Additional lnformation and Where to Find It

In connection with the proposed merger, the Company has filed a joint proxy statement/prospectus with the Securities and Exchange Commission and distributed it to shareholders along with this brochure. The joint proxy statement/prospectus distributed to shareholders contains information about each of AmREIT and REITPIus, Inc. (“REITPIus”), the proposed merger, and related matters. SHAREHOLDERS OF EACH COMPANY ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS CAREFULLY, AS IT CONTAINS IMPORTANT INFORMATION THAT SHAREHOLDERS SHOULD CONSIDER BEFORE MAKING A DECISION ABOUT THE MERGER. In addition to receiving the joint proxy statement/prospectus from either AmREIT or REITPIus by mail, shareholders of each company will be able to obtain the joint proxy statement/prospectus, as well as other filings containing information about AmREIT, without charge, from the Securities and Exchange Commission’s website (http://www.sec.gov) or, without charge, from AmREIT at http://www.amreit.com/fw/main/Proxy-1257.html or by directing such request to AmREIT, 8 Greenway Plaza, Suite 1000, Houston, TX, 77046, Attention: Investor Relations. Terms not defined in this brochure are used as such terms are defined in the joint proxy statement/prospectus.

Participants in the Solicitation

AmREIT, REITPIus, their respective trustees, directors and executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies with respect to the merger. lnformation about each of AmREIT and REITPIus’ respective trustees, directors and executive officers, and their ownership of AmREIT or REITPIus common stock is set forth in the joint proxy statement/prospectus related to the merger. Shareholders may obtain additional information regarding the interests of AmREIT, REITPIus, and their respective directors and executive officers in the merger, which may be different than those of AmREIT or REITPIus shareholders generally, by reading the joint proxy statement/prospectus and other relevant documents regarding the merger, as filed with the SEC.

Cautionary Statement Regarding Forward-Looking Statements

The joint proxy statement/prospectus and this brochure may contain forward-looking statements which are subject to risks and uncertainties. These statements are based on the beliefs and assumptions of AmREIT and REITPIus, as the case may be, and on the information currently available to AmREIT and REITPIus.

When used or referred to in these materials, these forward-looking statements may be preceded by, followed by, or otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects” or similar expressions, or statements that certain events or conditions “will” or “may” occur. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements:

| | |

| • | occupancy rates from AmREIT’s properties or REITPIus’ property may deteriorate or fail to recover as predicted; |

| | |

| • | AmREIT may not be able to sustain the rental rate increases upon lease renewals that it has recently experienced; |

| | |

| • | AmREIT and REITPIus may experience tenant defaults due to recessionary conditions, as well as tenant bankruptcies and abandonments of leases; |

| | |

| • | general economic conditions, either internationally or nationally or in the jurisdictions in which REITPIus or AmREIT are doing business, may be less favorable than expected; |

| | |

| • | legislative or regulatory changes, including changes in environmental regulation, may adversely affect the businesses in which REITPIus and AmREIT are engaged; |

| | |

| • | there may be environmental risks and liability under federal, state and foreign environmental laws and regulations; |

| | |

| • | changes may occur in the securities or capital markets; |

| | |

| • | cost savings expected from the merger may not be fully realized; and |

| | |

| • | revenue of the combined company following the merger may be lower than expected. |

Except for its ongoing obligations to disclose material information as required by the federal securities laws, neither AmREIT nor REITPIus has any intention or obligation to update these forward-looking statements after they distribute these materials.

Dear Shareholder,

Our primary focus for the past 18 months has been the execution of Vision 2010, our comprehensive strategic plan to create value for our shareholders by making our platform more efficient (phase one), simplifying our capital structure (phase two), and preparing for growth as our nation’s current recession passes (phase three). During phase one, we took some bold steps to simplify our operating platform to become more productive by eliminating two inefficient areas of AmREIT. In so doing, we were able to reduce AmREIT’s overhead expenses by approximately 50% and increase the predictability of its earnings and cash flow.

Our first step in phase two was the redomestication of AmREIT to Maryland. Of AmREIT’s shareholders who voted, approximately ninety-three percent voted to approve the AmREIT Board recommendation. As previously announced, the final step in phase two of Vision 2010 is our proposed merger with REITPlus, a Houston-based non-traded REIT sponsored by AmREIT that is also domiciled in Maryland. Following the proposed merger, the name of the combined company will be changed to AmREIT, Inc.

Upon consummation of the merger, the boards of the two companies will be combined, and we will operate under the direction of a combined 7-member board of directors, with six of the members being independent. Our management team and both boards believe that the merger will:

| | |

| • | Simplify AmREIT’s capital structure, making the combined company more attractive to lenders, national securities exchanges, institutional investors and securities analysts, as well as helping us to better weather the deep recession in which our nation finds itself; |

| | |

| • | Provide for a more sustainable earnings and liquidity model that would better enable the combined company to pay a stable dividend and decrease the likelihood of liquidity issues and dividend cuts in the future (although no assurances can be given); |

| | |

| • | Facilitate the raising of additional equity and debt to fund the growth anticipated in phase three of Vision 2010; |

| | |

| • | Provide savings of administrative costs, including reduced legal, audit and overhead costs; |

| | |

| • | Eliminate conflicts of interest in the allocation of opportunities between AmREIT and REITPlus and provide REITPlus with internal management; and |

| | |

| • | Allow AmREIT shareholders to exchange their shares on a tax-deferred basis, except to the extent of cash paid for fractional shares. |

The independent board of trustees of AmREIT and the independent board of directors of REITPlusunanimously recommend that you vote FOR this proposal.

As we complete this final step in phase two of Vision 2010, we believe we will be in a good position to build meaningful liquidity for all our shareholders through phase three. This may take the form of re-listing on a major stock exchange, bringing in large institutional investors and/or launching an Initial Public Offering. All this, of course, is contingent upon the health of the economy, the state of the capital markets, and the commercial real estate industry. We cannot predict when the national economy, generally, and the commercial real estate economy, specifically, are going to turn, but whenever that may be, we must be positioned to take advantage of the inevitable opportunities that will present themselves. Your management, the board of trustees of AmREIT and the board of directors of REITPlus believe this merger will so position us.

We have prepared this summary piece for you to read in conjunction with the enclosed joint proxy statement/prospectus. We encourage you to thoroughly read the enclosed materials and to visit AmREIT’s website atwww.amreit.com, where you can find additional information on AmREIT, its properties, our management team and board. In addition, please contact us if you would like additional insight or help by calling 713-850-1400 to speak with either Chad Braun, Chief Financial Officer of both AmREIT and REITPlus, at extension 124, our investor services group at extension 135 or 151, or myself at extension 114.

I would like to thank each of you for your investment and trust during these very challenging times. All of us are optimistic and enthusiastic about building our company and look forward to striving each day, with God’s help, toward a bright future.

|

|

Best Regards, |

|

H. Kerr Taylor |

Chairman and CEO |

AmREIT and REITPlus, Inc. |

Questions & Answers

Will the proposed merger improve the potential for shareholder liquidity?

(See the Joint Proxy Statement/Prospectus,Reasons For and Consequences of the Merger, page 45)

Your respective boards and management believe that the proposed merger should improve our opportunities for liquidity. As we have sought counsel from top national banks, real estate investment banking firms, securities analysts and shareholders, the broad consensus of these constituencies agrees with this opinion. The proposed merger will complete phase two of our strategic plan, Vision 2010, and position us for phase three — which is liquidity and growth. Currently, neither the REITPlus shares nor any of the AmREIT shares trade on an established securities exchange. The small size of REITPlus and the complicated capital structure (three separate classes of common stock) of AmREIT make liquidity very challenging. The combination of the two companies will create a conforming REIT with a single class of common stock that should position us to access capital through the public markets or by attracting institutional investors as the national and commercial real estate economies emerge from our current recession.

Plaza in the Park - Houston, TX

For these reasons and others, your board unanimously recommends

that you vote “YES” for the proposed merger.

What happens if the merger does not go through?

(See the Joint Proxy Statement/Prospectus,Risk Factors, page 24)

We have spent the last 18 months working on Vision 2010, consulting with national real estate investment banking firms, real estate securities analysts, and commercial banks. We believe that the merger between AmREIT and REITPlus positions the combined company and its shareholders with the best potential for liquidity, sustained dividends, and growth.

If we are unsuccessful with the merger, we will likely not be able to reinstate the dividends for REITPlus. REITPlus has only one real estate investment, has not achieved efficiencies with its operating expenses, and is not generating cash flow to support dividends.

If we are unsuccessful with the merger, we believe AmREIT’s ability to raise capital and debt in the future could be significantly damaged. If the merger is not consummated, the AmREIT board of trustees may deem it prudent to begin setting aside reserve funds to meet unanticipated capital needs of the company and to pay down debt. These funds would most likely be generated through a reduction of dividends.

Additionally, both the AmREIT and REITPlus boards have spent an estimated $1.3 million to accomplish the merger. If we are unsuccessful, this expense would have a negative effect on REITPlus and AmREIT’s operating results and ability to pay distributions.

Cinco Ranch Shopping Center - Katy, TX

Walgreens

What will happen to my dividends after the merger?

(See the Joint Proxy Statement/Prospectus,Dividend Policy, page 23)

Your respective boards and management believe that the proposed merger will improve the potential that dividends will be sustained. It is our desire to maintain AmREIT’s current dividend of $0.50 per share per year for the combined company following the merger. However, it must be emphasized that there can be no guarantee that dividends will not be reduced in the future, even if the merger is approved. The combined company’s ability to pay dividends depends on many factors that are outside of our control, such as occupancy at our properties, liquidity in the market, and overall health of our balance sheet and our industry. The following table sets forth the anticipated dividends per share based on AmREIT’s current S0.50 per share dividend rate and the proposed exchange rate for each class of AmRElT common stock after the merger.

| | | | | | | | | | | | |

| | | | | | Class A | | | Class C | | | Class D |

Dividend Pre Merger | | | REITPIus(2) | | | Stock | | | Stock | | | Stock |

Per Month | | | $0.0250 | | | $0.0416 | | | $0.0583 | | | $0.0541 |

Per Year | | | $0.30 | | | $0.50 | | | $0.70 | | | $0.65 |

Exchange Ratio | | | 1.0 to 1.0 | | | 1.0 to 1.0 | | | 1.16 to 1.0 | | | 1.11 to 1.0 |

As Converted Dividend

Equivalent | | | | | | | | | | | | |

Per Month | | | $0.04166 | | | $0.04166 | | | $0.04833 | | | $0.04583 |

Per Year | | | $0.50 | | | $0.50 | | | $0.58 | | | $0.55 |

Annual Difference per

1,000 shares | | | $200 | | | $ - | | | ($120) | | | ($100) |

Yield on Original

Investment | | | 5.0% | | | (1) | | | 5.8% | | | 5.5% |

| | |

| (1) | Based on the multiple historical issuance prices, we are not able to calculate a yield on original investment. |

| (2) | As of September, 2009, REITPlus suspended its monthly dividend due to insufficient operating cash flow. |

How was the value for the merger established?

(See the Joint Proxy Statement/Prospectus,Opinion of AmRElT’s Fairness Opinion Provider, page 47-51)

Your respective boards and management have been extremely diligent in hiring some of the most experienced and recognized valuation and fairness experts in the nation. Each of the AmREIT properties and the REITPlus property was appraised by one of two independent third party national commercial real estate appraisal firms: CB Richard Ellis or

| | |

Valuation Associates. In addition to being used by each of the independent boards, these appraisals were used by KeyBanc Capital Markets, a nationally recognized real estate investment banking firm, which rendered a fairness opinion for the transaction. KeyBanc utilized three well known, traditional valuation methodologies to arrive at its conclusion that the stock price of $9.50 per share and the applicable conversion rates were both fair, from a financial perspective, to the AmREIT shareholders. Each of these professionals took into consideration the | |

|

The Courtyard at San Felipe - Houston, TX |

current stressful economic climate. The class A shares will convert on a one-for-one basis. The class C shares will convert on a 1.16 to 1.0 basis due to their 10% conversion premium. The class D shares will convert on a 1.11 to 1.0 basis due to their 5.5% (7.7% prorated for 5 years) conversion premium.

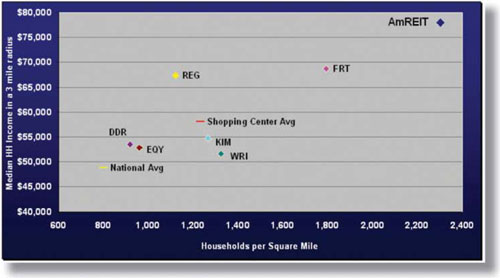

This valuation is supported by the quality of our real estate portfolio, which targets high barriers to entry, dense populations (100,000 people in a 3-mile radius), strong average household incomes ($80,000 in a 3-mile radius) and high traffic counts (30,000 cars per day). As the following chart shows, our portfolio demographics rank high as compared to other shopping center REITs.

Source: Merrill Lynch Research, 9/30/07 and ScanUS

|

Will the merger be taxable to me as a shareholder? |

(See the Joint Proxy Statement/Prospectus,Material Tax Consequences of the Merger, page 14) |

| | |

No. The merger is intended to qualify as a reorganization for federal tax purposes. Therefore, holders of AmREIT common stock are not expected to recognize any gain or loss upon the exchange of their shares (except with respect to cash received |

| | for fractional shares). Your individual tax consequences will depend on your personal situation. You are urged to consult your own tax advisor for a full understanding of the tax consequences of the merger to you. |

Shadow Creek Ranch Town Center - Pearland, TX | | |

For these reasons and others, your board unanimously recommends

that you vote “YES” for the proposed merger.

| | | |

|

| VISION 2010 | |

| | | |

| | | |

| | | |

| PHASE I - BUSINESS MODEL | |

| Changes to reach greater efficiency and reduce volatility of earnings. This phase includes the elimination of the general contracting business and IBD Securities business. Estimated G&A Savings of $4 - $4.5 million per year. Phase I was executed during the 3rd and 4th quarters of 2008. | |

| | |

| PHASE II - CAPITAL STRUCTURE | |

| Changes to reach greater efficiency and reduce volatility of earnings: | |

| • the privatization of the Company, the potential consolidation of AmREIT into REITPlus, and | |

| • the simplification of AmREIT’s equity capitalization into one class of stock. | |

| | |

| PHASEIII-GROWTH | |

| Grow our platform and provide liquidity for shareholders by bringing in Institutional Investors, listing on the NYSE, and/or launching an IPO. | |

| | |

| | |

INDEPENDENT BOARDS

| | | | | | |

AMREIT BOARD OF TRUSTEES | | REITPLUS BOARD OF DIRECTORS |

| | | | | | |

| | | | | | |

| | H.L. “HANK” RUSH, JR.

CEO of Star of Hope. Formerly a top executive of BMC Software and Stewart Title. | |

| | MACK D. PRIDGEN, III

Attorney with tax and audit experience. Formerly a top executive of Highwoods Properties (NYSE) while they grew from $250 million to $4.5 billion. |

| | | | | | |

| | | | | | |

| | PHILIP TAGGART

President and Chief Executive Officer of Taggart Financial Group, Inc., and co-author ofTaking YourCompany Public. | |

| | SCOT J. LUTHER

President and sole owner of Luther Properties, LLC, a commercial reaJ estate development company. |

| | | | | | |

| | | | | | |

| | ROBERT S. CARTWRIGHT, JR.

Graduate of Harvard (BA) and Stanford (PhD). Distinguished professor at Rice University. | |

| | BRENT M. LONGNECKER

Former national partner with Deloitte & Touche, author of eight books on governance and compensation, and CEO of Longnecker & Associates, a national consulting organization. |

| | | | | | |

ONE COMBINED BOARD COMPRISED OF

DIVERSIFIED, STRONG, INDUSTRY EXPERIENCE

SUMMARY RISK FACTORS

The consummation of the merger, as well as an investment in shares of REITPlus common stock and the combined company,involve significant risks, including the following (see the Joint Proxy Statement/Prospectus, Risk Factors, pages 24-35):

| |

| The values of the Class A stock and the REITPlus common stock, which are important factors in determining the ClassA Exchange Ratio, the Class C Exchange Ratio and the Class D Exchange Ratio, were estimated by the AmREIT Boardand the REITPlus Board, respectively, and were based on the appraised value of the real estate and the delivery of a fairness opinion by KeyBanc Capital Markets, not on an active trading market. Accordingly, there can be no assurance that the exchange ratios accurately represent the relative values of the various classes of AmREIT common stock and the REITPlus common stock or appropriately allocate the merger consideration among the various classes of AmREIT common stock. |

| |

| AmREIT shareholders have no rights to demand cash payment for their shares of AmREIT common stock in connectionwith the merger, and objecting AmREIT shareholders will be required to accept REITPlus common stock, if the mergeris consummated. Therefore, AmREIT shareholders will have no right to receive fair value in cash for their shares of AmREIT common stock and will generally have no means of disposing of such stock. |

| |

| The combined company’s common stock will not have a trading market and will have some limited restrictions ontransferability, which may prevent the combined company’s shareholders from selling or transferring their REITPlus common stock. |

| |

| REITPlus and AmREIT expect to incur significant costs and expenses in connection with the merger, which could resultin the combined company not realizing some or all of the anticipated benefits of the merger. |

| |

| There may be unexpected delays in the consummation of the merger, which would delay AmREIT shareholders’ receiptof the merger consideration and could impact AmREIT’s ability to timely achieve cost savings associated with themerger. |

| |

| REITPlus has interests in the merger that may be different from, or in addition to, the interests of other AmREIT shareholders generally, which may cause REITPlus and its shareholders to realize financial benefits at the expense of AmREIT and its shareholders. |

| |

| Failure to complete the merger could negatively impact REITPlus’s and/or AmREIT’s business, financial condition, operating results and cash flows, including the ability to service debt and to make distributions. |

| |

| After the merger is completed, AmREIT shareholders will be governed by the REITPlus Charter, and AmREITshareholders will have different rights that may be less advantageous than their current rights. |

| |

| The combined company may be unable to effectuate the contemplated growth strategy, which may curtail furtherproperty acquisitions or reduce cash available for distributions to shareholders. |

| |

| The interest of the combined company’s shareholders could be diluted, which may adversely impact the ownership position and other interests of the combined company’s shareholders. |

| |

| The combined company may own properties in joint ventures with unrelated third parties, which properties could be adversely affected by the combined company’s lack of sole decision-making authority, its reliance on its joint venture partner’s financial condition, and disputes between the combined company and its joint venture partner. |

| |

| The combined company may not be able to obtain capital to make investments, which could adversely affect its growth,its ability to make capital expenditures and its ability to make distributions to shareholders. |

| |

| AmREIT is subject to conflicts of interest arising out of its relationships with its merchant development funds, and there can be no assurances that AmREIT shareholder interests and investment objectives will take priority. |

| |

| Tenant, geographic or retail product concentrations in AmREIT’s real estate portfolio could make the combined companyvulnerable to negative economic and other trends. |

| |

| Covenants in AmREIT’s debt instruments could adversely affect the combined company’s financial condition and its acquisitions and development activities. |

Corporate Offices

8 Greenway Plaza, Suite 1000 • Houston, Texas 77046 • 713.850.1400 [office] • 713.850.0498 [fax] • www.amreit.com