UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

|

| | |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | December 31, 2013 |

or

|

| | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from | to |

| Commission file number | 0-22660 |

TRIQUINT SEMICONDUCTOR, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 95-3654013 |

State or other jurisdiction of incorporation or organization | | (I.R.S. Employer Identification No.) |

| | | |

| 2300 N.E. Brookwood Parkway, Hillsboro, Oregon | | 97124 |

| (Address of principal executive offices) | | (Zip Code) |

| Registrant's telephone number, including area code | | (503) 615-9000 |

| Securities registered pursuant to Section 12(b) of the Act: | | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | The NASDAQ Stock Market LLC |

| | | |

| Securities registered pursuant to Section 12(g) of the Act: |

| None |

| (Title of class) |

| |

| (Title of class) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes £ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes £ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No £

Indicate by a check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer £

Non-accelerated filer £ (Do not check if a smaller reporting company) Smaller reporting company £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No x

The aggregate market value of the voting common stock held by non-affiliates of the Registrant, based upon the closing sale price of the common stock on June 30, 2013, the last day of the Registrant’s second fiscal quarter was approximately $866,697,131. Shares of common stock held by each executive officer and director and by each person who owns 5% or more of the Registrant’s outstanding common stock have been excluded from this computation. The determination of affiliate status for this purpose is not necessarily a conclusive determination for other purposes. The Registrant does not have any non-voting common equity securities.

As of April 4, 2014, there were 168,678,200 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Not applicable.

EXPLANATORY NOTE

TriQuint Semiconductor, Inc. (“TriQuint” or the “company”) is filing this Amendment Number 1 on Form 10-K/A to amend its Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Exchange Commission ("SEC")on February 21, 2014, to provide the information required by Part III of Form 10-K. In its original Annual Report on Form 10-K for the year ended December 31, 2013, the company incorporated Part III of Form 10-K by reference to its proxy statement for the 2014 Annual Meeting of Stockholders, pursuant to General Instruction G(3) to Form 10-K. However, the proxy statement for the 2014 Annual Meeting of Stockholders will not be filed within 120 days after the end of the company’s 2013 fiscal year, so the company is filing this amendment pursuant to Rule 12b-15 of the Securities Exchange Act of 1934 to provide the information required by Part III of Form 10-K.

Unless otherwise expressly stated herein, this amendment does not reflect any events occurring after the filing of the Company’s original Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on February 21, 2014.

TRIQUINT SEMICONDUCTOR, INC.

INDEX

|

| | | | |

| | | | | |

| | | PART III | | |

| Item 10. | | | | |

| Item 11. | | | | |

| Item 12. | | | | |

| Item 13. | | | | |

| Item 14. | | | | |

| | | PART IV | | |

| Item 15. | | | | |

| | | | | |

| | | | |

| | | | |

Part III

| |

| Item 10. | Directors, Executive Officers and Corporate Governance |

Executive Officers

The biographical information concerning our executive officers, including their ages as of February 21, 2014, is set forth below:

|

| | | | | |

| Name | Age | | Current Position(s) with Company | | Position Held Since |

| Ralph G. Quinsey | 58 | | President, Chief Executive Officer and Director | | 2002 |

| Steven J. Buhaly | 57 | | Chief Financial Officer | | 2007 |

| Deborah Burke | 59 | | Vice President, Human Resources | | 2007 |

| James L. Klein | 49 | | Vice President, Infrastructure & Defense Products | | 2011 |

| Todd A. DeBonis | 49 | | Vice President, Worldwide Sales, Strategic Development and Customer Service | | 2006 |

| Timothy A. Dunn | 52 | | Vice President, Mobile Devices | | 2006 |

| Steven R. Grant | 54 | | Vice President, Worldwide Operations | | 2008 |

Ralph G. Quinsey joined TriQuint in July 2002 as President, Chief Executive Officer and Director. From September 1999 to January 2002, Mr. Quinsey was employed by ON Semiconductor, a manufacturer of semiconductors for a wide array of applications, as Vice President and General Manager of the Analog Division. From 1979 to September 1999, Mr. Quinsey was employed by Motorola, a manufacturer of semiconductors and communications equipment, holding various positions, including Vice President and General Manager of the RF/IF Circuits Division, which developed both silicon and GaAs technologies for wireless phone applications. Mr. Quinsey received a B.S. degree in Electrical Engineering from Marquette University.

Steven J. Buhaly joined TriQuint in September 2007 as Chief Financial Officer. Prior to joining TriQuint, Mr. Buhaly was Chief Financial Officer at Longview Fibre Company, a manufacturer of paper container products, from 2006 to 2007. He joined Planar Systems, Inc., a provider of specialty display solutions, in 1999 as Medical Business Vice President. From 2000 to 2006, while also at Planar Systems, he served first as Chief Financial Officer, then Chief Operating Officer. Prior to 1999, he held positions of increasing responsibility in finance and operations at Tektronix, Inc., a supplier of test, measurement, and monitoring products, solutions and services. Mr. Buhaly received B.S. and M.B.A. degrees from the University of Washington.

Deborah Burke joined TriQuint Semiconductor in May of 2007 as Vice President of Human Resources. From 2003 to 2007, Ms. Burke was Vice President of Human Resources for Merix Corporation, a provider of circuit boards used in the design and development of electronic applications. Before her Merix Corporation tenure, from 2001 to 2002, she was Vice President of Human Resources for Unicru Inc. in Beaverton, Oregon, a provider of workforce selection and optimization solutions, and, prior to that time, she worked at Intel Corporation from 1991 to 2001 in managerial and director positions. Ms. Burke holds a B.A. in economics from Smith College and received her M.B.A degree from the University of Vermont.

James L. Klein joined TriQuint in July 2011 as Vice President Defense Products and Foundry Services. Mr. Klein became Vice President and General Manager of Infrastructure & Defense Products in September of 2012. Mr. Klein joined TriQuint with more than 20 years of experience in the RF industry. Most recently, Mr. Klein was the General Manager of the Advanced Products Center at Raytheon in the Space and Airborne Systems division responsible for the design and manufacturing of advanced RF and microwave subsystems and components. Prior to Raytheon, Mr. Klein held various executive and managerial positions with Texas Instruments where he focused on MMIC and Transmit / Receive module engineering. Mr. Klein received both Bachelor and Master of Science degrees in Electrical Engineering from Texas A&M University.

Todd A. DeBonis joined TriQuint in April 2004 as Vice President, Worldwide Sales. He became Vice President, Worldwide Sales and Customer Service in 2006 and added Strategic Development to his list of responsibilities in 2010. From February 2002 to April 2004, Mr. DeBonis held the position of Vice President, Worldwide Sales and Marketing at Centillium Communications. Mr. DeBonis also served as the Vice President, Worldwide Sales for Ishoni Networks and Vice President, Sales & Marketing for the Communications Division of Infineon Technologies North America. Mr. DeBonis has a B.S. degree in Electrical Engineering from the University of Nevada.

Timothy A. Dunn joined TriQuint in July 2006 as Vice President, Mobile Devices. Prior to joining TriQuint, Mr. Dunn was Vice President and General Manager of Intel’s Platform Components Group. Mr. Dunn worked at Intel from 1988 to 1991,

and again from 1994 to 2006, holding various executive and managerial positions. In addition to his Intel tenure, he has held marketing and product management positions with Hewlett-Packard and Cirrus Logic. Mr. Dunn holds an M.B.A. from the Amos Tuck School of Business at Dartmouth College and a B.S. degree in Electrical Engineering from Oregon State University.

Steven R. Grant joined TriQuint in June 2008 as Vice President, Worldwide Operations. Prior to joining TriQuint Mr. Grant spent 27 years at Intel and was most recently Vice President of Intel’s Technology and Manufacturing Group in Oregon from 2001 to 2008. During his Intel tenure, he managed the fabrication manufacturing network and was key to driving the manufacturing structure and efficiency improvements to record performance levels. Mr. Grant holds a B.S. degree in Material Science from the University of Illinois.

Directors

|

| | | | | | | | |

| Name of Director | Age(1) | | Position with TriQuint | | Since | | Board Committees(2) |

| Charles Scott Gibson | 61 |

| | Director | | 1992 | | A, N |

| David H.Y. Ho | 54 |

| | Director | | 2010 | | N, C |

| Nicolas Kauser | 74 |

| | Director | | 1999 | | A, N* |

| Roderick D. Nelson | 54 |

| | Director | | 2012 | | N, C |

| Ralph G. Quinsey | 58 |

| | President and Chief Executive Officer, Director | | 2002 | | — |

| Dr. Walden C. Rhines | 67 |

| | Director | | 1995 | | C*, N |

| Steven J. Sharp | 72 |

| | Chairman of the Board, Director | | 1992 | | — |

| Willis C. Young | 73 |

| | Director | | 2001 | | A*, N |

___________________________________________

| |

(2) | Board Committees: A-Audit, C-Compensation, N-Nominating and Governance |

|

| |

| * | Designates chair of that committee |

There is no family relationship between any director and/or executive officer of our company.

Charles Scott Gibson Since March 1992, Mr. Gibson's full time job is to serve as a director of a number of high technology companies and not-for-profit organizations. He co-founded Sequent Computer Systems Inc., a computer systems company, in 1983 (which was acquired by International Business Machines Corporation), and served as its CFO and Senior VP Operations from 1983 to 1984, was President from January 1988 to March 1992 and was also Co-CEO from 1990 to March 1992. From 1976 to 1983, Mr. Gibson was employed at Intel Corporation as General Manager, Memory Components Operations. He also serves on the board of directors of RadiSys Corporation (“RadiSys”), an embedded solutions company for the communications industry, Pixelworks, Inc. (“Pixelworks”), a fabless semiconductor company, and Northwest Natural Company (“NW Natural”), a natural gas distribution company. Mr. Gibson also served on the board of Electroglas, Inc., a manufacturer of semiconductor test equipment from 2003 to 2009, and Verigy Ltd. from 2006 through July 2011 when it was sold. Mr. Gibson also serves on the Board of Trustees of St. Johns Medical Center and the Community Foundation of Jackson Hole. Mr. Gibson brings extensive financial expertise, and technology industry experience including executive level experience to the board and committees. Mr. Gibson received a B.S. degree in electrical engineering in 1974 and an M.B.A. in Finance from the University of Illinois in 1976.

David H.Y. Ho is Chairman and Founder of Kiina Investment Ltd., a venture capital firm that invests in start-up companies in the technology, media, and telecommunications industries. Mr. Ho previously served as Chairman of Greater China for Nokia Siemens Networks, President of Greater China for Nokia Corporation, and Senior Vice President of the Nokia Networks Business Group. He has also held senior leadership roles with Nortel Networks and Motorola in China and Canada. Mr. Ho currently serves as a member of the board of Pentair Limited (since 2007) and Air Products and Chemical (since 2013) in the United States and two Chinese state-owned enterprises: China Ocean Shipping Company (since 2012) and Dong Fang Electric Corporation (since 2009), and was a director of 3Com Corporation from 2008 through 2010, Owens-Illinois Inc. from 2008 to 2012 and Sinosteel Corporation from 2008 until 2012. Mr. Ho graduated from the University of Waterloo in Canada with a Bachelor's degree in Engineering and obtained his Master's degree in Management Sciences, also from the University of Waterloo in Canada. Mr. Ho brings to the board and committees extensive experience and business knowledge of global markets in diversified industries, with strong track record in establishing and building mobile handset and infrastructure businesses in China, and management expertise in operations, mergers, acquisitions and joint ventures in China.

Nicolas Kauser Mr. Kauser is now retired. Until mid 2008, he was the President of Clearwire International and member of the board of directors of Clearwire Inc., a publicly held company dedicated to the implementation of wireless broadband services in various countries. From 1990 through 1998, Mr. Kauser served as executive vice president and chief technology officer of AT&T Wireless Services (formerly McCaw Cellular Communications, Inc.). From 1984 through 1990, Mr. Kauser was employed by Rogers Cantel, Inc., a Canadian wireless service provider, as vice president of engineering and later, senior vice president of network operations. Mr. Kauser also serves on the board of Pendrell Corporation, an intellectual property solutions company. Mr. Kauser brings extensive experience in the wireless broadband and networks industry to the board and committees. Mr. Kauser received a B.S. degree in electrical engineering from McGill University, Montreal, Canada.

Roderick D. Nelson Mr. Nelson became a director of TriQuint in August 2012. His career in the telecommunications industry spans over 25 years, ranging from AT&T Wireless to a number of start-up companies. From 2009, he has been the co-founder and principal of Tritech Sales and Services, LLC, a strategic product, business development and sales function consulting firm. He served as Executive Vice President and Chief Technology Officer of AT&T Wireless Services, based in Redmond, Washington, where he led the Technology Development Group responsible for the development and deployment of the first 3G networks in the U.S. During his career, Mr. Nelson has worked closely with both national and international regulators and standards bodies on the creation of 3G specifications and standards. Mr. Nelson also serves on the board of Aegis Mobility, Inc., a private mobility company. Mr. Nelson received a Bachelor of Science degree in Electrical Engineering from the University of Minnesota and is the inventor of numerous patents covering broad and fundamental aspects of wireless communications. Mr. Nelson brings his extensive wireless and 3G experience to the board and committees.

Ralph G. Quinsey Mr. Quinsey joined our company in July 2002 as president and chief executive officer and as a director. From September 1999 to January 2002, Mr. Quinsey was vice president and general manager of the Analog Division of ON Semiconductor, a manufacturer of semiconductors for a wide array of applications. From 1979 to September 1999, Mr. Quinsey held various positions at Motorola, a manufacturer of semiconductors and communications equipment, including vice president and general manager of the RF/IF Circuits Division, which developed both silicon and GaAs technologies for wireless phone applications. Mr. Quinsey received a B.S. degree in electrical engineering from Marquette University. As the chief executive officer of our company, Mr. Quinsey brings his knowledge and breadth of experience within the company to the board.

Dr. Walden C. Rhines Dr. Rhines has been the chief executive officer of Mentor Graphics Corporation, an electronic design automation company, since 1993 and chairman of its board of directors since 2002. Prior to joining Mentor Graphics, he spent 21 years at Texas Instruments Incorporated ("Texas Instruments"), a semiconductor manufacturer, with his most recent position having responsibility for directing its worldwide semiconductor business as the executive vice president of Texas Instruments' Semiconductor Group. Dr. Rhines also served as a director of Cirrus Logic, Inc., a semiconductor company, from 1995 to 2009, is the vice chairman of the board of Electronic Design Automation Consortium, a trade association for electronic design companies, and serves on the board of Semiconductor Research Corporation, a technology research consortium. Dr. Rhines holds a B.S. degree in metallurgical engineering from the University of Michigan, M.S. and Ph.D. degrees in materials science and engineering from Stanford University and an M.B.A. from Southern Methodist University. Dr. Rhines brings his substantial experience as an executive with high technology companies to the board and its committees.

Steven J. Sharp Mr. Sharp joined our company in September 1991 as director, president and chief executive officer. In May 1992, he became chairman of our board. In July 2002, Mr. Sharp stepped down as president and chief executive officer of TriQuint, and in September 2004, he resigned as an employee of TriQuint. Previously, Mr. Sharp had served various roles associated with semiconductor industry related companies. He was founder of Power Integrations, and Silicon Architects, Inc., (now Synopsys). As a board director and venture investor, Mr. Sharp also participated in the establishment of Crystal Semiconductor (now Cirrus Logic), Megatest (now Teradyne Inc.) and Volterra. Prior to that time, Mr. Sharp was employed for 14 years by Philips Electronics N.V. and for nine years by Texas Instruments. Mr. Sharp also serves as a board member of Power Integrations, Inc. Mr. Sharp received a B.S. degree in Mechanical Engineering from Southern Methodist University, a M.S. degree in Engineering Science from California Institute of Technology and a M.B.A. from Stanford University. As a former chief executive officer of our company and industry participant for over 50 years, Mr. Sharp brings his extensive experience and knowledge of the company, the semiconductor industry, our customers and the investment community to the board.

Willis C. Young Prior to joining our board, Mr. Young was a director of Sawtek Inc., a surface acoustic wave filter company, from 1996 until 2001, when Sawtek merged with TriQuint. Mr. Young was a senior partner in the Atlanta office of BDO Seidman, LLP, an international accounting and consulting firm, from January 1996 to June 2000. Mr. Young retired in July 2000. From April 1995 to December 1995, Mr. Young was the chief financial officer for Hayes Microcomputer Products, Inc., a manufacturer of modems and communication equipment. From 1965 to 1995, Mr. Young held various positions with BDO Seidman, and from 1988 to 1995 he was vice chairman and a member of BDO Seidman's Executive Committee. Mr. Young received a B.S. degree in accounting from Ferris State University. He is a certified public accountant. Mr. Young brings his extensive financial expertise in the technology field to the board and its committees.

Code of Ethics

We have adopted a code of ethics that applies to all of our employees and outside directors, including our principal executive officer and principal financial officer. This code of ethics is posted on our Internet web site. The Internet address for our web site is www.TriQuint.com, and the code of ethics may be found as follows:

| |

| 1. | From our main web page, first click on “Investors” |

| |

| 2. | Next, click on “Corporate Governance” |

| |

| 3. | Next, click on “Business Ethics Code of Conduct” |

If you wish to receive a copy of our code of ethics and do not have access to the Internet, please write to us at the address below, and we will furnish you a copy without charge:

Chief Financial Officer

TriQuint Semiconductor, Inc.

2300 NE Brookwood Parkway

Hillsboro, OR 97124

Audit Committee. The audit committee, consisting of Messrs. Young (who serves as chairman), Kauser and Gibson, is responsible for appointing and overseeing actions taken by our independent registered public accounting firm, reviewing our external financial reports and filings with the SEC and reviewing our internal controls over financial reporting. The board has also delegated oversight of information technology and cyber-security risk to the audit committee. The board has adopted a written charter for the audit committee that details the responsibilities of the committee and is posted on our Internet web site. The Internet address for our web site is www.TriQuint.com, and the audit committee charter may be found as follows:

| |

| 1. | From our main web page, first click on “Investors” |

| |

| 2. | Next, click on “Corporate Governance.” |

| |

| 3. | Next, click on “Audit Committee Charter.” |

The board of directors has determined that Mr. Young and Mr. Gibson are each an “audit committee financial expert” pursuant to the rules and regulations of the SEC. All audit committee members are independent pursuant to TriQuint's standard of independence, discussed above.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of the forms we have received, or written representations from certain reporting persons, we believe that during 2013 all executive officers, except Tim Dunn, directors and greater than 10% stockholders complied with all applicable filing requirements. Tim Dunn filed one late report, which disclosed one transaction.

| |

| Item 11. | Executive Compensation |

Compensation Committee Interlocks and Insider Participation

The compensation committee, consists of Messrs. Rhines (who serves as chairman), Gibson (until May 14, 2013) Ho and Nelson. None of the members of the compensation committee in 2013 has interlocking relationships as described in Item 407(e)(4) of Regulation S-K or had any relationships requiring disclosure by TriQuint under the SEC's rules requiring disclosure of certain relationships and related person transactions.

Compensation Committee Report

The compensation committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on the review and discussions, the committee recommended to the board that the Compensation Discussion and Analysis be included in the Annual Report on Form 10-K for the year ended December 31, 2013.

SUBMITTED BY THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS:

Dr. Walden C. Rhines-Chairman

Mr. Roderick D. Nelson

Mr. David H.Y. Ho

Director Compensation

Each non-employee director receives the following compensation components:

Cash component. We do not pay director fees to directors who are our employees. Our non-employee directors receive the following cash compensation:

| |

| • | the chairman of the board receives an annual retainer of $60,000. |

| |

| • | each director, other than the chairman of the board, receives an annual retainer of $45,000. |

| |

| • | an additional fee of $22,000 is paid to the chairman of the audit committee; $15,000 to the chairman of the compensation committee and $7,000 to the chairman of the nominating and governance committee. |

| |

| • | members of the audit committee, other than the chairman, receive an annual fee of $11,000. |

| |

| • | members of the compensation committee, other than the chairman, receive an annual fee of $7,000. |

| |

| • | members of the nominating and governance committee, other than the chairman, receive an annual fee of $5,000. |

In addition, we offer participation in our group medical insurance program to any non-employee director who agrees to pay the full amount of the premium. Mr. Sharp and Mr. Nelson have opted to participate in this program to date.

All fees earned by our non-employee directors are paid in four equal quarterly installments. In addition, our non-employee and employee directors are also reimbursed for out-of-pocket expenses incurred in connection with their attendance at board meetings. Mr. Sharp's and Mr. Nelson's quarterly installment payments are reduced by the group medical premium.

Equity component. The Board has implemented an Automatic Stock Option Grant Program for Eligible Directors that currently provides for an automatic, one-time grant of an option to purchase shares of common stock equal to the number of shares with a fair value of $200,000 to each non-employee director, effective on the date of the director's initial appointment or election. The exercise price per share of the option is equal to the fair market value of our common stock as of the date of grant, and the option vests at a rate of 28% on the first anniversary of the grant date and 2% per month thereafter. These one-time grants to directors have terms of ten years.

In addition, this program provides for an automatic, nondiscretionary annual grant, effective at each annual meeting of stockholders, of an option to purchase shares of common stock equal to the number of shares with a fair value of $100,000 to each non-employee director, other than the chairman of the board. A non-employee director who acts as chairman of the board of directors receives an annual grant of an option to purchase shares of our common stock equal to the number of shares with a fair value of $115,000 under this program if, immediately after the annual meeting, the director continues to serve as chairman. The grants are adjusted pro rata for a partial year if a director becomes a member of the board at any time other than at the annual meeting of stockholders. The options have an exercise price equal to the fair market value of our common stock as of the date of grant and vest immediately on the date of grant. These annual option grants to directors have terms of ten years.

The company's Nonqualified Deferred Compensation Plan provides that nonemployee directors are eligible to participate in the plan. In 2013 Mr. Rhines elected to participate in the plan. No other nonemployee director participates in the plan.

Stock Ownership Guidelines

In 2012, the Board increased the minimum stock ownership requirements applicable to our non-employee directors under our stock ownership guidelines so that their share ownership would represent a more meaningful financial commitment. Under the revised stock ownership guidelines, each non-employee director must maintain ownership of TriQuint stock with a value equal to at least three (3) times the director's annual retainer. Each nonemployee director must achieve the applicable stock ownership level under these revised ownership guidelines within a five year period.

The following table sets forth the compensation paid to each director during the year ended December 31, 2013:

2013 DIRECTOR COMPENSATION TABLE

|

| | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | | Option Awards ($)(1) | | Total ($) |

| Charles Scott Gibson | 64,500 |

| | | 99,989 |

| | | 164,489 |

| |

| David H.Y. Ho | 57,000 |

| | | 99,989 |

| | | 156,989 |

| |

| Nicolas Kauser | 63,000 |

| | | 99,989 |

| | | 162,989 |

| |

| Rod Nelson | 34,792 |

| 34,792 |

| | 99,989 |

| | | 134,781 |

| |

| Dr. Walden C. Rhines | 65,000 |

| | | 99,989 |

| | | 164,989 |

| |

| Steven J. Sharp | 45,628 |

| | | 114,987 |

| | | 160,615 |

| |

| Willis C. Young | 72,000 |

| | | 99,989 |

| | | 171,989 |

| |

| |

| (1) | These amounts represent the aggregate grant date fair value for stock options granted to the indicated director in 2013 computed in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 718 “Compensation-Stock Compensation,” excluding the effect of any estimated forfeitures. A summary of the assumptions we apply in calculating these amounts is set forth in Note 12 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2013. The aggregate number of stock options that were outstanding at December 31, 2013 and granted in 2013 for each of the directors were as follows: |

|

| | | | | | | |

| Name | Aggregate Number of Option Awards Outstanding at December 31, 2013 (#) | | Number of Option Awards Granted in 2013 (#) |

| Charles Scott Gibson | 94,850 |

| | | 29,786 |

| |

| David H.Y. Ho | 127,902 |

| | | 29,786 |

| |

| Nicolas Kauser | 121,363 |

| | | 29,786 |

| |

| Rod Nelson | 92,961 |

| | | 29,786 |

| |

| Dr. Walden C. Rhines | 121,363 |

| | | 29,786 |

| |

| Steven J. Sharp | 139,443 |

| | | 34,254 |

| |

| Willis C. Young | 121,363 |

| | | 29,786 |

| |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes our compensation program for our president and chief executive officer, our chief financial officer and our three other most highly compensated executive officers, whom we collectively refer to as our named executive officers.

Results of 2013 Stockholder Advisory Vote to Approve Executive Compensation

At our 2013 annual meeting of stockholders, the Company requested our stockholders to approve, on an advisory (non-binding) basis, the compensation paid to our executive officers as reported in the proxy statement for the 2013 annual meeting. Over 93% of our stockholders expressed support for our executive compensation, with approximately 91% of the shares present and entitled to vote voting for approval of the “say on pay” advisory vote on executive compensation. Because of the high level of support expressed by our stockholders for the 2012 fiscal year executive compensation, the Compensation Committee continued to apply a similar approach for executive compensation decisions and policies for the 2013 fiscal year.

Overview-Linking Pay to Performance

TriQuint links named executive officer compensation to performance. Specifically, short-term incentive compensation is tied directly to corporate performance under TriQuint's management and/or sales incentive plans, while long-term incentive

compensation is tied more directly to long-term corporate performance by our equity compensation awards. TriQuint has allocated these compensation elements in a manner that the compensation committee believes will support TriQuint's long-term success and profitability, aligned with total stockholder return. This balanced approach employs a larger percentage of short-term and long-term incentives as compared to total compensation at increasingly higher levels of responsibility, where individuals have the greatest influence on TriQuint's strategic direction and results over time. Under TriQuint's incentive compensation plans, company performance above targeted objectives results in increased total compensation, while performance below targeted objectives results in decreased total compensation. In recommending our chief executive officer's compensation for 2013, the committee applied the principles outlined above in a similar manner as they were applied to our other executives.

Compensation Philosophy and Objectives

TriQuint's named executive officer compensation program is designed to align the interests of our executives with the interests of our stockholders by creating an environment that rewards performance relative to TriQuint's strategic and financial goals and increasing stockholder value. Our executive compensation program is also designed to attract and retain qualified executives in the highly competitive high technology marketplace in which we compete for executive talent. In this regard, the amounts and types of executive compensation that make up TriQuint's executive compensation packages are designed to be competitive with those available to similar executives at other companies in our industry. In particular:

| |

| • | We base each executive's compensation on the executive's level of job responsibility and individual performance. A relatively high proportion of the executive's pay is linked to company performance and stockholder returns through our management and/or sales incentive plans and equity compensation awards, ensuring total compensation correlates with financial and strategic success of the company as a whole. |

| |

| • | We generally endeavor to offer a compensation program that provides compensation opportunities that are competitive with those offered for similar executive positions in other high technology employers in our industry or that compete with us for talent, so that we can attract and retain a highly-skilled executive team. |

| |

| • | We develop and administer our compensation program to foster the long-term retention of our executives. |

| |

| • | We always consider our compensation program in light of the overall affordability of the program and to ensure that our shareholders benefit from a significant portion of our operating income. |

The compensation committee considers the semi-annual, annual and long-term components of our executive compensation program together in assessing whether the program is attaining its designed objectives.

How We Set Compensation

In determining total named executive officer compensation for 2013, the compensation committee considered various measures of company and industry performance, including revenue, operating income, market capitalization, gross margins, total stockholder return, and growth rates, as good indicators of company performance, but did not assign these performance measures relative weights. The committee makes a subjective determination after considering all of these measures collectively.

The compensation committee also compared TriQuint's programs with those of other technology companies of comparable size and stature selected by the committee in consultation with its compensation consultant. The company's process for selecting peer companies is as follows: the committee considers all semiconductor companies; removes all equipment companies and other companies that are in a substantially different business; narrows the list to companies that are within 0.5 times to 2.0 times of the company with respect to revenue or enterprise value; and adds back companies that are direct competitors. The committee used the following companies for peer comparison in setting named executive officer compensation for 2013:

|

| | |

| Atmel Corporation | Cree, Inc. | Cypress Semiconductor Corp |

| Diodes Inc. | Fairchild Semiconductor Intl | Finisar Corporation |

| Hittite Microwave Corporation | Integrated Device Technology | International Rectifier Corp. |

| Intersil Corporation | Lattice Semiconductor Corp. | Microsemi Corporation |

| OmniVision Technologies, Inc. | PMC-Sierra, Inc. | R.F. Micro Device, Inc. |

| Semtech Corporation | Silicon Laboratories Inc. | Skyworks Solutions, Inc. |

| Spansion Inc. | | |

The compensation consultant used a combination of peer company proxy data and the Radford High-Tech Industry Executive Compensation Survey for companies $500 million to $1 billion for its analysis. In analyzing this information, the compensation committee compared the executive compensation programs as a whole, and compared the pay of individual executives if the

committee believed the jobs are sufficiently similar to make meaningful comparisons. The primary reason the committee analyzed peer group data was to ensure that the executive compensation program as a whole was competitive with compensation programs at peer group companies. The committee did not target a specific position in the range of comparative data for each individual or for each component of compensation. In determining the amount of base salary, target incentive award and level of equity compensation for each named executive officer, the committee considered each executive's level of responsibility, prior experience, past job performance, contribution to TriQuint's success, capability and results achieved, and reviewed the comparative compensation data provided by the compensation consultant. The committee did not apply formulas or assign these factors specific mathematical weights; instead, the committee exercised its business judgment and discretion.

Elements of Compensation

|

| | |

| Compensation Element | Objective | Key Features |

| Base Salaries | To attract and retain key executive talent. | Base salaries are compared with those of executives holding similar positions with other companies in our industry peer group. Base salaries are reviewed annually and increases are based on company performance, individual performance and pay relative to the market. |

| Management Incentive Plan (MIP) | To reward executives for strong operational and financial performance of the company. | Target management incentive percentages (MIP %) are competitive when compared with those of executives in our peer group. MIP provides incentives to participants if specified minimum operating income and year-over-year financial comparison goals are achieved during the applicable period. The goals are typically set either semi-annually or annually. |

| Sales Incentive Plan (SIP) | To reward sales executives for strong revenue and financial performance of the company. | SIP provides incentives for sales executives if specific sales goals are met. These may include annual revenue, design win revenue, specific market revenue, forecast accuracy, cost of sales, and other sales related targets. |

| Other Cash Incentives | Discretionary awards or programs designed to recognize outstanding performance of individuals. | These awards are granted on a discretionary basis when an executive has achieved outstanding results or to incentivize a specific goal achievement above and beyond normal business operations. |

| Equity Compensation | To reward current and anticipated future contributions to company performance. To retain key executives. To align compensation with shareholder returns. | Equity compensation is made up of stock options and market (performance) stock unit (MSU) awards. TriQuint has chosen stock options as a key compensation element because the receipt of value by an executive officer under a stock option is dependent upon an increase in the price of TriQuint's common stock and thus this portion of the executives' compensation is directly aligned with increases in stockholder returns. The MSU awards have a 3-year performance period and performance is measured based on TriQuint’s total shareholder return as compared to the SPDR S&P Semiconductor ETF Index. |

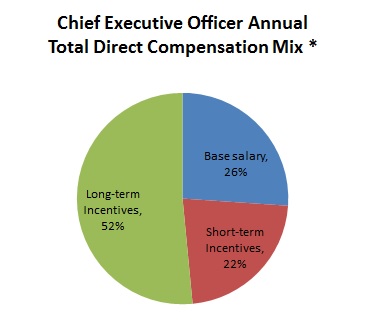

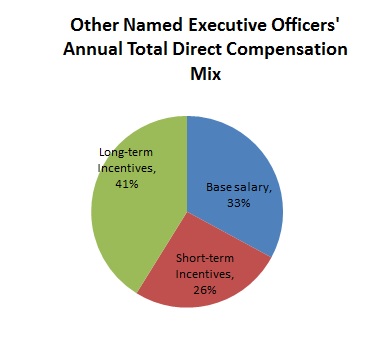

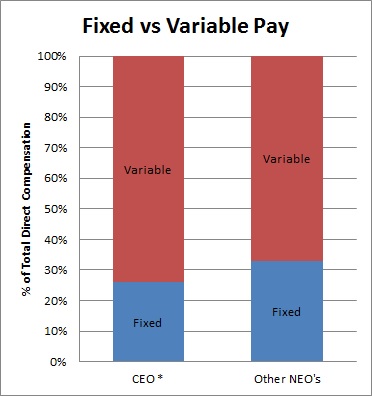

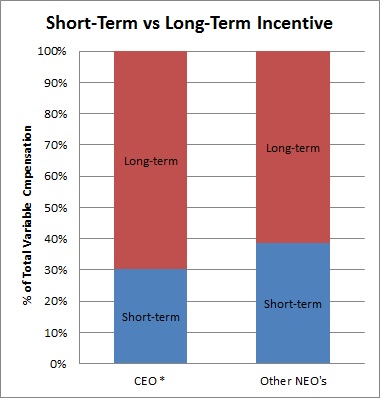

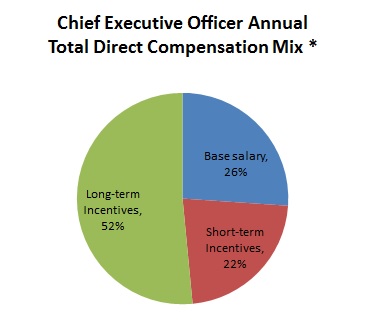

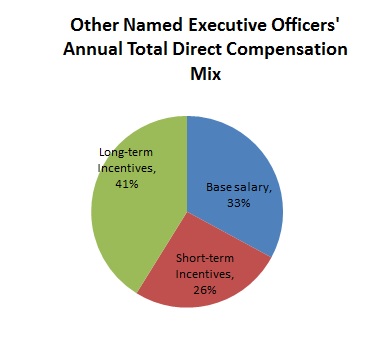

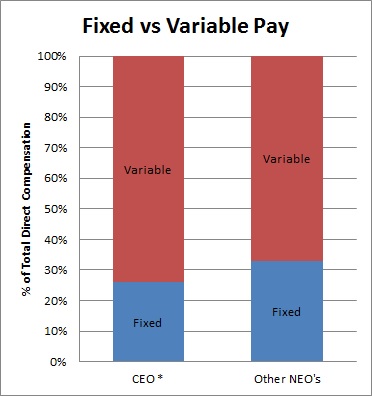

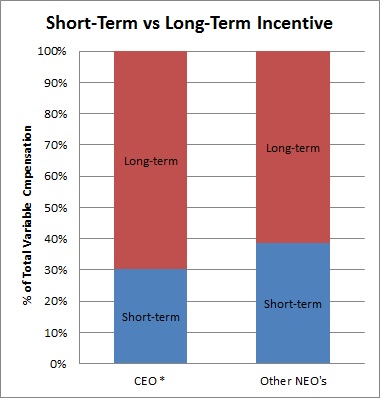

Pay Mix. The compensation program includes a mixture of base pay through base salaries and at-risk pay through the various incentive plans and equity compensations. Through the at-risk components, executives are rewarded on a short-term and long-term basis for strong company financial and stock price performance. At the same time, if TriQuint's financial or stock price performance is below targeted expectations, the at-risk components of the compensation plan will result in reduced compensation. All elements of compensation, except for base salary, are considered to be at-risk and variable. The management incentive plan, sales incentive plan and other cash incentives are considered short-term variable incentives while the equity compensation is considered a long-term variable incentive. The following charts illustrate the composition of target total direct compensation for the CEO and for the other named executive officers between base salary, short term and long term compensation as well as the percentage of compensation that is fixed versus variable and the percentage of incentive pay that is short-term versus long-term.

Base Salaries. Compared to the peer group, Mr. Quinsey's base salary is below the 25th percentile. Mr. Quinsey's cash compensation is, by his request, below market. Mr. Quinsey prefers that his pay be largely variable and correlates with company performance. Since the overall company performance was below expectations in 2012 he requested no base pay increase again in 2013. It is the committee's belief that Mr. Quinsey's overall compensation package should be competitive in the market but it also respects and supports his request to have his compensation clearly reflect the financial results of the company and maintain his base salary at its current level. The committee recommended, and the company's independent directors approved, a zero base pay increase for Mr. Quinsey for 2013.

Mr. Buhaly’s and Mr. Klein’s base salaries were also each below the 25th percentile and each of their performance was strong in 2012. Mr. Buhaly received a 4.6% base pay increase in 2013 for effective management of our Finance and IT organizations and successful leadership in developing and implementing our Asia headquarters strategy. The new salary placed Mr. Buhaly between the 25th and 50th percentile. Mr. Klein received a 5% base pay increase in 2013 for solid execution of our product line reorganization in 2012, increasing the momentum of new product development and many and various business process improvements within his organization. While Mr. DeBonis’ base salary was below the 25th percentile, his target total cash compensation was above the 50th percentile so he did not receive a base pay increase in 2013. Mr. Grant’s base pay and target total cash compensation are between the 50th and 75th percentile so he also did not receive a base pay increase in 2013.

Annual Cash Incentives. The committee established annual cash incentives for each of our named executive officers for 2013.

Management Incentive Plan. All named executive officers, except Todd DeBonis, our vice president of worldwide sales, customer service and business development, participated in TriQuint's 2013 management incentive plan. This plan provided incentives for our named executive officer participants if specified minimum operating income goals and year-over-year revenue growth goals were achieved during 2013. The operating income goal related to the company as a whole, which we believe provided an appropriate incentive for the named executive officers to take actions that would have a positive impact on the company overall and aligned their interests with the interests of our stockholders. The year-over-year revenue growth goals were different for each of our two major product line groups: Mobile Devices and Infrastructure and Defense Products. Mr. Klein’s revenue growth target was based solely on year-over-year revenue growth for our Infrastructure and Defense Products product line group. For the other named officers, Mr. Quinsey, Mr. Buhaly and Mr. Grant, the revenue growth component of their incentive target was split equally between Mobile Devices and Infrastructure and Defense Products, since they provide support and have impact on both product lines equally. We believe that our focus on operating income and revenue growth encouraged management to appropriately balance risk and profitability. The committee maintained 2013 management incentive plan targets for the named executive officers (expressed as a percentage of base pay) at 2012 levels since these target percentages were competitive with their peers.

The operating income and year-over-year revenue growth used to calculate the award payments for 2013 under this plan were based on TriQuint's non-GAAP operating income, which the committee could adjust to exclude certain unusual items (including, but not limited to, severance, impairment, restructuring costs, litigation costs, first year losses or gains of any acquired entities, and same year losses or gains of divestitures). In setting the incentive award target amounts for 2013, the committee determined the overall affordability of the management incentive plan and considered the industry benchmark data provided by the compensation consultant.

For all officers, the specific target operating income goal for 2013 was $54 million. During the August 2013 Board meeting, the compensation committee determined that the minimum threshold for the operating income goal had been calculated incorrectly and made an adjustment. Actual non-GAAP operating income was $19.6 million, resulting in 25.2% payout under the management incentive plan for 2013. The year-over-year revenue growth goal for select Mobile Devices customers for the first half was 5%, and actual growth was 0%, resulting in no payout under the management incentive plan for the first half of 2013. The year-over-year revenue growth goal for select Mobile Devices customers for the second half was 39%, and actual growth was 34%, resulting in a 41.1% payout under the management incentive plan for the second half of 2013. The year-over-year revenue growth goal for Infrastructure and Defense Products for the first half was 10%, and actual growth was 12.5%, resulting in a 123.4% payout under the management incentive plan for the first half of 2013. The year-over-year revenue growth goal for Infrastructure and Defense Products for the second half 2013 was based on growth in core revenue. The core revenue growth goal for the second half was 8%, and actual growth was 6%, resulting in a 51% payout under the management incentive plan for the second half of 2013. In addition, an adjustment of $15,000 was made to Mr. Grant’s and Mr. Klein’s full year payouts. Mr. Grant's payout was adjusted to reflect individual contributions in the management of manufacturing seasonality and margin improvement. Mr. Klein’s payout was adjusted to reflect individual contributions and leadership in the continued reorganization of our infrastructure and defense product lines.

Other Cash Incentives. Todd DeBonis, our Vice President of Worldwide Sales, is not eligible to participate in the management incentive plan, but instead participates in a sales incentive program. For 2013, his sales incentive target award remained at 100% of his base salary, which is above the 75th percentile of peer companies. This program provided incentives to Mr. DeBonis if specified minimum sales performance goals are achieved for the applicable periods. The sales performance goals for 2013 were related to achievement of specified levels of annual revenue, design win revenue, forecast accuracy and cost of sales. The revenue, design wins and forecast accuracy portions of the award were payable quarterly based on achievement of these goals for each quarter, while the cost of sales expense portion of the award was payable annually. The elements of this incentive plan were weighted as follows: 25% revenue attainment; 50% design wins; 15% forecast accuracy; and 10% cost of sales. The revenue attainment and design wins were capped at 200%. The forecast accuracy and cost of sales were capped at 100%. The annual revenue attainment goal for 2013 was based on achievement of revenue for certain product lines within the Mobile Devices, Defense, and Network Infrastructure markets. The goal was $530 million; actual achievement was $473.1 million, resulting in an 89% payout. The annual non-GAAP cost of sales expense goal was $34.2 million. The actual achievement of the non-GAAP cost of sales expense goal was $32.5 million, resulting in a 100% payout. The targeted design win revenue quota and forecast accuracy goals were set to meet TriQuint's future growth objectives. Mr. DeBonis achieved 84% of the design win goal and 75% of the forecast accuracy goal. Overall achievement for 2013 resulted in an 84% payout.

Long-Term Incentives. In 2013, TriQuint provided its named executive officers with long-term incentives through the grant of stock options and performance-based restricted stock unit awards. TriQuint has chosen stock options as a key compensation element because the receipt of value by an executive officer under a stock option is dependent upon an increase in the price of TriQuint's common stock and thus this portion of the executive's compensation is directly aligned with stockholder returns. TriQuint added market stock unit (MSU) awards to the long-term incentive award mix for executives in 2013 to provide a more

direct link to shareholder value creation and preservation. The MSU awards are restricted stock units that vest based on TriQuint’s Total Shareholder Return (TSR) as compared to an external index over a 3-year performance period. For the 2013 MSUs the index selected was the SPDR S&P Semiconductor ETF Index because of its correlation to TriQuint’s performance. The MSU awards can vest with respect to up to 150% of the target number of shares.

In determining the value of the equity compensation to be awarded to each named executive officer in 2013, the committee considered the following:

| |

| (i) | the executive's current contribution to TriQuint's performance; |

| |

| (ii) | the executive's anticipated contribution in meeting TriQuint's long-term strategic performance goals; and |

| |

| (iii) | comparisons of the value and number of shares for such awards to published surveys of executive equity compensation awards made by our peer group companies discussed above. |

Individual considerations, such as the executive's current and anticipated contributions to TriQuint's performance, were more subjective and less measurable by financial results at the corporate level. In this respect, the committee exercised significant judgment in measuring the current or anticipated contribution to TriQuint's performance. The committee also reviewed the total number of shares and value of the equity compensation awards granted to evaluate whether there was an appropriate distribution of those awards among the executive officers.

Other Compensation Issues

Deferred Compensation. TriQuint has chosen to provide its named executive officers the opportunity to defer a specified portion of their cash compensation into a non-qualified deferred compensation plan because it believes the deferred compensation plan is a cost effective way to provide executives with retirement planning benefits.

Termination and Change in Control Arrangements. Our change of control policy that covers our named executive officers provides for the payment of severance benefits in the event that they are terminated without cause, or as a result of death or disability, or resign for good reason, within a specified period of time before or after a change of control. Payments are activated by a double trigger and are intended to reinforce and encourage the continued attention and dedication of the management team to their assigned duties without distraction in circumstances arising from the possibility of a change of control of TriQuint. The level of these severance benefits is tied to the executive's annual base salary and targeted annual cash management incentive opportunity. In addition, each of our named executive officers is also party to an employment letter agreement pursuant to which the executive will receive benefits in the event of termination without cause or for good reason other than in connection with a change of control. A more detailed discussion of these agreements can be found under the “Potential Payments Upon Termination or Change of Control” section below.

Stock Ownership Guidelines. To further align the interests of the named executive officers with those of our stockholders, each named executive officer must achieve target levels of stock ownership within a five year period. The value of the shares required to be owned by Mr. Quinsey is three times his base salary. The value of the shares required to be owned by each of the other officers is equal to their respective base salaries. The officers have until 2017 to attain the levels required.

Deductibility of Executive Compensation. The committee has considered the potential impact of Section 162(m) of the Internal Revenue Code on the compensation paid to our named executive officers for 2013. Section 162(m) disallows a tax deduction for any publicly held corporation for individual compensation exceeding $1,000,000 in any taxable year for certain executive officers, unless certain exemption requirements are met. Compensation that qualifies as “performance-based” is excluded for purposes of calculating the amount of compensation subject to the $1,000,000 limit under Section 162(m). We believe that all taxable compensation paid in 2013 to those of our named executive officers who are covered by Section 162(m) will be fully deductible for federal income tax purposes. In some circumstances, however, the compensation committee may approve compensation that will not meet such requirements as a means to ensure competitive levels of compensation for our executive officers and promote varying corporate goals.

Forfeiture of Bonuses - Clawback Policy. If TriQuint is required to prepare an accounting restatement on an annual financial statement included in a report on Form 10-K, the CEO and CFO may each be required to repay a portion of any cash bonus received during the period covered by the restatements. This repayment should be equal to the amount earned minus the amount they would have received if the bonus had been calculated using the information contained in the restated financial statements. If a majority of the independent members of the board of directors determines that the financial restatement was not due to the recklessness of the CEO and/or the CFO, causing material noncompliance with any financial reporting requirement under the federal securities laws, then the amount repaid shall be returned, together with any accrued interest.

2013 Summary Compensation Table

The following table sets forth information regarding compensation for the years indicated for each of our named executive officers. Salary includes amounts deferred at the officer's election.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | Year | Salary ($) | Stock Awards ($) (1) | Option Awards ($)(2) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($)(2) | Total ($) |

| Ralph G. Quinsey | 2013 | $ | 436,132 |

| | $ | 437,110 |

| | $ | 443,147 |

| | $ | 382,692 |

| | $ | 9,597 |

| | $ | 1,271,568 |

| |

| President and Chief Executive Officer | 2012 | 428,879 | | | — | | | 395,913 (4) | | | 104,788 | | | 9,422 | | | 543,089 | | |

| 2011 | 422,593 | | | — | | | 1,652,900 | | | — | | | 10,606 | | | 2,086,099 | | |

| | | | | | | | |

| Steven J. Buhaly | 2013 | 334,670 | | | 240,358 | | | 243,682 | | | 201,840 | | | 9,597 | | | 789,789 | | |

| Chief Financial Officer | 2012 | 326,786 | | | — | | | 475,095 | | | 54,600 | | | 9,422 | | | 865,903 | | |

| 2011 | 320,055 | | | — | | | 793,392 | | | — | | | 10,393 | | | 1,123,840 | | |

| | | | | | | | |

| Todd A. DeBonis | 2013 | 300,824 | | | 190,806 | | | 193,439 | | | 409,737 | | | 9,597 | | | 913,597 | | |

| Vice President, Worldwide Sales | 2012 | 229,632 | | | — | | | 380,076 | | | 311,046 | | | 9,422 | | | 930,176 | | |

| 2011 | 291,483 | | | — | | | 793,392 | | | 255,339 | | | 26,013 | | | 1,366,227 | | |

| | | | | | | | |

| James L. Klein | 2013 | 309,602 | | | 182,140 | | | 184,649 | | | 200,761 | | | 8,427 | | | 703,439 | | |

| Vice President, Infrastructure & Defense Products | 2012 | 279,867 | | | — | | | 285,057 | | | 108,492 | | | 8,193 | | | 681,609 | | |

| 2011 | 196,039 | | | — | | | 570,338 | | | 62,827 | | | 2,853 | | | 832,057 | | |

| | | | | | | | |

| Steven R. Grant | 2013 | 315,866 | | | 190,806 | | | 193,439 | | | 208,644 | | | 5,933 | | | 723,882 | | |

Vice President, Operations | 2012 | 316,731 | | | — | | | 380,076 | | | 52,920 | | | 5,714 | | | 755,441 | | |

| 2011 | 310,028 | | | — | | | 793,392 | | | — | | | 5,587 | | | 1,109,007 | | |

| |

(1) | In 2013, each executive received a grant of performance-vesting restricted stock units, which we refer to as Market Stock Units (MSUs), that vest with respect to between 0 and 150% of the target number of shares based on TriQuint's Total Shareholder Return (TSR) as compared to the SPDR S&P Semiconductor ETF Index over a 3-year performance period and are reported here assuming target performance. The grant date fair value of these MSUs assuming the highest level of achievement under this award, computed in accordance with FASB ASC Topic 718 “Compensation-Stock Compensation,” excluding the effect of any estimated forfeitures, is as follows: |

|

| |

| Ralph G. Quinsey | 655,665 |

| Steven J. Buhaly | 360,536 |

| Todd A. DeBonis | 286,209 |

| James L. Klein | 273,211 |

| Steven R. Grant | 286,209 |

These amounts do not reflect compensation actually received by the named executive officer. A summary of the assumptions we apply in calculating these amounts is set forth in Note 12 to the Condensed Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2013

| |

(2) | These amounts do not reflect compensation actually received by the named executive officer. Instead, the amounts represent the aggregate grant date fair value for option awards granted in 2013, 2012 and 2011 to the indicated named executive officer, computed in accordance with FASB ASC Topic 718 “Compensation-Stock Compensation,” excluding the effect of any estimated forfeitures. A summary of the assumptions we apply in calculating these amounts is set forth in Note 12 to the Condensed Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2013. |

| |

(3) | For 2013, consists of group term life insurance and Accidental Death and Dismemberment premiums paid by TriQuint on behalf of each executive, and matching contributions to TriQuint's 401(k) plan for each executive. The table below details the matching contribution to TriQuint's 401(k) plan for each executive for 2013: |

|

| | | | |

| Ralph G. Quinsey | $ | 8,925 |

| |

| Steven J. Buhaly | 8,925 | | |

| Todd A. DeBonis | 8,925 | | |

| James L. Klein | 7,755 | | |

| Steven R. Grant | 5,261 | | |

| |

(4) | Mr. Quinsey received a performance- and time-vesting option that is included here at a value of zero. At the time of grant, the performance was not considered probable. However, as of December 31, 2012, performance was determined to be probable. Per ASC 718, the Company began recognizing expense relating to this performance-based stock option in December 2012. The total expense to be recognized will be $395,913. The time-based vesting schedule vests 25% each quarter starting the ninth quarter after grant, but only if the performance conditions have been achieved. |

2013 Grants of Plan-Based Awards Table

The following table sets forth information concerning cash and equity-based awards granted during 2013 to each of the named executive officers:

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Name | Grant Date | Approval Date

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($)(1) |

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) |

| Ralph G. Quinsey | 4/5/2013 | 3/27/2013 | | | | | | | 84,833 |

| $ | 4.85 |

| $ | 220,388 |

|

| 6/7/2013 | 5/14/2013 | | | | | | | 59,081 |

| 7.01 |

| 222,759 |

|

| | 5/14/2013 | 5/14/2013 | | | | 0 |

| 32,427 |

| 48,641 |

| | | 217,261 |

|

| | 6/7/2013 | 5/14/2013 | | | | 0 |

| 26,235 |

| 39,353 |

| | | 219,849 |

|

| | | | $ | 18,333 |

| $ | 440,000 |

| $ | 880,000 |

| | | | | | |

| Steven J. Buhaly | 4/5/2013 | 3/27/2013 | | | | | | | 46,649 |

| 4.85 |

| 121,189 |

|

| 6/7/2013 | 5/14/2013 | | | | | | | 32,488 |

| 7.01 |

| 122,493 |

|

| | 5/14/2013 | 5/14/2013 | | | | 0 |

| 17,831 |

| 26,747 |

| | | 119,468 |

|

| | 6/7/2013 | 5/14/2013 | | | | 0 |

| 14,426 |

| 21,639 |

| | | 120,890 |

|

| | | | 9,917 |

| 238,000 |

| 476,000 |

| | | | | | |

| | | | | | | | | | | | |

| Todd A. DeBonis | 4/5/2013 | 3/27/2013 | | | | | | | 37,030 |

| 4.85 |

| 96,200 |

|

| 6/7/2013 | 5/14/2013 | | | | | | | 25,790 |

| 7.01 |

| 97,239 |

|

| | 5/14/2013 | 5/14/2013 | | | | 0 |

| 14,155 |

| 21,233 |

| | | 94,838 |

|

| | 6/7/2013 | 5/14/2013 | | | | 0 |

| 11,452 |

| 17,178 |

| | | 95,968 |

|

| | | | — |

| 300,000 |

| — |

| | | | | | |

| James L. Klein | 4/5/2013 | 3/27/2013 | | | | | | | 35,347 |

| 4.85 |

| 91,829 |

|

| 6/7/2013 | 5/14/2013 | | | | | | | 24,618 |

| 7.01 |

| 92,820 |

|

| | 5/14/2013 | 5/14/2013 | | | | 0 |

| 13,512 |

| 20,268 |

| | | 90,530 |

|

| | 6/7/2013 | 5/14/2013 | | | | 0 |

| 10,932 |

| 16,398 |

| | | 91,610 |

|

| | | | 7,875 |

| 189,000 |

| 378,000 |

| | | | | | |

| Steven R. Grant | 4/5/2013 | 3/27/2013 | | | | | | | 37,030 |

| 4.85 |

| 96,200 |

|

| 6/7/2013 | 5/14/2013 | | | | | | | 25,790 |

| 7.01 |

| 97,239 |

|

| | 5/14/2013 | 5/14/2013 | | | | 0 |

| 14,155 |

| 21,233 |

| | | 94,838 |

|

| | 6/7/2013 | 5/14/2013 | | | | 0 |

| 11,452 |

| 17,178 |

| | | 95,968 |

|

| | | | 9,188 |

| 220,500 |

| 441,000 |

| | | | | | |

| |

(1) | These amounts do not reflect compensation actually received by the named executive officer. Instead, the amounts represent the grant date fair value for the stock options granted to the indicated named executive officer in 2013 based on the fair value of these awards computed in accordance with FASB ASC Topic 718 “Compensation-Stock Compensation” excluding the effect of estimated forfeitures. A summary of the assumptions we apply in calculating these amounts is set forth in Note 12 to the Condensed Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2013. |

(2) No market stock units (MSUs) will be earned at threshold performance.

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

Amounts in the Non-Equity Incentive Plan Compensation column of the Summary Compensation Table represent the annual incentive award, which is a cash incentive award granted under TriQuint's management incentive plan for all the executives other than Mr. DeBonis, who instead participates in a sales incentive program. All award amounts are determined based on the executive's actual base salary and the applicable percentages of base salary determined by the compensation committee. See “Executive Compensation - Compensation Discussion and Analysis-Elements of Compensation - Annual Cash Incentives-Management Incentive Plan” for a more detailed description of these programs.

TriQuint offers a 401(k) retirement plan and a nonqualified deferred compensation plan. Generally, TriQuint also provides other benefits to executives, including eligibility to participate in TriQuint's employee stock purchase plan and in TriQuint's change of control policy (discussed below). TriQuint may also reimburse the costs for business meals and travel, and provide communication devices for its executives, but only if the items are integrally and directly related to the performance of the executive's duties.

TriQuint's stock incentive plans allow for the award of restricted stock, restricted stock units, stock appreciation rights, performance shares and performance units. Through 2012 TriQuint granted only stock options. Starting in 2013, TriQuint began granting performance-vesting restricted stock units, which we refer to as Market Stock Units (MSUs), that vest with respect to between 0 and 150% of the target number of shares based on TriQuint's Total Shareholder Return (TSR) as compared to the SPDR S&P Semiconductor ETF Index over a 3-year performance period. Equity compensation awards are generally granted to executive officers in conjunction with each executive officer's commencement of employment with TriQuint and upon promotion to executive officer. The compensation committee also awards two types of annual stock option grants to executive officers: refresh grants and special grants. Refresh grants are based on the recipient's value and contribution to the company and vest in four equal quarterly increments beginning in the third year from the date of grant. Special grants are designed to retain key performers and vest in equal quarterly increments over the four years following the grant date. Stock options granted to the named executive officers include both incentive stock options and nonqualified stock options. Stock options are granted at an exercise price equaling 100% of fair market value on the date of grant and have a 10-year term.

TriQuint provides its named executive officers the opportunity to defer a specified portion of their cash compensation into a non-qualified deferred compensation plan under which TriQuint is obligated to pay accumulated balances on a future date. TriQuint does not contribute any funds to this program and the payout to each participant is affected by results from investment alternatives selected by the participant under the deferred compensation plan.

2013 Outstanding Equity Awards at Fiscal Year-End Table

The following table provides information relating to equity awards outstanding at December 31, 2013 held by the named executive officers.

|

| | | | | | | | | | | | | | | | | | | |

| | | | | Option Awards | Stock Awards |

| Name | | | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | | Option Exercise Price ($) | | Option Expiration Date | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#) | Equity Incentive Plan Awards: Market Value or Payout Value of Unearned Shares, Units or Other Rights that Have not Vested ($) |

Ralph G. Quinsey (2) | | 8/18/2005 | 150,000 |

| | | | | | 3.65 | | 8/18/2015 | | |

Ralph G. Quinsey (3) | | 8/23/2006 | 50,000 |

| | | | | | 4.38 | | 8/23/2016 | | |

Ralph G. Quinsey (4) | | 8/23/2006 | 100,000 |

| | | | | | 4.38 | | 8/23/2016 | | |

Ralph G. Quinsey (5) | | 4/27/2007 | 312,500 |

| | | | | | 5.18 | | 4/27/2017 | | |

Ralph G. Quinsey (7) | | 5/21/2008 | 120,000 |

| | | | | | 6.52 | | 5/21/2018 | | |

Ralph G. Quinsey (4) | | 5/21/2008 | 200,000 |

| | | | | | 6.52 | | 5/21/2018 | | |

Ralph G. Quinsey (7) | | 3/2/2009 | 120,000 |

| | | | | | 2.15 | | 3/2/2019 | | |

Ralph G. Quinsey (9) | | 3/2/2009 | 240,000 |

| | | | | | 2.15 | | 3/2/2019 | | |

Ralph G. Quinsey (7) | | 4/1/2010 | 150,000 |

| | | | | | 7.07 | | 4/1/2020 | | |

Ralph G. Quinsey (9) | | 4/1/2010 | 350,000 |

| | | | | | 7.07 | | 4/1/2020 | | |

Ralph G. Quinsey (9) | | 4/1/2011 | 125,000 |

| | 125,000 |

| | | | 12.56 | | 4/1/2021 | | |

Ralph G. Quinsey (9) | | 4/1/2012 | | | 125,000 |

| | | | 5.94 | | 4/1/2022 | | |

Ralph G. Quinsey (10) | | 4/9/2012 | | | | | 125,000 | | 5.94 | | 4/9/2022 | | |

Ralph G. Quinsey (9) | | 4/5/2013 | | | 84,833 |

| | | | 4.85 | | 4/5/2023 | | |

|

| | | | | | | | | | | | | | | | | | | |

Ralph G. Quinsey (9) | | 6/7/2013 | | | 59,081 |

| | | | 7.01 | | 4/5/2023 | | |

Ralph G. Quinsey (12) | | 4/5/2013 | | | | | | | | | | 32,427 | | 270,441 |

Ralph G. Quinsey (12) | | 6/7/2013 | | | | | | | | | | 26,235 | | 218,800 |

Steven J. Buhaly (6) | | 9/27/2007 | 148,750 |

| | — |

| | | | 4.86 | | 9/27/2017 | | |

Steven J. Buhaly (3) | | 5/21/2008 | 60,000 |

| | — |

| | | | 6.52 | | 5/21/2018 | | |

Steven J. Buhaly (8) | | 3/2/2009 | 11,250 |

| | — |

| | | | 2.15 | | 3/2/2019 | | |

Steven J. Buhaly (9) | | 3/2/2009 | 85,000 |

| | — |

| | | | 2.15 | | 3/2/2019 | | |

Steven J. Buhaly (9) | | 4/1/2010 | 140,000 |

| | — | | | | 7.07 | | 4/1/2020 | | |

Steven J. Buhaly (9) | | 4/1/2011 | 60,000 |

| | 60,000 |

| | | | 12.56 | | 4/1/2021 | | |

Steven J. Buhaly (9) | | 4/9/2012 | — |

| | 150,000 |

| | | | 5.94 | | 4/9/2022 | | |

Steven J. Buhaly (9) | | 4/5/2013 | | | 46,649 |

| | | | 4.85 | | 4/5/2023 | | |

Steven J. Buhaly (9) | | 6/7/2013 | | | 32,488 |

| | | | 7.01 | | 6/7/2023 | | |

Steven J. Buhaly (12) | | 4/5/2013 | | | | | | | | | | 17,831 | 148,771 |

Steven J. Buhaly (12) | | 6/7/2013 | | | | | | | | | | 14,426 | 120,313 |

| | | | | | | | | | | | | | |

Todd A. DeBonis (1) | | 4/21/2004 | 56,000 |

| | — |

| | | | 6.87 | | 4/21/2014 | | |

Todd A. DeBonis (3) | | 3/2/2006 | 35,000 |

| | — |

| | | | 4.83 | | 3/2/2016 | | |

Todd A. DeBonis (4) | | 3/2/2006 | 4,375 |

| | — |

| | | | 4.83 | | 3/2/2016 | | |

Todd A. DeBonis (4) | | 4/27/2007 | 60,000 |

| | — |

| | | | 5.18 | | 4/27/2017 | | |

Todd A. DeBonis (4) | | 5/21/2008 | 65,000 |

| | — |

| | | | 6.52 | | 5/21/2018 | | |

Todd A. DeBonis (8) | | 3/2/2009 | 15,000 |

| — |

| | — |

| | | | 2.15 | | 3/2/2019 | | |

Todd A. DeBonis (9) | | 3/2/2009 | 95,000 |

| | — |

| | | | 2.15 | | 3/2/2019 | | |

Todd A. DeBonis (9) | | 4/1/2010 | 140,000 |

| | — |

| | | | 7.07 | | 4/1/2020 | | |

Todd A. DeBonis (9) | | 4/1/2011 | 60,000 |

| | 60,000 |

| | | | 12.56 | | 4/1/2021 | | |

Todd A. DeBonis (9) | | 4/9/2012 | — |

| | 120,000 |

| | | | 5.94 | | 4/9/2022 | | |

Todd A. DeBonis (9) | | 4/5/2013 | | | 37,030 |

| | | | 4.85 | | 4/5/2023 | | |

Todd A. DeBonis (9) | | 6/7/2013 | | | 25,790 |

| | | | 7.01 | | 6/7/2023 | | |

Todd A. DeBonis (12) | | 4/5/2013 | | | | | | | | | | 14,155 | | 118,053 |

Todd A. DeBonis (12) | | 6/7/2013 | | | | | | | | | | 11,452 | | 95,510 |

|

| | | | | | | | | | | | | | | | | | |

Steven R. Grant (6) | | 7/16/2008 | 300,000 |

| | — |

| | | | 5.67 |

| | 7/16/2018 | | |

Steven R. Grant (8) | | 3/2/2009 | 20,000 |

| | — |

| | | | 2.15 |

| | 3/2/2019 | | |

Steven R. Grant (9) | | 3/2/2009 | 95,000 |

| | — |

| | | | 2.15 |

| | 3/2/2019 | | |

Steven R. Grant (9) | | 4/1/2010 | 140,000 |

| | — | | | | 7.07 |

| | 4/1/2020 | | |

Steven R. Grant (9) | | 4/1/2011 | 60,000 |

| | 60,000 |

| | | | 12.56 |

| | 4/1/2021 | | |

Steven R. Grant (9) | | 4/9/2012 | — |

| | 120,000 |

| | | | 5.94 |

| | 4/9/2022 | | |

Steven R. Grant (9) | | 4/5/2013 | | | 37,030 |

| | | | 4.85 |

| | 4/5/2023 | | |

Steven R. Grant (9) | | 6/7/2013 | | | 25,790 |

| | | | 7.01 |

| | 6/7/2023 | | |

Steven R. Grant (12) | | | | | | | | | | | | 14,155 |

| 118,053 |

|

Steven R. Grant (12) | | | | | | | | | | | | 11,452 |

| 95,510 |

|

| | | | | | | | | | | | | | |

James L. Klein(11) | | 8/5/2011 | 87,187 |

| | 67,813 |

| | | | 6.99 |

| | 8/5/2021 | | |

James L. Klein(9) | | 4/9/2012 | | | 90,000 |

| | | | 5.94 |

| | 4/9/2022 | | |

James L. Klein(9) | | 4/5/2013 | | | 35,347 |

| | | | 4.85 |

| | 4/5/2023 | | |

James L. Klein(9) | | 6/7/2013 | | | 24,618 |

| | | | 7.01 |

| | 6/7/2023 | | |

James L. Klein(12) | | | | | | | | | | | | 13,512 |

| 112,690 |

|

James L. Klein(12) | | | | | | | | | | | | 10,932 |

| 91,173 |

|

(1) Option vested as to 28% of the shares subject to the option one year after date of grant and as to an additional 2% of the shares subject to the option each month thereafter, so that 100% of the shares subject to the option will be exercisable four years after its date of grant.

(2) Option vested in monthly installments commencing 7/1/07 and ending 6/1/08.

(3) Option vests quarterly over four years commencing on the first quarterly vest date after grant. Quarterly vesting dates are March 1, June 1, September 1 and December 1.

(4) Option vests in four quarterly installments commencing on the ninth quarterly vest date after grant. Quarterly vesting dates are March 1, June 1, September 1 and December 1.

(5) Option vested 9,375 shares on 9/1/07, 12/1/07, 3/1/08 and 6/1/08; 21,875 shares on 9/1/08, 12/1/08, 3/1/09 and 6/1/09; 46,875 shares on 9/1/09, 12/1/09 and 3/1/10. 46,875 shares vested on 6/1/10.

(6) Option vests 25% on the first quarterly vest date following 12 months from the date of grant and 6.25% on each of the next twelve quarterly vest dates. Quarterly vest dates are March 1, June 1, September 1 and December 1.

| |

(7) | Option vests quarterly over three years. |

| |

(8) | Option vests quarterly over four years. |

| |

(9) | Option vests in four quarterly installments commencing the ninth quarter after grant. |

| |

(10) | Option vests in four quarterly installments commencing the ninth quarter after grant once the performance conditions are obtained. |

| |

(11) | Option vests 25% 12 months from the date of grant and 6.25% each of the next twelve quarters. |

| |

(12) | The Market Stock Unit (MSUs) awards are performance-vesting restricted stock units that vest with respect to between 0 and 150% of the target number of shares based on TriQuint's Total Shareholder Return (TSR) as compared to the SPDR S&P Semiconductor ETF Index over a 3 year performance period and are reported here based on target level performance. |

2013 Option Exercises Table

The following table provides information relating to stock option exercises during 2013 by the named executive officers. The amounts shown in the "Value Realized on Exercise" column in the table below are calculated by subtracting the aggregate exercise price of the options exercised, which is calculated by multiplying the number of shares being purchased by the

exercise price of the options, from the aggregate market value of the shares of common stock acquired on the date of exercise, which is calculated by multiplying the number of shares being purchased by the actual exercise price of the stock.

|

| | | | | | | |

Name | Option Awards |

Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) |

| Ralph G. Quinsey | 28,328 |

| | $ | 36,826 |

| |

| Steven J. Buhaly | — |