UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported)

October 20, 2003

THE SHAW GROUP INC.

(Exact name of registrant as specified in its charter)

| Louisiana | | 1-12227 | | 72-1106167 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

4171 Essen Lane, Baton Rouge, Louisiana 70809

(Address of principal executive offices and zip code)

(225) 932-2500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Item 7(c). Exhibits

99.1 Slide show accompanying the series of presentations.

Item 9. Regulation FD Disclosure

In accordance with General Instruction B.2. of Form 8-K, the following information will not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in a filing.

Representatives of The Shaw Group Inc. (“Shaw”) will make a series of presentations in connection with its recently announced public offering. The slides for those presentations give an overview of Shaw—including financial position, industry fundamentals, and business plan—and are furnished herewith as Exhibit 99.1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

THE SHAW GROUP INC.

(Registrant)

Date: October 20, 2003

By:/s/ Robert L. Belk

Robert L. Belk, Executive Vice President

and Chief Financial Officer

2

The Shaw Group Inc.

Add-on Common Stock Offering

October 2003

Forward Looking Statement &

Regulation G Disclosure

Any statements in this presentation which express a belief, expectation or intention, as well as

those which are not historical fact, are forward looking and are protected under the safe harbor

of the Private Securities Litigation Reform Act. They involve a number of risks and

uncertainties, which may cause the Company’s actual results to differ materially from such

forward-looking statements. These risks and uncertainties include factors detailed in the

Company’s filings with the Securities and Exchange Commission, including its Form 10-K for

the year ended August 31, 2003 and on the Company’s web site under the heading “Forward

Looking Statement”.

During today’s presentation, we will use certain financial measures which are considered non-

GAAP, such as EBITDA, Net Debt and Net Capitalization. As required by the recently issued

SEC Regulation G, a reconciliation of these measures to their most comparable GAAP

measures is available either in this presentation or on our website at www.shawgrp.com in the

Investor Relations section under Regulation G Disclosures.

Current Offering

Credit Suisse First Boston

Merrill Lynch & Co.

Joint book-running managers:

Launch: October 17

Roadshow: October 20 – 23

Pricing: October 23

Transaction timing:

Fund a portion of tender for

~$250 MM of LYONs

Use of Proceeds:

20 million share add-on common

stock offering

15% (3.0 MM share) over-

allotment option

Offering Size:

SGR/NYSE

Ticker/Exchange:

Roadshow/Management Team

J.M. Bernhard, Jr.

Founder, Chairman and CEO

Under Mr. Bernhard's leadership, Shaw has grown intrinsically and through

a series of strategic acquisitions to over $3 billion in revenues and is one of

the youngest companies to be named to the Fortune 500.

Robert L. Belk

Executive Vice President and CFO

Robert L. Belk joined Shaw in 1998 as EVP, CFO and Treasurer.

Previously, Mr. Belk was with Ocean Energy, Inc., where he served as

Executive Vice President and Chief Financial Officer. Prior to joining Ocean

Energy, Inc., Mr. Belk was engaged in public accounting with national and

local firms and as a sole-practitioner.

T.A. Barfield, Jr.

President and COO

Since joining Shaw in 1994, Mr. Barfield has served in several strategic

positions. Most recently, Mr. Barfield served as President of Shaw

Environmental and Infrastructure, Inc. where he successfully led the

integration of The IT Group into Shaw's business portfolio.

Company Overview

Jim Bernhard

Founder, Chairman & CEO

Proven growth strategy through exploiting market leadership

positions

Diversified backlog with highly visible recurring revenue

Predominantly cost-plus contract profile

Positioned for expansion/recovery across power business lines

Diverse service, end market, customer and contract portfolio

Strong pro forma financial position

Investment Highlights

Leading Market Positions

Environmental & Infrastructure (“E&I”)

Environmental – Ranked #2 in construction/remediation and #5 in

hazardous waste and Top 10 in 8 of 12 service categories in ENR Rankings

Infrastructure – Blue chip clients, including NASA, DoD, DoE and Los

Alamos National Laboratory

Engineering, Construction & Maintenance Services (“ECM”)

Power: Ranked #3 in ENR’s overall power category

Fossil Fuel Power: Ranked #2 by ENR; designed and/or constructed

110 power plants

Nuclear Power: Ranked #3 in ENR’s nuclear power category; provided

services to 95% of domestic nuclear fleet; currently working on the only

2 active restarts in North America

Ethylene and Downstream Processing Technologies (Fluid Catalytic

Cracking, Ethyl Benzene, Cumene, Styrene) – Designed and/or

constructed over 120 plants; 40% of worldwide incremental capacity based

on proprietary technology

Fabrication, Manufacturing & Distribution

Piping Fabrication – Leading market share worldwide; industry’s most

advanced induction bending technology

* Source: Engineering News Record 2002 Rankings.

Growth Strategy

Expand E&I’s market share in rapidly growing federal services

platforms (Privatization, Facilities Management)

Expand federal business by bringing complete portfolio of Shaw’s

capabilities to DOE, DOD, DHS and other agencies

Leverage global market leadership position to capture power,

transmission and distribution opportunities

Cross-sell broad range of services to established multinational,

industrial customer base

Continue to expand maintenance operations

Grow international presence across all business lines

Pursue strategic alliances

Selectively pursue strategic acquisitions

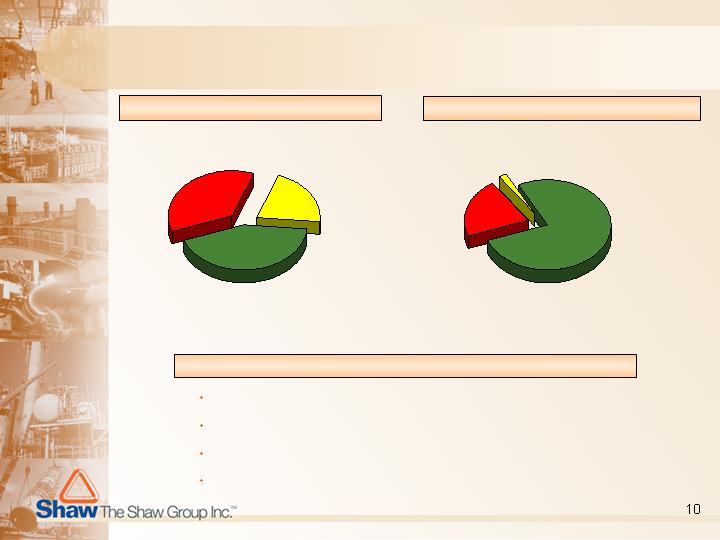

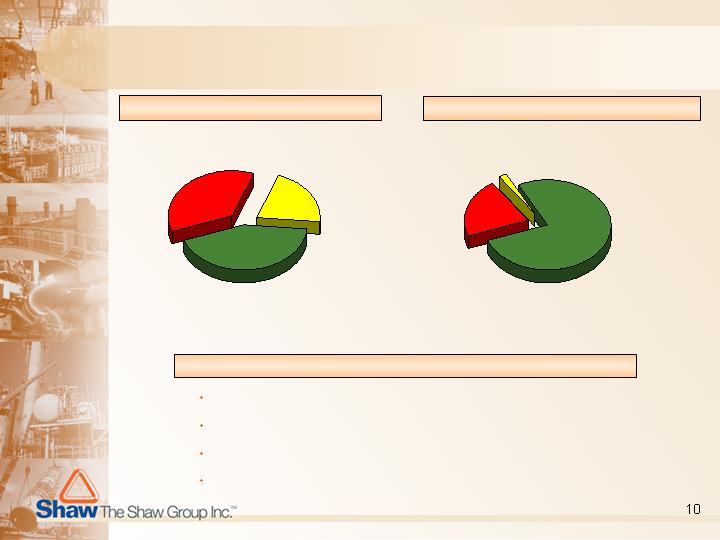

Diversification of Backlog

Infrastructure

15%

Process

Industries

11%

Other

Industries

1%

Fossil-Fuel

EPC

4%

Nuclear

Power

23%

Other Power

2%

Process

Industries

16%

Other

Industries

1%

Fossil-Fuel

EPC

53%

Nuclear Power

10%

Other Power

20%

Backlog at 8/31/01

$4.3 Billion

Backlog at 8/31/03

$4.8 Billion

Environmental

43%

Greater than 52% of backlog

from federal contracts

Announced projects since

8/31/03 of approximately

$1 billion

Highly Visible Recurring Revenue

Over 1,500 active contracts

77% of backlog is cost-plus

$2.5 billion in Federal Contracts in backlog

Demonstrated ability to redistribute resources to areas of growth

Backlog Conversion at 8/31/03

Highlights

Contract Mix at 8/31/03

Fixed-Price

21%

Unit-Price

2%

Cost-Plus

77%

Next 12 months

36%

13-24

months

21%

Greater than

24 months

43%

Top Ten Contracts in Backlog

Company

Contract Type

Customer

Unsecured

Credit Rating

Services Contracted

Backlog

8/31/03

($ MM)

1.

TVA -Browns Ferry Unit 1

Cost-plus

AAA

Nuclear Restart

$374

2.

TVA

Cost-plus

AAA

Nuclear Maintenance

317

3.

BASF-SINOPEC

Negotiated

Fixed-price

BBB

Ethylene Plant EPC

189

4.

DOE LANL (Los Alamos)

Cost-plus

U.S. Government

Maintenance Services

186

5.

Entergy

Cost-plus

BBB

Nuclear Maintenance

171

6.

Exelon

Cost-plus

BBB+

Nuclear Maintenance

169

7.

USACE Omaha-FPRI

Fixed-plus

U.S. Government

Environmental Remediation

1

50

8.

USACE Omaha TERC V

Cost-plus

U.S. Government

Environmental Remediation

137

9.

USACE -KC TERC

Cost-plus

U.S. Government

Environmental Remediation

135

10.

USACE -SAC TERC II

Cost-plus

U.S. Government

Environmental Remediation

133

Top Ten

Total

$1,961

% of

Total

Backlog

41%

Announced Projects Since August 31, 2003

Astoria power project in New York City (fossil fuel)

Marathon Ashland Clean Fuels project (process)

Entergy Nuclear Northeast maintenance and modifications work

(nuclear maintenance - not currently under contract)

U.S. Army Corps of Engineers Rapid Response contract

(environmental)

Total Estimated Project Value of Approximately $1 Billion

* Not in backlog at August 31, 2003.

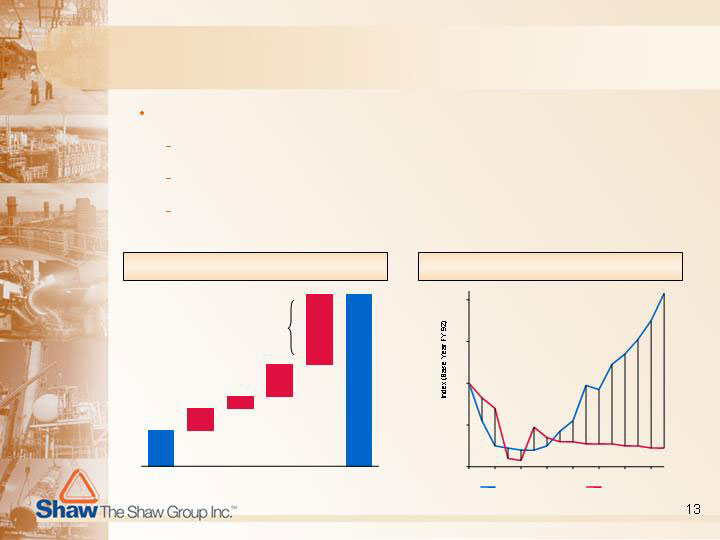

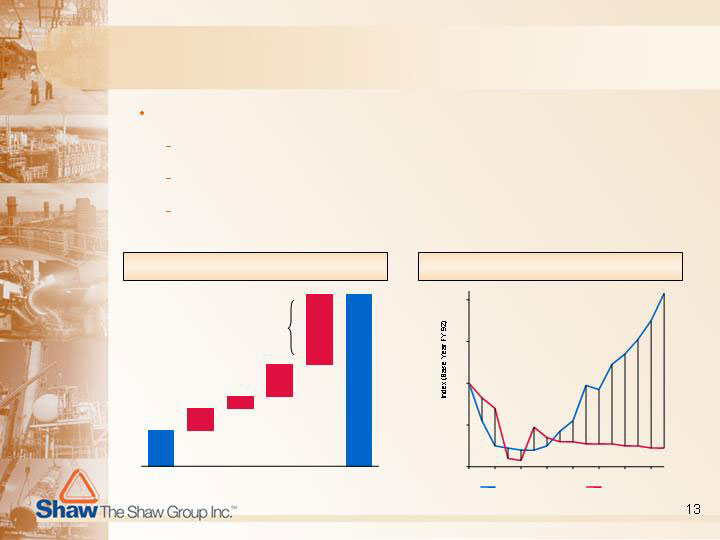

Attractive Government Services Opportunities

The Government Services Industry is experiencing robust growth:

Increased outsourcing opportunities

Increased service requirements driven by aging base of equipment

Increased overall defense spending with focus on homeland

defense initiatives

($ in billions)

Shaw

Core

Competency

Increased O&M Spending

Increased O&M Spending

FY 01

R&D

Procurement

Personnel

O&M

FY 03

Source: OSD, CSP.

$296

$13

$7

$19

$42

$377

60

80

100

120

140

FY 92

FY 94

FY 96

FY 98

FY 00

FY 02

FY 04

FY 06

DoD Procurement Budget

DoD Headcount

Source: OSD, CSP.

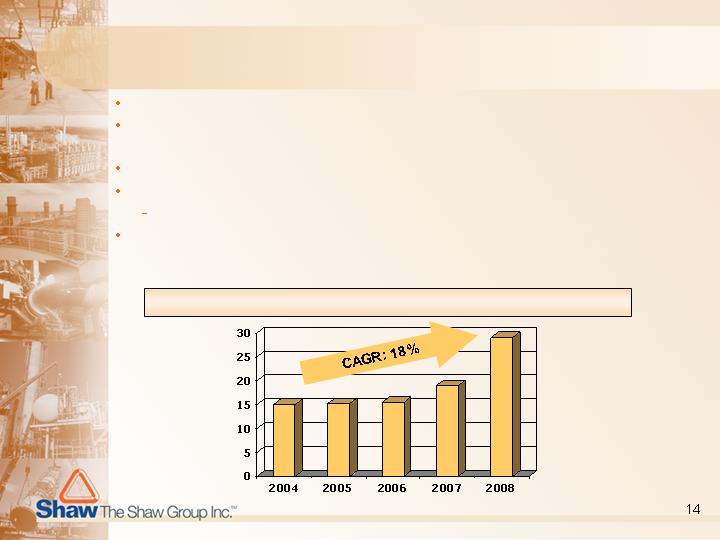

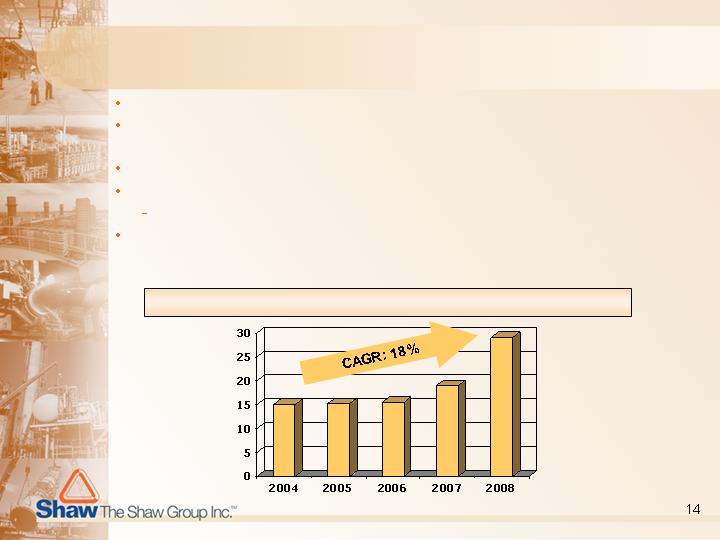

Expected U.S. Power Market Recovery

Near-term power shortage in the New York City area

Other known capacity constrained regions (Western U.S., Carolinas,

Florida)

Constrained transmission pockets which present shortages in local areas

U.S. generation added in last 3 years: ~140 GW

Significant cancellations and suspended construction

Clean Air market estimated to grow from $1 billion in 2004 to over $4

billion in 2007, pending passage of Clear Skies bill (Source: McIlvaine

Company)

Projected U.S. Generation Additions (GW added)

* Sources: Platts and Shaw Group.

Environmental & Infrastructure

2003 Revenues

$1.2 billion

Services Provided

Toxic waste remediation and

lifecycle management of solid

waste

Vulnerability assessment and

biological agent detection and

response

Facilities management and other

O&M services to military bases

Infrastructure planning,

engineering and maintenance

Federal Housing and Utility

Privatization

Significant Customers

U.S. Department of Defense

U.S. Environmental Protection Agency

U.S. Department of Energy

South Florida Water Management

ExxonMobil

Opportunities

Military housing privatization

Federal facilities management

Homeland security initiatives

Transportation and water

Coastal restoration

Environmental regulation

Chemical weapons demilitarization

Unexploded ordnance and explosives

International expansion

Commercial expansion

Engineering, Construction & Maintenance

2003 Revenues

$1.8 billion

Services Provided

Consulting and feasibility studies

Engineering and design,

procurement and construction

Turnarounds, restarts,

decommissioning, retrofitting and

maintenance

Project and construction

management

Refining and Petrochemical

technologies

Modularization

Reduces field man-hours

No onsite fabrication needed

Full control of construction -

no subcontractors

Significant Customers

Tennessee Valley Authority

Duke Energy

BASF

Entergy

Opportunities

Power Plant Retrofitting from Clean

Air Act Standards (scrubbers)

Clean Fuels

Power Plant Upgrades and Re-

powerings

Transmission & Distribution

Outsourcing of Maintenance

Operations

International Expansion

Marathon

KeySpan

Exelon

FPL

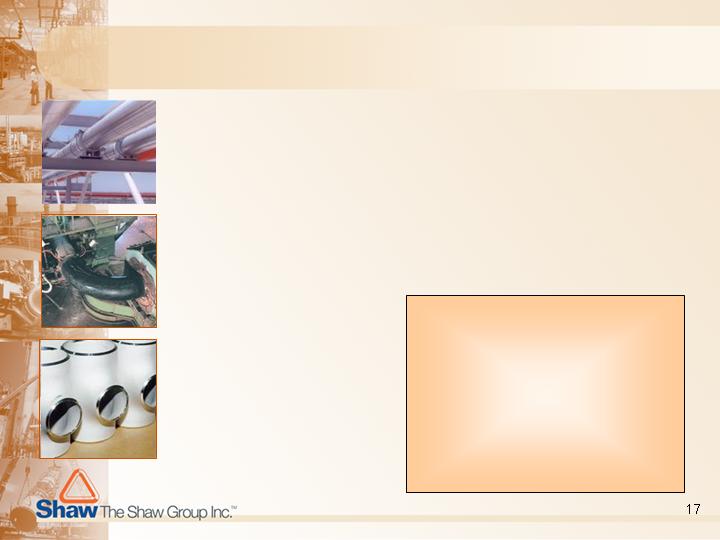

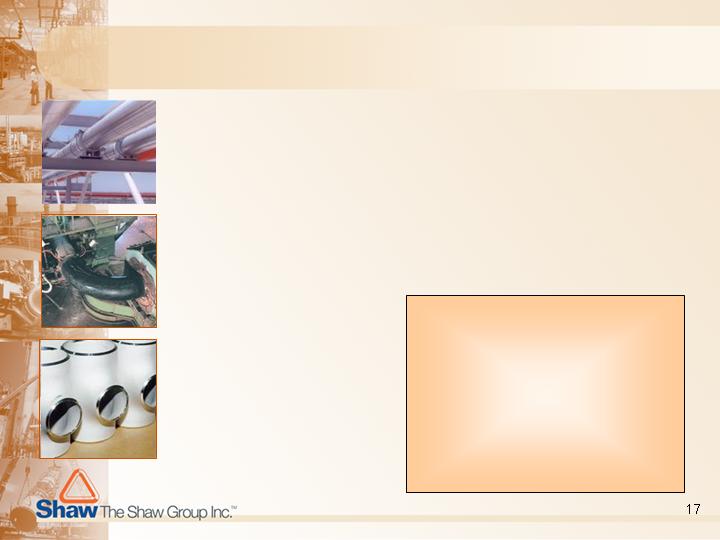

Fabrication, Manufacturing & Distribution

2003 Revenues

$263 million

Services Provided

Leading supplier of pre-fabricated piping systems for power plants and process

facilities worldwide

Leading manufacturer and master distributor of specialty pipe fittings

Industry leader in engineered pipe supports and fabricated structural steel

products for power, petrochemical and other industries

Industry’s most advanced induction bending technology

Significant Customers

Dow Chemical

Fluor

Bechtel

GE

TVA

Opportunities

Capital and maintenance projects in

petrochemical and power sectors

Nuclear maintenance and upgrades

Desalination projects

Clean fuel initiatives driven by Clean Air

Act

International expansion - China facility

Financial Overview

Bob Belk

Executive Vice President and CFO

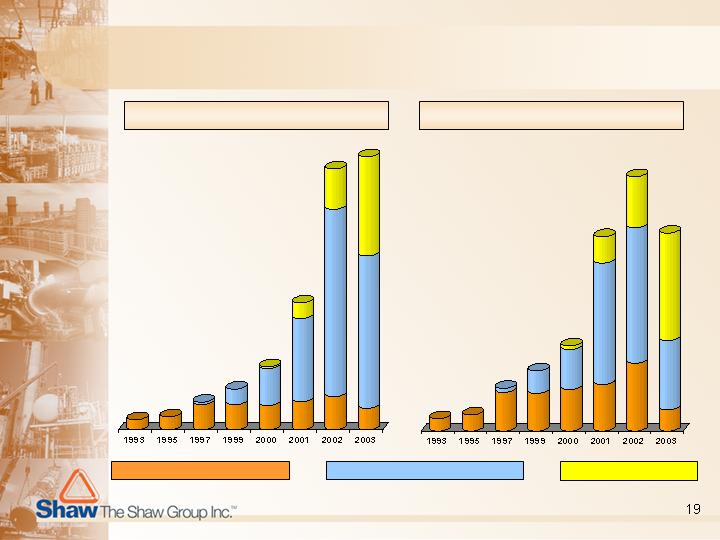

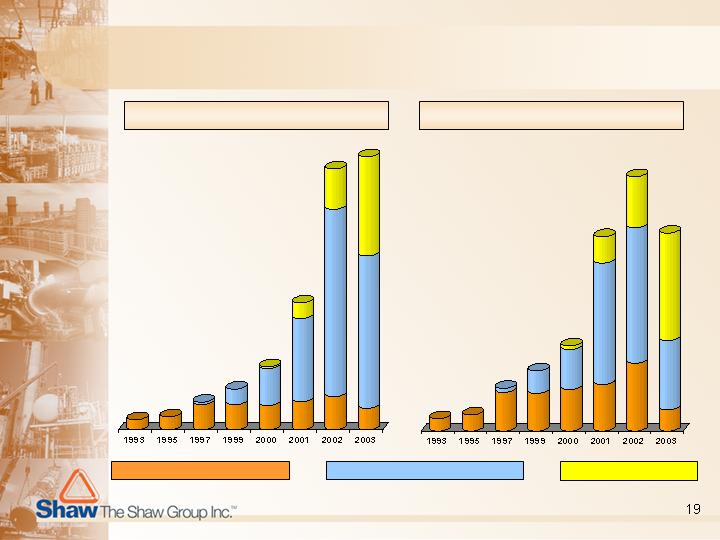

Historical Financial Performance

$121

$157

$338

$494

$1,539

$3,171

$763

$10

$13

$34

$48

$155

$70

Historical Revenue

Historical EBITDA

$203

Fabrication, Manufacturing & Distribution

Engineering, Construction & Maintenance

Environmental & Infrastructure

Fiscal Year Ended 8/31

($ in millions)

Fiscal Year Ended 8/31

($ in millions)

$3,307

$158*

* 2003 EBITDA of $158 million excludes a $30.0 million charge related to NEG and a $12.4 million charge related to

Orion and other receivables. See the Reconciliation of Non-GAAP Financial Measures slide herein for further details.

Fiscal 2004 Guidance

Guidance on fiscal 2004 operating performance was reconfirmed to the public

markets on October 16, 2003.

The guidance above does not include the application of the proceeds from this

offering and cash on hand to tender for approximately $250 million of

outstanding LYONs ($373 million face amount)

Transaction quantifies dilution and eliminates “overhang” from otherwise

potential conversion of remaining ~$250 million of LYONs in May 2004

Eliminates any near term liquidity events, allowing management to focus

on business operations

* Based on previously provided guidance of $1.15 - $1.25 per share and 38.3 million shares outstanding.

($ in millions)

Forecasted Financial Data

Fiscal 2004

Revenue

$

2,400

-

$

2,800

EBITDA

$140

-

$150

Net Income

*

$

44

-

$

48

Pro Forma Capitalization

Substantial liquidity from unrestricted cash balances and availability under

amended credit facility provides for LC and other growth and operating

flexibility

Substantially improved leverage statistics

Financial flexibility to pursue new business and other strategic opportunities

* Pro forma available liquidity reflects $50 million upsizing of revolver.

($ in millions)

Status Quo

Transaction

Pro Forma

8/31/2003

Adjustments

8/31/2003

Capitalization:

Unrestricted Cash & Equivalents

$184.9

($53.2)

$131.7

Restricted Cash

58.0

--

58.0

Total Cash & Equivalents

$243.0

($53.2)

$189.8

Revolving Credit Facility

$0.0

--

$0.0

10.75% Senior Notes

250.1

--

250.1

LYONs

251.5

($251.5)

0.0

Other Debt

11.5

--

11.5

Total Debt

$513.2

($251.5)

$261.7

Shareholders' Equity

$661.6

$198.0

$859.6

Total Capitalization

$1,174.7

($53.5)

$1,121.3

LTM Credit Statistics:

Available Liquidity*

$188.6

$271.7

Total Debt / Total Capitalization

43.7%

23.3%

Net Debt / Net Capitalization

33.2%

13.1%

Proven growth strategy through exploiting market leadership

positions

Diversified backlog with highly visible recurring revenue

Predominantly cost-plus contract profile

Positioned for expansion/recovery across power business lines

Diverse service, end market, customer and contract portfolio

Strong pro forma financial position

Investment Highlights

Reconciliation of Non-GAAP Financial Measures

* Other charges excluded from 2003 EBITDA are comprised of a $30.0 million charge related to NEG and a $12.4 million

charge related to Orion and other receivables.

($ in millions)

Fiscal Year Ended August 31,

1993

1995

1997

1999

2000

2001

2002

2003

Net Income

$4.2

$4.4

$14.0

$18.1

$29.5

$61.0

$98.4

$20.9

Add (deduct):

Interest

2.2

3.5

6.8

8.6

8.0

15.7

23.0

32.0

Income taxes

2.4

2.0

6.1

8.6

16.4

38.4

54.3

11.7

Depreciation and amortization

1.1

3.0

7.4

13.3

16.8

39.7

28.6

44.8

Extraordinary (gains) losses,

net of taxes

- -

(0.5)

- -

- -

0.6

0.2

- -

- -

(Earnings) losses from

unconsolidated entities

(0.3)

0.6

(0.4)

(0.7)

(1.2)

0.3

(1.7)

3.0

Discontinued Operations, net of

taxes

- -

- -

0.3

- -

- -

- -

- -

- -

Cumulative effect of accounting

change, net of taxes

- -

- -

- -

- -

0.3

- -

- -

- -

Acquired EBITDA (Badger)

- -

- -

- -

- -

- -

- -

- -

2.7

Other excluded charges

- -

- -

- -

- -

- -

- -

- -

42.4

EBITDA

$9.7

$13.0

$34.1

$48.0

$70.4

$155.3

$202.6

$157.5