POLY COMPANY OVERVIEW November 5, 2019 NYSE:PLT © 2019 Plantronics Inc. All rights reserved. 1

FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to: (i) expectations for the UC&C market and Enterprise TAM and our ability to differentiate ourselves and take advantage of the opportunities based on our positioning, product portfolio and launch dates; (ii) expectations regarding synergies from previous integration efforts and anticipation for additional synergies, accretion and long-term operating model targets, and our ability to attain them in the timeframes expected; (iii) beliefs regarding what is required to succeed in the UCC market and our strategy to achieve success; (iv) our expectations for tariff mitigation and resolution of transitory issues and the timeframes in which we believe we can achieve them; (v) expectations for end user and software analytics and services, the positioning of our product portfolio and the potential for near-term gains; (vi) expectations regarding debt repayment actions and timing; (vii) our expectations to reduce channel inventory materially in the third quarter of Fiscal Year 2020 and its impact on guidance; (viii) estimates of GAAP and non-GAAP financial results for the third quarter and full year Fiscal Year 2020, including net revenues, purchase accounting adjustments, adjusted EBITDA, tax rates, intangibles amortization, and diluted weighted average shares outstanding and diluted EPS, gross margins, operating expenses, income and margins, in addition to other matters discussed in this presentation that are not purely historical data. We do not assume any obligation to update or revise any such forward- looking statements, whether as the result of new developments or otherwise. The factors that could cause actual results to differ are discussed in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on May 17, 2019, in our reports on Form 10-Q and Form 8-K filed with the SEC as well as our other public disclosures, including our press releases. Please also refer to the Safe Harbor included in our press release regarding our results for Q2 FY20 filed with the SEC on Form 8-K on November 5, 2019. The SEC filings and our press releases can be accessed on our website at investor.poly.com. © 2019 Plantronics Inc. All rights reserved. 2

USE OF NON-GAAP INFORMATION To supplement our condensed consolidated financial statements presented on a GAAP basis, we use non-GAAP, and where applicable, combined comparative measures of operating results, including non-GAAP net revenues, non-GAAP gross profit, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income, adjusted EBITDA, and non-GAAP diluted EPS, which exclude certain unusual or non-cash expenses and charges that are included in the most directly comparable GAAP measure. These unusual or non-cash expenses and charges include the effect, where applicable, of purchase accounting on deferred revenue and inventory, stock-based compensation, acquisition related expenses, purchase accounting amortization and adjustments, restructuring and other related charges and credits, asset impairments, executive transition charges, rebranding costs, gains or losses from litigations settlements, unusual and/or irregular gains or losses from the sale of investments, and the impact of participating securities, all net of any associated tax impact. We also exclude tax benefits from the release of tax reserves, discrete tax adjustments including transfer pricing, tax deduction and tax credit adjustments, and the impact of tax law changes. We exclude these amounts from our non-GAAP and combined comparative measures primarily because management does not believe they are consistent with the development of our target operating model. Combined comparative results refer to the results for periods prior to the Plantronics and Polycom combination, which were prepared by combining the non-GAAP results of as if they had been combined during that period. These prior period results are presented on a non-GAAP as-reported basis, with immaterial adjustments to align the treatment of non- GAAP adjustments for comparative purposes. We believe that the use of non-GAAP and combined comparative financial measures provides meaningful supplemental information regarding our performance and liquidity and helps investors compare actual results with our historical and long-term target operating model goals as well as our performance as a combined company. We believe presenting non-GAAP net revenue provides meaningful supplemental information regarding how management views the performance of the business and underlying performance of our individual product categories. We believe that both management and investors benefit from referring to these non-GAAP and combined comparative financial measures in assessing our performance and when planning, forecasting and analyzing future periods; however, non-GAAP and combined comparative financial measures are not meant to be considered in isolation of, or as a substitute for, or superior to, net revenues, gross margin, operating expenses, operating income, operating margin, net income or EPS prepared in accordance with GAAP. A reconciliation between GAAP and Non-GAAP measures for all periods presented in this document is included as an appendix to this document. Other historical reconciliations are available at investor.poly.com. © 2019 Plantronics Inc. All rights reserved. 3

Learn about our corporate strategy, financial update, product and partner news. FY21 outlook to be updated at our FY20 Investor Day on November 20, 2019. For dial-in and webcast information, please visit investor.poly.com. WEDNESDAY, NOVEMBER 20, 2019 8:30 AM - 1:00 PM ET © 2019 Plantronics Inc. All rights reserved. 4

OVERVIEW & STRATEGY © 2019 Plantronics Inc. All rights reserved. 5

PLANTRONICS + POLYCOM. NOW POLY. Poly is the global communications company that powers authentic human connection and collaboration. One to one, one to many, many to many. © 2019 Plantronics Inc. All rights reserved. 6

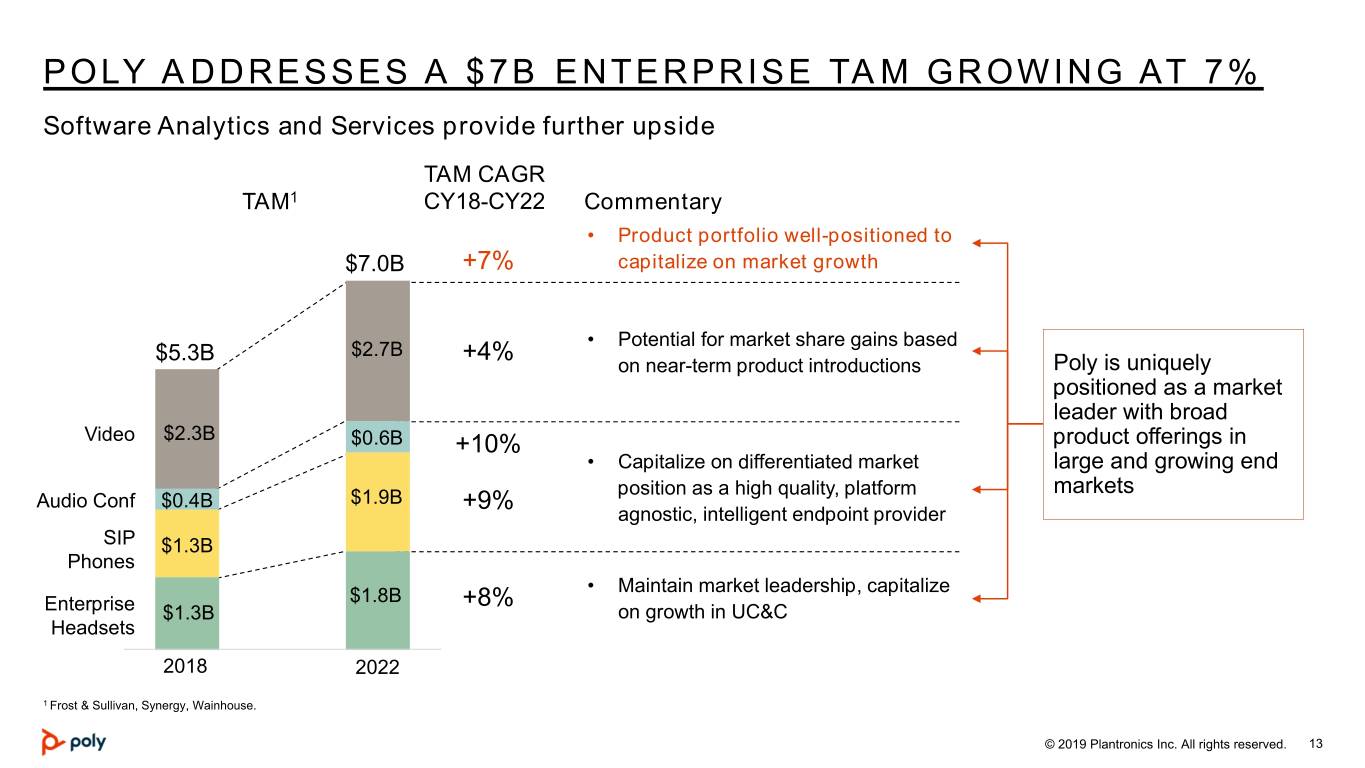

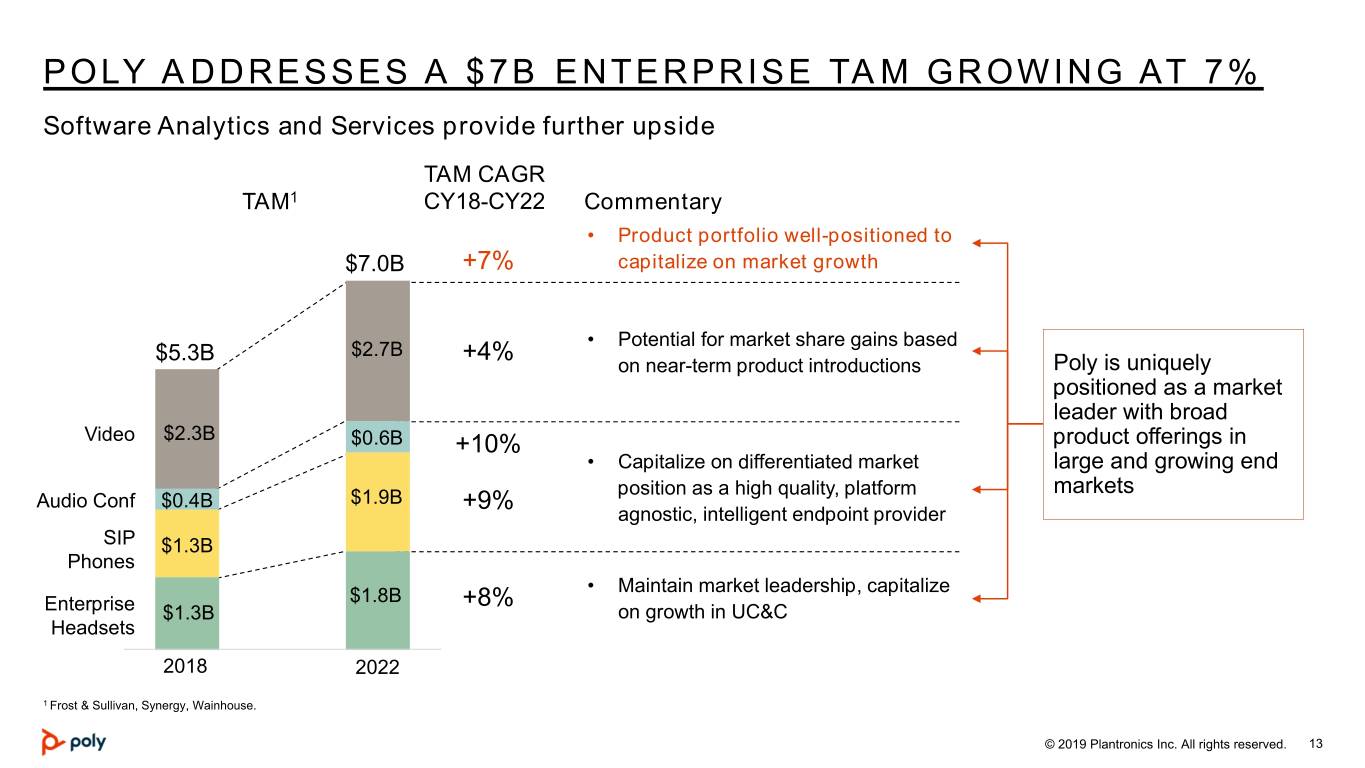

A COMPELLING INVESTMENT OPPORTUNITY $40B UC&C1 Market UC&C Market Leader Strategic Innovator • We operate in a $40B UC&C • Approximately $2B in annual • Reinventing the UC&C industry market with strong growth drivers revenues and over $400M TTM through product integration, EBITDA software and analytics • Rise in open architectures creates need for a unified endpoint • Platform-agnostic, intelligent • Valuable business insights available solutions through unique software and • Cloud deployments on rise with high demand for analytics and • Synergy execution ahead of analytics capabilities insights schedule • We address a $7B Enterprise TAM growing at 7% 1 Frost & Sullivan, March 2018. © 2019 Plantronics Inc. All rights reserved. 7

THREE FUNDAMENTAL INDUSTRY DRIVERS On-Premise to Move to Open Rise of Mobile Cloud UCC Offices Working © 2019 Plantronics Inc. All rights reserved. 8

OUR STRATEGY Deliver a comprehensive set of endpoints for the UC&C market and differentiate through software Management Analytics Interoperability Video Conference Desktop Headsets Software Services © 2019 Plantronics Inc. All rights reserved. 9

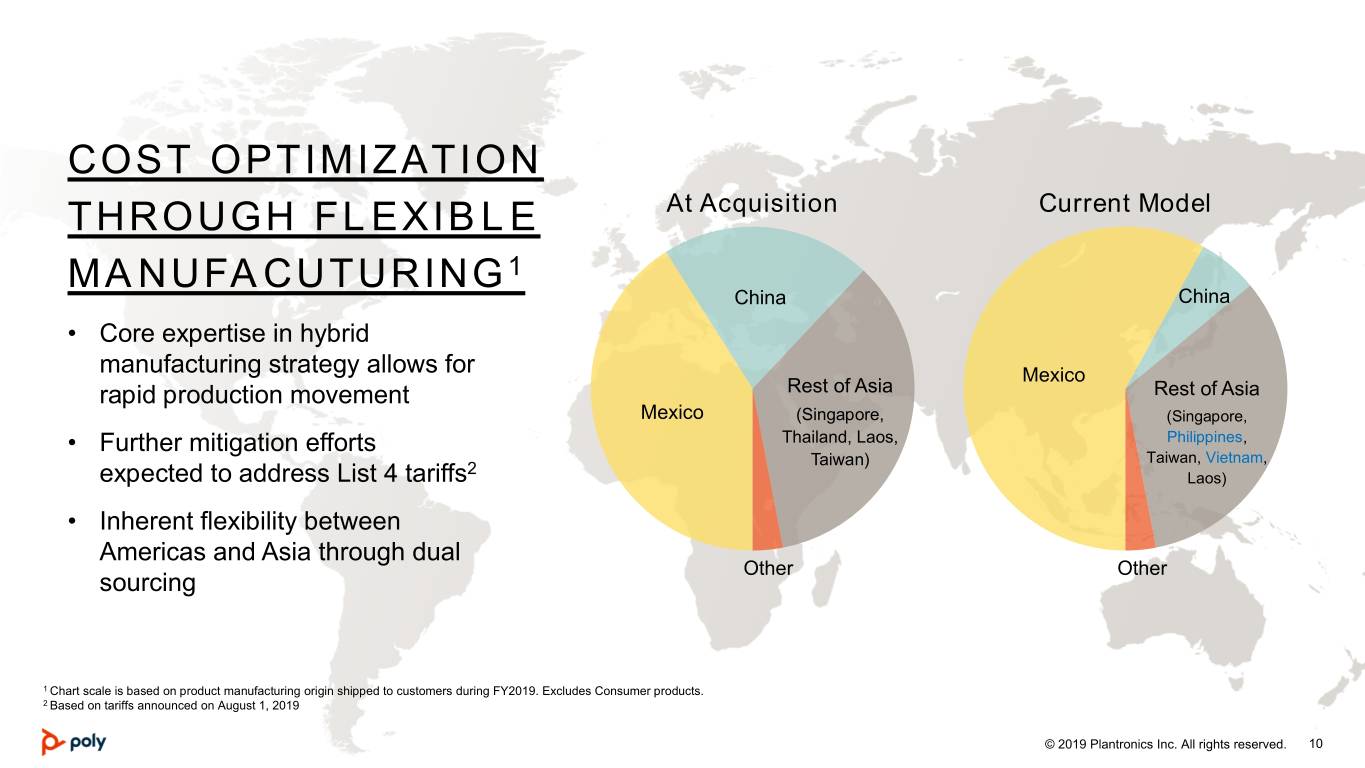

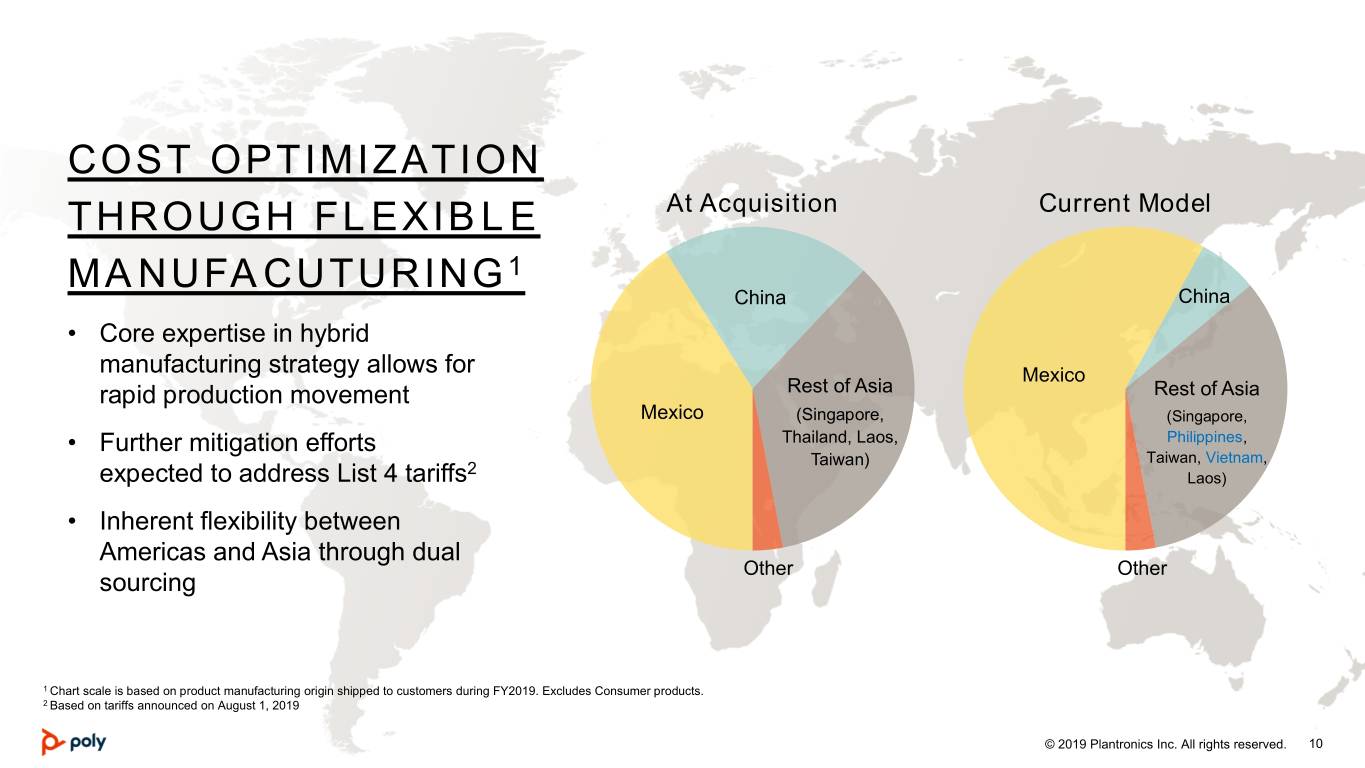

COST OPTIMIZATION THROUGH FLEXIBLE At Acquisition Current Model MANUFACUTURING 1 China China • Core expertise in hybrid manufacturing strategy allows for Mexico rapid production movement Rest of Asia Rest of Asia Mexico (Singapore, (Singapore, • Further mitigation efforts Thailand, Laos, Philippines, Taiwan) Taiwan, Vietnam, 2 expected to address List 4 tariffs Laos) • Inherent flexibility between Americas and Asia through dual Other Other sourcing 1 Chart scale is based on product manufacturing origin shipped to customers during FY2019. Excludes Consumer products. 2 Based on tariffs announced on August 1, 2019 © 2019 Plantronics Inc. All rights reserved. 10

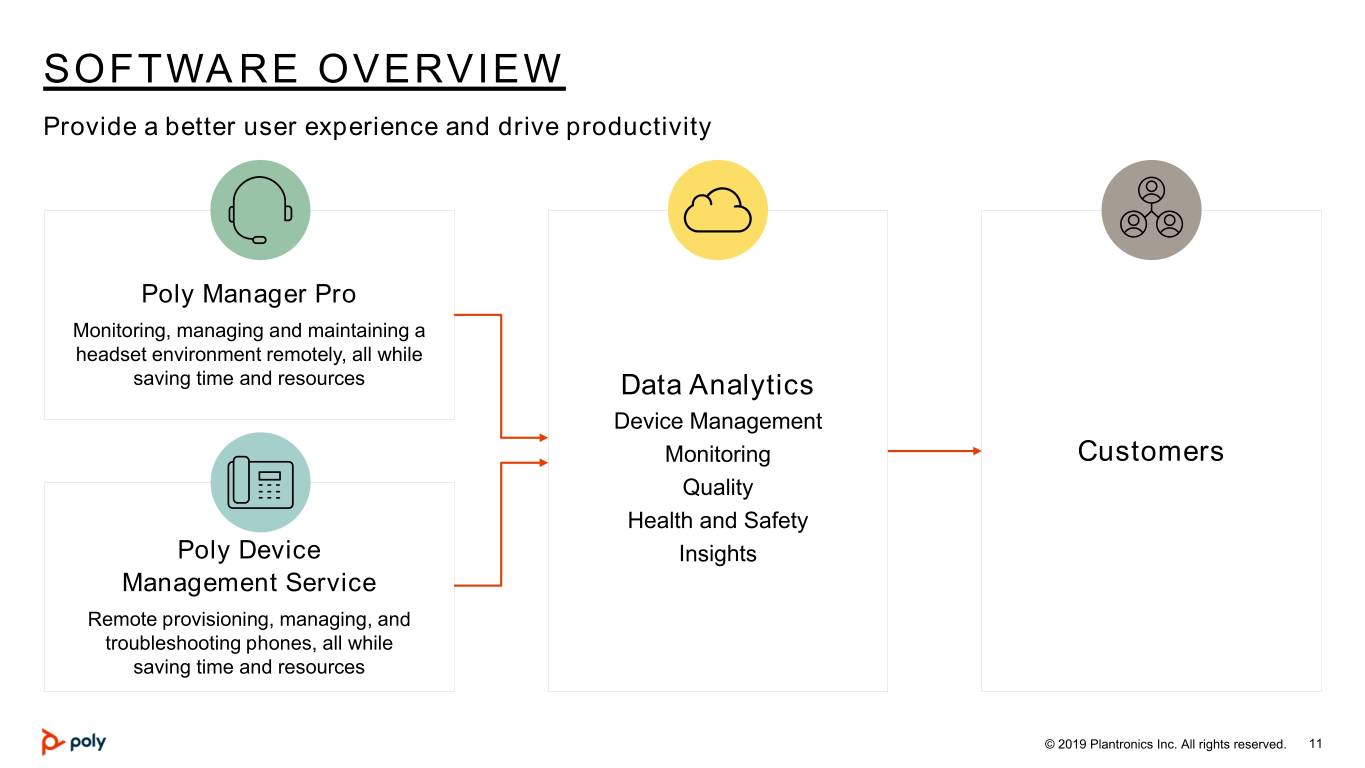

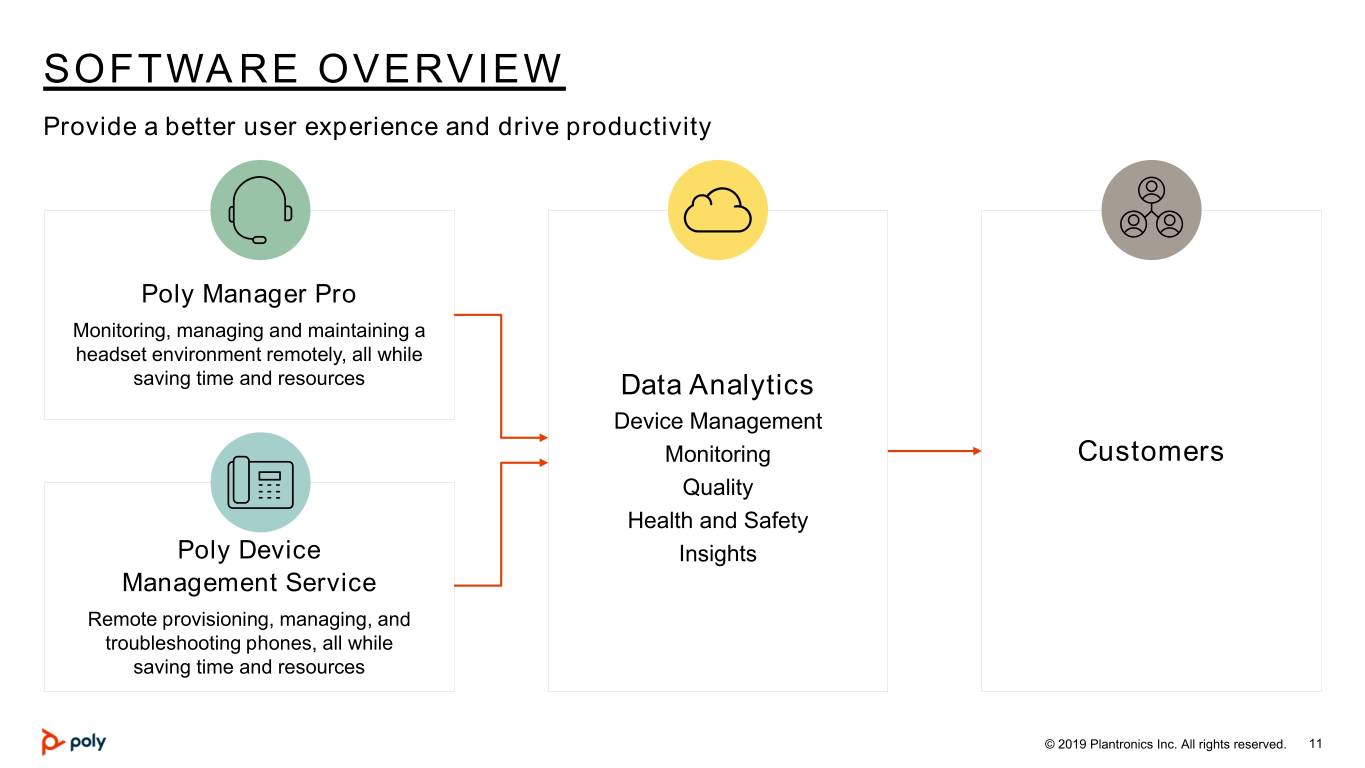

SOFTWARE OVERVIEW Provide a better user experience and drive productivity Poly Manager Pro Monitoring, managing and maintaining a headset environment remotely, all while saving time and resources Data Analytics Device Management Monitoring Customers Quality Health and Safety Poly Device Insights Management Service Remote provisioning, managing, and troubleshooting phones, all while saving time and resources © 2019 Plantronics Inc. All rights reserved. 11

BROADER UC MARKET AND ECOSYSTEM Key Partners Our platform agnostic and best-in-class unified endpoint strategy differentiates us © 2019 Plantronics Inc. All rights reserved. 12

POLY ADDRESSES A $7B ENTERPRISE TAM GROWING AT 7% Software Analytics and Services provide further upside TAM CAGR TAM1 CY18-CY22 Commentary • Product portfolio well-positioned to $7.0B +7% capitalize on market growth • Potential for market share gains based $5.3B $2.7B +4% on near-term product introductions Poly is uniquely positioned as a market leader with broad Video $2.3B $0.6B +10% product offerings in • Capitalize on differentiated market large and growing end position as a high quality, platform markets Audio Conf $0.4B $1.9B +9% agnostic, intelligent endpoint provider SIP $1.3B Phones • Maintain market leadership, capitalize $1.8B +8% Enterprise $1.3B on growth in UC&C Headsets 2018 2022 1 Frost & Sullivan, Synergy, Wainhouse. © 2019 Plantronics Inc. All rights reserved. 13

NEW PRODUCT & PARTNER ANNOUNCEMENTS © 2019 Plantronics Inc. All rights reserved. 14

NEW PRODUCTS ACROSS THE PORTFOLIO ANNOUNCED OR COMING SOON © 2019 Plantronics Inc. All rights reserved. 15

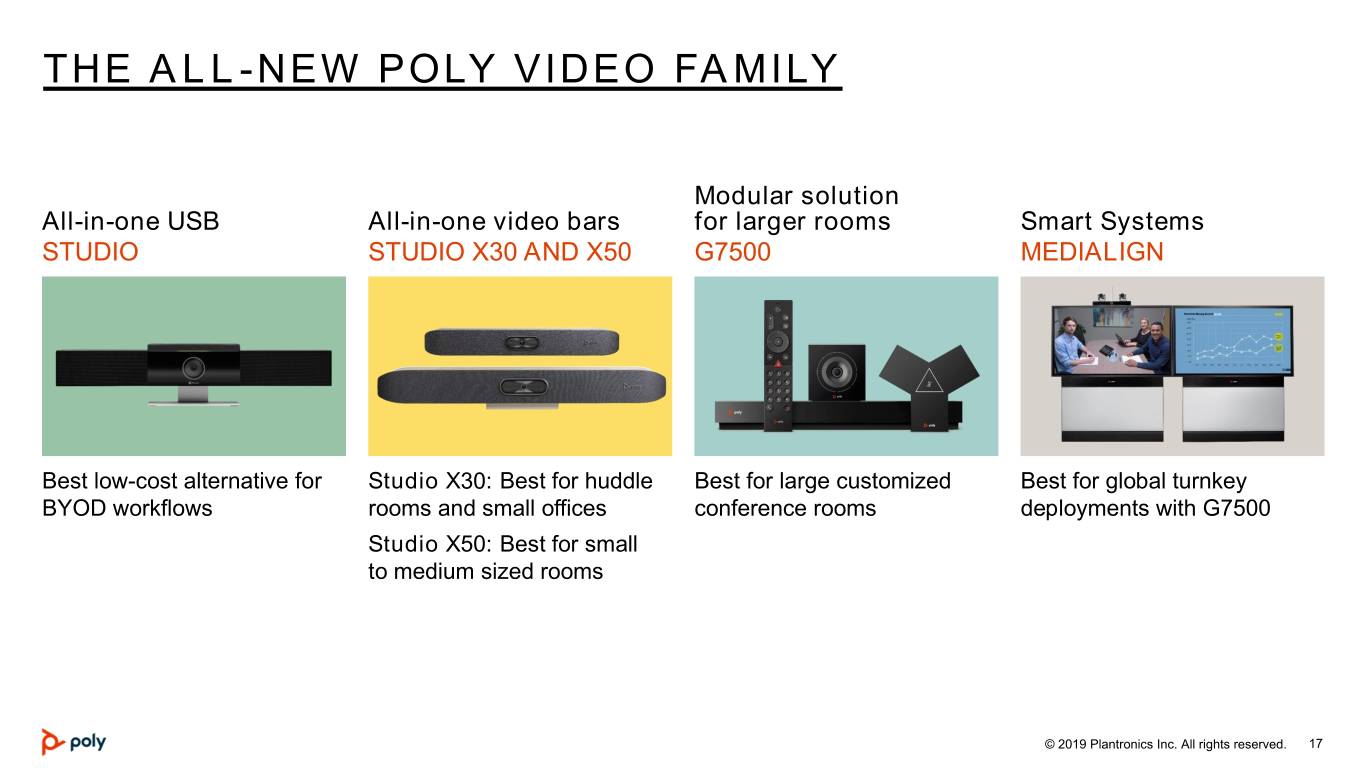

INTRODUCING POLY STUDIO X30 AND X50 RADICALLY SIMPLE VIDEO BAR POWERING YOUR FAVORITE MEETING SERVICE © 2019 Plantronics Inc. All rights reserved. 16

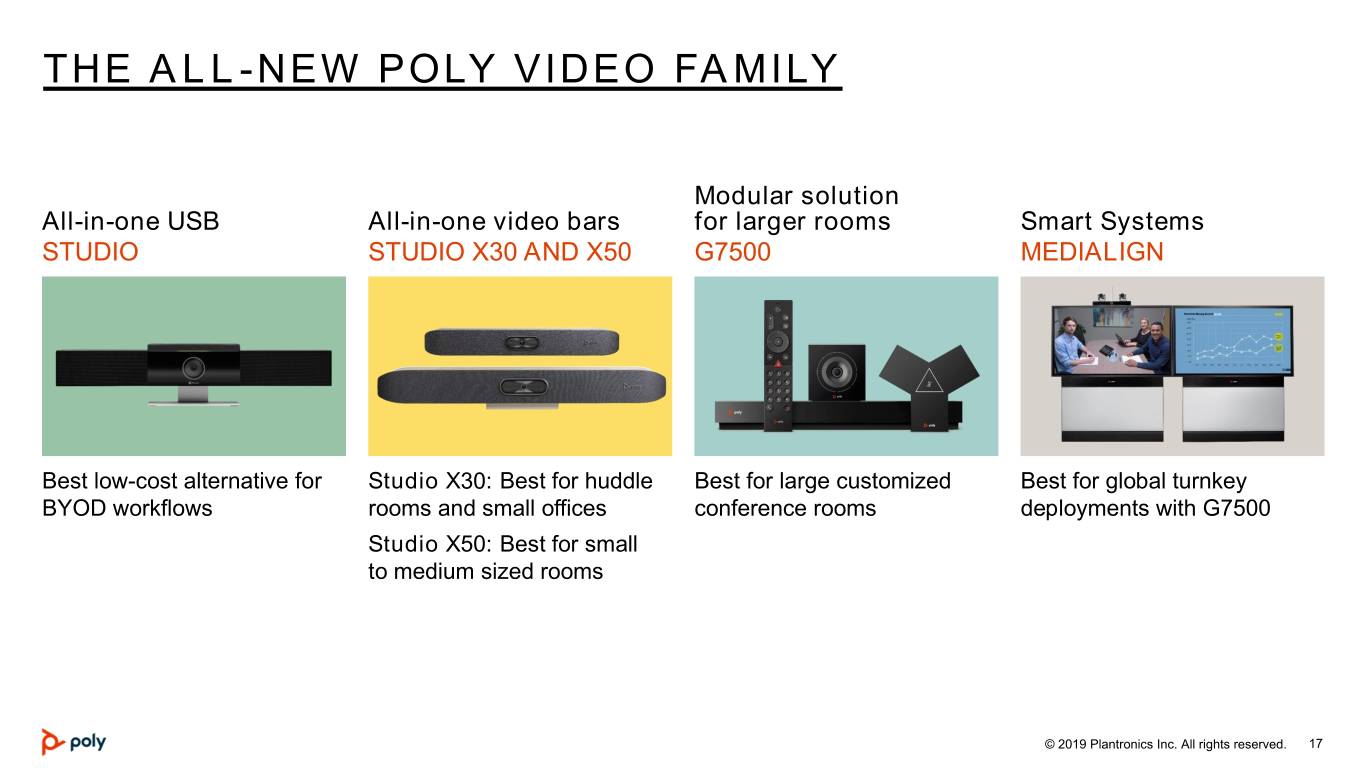

THE ALL-NEW POLY VIDEO FAMILY Modular solution All-in-one USB All-in-one video bars for larger rooms Smart Systems STUDIO STUDIO X30 AND X50 G7500 MEDIALIGN Best low-cost alternative for Studio X30: Best for huddle Best for large customized Best for global turnkey BYOD workflows rooms and small offices conference rooms deployments with G7500 Studio X50: Best for small to medium sized rooms © 2019 Plantronics Inc. All rights reserved. 17

INTRODUCING THE CCX FAMILY THE NEW STANDARD FOR INTELLIGENT COMMUNICATIONS IN DESKTOP PHONES FOR MICROSOFT TEAMS © 2019 Plantronics Inc. All rights reserved. 18

INTRODUCING POLY TRIO 8300 SMART CONFERENCE PHONE FOR SMALL MEETING ROOMS © 2019 Plantronics Inc. All rights reserved. 19

INTRODUCING THE NEXT GENERATION OF SAVI WIRELESS HEADSETS POLY IS THE FIRST ENTERPRISE HEADSET COMPANY TO OFFER A DECT™ HEADSET WITH ACTIVE NOISE CANCELING © 2019 Plantronics Inc. All rights reserved. 20

Q2 FY20 EARNINGS RESULTS © 2019 Plantronics Inc. All rights reserved. 21

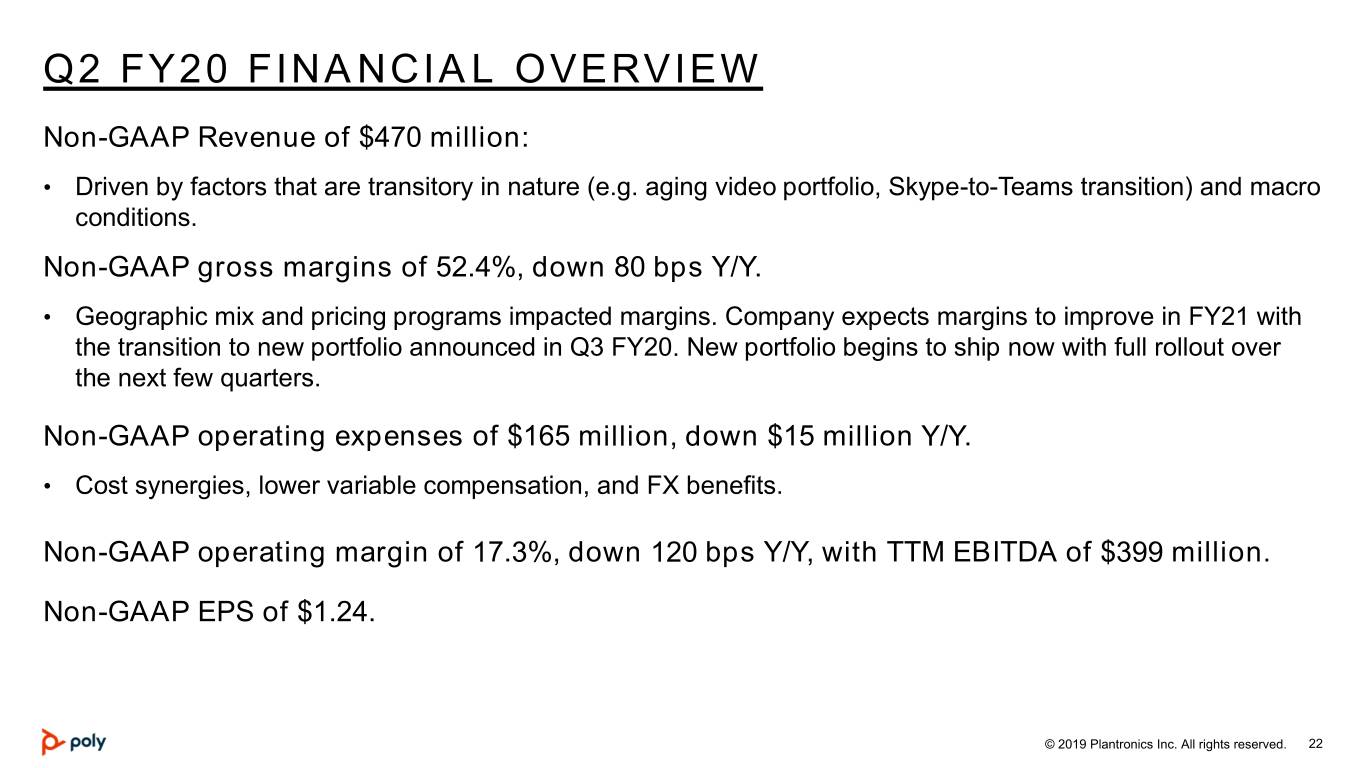

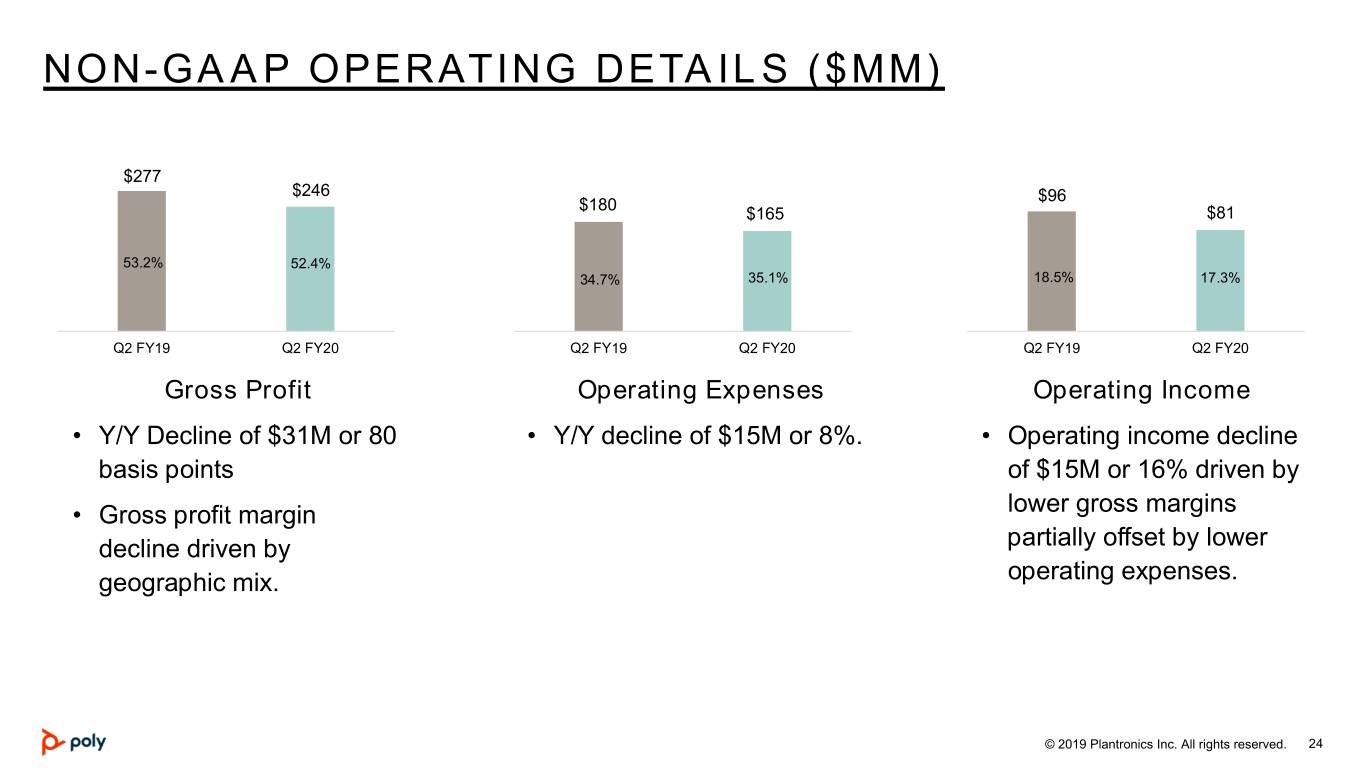

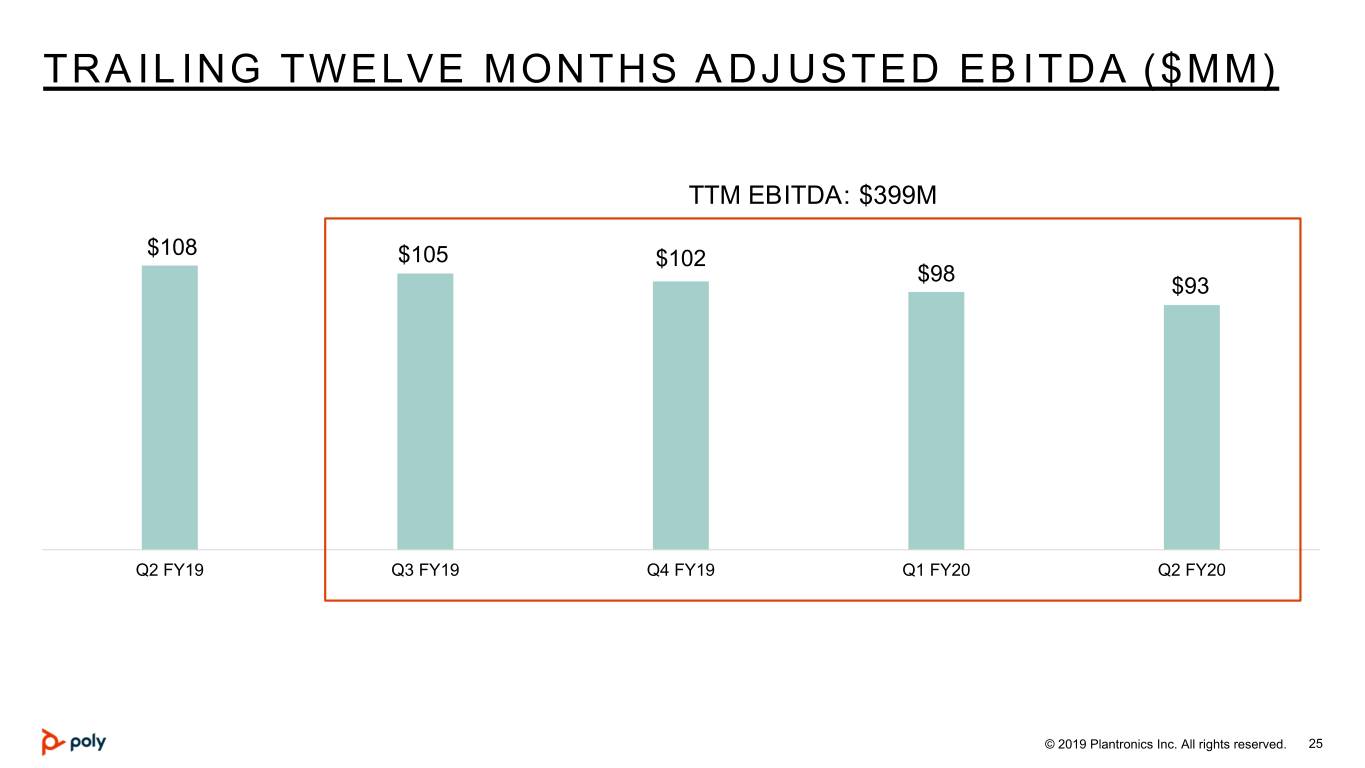

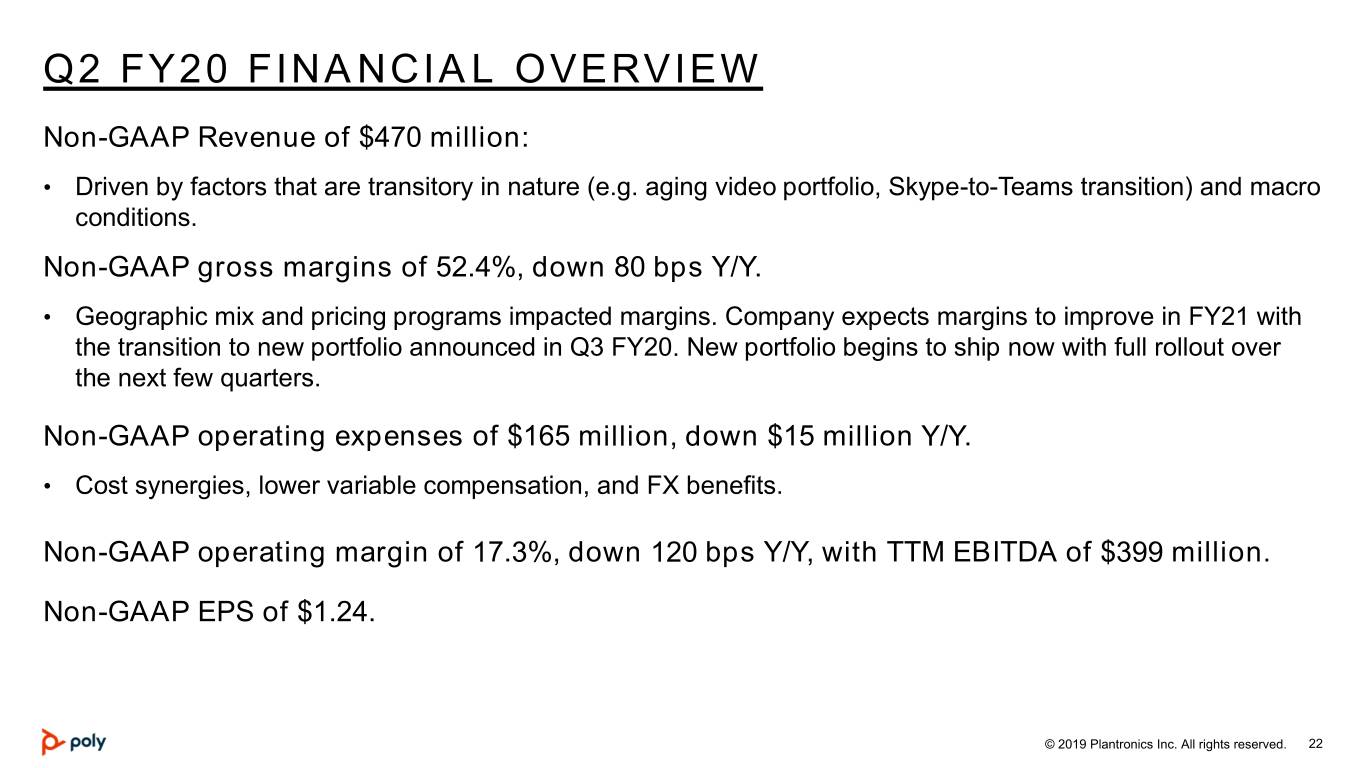

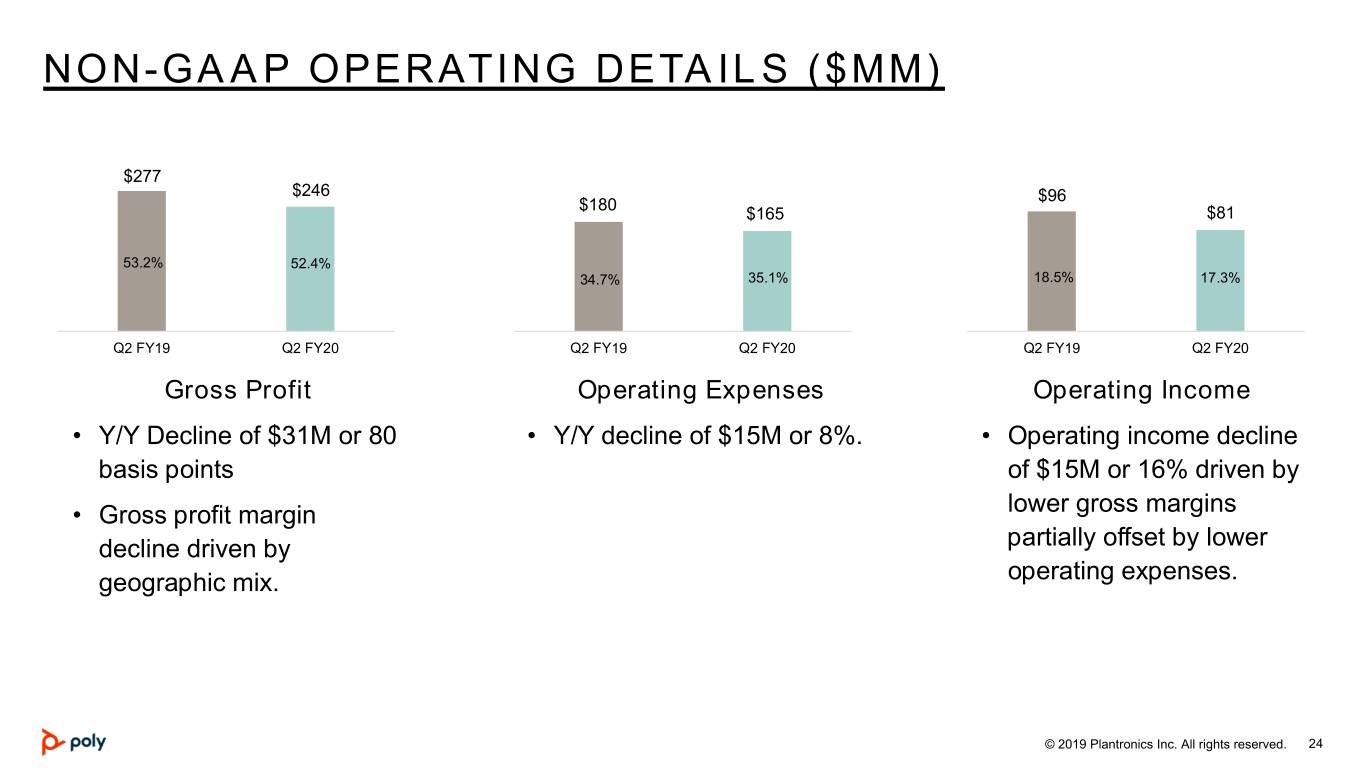

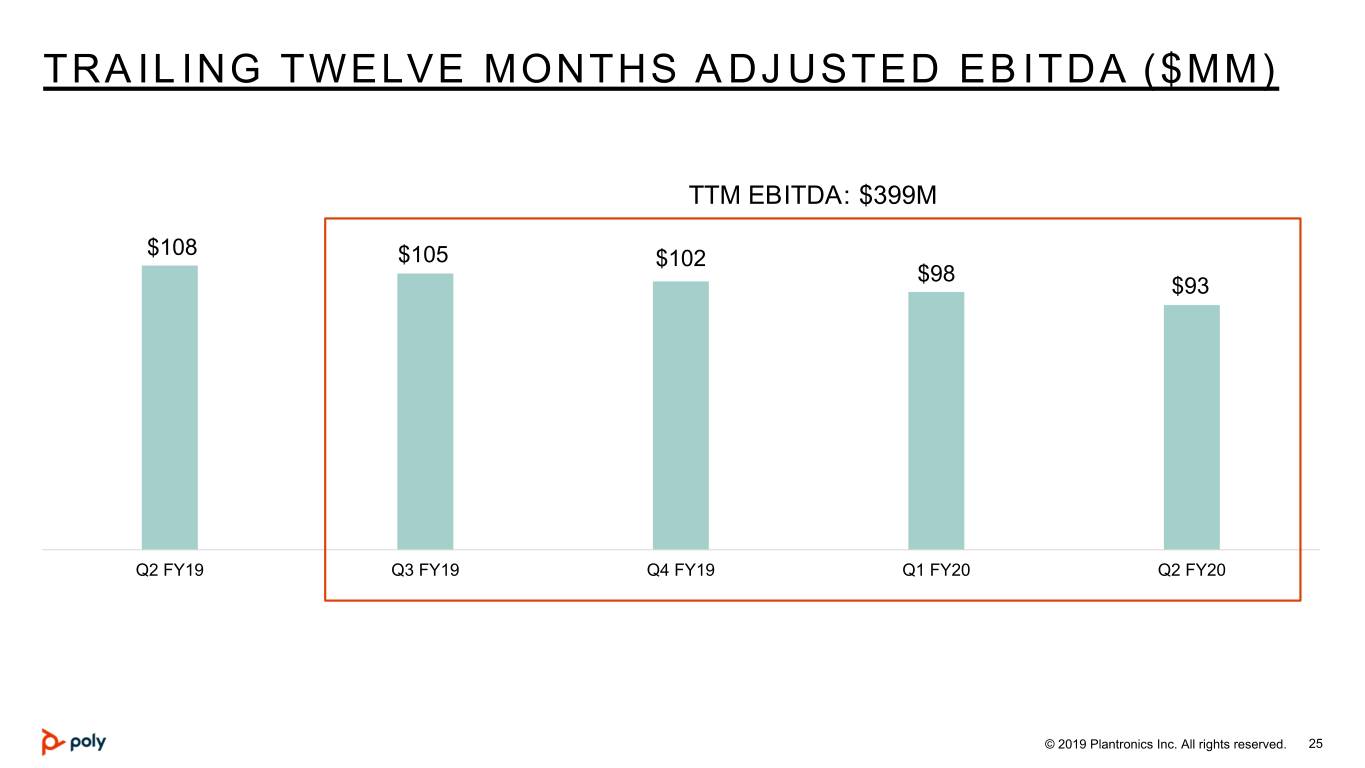

Q2 FY20 FINANCIAL OVERVIEW Non-GAAP Revenue of $470 million: • Driven by factors that are transitory in nature (e.g. aging video portfolio, Skype-to-Teams transition) and macro conditions. Non-GAAP gross margins of 52.4%, down 80 bps Y/Y. • Geographic mix and pricing programs impacted margins. Company expects margins to improve in FY21 with the transition to new portfolio announced in Q3 FY20. New portfolio begins to ship now with full rollout over the next few quarters. Non-GAAP operating expenses of $165 million, down $15 million Y/Y. • Cost synergies, lower variable compensation, and FX benefits. Non-GAAP operating margin of 17.3%, down 120 bps Y/Y, with TTM EBITDA of $399 million. Non-GAAP EPS of $1.24. © 2019 Plantronics Inc. All rights reserved. 22

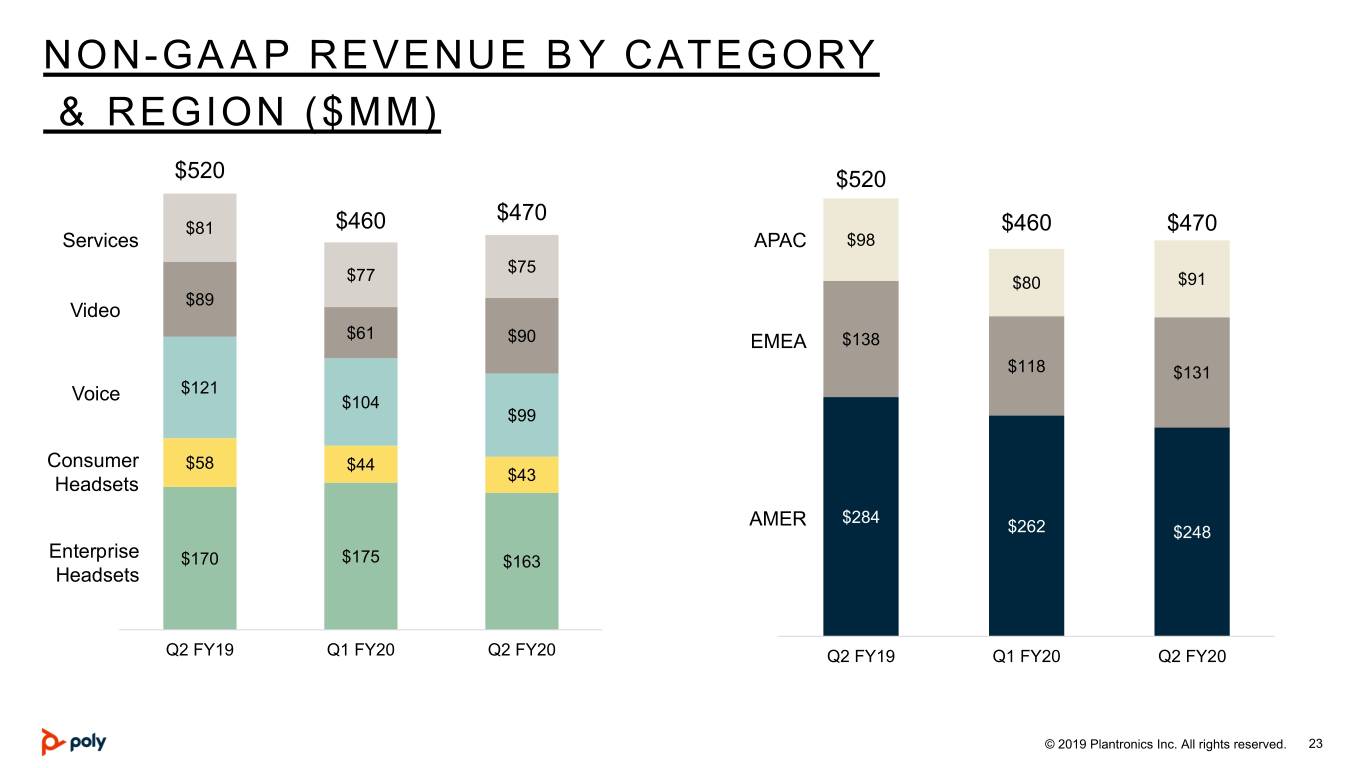

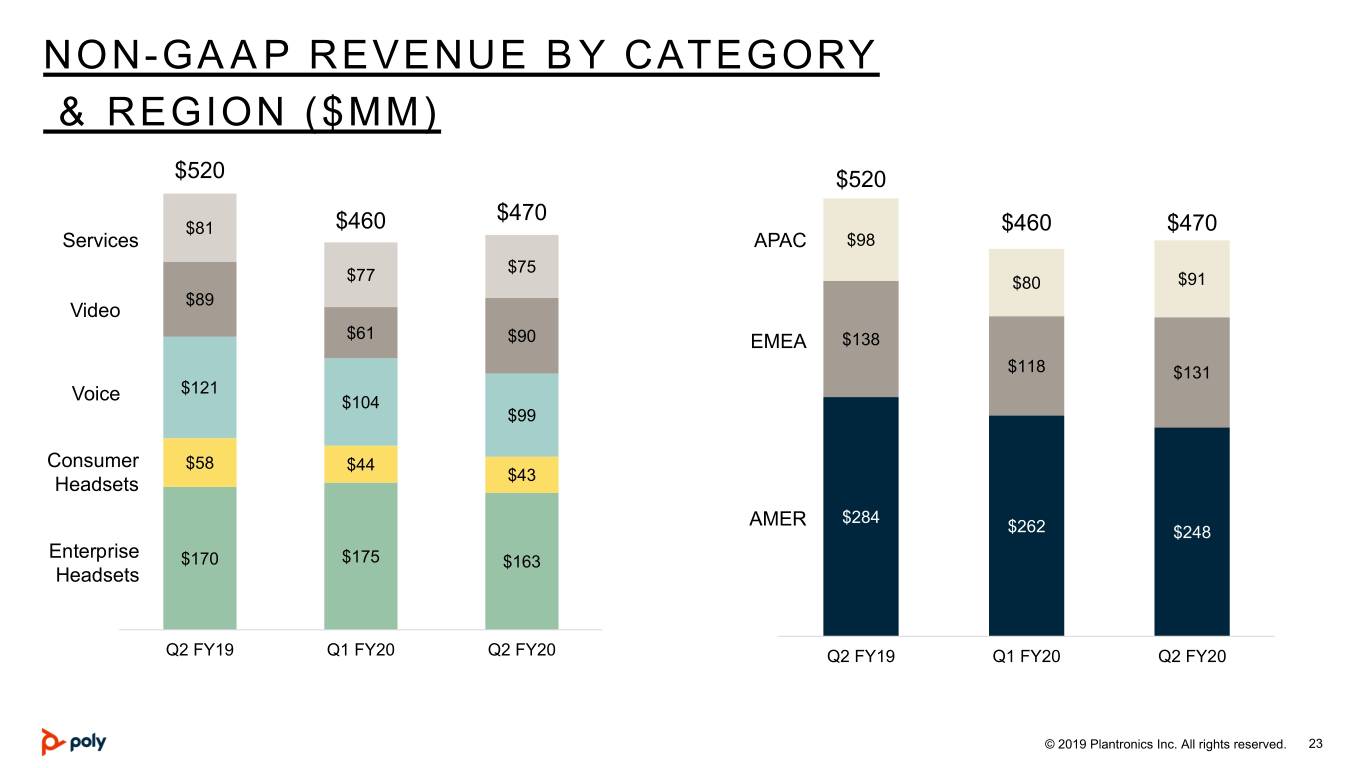

NON-GAAP REVENUE BY CATEGORY & REGION ($MM) $520 $520 $470 $81 $460 $460 $470 Services APAC $98 $75 $77 $80 $91 $89 Video $61 $90 EMEA $138 $118 $131 $121 Voice $104 $99 Consumer $58 $44 Headsets $43 AMER $284 $262 $248 Enterprise $170 $175 $163 Headsets Q2 FY19 Q1 FY20 Q2 FY20 Q2 FY19 Q1 FY20 Q2 FY20 © 2019 Plantronics Inc. All rights reserved. 23

NON-GAAP OPERATING DETAILS ($MM) $277 $246 $96 $180 $165 $81 53.2% 52.4% 34.7% 35.1% 18.5% 17.3% Q2 FY19 Q2 FY20 Q2 FY19 Q2 FY20 Q2 FY19 Q2 FY20 Gross Profit Operating Expenses Operating Income • Y/Y Decline of $31M or 80 • Y/Y decline of $15M or 8%. • Operating income decline basis points of $15M or 16% driven by • Gross profit margin lower gross margins decline driven by partially offset by lower geographic mix. operating expenses. © 2019 Plantronics Inc. All rights reserved. 24

TRAILING TWELVE MONTHS ADJUSTED EBITDA ($MM) TTM EBITDA: $399M $108 $105 $102 $98 $93 Q2 FY19 Q3 FY19 Q4 FY19 Q1 FY20 Q2 FY20 © 2019 Plantronics Inc. All rights reserved. 25

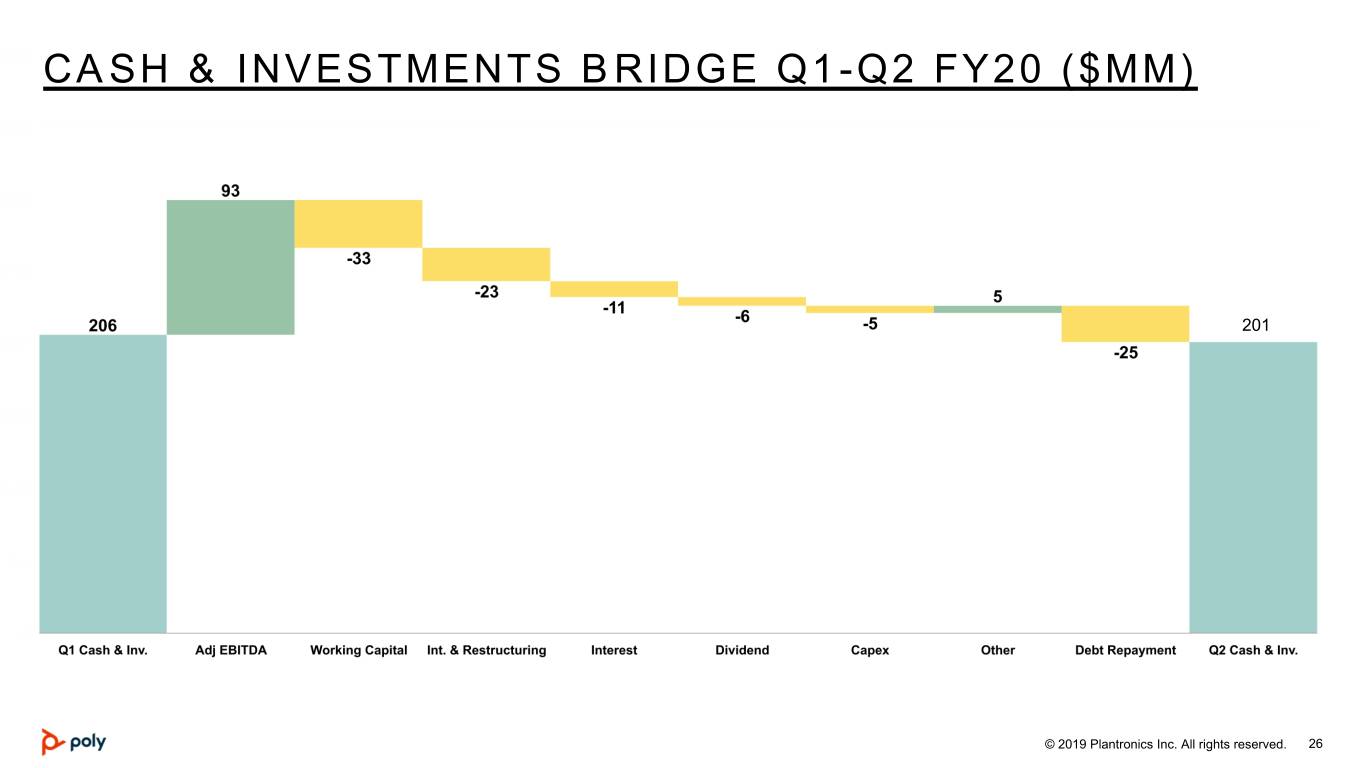

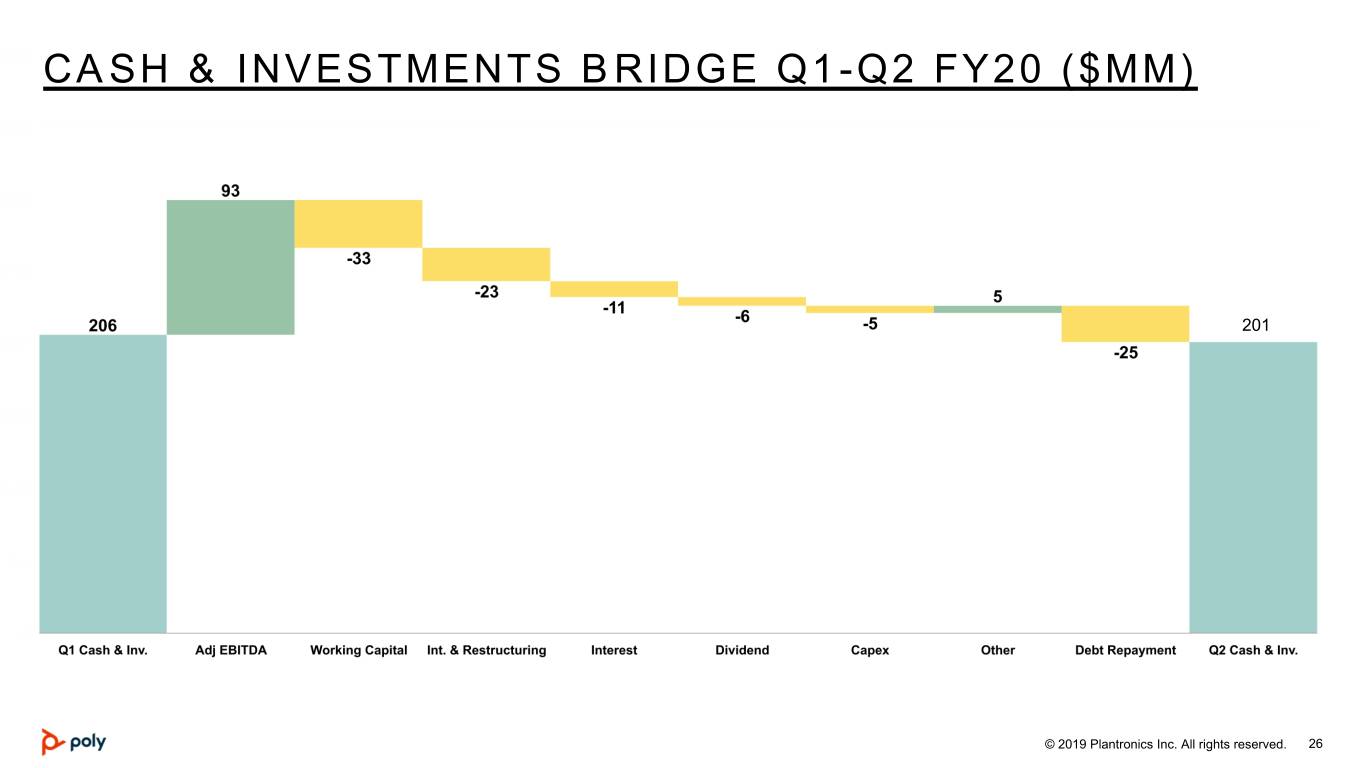

CASH & INVESTMENTS BRIDGE Q1 -Q2 FY20 ($MM) 201 © 2019 Plantronics Inc. All rights reserved. 26

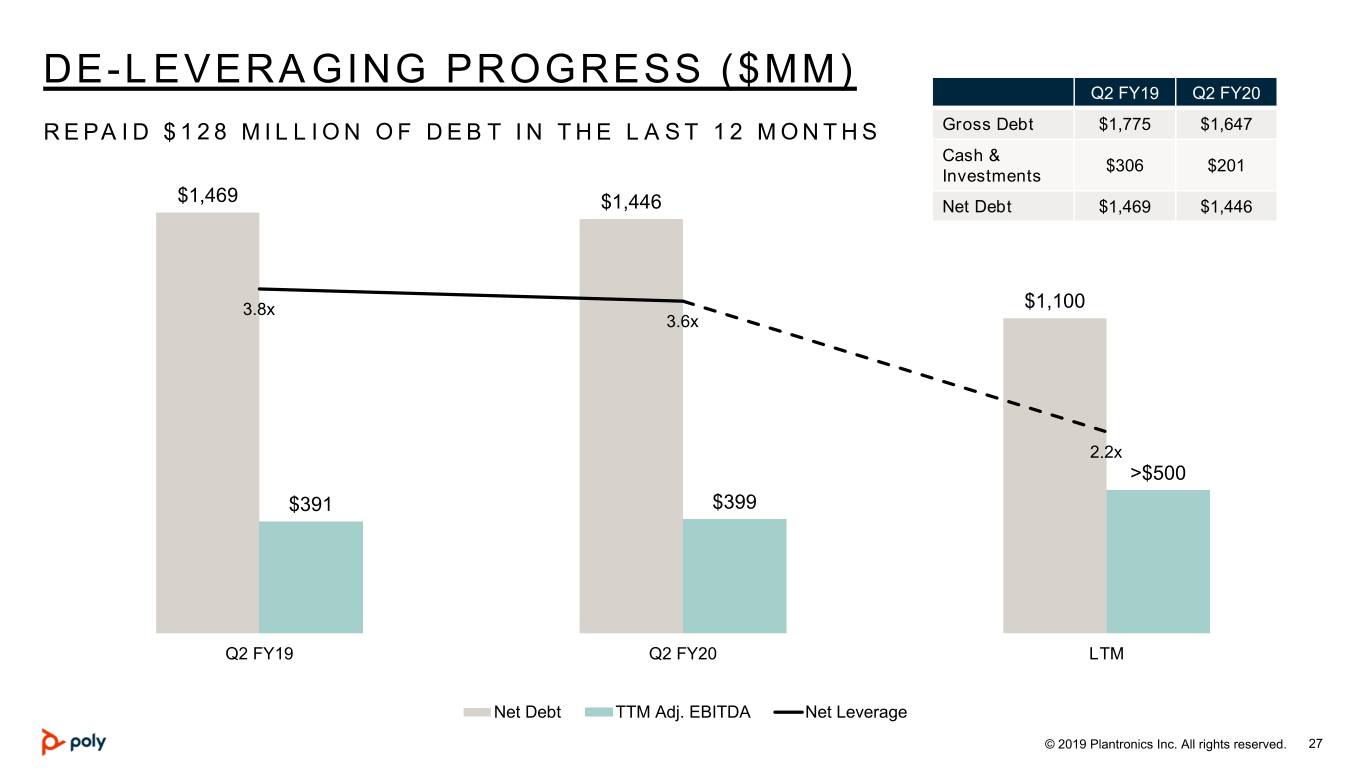

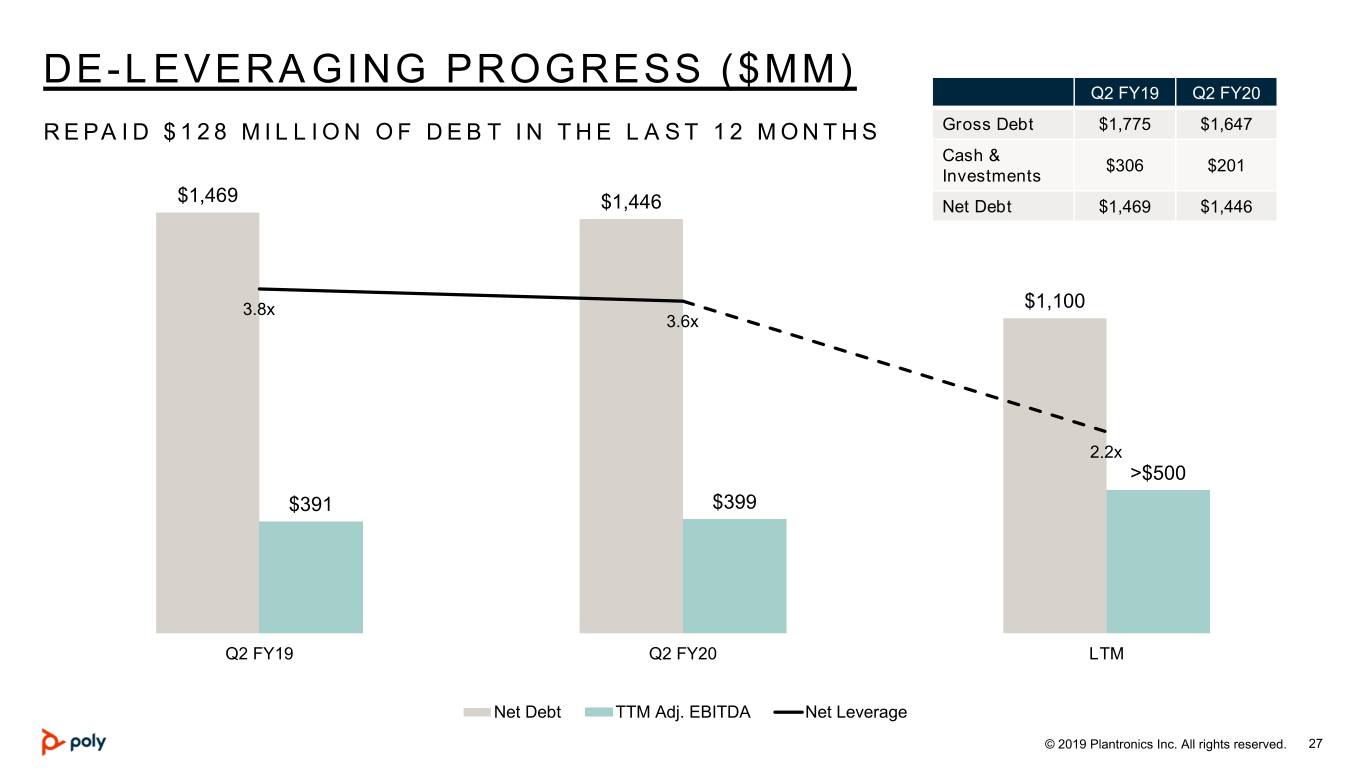

DE-LEVERAGING PROGRESS ($MM) Q2 FY19 Q2 FY20 REPAID $128 MILLION OF DEBT IN THE LAST 12 MONTHS Gross Debt $1,775 $1,647 Cash & $306 $201 Investments $1,469 $1,446 Net Debt $1,469 $1,446 3.8x $1,100 3.6x 2.2x >$500 $391 $399 Q2 FY19 Q2 FY20 LTM Net Debt TTM Adj. EBITDA Net Leverage © 2019 Plantronics Inc. All rights reserved. 27

GUIDANCE & LONG TERM MODEL © 2019 Plantronics Inc. All rights reserved. 28

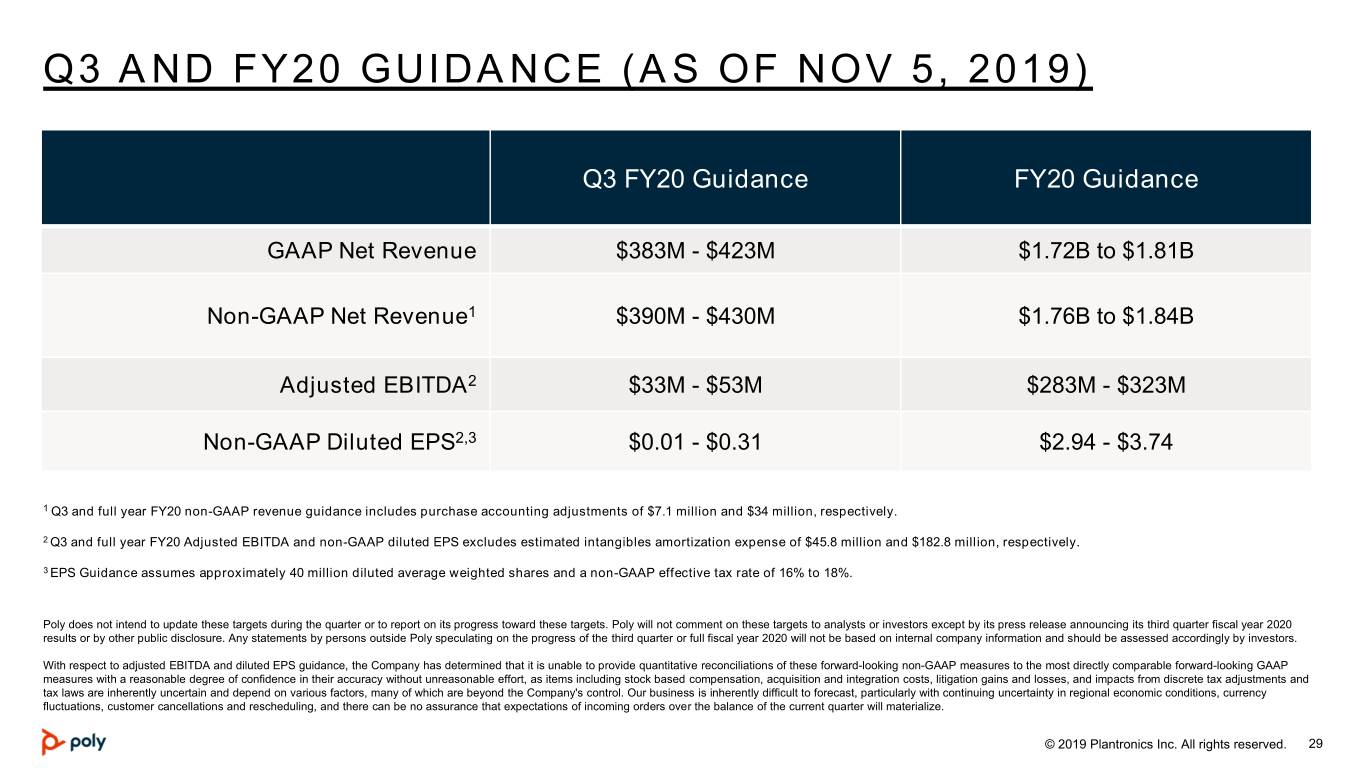

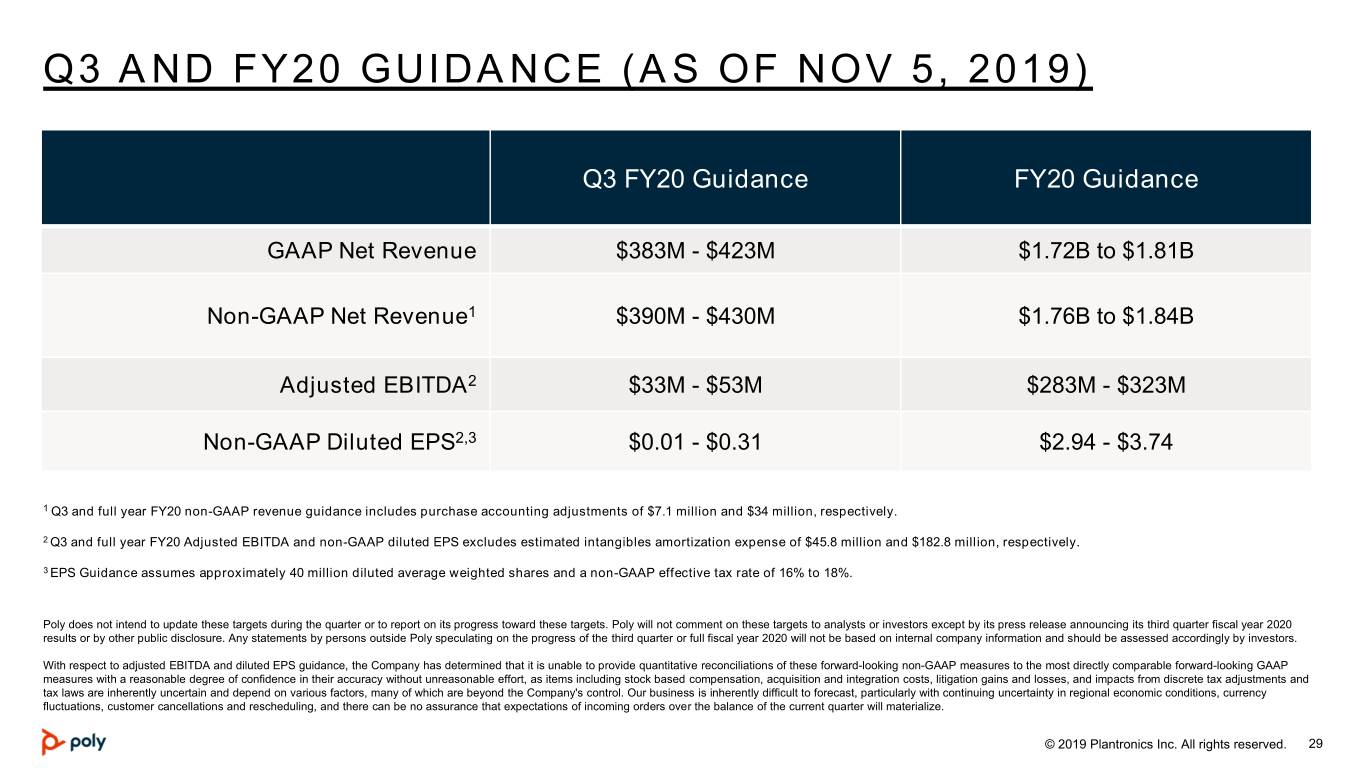

Q3 AND FY20 GUIDANCE (AS OF NOV 5, 2019) Q3 FY20 Guidance FY20 Guidance GAAP Net Revenue $383M - $423M $1.72B to $1.81B Non-GAAP Net Revenue1 $390M - $430M $1.76B to $1.84B Adjusted EBITDA2 $33M - $53M $283M - $323M Non-GAAP Diluted EPS2,3 $0.01 - $0.31 $2.94 - $3.74 1 Q3 and full year FY20 non-GAAP revenue guidance includes purchase accounting adjustments of $7.1 million and $34 million, respectively. 2 Q3 and full year FY20 Adjusted EBITDA and non-GAAP diluted EPS excludes estimated intangibles amortization expense of $45.8 million and $182.8 million, respectively. 3 EPS Guidance assumes approximately 40 million diluted average weighted shares and a non-GAAP effective tax rate of 16% to 18%. Poly does not intend to update these targets during the quarter or to report on its progress toward these targets. Poly will not comment on these targets to analysts or investors except by its press release announcing its third quarter fiscal year 2020 results or by other public disclosure. Any statements by persons outside Poly speculating on the progress of the third quarter or full fiscal year 2020 will not be based on internal company information and should be assessed accordingly by investors. With respect to adjusted EBITDA and diluted EPS guidance, the Company has determined that it is unable to provide quantitative reconciliations of these forward-looking non-GAAP measures to the most directly comparable forward-looking GAAP measures with a reasonable degree of confidence in their accuracy without unreasonable effort, as items including stock based compensation, acquisition and integration costs, litigation gains and losses, and impacts from discrete tax adjustments and tax laws are inherently uncertain and depend on various factors, many of which are beyond the Company's control. Our business is inherently difficult to forecast, particularly with continuing uncertainty in regional economic conditions, currency fluctuations, customer cancellations and rescheduling, and there can be no assurance that expectations of incoming orders over the balance of the current quarter will materialize. © 2019 Plantronics Inc. All rights reserved. 29

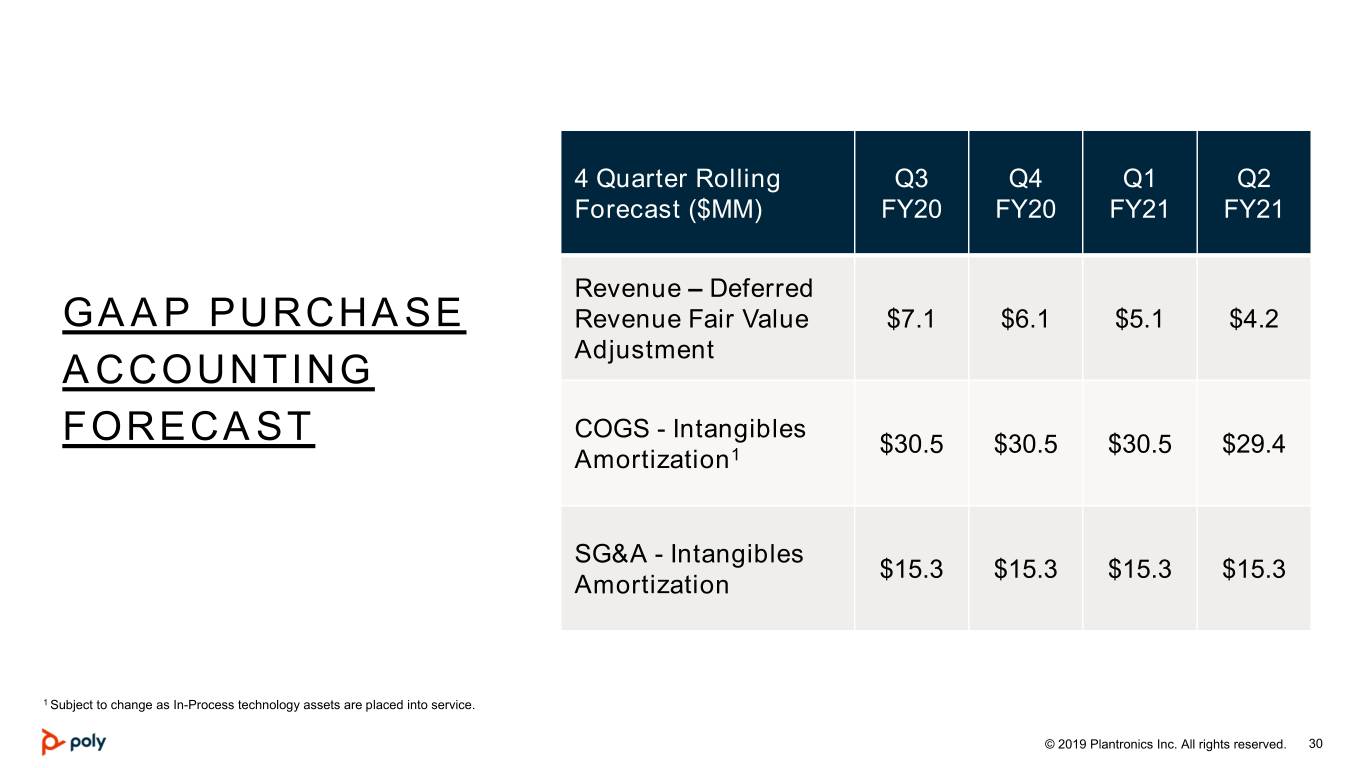

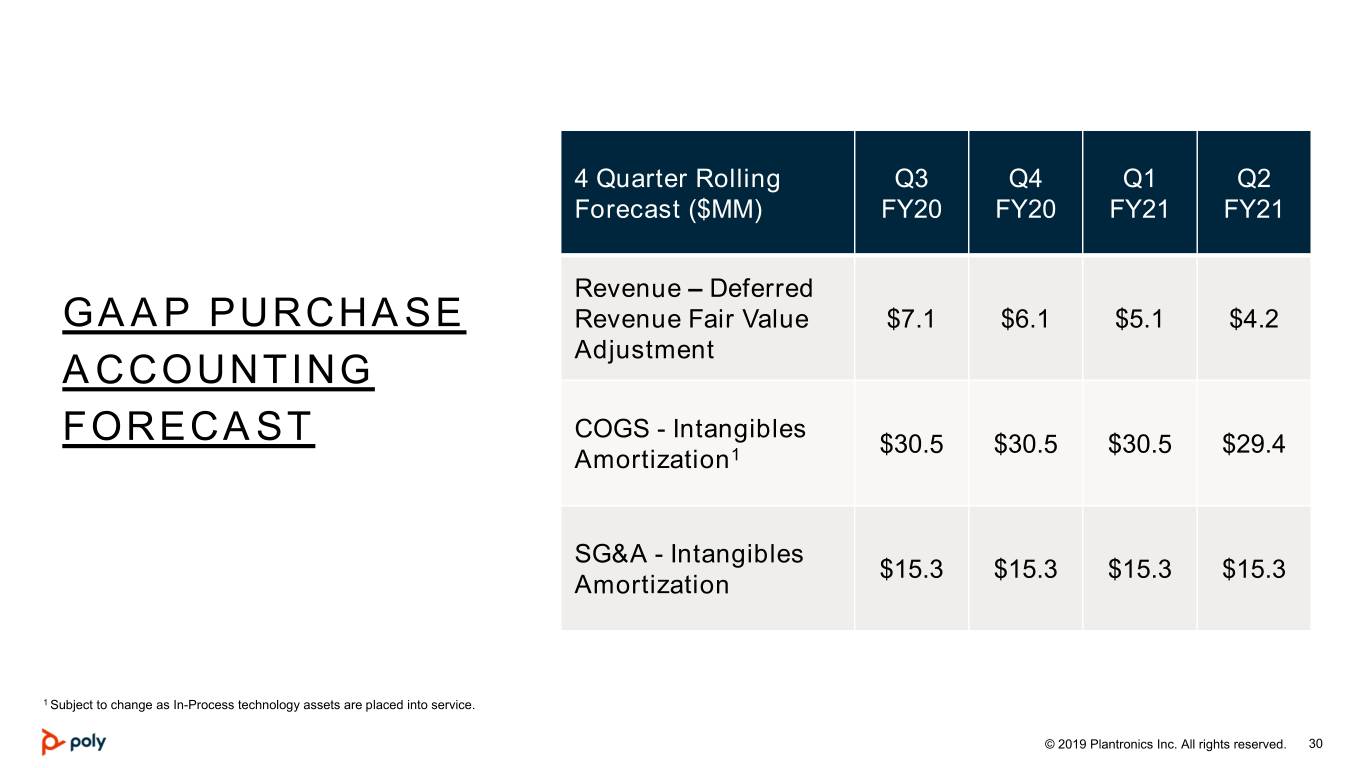

4 Quarter Rolling Q3 Q4 Q1 Q2 Forecast ($MM) FY20 FY20 FY21 FY21 Revenue – Deferred GAAP PURCHASE Revenue Fair Value $7.1 $6.1 $5.1 $4.2 Adjustment ACCOUNTING COGS - Intangibles FORECAST $30.5 $30.5 $30.5 $29.4 Amortization1 SG&A - Intangibles $15.3 $15.3 $15.3 $15.3 Amortization 1 Subject to change as In-Process technology assets are placed into service. © 2019 Plantronics Inc. All rights reserved. 30

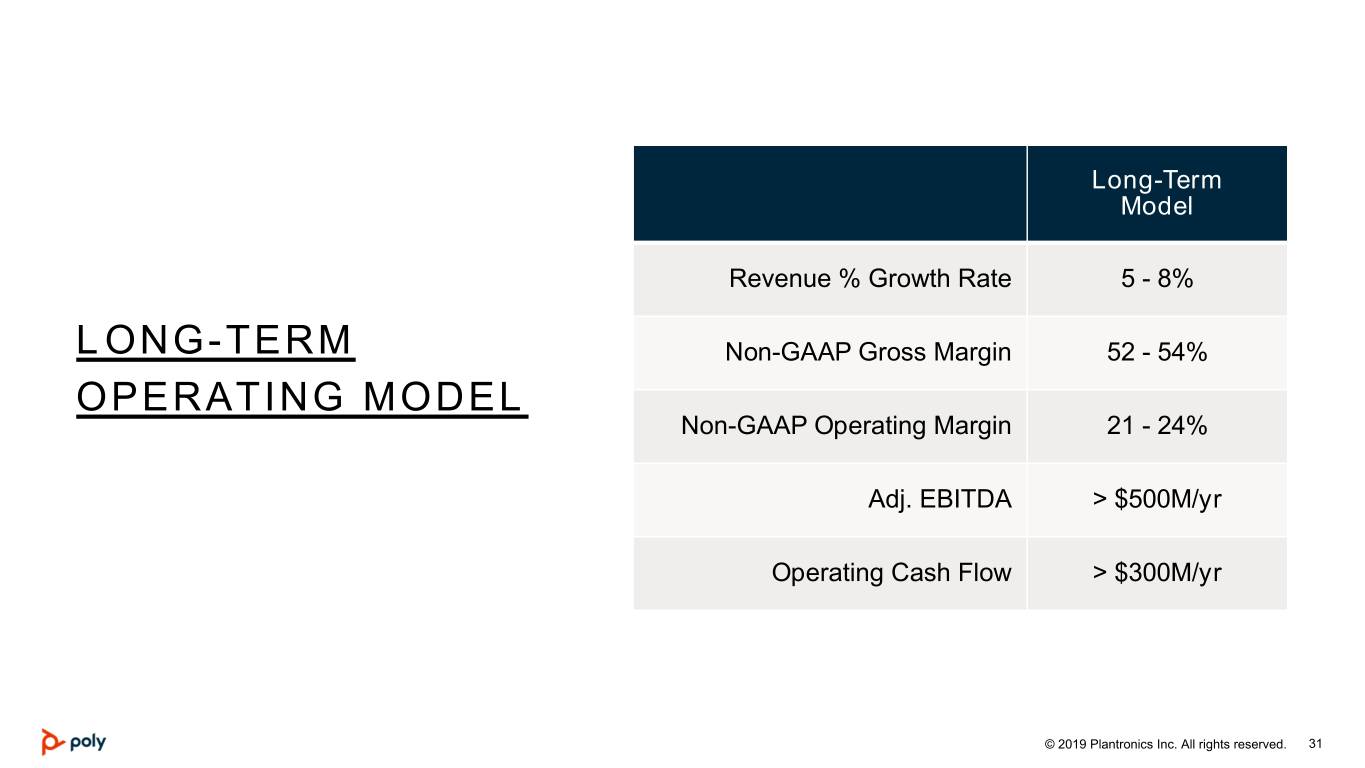

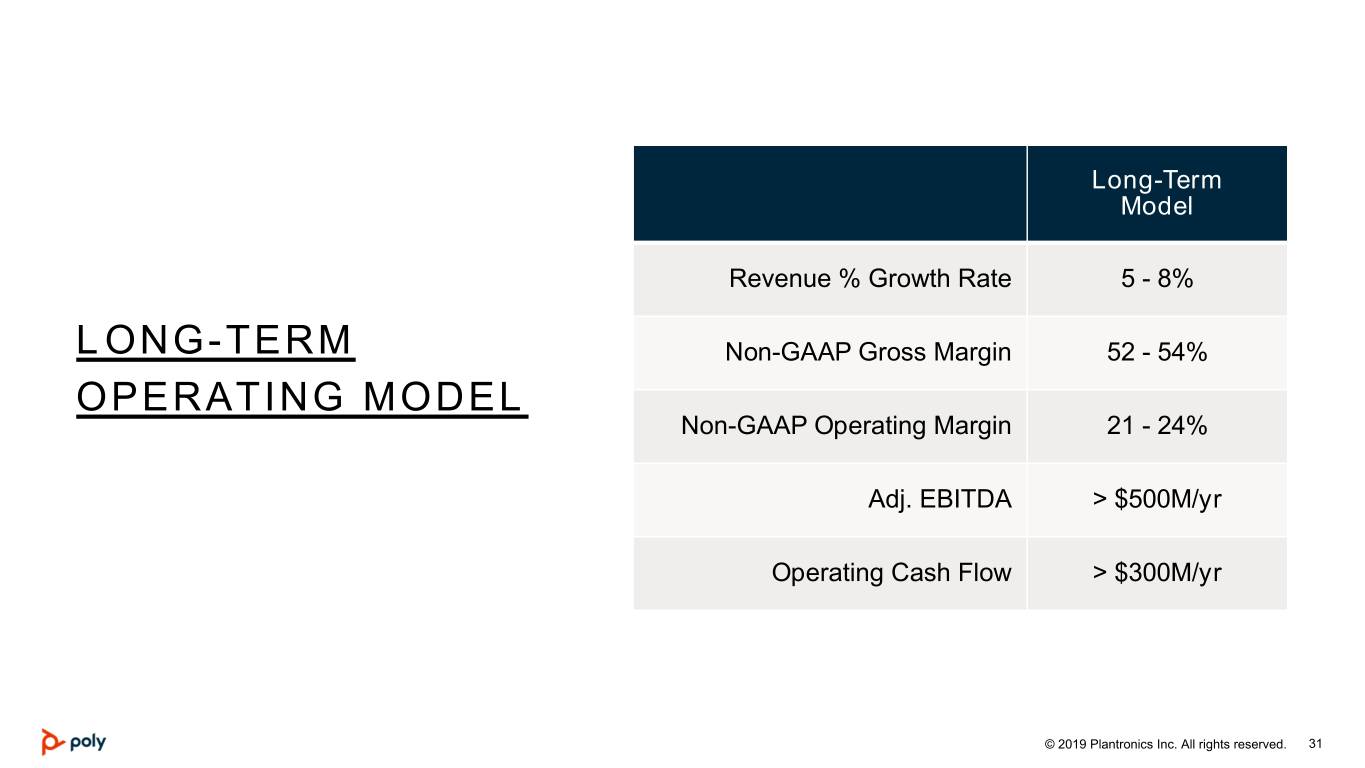

Long-Term Model Revenue % Growth Rate 5 - 8% LONG-TERM Non-GAAP Gross Margin 52 - 54% OPERATING MODEL Non-GAAP Operating Margin 21 - 24% Adj. EBITDA > $500M/yr Operating Cash Flow > $300M/yr © 2019 Plantronics Inc. All rights reserved. 31

SUPPLEMENTAL DATA & GAAP TO NON-GAAP RECONCILIATIONS © 2019 Plantronics Inc. All rights reserved. 32

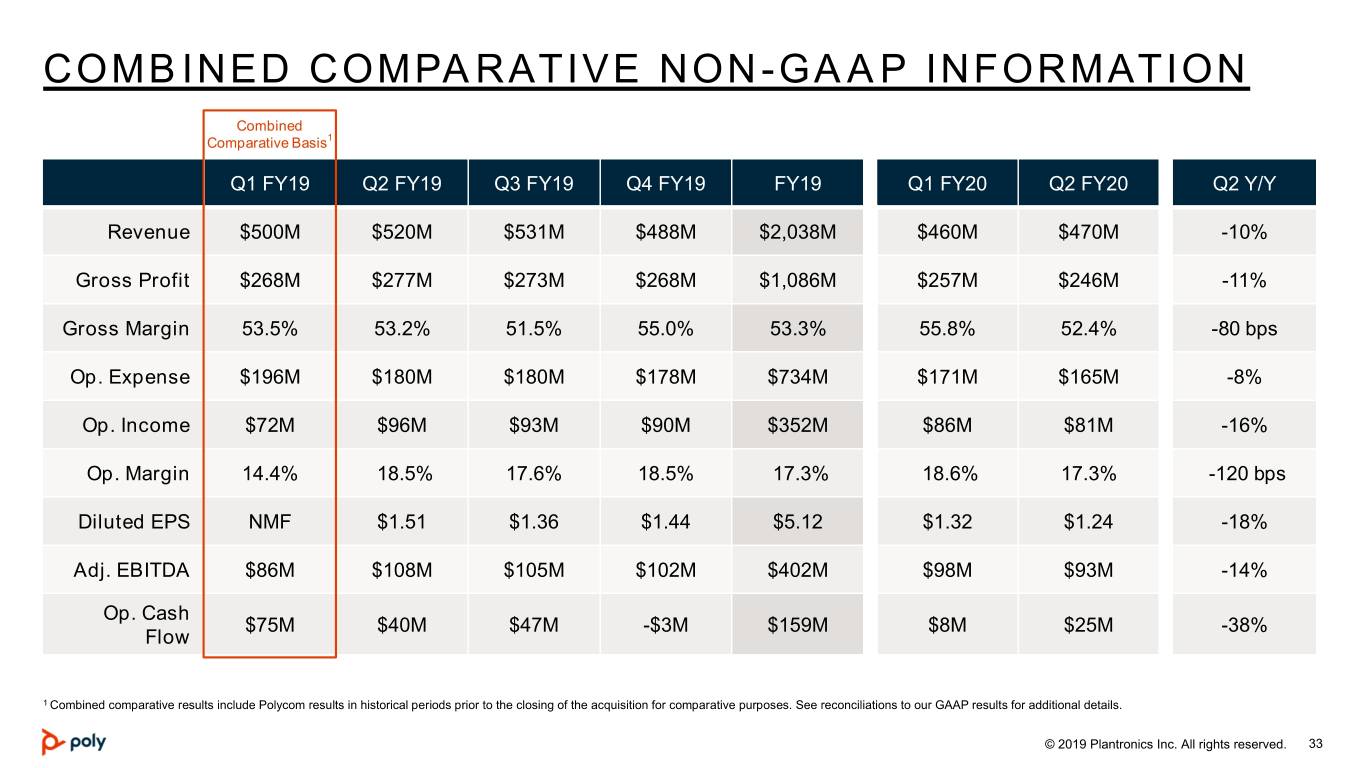

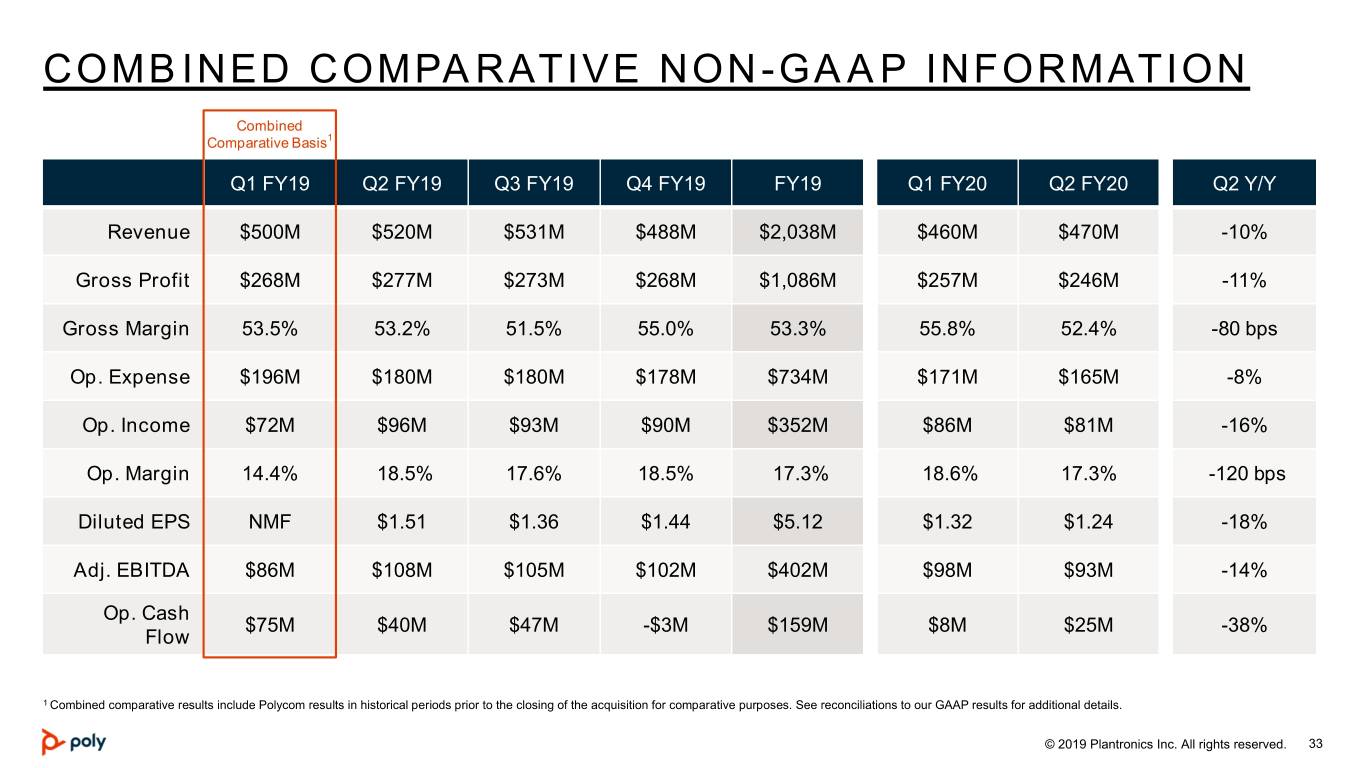

COMBINED COMPARATIVE NON -GAAP INFORMATION Combined Comparative Basis1 Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19 FY19 Q1 FY20 Q2 FY20 Q2 Y/Y Revenue $500M $520M $531M $488M $2,038M $460M $470M -10% Gross Profit $268M $277M $273M $268M $1,086M $257M $246M -11% Gross Margin 53.5% 53.2% 51.5% 55.0% 53.3% 55.8% 52.4% -80 bps Op. Expense $196M $180M $180M $178M $734M $171M $165M -8% Op. Income $72M $96M $93M $90M $352M $86M $81M -16% Op. Margin 14.4% 18.5% 17.6% 18.5% 17.3% 18.6% 17.3% -120 bps Diluted EPS NMF $1.51 $1.36 $1.44 $5.12 $1.32 $1.24 -18% Adj. EBITDA $86M $108M $105M $102M $402M $98M $93M -14% Op. Cash $75M $40M $47M -$3M $159M $8M $25M -38% Flow 1 Combined comparative results include Polycom results in historical periods prior to the closing of the acquisition for comparative purposes. See reconciliations to our GAAP results for additional details. © 2019 Plantronics Inc. All rights reserved. 33

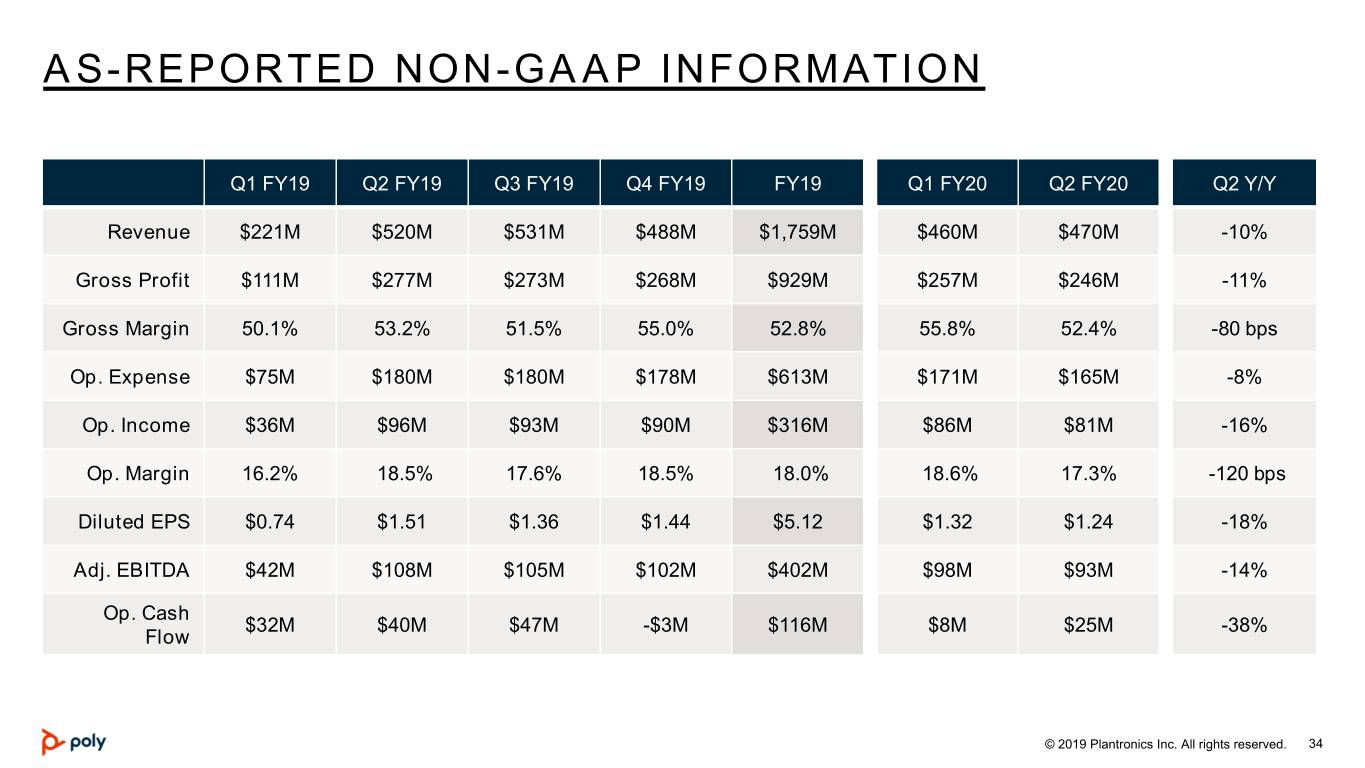

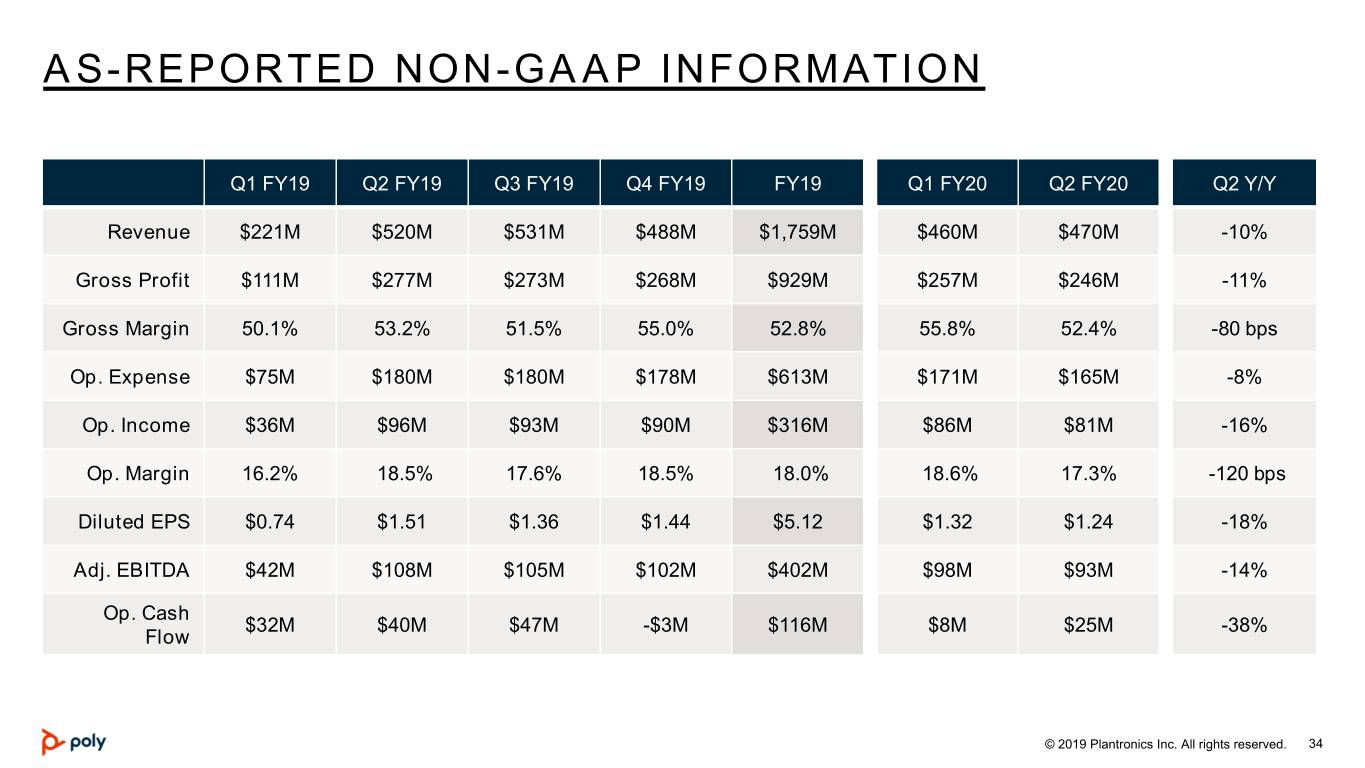

AS-REPORTED NON-GAAP INFORMATION Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19 FY19 Q1 FY20 Q2 FY20 Q2 Y/Y Revenue $221M $520M $531M $488M $1,759M $460M $470M -10% Gross Profit $111M $277M $273M $268M $929M $257M $246M -11% Gross Margin 50.1% 53.2% 51.5% 55.0% 52.8% 55.8% 52.4% -80 bps Op. Expense $75M $180M $180M $178M $613M $171M $165M -8% Op. Income $36M $96M $93M $90M $316M $86M $81M -16% Op. Margin 16.2% 18.5% 17.6% 18.5% 18.0% 18.6% 17.3% -120 bps Diluted EPS $0.74 $1.51 $1.36 $1.44 $5.12 $1.32 $1.24 -18% Adj. EBITDA $42M $108M $105M $102M $402M $98M $93M -14% Op. Cash $32M $40M $47M -$3M $116M $8M $25M -38% Flow © 2019 Plantronics Inc. All rights reserved. 34

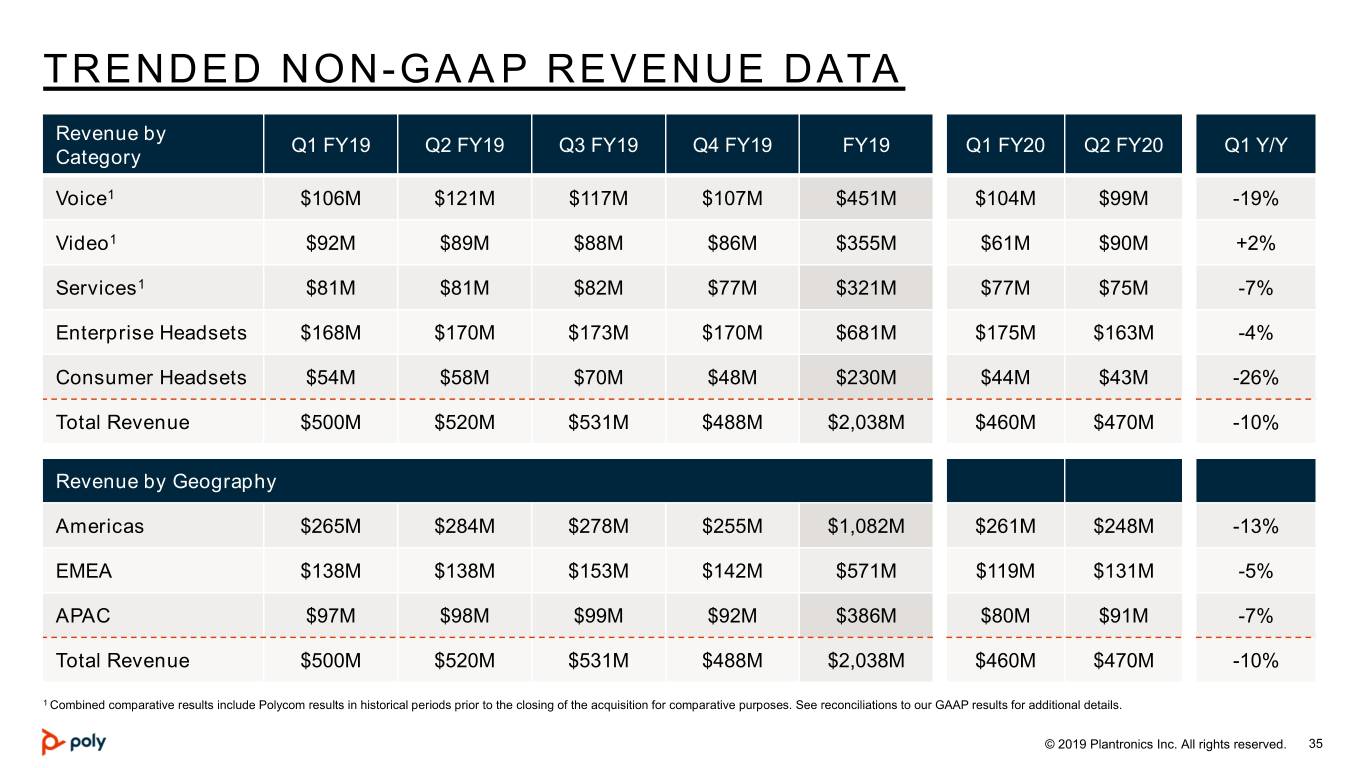

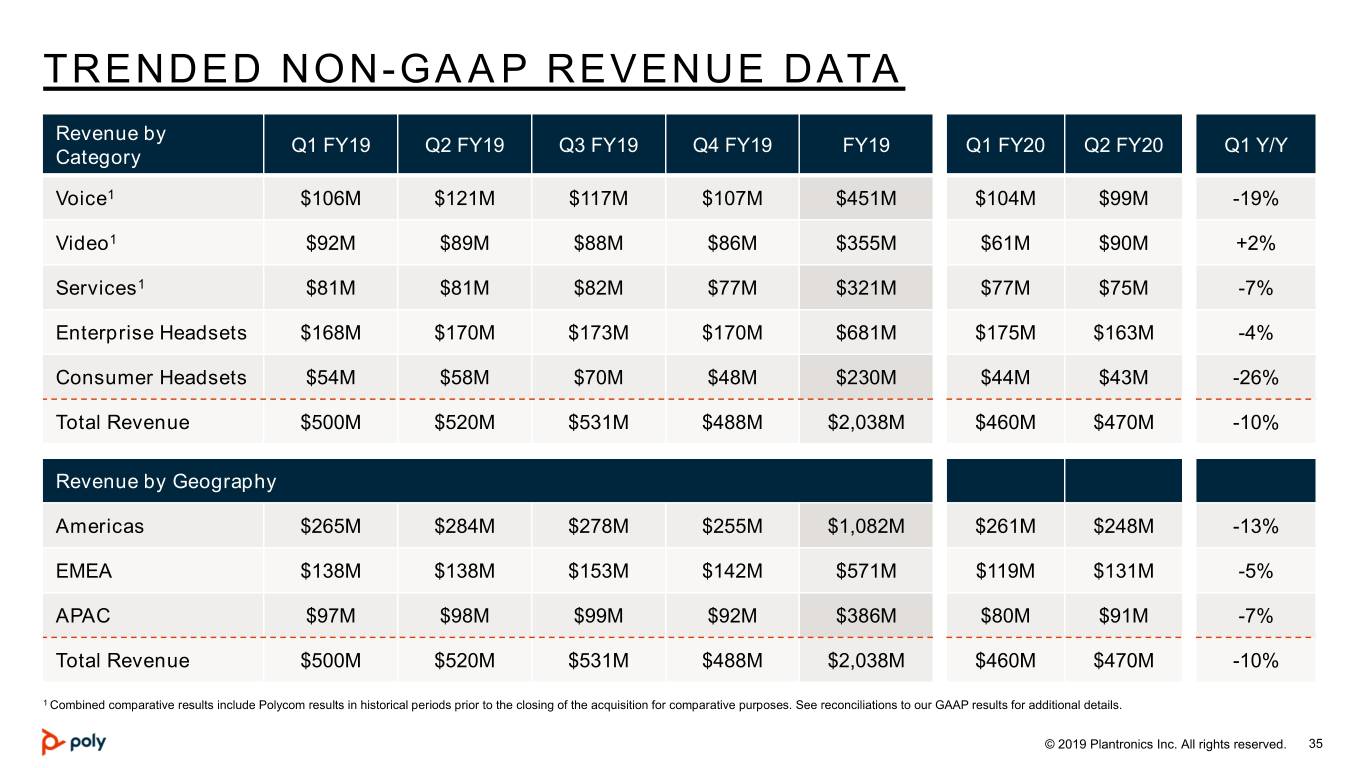

TRENDED NON-GAAP REVENUE DATA Revenue by Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19 FY19 Q1 FY20 Q2 FY20 Q1 Y/Y Category Voice1 $106M $121M $117M $107M $451M $104M $99M -19% Video1 $92M $89M $88M $86M $355M $61M $90M +2% Services1 $81M $81M $82M $77M $321M $77M $75M -7% Enterprise Headsets $168M $170M $173M $170M $681M $175M $163M -4% Consumer Headsets $54M $58M $70M $48M $230M $44M $43M -26% Total Revenue $500M $520M $531M $488M $2,038M $460M $470M -10% Revenue by Geography Americas $265M $284M $278M $255M $1,082M $261M $248M -13% EMEA $138M $138M $153M $142M $571M $119M $131M -5% APAC $97M $98M $99M $92M $386M $80M $91M -7% Total Revenue $500M $520M $531M $488M $2,038M $460M $470M -10% 1 Combined comparative results include Polycom results in historical periods prior to the closing of the acquisition for comparative purposes. See reconciliations to our GAAP results for additional details. © 2019 Plantronics Inc. All rights reserved. 35

ADJUSTED ENTERPRISE AND CONSUMER HEADSET REVENUE COMPARISON Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19 FY19 Q1 FY20 Q2 FY20 Q1 Y/Y As Reported: Enterprise $168M $170M $173M $170M $681M $175M $163M -4% Headsets As Reported: Consumer $54M $58M $70M $48M $230M $44M $43M -26% Headsets Adjusted Enterprise $186M $187M $190M $185M $748M $187M $173M -7% Headsets1 Adjusted Consumer $36M $41M $53M $33M $163M $32M $33M -20% Headsets1 FY19 average Adjusted Consumer Headsets gross margins of ~25% 1 For informational purposes related to our announcement to explore strategic alternatives for the Consumer business, Consumer Headsets and Enterprise Headsets shown here have been adjusted in all periods presented to reclassify revenues from the Mono Premium Bluetooth subcategory from As Reported Consumer Headsets into As Reported Enterprise Headsets. © 2019 Plantronics Inc. All rights reserved. 36

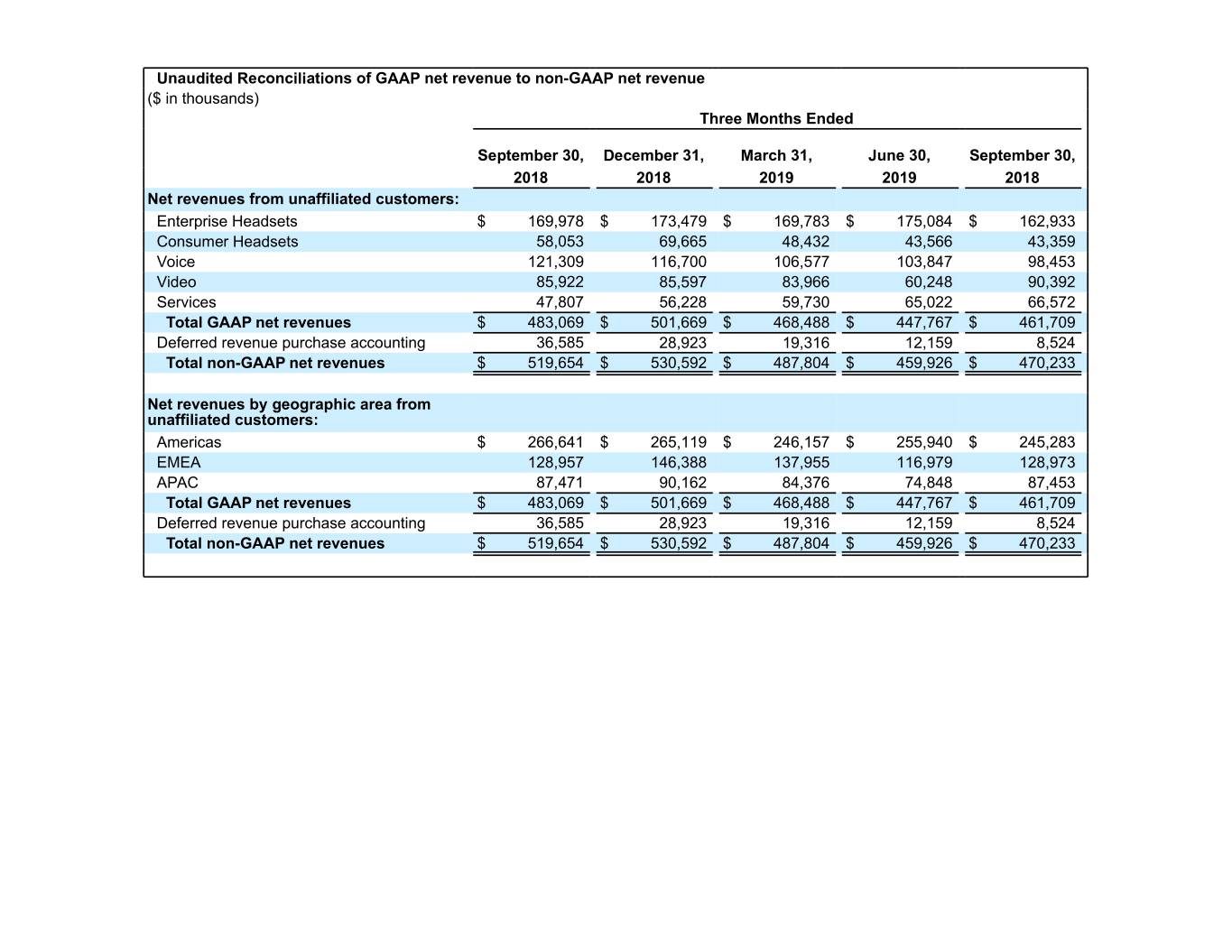

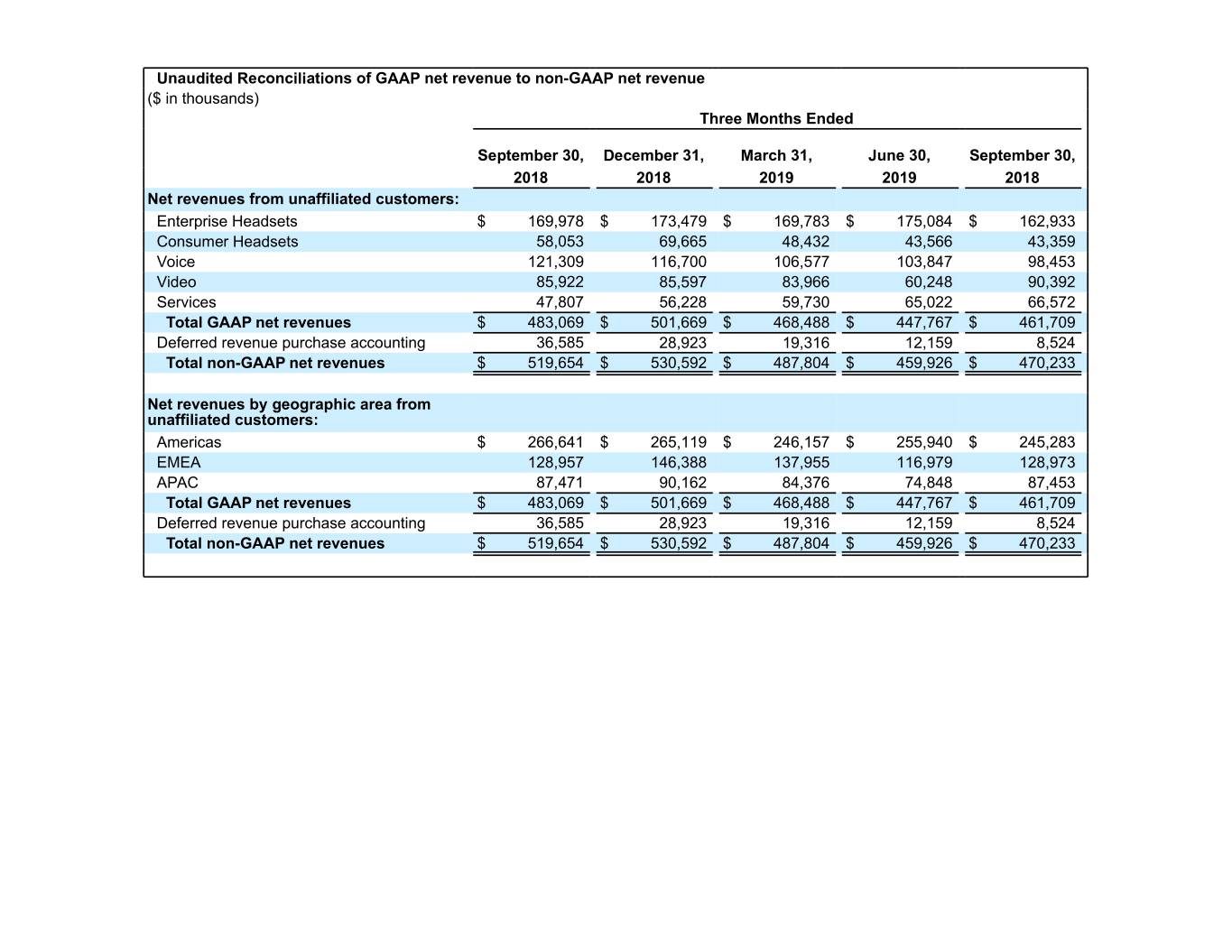

Unaudited Reconciliations of GAAP net revenue to non-GAAP net revenue ($ in thousands) Three Months Ended September 30, December 31, March 31, June 30, September 30, 2018 2018 2019 2019 2018 Net revenues from unaffiliated customers: Enterprise Headsets $ 169,978 $ 173,479 $ 169,783 $ 175,084 $ 162,933 Consumer Headsets 58,053 69,665 48,432 43,566 43,359 Voice 121,309 116,700 106,577 103,847 98,453 Video 85,922 85,597 83,966 60,248 90,392 Services 47,807 56,228 59,730 65,022 66,572 Total GAAP net revenues $ 483,069 $ 501,669 $ 468,488 $ 447,767 $ 461,709 Deferred revenue purchase accounting 36,585 28,923 19,316 12,159 8,524 Total non-GAAP net revenues $ 519,654 $ 530,592 $ 487,804 $ 459,926 $ 470,233 Net revenues by geographic area from unaffiliated customers: Americas $ 266,641 $ 265,119 $ 246,157 $ 255,940 $ 245,283 EMEA 128,957 146,388 137,955 116,979 128,973 APAC 87,471 90,162 84,376 74,848 87,453 Total GAAP net revenues $ 483,069 $ 501,669 $ 468,488 $ 447,767 $ 461,709 Deferred revenue purchase accounting 36,585 28,923 19,316 12,159 8,524 Total non-GAAP net revenues $ 519,654 $ 530,592 $ 487,804 $ 459,926 $ 470,233

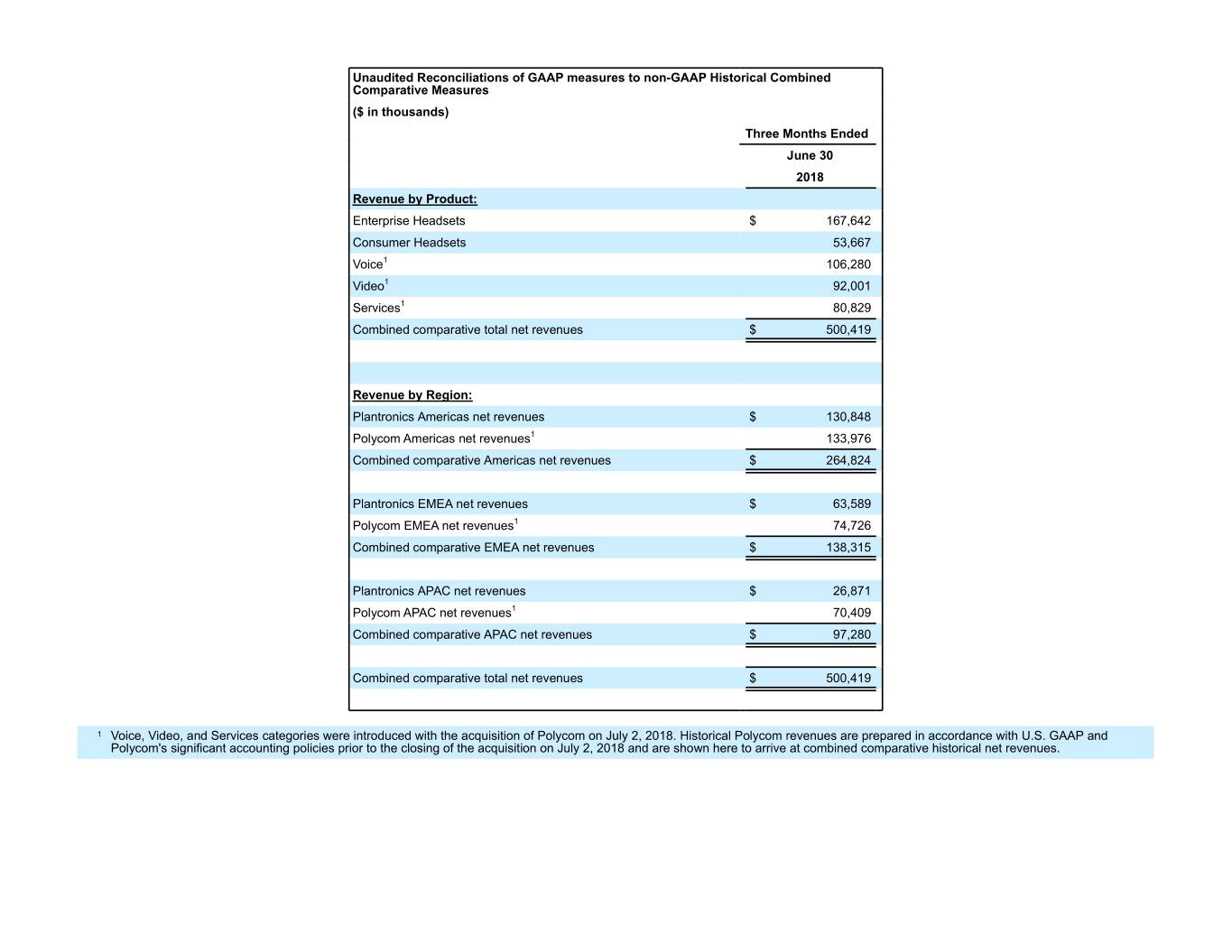

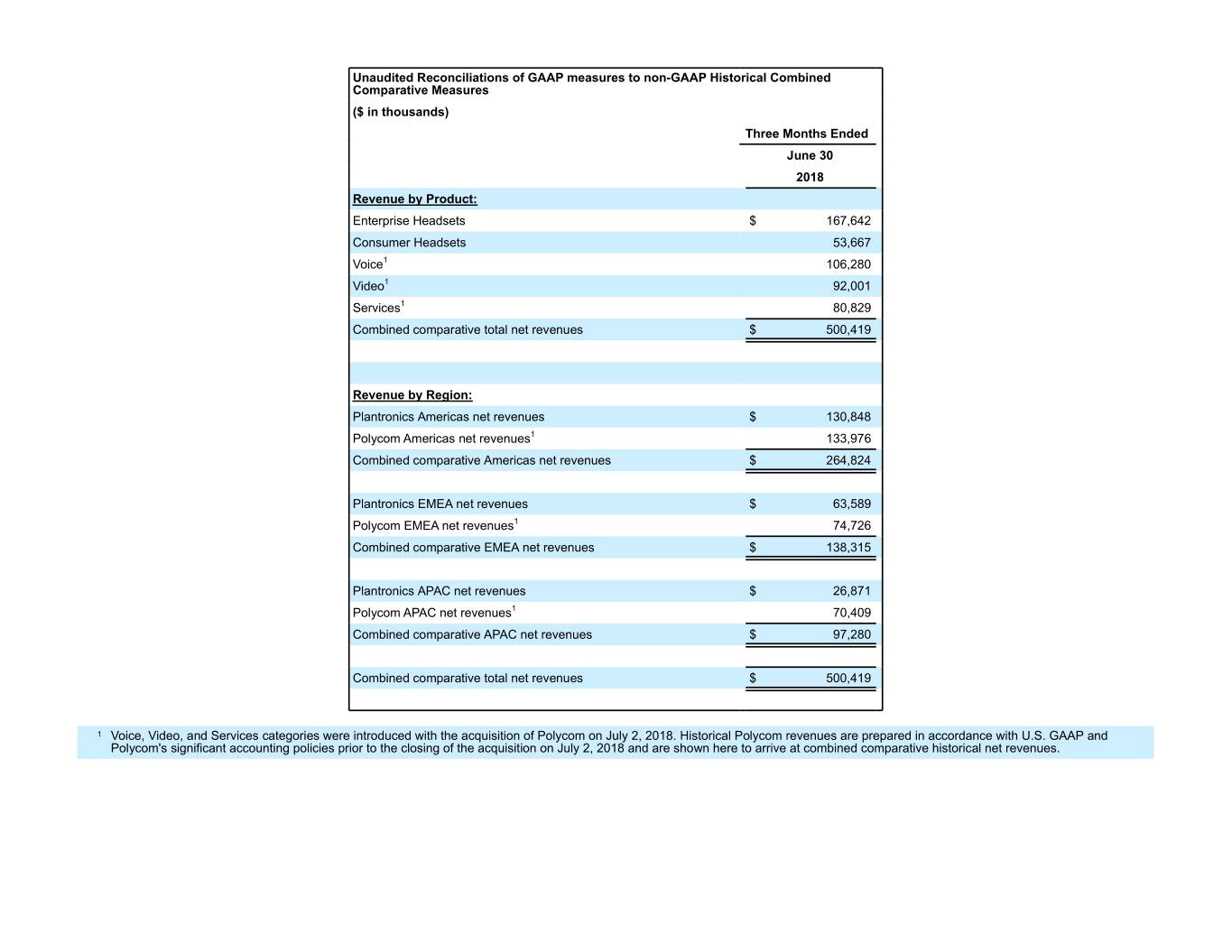

Unaudited Reconciliations of GAAP measures to non-GAAP Historical Combined Comparative Measures ($ in thousands) Three Months Ended June 30 2018 Revenue by Product: Enterprise Headsets $ 167,642 Consumer Headsets 53,667 Voice1 106,280 Video1 92,001 Services1 80,829 Combined comparative total net revenues $ 500,419 Revenue by Region: Plantronics Americas net revenues $ 130,848 Polycom Americas net revenues1 133,976 Combined comparative Americas net revenues $ 264,824 Plantronics EMEA net revenues $ 63,589 Polycom EMEA net revenues1 74,726 Combined comparative EMEA net revenues $ 138,315 Plantronics APAC net revenues $ 26,871 Polycom APAC net revenues1 70,409 Combined comparative APAC net revenues $ 97,280 Combined comparative total net revenues $ 500,419 1 Voice, Video, and Services categories were introduced with the acquisition of Polycom on July 2, 2018. Historical Polycom revenues are prepared in accordance with U.S. GAAP and Polycom's significant accounting policies prior to the closing of the acquisition on July 2, 2018 and are shown here to arrive at combined comparative historical net revenues.

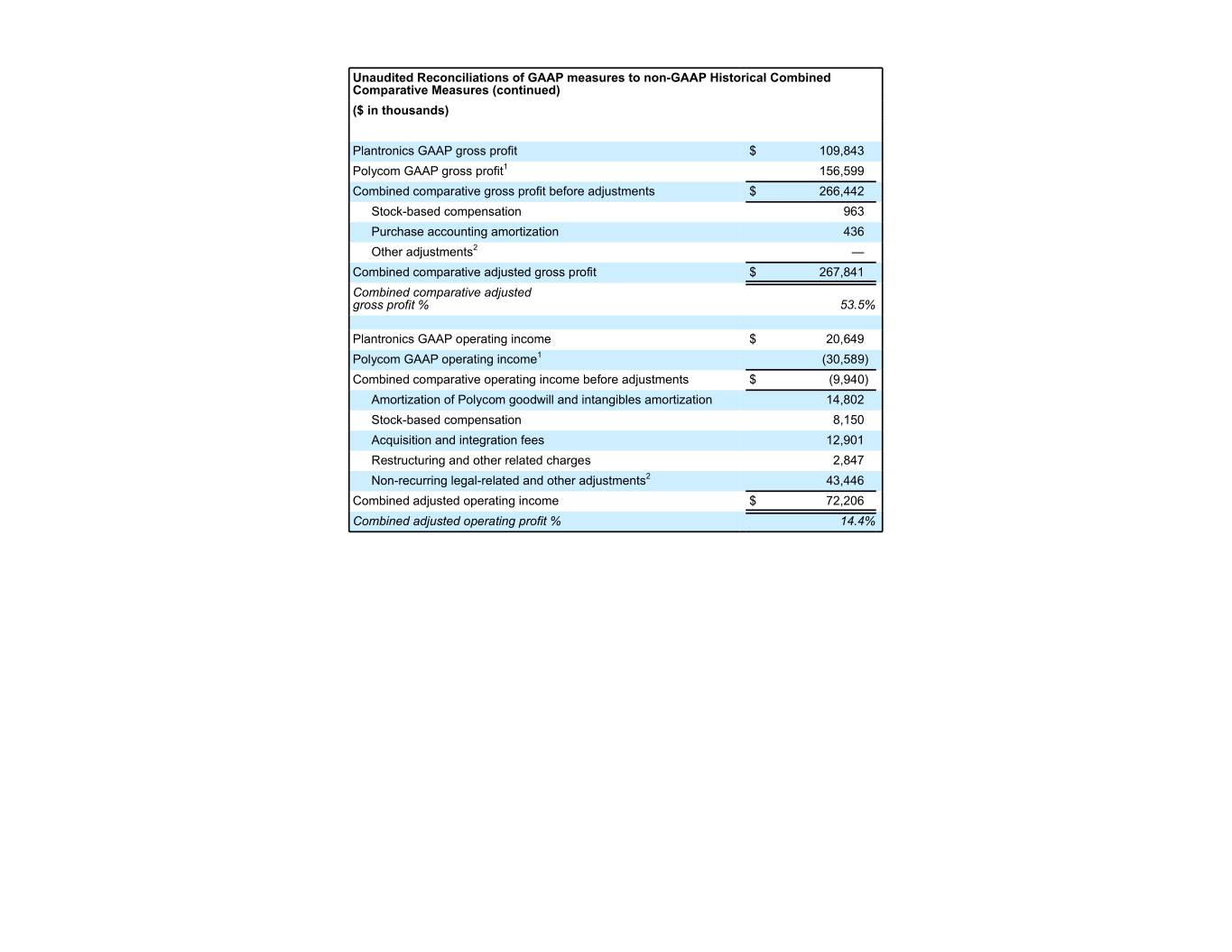

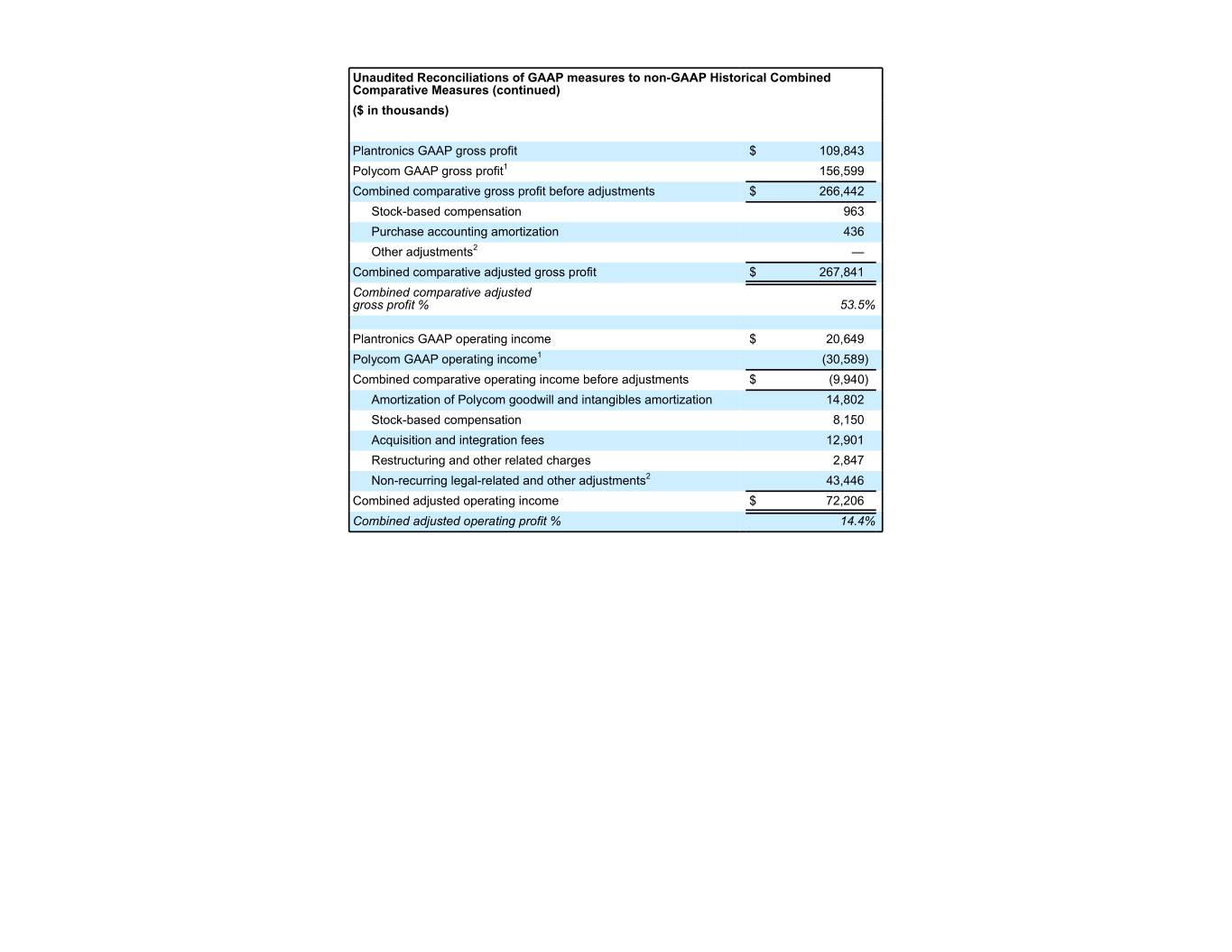

Unaudited Reconciliations of GAAP measures to non-GAAP Historical Combined Comparative Measures (continued) ($ in thousands) Plantronics GAAP gross profit $ 109,843 Polycom GAAP gross profit1 156,599 Combined comparative gross profit before adjustments $ 266,442 Stock-based compensation 963 Purchase accounting amortization 436 Other adjustments2 — Combined comparative adjusted gross profit $ 267,841 Combined comparative adjusted gross profit % 53.5% Plantronics GAAP operating income $ 20,649 Polycom GAAP operating income1 (30,589) Combined comparative operating income before adjustments $ (9,940) Amortization of Polycom goodwill and intangibles amortization 14,802 Stock-based compensation 8,150 Acquisition and integration fees 12,901 Restructuring and other related charges 2,847 Non-recurring legal-related and other adjustments2 43,446 Combined adjusted operating income $ 72,206 Combined adjusted operating profit % 14.4%

Unaudited Reconciliations of GAAP measures to Combined Comparative Adjusted EBITDA ($ in thousands) Three Months Ended June 30, 20181 Plantronics GAAP operating income $ 20,649 Polycom GAAP operating income2 (30,589) Combined comparative operating income before adjustments (9,940) Acquisition and integration fees 12,901 Stock-based compensation 8,150 Restructuring and other related charges 2,847 Other adjustments3 43,446 Depreciation and amortization4 29,231 Adjusted EBITDA 86,635 Unaudited Reconciliations of GAAP measures to non-GAAP Historical Combined Comparative Measures (continued) ($ in thousands) Three Months Ended June 30 2018 Plantronics Cash Flow from Operations $ 32,082 Polycom Cash Flow from Operations1 $ 43,059 Combined Comparative Cash Flow from Operations $ 75,141 1 Polycom results shown in these periods are prior to the close of the acquisition on July 2, 2018. These results are shown here to arrive at combined comparative historical results. 2 Prepared in accordance with U.S. GAAP and Polycom's significant accounting policies prior to the closing of the acquisition on July 2, 2018, and further adjusted in accordance with U.S. GAAP for subsequent events occurring after the balance sheet date of June 30, 2018. Refer to footnote 3 for further information. Includes losses from litigation settlements and immaterial adjustments to conform historical Polycom results to Plantronics non-GAAP policy. In the period ended June 30, 2018, this 3 includes litigation settlements of approximately $37 million related to the settlement of a previously disclosed FCPA matter and approximately $6 million related other legal settlements, both of which were recognized as subsequent events. More information on these and other legal matters is available in Note 7. Commitments and Contingencies within our Form 10-Q filed on February 6, 2019. 4 In the three months ending December 31, 2017, March 31, 2018, and June 30, 2018, depreciation and amortization includes amortization of Polycom goodwill in accordance with U.S. GAAP and Polycom's significant accounting policies prior to the closing of the acquisition on July 2, 2018.

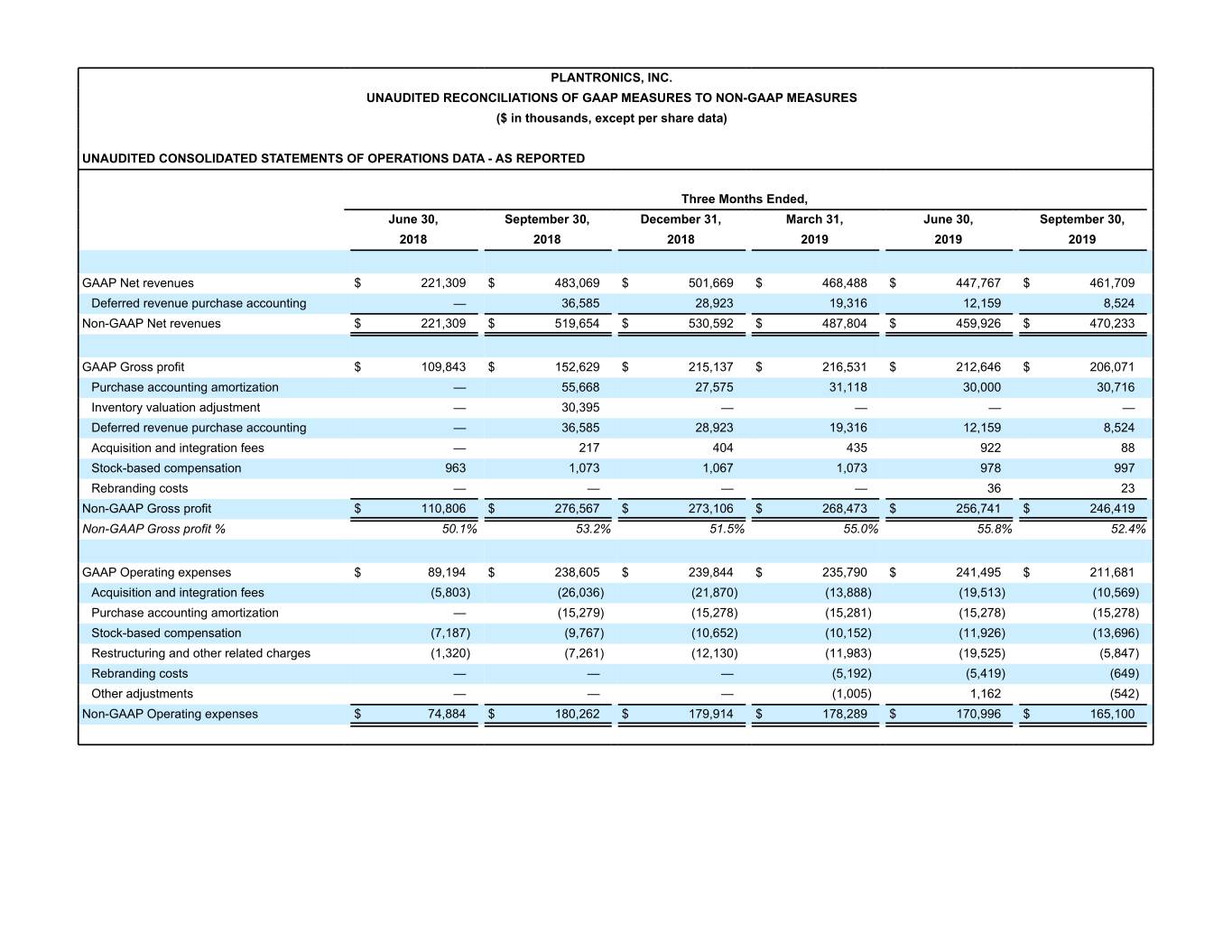

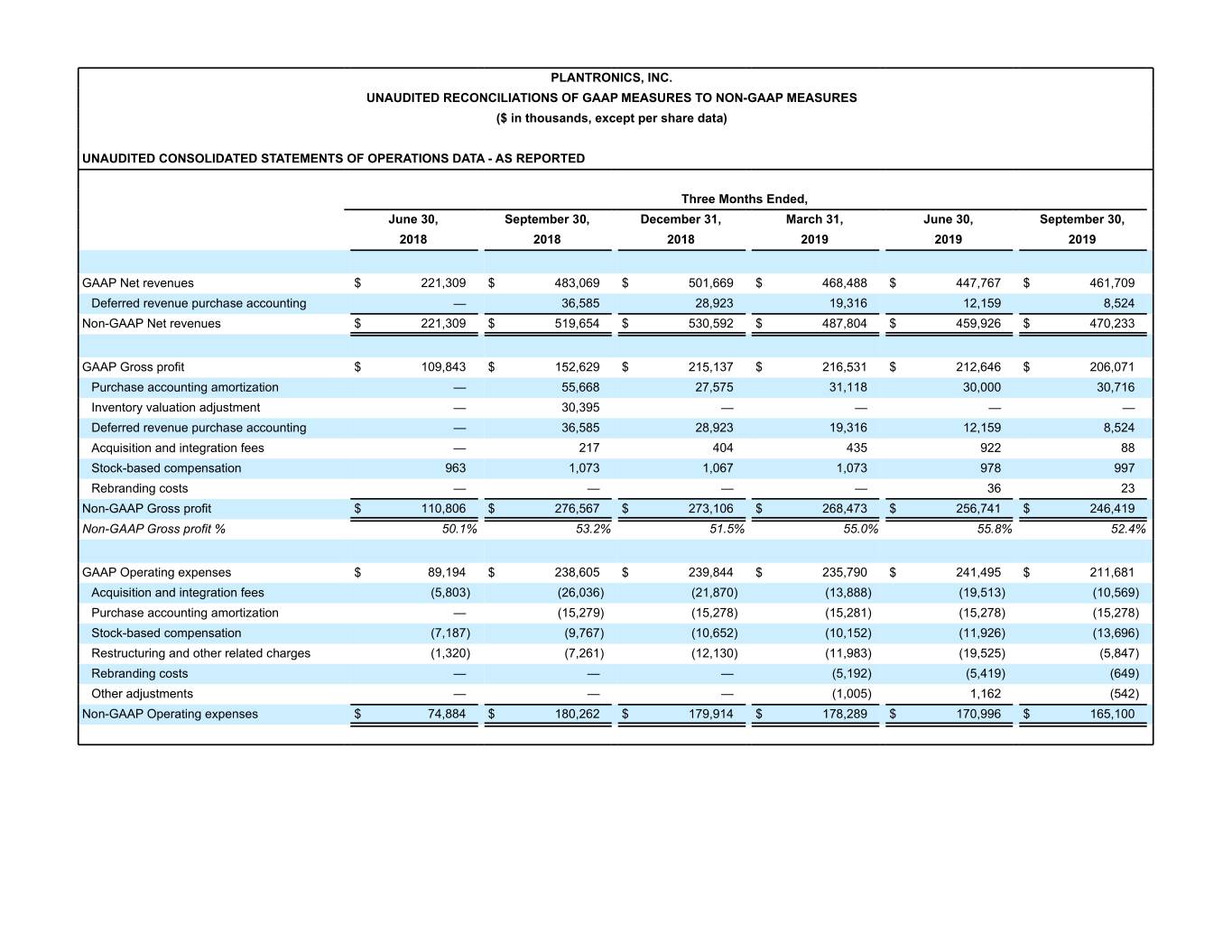

PLANTRONICS, INC. UNAUDITED RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES ($ in thousands, except per share data) UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA - AS REPORTED Three Months Ended, June 30, September 30, December 31, March 31, June 30, September 30, 2018 2018 2018 2019 2019 2019 GAAP Net revenues $ 221,309 $ 483,069 $ 501,669 $ 468,488 $ 447,767 $ 461,709 Deferred revenue purchase accounting — 36,585 28,923 19,316 12,159 8,524 Non-GAAP Net revenues $ 221,309 $ 519,654 $ 530,592 $ 487,804 $ 459,926 $ 470,233 GAAP Gross profit $ 109,843 $ 152,629 $ 215,137 $ 216,531 $ 212,646 $ 206,071 Purchase accounting amortization — 55,668 27,575 31,118 30,000 30,716 Inventory valuation adjustment — 30,395 — — — — Deferred revenue purchase accounting — 36,585 28,923 19,316 12,159 8,524 Acquisition and integration fees — 217 404 435 922 88 Stock-based compensation 963 1,073 1,067 1,073 978 997 Rebranding costs — — — — 36 23 Non-GAAP Gross profit $ 110,806 $ 276,567 $ 273,106 $ 268,473 $ 256,741 $ 246,419 Non-GAAP Gross profit % 50.1% 53.2% 51.5% 55.0% 55.8% 52.4% GAAP Operating expenses $ 89,194 $ 238,605 $ 239,844 $ 235,790 $ 241,495 $ 211,681 Acquisition and integration fees (5,803) (26,036) (21,870) (13,888) (19,513) (10,569) Purchase accounting amortization — (15,279) (15,278) (15,281) (15,278) (15,278) Stock-based compensation (7,187) (9,767) (10,652) (10,152) (11,926) (13,696) Restructuring and other related charges (1,320) (7,261) (12,130) (11,983) (19,525) (5,847) Rebranding costs — — — (5,192) (5,419) (649) Other adjustments — — — (1,005) 1,162 (542) Non-GAAP Operating expenses $ 74,884 $ 180,262 $ 179,914 $ 178,289 $ 170,996 $ 165,100

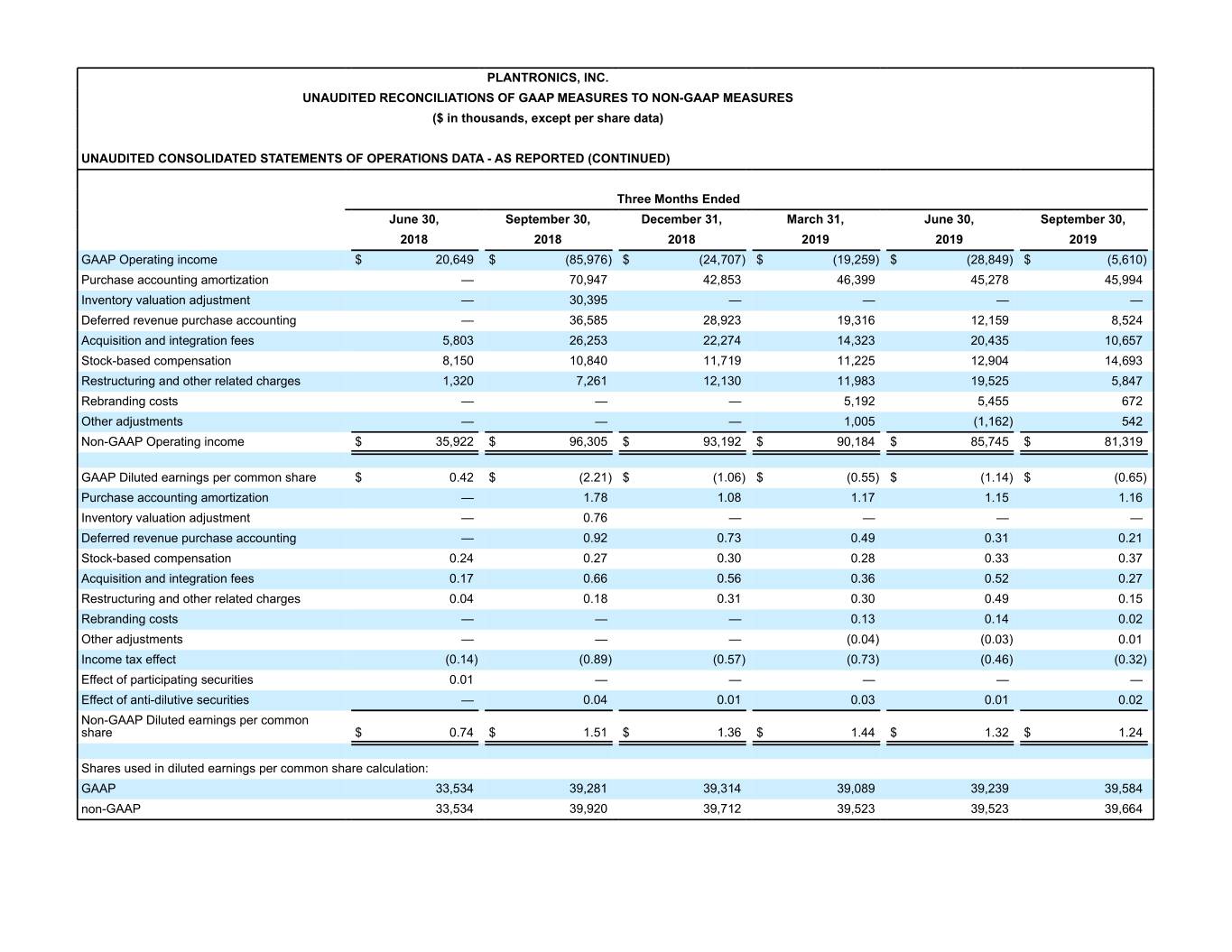

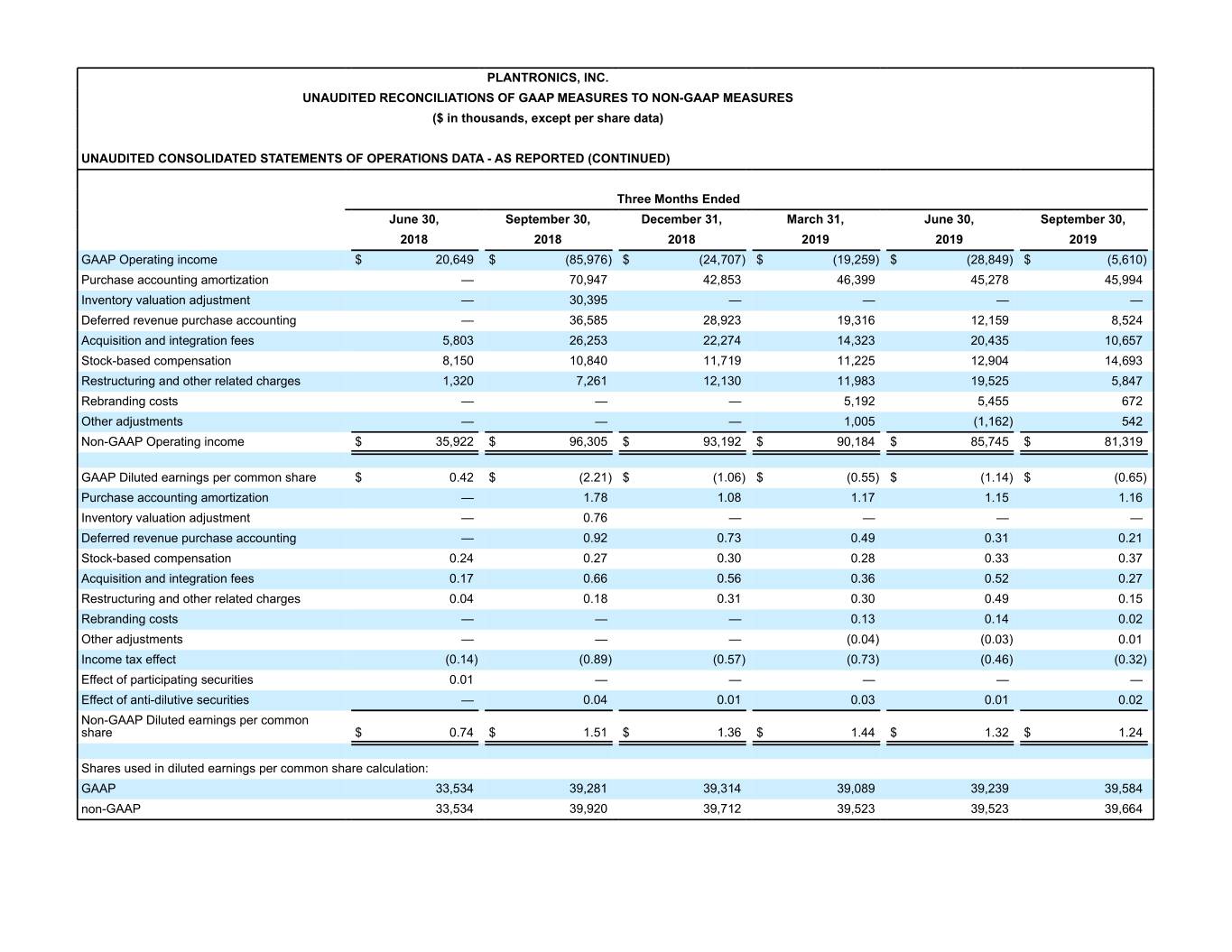

PLANTRONICS, INC. UNAUDITED RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES ($ in thousands, except per share data) UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA - AS REPORTED (CONTINUED) Three Months Ended June 30, September 30, December 31, March 31, June 30, September 30, 2018 2018 2018 2019 2019 2019 GAAP Operating income $ 20,649 $ (85,976) $ (24,707) $ (19,259) $ (28,849) $ (5,610) Purchase accounting amortization — 70,947 42,853 46,399 45,278 45,994 Inventory valuation adjustment — 30,395 — — — — Deferred revenue purchase accounting — 36,585 28,923 19,316 12,159 8,524 Acquisition and integration fees 5,803 26,253 22,274 14,323 20,435 10,657 Stock-based compensation 8,150 10,840 11,719 11,225 12,904 14,693 Restructuring and other related charges 1,320 7,261 12,130 11,983 19,525 5,847 Rebranding costs — — — 5,192 5,455 672 Other adjustments — — — 1,005 (1,162) 542 Non-GAAP Operating income $ 35,922 $ 96,305 $ 93,192 $ 90,184 $ 85,745 $ 81,319 GAAP Diluted earnings per common share $ 0.42 $ (2.21) $ (1.06) $ (0.55) $ (1.14) $ (0.65) Purchase accounting amortization — 1.78 1.08 1.17 1.15 1.16 Inventory valuation adjustment — 0.76 — — — — Deferred revenue purchase accounting — 0.92 0.73 0.49 0.31 0.21 Stock-based compensation 0.24 0.27 0.30 0.28 0.33 0.37 Acquisition and integration fees 0.17 0.66 0.56 0.36 0.52 0.27 Restructuring and other related charges 0.04 0.18 0.31 0.30 0.49 0.15 Rebranding costs — — — 0.13 0.14 0.02 Other adjustments — — — (0.04) (0.03) 0.01 Income tax effect (0.14) (0.89) (0.57) (0.73) (0.46) (0.32) Effect of participating securities 0.01 — — — — — Effect of anti-dilutive securities — 0.04 0.01 0.03 0.01 0.02 Non-GAAP Diluted earnings per common share $ 0.74 $ 1.51 $ 1.36 $ 1.44 $ 1.32 $ 1.24 Shares used in diluted earnings per common share calculation: GAAP 33,534 39,281 39,314 39,089 39,239 39,584 non-GAAP 33,534 39,920 39,712 39,523 39,523 39,664

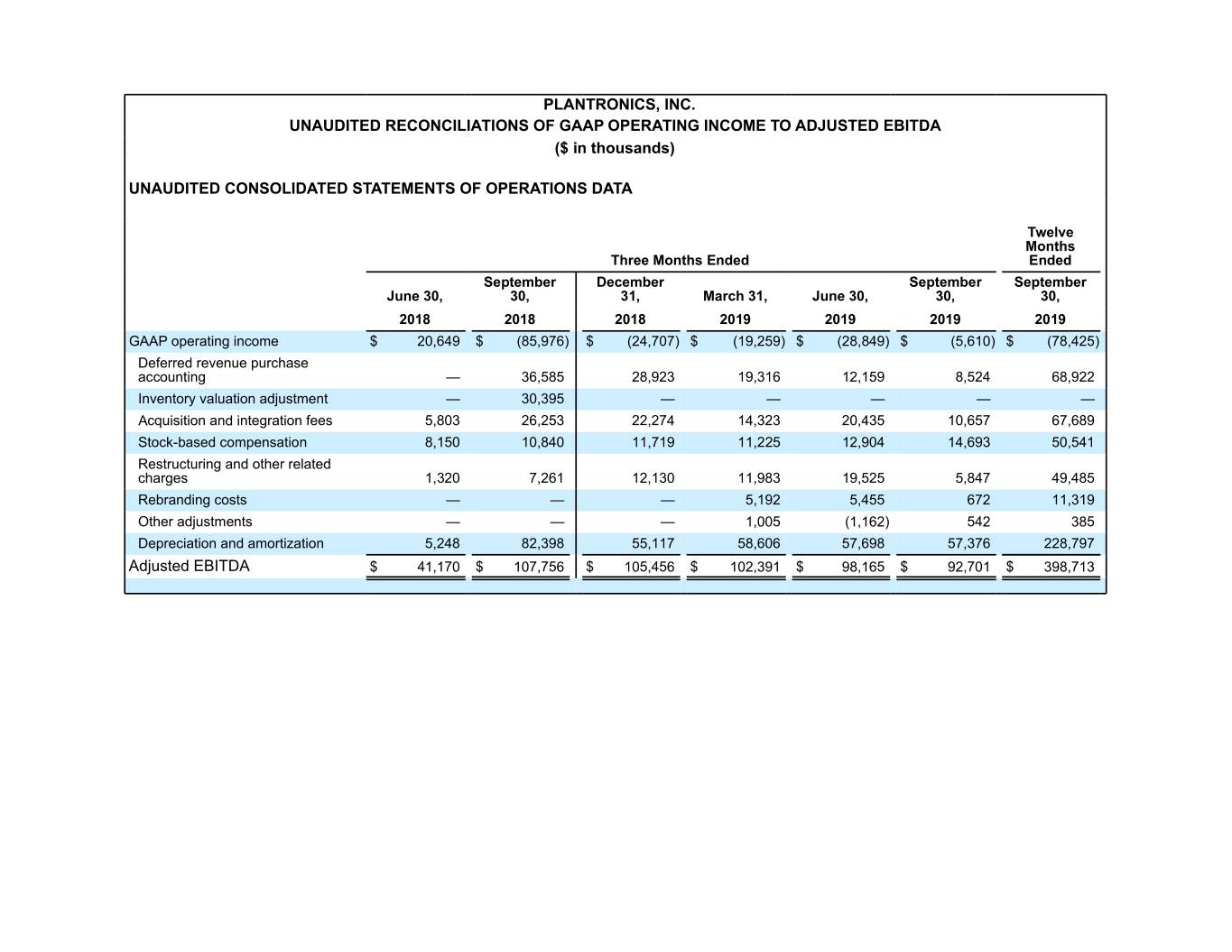

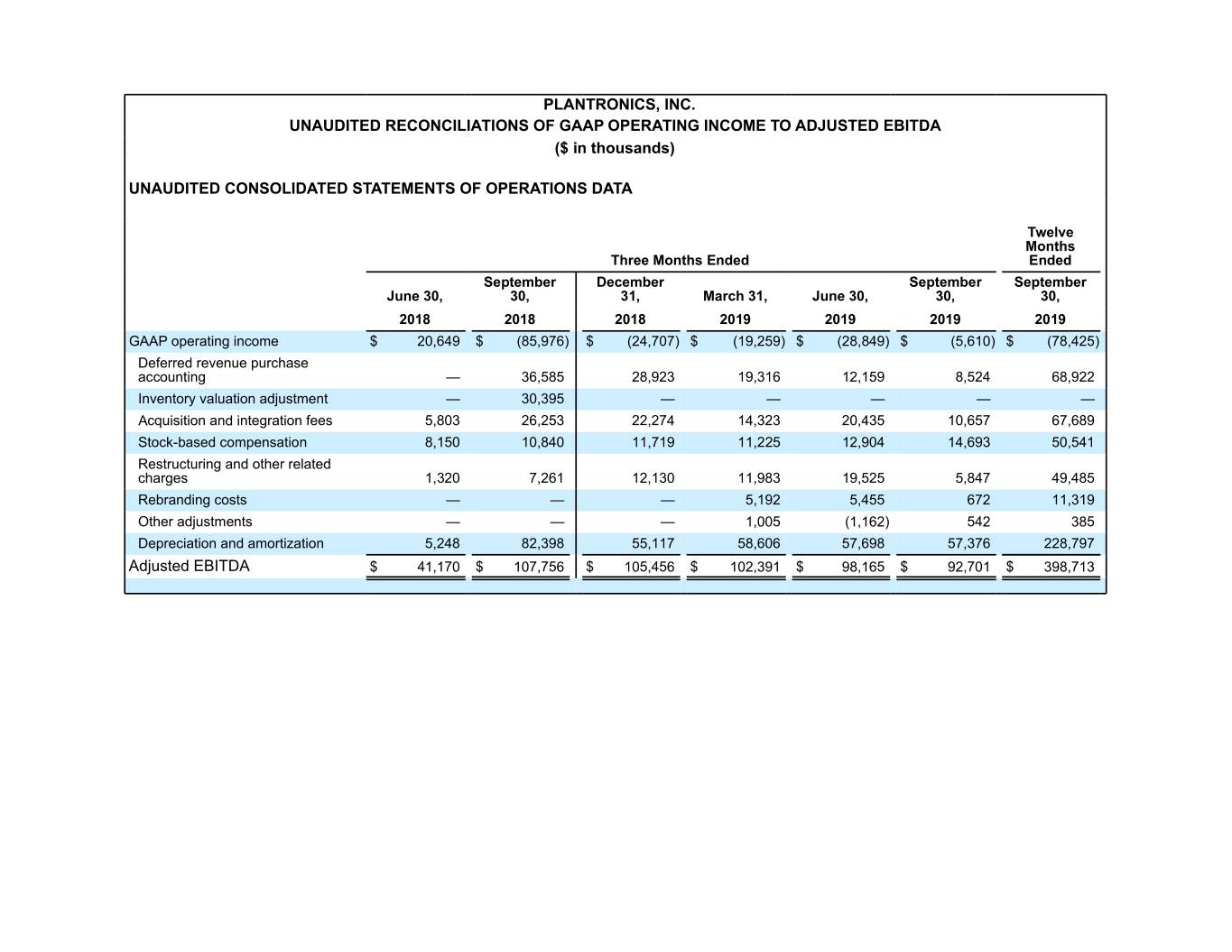

PLANTRONICS, INC. UNAUDITED RECONCILIATIONS OF GAAP OPERATING INCOME TO ADJUSTED EBITDA ($ in thousands) UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA Twelve Months Three Months Ended Ended September December September September June 30, 30, 31, March 31, June 30, 30, 30, 2018 2018 2018 2019 2019 2019 2019 GAAP operating income $ 20,649 $ (85,976) $ (24,707) $ (19,259) $ (28,849) $ (5,610) $ (78,425) Deferred revenue purchase accounting — 36,585 28,923 19,316 12,159 8,524 68,922 Inventory valuation adjustment — 30,395 — — — — — Acquisition and integration fees 5,803 26,253 22,274 14,323 20,435 10,657 67,689 Stock-based compensation 8,150 10,840 11,719 11,225 12,904 14,693 50,541 Restructuring and other related charges 1,320 7,261 12,130 11,983 19,525 5,847 49,485 Rebranding costs — — — 5,192 5,455 672 11,319 Other adjustments — — — 1,005 (1,162) 542 385 Depreciation and amortization 5,248 82,398 55,117 58,606 57,698 57,376 228,797 Adjusted EBITDA $ 41,170 $ 107,756 $ 105,456 $ 102,391 $ 98,165 $ 92,701 $ 398,713