C. Larry Pope President and Chief Executive Officer Robert W. Manly Executive Vice President and Chief Financial Officer

3 Forward-Looking Statements This presentation contains “forward-looking” statements within the meaning of the federal securities laws. The forward-looking statements include statements concerning the Company’s outlook for the future, as well as other statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning matters that are not historical facts. The Company’s forward-looking information and statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, the statements. These risks and uncertainties include the availability and prices of live hogs, raw materials, fuel and supplies, food safety, livestock disease, live hog production costs, product pricing, the competitive environment and related market conditions, risks associated with our indebtedness, including cost increases due to rising interest rates or changes in debt ratings or outlook, hedging risk, operating efficiencies, changes in foreign currency exchange rates, access to capital, the cost of compliance with changes to regulations and laws, including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational, health and safety laws, adverse results from on-going litigation, actions of domestic and foreign governments, labor relations issues, credit exposure to large customers, the ability to make effective acquisitions and dispositions and successfully integrate newly acquired businesses into existing operations, the Company’s ability to effectively restructure portions of its operations and achieve cost savings from such restructurings and other risks and uncertainties described in the Company’s Annual Report on Form 10-K for fiscal 2011 and the Company’s Quarterly Report on Form 10-Q for the quarter ended October 30, 2011. Readers are cautioned not to place undue reliance on forward-looking statements because actual results may differ materially from those expressed in, or implied by, the statements. Any forward-looking statement that the Company makes speaks only as of the date of such statement, and the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

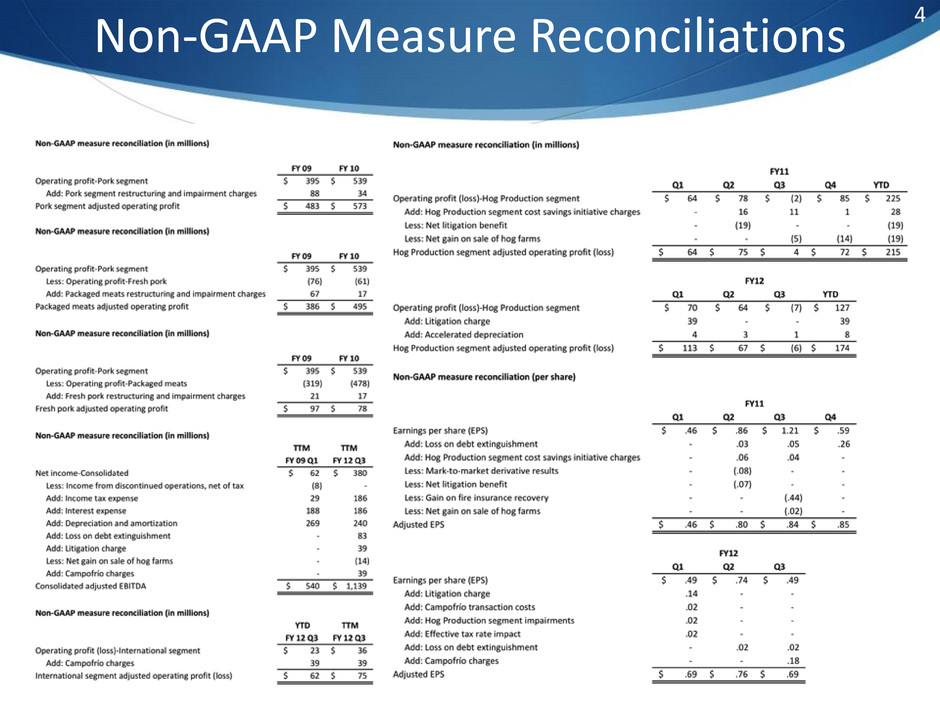

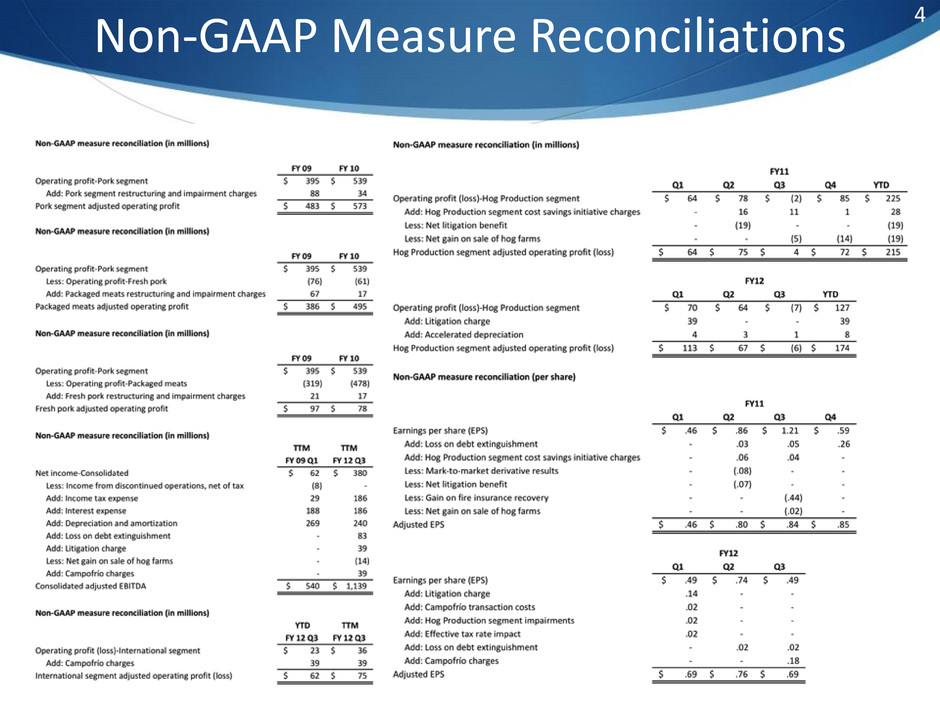

4 Non-GAAP Measure Reconciliations

Why Invest In SFD?

6 Investment Thesis Why Invest In SFD? Consistently Delivering Solid & More Predictable Earnings Focus On Growth In Packaged Meats Market Fundamentals Remain Supportive Positive Outlook For Fiscal 2012 & Fiscal 2013 Solid Financial Management Ongoing Share Repurchase & Debt Reduction Remain Priorities

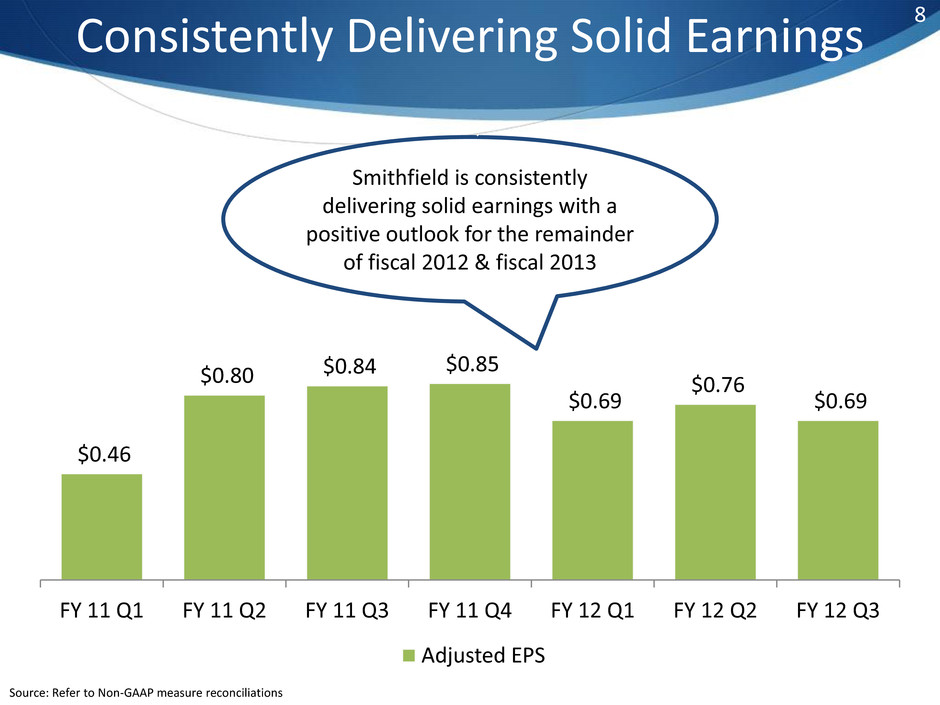

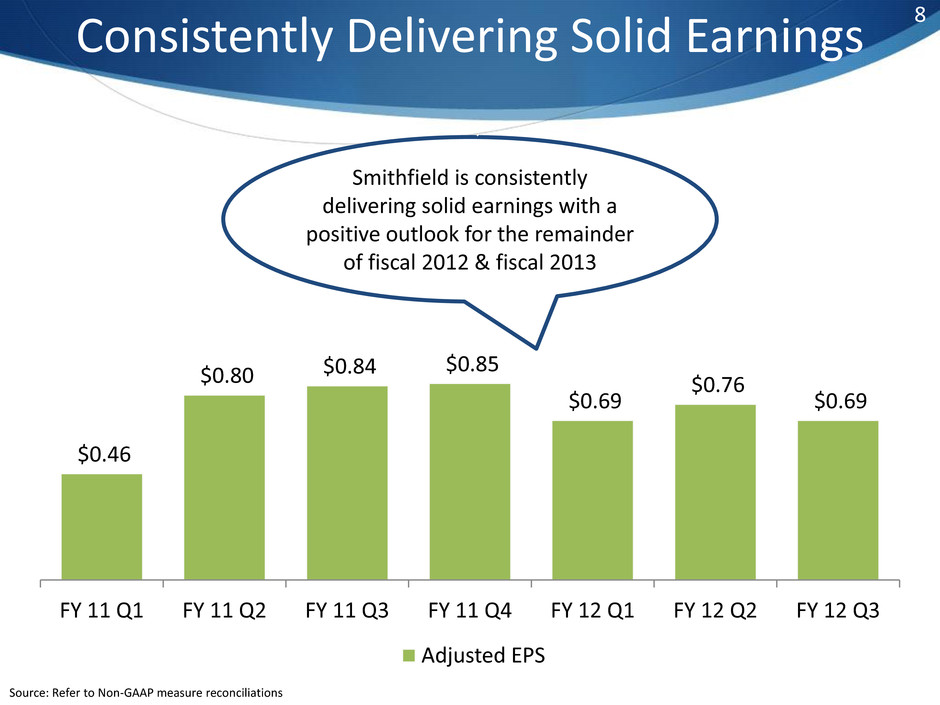

Consistently Delivering Solid & More Predictable Earnings

8 Consistently Delivering Solid Earnings $0.46 $0.80 $0.84 $0.85 $0.69 $0.76 $0.69 FY 11 Q1 FY 11 Q2 FY 11 Q3 FY 11 Q4 FY 12 Q1 FY 12 Q2 FY 12 Q3 Adjusted EPS Source: Refer to Non-GAAP measure reconciliations Smithfield is consistently delivering solid earnings with a positive outlook for the remainder of fiscal 2012 & fiscal 2013

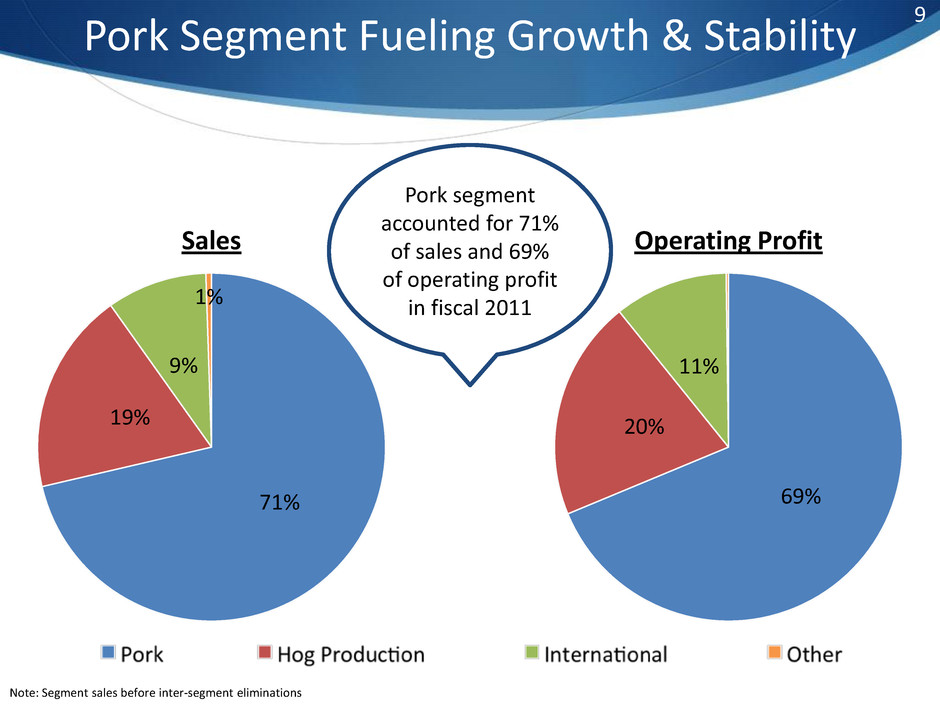

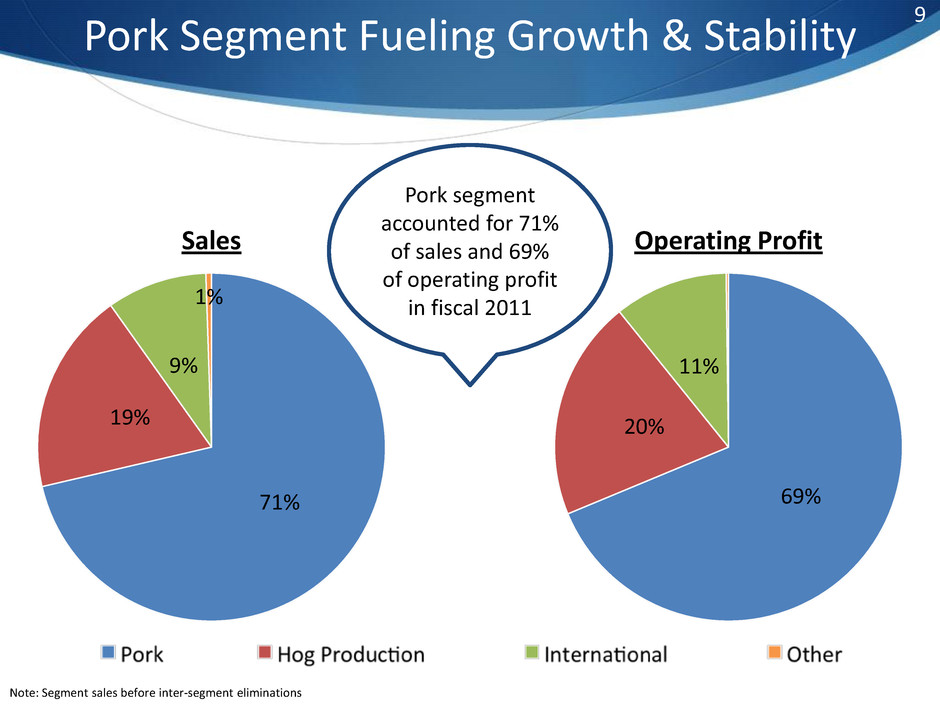

9 Pork Segment Fueling Growth & Stability Note: Segment sales before inter-segment eliminations 71% 19% 9% 1% Sales Pork segment accounted for 71% of sales and 69% of operating profit in fiscal 2011 69% 20% 11% Operating Profit

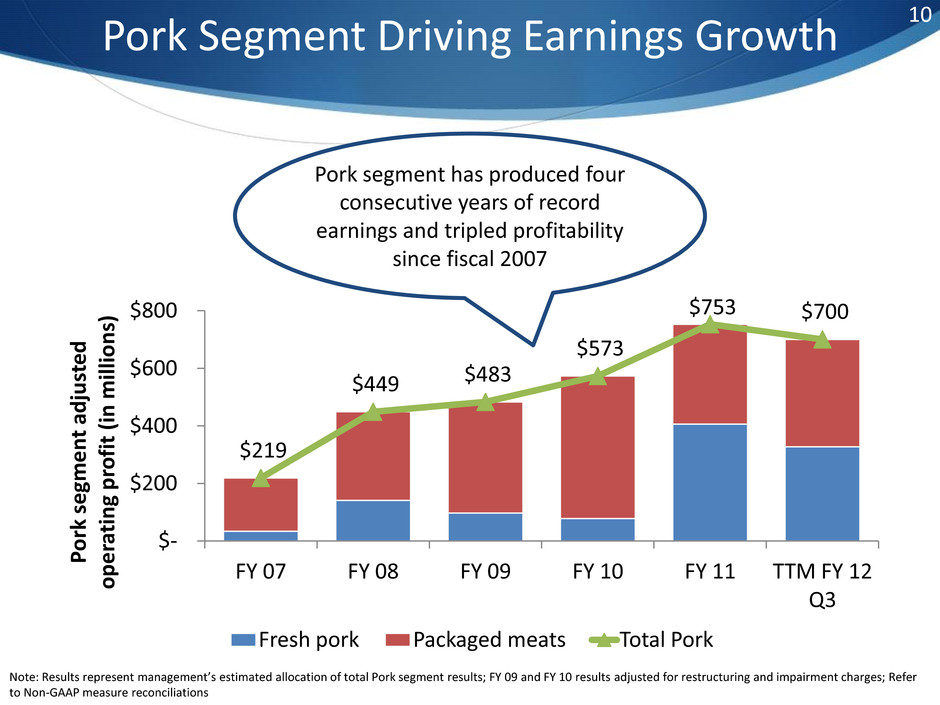

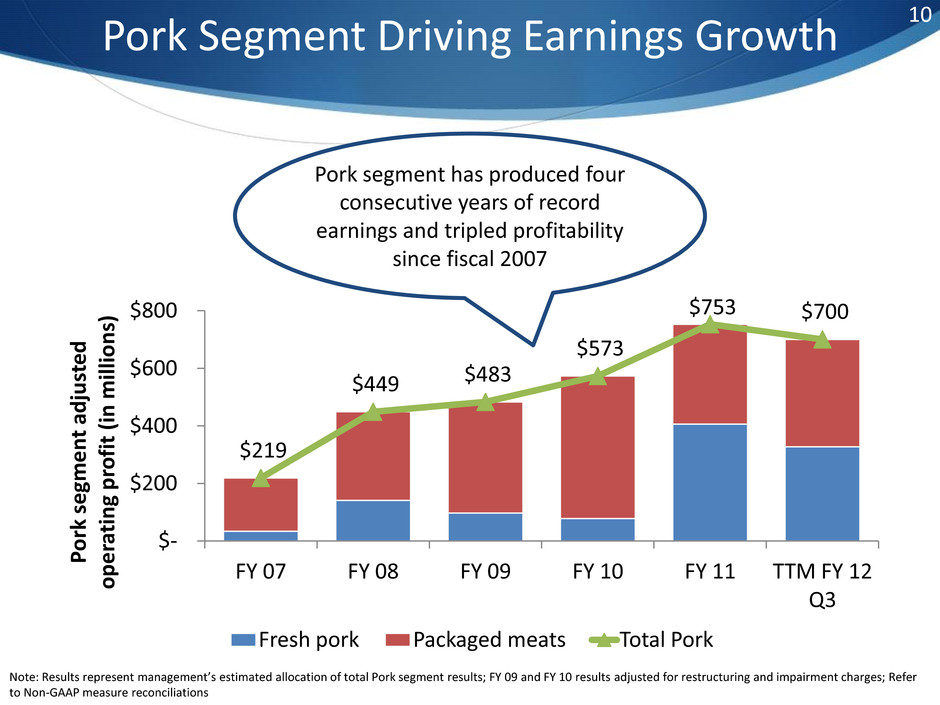

10 Pork Segment Driving Earnings Growth $219 $449 $483 $573 $753 $700 $- $200 $400 $600 $800 FY 07 FY 08 FY 09 FY 10 FY 11 TTM FY 12 Q3 P ork s e gm e n t adj u st e d o p e ra ti n g p rofit (i n milli o n s) Fresh pork Packaged meats Total Pork Note: Results represent management’s estimated allocation of total Pork segment results; FY 09 and FY 10 results adjusted for restructuring and impairment charges; Refer to Non-GAAP measure reconciliations Pork segment has produced four consecutive years of record earnings and tripled profitability since fiscal 2007

$0.10 $0.12 $0.17 $0.13 $0.14 5.6% 6.9% 9.6% 6.1% 6.2% FY 08 FY 09 FY 10 FY 11 FY 12 Q3 YTD Packaged Meats Adjusted Operating profit ($ per pound) Adjusted Operating profit (% of sales) 11 Consistently Solid & Predictable Margins Note: Results represent management’s estimated allocation of total Pork Segment results; FY 09 and FY 10 results adjusted for restructuring and impairment charges; Refer to Non-GAAP measure reconciliations; Sales before inter-segment eliminations $5 $3 $3 $15 $12 3.4% 2.0% 1.9% 8.9% 6.5% FY 08 FY 09 FY 10 FY 11 FY 12 Q3 YTD Fresh Pork Adjusted Operating profit ($ per head) Adjusted Operating profit (% of sales) Normalized Range=$3-7 per head Normalized Range=$0.10-0.15 per pound

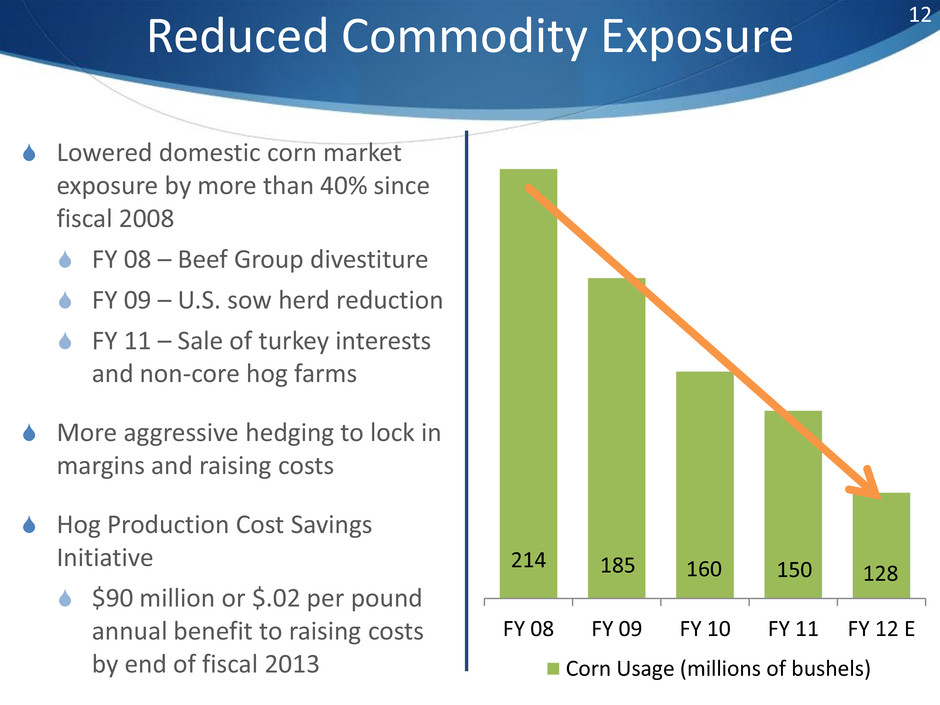

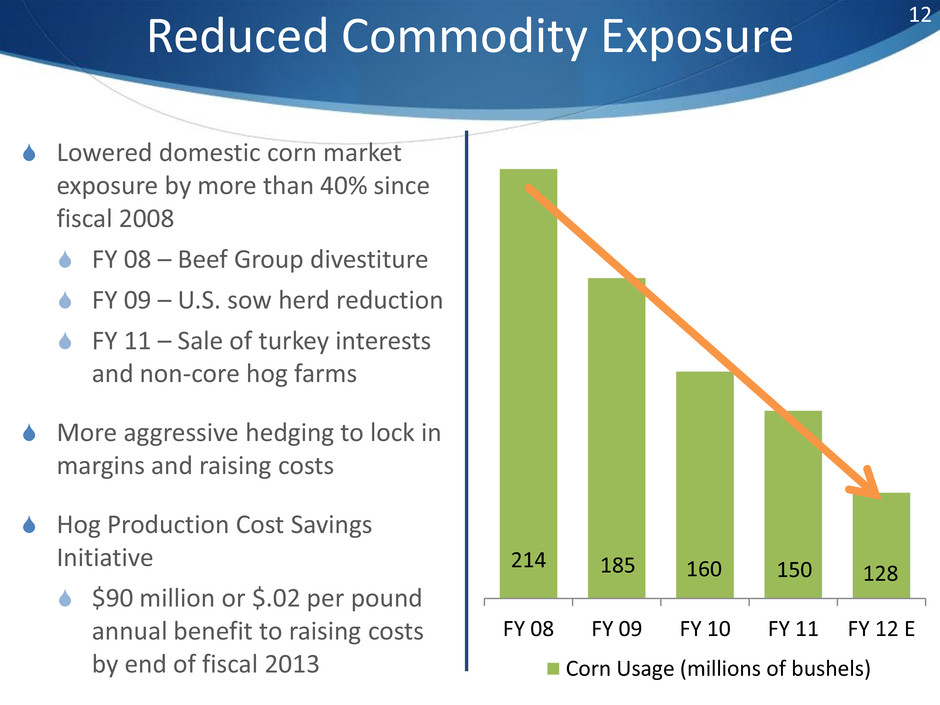

Reduced Commodity Exposure Lowered domestic corn market exposure by more than 40% since fiscal 2008 FY 08 – Beef Group divestiture FY 09 – U.S. sow herd reduction FY 11 – Sale of turkey interests and non-core hog farms More aggressive hedging to lock in margins and raising costs Hog Production Cost Savings Initiative $90 million or $.02 per pound annual benefit to raising costs by end of fiscal 2013 214 185 160 150 128 FY 08 FY 09 FY 10 FY 11 FY 12 E Corn Usage (millions of bushels) 12

Focus On Growth In Packaged Meats

14 Executing Strategy For Growth • Consumer marketing spending +20% in fiscal 2012 • Restructured Pork Group is platform for growth • Driving consumer relevant product innovation • Leveraging consolidated brand portfolio Focus on 12 core brands Building strong innovation pipeline Investing in advertising to activate brands Coordinated sales & marketing team Growing share & distribution

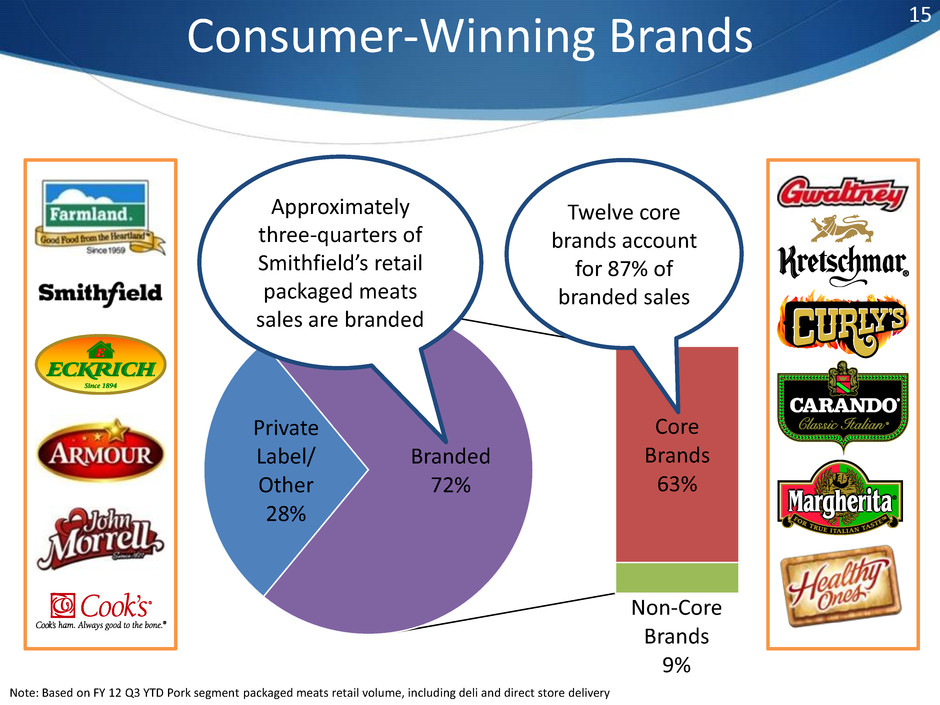

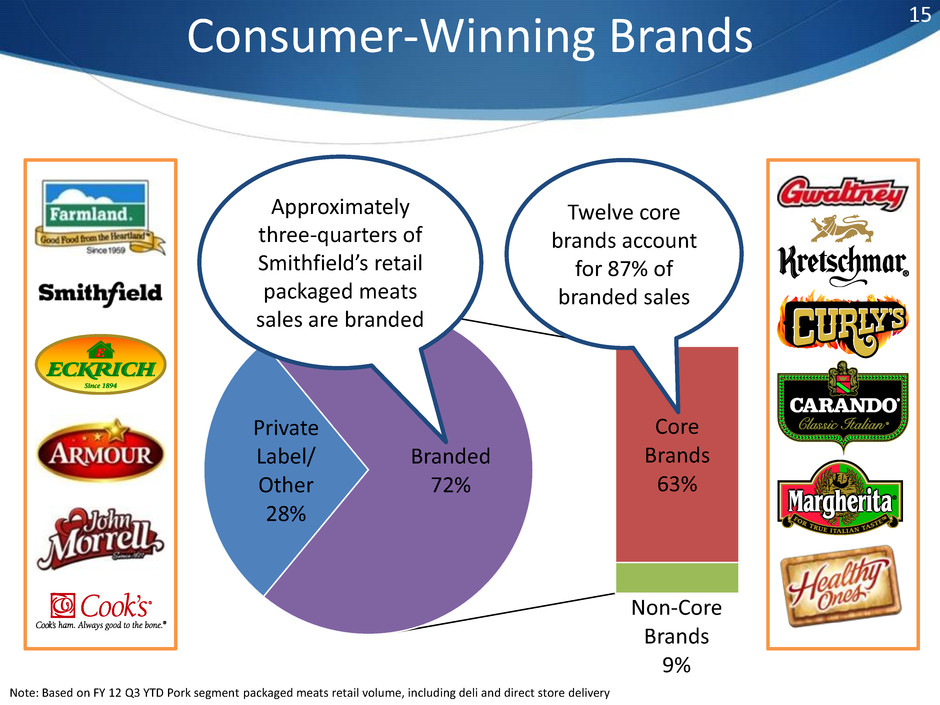

15 Consumer-Winning Brands Note: Based on FY 12 Q3 YTD Pork segment packaged meats retail volume, including deli and direct store delivery Private Label/ Other 28% Core Brands 63% Non-Core Brands 9% Branded 72% Approximately three-quarters of Smithfield’s retail packaged meats sales are branded Twelve core brands account for 87% of branded sales

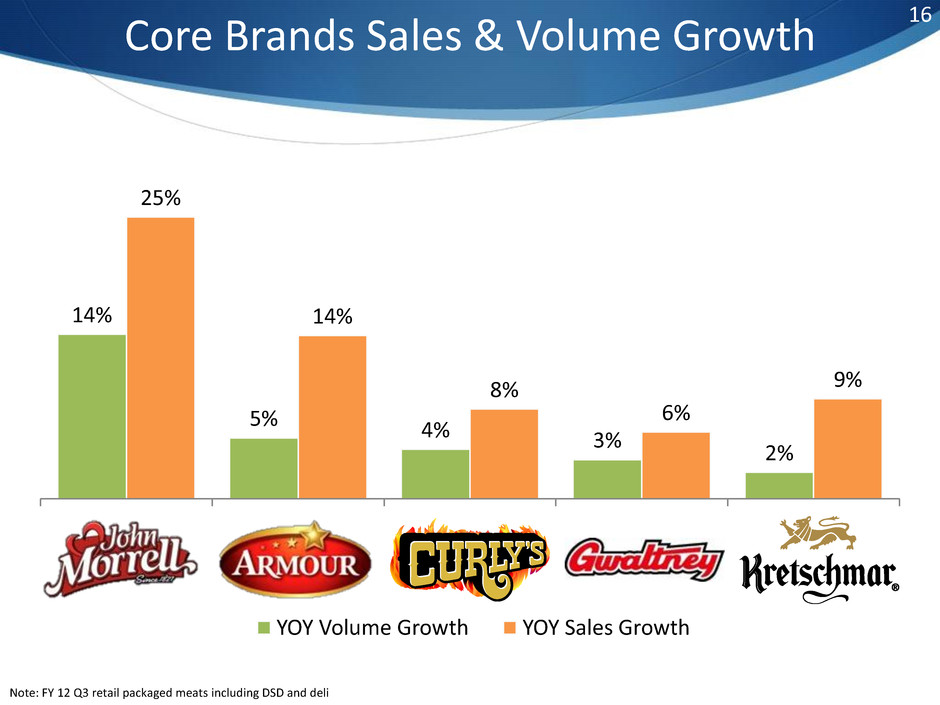

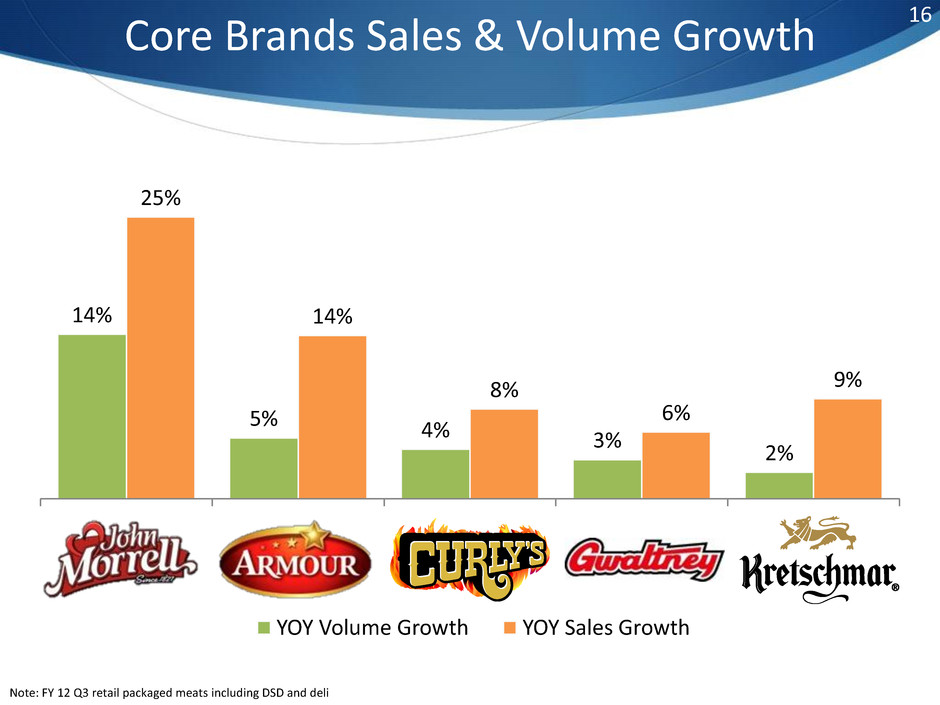

16 Core Brands Sales & Volume Growth 14% 5% 4% 3% 2% 25% 14% 8% 6% 9% John Morrell Armour Curly's Gwaltney Kretschmar YOY Volume Growth YOY Sales Growth Note: FY 12 Q3 retail packaged meats including DSD and deli

17 Gaining Distribution In Key Categories Source: Information Resources, Inc. (IRI) 12 weeks ending 01/29/12 and Freshlook Marketing 12 weeks ending 01/01/12 +14% +8% +3% +3% +1% Dry Sausage BBQ Portable Lunches Deli Meats Marinated Pork YOY ACV % Growth

18 Innovation & Brand Activation Driving Consumer Relevant Product Innovation Convenience Health & Nutrition Packaging Investing In Advertising To Drive Awareness Digital FSIs Print Radio Retail POS Social Media Television Innovation Brand Activation

Curly’s Sauceless BBQ Eckrich Bacon Covered Ham Farmland Re-sealable Thick Sliced Bacon Smithfield Ham Steaks with Glaze Smithfield PouchPack Bacon 19 New Innovative Product Launches

20 Richard Petty Motorsports NASCAR Partnership Multiyear, integrated partnership with Richard Petty Motorsports NASCAR team Primary sponsor of No. 43 Ford Fusion in fifteen NASCAR races in 2012, including Daytona 500 Underscores strategy to activate brands with consumer-focused marketing

Market Fundamentals Remain Supportive

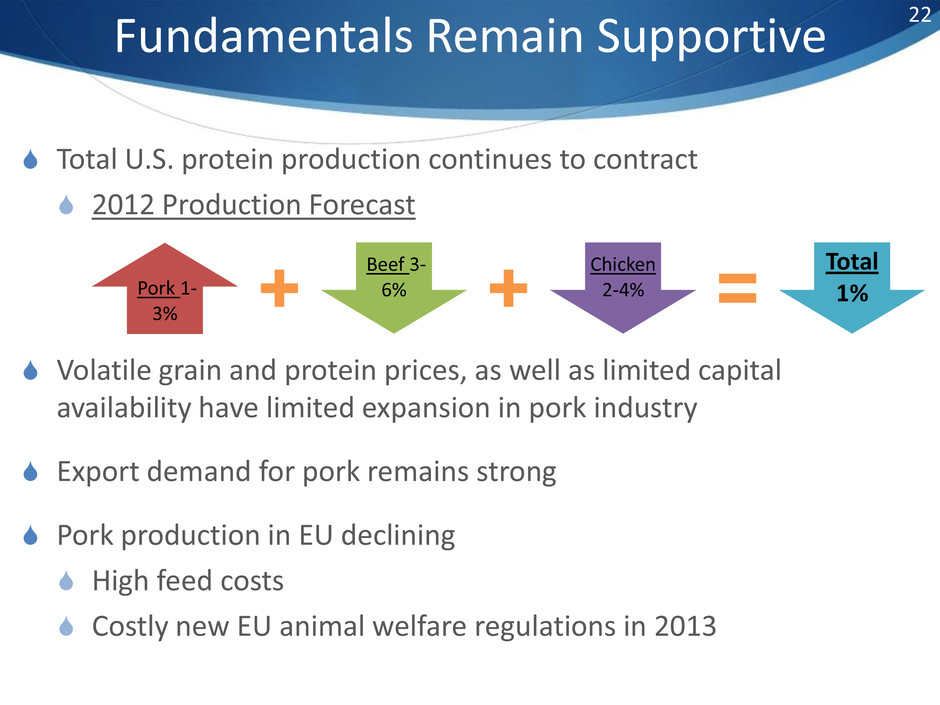

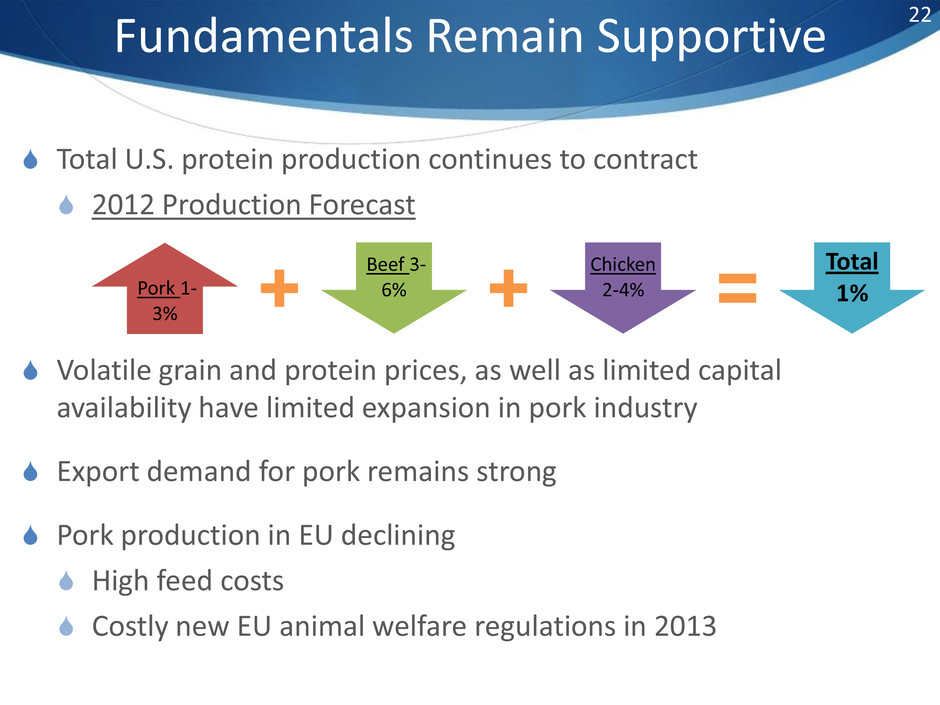

22 Fundamentals Remain Supportive Total U.S. protein production continues to contract 2012 Production Forecast Volatile grain and protein prices, as well as limited capital availability have limited expansion in pork industry Export demand for pork remains strong Pork production in EU declining High feed costs Costly new EU animal welfare regulations in 2013 Pork 1- 3% Beef 3- 6% Chicken 2-4% Total 1%

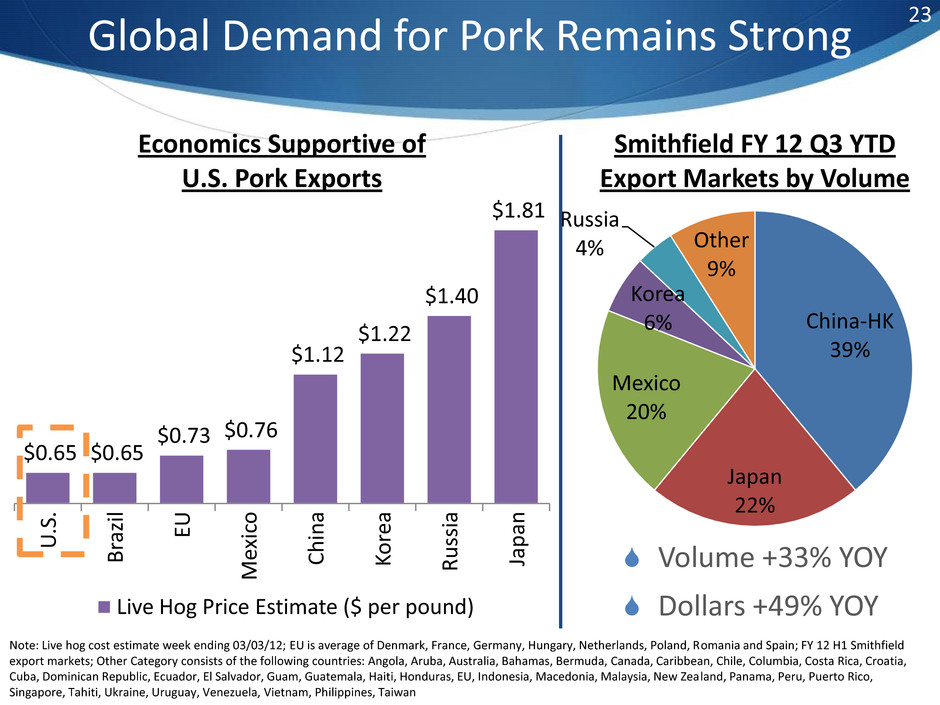

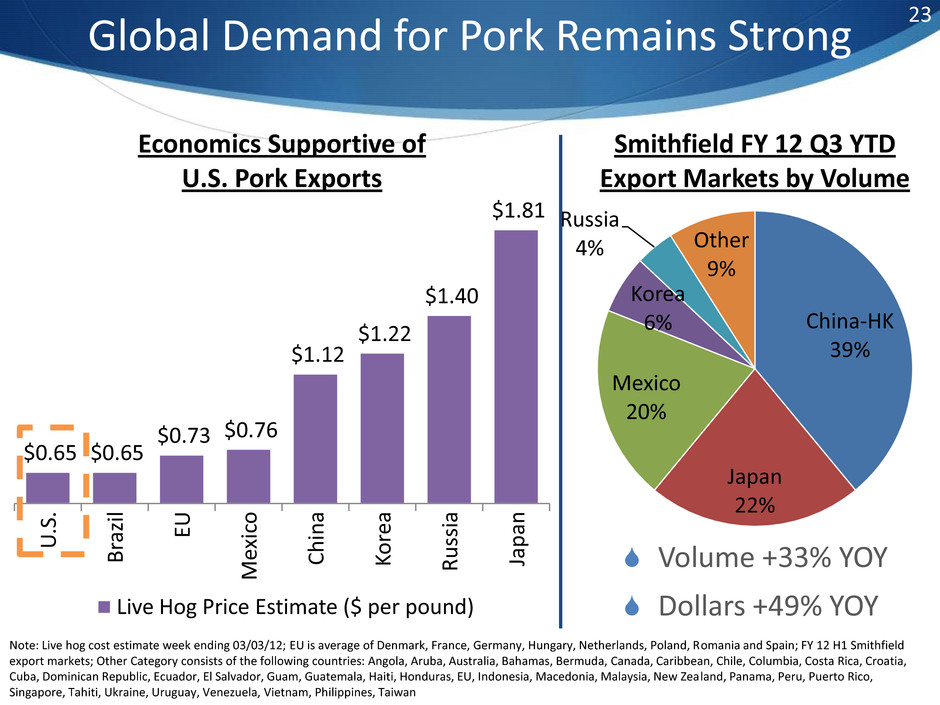

$0.65 $0.65 $0.73 $0.76 $1.12 $1.22 $1.40 $1.81 U .S . B raz il EU M exi co Chin a Ko re a Rus si a Ja p an Economics Supportive of U.S. Pork Exports Live Hog Price Estimate ($ per pound) China-HK 39% Japan 22% Mexico 20% Korea 6% Russia 4% Other 9% Smithfield FY 12 Q3 YTD Export Markets by Volume 23 Global Demand for Pork Remains Strong Volume +33% YOY Dollars +49% YOY Note: Live hog cost estimate week ending 03/03/12; EU is average of Denmark, France, Germany, Hungary, Netherlands, Poland, Romania and Spain; FY 12 H1 Smithfield export markets; Other Category consists of the following countries: Angola, Aruba, Australia, Bahamas, Bermuda, Canada, Caribbean, Chile, Columbia, Costa Rica, Croatia, Cuba, Dominican Republic, Ecuador, El Salvador, Guam, Guatemala, Haiti, Honduras, EU, Indonesia, Macedonia, Malaysia, New Zealand, Panama, Peru, Puerto Rico, Singapore, Tahiti, Ukraine, Uruguay, Venezuela, Vietnam, Philippines, Taiwan

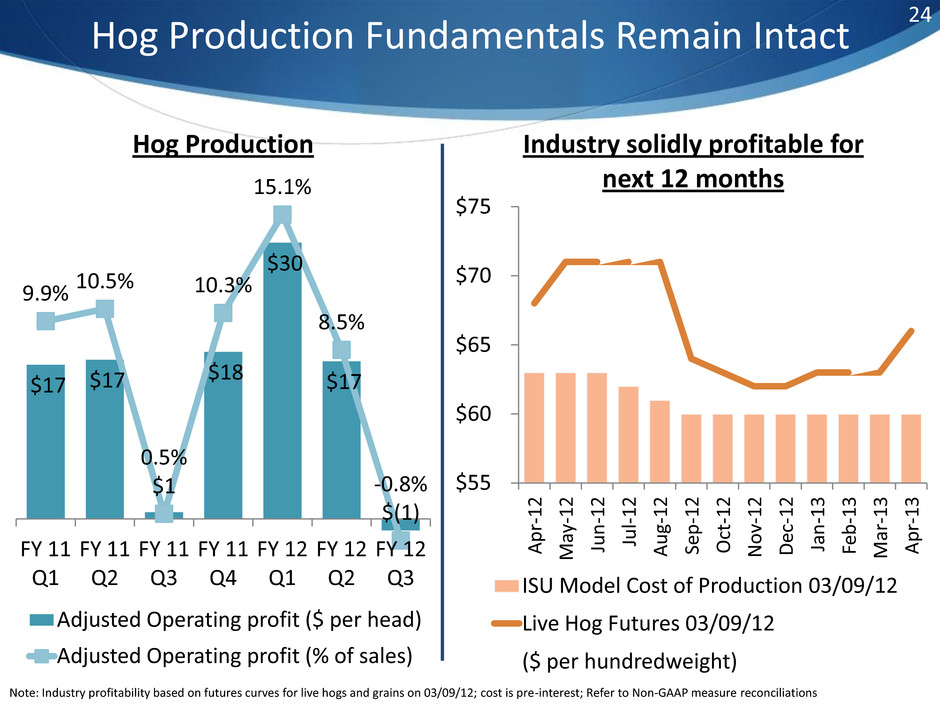

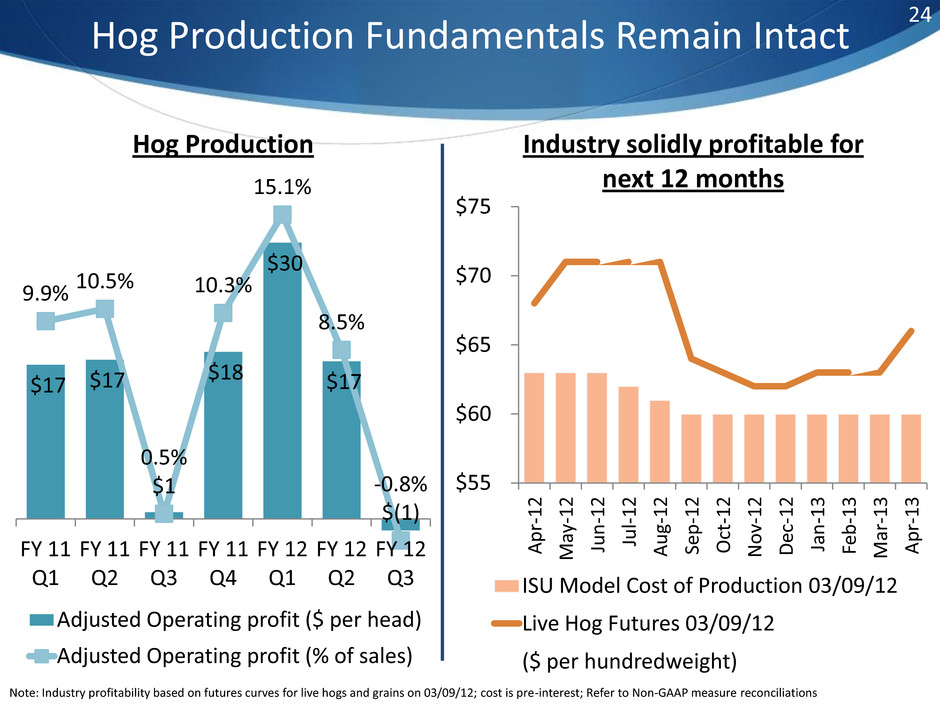

24 Hog Production Fundamentals Remain Intact $55 $60 $65 $70 $75 Ap r- 1 2 M ay -1 2 Ju n -1 2 Ju l- 1 2 Au g- 1 2 Se p -1 2 Oc t- 1 2 N o v- 1 2 De c- 1 2 Ja n -1 3 Fe b -1 3 M ar -1 3 Ap r- 1 3 Industry solidly profitable for next 12 months ISU Model Cost of Production 03/09/12 Live Hog Futures 03/09/12 Note: Industry profitability based on futures curves for live hogs and grains on 03/09/12; cost is pre-interest; Refer to Non-GAAP measure reconciliations $17 $17 $18 $30 $17 9.9% 10.5% 0.5% $1 10.3% 15.1% 8.5% -0.8% $(1) FY 11 Q1 FY 11 Q2 FY 11 Q3 FY 11 Q4 FY 12 Q1 FY 12 Q2 FY 12 Q3 Hog Production Adjusted Operating profit ($ per head) Adjusted Operating profit (% of sales) ($ per hundredweight)

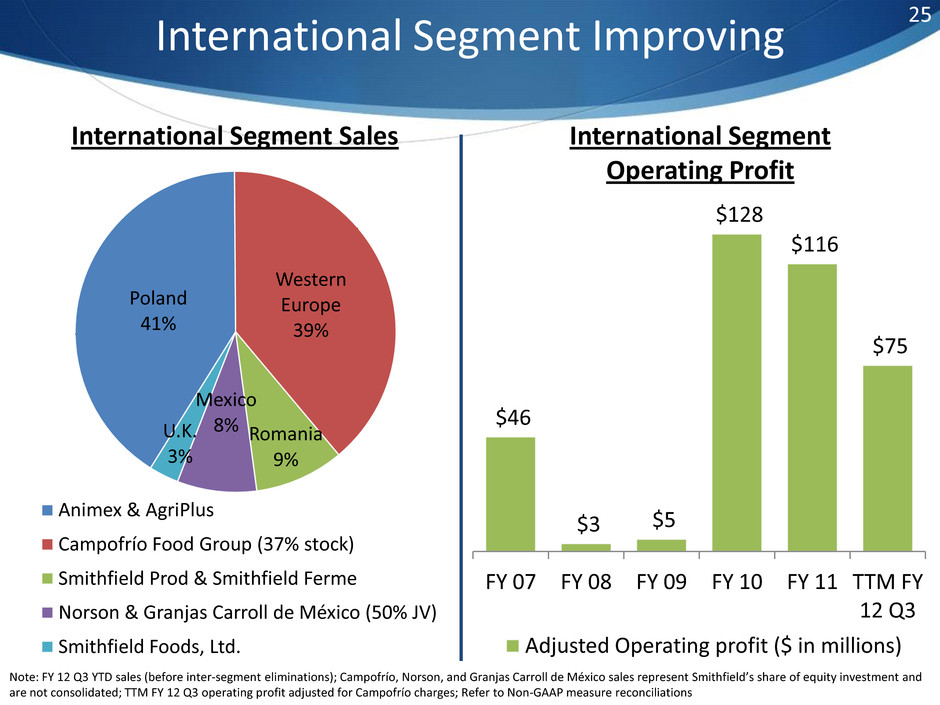

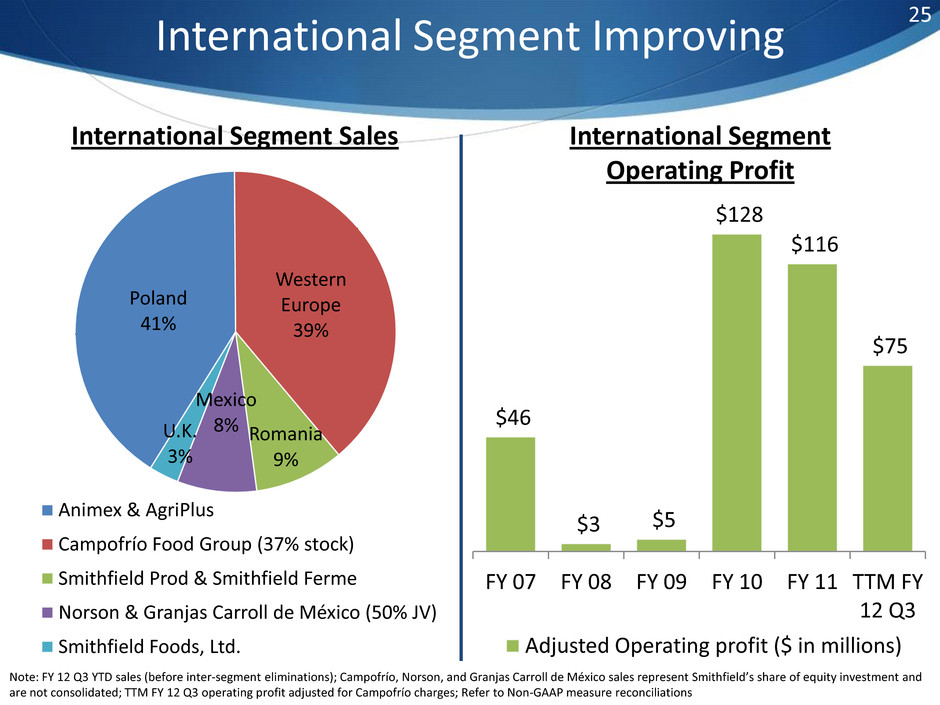

Poland 41% Western Europe 39% Romania 9% Mexico 8% U.K. 3% International Segment Sales Animex & AgriPlus Campofrío Food Group (37% stock) Smithfield Prod & Smithfield Ferme Norson & Granjas Carroll de México (50% JV) Smithfield Foods, Ltd. 25 International Segment Improving Note: FY 12 Q3 YTD sales (before inter-segment eliminations); Campofrío, Norson, and Granjas Carroll de México sales represent Smithfield’s share of equity investment and are not consolidated; TTM FY 12 Q3 operating profit adjusted for Campofrío charges; Refer to Non-GAAP measure reconciliations $46 $3 $5 $128 $116 $75 FY 07 FY 08 FY 09 FY 10 FY 11 TTM FY 12 Q3 International Segment Operating Profit Adjusted Operating profit ($ in millions)

Solid Financial Management

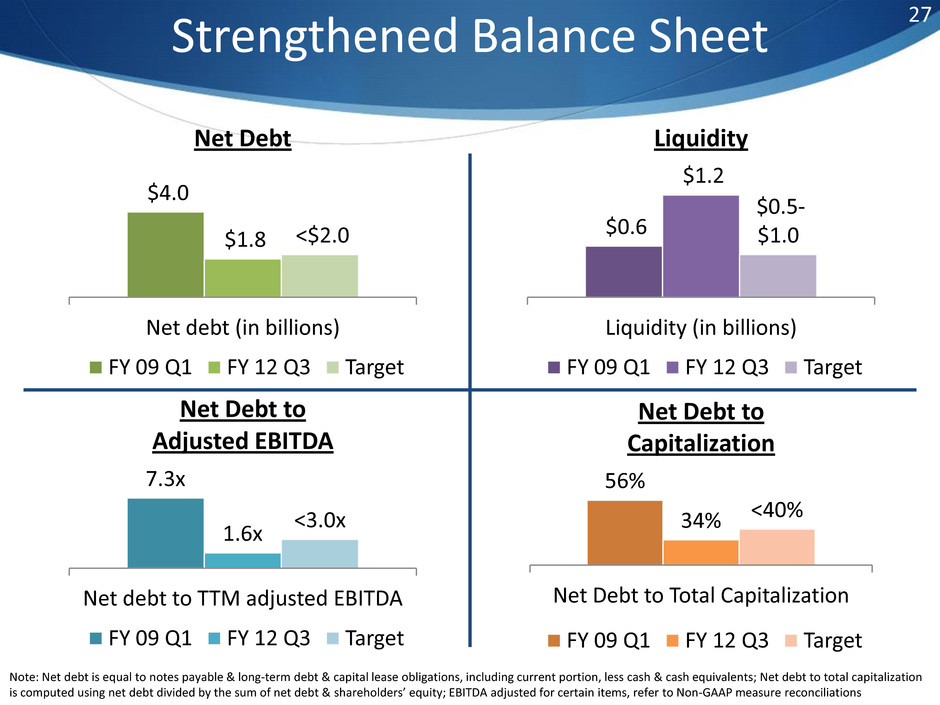

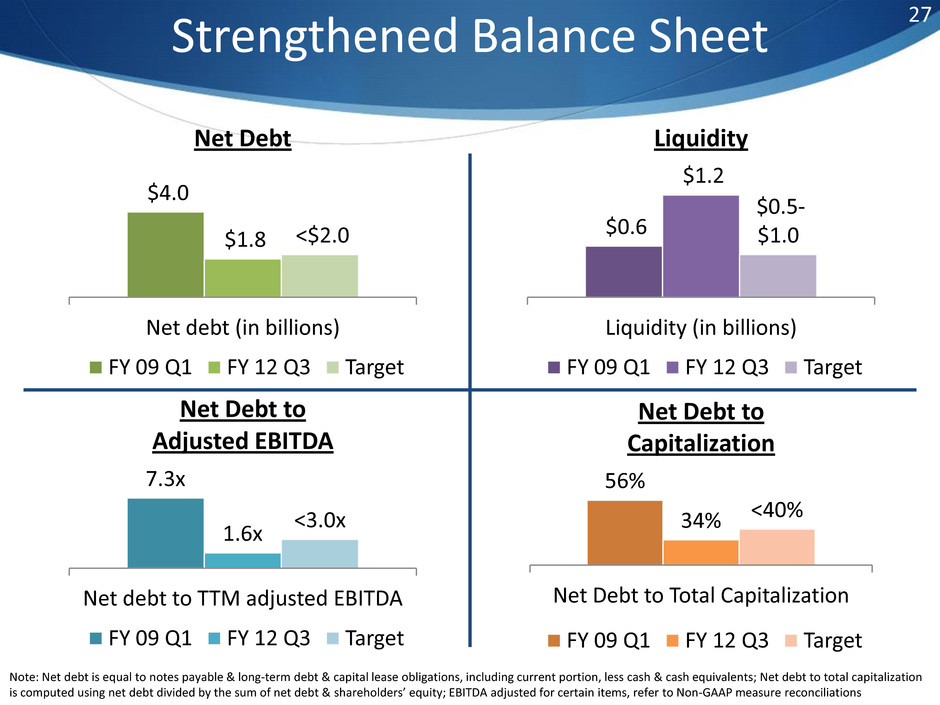

27 Strengthened Balance Sheet $4.0 $1.8 <$2.0 Net debt (in billions) Net Debt FY 09 Q1 FY 12 Q3 Target 7.3x 1.6x <3.0x Net debt to TTM adjusted EBITDA Net Debt to Adjusted EBITDA FY 09 Q1 FY 12 Q3 Target 56% 34% <40% Net Debt to Total Capitalization Net Debt to Capitalization FY 09 Q1 FY 12 Q3 Target $0.6 $1.2 $0.5- $1.0 Liquidity (in billions) Liquidity FY 09 Q1 FY 12 Q3 Target Note: Net debt is equal to notes payable & long-term debt & capital lease obligations, including current portion, less cash & cash equivalents; Net debt to total capitalization is computed using net debt divided by the sum of net debt & shareholders’ equity; EBITDA adjusted for certain items, refer to Non-GAAP measure reconciliations

$69 $66 $60 $51 $48 $44 $42 FY 11 Q1 FY 11 Q2 FY 11 Q3 FY 11 Q4 FY 12 Q1 FY 12 Q2 FY 12 Q3 Quarterly Interest Expense ($ in millions) 28 Reduced Cost Profile Smithfield has eliminated $100 million in annual finance and interest expense

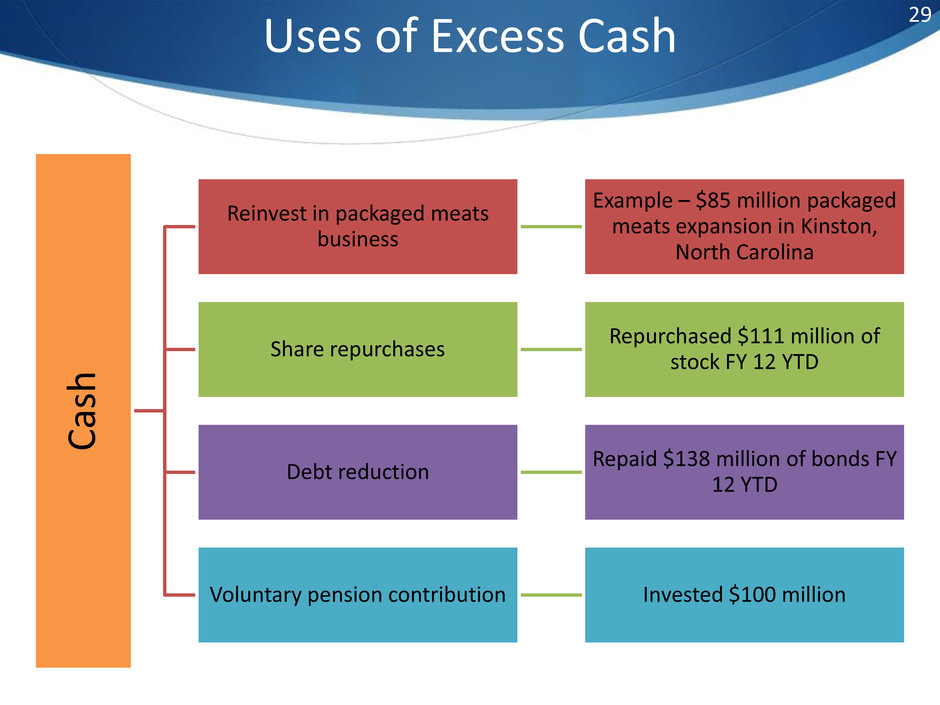

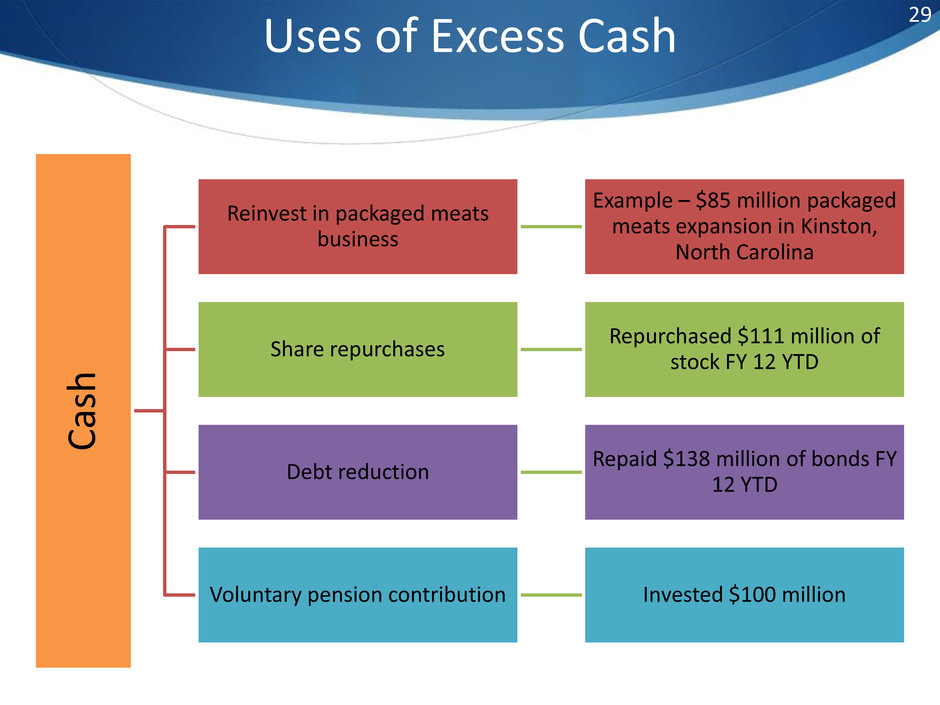

29 Uses of Excess Cash Ca sh Reinvest in packaged meats business Example – $85 million packaged meats expansion in Kinston, North Carolina Share repurchases Repurchased $111 million of stock FY 12 YTD Debt reduction Repaid $138 million of bonds FY 12 YTD Voluntary pension contribution Invested $100 million

Positive Outlook for Fiscal 2012 and Fiscal 2013

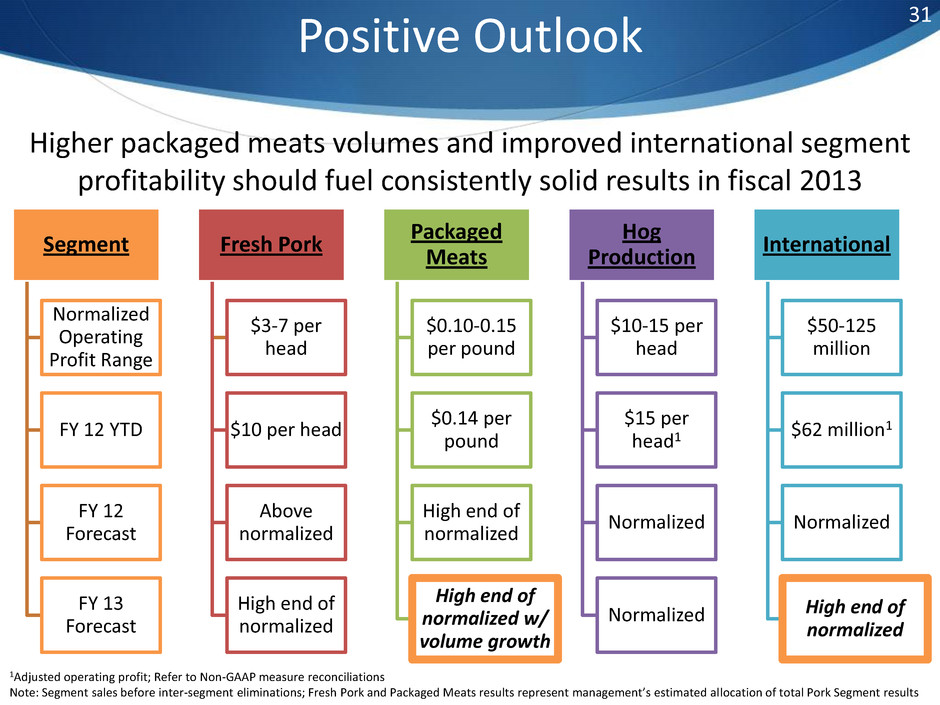

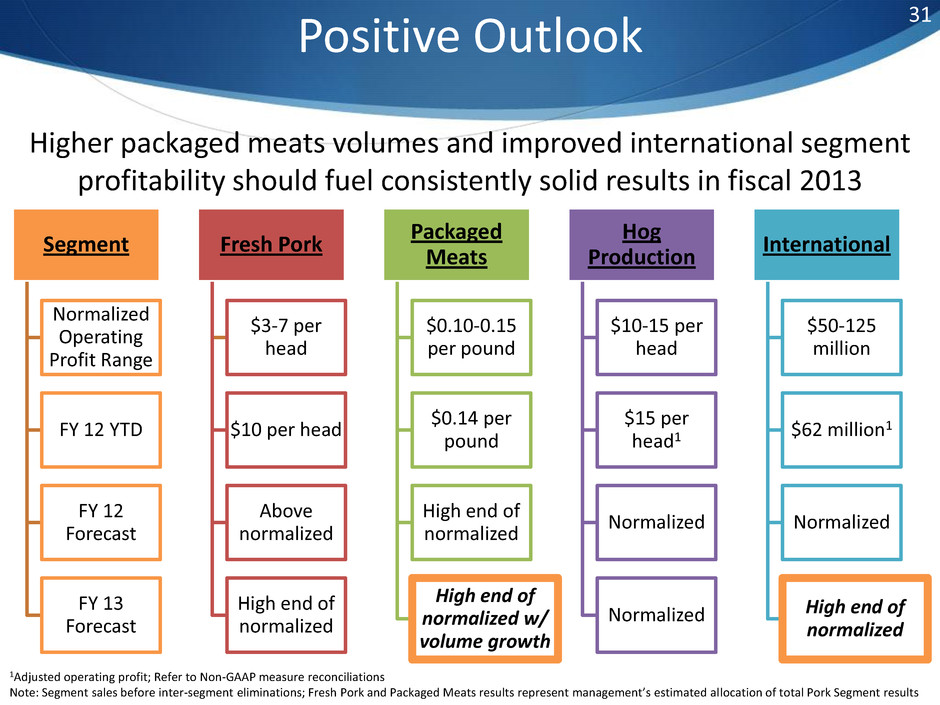

Segment Normalized Operating Profit Range FY 12 YTD FY 12 Forecast FY 13 Forecast Fresh Pork $3-7 per head $10 per head Above normalized High end of normalized Packaged Meats $0.10-0.15 per pound $0.14 per pound High end of normalized High end of normalized w/ volume growth Hog Production $10-15 per head $15 per head1 Normalized Normalized International $50-125 million $62 million1 Normalized High end of normalized 31 Positive Outlook 1Adjusted operating profit; Refer to Non-GAAP measure reconciliations Note: Segment sales before inter-segment eliminations; Fresh Pork and Packaged Meats results represent management’s estimated allocation of total Pork Segment results Higher packaged meats volumes and improved international segment profitability should fuel consistently solid results in fiscal 2013

Why Invest In SFD?

33 Investment Thesis Why Invest In SFD? Consistently Delivering Solid & More Predictable Earnings Focus On Growth In Packaged Meats Market Fundamentals Remain Supportive Positive Outlook For Fiscal 2012 & Fiscal 2013 Solid Financial Management Ongoing Share Repurchase & Debt Reduction Remain Priorities

Appendix Smithfield: A Leading Global Food Company

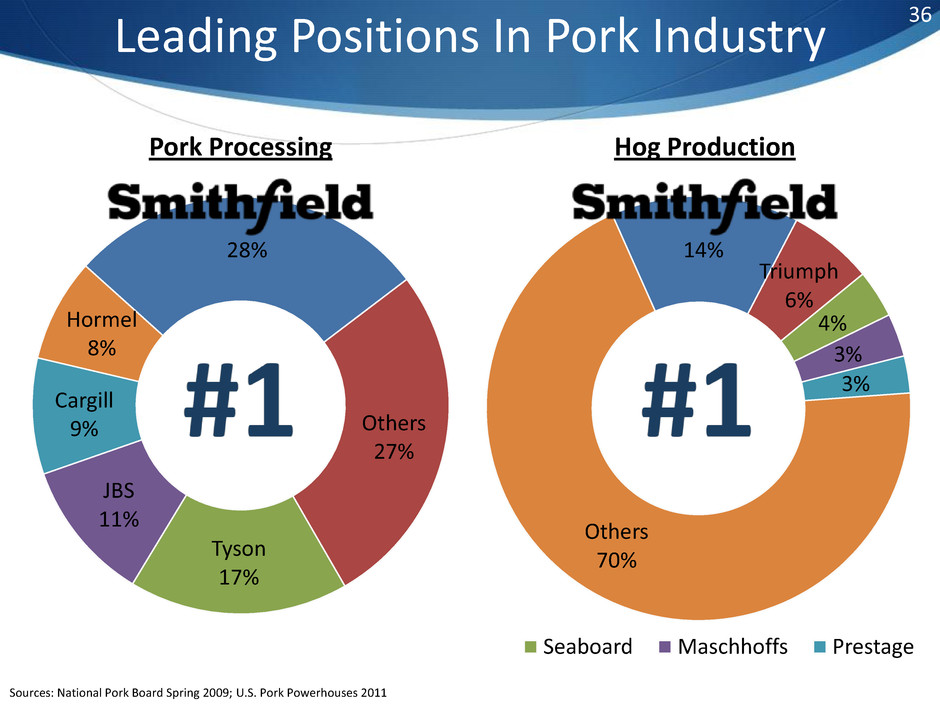

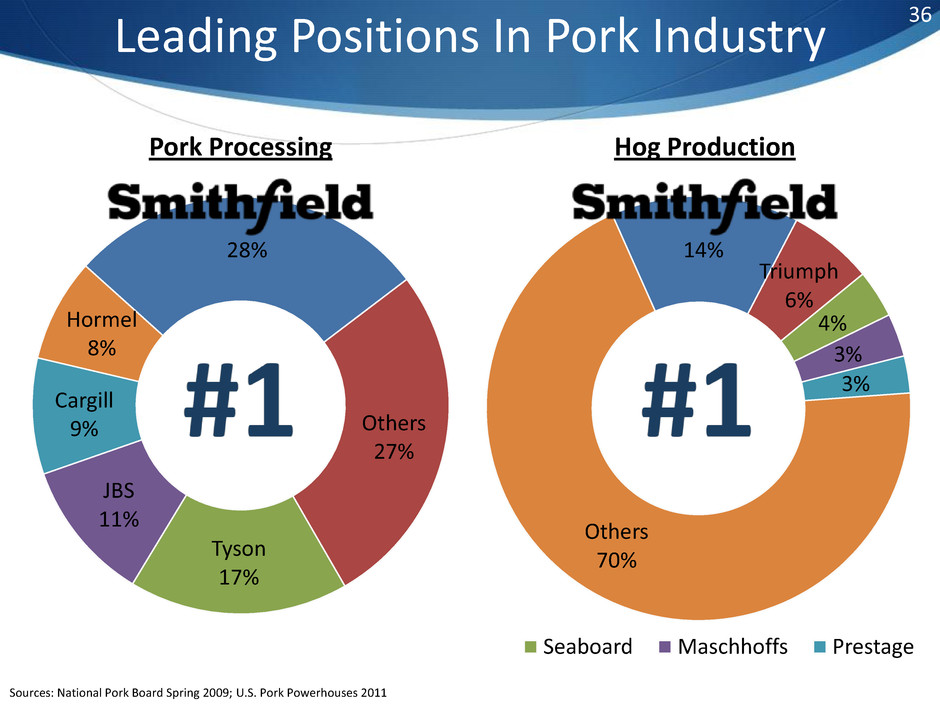

36 Leading Positions In Pork Industry Sources: National Pork Board Spring 2009; U.S. Pork Powerhouses 2011 14% Triumph 6% 4% 3% 3% Others 70% Hog Production Seaboard Maschhoffs Prestage 28% Others 27% Tyson 17% JBS 11% Cargill 9% Hormel 8% Pork Processing

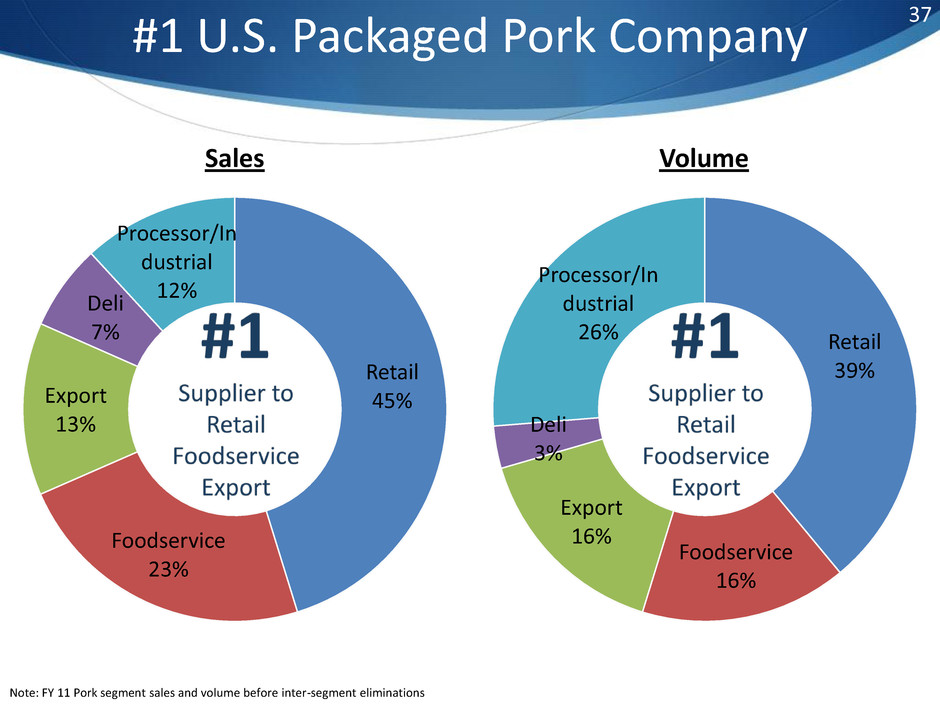

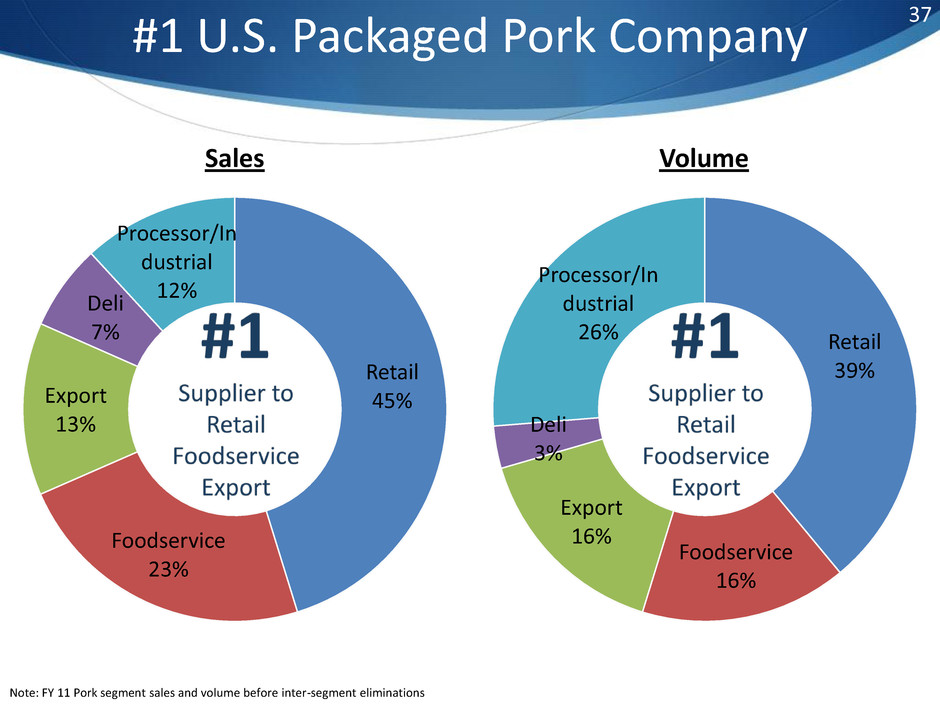

Retail 39% Foodservice 16% Export 16% Deli 3% Processor/In dustrial 26% Volume 37 #1 U.S. Packaged Pork Company Retail 45% Foodservice 23% Export 13% Deli 7% Processor/In dustrial 12% Sales Note: FY 11 Pork segment sales and volume before inter-segment eliminations

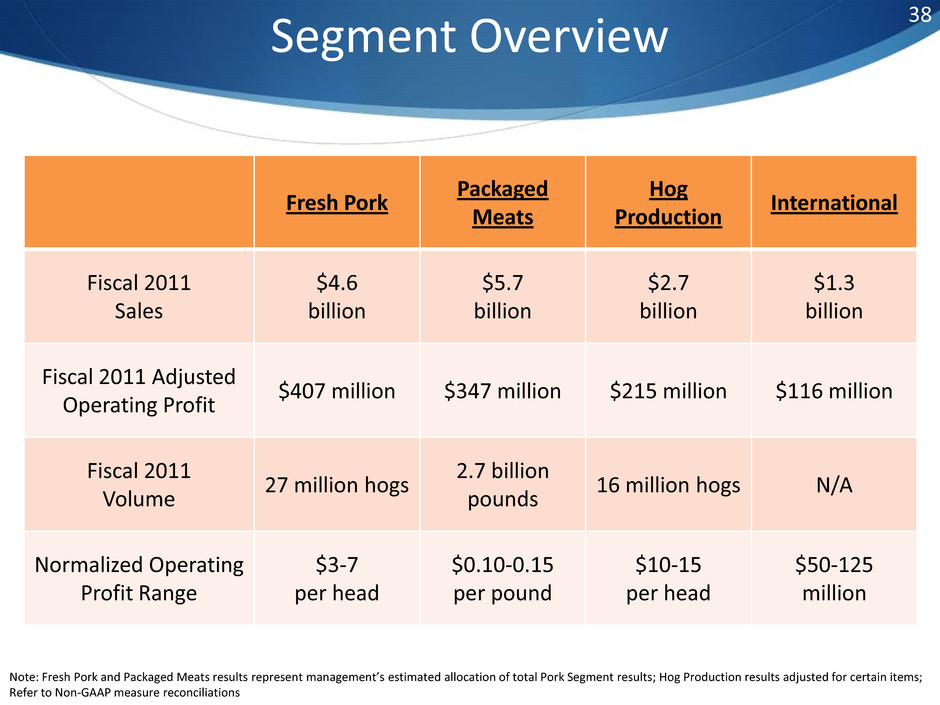

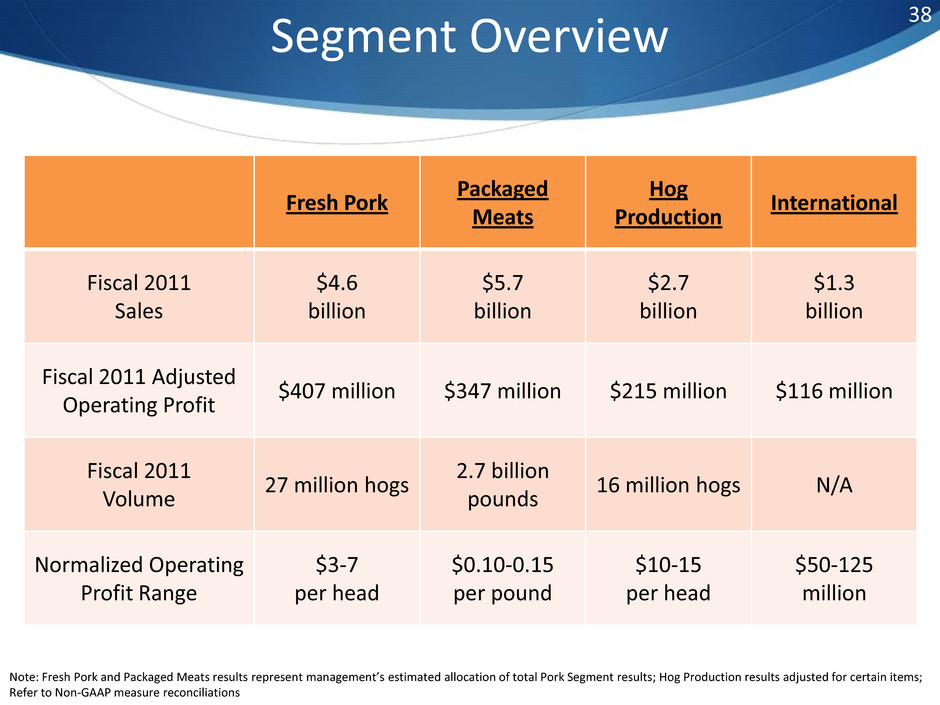

38 Segment Overview Fresh Pork Packaged Meats Hog Production International Fiscal 2011 Sales $4.6 billion $5.7 billion $2.7 billion $1.3 billion Fiscal 2011 Adjusted Operating Profit $407 million $347 million $215 million $116 million Fiscal 2011 Volume 27 million hogs 2.7 billion pounds 16 million hogs N/A Normalized Operating Profit Range $3-7 per head $0.10-0.15 per pound $10-15 per head $50-125 million Note: Fresh Pork and Packaged Meats results represent management’s estimated allocation of total Pork Segment results; Hog Production results adjusted for certain items; Refer to Non-GAAP measure reconciliations