The following table provides information as of December 31, 2003, about our common stock that may be issued upon the exercise of options and rights granted to employees, consultants or members of our board of directors under all existing equity compensation plans including the 1987 Stock Incentive Program, the 1996 Stock Incentive Program, the 1998 Nonstatutory Stock Option Plan, the 1998 Employee Stock Purchase Plan, the Sawtek Inc. Second Stock Option Plan and the Sawtek Inc. Stock Option Plan for Acquired Companies:

1998 Nonstatutory Stock Option Plan

In January 1998, the board of directors approved the 1998 Nonstatutory Stock Option Plan (the “1998 Plan”). The 1998 Plan was subsequently amended and restated in July 2003. The 1998 Plan has not been submitted to our stockholders for approval.

The material terms of the 1998 Plan are summarized as follows:

Purpose

The purposes of the 1998 Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to employees and consultants and to promote the success of our business.

Eligibility to Participate in the 1998 Plan

Nonstatutory stock options may be granted to our consultants and our employees who are not officers or directors.

Number of Shares Covered by the 1998 Plan

The board of directors initially reserved 500,000 shares of our common stock for issuance under the 1998 Plan. Our shares of common stock have split three times (3 for 2 stock split in July 1999, 2 for 1 in February 2000 and 2 for 1 in July 2000), thus producing an equivalent effect of a 6 for 1 stock split. Due to these stock splits, the shares of our common stock reserved for issuance under the 1998 Plan increased from 500,000 to 3,000,000 shares. In December 2002, the board of directors amended the 1998 Plan to increase the aggregate number of shares of common stock authorized for issuance by 1,000,000 due to the grant of stock options to our new employees from businesses that we acquired in 2002 and early 2003. As of March 24, 2004, options to acquire 1,043,706 shares were exercised, options to acquire 2,438,901 shares were outstanding and options to acquire 517,393 shares remain to be granted under the 1998 Plan, out of the 4,000,000 shares reserved for issuance.

Awards Permitted under the 1998 Plan

The 1998 Plan authorizes the granting of nonstatutory stock options only.

Terms of Options

The exercise price of an option may not be less than the fair market value of our common stock on the date of grant and the term of each option shall be stated in the stock option agreement. All of the options that are currently outstanding under the 1998 Plan vest and become exercisable over a four-year period beginning at the grant date. Payment of the exercise price may be made by cash, check, promissory note, cashless exercise, other shares of our common stock, any other form of consideration permitted by applicable law or any combination of the foregoing methods of payment. Options may be made exercisable only under the conditions the board of directors or its appointed committee may establish. If an optionee’s employment terminates for any reason, the option remains exercisable for a fixed period of three months or such longer period as may be fixed by the board of directors or its appointed committee up to the remainder of the option’s term.

Capital Changes

The number of shares available for future grant and previously granted but unexercised options are subject to adjustment for any future stock dividends, splits, mergers, combinations, reclassification of the common stock or other changes in capitalization as described in the 1998 Plan.

Merger or Change of Control

In the event of a merger of our company with or into another corporation, or the sale of substantially all of our assets, each outstanding option under the 1998 Plan must be assumed or an equivalent option or right substituted by the successor corporation or a parent or subsidiary of such successor corporation. If the successor corporation

27

refuses to assume or substitute for the option, the optionee will fully vest in and have the right to exercise the option as to all of the optioned stock, including shares as to which it would not otherwise be vested or exercisable.

Termination and Amendment

The 1998 Plan provides that the board of directors may amend or terminate the 1998 Plan without stockholder approval, but no amendment or termination of the 1998 Plan or any award agreement may adversely affect any award previously granted under the 1998 Plan without the written consent of the optionee.

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND

CHANGE-OF-CONTROL ARRANGEMENTS

Employment Contracts and Termination of Employment Arrangements

In September 1991, under the terms of his acceptance of employment, Steven J. Sharp, our chairman of the board of directors, entered into a letter agreement with us. Effective September 27, 2003, the board approved changes to Mr. Sharp’s employment letter agreement that (i) set his base salary at $60,000 per year (which will be initially reduced to $54,000 per year to correspond to the other executive officers salary reductions during 2003) and (ii) provided for the grant of an option to purchase 35,000 shares to Mr. Sharp, if elected at the 2004 annual meeting, effective on the date of the annual meeting. In the event that we desire to terminate Mr. Sharp’s employment, we must provide Mr. Sharp with one year’s advance notice or, in lieu of such notice, a payment equal to one year’s salary.

In June 2002, under the terms of his acceptance of employment, Ralph G. Quinsey, our president and chief executive officer, entered into a letter agreement with us pursuant to which he was to receive an annual base salary of $330,200, subject to annual review, an annual target bonus of 50% of his base salary subject to compliance with performance against a corporate wide bonus plan and a stock option grant for 500,000 shares of our common stock (vesting 28% on first anniversary of option grant, then 2% monthly thereafter until fully vested), a moving and relocation allowance consistent with our corporate polices, with a tax equalization adjustment, and a signing bonus of $25,000. In the event that we desire to terminate Mr. Quinsey’s employment without cause, we must provide Mr. Quinsey a lump sum payment equal to one year’s compensation at Mr. Quinsey’s then-current base salary and health and life benefits at company expense for 12 months. The agreement also provides for a change of control benefit of full vesting of 12 months’ worth of unvested options in the event Mr. Quinsey is terminated without cause or resigns for good reason within 12 months of a change of control.

In November 2002, and modified in February 2004, we entered into a letter agreement with Raymond A. Link, our vice president of finance and administration, chief financial officer and secretary. Pursuant to the agreement, Mr. Link receives an annual base salary of $225,750, subject to annual review, an annual bonus consistent with our bonus programs and an annual option grant in accordance with our current guidelines. The agreement also provides for a change of control benefit of one year’s base pay as a lump sum and full vesting of the 60,000 options granted to Mr. Link in July 2001 in the event of (i) a change of control or (ii) a merger of our company resulting in an ownership change of less than 50% and greater than 30% in which Mr. Link is not retained as the Chief Financial Officer of the surviving entity for a period of not less than one year. In the event that we desire to terminate Mr. Link’s employment without cause, we must provide Mr. Link a lump sum payment equal to 12 month’s compensation at Mr. Link’s then-current base salary and health and life benefits at the company’s expense for 12 months. In the event of a resignation with cause, we must provide Mr. Link a lump sum payment equal to 12 month’s compensation at Mr. Link’s then-current base salary and health and life benefits at the company’s expense for 12 months.

Change-of-Control Arrangements

In January 1995, the board approved an amendment to each stock option held by our then-current executive officers, and to each stock option granted to our future executive officers, as determined from time to time by the board of directors or a committee thereof, to provide that, in the event we experience a change of control, certain outstanding stock options held by each executive officer at the time of any such change of control, regardless of

28

whether such stock options are then exercisable in accordance with their terms, shall become vested and exercisable as follows:

| 1. | | The chief executive officer shall become immediately vested for those shares that would have otherwise become vested over the last twelve months of the options’ vesting schedules. |

| 2. | | The chief financial officer shall become immediately vested for those shares that would otherwise have become vested over the last eight months of the options’ vesting schedules. |

| 3. | | All other executive officers shall become immediately vested for those shares that would have otherwise become vested over the last four months of the options’ vesting schedules. |

This arrangement is applicable to all stock options held by our current executive officers.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Since January 1, 2003, we believe that, except as described below, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or are to be a party in which the amount involved exceeds $60,000 and in which any director, executive officer or holder of more than 5% of our common stock, or members of any such person’s immediate family, had or will have a direct or indirect material interest, other than the compensation agreements described in “Executive Compensation and Other Matters.” We intend that any such future transactions will be approved by a majority of the board of directors, including a majority of the independent and disinterested outside directors, and will be on terms no less favorable to our company than could be obtained from unaffiliated third parties. Steven P. Miller, a former director, was the Chairman of the Board of Directors of Xytrans, Inc. In 2003, we sold products to Xytrans totaling approximately $17,600. Mr. Miller resigned from our board of directors in December 2003 and is no longer on the board of directors of Xytrans. We believe that our transactions with Xytrans were on terms no more favorable than those with unrelated parties. Edward F. Tuck, one of our directors, was the Chairman of the Board of Directors and Chief Executive Officer of Wavestream Corporation. In 2003, we made an equity investment in Wavestream in the amount of approximately $226,600 and we have a total investment of approximately $384,130. Mr. Tuck is no longer on the board of directors of Wavestream, nor is he an officer or an employee of Wavestream. We believe that our transactions with Wavestream were on terms no more favorable than those with unrelated parties. In addition, we provided Mr. Ralph G. Quinsey with a relocation and moving package of approximately $14,124 in 2003, and provided Mr. Raymond A. Link with an apartment with rent of approximately $4,260 in 2003. Mr. Link no longer leases the apartment.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Our compensation committee is responsible for determining salaries, incentives and other forms of compensation for directors and executive officers. Our compensation committee consists of Messrs. Gibson, Gary, Kauser and Rhines. Mr. Quinsey, our chief executive officer, participates in all discussions and decisions regarding salaries and incentive compensation for all of our executive officers, except during discussions regarding his own salary and incentive compensation. No interlocking relationship exists between any member of our compensation committee and any member of any other company’s board of directors or compensation committee.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Notwithstanding any statement to the contrary in any of our previous or future filings with the Securities and Exchange Commission, this board compensation committee report on executive compensation shall not be deemed “filed” with the Commission or “soliciting material” under the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any such filings.

The compensation committee reviews and approves TriQuint’s executive compensation policies. The compensation committee operates under a written charter adopted by the board of directors in September 2002 and amended in February 2004. The following is the report of the compensation committee describing compensation policies and the rationale applicable to the compensation paid to TriQuint’s executive officers for fiscal 2003.

29

Compensation Philosophy and Policies for Executive Officers

TriQuint’s executive compensation program is designed to align the interests of executives with the interest of the stockholders by creating a performance-oriented environment that rewards performance related to the goals of TriQuint. TriQuint’s executive compensation program is also designed to attract and retain qualified executives in the highly competitive high technology marketplace in which TriQuint competes. In this regard, the levels of executive compensation established by the compensation committee are designed to be consistent with those available to other executives in the industry. TriQuint’s executive compensation program consists primarily of the following integrated components:

| 1. | | Base Salary—which is designed to compensate executives competitively within the industry and the marketplace; |

| 2. | | Quarterly Profit Sharing—which provides a direct link between executive compensation and the quarterly performance of TriQuint; |

| 3. | | Key Employee Incentive Plan—which provides a direct link between executive compensation and the quarterly and annual performance of TriQuint; and |

| 4. | | Long Term Incentives—which consist of stock options that link management decision making with TriQuint’s long-term performance and stockholder interests. |

The compensation committee has considered the potential impact of Section 162(m) of the Internal Revenue Code on the compensation paid to TriQuint’s executive officers. Section 162(m) disallows a tax deduction for any publicly held corporation for individual compensation exceeding $1.0 million in any taxable year for any of the named executive officers, unless compensation is performance-based. In general, it is the compensation committee’s policy to qualify, to the maximum extent possible, its executives’ compensation for deductibility under applicable tax laws.

Base Salaries

Base salary levels for the chief executive officer and other executive officers of TriQuint are reviewed annually by the compensation committee. The compensation committee’s current policy is to maintain base salary levels in the second quartile for the industry when compared with those of executives holding similar positions with other companies in the high technology and semiconductor industries that are similar in size to TriQuint. Certain companies included in the peer group index of the stock performance graph are also included in surveys reviewed by TriQuint in determining salary levels for the chief executive officer and other executive officers of TriQuint. The compensation committee and full board of directors set the base salary for Mr. Quinsey on his date of hire in July 2002 at $330,200 per year subject to annual review. Mr. Quinsey took a voluntary 10% reduction in his base salary during the second half of 2003. The compensation committee will review Mr. Quinsey’s compensation in the second quarter of 2004.

Quarterly Profit Sharing

All U.S. based employees and employees in certain foreign subsidiaries participate in TriQuint’s profit sharing program. Profit sharing is paid quarterly and equals a percentage of the employees’ quarterly earnings. The profit sharing pool is equal to 10% of adjusted operating income. For all employees employed in the United States, one half of the profit sharing amount is paid quarterly in cash, with the other half paid as an employer contribution to each eligible employee’s 401(k) account. Only employees who are employed at the end of the quarter receive profit sharing amounts. There were no profit sharing payments to any employee or officer from this program in 2002 or 2003 and substantially all of the payments listed in the summary compensation table for 2001 were amounts earned based on the financial results for 2000, but the actual payment was made in 2001. A small profit sharing, less than $1,000 per each executive officer, was earned in the fourth quarter of 2003 and paid in the first quarter of 2004.

30

Officer and Key Employee Incentive Plan

In February 2004, the compensation committee of the board of directors approved the officer and key employee incentive plan for 2004. Participants must be employed full-time by TriQuint during the year to be eligible for a bonus. The bonus is based on actual versus budget operating income adjusted for certain one-time gains and charges. The bonuses vary with the level of achievement of budgeted operating income. There were no payments in 2001, 2002 or 2003 to any officer or employee pursuant to this bonus program.

Long-Term Incentives

TriQuint provides its executives, including the chief executive officer, long-term incentives through the grant of stock options under its 1996 Stock Incentive Program. The purpose of the 1996 Stock Incentive Program is to create a direct link between compensation and the long-term performance of TriQuint. Stock options under this program are generally granted at an exercise price equaling 100% of fair market value, have a ten-year term and generally vest in installments over four years. Because the receipt of value by an executive officer under a stock option is dependent upon an increase in the price of TriQuint’s common stock, this portion of the executives’ compensation is directly aligned with an increase in stockholder value. Stock options are granted to executive officers in conjunction with each executive officer’s acceptance of employment with TriQuint, upon promotion to executive officer, and annually based on several factors. When determining the number of stock options to be awarded to an executive officer, the compensation committee considers (i) the executive’s current contribution to TriQuint’s performance, (ii) the executive’s anticipated contribution in meeting TriQuint’s long-term strategic performance goals and (iii) comparisons to an internally generated informal survey of executive stock option grants made by other high technology and semiconductor companies at a similar stage of development as TriQuint. Individual considerations, such as the executive’s current and anticipated contributions to TriQuint’s performance, may be more subjective and less measurable by financial results at the corporate level. In this respect, the compensation committee exercises significant judgment in measuring the contribution or anticipated contribution to TriQuint’s performance. The compensation committee also periodically reviews the stock options granted to insure equitable distribution of such options among the officers.

Other

TriQuint’s executive officers are also eligible to participate in compensation and benefit programs generally available to other employees, including TriQuint’s employee stock purchase plan.

SUBMITTED BY THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS:

Mr. Charles Scott Gibson — Chairman

Dr. Paul Gary

Mr. Nicolas Kauser

Dr. Walden C. Rhines

31

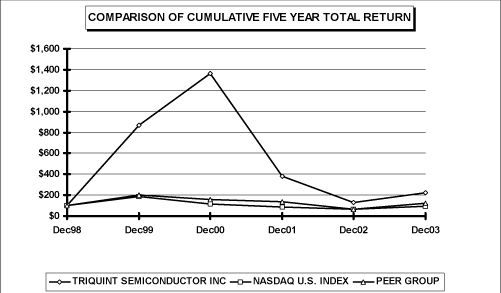

STOCK PRICE PERFORMANCE GRAPH

Notwithstanding any statement to the contrary in any of our previous or future filings with the Securities and Exchange Commission, the following information relating to the price performance of our common stock shall not be deemed “filed” with the Commission or “soliciting material” under the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any such filings.

Set forth below is a line graph comparing the annual percentage change in the cumulative return to the stockholders of our common stock with the cumulative return of the Nasdaq U.S. Index and the SIC Code 3674—Semiconductors and Related Devices Index for the period commencing December 31, 1998, and ending on December 31, 2003.

No cash dividends have been declared or paid on our common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

The peer group index used, SIC Code 3674—Semiconductors and Related Devices, utilizes the same methods of presentation and assumptions for the total return calculation as our company and the Nasdaq U.S. Index. All companies in the peer group index are weighted in accordance with their market capitalizations.

32

OTHER MATTERS

We know of no other matters to be submitted at the annual meeting. If any other matters properly come before the annual meeting, it is the intention of the persons named in the enclosed proxy card to vote the shares they represent as the board of directors may recommend.

THE BOARD OF DIRECTORS OF

TRIQUINT SEMICONDUCTOR, INC.

33

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF TRIQUINT. IF NO SPECIFIC DIRECTION IS GIVEN AS TO ANY OF THE ABOVE ITEMS, THIS PROXY WILL BE VOTEDFOR EACH OF THE NOMINEES NAMED IN PROPOSAL 1,FOR PROPOSAL 2 ANDFOR PROPOSAL 3. | | Please

Mark Here

for Address

Change or

Comments | £ | |

| | SEE REVERSE SIDE |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR EACH OF THE NOMINEES NAMED BELOW. | | THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE APPROVAL OF PROPOSAL 2. | FOR | AGAINST | ABSTAIN |

PROPOSAL 1: ELECTION OF DIRECTORS. | Nominees: | | PROPOSAL 2: | To approve an amendment to the TriQuint Semiconductor, Inc. 1996 Stock Incentive Program to increase the aggregate number of shares of common stock that may be issued thereunder by 5,000,000 shares. | £ | £ | £ |

| 01 Francisco Alvarez

02 Dr. Paul A. Gary

03 Charles Scott Gibson

04 Nicolas Kauser

05 Ralph G. Quinsey

06 Dr. Walden C. Rhines

07 Steven J. Sharp

08 Edward F. Tuck

09 Willis C. Young | | |

FOR all

nominees listed

(except as marked

to the contrary)

£ | WITHHOLD

AUTHORITY

to vote for all

nominees listed

£ | | | FOR | AGAINST | ABSTAIN |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE APPROVAL OF PROPOSAL 3. | £ | £ | £ |

| PROPOSAL 3: | To ratify the audit committee’s appointment of KPMG LLP as TriQuint’s independent auditors for the fiscal year ending December 31, 2004. |

| | | | |

| | | | | |

| PROPOSAL 4: | Upon such other matters as may properly come before or incident to the conduct of the Annual Meeting, the proxy holders shall vote in such manner as they determine to be in the best interests of TriQuint. TriQuint is not presently aware of any such matters to be presented for action at the meeting. |

| | |

(Instructions: To withhold authority to vote for any individual nominee, strike a line through the nominee’s name in the list above.) | | | |

| | |

| | | I (We) plan to attend the meeting | £ |

| | |

| | | | | |

| | | | | |

| | | | | | |

Stockholder Name | | Signature | | Date | |

Please sign above exactly as your name appears on this Proxy Card. If shares are registered in more than one name, the signatures of all such persons are required. A corporation should sign in its full corporate name by a duly authorized officer, stating his/her title. Trustees, guardians, executors and administrators should sign in their official capacity, giving their full title as such. If a partnership, please sign in the partnership name by authorized person(s). If you receive more than one Proxy Card, please sign and return all such cards in the accompanying envelope. |

p FOLD AND DETACH HERE p |

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

Internet

http://www.eproxy.com/tqnt | OR | Telephone

1-800-435-6710 | OR | Mail

Mark, sign and date

your proxy card

and

return it in the

enclosed postage-paid

envelope. |

Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. | Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. |

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

| TRIQUINT SEMICONDUCTOR, INC. | |

| | |

| Proxy for Annual Meeting of Stockholders to be Held on May 14, 2004 | |

| | |

| The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 5, 2004, and hereby names, constitutes and appoints Ralph G. Quinsey and Raymond A. Link, or either of them acting in absence of the other, with full power of substitution, my true and lawful attorneys and proxies for me and in my place and stead to attend the Annual Meeting of the Stockholders of TriQuint Semiconductor, Inc. (“TriQuint”) to be held at 8:00 a.m. on Friday, May 14, 2004, and at any adjournment or postponement thereof, and to vote all the shares of Common Stock held of record in the name of the undersigned on March 24, 2004, with all the powers that the undersigned would possess if personally present. | |

| | |

| | |

| | |

| | |

| Address Change/Comments (Mark the corresponding box on the reverse side) | |

| | |

| | |

| | |

| | |

| | |

You can now access your TriQuint Semiconductor, Inc. account online.

Access your TriQuint Semiconductor, Inc. stockholder account online via Investor ServiceDirect®(ISD).

Mellon Investor Services LLC, Transfer Agent for TriQuint Semiconductor, Inc., now makes it easy and convenient to get current information on your stockholder account.

• | View account status | • | View payment history for dividends |

• | View certificate history | • | Make address changes |

• | View book-entry information | • | Obtain a duplicate 1099 tax form |

| | • | Establish/change your PIN |

Visit us on the web at http://www.melloninvestor.com

Call 1-877-978-7778 between 9am-7pm

Monday-Friday Eastern Time