UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

The Shaw Group Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | |

2012 Proxy Statement | | Notice of Annual |

The Shaw Group Inc. | | Meeting of Shareholders |

| | to be held on January 25, 2012 |

a world of Solutions™

December 15, 2011

The Shaw Group Inc.

4171 Essen Lane

Baton Rouge, Louisiana 70809

LETTER FROM OUR BOARD OF DIRECTORS TO OUR SHAREHOLDERS

Each year we look forward to hearing our shareholders’ views on our performance. This year is particularly exciting as, for the first time at our annual meeting, we will hear your views on the compensation of our named executive officers (more commonly referred to as the “say on pay” proposal) and how often you would like to hold an advisory vote on such compensation (more commonly referred to as the “say on frequency” proposal).

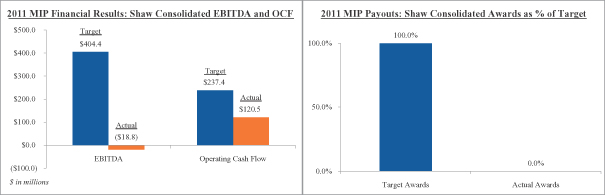

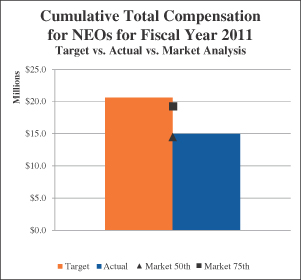

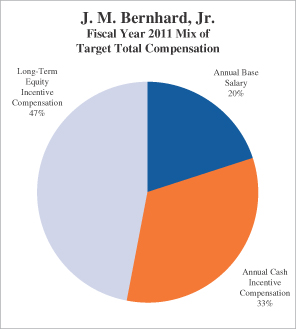

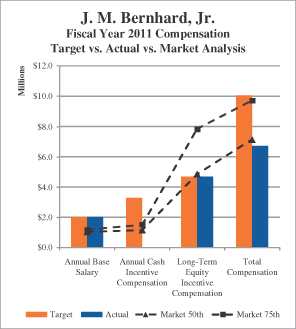

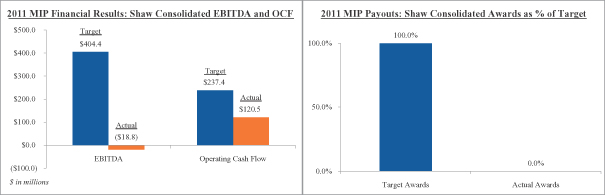

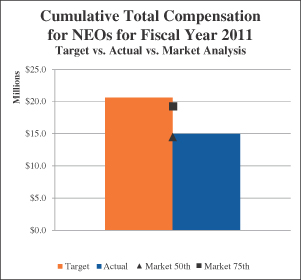

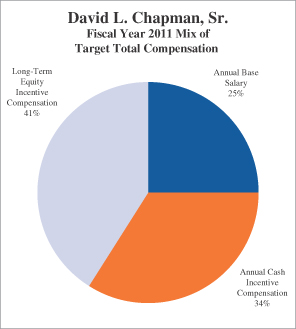

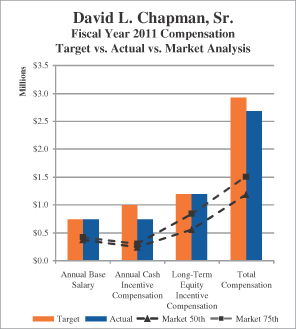

Last year we set aggressive financial and other goals for the Company. The Company did not meet these goals. Thus, we did not award performance bonuses and almost all of our named executive officers saw a reduction in year-over-year compensation. This underscores our commitment to pay for performance.

This year we reinvigorated our pay for performance philosophy. We changed our long term incentive awards for fiscal year 2012 so that 50% of these awards, which were formerly granted as stock options, are now performance awards that will only pay out if certain targets are achieved. The remaining 50% will continue to be paid in restricted stock units, the value of which is tied to the stock performance of the Company.

Also, working closely with our Chief Executive Officer, we modified his contract to eliminate the excise tax gross-ups upon a change in control and to convert his deferred compensation award to a more traditional supplemental executive retirement plan.

Our goal is to continue to develop and maintain a good governance strategy to maximize long-term performance and to respond effectively if revisions are needed to address evolving best practices and changing regulatory requirements. Accordingly, our governance strategy as described in this proxy statement is to ensure that the Company continues to: (i) attract and maintain high caliber directors, executives and employees; (ii) manage operational and financial risk to maximize performance; and (iii) bolster the Company’s financial performance and competitiveness as we provide solutions in an increasingly competitive and complex world.

In this, our first year including a say on pay proposal, we want you to be confident that we have a solid pay for performance program, we are dedicated to business integrity and we will work with you, the owners of our Company, to make The Shaw Group Inc. the company that we want it to be.

Please send any opinions, interest and concerns to The Shaw Group Inc., Board of Directors, c/o John Donofrio, Executive Vice President, General Counsel and Corporate Secretary, 4171 Essen Lane, Baton Rouge, Louisiana 70809. You can also email the independent directors atboard@shawgrp.com.

By continuing to have an open dialogue with you – our shareholders – we are better positioned to fulfill our obligations to you and to the Company.

The Board of Directors of The Shaw Group Inc.

The Shaw Group Inc.

4171 Essen Lane

Baton Rouge, Louisiana 70809

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF

THE SHAW GROUP INC.

Date: January 25, 2012

Time: 9:00 a.m. Central Time

Place: The Shaw Group Inc. Headquarters

4171 Essen Lane, Baton Rouge, Louisiana 70809

Matters to be voted on:

| 1. | Electing each of the eight nominees listed in the proxy statement to our Board of Directors to hold office until the 2013 annual meeting of shareholders or until a successor is elected and qualified; |

| 2. | Ratifying the Audit Committee’s selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending August 31, 2012; |

| 3. | Approving, on a non-binding advisory basis, the compensation of our named executive officers (say on pay); |

| 4. | Approving, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of our named executive officers (say on frequency); and |

| 5. | Transacting such other business as may properly be brought before the meeting and any continuations, adjournments or postponements thereof. |

Shareholders of record at the close of business on December 5, 2011, will be entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

Even if you plan to attend the Annual Meeting, please sign, date and return the enclosed proxy card to us in the enclosed postage-paid envelope as soon as possible to ensure that your shares are voted at the Annual Meeting. If you attend the Annual Meeting, you may withdraw any previously submitted proxy and vote in person. If you attend, you will be asked to present your admission ticket and photo identification, as described in the proxy statement. For detailed information regarding voting instructions, see the section of the proxy statement titled “GENERAL INFORMATION ABOUT THE MEETING—Questions and Answers about the Proxy Materials, Annual Meeting and Voting.”

BY ORDER OF THE BOARD OF DIRECTORS,

John Donofrio

Executive Vice President, General Counsel and Corporate Secretary

December 15, 2011

This summary highlights information contained elsewhere in this proxy statement. It does not contain all information that you should consider, and you should read the entire proxy statement carefully before voting.

MEETING AGENDA AND VOTING RECOMMENDATIONS

| | | | | | | | |

Agenda Proposal | | Board Recommendation | | Page | |

Proposal 1 – | | Election of Eight Director Nominees | | “FOR” each of the nominees | | | 8 | |

Proposal 2 – | | Ratification of Independent Registered Public Accounting Firm | | “FOR” | | | 22 | |

Proposal 3 – | | Advisory Vote on the Compensation of our Named Executive Officers | | “FOR” | | | 77 | |

Proposal 4 – | | Advisory Vote on the Frequency of Future Advisory Votes on the Compensation of our Named Executive Officers | | “EVERY 1 YEAR” | | | 78 | |

BUSINESS HIGHLIGHTS

Our fiscal year 2011 was very challenging from an earnings perspective, as a number of significant events impacted our earnings. Despite the earnings challenges, we had a number of non-operational successes as highlighted below.

Amended and Restated Credit Facility

On June 15, 2011, we entered into an unsecured second amended and restated credit agreement (Facility) with a group of lenders that effectively terminated the September 2009 prior credit agreement. The Facility provides lender commitments up to $1.45 billion, all of which may be available for the issuance of performance letters of credit. Of the $1.45 billion in maximum commitments, a sublimit of $1.25 billion is available for the issuance of financial letters of credit and/or borrowings for working capital needs and general corporate purposes. Under the Facility, all collateral securing the previous agreement was released and the expiration of commitments was extended through June 15, 2016. The Facility continues to require guarantees by the Company’s material wholly-owned domestic subsidiaries.

Put Option Determination

In September 2011, we announced that our special purpose subsidiary, Nuclear Energy Holdings L.L.C. (NEH), intends to exercise its put option agreements (Put Option) to sell its investment in Westinghouse back to Toshiba Corporation (Toshiba). NEH received the Put Option in connection with its 2006 acquisition of 20% of the shares in the companies referred to as the Westinghouse Group (Westinghouse). The exercise of the Japanese Yen-denominated Put Option prior to October 2012 requires the consent of the trustee acting on behalf of the bond holders of the Yen-denominated bonds that were issued in connection with the funding of the acquisition of the Westinghouse shares. Since the acquisition, the Yen-denominated debt has increased by approximately $600 million to a total of almost $1.7 billion as of August 31, 2011. On December 8, 2011, we were notified that the trustee decided not to consent to the proposed early exercise to the Put Option.

Under the terms of the Put Option, the Put Option will be exercised automatically on October 6, 2012, for cash settlement on January 4, 2013. Proceeds from the sale must be used to repay the bonds in full on their scheduled maturity date of March 15, 2013.

While the sale of NEH’s investment in Westinghouse would terminate the formal contractual arrangement between Shaw and Toshiba, Shaw looks to continue the successful global cooperation that Shaw, Westinghouse

i

and Toshiba have demonstrated. Shaw and Westinghouse currently are under contract for six new AP1000™ nuclear power units in the U.S., as well as four units under construction in China. In addition, Shaw has a contract for technical support services on an additional two-unit AP1000TM project in China that follows the original units at Sanmen and Haiyang. This vast experience is unparalleled in the industry and positions Shaw for continued success in this field.

Acquisitions

On March 7, 2011, we acquired 100% of the outstanding common stock of Coastal Planning & Engineering, Inc. (CPE). CPE offers a full range of services, including coastal modeling, oceanographic measurements, marine biology, geotechnical surveys, hydrographic surveys and marine geology. CPE’s coastal projects include beach nourishment and island restoration following hurricanes and other erosion, offshore sand inventory and ship maneuvering studies for new and existing ports.

Share Repurchase Program

In May 2011, we completed our $500.0 million share repurchase program that was authorized by our Board of Directors in December 2010. The program, which was funded by our available cash and short-term investments, resulted in the retirement of 13,688,354 shares, at a weighted-average cost of $36.51 per share.

In June 2011, our Board authorized an additional $500.0 million share repurchase program. As of August 31, 2011, we had spent $21.8 million to repurchase 945,100 shares at a weighted-average cost of $23.01 per share.

Subsequent to our fiscal year end, on November 8, 2011, the Company launched a modified Dutch auction tender offer to purchase up to $150 million in value of its common stock at a price not greater than $25.25 nor less than $22.25 per share. The tender offer expired on December 8, 2011, resulting in 6,185,567 shares being repurchased at a purchase price of $24.25 per share. The Company will fund the share purchases in the tender offer with available cash.

GOVERNANCE AND COMPENSATION HIGHLIGHTS

Consistent with our goal to develop and maintain a good governance strategy and adopt good governance practices, in the past two years, we have implemented the following:

| | • | | Independent directors are now required to hold at least 25% of the shares of stock-based awards granted until departing from service to our Board, with flexibility for tax considerations. |

| | • | | Our Board determined that it was in our shareholders’ best interests to eliminate our Shareholder Rights Plan, and terminated the plan, effective January 1, 2011. |

| | • | | Our Board committed to shareholders that over a three-year period, beginning September 1, 2010, we would not grant a number of shares subject to options, stock appreciation rights or other stock awards to employees or non-employee directors, at an average rate greater than 1.95% of the weighted average common shares outstanding. |

| | • | | Our Board determined that an independent director who either retires from or changes the professional position held when initially elected to the Board shall notify our Board of the change and offer to resign. Our Nominating and Corporate Governance Committee will recommend whether the member resigns or continues to serve and the member shall follow the recommendation. |

| | • | | Equity awards now have a minimum vesting of no less than three years. Our Company’s historic and fiscal year 2011 equity awards include a vesting period of four years, longer than common market practice. |

| | • | | Our corporate governance principles provide that our executive officers should hold shares of Company stock equal to six times (for our CEO) and two and one-half times (for other executive officers) their base salary. As of August 31, 2011, all of our named executive officers met their minimum stock ownership guidelines. |

ii

| | • | | In fiscal year 2011, we did not amend or enter into any new employment agreements containing future guaranteed annual incentive compensation payments. |

| | • | | We limited personal use of corporate aircraft by executive officers: personal use must be paid in advance by the executive officer, except to ensure the safety of the CEO. |

| | • | | We eliminated additional compensation to cover the cost of taxes assessed, if any, on perquisites. No new or amended employment agreements in fiscal year 2011 included excise tax gross-up provisions, and we have amended certain executive employment agreements to remove the excise tax gross-up provisions. |

| | • | | We expanded our clawback policy to include all executive officers, in addition to the Chief Executive Officer and Chief Financial Officer, who had been subject to clawback provisions under the Sarbanes-Oxley Act of 2002. |

We continue to review our compensation policies and guidelines, and this year:

| | • | | We modified our long-term incentive award program to include a relative total shareholder return performance plan. |

| | • | | We modified one of our named executive officer’s employment agreement to remove the excise tax gross-up provision and his guaranteed annual incentive compensation award. |

| | • | | We amended our Chief Executive Officer’s employment agreement to remove the change in control tax gross-up provisions and added a net best provision in connection with termination payments upon a change in control. |

| | • | | We converted a $15 million, plus accumulated interest, deferred compensation award that was owed to our CEO into a Supplemental Executive Retirement Plan. |

For more detail, please see our “COMPENSATION DISCUSSION AND ANALYSIS” section below.

iii

1

THE SHAW GROUP INC.

4171 Essen Lane

Baton Rouge, Louisiana 70809

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 25, 2012

GENERAL INFORMATION ABOUT THE MEETING

The 2011 annual report to shareholders, including financial statements, is being made available to shareholders together with these proxy materials on or about December 15, 2011.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS, ANNUAL MEETING AND VOTING

Why am I receiving these proxy materials?

Our Board of Directors (Board) is soliciting your proxy to vote at our 2012 Annual Meeting of shareholders because you owned shares of our common stock at the close of business on December 5, 2011, the record date for the Annual Meeting, and are therefore entitled to vote at the Annual Meeting. This proxy statement, along with a proxy card or a voting instruction card, is being made available to shareholders on or about December 15, 2011. We have made these materials available to you on the internet and, in some cases, we have delivered printed proxy materials to you. This proxy statement summarizes the information that you need to know in order to cast your vote at the Annual Meeting. You do not need to attend the Annual Meeting in person to vote your shares.

Why did I receive a notice of internet availability of proxy materials instead of a full set of proxy materials?

In accordance with the rules of the U.S. Securities and Exchange Commission (SEC), we are permitted to furnish proxy materials, including this proxy statement and our 2011 annual report to shareholders by providing access to these documents on the internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless requested. Instead, the notice will instruct you as to how you may access and review the proxy materials on the internet. The notice also instructs you as to how you may cast your vote via the internet. If you would like to receive a printed or email copy of our proxy materials, please follow the instructions for requesting the proxy materials in the notice.

To view the notice of annual meeting of shareholders, this proxy statement and our annual report on Form 10-K for the fiscal year ended August 31, 2011, go tohttps://materials.proxyvote.com/820280 orwww.shawgrp.com/AnnualMeeting.

When and where will the Annual Meeting be held?

The Annual Meeting will be held at 9:00 a.m. Central Time on Wednesday, January 25, 2012, at our Corporate Headquarters, located at 4171 Essen Lane, Baton Rouge, Louisiana 70809. Directions to our Corporate Headquarters can be obtained by contacting our Investor Relations department at (225) 932-2500.

Who is soliciting my proxy?

Our Board is soliciting your proxy to vote on all matters scheduled to come before the 2012 Annual Meeting of shareholders, whether or not you attend in person. By completing and returning the proxy card or voting instruction card, or by transmitting your voting instructions via the internet, you are authorizing the proxy holders to vote your shares at our Annual Meeting as you have instructed.

2

On what matters will I be voting? How does the Board recommend that I cast my vote?

At the Annual Meeting, you will be asked to: elect the eight director nominees listed in this proxy statement; ratify the appointment of our independent registered public accounting firm; approve, on an advisory basis, the compensation of our named executive officers; and approve, on an advisory basis, the frequency of future advisory votes on the compensation of our named executive officers.

Our Board unanimously recommends that you vote:

| | • | | FOR all eight of the director nominees listed in this proxy statement; |

| | • | | FOR the ratification of the appointment of our independent registered public accounting firm; |

| | • | | FOR the approval, on an advisory basis, of the compensation of our named executive officers; and |

| | • | | In favor of holding future advisory votes on the compensation of our named executive officers EVERY 1 YEAR. |

We do not expect any matters to be presented for action at the Annual Meeting other than the matters described in this proxy statement. By signing and returning a proxy card, however, you will give to the persons named as proxies discretionary voting authority with respect to any other matter that may properly come before the Annual Meeting, and they intend to vote on any such other matter at their discretion in the manner they believe to be in the Company’s best interest.

How many votes may I cast?

You may cast one vote for every share of our common stock that you owned on December 5, 2011, the record date.

How many shares are eligible to be voted?

As of the record date, we had 71,341,660 shares of common stock outstanding, each of which is entitled to one vote.

How many shares must be present to hold the Annual Meeting?

Under Louisiana law and our By-Laws, the presence in person or by proxy of a majority of the issued and outstanding shares of our common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. The inspector of election will determine whether a quorum is present. If you are a beneficial owner (as defined below) of shares of our common stock and you do not instruct your bank, broker, or other holder of record how to vote your shares on any of the proposals, your shares will be counted as present at the Annual Meeting for purposes of determining whether a quorum exists. In addition, shares held by shareholders of record who are present at the Annual Meeting in person or by proxy will be counted as present at the Annual Meeting for purposes of determining whether a quorum exists, whether or not such holder abstains from voting his shares on any of the proposals.

How do I vote?

Shareholders of Record

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC (AST), you are the shareholder of record of those shares and these proxy materials have been made available or mailed to you by us. You may vote your shares by internet, by mail or by telephone as further described below. Your vote authorizes each of Brian Ferraioli and Regina N. Hamilton, as your proxies, to

3

appoint his or her substitute, and to represent and vote your shares as you directed. Mr. Ferraioli is Executive Vice President and Chief Financial Officer and Ms. Hamilton is Associate General Counsel and Assistant Corporate Secretary.

| | • | | Vote by Internet—Go tohttps://secure.amstock.com/voteproxy/login2.asp (control number on notice card required). |

| | – | Use the internet to transmit your voting instructions 24 hours a day, seven days a week until 11:59 p.m. (Central Time) on January 24, 2012. |

| | – | Please have your proxy card available and follow the instructions to obtain your records and create an electronic ballot. |

| | • | | Vote by Mail—Complete, date and sign your proxy card and return it in the postage-paid envelope provided. |

| | • | | Vote by Telephone—Call toll-free 800-776-9437 within the USA, Territories and Canada, or 1-718-921-8500 from other foreign countries. |

| | – | Use the phone to transmit your voting instructions 24 hours a day, seven days a week until 11:59 p.m. (Central Time) on January 24, 2012. |

Only the latest dated proxy received from you, whether submitted by internet, mail or telephone, will be voted at the Annual Meeting. If you vote by internet or telephone, please do not mail your proxy card. You may also vote in person at the Annual Meeting.

Beneficial Owners

If your shares are held in a stock brokerage account, by a bank, broker, or other holder of record, you are considered the beneficial owner of shares held in street name. As the beneficial owner, you may vote your shares via the internet or by telephone, or by signing and returning a voting instruction card as further described below. For a discussion of the rules regarding the voting of shares held by beneficial owners, please see the question below entitled “What happens if I don’t vote for a proposal? What is discretionary voting? What is a broker non-vote?” The notice of annual meeting of shareholders, the proxy statement and our annual report on Form 10-K for the fiscal year ended August 31, 2011, are available athttps://materials.proxyvote.com/820280 orwww.shawgrp.com/AnnualMeeeting.

| | • | | Vote by Internet—Go towww.proxyvote.com (control number on notice card required). |

| | • | | Vote by Mail—Complete, date and sign your proxy card and return it in the postage-paid envelope provided. |

| | • | | Vote by Telephone—Call toll-free 800-454-8683 within the USA, Territories and Canada. |

Participants in The Shaw Group Inc. 401(k) Plan

If you are a participant in The Shaw Group Inc. 401(k) Plan (401(k) Plan) and you own shares of our common stock through the 401(k) Plan, the proxy card sent to you by AST will also serve as your voting instruction card to the 401(k) Plan trustee, who actually votes the shares of our common stock that you own through the 401(k) Plan. If you do not provide voting instructions for these shares to the trustee, as directed by the terms of the 401(k) Plan, the Company, in its capacity as the 401(k) Plan administrator, will instruct the trustee not to vote those 401(k) Plan shares.

What happens if I don’t vote for a proposal? What is discretionary voting? What is a broker non-vote?

If you properly execute and return a proxy or voting instruction card, your shares will be voted as you specify. If you are a shareholder of record and you return an executed proxy card but make no specifications on your proxy card, your shares will be voted in accordance with the recommendations of our Board, as provided above.

4

If you are a beneficial owner and you do not provide voting instructions to your broker, bank or other holder of record holding shares for you, your shares will not be voted with respect to any proposal for which the holder of record does not have discretionary authority to vote. Rules of the New York Stock Exchange (NYSE) determine whether proposals presented at shareholder meetings are “discretionary” or “non-discretionary.” If a proposal is determined to be discretionary, your broker, bank or other holder of record is permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. If a proposal is determined to be non-discretionary, your broker, bank or other holder of record is not permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a non-discretionary proposal because the holder of record has not received voting instructions from the beneficial owner.

Under the rules of the NYSE, the proposal relating to the ratification of our independent registered public accounting firm is a discretionary proposal and all other proposals included in this proxy statement are non-discretionary proposals. If you are a beneficial owner and you do not provide voting instructions to your bank, broker or other holder of record holding shares for you, your shares may be voted with respect to the ratification of our independent registered public accounting firm, but willnot be voted with respect to the election of directors, the approval of the compensation of our named executive officers or the approval of the frequency of future advisory votes on the compensation of our named executive officers. Without your voting instructions on these matters, a broker non-vote will occur with respect to your shares. Shares subject to broker non-votes will not be counted as votes for or against and will not be included in calculating the number of votes necessary for approval of such matters to be presented at the Annual Meeting; however, such shares will be considered present at the Annual Meeting for purposes of determining the existence of a quorum. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares

What vote is required, and how will my votes be counted, to elect directors and to adopt the other proposals?

| | | | | | | | |

| Proposal | | Voting Options | | Vote Required to

Adopt the Proposal | | Effect of

Abstentions | | Effect of Broker

Non-Votes |

| No. 1: Election of the eight directors listed in this proxy statement | | For, against or abstain for each nominee | | Plurality of

votes cast | | No effect | | No effect |

| No. 2: Ratification of independent registered public accounting firm | | For, against or abstain | | Affirmative

vote of a

majority of

the votes cast | | No effect | | N/A |

| No. 3: Approval, on an advisory basis, of the compensation of our named executive officers | | For, against or abstain | | Affirmative

vote of a

majority of

the votes cast | | No effect | | No effect |

| No. 4: Approval, on an advisory basis, of the frequency of future advisory votes on the compensation of our named executive officers | | Shareholders may select whether such votes should occur every year, every two years or every three years, or shareholders may abstain from voting | | Plurality of

votes cast | | No effect | | No effect |

At each meeting of shareholders for the election of directors at which a quorum is present under our By-Laws, the persons receiving a plurality of the votes cast shall be elected directors. Under our By-Laws, all other matters considered at a meeting of shareholders require the affirmative vote of the holders of a majority of the votes cast at such meeting, except as otherwise provided by law, our Articles of Incorporation or our By-Laws. With respect to Proposal No. 4, although the vote is non-binding, our Board will consider the shareholders to have “approved” the frequency selected by a plurality of the votes cast; that is, the frequency receiving the highest number of affirmative votes.

5

Can I revoke or change my vote after I deliver my proxy?

Yes. Your proxy can be revoked or changed at any time before it is voted if you provide notice in writing to our Corporate Secretary before the Annual Meeting, if you timely provide to us another proxy with a later date or if you vote in person at the Annual Meeting or notify the Corporate Secretary in writing at the Annual Meeting of your wish to revoke your proxy.

Who pays for soliciting proxies?

We pay all expenses incurred in connection with the solicitation of proxies for the Annual Meeting. In addition to solicitations by mail, our directors, officers, and employees, without additional remuneration, may solicit proxies by internet, telephone, telegraph, and personal interviews and we reserve the right to retain outside agencies for the purpose of soliciting proxies. Banks, brokers or other holders of record will be requested to forward proxy soliciting material to the beneficial owners, and, as required by law, we will reimburse them for their out-of-pocket expenses in this regard.

Could other matters be considered and voted upon at the Annual Meeting?

Our Board does not expect to bring any other matter before the Annual Meeting, and it is not aware of any other matter that may be considered at the Annual Meeting. However, pursuant to our By-Laws, our shareholders still have time to submit the written notice required to properly bring a matter before the Annual Meeting. If any other matter does properly come before the Annual Meeting, the proxy holders will vote the proxies in his or her discretion.

What happens if the Annual Meeting is postponed or adjourned?

Unless a new record date is fixed, your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted.

I share an address with another shareholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

Some banks, brokers and other holders of record are “householding” our proxy statements, annual reports and notices of internet availability of proxy materials for their customers. This means that only one copy of our proxy materials or the notice of internet availability of proxy materials may have been sent to multiple shareholders in your household. We will promptly deliver a separate copy of any of these documents to you if you call us at (225) 932-2500 or write to us at: The Shaw Group Inc., Investor Relations, 4171 Essen Lane, Baton Rouge, Louisiana 70809.

If you would like to receive separate copies of the annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other holders of record, or you may contact us at the above address and telephone number.

What is the Company’s fiscal year?

Our fiscal year ends on August 31. When we refer to a particular fiscal year, we are referring to the fiscal year ended on August 31 of that year. For example, fiscal year 2011 refers to the fiscal year ended August 31, 2011.

6

SHAREHOLDER PROPOSALSFOR 2013 ANNUAL MEETING

In order for a shareholder proposal to be considered for inclusion in our 2013 proxy statement, we must receive any such proposal no later than August 17, 2012, to the following address: The Shaw Group Inc., Corporate Secretary, 4171 Essen Lane, Baton Rouge, Louisiana 70809. Also, our By-Laws establish an advance notice procedure for shareholders who wish to present a proposal before an annual meeting of shareholders, but do not intend for the proposal to be included in our proxy statement.

Specifically, our By-Laws provide that the only business that may be conducted at an annual meeting is business that is: (1) brought by or at the direction of our Board; or (2) brought by a shareholder of record as of the record date and who has timely delivered written notice to our Corporate Secretary, which notice must contain the information specified in our By-Laws. For a shareholder proposal not intended to be included in our proxy statement to be timely for our 2013 annual meeting, our Corporate Secretary must receive the written notice, prepared in accordance with our By-Laws, at our principal executive offices not fewer than 30 nor more than 60 days in advance of the annual meeting. If fewer than 40 days’ notice or prior disclosure of the date of the annual meeting is given or made to the shareholders, the Corporate Secretary must receive the written notice no later than the tenth day following the day on which the notice of the date of the annual meeting was mailed or the prior disclosure was made.

ANNUAL REPORT TO SHAREHOLDERS

The annual report on Form 10-K containing our consolidated financial statements for fiscal year 2011, has been mailed or made available to shareholders prior to or with this proxy statement. However, the annual report on Form 10-K does not form any part of the material for the solicitation of proxies. The Company filed with the SEC an annual report on Form 10-K for the fiscal year ended August 31, 2011.

We will provide you, without charge upon your request, additional copies of our annual report on Form 10-K for the fiscal year ended August 31, 2011. We will furnish a copy of any exhibit to our annual report on Form 10-K upon payment of a reasonable fee, which shall be limited to our reasonable expenses in furnishing the exhibits. You may request such copies by contacting Investor Relations at: The Shaw Group Inc., Investor Relations, 4171 Essen Lane, Baton Rouge, Louisiana 70809 or by telephone at (225) 932-2500.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 25, 2012

The notice of the 2012 Annual Meeting of shareholders, the proxy statement for the 2012 Annual Meeting of shareholders, the 2011 annual report to shareholders, and the annual report on Form 10-K for the fiscal year ended August 31, 2011 of The Shaw Group Inc. are available at https://materials.proxyvote.com/820280 or www.shawgrp.com/AnnualMeeting.

7

PROPOSAL 1 – ELECTION OF DIRECTORS

As provided by our Articles of Incorporation, the Board shall consist of no fewer than three and no more than 15 directors, the exact number of directors to be determined from time to time by the Board, or by the affirmative vote of shareholders holding more than 50% of the voting power of our common stock.

Our Board has nominated the eight directors listed below for election at this Annual Meeting to hold office until the next annual meeting and the election of their successors. All of the nominees are currently directors previously elected by our shareholders. Each agreed to be named in this proxy statement and to serve if elected. All of the nominees are expected to attend the 2012 Annual Meeting.

Vote Required

To be elected as a director, a nominee must receive a plurality of the shareholder votes cast at the Annual Meeting. The eight nominees receiving the most votes will be elected as members of our Board. The enclosed form of proxy provides a means for you to vote “For,” “Against” or “Abstain” on each of the eight director nominees. Each properly executed proxy received in time for the Annual Meeting will be voted as specified therein. The persons named as proxies on the proxy card intend to vote your proxy for the election of each of the eight nominees, unless otherwise directed. If, contrary to our expectations, a nominee should become unavailable for any reason, your proxy will be voted for a substitute nominee designated by our Board, unless otherwise directed. Abstentions will have no effect on the outcome of the vote on this proposal.

Board Recommendation

OUR BOARD RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF ALL EIGHT OF THE DIRECTOR NOMINEES LISTED IN THIS PROXY STATEMENT.

DIRECTOR CRITERIA, QUALIFICATIONS AND EXPERIENCE

Our Nominating and Corporate Governance Committee identifies individuals qualified to become members of our Board based on criteria delineated in our Corporate Governance Principles. Our Nominating and Corporate Governance Committee performs an assessment of the skills and experience needed to oversee the interests of the Company properly.

Backed by an industry leadership position and strong global presence, the Company is a vertically integrated provider of engineering, design, construction, technology, maintenance, and pipe fabrication services. As a Fortune 500 company with 27,000 employees in nearly 150 locations around the world, we provide solutions for clients in the power, environmental, infrastructure, and energy and chemicals industries. Throughout the Company’s history, our core values have remained constant: safety, commitment to quality, execution excellence, initiative, innovations, integrity, value of the individual, focus on our customers, accountability, and open and honest communication. These values are not only practiced and embodied internally, but they are also reflected in our performance and are recognized by our customers. Our core values are at the heart of our ability to create and respond to opportunities and fuel growth.

Our Nominating and Corporate Governance Committee intends that the Company’s current and future directors collectively have a mix of qualifications and experience necessary to understand and promote our industry and core values. We also seek directors who have integrity, judgment, leadership skills, and who commit their energy to the success of the Company. Our Nominating and Corporate Governance Committee also considers the slate as a whole, aiming for a well-rounded Board that reflects the expertise and values of the Company.

8

DIRECTOR NOMINEES

Below each nominee’s biography, we have included an assessment of the qualifications and experience of such nominee.

| | | | |

| J.M. BERNHARD, JR. | | Board Committees: | | Company Positions: |

Age:57 Director Since: 1987 | | • Executive | | • Chairman of the Board, Chief Executive Officer and President |

Mr. Bernhard, our founder, has been our Chief Executive Officer and a director since the Company began in 1987. Mr. Bernhard served as our President from 1987 until 2003. Our Board re-elected him as President in November 2006, and he has continually served in that position ever since. He has been Chairman of our Board since August 1990. Prior to founding the Company, Mr. Bernhard was Vice President and General Manager of Sunland Services, a pipe fabrication and industrial construction company that the Company later acquired. He is also a member of numerous trade and civic organizations. He graduated from Louisiana State University in 1976 with a degree in Construction Management.

Under Mr. Bernhard’s leadership, the Company has grown dramatically through a series of strategic acquisitions. The Company has been named to the Fortune 500 list seven times and is one of the youngest companies to appear on such list. In addition, the Company has been recognized twice as one of the Fortune 500 Magazine’s “Most Admired Companies.” The Company also has been named “Contractor of the Year” by Associated Builders and Contractors.

Mr. Bernhard is our longest-serving Board member. For over 20 years, he has contributed to the Company his operational, financial and strategic experience garnered from his career and involvement in the fabrication, engineering, and construction industry. In addition to these qualifications, attributes and skills, Mr. Bernhard offers the perspective, institutional knowledge and deep understanding of our business. As the only member of our management to serve on our Board, Mr. Bernhard contributes a level of understanding of our Company not easily attainable by an outside director.

| | |

| JAMES F. BARKER | | Private Directorships: |

| Age:64 | | • President, Clemson University |

Director Since: January 2004 | | |

Mr. Barker has served as President of Clemson University since December 1999. He earned his bachelor of architecture degree from Clemson in 1970 and his master of architecture and urban design degree from Washington University in St. Louis in 1973. Before returning to Clemson in 1986 to serve as dean of the College of Architecture, he was dean of the School of Architecture at Mississippi State University.

As president of a large public university, Mr. Barker understands the management concerns created by varied interests and business units within one organization operating in a public domain. His ability to make policy and financial decisions for the entire organization under stakeholder stresses positively contributes to our Board’s deliberations. His experience administering and managing the finances of a university and of several non-profit organizations make him a valued member of our Board.

9

| | | | |

| THOS. E. CAPPS | | Board Committees: | | Public Directorships: |

| Age:76 | | • Audit | | • Amerigroup Corp. |

| Director Since: July 2007 | �� | | | Private Directorships: |

| | | | | • Associated Electric & Gas Insurance Services Ltd. |

Mr. Capps served as Chief Executive Officer of Dominion Resources, Inc. (NYSE: D) from January 2000 to December 2005; as President from September 1995 to December 2003; as Chairman from September 1995 to January 2000; as Vice Chairman of the board of directors from January 2000 to August 2000; and as President and Chief Executive Officer from September 1995 to January 2000. Dominion Resources is a publicly-held power and energy company that supplies electricity, natural gas and other energy sources and operates generation facilities. Mr. Capps is a member of the board of directors of Amerigroup Corp. (NYSE: AGR) of Virginia Beach, a publicly-held, managed-healthcare company, and Associated Electric & Gas Insurance Services Ltd., which operates as a non-assessable mutual insurance company in the U.S., offering insurance and risk management products and services to the utility and related energy industry.

Mr. Capps brings his nearly twenty year’s experience with Dominion Resources, Inc., to our Board. This knowledge of power sources, power generation and supply contributes to our Board’s understanding of both our clients’ and our Company’s needs and capacities. His enduring leadership as Chairman, President and CEO of Dominion Resources evidences his ability to manage a depth and breadth of public company matters. His experience supervising financial and accounting personnel and broad understanding of accounting principles, internal controls over financial reporting and audit committee functions are important contributions to our Audit Committee.

| | | | |

| DANIEL A. HOFFLER | | Board Committees: | | Private Directorships: |

| Age:63 | | • Compensation(Chair) | | • Armada Hoffler |

| Director Since: January 2006 | | • Nominating and Corporate Governance | | |

Mr. Hoffler is the chairman of the board of directors of Armada Hoffler, a premier commercial real estate development and construction organization located in Virginia, which he founded over 25 years ago. Before founding Armada Hoffler, Mr. Hoffler was employed as Vice President of Marketing for Eastern International, Inc., a commercial real estate development and construction company specializing in construction of warehouse and office buildings. Prior to that, Mr. Hoffler was employed as a Regional Manager for Dun and Bradstreet, a credit information provider. From 1992 through 1996, Mr. Hoffler served on the University of Virginia’s Board of Visitors. In 1987, he was chosen as the Outstanding Citizen of Hampton Roads, Virginia. In 1986, Mr. Hoffler was appointed to a five-year term in the Virginia Governor’s Advisory Board for Industrial Development for the Commonwealth of Virginia.

Mr. Hoffler’s vast experience in real estate development and construction and his understanding of debt and equity markets complements the experience and knowledge base of our other directors. His unique skill set relating to design-build collaborations and public/private partnerships combined with his understanding of financial markets assist our Board in evaluating creative and value-creating Company initiatives. As founder of his company, he understands issues relating to the growth of a business and the concerns involved in running a profitable company. His business leadership and experience in growing a company make him uniquely qualified to serve as the Chair of our Compensation Committee.

10

| | | | |

| DAVID W. HOYLE | | Board Committees: | | Public Directorships: |

Age:72 Director Since: January 1995 | | • Audit • Nominating and Corporate Governance(Chair) • Executive | | • Citizens South Banking Corporation |

| | | Government Positions: • Secretary of Revenue, North Carolina |

| | | |

For the past 25 years, Secretary Hoyle has been self-employed, primarily as a real estate developer. From 1992 until 2010, he served as a Senator in the North Carolina General Assembly. He served as chairman of the North Carolina Senate Finance Committee for 12 years. In October 2010, he was sworn in as Secretary of Revenue for the State of North Carolina. Secretary Hoyle is the chairman of the board of directors of Citizens South Banking Corporation, a bank holding company, and is the chairmanemeritus of the board of directors of its wholly-owned subsidiary, Citizens South Bank. His government leadership and integrity serve the Company well in his capacity as Chair of the Nominating and Corporate Governance Committee.

Secretary Hoyle contributes his knowledge of banking, tax and real estate development issues and experience with financial management to our Board’s deliberations. His long tenure in the North Carolina Senate evidences his understanding of governance, leadership skills, and knowledge of working with government bodies. With 15 years’ service on our Board, his institutional knowledge and historical perspective are vital assets to our Board and our shareholders.

| | | | |

| MICHAEL J. MANCUSO | | Board Committees: | | Public Directorships: |

| Age:69 | | • Audit(Chair) | | • SPX Corporation |

| Director Since: August 2006 | | • Executive | | Former Public Directorships Held During the Past Five Years: |

| | | | • LSI Logic Corporation |

| | | | | • CACI International Inc. |

Mr. Mancuso was named Vice President and Chief Financial Officer of Computer Services Corporation (NYSE: CSC), a publicly-held leading provider of information technology and professional services to large corporations and governments, on December 1, 2008. In June 2006, after 13 years’ service, Mr. Mancuso retired from General Dynamics Corporation (NYSE: GD), a company engaged in the field of mission-critical information systems and technologies, land and expeditionary combat systems, armaments and munitions, shipbuilding and marine systems and business aviation. Mr. Mancuso had served as Senior Vice President and Chief Financial Officer of General Dynamics since 1994. Before joining General Dynamics, Mr. Mancuso spent seven years with United Technologies, where he served as Vice President and Chief Financial Officer for the Commercial Engine Business of the Pratt & Whitney Group. He joined United Technologies Defense and Space Systems Group in 1986 as Group Financial Manager, moved to the Aerospace and Defense Section in 1989 as Director, Financial Planning and Analysis, and spent three years as Vice President, Finance and Administration for the Hamilton Standard Division. His background also includes 21 years with General Electric. Mr. Mancuso also serves on the board of directors for SPX Corporation (NYSE: SPW), a publicly-held industrial manufacturer headquartered in Charlotte, North Carolina. From 2007 until 2009, Mr. Mancuso also served on the board of directors for LSI Logic Corporation (NYSE: LSI), a publicly-held leading provider of silicon systems and software technologies, headquartered in Milpitas, California. From 2007 until 2008, Mr. Mancuso also served on the board of directors for CACI International Inc. (NYSE: CACI), a publicly-held provider of information technology and professional services to the U.S. federal government and commercial markets in North America and internationally, headquartered in Arlington, Virginia.

Mr. Mancuso brings a strong background in operations, finance and financial reporting with large, blue chip, publicly traded companies to our Board. As Chief Financial Officer of a leading information technology company and former Chief Financial Officer of a major technology and defense company, he has the financial

11

background and operational experience to understand and to provide guidance in evaluating complex business and financial issues facing large public companies. His strategic and financial perspective, and long involvement with government and international operations, brings a valuable perspective to our Board and to his leadership as chair of our Audit Committee.

| | | | |

| ALBERT D. McALISTER | | Board Committees: | | Private Directorships: |

| Age:60 | | • Compensation | | • McAlister & McAlister |

| Director Since: April 1990 | | • Nominating and Corporate Governance | | • President’s Advisory Board, Clemson University |

| | | • Executive | | |

Since 1975, Mr. McAlister has been a partner in the law firm of McAlister &McAlister in Laurens, South Carolina. Mr. McAlister is a director of a private charitable foundation and a member of the Clemson University – President’s Advisory Board.

Mr. McAlister contributes to our Board the skills and experience gained from his years of legal service to various businesses and corporations and as a litigator. As a founder of his firm, he has sophisticated legal experience and a reputation for resolving complex legal matters. Having joined our Company at its inception, he is a repository of institutional knowledge and historical perspective and has been a key advisor to our management as we have grown from a start-up to a Fortune 500 company.

| | | | |

| STEPHEN R. TRITCH | | Board Committees: | | Public Directorships: |

Age:62 Director Since: April 2009 | | • Nominating and Corporate Governance | | • Koppers Holdings, Inc. |

| | | | Private Directorships: |

| | | | • PaR Systems |

| | | | • Board of Trustees, University of Pittsburgh (Chair) |

| | | | • Board of Trustees, Senator John Heinz History Center, Pittsburgh, PA |

| | | | | • UPMC Health System |

Mr. Tritch is the retired Chairman of Westinghouse Electric Company (Westinghouse) and served in that capacity from July 1, 2008, to July 1, 2010. Westinghouse is a pioneering nuclear power company and a leading supplier of nuclear plant products and technologies to utilities throughout the world. From July 2002 to July 2008, Mr. Tritch served as President and Chief Executive Officer of Westinghouse. Mr. Tritch had been employed by Westinghouse since 1971. Mr. Tritch was appointed in 2007 by then-President George W. Bush to the President’s Export Council. Mr. Tritch is also chairman of the board of trustees at the University of Pittsburgh; first Vice Chairman of the UPMC Health System; a member of the board of trustees for the Senator John Heinz History Center in Pittsburgh for which he previously served as chairman until July 2010; and a member of the board of directors of Koppers Holdings, Inc. (NYSE: KOP), a publicly-held company and a leading producer of carbon compounds and treated wood products, headquartered in Pittsburgh, Pennsylvania. He is also a member of the board of PaR Systems, a privately-held robotic systems supplier, headquartered in Minneapolis, Minnesota.

Mr. Tritch’s experience with Westinghouse, a partner in many of our nuclear plant projects, makes him a valued member of our Board as our Company continues to grow in this field. He brings a wealth of knowledge about the nuclear power industry and understanding of the unique issues involved in this complex and historically significant industry sector. Mr. Tritch’s broad experience with nuclear power technology companies and his insight into global electric power production complement the spectrum of experience on our Board.

12

CORPORATE GOVERNANCE

Our Board has adopted Corporate Governance Principles, which are available on our website atwww.shawgrp.com on the “About Shaw” page under the “Corporate Governance” link. The Corporate Governance Principles reflect our Board’s commitment to oversee the effectiveness of policy and decision-making both at the board and management level, with a view towards enhancing shareholder value over the long-term.

PROCESS FOR SELECTING DIRECTORS

In considering a candidate to include on our Board’s slate of director nominees, our Nominating and Corporate Governance Committee applies the qualifications set forth in our Corporate Governance Principles and evaluates nominees for the skills and qualifications identified above. Our Nominating and Corporate Governance Committee considers the candidate’s integrity, business acumen, experience in areas relevant to the Company’s businesses, ability to devote the time needed to be an effective director and a broad range of personal characteristics such as management skills and independent thinking. In addition, our Nominating and Corporate Governance Committee considers the various qualifications required by the SEC and the NYSE, such as independence and financial expertise (as defined by applicable SEC and NYSE rules).

Our Nominating and Corporate Governance Committee and our Board do not have formal diversity policies; however, our Corporate Governance Principles require that members of our Board bring a diversity of perspectives to our Board. Although our Nominating and Corporate Governance Committee focuses on obtaining diverse professional expertise on the Board rather than diverse personal characteristics, it recognizes the desirability of racial, ethnic and gender diversity and considers it a benefit when a new director can also increase the diversity of the Board as a whole. Our Nominating and Corporate Governance Committee also considers the diversity of high quality business and professional backgrounds.

In considering the candidates, our Nominating and Corporate Governance Committee considers the background and qualifications of the directors, as a group, and whether together they will provide an appropriate mix of experience, knowledge and attributes that will allow our Board to fulfill its responsibilities. Our Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees.

The director nominee biographies above demonstrate each nominee’s experience, qualifications, attributes, and skills which led our Nominating and Corporate Governance Committee and our Board to conclude that each nominee should continue to serve as a director of the Company. Each member of our Nominating and Corporate Governance Committee and our Board believe that each of the nominees has the individual attributes and characteristics required of our directors, and that the nominees as a group possess the skill sets and experience desired for our Board as a whole.

The process followed by our Nominating and Corporate Governance Committee to identify and evaluate director candidates includes requesting Board members and others to submit recommendations, meeting from time to time to consider biographical information and background materials relating to potential candidates and interviewing (with Board members) selected candidates.

SHAREHOLDER-RECOMMENDED DIRECTOR CANDIDATES

Our Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders in accordance with the criteria for director selection described above under “Process for Selecting Directors.” Shareholders recommending candidates for consideration should send their recommendations to: The Shaw Group Inc., General Counsel, 4171 Essen Lane, Baton Rouge, Louisiana 70809.

13

DIRECTOR INDEPENDENCE

The NYSE listing standards and the Company’s standards of independence enumerated in our Corporate Governance Principles require our Board to consist of at least a majority of independent directors. Only one director is a Company employee, and our Board has affirmatively determined that a majority of our current directors qualify as “independent” directors pursuant to the rules adopted by the SEC, the NYSE listing standards and our Corporate Governance Principles. The Company’s Corporate Governance Principles are available on our website atwww.shawgrp.com on the “About Shaw” page under the “Corporate Governance” link.

Under our Board’s standards for director independence, a director is considered independent if our Board affirmatively determines that the director has no direct or indirect “material relationship” with the Company, other than as a director or owner of shares of our common stock. When assessing the “materiality” of a director’s relationship, our Board considers all facts and circumstances, not just from the director’s viewpoint, but from that of the persons or organizations with whom or which the director has an affiliation. Our Board also considers the frequency and regularity of any services the director provides, whether provided at arm’s length in the ordinary course of business and substantially on the same terms to the Company as those prevailing at the time from unrelated third parties for comparable transactions. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships, among others. Our Board also considered the following transactions, relationships, and arrangements in determining director independence and determined that they were not material and did not impair independence:

| | | (a) In the ordinary course of business, Shaw has made payments to an entity, which, among other things, supplies equipment to power plants, for which Mr. Mancuso serves as a director. The payments by Shaw to such entity have not, within any of the other entity’s three most recently completed fiscal years, exceeded the greater of $1 million or 2% of the other entity’s consolidated gross revenues for such years. |

| | | (b) In the ordinary course of business, each of Shaw and another publicly-held company, for which Mr. Mancuso serves as an executive officer, formed lower tiered subsidiaries to engage in two separate joint ventures. In one of these joint venture entities, Shaw’s subsidiary has a 35% interest and the other joint venture entity has a 65% interest. One of the joint venture entities is a single purpose, limited liability company that services a U.S. government contract awarded through a competitive bidding process to provide maintenance and facilities management services at a military base located in Florida. Such joint venture entity was formed before Mr. Mancuso became an executive officer at the parent company level of the publicly-held company that is Shaw’s joint venture partner. Servicing the government contract is such joint venture entity’s only business. The second joint venture entity is also a single purpose entity, formed to service a single U.S. government contract awarded through a competitive bidding process. Servicing that government contract is also such joint venture entity’s only business. |

| | | Neither Shaw nor the other publicly-held company make payments to or receive payments from the other. Payments made by either joint venture entity to Shaw or to the other publicly-held company, for which Mr. Mancuso serves as an executive officer, have not exceeded (and are not expected to exceed) the greater of 2% of either company’s consolidated gross revenue or $1 million, nor do they exceed these amounts when combined. Mr. Mancuso does not serve and never has served as a director, officer, or employee of either of the joint venture entities. |

Our Board has reviewed the above transactions and has affirmatively determined that Mr. Mancuso qualifies as an independent director.

Applying the standards listed above and on the basis of information solicited from our directors, our Board has affirmatively determined that the following directors currently qualify as independent, because they have no direct or indirect material relationship with the Company (other than being a member of our Board and owning shares of our common stock): Thos. E. Capps, Daniel A. Hoffler, David W. Hoyle, Michael J. Mancuso, Albert D. McAlister and Stephen R. Tritch. J.M. Bernhard, Jr., our Chairman, President, and Chief Executive Officer and James F. Barker are currently our only non-independent directors.

14

BOARD LEADERSHIP

J.M. Bernhard, Jr. currently serves as both the Chairman of our Board and Chief Executive Officer (CEO). Our Board does not have a policy regarding the separation of the roles of Chairman and CEO. Our Board believes that its current leadership structure is in the Company’s best interest and will continue to assess the merits of this structure based on regular assessments of the Company’s current condition and our Board’s overall composition. Our Board has determined that J.M. Bernhard, Jr., the Company’s founder and, as CEO, the individual with primary responsibility for managing the Company’s day-to-day operations, is highly qualified to serve in the combined role of Chairman and CEO because he is best positioned to lead the meetings of our Board, facilitate discussions, and provide direction on key business and strategy matters. Our Board believes that having Mr. Bernhard act in both roles is in the best interest of our shareholders at this time because it makes the best use of Mr. Bernhard’s extensive knowledge of the Company and our industry, as well as fostering greater communication between management and our Board.

Our Corporate Governance Principles provide that when the Chairman of our Board is not an independent director, the Chair of our Nominating and Corporate Governance Committee shall serve as the Lead Director, unless a majority of the independent directors designate another independent director to serve as Lead Director. The primary duties of the Lead Director are to: (i) preside over executive sessions of the independent directors and any Board meetings when the Chairman is not present; (ii) assist the Chairman with the preparation of the agenda for Board meetings and committee meetings; and (iii) serve as liaison between the independent directors and the Company and the Chairman and the CEO. The Lead Director is also authorized to engage in communications with shareholders as requested by our Board. Mr. Hoyle, Chair of our Nominating and Corporate Governance Committee, currently serves as our Lead Director.

BOARD RISK OVERSIGHT

As part of its oversight responsibilities, our Board regularly reviews and discusses with management the methods by which the Company assesses and mitigates enterprise risk. As part of routine meetings of our Board, management presents our Board with updates regarding the relative risks associated with key facets of the Company’s operations. The full Board focuses primarily on operational and financial risks related to project development and execution and relies on our Audit, Compensation, and Nominating and Corporate Governance Committees to monitor and report on those risks specific to the particular committee’s purview. Our Audit Committee reviews and discusses the effectiveness of policies and procedures that the Company develops to assess and mitigate risk relating to financial reporting, tax, liquidity, and capital resources. Our Audit Committee is responsible for monitoring the Company’s financial risk. Our Compensation Committee reviews and discusses the Company’s compensation programs, strategy, and philosophy to determine whether the programs mitigate or reduce compensation-related risks and whether the programs align with shareholders’ interests. Our Nominating and Corporate Governance Committee reviews and discusses appropriate corporate governance practices that mitigate regulatory risk. Additionally, because risk issues often overlap, committees from time to time request that the full Board discuss particular risks.

SUCCESSION PLANNING

Our Nominating and Corporate Governance Committee is charged with identifying, periodically reviewing and re-assessing the qualities and characteristics necessary for an effective CEO and consulting with our CEO on senior executive management planning. Each year, members of our Board, our Nominating and Corporate Governance Committee and a select few employees who have a need to know, discuss in an executive session how to address unexpected occurrences (death, disability, resignation or removal) and temporary unplanned absences (such as a treatable illness). The positions reviewed include those executive officers who might succeed our CEO.

15

COMMUNICATIONS WITH DIRECTORS

General

Shareholders and other interested parties may contact our non-employee directors by sending an e-mail toboard@shawgrp.com, or by writing to them at the following address: The Shaw Group Inc., Board of Directors, 4171 Essen Lane, Baton Rouge, Louisiana 70809. All e-mails and letters received by either of these two methods are categorized and processed by either our Vice President of Internal Audit, who reports directly to our Audit Committee, or by our Chief Compliance Officer, each of whom may forward on to our non-employee directors as warranted. For additional information, please see our website atwww.shawgrp.com on the “About Shaw” page under the “Corporate Governance” link.

Accounting, Internal Control and Auditing Matters

Our Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding questionable accounting, internal control and auditing matters. An employee may file a complaint through several different avenues, including: (1) our non-employee director e-mail account (board@shawgrp.com); (2) our Speak Up line (1.888.337.7499); or (3) internally reporting the matter to a member of management, our Chief Compliance Officer or other employees of the Company designated in our Code of Corporate Conduct. Our Chief Compliance Officer is responsible for monitoring and reporting such complaints to our Audit Committee.

MEETINGS OF INDEPENDENT DIRECTORS; PRESIDING DIRECTOR

Our independent directors met separately three times during fiscal year 2011 in non-management executive sessions. The Chairman of our Nominating and Corporate Governance Committee, Secretary Hoyle, in his capacity as Lead Director, served as presiding director at each meeting of the independent directors. The independent directors will continue to meet in executive sessions without any members of management or any non-independent directors being present, pursuant to the rules promulgated by the NYSE.

DIRECTOR ATTENDANCE

We do not require our Board members to attend our annual meetings; however, the Corporate Governance Principles encourage directors to do so. Seven out of the eight current members of our Board attended last year’s annual meeting either in person or telephonically.

COMMITTEES OF OUR BOARD

Audit Committee

Our Audit Committee oversees our accounting, auditing, disclosure and financial reporting practices. We believe our Audit Committee members are highly qualified individuals with significant relevant experience. Our Audit Committee met five times during fiscal year 2011, and held periodic executive sessions separately with our Vice President of Internal Audit and our independent registered public accounting firm. Our Audit Committee also reviews and discusses with management and our independent registered public accounting firm our annual and quarterly financial statements before they are filed with the SEC, and meets with management to discuss our earnings announcements.

Our Board, in its business judgment, has determined that our Audit Committee is comprised entirely of directors who satisfy the standards of independence established under the rules and regulations of the SEC, the NYSE listing standards and our Corporate Governance Principles. Our Board has determined that each member of our Audit Committee has the requisite accounting and related financial management expertise under the NYSE listing standards. Additionally, our Board determined that Mr. Mancuso is qualified as an “audit committee financial expert” under the rules and regulations of the SEC. Our Board has adopted a written charter describing the roles and responsibilities of the Audit Committee. You may review the charter atwww.shawgrp.comon the “About Shaw” page under the “Corporate Governance” link.

16

Compensation Committee

Our Compensation Committee reviews and approves our compensation philosophy and objectives for corporate officers and other key management employees; reviews the competitiveness of our total compensation practices; determines the compensation and incentive awards to be paid to, and approves the compensation of, corporate officers and other key management employees; approves the terms and conditions of proposed incentive plans applicable to corporate officers and other key management employees; and reviews and approves, if appropriate, employment agreements, and severance and change in control arrangements for corporate officers

and other key management employees. Our Board has adopted a written charter describing the roles and responsibilities of the Compensation Committee, which includes the review of and recommendation to approve the Compensation Discussion and Analysis. You may review the charter atwww.shawgrp.comon the “About Shaw” page under the “Corporate Governance” link.

In July of 2010, the Compensation Committee retained Hewitt Associates to provide it with independent analysis and advice regarding compensation programs. During fiscal year 2011, Hewitt Associates spun off its executive compensation consulting group, which became Meridian Compensation Partners, LLC. Accordingly, the Compensation Committee elected to engage Meridian Compensation Partners, LLC (Hewitt Associates or Meridian Compensation Partners, LLC are referred to hereafter as “Meridian”). Neither provides any other services directly to the Company.

In June of 2011, our Compensation Committee replaced Meridian with Pay Governance LLC (“Pay Governance,” and together with Meridian, the “Compensation Consultant”). Pay Governance provides no other services directly to the Company.

Our Board, in its business judgment, has determined that the Compensation Committee is comprised entirely of directors who satisfy the standards of independence established under the rules and regulations of the SEC, the NYSE listing standards, and our Corporate Governance Principles. Our Compensation Committee met five times during fiscal year 2011, and acted pursuant to a unanimous written consent in lieu of meeting on one occasion.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee reviews and approves directorship policies and practices from time to time; evaluates potential director candidates and recommends qualified candidates to the full Board; advises our Board on composition of the Board and committees of the Board; directs all matters concerning the Chief Executive Officer succession plan; and recommends and implements significant corporate governance matters. Our Board, in its business judgment, has determined that the Nominating and Corporate Governance Committee is comprised entirely of directors who satisfy the standards of independence established under the rules and regulations of the SEC, the NYSE listing standards, and our Corporate Governance Principles. In accordance with our Corporate Governance Principles and our Nominating and Corporate Governance Committee Charter, our Nominating and Corporate Governance Committee considers shareholder nominated directors on the same basis as it considers nominations from other sources. Shareholders may recommend candidates for our Nominating and Corporate Governance Committee to consider as potential director nominees by submitting the nominee’s name, biographical information, and background materials to: The Shaw Group Inc., Nominating and Corporate Governance Committee c/o General Counsel, 4171 Essen Lane, Baton Rouge, Louisiana 70809. The Nominating and Corporate Governance Committee will consider a recommendation only if the appropriate biographical information and background material is provided on a timely basis. Assuming that the appropriate biographical and background material is provided for candidates recommended by shareholders, our Nominating and Corporate Governance Committee will evaluate those candidates by following the same criteria used for candidates submitted by the members of our Board. Our Nominating and Corporate Governance Committee will also consider whether to nominate any person nominated by a shareholder in accordance with the provisions of our By-Laws relating to shareholder nominations. To date, no shareholder has recommended a candidate for director nominee to our Nominating and Corporate Governance Committee or our Board.

17

Our Nominating and Corporate Governance Committee met four times during fiscal year 2011. Our Board has a written charter describing the roles and responsibilities of our Nominating and Corporate Governance Committee. You may review the charter atwww.shawgrp.com on the “About Shaw” page under the “Corporate Governance” link.

Executive Committee

Our Executive Committee provides an efficient means of considering matters and taking actions that may require the attention of our Board or our Board’s authorization when our Board is not in session. Except as provided by law, our Executive Committee possesses and may exercise all of the powers of our Board in the management and direction of all the business and affairs of the Company during the intervals between the meetings of our Board. Our Executive Committee met two times during fiscal year 2011.

The Board and Committees

Each of our current directors attended at least 75% of all meetings of the Board and 75% of all meetings of the committees of our Board on which he served during fiscal year 2011 or such shorter period of service. The following table shows the committee memberships of directors serving during fiscal year 2011 and the total number of meetings of our Board and its committees.

| | | | | | | | | | |

| Director | | Board | | Audit | | Compensation | | Nominating &

Corporate

Governance | | Executive |

J.M. Bernhard, Jr. | | CHAIR | | | | | | | | • |

James F. Barker(1) | | | | •(1) | | •(1) | | | | |

Thos. E. Capps | | | | • | | | | | | |

Daniel A. Hoffler | | | | | | CHAIR | | • | | |

David W. Hoyle | | LEAD | | • | | | | CHAIR | | • |

Michael J. Mancuso | | | | CHAIR | | | | | | • |

Albert D. McAlister | | | | | | • | | • | | • |

Stephen R. Tritch | | | | | | | | • | | |

FY 2011 Meetings | | 7(2) | | 5 | | 6(3) | | 4 | | 2 |

| (1) | Mr. Barker ceased serving as a member of our Audit and Compensation Committees on February 24, 2011, when he was determined to no longer be independent. |

| (2) | Our Board acted by unanimous written consent twice during fiscal year 2011. |

| (3) | Our Compensation Committee acted by unanimous written consent once during fiscal year 2011. The charter of our Compensation Committee stipulates that actions by unanimous written consent constitute a meeting of the Compensation Committee. |

Compensation Committee Interlocks and Insider Participation