SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement x Definitive Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

¨ Definitive Additional Materials | | |

|

¨ Soliciting Material under Rule 14a-12 | | |

TFC ENTERPRISES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box);

| | | $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)1 and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously by written preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form Schedule or Registration Statement No.: |

TFC ENTERPRISES, INC.

Corporate Executive Offices

October 17, 2002

Dear Shareholder:

You are cordially invited to attend the 2002 Annual Meeting of Shareholders of TFC Enterprises, Inc. that will be held at Williams Mullen, One Columbus Center, Suite 400, Virginia Beach, Virginia, 23462, at 9:00 a.m. Eastern Time, on Tuesday, November 19, 2002.

Enclosed are a Notice of the Annual Meeting, a Proxy Card, and a Proxy Statement containing information about the matters to be acted upon at the meeting. Directors and Officers of the Company as well as a representative of McGladrey & Pullen will be present at the Annual Meeting to respond to any questions our shareholders may have.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. Accordingly, we urge you to sign and date the enclosed Proxy Card and promptly return it to us in the enclosed, self-addressed, postage-paid envelope, even if you are planning to attend the meeting. If you attend the meeting, you may vote in person, even if you have previously returned a Proxy Card.

We look forward to the 2002 Annual Meeting of Shareholders, and we hope you will attend the meeting or be represented by proxy.

| Sincerely, |

|

/s/ ROBERT S. RALEY, JR.

|

Robert S. Raley, Jr. Chairman of the Board and Chief Executive Officer |

TFC ENTERPRISES, INC.

5425 Robin Hood Road

Norfolk, Virginia 23513

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD

TUESDAY, NOVEMBER 19, 2002

TO THE SHAREHOLDERS:

NOTICE IS HEREBY GIVEN THAT the Annual Meeting of Shareholders of TFC Enterprises, Inc. will be held at Williams Mullen, One Columbus Center, Suite 400, Virginia Beach, Virginia 23462, at 9:00 a.m. Eastern Time, on Tuesday, November 19, 2002, for the following purposes:

1. To elect three (3) directors to hold office for a term of three years and one (1) director to hold office for a term of two years and until their respective successors are elected and qualified;

2. To ratify the appointment of McGladrey & Pullen LLP as independent auditors for 2002; and

3. To act upon such other matters as may properly come before the meeting or any adjournment thereof.

Information concerning the matters to be acted upon at the meeting is set forth in the accompanying Proxy Statement. The Board of Directors has established the close of business on October 14, 2002 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof.

| By Order of the Board of Directors |

|

/s/ ROBERT S. RALEY, JR.

|

Robert S. Raley, Jr. Chairman of the Board and Chief Executive Officer |

Norfolk, Virginia

October 17, 2002

PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY VOTE EITHER IN PERSON OR THROUGH YOUR PROXY.

PROXY STATEMENT

This Proxy Statement and the enclosed proxy card (“Proxy”) are furnished in connection with the solicitation of proxies on behalf of the Board of Directors of TFC Enterprises, Inc. (the “Company”) to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held at Williams Mullen, One Columbus Center, Suite 400, Virginia Beach, Virginia 23462, at 9:00 a.m. Eastern Time, on Tuesday, November 19, 2002, and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting.

Only shareholders of record at the close of business on October 14, 2002, the record date for the Annual Meeting (the “Record Date”), are entitled to notice of, and to vote at, the Annual Meeting. This Proxy Statement and the enclosed Proxy are being mailed on or about October 17, 2002 to all stockholders entitled to vote at the Annual Meeting.

Revocability of Proxy

Any shareholder who executes a proxy has the power to revoke it at any time by written notice to the Secretary of the Company, by executing a proxy dated as of a later date or by voting in person at the Annual Meeting. Execution of the enclosed Proxy will not affect a shareholder’s right to attend the Annual Meeting and vote in person. If your Proxy is properly signed, received by the Company and not revoked by you, the shares to which it pertains will be voted at the Annual Meeting in accordance with your instructions. If a shareholder does not return a signed Proxy, his or her shares cannot be voted by proxy by the Board of Directors.

Persons Making the Solicitation

The cost of soliciting Proxies will be borne by the Company. The Company has retained American Stock Transfer & Trust Company to assist in the solicitation of proxies from brokers and nominees and in the counting of proxies. The Company pays American Stock Transfer & Trust Company $500 per month plus out-of-pocket expenses for this assistance as well as for the transfer agent services it provides to the Company. In addition to solicitation by mail, the Company will request banks, brokers and other custodians, nominees and fiduciaries to send proxy materials to the beneficial owners and to secure their voting instructions if necessary. The Company, upon request, will reimburse them for their expenses in so doing. Officers of the Company may solicit Proxies personally, by telephone or by telegram from some shareholders if Proxies are not received promptly, for which no additional compensation will be paid.

Voting Shares and Vote Required

On the Record Date, the Company had 11,541,033 shares of Common Stock outstanding. Each share of Common Stock is entitled to one vote on each matter presented at the Annual Meeting. A majority of the shares entitled to vote, represented in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

Directors are elected by a plurality of shares of Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting, meaning that the four (4) nominees receiving the greatest number of votes will be elected. The affirmative vote of the holders of a majority of the Common Stock present at the annual meeting, in person or by proxy, and entitled to vote, is required to ratify the appointment of the Company’s independent auditors and approve any other matter duly brought to a vote at the annual meeting. Under the laws of Delaware, the Company’s state of incorporation, “shares present in person or represented by proxy and entitled to vote” are determinative of the outcome of the matter subject to vote. Abstentions will, but broker non-votes will not, be considered “shares present in person or represented by proxy” based on the Company’s understanding of state law requirements and the Company’s Certificate of Incorporation and Bylaws.

All shareholder meeting proxies, ballots and tabulations that identify individual shareholders are kept confidential, and no such document shall be available for examination, nor shall the identity or the vote of any

1

shareholder be disclosed except as may be necessary to meet legal requirements and the laws of Delaware. Votes will be counted and certified by the Company’s general counsel who will act as the inspector of elections.

Unless specified otherwise, the Proxy will be voted as follows:

1. FOR the election of the three (3) nominees to serve as directors of the Company for a three-year term and and one (1) nominee for a two-year term and until their respective successors are duly elected and qualified;

2. FOR the ratification of the appointment of McGladrey & Pullen LLP as independent auditors for 2002.

3. In the discretion of the Proxy holders, the Proxies will also be voted for or against such other matters as may properly come before the Annual Meeting. Management is not aware of any other matters to be presented for action at the Annual Meeting. If any such matter requiring a vote of shareholders should properly come before the Annual Meeting, unless otherwise instructed, it is the intention of the persons named in the Proxy to vote such Proxy in accordance with their best judgment.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth information as of October 14, 2002 relating to the beneficial ownership of the Company’s Common Stock by (i) each director nominee and each of the Company’s directors and named executive officers, (ii) each person (or group of affiliated persons) who is known by the Company to own beneficially more than 5% of the Common Stock, and (iii) all of the Company’s directors and executive officers as a group.

Name and Address of Beneficial Owner(1)

| | Amount of Beneficial Ownership

| | | Percent of Class

| |

| Robert S. Raley, Jr. | | 1,436,359 | (2) | | 12.23 | % |

| Walter S. Boone, Jr. | | 409,224 | (3)(6) | | 3.54 | % |

| Douglas E. Bywater | | 401,409 | (4)(6) | | 3.47 | % |

| Andrew M. Ockershausen | | 163,000 | (6) | | 1.41 | % |

| Phillip R. Smiley | | 48,200 | (5)(6) | | * | |

| Linwood R. Watson | | 19,000 | (6) | | * | |

| Ronald G. Tray | | 174,276 | (7) | | 1.49 | % |

| Rick S. Lieberman | | 42,078 | (8) | | * | |

| Delma H. Ambrose | | 38,522 | (9) | | * | |

| General Electric Capital Corporation | | 1,135,280 | (10) | | 9.84 | % |

| New Generation Advisers, Inc. | | 770,900 | (11) | | 6.68 | % |

| Grand Slam Capital Partners, LLC | | 650,000 | (12) | | 5.63 | % |

| All directors and executive Officers as a group (11 persons) | | 2,867,551 | | | 23.75 | % |

| * | | Less than 1% beneficial ownership. |

| (1) | | All directors and executive officers receive mail at the Company’s corporate executive offices at 5425 Robin Hood Road, Suite 101B, Norfolk, Virginia 23513. |

2

| (2) | | Includes 29,254 shares owned jointly by Mr. Raley and his wife, 10,100 shares owned solely by his wife and 200,000 shares which Mr. Raley has the right to acquire within 60 days through the exercise of stock options granted to Mr. Raley in January 1997 under the Company’s 1995 Long-Term Incentive Plan (“Incentive Plan”) in connection with his 1997 compensation package. See “Executive Compensation—Raley Employment Agreement.” |

| (3) | | Includes 203,112 shares owned by the Walter S. Boone, Jr. Living Trust and 193,112 shares owned by the Rose K. Boone Living Trust. |

| (4) | | Includes 387,224 shares owned jointly by Mr. Bywater and his wife and 1,185 shares owned jointly by Mr. Bywater and his children. |

| (5) | | Includes 35,200 shares owned jointly by Mr. Smiley and his wife. |

| (6) | | Includes 13,000 shares that each has the right to acquire within 60 days through the exercise of stock options granted under the Non-Employee Director Stock Option Plan. |

| (7) | | Includes 123,743 shares which Mr. Tray has the right to acquire within 60 days through the exercise of stock options granted under the Incentive Plan and 2,000 shares owned by his wife. |

| (8) | | Includes 37,600 shares that Mr. Lieberman has the right to acquire within 60 days through the exercise of stock options granted under the Incentive Plan. |

| (9) | | Includes 33,600 shares that Ms. Ambrose has the right to acquire within 60 days through the exercise of stock options granted under the Incentive Plan. |

| (10) | | Per a Schedule 13D dated April 4, 1997, consists of the right to acquire shares within 60 days pursuant to two warrants issued to General Electric Capital Corporation by the Company pursuant to a loan transaction in December 1996 and a subsequent amendment thereto in April 1997. |

| (11) | | Per a Schedule 13G dated March 13, 2002, New Generation Advisers, Inc, 225 Friend Street, Suite 801, Boston MA, 02114, an investment adviser, owned 6.68% of common stock at December 31, 2001. |

| (12) | | Per a Schedule 13D dated August 19, 2002, Grand Slam Capital Partners LP, One Bridge Plaza, Fort Lee NJ, 07024, an asset management company, owned 5.63% of common stock at August 19, 2002. |

PROPOSAL 1. ELECTION OF DIRECTORS

The Company’s Certificate of Incorporation provides for the Board of Directors to be divided into three classes, with each class serving a staggered three-year term. The directors for each class are elected at the Annual Meeting of Shareholders held in the year in which the term of such class expires. Directors serve for three years and until their successors are duly elected and qualify. The Company’s bylaws currently provide that the size of the Board is comprised of seven persons.

The terms of office for Walter S. Boone, Jr., Robert S. Raley, Jr., Phillip R. Smiley and Ronald G. Tray expire at the Annual Meeting on November 19, 2002. The Board of Directors recommends that the nominees, Messrs. Boone, Raley, Smiley and Tray, be re-elected and Proxies received will be voted for the election of these nominees unless marked to the contrary. A shareholder who desires to withhold voting of the Proxy for any one of the nominees may so indicate on the Proxy. Each nominee is currently a member of the Board of Directors, has consented to be named and has indicated his intent to serve if elected. If a nominee becomes unable to serve, an event that is not anticipated, the Proxy will be voted for a substitute nominee to be designated by the Board of Directors, or the number of directors will be reduced.

3

The following information relates to the nominees and the directors whose terms of office will continue after the Annual Meeting. There are no family relationships among any of the nominees or directors nor among any of the nominees or directors and any officer, nor is there any arrangement or understanding between any nominee or director and any other person pursuant to which the nominee or director was selected.

Nominee for Term Expiring in 2004

Ronald G. Tray, 60, joined TFC as a Vice President and director for Management Information Systems in 1989. Mr. Tray was appointed Chief Operating Officer and Director of TFC in 1996 and then appointed President in 2000. Mr. Tray was appointed Vice President of the Company in 1996, appointed President and Director in 2001 and Chief Financial Officer in April 2001. Prior to joining TFC, Mr. Tray was employed by MTech Corporation, a data processing service bureau for banks, located in Fairfax, Virginia, for approximately 20 years. He served as President of MTech’s Mid-Atlantic Division for the last 2 1/2 years.

Nominees for Terms Expiring in 2005

Walter S. Boone, Jr., 75, was director of the Company from 1984 through 1988 and has been a director since 1990. Mr. Boone has been President of Virginia General Investment, Inc., a private investment firm, since 1978 and is a director of Herald Newspapers, Inc. He was President of Scope Inc., Reston, Virginia, a director of First Virginia Bank and a director of Arlington Mortgage Company. Mr. Boone is a member of the Audit and Executive Committees.

Robert S. Raley, Jr., 64, founded The Finance Company, Inc. (“TFC”) in 1977 and has served as Chairman of the Board from that time until April 1990 and again from May 1990 to the present. Additionally, he served as Chief Executive Officer from 1977 to April 1990, from May 1990 to December 1992 and from August 1996 to the present. Mr. Raley has also served as Chairman of the Board of the Company since inception in 1984 until April 1990 and again from May 1990 to the present and as its Chief Executive Officer from 1984 until April 1990 and again from May 1990 through 1992 and from August 1996 to the present. Mr. Raley has served as Chairman of the Board and Executive Vice President of First Community Finance, Inc. (“FCF”) since inception in 1995. Mr. Raley initially entered the consumer finance industry in 1959. Mr. Raley is a member of the Executive Committee.

Phillip R. Smiley, 63, is retired from Lockheed Martin, where he served as a Field Services Regional Manager, a position for which Mr. Smiley was responsible for computer hardware installation, documentation and maintenance. Mr. Smiley had been employed by Lockheed Martin, and its predecessors, UNISYS and Sperry Corp. in various positions for 25 years. Mr. Smiley has been director of the Company since 1994. Mr. Smiley is a member of the Audit Committee.

The Board of Directors recommends that the shareholders voteFOR the nominees set forth above.

Directors Whose Terms Expire in 2003

Douglas E. Bywater, 58, has been director of the Company since 1990. Mr. Bywater is a partner in the law firm of Tate & Bywater, Ltd., with whom he has practiced law since 1972. He was also director and General Counsel for the Bank of Vienna. Mr. Bywater is a member of the Executive and Compensation Committees.

Linwood R. Watson, 65, has been a director of the Company since 1993. Mr. Watson has been associated with Thompson, Greenspon & Co., P.C. certified public accountants and management consultants, of Fairfax, Virginia since 1979. Mr. Watson, a certified public accountant since 1965, has been engaged in public accounting since 1974. Mr. Watson is a member of the Audit and Compensation Committees.

Director Whose Term Expires in 2004

Andrew M. Ockershausen, 72, has been a director of the Company since 1990. Mr. Ockershausen is currently the Director of Business Development for the cable television regional sports network Comcast SportsNet,

4

Washington, D.C. He is a director of the Police Boys/Girls Club and Hero’s Inc., and a past Chairman of the National Association of Broadcasters. From 1987 to 1993, Mr. Ockershausen was Vice President and General Manager of WBSO television in Rockville, Maryland. Mr. Ockershausen is a member of the Compensation Committee.

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires directors, officers and persons who beneficially own more than 10% of a registered class of stock of the Company to file initial reports of ownership (Forms 3) and reports of changes in beneficial ownership (Forms 4 and 5) with the Securities and Exchange Commission (the “Commission”) and the NASDAQ Stock Market. Such persons are also required under the rules and regulations promulgated by the Commission to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely upon a review of the copies of such reports furnished to the Company and in written representations that no other reports were required, the Company believes that applicable Section 16(a) filing requirements were satisfied for transactions that occurred.

Pursuant to General Instruction G(3) of Form 10-K, certain information concerning the Company’s executive officers is set forth under the caption entitled “Executive Officers of the Company” in Part I, Item 1, of the Company’s Form 10-K/A for the fiscal year ended December 31, 2001 which was filed with the Commission.

Meetings and Committees of the Board of Directors

Meetings

The business of the Company is managed under the direction of the Board of Directors. The Board of Directors meets on a regularly scheduled basis during the year to review significant developments affecting the Company and to act on matters requiring approval by the Board of Directors. It also holds special meetings when an important matter requires action by the Board of Directors between scheduled meetings. The Board of Directors held nine meetings during 2001. In accordance with the current Rules of the NASDAQ Stock Market, Messrs. Boone, Bywater, Ockershausen, Smiley and Watson are independent directors. During 2001, each member of the Board of Directors participated in at least 75% of all meetings of the Board of Directors and at least 75% of all meetings of the applicable committees during the period for which he was a director.

Committees

The Board of Directors has established Executive, Audit, and Compensation Committees. There is no nominating committee. The members of these committees are noted in the director biographies set forth above. The Executive Committee is delegated the power, with certain exceptions, of the Board of Directors to act in place of the full Board during all periods between regular meetings of the Board. The Executive Committee did not meet during 2001. The Audit Committee is empowered by the Board of Directors to, among other things, recommend the firm to be employed by the Company as its independent auditor and to consult with such auditor regarding audits and the adequacy of internal accounting controls. The Audit Committee held four meetings in 2001. The Compensation Committee makes recommendations to the Board of Directors as to, among other things, the compensation of the Chief Executive Officer and designated other members of senior management, as well as new compensation and stock plans. The Compensation Committee met two times in 2001.

How do Shareholders Recommend Directors?

The Company will consider director-nominees recommended by shareholders, although it has not actively solicited recommendations from shareholders for nominees nor has the Company established any procedure for this purpose for the Annual Meeting other than as set forth in the bylaws of the Company. Section 3.03 of the Company’s bylaws provides that shareholders who wish to nominate directors must send the Company a written notice (the “Nomination Notice”) containing the following information: as to each individual nominated, (i) the name, date of birth, business address, and residence address of such individual, (ii) the business experience during the past five years of such nominee, including his or her principal occupations and employment during such period, the name and principal business of any corporation or other organization for which such occupations and

5

employment were carried on, and such other information as to the nature of his or her responsibilities and level of professional competence as may be sufficient to permit assessment of his or her prior business experience, (iii) whether the nominee is or has ever been at any time a director, officer, or owner of 5% or more of any class of capital stock, partnership interests, or other equity interest of any corporation, partnership, or other entity, (iv) any directorships held by such nominee in any company with a class of securities registered pursuant to Section 12 of the Exchange Act, or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940 and (v) whether, in the last five years, such nominee has been subject to any judgments, orders, findings, or decrees which may be material to an evaluation of the ability or integrity of the nominee. In addition, the person submitting the Nomination Notice must provide certain information regarding his beneficial ownership of the Common Stock of the Company. The nominee must consent to being named in a proxy statement as a nominee and to serve as a director if elected. The shareholder must deliver the Nomination Notice to the Secretary of the Company at the Company’s principal executive office not later than 120 days in advance of the anniversary date of the Company’s proxy statement for the previous year’s annual meeting or, in the case of special meetings, at the close of business on the seventh day following the first date on which notice of the meeting is first given to shareholders.

Directors’ Compensation

Each director of the Company who is not also an executive officer of the Company receives (i) a $5,000 annual retainer, (ii) a $1,000 fee for personal attendance at each Board Meeting, (iii) a $500 fee for attendance on a telephonic Board Meeting and (iv) a $500 fee is paid to each director who personally attends Committee Meetings held on days on which there is no Board meeting. Each Audit Committee member receives (i) an additional $2,000 annual retainer with the Chairman receiving a $4,000 annual retainer, and (ii) a $500 fee for each Committee Meeting regardless of when held. Directors who are also employees of the Company receive no additional compensation for serving as directors. The Company reimburses all of its directors for travel and out of pocket expenses in connection with their attendance at meetings of the Board of Directors.

In 2000, the Board of Directors of the Company adopted the Non-Employee Director Stock Option Plan (“Director Plan”), reserving up to 200,000 shares of the Company’s Common Stock for issuance under the Director Plan, which was approved by the shareholders at the 2000 Annual Meeting. Pursuant to the Director Plan, non-employee directors of the Company are eligible to receive non-qualified stock options pursuant to a formula that grants existing non-employee directors and any new non-employee directors an initial grant to purchase 10,000 shares and existing directors 3,000 additional shares on an annual basis on the date of each annual meeting of shareholders at which directors are elected, provided that such director is elected at such annual meeting, commencing with the 2001 annual meeting. All options granted are immediately exercisable. The exercise price of all options granted under the Director’s Plan is the fair market value of the Common Stock at the time of the grant. All options granted under the Director’s Plan expire on the first to occur of: (i) the date the option holder resigns from the Board; (ii) 90 days after an option holder fails to be elected at a meeting of shareholders called for the purpose of electing Board members; (iii) one year following the date the option holder ceases to be a member of the Board because of death or disability; and (iv) five years from the date of grant. An option holder may not sell or dispose of any shares of Common Stock acquired pursuant to the exercise of an option under the plan until at least six months have elapsed from the date of grant. As of December 31, 2001, options to purchase up to 65,000 shares of Common Stock were outstanding under the Director Plan at prices ranging from $1.74-$2.13 per share.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires directors, officers and persons who beneficially own more than 10% of a registered class of stock of the Company to file initial reports of ownership (Forms 3) and reports of changes in beneficial ownership (Forms 4 and 5) with the Commission and the NASDAQ Stock Market. Such persons are also required under the rules and regulations promulgated by the Commission to furnish the Company with copies of all Section 16(a) forms they file.

6

To the Company’s knowledge, based solely upon a review of the copies of such reports furnished to the Company and in written representations that no other reports were required, the Company believes that applicable Section 16(a) filing requirements were satisfied for transactions that occurred.

EXECUTIVE COMPENSATION

Summary Executive Compensation Table

The following table sets forth certain information regarding cash and other compensation earned during the years 2001, 2000, and 1999 by Robert S. Raley, Jr., the Company’s current Chief Executive Officer and the Company’s four most highly compensated other executive officers during 2001, 2000 and 1999 (the “Named Executive Officers”). In addition, all named executives are reimbursed for travel and lodging expenses. The reimbursements are not included in the compensation table.

| | | Annual Compensation

| | Long Term Compensation

| | | |

Name and Principal Position

| | Year

| | Salary

| | Bonus(1)

| | Other Annual Compensation(2)

| | Securities Underlying Options (#s)(3)

| | All Other Compensation

| |

| Robert S. Raley, Jr., | | 2001 | | $ | 300,000 | | $ | 328,554 | | — | | — | | $ | 2,815 | |

| Chairman of the Board, and | | 2000 | | | 300,000 | | | 300,000 | | — | | — | | | 274,407 | (4) |

| Chief Executive Officer of the Company | | 1999 | | | 300,000 | | | 409,423 | | — | | — | | | 139,903 | (4) |

|

| Ronald G. Tray, President, | | 2001 | | $ | 205,437 | | $ | 36,141 | | — | | — | | $ | 3,605 | |

| Chief Financial Officer and | | 2000 | | | 191,771 | | | 34,235 | | — | | 100,000 | | | 3,877 | |

| Assistant Secretary of the Company | | 1999 | | | 175,000 | | | 45,037 | | — | | — | | | 3,653 | |

|

| G. Kent Brooks, President, | | 2001 | | $ | 125,419 | | $ | 18,382 | | — | | — | | $ | 3,161 | |

| Chief Executive Officer and | | 2000 | | | 113,344 | | | 9,572 | | — | | 50,000 | | | 4,324 | |

| Director of FCF | | 1999 | | | 104,136 | | | — | | — | | — | | | 8,175 | |

|

| Rick S. Lieberman, | | 2001 | | $ | 121,349 | | $ | 27,379 | | — | | — | | $ | 3,674 | |

| Executive Vice President And | | 2000 | | | 115,569 | | | 25,936 | | — | | 50,000 | | | 4,324 | |

| Chief Lending Officer of TFC | | 1999 | | | 110,031 | | | 34,119 | | — | | — | | | 8,175 | |

|

| Delma H. Ambrose, | | 2001 | | $ | 101,648 | | $ | 27,379 | | — | | — | | $ | 3,684 | |

| Senior Vice President and | | 2000 | | | 96,633 | | | 29,684 | | — | | 50,000 | | | 4,442 | |

| Chief Servicing Officer of TFC | | 1999 | | | 88,025 | | | 3,749 | | — | | — | | | 3,823 | |

| (1) | | Bonuses reported in the table reflect the amount earned by the Named Executive Officer for each year shown. Payment of such bonuses occurred in the year following the year in which such bonuses were earned. |

| (2) | | The dollar value of perquisites and other personal benefits received by each of the Named Executive Officers did not exceed the lesser of either $50,000 or 10% of the total amount of annual salary and bonus reported for any named individual. |

| (3) | | Options granted pursuant to the Company’s 1995 Long-Term Incentive Plan (“Incentive Plan”). |

| (4) | | Includes $269,982 and $135,000 in 2000 and 1999, respectively, related to the revision to the Raley Note. See “Raley Employment Agreement.” |

7

Option Grants in Last Fiscal Year

No options were granted to the Named Executive Officers during the 2001 fiscal year.

Fiscal Year End Options Values

The table below sets forth information concerning the value of stock options held by the Named Executive Officers as of December 31, 2001, all of which were granted pursuant to the Incentive Plan.

| | | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#)

| | Value of Unexercised In-The-Money Options at Fiscal Year-End $(1)

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Robert S. Raley | | 200,000 | | — | | | — | | — |

| Ronald G. Tray | | 92,805 | | 101,874 | | $ | 5,200 | | — |

| Rick S. Lieberman | | 23,200 | | 48,800 | | | — | | — |

| Delma H. Ambrose | | 20,200 | | 46,800 | | | — | | — |

| (1) | | The value of in-the-money options at fiscal year end was calculated by determining the difference between the average of the high and low sales prices of $1.38 per share of the Company’s Common Stock on the Nasdaq Stock Market on December 31 the last trading day of the year, and the exercise price of the options. |

Raley | | Employment Agreement |

Basic Terms of Employment Agreement

TFC and Robert S. Raley, Jr. entered into an employment agreement (the “Raley Employment Agreement”), commencing January 1, 1993 and, as amended, expiring December 31, 2002, unless terminated earlier in accordance with its provisions. Under the terms of the Raley Employment Agreement, TFC agreed to pay Mr. Raley (i) a base salary of $50,000 per annum and (ii) a bonus, after deduction of Mr. Raley’s base salary payments, equal to 3% of the consolidated annual net pre-tax income of TFC. The computation of the consolidated annual net pre-tax income of TFC is made without deducting federal or state income taxes or executive bonuses paid by TFC to Mr. Raley or to any other employee. In addition, Mr. Raley is reimbursed for all reasonable business expenses and is furnished with two automobiles for his use, the reasonable expenses for the operation of which are paid by TFC. Further, TFC has agreed to provide Mr. Raley with all other employee benefits that he enjoyed on the date of such agreement or those benefits that TFC may approve for employees generally or for its senior executives.

Notwithstanding the terms of the Raley Employment Agreement, which remains in effect in its original form, the Board passed a resolution modifying the salary and bonus components of his compensation. Under the terms of this resolution Mr. Raley is to receive a base salary of $300,000 per year and a guaranteed bonus of $300,000 to be credited against the bonus payable to Mr. Raley in each year pursuant to the Raley Employment Agreement. In the event the terms of the Raley Employment Agreement result in a bonus in excess of $300,000, Mr. Raley will be paid such excess. However, should the bonus calculation under the Raley Employment Agreement result in a bonus of less than $300,000, then Mr. Raley will not be required to repay any of the $300,000 guaranteed bonus. The salary arrangement is not guaranteed under the Raley Employment Agreement.

In addition to termination upon the occurrence of Mr. Raley’s disability or death, TFC may terminate the Raley Employment Agreement prior to the expiration of its term in the event that: (i) Mr. Raley ceases to serve as the Chairman of TFC’s Board of Directors; (ii) all or substantially all of TFC’s assets are sold to a third party; (iii) more

8

than 50% of the then issued and outstanding stock of TFC or the Company is sold to, or exchanged for equity interests in, any person or entity, which sale or exchange would not constitute a “continuity of interest;” (iv) TFC is involved in a business combination in which it is not the surviving corporation; or (v) TFC is dissolved voluntarily or by operation of law. Further, the Raley Employment Agreement provides that TFC reserves the right to terminate such agreement, without notice for “cause,” as defined therein. The Raley Employment Agreement also includes a covenant not to compete, which continues for as long as Mr. Raley receives payments thereunder.

Bonus Repayment Obligation

Although the Company cannot make a final determination regarding the amount, if any, of the 3% bonus of net pre-tax income of TFC until the end of each year, in 1995 and prior years, TFC made estimated bonus payments to Mr. Raley and other executives throughout the year on a monthly basis. In 1995, these estimated bonus payments to Mr. Raley totaled $354,982. However, because TFC did not have any net pre-tax income in 1995, Mr. Raley was obligated to return to TFC all estimated bonus payments made in 1995. In addition, although Mr. Raley also received $50,000 in base salary during 1995, Mr. Raley elected to repay that amount as well. To fulfill this obligation, Mr. Raley delivered a Promissory Note to TFC dated as of January 1, 1996, in the principal amount of $404,982 (“Raley Note”) and an Excess Compensation Repayment Agreement also dated as of January 1, 1996 (“Raley Repayment Agreement”). Effective July 1999, the Board voted to revise the terms of the Raley Note whereas the balance of the note was reduced monthly on a pro rata basis from July 1999 through December 2000 at which time the obligation was satisfied.

Employment Agreements

The named executives, excluding Robert S. Raley, Jr., entered into a Change of Control agreement with TFC in July 2001. Each agreement terminates on the earlier of (i) the cessation of the employee’s employment with the Company for any reason, or (ii) the Company’s notice of termination of employment, irrespective of the effective date of the termination.

Compensation Committee Interlocks and Insider Participation

No member of the Company’s compensation committee was an officer or employee of the Company or any of its subsidiaries during 2001. During 2001, no executive officer of the Company served as a member of the compensation committee of another entity, nor did any executive officer of the Company serve as a director of another entity.

Compensation Committee Report Concerning 2001 Compensation of Certain Executive Officers

This report describes the Company’s officer compensation strategy, the components of the compensation program, and the manner in which the 2001 compensation determinations were made for the Company’s senior management team, including the Chief Executive Officer, Robert S. Raley, Jr.; TFC’s President and Chief Operating Officer, and Chief Financial Officer Ronald G. Tray; TFC’s Executive Vice President and Chief Lending Officer, Rick S. Lieberman; and TFC’s Senior Vice President and Chief Servicing Officer, Delma H. Ambrose(collectively referred to as the “Executive Officers”) whose 2001 compensation is disclosed in the Summary Compensation table.

In addition to the information set forth under “Executive Compensation,” the Company’s Compensation Committee (the “Compensation Committee”) is required to provide shareholders a report explaining the rationale and considerations that led to the fundamental executive compensation decisions affecting the Company’s Executive Officers. None of the members of the Compensation Committee are executive officers or employees of the Company.

9

Compensation Philosophy

The Company’s compensation packages are designed to attract, retain, motivate and reward qualified, dedicated executives, and to directly link compensation with (i) previous and anticipated performance and (ii) the Company’s profitability. Historically, the principal components of executive compensation have been (i) a base salary at a stated annual rate, together with certain other benefits as may be provided from time to time, and (ii) bonuses keyed to the net pre-tax earnings of TFC.

Unless the Board awards a specified bonus for a uniquely beneficial contribution to the Company, no bonuses will be paid to Mr. Tray, Mr. Lieberman, orMs. Ambrose, individually or collectively, (i) except as a percentage of TFC and its subsidiaries’ earnings before bonus and taxes for the accounting period on which the bonus is based, or (ii) if the payment of the bonus will have a material adverse affect the Company’s cash flow requirements. To emphasize the importance of the Company’s profitability, bonuses may be paid monthly on the basis of the Company’s performances during the preceding month, but are limited cumulatively and are subject to adjustment on the basis of the Company’s fiscal year performance as determined by independent auditors.

The Compensation Committee believes the Raley Employment Agreement is consistent with the objectives of its compensation packages. His leadership, previous and anticipated performance and the Company’s profitability in an extremely tough environment for sub-prime specialty lenders is viewed by the Compensation Committee as being extremely valuable to the Company’s shareholders.

1995 Long-Term Incentive Plan

In 1994, the Board of Directors adopted the 1995 Long-Term Incentive Plan (the “Incentive Plan”), which was approved by shareholders of the Company at the 1995 Annual Meeting. The purpose of the Incentive Plan is to support the business goals of the Company and to attract, retain, and motivate management officials of high caliber by providing incentives to associate more closely the interest of certain officers and key executives of the Company with the interests of the Company’s shareholders. Participation is limited to officers and other key employees of the Company who are in positions in which their decisions, actions and counsel significantly contribute to the success of the Company. Directors of the Company who are not otherwise officers or employees of the Company are not eligible for participation under the Incentive Plan. The Company has reserved 1,500,000 shares of the Company’s Common Stock for issuance of awards under the Incentive Plan. Awards under the Incentive Plan can be made in the form of nonqualified stock options, incentive stock options, or restricted stock, separately or in combination. The Incentive Plan is administered and interpreted by the Compensation Committee. The Compensation Committee has full and final authority to make and adopt rules and regulations for the administration of the Incentive Plan, to interpret the provisions of the Incentive Plan, to determine the employees to whom awards shall be made under the Incentive Plan, and to determine the type of award to be made and the amount, size, and terms of each such award. At December 31, 2001, there were 1,012,679 options outstanding at various option prices, vesting periods and exercise periods. See “Fiscal Year End Options Table” for options granted to the Named Executive Officers.

Employee Stock Purchase Plan

The Board adopted the Employee Stock Purchase Plan (the “Stock Purchase Plan”) on December 11, 1993, which provides for awards of Common Stock to employees, including eligible officers of the Company, TFC, and any future majority owned subsidiary. Awards under the Stock Purchase Plan are in the form of options to purchase Common Stock of the Company. The price at which shares of Common Stock are sold under the Stock Purchase Plan to employees is the lower of 85% of the fair market value of a share of Common Stock on the date of grant or 85% of the fair market value of Common Stock on the date of purchase of the shares. During 2001, approximately 15,000 options were exercised at prices ranging from $0.74 per share to $1.62 per share, of which 341 options were exercised by the Named Executive Officers. As of December 31, 2001, there were no outstanding unexercised options.

Awards granted pursuant to the Stock Purchase Plan are intended to increase the recipients motivation for an interest in the Company’s long-term success as measured by the value of the Company’s Common Stock. The Company has reserved 530,000 shares of the Company’s Common Stock for issuance of awards under the Stock Purchase Plan. The Stock Purchase Plan is administered and interpreted by the Compensation Committee. The

10

Compensation Committee has full and final authority to make and adopt rules and regulations for the administration of the Stock Purchase Plan, to interpret the provisions of the Stock Purchase Plan, to determine the employees to whom awards shall be made under the Stock Purchase Plan and to determine the type of award to be made and the amount, size and terms of each such award.

Directors’ Compensation

Each director of the Company who is not also an executive officer of the Company receives (i) a $5,000 annual retainer, (ii) a $1,000 fee for personal attendance at each Board Meeting, (iii) a $500 fee for attendance on a telephonic Board Meeting and (iv) a $500 fee is paid to each director who personally attends Committee Meetings held on days on which there is no Board meeting. Each Audit Committee member receives (i) an additional $2,000 annual retainer with the Chairman receiving a $4,000 annual retainer, and (ii) a $500 fee for each Committee Meeting regardless of when held. Directors who are also employees of the Company receive no additional compensation for serving as directors. The Company reimburses all of its directors for travel and out of pocket expenses in connection with their attendance at meetings of the Board of Directors.

In 2000, the Board of Directors of the Company adopted the Non-Employee Director Stock Option Plan (“Director Plan”), reserving up to 200,000 shares of the Company’s Common Stock for issuance under the Director Plan, which was approved by the shareholders at the 2000 Annual Meeting. Pursuant to the Director Plan, non-employee directors of the Company are eligible to receive non-qualified stock options pursuant to a formula that grants existing non-employee directors and any new non-employee directors an initial grant to purchase 10,000 shares and existing directors 3,000 additional shares on an annual basis on the date of each annual meeting of shareholders at which directors are elected, provided that such director is elected at such annual meeting, commencing with the 2001 annual meeting. All options granted are immediately exercisable. The exercise price of all options granted under the Director’s Plan is the fair market value of the Common Stock at the time of the grant. All options granted under the Director’s Plan expire on the first to occur of: (i) the date the option holder resigns from the Board; (ii) 90 days after an option holder fails to be elected at a meeting of shareholders called for the purpose of electing Board members; (iii) one year following the date the option holder ceases to be a member of the Board because of death or disability; and (iv) five years from the date of grant. An option holder may not sell or dispose of any shares of Common Stock acquired pursuant to the exercise of an option under the plan until at least six months have elapsed from the date of grant. As of December 31, 2001, options to purchase up to 65,000 shares of Common Stock were outstanding under the Director Plan.

Limitation on Deductibility of Certain Compensation for Federal Income Tax Purposes

Section 162(m) of the Internal Revenue Code (“162(m)”) precludes the Company from taking a deduction for compensation in excess of $1,000,000 for the Chief Executive Officer or any of its four other highest paid officers. Certain performance-based compensation, however, is specifically exempt from the deduction limit. In adopting the Incentive Plan, the Compensation Committee duly considered Section 162(m) and structured the Incentive Plan accordingly. The Compensation Committee believes that the Incentive Plan and the Employee Stock Purchase Plan will both qualify as performance-based compensation under the regulations issued under Section 162(m).

Douglas E. Bywater, Compensation Committee Chair

Andrew M. Ockershausen, Compensation Committee Member

Walter S. Boone, Jr., Compensation Committee Member

THE PRECEDING “COMPENSATION COMMITTEE REPORT CONCERNING THE 2001 COMPENSATION OF CERTAIN EXECUTIVE OFFICERS” SHALL NOT BE DEEMED TO BE SOLICITING MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, OR INCORPORATED BY REFERENCE IN ANY DOCUMENTS SO FILED.

11

Related Party Transactions

During 2000, 1999, and 1998, the Company issued$0.2 million, $1.3 million, and $0.7 million, respectively, of unsecured subordinated debt due three years from origination. During 2001, approximately $0.5 million renewed for an additional three years. The notes bear interest at 15% per year. These notes were offered for cash pursuant to a private placement to a limited number of prospective investors, including but not limited to, the Board of Directors, officers and certain existing shareholders of the Company. Notes outstanding under this private placement totaled $2.2 million at December 31, 2001.

During 2001 and 2000, the Company issued $0.3 million and$0.7 million, respectively of unsecured subordinated debt due six months from origination. The notes bear interest at 12% per year and automatically renew for same term unless notice given by investor. These notes were offered for cash pursuant to a private placement to a limited number of prospective investors, including but not limited to, the Board of Directors, officers and certain existing shareholders of the Company. Notes outstanding under this private placement totaled $0.9 million at December 31, 2001.

The following table recaps the Subordinated Notes held or controlled by the Company’s Officers and Directors:

Name

| | Relation with the Company

| | |

| Robert S. Raley, Jr. | | Chairman of the Board and Chief Executive Officer | | $ | 1,440,000 |

| Andrew M. Ockershausen | | Director | | | 100,000 |

| Linwood R. Watson | | Director | | | 100,000 |

| Phillip R. Smiley | | Director | | | 30,000 |

| Walter S. Boone, Jr. | | Director | | | 74,035 |

| Ronald G. Tray | | Director, President, Chief Financial Officer and Assistant Secretary of the Company | | | 100,000 |

| | | | |

|

|

| | | | | $ | 1,844,035 |

| | | | |

|

|

On December 20, 1996, TFC entered into an Amended and Restated Motor Vehicle Installment Contract Loan Security Agreement (the “GECC Loan Agreement”) with General Electric Capital Corporation (“GECC”), under which GECC agreed to amend and restate the agreement governing the previous credit arrangement between GECC and TFC. The GECC Loan Agreement provided for maximum borrowings by TFC from GECC of $150,000,000. As consideration for GECC extending credit under the GECC Loan Agreement, the Company and certain affiliates guaranteed TFC’s performance and payment under the GECC Loan Agreement in separate guarantees made by each and dated December 20, 1996. As further consideration for GECC entering into the GECC Loan Agreement, the Company issued to GECC a Warrant to Purchase Common Stock, dated December 20, 1996 (the “First Warrant”), whereby GECC was granted rights to purchase 567,640 shares of the Common Stock (or 4.79%) of the Company. In connection with the First Warrant, the Company entered into a Registration Rights Agreement with GECC dated December 20, 1996 (the “Registration Rights Agreement”), in order to provide GECC with certain registration rights with respect to the shares of Common Stock purchasable under the First Warrant.

In early 1997, the Company breached certain restrictive covenants under the GECC Loan Agreement, and negotiated a loan restructuring with GECC which, among other things, caused GECC to advance additional monies to TFC to pay certain amounts to another creditor of TFC (the “Loan Restructure”). The Loan Restructure was evidenced by an Amendment No. 1 to the GECC Loan Agreement dated April 4, 1997. As a condition to the Loan Restructure, GECC required that the Company grant GECC another warrant to purchase shares of Common Stock at an exercise price of $1.00 per share (the “Second Warrant”) under terms substantially similar to those in the First Warrant which, upon exercise together with the First Warrant, would give GECC beneficial ownership of the Company totaling 9.1% at that time. GECC also required that the First Warrant be amended to reduce the exercise price from $2.00 per share to $1.00 per share and to extend the expiration date thereof from December 31, 2000 to March 31, 2002 (the same expiration date under the Second Warrant). Furthermore, the Company amended and restated the Registration Rights Agreement to provide for registration rights with respect to the Common Stock issuable under both the First Warrant and the Second Warrant. As a part of the Restructure, the maximum amount

12

which could be borrowed by TFC under the Loan Agreement was reduced to $110 million. Although both warrants are immediately exercisable, as of the date of this Statement, neither the First Warrant nor the Second Warrant had been exercised by GECC. The expiration of the warrants was subsequently amended to 120 days after the termination of the agreement.

In December 2000, GECC announced that it would no longer participate in the business of financing automobiles or automobile finance companies and renewed the amended revolving line of credit through March 2001. In March 2001, The Finance Company signed an amendment with this lender that terminated January 1, 2002. The credit line available under the amendment declined from $130 million to $100 million at the closing of the securitization on April 2, 2001, declined to $75 million on August 1, 2001, and terminated January 1, 2002. On December 3, 2001 the credit line was reduced to $50 million and extended through April 1, 2002. In March 2002, the Company signed a new amendment with this lender that was to terminate on January 2, 2003. The credit line available under the amendment declined from $50 million to $40 million on July 1, 2002. In October 2002, the Company signed a new amendment with this lender that terminates April 1, 2003.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

13

COMPANY STOCK PRICE PERFORMANCE

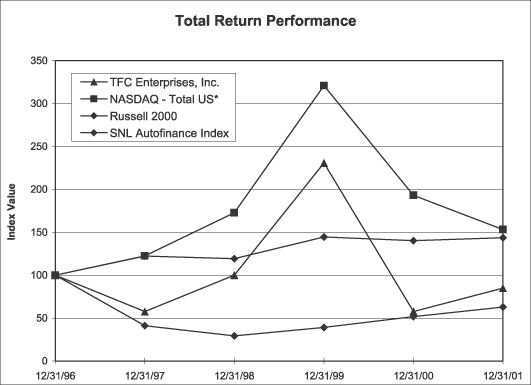

The following graph shows a comparison of cumulative total stockholder returns for the Company, the Nasdaq Composite Index, the Russell 2000 Index (a published index which includes companies with market values between $20 million and $300 million) and the SNL Auto Finance Index (a published industry index) for December 31, 1996 through December 31, 2001. The total stockholder return assumes $100 invested at the beginning of the period in the Company’s Common Stock, the Nasdaq Composite Index, the Russell 2000 Index and the SNL Auto Finance index. In developing each index, the returns of the companies were weighted according to stock market capitalization at the beginning of each period for which a return is indicated.

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG THE COMPANY, THE NASDAQ COMPOSITE INDEX, THE RUSSELL 2000 AND THE SNL AUTO FINANCE INDEX

| | | Period Ending

|

Index

| | 12/31/96

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

|

| TFC Enterprises, Inc. | | 100.00 | | 57.72 | | 100.00 | | 230.77 | | 57.69 | | 84.92 |

| NASDAQ—Total US* | | 100.00 | | 122.48 | | 172.68 | | 320.89 | | 193.01 | | 153.15 |

| Russell 2000 | | 100.00 | | 122.36 | | 119.25 | | 144.60 | | 140.23 | | 143.71 |

| SNL Autofinance Index | | 100.00 | | 41.10 | | 29.29 | | 39.19 | | 51.67 | | 62.88 |

14

AUDIT INFORMATION

The Board of Directors has adopted a written charter for the Audit Committee. A copy of the Audit Committee charter was set forth in Exhibit A to the Company’s Proxy Statement for the 2001 Annual Meeting of Shareholders which was filed with the Commission. The three members of the Audit Committee are independent as that term is defined in the current listing standards of the NASDAQ Stock Market.

Changes in Company’s Certifying Accountant

At a meeting held on January 23, 2001, the Audit Committee of the Board of Directors of the Company approved the engagement of McGladrey & Pullen, LLP as its independent auditors for the fiscal year ending December 31, 2001 to replace the firm of Ernst & Young, LLP (“E&Y”) who declined to stand for reelection. E&Y declined to stand for reelection due to their perception of the inherent risks of the subprime auto lending industry, the level of audit fees and availability of local area human resources. E&Y agreed to complete the audit for the fiscal year ended December 31, 2000. The Board of Directors ratified the approval of the change in auditors on January 23, 2001.

The reports of E&Y on the Company’s financial statements for the past two fiscal years did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

In connection with the audits of the Company’s financial statements for the years ended December 31, 2000 and December 31, 1999, and in the subsequent interim period, there were no disagreements with E&Y on any matters of accounting principles or practices, financial statement disclosure, or auditing scope and procedures which, if not resolved to the satisfaction of E&Y would have caused E&Y to make reference to the matter in their report. The Company requested that E&Y to furnish it a letter addressed to the Commission stating whether it agreed with the above statements. A copy of such a letter, dated January 25, 2001 was filed as an Exhibit 16 to a Current Report on Form 8-K filed with the Commission on January 26, 2001.

There were no “reportable events” as that term is described in Item 304(a)(1)(v) of Regulation S-K.

A representative of McGladrey & Pullen is expected to be present at the Annual Meeting and will have the opportunity to make a statement if he desires to do so, and is expected to be available to respond to appropriate questions.

Fees of Independent Public Accountants

Audit Fees

The aggregate amount of fees billed or expected to be billed to the Company by McGladrey & Pullen LLP for professional services rendered in connection with the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2001, and for the review of the Company’s interim financial statements included in the Company’s quarterly reports on Form 10-Q for that fiscal year was $131,961.

Financial Information System Design and Implementation Fees

There were no professional services rendered to the Company by McGladrey & Pullen LLP for the design and implementation of financial information systems for the fiscal year ended December 31, 2001.

All Other Fees

The aggregate amount of fees billed to the Company by McGladrey & Pullen LLP for all other non-audit services rendered to the Company for the fiscal year ended December 31, 2001, was $320,517, including audit-related services of $120,934 and non-audit services of $199,584. Audit-related services generally include fees for statutory and pension audits, business acquisitions, accounting consultations and Commission registration statements.

15

Audit Committee Report

Management is responsible for the Company’s internal controls, financial reporting process and compliance with laws and regulations and ethical business standards. The independent auditor is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes on behalf of the Board of Directors.

In this context, the Audit Committee has reviewed the audited financial statements and held discussions with management and the independent auditors concerning the quality, not just the acceptability of accounting principles, the reasonableness of significant judgments, and clarity of disclosures in the financial statements. The Committee met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluation of the Company’s internal controls and overall quality of the Company’s financial reporting. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received from the independent auditors the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with them their independence from the Company and its management. Moreover, the Audit Committee has considered whether the independent auditor’s provision of information technology services and other non-audit services to the Company is compatible with maintaining the auditor’s independence. The Committee held[five] meetings during fiscal year 2001.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission. By recommending to the Board of Directors that the audited financial statements be so included, the Audit Committee is not opining on the accuracy, completeness or presentation of the information contained in the audited financial statements.

Audit Committee

Linwood R. Watson, Audit Committee Chair

Walter Boone, Audit Committee Member

Phillip R. Smiley, Audit Committee Member

Norfolk, Virginia

October 17, 2002

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF AUDITORS

As discussed above, the Board of Directors, upon the recommendation of its Audit Committee, has appointed, subject to ratification by the shareholders, the firm of McGladrey & Pullen, LLP as the firm of independent certified public accountants to audit the financial statements of the Company for the fiscal year ending December 31, 2002. The Board of Directors desires that the appointment be ratified by the shareholders. A representative of McGladrey & Pullen, LLP is expected to be present at the Annual Meeting, will have an opportunity to make a statement if they desire to do so and is expected to be available to respond to appropriate questions.

The Board of Directors recommends that the shareholders vote FOR the ratification of the appointment of McGladrey & Pullen LLP as its auditors for 2002.

OTHER MATTERS

The Board of Directors does not know of any matters that will be presented for action at the Annual Meeting other than those described above or matters incident to the conduct of the Annual Meeting. If, however, any other matters not presently known to management should come before the Annual Meeting, it is intended that the shares represented by the Proxy will be voted on such matters in accordance with the discretion of the holders of such proxy.

16

SUBMISSION OF PROPOSALS FOR 2003

Under the regulations of the Commission, any shareholder desiring to make a proposal to be acted upon at the 2003 Annual Meeting of Shareholders must cause such proposal to be delivered, in proper form, to Robert S. Raley, Jr., Chief Executive Officer, whose address is 5425 Robin Hood Road, Suite 101B, Norfolk, VA 23513 no later than December 17, 2002, in order for the proposal to be considered for inclusion in the Company’s proxy statement and form of proxy for that meeting and in order for the proposal to be considered timely. The Company anticipates holding the 2003 Annual Meeting of Shareholders on May 13, 2003.

GENERAL

The Company’s 2001 Annual Report to Shareholders on Form 10-K/A for the year ended December 31, 2001, as filed with the Commission, accompanies this Proxy Statement. Except for such portions of the Form 10-K/A as described above with respect to the information regarding the Company’s executive officers, the 2001 Annual Report to Shareholders does not form any part of the material for the solicitation of proxies.

PLEASE MARK, SIGN, DATE, AND RETURN THE PROXY PROMPTLY

By Order of the Board of Directors

October 17, 2002

17

TFC ENTERPRISES, INC.

Proxy Solicited on Behalf of the Board of Directors

for Annual Meeting of Shareholders to be held on November 19, 2002

The undersigned, having received the Annual Report to Shareholders and the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement dated October 17, 2002, hereby appoints Robert S. Raley, Jr. and Douglas E. Bywater (each with power to act alone) as proxies, with full power of substitution, and hereby authorizes them to represent and vote, as directed on the reverse side, all the shares of the Common Stock of TFC Enterprises, Inc. held of record by the undersigned on October 14, 2002, at the Annual Meeting of Shareholders to be held on November 19, 2002, and any adjournment thereof.

(continued and to be signed on other side)

Please date, sign and mail your

proxy card back as soon as possible!

Annual Meeting of Shareholders

TFC ENTERPRISES, INC.

November 19, 2002

¯ Please Detach and Mail in the Envelope Provided ¯

A | | x | | | Please mark your votes as in this example. |

| | | FOR all nominees listed (except as indicated to the contrary) | | WITHHOLD AUTHORITY to vote for all nominees | | |

1. ELECTION OF DIRECTORS | | ¨ | | ¨ | | Nominees: Robert S. Raley, Jr. Walter S. Boone, Jr. Phillip R. Smiley Ronald G. Tray |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, write the nominee’s name on the line provided below.) | | |

| | | |

| | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1 AND 2.

| | | FOR | | AGAINST | | ABSTAIN |

| 2. To ratify the appointment of McGladrey & Pullen LLP as independent auditors for 2002. | | ¨ | | ¨ | | ¨ |

| 3. IN THEIR DISCRETION, on such other matters as may properly come before the meeting, or, if any nominee listed in Proposal 1 is unable to serve for any reason, to vote or refrain from voting for a substitute nominee or nominees. |

|

This proxy is revocable at any time prior to its exercise. This proxy when properly executed, will be voted as directed. Where no direction is given, this proxy will be voted for Proposals 1 and 2. |

|

Please complete, date, sign and return this proxy promptly in the accompanying envelope. |

Signature Date Signature Date

NOTE: | | Please sign your name(s) exactly as they appear hereon. If signer is a corporation, please sign the full corporate name by duly authorized officer. If an attorney, guardian, administrator, executor or trustee, please give title as such. If a partnership, sign in partnership name by authorized person. |