Exhibit 99.3

1 Earnings Call – November, 2008 AmREIT Portfolio Presentation

2 Investing in Three of the Top Seven U.S. Growth Markets (Gp:) Three Top U.S. Growth Markets (Gp:) Prior/Non-core Holdings

3 AmREIT Portfolio Operating Platform Approaching $1 Billion Institutional Quality Real Estate Invested in Three of the Top Seven Employment Growth Markets Creating Value for a Quarter of a Century

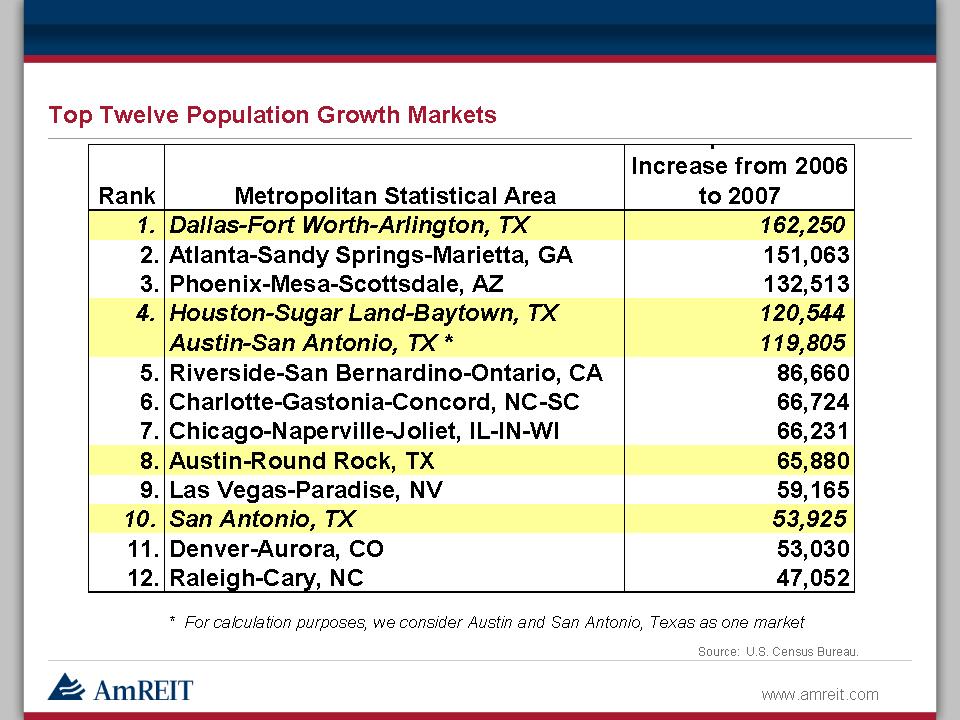

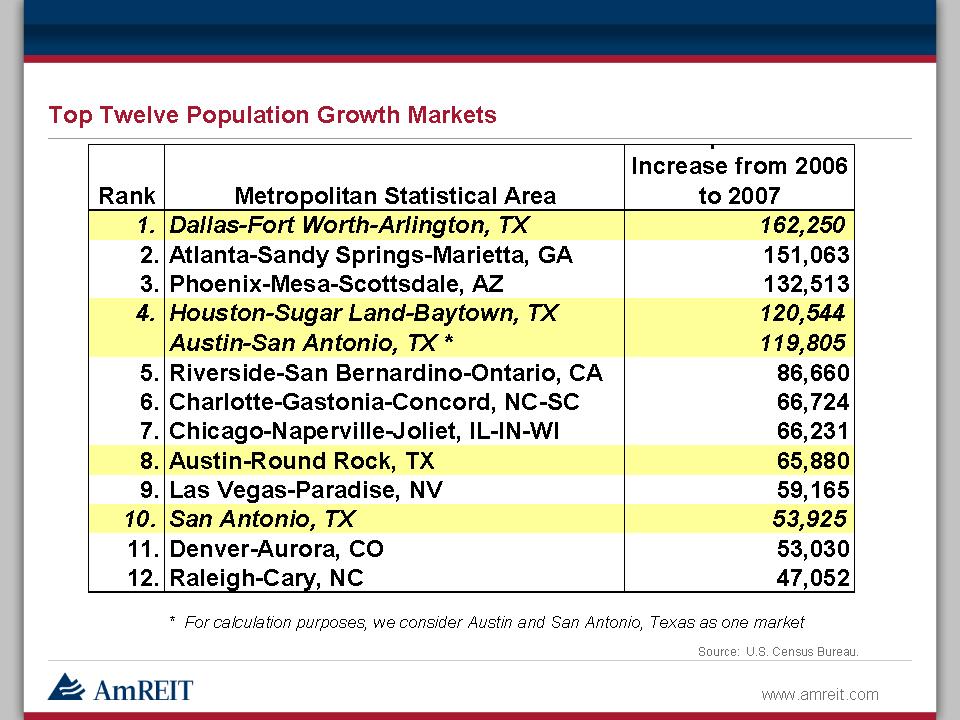

4 Top Twelve Population Growth Markets Source: U.S. Census Bureau.

5 Top Twelve Employment Growth Markets Source: Bureau of Labor Statistics.

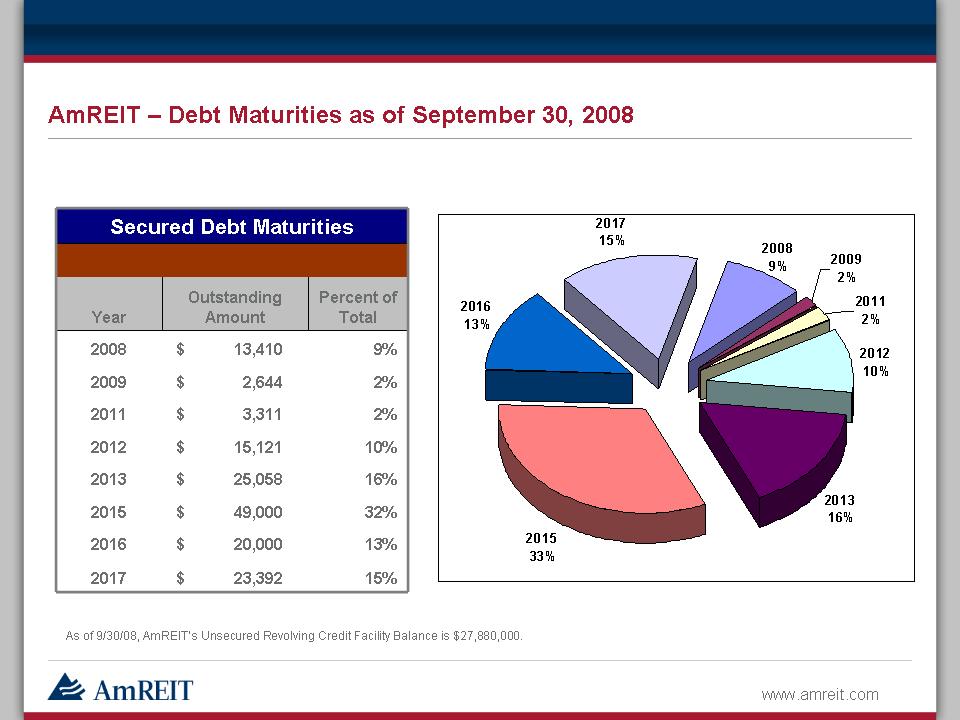

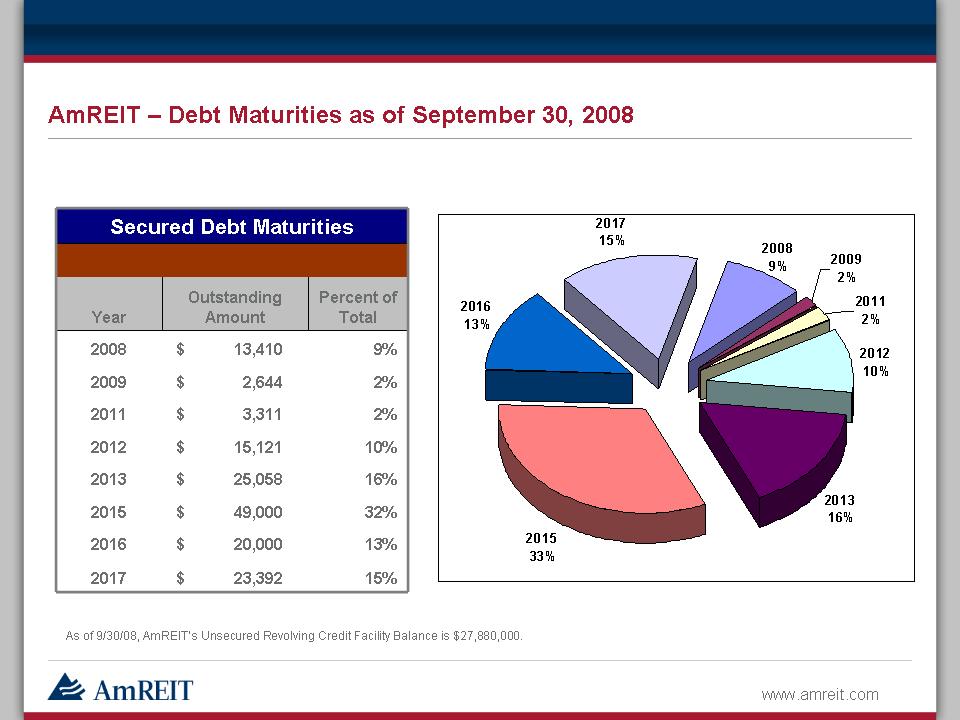

6 AmREIT – Debt Maturities as of September 30, 2008 As of 9/30/08, AmREIT’s Unsecured Revolving Credit Facility Balance is $27,880,000.

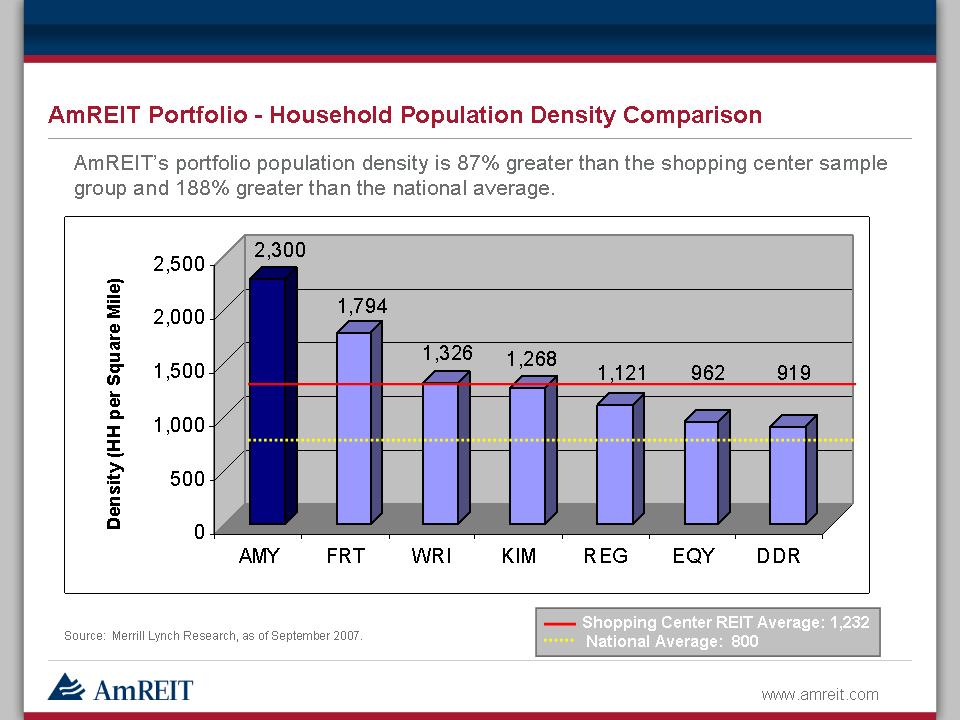

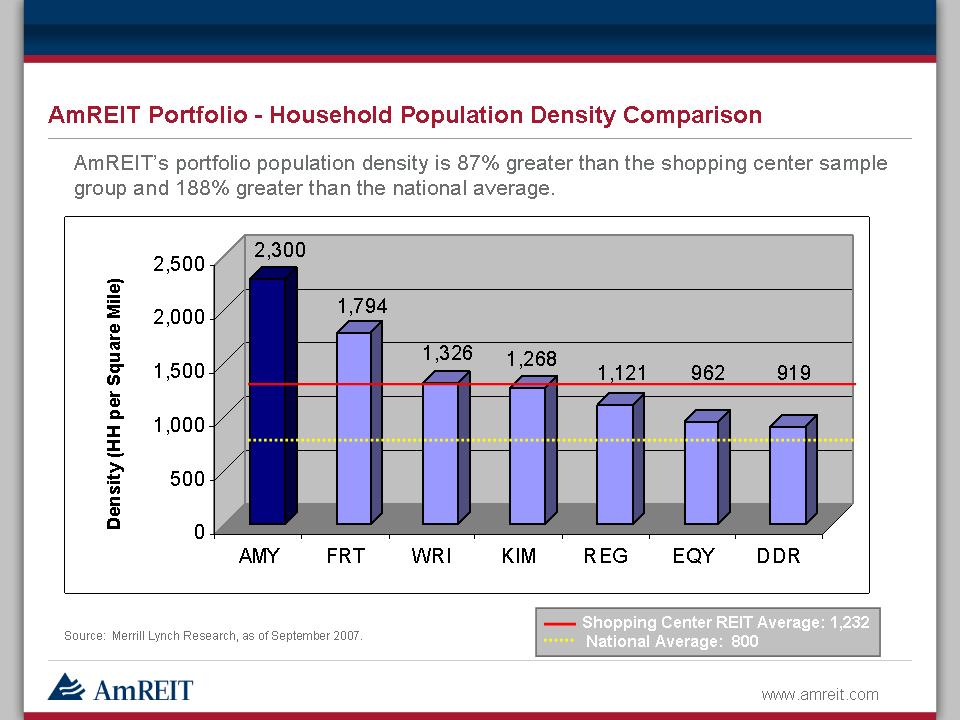

7 AmREIT Portfolio - Household Population Density Comparison (Gp:) Shopping Center REIT Average: 1,232 National Average: 800 Source: Merrill Lynch Research, as of September 2007. AmREIT’s portfolio population density is 87% greater than the shopping center sample group and 188% greater than the national average.

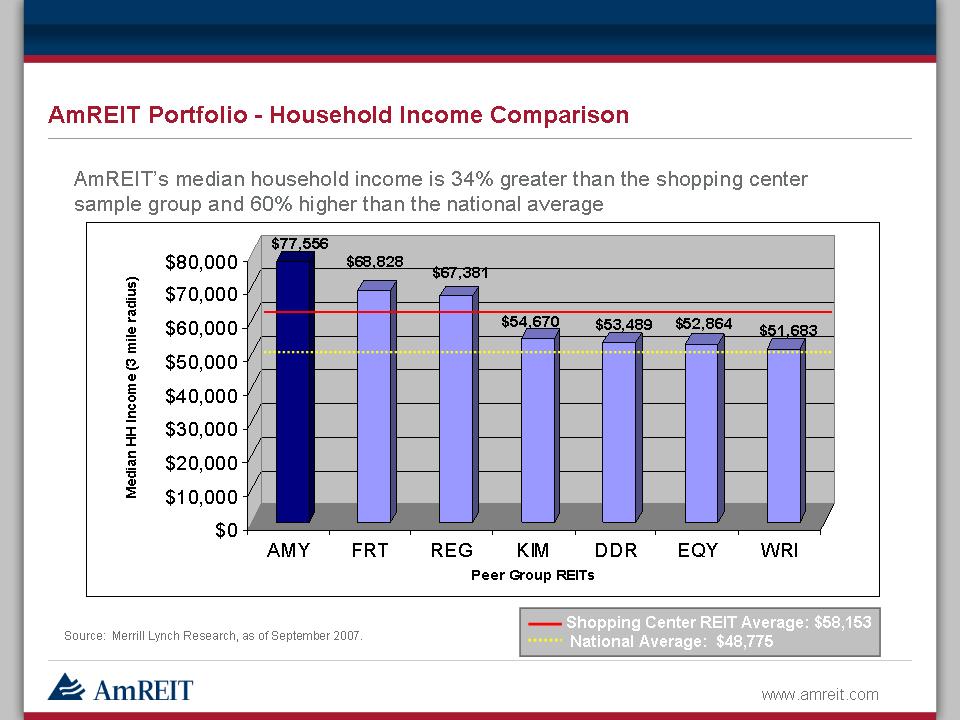

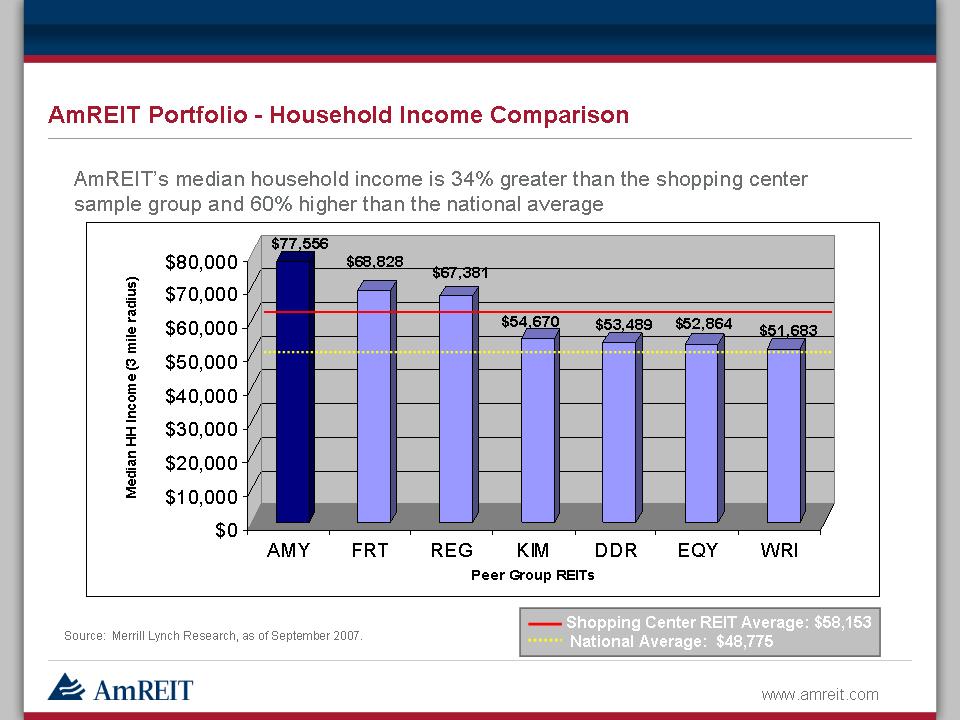

8 AmREIT Portfolio - Household Income Comparison (Gp:) Shopping Center REIT Average: $58,153 National Average: $48,775 Source: Merrill Lynch Research, as of September 2007. AmREIT’s median household income is 34% greater than the shopping center sample group and 60% higher than the national average

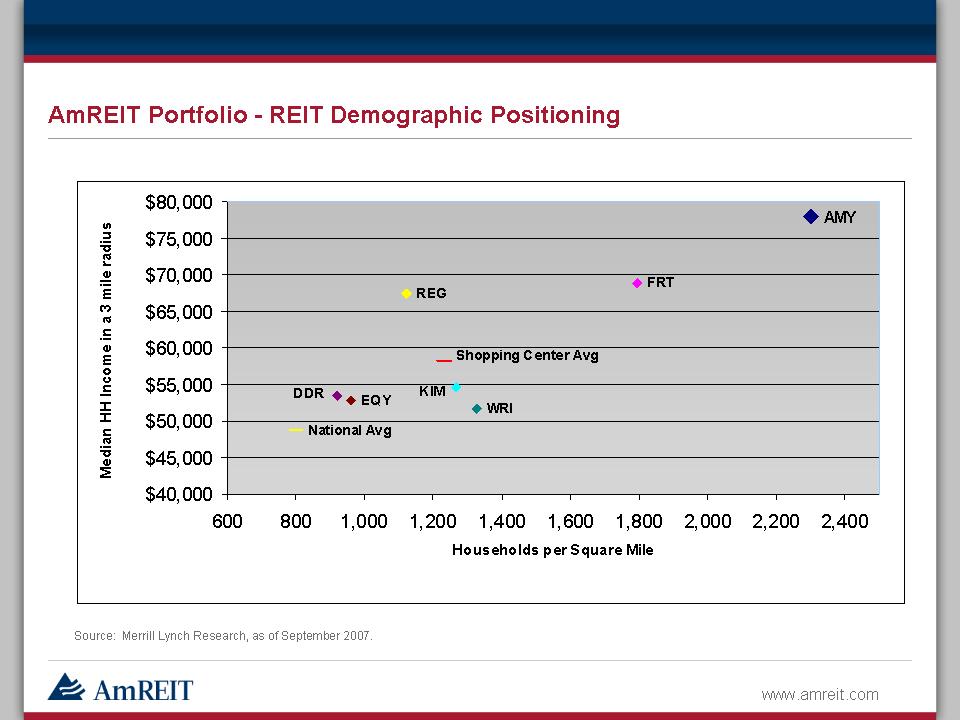

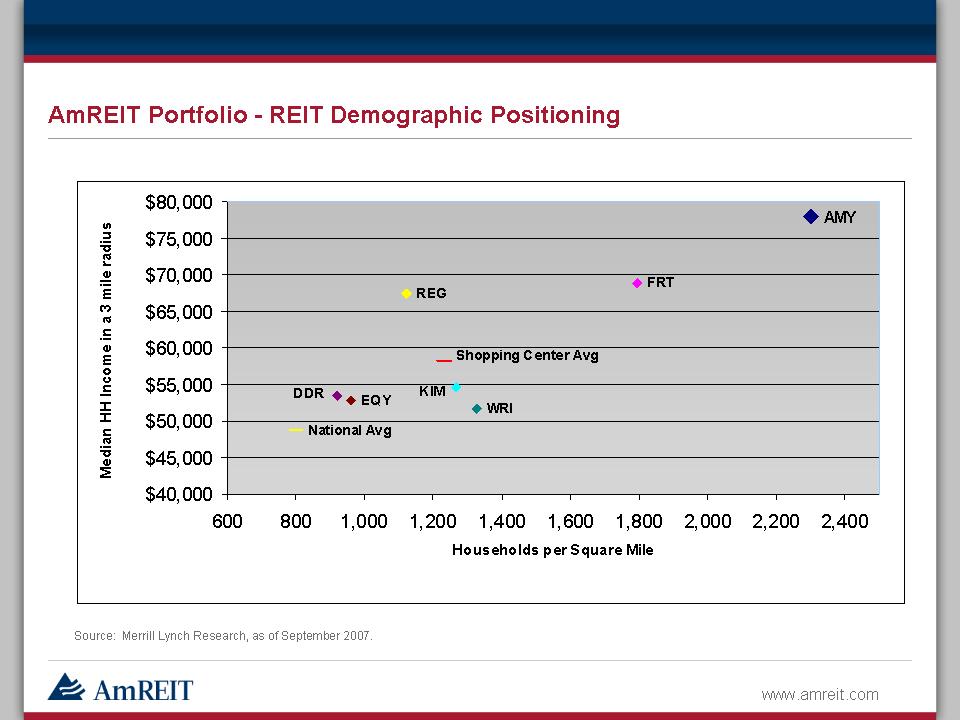

9 AmREIT Portfolio - REIT Demographic Positioning Source: Merrill Lynch Research, as of September 2007.

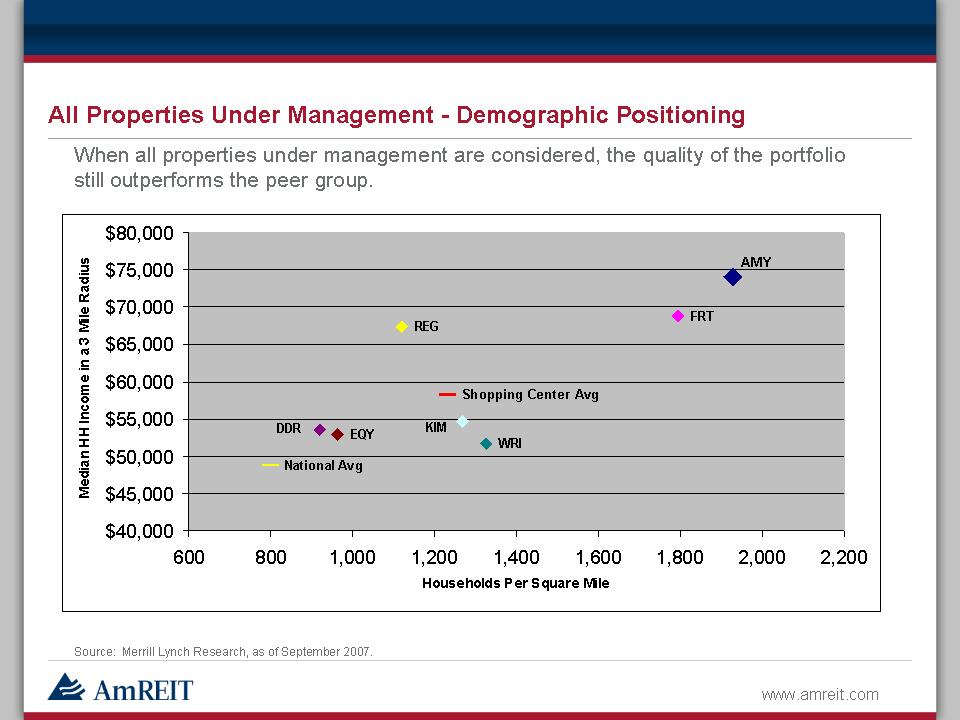

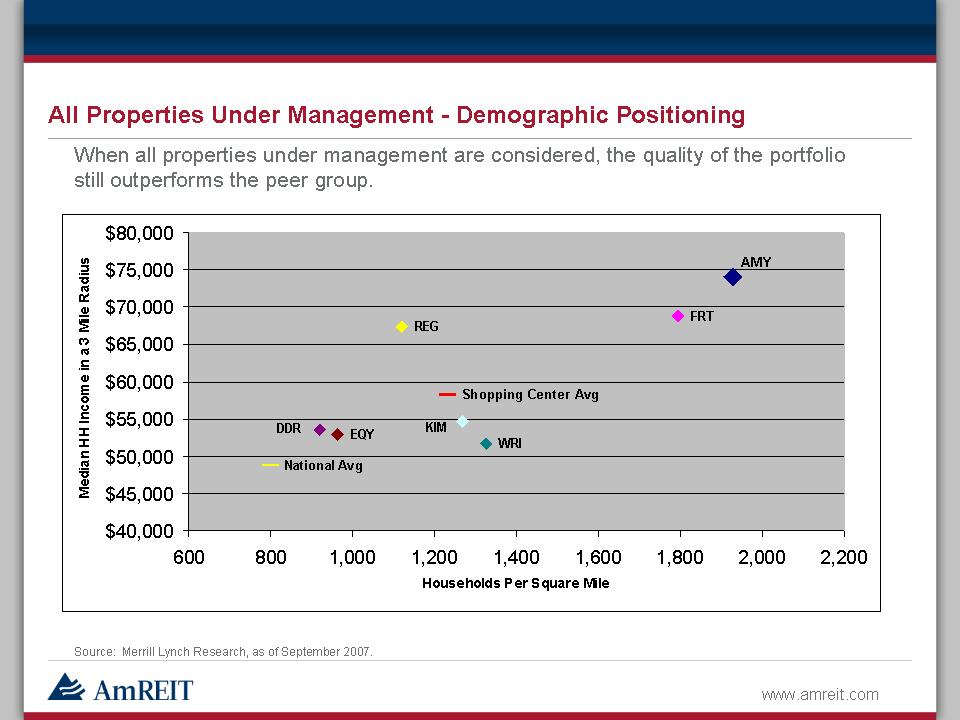

10 All Properties Under Management - Demographic Positioning Source: Merrill Lynch Research, as of September 2007. When all properties under management are considered, the quality of the portfolio still outperforms the peer group.

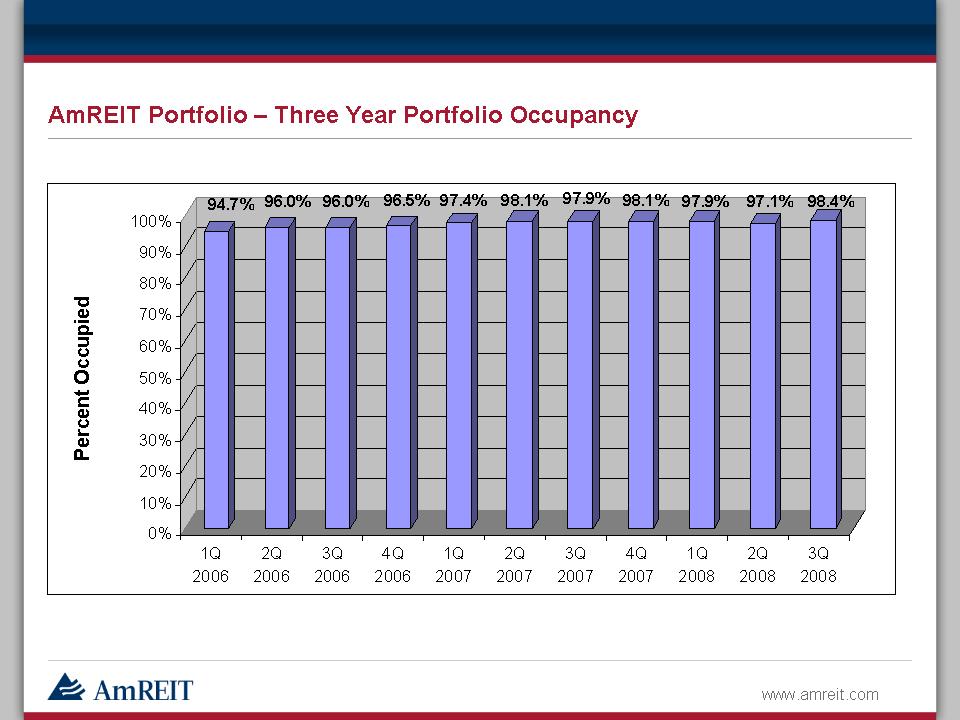

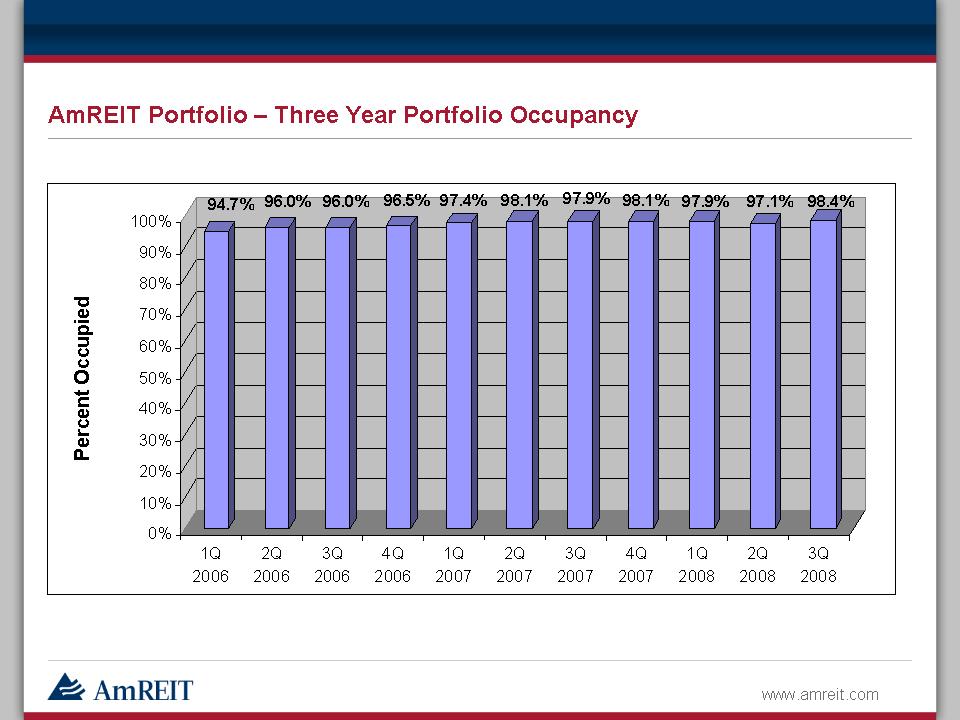

11 AmREIT Portfolio – Three Year Portfolio Occupancy

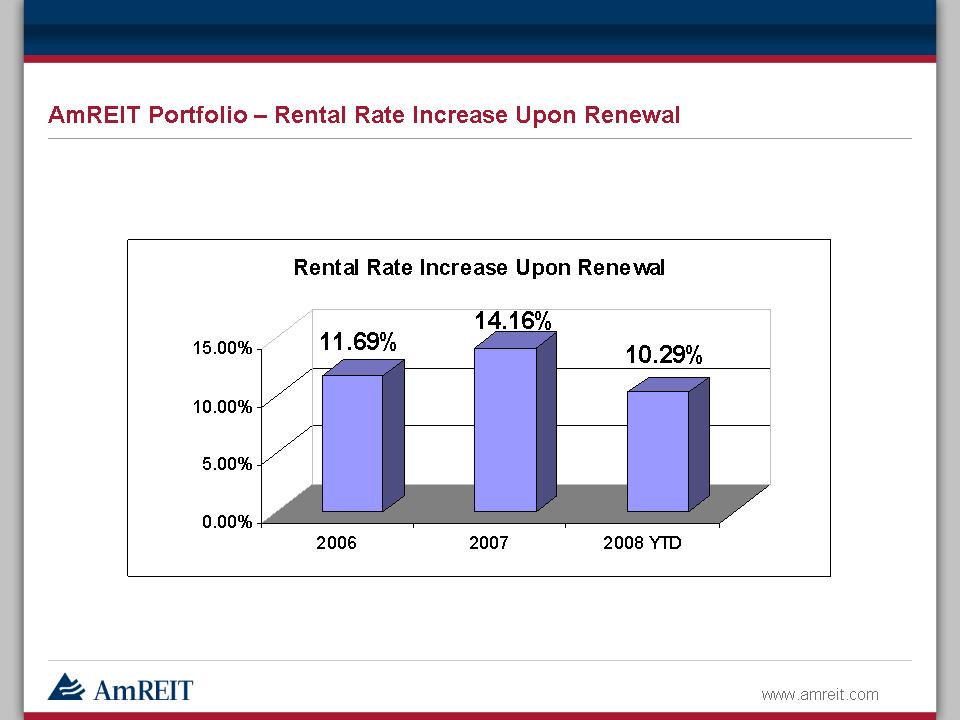

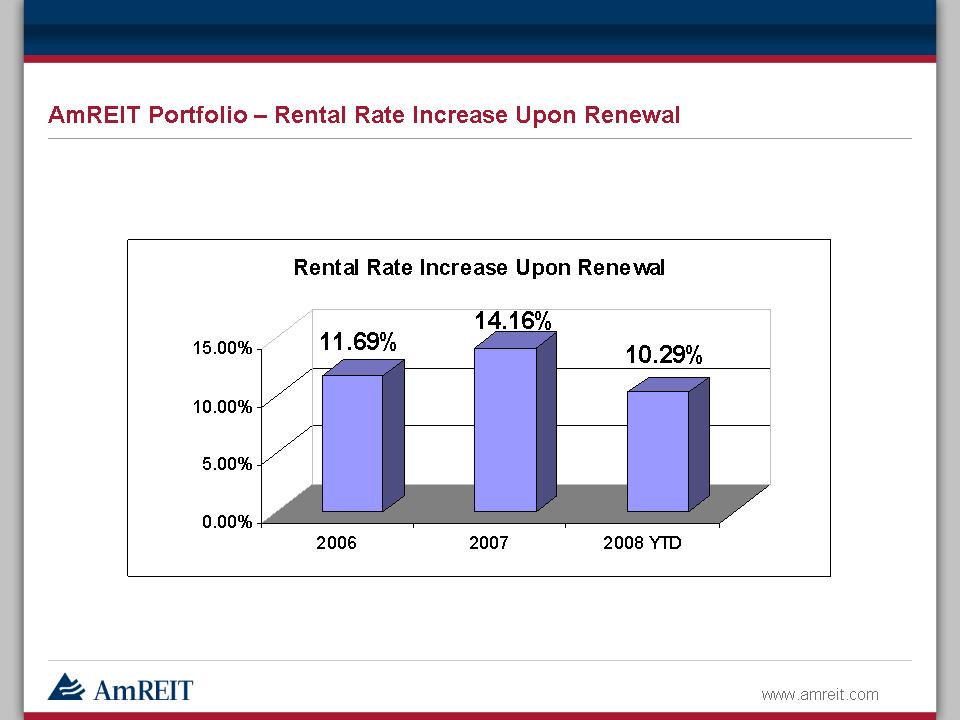

12 AmREIT Portfolio – Rental Rate Increase Upon Renewal

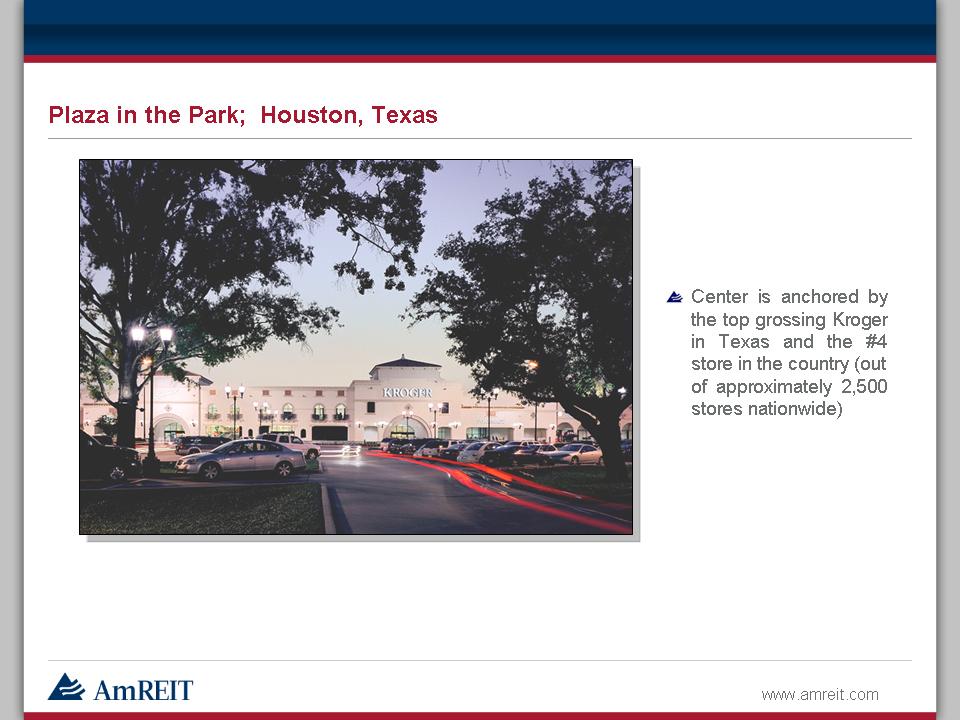

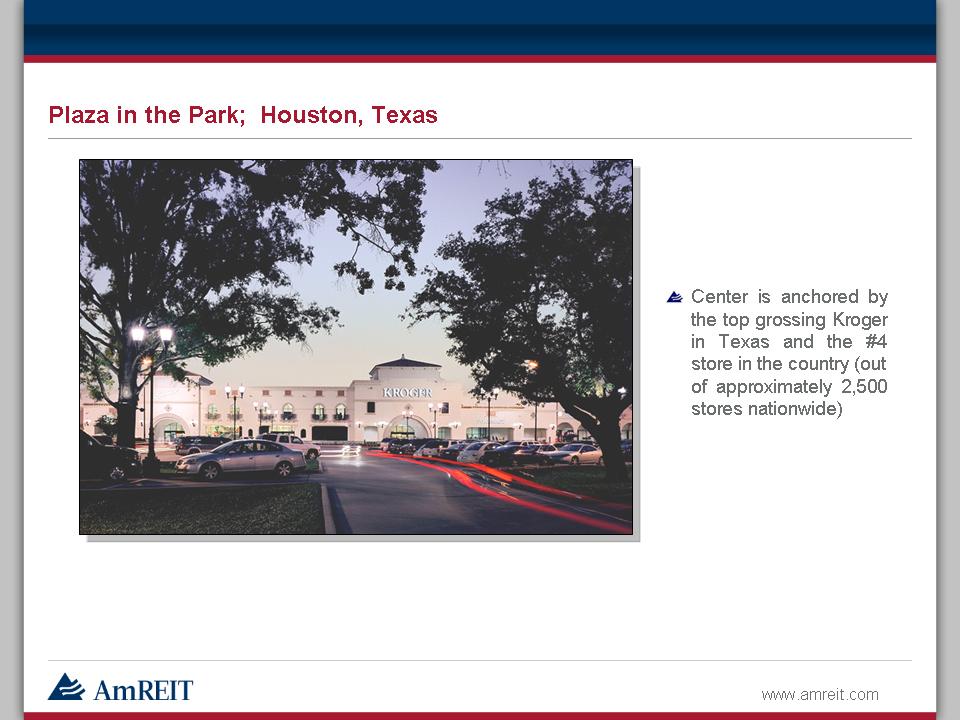

13 Plaza in the Park; Houston, Texas Center is anchored by the top grossing Kroger in Texas and the #4 store in the country (out of approximately 2,500 stores nationwide)

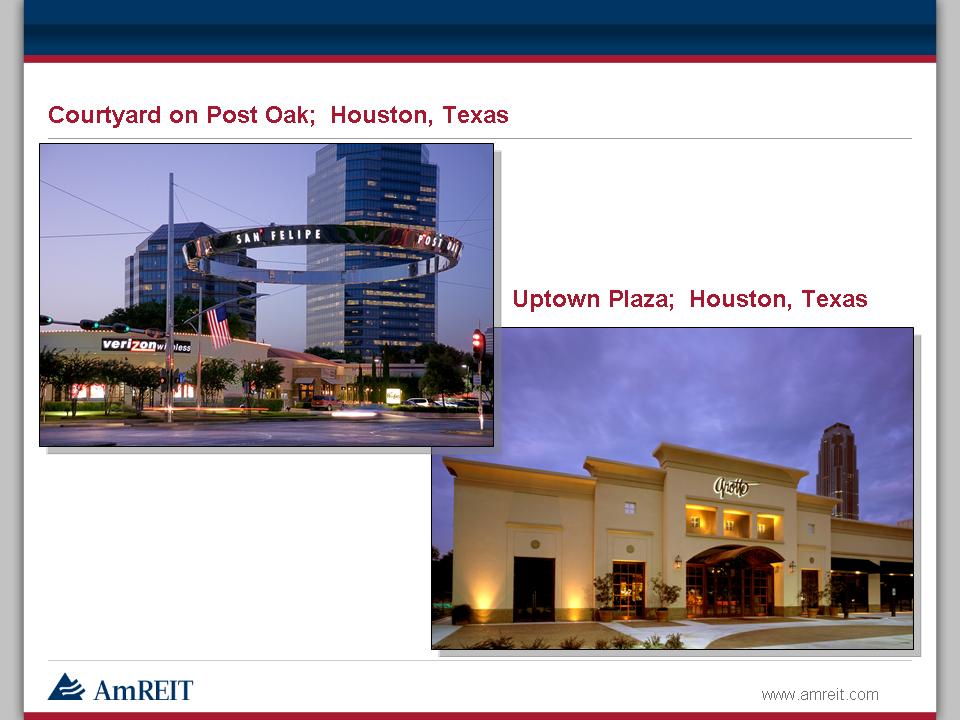

14 Courtyard on Post Oak; Houston, Texas Uptown Plaza; Houston, Texas

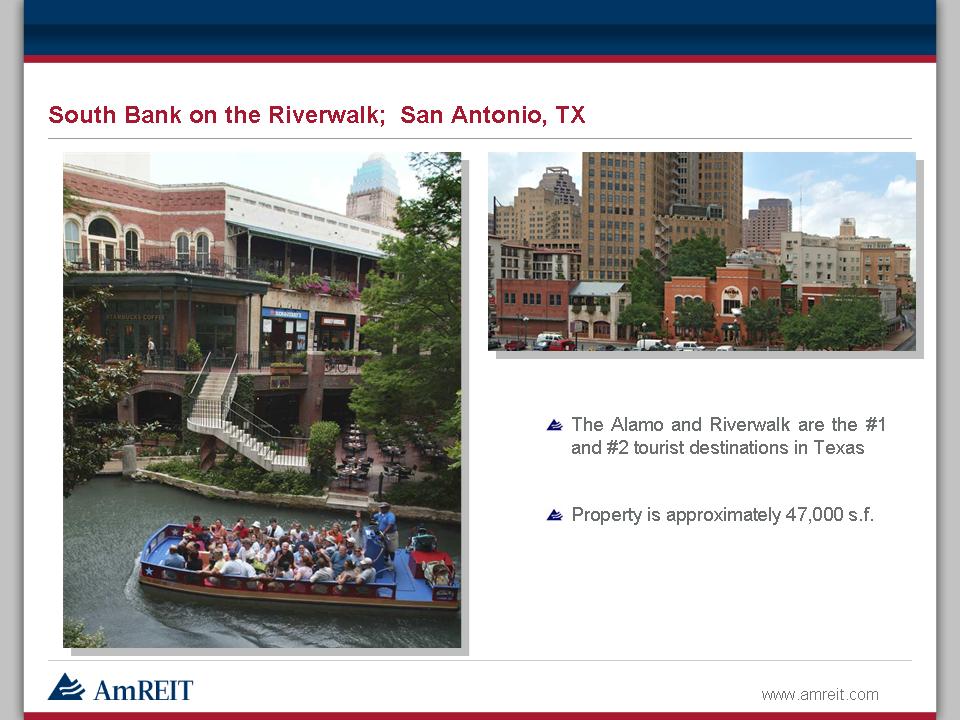

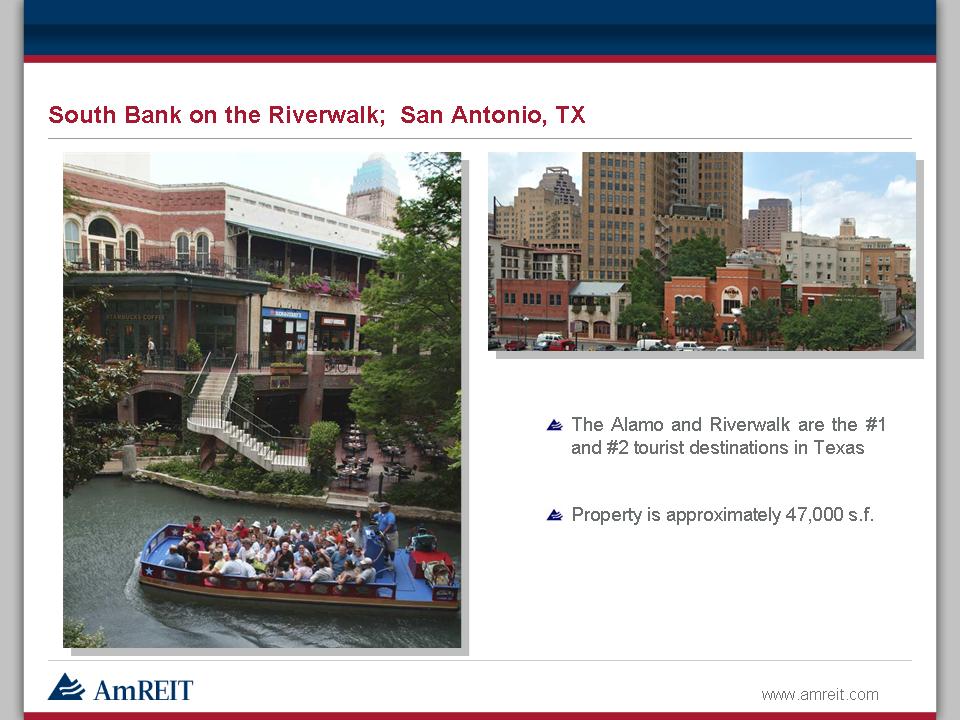

15 South Bank on the Riverwalk; San Antonio, TX The Alamo and Riverwalk are the #1 and #2 tourist destinations in Texas Property is approximately 47,000 s.f.

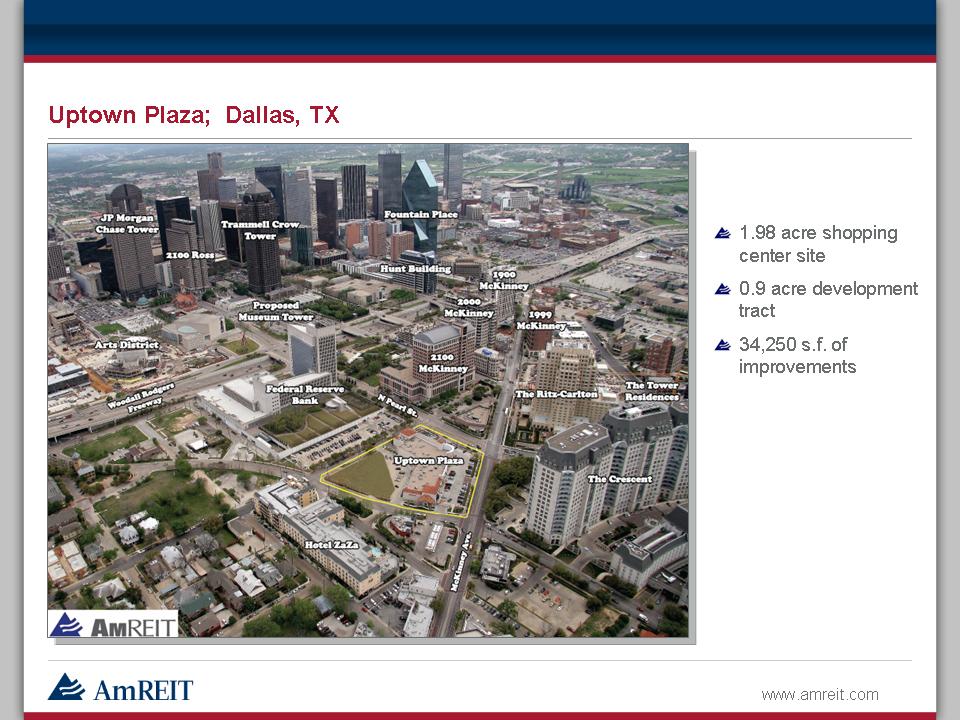

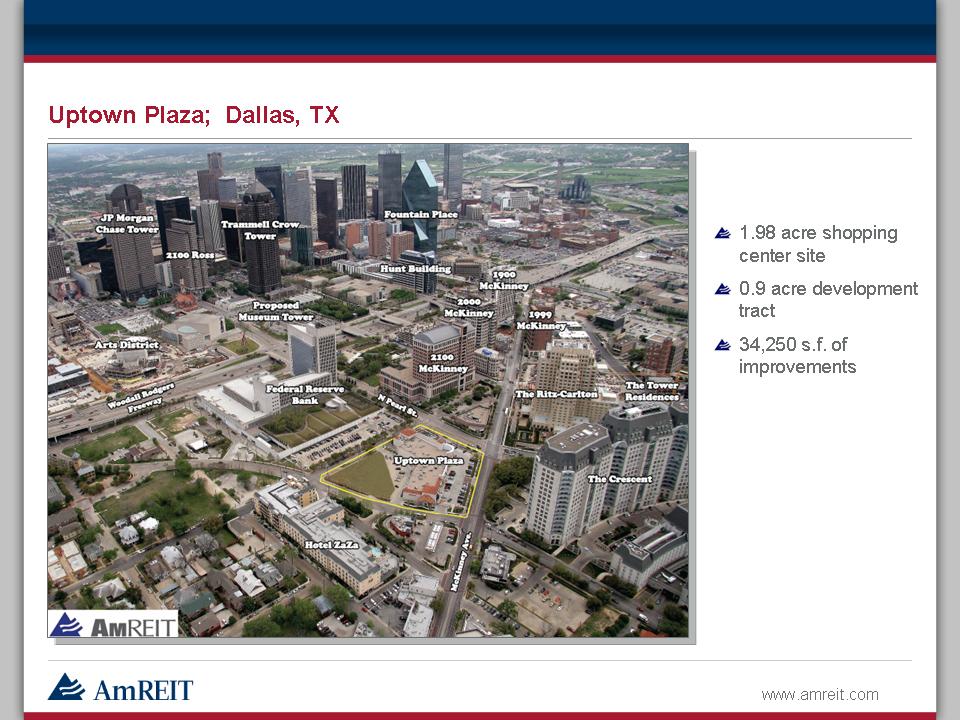

16 Uptown Plaza; Dallas, TX 1.98 acre shopping center site 0.9 acre development tract 34,250 s.f. of improvements

17 Uptown Park; Houston, TX – Future Development Potential Uptown Park Houston TX - June 2006 Urban Context Conceptual Rendering