Goldman Sachs Fifteenth Annual Agricultural Biotech Forum

Smithfield Foods, Inc.C. Larry PopePresident and Chief Executive OfficerRobert W. ManlyExecutive Vice President and Chief Financial Officer

Forward-Looking Statements

This presentation contains “forward-looking” statements within the meaning of the federal securities laws. The forward-looking statements include statements concerning the Company’s outlook for the future, as well as other statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning matters that are not historical facts. The Company’s forward-looking information and statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, the statements. These risks and uncertainties include the availability and prices of live hogs, raw materials, fuel and supplies, food safety, livestock disease, live hog production costs, product pricing, the competitive environment and related market conditions, risks associated with our indebtedness, including cost increases due to rising interest rates or changes in debt ratings or outlook, hedging risk, operating efficiencies, changes in foreign currency exchange rates, access to capital, the cost of compliance with changes to regulations and laws, including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational, health and safety laws, adverse results from on-going litigation, actions of domestic and foreign governments, labor relations issues, credit exposure to large customers, the ability to make effective acquisitions and dispositions and s uccessfully integrate newly acquired businesses into existing operations, the Company’s ability to effectively restructure portions of its operations and achieve cost savings from such restructurings and other risks and uncertainties described in the Company’s Annual Report on Form 10-K for fiscal 2010 and in its subsequent Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on forward-looking statements because actual results may differ materially from those expressed in, or implied by, the statements. Any forward looking statement that the Company makes speaks only as of the date of such statement, and the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

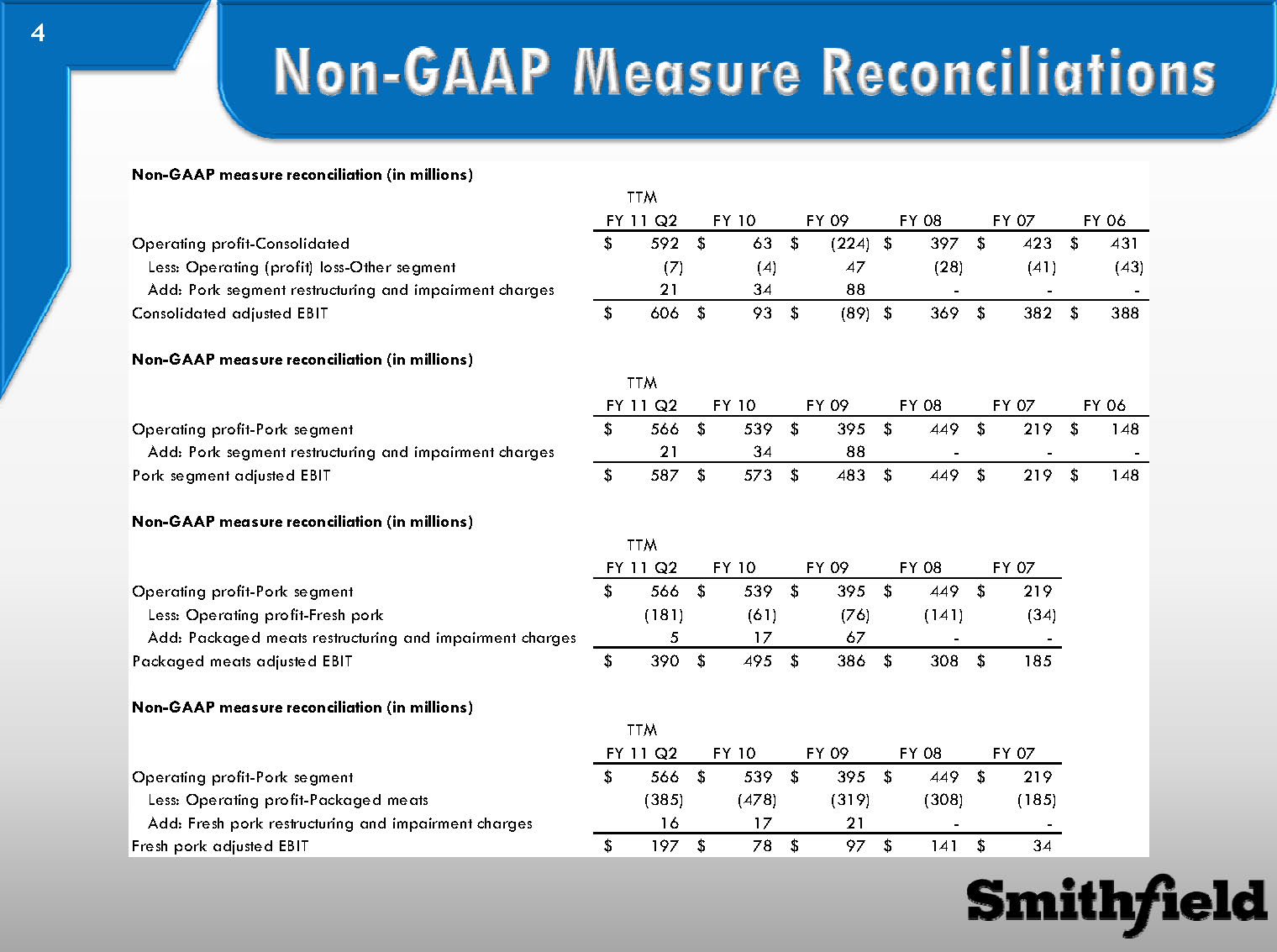

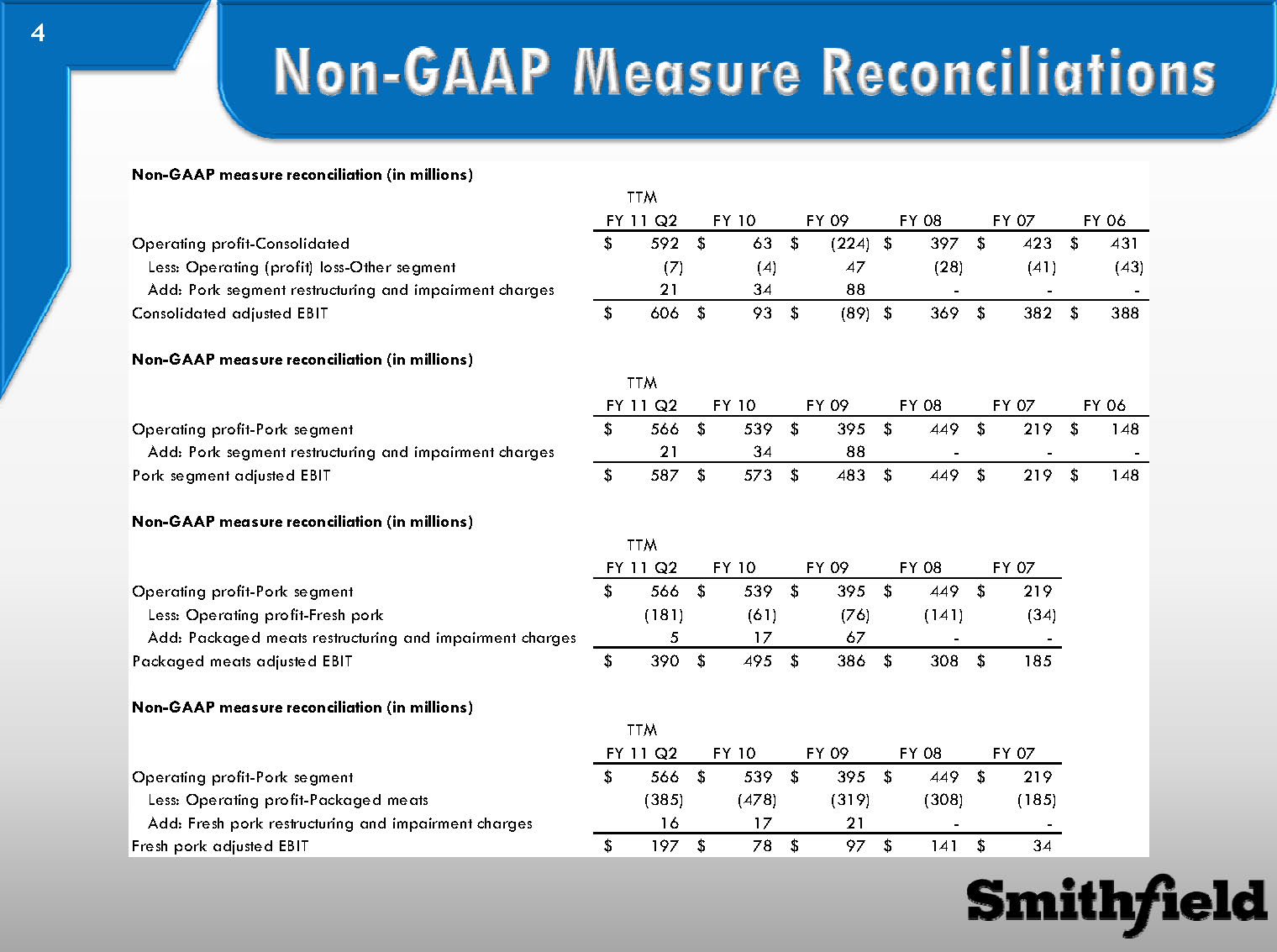

Non-GAAP Measure Reconcilia tions Non-GAAP measure reconciliation (in millions)

TTMFY 11 Q2FY 10FY 09FY 08FY 07FY 06Operating profit-Consolidated592$ 63$ (224)$ 397$ 423$ 431$ Less: Operating (profit) loss-Other segment(7) (4) 47 (28) (41) (43) Add: Pork segment restructuring and impairment charges21 34 88 - - - Consolidated adjusted EBIT606$ 93$ (89)$ 369$ 382$ 388$

Non-GAAP measure reconciliation (in millions)

TTMFY 11 Q2FY 10FY 09FY 08FY 07FY 06Operating profit-Pork segment566$ 539$ 395$ 449$ 219$ 148$ Add: Pork segment restructuring and impairment charges21 34 88 - - - Pork segment adjusted EBIT587$ 573$ 483$ 449$ 219$ 148$

Non-GAAP measure reconciliation (in millions)

TTMFY 11 Q2FY 10FY 09FY 08FY 07Operating profit-Pork segment566$ 539$ 395$ 449$ 219$ Less: Operating profit-Fresh pork(181) (61) (76) (141) (34) Add: Packaged meats restructuring and impairment charges5 17 67 - - Packaged meats adjusted EBIT390$ 495$ 386$ 308$ 185$

Non-GAAP measure reconciliation (in millions)

TTMFY 11 Q2FY 10FY 09FY 08FY 07Operating profit-Pork segment566$ 539$ 395$ 449$ 219$ Less: Operating profit-Packaged meats(385) (478) (319) (308) (185) Add: Fresh pork restructuring and impairment charges16 17 21 - - Fresh pork adjusted EBIT197$ 78$ 97$ 141$ 34$

The New Era of Smithfield

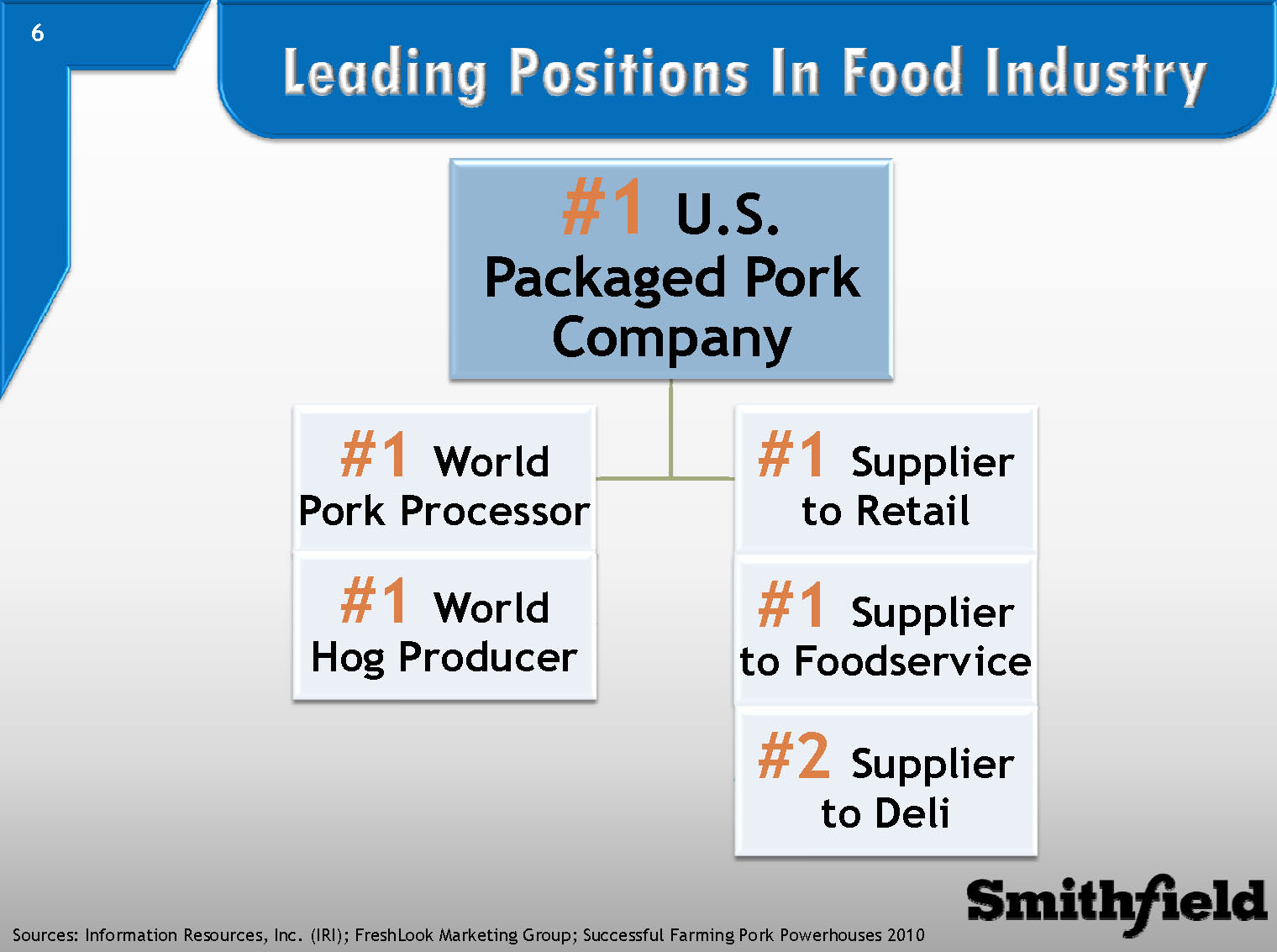

Leading Positions In Food Industry

#1U.S. Packaged Pork Company

#1World Pork Processor

#1World Hog Producer

#1Supplier to Retail

#1Supplier to Foodservice

#2Supplier to Deli

Sources: Information Resources, Inc. (IRI); FreshLook Marketing Group; Successful Farming Pork Powerhouses 2010

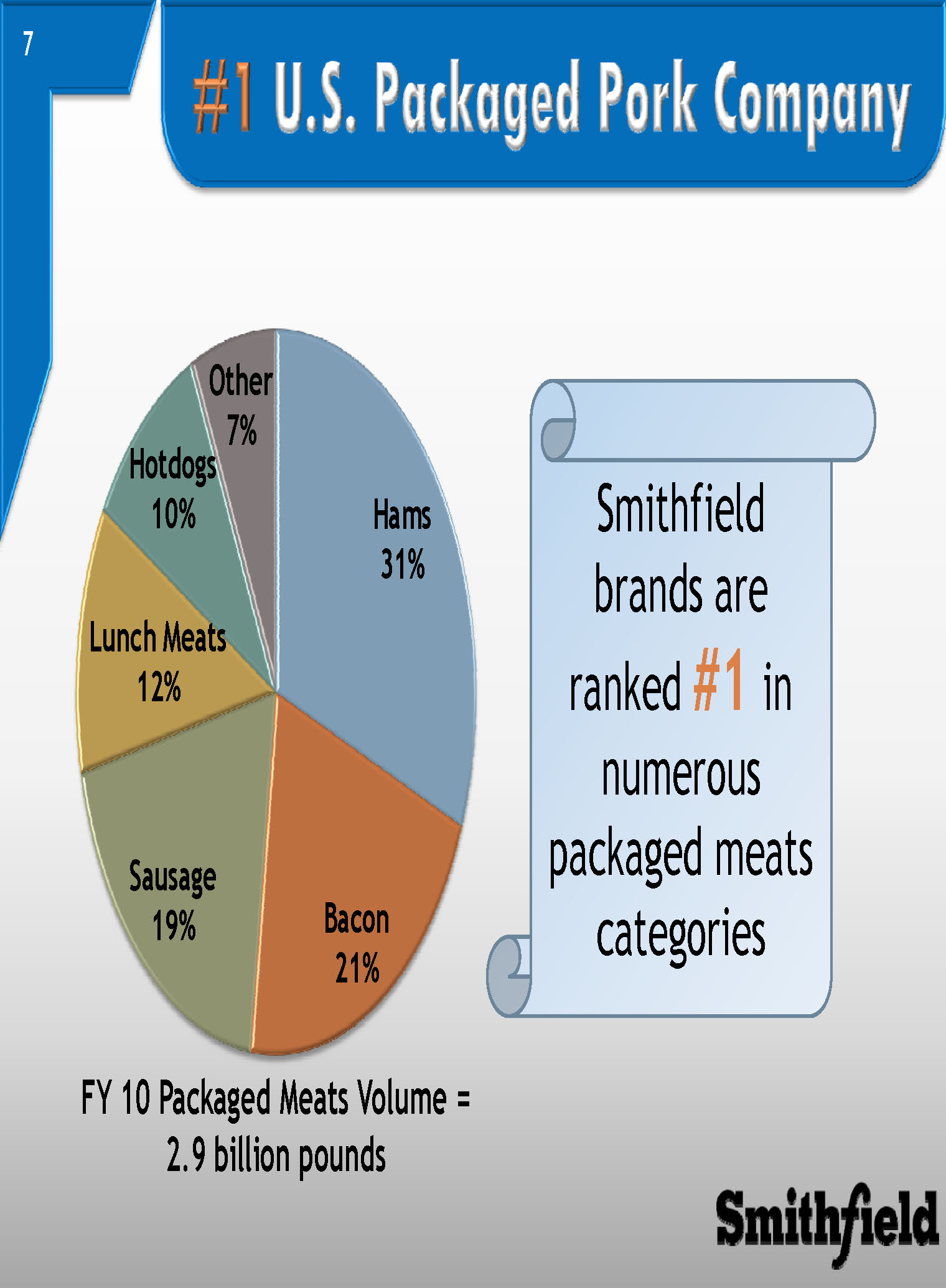

#1 U.S. Packaged Pork Company

Hams 31% Bacon21% Sausage19% Lunch Meats12% Hotdogs10% Other7%

Smithfield brands are ranked #1 in numerous packaged meats categories

FY 10 Packaged Meats Volume = 2.9 billion pounds

The New Era of Smithfield

Driving profitable top and bottom line growth

Competitive cost structure in all operating segments

Closely coordinated sales & marketing platform

Consolidated portfolio of leading consumer brands

Focus on quality and consistent earnings

Conservative balance sheet with focus on ROIC

Competitive Cost Structure

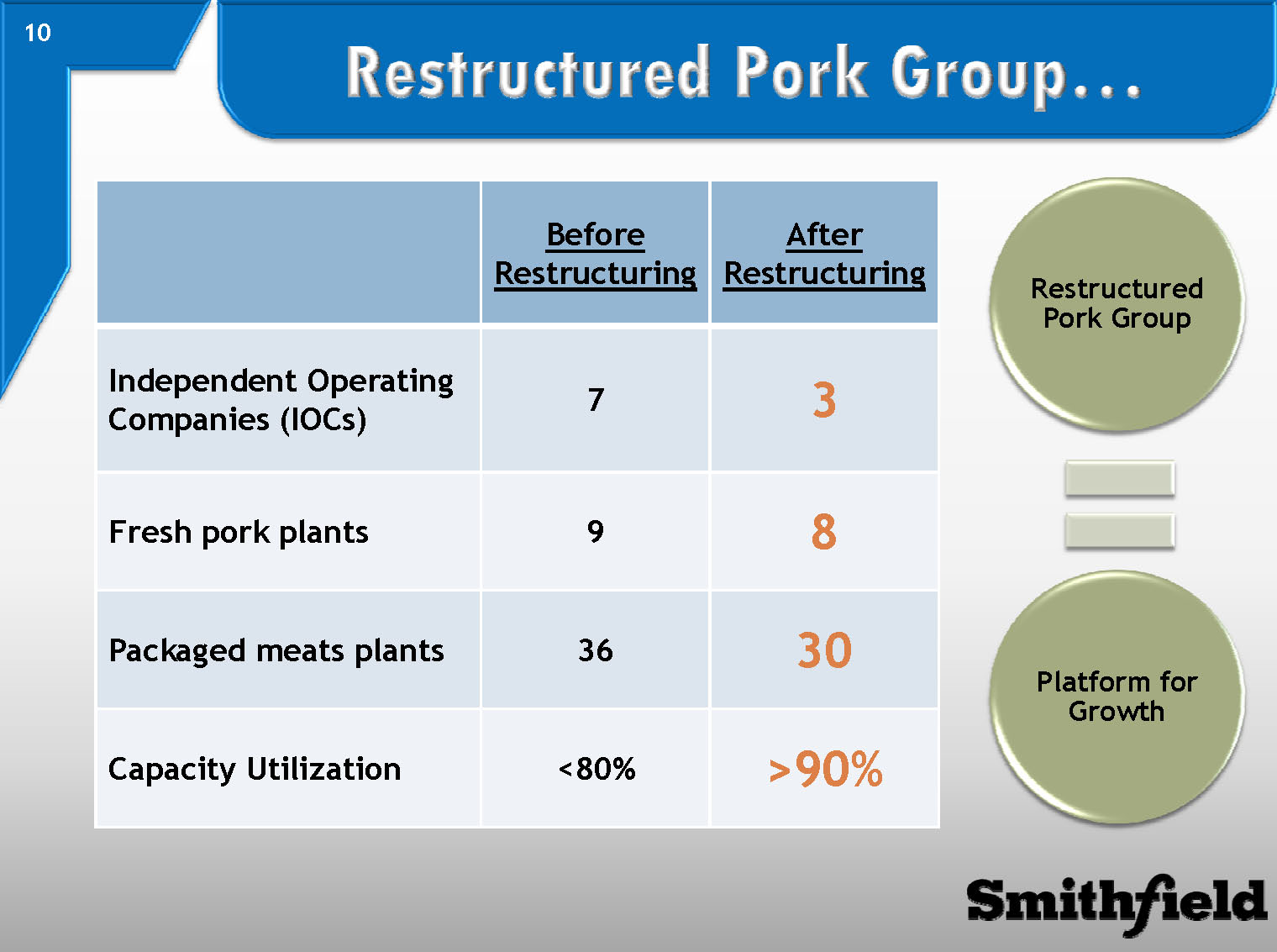

Restructured Pork Group…

Before Restructuring After Restructuring

Independent Operating Companies (IOCs) 7 3

Fresh pork plants 9 8

Packaged meats plants 36 30

Capacity Utilization <80% >90%

Restructured Pork Group = Platform for Growth

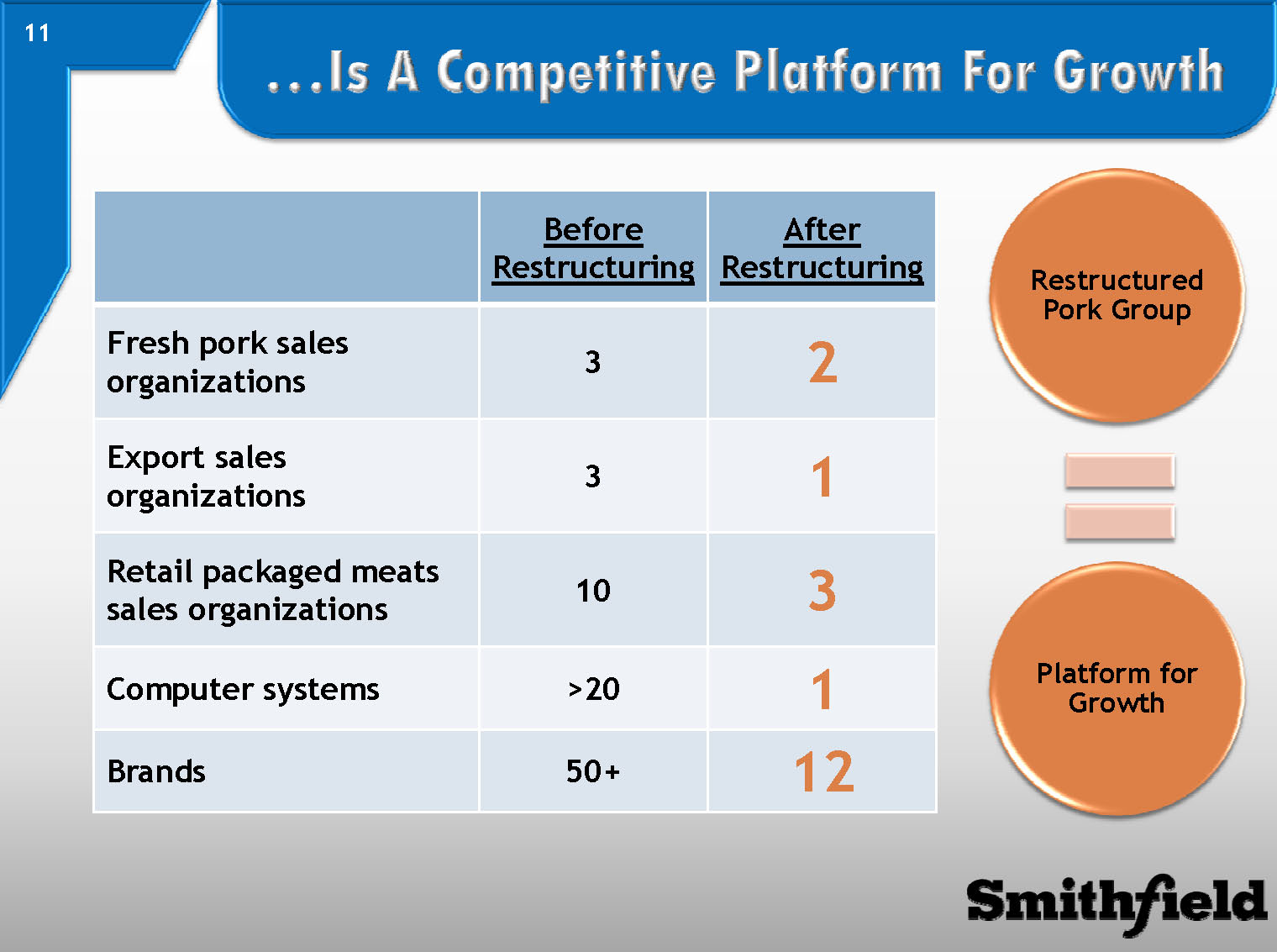

…Is A Competitive Platform For Growth

Before Restructuring After Restructuring

Fresh pork sales organizations 3 2

Export sales organizations 3 1

Retail packaged meats sales organizations 10 3

Computer systems >20 1

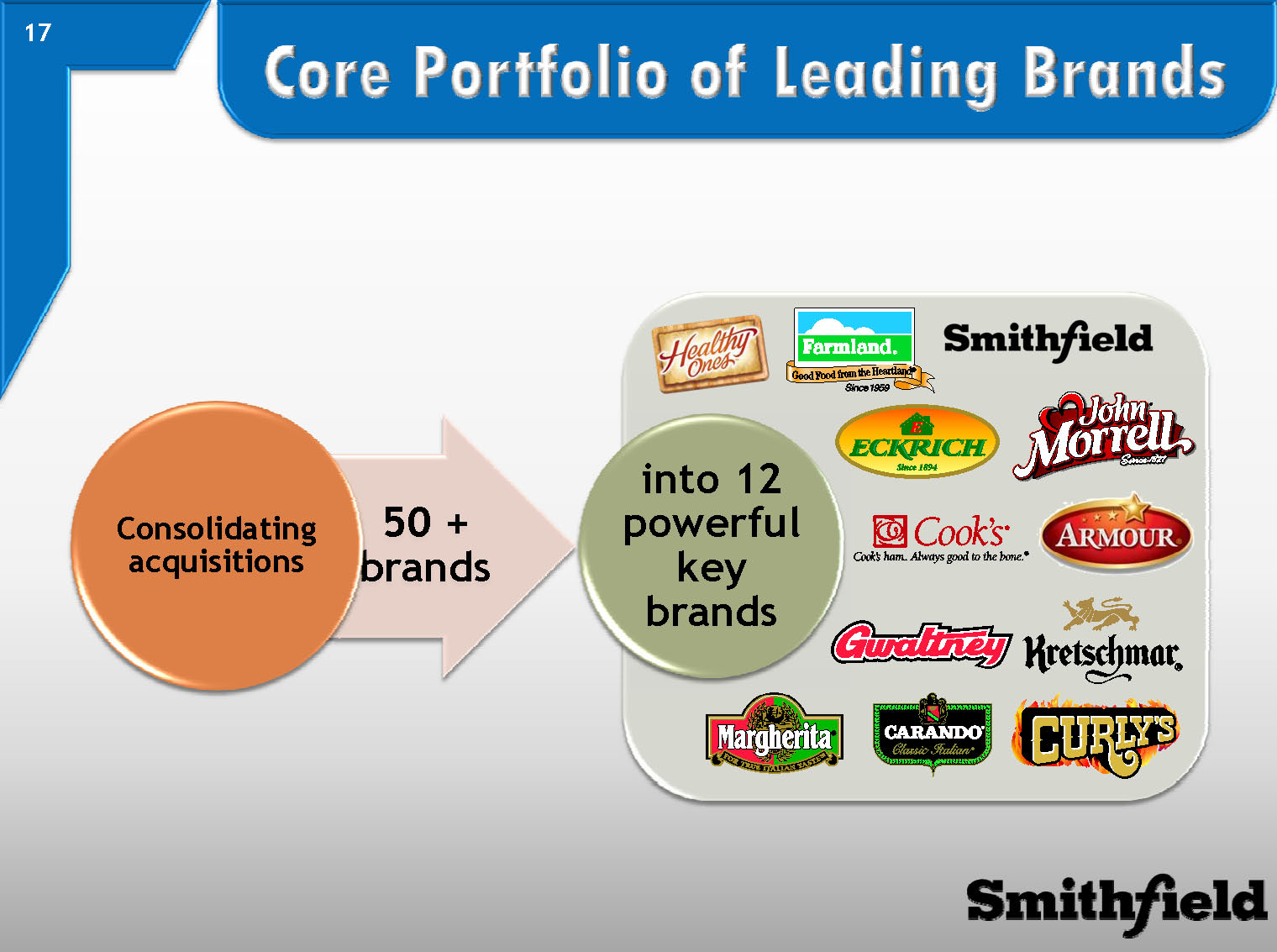

Brands 50+ 12

Restructured Pork Group = Platform for Growth

Hog Production Cost Savings Initiative

oPhilosophy –Least cost is only competitively sustainable position

oPlan –Improve operating efficiencies, productivity, competitive cost structure and profitability

oBenefits –Fully achieved by end of three-year period

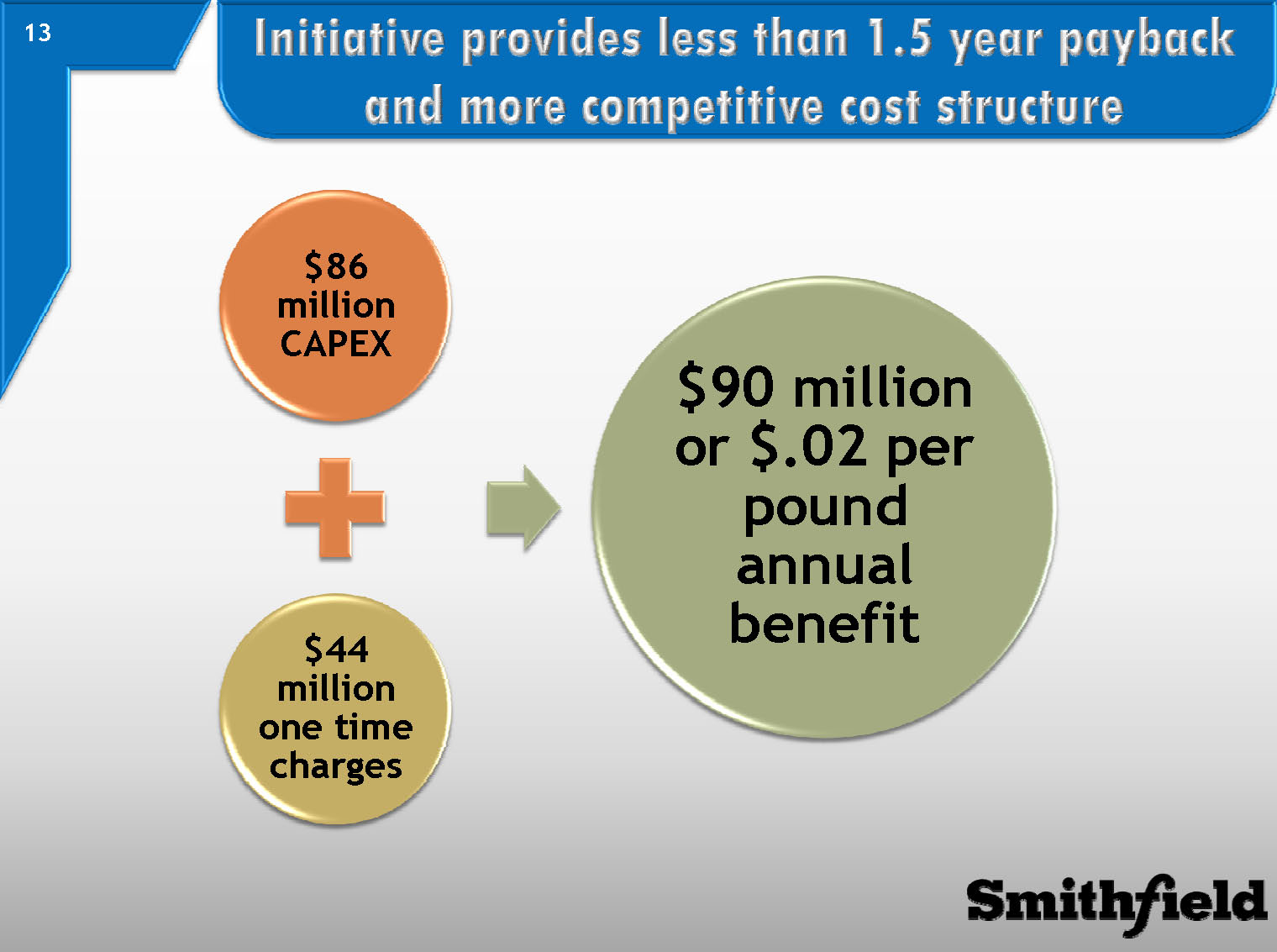

Initiative provides less than 1.5 year payback and more competitive cost structure

$86 million CAPEX

$44 million one time charges

$90 million or $.02 per pound annual benefit

Sales & Marketing Platform

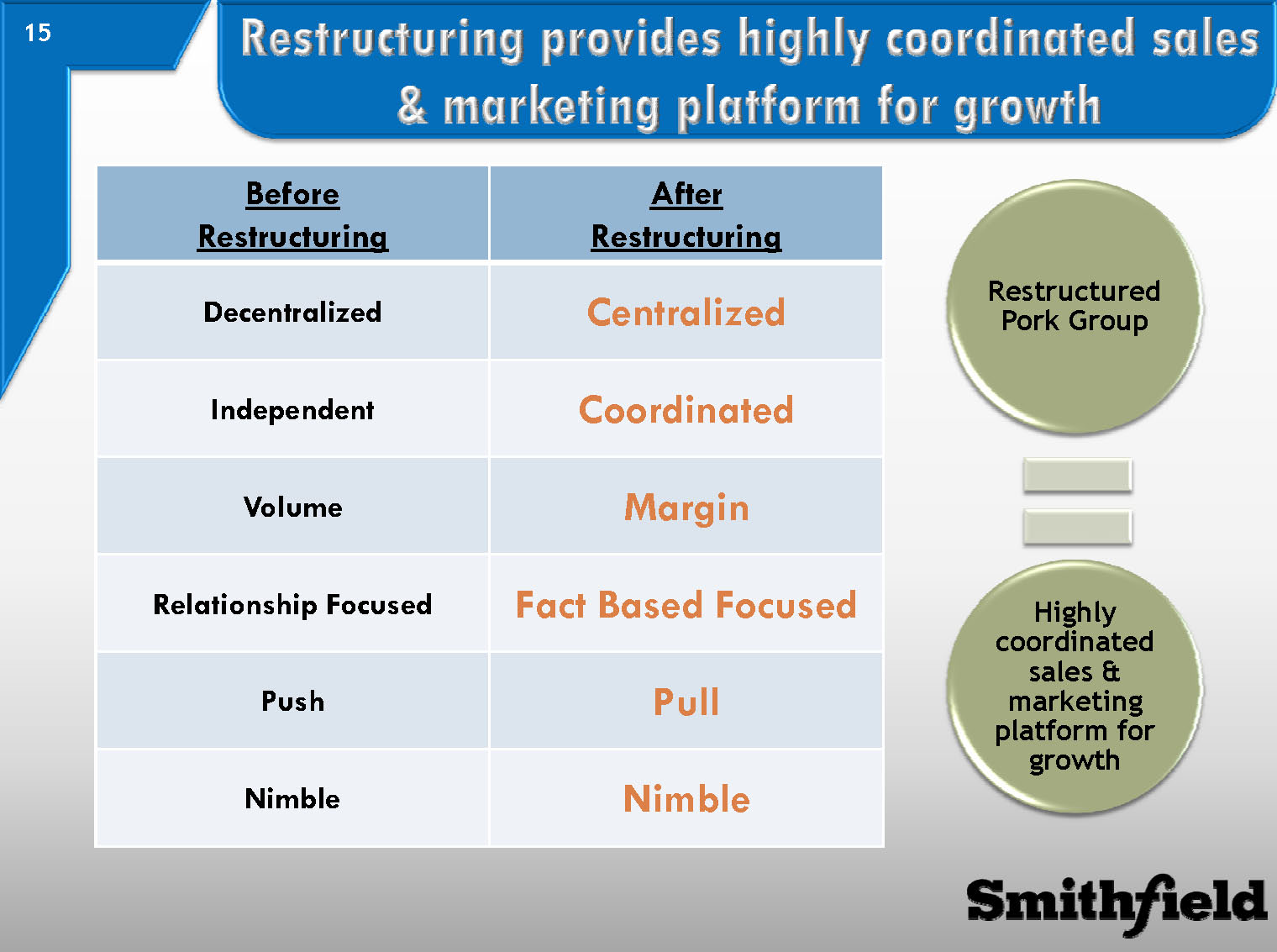

Restructuring provides highly coordinated sales & marketing platform for growth

Restructured Pork Group = Highly coordinated sales & marketing platform for growth

Before Restructuring After Restructuring

Decentralized Centralized

Independent Coordinated

Volume Margin

Relationship Focused Fact Based Focused

Push Pull

Nimble Nimble

Leading Consumer Brands

Core Portfolio of Leading Brands

50 + brands Consolidating acquisitions into 12 powerful key brands

Quality and Consistent Earnings

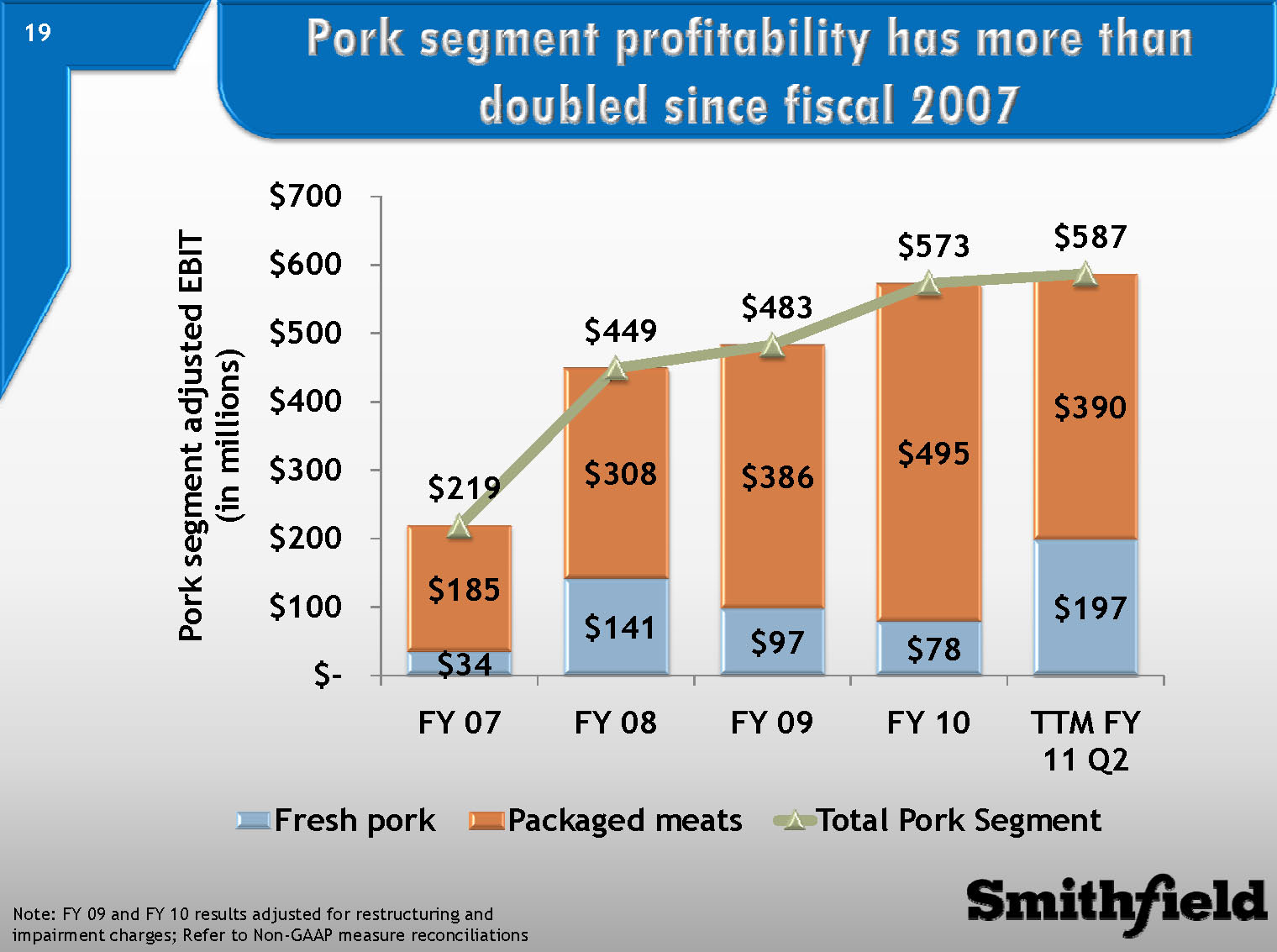

Pork segment profitability has more than doubled since fiscal 2007

Note: FY 09 and FY 10 results adjusted for restructuring and impairment charges; Refer to Non-GAAP measure reconciliations

Pork segment adjusted EBIT (in millions) Fresh pork Packaged meats Total Pork Segment

FY 07 $34 $185 $219

FY 08 $141 $308 $449

FY 09 $97 $386 $483

FY 10 $78 $495 $573

TTM FY 11 Q2 $197 $390 $587

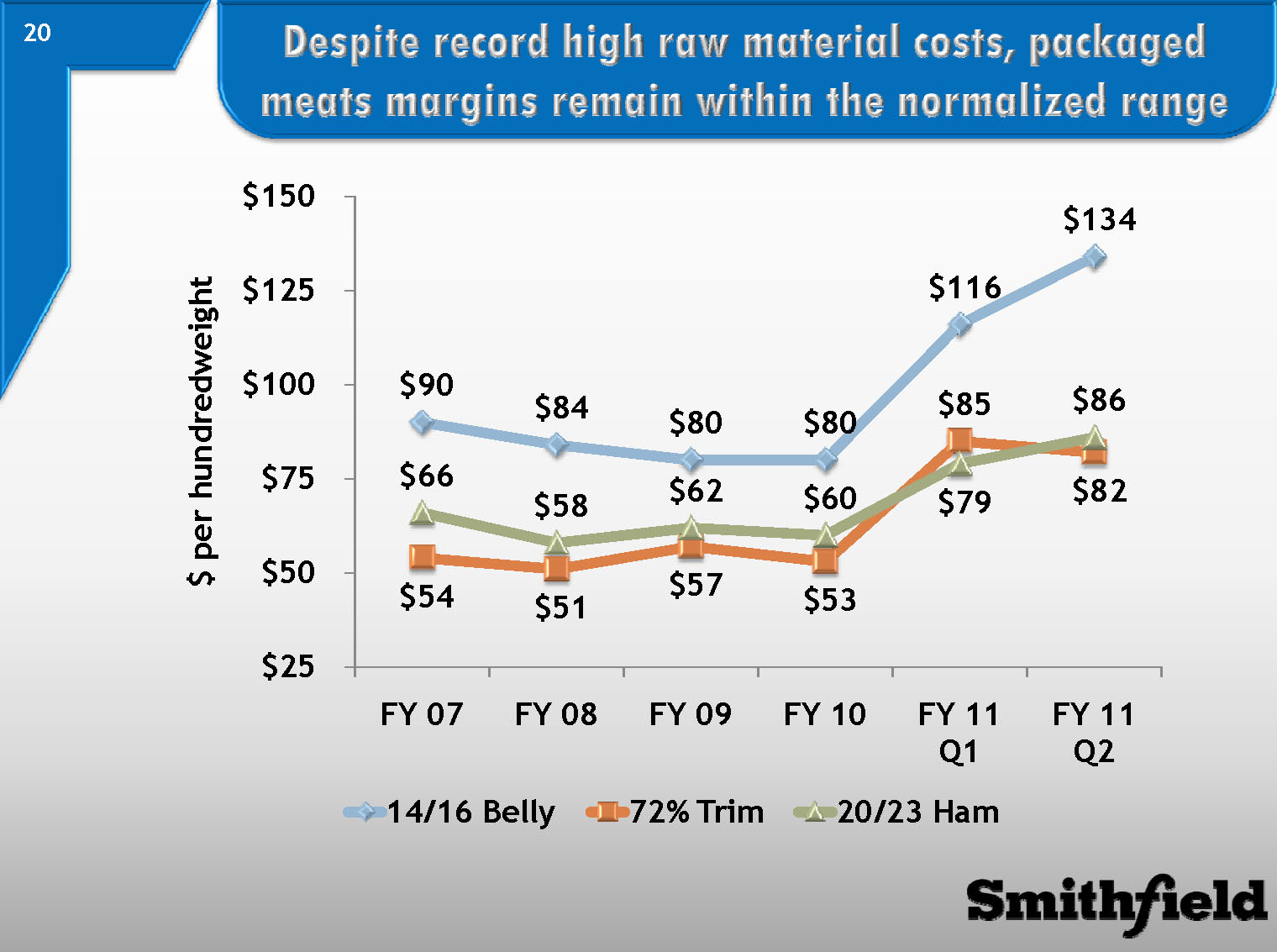

Despite record high raw material costs, packaged meats margins remain within the normalized range

$ per hundredweight 14/16 Belly 72% Trim 20/23 Ham

FY 07 $90 $54 $66

FY 08 $84 $51 $58

FY 09 $80 $57 $62

FY 10 $80 $53 $60

FY 11 Q1 $116 $85 $79

FY 11 Q2 $134 $82 $86

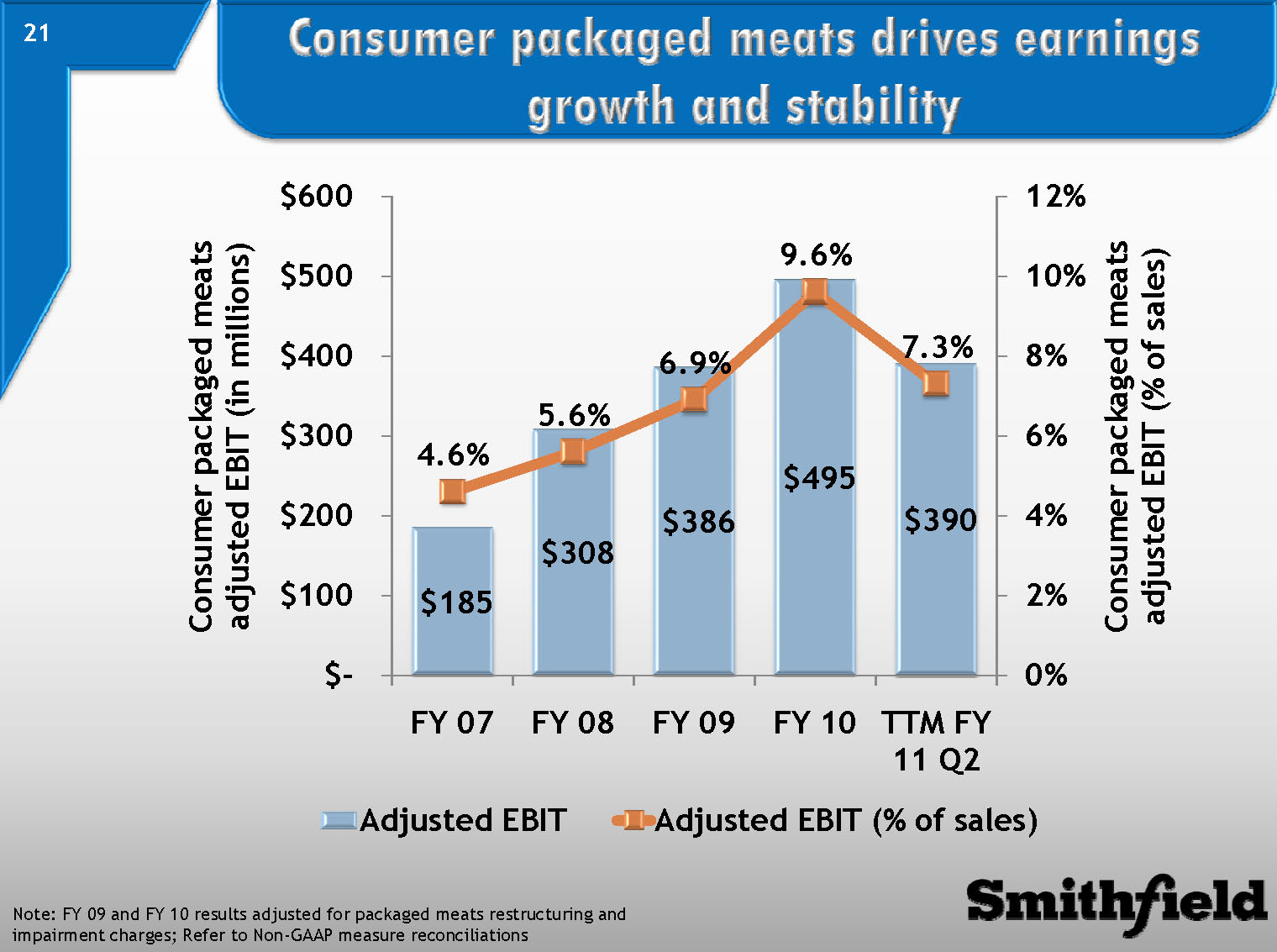

Consumer packaged meats drives earnings growth and stability

Note: FY 09 and FY 10 results adjusted for packaged meats restructuring and impairment charges; Refer to Non-GAAP measure reconciliations

Consumer packaged meats adjusted EBIT (in millions) Consumer packaged meats adjusted EBIT (% of sales)

FY 07 $185 4.6%

FY 08 $308 5.6%

FY 09 $386 6.9%

FY 10 $495 9.6%

TTM FY 11 Q2 $390 7.3%

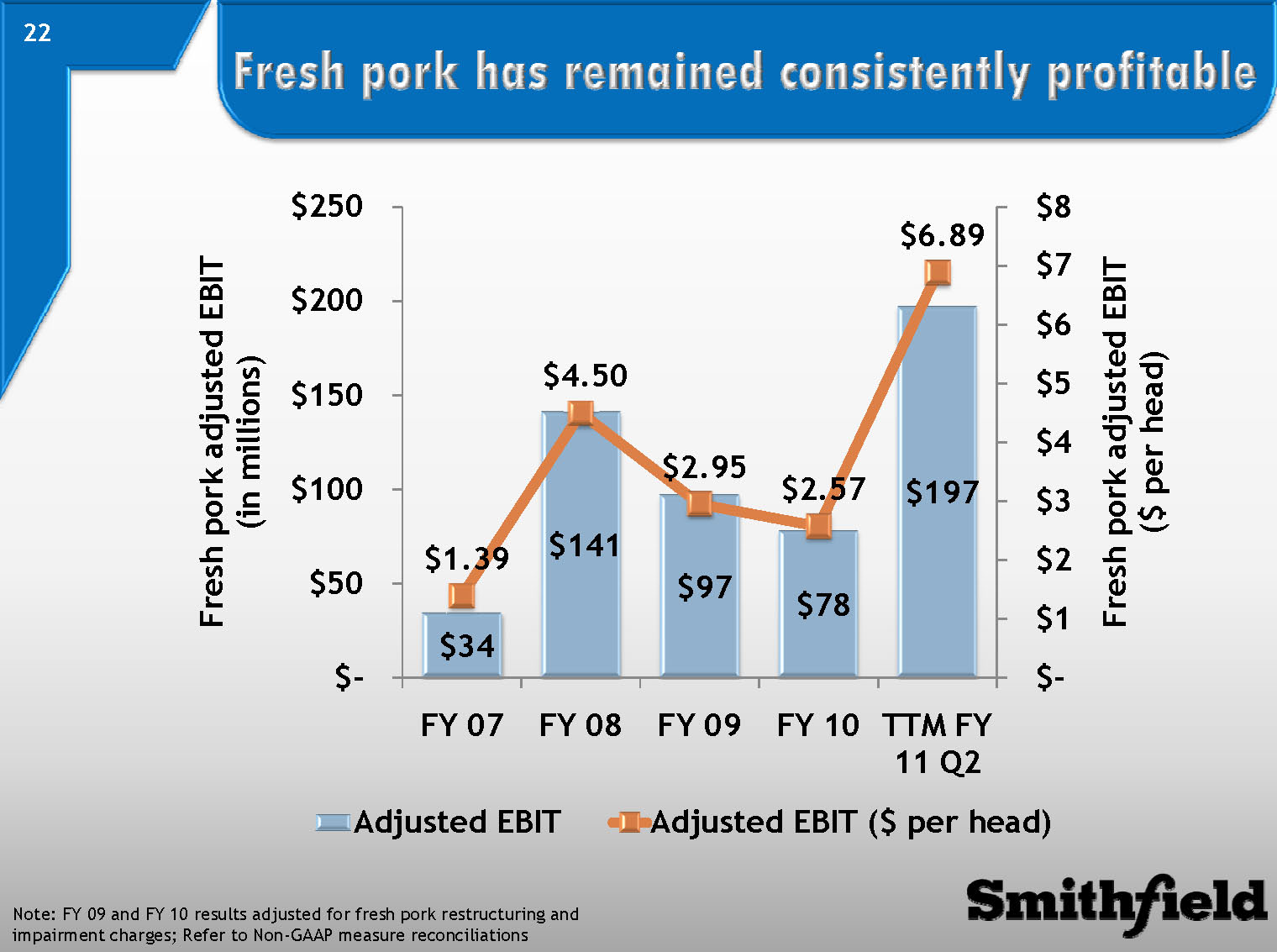

Fresh pork has remained consistently profitable

Note: FY 09 and FY 10 results adjusted for fresh pork restructuring and impairment charges; Refer to Non-GAAP measu re reconciliations

Fresh pork adjusted EBIT(in millions) Fresh pork adjusted EBIT($ per head)

FY 07 $34 $1.39

FY 08 $141 $4.50

FY 09 $97 $2.95

FY 10 $78 $2.57

TTM FY 11 Q2 $197 $6.89

;

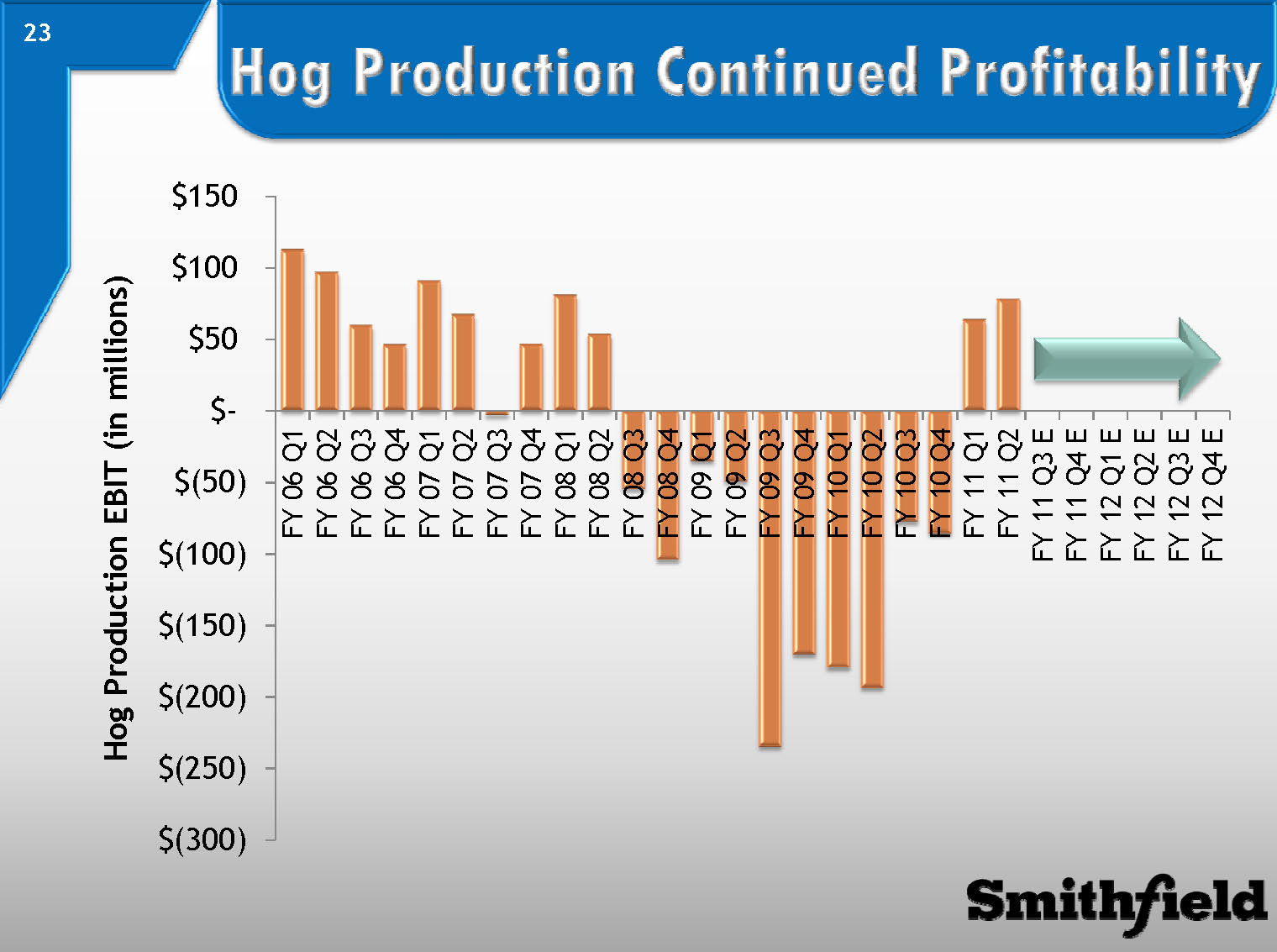

Hog Production Continued Profitability

Hog Production EBIT (in millions)

Conservative Balance Sheet with Focus on ROIC

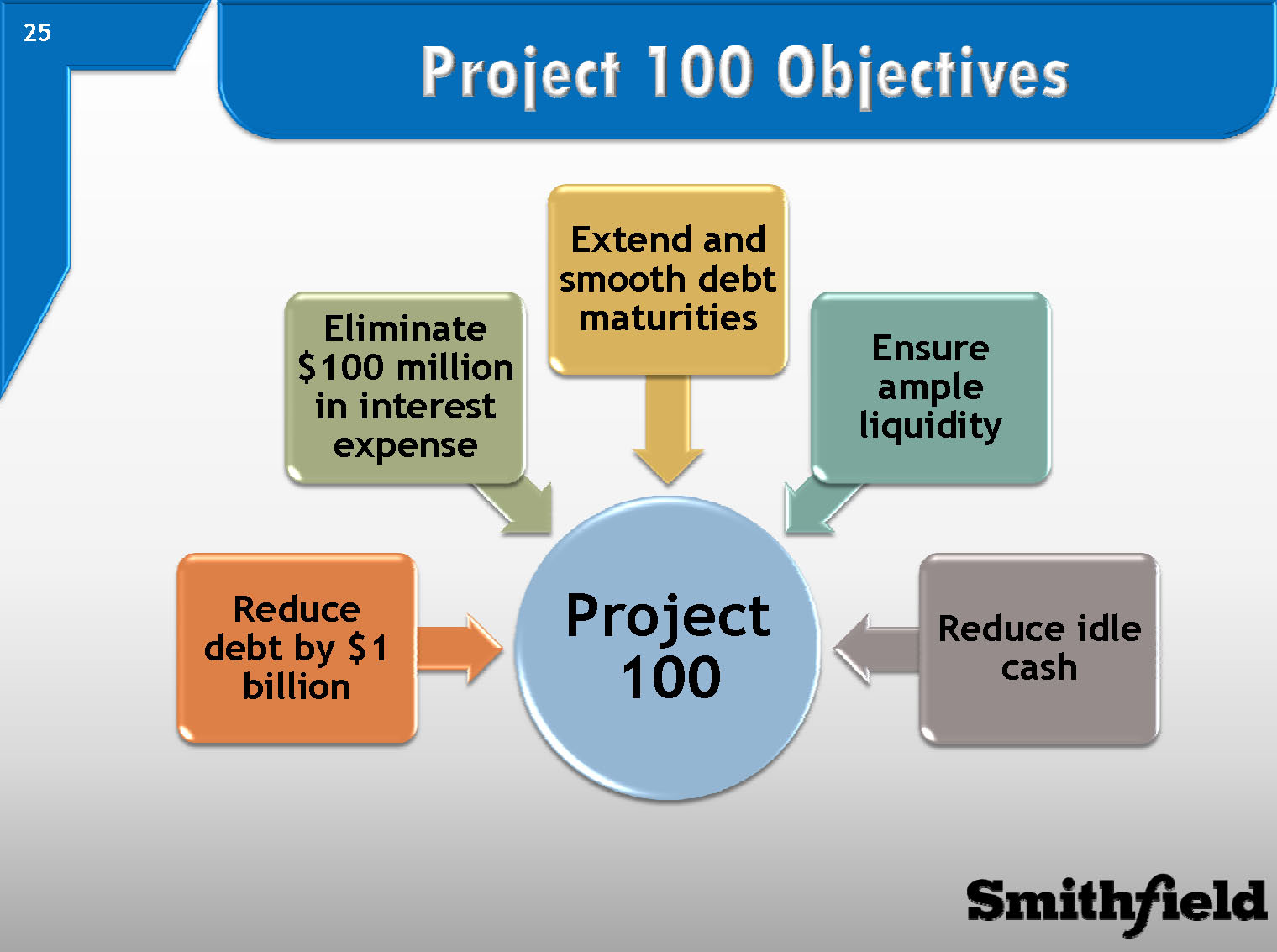

Project 100 Objectives

Project 100 Reduce debt by $1 billion Eliminate $100 million in interest exp ense Extend and smooth debt maturities Ensure ample liquidity Reduce idle cash

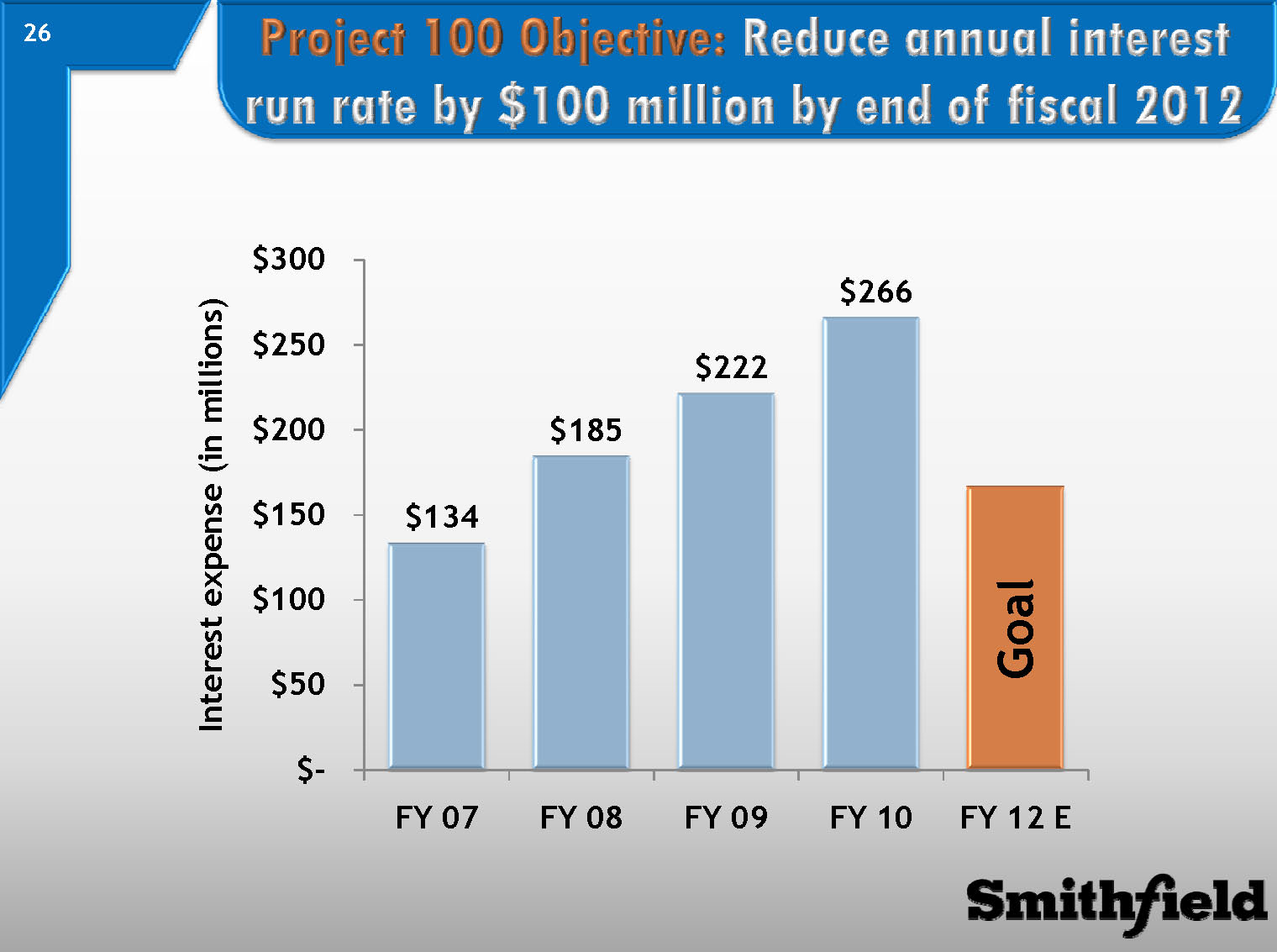

Project 100 Objective: Reduce annual interest run rate by $100 million by end of fiscal 2012

Interest expense (in millions)

FY 07 $134

FY 08 $185

FY 09 $222

FY 10 $266

FY 12 E Goal

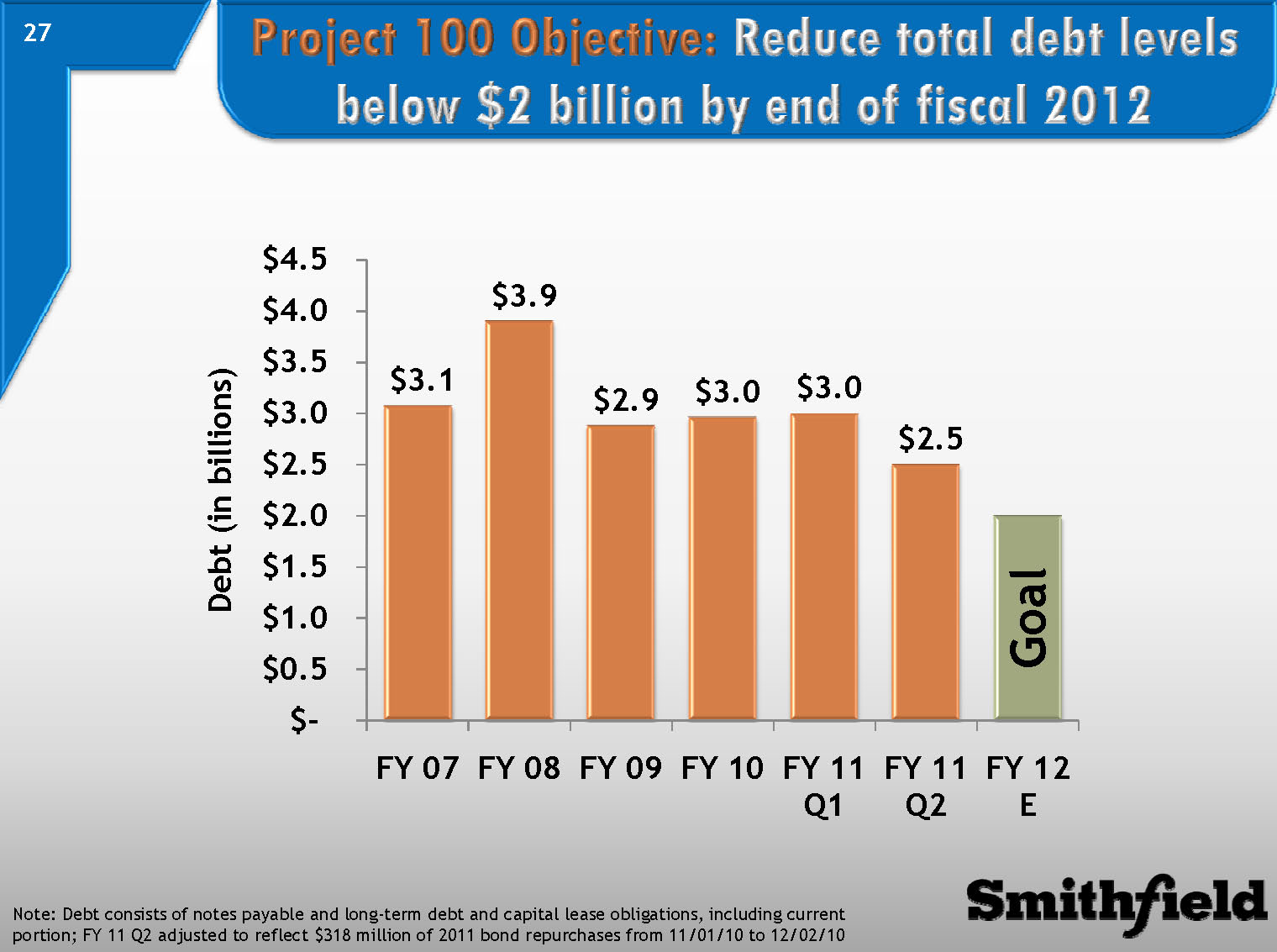

Project 100 Objective: Reduce total debt levels below $2 billion by end of fiscal 2012

Note: Debt consists of notes payable and l ong-term debt and capital lease obligations, including current

portion; FY 11 Q2 adjusted to reflect $318 million of 2011 bond repurchases from 11/01/10 to 12/02/10

Debt (in billions)

FY 07 $3.1

FY 08 $3.9

FY 09 $2.9

FY 10 $3.0

FY 11 $3.0

Q1 FY 11 $2.5

Q2 FY 12 E Goal

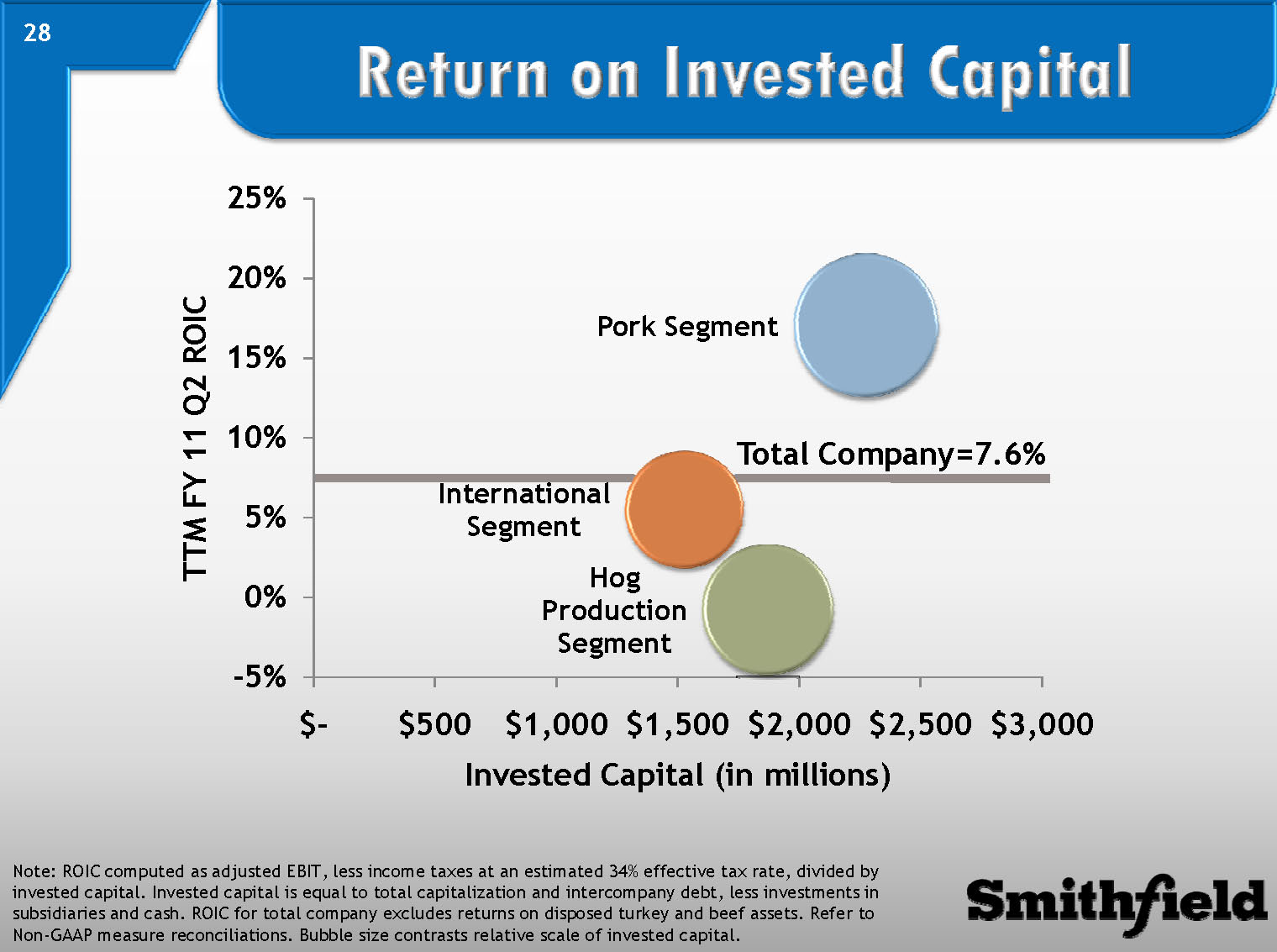

Return on Invested Capital

Note: ROIC computed as adjusted EBIT, less income taxes at an estimated 34% effective tax rate, divided by

invested capital. Invested capital is equal to total capitalization and intercompany debt, less investments in

subsidiaries and cash. ROIC for total company excludes returns on disposed turkey and beef assets. Refer to

Non-GAAP measure reconciliations. Bubble size contrasts relative scale of invested capital.

TTM FY 11 Q2 ROIC Invested Capital (in millions)

Total Company=7.6%

Pork Segment International SegmentHog Production Segment

Market Dynamics

Fundamentals Remain Strong

oFresh pork margins remain robust

oExport demand strong

oPork cold storage levels relatively flat

Company expects profitability in Hog Production segment in fiscal 2011 and beyond

oRaising costs in the mid-$50’s per hundredweight in fiscal 2011, despite higher grain prices

oTotal breeding herd historically low

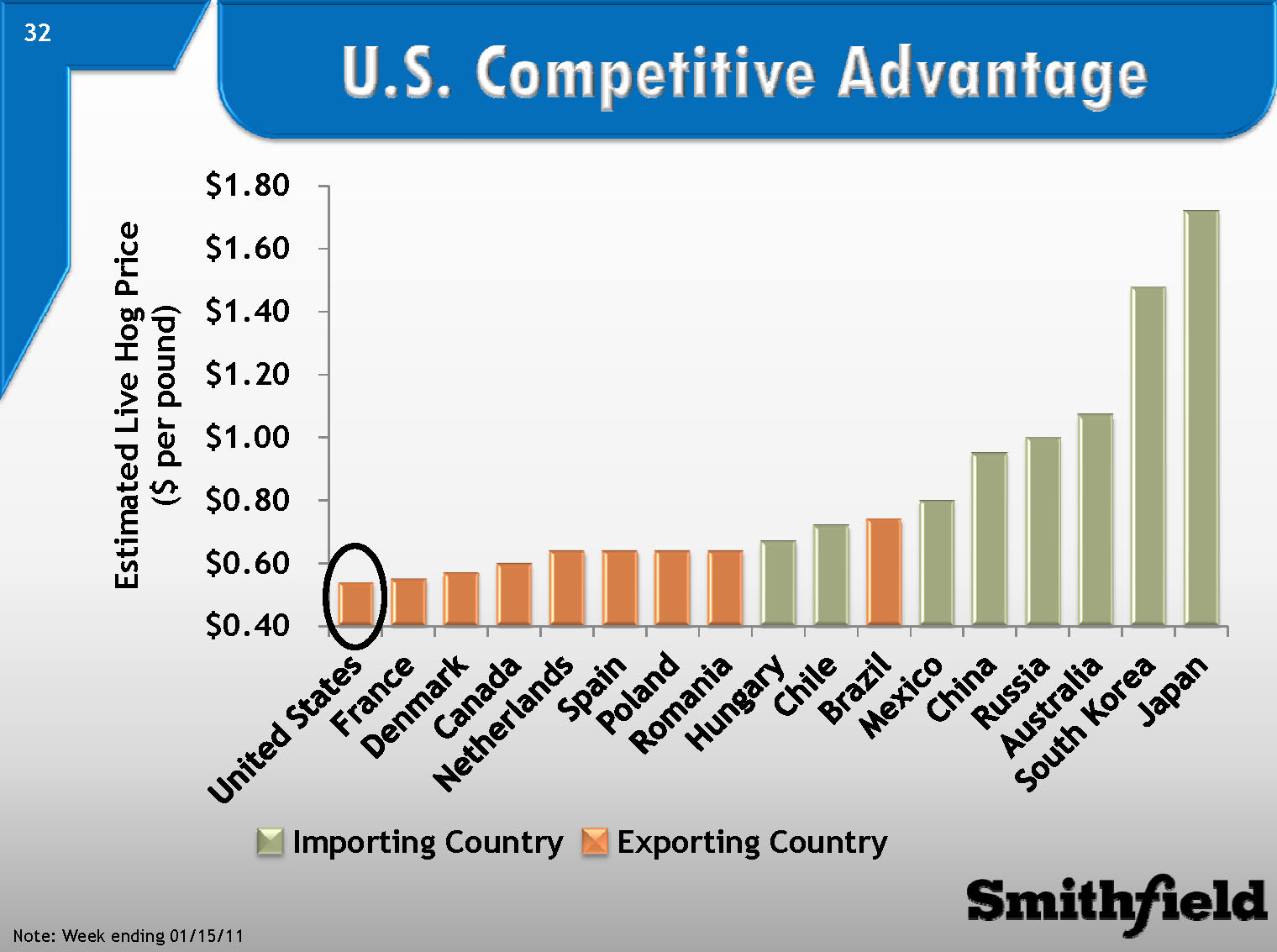

U.S. Is Most Competitive Exporter

U.S. Competitive Advantage

Note: Week ending 01/15/11

Estimated Live Hog Price ($ per pound)

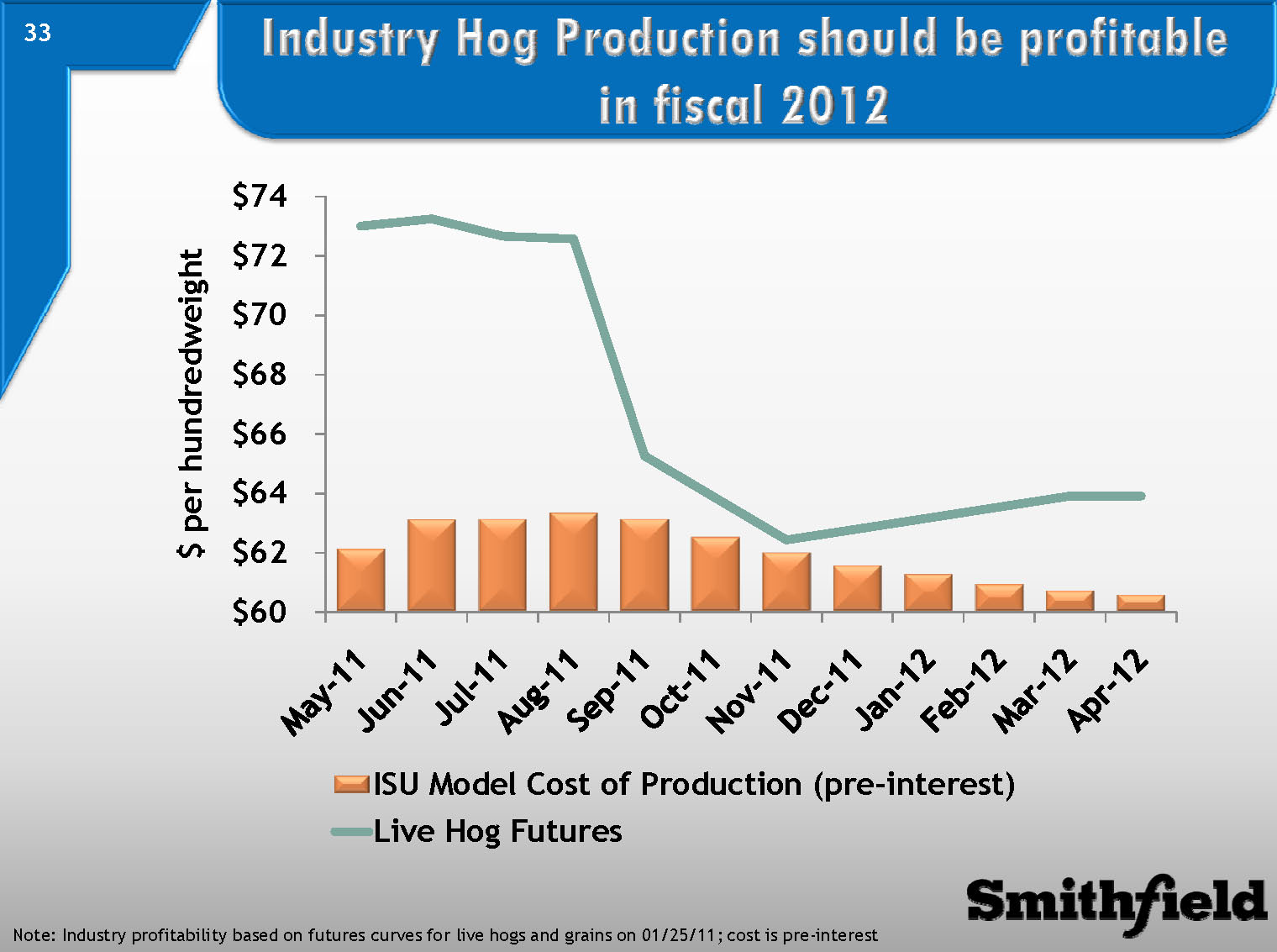

Industry Hog Production should be profitable in fiscal 2012

$ per hundredweightISU Model Cost of Production (pre-interest)

Note: Industry profitability based on futures curves for live hogs and grains on 01/25/11; cost is pre-interest

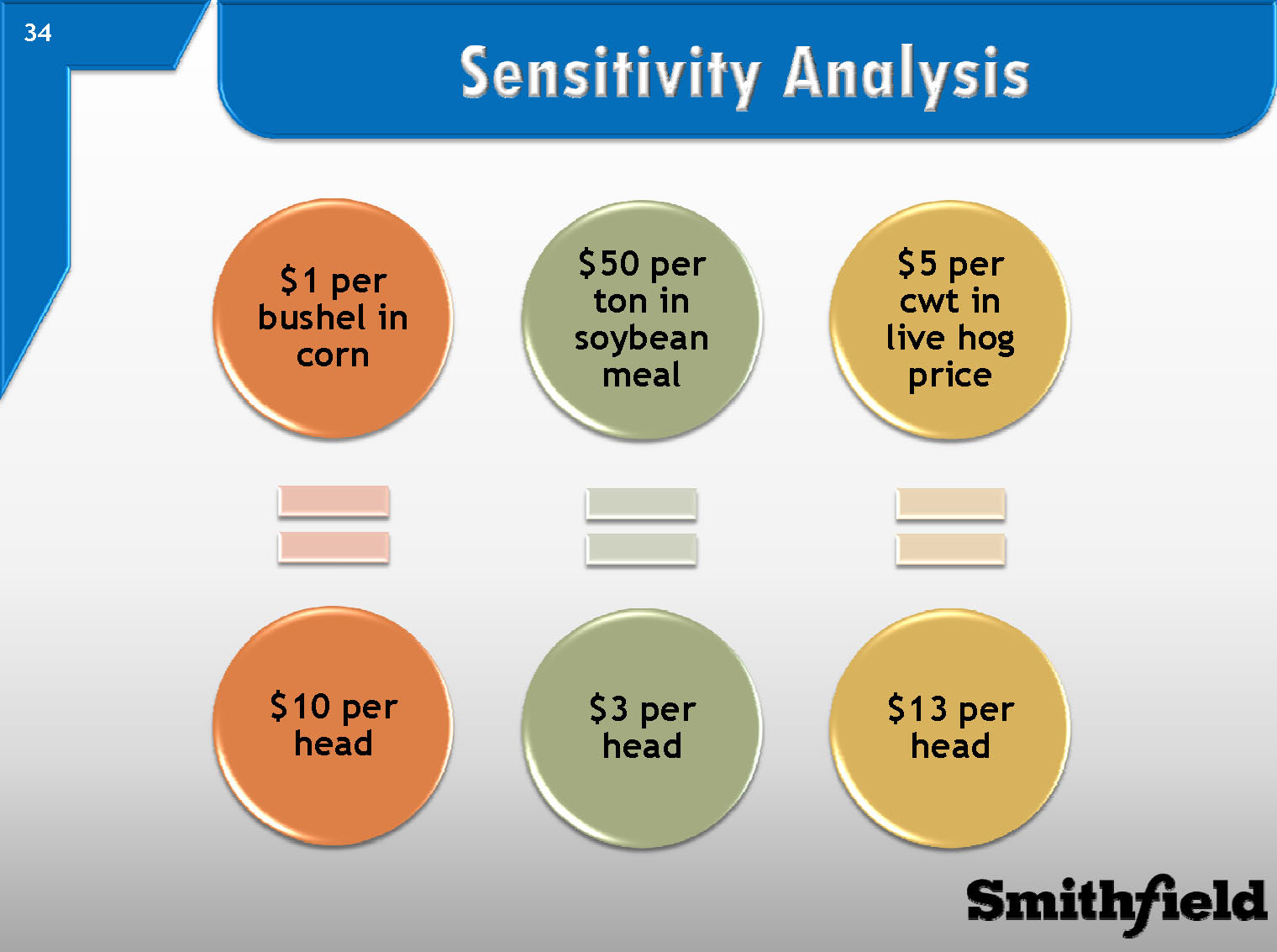

Sensitivity Analysis

$1 per bushel in corn = $10 per head

$50 per ton in soybean meal = $3 per head

$5 per cwt in live hog price = $13 per head

Conclusion

Conclusion

oThis is a New Era for Smithfield Foods

oSmithfield evolving to a Consumer Packaged Meat company

oRestructured Pork Segment has highly competitive cost structure driving profitability

oSales and marketing coordinated across all trade channels with focus on consolidated brand portfolio

oHog Production Cost Savings Init iative will improve cost structure by $90 million annually

oSmithfield continues to improve conservative balance sheet with focus on ROIC

Smithfield has growth opportunities in all business segments

Questions?

Appendix

#1 World Pork Processor

Smithfield31% Tyson19%JBS11%Excel9%Hormel7%Other23%(% of U.S. hogs processed)

TTMFY 11 Q2 Fresh Pork Packaged Meats Sales $4.4 billion $5.3 billion Volume 29 million hogs 2.8 billion pounds Operating Profit $181.2 million $385.0 million Normalized EBIT Range $3-7 per head 10 to 14 cents per pound

Note: TTM FY 11 Q2 sales (before inter-segment eliminations), volume and operating profit Source: United States Industry Data Successful Farming

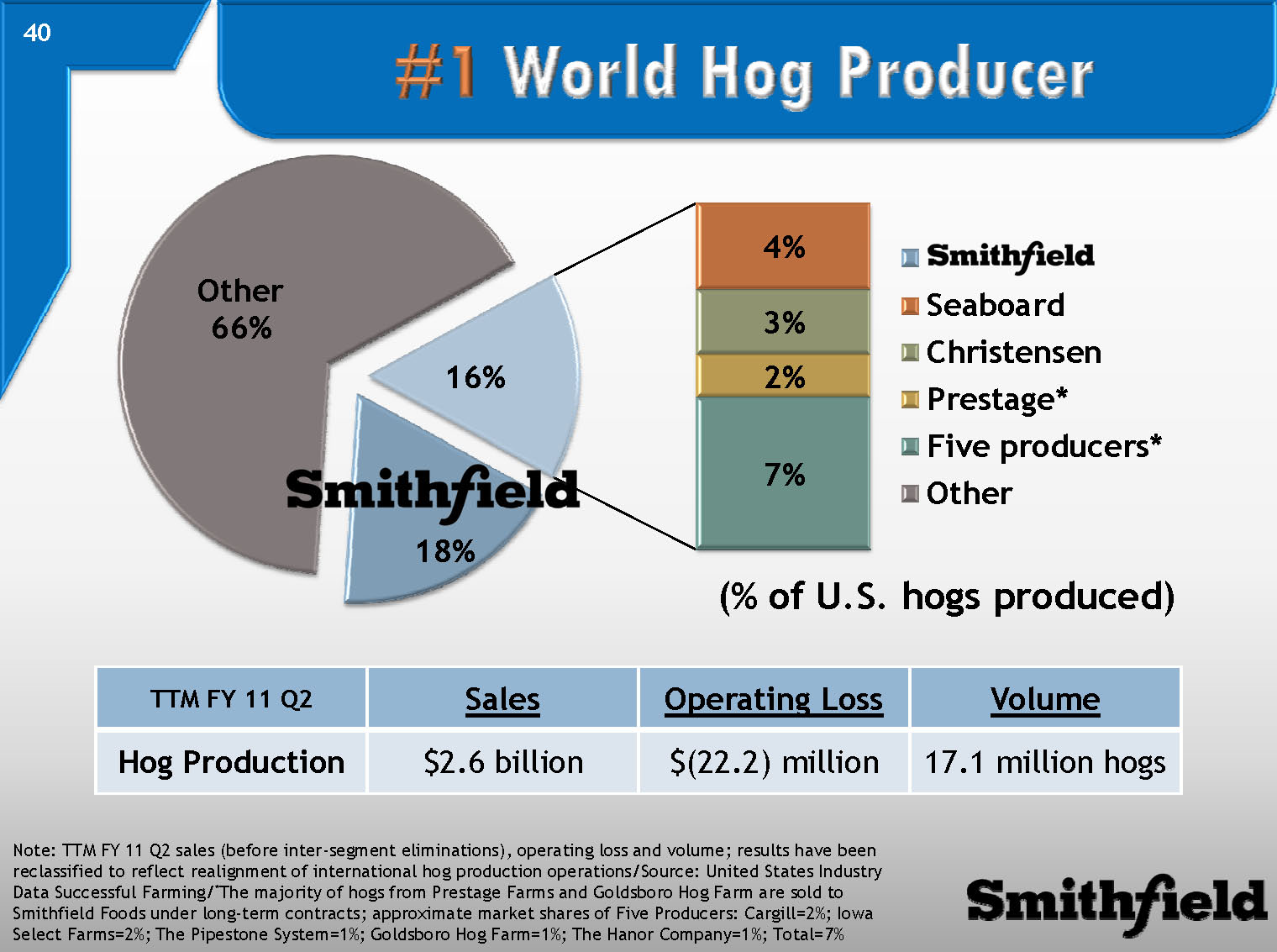

#1 World Hog Producer

(% of U.S. hogs produced) Other66%Smithfield18%Five producers*7%Seaboard4%Christensen3%Prestage*2%

TTMFY 11 Q2 Sales Operating Loss Volume HogProduction $2.6 billion $(22.2) million 17.1 million hogs

Note: TTM FY 11 Q2 sales (before inter-segment eliminations), operating loss and volume; results have been reclassified to reflect realignment of international hog production operations/Source: United States Industry Data Successful Farming/*The majority of hogs from Prestage Farms and Goldsboro Hog Farm are sold to Smithfield Foods under long-term contracts; approximate market shares of Five Producers: Cargill=2%; Iowa Select Farms=2%; The Pipestone System=1%; Goldsboro Hog Farm=1%; The HanorCompany=1%; Total=7%

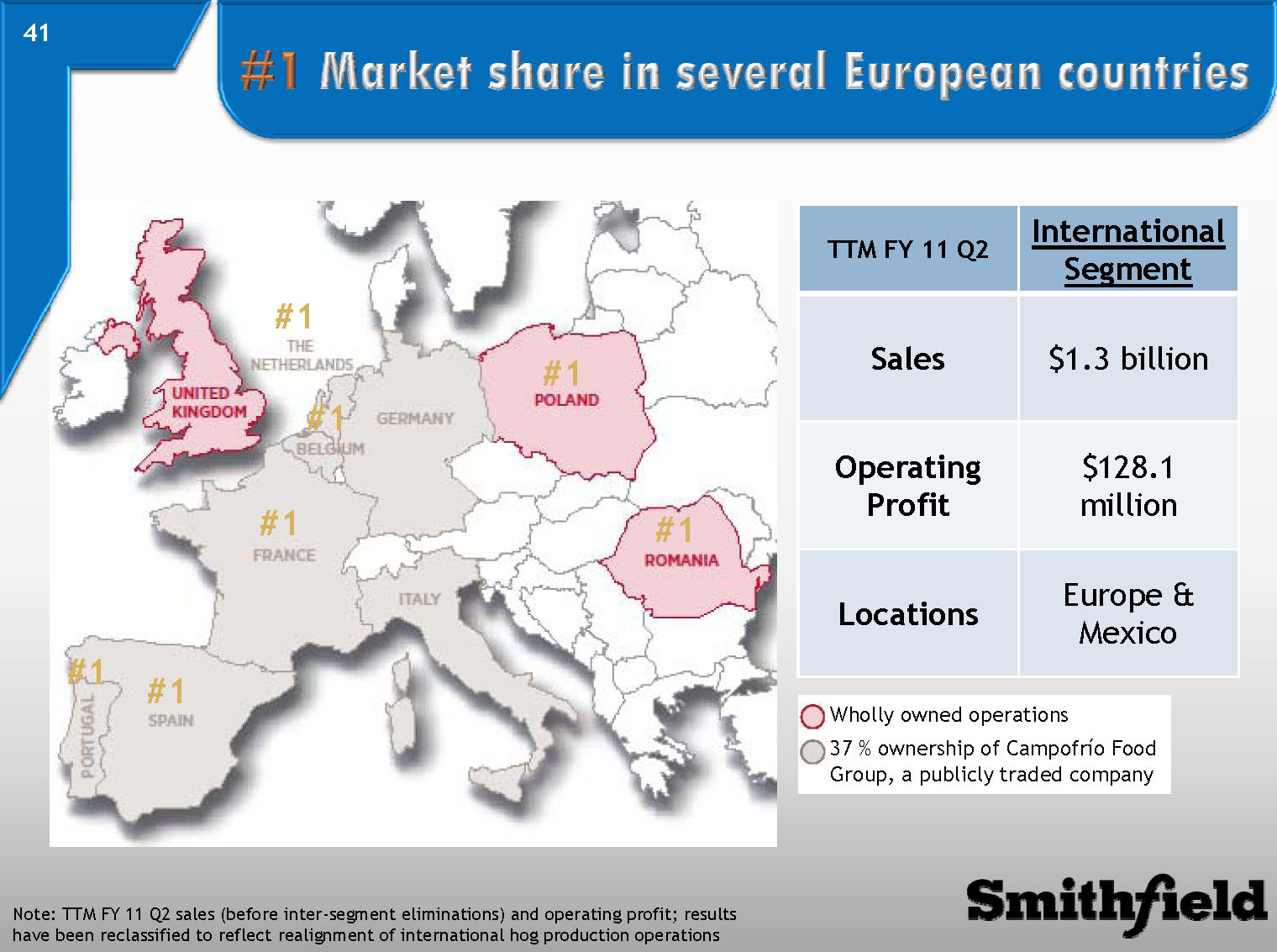

#1 Market share in several European countries

TTMFY 11 Q2 International Segment Sales $1.3billion Operating Profit $128.1 million Locations Europe & Mexico

Note: TTM FY 11 Q2 sales (before inter-segment eliminations) and operating profit; results have been reclassified to reflect realignment of international hog production operations

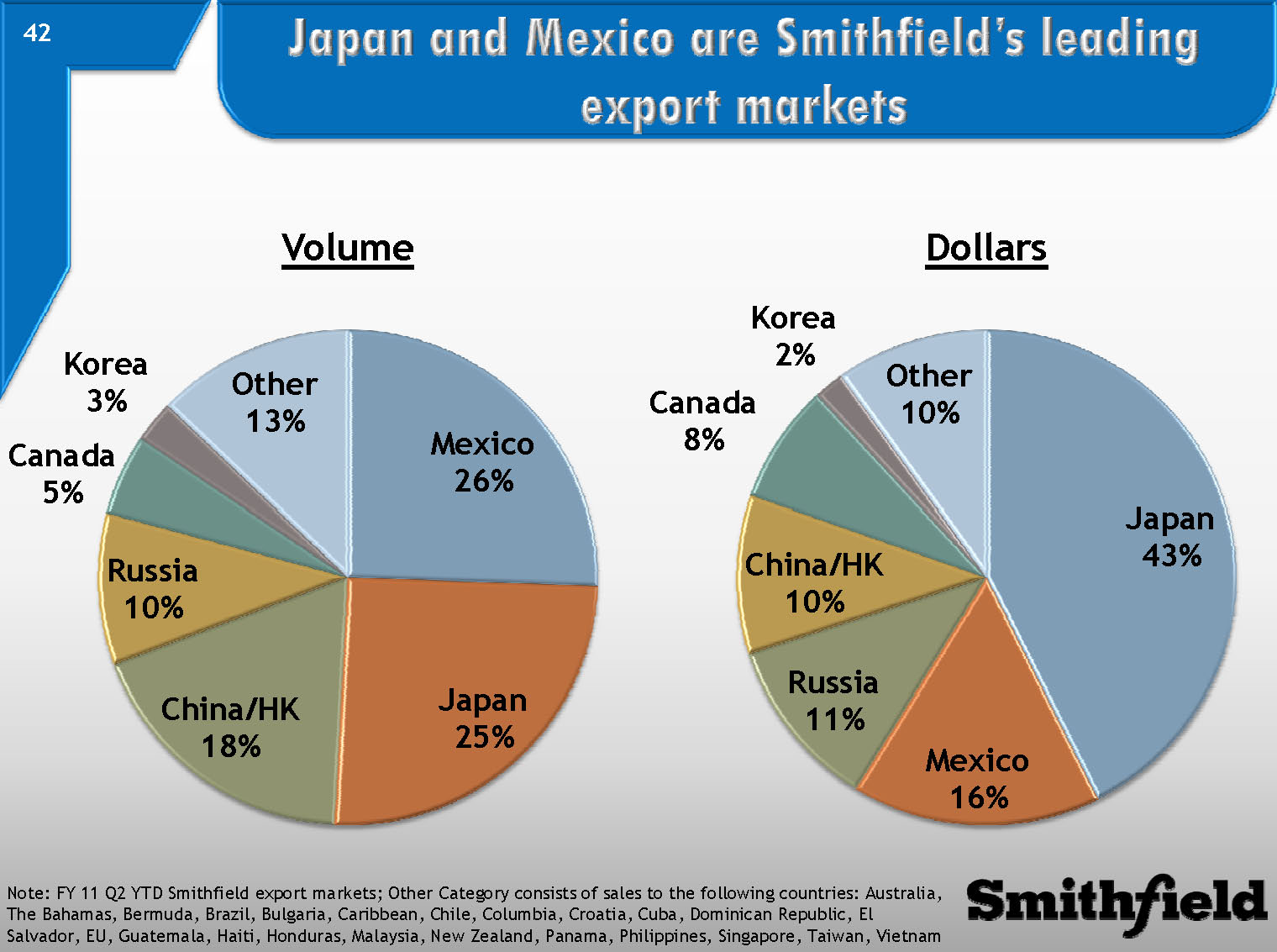

Japan and Mexico are Smithfield’s leading export markets

Volume Mexico26% Japan25% China/HK18% Russia10% Canada5% Korea3% Other13% DollarsJapan43% Mexico16% Russia11% China/HK10% Canada8% Korea2% Other10%

Note: FY 11 Q2 YTD Smithfield export markets; Other Category consists of sales to the following countries: A ustralia, The Bahamas, Bermuda, Brazil, Bulgaria, Caribbean, Chile, Columbia, Croatia, Cuba, Dominican Republic, El Salvador, EU, Guatemala, Haiti, Honduras, Malaysia, New Zealand, Panama, Philippines, Singapore, Taiwan, Vietnam

Smithfield Foods, Inc.