UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

TriQuint Semiconductor, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

TRIQUINT SEMICONDUCTOR, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Wednesday, May 21, 2008

4:00 p.m. (Pacific Time)

TO OUR STOCKHOLDERS:

The 2008 Annual Meeting of Stockholders of TriQuint Semiconductor, Inc., a Delaware corporation (“TriQuint,” “we,” “us” or “our company”), will be held on Wednesday, May 21, 2008, at 4:00 p.m., Pacific time, at 2300 NE Brookwood Parkway, Hillsboro, Oregon 97124, for the following purposes:

| | 1. | To elect seven directors to serve until the next annual meeting of stockholders or until their successors are duly elected and qualified; |

| | 2. | To ratify the audit committee’s appointment of KPMG LLP as TriQuint’s independent registered public accounting firm for the fiscal year ending December 31, 2008; |

| | 3. | To transact such other business as may properly come before the annual meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary, or before any adjournment thereof. |

The foregoing items of business are described in greater detail in the proxy statement accompanying this notice. Stockholders who owned shares of our common stock at the close of business on Monday, March 31, 2008, are entitled to attend and vote at the annual meeting. A complete list of these stockholders will be available during normal business hours for ten days prior to the meeting at our headquarters located at 2300 NE Brookwood Parkway, Hillsboro, Oregon 97124. A stockholder may examine the list for any legally valid purpose relating to the meeting. The list will also be available during the annual meeting for inspection by any stockholder present at the meeting.

This year we are furnishing proxy materials to our stockholders over the Internet. You may read, print and download our annual report to stockholders and proxy statement at the Investor Relations section of our website at http://www.triquint.com/investors/materials/filings/. On April 11, 2008, we mailed our stockholders a notice containing instructions on how to access our 2008 proxy statement and annual report to stockholders via the Internet and vote online. The notice also provides instruction on how you can request a paper copy of these documents free of charge if you desire, and how you can enroll in e-delivery to receive future annual materials via email.

Whether or not you plan to attend the annual meeting, please vote your shares as directed in the proxy card for the annual meeting as promptly as possible to ensure your representation and the presence of a quorum at the annual meeting.

For the Board of Directors of

TRIQUINT SEMICONDUCTOR, INC.

Steven J. Buhaly

Chief Financial Officer, Vice President of Finance and Secretary

Hillsboro, Oregon

April 11, 2008

YOUR VOTE IS IMPORTANT

PLEASE VOTE YOUR SHARES AS INSTRUCTED IN YOUR PROXY CARD AS PROMPTLY AS POSSIBLE.

2008 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

1

TRIQUINT SEMICONDUCTOR, INC.

PROXY STATEMENT FOR THE

2008 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

The enclosed proxy is solicited on behalf of the board of directors of TriQuint Semiconductor, Inc., a Delaware corporation (“TriQuint,” “we,” “us,” “our,” or “our company”), for use at our 2008 Annual Meeting of Stockholders, or at any adjournment. The annual meeting will be held on Wednesday, May 21, 2008, at 4:00 p.m., Pacific time, for the purposes set forth in the accompanying notice of annual meeting of stockholders. The annual meeting will be held at 2300 NE Brookwood Parkway, Hillsboro, Oregon 97124. Our telephone number at that location is (503) 615-9000.

A Notice of Internet Availability of Proxy Materials, which includes instructions about how to access this proxy statement, our 2007 Annual Report to Stockholders and the proxy card, was mailed on or about April 11, 2008, to all stockholders entitled to vote at the annual meeting.

Record Date and Shares Outstanding

Only stockholders of record at the close of business on March 31, 2008, are entitled to attend and vote at the annual meeting. On the record date, 143,024,725 shares of our common stock were outstanding and held of record by 448 stockholders. The closing price of our common stock on the NASDAQ Global Market on the record date was $5.06 per share.

Internet Availability of Proxy Materials

This year, we have voluntarily elected to take advantage of recent Securities and Exchange Commission rules that allow us to (i) mail our stockholders a Notice of Internet Availability of Proxy Materials and a proxy card, (ii) provide access to our proxy materials on our website, and (iii) mail a printed copy of the proxy materials to any stockholder who requests it. Next year we will be required to comply with these rules.

The Notice of Internet Availability of Proxy Materials provides instructions on how to view our proxy materials for the Annual Meeting at our website and, if desired, instruct us to send you future proxy materials electronically via email. Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

2

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Although we encourage you to read the enclosed proxy statement in its entirety, we include this question and answer section to provide some background information and brief answers to several questions you might have about the annual meeting.

| Q: | Why is TriQuint providing these materials? |

| A: | TriQuint’s board of directors is providing these proxy materials for you in connection with TriQuint’s annual meeting of stockholders, which will take place on May 21, 2008, at 4:00 p.m. Stockholders are invited to attend the annual meeting and are requested to vote on the proposals described in this proxy statement. |

| Q: | What information is contained in these materials? |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of directors and our most highly paid officers, and certain other required information. |

| Q: | What proposals will be voted on at the annual meeting? |

| A: | There are two proposals scheduled to be voted on at the annual meeting: |

| | • | | the election of directors (Proposal No. 1); and |

| | • | | the ratification of the audit committee’s appointment of KPMG LLP as TriQuint’s independent registered public accounting firm for the fiscal year ending December 31, 2008 (Proposal No. 2). |

| | We will also consider other business that properly comes before the annual meeting. |

| Q: | How does the board recommend that I vote? |

| A: | TriQuint’s board recommends that you vote your shares “FOR” each of the nominees to the board; and “FOR” the ratification of the audit committee’s appointment of KPMG as our independent registered public accounting firm. |

| Q: | What shares owned by me can be voted? |

| A: | All shares of TriQuint common stock owned by you as of the close of business on March 31, 2008 (the “Record Date”) may be voted by you. On all matters other than the election of directors, you may cast one vote per share of common stock that you held on the Record Date. These shares include shares that are: (1) held directly in your name as the stockholder of record, and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee or shares acquired through the Sawtek Employee Stock Option Plan and 401(k) Plan. |

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Most stockholders of TriQuint hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Stockholder of Record

If your shares are registered directly in your name with TriQuint’s transfer agent, Mellon Investor Services, LLC, you are considered, with respect to those shares, the stockholder of record, and the Notice of Internet Availability of these proxy materials is being sent directly to you by TriQuint. As the stockholder of record, you have the right to grant your voting proxy directly to TriQuint or to vote in person at the annual meeting. You may also vote your shares as described below under “How can I vote my shares without attending the annual meeting?”

3

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the annual meeting unless you obtain a legal proxy from your broker or other nominee authorizing you to vote your shares at the annual meeting. Your broker or nominee has sent you instructions for how you can direct the broker or nominee to vote your shares. You may vote your shares by Internet or by telephone as described below under “How can I vote my shares without attending the annual meeting?”

| Q: | How can I vote my shares in person at the annual meeting? |

| A: | Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to do so, please bring your proxy card or proof of identification. Even if you plan to attend the annual meeting, TriQuint recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the annual meeting. |

Shares held in street name may be voted in person by you only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

| Q: | How can I vote my shares without attending the annual meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the annual meeting by Internet by following the instructions in the proxy card. You may access your proxy materials and proxy card online by accessing the www.investoreconnect.com website and entering your 12 digit control number found on the notice that you received. The voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their voting instructions have been properly recorded. |

| A: | You may change your proxy instructions at any time prior to the vote at the annual meeting. You may accomplish this by entering a new vote by Internet, by telephone, by delivering a written notice of revocation to the corporate secretary of our company, by granting a new proxy card or new voting instruction card bearing a later date (which automatically revokes the earlier proxy instructions), or by attending the annual meeting and voting in person. Attendance at the annual meeting will not cause your previously granted proxy to be revoked unless you specifically so request. |

| A: | In the election of directors, you may vote “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. With respect to the elections for ratification of the appointment of our independent registered public accounting firm, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN,” your vote has the same effect as a vote “AGAINST.” If you vote your shares without providing specific instructions regarding each of these proposals, your shares will be voted in accordance with the recommendations of the board. |

If you vote to “ABSTAIN” from voting in all matters, the shares represented will be counted as present for the purpose of determining a quorum, but they will not be voted on any matter at the annual meeting. Consequently, if you abstain from voting on the proposal to elect directors, your abstention will have no effect on the outcome of the vote with respect to this proposal. If you abstain from voting

4

on the proposal for the ratification of the audit committee’s appointment of KPMG LLP as our independent registered public accounting firm, your abstention will have the same effect as a vote against the proposals.

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote or votes cast on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

Under the rules that govern brokers who have record ownership of shares that are held in street name for their clients, who are the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. Thus, if you do not otherwise instruct your broker, the broker may turn in a proxy card voting your shares “for” routine matters but expressly instructing that the broker is not voting on non-routine matters. A broker non-vote occurs when a broker expressly instructs on a proxy card that the broker is not voting on a matter, whether routine or non-routine. Proposals One and Two contained in these proxy materials are considered routine matters, so unless you have provided otherwise, your broker will have discretionary authority to vote your shares. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum but are not counted for determining the number of votes cast for or against a proposal.

| Q: | What is the quorum requirement for the annual meeting? |

| A: | The quorum requirement for holding the annual meeting and transacting business is a majority of the outstanding shares entitled to be voted. The shares may be present in person or represented by proxy at the annual meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the annual meeting. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | In the election of directors, the seven persons receiving the highest number of “FOR” votes will be elected. The proposal for ratification of the audit committee’s appointment of the independent registered public accounting firm require the affirmative “FOR” vote of a majority of those shares present in person or represented by proxy and entitled to vote at the annual meeting. |

| Q: | Who are the proxyholders and what do they do? |

| A: | The two persons named as proxyholders on the proxy card, Ralph G. Quinsey, our president and chief executive officer, and Steven J. Buhaly, our chief financial officer, vice president of finance and secretary, were designated by the board. The proxyholders will vote all properly tendered proxies (except to the extent that authority to vote has been withheld) and where a choice has been specified by you as provided in the proxy card, it will be voted in accordance with the instructions you indicate on the proxy card. If you vote your shares without providing specific instructions regarding each of the proposals, your shares will be voted, your shares will be voted “FOR” each of the proposals. |

5

| Q: | May I cumulate my votes? |

| A: | Every stockholder voting for the election of directors may cumulate such stockholder’s votes and (i) give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares that such stockholder is entitled to vote or (ii) distribute such stockholder’s votes on the same principle among as many candidates as the stockholder may select, provided that votes cannot be cast for more than seven candidates. However, no stockholder is entitled to cumulate votes unless the candidate’s name has been placed in nomination prior to the voting and the stockholder, or any other stockholder, has given notice at the meeting, and prior to the voting, of the intention to cumulate the stockholder’s votes. |

Cumulative voting applies only to the election of directors. For all other matters, each share of common stock outstanding as of the close of business on the Record Date is entitled to one vote.

| Q: | What does it mean if I receive more than one Notice of Internet Availability? |

| A: | You may receive more than one Notice of Internet Availability. For example, if you hold your shares in more than one brokerage account, you may receive a separate Notice of Internet Availability for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Notice of Internet Availability. Please vote your shares for each Notice of Internet Availability that you receive by following the instructions in the proxy card. You may access your proxy materials and proxy card online by accessing thewww.investoreconnect.com website and entering your 12 digit control number found on the notice that you received. |

| Q: | How can I revoke my proxy? |

| A: | You may revoke your proxy at any time before it is voted at the annual meeting. In order to do this, you may do any of the following: |

| | • | | sign and return another proxy card bearing a later date; |

| | • | | enter a new vote by Internet or by telephone following the instructions in the proxy card; |

| | • | | provide written notice of the revocation to TriQuint’s secretary, Steven J. Buhaly, at TriQuint Semiconductor, Inc., 2300 NE Brookwood Parkway, Hillsboro, Oregon 97124, prior to the vote at the annual meeting; or |

| | • | | attend the meeting and vote in person. |

| Q: | Where can I find the voting results of the annual meeting? |

| A: | We will announce preliminary voting results at the annual meeting and publish final results in TriQuint’s quarterly report on Form 10-Q for the quarter ending June 30, 2008. |

| Q. | What happens if additional proposals are presented at the annual meeting? |

| A: | Other than the two proposals described in this proxy statement, TriQuint does not expect any additional matters to be presented for a vote at the annual meeting. If you grant a proxy, the persons named as proxy holders, Ralph G. Quinsey, TriQuint’s president and chief executive officer, and Steven J. Buhaly, TriQuint’s chief financial officer, vice president of finance and secretary, will have the discretion to vote your shares on any additional matters properly presented for a vote at the annual meeting. If for any unforeseen reason any of TriQuint’s nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the board. |

6

| Q: | Who will count the vote? |

| A: | Joseph Pugh, our assistant secretary, has been appointed to act as the inspector of election and will tabulate the votes. In the event he is unable to do so, Susan Liles, our treasurer, will act in this role. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within TriQuint or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by the board. Occasionally, stockholders provide written comments on their proxy card, which are then forwarded to TriQuint’s management. |

| Q: | Who will bear the cost of soliciting votes for the annual meeting? |

| A: | TriQuint will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by TriQuint’s directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. TriQuint may retain the services of a third party firm to aid in the solicitation of proxies. TriQuint estimates that proxy solicitation costs, if there are any, will not exceed $15,000. In addition, TriQuint may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. |

| Q: | What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? |

| A: | You may submit proposals for consideration at future annual stockholder meetings, including director nominations. |

Stockholder Proposals:In order for a stockholder proposal to be considered for inclusion in our proxy statement for next year’s annual meeting, the written proposal must be received by us no later than December 12, 2008, and should contain such information as is required under TriQuint’s bylaws. If the date of next year’s annual meeting is moved more than 30 days before or after the anniversary date of this year’s annual meeting, the deadline for inclusion of proposals in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials. Such proposals will also need to comply with the regulations of the Securities and Exchange Commission (the “SEC”) under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to our corporate secretary at our principal executive offices.

If you intend to present a proposal at our 2009 annual meeting and the proposal is not intended to be included in our proxy statement relating to that meeting, you must give us advance notice of such proposal in accordance with our bylaws. Pursuant to our bylaws, in order for a stockholder proposal to be deemed properly presented under such circumstances, a stockholder must deliver notice of such proposal to our corporate secretary at our principal executive offices no later than the close of business on December 12, 2008. However, if the date of the 2009 annual meeting is more than 30 days before May 21, 2009, the first anniversary of this year’s annual meeting, stockholders must give us notice of any stockholder proposals within a reasonable time before the mailing date of the proxy statement. If a stockholder does not provide us with notice of a stockholder proposal in accordance with the deadlines described above, the stockholder will not be permitted to present the proposal to the stockholders for a vote at the meeting.

7

The SEC rules establish a different deadline with respect to discretionary voting (the “Discretionary Vote Deadline”) for stockholder proposals that are not intended to be included in a company’s proxy statement. The Discretionary Vote Deadline for our 2009 annual meeting is February 25, 2009, which is 45 calendar days prior to the anniversary of the mailing date of this proxy statement. If a stockholder gives notice of a proposal after the Discretionary Vote Deadline, our proxy holders will be allowed to use their discretionary voting authority to vote against the stockholder proposal when and if the proposal is raised at our 2009 annual meeting. Because the stockholder proposal deadline provided for in our bylaws cannot be determined until we publicly announce the date for our 2009 annual meeting, it is possible that the bylaw deadline may occur after the Discretionary Vote Deadline. In such a case, a stockholder proposal received after the Discretionary Vote Deadline but before the bylaw deadline would be eligible to be presented at the next year’s annual meeting, but we believe that our proxy holders would be allowed to use the discretionary authority granted by the proxy card to vote against the proposal at the annual meeting without including any disclosure of the proposal in the proxy statement relating to such meeting.

Nomination of Director Candidates: You may propose director candidates for consideration by the board’s nominating and governance committee. See “Consideration of Director Nominees” below.

Copy of Bylaw Provisions: You may contact TriQuint’s corporate secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

| Q: | How do I communicate with the board? |

| A: | The board has adopted a process for stockholder communications with the board and has selected Steven J. Buhaly, chief financial officer, to act as TriQuint’s contact person for stockholder communication directed to the board. Mr. Buhaly will relay all relevant questions and messages from the stockholders of TriQuint to the specific director identified by the stockholder or, if no specific director is requested, to a director selected by him. Mr. Buhaly can be reached at: |

Chief Financial Officer

TriQuint Semiconductor, Inc.

2300 NE Brookwood Parkway

Hillsboro, OR 97124

| Q: | Are there any other matters to come before the meeting? |

| A: | Other than the proposals listed above, the board does not intend to present any other matters to be voted on at the meeting. The board is not currently aware of any other matters that will be presented for action at the meeting. However, if other matters are properly brought before the stockholders at the meeting and you have signed and returned your proxy card, the proxy holders will have discretion to vote your shares on these matters to the extent authorized under the Securities Exchange Act of 1934, as amended. |

8

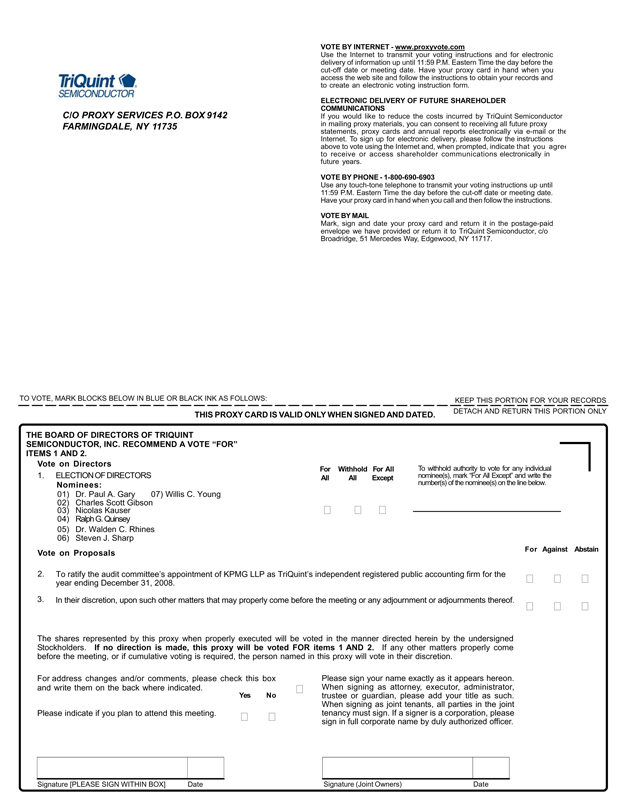

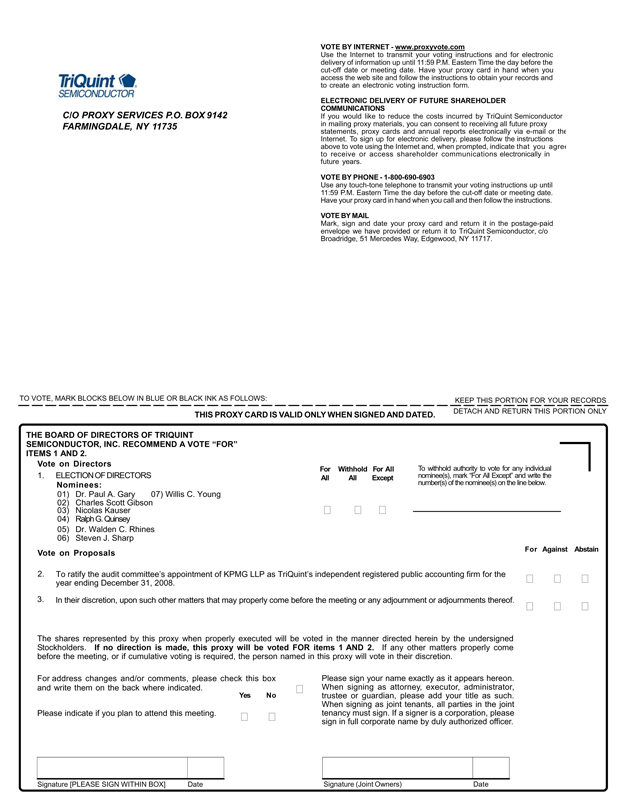

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees

The board has nominated TriQuint’s current directors to stand for election at the annual meeting. Unless otherwise instructed, the proxyholders will vote the proxies received by them for the seven nominees named below. In the event that any nominee is unable or declines to serve as a director at the time of the annual meeting, the proxyholders will be voted for any nominee who has been designated by the present board to fill the vacancy. The term of office for each person elected as a director will continue until the next annual meeting or until a successor has been elected and qualified. The following table lists the persons recommended by the nominating and governance committee and nominated by the board to be elected as directors and their ages as of April 1, 2008:

| | | | | | | | |

Name of Nominee | | Age | | Position with TriQuint | | Since | | Board

Committees |

Dr. Paul A. Gary | | 67 | | Director | | 1996 | | A, N* |

Charles Scott Gibson | | 55 | | Director | | 1992 | | A, C, N |

Nicolas Kauser | | 68 | | Director | | 1999 | | C, N |

Ralph G. Quinsey | | 52 | | President and Chief Executive Officer, Director | | 2002 | | — |

Dr. Walden C. Rhines | | 61 | | Director | | 1995 | | C*, N |

Steven J. Sharp | | 66 | | Chairman of the Board, Director | | 1992 | | — |

Willis C. Young | | 67 | | Director | | 2001 | | A*, N |

Board Committees:A-Audit,C-Compensation,N-Nominating and Governance

| * | Designates chair of that committee |

There is no family relationship between any director and/or executive officer of our company.

Dr. Gary has been a director of our company since May 1996. Dr. Gary has been retired since 1996. From 1967 until 1996, he served in various capacities for Bell Laboratories, Western Electric Corporation and the Microelectronics division of AT&T Corporation (now Agere Systems, Inc.), with his last position being vice president of the Netcom IC business unit. He also serves as chairman of the board of directors of Data I/O Corporation, a provider of manual and automated device programming systems. Dr. Gary holds a B.S. degree in electrical engineering from Lafayette College, a M.S. degree in electrical engineering from Stanford University and a Ph.D. in electrical engineering from Stanford University.

Mr. Gibson has been a director of our company since September 1992. Since March 1992, Mr. Gibson has been a director of a number of high technology companies and not-for-profit organizations. He co-founded Sequent Computer Systems Inc., a computer systems company, in 1983 (which was acquired by International Business Machines Corporation), and served as its president from January 1988 to February 1992. From 1976 to 1983, Mr. Gibson was employed at Intel Corporation as general manager, Memory Components Operations. He also serves as chairman of the board of directors of RadiSys Corporation, an embedded solutions company for the communications industry, and is a director of Pixelworks, Inc., a semiconductor manufacturer, Electroglas, Inc. and Verigy, Ltd., both of which are manufacturers of semiconductor test equipment; and Northwest Natural Company, a natural gas distribution company. Mr. Gibson also serves on the Board of Trustees of the Olin School of Engineering and is the vice chairman of the Oregon Health and Sciences University Governing and Foundation Board of Trustees and as a director of the Oregon Community Foundation. He received a B.S. degree in electrical engineering and a M.B.A. from the University of Illinois.

Mr. Kauser has been a director of our company since December 1999. From February 2004 to present, Mr. Kauser has served as a member of the board of directors, and from January 2005 until his retirement in August of 2007, additionally served as chief technology officer of Clearwire Corporation, a company

9

dedicated to the implementation of wireless broadband services in the United States and several European countries. From 1990 through 1998, Mr. Kauser served as executive vice president and chief technology officer of AT&T Wireless Services, Seattle, Washington (formerly McCaw Cellular Communications, Inc.). From 1984 through 1990, Mr. Kauser was employed by Rogers Cantel, Inc., a Canadian wireless service provider, as vice president of engineering and later, senior vice president of network operations. He was a member of Cantel’s board of directors from 1990 to 1998. Mr. Kauser received a B.S. degree in electrical engineering from McGill University, Montreal, Canada.

Mr. Quinsey joined our company in July 2002 as president and chief executive officer and a director. From September 1999 to January 2002, Mr. Quinsey was with ON Semiconductor, a manufacturer of semiconductors for a wide array of applications, as vice president and general manager of the Analog Division. From 1979 to September 1999, Mr. Quinsey was with Motorola, a manufacturer of semiconductors and communications equipment holding various positions including vice president and general manager of the RF/IF Circuits Division, which developed both silicon and gallium arsenide technologies for wireless phone applications. Mr. Quinsey received a B.S. degree in electrical engineering from Marquette University.

Dr. Rhines has been a director of our company since May 1995. Dr. Rhines has been the chief executive officer of Mentor Graphics Corporation, an electronic design automation company, since 1993 and chairman of their board of directors since 2002. Prior to joining Mentor Graphics, he spent 21 years at Texas Instruments Incorporated, as the executive vice president of Texas Instruments’ Semiconductor Group where he managed the semiconductor business. Dr. Rhines also serves as a director of Cirrus Logic, Inc, a semiconductor company, is the vice-chairman of the Electronic Design Automation Consortium (“EDAC”) and serves on the boards of Semiconductor Research Corporation (SRC), Lewis & Clark College and the Oregon Engineering and Technology Industry Council. Dr. Rhines holds a B.S. degree in metallurgical engineering from the University of Michigan, a M.S. degree and Ph.D. in materials science and engineering from Stanford University and a M.B.A. from Southern Methodist University.

Mr. Sharp joined our company in September 1991 as director, president and chief executive officer. In May 1992, he became chairman of our board. In July 2002, Mr. Sharp stepped down as president and chief executive officer of TriQuint, and in September 2004, he resigned as an employee of TriQuint. Previously, Mr. Sharp had served various roles associated with venture capital-financed semiconductor companies. In these assignments he was founder of Power Integrations, Inc. and Silicon Architects, Inc. (since acquired by Synopsys, Inc.). Prior to that time, Mr. Sharp was employed for 14 years by Signetics Corporation (since acquired by Philips Electronics N.V.), a semiconductor manufacturer and for nine years by Texas Instruments, a semiconductor manufacturer. Mr. Sharp also serves as chairman of the board of directors of Power Integrations, Inc. and as a director of Ambric, Inc. He received a B.S. degree in mechanical engineering from Southern Methodist University, a M.S. degree in engineering science from California Institute of Technology and a M.B.A. from Stanford University.

Mr. Young has been a director of our company since July 2001. Prior to joining our board, he was a director of Sawtek Inc., a surface acoustic wave filter company, from 1996 until 2001 when Sawtek merged with TriQuint. Mr. Young was a senior partner in the Atlanta office of BDO Seidman, LLP, an international accounting and consulting firm, from January 1996 to June 2000. Mr. Young retired in July 2000. From April 1995 to December 1995, Mr. Young was the chief financial officer for Hayes Microcomputer Products, Inc., a manufacturer of modems and communication equipment. From 1965 to 1995, Mr. Young held various positions with BDO Seidman, LLP, and from 1988 to 1995 he was vice chairman and a member of BDO Seidman’s Executive Committee. Mr. Young has a B.S. degree in accounting from Ferris State University. He is a certified public accountant.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED ABOVE.

10

CORPORATE GOVERNANCE AND OTHER MATTERS

Consideration of Director Nominees

The nominating and governance committee of the board considers both recommendations and nominations for candidates to the board proposed by stockholders. Any stockholder who wants to recommend or nominate a candidate for the nominating and governance committee’s consideration may do so by following the approved policies and procedures for director candidates. Stockholders must hold no less than 5% of TriQuint’s securities continuously for at least twenty-four months prior to the date of the submission of the recommendation or nomination.

Stockholder recommendations for candidates to the board must be directed in writing to TriQuint Semiconductor, Inc., Attn: Corporate Secretary, 2300 NE Brookwood Parkway, Hillsboro, Oregon 97124, and must include:

| | • | | the candidate’s name, business address and residence address; |

| | • | | the candidate’s principal occupation or employment; |

| | • | | the number of shares of TriQuint which are beneficially owned by such candidate; |

| | • | | detailed biographical data and qualifications and information regarding any relationships between the candidate and TriQuint within the last three years; and |

| | • | | any other information relating to such candidate that is required to be disclosed in solicitations of proxies for elections of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act. |

A stockholder’s recommendation to the secretary must also set forth:

| | • | | the name and address, as they appear on our books, of the stockholder making such recommendation; |

| | • | | the class and number of shares of TriQuint which are beneficially owned by the stockholder and the date such shares were acquired by the stockholder; |

| | • | | any material interest of the stockholder in such nomination; |

| | • | | a description of all arrangements or understandings between the stockholder making such nomination and the candidate and any other person or persons (naming such person or persons) pursuant to which the nomination is made by the stockholder; |

| | • | | a statement from the recommending stockholder in support of the candidate, references for the candidate, and an indication of the candidate’s willingness to serve, if elected; and |

| | • | | any other information that is required to be provided by the stockholder pursuant to Regulation 14A under the Exchange Act, in his/her capacity as a proponent to a stockholder proposal. |

Stockholder nominations to the board must meet the requirements set forth in Sections 2.2 and 2.5 of our bylaws. For a nomination to be properly brought before an annual meeting by a stockholder, the stockholder must have given timely notice thereof in writing to the corporate secretary of TriQuint. To be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices not less than 120 calendar days in advance of the date that proxy statements were mailed to stockholders in connection with the previous year’s annual meeting of stockholders. However, in the event that no annual meeting was held in the previous year or the date of the annual meeting had been changed by more than 30 days from the date contemplated at the time of the previous year’s proxy statement, notice by the stockholder must be received a reasonable amount of time before the solicitation is made in order to be considered timely.

11

Identifying and Evaluating Nominees for Director

The nominating and governance committee uses the following procedures to identify and evaluate the individuals that it selects, or recommends that the board select, as director nominees:

| | • | | The committee reviews the qualifications of any candidates who have been properly recommended or nominated by the stockholders, as well as those candidates who have been identified by management, individual members of the board or, if the committee determines, a search firm. Such review may, in the committee’s discretion, include a review solely of information provided to the committee or may also include discussions with persons familiar with the candidate, an interview with the candidate or other actions that the committee deems proper. |

| | • | | The committee evaluates the performance and qualifications of individual members of the board eligible for re-election at the annual meeting of stockholders. |

| | • | | The committee considers the suitability of each candidate, including the current members of the board, in light of the current size and composition of the board. Except as may be required by rules promulgated by the NASDAQ Global Market or the SEC, it is the current sense of the committee that there are no specific, minimum qualifications that must be met by each candidate for the board, nor are there specific qualities or skills that are necessary for one or more of the members of the board to possess. In evaluating the suitability of the candidates, the committee considers relevant factors, including, among other things, issues of character, judgment, independence, expertise, diversity of experience, length of service, other commitments and the like. The committee evaluates such factors, among others, and considers each individual candidate in the context of the current perceived needs of the board as a whole. |

| | • | | After such review and consideration, the committee selects, or recommends that the board select, the slate of director nominees, either at a meeting of the committee at which a quorum is present or by unanimous written consent of the committee. |

| | • | | The committee endeavors to notify, or causes to be notified, all director candidates of its decision as to whether to nominate such individual for election to the board. |

The board has final authority on determining the selection of director candidates for nomination to the board. These policies and procedures may be modified at any time as may be determined by the committee.

Statement on Corporate Governance

We have been committed to having sound corporate governance principles since our inception, and in September 2002, we adopted formal corporate governance standards. We have reviewed internally and with the board the provisions of the Sarbanes-Oxley Act of 2002, the rules of the SEC and the Nasdaq Global Market’s listing standards regarding corporate governance policies and processes and are in compliance with the rules and listing standards. You can access our committee charters, and our code of business conduct and ethics without charge on our website at www.TriQuint.com under the “Investors” section, and by clicking on “Governance,” or by writing to us at TriQuint Semiconductor, Inc., 2300 NE Brookwood Parkway, Hillsboro, OR 97124 Attention: CFO. Mr. Paul Gary has been designated as the lead independent director, and as such he chairs the regularly scheduled executive sessions among TriQuint’s non-management directors without management present.

Code of Business Conduct and Ethics

We have a code of business conduct and ethics that applies to all of our employees, including our principal executive officer, principal financial officer and principal accounting officer. This code of ethics is posted on our Internet web site. The Internet address for our web site is www.TriQuint.com, and the code of ethics may be found as follows:

| | 1. | From our main web page, first click on “Investors.” |

12

| | 2. | Next, click on “Governance.” |

| | 3. | Next, click on “Code of Business Conduct and Ethics.” |

We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of this code of ethics by posting such information on our web site, at the address and location specified above. If you wish to receive a copy of our code of ethics and do not have access to the Internet, please write to us at the address below, and we will furnish you a copy without charge:

Chief Financial Officer

TriQuint Semiconductor, Inc.

2300 NE Brookwood Parkway

Hillsboro, OR 97124

Director Independence

TriQuint has adopted standards for director independence, which are compliant with the rules of the NASDAQ Global Market. These independence standards are posted on our Internet web site. The Internet address for our web site is www.TriQuint.com, and the code of ethics may be found as follows:

| | 1. | From our main web page, first click on “Investors.” |

| | 2. | Next, click on “Governance.” |

| | 3. | Next, click on “Policy Regarding Director Independence.” |

Each member of the board and the board committees, except for Mr. Quinsey, meet these independence standards. Mr. Quinsey does not meet these independence standards, because he is the current president, chief executive officer and an employee of TriQuint. Mr. Quinsey does not sit on any board committee.

Attendance by Board Members at the Annual Meeting of Stockholders

It is the policy of the board to require board members to attend the annual meeting of stockholders. Exceptions may be made due to illness, travel or other commitments. All members of the board attended our annual meeting of stockholders on May 14, 2007.

Information about the Board and Committees of the Board of Directors

Our board held six meetings during 2007. All of the directors who served on the board during 2007 attended at least 75% of the meetings of the board, either in person or by teleconference. Currently, the board has three committees, each of which operates under a charter approved by the board: an audit committee, a compensation committee and a nominating and governance committee. Each director except Mr. Kauser attended at least 75% of the committee meetings on which they served during 2007 either in person or by teleconference. Mr. Kauser attended 50% of the nominating and governance committee meetings and at least 75% of the compensation committee meetings.

Audit Committee. The audit committee, consisting of Messrs. Young (who serves as chairman), Gary and Gibson, held nine meetings in 2007. The audit committee is responsible for appointing and overseeing actions taken by our independent registered public accounting firm, reviewing our external financial reports and filings with the SEC and reviewing our internal financial controls. The board has determined that Mr. Young is the “audit committee financial expert” pursuant to the rules and regulations of the SEC. The board has adopted a written charter for the audit committee that details the responsibilities of the audit committee and is posted on our Internet web site. The Internet address for our web site is www.TriQuint.com, and the audit committee charter may be found as follows:

| | 1. | From our main web page, first click on “Investors.” |

13

| | 2. | Next, click on “Governance.” |

| | 3. | Next, click on “Audit Committee Charter.” |

Compensation Committee. The compensation committee, consisting of Messrs. Rhines (who serves as chairman) Gibson and Kauser, held seven meetings in 2007. The compensation committee is responsible for determining salaries, incentives and other forms of compensation for our executive officers as well as overseeing the administration of various incentive compensation and benefit plans, including our 1996 Stock Incentive Program and 2007 Employee Stock Purchase Plan. The compensation committee makes all decisions regarding executive officer compensation. The board has adopted a written charter for the compensation committee that details the responsibilities of the compensation committee and is posted on our Internet web site. The Internet address for our web site is www.TriQuint.com, and the compensation committee charter may be found as follows:

| | 1. | From our main web page, first click on “Investors.” |

| | 2. | Next, click on “Governance.” |

| | 3. | Next, click on “Compensation Committee Charter.” |

The compensation committee’s responsibilities as set forth in its charter include determination and approval of the following items for executive officer compensation:

| | • | | Annual CEO base salary, incentive bonus including specific performance goals and amount, equity grants, employment, severance and change of control agreements/provisions, and any other benefits or compensation arrangements |

| | • | | Annual CEO performance evaluation |

Responsibilities also include review and approval of:

| | • | | Annual Executive Officer base salaries, incentive bonuses, equity grants, employment, severance and change of control agreements/provisions, and any other benefits or compensation arrangements |

The compensation committee has an annual calendar which includes specific officer compensation items to be reviewed and approved. During these meetings they review and discuss data and recommendations from the external compensation consultant and formulate final decisions and recommendations. From time to time the compensation committee holds additional meetings to further review compensation data and finalize recommendations if they believe that additional information is necessary. These meetings are called by Mr. Rhines on an as needed basis.

For 2007, the compensation committee engaged Wade Meyercord of Meyercord & Associates, an executive compensation consulting firm, as its compensation consultant to review the executive compensation levels and practices of our peer companies and make recommendations to the Compensation Committee. The consultant works independently and reports directly to the compensation committee. At each committee meeting the compensation consultant presents market data and trends and makes recommendations to the compensation committee. The compensation committee reviews the data and makes decisions based on the recommendations of the compensation consultant. The compensation consultant is on retainer to the compensation committee and is responsible for the following items:

| | • | | Annual executive bonus plan analysis and recommendation |

| | • | | Annual dilution analysis and recommendations |

| | • | | Annual board compensation analysis and recommendations |

On request the compensation consultant also provides data from peer companies for executive salaries, bonuses, cash compensation and equity. The compensation consultant provided this information in 2007 at the request of the compensation committee.

14

Mr. Quinsey, our chief executive officer, and Ms. Burke, our VP Human Resources, participate in all discussions and decisions regarding salaries and incentive compensation for all of our executive officers, except during discussions regarding their own salary and incentive compensation. Mr. Quinsey and Ms. Burke may make suggestions or recommendations during these discussions, however all decisions regarding the compensation of our executive officers are made solely by the compensation committee.

Nominating and Governance Committee.The nominating and governance committee, consisting of Messrs. Gary (who serves as chairman), Gibson, Kauser, Rhines and Young, held four meetings in 2007. The purpose of the nominating and governance committee is to ensure that the board is properly constituted to meet its fiduciary obligations to stockholders and our company and that we have and follow appropriate governance standards. To carry out this purpose, the nominating and governance committee: (1) assists the board by identifying prospective director nominees and recommending to the board the director nominees for the next annual meeting of stockholders; (2) develops and recommends to the board the governance principles applicable to us; (3) oversees the evaluation of the board and management; and (4) recommends director nominees for each committee. The board has adopted a written charter for the nominating and governance committee that details the responsibilities of the nominating and governance committee and is posted on our Internet web site. The Internet address for our web site is www.TriQuint.com, and the nominating and governance committee charter may be found as follows:

| | 1. | From our main web page, first click on “Investors.” |

| | 2. | Next, click on “Governance.” |

| | 3. | Next, click on “Nominating and Governance Committee Charter.” |

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee in 2007 has interlocking relationships as defined by the SEC or had any relationships requiring disclosure by TriQuint under the SEC’s rules requiring disclosure of certain relationships and related party transactions. Mr. Quinsey, our chief executive officer, participates in all discussions and decisions regarding salaries and incentive compensation for all of our executive officers, except discussions regarding his own salary and incentive compensation. Mr. Quinsey may make suggestions or recommendations during these discussions, however all deliberations and determinations regarding the compensation of our executive officers are made solely by the Committee.

Director Compensation

The board of directors, upon review of comparable company data and in light of additional governance responsibilities, modified the director compensation arrangements in February 2007 and August 2007 for the Company’s non-employee directors and its non-employee chairman, respectively. The changes did not affect directors who are employees of our company, who receive no additional or special remuneration for serving as directors.

Each non-employee director receives the following compensation components, in addition to reimbursement for out-of-pocket expenses:

Cash component—We do not pay director fees to directors who are our employees. Our non-employee directors receive the following cash compensation:

| | • | | the chairman of the board receives an annual retainer of $50,000 (which decreased on August 10, 2007 from $55,000). |

| | • | | each director, other than the chairman of the board, receives an annual retainer of $30,000 (which increased on August 10, 2007 from $25,000). |

| | • | | an additional fee of $20,000 for the chairman of the audit committee (which increased on August 10, 2007 from $15,000); $10,000 for the chairman of the compensation committee and $5,000 for the chairman of the nominating and governance committee. |

15

| | • | | members of the audit and compensation committees, other than the chairman, receive an annual fee of $8,000 (which increased on August 10, 2007 from $5,000). |

In addition, we offer participation in our group medical insurance program to all outside directors if they agree to pay the full COBRA rate. Only Mr. Sharp has opted to participate in this program at this time.

All fees earned by our non-employee directors are paid in four equal quarterly installments. In addition, our non-employee and employee directors are also reimbursed for out-of-pocket expenses incurred in connection with their attendance at board meetings. Mr. Sharp’s quarterly installment payments are reduced by the group medical premium.

Equity component—The 1996 Stock Incentive Program (as amended and restated effective February 2007) provides for an automatic, one-time grant of an option to purchase 33,000 shares of common stock to each non-employee director, effective on the date of each such director’s initial appointment or election. The exercise price per share of the option is equal to the fair market value of our common stock as of the date of grant, the term of the option is 10 years, and the option vests at a rate of 28% on the first anniversary of the grant date and 2% per month thereafter so long as the optionee remains a director of TriQuint.

In addition, the 1996 Program provides for an automatic, nondiscretionary annual grant, effective at each annual meeting of stockholders, of an option to purchase 17,500 shares of common stock to each non-employee director, other than the chairman of the board, who does not represent stockholders owning more than 1% of our outstanding common stock. A non-employee director who acts as chairman of the board receives an annual grant in the amount of 20,000 stock options under the 1996 Program, if immediately after such meeting, he or she shall continue to serve as chairman. The grants are adjusted pro-rata for a partial year if a director becomes a member of the board of directors at any time other than at the annual meeting of stockholders. All such options have an exercise price equal to the fair market value of our common stock as of the date of grant and vest at a rate of 25% six months after grant date and 12.5% per calendar quarter thereafter following the date of grant so long as the optionee remains a director of our company. These annual option grants to directors have terms of 5 years.

Stock Ownership Guidelines

TriQuint requires each board member to maintain a minimum ownership interest in TriQuint of 1,000 shares in an effort to align the interest of the board with the interests of stockholders. Further, the board members receive long-term incentives in the form of stock option awards to further align these interests. As of December 31, 2007, all board members met the minimum ownership requirement.

The following table details compensation paid to each director during the year ended December 31, 2007:

2007 DIRECTOR COMPENSATION TABLE

| | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash ($) | | Option

Awards

($)(1) | | Total

($) |

Paul A. Gary | | $ | 37,000 | | $ | 37,822 | | $ | 74,822 |

Charles Scott Gibson | | | 37,000 | | | 37,822 | | | 74,822 |

Nicolas Kauser | | | 31,250 | | | 37,822 | | | 69,072 |

Walden C. Rhines | | | 36,250 | | | 37,822 | | | 74,072 |

Steven J. Sharp | | | 53,250 | | | 64,261 | | | 117,511 |

Willis C. Young | | | 42,500 | | | 37,822 | | | 80,322 |

(1) | These amounts represent the amount of expense we recognized in 2007 for stock options granted to the indicated director in 2007 and previous years based on the estimated fair value of these awards under Financial Accounting Standards Board issued Statement No. 123R “Share Based Payment” (FAS 123R), but excluding the effect of any estimated forfeitures. A summary of the assumptions we apply |

16

| | in calculating these amounts is set forth in the Notes to Condensed Consolidated Financial Statements included in our Annual Report on Form 10-K for the year. The aggregate number of shares subject to stock options outstanding at December 31, 2007 and the grant date fair value of option awards granted in 2007 for each of the directors was as follows: |

| | | | | |

Name | | Aggregate number of Option

Awards Outstanding at

December 31, 2007

(#) | | Grant Date Fair Value of

Option Awards

Granted in 2007

($) |

Paul A. Gary | | 144,940 | | $ | 2.4016 |

Charles Scott Gibson | | 54,687 | | $ | 2.4016 |

Nicolas Kauser | | 177,500 | | $ | 2.4016 |

Walden C. Rhines | | 159.500 | | $ | 2.4016 |

Steven J. Sharp | | 670,004 | | $ | 2.4016 |

Willis C. Young | | 120,500 | | $ | 2.4016 |

17

REPORT OF THE AUDIT COMMITTEE

The audit committee currently consists of three non-employee, independent directors: Willis C. Young, Paul A. Gary and Charles Scott Gibson. The audit committee evaluates audit performance, manages relations with our independent registered public accounting firm and evaluates policies and procedures relating to internal accounting functions and controls. The board has adopted a written charter for the audit committee which details the responsibilities of the audit committee. This report relates to the activities undertaken by the audit committee in fulfilling such responsibilities.

The audit committee members are not active professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent registered public accounting firm. The audit committee oversees our financial reporting process on behalf of the board. Management has the primary responsibility for the financial statements and reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviews TriQuint’s financial statements and discusses the quality and acceptability of the controls, including the clarity of disclosures in the financial statements with management. The audit committee also reviews the financial statements with KPMG LLP, TriQuint’s independent registered public accounting firm, who are responsible for expressing an opinion on the conformity of our audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality and the acceptability of our financial reporting and such other matters required to be discussed with the audit committee under auditing standards generally accepted in the United States, including Statement on Auditing Standards No. 61, as amended,Communication withAudit Committee or Others with Equivalent Authority and Responsibility. The audit committee also receives written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Statement No. 1.

The audit committee further discusses with our independent registered public accounting firm the overall scope and plans for their audits. The audit committee meets periodically with the independent registered public accounting firm, with and without management present, to discuss the results of the independent registered public accounting firm’s evaluations of the effectiveness of our internal controls, and the overall quality of our financial reporting.

The audit committee also reviews management’s report on internal controls as well as the independent registered public accounting firm’s report to TriQuint as to its review of the effectiveness of TriQuint’s internal controls as required under section 404 of the Sarbanes-Oxley Act.

In connection with the financial statements for the year ended December 31, 2007, the Audit Committee has performed the following:

| | (1) | reviewed and discussed the audited financial statements and related disclosures with management; |

| | (2) | reviewed management’s report on internal controls; |

| | (3) | discussed with our independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended; and |

| | (4) | discussed with our independent registered public accounting firm their independence from management and TriQuint, including the matters in their written disclosures required by Independence Standards Board Statement No. 1. |

In reliance on the reviews and discussions referred to above, the audit committee recommended to the board (and the board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2007, for filing with the SEC.

SUBMITTED BY THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS:

Mr. Willis C. Young—Chairman

Dr. Paul Gary

Mr. Charles Scott Gibson

18

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of the board has appointed KPMG LLP as TriQuint’s independent registered public accounting firm to audit its consolidated financial statements for 2008. During 2007, KPMG LLP served as TriQuint’s independent registered public accounting firm and has done so since 1991. Although TriQuint is not required to seek stockholder approval of this appointment, the board believes it to be sound corporate governance to do so. If the appointment is not ratified, the audit committee will investigate the reasons for stockholder rejection and will reconsider the appointment.

Representatives of KPMG LLP are expected to attend the annual meeting where they will be available to respond to questions and, if they desire, to make a statement.

Before selecting KPMG LLP, the audit committee carefully considered KPMG LLP’s qualifications as an independent registered public accounting firm. This included a review of the qualifications of the engagement team, the quality control procedures the firm has established, any issues raised by the most recent quality control review of the firm, as well as its reputation for integrity and competence in the fields of accounting and auditing. The audit committee’s review also included matters to be considered under the rules of the SEC, including the nature and extent of non-audit services, to ensure that the independent registered public accounting firm’s independence will not be impaired. The audit committee expressed its satisfaction with KPMG LLP in all of these respects. The audit committee of our board has determined that the provision of services by KPMG LLP other than for audit related services is compatible with maintaining the independence of KPMG LLP as our independent registered public accounting firm. After review of all credentials, including industry expertise and services, the audit committee appointed KPMG LLP for the audit of TriQuint’s financial statements for 2008.

The following table shows KPMG LLP’s fees billed to us for the audit and other services for 2007 and 2006:

| | | | | | |

| | | 2007 | | 2006 |

Audit Fees(1) | | $ | 1,027,160 | | $ | 1,102,791 |

Audit-Related Fees | | | — | | | — |

Tax Fees(2) | | | — | | | — |

All Other Fees(2) | | | — | | | — |

| | | | | | |

| | $ | 1,027,160 | | $ | 1,102,791 |

| | | | | | |

(1) | Audit fees represent fees for professional services provided in connection with the audit of our financial statements and review of our quarterly financial statements and audit services provided in connection with other statutory or regulatory filings. |

(2) | We did not engage KPMG LLP to provide advice to us regarding tax or financial information systems design and implementation during the years ended December 31, 2007 or 2006. |

Pre-Approval of Audit and Non-Audit Services

The audit committee pre-approves all audit and permissible non-audit services provided by its independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Prior to engaging TriQuint’s independent registered public accounting firm to render an audit or permissible non-audit services, the audit committee specifically approves the engagement of TriQuint’s independent registered public accounting firm to render that service. Accordingly, TriQuint does not engage its independent registered public accounting firm to render audit or permissible non-audit services pursuant to pre-approval policies or procedures or otherwise, unless the engagement to provide such services has been approved by the audit committee in advance. As such, the engagement of KPMG LLP to render 100% of the services described in the categories above was approved by the audit committee in advance of rendering these services. The audit committee has determined that the

19

rendering of the services other than audit services by KPMG LLP is compatible with maintaining the principal accountant’s independence.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE RATIFICATION OF THE AUDIT COMMITTEE’S APPOINTMENT OF KPMG LLP AS TRIQUINT’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2008.

20

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information regarding the beneficial ownership of our common stock as of March 24, 2008, by:

| | • | | each stockholder known by us to beneficially own more than 5% of our common stock; |

| | • | | each of our directors and director nominees; |

| | • | | each of our executive officers named in the summary compensation table on page 24; and |

| | • | | all of our directors and executive officers as a group. |

Except as otherwise indicated below and subject to applicable community property laws, each owner has sole voting and sole investment powers with respect to the common stock listed.

| | | | | | | | | |

Beneficial Owners(1) | | Number of

Outstanding

Shares

Beneficially

Owned | | Number of

Shares

Underlying

Options

Exercisable | | Total Shares

Beneficially

Owned and

Shares

Underlying

Exercisable

Options | | Percent of

Outstanding

Shares

(%)(2) | |

5% Shareholders | | | | | | | | | |

Mazama Capital Management

One S.W. Columbia, Suite 1500

Portland, OR 97258 | | 13,496,770 | | — | | 13,496,770 | | 9.4 | % |

FMR LLC

82 Devonshire Street

Boston, MA 02109 | | 12,823,555 | | — | | 12,823,555 | | 9.0 | % |

Dimensional Fund Advisors Inc

1299 Ocean Avenue

Santa Monica, CA 90401 | | 11,338,449 | | — | | 11,338,449 | | 7.9 | % |

Barclays Global Investors

UK Holdings Ltd

Pza de Colon 2

28046

Madrid, Spain | | 7,833,977 | | — | | 7,833,977 | | 5.5 | % |

| | | | |

Directors and Named Executive Officers | | | | | | | | | |

Dr. Paul A. Gary | | 10,000 | | 136,190 | | 146,190 | | * | |

Charles Scott Gibson(3) | | 32,813 | | 45,937 | | 78,750 | | * | |

Nicolas Kauser | | 4,000 | | 168,750 | | 172,750 | | * | |

Ralph G. Quinsey | | 39,000 | | 959,375 | | 998,375 | | * | |

Dr. Walden C. Rhines(4) | | 76,000 | | 150,750 | | 226,750 | | * | |

Steven J. Sharp(5) | | 512,742 | | 660,004 | | 1,172,746 | | * | |

Willis C. Young | | 26,609 | | 94,250 | | 120,859 | | * | |

Steven J. Buhaly | | 20,000 | | — | | 20,000 | | * | |

Thomas V. Cordner | | 66,109 | | 355,146 | | 421,255 | | * | |

Todd A. DeBonis | | 26,580 | | 313,280 | | 339,860 | | * | |

Timothy A. Dunn | | 5,012 | | 93,750 | | 98,762 | | * | |

Stephanie J. Welty | | 32,322 | | 180,012 | | 212,334 | | * | |

All directors and executive officers as a group

(19 persons) | | 1,298,447 | | 5,208,790 | | 6,507,237 | | 4.6 | % |

21

(1) | The address of all directors and named executive officers is the address of our company: 2300 NE Brookwood Parkway, Hillsboro, Oregon 97124. Information for 5% shareholders is based solely on the information reported by these shareholders on Schedule 13D or 13G filed with the Securities and Exchange Commission. FMR LLC filed Amendment No. 1 to Schedule 13G with the SEC on March 10, 2008, reporting that it beneficially owned 2,582,300 shares, which is less that 5% of our outstanding common stock. |

(2) | Applicable percentage of ownership is based on 143,022,091 shares of common stock outstanding as of March 24, 2008, together with applicable options for such stockholders. Beneficial ownership is determined in accordance with the rules of the SEC, and includes voting and investment power with respect to shares. Shares of common stock subject to options currently exercisable or exercisable within 60 days after March 24, 2008, are deemed outstanding for computing the percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage of any other person. |

(3) | Includes 1,000 shares held in trust by Mr. Gibson. |

(4) | Includes 6,000 shares held by Dr. Rhines’ wife, and 20,000 shares held by a not for profit charitable foundation to which Mr. Rhines disclaims beneficial ownership. |

(5) | Includes 13,600 shares held by a not-for-profit charitable foundation which Mr. Sharp is the trustee but receives no benefits from the foundation. |

There were no arrangements that may result in a change of control of TriQuint. There were no material legal proceedings in which any director, officer, affiliate or stockholder known by us to beneficially own more than 5% of our common stock, or an associate of any of them, has an adverse interest.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC and the National Association of Securities Dealers, Inc. Executive officers, directors and greater than 10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of such forms we have received, or written representations from certain reporting persons, we believe that during 2007, all executive officers, directors and greater than 10% stockholders complied with all applicable filing requirements.

22

COMPENSATION COMMITTEE REPORT

The Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Committee recommended to the board that the Compensation Discussion and Analysis be included in our Annual Report on Form 10-K for the year ended December 31, 2007 and this Proxy Statement.

SUBMITTED BY THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS:

Dr. Walden C. Rhines—Chairman

Mr. Charles Scott Gibson

Mr. Nicolas Kauser

23

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee of the Board of Directors is responsible for determining all components of the compensation to be paid to each of our named executive officers, including salaries, incentives and other forms of compensation.

Compensation Philosophy and Objectives

TriQuint’s named executive officer compensation program is designed to align the interests of our executives with the interests of the stockholders by creating an environment that rewards performance relative to TriQuint’s goals and total shareholder return. Our executive compensation program is also designed to attract and retain qualified executives in the highly competitive high technology marketplace in which we compete. In this regard, the levels and types of executive compensation that make up TriQuint’s executive compensation packages, which are established by the Committee, are designed to be consistent with those available to executives at other companies in our industry. In particular:

| | • | | We base our compensation on the level of job responsibility, individual performance, and company performance. As executives progress to higher levels of responsibility in the organization, an increasing proportion of their pay is linked to company performance and stockholder returns through bonus programs and stock option awards. |

| | • | | We reflect in our compensation programs the market compensation of the executive position in similarly situated companies in our industry. To attract and retain a highly skilled executive team, we must remain competitive with the compensation packages of other high technology employers who compete with us for talent. |

| | • | | We develop and administer our compensation programs to foster the long-term retention of such executives required for success in our industry. |

Our executive compensation programs consist of quarterly, semi-annual, annual and long-term components, which are considered together in assessing whether the program is attaining its designed objectives. The Committee recommends a compensation philosophy, which is subsequently approved by the board. Recent changes in the philosophy recommended by the Committee and approved by the board include a move from paying below market wages and above market equity compensation to paying market wages and equity compensation with more variable pay components, based on individual and company performance. The Committee’s intention is to increase variable compensation based upon operating income to provide an incentive to improve Company profitability.

How We Set Compensation

On an annual basis, the Committee is responsible for reviewing and approving the compensation of our named executive officers. In determining total executive compensation packages for 2007, the Committee considered various measures of company and industry performance including revenue, operating income, market capitalization, gross margins, total shareholder return, and growth rates. The Committee does not assign these performance measures relative weights. Instead, the Committee makes a subjective determination after considering all such measures collectively.