UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number 000-23554

INTERNATIONAL ASSETS HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 59-2921318 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

220 East Central Parkway, Suite 2060

Altamonte Springs, Florida 32701

(Address of principal executive offices) (Zip Code)

(407) 741-5300

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 8, 2008, there were 8,586,462 shares of the registrant’s common stock outstanding.

INTERNATIONAL ASSETS HOLDING CORPORATION

INDEX

INTERNATIONAL ASSETS HOLDING CORPORATION

Condensed Consolidated Balance Sheets

(In thousands, except par value and share amounts)

| | | | | | | |

| | | June 30,

2008 | | September 30,

2007 | |

| | | (Unaudited) | | | |

| ASSETS | | | | | | | |

Cash | | $ | 48,517 | | $ | 36,017 | |

Cash and cash equivalents deposited with brokers, dealers and clearing organization | | | 18,153 | | | 17,662 | |

Receivable from brokers, dealers and clearing organization | | | 25,703 | | | 31,471 | |

Receivable from customers, net | | | 55,786 | | | 40,367 | |

Financial instruments owned, at fair value | | | 263,586 | | | 146,951 | |

Physical commodities inventory, at cost | | | 67,816 | | | 39,433 | |

Trust certificates, at fair value | | | — | | | 11,217 | |

Prepaid income taxes | | | — | | | 1,123 | |

Investment in managed funds, at fair value | | | 11,891 | | | 16,260 | |

Deferred income taxes | | | 840 | | | 5,603 | |

Fixed assets and leasehold improvements, net | | | 2,751 | | | 2,441 | |

Intangible assets, net | | | 677 | | | 817 | |

Goodwill | | | 8,764 | | | 7,339 | |

Debt issuance costs, net | | | 961 | | | 1,183 | |

Other assets | | | 6,204 | | | 3,323 | |

| | | | | | | |

Total assets | | $ | 511,649 | | $ | 361,207 | |

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

Liabilities: | | | | | | | |

Accounts payable and accrued expenses | | $ | 4,786 | | $ | 5,173 | |

Financial instruments sold, not yet purchased, at fair value | | | 197,184 | | | 163,763 | |

Payable to lenders under loans and overdrafts | | | 123,021 | | | 85,094 | |

Payable to brokers, dealers and clearing organization | | | 46,802 | | | 14,516 | |

Payable to customers | | | 24,730 | | | 18,319 | |

Accrued compensation and benefits | | | 7,730 | | | 7,250 | |

Income taxes payable | | | 1,839 | | | 2,986 | |

Deferred income taxes | | | 5,449 | | | — | |

Other long-term liabilities | | | 521 | | | 549 | |

| | | | | | | |

| | | 412,062 | | | 297,650 | |

Convertible subordinated notes payable, net | | | 24,939 | | | 24,911 | |

| | | | | | | |

Total liabilities | | | 437,001 | | | 322,561 | |

| | | | | | | |

Commitments and contingencies (see Note 11) | | | | | | | |

| | |

Minority owners’ interest in consolidated entities | | | 10,139 | | | 3,065 | |

| | | | | | | |

Stockholders’ equity: | | | | | | | |

Preferred stock, $.01 par value. Authorized 1,000,000 shares; no shares issued or outstanding | | | — | | | — | |

Common stock, $.01 par value. Authorized 17,000,000 shares; issued and outstanding 8,570,753 shares at June 30, 2008 and 8,253,508 shares at September 30, 2007 | | | 85 | | | 83 | |

Additional paid-in capital | | | 39,753 | | | 36,619 | |

Retained earnings (deficit) | | | 24,639 | | | (1,084 | ) |

Accumulated other comprehensive income | | | 32 | | | (37 | ) |

| | | | | | | |

Total stockholders’ equity | | | 64,509 | | | 35,581 | |

| | | | | | | |

Total liabilities and stockholders’ equity | | $ | 511,649 | | $ | 361,207 | |

| | | | | | | |

See accompanying notes to condensed consolidated financial statements.

- 1 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | June 30,

2008 | | June 30,

2007 | | | June 30,

2008 | | June 30,

2007 | |

Revenues: | | | | | | | | | | | | | | |

Sales of physical commodities | | $ | 5,740,520 | | $ | 1,408,433 | | | $ | 11,345,764 | | $ | 2,363,340 | |

Net dealer inventory and investment gains (losses) | | | 22,469 | | | (869 | ) | | | 51,845 | | | 5,981 | |

Asset management fees | | | 4,249 | | | 2,723 | | | | 12,852 | | | 5,484 | |

Other | | | 2,444 | | | 1,048 | | | | 6,437 | | | 2,427 | |

| | | | | | | | | | | | | | |

Total revenues | | | 5,769,682 | | | 1,411,335 | | | | 11,416,898 | | | 2,377,232 | |

Cost of sales of physical commodities | | | 5,738,727 | | | 1,401,847 | | | | 11,311,377 | | | 2,343,782 | |

| | | | | | | | | | | | | | |

Operating revenues | | | 30,955 | | | 9,488 | | | | 105,521 | | | 33,450 | |

Interest expense | | | 2,415 | | | 2,459 | | | | 8,251 | | | 5,700 | |

| | | | | | | | | | | | | | |

Net revenues | | | 28,540 | | | 7,029 | | | | 97,270 | | | 27,750 | |

| | | | | | | | | | | | | | |

Non-interest expenses: | | | | | | | | | | | | | | |

Compensation and benefits | | | 10,024 | | | 7,139 | | | | 32,033 | | | 20,863 | |

Clearing and related expenses | | | 3,651 | | | 3,194 | | | | 11,690 | | | 8,091 | |

Occupancy and equipment rental | | | 455 | | | 289 | | | | 1,319 | | | 793 | |

Professional fees | | | 827 | | | 665 | | | | 1,576 | | | 1,262 | |

Depreciation and amortization | | | 285 | | | 202 | | | | 818 | | | 442 | |

Business development | | | 913 | | | 627 | | | | 2,229 | | | 1,231 | |

Insurance | | | 120 | | | 87 | | | | 293 | | | 221 | |

Other | | | 660 | | | 516 | | | | 2,956 | | | 1,314 | |

| | | | | | | | | | | | | | |

Total non-interest expenses | | | 16,935 | | | 12,719 | | | | 52,914 | | | 34,217 | |

| | | | | | | | | | | | | | |

Income (loss) before income tax and minority interest | | | 11,605 | | | (5,690 | ) | | | 44,356 | | | (6,467 | ) |

Income tax expense (benefit) | | | 4,642 | | | (2,043 | ) | | | 17,140 | | | (2,326 | ) |

| | | | | | | | | | | | | | |

Income (loss) before minority interest | | | 6,963 | | | (3,647 | ) | | | 27,216 | | | (4,141 | ) |

Minority interest in income of consolidated entities | | | 165 | | | 95 | | | | 1,493 | | | 417 | |

| | | | | | | | | | | | | | |

Net income (loss) | | $ | 6,798 | | $ | (3,742 | ) | | $ | 25,723 | | $ | (4,558 | ) |

| | | | | | | | | | | | | | |

Earnings (loss) per share: | | | | | | | | | | | | | | |

Basic | | $ | 0.80 | | $ | (0.46 | ) | | $ | 3.06 | | $ | (0.57 | ) |

| | | | | | | | | | | | | | |

Diluted | | $ | 0.72 | | $ | (0.46 | ) | | $ | 2.69 | | $ | (0.57 | ) |

| | | | | | | | | | | | | | |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | |

Basic | | | 8,482 | | | 8,197 | | | | 8,402 | | | 8,033 | |

| | | | | | | | | | | | | | |

Diluted | | | 9,954 | | | 8,197 | | | | 9,950 | | �� | 8,033 | |

| | | | | | | | | | | | | | |

Net income (loss) | | $ | 6,798 | | $ | (3,742 | ) | | $ | 25,723 | | $ | (4,558 | ) |

Other comprehensive (loss) income | | | 110 | | | 2 | | | | 69 | | | 2 | |

| | | | | | | | | | | | | | |

Total comprehensive income (loss) | | $ | 6,908 | | $ | (3,740 | ) | | $ | 25,792 | | $ | (4,556 | ) |

| | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

- 2 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | |

| | | Nine Months Ended | |

| | | June 30,

2008 | | | June 30,

2007 | |

Cash flows from operating activities: | | | | | | | | |

Net income (loss) | | $ | 25,723 | | | $ | (4,558 | ) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | |

Depreciation and amortization | | | 818 | | | | 442 | |

Deferred income taxes | | | 9,089 | | | | (4,778 | ) |

Amortization of debt issuance costs and debt discount | | | 250 | | | | 263 | |

Convertible debt interest settled in company stock upon partial conversion | | | — | | | | 29 | |

Minority interest | | | 1,493 | | | | 417 | |

Amortization of stock-based compensation expense | | | 1,116 | | | | 543 | |

Unrealized investment gain from INTL Consilium managed funds | | | (1,498 | ) | | | (868 | ) |

Changes in operating assets and liabilities: | | | — | | | | | |

Receivable from brokers, dealers and clearing organization | | | 5,767 | | | | (33,729 | ) |

Receivable from customers | | | (26,115 | ) | | | (19,860 | ) |

Financial instruments owned, at fair value | | | (10,910 | ) | | | (96,505 | ) |

Physical commodities inventory, at cost | | | (28,383 | ) | | | (12,824 | ) |

Prepaid income taxes | | | 1,123 | | | | 85 | |

Other assets | | | (2,483 | ) | | | (1,442 | ) |

Accounts payable and accrued expenses | | | (1,440 | ) | | | 1,160 | |

Financial instruments sold, not yet purchased, at fair value | | | 12,743 | | | | 63,558 | |

Payable to brokers, dealers and clearing organization | | | 32,286 | | | | 6,595 | |

Payable to customers | | | (54,384 | ) | | | 38,740 | |

Accrued compensation and benefits | | | 480 | | | | 434 | |

Income taxes payable | | | 1,173 | | | | 313 | |

Other liabilities | | | (59 | ) | | | (151 | ) |

| | | | | | | | |

Net cash used in operating activities | | | (33,211 | ) | | | (62,136 | ) |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Capital contribution of consolidated joint venture partner | | | — | | | | 2,000 | |

Capital distribution of consolidated joint venture partner | | | (2,794 | ) | | | (757 | ) |

Cash from consolidation of ICCAF Fund | | | 16,394 | | | | — | |

Cash acquired with acquisition of Gainvest | | | — | | | | 2,223 | |

Payments related to acquisition of Gainvest | | | (1,425 | ) | | | (2,778 | ) |

Payments related to acquisition of INTL Global Currencies | | | — | | | | (801 | ) |

Investment in managed funds | | | (5,000 | ) | | | (13,500 | ) |

Purchase of fixed assets, leasehold improvements | | | (989 | ) | | | (817 | ) |

| | | | | | | | |

Net cash provided by (used in) investing activities | | | 6,186 | | | | (14,430 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Payable to lenders under loans and overdrafts | | | 37,927 | | | | 76,592 | |

Exercise of stock options | | | 1,188 | | | | 972 | |

Income tax benefit on stock awards exercised | | | 833 | | | | 784 | |

| | | | | | | | |

Net cash provided by financing activities | | | 39,948 | | | | 78,348 | |

| | | | | | | | |

Effect of exchange rates on cash and cash equivalents | | | 68 | | | | 2 | |

| | | | | | | | |

Net decrease in cash and cash equivalents | | | 12,991 | | | | 1,784 | |

Cash and cash equivalents at beginning of period | | | 53,679 | | | | 38,029 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 66,670 | | | $ | 39,813 | |

| | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid for interest | | $ | 7,601 | | | $ | 4,806 | |

| | | | | | | | |

Income taxes paid | | $ | 3,909 | | | $ | 1,293 | |

| | | | | | | | |

Supplemental disclosure of non-cash investing and financing activities: | | | | | | | | |

Additional goodwill in connection with acquisition | | $ | 1,425 | | | $ | 10 | |

| | | | | | | | |

Conversion of subordinated notes to common stock, net of debt issuance costs of $112 | | $ | — | | | $ | 1,888 | |

| | | | | | | | |

Release of trust certificates | | $ | 11,217 | | | $ | 2,939 | |

| | | | | | | | |

Estimated beginning fair value of assets and (liabilities) received on consolidation: | | | | | | | | |

Assets acquired | | $ | 50,855 | | | $ | — | |

Liabilities assumed | | $ | (43,677 | ) | | $ | — | |

Minority owners interest | | $ | (7,178 | ) | | $ | — | |

See accompanying notes to condensed consolidated financial statements.

- 3 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1 – Basis of Presentation and Consolidation and Recent Accounting Pronouncements

International Assets Holding Corporation and its subsidiaries (collectively “INTL” or “the Company”) form a financial services group focused on select international markets. We commit our capital and expertise to market-making and dealing in financial instruments, currencies and commodities, and to asset management. The Company’s activities are divided into five functional areas - international equities market-making, international debt capital markets, foreign exchange trading, commodities trading and asset management.

Basis of Presentation and Consolidation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions and requirements of Form 10-Q and, therefore, do not include all information and footnotes necessary for a fair presentation of financial position, results of operations and cash flows in conformity with accounting principles generally accepted in the United States of America (“GAAP”). In the opinion of management, these financial statements reflect all adjustments, consisting of only normal recurring items necessary for a fair statement of the results of operations, cash flows and financial position for the interim periods presented.

Operating results for the interim periods are not necessarily indicative of the results that may be expected for the full year. These financial statements should be read in conjunction with the Company’s consolidated financial statements and related notes contained in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2007 as filed with the Securities and Exchange Commission.

These financial statements include the accounts of International Assets Holding Corporation and its subsidiaries. Intercompany transactions and balances have been eliminated in consolidation. Equity investments in which we exercise control or variable interest entities in which we are the primary beneficiary have been consolidated. Our fiscal year end is September 30, and our fiscal quarters end on December 31, March 31 and June 30. Unless otherwise stated, all dates refer to our fiscal years and fiscal periods.

Recent Accounting Pronouncements

In June 2008, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position (FSP) EITF 03-6-1,Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities. This FSP states that unvested share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are participating securities and shall be included in the computation of earnings per share pursuant to the two-class method. The FSP is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those years. Upon adoption, a company is required to retrospectively adjust its earnings per share data (including any amounts related to interim periods, summaries of earnings and selected financial data) to conform with the provisions in this FSP. However, early application of the provisions in this FSP is prohibited. We are currently evaluating the potential impact of the adoption of FSP 03-6-1 on our results of operations.

In April 2008, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position (FSP) FAS 142-3,Determination of the Useful Life of Intangible Assets. This FSP amends the factors that should be considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible asset under FASB Statement No. 142,Goodwill and Other Intangible Assets. The intent of this FSP is to improve the consistency between the useful life of a recognized intangible asset under Statement 142 and the period of expected cash flows used to measure the fair value of the asset under FASB Statement No. 141 (Revised 2007),Business Combinations, and other U.S. generally accepted accounting principles (GAAP). This FSP is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Early adoption is prohibited. We are currently evaluating the potential impact that the adoption of FSP 142-3 will have on our consolidated financial position, results of operations and cash flows.

In March 2008, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 161,Disclosures about Derivative Instruments and Hedging Activities—an amendment of FASB Statement No. 133. SFAS No. 161 expands quarterly disclosure requirements in SFAS 133 about an entity’s derivative instruments and hedging activities. SFAS 161 is effective for fiscal years beginning after November 15, 2008. We are currently evaluating the potential impact of the adoption of SFAS No. 161 on disclosures in our financial statements.

- 4 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

In February 2008, the FASB issued FASB Staff Position No. FAS 157-2 (FSP 157-2),Effective Date of FASB Statement No. 157. FSP 157-2 deferred the effective date of SFAS 157 for nonfinancial assets and nonfinancial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis, until fiscal years beginning after November 15, 2008. As a result of FSP 157-2, we will adopt SFAS 157 for our nonfinancial assets and nonfinancial liabilities beginning with the first interim period of our fiscal year 2010. We are currently evaluating the potential impact that the adoption of SFAS 157 will have on our consolidated financial position, results of operations and cash flows.

In December, 2007, the U.S. Securities and Exchange Commission (SEC) issued Staff Accounting Bulletin No. 110 (SAB 110). SAB 110 amends the SEC’s views discussed in Staff Accounting Bulletin No. 107 (SAB 107) regarding the use of the simplified method in developing estimates of the expected lives of share options in accordance with SFAS No. 123 (revised 2004),Share-Based Payment (SFAS No. 123(R)). During 2007 the Company calculated the expected term of options granted using the simplified method in accordance with SAB 107. The simplified method was intended to be a temporary estimation technique and was to be phased out as more detailed information about exercise behavior became readily available. SAB 110 was effective for us beginning in the first quarter of 2008. Beginning in the second quarter of 2008, we estimate the expected term of options granted based on our historical experience with our employees’ exercise of stock options and other factors. The implementation of SAB 110 is not expected to have a material effect on our consolidated financial position, results of operations or cash flows.

In December 2007, the FASB issued SFAS No. 141(R) (revised 2007),Business Combinations. SFAS No. 141(R) significantly changes the accounting for business combinations in a number of areas including the treatment of contingent consideration, preacquisition contingencies, transaction costs, in-process research and development and restructuring costs. In addition, under SFAS No. 141(R), changes in an acquired entity’s deferred tax assets and uncertain tax positions after the measurement period will impact income tax expense. SFAS No. 141(R) is effective for fiscal years beginning after December 15, 2008, and earlier adoption is prohibited. We will adopt SFAS No. 141(R) beginning October 1, 2009 and will change our accounting treatment for business combinations on a prospective basis for business combinations completed on or after that date.

In December 2007, the FASB issued SFAS No. 160,Noncontrolling Interests in Consolidated Financial Statements, an amendment of ARB No. 51. SFAS No. 160 changes the accounting and reporting for minority interests, which will be recharacterized as noncontrolling interests and classified as a component of equity. This new consolidation method significantly changes the accounting for transactions with minority interest holders. SFAS No. 160 is effective for fiscal years beginning after December 15, 2008, and earlier adoption is prohibited. SFAS No. 160 will be effective for us beginning on October 1, 2009 and will be applied prospectively, except for the presentation and disclosure requirements, which will be applied retrospectively. We are currently evaluating the potential impact that the adoption of SFAS No. 160 will have on our consolidated financial position, results of operations and cash flows.

In April 2007, the FASB issued FASB Staff Position (FSP) No. FIN 39-1,Amendment of FASB Interpretation No. 39. FSP FIN 39-1 modifies FIN 39,Offsetting of Amounts Related to Certain Contracts, and permits companies to offset cash collateral receivables or payables with net derivative positions under certain circumstances. FSP FIN 39-1 is effective for fiscal years beginning after November 15, 2007, with early adoption permitted. The Company has adopted FSP FIN 39-1 which did not have a material effect on our consolidated financial position and results of operations.

In December 2006, the FASB issued EITF 00-19-2,Accounting for Registration Payment Arrangements. EITF 00-19-2 specifies that the contingent obligation to make future payments or otherwise transfer consideration under a registration payment arrangement, whether issued as a separate agreement or included as a provision of a financial instrument or other agreement, should be separately recognized and measured in accordance with FASB Statement No. 5,Accounting for Contingencies. EITF 00-19-2 was effective for fiscal years beginning after December 15, 2006. We adopted EITF 00-19-2 with effect from October 1, 2007. The adoption has not had a material impact on our consolidated financial position, results of operations or cash flows.

- 5 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 2 – Reclassifications and Change in Accounting Policy

Effective for the quarter ended December 31, 2007, the Company has elected to change its accounting policy related to netting of customer cash collateral balances against financial instruments where a right of setoff exists with the same counterparty under master netting agreements. The Company believes that it is preferable to net these balances against each other in order to better present the Company’s exposure related to financial instruments and customer balances. The balance sheet as of September 30, 2007 has been adjusted to reflect the netting of $60,795,000 in balances payable to customers representing cash collateral offset against financial instruments executed with the same counterparty under master netting agreements.

Effective for the quarter ended June 30, 2008, the Company reclassified certain prior period balances from professional fees to clearing and related expenses. The reclassified fees were fund service accounting charges which are based on the value of the respective fund. The net result of this change for the year-to-date period ended June 30, 2007 was an increase in clearing and related expenses of $276,000 and a corresponding decrease of $276,000 in professional fees. The change for the quarter ended June 30, 2007 was an increase in clearing and related expenses of $109,000 and a corresponding decrease of $109,000 in professional fees.

Note 3 – Financial Instruments Owned and Financial Instruments Sold, Not Yet Purchased, at Market Value

Financial instruments owned and financial instruments sold, not yet purchased, at June 30, 2008 and September 30, 2007 consisted of trading and investment financial instruments at market values, as follows:

| | | | | | | | | | | | |

| | | June 30, 2008 | | September 30, 2007 |

| (In thousands) | | Owned | | Sold, not yet

purchased | | Owned | | Sold, not yet

purchased |

Common stock and ADR’s | | $ | 29,796 | | $ | 4,360 | | $ | 20,311 | | $ | 10,312 |

Exchangeable foreign ordinary equities and ADR’s | | | 31,080 | | | 31,163 | | | 30,017 | | | 30,129 |

Corporate and municipal bonds | | | 86,867 | | | 45,920 | | | 9,435 | | | — |

Foreign government obligations | | | 296 | | | — | | | 201 | | | — |

U.S. Treasury Bonds under total return swap transactions | | | — | | | — | | | — | | | 21,914 |

Derivatives | | | 47,702 | | | 32,566 | | | 66,755 | | | 72,582 |

Commodities | | | 63,268 | | | 83,175 | | | 18,838 | | | 28,826 |

U.S. Government obligations | | | 847 | | | — | | | 61 | | | — |

Mutual funds, proprietary securitized trusts and other | | | 3,730 | | | — | | | 1,333 | | | — |

| | | | | | | | | | | | |

| | $ | 263,586 | | $ | 197,184 | | $ | 146,951 | | $ | 163,763 |

| | | | | | | | | | | | |

The significant increase in corporate and municipal bond balances between September 30, 2007 and June 30, 2008 relates to the consolidation of the assets and liabilities of the INTL Consilium Convertible Arbitrage Fund with effect from the quarter ended June 30, 2008 (see Note 8).

Note 4 – Financial Instruments with Off-Balance Sheet Risk and Concentrations of Credit Risk

The Company is party to certain financial instruments with off-balance sheet risk in the normal course of its business. The Company has sold financial instruments that it does not currently own and will therefore be obliged to purchase such financial instruments at a future date. The Company has recorded these obligations in the consolidated financial statements at June 30, 2008 at the fair values of the related financial instruments. The Company will incur losses if the market value of the financial instruments increases subsequent to June 30, 2008. The total of $197,184,000 at June 30, 2008 includes $32,566,000 for derivative contracts, which represent a liability to the Company based on their fair values as of June 30, 2008.

- 6 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Listed below are the fair values of trading-related derivatives as of June 30, 2008 and September 30, 2007. Assets represent net unrealized gains and liabilities represent net unrealized losses.

| | | | | | | | | | | | |

| | | June 30, 2008 | | September 30, 2007 |

| (In thousands) | | Assets | | Liabilities | | Assets | | Liabilities |

Equity index derivatives | | $ | 441 | | $ | — | | $ | 82 | | $ | — |

Foreign exchange derivatives | | | 90 | | | 9 | | | 28 | | | — |

Interest rate derivatives | | | 132 | | | — | | | — | | | — |

Commodity price derivatives | | | 47,039 | | | 32,557 | | | 66,645 | | | 72,582 |

| | | | | | | | | | | | |

| | $ | 47,702 | | $ | 32,566 | | $ | 66,755 | | $ | 72,582 |

| | | | | | | | | | | | |

The derivatives as of June 30, 2008 mature over fiscal years 2008 and 2009 as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Assets at June 30, 2008 | | Liabilities at June 30, 2008 |

| (In thousands) | | Total | | Maturing

in Fiscal

2008 | | Maturing

in Fiscal

2009 | | Maturing

2010 &

Later | | Total | | Maturing

in Fiscal

2008 | | Maturing

in Fiscal

2009 | | Maturing

2010 &

Later |

Equity index derivatives | | $ | 441 | | $ | 441 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — |

Foreign exchange derivatives | | | 90 | | | 90 | | | — | | | — | | | 9 | | | 9 | | | — | | | — |

Interest rate derivatives | | | 132 | | | — | | | — | | | 132 | | | — | | | — | | | — | | | — |

Commodity price derivatives | | | 47,039 | | | 41,453 | | | 5,586 | | | — | | | 32,557 | | | 28,895 | | | 3,662 | | | — |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 47,702 | | $ | 41,984 | | $ | 5,586 | | $ | 132 | | $ | 32,566 | | $ | 28,904 | | $ | 3,662 | | $ | — |

| | | | | | | | | | | | | | | | | | | | | | | | |

Commodity price derivatives: | | | | | | | | | | | | | | | | | | | | | | | | |

Base metals | | $ | 24,652 | | $ | 21,033 | | $ | 3,619 | | $ | — | | $ | 12,070 | | $ | 10,015 | | $ | 2,055 | | $ | — |

Precious metals | | | 22,387 | | | 20,420 | | | 1,967 | | | — | | | 20,487 | | | 18,880 | | | 1,607 | | | — |

The Company’s derivative contracts are principally held in its commodities business segment. The Company assists its commodities customers in protecting the value of their future production by entering into option or forward agreements with them on an OTC basis. The Company also provides its commodities customers with sophisticated option products, including combinations of buying and selling puts and calls. The Company mitigates its risk by effecting offsetting OTC options with market counterparties or through the purchase or sale of exchange-traded commodities futures. The risk mitigation of offsetting options is not within the documented hedging designation requirements of SFAS No. 133.

These derivative contracts are traded along with cash transactions because of the integrated nature of the markets for such products. The Company manages the risks associated with derivatives on an aggregate basis along with the risks associated with its proprietary trading and market-making activities in cash instruments as part of its firm-wide risk management policies. In particular, the risks related to derivative positions may be partially offset by inventory, unrealized gains in inventory or cash collateral paid or received.

In the normal course of business, the Company purchases and sells financial instruments and foreign currencies as either principal or agent on behalf of its customers. If either the customer or counterparty fails to perform, the Company may be required to discharge the obligations of the nonperforming party. In such circumstances, the Company may sustain a loss if the market value of the financial instrument or foreign currency is different from the contract value of the transaction.

The majority of the Company’s transactions and, consequently, the concentration of its credit exposure is with customers, broker-dealers and other financial institutions. These activities primarily involve collateralized and uncollateralized arrangements and may result in credit exposure in the event that a counterparty fails to meet its contractual obligations. The Company’s exposure to credit risk can be directly impacted by volatile financial markets, which may impair the ability of counterparties to satisfy their contractual obligations. The Company seeks to control its credit risk through a variety of reporting and control procedures, including establishing credit limits based upon a review of the counterparties’ financial condition and credit ratings. The Company monitors collateral levels on a daily basis for compliance with regulatory and internal guidelines and requests changes in collateral levels as appropriate. The Company established a bad debt provision of $1,191,000 during the fiscal quarter ended March 31, 2008, arising from the failure of a customer to meet its obligations under a contract with the Company. The total amount payable by the customer was $2,382,000. In the event that the Company is unsuccessful in recovering any of the amount owed, the Company will incur an additional charge for any balance owed.

- 7 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 5 – Physical Commodities Inventory

Physical commodities inventory is valued at the lower of cost or market value, determined using the specific identification weighted average price method. Commodities in process include commodities in the process of being recycled. The values of the Company’s inventory at June 30, 2008 and September 30, 2007 are shown below.

| | | | | | |

| (In thousands) | | June 30,

2008 | | September 30,

2007 |

Commodities in process | | $ | 10,364 | | $ | 10,821 |

Finished commodities | | | 57,452 | | | 28,612 |

| | | | | | |

| | $ | 67,816 | | $ | 39,433 |

| | | | | | |

Note 6 – Trust Certificates and Total Return Swap

During the quarter ended December 31, 2004, the Company entered into a series of financial transactions (the ‘Transactions’) with an unaffiliated financial institution for a transaction fee. These Transactions involved three distinct and simultaneous steps:

| | a) | the acquisition by the Company of beneficial interests (‘Trust Interests’) in certain trusts (the ‘Trusts’) in exchange for the assumption of a liability to deliver securities, at a transaction value of $29,740,000. This step did not require any prior purchase or delivery of securities by the Company. The Trusts were previously established by the financial institution to hold a variety of real estate assets; |

| | b) | the entry into a repurchase agreement under the terms of which the Company notionally repurchased these undelivered securities for cash, at a price of $29,740,000; |

| | c) | the entry into a total return swap (‘TRS’) agreement. |

Under the TRS agreement the Company received, on a notional basis, the cash amount of $29,740,000 as collateral for the potential liability of the financial institution to the Company.

The net result is that the Company initially reported the effects of a) above as an increase in assets represented by the Trust Interests, and the assumption of a liability to deliver securities, at the initial transaction value of $29,740,000. Over time, as the values of the Trust Interests and securities deliverable changed as a result of changes in value or the sale of the Trust Interests, the Company recorded equal and offsetting changes in the values of the TRS receivables or payables.

During the quarter ended December 31, 2007, the remaining Trust Interests were sold by the Company in exchange for the release of its obligation to deliver to the buyer United States Government strip bonds maturing February 15, 2008, at fair value of $22,134,000. As anticipated, the only net impact of the transactions on the Company’s net cash flow was the receipt of fee revenue.

Note 7 – Goodwill

The Company acquired the Gainvest group of companies (“INTL Gainvest”), specialists in local markets securitization and asset management in Argentina, Brazil and Uruguay, in May 2007. Pursuant to this acquisition, the Company made a payment of $1,425,000 to the sellers on June 1, 2008 equal to 25% of the aggregate revenues of INTL Gainvest earned for the year ended April 30, 2008, which has been recorded as additional goodwill. The Company is obligated to make a further payment on June 1, 2009 equal to 25% of the aggregate revenues that INTL Gainvest will earn during the year ending April 30, 2009. The revenues on which the 25% is calculated are subject to a minimum threshold of $5.5 million and a maximum ceiling of $11 million for the year ending April 30, 2009. As of June 30, 2008, the aggregate revenues of INTL Gainvest since May 1, 2008 had not exceeded the minimum threshold of $5.5 million for the year ending April 30, 2009. An amount equal to 25% of INTL Gainvest’s revenues for the year ending April 30, 2009 will be recorded as additional goodwill if and when the minimum revenue threshold is achieved.

- 8 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 8 – Related Party Transactions

As of June 30, 2008, the Company had investments valued at $11,946,000 in two hedge funds managed by INTL Consilium, LLC (‘INTL Consilium’), including $11,081,000 in the INTL Consilium Convertible Arbitrage Fund (‘the ICCAF fund’). The Company owns a 50.1% interest in INTL Consilium. The Company also has an investment valued at $11,026,000 in the INTL Trade Finance Fund Limited, a fund managed by the Company’s wholly-owned subsidiary, INTL Capital Limited. This fund invests primarily in global trade finance-related assets. During the quarter ended June 30, 2008, the Company invested an additional $5 million in the ICCAF fund, increasing its interest in the ICCAF fund to 69%. Under the provisions of FIN 46 (R) the Company was required to consolidate the ICCAF fund as a variable interest entity in the quarter ended June 30, 2008. Accordingly, the minority interest shown in the Condensed Consolidated Statements of Operations also includes the minority interests in the ICCAF fund. The creditors of the ICCAF fund have no recourse on the general assets of the Company. The Company’s investments in unconsolidated hedge funds are included in ‘Investment in managed funds, at fair value’ on the balance sheet.

Note 9 – Payable to Lenders under Loans and Overdrafts

As of June 30, 2008 the Company had four credit facilities under which the Company may borrow up to $185 million, subject to certain conditions. Interest expense related to the Company’s credit facilities was approximately $1,628,000 and $1,693,000 for the three months and $5,173,000 and $3,411,000 for the nine months ended June 30, 2008 and 2007, respectively.

The Company’s four credit facilities at June 30, 2008 consisted of the following:

A one-year, renewable, revolving syndicated committed loan facility established on June 27, 2008 under which the Company’s wholly-owned subsidiary, INTL Commodities, Inc. (‘INTL Commodities’) is entitled to borrow up to $125 million, subject to certain conditions. There are six commercial banks that are the underlying lenders within the syndicate group. The loan proceeds will be used to finance the activities of INTL Commodities and are secured by its inventory and receivables. The interest rate for the facility depends on the ratio of borrowings to equity and ranges between 2.00% and 2.25% over the federal funds rate (2.00% at June 30, 2008) or over the LIBOR rate for the applicable term, at the Company’s election.

A demand facility established on March 5, 2008, under which the Company’s Dubai joint venture, INTL Commodities DMCC, may borrow up to $15 million, subject to certain conditions. The facility is secured by inventory and receivables.

Two additional lines of credit with a commercial bank under which the Company may borrow up to $45 million, subject to certain conditions. One of these lines of credit is secured by certain of the Company’s assets. The other is secured by a pledge of shares held in certain of the Company’s foreign subsidiaries. The interest rate on these facilities was 2.40% over the one-month London Interbank Offered Rates (‘LIBOR’) (approximately 2.46% at June 30, 2008).

At June 30, 2008, the Company had the following credit facilities and outstanding borrowings:

| | | | | | | | |

| | | | | June 30, 2008 |

Security | | Maturity Date | | Maximum

Amount | | Amount

Outstanding |

Certain foreign exchange assets | | July 31, 2008 | | $ | 20,000,000 | | $ | 13,795,000 |

Certain pledged shares | | July 31, 2008 | | | 25,000,000 | | | 19,450,000 |

Certain commodities assets | | On demand | | | 15,000,000 | | | 9,776,000 |

Certain commodities assets | | June 27, 2009 | | | 125,000,000 | | | 80,000,000 |

| | | | | | | | |

| | | | $ | 185,000,000 | | $ | 123,021,000 |

| | | | | | | | |

- 9 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 10 – Convertible Subordinated Notes and Debt Issuance Costs

The Company had $25 million in aggregate principal amount of the Company’s senior subordinated convertible notes due 2011 (‘Notes’) outstanding as of June 30, 2008 and September 30, 2007. The Notes are general unsecured obligations of the Company and bear interest at the rate of 7.625% per annum, payable quarterly in arrears. Debt issuance costs are net of accumulated amortization of $533,000 and $311,000 at June 30, 2008 and September 30, 2007, respectively. Amortization charged to interest expense in the condensed consolidated statements of operations was $74,000 for the three months ended June 30, 2008 and 2007, and $222,000 and $228,000 for the nine months ended June 30, 2008 and June 30, 2007, respectively.

The Notes are currently convertible by the holders into 981,547 shares of common stock of the Company, at a conversion price of $25.47 per share. Effective March 22, 2008, if the dollar-volume weighted average price of the common stock exceeds, for any twenty out of thirty consecutive trading days, 150% of the conversion price of the Notes, the Company has the right to require the holders of the Notes to convert all or any portion of the Notes into shares of Common Stock at the then-applicable conversion price.

In the event that the Consolidated Interest Coverage Ratio for the 12 months preceding the end of any fiscal quarter is less than 2.0, the interest rate on the Notes will be increased by 2.0% to 9.625% per annum, effective as of the first day of the following fiscal quarter. Through the quarter ended June 30, 2008, no such increase has been necessary. Holders may redeem their Notes at par if the interest coverage ratio set forth in the Notes is less than 2.75 for the twelve-month period ending December 31, 2009.

The Company entered into a separate Registration Rights Agreement with the holders of the Notes, under which the Company was required to file with the U.S. Securities and Exchange Commission (‘the SEC’) a Registration Statement on Form S-3 within a specified period of time. The Registration Statement was declared effective by the SEC on October 24, 2006. The Company is required, under the Registration Rights Agreement, to maintain the effectiveness of the Registration Statement, failing which it could become liable to pay holders of the Notes liquidated damages of 1% of the value of the Notes upon a failure to maintain effectiveness of the Registration Statement, plus a further 1% for every 30 days that it remains ineffective thereafter, up to an aggregate maximum of 10% of the value of the Notes. At June 30, 2008 the Company was in compliance with its requirements under the Registration Rights Agreement.

Note 11 – Commitments and Contingencies

As discussed in Note 7 – Goodwill, the Company has a contingent liability relating to the acquisition of INTL Gainvest which may result in the payment of additional consideration in June 2009.

As discussed in Note 10 – Convertible Subordinated Notes and Related Debt Issuance Costs, the Notes may be converted into shares of common stock of the Company at any time by the holders. The Notes also contain a provision to increase the interest rate by 2%, subject to certain conditions measured on a quarterly basis.

Note 12 – Capital and Other Regulatory Requirements

Our wholly-owned subsidiary INTL Trading, Inc. (‘INTL Trading’) is a registered broker dealer and member of the Financial Industry Regulatory Authority (“FINRA”) and is subject to the SEC Uniform Net Capital Rule 15c3-1. This rule requires the maintenance of minimum net capital, and requires that the ratio of aggregate indebtedness to net capital not exceed 15 to 1. Equity capital may not be withdrawn if the resulting net capital ratio would exceed 10 to 1. At June 30, 2008, INTL Trading’s net capital was $1.5 million, which was $500,000 in excess of its minimum requirement.

The Company has invested $3.8 million in one of its subsidiaries, INTL Global Currencies (Asia) Ltd., and made a $1 million subordinated loan to that subsidiary in order to meet the minimum capital requirements imposed by the Hong Kong Securities and Futures Commission. Another subsidiary, INTL Capital Limited (‘INTL Capital’), is regulated by the Dubai Financial Services Authority, in the United Arab Emirates, and is subject to a minimum capital requirement of approximately $500,000 as of June 30, 2008.

- 10 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 13 – Stock-Based Compensation

In December 2004, the FASB issued SFAS No. 123(R),Share-Based Payment. This pronouncement amended SFAS No. 123,Accounting for Stock-Based Compensation, and superseded Accounting Principles Board (APB) Opinion No. 25,Accounting for Stock Issued to Employees. SFAS No. 123(R) requires that companies account for awards of equity instruments under the fair value method of accounting and recognize such amounts in their statements of operations. On October 1, 2006 the Company adopted SFAS No. 123(R),Share-Based Payment, using the modified prospective method. Under SFAS No. 123(R), the Company is required to measure compensation cost for all stock-based awards at fair value on the date of grant and recognize compensation expense in its consolidated statements of operations over the service period that the awards are expected to vest. As permitted under SFAS No. 123(R), the Company has elected to recognize compensation cost for all options with graded vesting on a straight-line basis over the vesting period of the entire option, including unvested option awards granted prior to the adoption of SFAS No. 123(R).

Prior to the adoption of SFAS No. 123(R), the Company accounted for employee stock-based compensation using the intrinsic value method in accordance with APB Opinion No. 25, as permitted by SFAS No. 123 and SFAS No. 148,Accounting for Stock-Based Compensation — Transition and Disclosure, and provided the necessary pro forma disclosures required under SFAS No. 123. Under the intrinsic value method, the difference between the market price on the date of grant and the exercise price is charged to the statement of operations over the vesting period. Since options that were granted prior to the adoption of SFAS No. 123(R) were granted with exercise prices at, or higher than, the then market value, no compensation expense had been recognized for the fair values of such grants under APB 25.

Stock-based compensation expense is included within ‘Compensation and benefits’ in the condensed consolidated statements of operations and totaled $428,000 and $194,000 for the three months and $1,116,000 and $543,000 for the nine months ended June 30, 2008 and 2007, respectively.

Stock Option Plans

Consistent with the valuation method for the disclosure-only provisions of SFAS No. 123, the Company uses the Black-Scholes-Merton model to value the compensation expense associated with stock-based awards under SFAS No. 123(R). In addition, forfeitures are estimated when recognizing compensation expense, and the estimate of forfeitures are adjusted over the requisite service period to the extent that actual forfeitures differ, or are expected to differ, from such estimates. Changes in estimated forfeitures are recognized through a cumulative catch-up adjustment in the period of change and also impact the amount of compensation expense to be recognized in future periods.

The following weighted average assumptions were used in the estimated grant date fair value calculations for stock options for the periods presented:

| | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | June 30,

2008 | | | June 30,

2007 | | | June 30,

2008 | | | June 30,

2007 | |

Stock option plans: | | | | | | | | | | | | |

Expected stock price volatility | | 65 | % | | 68 | % | | 61 | % | | 66 | % |

Expected dividend yield | | 0 | % | | 0 | % | | 0 | % | | 0 | % |

Risk free interest rate | | 2.78 | % | | 4.61 | % | | 3.18 | % | | 4.54 | % |

Average expected life (in years) | | 2.80 | | | 3.50 | | | 2.96 | | | 3.50 | |

Expected stock price volatility rates are based on the historical volatility of the Company’s common stock. We have not paid dividends in the past and do not currently expect to do so in the future. Risk free interest rates are based on the U.S. Treasury yield curve in effect at the time of grant for periods corresponding with the expected life of the option or award. The average expected life represents the estimated period of time that options or awards granted are expected to be outstanding, based on the Company’s historical share option exercise experience for similar option grants.

- 11 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

The following is a summary of all option activity through June 30, 2008:

| | | | | | | | | | | | | | |

| | | Shares

Available for

Grant | | | Number of

Shares

Outstanding | | | Weighted

Average Price | | Weighted

Average

Remaining

Term

(in years) | | Aggregate

Intrinsic Value |

Balances at September 30, 2007 | | 493,392 | | | 812,006 | | | $ | 6.70 | | 3.78 | | $ | 13,328,000 |

| | | | | | | | | | | | | | |

Granted | | (57,906 | ) | | 57,906 | | | $ | 27.31 | | | | | |

Exercised | | | | | (230,806 | ) | | $ | 5.17 | | | | | |

Forfeited | | 7,149 | | | (7,149 | ) | | $ | 16.90 | | | | | |

Expired | | 23,400 | | | (23,400 | ) | | $ | 4.75 | | | | | |

| | | | | | | | | | | | | | |

Balances at June 30, 2008 | | 466,035 | | | 608,557 | | | $ | 9.20 | | 3.43 | | $ | 12,697,000 |

| | | | | | | | | | | | | | |

Exercisable at June 30, 2008 | | | | | 460,046 | | | $ | 4.98 | | 3.71 | | $ | 11,539,000 |

| | | | | | | | | | | | | | |

We settle stock option exercises with newly issued shares of common stock. The total compensation cost not yet recognized for non-vested awards of $912,000 has a weighted average period of 1.57 years over which the compensation expense is expected to be recognized.

Restricted Stock Plan

The following is a summary of all restricted stock activity through June 30, 2008:

| | | | | | | | | | | | | | |

| | | Shares

Available for

Grant | | | Number of

Shares

Outstanding | | | Weighted

Average

Grant Date

Fair Value | | Weighted

Average

Remaining

Term

(in years) | | Aggregate

Intrinsic Value |

Balances at September 30, 2007 | | 733,516 | | | 16,484 | | | $ | 21.97 | | 2.70 | | $ | 362,000 |

| | | | | | | | | | | | | | |

Granted | | (79,361 | ) | | 79,361 | | | $ | 25.88 | | | | | |

Vested | | | | | (5,377 | ) | | $ | 24.33 | | | | | |

Forfeited | | 9,406 | | | (9,406 | ) | | $ | 26.38 | | | | | |

| | | | | | | | | | | | | | |

Balances at June 30, 2008 | | 663,561 | | | 81,062 | | | $ | 25.13 | | 2.44 | | $ | 2,437,000 |

| | | | | | | | | | | | | | |

The total compensation cost not yet recognized of $1,686,000 has a weighted average period of 2.44 years over which the compensation expense is expected to be recognized. Compensation expense is amortized on a straight-line basis over the vesting period. Restricted stock grants are included in the Company’s total issued and outstanding common shares.

- 12 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 14 – Basic and Diluted Earnings (Loss) per Share

Basic earnings (loss) per share has been computed by dividing net income (loss) by the weighted average number of common shares outstanding. The following is a reconciliation of the numerator and denominator of the diluted net income (loss) per share computations for the periods presented below.

| | | | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended | |

| (In thousands) | | June 30,

2008 | | June 30,

2007 | | | June 30,

2008 | | June 30,

2007 | |

Diluted earnings (loss) per share | | | | | | | | | | | | | | |

Numerator: | | | | | | | | | | | | | | |

Net income (loss) | | $ | 6,798 | | $ | (3,742 | ) | | $ | 25,723 | | $ | (4,558 | ) |

Add: Interest on convertible debt, net of tax | | | 353 | | | — | | | | 1,061 | | | — | |

| | | | | | | | | | | | | | |

Diluted net income (loss) | | $ | 7,151 | | $ | (3,742 | ) | | $ | 26,784 | | $ | (4,558 | ) |

| | | | | | | | | | | | | | |

Denominator: | | | | | | | | | | | | | | |

Weighted average number of: | | | | | | | | | | | | | | |

Common shares outstanding | | | 8,482 | | | 8,197 | | | | 8,402 | | | 8,033 | |

Dilutive potential common shares outstanding: | | | | | | | | | | | | | | |

Share-based awards | | | 490 | | | — | | | | 566 | | | — | |

Convertible debt | | | 982 | | | — | | | | 982 | | | — | |

| | | | | | | | | | | | | | |

Diluted weighted-average shares | | | 9,954 | | | 8,197 | | | | 9,950 | | | 8,033 | |

| | | | | | | | | | | | | | |

The dilutive effect of share-based awards is reflected in diluted net income per share by application of the treasury stock method, which includes consideration of unamortized share-based compensation expense required by SFAS No. 123 (R). The dilutive effect of convertible debt has been reflected in diluted net income per share by application of the if-converted method.

Options to purchase 124,439 shares of common stock for the three months and nine months ended June 30, 2008 were excluded from the calculation of diluted earnings per share because they would have been anti-dilutive. No options to purchase shares of common stock or convertible subordinated notes payable which are convertible into common shares were considered in the calculation of diluted loss per share for the three months and nine months ended June 30, 2007 because they would have been anti-dilutive.

Note 15 – Taxes

In June 2006, the FASB issued FIN 48,Accounting for Uncertainty in Income Taxes. FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with FASB Statement No. 109, Accounting for Income Taxes. This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. The Company adopted the provisions of FIN 48 on October 1, 2007 and was not required to record any cumulative effect adjustment to retained earnings as a result of this adoption. The Company recognizes potential interest and penalties as a component of income tax expense.

The Company and its subsidiaries file income tax returns with the U.S. federal jurisdiction, various states, and various foreign jurisdictions. We are in the process of a review by the Internal Revenue Service (‘IRS’) for fiscal year 2006 which we expect will result in offsetting changes to our current taxes payable and our provision for deferred taxes but will have no effect on our recorded tax expense.

- 13 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 16 – Segment Analysis

The Company’s activities are currently divided into five functional areas: international equities market-making, international debt capital markets, foreign exchange trading, commodities trading and asset management.

International Equities Market-Making

Through INTL Trading, the Company acts as a wholesale market maker in select foreign securities including unlisted ADRs and foreign ordinary shares. INTL Trading provides execution and liquidity to national broker-dealers, regional broker-dealers and institutional investors.

International Debt Capital Markets

The Company actively trades a wide variety of international debt instruments including both investment grade and higher yielding emerging market bonds with particular focus on smaller emerging market sovereign, corporate and bank bonds that trade worldwide on an over-the-counter basis. The Company also arranges international debt transactions and asset backed securitizations for issuers located primarily in emerging markets. These transactions include bond issues, syndicated loans, and asset backed securitizations, as well as forms of other negotiable debt instruments. The revenues, expenses, assets and liabilities relating to the Trust Certificate and Total Return Swap discussed in Note 6 are included in this segment.

Foreign Exchange Trading

The Company trades currencies, with a focus on illiquid currencies of developing countries. The Company’s customers are financial institutions, multi-national corporations, governmental organizations and charitable organizations operating in these developing countries. In addition, the Company executes trades based on the foreign currency flows inherent in the Company’s existing business activities. The Company primarily acts as a principal in buying and selling foreign currencies on a spot basis. The Company derives revenue from the difference between the purchase and sale prices.

Commodities Trading

The Company provides a full range of trading and hedging capabilities to select producers, consumers, recyclers and investors in precious metals and certain base metals. Acting as a principal, the Company commits its own capital to buy and sell the metals on a spot and forward basis.

The Company records all of its physical commodities revenues on a gross basis. Operating revenues and losses from the Company’s commodities derivatives activities are recorded in ‘Net dealer inventory and investment gains’. All of the Company’s other businesses report their revenues on a net basis. Inventory for the commodities business is valued at the lower of cost or market value, under the provisions of ARB No. 43. The Company generally mitigates the price risk associated with commodities held in inventory through the use of derivatives. This price risk mitigation does not generally qualify for hedge accounting under GAAP. In such situations, unrealized gains in inventory are not recognized under GAAP, but unrealized gains and losses in related derivative positions are recognized under GAAP. As a result, the Company’s reported earnings from commodities trading are subject to significant volatility.

Asset Management

The asset management segment revenues include fees, commissions and other revenues received by the Company for management of third party assets and investment gains or losses on the Company’s investments in managed funds and proprietary accounts managed either by the Company’s investment managers or by independent investment managers.

Other

All other transactions that do not relate to the operating segments above are classified as ‘Other’. Certain cash accounts and balances were maintained to support the administration of all of the operating segments. These multi-segment assets were allocated to ‘Other’. Revenue reported for ‘Other’ includes interest income but not interest expense.

The total revenues reported combine gross revenues for the commodities business and net revenues for all other businesses. In order to reflect the way that the Company’s management views the results, the tables below also reflect the segmental contribution to ‘Operating revenues’, which is shown on the face of the Condensed Consolidated Statements of Operations and which is calculated by deducting physical commodities cost of sales from total revenues.

- 14 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Segment data includes the profitability measure of net contribution by segment. Net contribution is one of the key measures used by management to assess the performance of each segment and for decisions regarding the allocation of the Company’s resources. Net contribution is calculated as revenue less direct cost of sales, clearing and clearing related charges and variable trader bonus compensation. Variable trader bonus compensation represents a fixed percentage of an amount equal to revenues produced less clearing and related charges, base salaries and an overhead allocation.

Inter-segment revenues, charges, receivables and payables are eliminated between segments, except revenues and costs related to foreign currency transactions undertaken on an arm’s length basis by the foreign exchange trading business for the equity and debt trading business. The foreign exchange trading business competes for this business as it does for any other business. If its rates are not competitive the equity and debt trading businesses buy or sell their foreign currency through other market counter-parties. The profit or loss made by the foreign exchange trading business on these transactions is not quantifiable.

Information concerning operations in these segments of business is shown in accordance with SFAS No. 131 as follows:

| | | | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended | |

| (In thousands) | | June 30,

2008 | | June 30,

2007 | | | June 30, 2008 | | June 30,

2007 | |

Total revenues: | | | | | | | | | | | | | | |

International equities market-making | | $ | 7,702 | | $ | 7,020 | | | $ | 25,118 | | $ | 20,181 | |

International debt capital markets | | | 832 | | | 1,859 | | | | 2,947 | | | 4,005 | |

Foreign exchange trading | | | 5,032 | | | 3,520 | | | | 16,447 | | | 9,002 | |

Commodities trading | | | 5,751,389 | | | 1,395,010 | | | | 11,354,459 | | | 2,334,535 | |

Asset management | | | 4,142 | | | 3,733 | | | | 16,150 | | | 8,958 | |

Other | | | 585 | | | 193 | | | | 1,777 | | | 551 | |

| | | | | | | | | | | | | | |

Total | | $ | 5,769,682 | | $ | 1,411,335 | | | $ | 11,416,898 | | $ | 2,377,232 | |

| | | | | | | | | | | | | | |

Operating revenues: | | | | | | | | | | | | | | |

International equities market-making | | $ | 7,702 | | $ | 7,020 | | | $ | 25,118 | | $ | 20,181 | |

International debt capital markets | | | 832 | | | 1,859 | | | | 2,947 | | | 4,005 | |

Foreign exchange trading | | | 5,032 | | | 3,520 | | | | 16,447 | | | 9,002 | |

Commodities trading | | | 12,662 | | | (6,837 | ) | | | 43,082 | | | (9,247 | ) |

Asset management | | | 4,142 | | | 3,733 | | | | 16,150 | | | 8,958 | |

Other | | | 585 | | | 193 | | | | 1,777 | | | 551 | |

| | | | | | | | | | | | | | |

Total | | $ | 30,955 | | $ | 9,488 | | | $ | 105,521 | | $ | 33,450 | |

| | | | | | | | | | | | | | |

Net contribution (loss): | | | | | | | | | | | | | | |

| (Revenues less cost of sales, clearing and related expenses and variable trader bonus compensation): | |

International equities market-making | | $ | 3,977 | | $ | 3,499 | | | $ | 12,813 | | $ | 10,434 | |

International debt capital markets | | | 755 | | | 1,302 | | | | 2,684 | | | 2,993 | |

Foreign exchange trading | | | 3,435 | | | 2,772 | | | | 12,006 | | | 7,039 | |

Commodities trading | | | 11,732 | | | (7,447 | ) | | | 39,395 | | | (11,712 | ) |

Asset management | | | 3,118 | | | 3,103 | | | | 13,028 | | | 7,674 | |

| | | | | | | | | | | | | | |

Total | | $ | 23,017 | | $ | 3,229 | | | $ | 79,926 | | $ | 16,428 | |

| | | | | | | | | | | | | | |

| Reconciliation of net contribution (loss) to income (loss) before income tax and minority interest: | |

Net contribution allocated to segments | | $ | 23,017 | | $ | 3,229 | | | $ | 79,926 | | $ | 16,428 | |

Fixed costs not allocated to operating segments | | | 11,412 | | | 8,919 | | | | 35,570 | | | 22,895 | |

| | | | | | | | | | | | | | |

Income (loss) before income tax and minority interest | | $ | 11,605 | | $ | (5,690 | ) | | $ | 44,356 | | $ | (6,467 | ) |

| | | | | | | | | | | | | | |

| | |

| | | Balances as of | | | | |

| | | June 30,

2008 | | September

30, 2007 | | |

Total assets: | | | | | | | | |

International equities market-making | | $ | 57,804 | | $ | 49,610 | | |

International debt capital markets | | | 6,028 | | | 27,181 | | |

Foreign exchange trading | �� | | 52,391 | | | 61,267 | | |

Commodities trading | | | 199,673 | | | 166,735 | | |

Asset management | | | 136,803 | | | 49,825 | | |

Other | | | 58,950 | | | 6,589 | | |

| | | | | | | | |

Total | | $ | 511,649 | | $ | 361,207 | | |

| | | | | | | | |

- 15 -

INTERNATIONAL ASSETS HOLDING CORPORATION

Notes to Condensed Consolidated Financial Statements – (Continued)

(Unaudited)

Note 17 – Subsequent events

On July 30, 2008, the Company renewed two of its credit facilities with one of its lenders. The first of those lines was increased from $20 million to $25 million at a rate of 2.25% over LIBOR (approximately 2.46% at June 30, 2008) and is secured by certain of the Company’s foreign exchange assets. The second line was increased from $25 million to $35 million at the existing rate of 2.40% above LIBOR, and is secured by a pledge of shares held in certain of the Company’s foreign subsidiaries. Both of these lines of credit are now scheduled to expire on December 31, 2009.

On August 1, 2008, the Company notified the employees of its Hong Kong subsidiary, INTL Global Currencies (Asia) Ltd., of its intention to discontinue its margin foreign exchange trading operations. The Company incurred losses of $435,000 and $1,370,000 in this subsidiary during the three months and nine months ended June 30, 2008, respectively, and incurred losses of $91,000 during the three months and nine months ended June 30, 2007. At June 30, 2008 the subsidiary’s net assets, excluding cash and intercompany balances, were $344,000. The Company is currently exploring either the closure or sale of INTL Global Currencies (Asia) Ltd.

- 16 -

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the financial statements and notes thereto appearing elsewhere in this report. This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond the Company’s control, including adverse changes in economic, political and market conditions, losses from the Company’s market-making and trading activities arising from counter-party failures and changes in market conditions, the possible loss of key personnel, the impact of increasing competition, the impact of changes in government regulation, the possibility of liabilities arising from violations of federal and state securities laws and the impact of changes in technology in the securities and commodities trading industries. Although the Company believes that its forward-looking statements are based upon reasonable assumptions regarding its business and future market conditions, there can be no assurances that the Company’s actual results will not differ materially from any results expressed or implied by the Company’s forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned that any forward-looking statements are not guarantees of future performance.

Principal Activities

International Assets Holding Corporation and its subsidiaries (collectively “INTL” or “the Company”) form a financial services group focused on select international markets. The Company commits its capital and expertise to market-making and dealing in financial instruments, currencies and commodities, and to asset management. The Company’s activities are divided into five reportable business segments - international equities market-making, international debt capital markets, foreign exchange trading, commodities trading and asset management.

International Equities Market-Making.The Company is a leading US market maker in select foreign securities, including unlisted American Depository Receipts and foreign common shares. The Company provides execution and liquidity primarily to U.S.-based wirehouses, regional broker-dealers and institutional investors.

International Debt Capital Markets. The Company actively trades a wide variety of international debt instruments including both investment grade and higher yielding emerging markets bonds with particular focus on smaller emerging market sovereign, corporate and bank bonds that trade worldwide on an over-the-counter basis. The Company also originates international debt transactions for issuers located primarily in emerging markets. This includes bond issues, syndicated loans, asset securitizations as well as forms of other negotiable debt instruments.

Foreign Exchange Trading. The Company trades select illiquid currencies of developing countries. The Company’s target customers are financial institutions, multi-national corporations, and governmental and charitable organizations operating in these developing countries. In addition, the Company executes trades based on the foreign currency flows inherent in its existing international securities activities. The Company primarily acts as a principal in buying and selling foreign currencies on a spot basis.

Commodities Trading. The Company provides a full range of over-the-counter precious and base metals trading and hedging capabilities to producers, consumers, recyclers and investors with a particular focus on transactions that include physical delivery. Acting as a principal, the Company commits its capital to buy and sell the metals on a spot and forward basis.

Asset Management. The Company provides asset management services through INTL Consilium, LLC, an asset management joint venture in which it holds a 50.1% interest, and through two wholly owned subsidiaries— INTL Capital Ltd. and Gainvest S.A. Sociedad Gerente de Fondos Communes de Inversion. INTL Consilium, LLC acts as the investment manager for private investment funds organized by INTL Consilium, LLC and others. INTL Capital Ltd. acts as the investment adviser to INTL Trade Finance Fund Ltd. Gainvest acts as an investment adviser to three investment funds organized and traded in Argentina.

- 17 -

Results of Operations

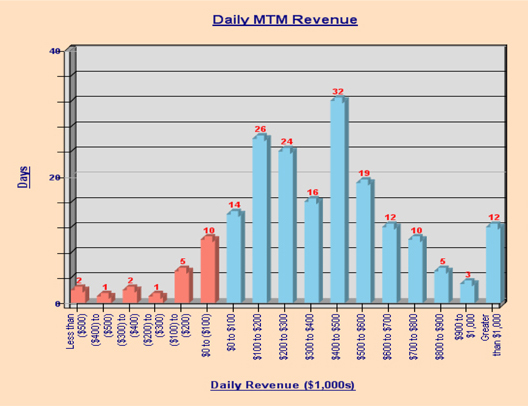

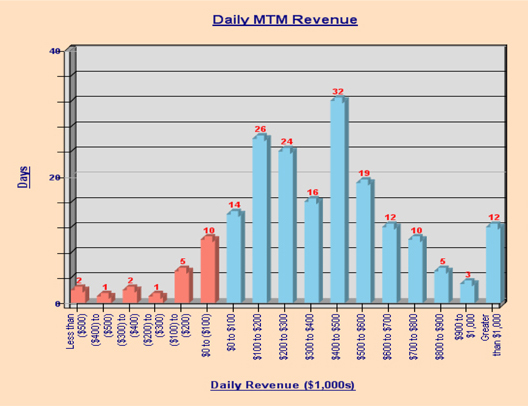

As discussed in prior quarters, the requirements of accounting principles generally accepted in the U.S. (“GAAP”) to carry derivatives at fair market value but physical commodities inventory at the lower of cost or market value have a significant temporary impact on our reported earnings. Under GAAP, gains and losses on commodities inventory and derivatives which the Company intends to be offsetting are often recognized in different quarters. Additionally, GAAP does not require us to reflect changes in the estimated values of forward commitments to purchase and sell commodities.

For these reasons, management assesses the Company’s operating results on a marked-to-market basis. Management relies on these adjusted operating results to evaluate the performance of the Company’s commodities business segment and its personnel.

In the past the Company has approximated marked-to-market results by disclosing the change in any unrealized gains in inventory, which is required to be valued at the lower of cost or market value for GAAP purposes. While this captures most of the difference between GAAP results and the fully marked-to-market results utilized by management, there are other differences. These consist of changes in the estimated values of commodities forward commitments, after taking into account the estimated price of the underlying commodity and any estimated freight and conversion costs.

To assist investors, the Company has elected to provide a table which sets forth adjustments to results of operations under GAAP reflecting both the changes in any unrealized gains in inventory and the estimated values of commodities forward commitments. The Company believes that the information in this table better reflects the economic results of the Company and allows investors to review the marked-to-market financial data utilized by management in managing the Company’s business.

Because this is the first time that the Company has presented this unaudited, non-GAAP internal financial information, the Company has included a quarterly history of selected information beginning with the first quarter of fiscal 2006, when the Company commenced its physical metals trading business. All differences between GAAP results and management’s marked-to-market results relate to the physical commodities business. All of the Company’s other businesses are accounted for and disclosed under GAAP on a fair value basis. We anticipate that in future filings the selected summary information will include only current and trailing twelve month disclosures of the unaudited, non-GAAP internal financial information.

- 18 -

Selected Summary Financial Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q3

2008 | | | Q2

2008 | | | Q1

2008 | | | Q4

2007 | | | Q3

2007 | | | Q2

2007 | | | Q1

2007 | | | Q4

2006 | | | Q3

2006 | | | Q2

2006 | | | Q1

2006 | |

As reported on a GAAP basis: | |

Operating revenues | | $ | 30,955 | | | $ | 32,499 | | | $ | 42,068 | | | $ | 20,135 | | | $ | 9,488 | | | $ | 14,783 | | | $ | 9,179 | | | $ | 4,414 | | | $ | 14,111 | | | $ | 9,021 | | | $ | 8,331 | |

Net income | | $ | 6,798 | | | $ | 6,007 | | | $ | 12,918 | | | $ | 66 | | | $ | (3,742 | ) | | $ | 681 | | | $ | (1,497 | ) | | $ | (1,962 | ) | | $ | 3,286 | | | $ | 1,090 | | | $ | 1,046 | |

Stockholders’ equity | | $ | 64,509 | | | $ | 57,130 | | | $ | 49,916 | | | $ | 35,581 | | | $ | 35,346 | | | $ | 37,133 | | | $ | 35,485 | | | $ | 33,943 | | | $ | 35,855 | | | $ | 31,006 | | | $ | 29,672 | |

|

Marked-to-market basis (unaudited, pro forma, non-GAAP): | |

Adjusted operating revenues | | $ | 23,281 | | | $ | 29,946 | | | $ | 28,824 | | | $ | 24,800 | | | $ | 18,661 | | | $ | 18,085 | | | $ | 15,438 | | | $ | 11,791 | | | $ | 12,058 | | | $ | 10,375 | | | $ | 9,208 | |

Adjusted, pro forma net income | | $ | 2,002 | | | $ | 4,411 | | | $ | 4,641 | | | $ | 2,982 | | | $ | 1,991 | | | $ | 2,745 | | | $ | 2,415 | | | $ | 2,649 | | | $ | 2,003 | | | $ | 1,936 | | | $ | 1,594 | |

Adjusted EBITDA | | $ | 5,993 | | | $ | 10,720 | | | $ | 11,491 | | | $ | 8,878 | | | $ | 5,946 | | | $ | 6,312 | | | $ | 5,606 | | | $ | 4,460 | | | $ | 3,899 | | | $ | 3,562 | | | $ | 3,037 | |

Adjusted stockholders’ equity | | $ | 69,187 | | | $ | 66,604 | | | $ | 60,986 | | | $ | 54,928 | | | $ | 51,777 | | | $ | 47,831 | | | $ | 44,119 | | | $ | 38,665 | | | $ | 35,966 | | | $ | 32,400 | | | $ | 30,220 | |

|

Trailing twelve months on marked-to-market basis (unaudited, pro forma, non-GAAP): | |

Adjusted operating revenues | | $ | 106,851 | | | $ | 102,231 | | | $ | 90,370 | | | $ | 76,984 | | | $ | 63,975 | | | $ | 57,372 | | | $ | 49,662 | | | $ | 43,432 | | | | | | | | | | | | | |

Adjusted, pro forma net income | | $ | 14,036 | | | $ | 14,025 | | | $ | 12,359 | | | $ | 10,133 | | | $ | 9,800 | | | $ | 9,812 | | | $ | 9,003 | | | $ | 8,182 | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 37,082 | | | $ | 37,035 | | | $ | 32,627 | | | $ | 26,742 | | | $ | 22,324 | | | $ | 20,277 | | | $ | 17,527 | | | $ | 14,958 | | | | | | | | | | | | | |

Adjusted return on average equity | | | 23.2 | % | | | 24.5 | % | | | 23.5 | % | | | 21.7 | % | | | 22.3 | % | | | 24.5 | % | | | 24.2 | % | | | 24.5 | % | | | | | | | | | | | | |

|

| The following marked-to-market adjustments were made to the GAAP basis numbers shown above (unaudited, pro forma, non-GAAP management data) (note 1): | |