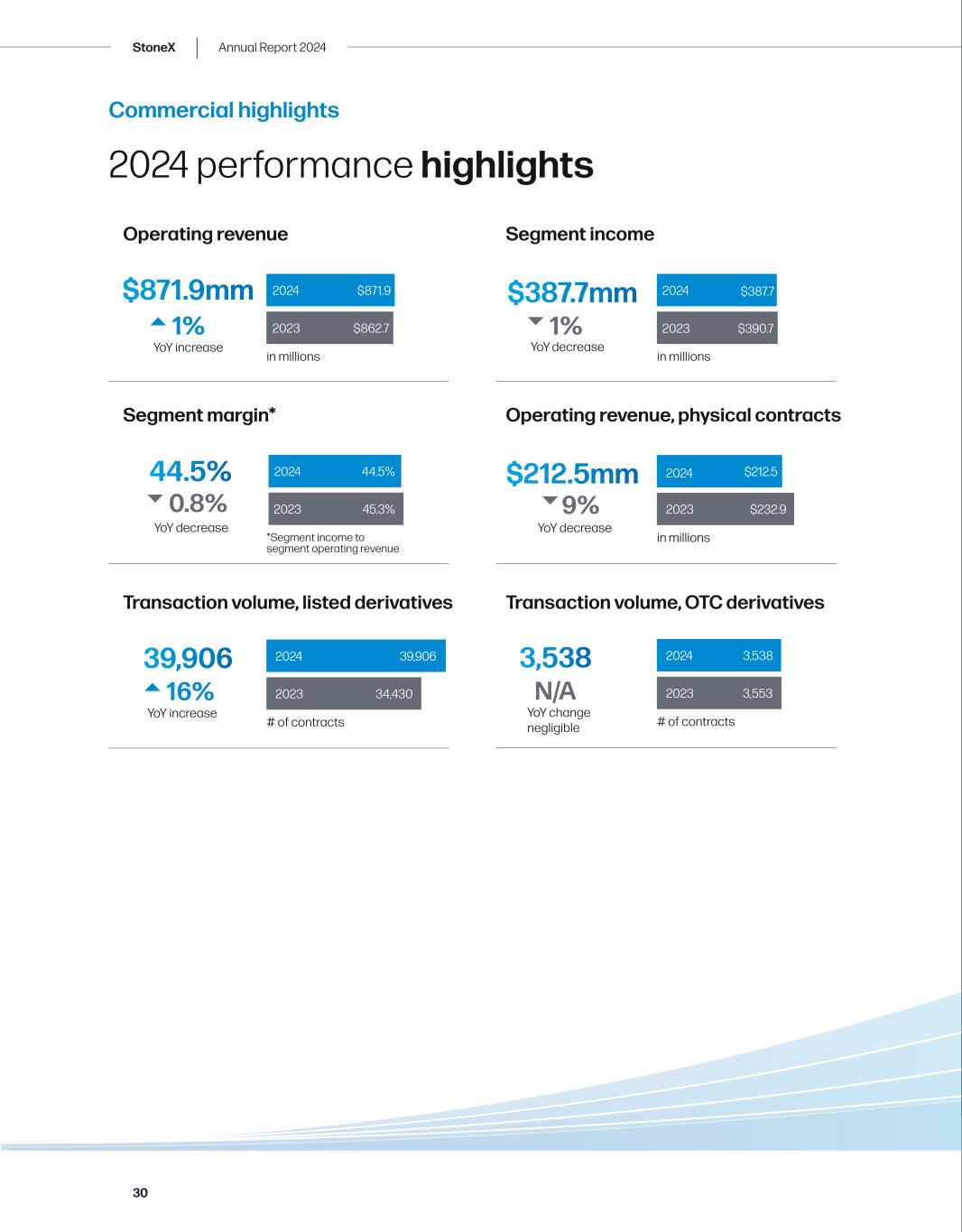

30 Commercial highlights 2024 performance highlights $871.9mm YoY increase 1% Operating revenue in millions 2024 2023 $862.7 $871.9 in millions 2024 2023 $390.7 $387.7$387.7mm YoY decrease 1% Segment income in millions 2024 2023 $212.5 $232.9 Operating revenue, physical contracts # of contracts 2024 2023 3,538 3,553 3,538 YoY change negligible N/A Transaction volume, OTC derivatives # of contracts 2024 2023 39,906 34,430 39,906 YoY increase 16% Transaction volume, listed derivatives $212.5mm YoY decrease 9% *Segment income to segment operating revenue 2024 2023 45.3% 44.5% 0.8% 44.5% YoY decrease Segment margin* StoneX | Annual Report 2024

Overview Strategy Governance Financial StatementsAppendixt StoneX’s commercial segment sits amid rapidly changing markets—characterized by price volatility, complex supply chains, rising ESG standards, and a shift to digital—fostering unprecedented demand for complete risk management and advisory services. This environment lets StoneX leverage its global reach, technology, and expertise to attract more clients, deepen relationships, and become the trusted partner for navigating complexity and driving future growth. Commercial roadmap Market opportunity 2019 2024 Future $871.9mm Operating revenue $404.4mm Operating revenue Commercial market drivers: Continued revenue growth driven by greater client adoption of comprehensive, data-driven risk management solutions and deepened client relationships through combined hedging services and advanced technology solutions. Accelerating growth as international markets become more sophisticated and adopt proven risk management practices from developed markets. Meeting the growing need for high-touch services with experienced professionals, a demand not well served by larger banks. Expanding our TAM by leveraging self-directed technology to reach smaller, more remote clients and overcome high- touch limitations. Global leader in risk management solutions for commercial entities 29.8mm Transaction volume(1) (1) Volume is defined as listed and OTC derivatives contracts traded. 43.4mm Transaction volume(1) Continued growth in transaction volumes

StoneX | Annual Report 2024 32 Institutional segment For our institutional clients, StoneX provides comprehensive services across every stage of the trade lifecycle, ensuring seamless support from start to finish. Our expertise spans from in-depth pre-market research and market color, helping clients make informed decisions, through execution with precision and efficiency, to post-trade services including settlement and clearing. At every step, we deliver tailored solutions to meet the unique needs of our clients, ensuring transparency, accuracy, and reliability throughout the entire process. How we work We are dedicated to empowering institutional clients with a complete suite of trading, clearing, financing solutions and prime services tailored to their diverse needs. Transactions in over 140 currencies Execution in over 185 countries Access to 40+ derivatives exchanges Trading capabilities Securities lending Repo and collateral financing Portfolio swaps Margin financing Customized financing Trading 100+ fixed income products across 30 desks Market maker in 16k+ securities Global execution CASS-compliant custody Self-clearing U.S. custody Systems are fully integrated across execution, financing, and settlement Global clearing & custody

33 Overview Strategy Governance Financial StatementsAppendixt Our main client segments Sovereign and public entities • Sovereign wealth funds • Central banks • Government agencies • Municipalities Corporates and commodity firms • Multinational corporations • Publicly listed companies • Privately held corporations • Agricultural producers • Commodity trading houses Specialized investment firms • Private equity firms • Private credit firms • Venture capital firms • Distressed asset funds Insurance companies • Life insurance • Property & casualty • Reinsurance firms Banks and financial institutions • Commercial banks • Investment banks • Regional and local banks • Broker/dealers • FCMs Asset managers • Mutual funds • ETFs • Hedge funds • Pension funds #1 market maker in ADRs and foreign securities traded OTC Approx. $2 trillion in transactional volumes globally for fixed income securities Nearly 10K+ institutional customers worldwide 120+ Global exchanges $31B+ Assets custodied 3,800+ F&O products Our global financial services network Who we serve

34 Institutional highlights 2024 performance highlights $1,962.1mm YoY increase 30% 22% Operating revenue in millions 2024 2023 $1,513.6 $1,962.1 in millions 2024 2023 $217.9 $266.0$266.0mm YoY increase Segment income in millions 2024 2023 $4,321 $3,827 $3,827mm YoY decrease Transaction volume, FX contracts (ADV) in millions 2024 2023 $7,156 $5,257 $7,156mm YoY increase 36% Transaction volume, securities (ADV) # of contracts in millions 2024 2023 175 125.9 175mm YoY increase 39% Transaction volume, listed derivatives 11%0.9% *Segment income to segment operating revenue 2024 2023 14.4% 13.5%13.5% YoY decrease Segment margin* StoneX | Annual Report 2024

Overview Strategy Governance Financial StatementsAppendixt StoneX presents significant growth potential in the institutional client services market. Leveraging its robust global infrastructure and deep local market expertise, StoneX delivers seamless execution tailored to client needs. As regulatory demands intensify and risk management becomes increasingly critical, StoneX’s unwavering focus on compliance, customized solutions, and cutting-edge market intelligence solidifies its position as a trusted partner for navigating the complexities of global markets. Institutional roadmap Market opportunity 2019 2024 Future $1,962.1mm Operating revenue $515.0mm Operating revenue Leading provider of multi-asset trade, financing, clearing and custody services to institutions globally. $2,801mm Transaction volume (ADV)(1) $10,983mm Continued growth in transaction volumes Institutional market drivers: Rapid growth projected in the mid-tier financial institution segment driven by greater flexibility and specialization, and capturing market share in underserved areas such as emerging markets and SME lending. Revenue growth driven by the addition of innovative products like crypto, strategic geographic expansion, and the ability to leverage our expansive footprint. This expanded ecosystem enhances our capacity to cross- sell products and services, delivering greater value to clients and fostering long-term relationships with them. Better internalization of spreads will continue to strengthen margins and bottom line. (1) Volume is defined as value of securities and FX contracts traded. Does not include listed derivatives. Transaction volume (ADV)(1)

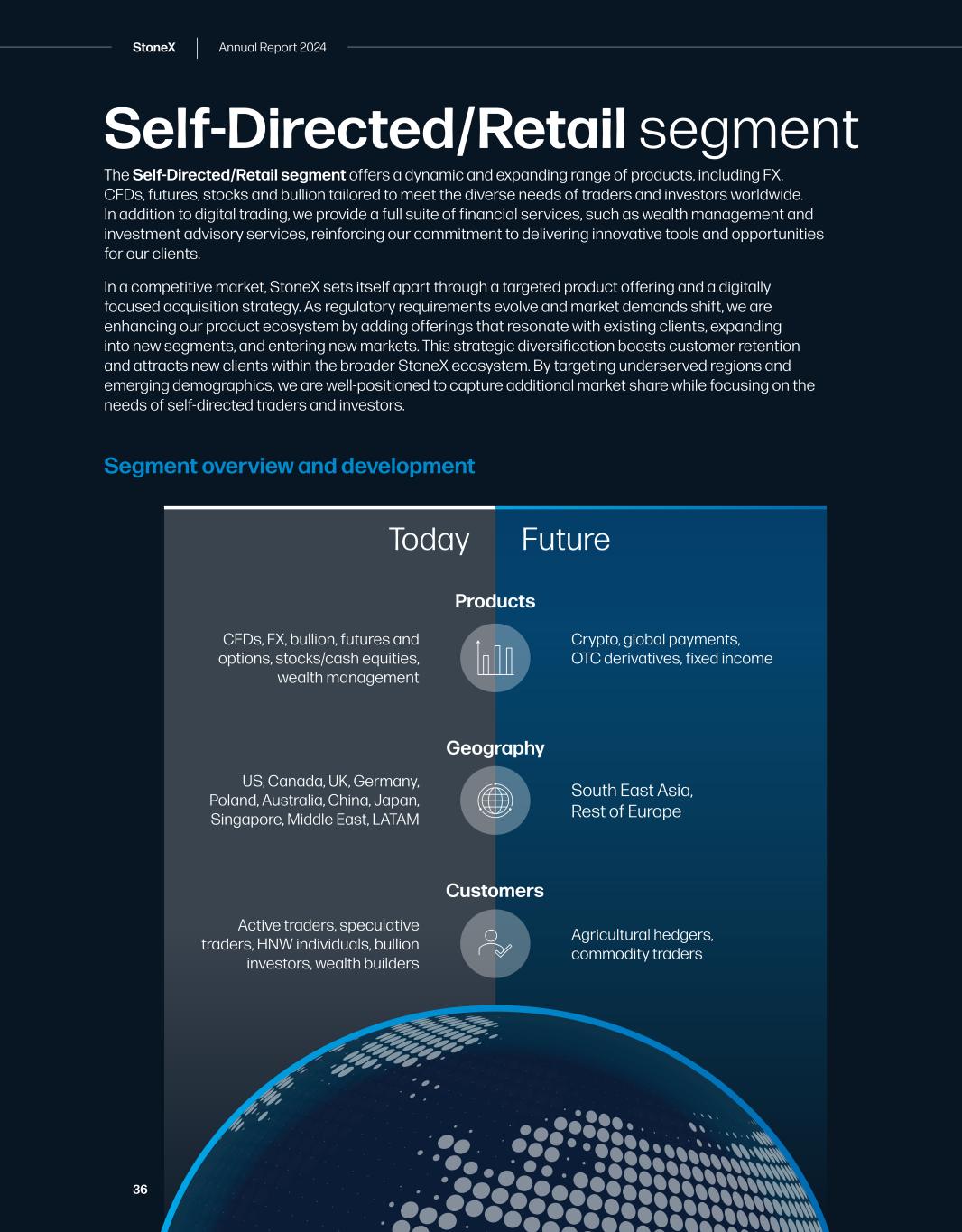

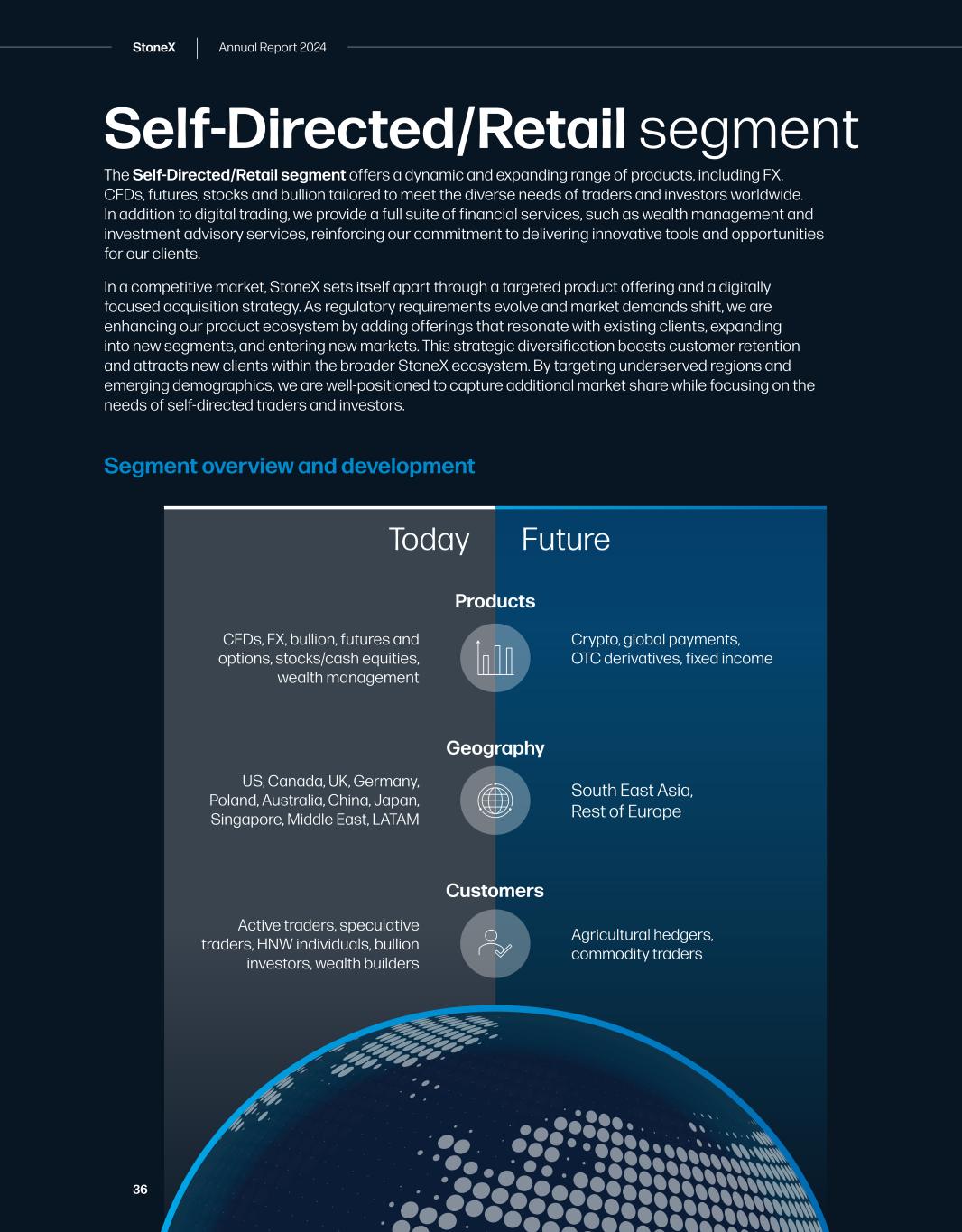

StoneX | Annual Report 2024 36 Self-Directed/Retail segment The Self-Directed/Retail segment offers a dynamic and expanding range of products, including FX, CFDs, futures, stocks and bullion tailored to meet the diverse needs of traders and investors worldwide. In addition to digital trading, we provide a full suite of financial services, such as wealth management and investment advisory services, reinforcing our commitment to delivering innovative tools and opportunities for our clients. In a competitive market, StoneX sets itself apart through a targeted product offering and a digitally focused acquisition strategy. As regulatory requirements evolve and market demands shift, we are enhancing our product ecosystem by adding offerings that resonate with existing clients, expanding into new segments, and entering new markets. This strategic diversification boosts customer retention and attracts new clients within the broader StoneX ecosystem. By targeting underserved regions and emerging demographics, we are well-positioned to capture additional market share while focusing on the needs of self-directed traders and investors. Today Future Geography US, Canada, UK, Germany, Poland, Australia, China, Japan, Singapore, Middle East, LATAM South East Asia, Rest of Europe Customers Active traders, speculative traders, HNW individuals, bullion investors, wealth builders Agricultural hedgers, commodity traders Products CFDs, FX, bullion, futures and options, stocks/cash equities, wealth management Crypto, global payments, OTC derivatives, fixed income Segment overview and development

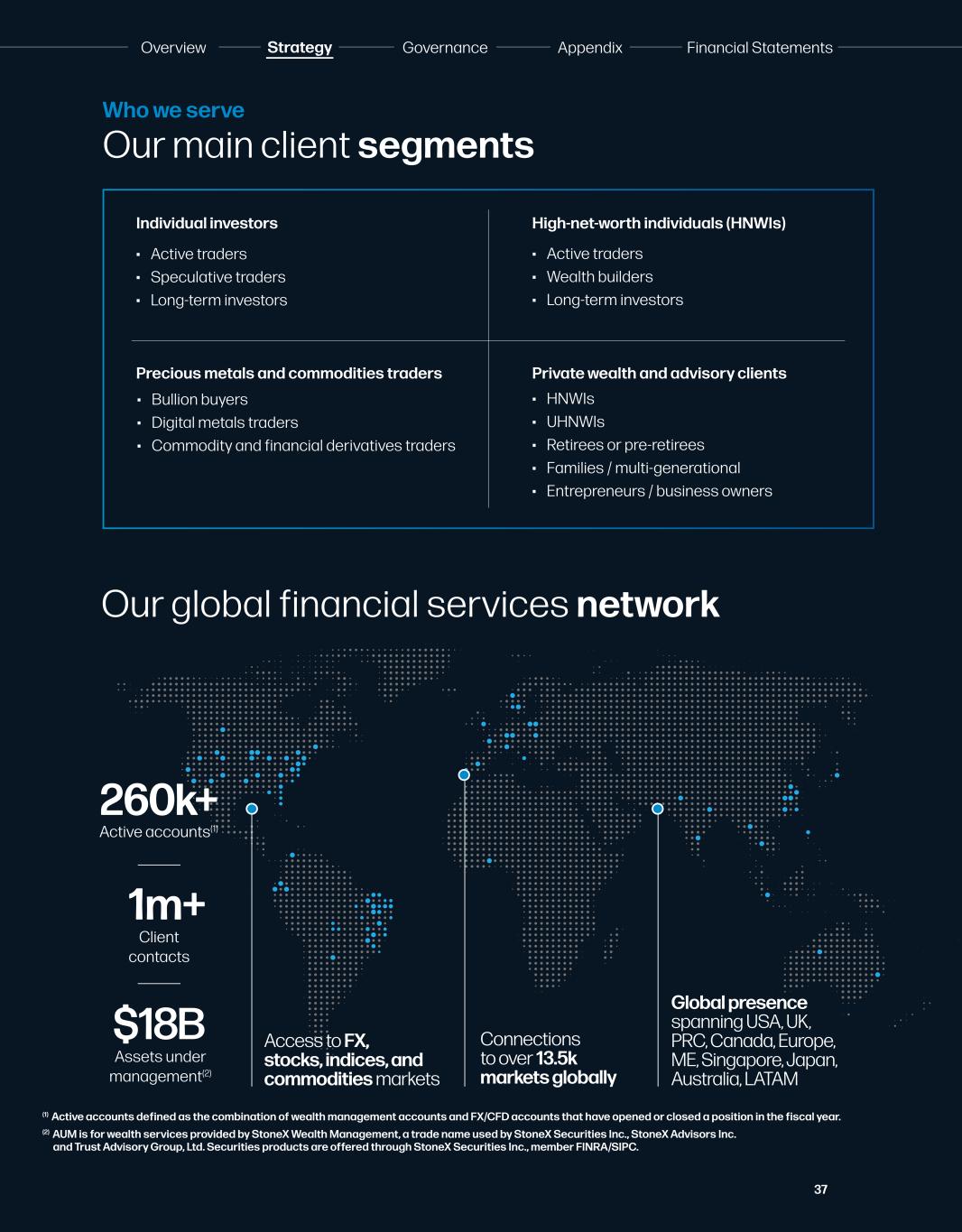

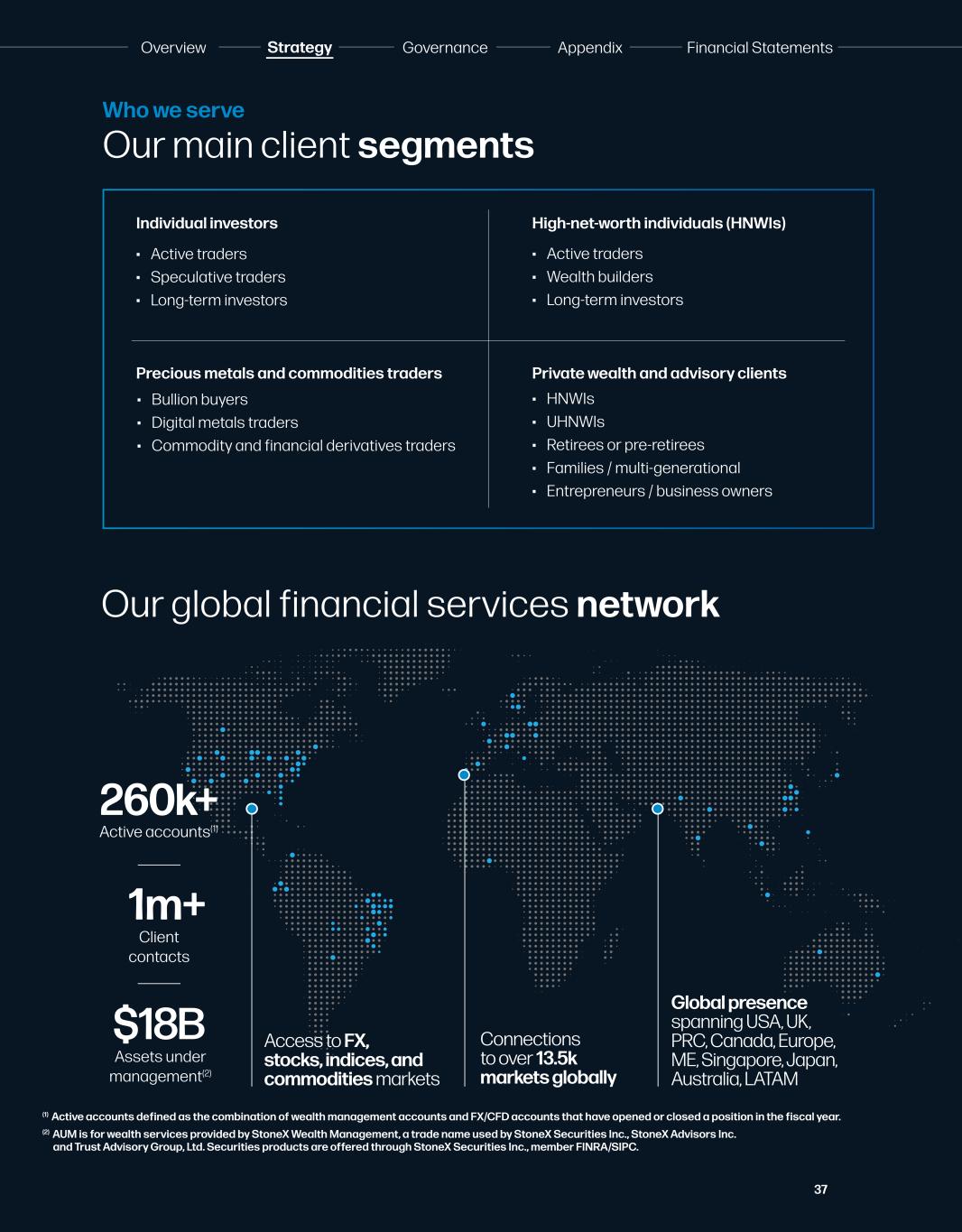

37 Overview Strategy Governance Financial StatementsAppendixt Our main client segments Who we serve Precious metals and commodities traders • Bullion buyers • Digital metals traders • Commodity and financial derivatives traders Private wealth and advisory clients • HNWIs • UHNWIs • Retirees or pre-retirees • Families / multi-generational • Entrepreneurs / business owners High-net-worth individuals (HNWIs) • Active traders • Wealth builders • Long-term investors Individual investors • Active traders • Speculative traders • Long-term investors Global presence spanning USA, UK, PRC, Canada, Europe, ME, Singapore, Japan, Australia, LATAM Access to FX, stocks, indices, and commodities markets Connections to over 13.5k markets globally 1m+ Client contacts $18B Assets under management(2) 260k+ Active accounts(1) (1) Active accounts defined as the combination of wealth management accounts and FX/CFD accounts that have opened or closed a position in the fiscal year. (2) AUM is for wealth services provided by StoneX Wealth Management, a trade name used by StoneX Securities Inc., StoneX Advisors Inc. and Trust Advisory Group, Ltd. Securities products are offered through StoneX Securities Inc., member FINRA/SIPC. Our global financial services network

38 Self-Directed/Retail roadmap Market opportunity Self-Directed/Retail highlights 2024 performance highlights $ 286.1mm YoY increase 26% $ 395.0mm YoY increase 19% Net operating revenueOperating revenue in millions 2024 2023 $227.3 $286.1 in millions 2024 2023 $333.0 $395.0 Segment income in thousands 2024 2023 190 130.1 New FX/CFD approved clients 141,000 YoY increase 20% Actively traded FX/CFD accounts 190,000 YoY increase 46% in thousands 2024 2023 141 117.5 StoneX Self-Directed/Retail serves thousands of active traders and investors globally through its proprietary digital platforms and acquisition strategy. In an ever- evolving self-directed market, StoneX Self-Directed/Retail is ideally positioned to grow market share in a multi-billion-dollar addressable market, as we leverage our global capabilities and expand our product offering and reach. in millions 2024 2023 $45.8 $119.3$119.3mm YoY increase 160% *Segment income to segment operating revenue 2024 2023 13.8% 30.2%30.2% YoY increase Segment margin* 16.4% StoneX | Annual Report 2024

Overview Strategy Governance Financial StatementsAppendixt 2019 2024 Future $0 FX/CFD transaction volume (ADV)(1) $6,986mm FX/CFD transaction volume (ADV) Continued growth in transaction volumes (1) Volume is defined as the value of FX/CFD contracts traded and does not include securities transactions. 2019 reflects volumes prior to the acquisition of Gain Capital Holdings, Inc. Self-Directed/Retail market drivers Tech-first strategy for global acquisition: Leverage automated targeting and messaging for cost- effective growth and ROI, supported by strategic marketing partnerships for user acquisition across diverse markets. Enhancing experience and optimize conversion: Use advanced KYC/AML/funding technology for fast, scalable onboarding of applicants of any size and in any geography via mobile devices. In FY 2024, StoneX onboarded 155,000+ instantly approved new applicants, processed in an average of 12 seconds. Expanding geographic footprint and protecting market share: Focus on leadership in core markets while using Tier 1 regulatory licenses to enter emerging markets with turnkey solutions. Product expansion and cross-selling: Offer a single entry point for electronic access to 13k+ OTC/FX products, listed products/equities, fixed income, crypto plus other StoneX offerings like payments. Secure, scalable ecosystem: As our range of products expands, our ecosystem remains secure and scalable, driving future growth. This expansion strengthens StoneX’s internalization engine, increasing revenue capture and boosting segment income. Leading platform provider of innovative multi-asset solutions and global access

StoneX | Annual Report 2024 40 Payments segment With over 30 years of experience, StoneX Payments provides unique FX settlement and international payment capabilities across 180 countries and more than 140 currencies. We manage the world’s largest proprietary correspondent banking network and are proud to be a trusted partner to many of the globe’s largest institutions in the Financial Services, Aid and Development, Higher Education, and Corporate sectors. Leveraging cutting-edge APIs and StoneX Technology Services, we enhance pricing, execution, and settlement for payments, helping clients build infrastructure that ensures fast, accurate transactions while reducing costs and optimizing access to the SWIFT network and other channels. We provide expert guidance on SWIFT initiatives, ensuring compliance with key frameworks such as SWIFT gpi and pre-validation standards, while strengthening security measures. Additionally, StoneX supports the automation of manual payment processes, reducing operational burdens and improving transaction speed and accuracy. How we work Committed to revolutionizing global payments, StoneX Payments delivers transparency, trust, and tangible value across every transaction, fostering a more inclusive and connected financial ecosystem. StoneX Payments model Traditional payments model Sender Recipient StoneX Payments Recipient’s bank Sender Recipient Sender’s bank Intermediary bank Recipient’s bank The sender agrees on the exchange rate before the transfer. This gives the sender certainty about the value date and the amount their beneficiary will receive. Remitter has no transparency when it comes to locally-applied exchange rates – no visibility to the total amount of funds the beneficiary will receive and when it will arrive. Problem StoneX solution

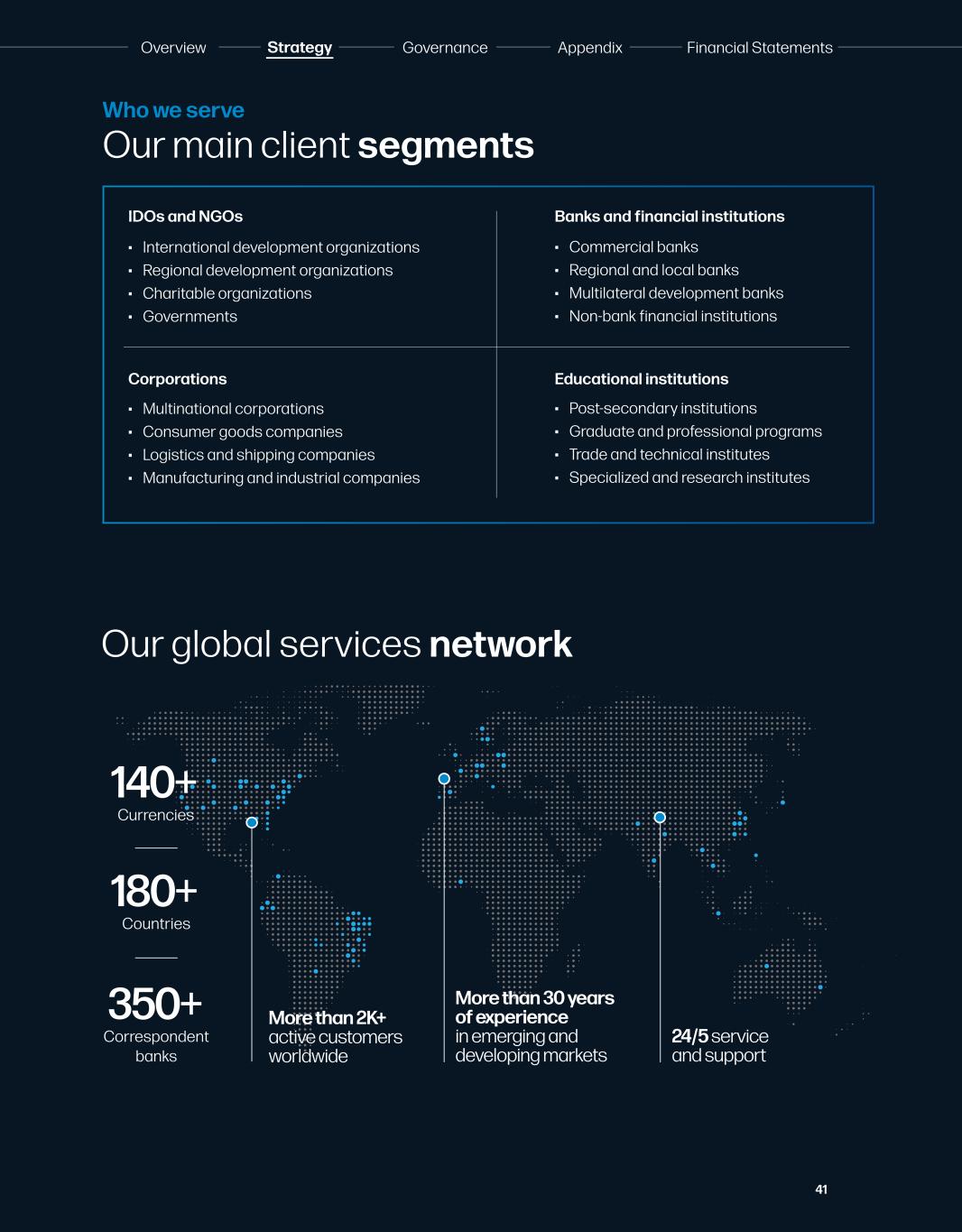

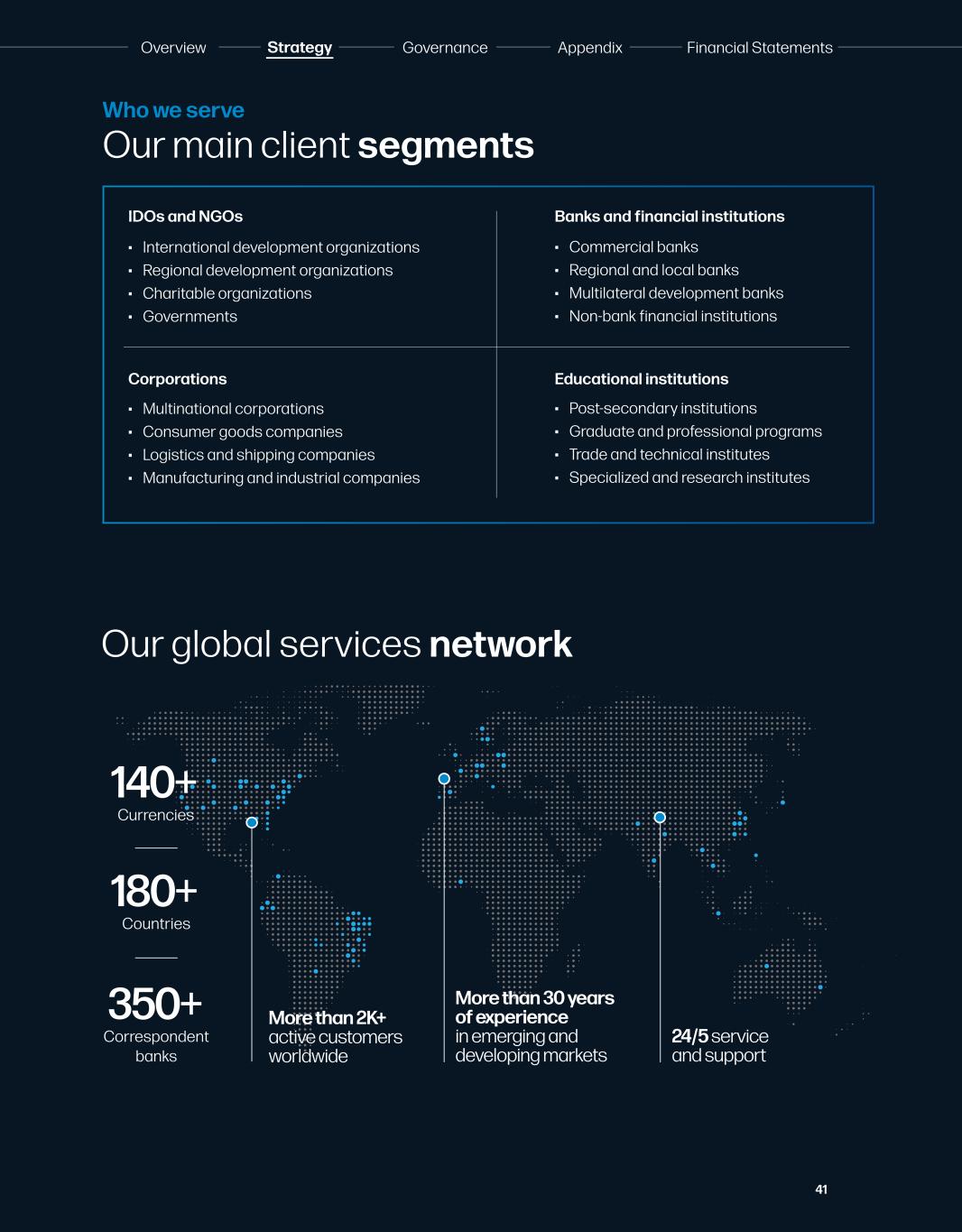

41 Overview Strategy Governance Financial StatementsAppendixt Our main client segments Who we serve Our global services network Educational institutions • Post-secondary institutions • Graduate and professional programs • Trade and technical institutes • Specialized and research institutes Corporations • Multinational corporations • Consumer goods companies • Logistics and shipping companies • Manufacturing and industrial companies Banks and financial institutions • Commercial banks • Regional and local banks • Multilateral development banks • Non-bank financial institutions IDOs and NGOs • International development organizations • Regional development organizations • Charitable organizations • Governments More than 30 years of experience in emerging and developing markets 24/5 service and support More than 2K+ active customers worldwide 180+ Countries 140+ Currencies 350+ Correspondent banks

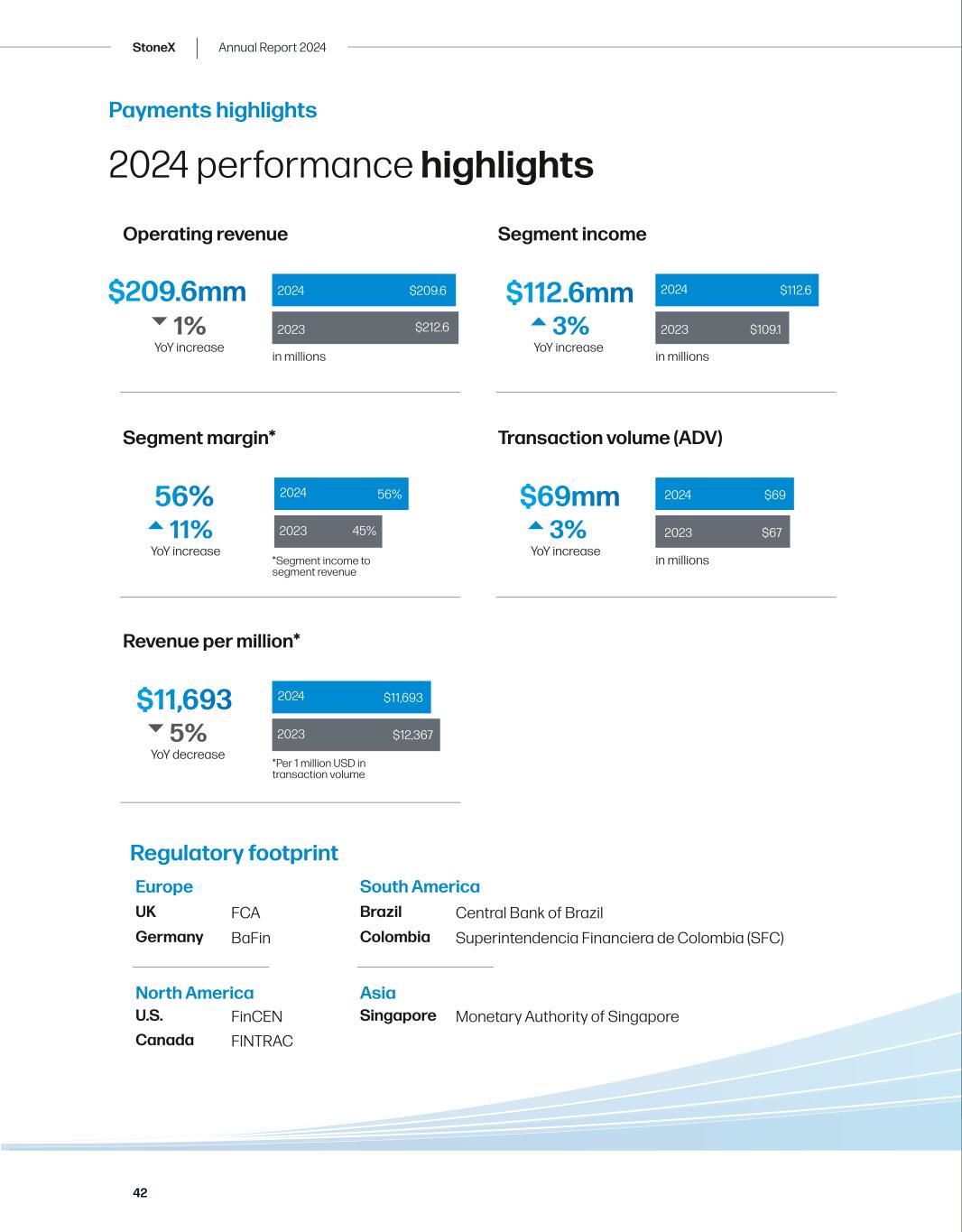

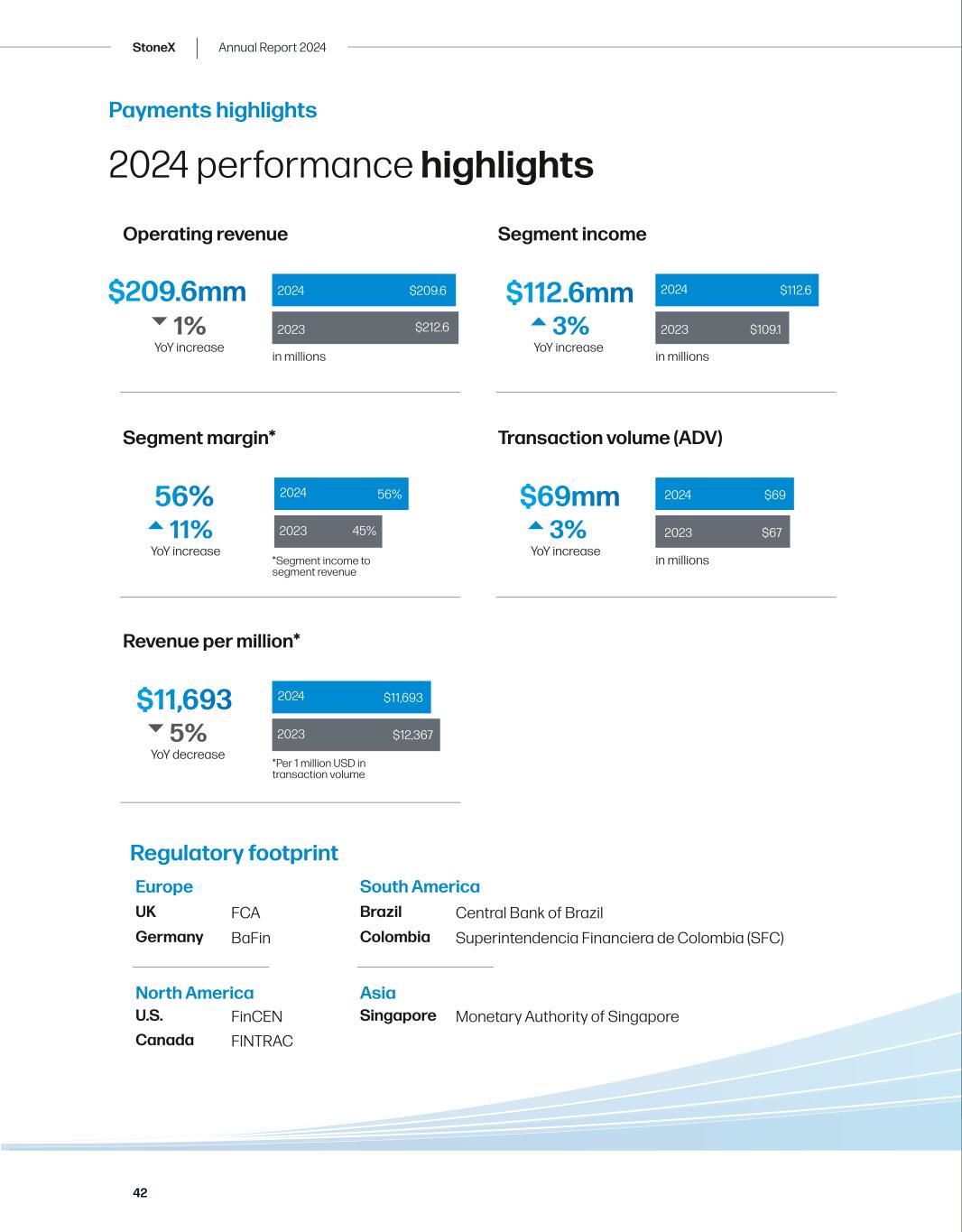

42 StoneX | Annual Report 2024 Payments highlights 2024 performance highlights Regulatory footprint $209.6mm YoY increase 1% Operating revenue in millions 2024 2023 $212.6 $209.6 in millions 2024 2023 $109.1 $112.6$112.6mm YoY increase 3% Segment income *Segment income to segment revenue 2024 2023 45% 56%56% YoY increase 11% Segment margin* 2024 2023 $12,367 $11,693$11,693 YoY decrease 5% Revenue per million* Europe UK FCA FinCEN Central Bank of Brazil Monetary Authority of Singapore BaFin FINTRAC Superintendencia Financiera de Colombia (SFC) U.S. Brazil Singapore Germany Canada Colombia North America South America Asia $69mm YoY increase 3% Transaction volume (ADV) in millions 2024 2023 $69 $67 *Per 1 million USD in transaction volume

Overview Strategy Governance Financial StatementsAppendixt StoneX Payments holds approximately 1% of the cross-border B2B payments market opportunity, reflecting a solid foundation in this competitive space but also highlighting significant potential for expansion. Given the rapid growth of global trade and the increasing demand for faster, more efficient cross-border payment solutions, StoneX is well-positioned to capture a larger share of this market. Payments roadmap Market opportunity 2019 2024 Future $209.6mm Operating revenue $112.8mm Operating revenue Leading payments fintech for cross-border currency services $45mm Transaction volume (ADV) $69mm Transaction volume (ADV) Continued growth in transaction volumes Payments market drivers: Largest market opportunity in financial services sector and least digitally transformed Emerging markets segment poised to grow at a faster pace Continual shift across users towards specialist payment firms, with multi-product and multi-country capabilities Major market banks retreat from emerging and frontier markets due to compliance and regulatory costs

44 StoneX | Annual Report 2024 Corporate governance statement The Company is committed to high standards of corporate governance and has put in place a framework that fosters good governance, is practical for a company of our size and satisfies our current listing and regulatory requirements. The Company has instituted a Code of Ethics that demands honest and ethical conduct from all employees. Specific topics covered are conflicts of interest, fair dealing, compliance with regulations, and accurate financial reporting. Board of Directors The Company has a Board of Directors consisting of one executive and seven independent directors. The Chairman is a non-executive director. The Board oversees the strategy, finances, operations and regulatory compliance of the Company through regular quarterly meetings and additional special meetings when required. The non-executive directors regularly meet independently of the executive director. The Nominating & Governance, Audit, Compensation, Risk, and Technology and Operations Committees are each composed of at least three independent Directors. The Audit Committee meets the SEC requirement that at least one of its members should be a financial expert. Board independence We are committed to maintaining the independence of our board as it relates to applicable rules and industry best practices because we believe doing so serves the best interests of our shareholders. No Director is considered independent if he or she is an executive officer or employee of the Company or has a relationship which, in the opinion of the Company’s Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director. In its annual review based on this criteria (in line with Rule 5600 of the NASDAQ Stock Exchange), the Nominating & Governance Committee of the Board determined that each of our directors qualifies as independent, with the exception of Sean O’Connor, the Company’s Executive Vice-Chairman of the Board of Directors. Executive structure The roles of Chairman and CEO are split in accordance with widely recognized best practices with regard to maintaining board independence. John Radziwill serves as the Company’s Chairman. The CEO and CFO make all necessary representations to satisfy regulatory and listing requirements. Executive compensation is determined by a Compensation Committee composed exclusively of independent directors. Executive pay tied to performance The pay for the members of our executive committee is closely tied to the financial performance of the Company. Specifically, the annual cash bonus for each executive is based entirely on the Company’s return on equity, a metric that is considered to be closely linked to stock price appreciation. A substantial portion of the annual cash bonus – generally 30% – is paid in the form of restricted company stock, which is purchased at a discount but vests over a three-year period. In addition, executives receive long-term cash awards, which generally vest five years following grant, and their growth in value is also tied to the Company’s return on equity. Executive compensation information can be found in our filings with the SEC on Form DEF 14A -Other definitive proxy statements.

45 Overview Strategy Governance Financial StatementsAppendix Forward-looking statements This Annual Report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements involve known and unknown risks and uncertainties, including the risks and uncertainties described in the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission, many of which are beyond the Company’s control. These risks and uncertainties include adverse changes in economic, political and market conditions, losses from the Company’s activities arising from customer or counterparty failures, changes in market conditions, the possible loss of key personnel, the impact of increasing competition, the impact of changes in government regulation, the possibility of liabilities arising from violations of laws or regulations and the impact of changes in technology on our businesses. Although the Company believes that its forward-looking statements are based upon reasonable assumptions regarding its businesses and future market conditions, there can be no assurances that the Company’s actual results will not differ materially from any results expressed or implied by the Company’s forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned that any forward-looking statements are not guarantees of future performance. Financial interest requirements for directors and CEO We require directors and our CEO to own a substantial equity stake in company stock. This requirement has been based on a meaningful percentage of the director’s or CEO’s most recent year’s cash compensation and we now require our directors and CEO to own an amount of company stock equal in value to three times their annual cash compensation, subject to a phase-in period for new directors. Financial reporting and internal control The Company strives to present clear, accurate and timely financial statements. Management has a system of internal controls in place, regularly assesses the effectiveness of these controls and modifies them as necessary. Risk management is an important aspect of this system of internal controls, and the Risk Committee monitors compliance with risk policies. Investor relations The Company seeks to provide accurate and timely information to stockholders and other stakeholders to facilitate a better understanding of the Company and its activities. The Company seeks to distribute such information as widely as possible through filings on Form 8-K, press releases and postings on its website, www.stonex.com.

StoneX | Annual Report 2024 46 Headquarters New York (US) 230 Park Avenue, 10th Floor New York, NY 10169, USA Tel: +1 212 485-3500 Office locations Alpharetta (GA) +1 404 836-7000 Birmingham (AL) +1 800 240-1428 Bloomfield (NE) +1 402 861-2522 Boca Raton (FL) +1 561 544-7611 Bowling Green (OH) +1 800 238-4146 Champaign (IL) +1 800 747-7001 Charlotte (NC) +1 800 334-1253 Chicago (IL) +1 312 780-6700 Dallas (TX) +1 833 798-8738 Fort Lauderdale (FL) +1 954 991-5022 Indianapolis (IN) +1 866 825-7942 Kansas City (MO) +1 800 255-6381 Lawrence (KS) +1 785 338-9230 Miami (FL) +1 305 925-4900 Minneapolis (MN) +1 800 447-7993 Omaha (NE) +1 800 228-2316 Orlando (FL) +1 800 541-1977 Park City (UT) +1 415 230-5505 Powell (OH) +1 614 792-2690 Richmond (VA) +1 804 659-4878 San Francisco (CA) Santa Monica (CA) +1 424 610-3897 Seattle (WA) St. Petersburg (FL) Stamford (CT) +1 212 692-5138 Twin Falls (ID) +1 800 635-0821 Warren (NJ) +1 877 367-3946 West Des Moines (IA) +1 800 422-3087 US offices 46

47 Overview Strategy Governance Financial StatementsAppendix International offices Asunción (Paraguay) +595 21 624 197 Bangalore (India) +91-9922731122 Beijing (China) +86 10 6513 0855 Bogota (Colombia) +57 1 484 1650 Buenos Aires (Argentina) +54 11 4390 7595 Cali (Columbia) +57 602 3800978 Campo Grande (Brazil) +55 67 2107 8300 Campo Novo do Parecis (Brazil) +55 (66) 3212-4133 Ciudad del Este (Paraguay) +59 59 7214 2960 Dubai (United Arab Emirates) +971 4 447 8500 Dublin (Ireland) +353 1 634 9140 Frankfurt (Germany) +49 (0)69 50 5060 4280 GIFT City (India)) +49 (0)69 50 5060 4280 Goiânia (Brazil) +55 62 3432 7912 Hamburg (Germany) +49 40 589660 000 Hong Kong +852 3469 1900 Katuete (Paraguay) Krakow (Poland) +48 539 534 658 Lagos (Nigeria) +234 1 700 0027 Lausanne (Switzerland) +41 21 612 65 65 Linhares (Brazil) Lisbon (Portugal) London (United Kingdom) +44 20 3580 6000 Luis Eduardo Magalhães (Brazil) +55 19 3515 2312 Luxembourg (Luxembourg) +352 4584841 Makati City (Philippines) Maringá (Brazil) +55 44 3033 6800 Melbourne (Australia) +55 44 3033 6800 Montreal (Canada) +1 438 469-1889 Nicosia (Cyprus) +357 220 900 62 Passo Fundo (Brazil) +55 54 2103 0200 Patrocinio (Brazil) +55 34 3199 1550 Pelotas (Brazil) +55 54 2103-0205 Primavera do Leste (Brazil) +55 11 3014 3298 Pune (India) 91-9892761516 Recife (Brazil) +55 81 3040 1900 Rio Verde (Brazil) +55 62 34327917 Santos (Brazil) São Paulo (Brazil) +55 11 3509 5400 Shanghai (China) +86 21 5108 1234 Singapore (Singapore) +65 6309 1000 Sorriso (Brazil) +55 66 3212 4130 Sydney (Australia) +61 2 8094 2000 Tokyo (Japan) +81 (0)3 5205 6161 Toronto (Canada) +1 647 475 0451 Varginha (Brazil) +55 (19) 3515-2321 West Bromwich (United Kingdom) +44 (0)121 525 1691 47

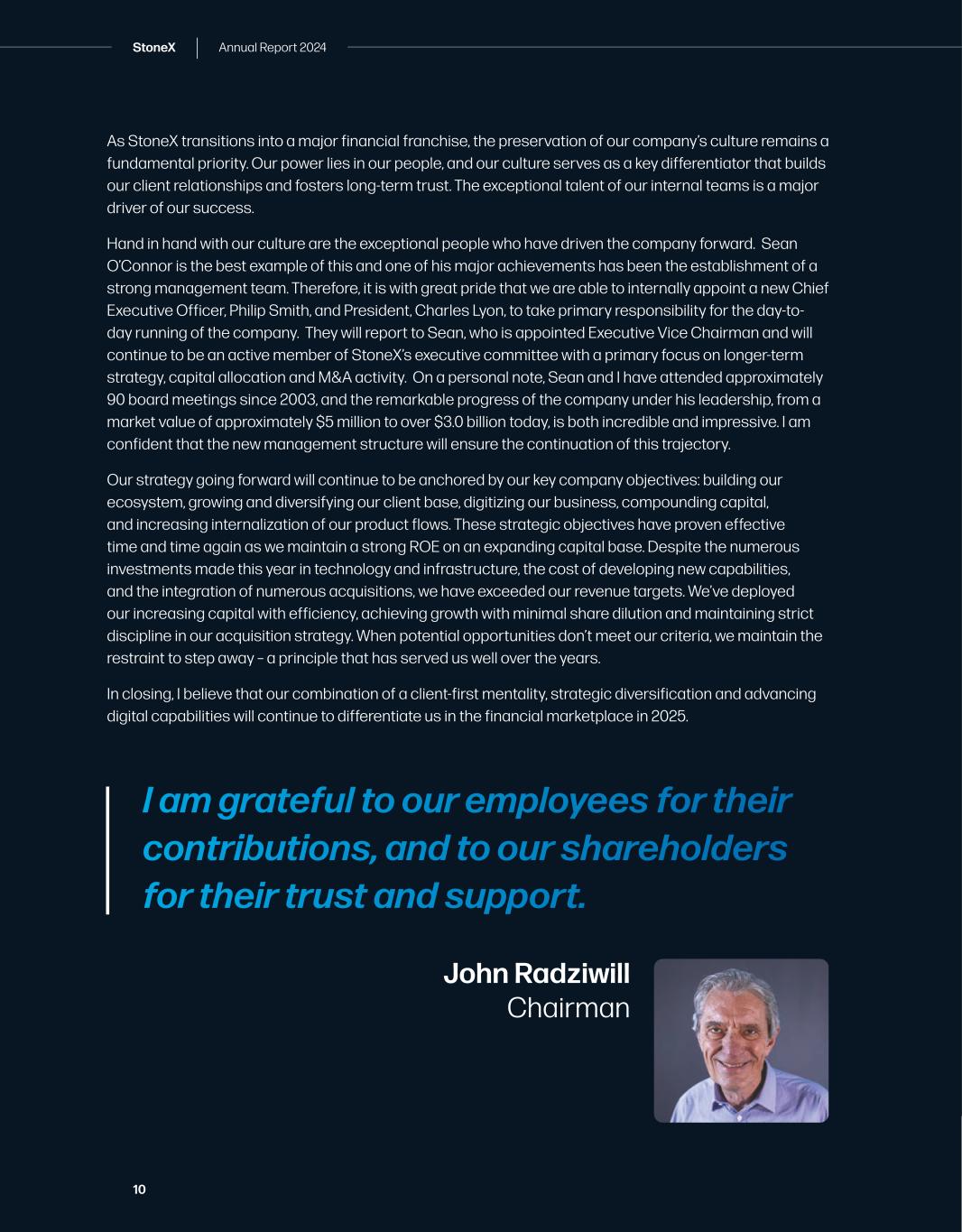

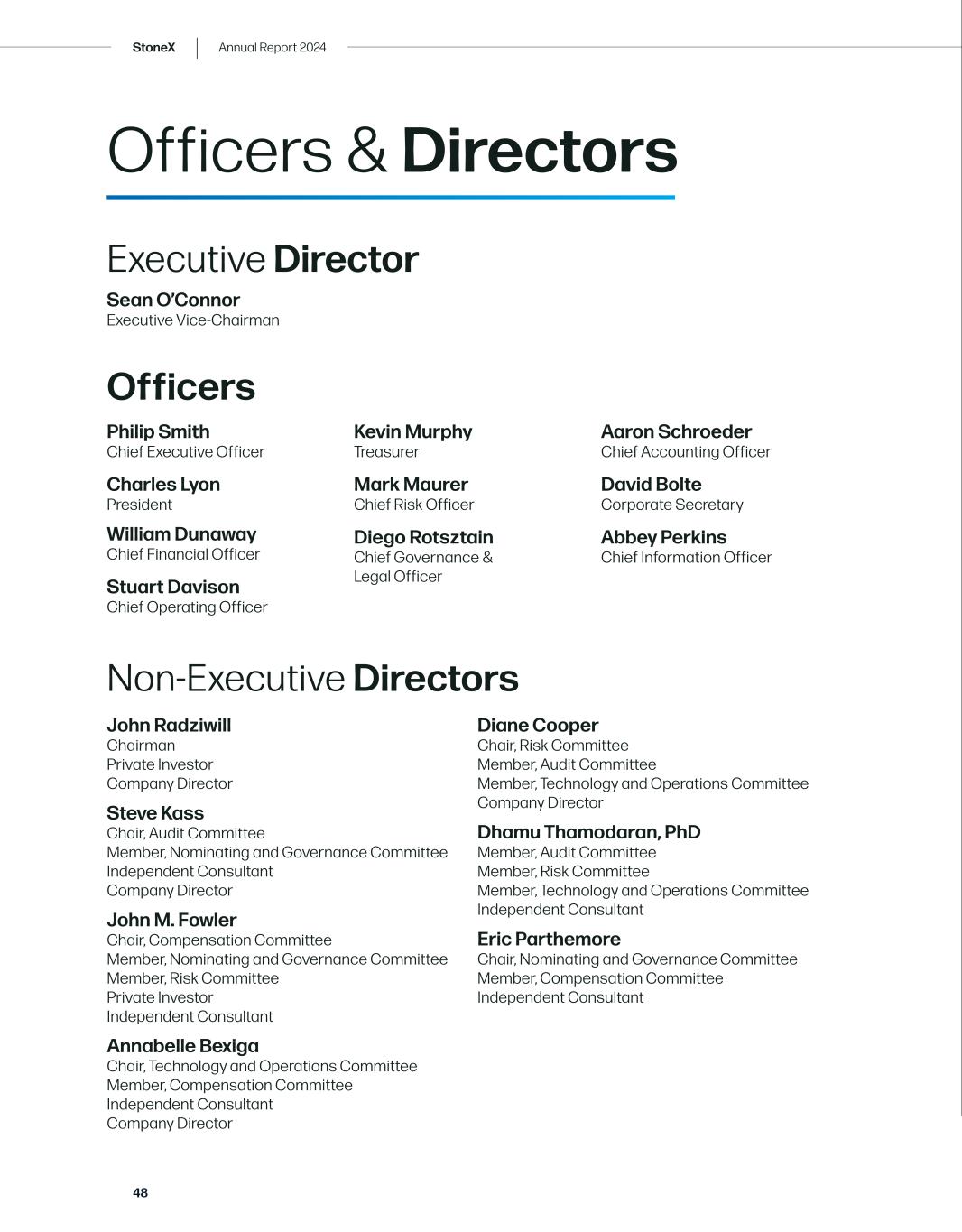

48 StoneX | Annual Report 2024 Executive Director Officers Non-Executive Directors Sean O’Connor Executive Vice-Chairman Philip Smith Chief Executive Officer Charles Lyon President William Dunaway Chief Financial Officer Stuart Davison Chief Operating Officer Kevin Murphy Treasurer Mark Maurer Chief Risk Officer Diego Rotsztain Chief Governance & Legal Officer Aaron Schroeder Chief Accounting Officer David Bolte Corporate Secretary Abbey Perkins Chief Information Officer Officers & Directors John Radziwill Chairman Private Investor Company Director Steve Kass Chair, Audit Committee Member, Nominating and Governance Committee Independent Consultant Company Director John M. Fowler Chair, Compensation Committee Member, Nominating and Governance Committee Member, Risk Committee Private Investor Independent Consultant Annabelle Bexiga Chair, Technology and Operations Committee Member, Compensation Committee Independent Consultant Company Director Diane Cooper Chair, Risk Committee Member, Audit Committee Member, Technology and Operations Committee Company Director Dhamu Thamodaran, PhD Member, Audit Committee Member, Risk Committee Member, Technology and Operations Committee Independent Consultant Eric Parthemore Chair, Nominating and Governance Committee Member, Compensation Committee Independent Consultant

49 Overview Strategy Governance Financial StatementsAppendix 230 Park Avenue, 10th Floor New York, NY 10169, USA Tel: +1 212 485 3500 Stock listing Corporate headquarters and stockholder relations The Company’s common stock trades on NASDAQ under the symbol “SNEX”. Company information To receive Company material, including additional copies of this annual report, Forms 10-K or 10-Q, or to obtain information on other matters of investor interest, please contact Group Treasurer Kevin Murphy at the Stockholder Relations address or visit our website at www.stonex.com. Stock transfer agent and registrar Computershare is the transfer agent and registrar for StoneX Group Inc. Inquiries about stockholders’ accounts, address changes or certificates should be directed to Computershare. To contact by mail: 150 Royall Street, Canton MA 02021