See notes to consolidated financial statements.

REITPLUS, INC. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2008 and 2007

| |

1. | DESCRIPTION OF BUSINESS AND NATURE OF OPERATIONS |

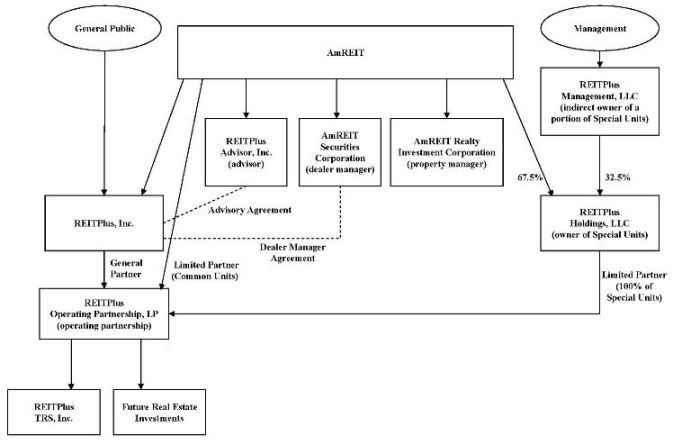

REITPlus, Inc. was formed on April 13, 2007 to acquire an interest in a portfolio of retail and mixed-use properties, including a combination of stabilized, income-producing properties and value-added opportunities. We are externally managed by REITPlus Advisor, Inc., a wholly-owned subsidiary of AmREIT, a Texas real estate investment trust. We elected to be treated as a real estate investment trust (“REIT”) for federal income tax purposes. The use of the words “we,” “us,” or “our” refers to REITPlus, Inc. and its subsidiary, except where the context otherwise requires.

We anticipate that we will conduct substantially all of our operations through our subsidiary, REITPlus Operating Partnership, LP (“REITPlus OP”). Subject to certain restrictions and limitations, our business will be managed by REITPlus Advisor, Inc. (our “Advisor”), an affiliate, pursuant to an advisory agreement. Our Advisor will supervise and manage our day-to-day operations and will select the properties we acquire, subject to oversight by our board of directors. Our Advisor will also provide marketing, sales and client services on our behalf. Our Advisor is affiliated with us in that we and our Advisor have common management. Our Advisor engages wholly-owned subsidiaries of AmREIT, including AmREIT Realty Investment Corporation, to provide various services to us and our properties.

Our charter authorizes us to issue 1,050,000,000 shares of capital stock, of which 1,000,000,000 shares of capital stock are designated as common stock with a par value of $0.01 per share and 50,000,000 shares of capital stock are designated as preferred stock with a par value of $0.01 per share. In 2008, we conducted a best efforts initial public offering (the “Offering”), in which we offered a maximum of 50,000,000 shares of our common stock for $10.00 per share to the public and 5,263,158 shares of our common stock pursuant to our distribution reinvestment plan (“the DRIP”) at $9.50 per share. We reached the minimum offering amount of $2.0 million on April 22, 2008, and had received $7.5 million for the sale of 752,307 shares of REITPlus Common Stock as of the close of the Offering on October 4, 2008.

We commenced our principal operations on April 22, 2008 when we raised the minimum offering of $2.0 million pursuant to the terms of our Offering. The Offering was closed on October 4, 2008, and, as of December 31, 2008, we had received $7.5 million for the sale of 752,307 shares of common stock. At December 31, 2008, we had an investment interest in a non-consolidated entity, which owned one property comprising 593,163 square feet of gross leasable area.

On January 7, 2009, our board of directors approved in concept the merger of AmREIT with REITPlus. The anticipated merger is part of Phase II in AmREIT’s strategic plan, referred to as “Vision 2010,” and would combine all AmREIT capital stock into a single class of common shares, accomplishing AmREIT’s goal of simplifying its capital structure. The merger will be subject to appraisal of AmREIT and REITPlus’s real estate properties, valuation by a third party investment banking firm of AmREIT’s three classes of common stock, entry into a definitive merger agreement, approval of shareholders of both REITs and other customary closing conditions. We believe these steps would better position us to raise Wall Street and/or institutional capital either through joint ventures at the entity level or through an initial public offering and re-listing of our shares.

| |

2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

Our financial records are maintained on the accrual basis of accounting whereby revenues are recognized when earned and expenses are recorded when incurred. The consolidated financial statements include our accounts as well as the accounts of any wholly- or majority-owned subsidiaries in which we have a controlling financial interest (see Note 3). Investments in joint ventures and partnerships where we have the ability to exercise significant influence but do not exercise financial and operating control are accounted for using the equity method. As applicable, we consolidate certain joint ventures and partnerships in which we own less than a 100% equity interest if the entity is a variable interest entity and we are the primary beneficiary (as defined in Financial Accounting Standard Board (“FASB”) Interpretation No. (“FIN”) 46(R):Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51, as revised (“FIN 46(R)”)). Following consideration under FIN 46(R), if required, we also evaluate applicable partially-owned entities under Emerging Issues Task Force (“EITF”) Issue No. 04-5,Determining Whether a General Partner, or the General Partners as a Group, Controls a Limited Partnership or Similar Entity when the Limited Partners Have Certain Rights, for consolidation considerations. All significant intercompany accounts and transactions have been eliminated in consolidation.

B-8

We operate in an umbrella partnership REIT structure in which REITPlus OP, our operating partnership, or wholly-owned subsidiaries of our operating partnership, owns substantially all of the properties acquired on our behalf. REITPlus, Inc. is the sole general partner of REITPlus OP and, as of December 31, 2008, owns an 83.53% general partnership interest therein. AmREIT, the parent of our Advisor, is a limited partner and, as of December 31, 2008, owns a 16.45% limited partnership interest in REITPlus OP. Additionally, REITPlus Holdings, LLC, an affiliate of AmREIT, which is partially owned by AmREIT and by AmREIT management, owns a 0.02% special limited partnership interest in REITPlus OP. As of December 31, 2008, AmREIT and REITPlus Holdings, LLC hold a 16.47% minority interest in REITPlus OP that we consolidate as a result of our controlling 83.53% financial interest in the partnership. Management expects our ownership percentage in REITPlus OP to increase significantly as we invest net proceeds from the Offering in REITPlus OP. Because REITPlus, Inc. is the sole general partner of REITPlus OP and has unilateral control over its management and major operating decisions (even if additional limited partners are admitted to our operating partnership), the accounts of our operating partnership are consolidated in our consolidated financial statements.

We were initially capitalized on May 16, 2007. Accordingly, the accompanying consolidated statements of operations, cash flows, and changes in partners’ capital related to 2007 represent activity for the period from May 16, 2007 (date of initial capitalization) through December 31, 2007. Unless otherwise noted, all references to the “2007 period” or “the period ended December 31, 2007” refer to the short period of operations from May 16, 2007 through December 31, 2007.

Investments in Non-consolidated Entities

As of December 31, 2008, we have an ownership interest in one property through a joint venture. Although we exercise significant influence over the activities of the property, we do not have a controlling financial interest in it. Accordingly, our joint venture interest in the property is reported under the equity method of accounting pursuant to U.S. generally accepted accounting principles. Certain of the significant accounting policies below are applicable specifically to property-level reporting and represent policies that are therefore primarily relevant at the investee entity level as of December 31, 2008.

The joint venture in which we invest accounts for real estate acquisitions pursuant to SFAS No. 141,Business Combinations (SFAS No. 141). Accordingly, it allocates the purchase price of the acquired properties to tangible and intangible assets as well as liabilities acquired. The joint venture computes depreciation using the straight-line method over an estimated life of up to 39 years for buildings, up to 16 years for site improvements and over the term of the lease for tenant improvements. The intangible assets are being amortized over the remaining term of their respective leases.

The joint venture reviews its properties for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets, including accrued rental income, may not be recoverable through operations. It determines whether an impairment in value occurred by comparing the estimated future cash flows (undiscounted and without interest charges), including the residual value of the property, with the carrying value of the individual property. If impairment is indicated, a loss will be recorded for the amount by which the carrying value of the asset exceeds its fair value. Both the estimated undiscounted cash flow analysis and fair value determination are based upon various factors which require complex and subjective judgments to be made by management. Such assumptions include projecting lease-up periods, holding periods, cap rates, rental rates, operating expenses, lease terms, tenant creditworthiness, tenant improvement allowances, terminal sales value and certain macroeconomic factors among other assumptions to be made for each property, The joint venture has not incurred any impairment losses since its inception.

The joint venture leases space to tenants under agreements with varying terms. All of the leases are accounted for as operating leases and although certain leases of the properties provide for tenant occupancy during periods for which no rent is due and/or increases or decreases in the minimum lease payments over the terms of the leases, revenue is recognized on a straight-line basis over the terms of the individual leases. In most cases, revenue recognition under a lease begins when the lessee takes possession of or controls the physical use of the leased asset. Generally, this occurs on the lease commencement date. When our joint ventures acquire a property, the terms of existing leases are considered to commence as of the acquisition date for the purposes of this calculation.

In all cases, we have determined that the joint venture is the owner of any tenant improvements that it funds pursuant to the lease terms. In cases where tenant improvements are made prior to lease commencement, the leased asset is considered to be the finished space, and revenue recognition therefore begins when the improvements are substantially complete. Accrued rents are included in tenant receivables. Revenue from tenant reimbursements of taxes, maintenance expenses and insurance is recognized in the period the related expense is recorded. Additionally, certain of the lease agreements contain provisions that grant additional rents based on tenants’ sales volumes (contingent or percentage rent). Percentage rents are recognized when the tenants achieve the specified targets as defined in their lease agreements. Lease termination income is recorded if there is a signed termination letter agreement, all of the conditions of the agreement have been met and collectability is certain. Upon early lease termination the joint venture provides for losses related to unrecovered intangibles and other assets. Cost recoveries from tenants are included in rental income in the period the related costs are incurred.

Environmental Exposures

Our joint venture is subject to numerous environmental laws and regulations as they apply to real estate pertaining to chemicals used by the dry cleaning industry, the existence of asbestos in older shopping centers, and underground petroleum storage tanks. We believe that the tenants who currently operate dry cleaning plants or gas stations do so in accordance with current laws and regulations. We believe that the ultimate disposition of any known environmental matters will not have a material effect on our joint venture’s financial position, liquidity, or operations. However, we can give no assurance that existing environmental studies with respect to the shopping centers have revealed all potential environmental liabilities; that any previous owner, occupant or tenant did not create any material environmental condition not known to it; that the current environmental condition of the shopping centers will not be affected by tenants and occupants, by the condition of nearby properties, or by unrelated third parties; or that changes in applicable environmental laws and regulations or their interpretation will not result in additional environmental liability to the Company.

B-9

Income Taxes

We elected to be taxed as a REIT, under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code, effective January 1, 2008. To qualify as a REIT, we must meet certain organizational and operational requirements, including a requirement to currently distribute at least 90% of our ordinary taxable income to stockholders. As a REIT, we generally are not subject to federal income tax on taxable income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will then be subject to federal income taxes on our taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost unless the Internal Revenue Service grants us relief under certain statutory provisions. Such an event could materially adversely affect our net income and net cash available for distribution to stockholders.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

New Accounting Standards

In September 2006, the Financial Accounting Standards Board (the “FASB”) issued SFAS No. 157,Fair Value Measurements(“SFAS No. 157”). SFAS No. 157 defines fair value, establishes a framework for measuring fair value and requires enhanced disclosures about fair value measurements. SFAS No. 157 requires companies to disclose the fair value of their financial instruments according to a fair value hierarchy. Additionally, companies are required to provide certain disclosures regarding instruments within the hierarchy, including a reconciliation of the beginning and ending balances for each major category of assets and liabilities. This statement is effective for our fiscal year beginning January 1, 2008, except for non-financial assets and liabilities that are not recognized or disclosed at fair value on a recurring basis, for which the effective date is our fiscal year beginning January 1, 2009. We adopted the provisions of SFAS No. 157 for financial assets and liabilities as of January 1, 2008 and there was no material effect on our results of operations, cash flows, or financial condition. Management is currently evaluating the impact SFAS No. 157 will have on our consolidated financial position and results of operations when it is applied to non-financial assets and liabilities.

In February 2007, the FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities(“SFAS No. 159”). SFAS No. 159 expands opportunities to use fair value measurement in financial reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. We currently do not measure any eligible financial assets and liabilities at fair value under the provisions of SFAS No. 159.

In December 2007, the FASB revised SFAS No. 141 (Revised 2007),Business Combinations (“SFAS No. 141R”). SFAS No. 141R will change the accounting for business combinations. Under SFAS No. 141R, an acquiring entity will be required to recognize all the assets acquired and liabilities assumed in a transaction at the acquisition-date fair value with limited exceptions. SFAS No. 141R applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. We currently capitalize acquisition costs as part of the basis of the asset acquired. Upon effectiveness of SFAS No. 141R, we will expense acquisition costs as incurred.

In December 2007, the FASB issued SFAS No. 160,Noncontrolling Interests in Consolidated Financial Statements—an amendment of ARB No. 51 (“SFAS No. 160”). SFAS No. 160 establishes accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. SFAS No. 160 requires retroactive adoption of the presentation and disclosure requirements for existing minority interests. All other requirements of SFAS No. 160 shall be applied prospectively. The impact of our adoption of SFAS No. 160 was to increase our stockholders’ equity, by approximately $1.0 million for both 2008 and 2007 as a result of transferring the minority interest in our consolidated subsidiaries from the mezzanine section of our balance sheet into equity.

In March 2008, the FASB issued SFAS No. 161,Disclosures about Derivative Instruments and HedgingActivities – an amendment of FASB Statement No. 133 (“SFAS No. 161”). This statement amends SFAS No. 133 to provide additional information about how derivative and hedging activities affect an entity’s financial position, financial performance and cash flows. The statement requires enhanced disclosures about an entity’s derivatives and hedging activities. SFAS No. 161 will be effective for financial statements issued for years beginning on or after November 15, 2008. The adoption of SFAS No. 161 is not expected to have a material effect on our results of operations or financial position.

B-10

Offering Costs

Our Advisor incurred $1.9 million of organization and offering costs on our behalf. As of December 31, 2008, we had reimbursed our Advisor for approximately $62,456 and $29,543 of organization and offering costs, respectively. Upon our closing of the Offering in October 2008, our Advisor wrote off the remaining unreimbursed costs. The organization costs that we paid were expensed in the accompanying consolidated statement of operations and are included in legal and professional fees. The offering costs that we paid, which include items such as legal and accounting fees, marketing, and promotional printing costs will be treated as a reduction of stockholders’ equity along with sales commissions and dealer manager fees of 6.75% and 3.25%, respectively (See Note 5).

Cash and Cash Equivalents

We consider all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents. Cash and cash equivalents consist of demand deposits at commercial banks and money market funds.

| |

3. | INVESTMENTS IN NON-CONSOLIDATED ENTITIES |

In May 2008, we acquired a 5.0% interest in AmREIT Shadow Creek Acquisition, LLC (“Shadow Creek”), which owns a multi-tenant retail property located in Pearland, Texas with a combined gross leasable area of 593,163 square feet. In June 2008, we acquired an additional 2.6% interest in Shadow Creek. In July 2008 and August 2008, we acquired an additional 2.0% and 0.4% interest, respectively, in Shadow Creek from AmREIT Realty Investment Company. The ownership interests were acquired at net book value from affiliates for a total of $5.3 million from AmREIT Realty Investment Company, an affiliated AmREIT entity. The remaining interest is owned by an unaffiliated third party (80%) and by AmREIT Monthly Income & Growth Fund IV, L.P. (10%), an affiliated AmREIT entity.

We report our investment in this joint venture using the equity method of accounting due to our ability to exercise significant influence over it. Combined condensed financial information for Shadow Creek (at 100%) is summarized as follows:

| | | | |

Combined Balance Sheet | | As of

December 31,

2008 | |

| | (In thousands) | |

Assets | | | | |

Property, net | | $ | 99,965 | |

Cash | | | 191 | |

Other assets | | | 23,493 | |

Total Assets | | $ | 123,649 | |

Liabilities and partners’ capital: | | | | |

Notes payable (1) | | | 65,000 | |

Other liabilities | | | 10,481 | |

Partners capital | | | 48,168 | |

Total Liabilities and Partners’ Capital | | $ | 123,649 | |

| | | | |

REITPlus share of net assets | | $ | 5,074 | |

| |

| (1) We serve as guarantor on debt in the amount of $20.0 million that is the primary obligation of this joint venture. |

B-11

| | | | |

Combined Statement of Operations | | Year Ended

December 31,

2008 | |

| | (In thousands) | |

| | | | |

Revenue | | | | |

Total Revenue | | $ | 5,339 | |

Expense | | | | |

Interest | | | 3,015 | |

Depreciation and amortization | | | 2,589 | |

Other | | | 2,238 | |

Total expense | | | 7,842 | |

Net loss | | $ | (2,503 | ) |

| | | | |

REITPlus share of net loss | | $ | (180 | ) |

| |

4. | STOCKHOLDERS’ EQUITY AND MINORITY INTEREST |

Common Stock

Our charter authorizes us to issue 1,050,000,000 shares of capital stock, of which 1,000,000,000 shares of capital stock are designated as common stock with a par value of $0.01 per share and 50,000,000 shares of capital stock are designated as preferred stock with a par value of $0.01 per share. In 2008 we offered a maximum of 50,000,000 shares of our REITPlus Common Stock in our primary offering for $10.00 per share and 5,263,158 shares of our REITPlus Common Stock pursuant to our distribution reinvestment plan at $9.50 per share. We reached the minimum offering of $2.0 million on April 22, 2008, and had received $7.5 million for the sale of 752,307 shares of REITPlus Common Stock as of the close of the Offering on October 4, 2008.

Share Redemption Program

Our board of directors has approved a share redemption program. Subject to certain restrictions and limitations, the share redemption program allows stockholders who have held their shares for a minimum of one year to redeem their shares at a price equal to or at a discount to the purchase price they paid for the shares being redeemed. The discount will vary based upon the length of time the stockholder held the shares subject to redemption. We are not obligated to redeem shares of our common stock under the share redemption plan, and share redemptions will be made at the sole discretion of the board of directors.

Incentive Plan

On October 18, 2007, our board of directors adopted the REITPlus, Inc. 2007 Incentive Plan, or the incentive stock plan. Under the terms of the incentive stock plan, the aggregate number of shares of our common stock subject to options, restricted stock awards, stock purchase rights, stock appreciation rights or other awards will be no more than 2,000,000 shares. On October 18, 2007, our board of directors approved the award of 2,000 restricted shares of our common stock to each of our independent directors pursuant to an award agreement and the REITPlus, Inc. 2007 Independent Directors Compensation Plan, or the Incentive Plan. On January 22, 2008, our board of directors and each independent director, in his individual capacity, approved the cancellation of the award grants to each independent director of 2,000 restricted shares of our common stock. These shares were not recorded in the accompanying consolidated financial statements as they were deemed to be of immaterial value at the date of issuance.

| |

5. | RELATED PARTY TRANSACTIONS |

Our Advisor funded all of the organization and offering costs on our behalf. As of December 31, 2008, we had reimbursed our Advisor for approximately $62,456 and $29,543 of organization and offering costs, respectively. Organization costs were expensed in the accompanying consolidated statement of operations and are included in legal and professional fees. The offering costs, which include items such as legal and accounting fees, marketing, and promotional printing costs will be treated as a reduction of stockholders’ equity along with sales commissions and dealer manager fees of 6.75% and 3.25%, respectively.

B-12

As of December 31, 2008, we have recorded $49,671 in Accounts Payable – Related Party, which consists of administrative cost reimbursements associated with our Advisor providing financial reporting services to us, as well as pursuit costs incurred in connection with potential acquisitions that ultimately were not consummated.

Certain of our affiliates received fees and compensation during the organizational stage of the entity, including securities commissions and due diligence reimbursements, marketing reimbursements and reimbursement of organizational and offering expenses. In the event that these companies are unable to provide us with the respective services, we would be required to find alternative providers of these services. The following table summarizes the amount of such compensation incurred by us related to services provided by our affiliates during the year ended December 31, 2008 and for the period from May 16, 2007 (inception) through December 31, 2007:

| | | | | | | | | |

Type of Service | | Service Description & Compensation | | 2008 | | 2007 | |

Selling Commissions and Dealer Manager Fees (1) | | Selling commissions (6.75%) and dealer manager fees (3.25%) received for the sale of shares in the primary offering. | | $ | 752,576 | | $ | — | |

| | | | | | | | | |

Organizational and Offering Cost Reimbursements | | Reimbursement of our organizational and offering costs, including legal and accounting fees, printing costs, filing fees and distribution costs. | | | 91,999 | | | — | |

Total | | | | $ | 844,575 | | $ | — | |

| |

| (1) $508,000 of the securities commissions paid by us to AmREIT Securities Company, an affiliated AmREIT entity, was paid to third-party broker dealers. |

We have no employees or offices. Additionally, certain of our affiliates receive fees and compensation during the operating stage, including compensation for providing services to us in the areas of asset management, development and acquisitions, property management and leasing, financing, brokerage and administration. We reimburse our Advisor for an allocation of salary and other overhead costs. The following table summarizes the amount of such compensation paid to our affiliates during the years ended December 31, 2008 and for the period from May 16, 2007 (inception) through December 31, 2007:

| | | | | | | | | |

Type of Service | | Service Description & Compensation | | 2008 | | 2007 | |

Asset Management | | A fee equal to 1.0% of the aggregate cost of all of our real property in connection with the active oversight and investment management of our real estate portfolio. | | $ | — | | $ | — | |

Acquisition | | A fee not to exceed, for any single acquisition, 2.25% of the contract purchase price. | | | 223,750 | | | — | |

Development and Redevelopment | | Development and redevelopment fees on properties we acquire an interest in and for which we intend to develop, redevelop or substantially renovate. These fees will be based on the total project costs, including the cost of acquiring the property, and will be paid as project costs are incurred. | | | — | | | — | |

Property Management and Leasing | | Property management fees not to exceed 4% of the gross revenue of each real property owned by us. Leasing fees not to exceed the fee customarily charged in arm’s-length transactions by others rendering similar services in the same geographic area for similar properties, as determined by a survey of brokers and agents in such area. | | | — | | | — | |

Financing Coordination Fees | | For services in connection with the origination or refinancing of any debt financing obtained that we use to acquire properties, we will pay our Advisor a fee not to exceed 1% of the amount available under such financing. | | | 40,500 | | | — | |

Real Estate Sales Commissions | | A fee not to exceed 50% of the reasonable, customary, and competitive commission paid for the sale of a comparable real property, provided that such commission shall not exceed 3% of the contract price of the property sold and, when added to all other real estate commissions paid to unaffiliated parties in connection with the sale, may not exceed the lesser of a competitive real estate commission or 6% of the sales price of the property. | | | — | | | — | |

Reimbursement of Operating Expenses | | We reimburse the actual expenses incurred by our Advisor for performing acquisition, development, management and administrative functions for us, including construction and construction management fees for development and redevelopment projects. | | | 105,829 | | | — | |

Total | | | | $ | 370,079 | | $ | — | |

In addition to the above fees paid by us, Shadow Creek paid a total of $1.3 million in property management and leasing fees to one of our affiliated entities for the year ended December 31, 2008. See also Note 3 regarding investments in non-consolidated entities.

B-13

| |

6. | COMMITMENTS AND CONTINGENCIES |

Litigation - In the ordinary course of business, we may become subject to litigation or claims. There are no material pending legal proceedings known to be contemplated against us.

Environmental matters - - In connection with the ownership and operation of real estate, we may be potentially liable for costs and damages related to environmental matters. We have not been notified by any governmental authority of any non-compliance, liability or other claim.

B-14

Report of Independent Registered Public Accounting Firm The Members of Shadow Creek Holding Company LLC and Subsidiaries:

We have audited the accompanying consolidated balance sheet of Shadow Creek Holding Company LLC and subsidiaries (collectively, the “Company”) as of December 31, 2008, and the related consolidated statement of operations, members’ equity and cash flows for the period from February 25, 2008 (inception) through December 31, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Shadow Creek Holding Company LLC and subsidiaries as of December 31, 2008, and the results of their operations and their cash flows for the period from February 25, 2008 (inception) through December 31, 2008, in conformity with U.S. generally accepted accounting principles.

KPMG LLP

Houston, Texas

April 30, 2009

B-15

Shadow Creek Holding Company LLC and Subsidiaries

CONSOLIDATED BALANCE SHEET

December 31, 2008

(in thousands)

| | | | |

| | December 31,

2008 | |

| | | | |

ASSETS | | | | |

Real estate investments at cost: | | | | |

Land | | $ | 23,991 | |

Buildings | | | 75,770 | |

Tenant improvements | | | 1,730 | |

| | | 101,491 | |

Less accumulated depreciation and amortization | | | (1,526 | ) |

| | | 99,965 | |

| | | | |

Acquired lease intangibles, net | | | 13,552 | |

Net real estate investments | | | 113,517 | |

| | | | |

Cash and cash equivalents | | | 191 | |

Tenant receivables, net | | | 1,717 | |

Accounts receivable - related party | | | 11 | |

Deferred costs, net | | | 1,368 | |

Other assets | | | 6,845 | |

TOTAL ASSETS | | $ | 123,649 | |

| | | | |

LIABILITIES AND MEMBERS’ EQUITY | | | | |

Liabilities: | | | | |

Note payable | | $ | 65,000 | |

Accounts payable and accrued liabilities | | | 2,166 | |

Advances - related party | | | 611 | |

Below market leases, net | | | 7,614 | |

Security deposits | | | 90 | |

TOTAL LIABILITIES | | | 75,481 | |

| | | | |

Members’ equity | | | 48,168 | |

TOTAL MEMBERS’ EQUITY | | | 48,168 | |

TOTAL LIABILITIES AND MEMBERS’ EQUITY | | $ | 123,649 | |

| | | | |

See Notes to Consolidated Financial Statements. | | | | |

B-16

Shadow Creek Holding Company LLC and Subsidiaries

CONSOLIDATED STATEMENT OF OPERATIONS

For the period from February 25, 2008 through December 31, 2008

(in thousands)

| | | | |

| | 2008 | |

| | | | |

Revenues: | | | | |

Rental income from operating leases | | $ | 5,296 | |

Total revenues | | | 5,296 | |

Expenses: | | | | |

General and administrative | | | 60 | |

Property expense | | | 1,936 | |

Property management fees - related party | | | 117 | |

Legal and professional | | | 82 | |

Depreciation and amortization | | | 2,589 | |

Total expenses | | | 4,784 | |

| | | | |

Operating income | | | 512 | |

| | | | |

Other income (expense): | | | | |

Interest and other income | | | 43 | |

Interest expense | | | (3,015 | ) |

State tax expense | | | (43 | ) |

Total other income (expense) | | | (3,015 | ) |

| | | | |

Net loss | | $ | (2,503 | ) |

| | | | |

See Notes to Consolidated Financial Statements. | | | | |

B-17

Shadow Creek Holding Company LLC and Subsidiaries

CONSOLIDATED STATEMENT OF MEMBERS’ EQUITY

For the period from February 25, 2008 (inception) through December 31, 2008

(in thousands)

| | | | |

| | Members’ Equity | |

| | | | |

Balance at February 25, 2008 (inception) | | $ | — | |

| | | | |

Contributions | | | 50,671 | |

Net loss | | | (2,503 | ) |

| | | | |

Balance at December 31, 2008 | | $ | 48,168 | |

See Notes to Consolidated Financial Statements.

B-18

Shadow Creek Holding Company LLC and Subsidiaries

CONSOLIDATED STATEMENT OF CASH FLOWS

For the period from February 25, 2008 (inception) through December 31, 2008

(in thousands)

| | | | |

| | 2008 | |

| | | | |

Cash flows from operating activities: | | | | |

Net loss | | $ | (2,503 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

Depreciation and amortization | | | 2,589 | |

Amortization of above/below market rent | | | (220 | ) |

Amortization of financing cost | | | 37 | |

Interest deposited on escrow | | | — | |

Increase in tenant receivables | | | (1,717 | ) |

Increase in accounts receivable - related party | | | (11 | ) |

Increase in deferred costs | | | (1,132 | ) |

Increase in other assets | | | (138 | ) |

Increase in accounts payable and accrued liabilities | | | 2,166 | |

Increase in advances - related party | | | 611 | |

Increase in security deposits | | | 90 | |

Net cash used in operating activities | | | (228 | ) |

| | | | |

Cash flows from investing activities: | | | | |

Improvements to real estate | | | (2,254 | ) |

Master lease payments received | | | 652 | |

Acquisition of investment properties | | | (50,855 | ) |

Net cash used in investing activities | | | (52,457 | ) |

| | | | |

Cash flows from financing activities: | | | | |

Funds received from escrow, net of interest earned | | | 2,518 | |

Contributions | | | 50,671 | |

Loan acquisition costs | | | (313 | ) |

Net cash provided by financing activities | | | 52,876 | |

| | | | |

Net increase in cash and cash equivalents | | | 191 | |

Cash and cash equivalents, beginning of period | | | — | |

Cash and cash equivalents, end of period | | $ | 191 | |

| | | | |

Supplemental schedule of cash flow information: | | | | |

| | | | |

Cash paid during the year for interest | | $ | 2,681 | |

| | | | |

Supplemental schedule of cash flow information: | | | | |

In conjunction with our acquisition of the Property in February 2008, we executed a $65 million loan, of which approximately $56 million was funded directly to the seller and approximately $9 million was retained in escrow by the lender and recorded in our accompanying consolidated balance sheet. |

See Notes to Consolidated Financial Statements.

B-19

Shadow Creek Holding Company LLC and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2008

| |

1. | DESCRIPTION OF BUSINESS |

Shadow Creek Holding Company LLC, a limited liability corporation and subsidiaries (collectively, the Company) was formed on February 25, 2008 to acquire Shadow Creek Ranch (the Property) a multi-tenant retail property with multiple buildings located in Pearland, Texas with a combined gross leasable area of 565,812 square feet. The members of the Company are Shadow Creek Ranch Town Center Acquisition LLC and AmREIT Shadow Creek Acquisitions, LLC which own 80% and 20% interests, respectively. All contributions and distributions have been, and will continue to be, split according to each member’s ownership percentage. AmREIT Shadow Creek Acquisitions, LLC, the Company’s Managing Member, maintains its principal place of business in Houston, Texas.

We have contracted with AmREIT Realty Investment Corporation (ARIC), an affiliate of the Company’s Managing Member, to provide property management and leasing services. ARIC is a wholly-owned subsidiary of AmREIT, a Texas real estate investment trust.

| |

2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| |

| BASIS OF PRESENTATION |

Our financial records are maintained on the accrual basis of accounting whereby revenues are recognized when earned and expenses are recorded when incurred. The consolidated financials statements include our accounts as well as the accounts of four wholly owned subsidiaries. All significant inter-company accounts and transactions have been eliminated in consolidation.

We were formed on February 25, 2008. Accordingly, the accompanying consolidated statements of operations, changes in members’ equity and cash flows related to 2008 represent activity for the period from February 25, 2008 (inception) through December 31, 2008. Unless otherwise noted, all references to the “2008 period” or “the period ended December 31, 2008” refer to the period of operations from February 25, 2008 through December 31, 2008.

REVENUE RECOGNITION

We lease space to tenants under agreements with varying terms. All of the leases are accounted for as operating leases and although certain leases of the property provide for tenant occupancy during periods for which no rent is due and/or increases or decreases in the minimum lease payments over the terms of the leases, revenue is recognized on a straight-line basis over the terms of the individual leases. In most cases, revenue recognition under a lease begins when the lessee takes possession of or controls the physical use of the leased asset. Generally, this occurs on the lease commencement date. In all cases, we have determined that we are the owner of any tenant improvements that we fund pursuant to the lease terms. In cases where tenant improvements are made prior to lease commencement, the leased asset is considered to be finished space, and revenue recognition therefore begins when the improvements are substantially complete. Accrued rents are included in tenant receivables. Revenue from tenant reimbursements of taxes, maintenance expenses and insurance is recognized in the period the related expense is recorded. Additionally, certain of the lease agreements contain provisions that grant additional rents based on tenants’ sales volumes (contingent or percentage rent). Percentage rents are recognized when the tenants achieve the specified targets as defined in their lease agreements. During the period ended December 31, 2008, we did not recognize any percentage rent. We record lease termination income if there is a signed termination letter agreement, all of the conditions of the agreement have been met and collectability is certain. Upon early lease termination we provide for losses related to unrecovered intangibles and other assets. No lease termination fees were recognized during the 2008 period.

REAL ESTATE INVESTMENTS

Acquired Properties and Acquired Lease Intangibles - We account for real estate acquisitions pursuant to Statement of Financial Accounting Standards No. 141,Business Combinations(“SFAS No. 141”). Accordingly, we allocate the purchase price of the acquired properties to land, building and improvements, identifiable intangible assets and acquired liabilities based on their respective fair values. Identifiable intangibles include amounts allocated to acquired above and below market leases, the value of in-place leases and customer relationship value, if any. We determine fair value based on estimated cash flow projections that utilize appropriate discount and capitalization rates and available market information. Estimates of future cash flows are based on a number of factors including the historical operating results, known trends and specific market and economic conditions that may affect the property. Factors considered by management in our analysis of determining the as-if-vacant property value include an estimate of carrying costs during the expected lease-up periods considering market conditions and costs to execute similar leases. In estimating carrying costs, management includes real estate taxes, insurance and estimates of lost rentals at market rates during the expected lease-up periods, tenant demand and other economic conditions. Management also estimates costs to execute similar leases including leasing commissions, tenant improvements, legal and other related expenses. Intangibles related to above, below and in-place lease value are recorded as acquired lease intangibles and are amortized as an adjustment to rental revenue or amortization expense, as appropriate, over the remaining terms of the underlying leases. Below market leases include any fixed-rate renewal periods. Premiums or discounts on acquired out-of-market debt are amortized to interest expense over the remaining term of such debt.

B-20

In conjunction with the acquisition of the property, we receive payments under a master lease agreement pertaining to certain non-revenue producing spaces at the time of our purchase of the property. These master leases were established at the time of purchase in order to mitigate the potential negative effects of loss of rent and of expense reimbursements. Master lease payments are received through a draw of funds escrowed at the time of purchase. These funds may be released to either us or the seller when certain leasing conditions are met. Upon our receipt of the payments, the receipts are recorded as a reduction in the purchase price of the property rather than as rental income. As of December 31, 2008, the Company has received payments of $652,000, and $359,000 remains in escrow to be released to either us or the seller when certain leasing conditions are met. The seller funded the escrow, and therefore it is not recorded in our financial statements.

Depreciation - -Depreciation is computed using the straight-line method over an estimated useful life of up to 39 years for buildings, 16 years for site improvements and over the term of lease for tenant improvements. We commence depreciation when a building is substantially complete, including completion of tenant improvements, but no later than one year from the completion of major construction activities. A building is considered substantially complete when tenant improvements have been completed for 90% of the leasable space of the building.

Impairment - -We review the property for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets, including accrued rental income, may not be recoverable through operations. We determine whether an impairment in value occurred by comparing the estimated future cash flows (undiscounted and without interest charges), including the residual value of the property, with the carrying value of the individual property. If impairment is indicated, a loss will be recorded for the amount by which the carrying value of the asset exceeds its fair value. Both the estimated undiscounted cash flow analysis and fair value determination are based upon various factors which require complex and subjective judgments to be made by management. Such assumptions include projecting lease-up periods, holding periods, cap rates, rental rates, operating expenses, lease terms, tenant creditworthiness, tenant improvement allowances, terminal sales value and certain macroeconomic factors among other assumptions to be made for each property. We have not incurred any impairment losses since our inception.

ENVIRONMENTAL EXPOSURES

We are subject to numerous environmental laws and regulations as they apply to real estate pertaining to chemicals used by the dry cleaning industry and underground petroleum storage tanks. We believe that the tenants who currently operate dry cleaning plants or gas stations do so in accordance with current laws and regulations. We can give no assurance that existing environmental studies with respect to the shopping center have revealed all potential environmental liabilities; that any previous owner, occupant or tenant did not create any material environmental condition not known to it; that the current environmental condition of the shopping center will not be affected by tenants and occupants, by the condition of nearby properties, or by unrelated third parties; or that changes in applicable environmental laws and regulations or their interpretation will not result in additional environmental liability to the Company.

RECEIVABLES AND ALLOWANCE FOR UNCOLLECTIBLE ACCOUNTS

Tenant Receivables -Included in tenant receivables are base rents, tenant reimbursements and receivables attributable to recording rents on a straight-line basis. An allowance for the uncollectible portion of accrued rents and accounts receivable is determined based upon customer credit-worthiness (including expected recovery of our claim with respect to any tenants in bankruptcy), historical bad debt levels, and current economic trends. Bad debt expenses and any related recoveries related to tenant receivables are included in property expense. As of December 31, 2008, we had recorded no allowance for uncollectible accounts related to our tenant receivables.

DEFERRED COSTS

Deferred costs include deferred leasing costs and loan acquisition costs, net of amortization. Loan acquisition costs are incurred in obtaining financing and are amortized to interest expense over the term of the debt agreements. Deferred leasing costs consist of external commissions associated with leasing our properties and are amortized to depreciation and amortization expense over the lease term. Accumulated amortization related to loan acquisition costs as of December 31, 2008 totaled $37,000. Accumulated amortization related to leasing costs as of December 31, 2008 totaled $39,000.

B-21

OTHER ASSETS

Other assets include funds that were withheld from our loan proceeds by our lender. These monies will be released to us in order to fund payment of tenant improvements and leasing commissions related to certain of the Property’s identified tenants. Any amounts not released to us to fund these expenditures will be used to pay down the loan. At December 31, 2008, the amount held in escrow was approximately $6.8 million.

INCOME TAXES

Federal - No provision for U.S. federal income taxes is included in the accompanying consolidated financial statements. As a limited liability corporation, we are not subject to federal income tax, and the federal tax effect of our activities is passed through to our members.

State - In May 2006, the State of Texas adopted House Bill 3, which modified the state’s franchise tax structure, replacing the previous tax based on capital or earned surplus with one based on margin (often referred to as the “Texas Margin Tax”) effective with franchise tax reports filed on or after January 1, 2007. The Texas Margin Tax is computed by applying the applicable tax rate (1% for the Company) to the profit margin. As of December 31, 2008 we had accrued state taxes related to the Texas Margin Tax of approximately $43,000.

USE OF ESTIMATES

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

FAIR VALUE OF FINANCIAL INSTRUMENTS

Our financial instruments consist primarily of cash and cash equivalents, tenant receivables, accounts receivable-related parties, note payable, accounts payable and accrued liabilities, and accounts payable-related party. The carrying value of cash, cash equivalents, tenant receivables, accounts receivable-related parties, accounts payable and accrued liabilities, and accounts payable-related party are representative of their respective fair values due to the short-term nature of these instruments. As of December 31, 2008, the carrying value of our total debt obligations was $65.0 million; all of which represents fixed-rate obligations with an estimated fair value of $65.4 million, based on a discounted cash flow analysis using current market rates of interest.

SFAS No. 157,Fair Value Measurements (“SFAS No. 157”) defines a hierarchy of inputs to valuation techniques based upon whether those inputs reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). The following summarizes the fair value hierarchy defined within SFAS 157:

| | |

| • | Level 1 Inputs – Quoted market prices (unadjusted) for identical assets and liabilities in an active market that the Company has the ability to access at the measurement date. |

| | |

| • | Level 2 Inputs – Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly. |

| | |

| • | Level 3 Inputs – Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements. |

SFAS No. 157 requires the use of observable market data, when available, in making fair value measurements. Observable inputs are inputs that the market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of ours. Unobservable inputs are inputs that reflect our assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement.

In determining the value of our debt instruments, we determine the appropriate Treasury Bill Rate based on the remaining time to maturity for each of the debt instruments. We then add the appropriate yield spread to the Treasury Bill Rate. The yield spread is a risk premium estimated by investors to account for credit risk involved in debt financing. The spread is typically estimated based on the property type and loan-to-value ratio of the debt instrument. The result is an estimate of the market interest rate a typical investor would expect to receive given the underlying subject asset (property type) and remaining time to maturity.

B-22

The following table presents our assets and liabilities and related valuation inputs within the fair value hierarchy utilized to measure fair value as of December 31, 2008 (in thousands):

| | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 | |

Notes Payable | | | $ — | | | $ — | | | $ 65,372 | |

NEWACCOUNTING STANDARDS

In September 2006, the Financial Accounting Standards Board (the “FASB”) issued SFAS No. 157. SFAS No. 157 defines fair value, establishes a framework for measuring fair value and requires enhanced disclosures about fair value measurements. SFAS No. 157 requires companies to disclose the fair value of their financial instruments according to a fair value hierarchy. Additionally, companies are required to provide certain disclosures regarding instruments within the hierarchy, including a reconciliation of the beginning and ending balances for each major category of assets and liabilities. This statement is effective for our fiscal year beginning January 1, 2008, except for non-financial assets and liabilities that are not recognized or disclosed at fair value on a recurring basis, for which the effective date is our fiscal year beginning January 1, 2009. We adopted the provisions of SFAS No. 157 for financial assets and liabilities as of January 1, 2008 and there was no material effect on our results of operations, cash flows, or financial condition. Management is currently evaluating the impact SFAS No. 157 will have on our consolidated financial position and results of operations when it is applied to non-financial assets and liabilities.

In February 2007, the FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities (“SFAS No. 159”). SFAS No. 159 expands opportunities to use fair value measurement in financial reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. We have elected not to measure any existing eligible financial assets and liabilities at fair value under the provisions of SFAS No. 159.

In December 2007, the FASB revised SFAS No. 141 (Revised 2007),Business Combinations (“SFAS No. 141R”). SFAS No. 141R will change the accounting for business combinations. Under SFAS No. 141R, an acquiring entity will be required to recognize all the assets acquired and liabilities assumed in a transaction at the acquisition-date fair value with limited exceptions. SFAS No. 141R applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. We currently capitalize acquisition costs as part of the basis of the asset acquired. Upon effectiveness of SFAS No. 141R, we will expense acquisition costs as incurred.

In December 2007, the FASB issued SFAS No. 160,Noncontrolling Interests in Consolidated Financial Statements—an amendment of ARB No. 51 (“SFAS No. 160”). SFAS No. 160 establishes accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a non-controlling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. SFAS No. 160 requires retroactive adoption of the presentation and disclosure requirements for existing minority interests. All other requirements of SFAS No. 160 shall be applied prospectively. We do not believe the adoption of SFAS No. 160 will have an impact on our consolidated financial statements as we have no minority interests.

In March 2008, the FASB issued SFAS No. 161,Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement No. 133 (“SFAS No. 161”). This statement amends SFAS No. 133 to provide additional information about how derivative and hedging activities affect an entity’s financial position, financial performance and cash flows. The statement requires enhanced disclosures about an entity’s derivatives and hedging activities. SFAS No. 161 will be effective for financial statements issued for years beginning on or after November 15, 2008. We do not expect that the application of this statement will have an effect on our consolidated financial statements.

CASH AND CASH EQUIVALENTS

We consider all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents. Cash and cash equivalents consist of demand deposits at commercial banks.

INTEREST

Interest is charged to interest expense as it accrues. No interest has been capitalized since inception of the Company.

B-23

Our operating leases generally range from one month to twelve years and generally include one or more five year renewal options. A summary of minimum future base rentals to be received, exclusive of any renewals, under non-cancelable operating leases in existence at December 31, 2008 is as follows (in thousands):

| | | | |

2009 | | $ | 5,015 | |

2010 | | | 5,078 | |

2011 | | | 5,100 | |

2012 | | | 5,147 | |

2013 | | | 5,023 | |

Thereafter | | | 43,447 | |

| | $ | 68,810 | |

Future minimum rental revenue excludes amounts that may be received from tenants for reimbursements of operating costs, real estate taxes and insurance. Expense reimbursements recognized as revenue totaled $1.3 million during the period ended December 31, 2008.

| |

4. | ACQUIRED LEASE INTANGIBLES |

In accordance with SFAS No. 141, we have identified and recorded the value of intangibles at the property acquisition date. Such intangibles include the value of acquired in-place leases and above and below market leases. Acquired lease intangible assets (in-place leases and above-market leases) are amortized over the leases’ remaining terms, which range from one month to approximately twenty years. The amortization of above-market leases is recorded as a reduction of rental income and the amortization of in-place leases is recorded to amortization expense. The amortization expense related to in-place leases was approximately $990,000 during the 2008 period. The amortization of above-market leases, which was recorded as a reduction of rental income, was approximately $4,000 during the 2008 period. Acquired lease intangible liabilities (below-market leases) are accreted over the leases’ remaining non-cancelable lease term plus any fixed rate renewal options, if applicable, which range from one month to approximately 35 years. Accretion of below-market leases was approximately $224,000 during the 2008 period. Such accretion is recorded as an increase to rental income.

Acquired in-place lease and above and below market lease values and their respective accumulated amortization are as follows (in thousands):

| | | | |

| | December 31,

2008 |

Acquired lease intangible assets: | | | | |

In-place leases | | $ | 14,486 | |

In-place leases – accumulated amortization | | | (990 | ) |

Above-market leases | | | 60 | |

Above-market leases – accumulated amortization | | | (4 | ) |

Acquired leases intangibles, net | | $ | 13,552 | |

| | | | |

Acquired lease intangible liabilities: | | | | |

Below-market leases | | $ | 7,838 | |

Below-market leases – accumulated amortization | | | (224 | ) |

Acquired below-market lease intangibles, net | | $ | 7,614 | |

B-24

The estimated aggregate amortization amounts from acquired lease intangibles for each of the next five years are as follows (in thousands):

| | | | | | | | | | | |

Year Ending

December 31, | | Amortization Expense

(in-place lease value) | | Rental Income

(above and below

market leases) | |

2009 | | | $ | 976 | | | | $ | 274 | | |

2010 | | | | 976 | | | | | 274 | | |

2011 | | | | 976 | | | | | 274 | | |

2012 | | | | 976 | | | | | 274 | | |

2013 | | | | 942 | | | | | 274 | | |

| | | $ | 4,846 | | | | $ | 1,370 | | |

Our outstanding debt at December 31, 2008 consisted entirely of a $65.0 million fixed-rate mortgage loan, which requires monthly interest-only payments for the first three years and matures in March 2015. Our mortgage loan is secured by the Property and may be prepaid, but may be subject to a prepayment penalty.

As of December 31, 2008, the interest rate on our fixed-rate debt is 5.48%, and the remaining life is 6 years. As of December 31, 2008, scheduled principal repayments on our note payable were as follows (in thousands):

| | | | | | | | | | | | | | | | | |

Scheduled Payments by Year | | Scheduled

Principal Payments | | Term-Loan

Maturities | | Total

Payments | |

| 2009 | | | $ | — | | | | $ | — | | | | $ | — | | |

| 2010 | | | | — | | | | | — | | | | | — | | |

| 2011 | | | | 729 | | | | | — | | | | | 729 | | |

| 2012 | | | | 920 | | | | | — | | | | | 920 | | |

| 2013 | | | | 971 | | | | | — | | | | | 971 | | |

| Thereafter | | | | 1,203 | | | | | 61,177 | | | | | 62,380 | | |

| Total | | | $ | 3,823 | | | | $ | 61,177 | | | | $ | 65,000 | | |

As of December 31, 2008, the Property consisted of 38 tenants; 4 of which comprised more than 10% of our total base rent. Following are the base rents generated by our top tenants during the periods ended December 31, 2008:

| | | | |

Tenant | | 2008 | |

HEB | | $ | 684 | |

Academy | | | 535 | |

Ashley Furniture | | | 454 | |

Hobby Lobby | | | 409 | |

Wachovia | | | 156 | |

| | $ | 2,238 | |

| |

7. | RELATED PARTY TRANSACTIONS |

We have no employees or offices. We rely on our General Partner to manage our business and affairs. Our Managing Member utilizes the services of AmREIT and its affiliates in performing its duties to us. These services primarily include supervision of the property manager and leasing of the Property, and construction management related to the tenant build out of the Property. As a result, we are dependent upon AmREIT and its affiliates. In the event that these companies are unable to provide us with the respective services, we would be required to find alternative providers of these services. During the 2008, we incurred property management and leasing fees of $1.3 million. Additionally, during 2008, we incurred an acquisition fee of $350,000.

From time to time, we receive operating cash advances from the parent of our Managing Member. These advances are typically outstanding for 30 days or less and are due upon demand. As of December 31, 2008, such amount outstanding totaled approximately $611,000.

B-25

| |

8. | REAL ESTATE ACQUISITIONS AND DISPOSITIONS |

The acquisition of the Property was accounted for as a purchase, and the results of its operations are included in the accompanying consolidated financial statements from the date of acquisition. Following is a summary of assets acquired and liabilities assumed as of the acquisition date (February 29, 2008):

| | | | | |

Summary of Assets Acquired

and Liabilities Assumed | | | As of

February 29, 2008 | |

| | (asset/(liability)) | |

Land | | $ | 23,991 | |

Buildings | | | 75,931 | |

Acquired lease intangibles | | | 14,546 | |

Below market leases | | | (7,838 | ) |

Net Assets Acquired | | $ | 106,630 | |

Following are our pro forma results of operations for the year ended December 31, 2008, assuming that we owned the Property for the twelve-month period:

| | | | |

| | Year Ended

December 31, 2008 | |

| | | | |

Revenues | | $ | 5,644 | |

Expenses | | | 9,060 | |

Net Loss | | $ | (3,416 | ) |

| |

9. | COMMITMENTS AND CONTINGENCIES |

Litigation - In the ordinary course of business, we may become subject to litigation or claims. There are no material pending legal proceedings known to be contemplated against us.

Environmental matters - In connection with the ownership and operation of real estate, we may be potentially liable for costs and damages related to environmental matters. We have not been notified by any governmental authority of any non-compliance, liability or other claim.

B-26

REITPLUS, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

| | | | | | | |

| | June 30,

2009 | | December 31,

2008 | |

| | (unaudited) | | | | |

ASSETS | | | | | | | |

Investment in non-consolidated entity | | $ | 5,117,207 | | $ | 5,074,248 | |

Investment in AmREIT common stock | | | 195,588 | | | — | |

Net real estate investments | | | 5,312,795 | | | 5,074,248 | |

| | | | | | | |

Cash and cash equivalents | | | 1,060,594 | | | 1,805,287 | |

Accounts receivable | | | — | | | 8 | |

Other assets | | | 10,871 | | | — | |

TOTAL ASSETS | | $ | 6,384,260 | | $ | 6,879,543 | |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

Liabilities: | | | | | | | |

Accounts payable and other liabilities | | $ | 8,308 | | $ | 16,272 | |

Accounts payable - related party | | | 112,127 | | | 49,671 | |

TOTAL LIABILITIES | | | 120,435 | | | 65,943 | |

| | | | | | | |

Stockholders’ equity: | | | | | | | |

REITPlus, Inc. stockholders’ equity | | | | | | | |

Preferred stock, $0.01 par value, 50,000,000 shares authorized, none issued | | | — | | | — | |

Common stock, $0.01 par value, 1,000,000,000 shares authorized; 752,307 shares issued and outstanding at June 30, 2009 and December 31, 2008, respectively | | | 7,523 | | | 7,523 | |

Additional paid-in capital | | | 6,733,434 | | | 6,733,434 | |

Accumulated distributions in excess of earnings | | | (1,414,065 | ) | | (889,630 | ) |

TOTAL REITPLUS, INC. STOCKHOLDERS’ EQUITY | | | 5,326,892 | | | 5,851,327 | |

| | | | | | | |

Non-controlling interests | | | 936,933 | | | 962,273 | |

TOTAL STOCKHOLDERS’ EQUITY | | | 6,263,825 | | | 6,813,600 | |

| | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 6,384,260 | | $ | 6,879,543 | |

See notes to consolidated financial statements.

B-27

REITPLUS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, | |

| | 2009 | | 2008 | | 2009 | | 2008 | |

|

Loss of non-consolidated entity | | $ | (141,734 | ) | $ | (19,636 | ) | $ | (157,084 | ) | $ | (19,636 | ) |

| | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | |

General and administrative | | | 66,425 | | | 110,667 | | | 135,499 | | | 110,667 | |

General and administrative - related party | | | 56,707 | | | 27,344 | | | 83,197 | | | 27,344 | |

Asset management fees - related party | | | 13,541 | | | — | | | 27,111 | | | — | |

Legal and professional | | | 34,097 | | | 129,518 | | | 54,693 | | | 129,518 | |

Total expenses | | | 170,770 | | | 267,529 | | | 300,500 | | | 267,529 | |

| | | | | | | | | | | | | |

Operating loss | | | (312,504 | ) | | (287,165 | ) | | (457,584 | ) | | (287,165 | ) |

| | | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | | |

Interest and dividend income | | | 20,086 | | | 4,476 | | | 21,538 | | | 9,559 | |

State tax expense | | | (138 | ) | | (50 | ) | | (838 | ) | | (86 | ) |

Income tax benefit | | | — | | | 1,728 | | | — | | | — | |

Total other income | | | 19,948 | | | 6,154 | | | 20,700 | | | 9,473 | |

| | | | | | | | | | | | | |

Net loss including non-controlling interests | | | (292,556 | ) | | (281,011 | ) | | (436,884 | ) | | (277,692 | ) |

| | | | | | | | | | | | | |

Net loss attributable to non-controlling interests | | | 22,503 | | | 2,621 | | | 25,340 | | | 2,621 | |

|

Net loss attributable to REITPlus, Inc. | | $ | (270,053 | ) | $ | (278,390 | ) | $ | (411,544 | ) | $ | (275,071 | ) |

See notes to consolidated financial statements.

B-28

REITPLUS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the six months ended June 30, 2009

(unaudited)

| | | | | | | | | | | | | | | | |

| | REITPlus, Inc. Stockholders’ Equity | | | | | | | |

| | Common stock | | Additional paid-

in capital | | Accumulated

distributions

in excess of

earnings | | Non-Controlling

Interests | | Total | |

Balance, December 31, 2008 | | $ | 7,523 | | $ | 6,733,434 | | $ | (889,630 | ) | $ | 962,273 | | $ | 6,813,600 | |

| | | | | | | | | | | | | | | | |

Net loss | | | — | | | — | | | (411,544 | ) | | (25,340 | ) | | (436,884 | ) |

Distributions | | | — | | | — | | | (112,891 | ) | | — | | | (112,891 | ) |

| | | | | | | | | | | | | | | | |

Balance, June 30, 2009 | | $ | 7,523 | | $ | 6,733,434 | | $ | (1,414,065 | ) | $ | 936,933 | | $ | 6,263,825 | |

See notes to consolidated financial statements.

B-29

REITPLUS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | |

| | Six months ended June 30, | |

| | 2009 | | 2008 | |

Cash flows from operating activities: | | | | | | | |

Net loss | | $ | (436,884 | ) | $ | (277,692 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

Amortization of prepaid expenses | | | 53,573 | | | 74,691 | |

Loss of non-consolidated entity | | | 157,084 | | | 19,636 | |

Decrease in accounts receivable | | | 8 | | | 2,588 | |

Decrease in accounts receivable - related party | | | — | | | 944 | |

Increase in other assets | | | (64,444 | ) | | (128,142 | ) |

(Decrease) increase in accounts payable and other liabilities | | | (7,964 | ) | | 71,854 | |

Increase in accounts payable - related party | | | 62,456 | | | 16,855 | |

Net cash used in operating activities | | | (236,171 | ) | | (219,266 | ) |

| | | | | | | |

Cash flows from investing activities: | | | | | | | |

Investment in non-consolidated entity | | | (200,043 | ) | | (3,850,000 | ) |

Investment in AmREIT common stock | | | (195,588 | ) | | — | |

Net cash used in investing activities | | | (395,631 | ) | | (3,850,000 | ) |

| | | | | | | |

Cash flows from financing activities: | | | | | | | |

Proceeds from sale of common stock | | | — | | | 3,768,357 | |

Issuance costs | | | — | | | (376,836 | ) |

Distributions | | | (112,891 | ) | | (4,794 | ) |

Net cash (used in) provided by financing activities | | | (112,891 | ) | | 3,386,727 | |

| | | | | | | |

Net decrease in cash and cash equivalents | | | (744,693 | ) | | (682,539 | ) |

Cash and cash equivalents, beginning of period | | | 1,805,287 | | | 1,019,608 | |

Cash and cash equivalents, end of period | | $ | 1,060,594 | | $ | 337,069 | |

See notes to consolidated financial statements.

B-30

REITPLUS, INC. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(unaudited)

| |

1. | DESCRIPTION OF BUSINESS AND NATURE OF OPERATIONS |

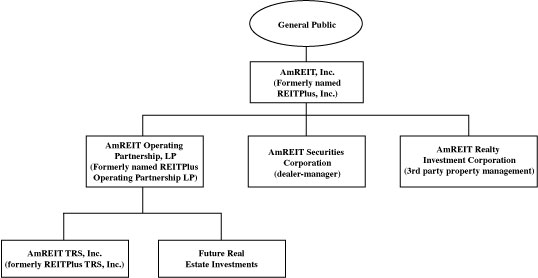

REITPlus, Inc. was formed on April 13, 2007 to acquire an interest in a portfolio of retail and mixed-use properties, including a combination of stabilized, income-producing properties and value-added opportunities. We are externally managed by REITPlus Advisor, Inc., a wholly-owned subsidiary of AmREIT, a Texas real estate investment trust. We elected to be treated as a real estate investment trust (“REIT”) for federal income tax purposes. The use of the words “we,” “us” or “our” refers to REITPlus, Inc. and its subsidiary, except where the context otherwise requires.

We conduct substantially all of our operations through our subsidiary, REITPlus Operating Partnership, LP (“REITPlus OP”). Subject to certain restrictions and limitations, our business is managed by REITPlus Advisor, Inc. (our “Advisor”), an affiliate, pursuant to an advisory agreement. Our Advisor supervises and manages our day-to-day operations and selects the properties we acquire, subject to oversight by our board of directors. Our Advisor provides marketing, sales and client services on our behalf. Our Advisor is affiliated with us in that we and our Advisor have common management. Our Advisor engages wholly-owned subsidiaries of AmREIT, including AmREIT Realty Investment Corporation, to provide various services to us and our properties.

Our charter authorizes us to issue 1,050,000,000 shares of capital stock, of which 1,000,000,000 shares of capital stock are designated as common stock with a par value of $0.01 per share and 50,000,000 shares of capital stock are designated as preferred stock with a par value of $0.01 per share. In 2008, we conducted a best efforts initial public offering (the “Offering”), in which we offered a maximum of 50,000,000 shares of our common stock for $10.00 per share to the public and 5,263,158 shares of our common stock pursuant to our distribution reinvestment plan (“the DRIP”) at $9.50 per share, aggregating up to $550,000,000, or the maximum offering.

We commenced our principal operations on April 22, 2008 when we raised the minimum offering amount of $2.0 million pursuant to the terms of our Offering. The Offering was closed on October 4, 2008, and, as of June 30, 2009, we had received $7.5 million from the sale of 752,307 shares of common stock. As of June 30, 2009, we had an investment interest in a non-consolidated entity, which owned one property comprising approximately 593,000 square feet of gross leasable area.

On May 20, 2009, our board of directors approved the agreement of merger between AmREIT and REITPlus. The anticipated merger is part of Phase II in AmREIT’s strategic plan, referred to as “Vision 2010,” and would combine all AmREIT capital stock into a single class of common shares, accomplishing AmREIT’s goal of simplifying its capital structure. The merger is subject to the approval of shareholders of both AmREIT and REITPlus and other customary closing conditions. We believe these steps, if successful, will better position us to raise Wall Street and/or institutional capital either through joint ventures at the entity level or through an initial public offering and listing of our shares. The cost of the merger will be subject to various factors, and we expect the ultimate costs to be as much as $1.3 million, of which we estimate our share to be in the range of $40,000 to $50,000. As of June 30, 2009, we have incurred $11,000 in merger costs, which have been deferred and are included in other assets in the accompanying consolidated balance sheet until consummation of the merger.

During the past 18 months, the United States has experienced an unprecedented business downturn, coupled with a substantial curtailment of available debt financing and a virtual shutdown of equity capital markets, particularly in the real estate sector. While we believe that we have sufficient cash on hand to meet our contractual obligations, a significant additional deterioration in the national economy, the bankruptcy or insolvency of one or more of our large tenants in our joint venture property could cause our 2009 cash resources to be insufficient to meet our obligations. If necessary, our joint venture property has the ability to defer capital improvements and to defer payment of certain operating costs, including property taxes, until cash resources are available.

B-31

| |

2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation