Addressing Investors’

Frequently Asked Questions

C. Larry Pope

President and Chief Executive Officer

Robert W. Manly

Executive Vice President and Chief Financial Officer

Forward-Looking Statements

This presentation contains “forward-looking” statements within the meaning of the federal securities laws. The

forward-looking statements include statements concerning the Company’s outlook for the future, as well as other

statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning

matters that are not historical facts. The Company’s forward-looking information and statements are subject to

risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by,

the statements. These risks and uncertainties include the availability and prices of live hogs, raw materials, fuel

and supplies, food safety, livestock disease, live hog production costs, product pricing, the competitive

environment and related market conditions, risks associated with our indebtedness, including cost increases due

to rising interest rates or changes in debt ratings or outlook, hedging risk, operating efficiencies, changes in

foreign currency exchange rates, access to capital, the cost of compliance with changes to regulations and laws,

including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational,

health and safety laws, adverse results from on-going litigation, actions of domestic and foreign governments,

labor relations issues, credit exposure to large customers, the ability to make effective acquisitions and

dispositions and successfully integrate newly acquired businesses into existing operations, the Company’s ability

to effectively restructure portions of its operations and achieve cost savings from such restructurings and other

risks and uncertainties described in the Company’s Annual Report on Form 10-K for fiscal 2010 and in its

subsequent Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on forward-

looking statements because actual results may differ materially from those expressed in, or implied by, the

statements. Any forward-looking statement that the Company makes speaks only as of the date of such

statement, and the Company undertakes no obligation to update any forward-looking statements, whether as a

result of new information, future events or otherwise. Comparisons of results for current and any prior periods

are not intended to express any future trends or indications of future performance, unless expressed as such, and

should only be viewed as historical data.

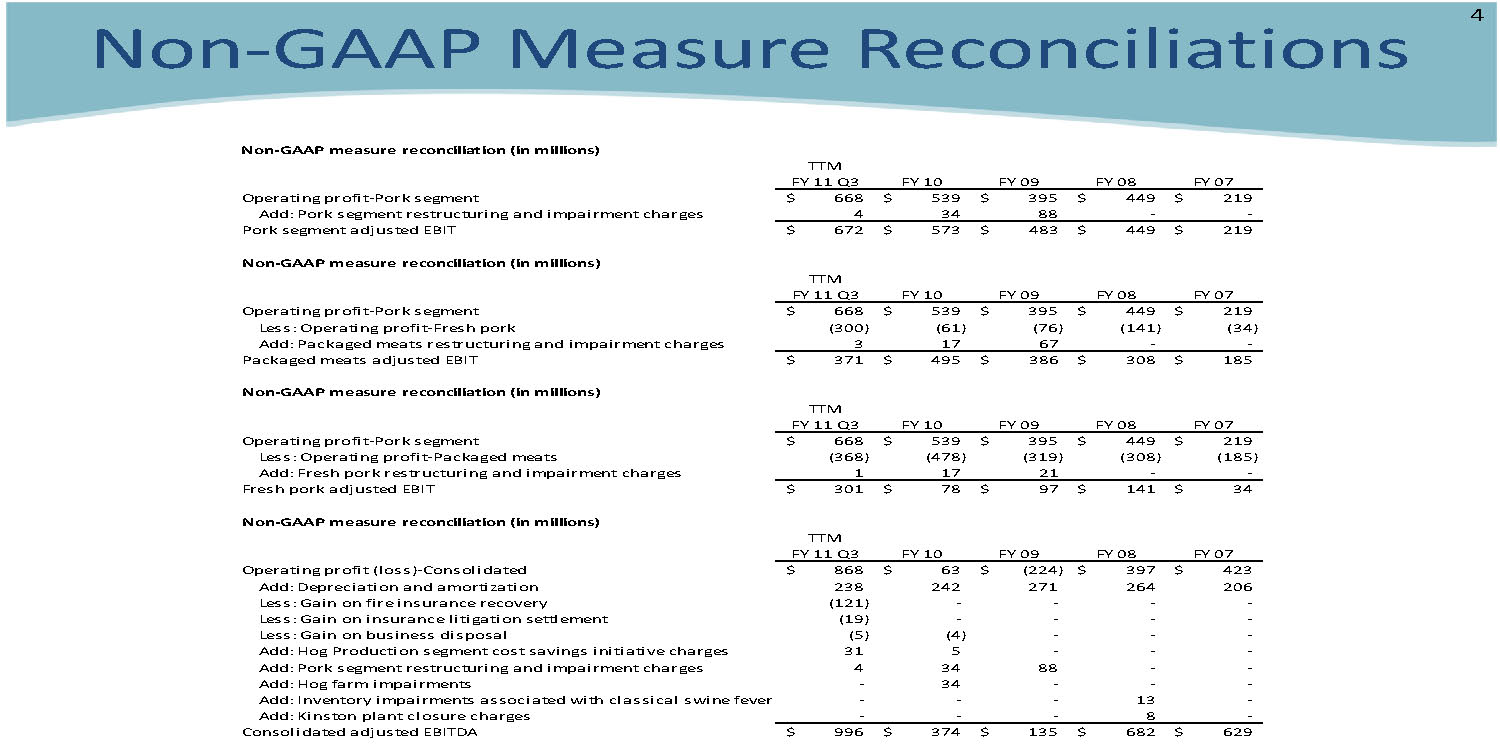

Non-GAAP Measure Reconciliations

Non-GAAP Measure Reconciliations

Frequently Asked Questions

1.Can Smithfield deliver a record year in fiscal

2012?

2.What are Smithfield’s core strategies for

growth?

3.How will the Campofrío acquisition benefit

Smithfield shareholders?

4.Is Smithfield committed to maintaining a

conservative balance sheet?

Can Smithfield deliver a record year in

fiscal 2012?

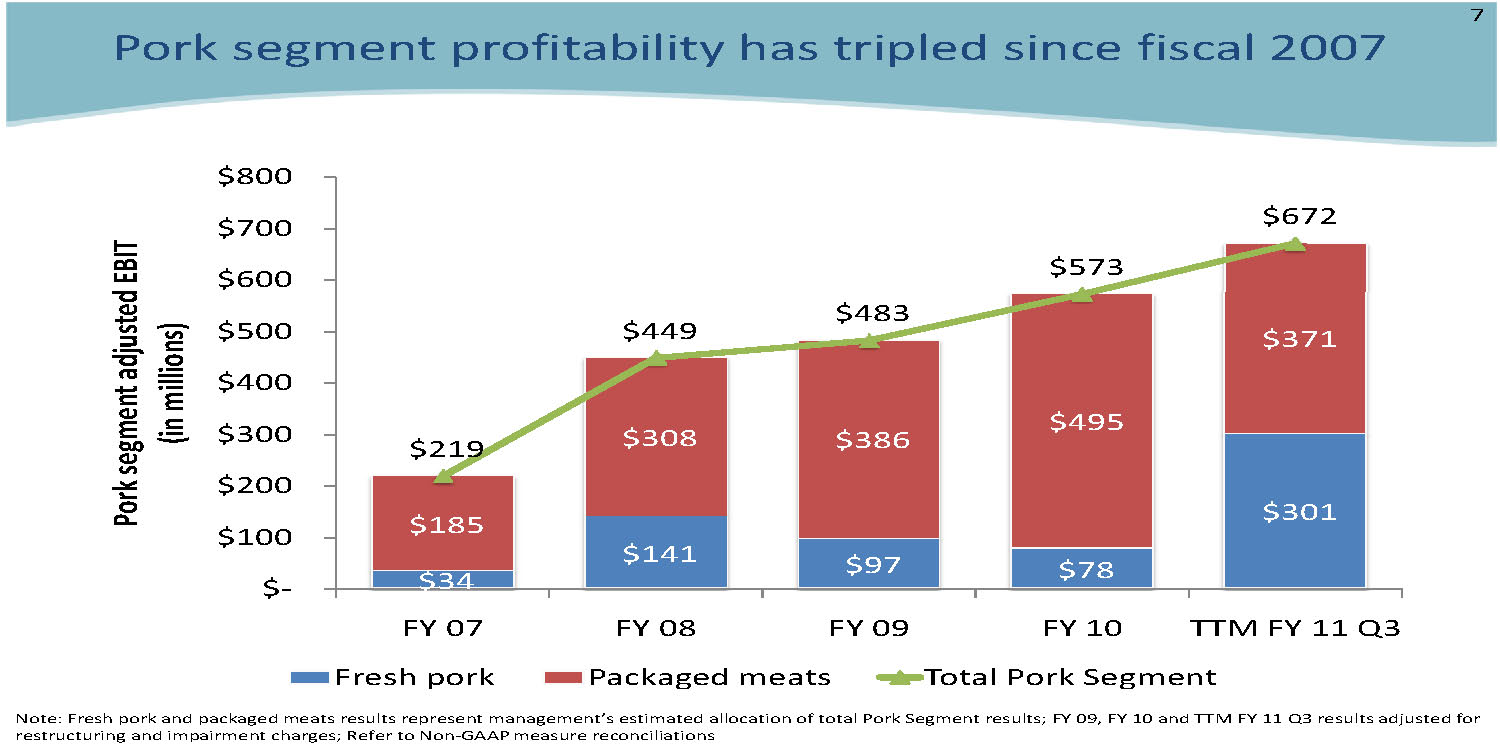

Pork segment profitability has tripled since fiscal 2007

Note: Fresh pork and packaged meats results represent management’s estimated allocation of total Pork Segment results; FY 09, FY 10and TTM FY 11 Q3 results adjusted for restructuring and impairment charges; Refer to Non-GAAP measure reconciliations

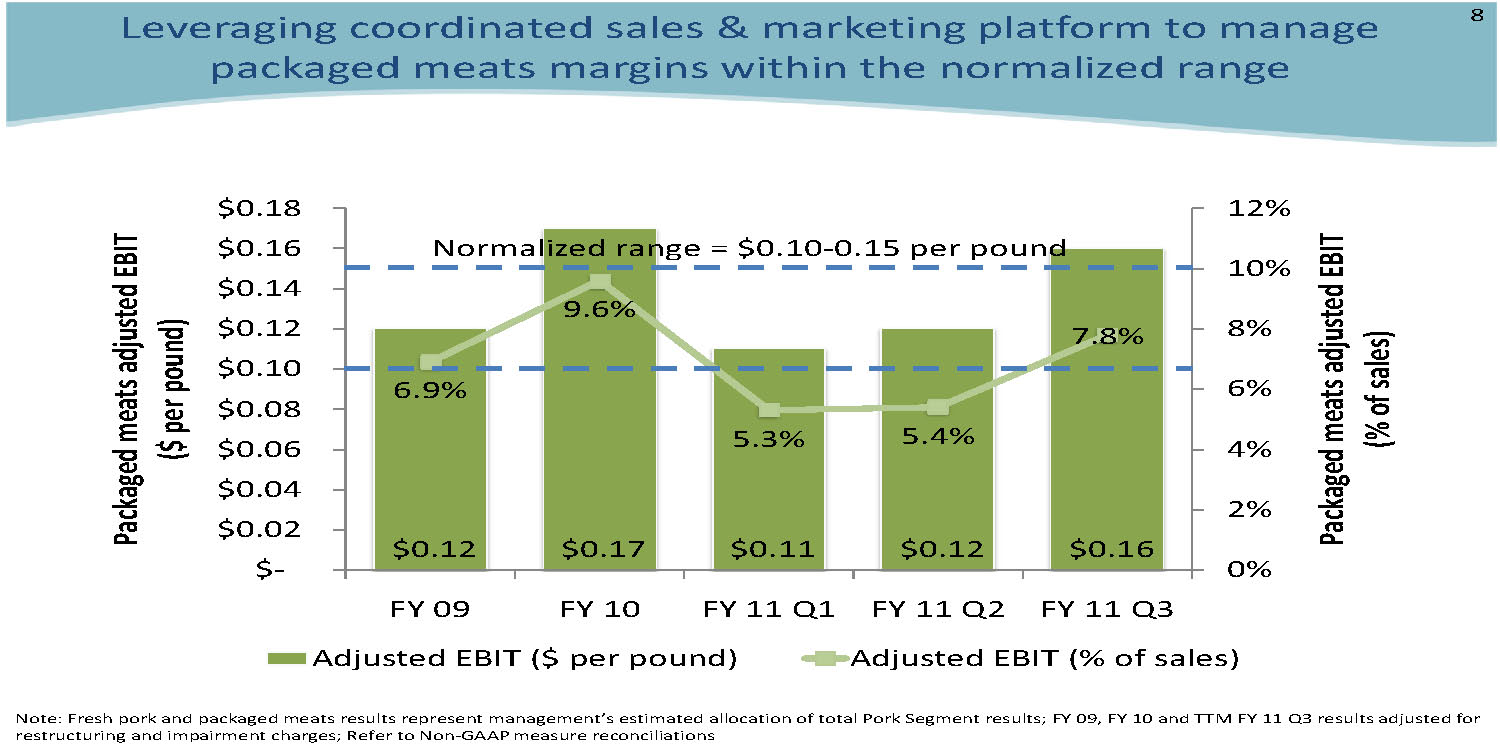

Leveraging coordinated sales & marketing platform to manage packaged meats margins within the normalized range

Normalized range = $0.10-0.15 per pound

Note: Fresh pork and packaged meats results represent management’s estimated allocation of total Pork Segment results; FY 09, FY 10and TTM FY 11 Q3 results adjusted for restructuring and impairment charges; Refer to Non-GAAP measure reconciliations

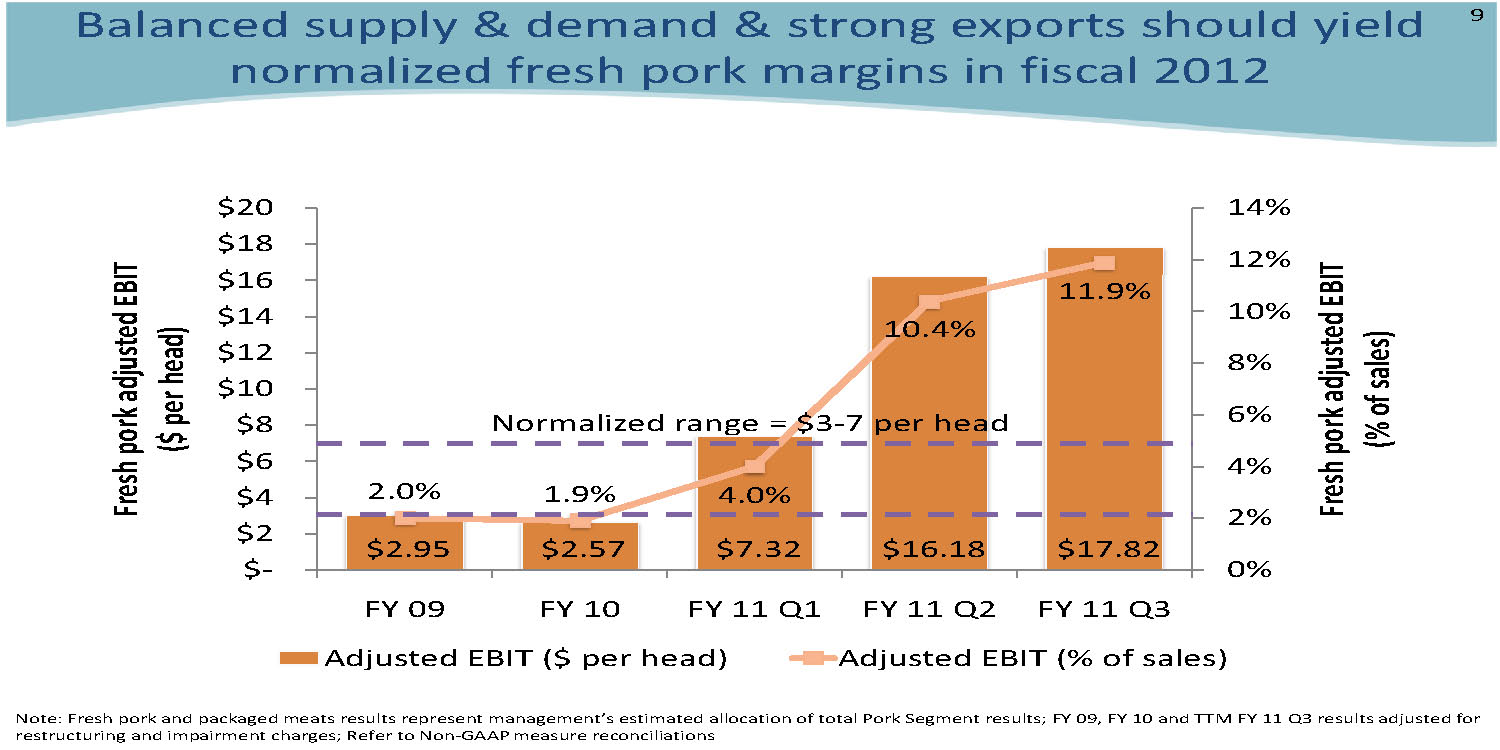

Balanced supply & demand & strong exports should yield normalized fresh pork margins in fiscal 2012

Normalized range = $3-7 per head

Note: Fresh pork and packaged meats results represent management’s estimated allocation of total Pork Segment results; FY 09, FY 10and TTM FY 11 Q3 results adjusted for restructuring and impairment charges; Refer to Non-GAAP measure reconciliations

Low global protein inventories are supporting a higher hog futures curve & yielding continued hog production profitability, despite higher grain prices

Note: Industry profitability based on futures curves for live hogs and grains on 05/12/11; cost is pre-interest

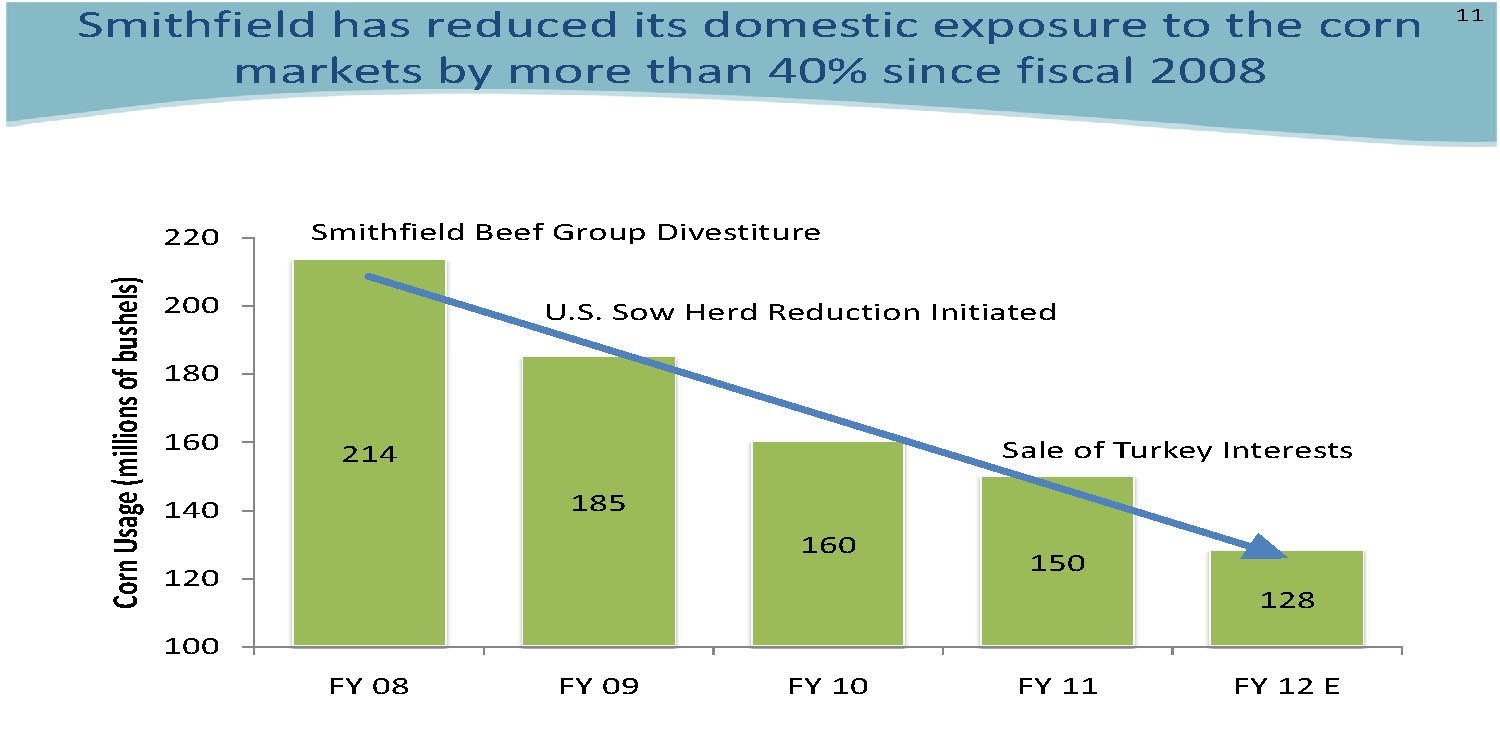

Smithfield has reduced its domestic exposure to the corn markets by more than 40% since fiscal 2008

Smithfield Beef Group Divestiture

Sale of Turkey Interests

U.S. Sow Herd Reduction Initiated

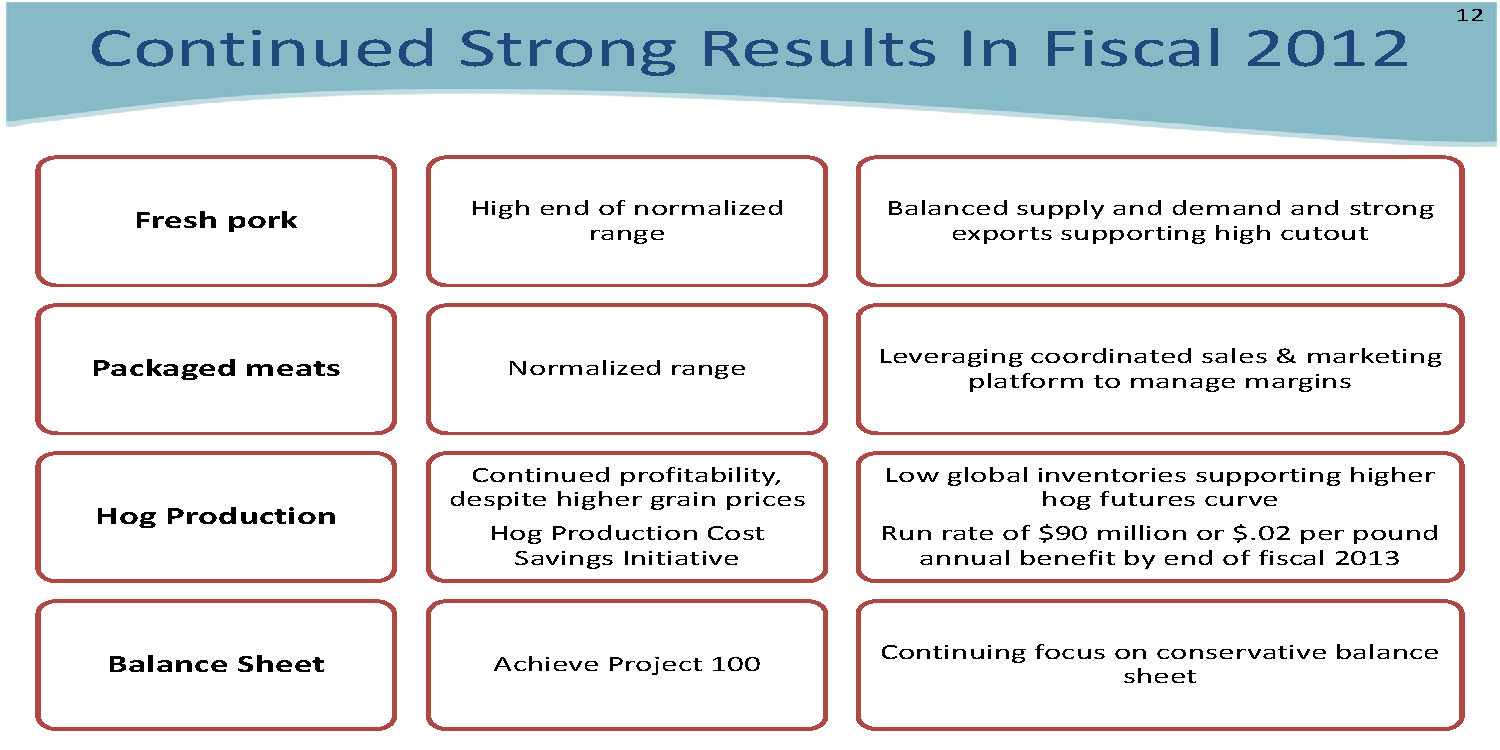

Continued Strong Results In Fiscal 2012

Fresh porkPackaged meatsHog ProductionBalance SheetHigh end of normalized

rangeNormalized rangeContinued profitability,

despite higher grain pricesHog Production Cost

Savings InitiativeAchieve Project 100Balanced supply and demand and strong

exports supporting high cutoutLeveraging coordinated sales & marketing

platform to manage marginsLow global inventories supporting higher

hog futures curveRun rate of $90 million or $.02 per pound

annual benefit by end of fiscal 2013Continuing focus on conservative balance

sheet

What are Smithfield’s

core strategies for growth?

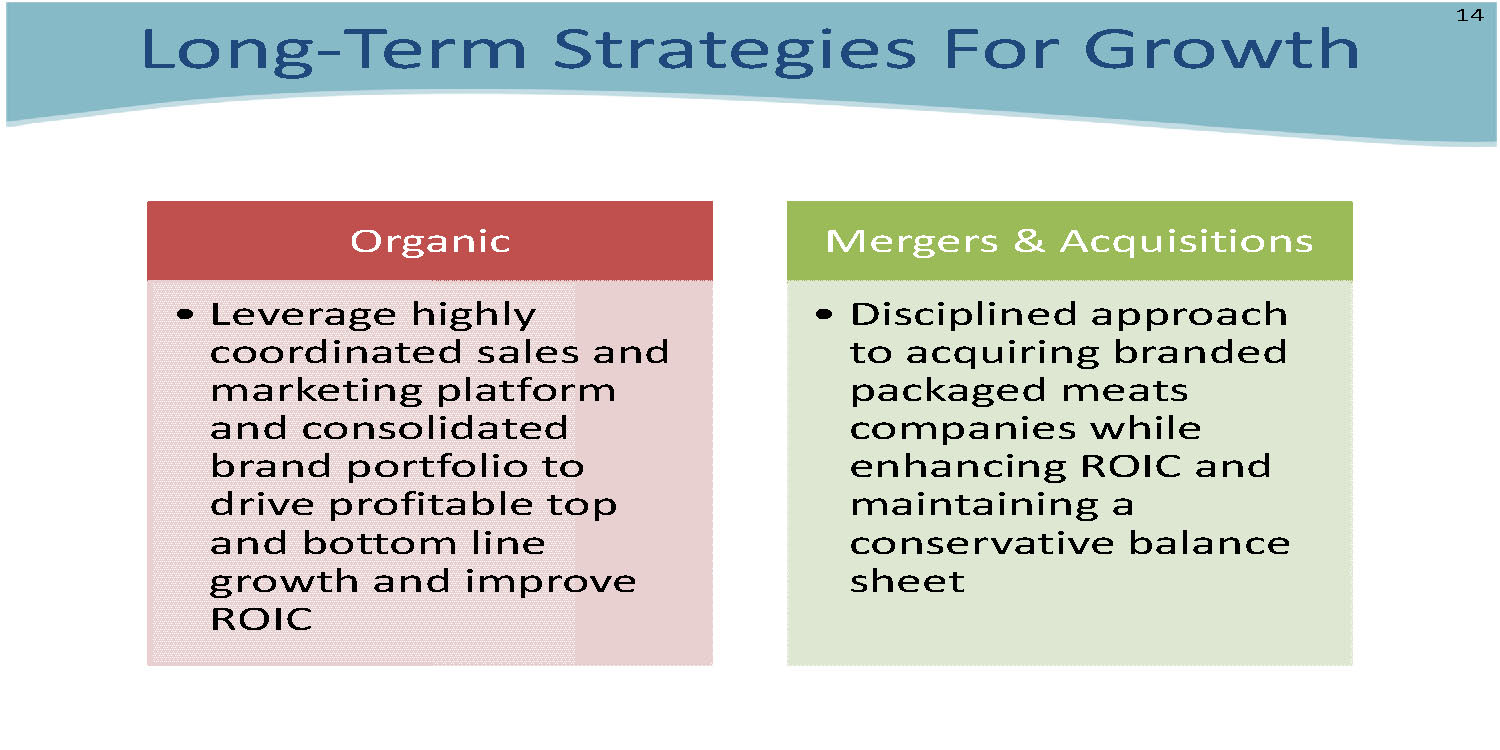

Long-Term Strategies For Growth

Organic•Leverage highly

coordinated sales and

marketing platform

and consolidated

brand portfolio to

drive profitable top

and bottom line

growth and improve

ROICMergers & Acquisitions•Disciplined approach

to acquiring branded

packaged meats

companies while

enhancing ROIC and

maintaining a

conservative balance

sheet

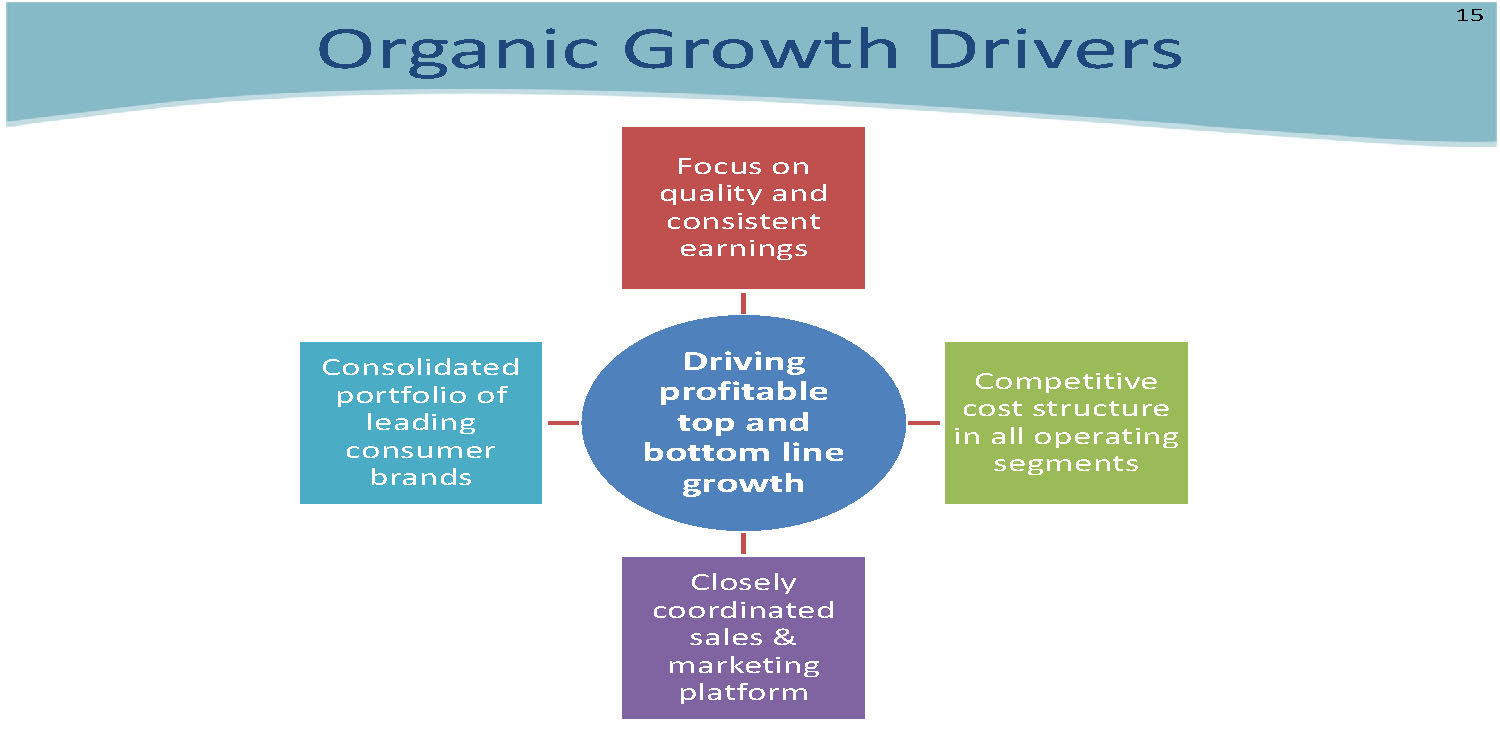

Organic Growth Drivers

Driving

profitable

top and

bottom line

growthFocus on

quality and

consistent

earningsCompetitive

cost structure

in all operating

segmentsClosely

coordinated

sales &

marketing

platformConsolidated

portfolio of

leading

consumer

brands

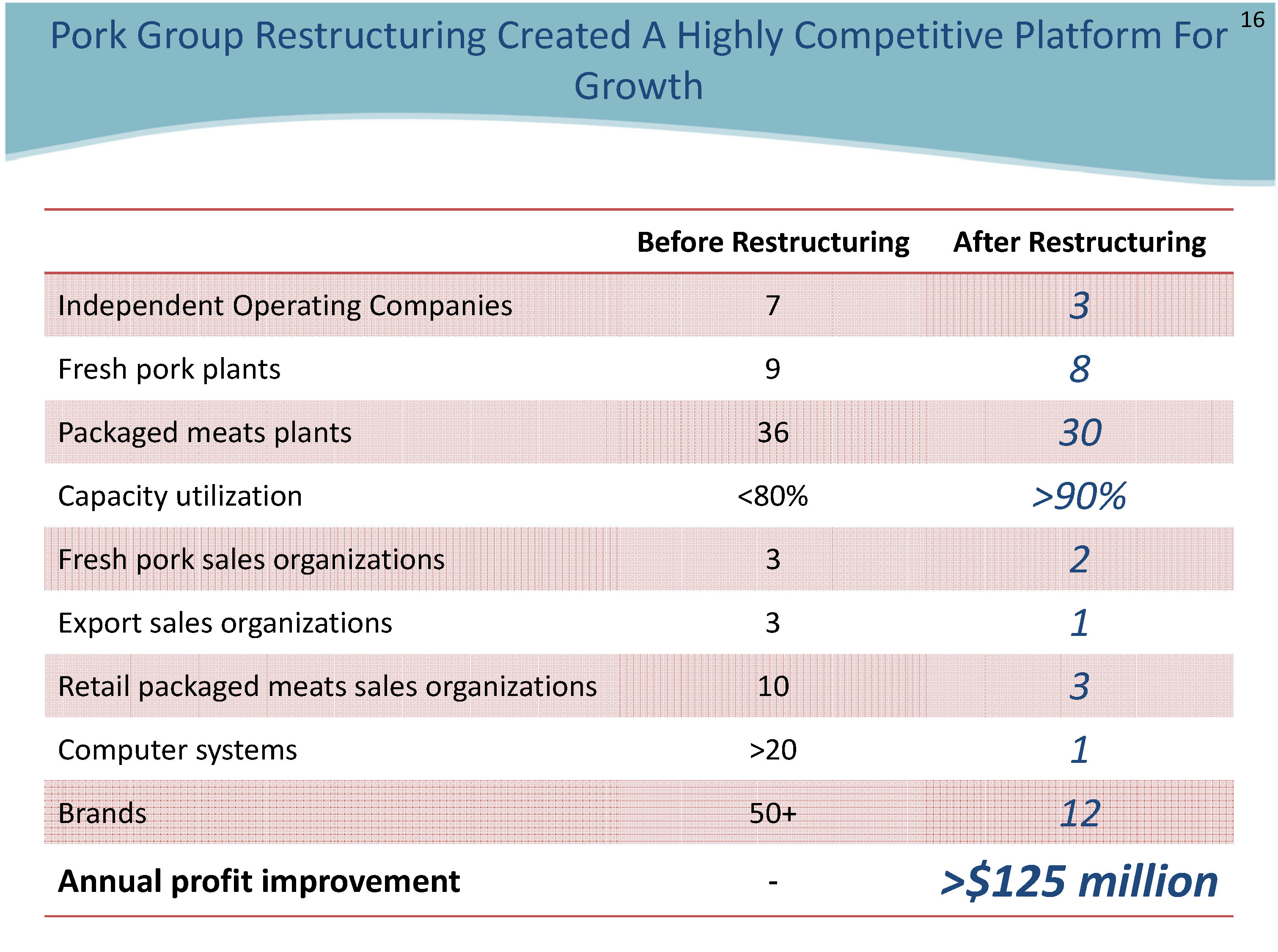

Pork Group Restructuring Created A Highly Competitive Platform For Growth

16

Before Restructuring

After Restructuring

IndependentOperating Companies

7

3

Freshpork plants

9

8

Packagedmeats plants

36

30

Capacityutilization

<80%

>90%

Fresh pork sales organizations

3

2

Exportsales organizations

3

1

Retail packagedmeats sales organizations

10

3

Computer systems

>20

1

Brands

50+

12

Annual profit improvement

-

>$125 million

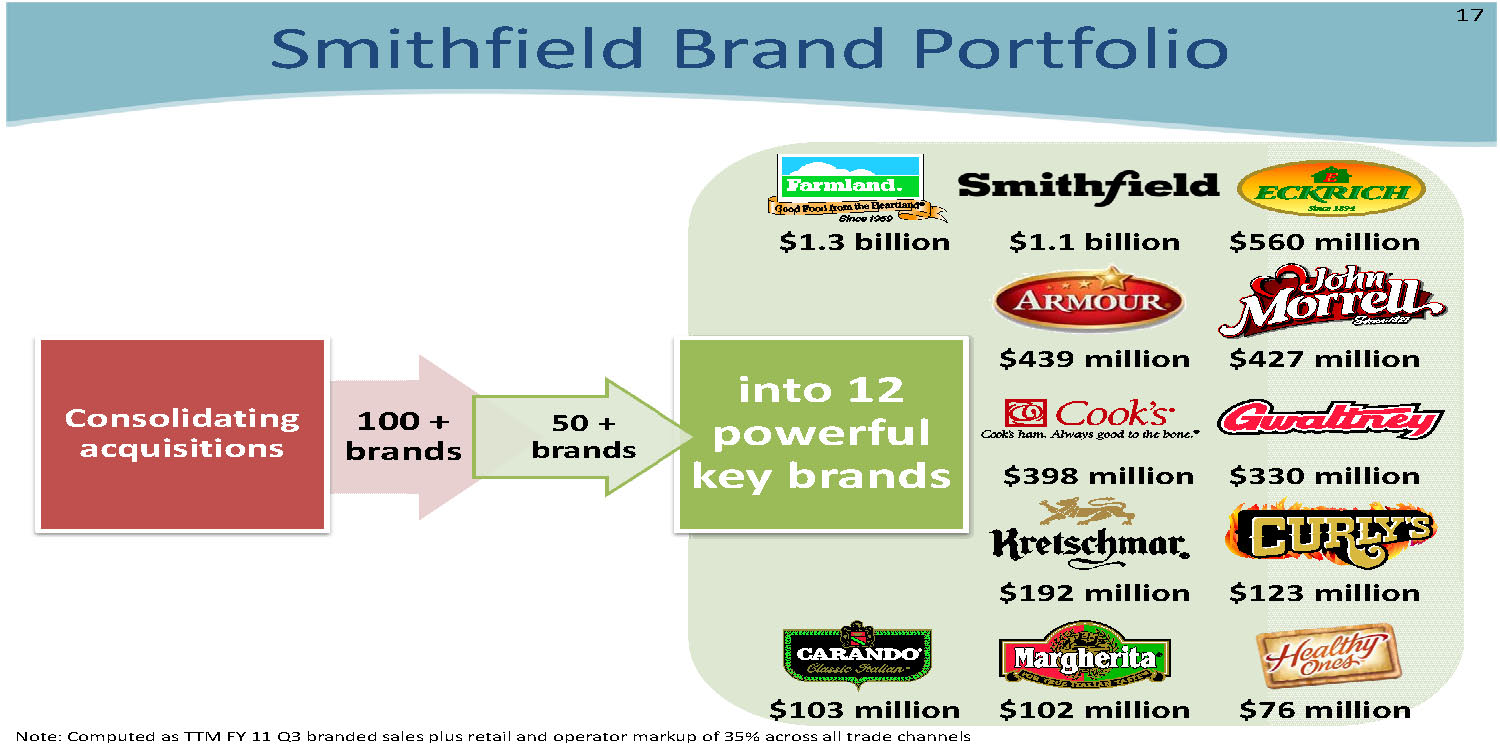

Smithfield Brand Portfolio

100 +

brandsConsolidating

acquisitionsinto 12

powerful

key brands

50 +

brands

Note: Computed as TTM FY 11 Q3 branded sales plus retail and operator markup of 35% across all trade channels

How will the Campofrío acquisition

benefit Smithfield shareholders?

Transaction Status

•Executed non-binding letters of intent

•Conducting confirmatory due diligence and

negotiating definitive agreements

•Takeover bid subject to various regulatory

approvals and approval of Campofrío's

shareholders

•Anticipated closing in second quarter of fiscal

2012

Rationale

•Positions Smithfield as leading global consumer

packaged meats company

•Increases percentage of sales and operating

profit from branded packaged meats and

geographically diversifies earnings base

•Unlocks existing investment to provide cash flow

and earnings stability

•Integration synergies and operational

improvements provide long term growth

opportunities

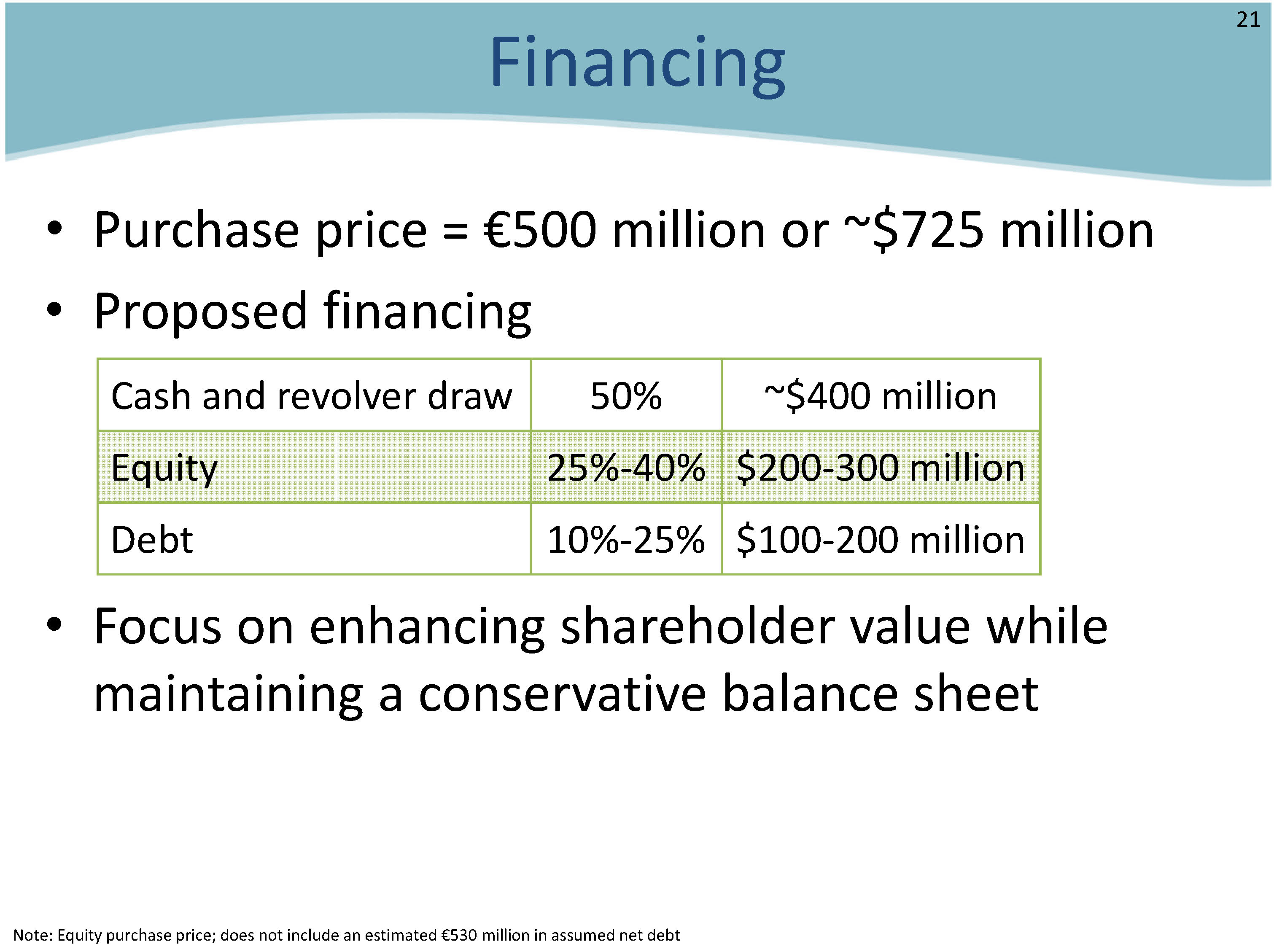

Financing

•Purchase price = €500 million or ~$725 million

•Proposed financing

•Focus on enhancing shareholder value while

maintaining a conservative balance sheet

Cash andrevolver draw

50%

~$400 million

Equity

25%-40%

$200-300 million

Debt

10%-25%

$100-200 million

Note: Equity purchase price; does not include an estimated €530 million in assumed net debt

Is Smithfield committed to maintaining a

conservative balance sheet?

Project 100 Objectives Achieved

Project

100Eliminate

$100 million

in interest

expenseReduce debt

by $1 billionImprove

credit

metricsExtend and

smooth debt

maturitiesEnsure

ample

liquidityReduce idle

cash

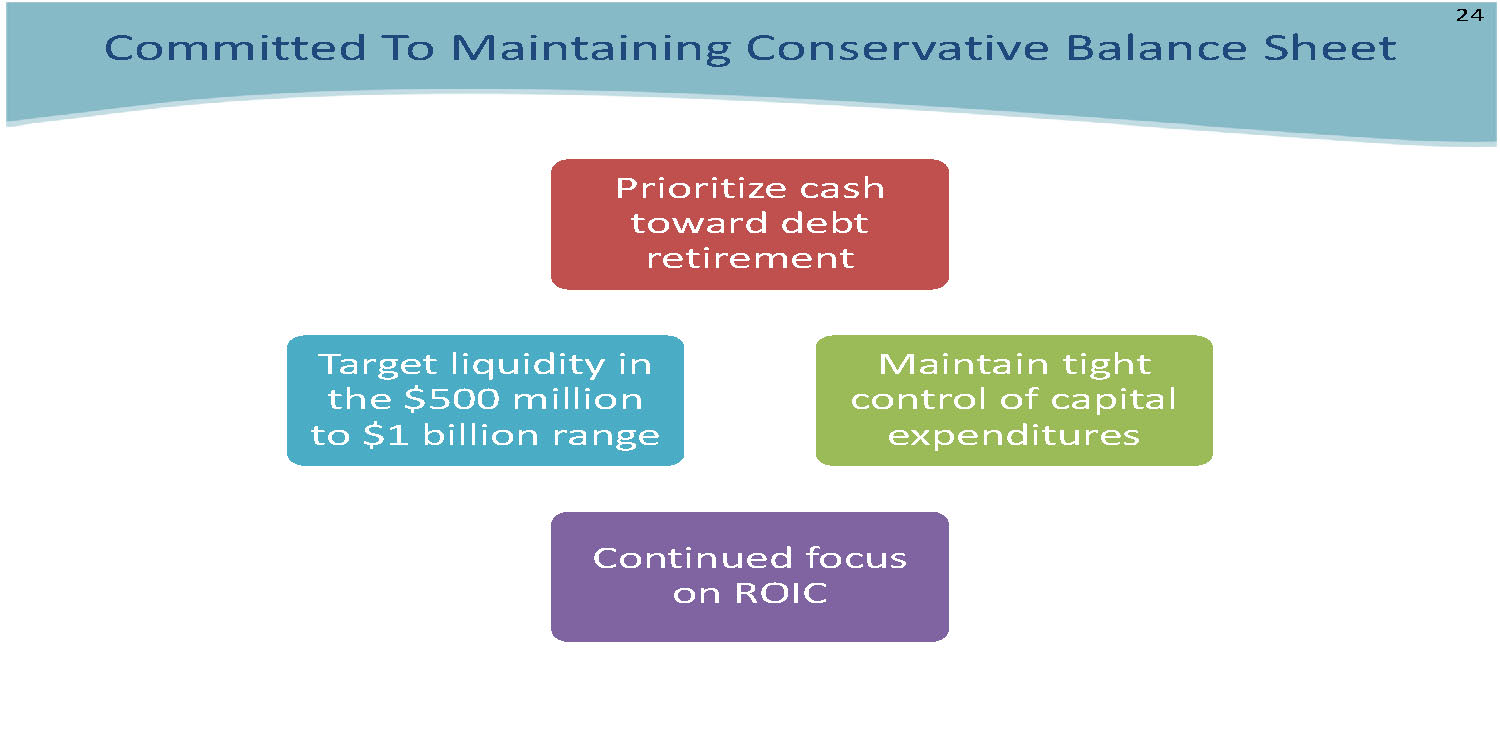

Committed To Maintaining Conservative Balance Sheet

Prioritize cash

toward debt

retirement

Maintain tight

control of capital

expendituresContinued focus

on ROICTarget liquidity in

the $500 million

to $1 billion range

Net debt to total capitalization ceiling of 50% with target of 40% or below

Note: Net debt is equal to notes payable and long-term debt and capital lease obligations, including current portion, less cash and cash equivalents; computed using net debt divided by the sum of net debt and shareholders’ equity.

Ceiling= 50% Net debt to total capitalization

Target= 40% Net debt to total capitalization

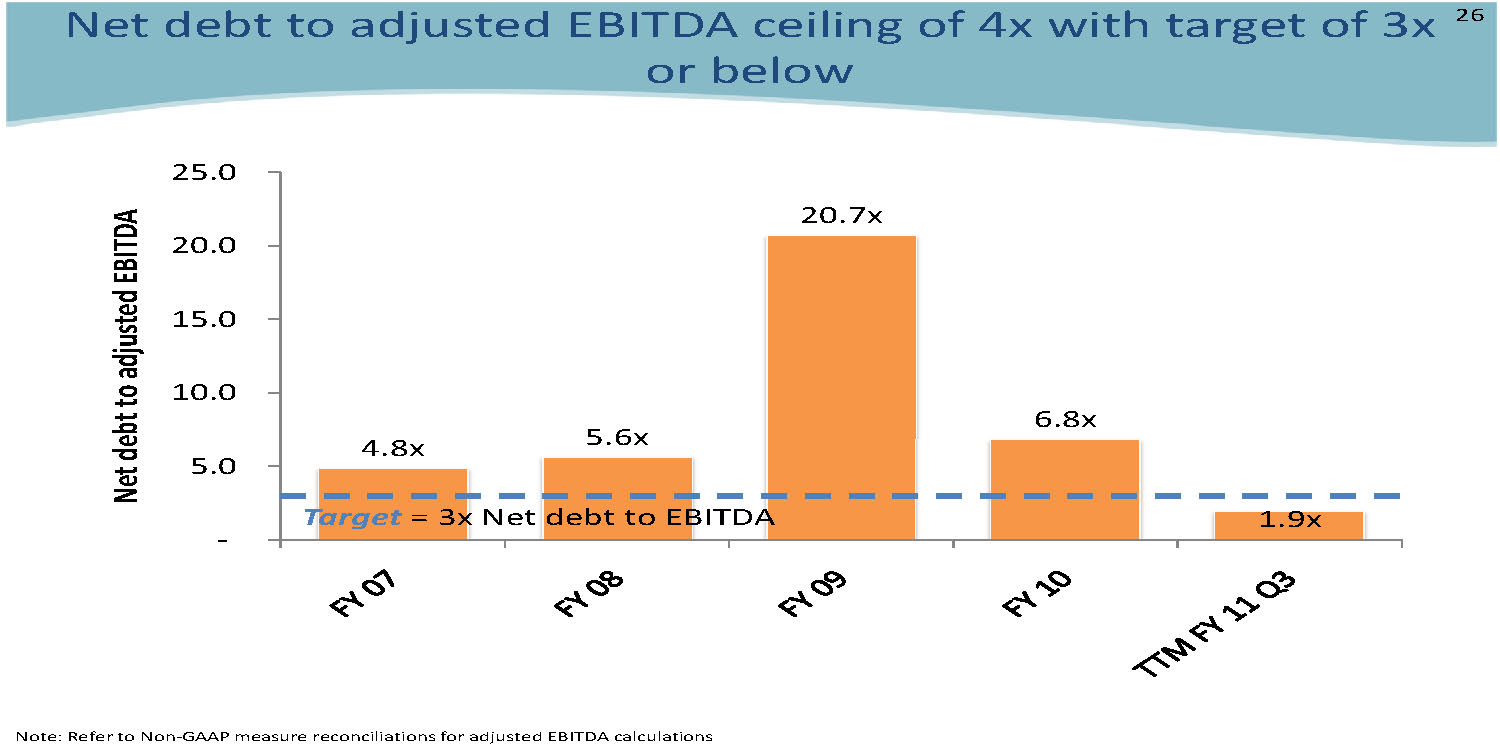

Net debt to adjusted EBITDA ceiling of 4x with target of 3x or below

Target= 3x Net debt to EBITDA

Note: Refer to Non-GAAP measure reconciliations for adjusted EBITDA calculations

Appendix –

More about Campofrío Food Group

Smithfield & Campofrío:

The Undisputed Global Leader In Consumer Packaged Meats

#1Global

Packaged

Meats

Company

#1U.S. Packaged

Pork Company#1European

Packaged Meats

Company

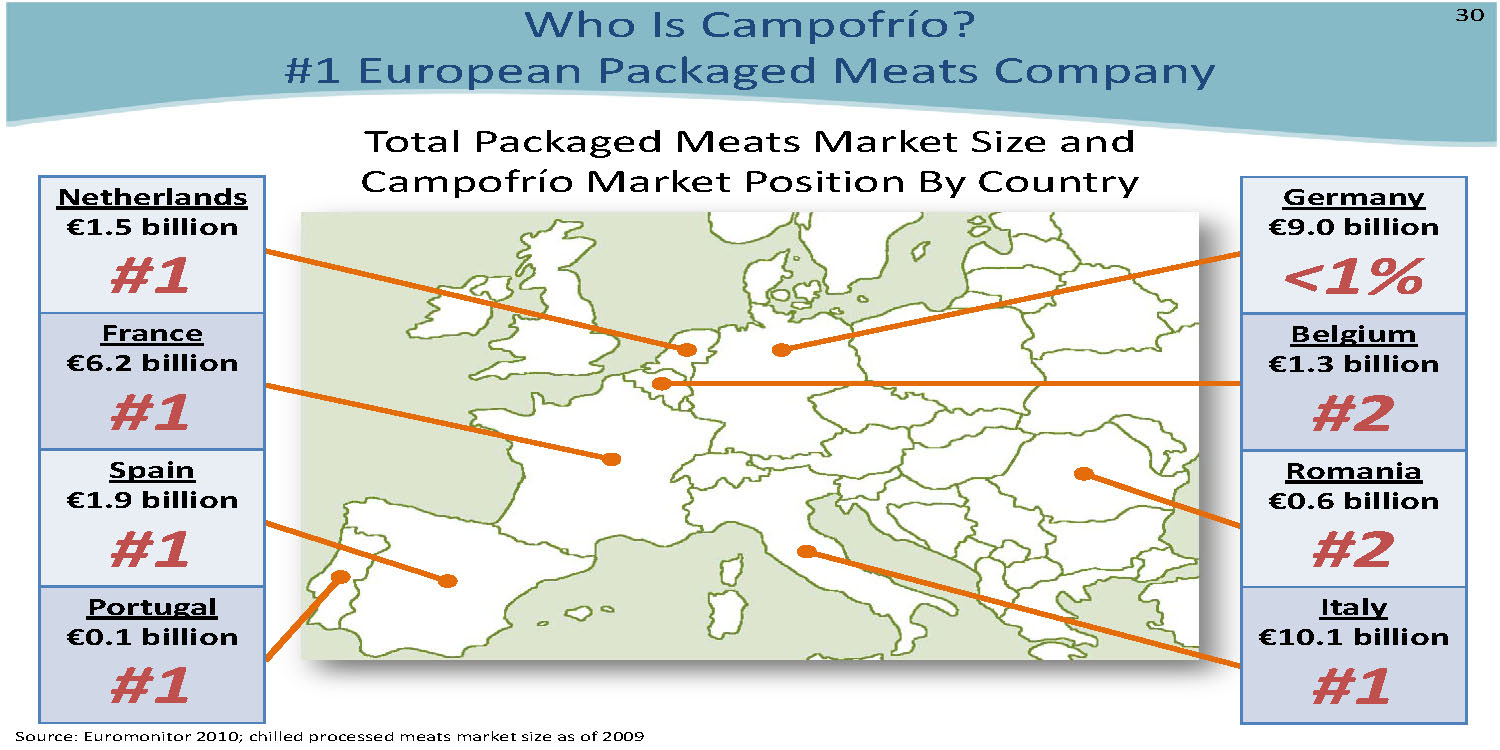

Who Is Campofrío?

#1 European Packaged Meats Company

Netherlands

€1.5 billion

#1

France

€6.2 billion

#1

Spain

€1.9 billion

#1

Portugal

€0.1 billion

#1

Germany

€9.0 billion

<1%

Belgium

€1.3 billion

#2

Romania

€0.6 billion

#2

Italy

€10.1 billion

#1

Source: Euromonitor2010; chilled processed meats market size as of 2009

Total Packaged Meats Market Size and

Campofrío Market PositionBy Country

Leading Branded Portfolio

European Packaged Meats Acquisition Strategy

1998-99Acquire SBS

SFGP in France2004Acquire Jean Caby in

FranceMerge SBS and SFGP

into Jean CabyAcquire 15% stake in

Campofrío from

HormelAccumulate 22% of

Campofrío through

private purchases and

stock dividends2006Contribute Jean Caby

into 50/50 joint

venture with Oaktree

Capital Management

to form Groupe

SmithfieldGroupe Smithfield

acquires Sara Lee's

European meats

business2008Merge Groupe

Smithfield with

Campofrío resulting in

Smithfield 37%

ownership of

Campofrío Food

Group2011Anticipated

acquisition of

additional 50% of

Campofrío resulting

in Smithfield 87.6%

ownership of

Campofrío Food

Group

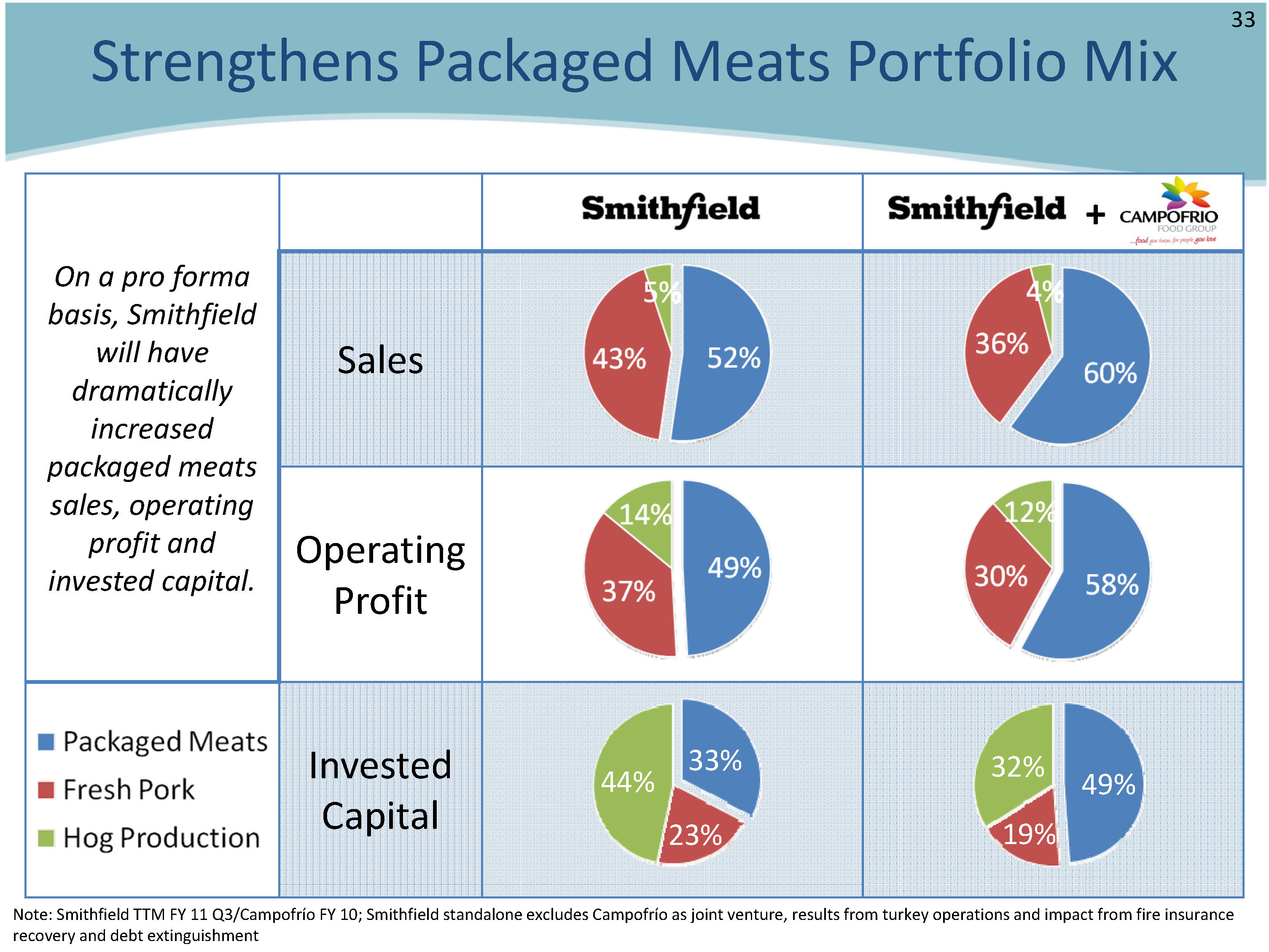

Strengthens Packaged Meats Portfolio Mix

On a pro forma

basis, Smithfield

will have

dramatically

increasedpackaged meatssales, operating

profit and

invested capital.

Sales

Operating

Profit

InvestedCapital