March 8, 2012

VIA EDGAR

Ms. Linda Cvrkel

Branch Chief

United States Securities and Exchange Commission

Division of Corporation Finance

Washington, D.C. 20549

Re: Smithfield Foods, Inc.

Form 10-K for the fiscal year ended May 1, 2011

Filed June 17, 2011

Form 10-Q for the fiscal quarter ended October 30, 2011

Filed December 9, 2011

File No. 001-15321

Dear Ms. Cvrkel:

We are writing to respond to your letter, dated February 23, 2012, to Robert W. Manly, IV, Chief Financial Officer of Smithfield Foods, Inc., with respect to the above-referenced filings. Throughout this letter, “we,” “our,” “us,” “Smithfield,” and the “Company” refer to Smithfield Foods, Inc. and its wholly-owned subsidiaries, unless the context requires otherwise.

For convenience of reference, each comment from your letter is reprinted in italics, numbered to correspond with the paragraph numbers assigned in your letter, and is followed by the corresponding response of the Company.

Form 10-Q for the Fiscal Quarter Ended October 30, 2011

Financial Statements, page 3

Notes to Consolidated Condensed Financial Statements, page 6

Note 6: Investments, page 12

| |

| 1. | We note your disclosure that because the carrying value of your investment in CFG continued to exceed the market value of the underlying securities as of October 30, 2011, you analyzed your investment in CFG for impairment and have determined that the fair value exceeded its carrying amount as of October 30, 2011. We further note that due to assumptions included in your analysis which are disclosed in Note 6, you determined that no impairment existed as of October 30, 2011. Please explain in further detail why you believe that your investment in CFG has not been impaired as of October 30, 2011. Also, in light of the fact that it does not appear that the market value of the CFG securities has increased significantly through the current date, please tell us if you have evaluated your investment in CFG for impairment subsequent to October 30, 2011 and if so, please |

provide us the results of your impairment analysis. If you have recorded any impairment loss, please explain to us how that loss was calculated or determined.

Response

October 30, 2011 Analysis

In evaluating our investment in CFG, which is accounted for under the equity method, for potential impairment we reviewed the guidance for a decline in investment value contained in ASC 323-10-35-31 and ASC 323-10-35-32, which requires the recognition of a loss in value of an investment that is other than temporary. ASC 323-10-35-32 states that “evidence of a loss in value might include, but would not necessarily be limited to, absence of an ability to recover the carrying amount of the investment or inability of the investee to sustain an earnings capacity that would justify the carrying amount of the investment. A current fair value of an investment that is less than its carrying amount may indicate a loss in value of the investment. However, a decline in the quoted market price below the carrying amount or the existence of operating losses is not necessarily indicative of a loss in value that is other than temporary. All are factors that shall be evaluated.”

CFG is Europe's largest packaged meats company, with leading market shares in Spain, France, Belgium, Holland, and Portugal. CFG's shares are traded on the Bolsa de Madrid stock exchange. The table below shows CFG's intra-day high share price and Smithfield's carrying value, expressed in euro per share, on various dates relevant to our disclosures1. The carrying value figures are based on prevailing currency exchange rates on those dates.

|

| | | | |

| Date | | Share Price | | Carrying Value |

| | | | | |

| October 30, 2011 | | €6.35 | | €7.83 |

| | | | | |

| January 29, 2012 | | €6.75 | | €7.55 |

| | | | | |

| February 17, 2012 | | €7.20 | | €7.54 |

| | | | | |

| March 5, 2012 | | €6.61 | | €7.51 |

| | | | | |

As of October 30, 2011, we considered the market price of CFG's stock in assessing the fair value of our investment. However, the price of a single equity share traded on the Madrid stock exchange is not, by itself, an appropriate indication of the fair value of our investment for the following reasons:

| |

| 1. | the minority shares traded on the Madrid exchange confer no special rights or privileges to buyers. In contrast, the shares comprising our 37% stake in CFG contractually entitle us to two seats on CFG's 9-person board of directors, giving us the ability to exert significant influence over the strategic and operational decisions of our investee. Indeed, if our shares were sold in a block, a buyer could likely increase its board representation to three seats under Spanish law. |

——————————————

1 Share prices on quarter end dates reflect the last trading day in the quarter

| |

| 2. | the stock is very thinly traded and is therefore not the most reliable measure of fair value of our investment. CFG is a closely held company, with the three largest shareholders owning approximately 74% of the outstanding shares. Even amongst the remaining shareholders there |

is significant concentration. Smithfield is the single largest shareholder, owning a 37% stake. The price on the Madrid exchange is reflective of a single minority share and does not reflect the fair value of shares with an attendant “influence” or “control” premium.

The average daily trading volume over the previous three months represents just 0.007% of the total outstanding shares (average trading volume of 7,200 shares while the total number of shares outstanding is in excess of 102 million). The lack of an active market has caused significant fluctuations and volatility in the stock price that are not commensurate with fundamental changes in the underlying business and the fair value of our holding in CFG.

For these reasons, we do not believe the market price of CFG's stock is, by itself, determinative in measuring the fair value of our investment. Therefore, we considered a number of other factors in assessing the fair value of our investment as of October 30, 2011, including:

| |

| 1. | A recent independent valuation report on CFG prepared for Spanish securities regulators by PricewaterhouseCoopers (“PwC”), an internationally recognized professional services firm. The report, dated less than 7 months prior to our quarter ended October 30, 2011, thoroughly examined the fair value of CFG using generally accepted valuation techniques, including discounted cash flow (“DCF”) analysis to estimate an enterprise value for CFG. The report estimates the fair value of CFG to range between €8.63 and €9.11 per share; values well in excess of the €7.83 carrying value of our investment as of October 30, 2011. |

The PwC report was commissioned by CFG in connection with a joint de-listing takeover bid involving the chairman of CFG and Smithfield Foods (see attached press release dated April 6, 2011 marked as Exhibit I). The takeover bid contemplated a price of €9.50 per share to be paid to selling minority shareholders. While the transaction was not ultimately consummated, Smithfield's public acknowledgment of our intention to acquire additional shares at €9.50 demonstrates Smithfield's determination of fair value at that time.

| |

| 2. | Expectations about the future cash flows of CFG. We compared the assumptions about future cash flows used in PwC's report to subsequent plans formulated by management in connection with their annual long range forecast budgeting process, noting no material change in valuation would result from an updated DCF analysis. In December 2011, CFG's board of directors approved a plan to consolidate and streamline its manufacturing operations. We expect this plan will significantly improve the future profitability and cash flows of CFG. |

| |

| 3. | Market multiples for comparable businesses obtained from our financial advisors. The multiples we examined are widely accepted measures of enterprise value (i.e. EBITDA multiple) and are therefore an appropriate indicator of the fair value of our investment. |

| |

| 4. | The market price of CFG's stock as quoted on the Bolsa de Madrid stock exchange. As discussed above, while we do not believe the market price of CFG's common stock is, by itself, determinative in measuring the fair value of our investment, we do nevertheless consider the market values quoted on the Madrid exchange to be an indicator of fair value. |

In assessing fair value based upon the quoted stock price, we assigned a range of reasonable “influence” premiums for our shares based on our large 37% stake, our two board seats, and our ability to significantly influence CFG's strategic and operational decisions. The range of premiums applied is supported by independent studies of premiums paid for minority ownership interests.

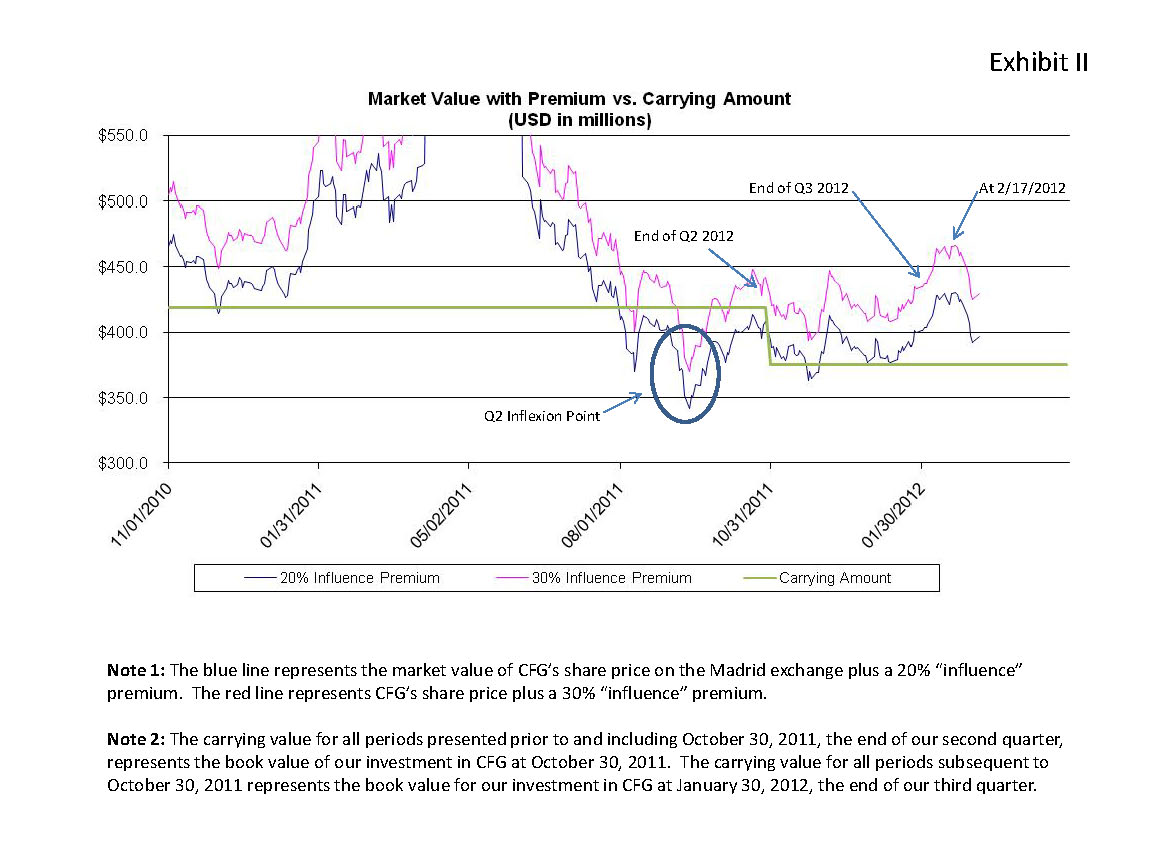

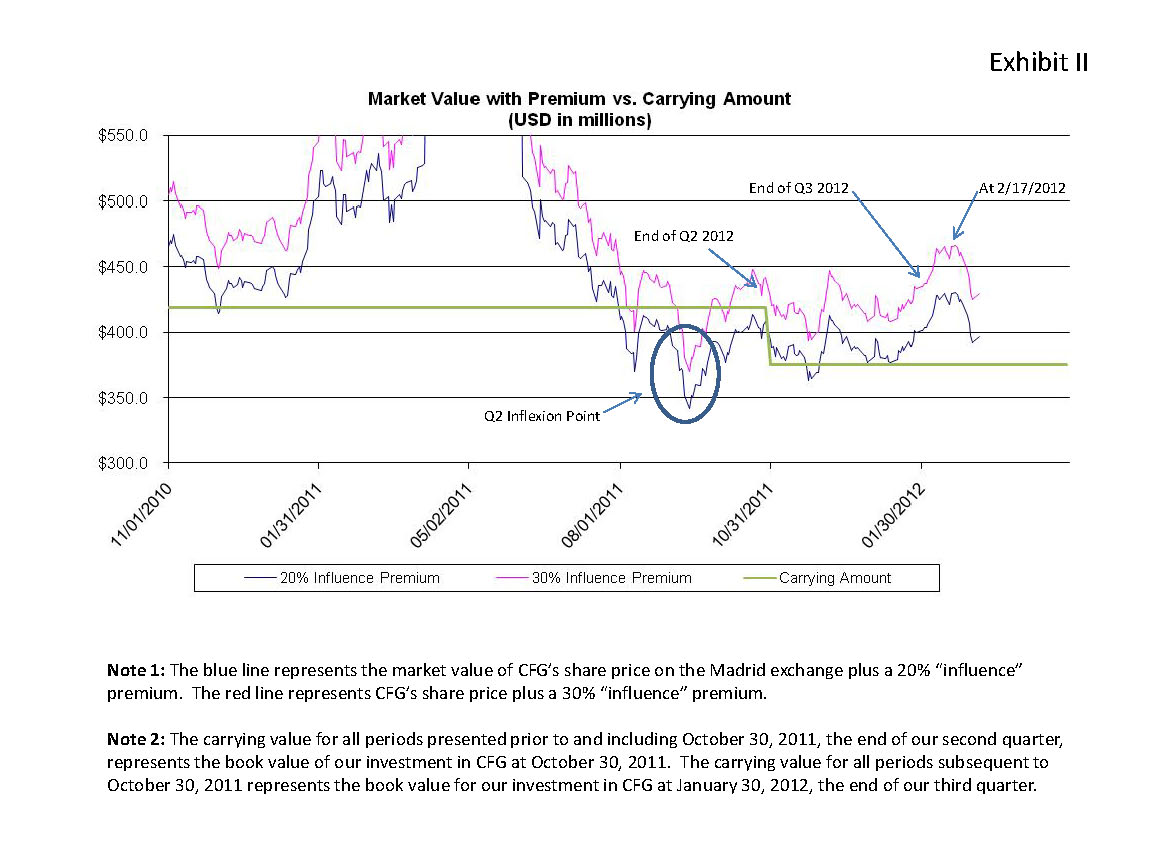

Exhibit II, attached, shows a 12 month comparison of CFG's share price, with an appropriate range of influence premiums applied, to the carrying value of our investment. The exhibit shows the inflexion point during our second quarter when the fair value of our investment, as measured only by the market price of the stock plus an influence premium, was briefly below the carrying value. By quarter end, the share price had increased such that no gap existed.

Based on an evaluation of all these factors, we concluded the fair value of our investment in CFG as of October 30, 2011, exceeded its carrying amount.

Subsequent Analysis

We analyzed the fair value of our investment in CFG again at the end of our third quarter of fiscal 2012, which ended January 29, 2012. From October 30, 2011 to January 29, 2012, the market price of CFG's stock rose 6%. By February 17, 2012, the stock had risen an additional 7% before falling back to quarter end levels (underscoring our concerns about volatility in a shallow market). At the same time, the carrying amount of our investment decreased by $43.9 million, largely representing our proportionate share of restructuring charges CFG recorded in December 2011. The restructuring plan formulated by CFG management is designed to improve operating efficiencies and profitability.

We assessed the fair value of our investment as of January 29, 2012 based on the same factors described above, updated for material changes or developments, and concluded that our investment in CFG was not impaired.

Other Factors

Supplemental to our analysis, in each of these periods, we believe we provided transparency in our disclosures. We believe our disclosures call attention to the issue, provide our assumptions and judgments made about the value of our investment, and enable the financial statement user to evaluate any potential impact on our financial statements of a potential write-down of our investment, if that write-down was based solely upon the market price of the stock. Qualitatively, our judgments about CFG, both at the end of the second and third quarters, are influenced by other factors, including:

| |

| – | CFG's stock price, even without any influence premium applied, traded well above our current carrying value as recently as June 2011, when the shares traded in excess of €9 per share. |

| |

| – | As recently as February 17, 2012, the market value of CFG's shares on the Madrid exchange, without any influence premium applied, was within 4.1% of the current carrying value of our shares. Moreover, the shortfall, when measured in the context of our balance sheet, is less than three tenths of one percent of Smithfield’s total assets. |

| |

| – | CFG has no history of operating losses. |

| |

| – | Contemporaneous discussions with investment bankers about fair values for CFG. |

We hope these explanations have been helpful. Should the Staff have further questions, we would welcome the opportunity to discuss our investment in CFG with the Staff.

Form 8-K filed November 7, 2011

Exhibit 99.1

| |

| 2. | We refer to the reconciliation of operating profit - consolidated to consolidated adjusted EBITDA on page 3. We note that the company has reconciled this measure to operating profit rather than net income, which would be the most comparable US GAAP measure. Please revise to reconcile the non-GAAP measure “consolidated adjusted EBITDA” to the company's net income, the most comparable GAAP measure. Refer to the guidance outlined in Regulation G and Questions 103.02 of the Compliance and Disclosure Interpretations issued by the Division of Corporation Finance regarding Non-GAAP Financial Measures. |

Response

We filed an amended 8-K on March 8, 2012 with a revision to the table containing the reconciliation of “operating profit - consolidated to consolidated adjusted EBITDA”. The revision reconciles “consolidated adjusted EBITDA” to “net income”. In any future filings, EBITDA will be reconciled to net income.

***********

The Company hereby acknowledges the following:

| |

| • | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| |

| • | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| |

| • | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please direct any further questions or comments you may have regarding this filing to the undersigned at (757) 365-3075.

|

| |

| | Very truly yours, |

| | /s/ KENNETH M. SULLIVAN |

| | Kenneth M. Sullivan |

| | Vice President, Finance and Chief Accounting Officer |

| | Smithfield Foods, Inc. |

cc:

C. Larry Pope

Robert W. Manly, IV

Michael H. Cole

Timothy Winder, Ernst & Young

Glenn Nunziata, Ernst & Young

EXHIBIT I

FOR IMMEDIATE RELEASE

Contact:

Keira Lombardo

Smithfield Foods, Inc.

(757) 365-3050

keiralombardo@smithfieldfoods.com

Smithfield Foods Confirms Discussions to Acquire Controlling Interest in Campofrío Food Group

SMITHFIELD, Virginia (April 6, 2011)-Smithfield Foods, Inc. (NYSE: SFD) confirmed today that the company and Pedro Ballvé are currently evaluating a joint de-listing takeover bid to acquire the remaining approximate 50 percent of Campofrío Food Group, S.A. for €9.5 per share. Mr. Ballvé is the current chairman of Campofrío. The acquisition would give Smithfield 87.6 percent controlling interest in Campofrío, Europe's leading packaged meats company. Smithfield currently owns 37 percent of Campofrío.

This announcement is being made following the filing earlier today by Campofrío of a Communication of Relevant Fact with the Spanish securities regulators relating to the potential joint de-listing takeover bid.

The takeover bid would be subject to various conditions, including (1) completion of confirmatory due diligence, (2) entering into all necessary binding agreements, (3) approval of the takeover bid by the Spanish securities commission, and (4) the waiver of the company's existing standstill agreement with Campofrío, which is currently effective until December 30, 2011. The transaction would also be subject to other regulatory approvals, including competition review.

“The acquisition of Campofrío would further Smithfield's long term strategy of becoming a leading global consumer packaged meats company,” said C. Larry Pope, president and chief executive officer. “In addition, we are assessing potential synergies relating to sales, operations and raw materials with both our U.S. and international businesses,” he continued.

While no financing arrangements have been finalized, the company anticipates the estimated €500 million required to fund the takeover bid would be provided through a combination of existing liquidity and capital markets financings that will enhance shareholder value while maintaining a conservative balance sheet.

In 2010, Campofrío reported revenues of €1.83 billion.

About Smithfield Foods

Smithfield Foods is the world's largest pork processor and hog producer, with revenues exceeding $11 billion in fiscal 2010. In the United States, the company is also the leader in numerous packaged meats categories. From national brands and regional powerhouses in the United States to some of the best-known European brands, Smithfield Foods products are prized by retail, foodservice, and deli customers alike. For more information, please visit www.smithfieldfoods.com.

This news release contains "forward-looking" statements within the meaning of the federal securities laws. The forward-looking statements include statements concerning our outlook for the future, as well as other statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning matters that are not historical facts. Our forward-looking information and statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, the statements. These risks and uncertainties include the availability and prices of live hogs, raw materials, fuel and supplies, food safety, livestock disease, live hog production costs, product pricing, the competitive environment and related market conditions, risks associated with our indebtedness, including cost increases due to rising interest rates or changes in debt ratings or

outlook, hedging risk, operating efficiencies, changes in foreign currency exchange rates, access to capital, the cost of compliance with and changes to regulations and laws, including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational, health and safety laws, adverse results from on-going litigation, actions of domestic and foreign governments, labor relations issues, credit exposure to large customers, the ability to make effective acquisitions and successfully integrate newly acquired businesses into existing operations, our ability to effectively restructure portions of our operations and achieve cost savings from such restructurings and other risks and uncertainties described in our Annual Report on Form 10-K for fiscal 2010 and our Quarterly Report on Form 10-Q for the fiscal quarter ended August 1, 2010. Readers are cautioned not to place undue reliance on forward-looking statements because actual results may differ materially from those expressed in, or implied by, the statements. Any forward-looking statements that we make speak only as of the date of such statements, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

Q2 Inflexion Point

End of Q2 2012

At 2/17/2012

Note 1:The blue line represents the market value of CFG’s share price on the Madrid exchange plus a 20% “influence” premium.The red line represents CFG’s share price plus a 30% “influence” premium.

Note 2:The carrying value for all periods presented prior to and including October 30, 2011, the end of our second quarter, represents the book value of our investment in CFG at October 30, 2011.The carrying value for all periods subsequent to October 30, 2011 represents the book value for our investment in CFG at January 30, 2012, the end of our third quarter.

Exhibit II

End of Q3 2012