©2021 Plantronics Inc. All rights reserved. 1 Q3 FY21 FINANCIAL RESULTS February 4, 2021 NYSE: PLT

©2020 Plantronics Inc. All rights reserved. 2 This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to our intentions, beliefs, projections, outlook, analyses or current expectations that are subject to many risks and uncertainties. Such forward-looking statements and the associated risks and uncertainties include, but are not limited to: (i) our beliefs with respect to the length and severity of the COVID-19 (coronavirus) outbreak, and its impact across our businesses, our operations and global supply chain, including (a) our expectations the virus has caused and will continue to cause an increase in customer and partner demand for our product lines, including increased demand in collaboration endpoints, and our ability to design new product offerings to meet the change in demand due to a global hybrid work environment; (b) risks related to increased freight and other costs associated with expediting shipment and delivery of high-demand products to key markets in order to meet customer demand, (c) our inability to source component parts from key suppliers in sufficient quantities necessary to meet the high demand for certain product lines, including our Enterprise Headsets and continued uncertainty and potential impact on future quarters if sourcing constraints continue and/or price volatility occurs, which could continue to negatively affect our profitability and/or market share; (d) expectations related to our voice product lines, as well as our services attachment rate for such products, which have been, and may continue to be, negatively impacted as companies have delayed returning their workforces to offices in many countries due to the continued impact of COVID-19; (e) expectations related to our ability to fulfill the backlog generated by supply constraints, to timely supply the number of products to fulfill current and future customer demand, including expectations that our manufacturing facility in Tijuana, Mexico will continue production at the capacity necessary to meet such demand; (f) the impact of the virus on our distribution partners, resellers, end-user customers and our production facilities, including our ability to obtain alternative sources of supply if our production facility or other suppliers are impacted by future shutdowns; (g) the impact if global or regional economic conditions deteriorate further, on our customers and/or partners, including increased demand for pricing accommodations, delayed payments, delayed deployment plans, insolvency or other issues which may increase credit losses; (h) risks related to restrictions or delays in global return to worksites as a result of COVID-19, which continues to impact our employees and our customers worldwide, which has negatively impacted our voice product lines for the quarter, and restricted customer engagement; and (i) the complexity of the forecast analysis and the design and operation of internal controls; and (ii) our belief that we can manufacture or supply products in a timely manner to satisfy perishable demand; (iii) expectations related to our customers’ purchasing decisions and our ability to pivot quickly enough and/or match product production to demand, particularly given long lead times and the difficulty of forecasting unit volumes and acquiring the component parts and materials to meet demand without having excess inventory or incurring cancellation charges; (iv) risks associated with significant and/or abrupt changes in product demand which increases the complexity of management’s evaluation of potential excess or obsolete inventory; (v) risks associated with the bankruptcy or financial weakness of distributors or key customers, or the bankruptcy of or reduction in capacity of our key suppliers; (vi) risks associated with the potential interruption in the supply of sole- sourced critical components, our ability to move to a dual-source model, and the continuity of component supply at costs consistent with our plans, which has negatively impacted in the quarter and may continue to impact our ability to timely supply product to meet our customer demand; (vii) expectations related to our services segment revenues, particularly as we introduce new generation, less complex, product solutions, or as companies shift from on premises to work from home options for their workforce, which may result in decreased demand for our professional, installation and/or managed service offerings; (viii) expectations that our current cash on hand, additional cash generated from operations, together with sources of cash through our credit facility, either alone or in combination with our election to suspend our dividend payments, will meet our liquidity needs during and following the unknown duration and impact of the COVID-19 pandemic; (ix) expectations relating to our ability to generate sufficient cash flow from operations to meet our debt covenants and timely repay all principal and interest amounts drawn under our credit facility as they become due; (x) risks associated with our channel partners’ sales reporting, product inventories and product sell through since we sell a significant amount of products to channel partners who maintain their own inventory of our products; (xi) our efforts to execute to drive sales and sustainable profitable revenue growth, to improve our profitability and cash flow, and accelerate debt reduction and de-levering; (xii) our expectations for new products launches, the timing of their releases and their expected impact on future growth and on our existing products; (xiii) our belief that our Partner Program and/or our product management and personal device services, including Poly Lens and/or Poly+ will drive growth and profitability for both us and our partners through the sale of our product, services and solutions; (xiv) risks associated with forecasting sales and procurement demands, which are inherently difficult, particularly with continuing uncertainty in regional and global economic conditions; (xv) uncertainties attributable to currency fluctuations, including fluctuations in foreign exchange rates and/or new or greater tariffs on our products; (xvi) our expectations regarding our ability to control costs, streamline operations and successfully implement our various cost-reduction activities and realize anticipated cost savings under such cost-reduction initiatives; (xvii) expectations relating to our quarterly and annual earnings guidance, particularly as economic uncertainty, including, without limitation, uncertainty related to the continued impact of COVID-19, the macro-economic and political climate and other external factors, puts further pressure on management judgments used to develop forward looking financial guidance and other prospective financial information; (xviii) expectations related to GAAP and non-GAAP financial results for the fourth quarter and full Fiscal Year 2021, including net revenues, adjusted EBITDA, tax rates, intangibles amortization, diluted weighted average shares outstanding and diluted EPS; (xix) our expectations of the impact of the acquisition of Polycom as it relates to our strategic vision and additional market and strategic partnership opportunities for our combined hardware, software and services offerings; (xx) our beliefs regarding the UC&C market, market dynamics and opportunities, and customer and partner behavior as well as our position in the market, including risks associated with the potential failure of our UC&C solutions to be adopted with the breadth and speed we anticipate; (xxi) our belief that the increased adoption of certain technologies and our open architecture approach has and will continue to increase demand for our solutions; (xxii) expectations related to the micro and macro-economic conditions in our domestic and international markets and their impact on our future business; (xxiii) our forecast and estimates with respect to tax matters, including expectations with respect to utilizing our deferred tax assets; (xxiv) our expectations related to building strategic alliances and key partnerships with providers of collaboration tools and platforms to drive revenue growth and market share; and (xxv) our expectations regarding pending and potential future litigation, in addition to other matters discussed in this press release that are not purely historical data. Such forward-looking statements are based on current expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. We do not assume any obligation to update or revise any such forward-looking statements, whether as the result of new developments or otherwise. For more information concerning these and other possible risks, please refer to our Annual Report on Form 10-K filed with the Securities and Exchange Commission on June 8, 2020 and other filings with the Securities and Exchange Commission, as well as recent press releases. FORWARD LOOKING STATEMENTS

©2020 Plantronics Inc. All rights reserved. 3 To supplement our condensed consolidated financial statements presented on a GAAP basis, we use non-GAAP measures of operating results, including non-GAAP net revenues, non-GAAP gross profit, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income, adjusted EBITDA, and non-GAAP diluted EPS. These non-GAAP measures are adjusted from the most directly comparable GAAP measures to exclude, or include where applicable, the effect of purchase accounting on deferred revenue, charges associated with the optimization of our Consumer product line, stock-based compensation, acquisition related expenses, purchase accounting amortization and adjustments, restructuring and other related charges and credits, impairment charges, rebranding costs, other unusual and/or non-cash charges and credits, and the impact of participating securities, all net of any associated tax impact. We also exclude tax benefits from the release of tax reserves, discrete tax adjustments including transfer pricing, tax deduction and tax credit adjustments, and the impact of tax law changes. We adjust these amounts from our non-GAAP measures primarily because management does not believe they are consistent with the development of our target operating model. We believe that the use of non-GAAP financial measures provides meaningful supplemental information regarding our performance and liquidity and helps investors compare actual results with our historical and long-term target operating model goals as well as our performance as a combined company. We believe presenting non-GAAP net revenue provides meaningful supplemental information regarding how management views the performance of the business and underlying performance of our individual product categories. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting and analyzing future periods; however, non-GAAP financial measures are not meant to be considered in isolation of, or as a substitute for, or superior to, net revenues, gross margin, operating expenses, operating income, operating margin, net income or EPS prepared in accordance with GAAP. A reconciliation between GAAP and Non-GAAP measures for all periods presented in this document is included as an appendix to this document and in our press release regarding our results for Q2 FY21 filed with the SEC on Form 8-K on October 29, 2020. Other historical reconciliations are available at investor.poly.com. USE OF NON-GAAP INFORMATION

© 2020 Plantronics Inc. All rights reserved. 4 OVERVIEW & STRATEGY

© 2020 Plantronics Inc. All rights reserved. 5 BUSINESS OVERVIEW • Poly’s markets have changed overnight: the pandemic accelerated the need for high- quality video and audio communications • Strong revenues and profitability driven by record Headset and Video revenues • New products, partnerships, and distribution strategies target post-pandemic environment and evolving purchasing patterns • Improved operational execution drives solid operating cash flow • De-levering continues with $12M debt repurchase in fiscal Q3 and plans to retire more than $80M in fiscal Q4, depending on market conditions Q3FY21 FINANCIAL OVERVIEW • GAAP Revenue of $485M Guidance range of $417M - $447M • Non-GAAP Revenue of $488M Guidance range of $420M - $450M • GAAP EPS of $0.48 • Non-GAAP EPS of $1.47 Guidance range of $0.85 - $1.05 • Adjusted EBITDA of $100M Guidance range of $70M - $80M • Cash and ST Investments of $245M SUMMARY

©2021 Plantronics Inc. All rights reserved. 6 THREE FUNDAMENTAL INDUSTRY DRIVERS 01 Work has permanently outgrown the office 02 Covid-19 has accelerated the digital transformation of the working world 03 Existing trends toward video, remote work, and new usage scenarios have proliferated

©2021 Plantronics Inc. All rights reserved. 7 A COMPELLING VALUE PROPOSITION • Product portfolio expanded to address in-office and remote work • Service offering evolving with new tools for remote management • Distribution strategy adapting to new purchasing patterns Continuous Innovation Turnaround & Transformation • Senior leadership team strengthened, including Chief Transformation and Chief Supply Chain Officers • Solidifying new partnerships and distribution channels • Ongoing cost discipline and balance sheet management • Work is work, regardless of location, and people need to connect reliably and clearly • We make tools, not toys, and our enterprise-grade gear is designed to work from anywhere on any platform • We back it up with industry-leading support and services Our Value Proposition: Stronger than Ever

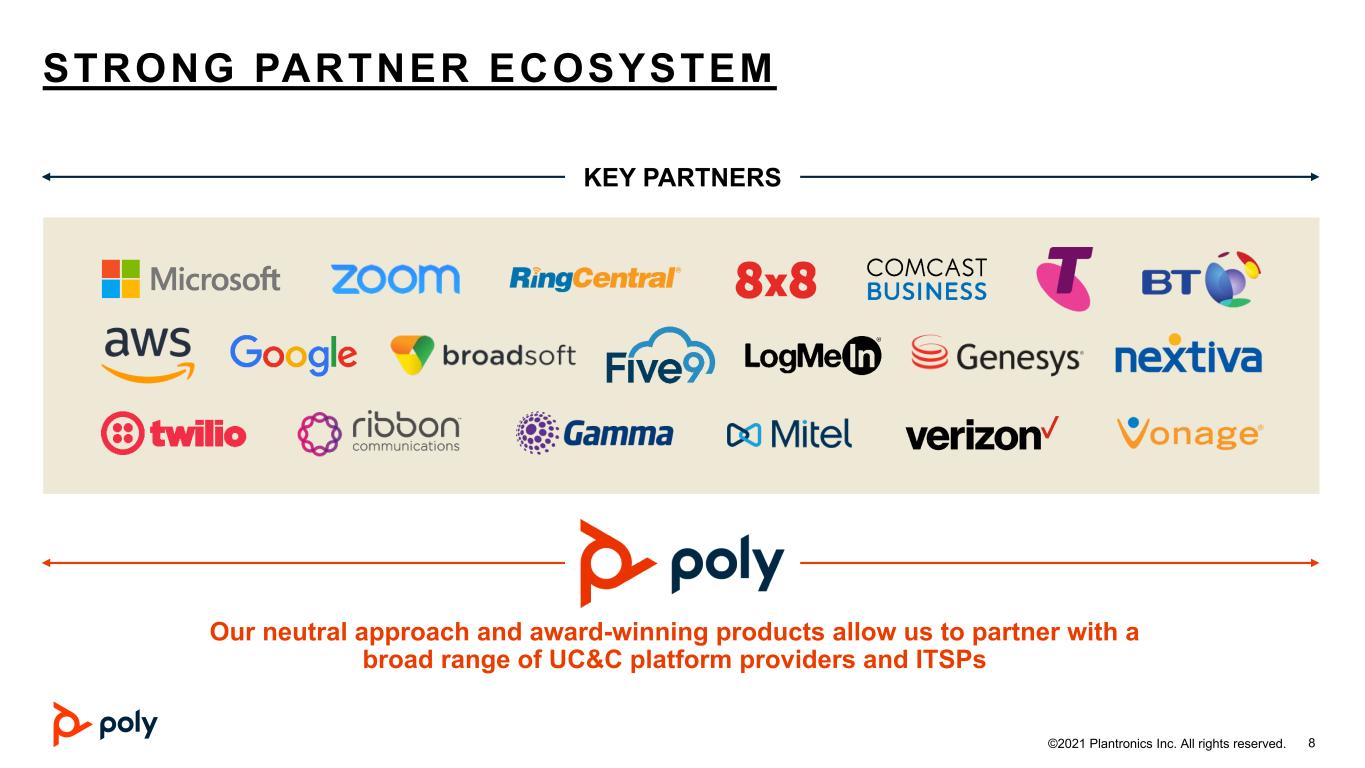

©2021 Plantronics Inc. All rights reserved. 8 KEY PARTNERS STRONG PARTNER ECOSYSTEM Our neutral approach and award-winning products allow us to partner with a broad range of UC&C platform providers and ITSPs

© 2020 Plantronics Inc. All rights reserved. 9 NEW PRODUCT & PARTNER ANNOUNCEMENTS

©2021 Plantronics Inc. All rights reserved. 10 POLY ANNOUNCES STUDIO P SERIES An entirely new family of personal pro- grade audio and video conferencing solutions so you can look and sound your best • Designed to up the game of today’s remote worker • Finely tuned camera optics and premium audio so you can command the conversation • One dynamic offering combines Poly P Series devices with Poly Lens remote management and Poly+ support and services

©2021 Plantronics Inc. All rights reserved. 11 POLY LENS DESKTOP APP AND POLY+ Poly Lens Desktop App and Poly+ Streamlined management of personal devices • Easily gain insights and manage a remote workforce from the cloud under a single pane of glass • Empower users with best practices and tips on device setup, ergonomics, as well as health and wellness tips – all managed through the desktop app • Poly+ subscription service features 24/7 support, an extended 3-year warranty and overnight device replacement

©2020 Plantronics Inc. All rights reserved. 12 POLY ANNOUNCES EXCLUSIVE PARTNERSHIP WITH MICROBAN® , GLOBAL LEADER IN ANTIMICROBIAL PRODUCT PROTECTION Exclusive partnership with Microban ® • Microban ® antimicrobial technology will be completely integrated into select Poly hardware • Microban® antimicrobial product protection keeps your favorite Poly devices cleaner for longer

© 2020 Plantronics Inc. All rights reserved. 13 Q3 FY21 EARNINGS RESULTS

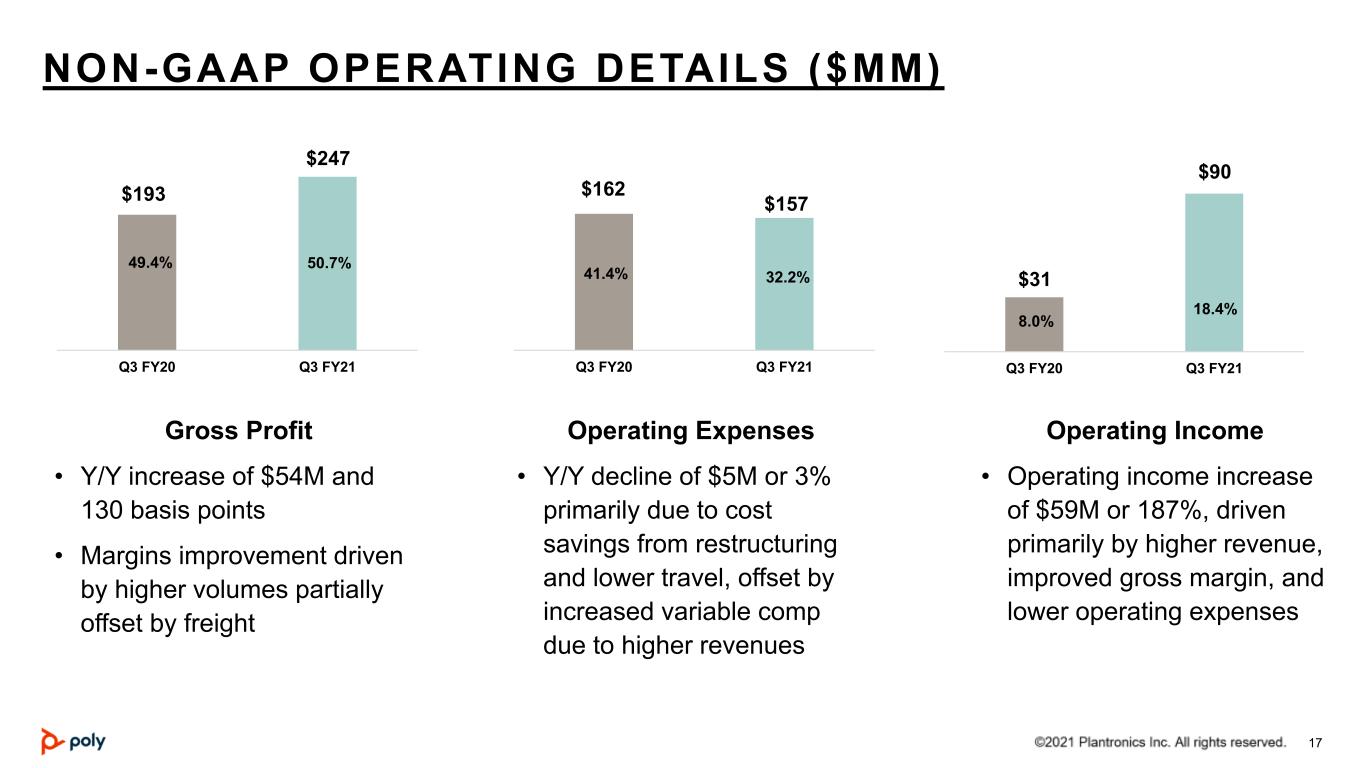

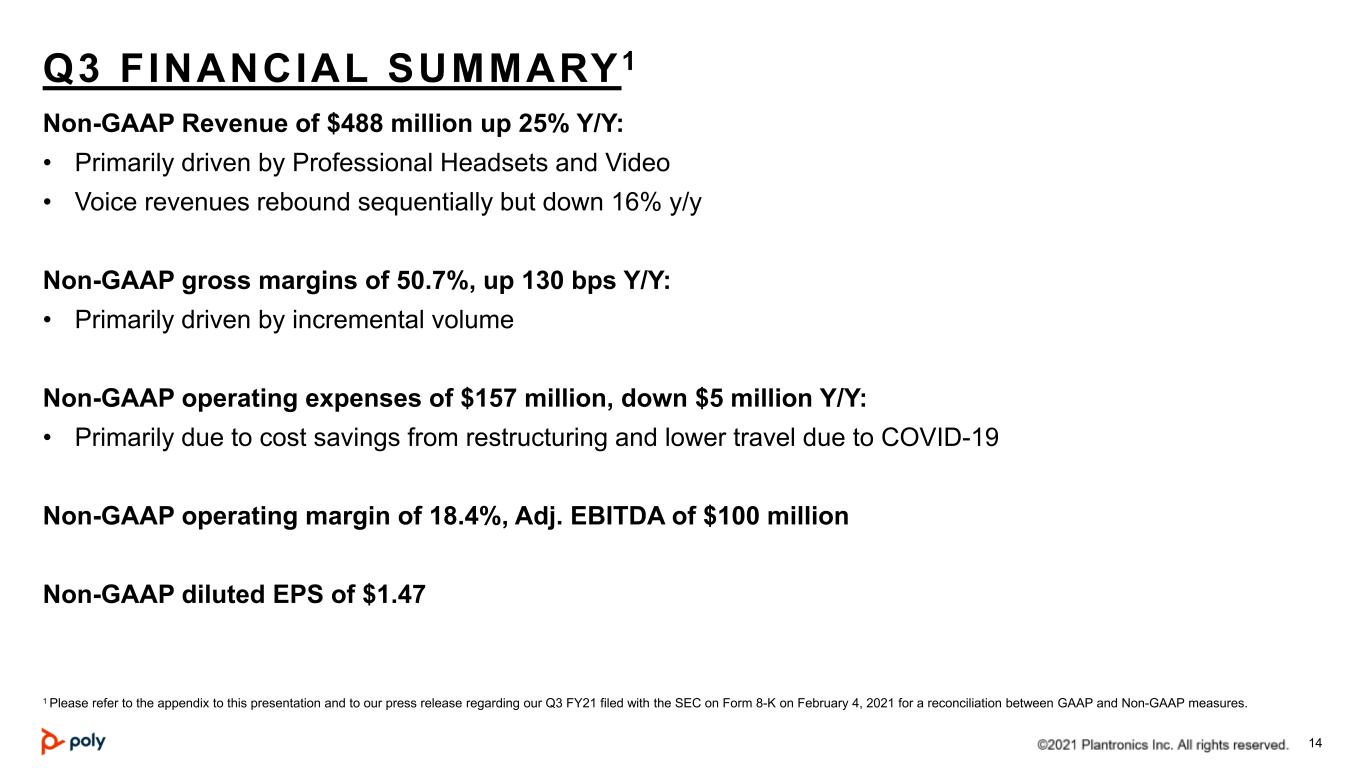

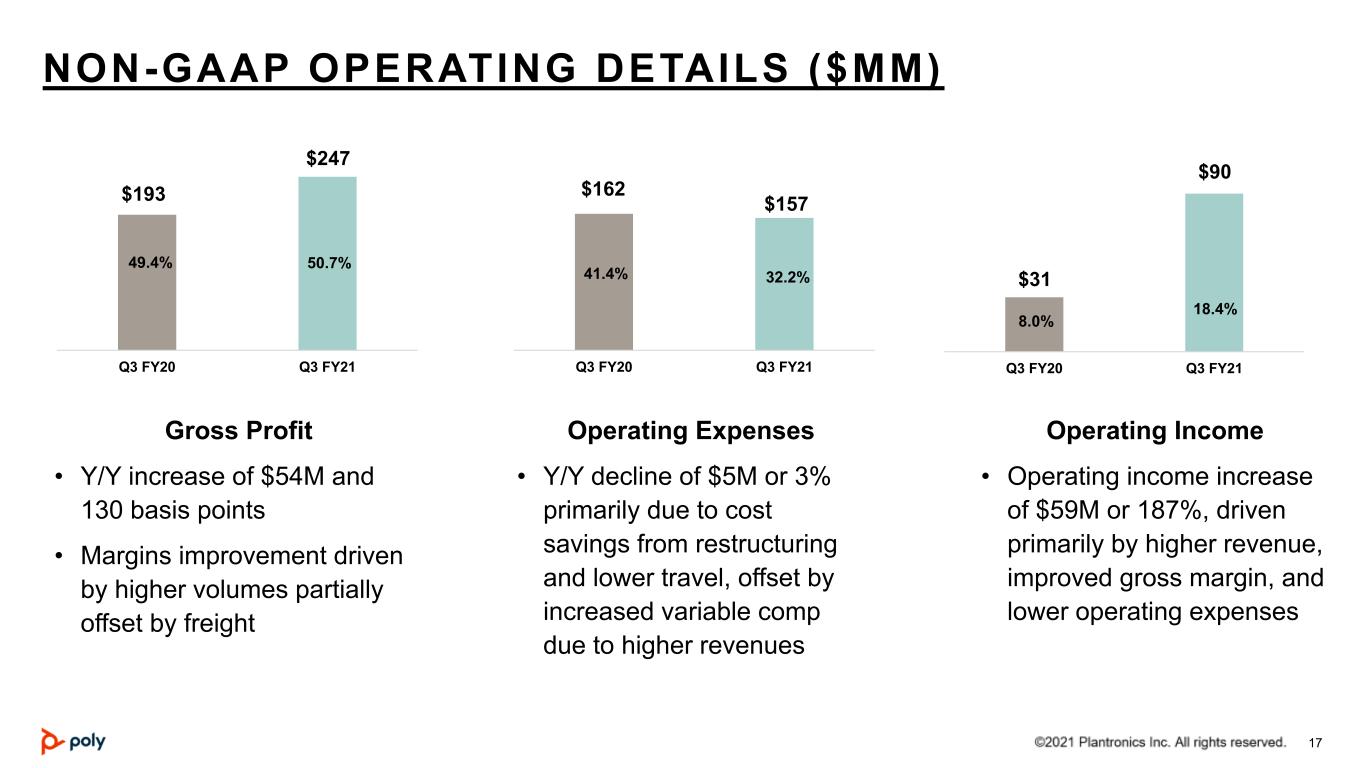

© 2020 Plantronics Inc. All rights reserved. 14 Q3 FINANCIAL SUMMARY1 Non-GAAP Revenue of $488 million up 25% Y/Y: • Primarily driven by Professional Headsets and Video • Voice revenues rebound sequentially but down 16% y/y Non-GAAP gross margins of 50.7%, up 130 bps Y/Y: • Primarily driven by incremental volume Non-GAAP operating expenses of $157 million, down $5 million Y/Y: • Primarily due to cost savings from restructuring and lower travel due to COVID-19 Non-GAAP operating margin of 18.4%, Adj. EBITDA of $100 million Non-GAAP diluted EPS of $1.47 1 Please refer to the appendix to this presentation and to our press release regarding our Q3 FY21 filed with the SEC on Form 8-K on February 4, 2021 for a reconciliation between GAAP and Non-GAAP measures.

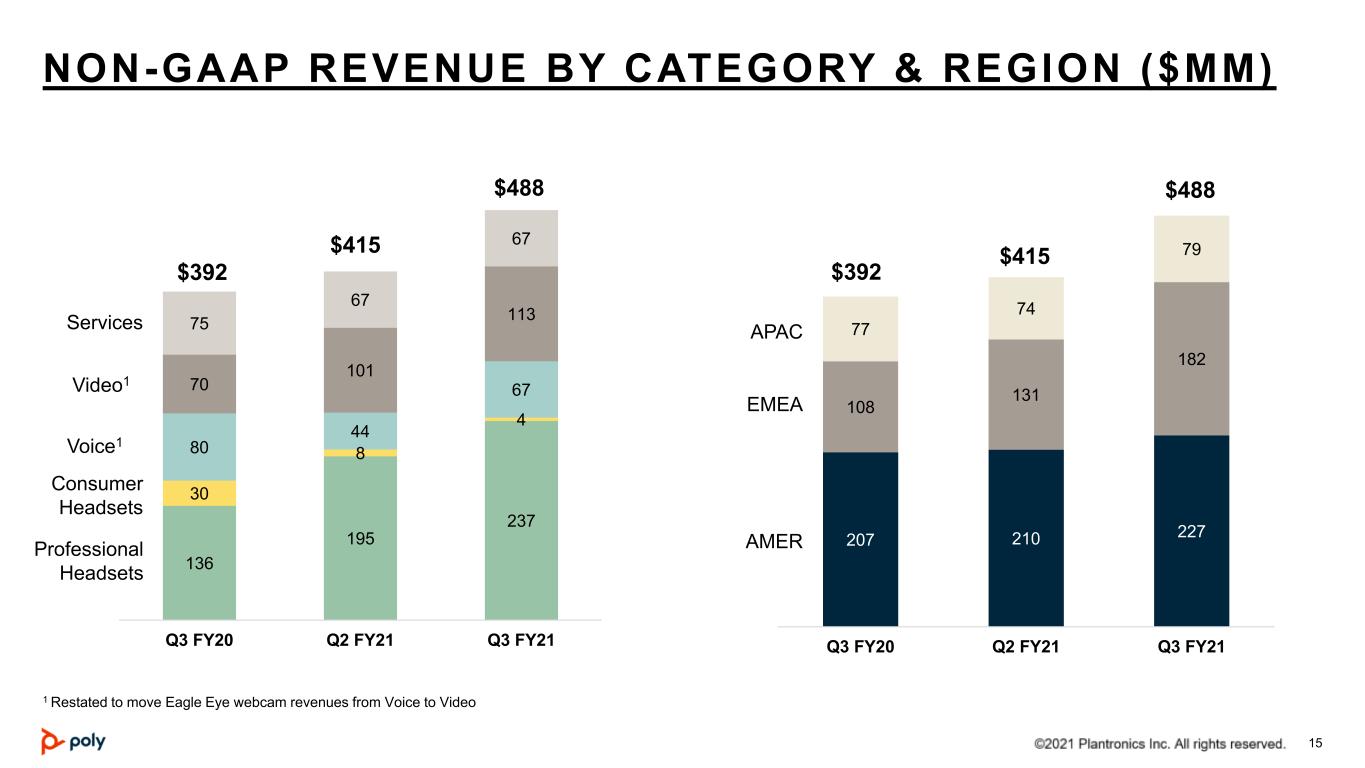

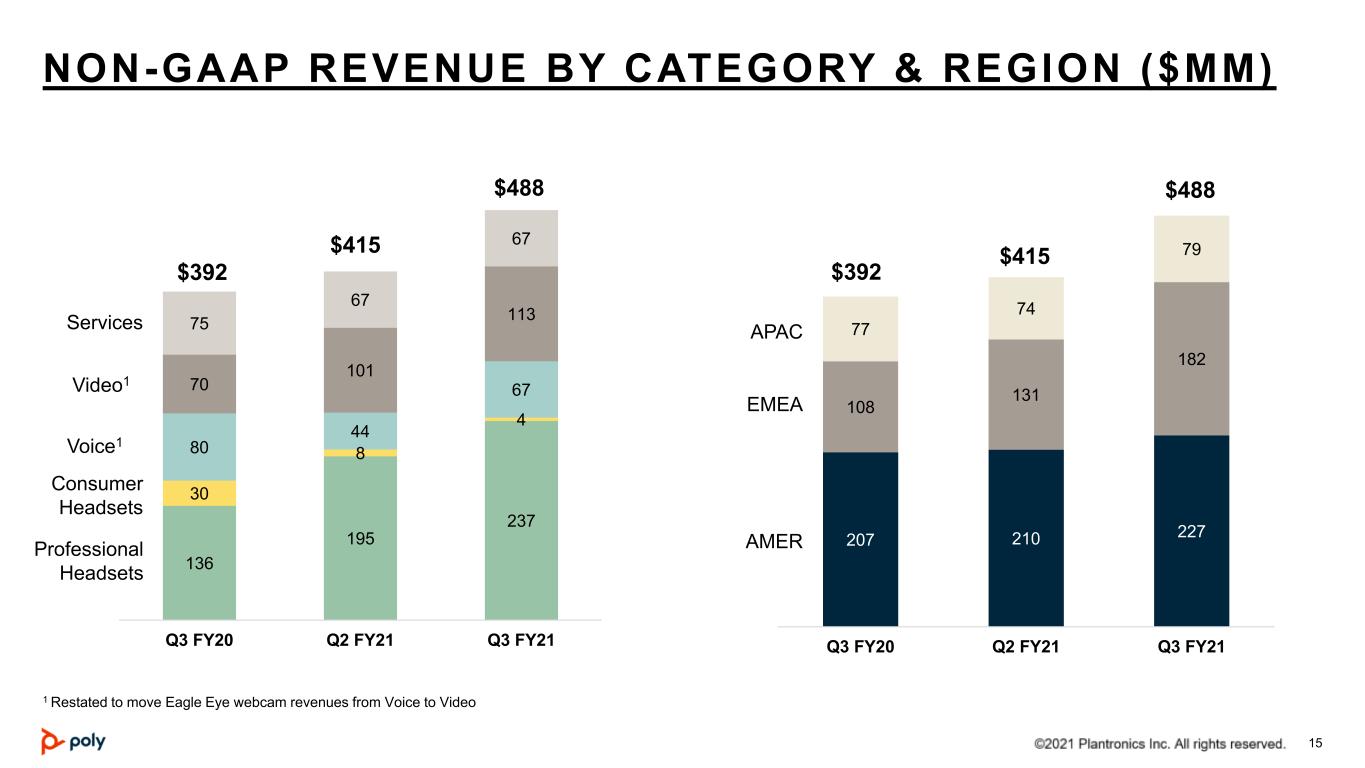

© 2020 Plantronics Inc. All rights reserved. 15 136 195 237 30 8 4 80 44 6770 101 11375 67 67 $392 $415 $488 Q3 FY20 Q2 FY21 Q3 FY21 207 210 227 108 131 182 77 74 79 $392 $415 $488 Q3 FY20 Q2 FY21 Q3 FY21 NON-GAAP REVENUE BY CATEGORY & REGION ($MM) Professional Headsets Consumer Headsets Voice1 Video1 Services AMER EMEA APAC 1 Restated to move Eagle Eye webcam revenues from Voice to Video

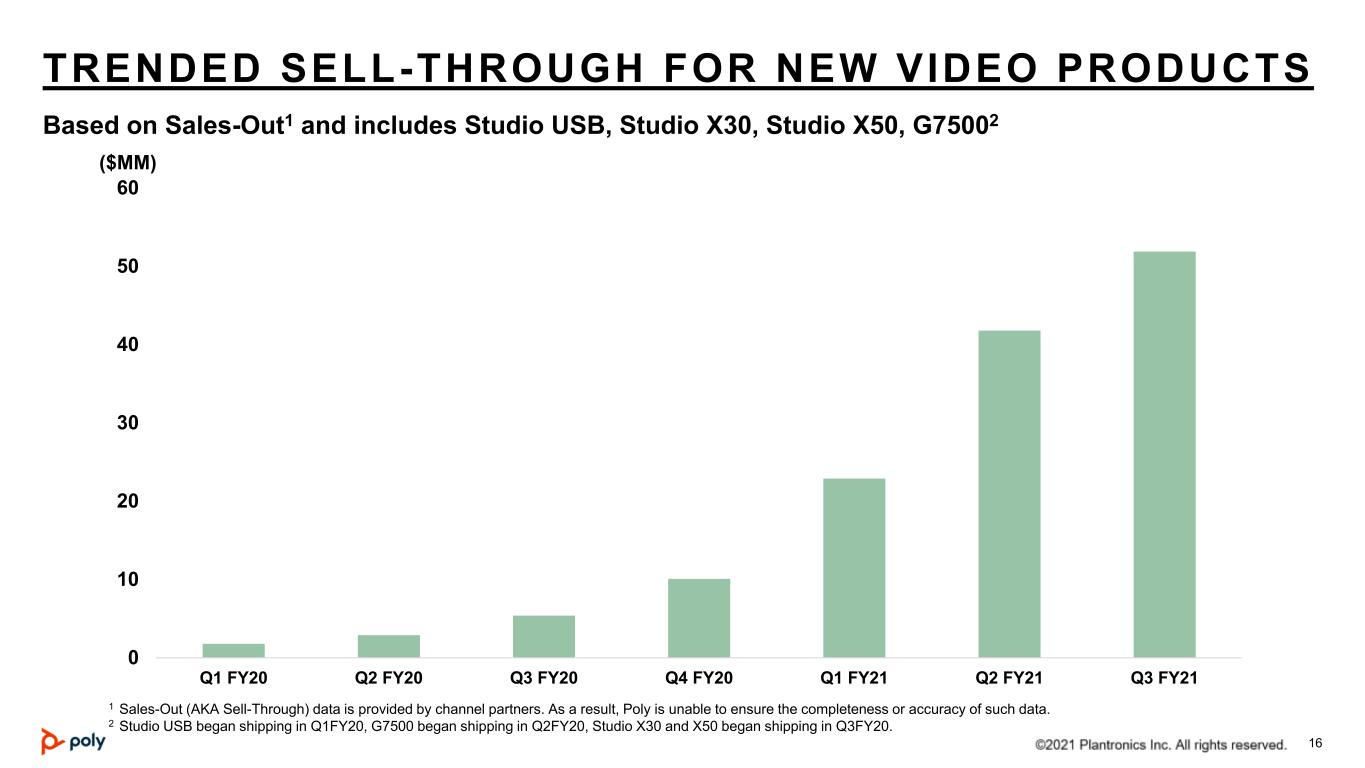

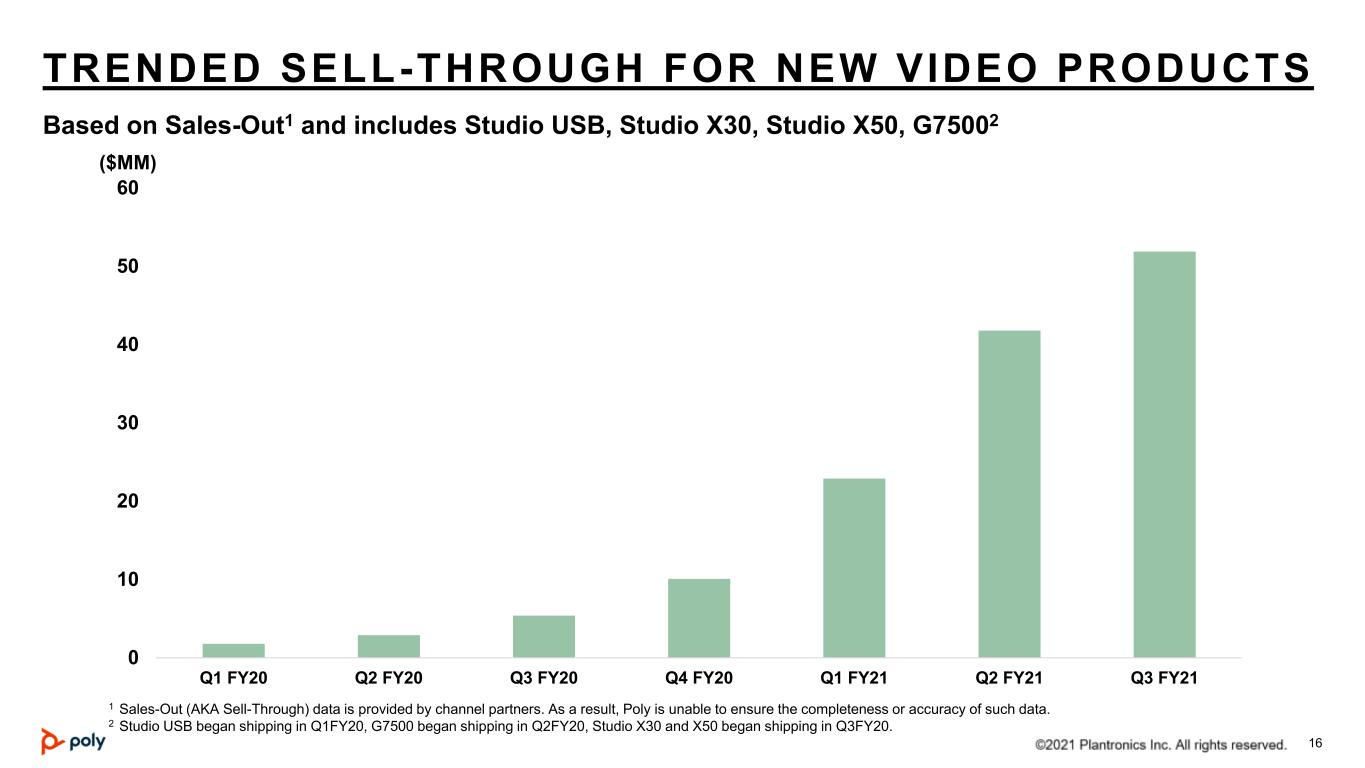

© 2020 Plantronics Inc. All rights reserved. 16 TRENDED SELL-THROUGH FOR NEW VIDEO PRODUCTS 0 10 20 30 40 50 60 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Q2 FY21 Q3 FY21 1 Sales-Out (AKA Sell-Through) data is provided by channel partners. As a result, Poly is unable to ensure the completeness or accuracy of such data. 2 Studio USB began shipping in Q1FY20, G7500 began shipping in Q2FY20, Studio X30 and X50 began shipping in Q3FY20. Based on Sales-Out1 and includes Studio USB, Studio X30, Studio X50, G75002 ($MM)

© 2020 Plantronics Inc. All rights reserved. 17 NON-GAAP OPERATING DETAILS ($MM) Operating Expenses • Y/Y decline of $5M or 3% primarily due to cost savings from restructuring and lower travel, offset by increased variable comp due to higher revenues Operating Income • Operating income increase of $59M or 187%, driven primarily by higher revenue, improved gross margin, and lower operating expenses $162 $157 Q3 FY20 Q3 FY21 41.4% $31 $90 Q3 FY20 Q3 FY21 8.0% Gross Profit • Y/Y increase of $54M and 130 basis points • Margins improvement driven by higher volumes partially offset by freight $193 $247 Q3 FY20 Q3 FY21 50.7% 32.2% 18.4% 49.4%

© 2020 Plantronics Inc. All rights reserved. 18 CASH & INVESTMENTS BRIDGE Q2FY21 – Q3FY21 ($MM) $245 $228

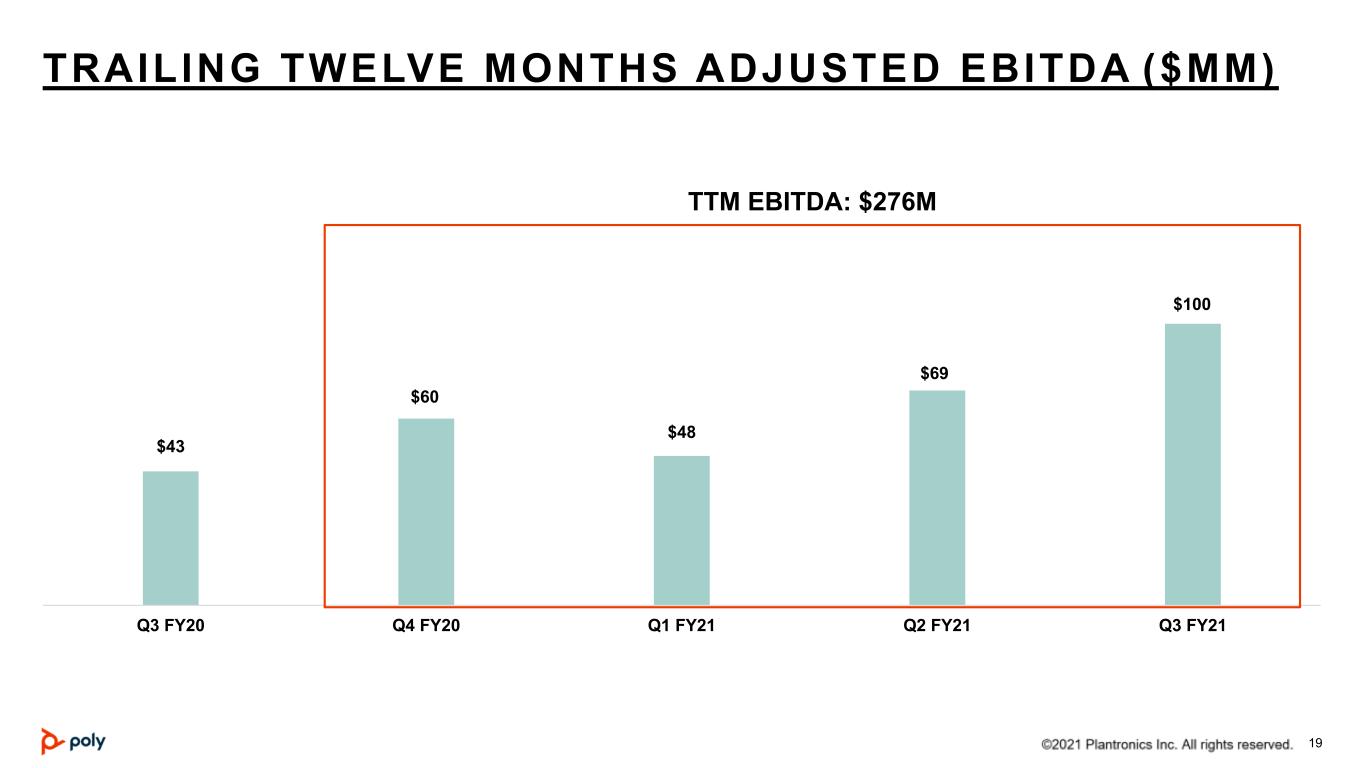

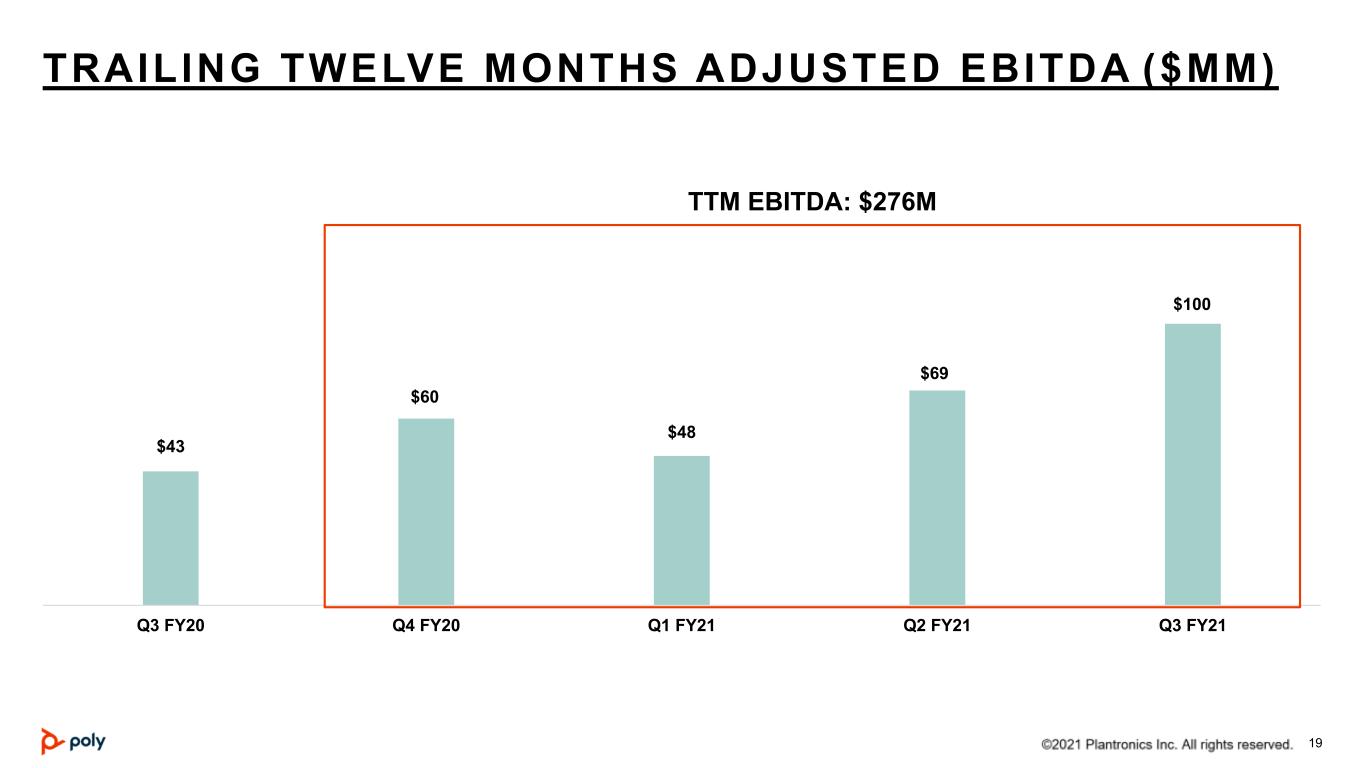

© 2020 Plantronics Inc. All rights reserved. 19 TRAILING TWELVE MONTHS ADJUSTED EBITDA ($MM) $43 $60 $48 $69 $100 Q3 FY20 Q4 FY20 Q1 FY21 Q2 FY21 Q3 FY21 TTM EBITDA: $276M

© 2020 Plantronics Inc. All rights reserved. 20 Q3 FY21 GUIDANCE

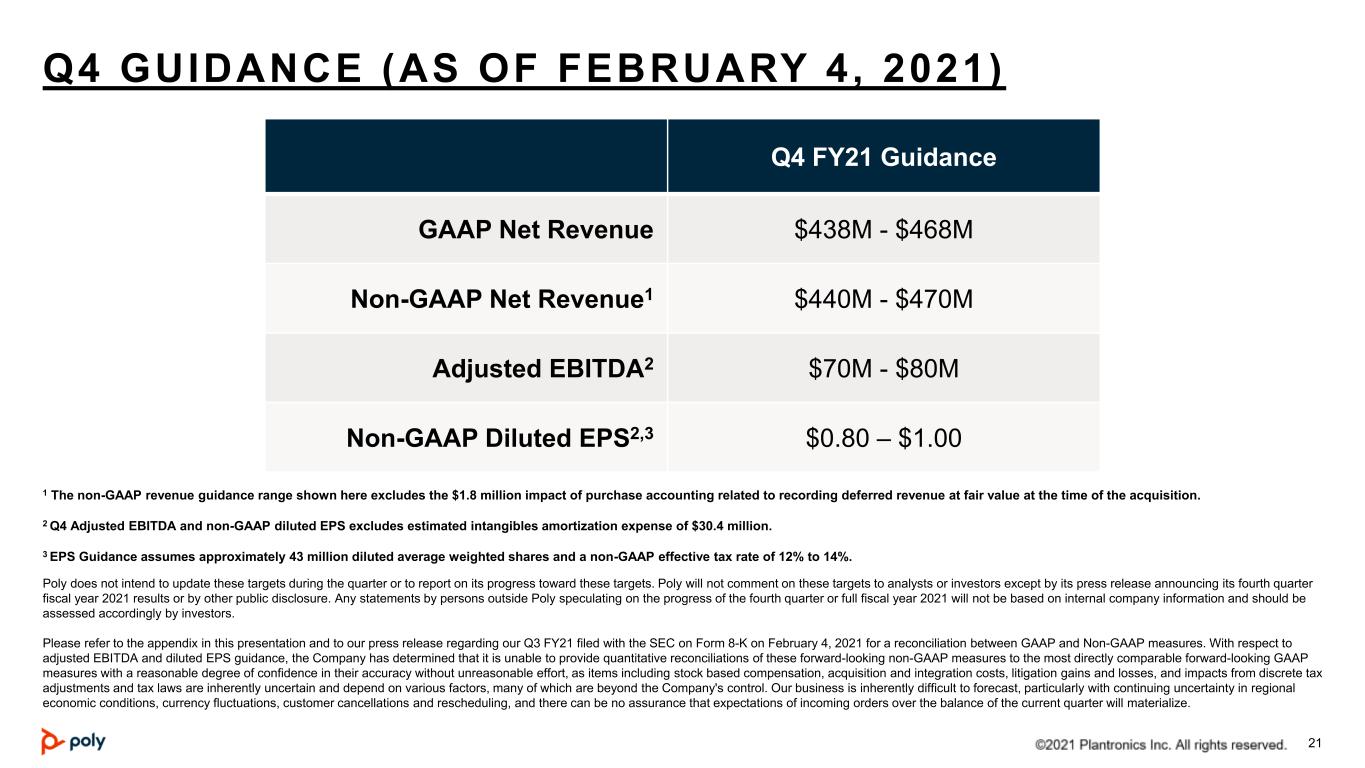

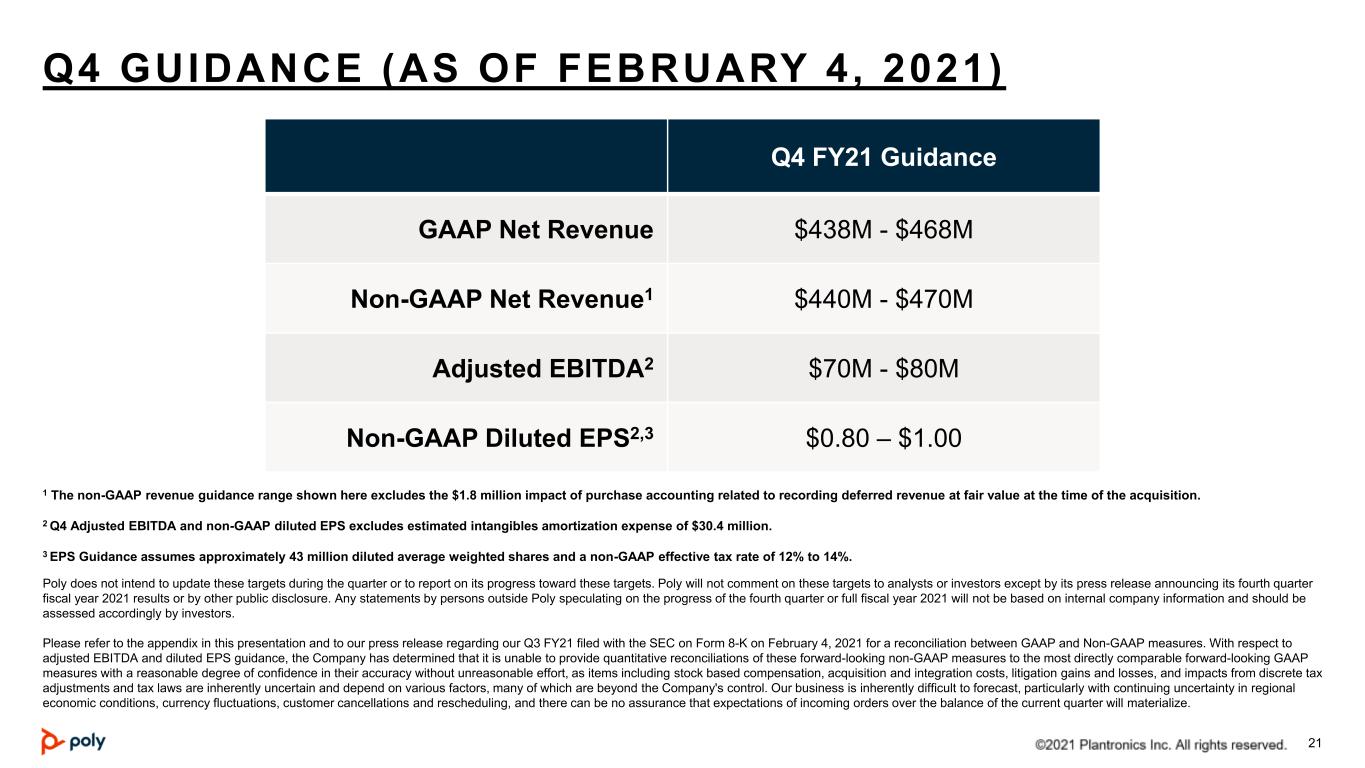

© 2020 Plantronics Inc. All rights reserved. 21 Q4 GUIDANCE (AS OF FEBRUARY 4, 2021) Q4 FY21 Guidance GAAP Net Revenue $438M - $468M Non-GAAP Net Revenue1 $440M - $470M Adjusted EBITDA2 $70M - $80M Non-GAAP Diluted EPS2,3 $0.80 – $1.00 Poly does not intend to update these targets during the quarter or to report on its progress toward these targets. Poly will not comment on these targets to analysts or investors except by its press release announcing its fourth quarter fiscal year 2021 results or by other public disclosure. Any statements by persons outside Poly speculating on the progress of the fourth quarter or full fiscal year 2021 will not be based on internal company information and should be assessed accordingly by investors. Please refer to the appendix in this presentation and to our press release regarding our Q3 FY21 filed with the SEC on Form 8-K on February 4, 2021 for a reconciliation between GAAP and Non-GAAP measures. With respect to adjusted EBITDA and diluted EPS guidance, the Company has determined that it is unable to provide quantitative reconciliations of these forward-looking non-GAAP measures to the most directly comparable forward-looking GAAP measures with a reasonable degree of confidence in their accuracy without unreasonable effort, as items including stock based compensation, acquisition and integration costs, litigation gains and losses, and impacts from discrete tax adjustments and tax laws are inherently uncertain and depend on various factors, many of which are beyond the Company's control. Our business is inherently difficult to forecast, particularly with continuing uncertainty in regional economic conditions, currency fluctuations, customer cancellations and rescheduling, and there can be no assurance that expectations of incoming orders over the balance of the current quarter will materialize. 1 The non-GAAP revenue guidance range shown here excludes the $1.8 million impact of purchase accounting related to recording deferred revenue at fair value at the time of the acquisition. 2 Q4 Adjusted EBITDA and non-GAAP diluted EPS excludes estimated intangibles amortization expense of $30.4 million. 3 EPS Guidance assumes approximately 43 million diluted average weighted shares and a non-GAAP effective tax rate of 12% to 14%.

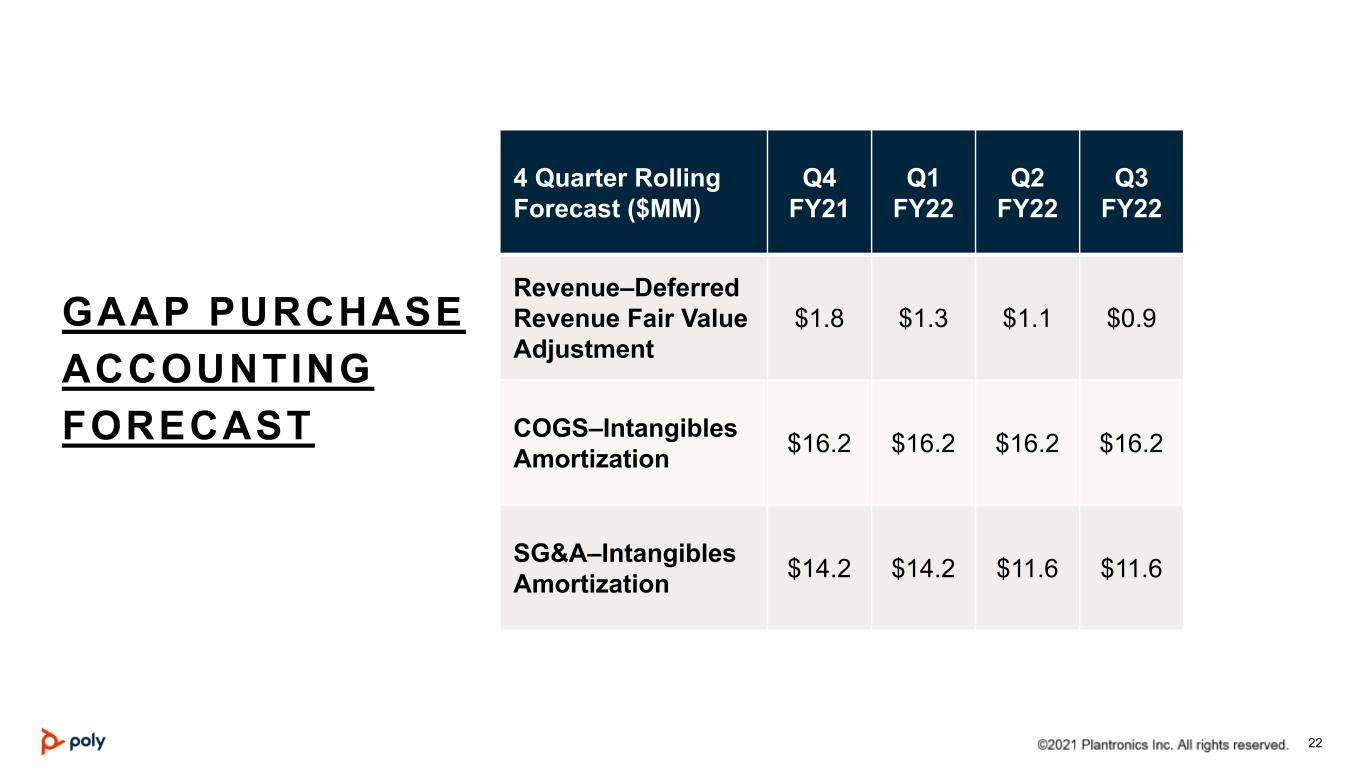

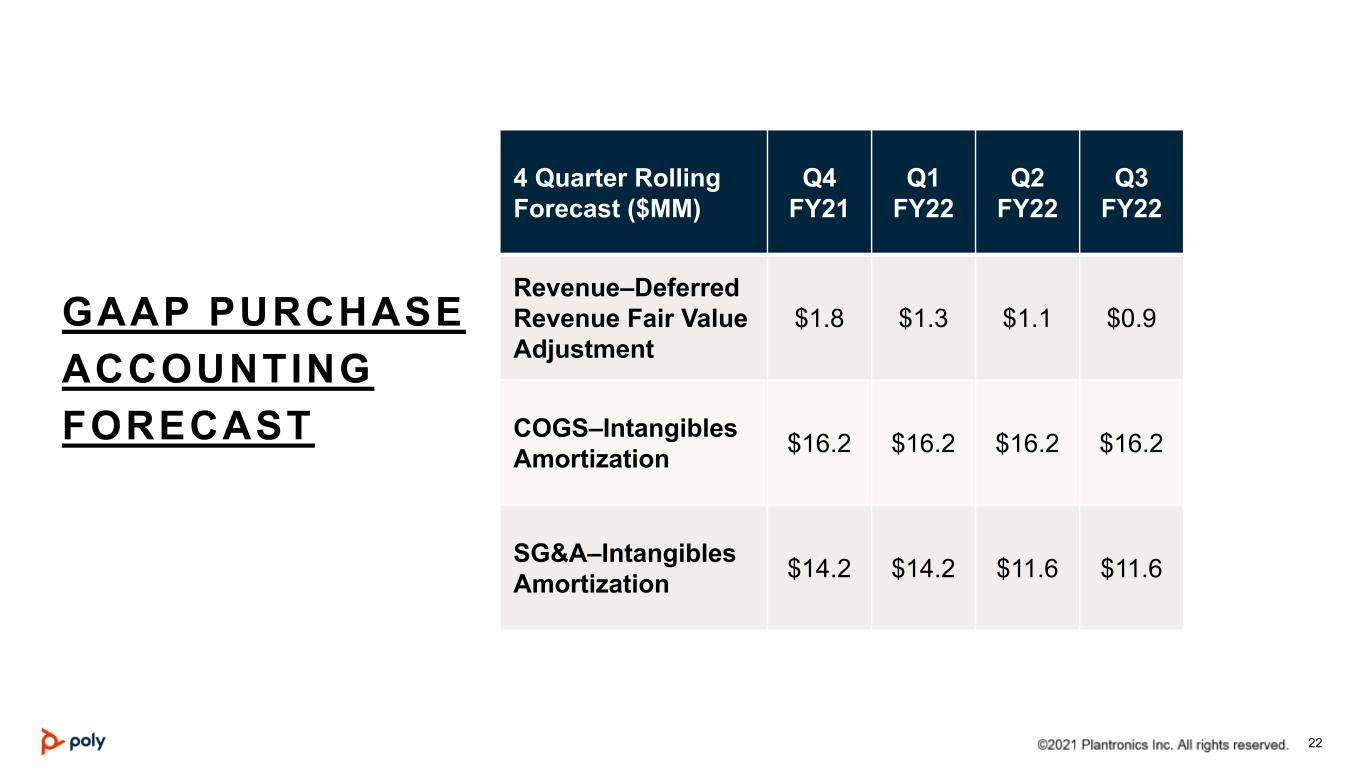

© 2020 Plantronics Inc. All rights reserved. 22 GAAP PURCHASE ACCOUNTING FORECAST 4 Quarter Rolling Forecast ($MM) Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 Revenue–Deferred Revenue Fair Value Adjustment $1.8 $1.3 $1.1 $0.9 COGS–Intangibles Amortization $16.2 $16.2 $16.2 $16.2 SG&A–Intangibles Amortization $14.2 $14.2 $11.6 $11.6

© 2020 Plantronics Inc. All rights reserved. 23 SUPPLEMENTAL DATA & GAAP TO NON-GAAP RECONCILIATIONS

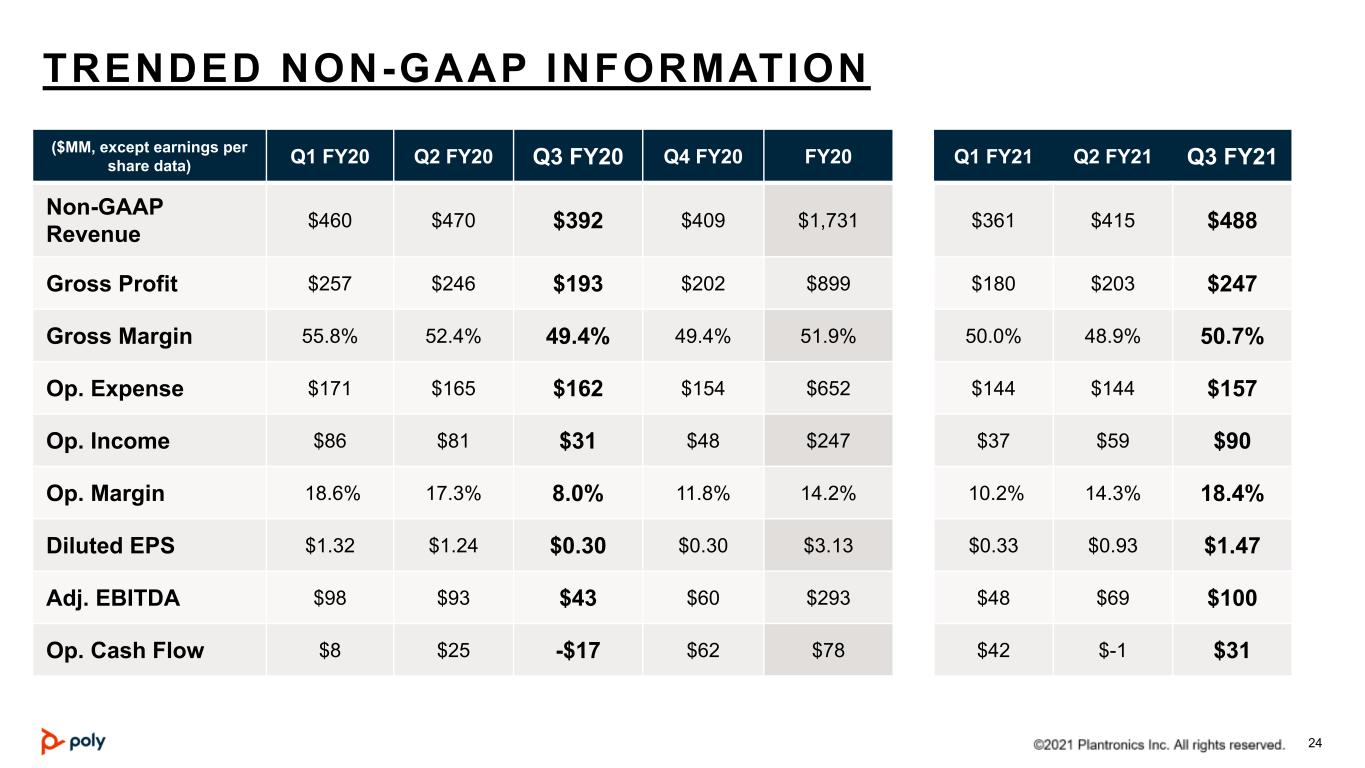

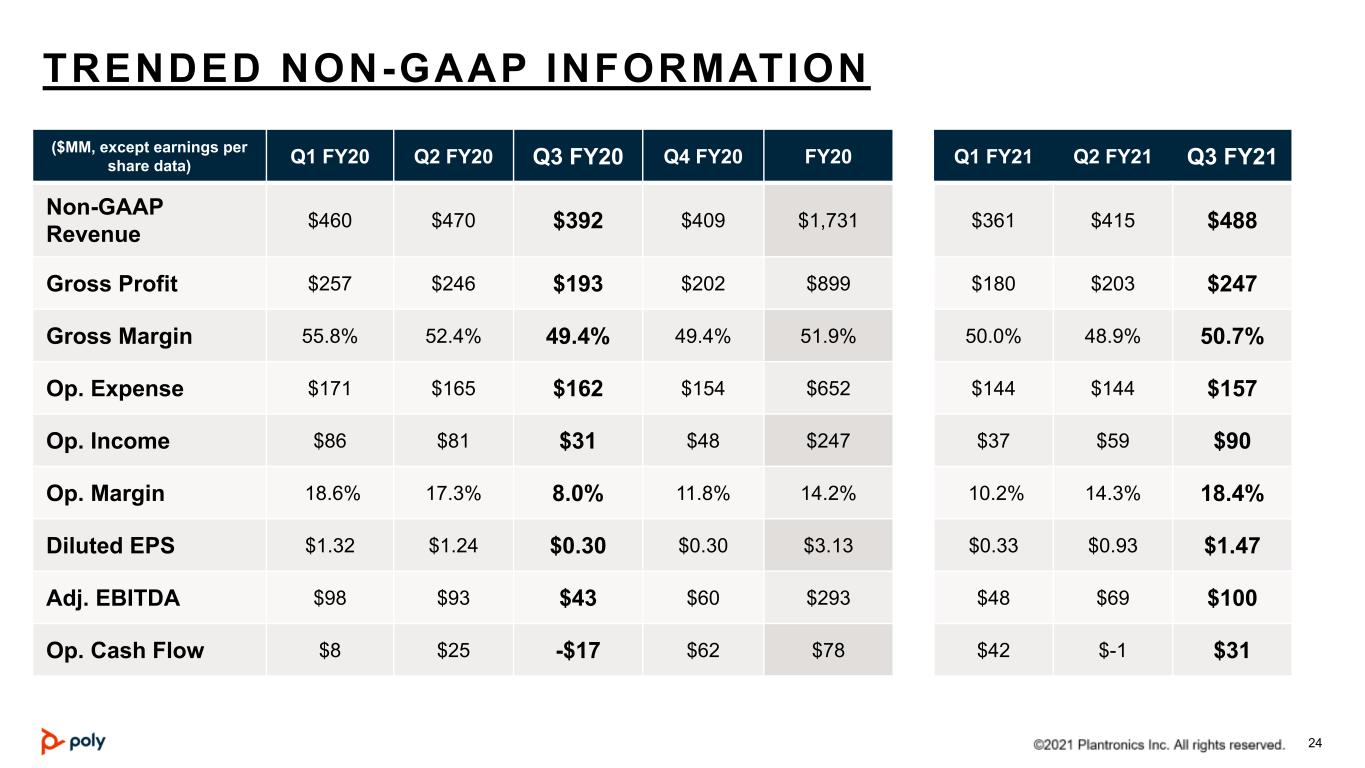

© 2020 Plantronics Inc. All rights reserved. 24 TRENDED NON-GAAP INFORMATION ($MM, except earnings per share data) Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 FY20 Q1 FY21 Q2 FY21 Q3 FY21 Non-GAAP Revenue $460 $470 $392 $409 $1,731 $361 $415 $488 Gross Profit $257 $246 $193 $202 $899 $180 $203 $247 Gross Margin 55.8% 52.4% 49.4% 49.4% 51.9% 50.0% 48.9% 50.7% Op. Expense $171 $165 $162 $154 $652 $144 $144 $157 Op. Income $86 $81 $31 $48 $247 $37 $59 $90 Op. Margin 18.6% 17.3% 8.0% 11.8% 14.2% 10.2% 14.3% 18.4% Diluted EPS $1.32 $1.24 $0.30 $0.30 $3.13 $0.33 $0.93 $1.47 Adj. EBITDA $98 $93 $43 $60 $293 $48 $69 $100 Op. Cash Flow $8 $25 -$17 $62 $78 $42 $-1 $31

© 2020 Plantronics Inc. All rights reserved. 25 TRENDED NON-GAAP REVENUE DATA Non-GAAP Rev by Category ($MM) Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 FY20 Q1 FY21 Q2 FY21 Q3 FY21 Voice1 $104 $99 $80 $95 $377 $46 $44 $67 Video1 $61 $90 $70 $62 $284 $71 $101 $113 Services $77 $75 $75 $70 $297 $69 $67 $67 Professional Headsets $187 $176 $137 $168 $668 $169 $195 $237 Cons Headsets $31 $30 $30 $13 $105 $6 $8 $4 Total Revenue $460 $470 $392 $409 $1,731 $361 $415 $488 Non-GAAP Revenue by Geography Americas $261 $248 $207 $232 $948 $199 $210 $227 EMEA $119 $131 $108 $115 $473 $95 $131 $182 APAC $80 $91 $77 $62 $310 $67 $74 $79 Total Revenue $460 $470 $392 $409 $1,731 $361 $415 $488 1 Restated to move Eagle Eye webcam revenues from Voice to Video

©2021 Plantronics, Inc. Poly and the propeller design are trademarks of Plantronics, Inc. 26 THANK YOU

Unaudited Reconciliations of GAAP net revenue to non-GAAP net revenue ($ in thousands) Three Months Ended December 28, March 28, June 27, September 26, December 26, 2019 2020 2020 2020 2020 Net revenues from unaffiliated customers: Enterprise Headsets1 $ 136,807 $ 168,002 $ 169,234 $ 195,128 $ 237,473 Consumer Headsets1 30,473 12,962 5,516 7,712 3,435 Voice 79,494 95,265 50,681 49,069 67,076 Video 69,859 61,992 66,027 95,768 112,727 Services 67,838 64,822 64,262 63,292 63,974 Total GAAP net revenues $ 384,471 $ 403,043 $ 355,720 $ 410,969 $ 484,685 Deferred revenue purchase accounting2 7,131 6,138 5,082 4,237 3,289 Total non-GAAP net revenues $ 391,602 $ 409,181 $ 360,802 $ 415,206 $ 487,974 Net revenues by geographic area from unaffiliated customers: Americas $ 204,910 $ 229,900 $ 197,350 $ 209,001 $ 226,433 EMEA 105,931 113,738 94,105 130,399 181,429 APAC 73,630 59,405 64,265 71,569 76,823 Total GAAP net revenues $ 384,471 $ 403,043 $ 355,720 $ 410,969 $ 484,685 Deferred revenue purchase accounting2 7,131 6,138 5,082 4,237 3,289 Total non-GAAP net revenues $ 391,602 $ 409,181 $ 360,802 $ 415,206 $ 487,974 1 Restated to move mono premium product revenues from Consumer Headsets to Enterprise Headsets. 2 Represents the impact of fair value purchase accounting adjustments related to deferred revenue recorded in connection with the acquisition of Polycom on July 2, 2018. The Company’s deferred revenue primarily relates to Service revenue associated with non-cancelable maintenance support on hardware devices which are typically billed in advance and recognized ratably over the contract term as those services are delivered. This adjustment represents the amount of additional revenue that would have been recognized during the period absent the write-down to fair value required under purchase accounting guidelines.

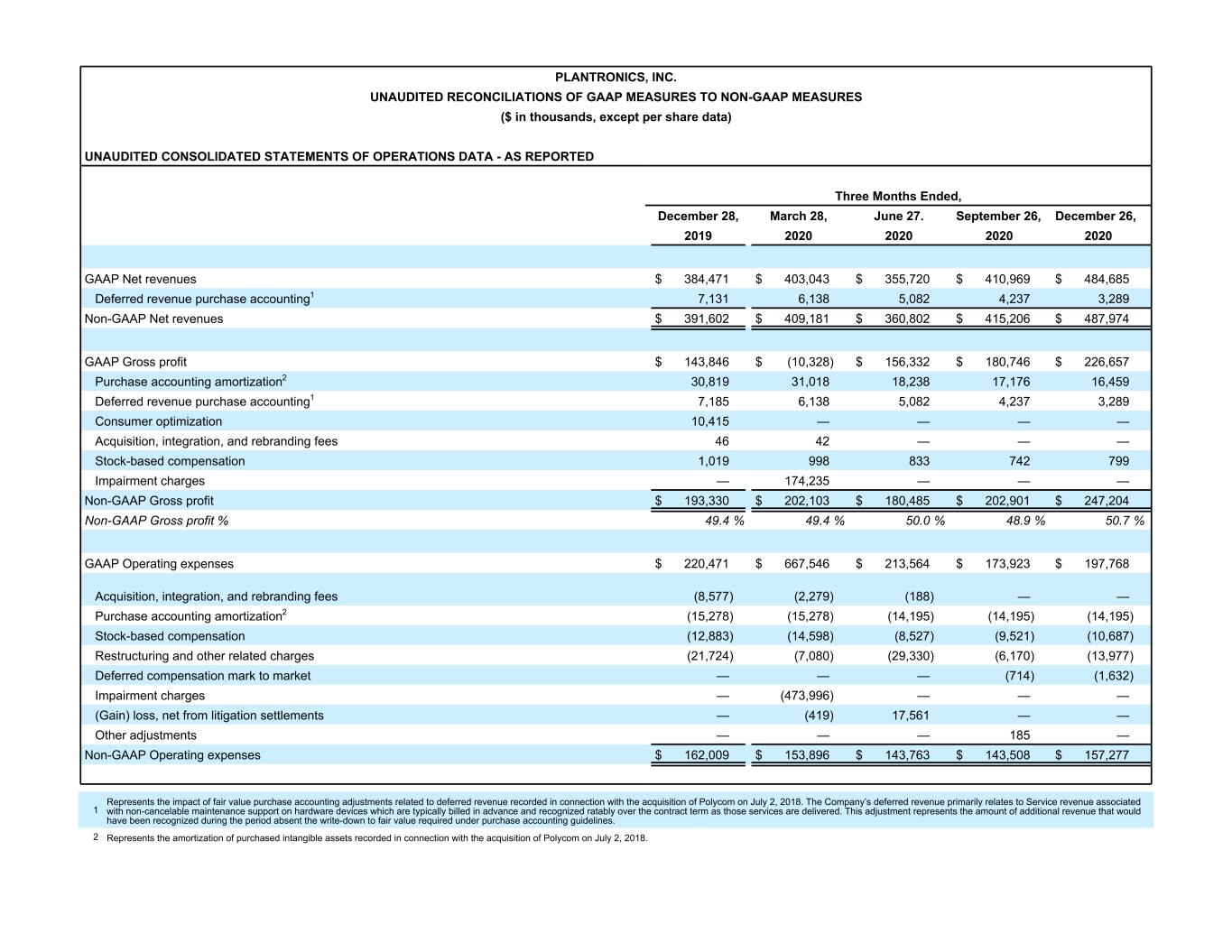

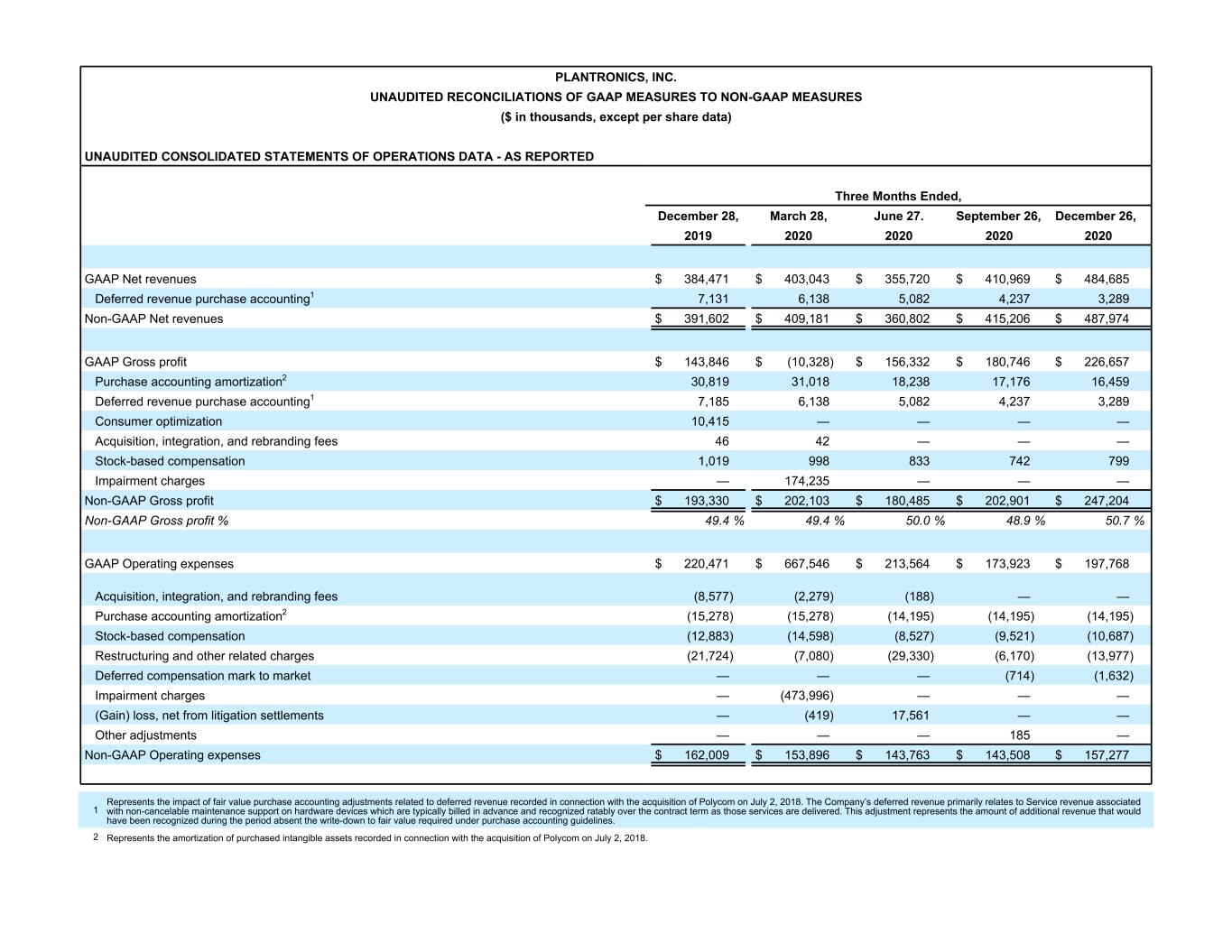

PLANTRONICS, INC. UNAUDITED RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES ($ in thousands, except per share data) UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA - AS REPORTED Three Months Ended, December 28, March 28, June 27. September 26, December 26, 2019 2020 2020 2020 2020 GAAP Net revenues $ 384,471 $ 403,043 $ 355,720 $ 410,969 $ 484,685 Deferred revenue purchase accounting1 7,131 6,138 5,082 4,237 3,289 Non-GAAP Net revenues $ 391,602 $ 409,181 $ 360,802 $ 415,206 $ 487,974 GAAP Gross profit $ 143,846 $ (10,328) $ 156,332 $ 180,746 $ 226,657 Purchase accounting amortization2 30,819 31,018 18,238 17,176 16,459 Deferred revenue purchase accounting1 7,185 6,138 5,082 4,237 3,289 Consumer optimization 10,415 — — — — Acquisition, integration, and rebranding fees 46 42 — — — Stock-based compensation 1,019 998 833 742 799 Impairment charges — 174,235 — — — Non-GAAP Gross profit $ 193,330 $ 202,103 $ 180,485 $ 202,901 $ 247,204 Non-GAAP Gross profit % 49.4 % 49.4 % 50.0 % 48.9 % 50.7 % GAAP Operating expenses $ 220,471 $ 667,546 $ 213,564 $ 173,923 $ 197,768 Acquisition, integration, and rebranding fees (8,577) (2,279) (188) — — Purchase accounting amortization2 (15,278) (15,278) (14,195) (14,195) (14,195) Stock-based compensation (12,883) (14,598) (8,527) (9,521) (10,687) Restructuring and other related charges (21,724) (7,080) (29,330) (6,170) (13,977) Deferred compensation mark to market — — — (714) (1,632) Impairment charges — (473,996) — — — (Gain) loss, net from litigation settlements — (419) 17,561 — — Other adjustments — — — 185 — Non-GAAP Operating expenses $ 162,009 $ 153,896 $ 143,763 $ 143,508 $ 157,277 1 Represents the impact of fair value purchase accounting adjustments related to deferred revenue recorded in connection with the acquisition of Polycom on July 2, 2018. The Company’s deferred revenue primarily relates to Service revenue associated with non-cancelable maintenance support on hardware devices which are typically billed in advance and recognized ratably over the contract term as those services are delivered. This adjustment represents the amount of additional revenue that would have been recognized during the period absent the write-down to fair value required under purchase accounting guidelines. 2 Represents the amortization of purchased intangible assets recorded in connection with the acquisition of Polycom on July 2, 2018.

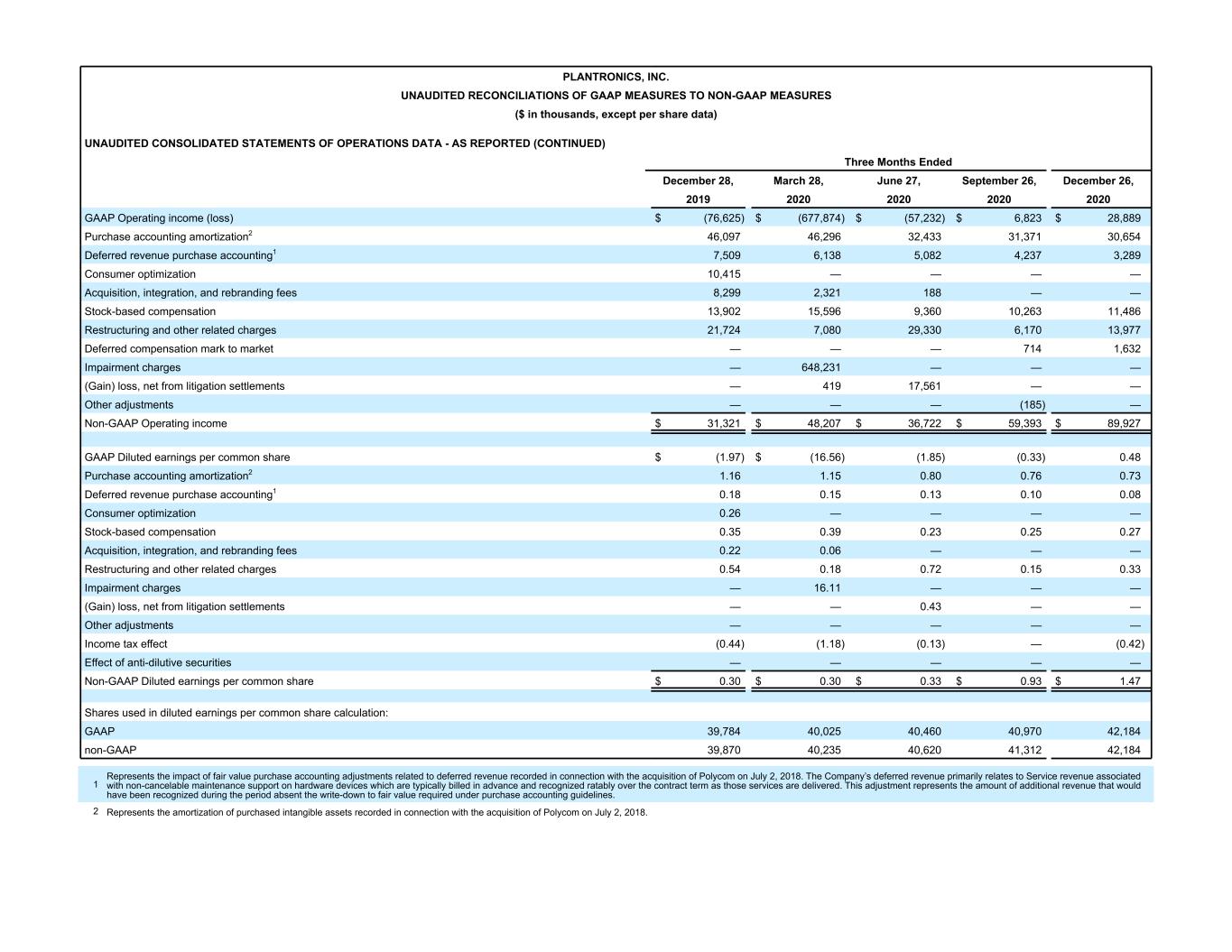

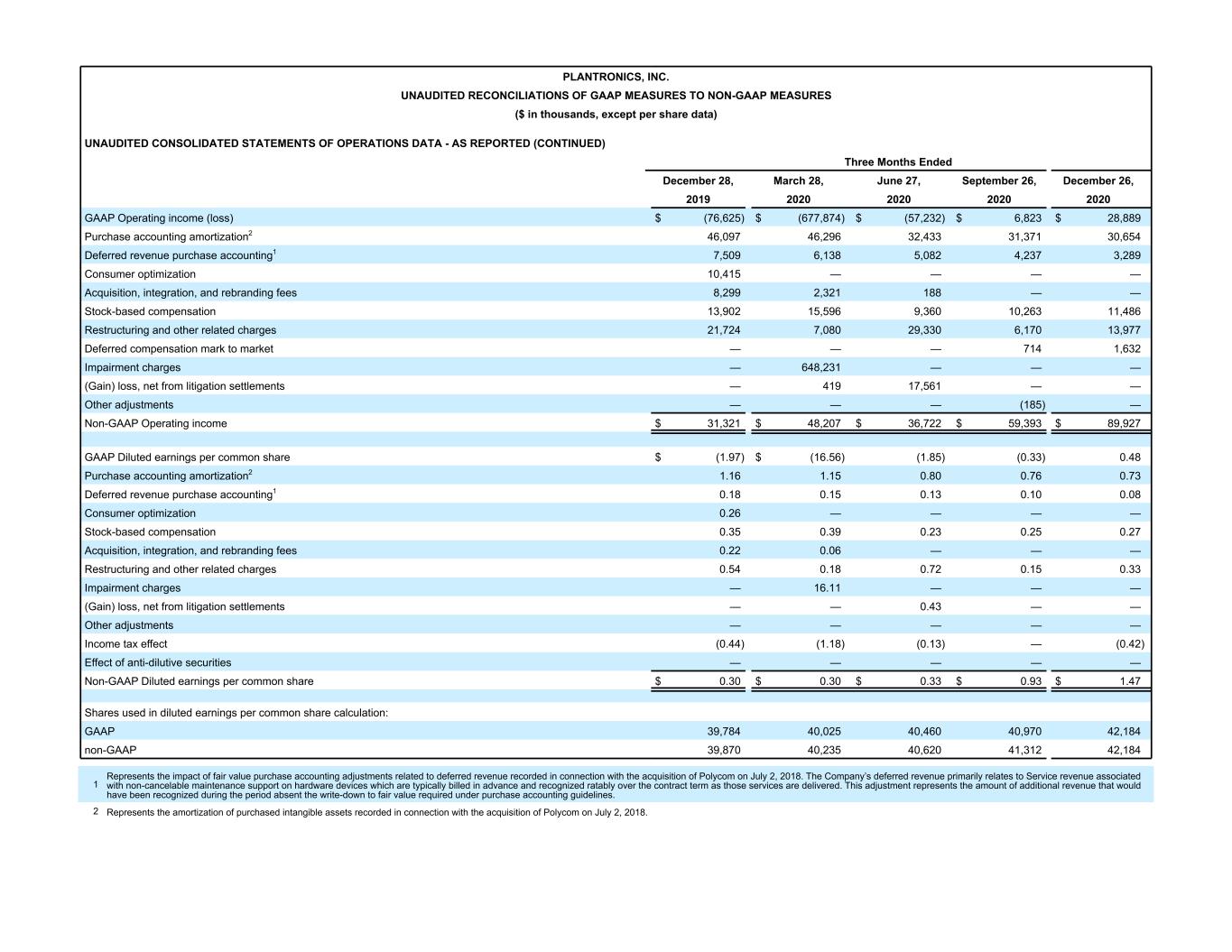

PLANTRONICS, INC. UNAUDITED RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES ($ in thousands, except per share data) UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA - AS REPORTED (CONTINUED) Three Months Ended December 28, March 28, June 27, September 26, December 26, 2019 2020 2020 2020 2020 GAAP Operating income (loss) $ (76,625) $ (677,874) $ (57,232) $ 6,823 $ 28,889 Purchase accounting amortization2 46,097 46,296 32,433 31,371 30,654 Deferred revenue purchase accounting1 7,509 6,138 5,082 4,237 3,289 Consumer optimization 10,415 — — — — Acquisition, integration, and rebranding fees 8,299 2,321 188 — — Stock-based compensation 13,902 15,596 9,360 10,263 11,486 Restructuring and other related charges 21,724 7,080 29,330 6,170 13,977 Deferred compensation mark to market — — — 714 1,632 Impairment charges — 648,231 — — — (Gain) loss, net from litigation settlements — 419 17,561 — — Other adjustments — — — (185) — Non-GAAP Operating income $ 31,321 $ 48,207 $ 36,722 $ 59,393 $ 89,927 GAAP Diluted earnings per common share $ (1.97) $ (16.56) (1.85) (0.33) 0.48 Purchase accounting amortization2 1.16 1.15 0.80 0.76 0.73 Deferred revenue purchase accounting1 0.18 0.15 0.13 0.10 0.08 Consumer optimization 0.26 — — — — Stock-based compensation 0.35 0.39 0.23 0.25 0.27 Acquisition, integration, and rebranding fees 0.22 0.06 — — — Restructuring and other related charges 0.54 0.18 0.72 0.15 0.33 Impairment charges — 16.11 — — — (Gain) loss, net from litigation settlements — — 0.43 — — Other adjustments — — — — — Income tax effect (0.44) (1.18) (0.13) — (0.42) Effect of anti-dilutive securities — — — — — Non-GAAP Diluted earnings per common share $ 0.30 $ 0.30 $ 0.33 $ 0.93 $ 1.47 Shares used in diluted earnings per common share calculation: GAAP 39,784 40,025 40,460 40,970 42,184 non-GAAP 39,870 40,235 40,620 41,312 42,184 1 Represents the impact of fair value purchase accounting adjustments related to deferred revenue recorded in connection with the acquisition of Polycom on July 2, 2018. The Company’s deferred revenue primarily relates to Service revenue associated with non-cancelable maintenance support on hardware devices which are typically billed in advance and recognized ratably over the contract term as those services are delivered. This adjustment represents the amount of additional revenue that would have been recognized during the period absent the write-down to fair value required under purchase accounting guidelines. 2 Represents the amortization of purchased intangible assets recorded in connection with the acquisition of Polycom on July 2, 2018.

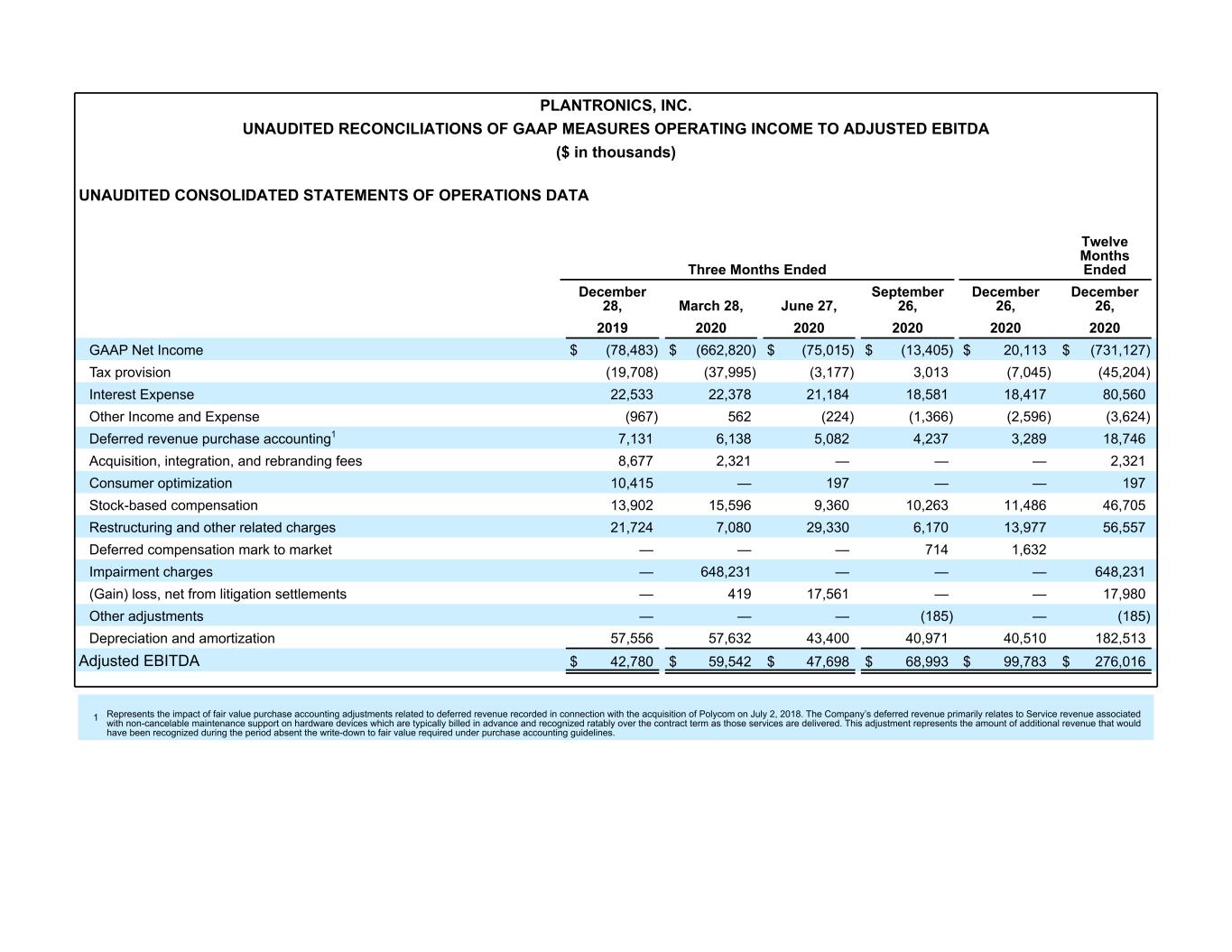

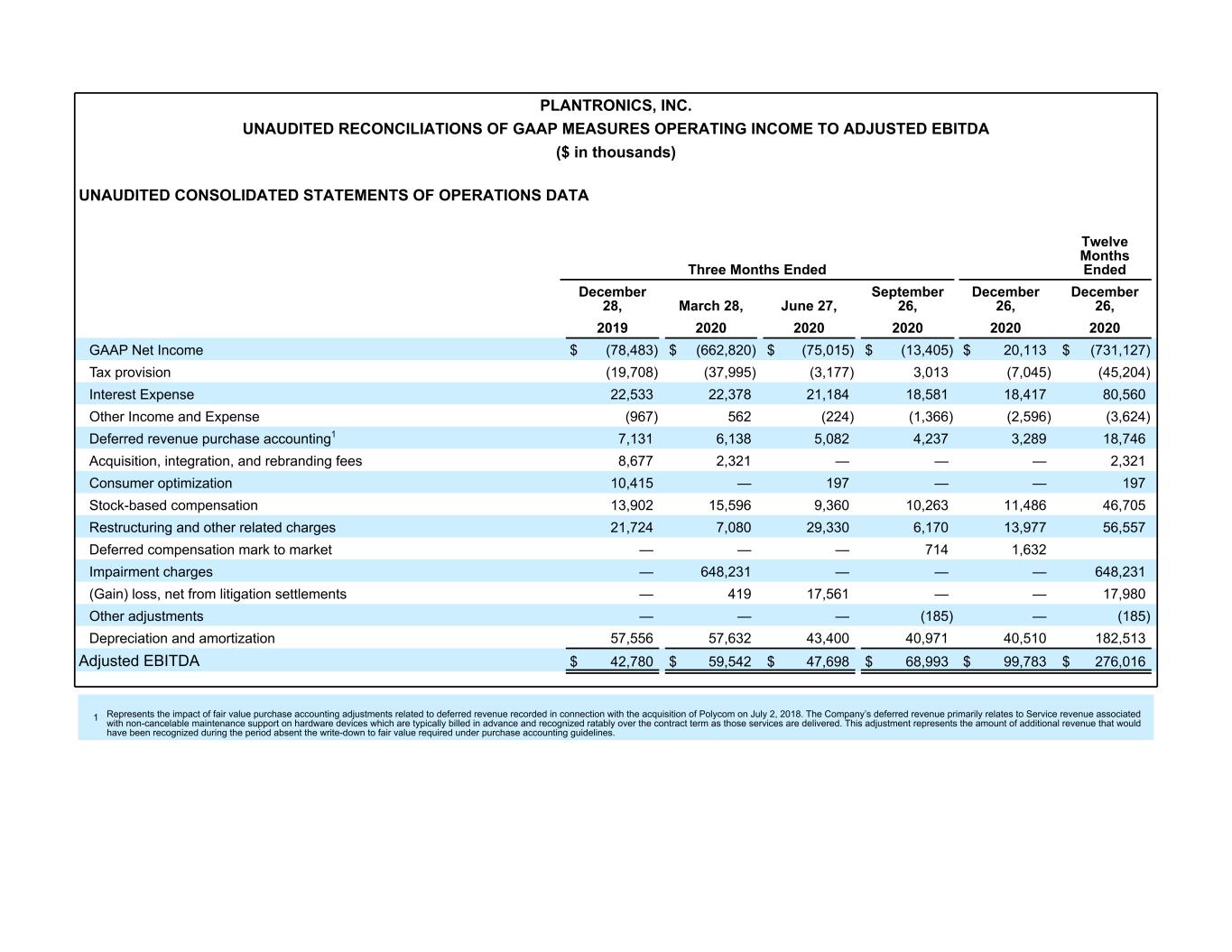

PLANTRONICS, INC. UNAUDITED RECONCILIATIONS OF GAAP MEASURES OPERATING INCOME TO ADJUSTED EBITDA ($ in thousands) UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA Three Months Ended Twelve Months Ended December 28, March 28, June 27, September 26, December 26, December 26, 2019 2020 2020 2020 2020 2020 GAAP Net Income $ (78,483) $ (662,820) $ (75,015) $ (13,405) $ 20,113 $ (731,127) Tax provision (19,708) (37,995) (3,177) 3,013 (7,045) (45,204) Interest Expense 22,533 22,378 21,184 18,581 18,417 80,560 Other Income and Expense (967) 562 (224) (1,366) (2,596) (3,624) Deferred revenue purchase accounting1 7,131 6,138 5,082 4,237 3,289 18,746 Acquisition, integration, and rebranding fees 8,677 2,321 — — — 2,321 Consumer optimization 10,415 — 197 — — 197 Stock-based compensation 13,902 15,596 9,360 10,263 11,486 46,705 Restructuring and other related charges 21,724 7,080 29,330 6,170 13,977 56,557 Deferred compensation mark to market — — — 714 1,632 Impairment charges — 648,231 — — — 648,231 (Gain) loss, net from litigation settlements — 419 17,561 — — 17,980 Other adjustments — — — (185) — (185) Depreciation and amortization 57,556 57,632 43,400 40,971 40,510 182,513 Adjusted EBITDA $ 42,780 $ 59,542 $ 47,698 $ 68,993 $ 99,783 $ 276,016 1 Represents the impact of fair value purchase accounting adjustments related to deferred revenue recorded in connection with the acquisition of Polycom on July 2, 2018. The Company’s deferred revenue primarily relates to Service revenue associated with non-cancelable maintenance support on hardware devices which are typically billed in advance and recognized ratably over the contract term as those services are delivered. This adjustment represents the amount of additional revenue that would have been recognized during the period absent the write-down to fair value required under purchase accounting guidelines.