UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-8092 |

|

Western Asset Worldwide Income Fund Inc. |

(Exact name of registrant as specified in charter) |

|

55 Water Street, New York, NY | | 10041 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place, 4th Floor

Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 451-2010 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2008 | |

| | | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The Annual Report to Stockholders is filed herewith.

ANNUAL REPORT / OCTOBER 31, 2008

Western Asset

Worldwide Income

Fund Inc.

(SBW)

Managed by WESTERN ASSET

INVESTMENT PRODUCTS: NOT FDIC INSURED · NO BANK GUARANTEE · MAY LOSE VALUE |

Fund objective

The Fund’s investment objective is to maintain a high level of current income. As a secondary objective, the Fund seeks to maximize total return.

What’s inside

Letter from chairman | I |

| |

Fund overview | 1 |

| |

Fund at a glance | 6 |

| |

Schedule of investments | 7 |

| |

Statement of assets and liabilities | 13 |

| |

Statement of operations | 14 |

| |

Statements of changes in net assets | 15 |

| |

Financial highlights | 16 |

| |

Notes to financial statements | 17 |

| |

Report of independent registered public accounting firm | 27 |

| |

Additional information | 28 |

| |

Annual chief executive officer and chief financial officer certifications | 34 |

| |

Dividend reinvestment plan | 35 |

| |

Important tax information | 39 |

| |

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager. Western Asset Management Company (“Western Asset”) and Western Asset Management Company Limited (“Western Asset Limited”) are the Fund’s subadvisers. LMPFA, Western Asset and Western Asset Limited are wholly-owned subsidiaries of Legg Mason, Inc.

Letter from the chairman

Dear Shareholder,

Economic growth in the U.S. was mixed during the 12-month reporting period ended October 31, 2008. Looking back, third quarter 2007 U.S. gross domestic product (“GDP”)i growth was a strong 4.8%. However, continued weakness in the housing market, an ongoing credit crunch and soaring oil and food prices then took their toll on the economy, as fourth quarter 2007 GDP declined 0.2%. The economy then expanded 0.9% and 2.8% during the first and second quarters of 2008, respectively. This rebound was due, in part, to rising exports that were buoyed by a weakening U.S. dollar, and solid consumer spending, which was aided by the government’s tax rebate program. The dollar’s rally and the end of the rebate program, combined with other strains on the economy, then caused GDP to take a step backward in the third quarter of 2008. According to the preliminary estimate released by the U.S. Department of Commerce, third quarter 2008 GDP declined 0.5%.

The latest Bureau of Economic Research release indicates that the U.S. is currently in recession. Evidence supporting this conclusion includes a slowdown in consumer spending, with four consecutive months of declining retail sales from July through October 2008. According to the Department of Commerce, October’s 2.8% fall in retail sales is the sharpest decline since it began tracking this data in 1992. In terms of the job market, the U.S. Department of Labor reported that payroll employment declined in each of the first 10 months of 2008. Year-to-date through October, roughly 1.2 million jobs have been shed and the unemployment rate now stands at 6.5%, its highest level since 1994.

Ongoing issues related to the housing and subprime mortgage markets and seizing credit markets prompted the Federal Reserve Board (“Fed”)ii to take aggressive and, in some cases, unprecedented actions. Beginning in September 2007, the Fed reduced the federal funds rateiii from 5.25% to 4.75%. This marked the first such reduction since June 2003. The Fed then reduced the federal funds rate on six additional occasions through April 2008, bringing the federal funds rate to 2.00%. The Fed then shifted gears in the face of mounting inflationary prices and a weakening U.S. dollar. At its meetings in June, August and September 2008, the Fed held

Western Asset Worldwide Income Fund Inc. | | I |

Letter from the chairman continued

rates steady. Then, on October 8, 2008, in a global coordination effort with six central banks around the world, interest rates were cut in an attempt to reduce the strains in the global financial markets. At that time, the Fed lowered the federal funds rate from 2.00% to 1.50%. The Fed again cut rates from 1.50% to 1.00% at its regularly scheduled meeting on October 29, 2008. In conjunction with its October meeting, the Fed stated: “The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures. ... Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit.”

In addition to the interest rate cuts, the Fed took several actions to improve liquidity in the credit markets. In March 2008, the Fed established a new lending program allowing certain brokerage firms, known as primary dealers, to also borrow from its discount window. Also in March, the Fed played a major role in facilitating the purchase of Bear Stearns by JPMorgan Chase. In mid-September 2008, it announced an $85 billion rescue plan for ailing AIG and pumped $70 billion into the financial system as Lehman Brothers’ bankruptcy and mounting troubles at other financial firms roiled the markets.

The U.S. Department of the Treasury has also taken an active role in attempting to stabilize the financial system, as it orchestrated the government’s takeover of mortgage giants Fannie Mae and Freddie Mac in September. In addition, on October 3, 2008, the Treasury’s $700 billion Troubled Asset Relief Program (“TARP”) was approved by Congress and signed into law by President Bush. As part of TARP, the Treasury had planned to make a $250 billion capital injection into some of the nation’s largest banks. However, in November 2008 (after the reporting period ended), Treasury Secretary Paulson said the Treasury no longer intended to use TARP to purchase bad loans and other troubled financial assets.

During the 12-month reporting period ended October 31, 2008, both short- and long-term Treasury yields experienced periods of extreme volatility. Investors were initially focused on the subprime segment of the mortgage-backed market. These concerns broadened, however, to include a wide range of financial institutions and markets. As a result, other fixed-income instruments also experienced increased price volatility. This unrest triggered several “flights to quality,” causing Treasury yields to move lower (and their prices higher), while riskier segments of the market saw their yields move higher (and their prices lower). This was particularly true toward the end of the reporting period, as the turmoil in the financial markets and sharply falling stock prices caused investors to flee securities that were perceived to be risky, even high-quality corporate bonds and high-grade municipal bonds. At one point in September, the yield available from the three-month Treasury bill fell to 0.04%, as investors were essentially willing to forgo any

II | | Western Asset Worldwide Income Fund Inc. |

return potential in order to access the relative safety of government-backed securities. During the 12 months ended October 31, 2008, two-year Treasury yields fell from 3.94% to 1.56%. Over the same time frame, 10-year Treasury yields moved from 4.48% to 4.01%. Looking at the 12-month period as a whole, the overall bond market, as measured by the Barclays Capital U.S. Aggregate Indexiv, returned 0.30%.

Periods of increased investor risk aversion caused the high-yield bond market to produce extremely poor results over the 12 months ended October 31, 2008. While the asset class rallied on several occasions, it was not enough to overcome numerous flights to quality. In particular, seizing credit markets, coupled with fears of a global recession and rising corporate bond default rates, sent high-yield bond prices sharply lower in September and October 2008. During those two months, the Citigroup High Yield Market Indexv (the “Index”) returned -8.01% and -15.34%, respectively. Over the 12 months ended October 31, 2008, the Index returned -25.69%.

Despite periods of extreme market volatility, emerging market debt prices held up fairly well during the first 10 months of the reporting period. During that time, the asset class was supported by solid demand, superior growth rates in emerging market countries, increased domestic spending and rating upgrades in countries such as Brazil. However, fears of a global recession, falling commodity prices and seizing credit markets sent emerging market debt prices sharply lower in September and October 2008. During those months, the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi returned -6.84% and -14.89%, respectively. Over the 12 months ended October 31, 2008, the EMBI Global returned -19.13%.

A special note regarding increased market volatility

In recent months, we have experienced a series of events that have impacted the financial markets and created concerns among both novice and seasoned investors alike. In particular, we have witnessed the failure and consolidation of several storied financial institutions, periods of heightened market volatility, and aggressive actions by the U.S. federal government to steady the financial markets and restore investor confidence. While we hope that the worst is over in terms of the issues surrounding the credit and housing crises, it is likely that the fallout will continue to impact the financial markets and the U.S. economy during the remainder of the year and into 2009 as well.

Like all asset management firms, Legg Mason has not been immune to these difficult and, in some ways, unprecedented times. However, today’s challenges have only strengthened our resolve to do everything we can to help you reach your financial goals. Now, as always, we remain committed to providing you with excellent service and a full spectrum of investment

Western Asset Worldwide Income Fund Inc. | | III |

Letter from the chairman continued

choices. And rest assured, we will continue to work hard to ensure that our investment managers make every effort to deliver strong long-term results.

We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our enhanced website, www.leggmason.com/cef. Here you can gain immediate access to many special features to help guide you through difficult times, including:

· Fund prices and performance,

· Market insights and commentaries from our portfolio managers, and

· A host of educational resources.

During periods of market unrest, it is especially important to work closely with your financial advisor and remember that reaching one’s investment goals unfolds over time and through multiple market cycles. Time and again, history has shown that, over the long run, the markets have eventually recovered and grown.

Information about your fund

Please read on for a more detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

Important information with regard to recent regulatory developments that may affect the Fund is contained in the Notes to Financial Statements included in this report.

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

December 1, 2008

IV | | Western Asset Worldwide Income Fund Inc. |

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

ii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

iv | The Barclays Capital (formerly Lehman Brothers) U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

v | The Citigroup High Yield Market Index is a broad-based unmanaged index of high-yield securities. |

vi | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

Western Asset Worldwide Income Fund Inc. | | V |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund seeks to maintain a high level of current income. As a secondary objective, the Fund seeks to maximize total return. The Fund will invest, under normal market conditions, at least 65% of its total assets in securities of issuers that are, or are incorporated in or generate the majority of their revenue in, emerging market countries. Under normal circumstances, the Fund will invest in securities of issuers located in at least four countries. The Fund can also invest up to 35% of its total assets in a broad range of other U.S. and non-U.S. fixed-income securities, both investment grade and high-yield securities, including but not limited to corporate bonds, loans, mortgage- and asset-backed securities, preferred stock and sovereign debt, derivative instruments of the foregoing securities and dollar rolls.

At Western Asset Management Company (“Western Asset”), the Fund’s subadviser, we utilize a fixed-income team approach, with decisions derived from interaction among various investment management sector specialists. The sector teams are comprised of Western Asset’s senior portfolio managers, research analysts and an in-house economist. Under this team approach, management of client fixed-income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization.

Q. What were the overall market conditions during the Fund’s reporting period?

A. During the fiscal year, the U.S. bond market experienced periods of increased volatility. Changing perceptions regarding the economy, inflation and future Federal Reserve Board (“Fed”)i monetary policy caused bond prices to fluctuate. Two- and 10-year Treasury yields began the reporting period at 3.94% and 4.48%, respectively. Treasury yields moved lower—and their prices moved higher—toward the end of 2007 and during the first quarter of 2008, as concerns regarding the subprime mortgage market and a severe credit crunch caused a “flight to quality.” During this period, investors were drawn to the relative safety of Treasuries, while increased risk aversion caused other segments of the bond market to falter.

Treasury yields then moved higher in April, May and early June 2008, as the economy performed better than expected and inflation moved higher. Over this period, riskier fixed-income asset classes, such as high-yield bonds and emerging market debt rallied. However, the credit crunch resumed in mid-June, resulting in another flight to quality. Investors’ risk aversion then intensified in September and October 2008 given the severe disruptions in the global financial markets. During this time, virtually every asset class, with the exception of short-term Treasuries, performed poorly. At the end of the fiscal year, two- and 10-year Treasury yields were 1.56% and 4.01%, respectively.

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 1 |

Fund overview continued

The Fed attempted to stimulate economic growth by cutting the federal funds rateii from 5.25% to 2.00% from September 2007 through April 2008. It then held rates steady until October 2008, citing inflationary pressures triggered by soaring oil prices. However, with the global economy moving toward a recession, oil prices falling sharply, and the financial markets in disarray, the Fed lowered interest rates twice in October 2008. The first cut occurred on October 8th, as the Fed and several other central banks around the world lowered rates in a coordinated effort. At that time, the Fed reduced the federal funds rate from 2.00% to 1.50%. Three weeks later, at its regularly scheduled meeting on October 29th, the Fed lowered rates from 1.50% to 1.00%. The Fed also left the door open to further actions, saying: “The Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability.”

Turning to emerging market debt, after performing well for much of the 12-month reporting period, the asset class gave back its earlier gains, and much more, in September and October 2008. During that two-month period, investor risk aversion spiked and investors fled emerging market debt for the safety of short-term U.S. Treasuries. In addition, sharply falling commodity prices negatively impacted the fundamentals in a number of emerging market countries. All told, during the 12 months ended October 31, 2008, the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)iii fell 19.13%.

Q. How did we respond to these changing market conditions?

A. As global risk aversion increased and volatility reached historic levels, we reduced the Fund’s exposure in the local currency markets. For example, positions in local markets, such as Turkey and India, were removed during the middle of the reporting period. A number of the Fund’s local currency bonds had short durationsiv. These positions were allowed to mature and their proceeds were reallocated to external markets (U.S. dollar-denominated) rather than reinvesting to maintain the Fund’s previous currency positions. Generally, the risk-return profile of external markets that do not include currency risk improved relative to local markets, as spreads widened to levels not seen since 2002.

2 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

Performance review

For the 12 months ended October 31, 2008, Western Asset Worldwide Income Fund Inc. returned -27.70% based on its net asset value (“NAV”)v and -28.48% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the EMBI Global, returned - -19.13% for the same period. The Lipper Emerging Markets Debt Closed-End Funds Category Averagevi returned -26.93% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the 12-month period, the Fund made distributions to shareholders totaling $1.15 per share. The performance table shows the Fund’s 12-month total return based on its NAV and market price as of October 31, 2008. Past performance is no guarantee of future results.

PERFORMANCE SNAPSHOT as of October 31, 2008 (unaudited)

PRICE PER SHARE | | 12-MONTH

TOTAL RETURN* |

$10.12 (NAV) | | -27.70% |

$8.55 (Market Price) | | -28.48% |

All figures represent past performance and are not a guarantee of future results.

*Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Q. What were the leading contributors to performance?

A. Generally, the Fund maintained its bias toward larger, more liquid countries. In contrast, we had underweight positions in a number of smaller countries, including Vietnam, Ukraine, Pakistan, Jamaica, El Salvador and Serbia. This proved to be beneficial to relative performance as smaller countries suffered disproportionately during the flight to quality following the Lehman Brothers collapse in mid-September 2008. Diversifying the Fund’s portfolio into short-duration Egyptian Treasury bills was also a positive contributor to performance, as the Egyptian pound remained relatively stable over the period. Our exposure in local currency markets in Malaysia and Russia had a positive impact on the Fund’s performance as their currency values held up reasonably well.

Q. What were the leading detractors from performance?

A. A number of select local currency markets, such as Brazil, as well as certain corporate issues, had a negative impact on performance. The Brazilian real suffered from mid-September 2008 through the end of the period as the global financial system became severely strained and investors sold local currencies in an effort to acquire U.S. dollars. During the final

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 3 |

Fund overview continued

weeks of the reporting period, corporate bonds generally sold off more than their sovereign counterparts. As a result, our decision to emphasize Russian and Kazakh corporate and quasi-sovereign bonds proved detrimental to the Fund’s performance. We held modest positions in a number of large Kazakh banks and, despite government re-capitalization, spreads widened dramatically toward the end of the reporting period. Finally, an underweight to the Philippines external sovereign market detracted from relative performance. Despite a relatively large amount of outstanding debt, their spreads widened less than the benchmark.

Looking for additional information?

The Fund is traded under the symbol “SBW” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XSBWX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites, as well as www.leggmason.com/cef.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 6:00 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Western Asset Worldwide Income Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Western Asset Management Company

November 18, 2008

4 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: As interest rates rise, bond prices fall, reducing the value of the Fund’s shares. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. High-yield bonds involve greater credit and liquidity risks than investment grade bonds. Foreign securities are subject to certain risks not associated with domestic investing, such as currency fluctuations and changes in political and economic conditions which could result in significant fluctuations. The risks are magnified in emerging markets.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

ii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

iii | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

iv | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

v | Net asset value (“NAV”) is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is at the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

vi | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the 12-month period ended October 31, 2008, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 12 funds in the Fund’s Lipper category. |

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 5 |

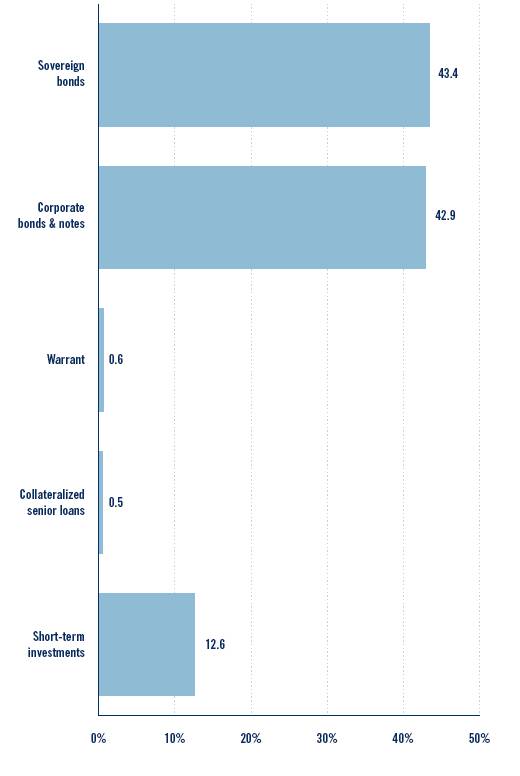

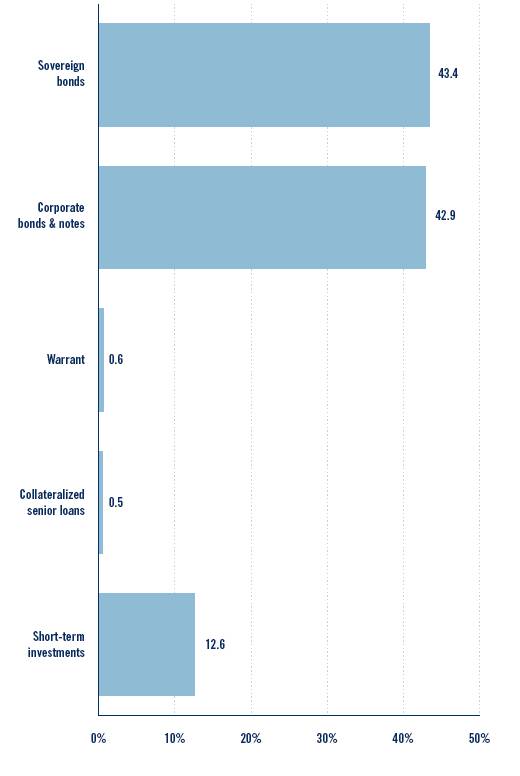

Fund at a glance (unaudited)

INVESTMENT BREAKDOWN (%) As a percent of total investments — October 31, 2008

6 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

Schedule of investments

October 31, 2008

WESTERN ASSET WORLDWIDE INCOME FUND INC.

FACE

AMOUNT† | | SECURITY | | VALUE | |

SOVEREIGN BONDS — 43.4% | | | |

| | Argentina — 2.7% | | | |

| | Republic of Argentina: | | | |

5,000,000 | DEM | 10.500% due 11/14/02(a)(b) | | $ 923,065 | |

3,500,000 | DEM | 7.000% due 3/18/04(a)(b) | | 671,764 | |

2,399,000 | | Bonds, 7.000% due 9/12/13(b) | | 485,531 | |

| | GDP Linked Securities: | | | |

1,700,000 | EUR | 1.262% due 12/15/35(b)(c) | | 70,306 | |

1,565,000 | | 1.330% due 12/15/35(b)(c) | | 61,426 | |

9,904,661 | ARS | 1.383% due 12/15/35(b)(c) | | 178,995 | |

| | Medium-Term Notes: | | | |

1,800,000 | EUR | 7.000% due 3/18/04(a)(b) | | 675,697 | |

2,000,000,000 | ITL | 7.000% due 3/18/04(a)(b) | | 400,888 | |

| | Total Argentina | | 3,467,672 | |

| | Brazil — 8.9% | | | |

| | Brazil Nota do Tesouro Nacional: | | | |

1,000 | BRL | 10.000% due 1/1/10 | | 438 | |

23,312,000 | BRL | 10.000% due 7/1/10 | | 9,949,558 | |

3,478,000 | BRL | 10.000% due 1/1/12 | | 1,352,194 | |

| | Total Brazil | | 11,302,190 | |

| | Colombia — 2.9% | | | |

4,385,000 | | Republic of Colombia, 7.375% due 9/18/37 | | 3,617,625 | |

| | Ecuador — 0.6% | | | |

2,680,000 | | Republic of Ecuador, 10.000% due 8/15/30(d) | | 790,600 | |

| | Egypt — 0.6% | | | |

5,790,000 | EGP | Arab Republic of Egypt, 8.750% due 7/18/12(b)(d) | | 799,695 | |

| | Gabon — 0.5% | | | |

993,000 | | Gabonese Republic, 8.200% due 12/12/17(d) | | 650,415 | |

| | Indonesia — 1.6% | | | |

| | Republic of Indonesia: | | | |

5,020,000,000 | IDR | 10.250% due 7/15/22 | | 281,761 | |

11,865,000,000 | IDR | 11.000% due 9/15/25 | | 689,544 | |

9,706,000,000 | IDR | 10.250% due 7/15/27 | | 523,363 | |

11,529,000,000 | IDR | 9.750% due 5/15/37 | | 589,820 | |

| | Total Indonesia | | 2,084,488 | |

| | Panama — 5.1% | | | |

| | Republic of Panama: | | | |

3,202,000 | | 7.250% due 3/15/15 | | 3,089,930 | |

1,290,000 | | 9.375% due 4/1/29 | | 1,257,750 | |

2,729,000 | | 6.700% due 1/26/36 | | 2,142,265 | |

| | Total Panama | | 6,489,945 | |

See Notes to Financial Statements.

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 7 |

Schedule of investments continued

October 31, 2008

WESTERN ASSET WORLDWIDE INCOME FUND INC.

FACE | | | | | |

AMOUNT† | | SECURITY | | VALUE | |

| | Peru — 3.9% | | | |

| | Republic of Peru: | | | |

2,467,000 | | 8.750% due 11/21/33 | | $ 2,257,305 | |

3,889,000 | | Bonds, 6.550% due 3/14/37 | | 2,702,855 | |

| | Total Peru | | 4,960,160 | |

| | Russia — 1.0% | | | |

| | Russian Federation: | | | |

173,000 | | 12.750% due 6/24/28(d) | | 200,718 | |

1,234,800 | | 7.500% due 3/31/30(d) | | 1,081,219 | |

| | Total Russia | | 1,281,937 | |

| | Turkey — 8.4% | | | |

| | Republic of Turkey: | | | |

1,490,000 | | 11.500% due 1/23/12 | | 1,497,450 | |

730,000 | | 11.000% due 1/14/13 | | 697,150 | |

425,000 | | 7.250% due 3/15/15 | | 350,625 | |

3,822,000 | | 11.875% due 1/15/30 | | 4,643,730 | |

463,000 | | Collective Action Securities, Notes, 9.500% due 1/15/14 | | 437,535 | |

4,384,000 | | Notes, 6.875% due 3/17/36 | | 3,003,040 | |

| | Total Turkey | | 10,629,530 | |

| | Venezuela — 7.2% | | | |

| | Bolivarian Republic of Venezuela: | | | |

365,000 | | 8.500% due 10/8/14 | | 206,225 | |

9,837,000 | | 5.750% due 2/26/16(d) | | 4,574,205 | |

2,234,000 | | 7.650% due 4/21/25 | | 1,016,470 | |

| | Collective Action Securities: | | | |

5,996,000 | | 9.375% due 1/13/34 | | 3,087,940 | |

445,000 | | Notes, 10.750% due 9/19/13 | | 304,825 | |

| | Total Venezuela | | 9,189,665 | |

| | TOTAL SOVEREIGN BONDS | | | |

| | (Cost — $80,257,406) | | 55,263,922 | |

CORPORATE BONDS & NOTES — 42.9% | | | |

| | Bahamas — 4.2% | | | |

| | Credit Suisse/Nassau: | | | |

119,800,000 | RUB | 6.790% due 10/29/09(d) | | 4,145,933 | |

39,930,000 | RUB | 7.000% due 10/27/11(d) | | 1,179,189 | |

| | Total Bahamas | | 5,325,122 | |

| | Brazil — 5.6% | | | |

1,470,000 | | Globo Communicacoes e Participacoes SA, Senior Bonds, 7.250% due 4/26/22(d) | | 1,036,350 | |

See Notes to Financial Statements.

8 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

WESTERN ASSET WORLDWIDE INCOME FUND INC.

FACE | | | | | |

AMOUNT† | | SECURITY | | VALUE | |

| | Brazil — 5.6% continued | | | |

| | GTL Trade Finance Inc.: | | | |

510,000 | | 7.250% due 10/20/17(d) | | $ 378,463 | |

976,000 | | 7.250% due 10/20/17(d) | | 718,792 | |

890,000 | | Odebrecht Finance Ltd., 7.500% due 10/18/17(d) | | 598,525 | |

| | Vale Overseas Ltd., Notes: | | | |

1,139,000 | | 8.250% due 1/17/34 | | 967,843 | |

4,861,000 | | 6.875% due 11/21/36 | | 3,516,865 | |

| | Total Brazil | | 7,216,838 | |

| | Colombia — 0.5% | | | |

| | EEB International Ltd.: | | | |

300,000 | | 8.750% due 10/31/14(d) | | 246,000 | |

550,000 | | Senior Bonds, 8.750% due 10/31/14(d) | | 451,000 | |

| | Total Colombia | | 697,000 | |

| | India — 0.1% | | | |

244,000 | | ICICI Bank Ltd., Subordinated Bonds, 6.375% due 4/30/22(c)(d) | | 111,518 | |

| | Ireland — 0.9% | | | |

1,940,000 | | Vimpel Communications, Loan Participation Notes, Secured Notes, 8.375% due 4/30/13(d) | | 1,130,492 | |

| | Kazakhstan — 2.8% | | | |

1,200,000 | | ATF Capital BV, Senior Notes, 9.250% due 2/21/14(d) | | 642,000 | |

630,000 | | HSBK Europe BV, 7.250% due 5/3/17(d) | | 324,450 | |

2,810,000 | | KazMunaiGaz Finance Sub B.V., Senior Notes, 8.375% due 7/2/13(d) | | 1,896,750 | |

| | TuranAlem Finance BV, Bonds: | | | |

1,391,000 | | 8.250% due 1/22/37(d) | | 448,598 | |

550,000 | | 8.250% due 1/22/37(d) | | 222,750 | |

| | Total Kazakhstan | | 3,534,548 | |

| | Luxembourg — 2.4% | | | |

240,000 | | Evraz Group SA, Notes, 8.875% due 4/24/13(d) | | 101,400 | |

3,354,000 | | RSHB Capital, Loan Participation Notes, Secured Notes, 7.125% due 1/14/14(d) | | 2,155,582 | |

| | TNK-BP Finance SA: | | | |

640,000 | | 7.500% due 7/18/16(d) | | 272,000 | |

113,000 | | 7.875% due 3/13/18(d) | | 46,895 | |

1,021,000 | | Senior Notes, 7.500% due 3/13/13(d) | | 484,975 | |

| | Total Luxembourg | | 3,060,852 | |

| | Mexico — 9.8% | | | |

1,420,000 | | America Movil SAB de CV, Senior Notes, 5.625% due 11/15/17 | | 1,081,141 | |

See Notes to Financial Statements.

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 9 |

Schedule of investments continued

October 31, 2008

WESTERN ASSET WORLDWIDE INCOME FUND INC.

FACE | | | | | |

AMOUNT† | | SECURITY | | VALUE | |

| | Mexico — 9.8% continued | | | |

| | Axtel SAB de CV, Senior Notes: | | | |

110,000 | | 11.000% due 12/15/13 | | $ 88,550 | |

4,310,000 | | 7.625% due 2/1/17(d) | | 2,941,575 | |

790,000 | | 7.625% due 2/1/17(d) | | 541,150 | |

120,000 | | Kansas City Southern de Mexico, Senior Notes, 9.375% due 5/1/12 | | 102,000 | |

| | Pemex Project Funding Master Trust: | | | |

1,280,000 | | 6.625% due 6/15/35(d) | | 959,988 | |

9,030,000 | | Senior Bonds, 6.625% due 6/15/35 | | 6,772,419 | |

| | Total Mexico | | 12,486,823 | |

| | Netherlands — 0.4% | | | |

390,000 | | ATF Capital BV, 9.250% due 2/21/14(d) | | 200,877 | |

520,000 | | HSBK Europe BV, Senoir Notes, 9.250% due 10/16/13(d) | | 283,400 | |

| | Total Netherlands | | 484,277 | |

| | Russia — 11.2% | | | |

| | Evraz Group SA, Notes: | | | |

2,200,000 | | 8.875% due 4/24/13(d) | | 957,000 | |

930,000 | | 9.500% due 4/24/18(d) | | 395,250 | |

52,630,000 | RUB | Gaz, 6.950% due 8/6/09 | | 1,845,658 | |

| | Gaz Capital SA: | | | |

740,000 | | Medium Term Notes, 7.288% due 8/16/37(d) | | 409,697 | |

4,440,000 | | Notes, 8.625% due 4/28/34(d) | | 3,108,000 | |

4,150,000 | | LUKOIL International Finance BV, 6.356% due 6/7/17(d) | | 2,178,750 | |

1,790,000 | | RSHB Capital, Loan Participation Notes, 7.125% due 1/14/14(d) | | 1,208,250 | |

| | Russian Agricultural Bank, Loan Participation Notes: | | | |

1,624,000 | | 7.175% due 5/16/13(d) | | 1,096,200 | |

854,000 | | 6.299% due 5/15/17(d) | | 508,130 | |

| | TNK-BP Finance SA: | | | |

3,060,000 | | Bonds, 7.500% due 7/18/16(d) | | 1,361,700 | |

400,000 | | Senior Notes, 7.875% due 3/13/18(d) | | 178,000 | |

460,000 | | UBS Luxembourg SA for OJSC Vimpel Communications, Loan Participation Notes, | | | |

| | 8.250% due 5/23/16(d) | | 235,750 | |

1,430,000 | | Vimpel Communications, Loan Participation Notes, 8.375% due 4/30/13(d) | | 858,692 | |

| | Total Russia | | 14,341,077 | |

| | Thailand — 1.1% | | | |

3,880,000 | | True Move Co., Ltd., 10.375% due 8/1/14(d) | | 1,377,400 | |

See Notes to Financial Statements.

10 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

WESTERN ASSET WORLDWIDE INCOME FUND INC.

FACE | | | | | |

AMOUNT† | | SECURITY | | VALUE | |

| | United Kingdom — 3.7% | | | |

22,771,000 | RUB | HSBC Bank PLC, Credit-Linked Notes | | | |

| | (Russian Agricultural Bank), 8.900% due 12/20/10(d) | | $ 487,533 | |

113,177,500 | RUB | JPMorgan Chase Bank, Credit-Linked Notes

(Russian Agricultural Bank), 9.500% due 2/11/11(b)(d) | | 2,842,911 | |

2,830,000 | | Vedanta Resources PLC, Senior Notes, 8.750% due 1/15/14(d) | | 1,400,850 | |

| | Total United Kingdom | | 4,731,294 | |

| | United States — 0.2% | | | |

140,000 | | Freeport-McMoRan Copper & Gold Inc., Senior Notes, 8.375% due 4/1/17 | | 110,052 | |

470,000 | | Galaxy Entertainment Finance Co. Ltd., 8.133% due 12/15/10(c)(d) | | 143,350 | |

| | Total United States | | 253,402 | |

| | TOTAL CORPORATE BONDS & NOTES

(Cost — $83,073,890) | | 54,750,643 | |

COLLATERALIZED SENIOR LOANS — 0.5% | | | |

| | United States — 0.5% | | | |

| | Ashmore Energy International: | | | |

114,773 | | Synthetic Revolving Credit Facility, 5.496% due 3/30/14(c) | | 76,324 | |

930,012 | | Term Loan, 6.762% due 3/30/14(c) | | 618,458 | |

| | TOTAL COLLATERALIZED SENIOR LOANS

(Cost — $986,710) | | 694,782 | |

WARRANTS | | | |

WARRANTS — 0.6% | | | |

| | Venezuela — 0.6% | | | |

23,180 | | Bolivarian Republic of Venezuela, Oil-linked payment obligations, Expires 4/15/20(b)*

(Cost — $0) | | 730,170 | |

| | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS

(Cost — $164,318,006) | | 111,439,517 | |

| | | | | |

FACE | | | | | |

AMOUNT† | | | | | |

SHORT-TERM INVESTMENTS — 12.6% | | | |

| | Sovereign Bonds — 6.1% | | | |

| | Bank Negara Malaysia Islamic Notes: | | | |

7,985,000 | MYR | Zero coupon bond to yield 3.340% due 11/27/08 | | 2,243,377 | |

207,000 | MYR | Zero coupon bond to yield 3.470% due 11/27/08 | | 58,149 | |

| | Bank Negara Malaysia Monetary Notes: | | | |

2,267,000 | MYR | Zero coupon bond to yield 3.449% due 11/13/08 | | 637,688 | |

2,867,000 | MYR | Zero coupon bond to yield 3.447% due 11/25/08 | | 805,548 | |

222,000 | MYR | Zero coupon bond to yield 3.430% due 12/30/08 | | 62,171 | |

1,200,000 | MYR | Zero coupon bond to yield 3.440% due 2/17/09 | | 334,260 | |

3,891,000 | BRL | Brazil Letras Tesouro Nacional, zero coupon bond to yield 11.300% due 1/1/09 | | 1,763,526 | |

See Notes to Financial Statements.

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 11 |

Schedule of investments continued

October 31, 2008

WESTERN ASSET WORLDWIDE INCOME FUND INC.

FACE | | | | | |

AMOUNT† | | SECURITY | | VALUE | |

| | Sovereign Bonds — 6.1% continued | | | |

10,025,000 | EGP | Egypt Treasury Bills, zero coupon bond to yield 6.500% due 11/11/08 | | $ 1,795,059 | |

| | Total Sovereign Bonds (Cost — $8,385,673) | | 7,699,778 | |

| | Repurchase Agreement — 6.5% | | | |

8,307,000 | | Morgan Stanley tri-party repurchase agreement dated 10/31/08, 0.150% due 11/3/08; Proceeds at maturity — $8,307,104; (Fully collateralized by U.S. government agency obligation, 5.125% due 8/23/10; Market value — $8,553,176) | | | |

| | (Cost — $8,307,000) | | 8,307,000 | |

| | TOTAL SHORT-TERM INVESTMENTS (Cost — $16,692,673) | | 16,006,778 | |

| | TOTAL INVESTMENTS — 100.0% (Cost — $181,010,679#) | | $ 127,446,295 | |

† Face amount denominated in U.S. dollars, unless otherwise noted.

* Non-income producing security.

(a) Security is currently in default.

(b) Security is valued in good faith at fair value by or under the direction of the Board of Directors (See Note 1).

(c) Variable rate security. Interest rate disclosed is that which is in effect at October 31, 2008.

(d) Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted.

# Aggregate cost for federal income tax purposes is $181,576,897.

Abbreviations used in this schedule: |

ARS | — | Argentine Peso |

BRL | — | Brazilian Real |

DEM | — | German Mark |

EGP | — | Egyptian Pound |

EUR | — | Euro |

GDP | — | Gross Domestic Product |

IDR | — | Indonesian Rupiah |

ITL | — | Italian Lira |

MYR | — | Malaysian Ringgit |

OJSC | — | Open Joint Stock Company |

RUB | — | Russian Ruble |

See Notes to Financial Statements.

12 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

Statement of assets and liabilities

October 31, 2008

ASSETS: | | | |

Investments, at value (Cost — $181,010,679) | | $ | 127,446,295 | |

Foreign currency, at value (Cost — $3,412,443) | | 3,174,319 | |

Cash | | 622 | |

Dividends and interest receivable | | 3,408,140 | |

Receivable for securities sold | | 1,744,641 | |

Receivable for open forward currency contracts | | 97,831 | |

Receivable for open swap contracts | | 76,514 | |

Prepaid expenses | | 9,890 | |

Total Assets | | 135,958,252 | |

LIABILITIES: | | | |

Payable for securities purchased | | 3,712,126 | |

Payable for open forward currency contracts | | 158,851 | |

Investment management fee payable | | 132,973 | |

Unrealized depreciation on swaps | | 11,875 | |

Directors’ fees payable | | 7,164 | |

Accrued expenses | | 284,087 | |

Total Liabilities | | 4,307,076 | |

TOTAL NET ASSETS | | $ | 131,651,176 | |

NET ASSETS: | | | |

Par value ($0.001 par value; 13,014,971 shares issued and outstanding; 100,000,000 shares authorized) | | $ | 13,015 | |

Paid-in capital in excess of par value | | 180,971,769 | |

Undistributed net investment income | | 4,537,737 | |

Accumulated net realized gain on investments, futures contracts, swap contracts and foreign currency transactions | | 145,803 | |

Net unrealized depreciation on investments, swap contracts and foreign currencies | | (54,017,148 | ) |

TOTAL NET ASSETS | | $ | 131,651,176 | |

Shares Outstanding | | 13,014,971 | |

Net Asset Value | | $10.12 | |

See Notes to Financial Statements.

| | Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 13 |

Statement of operations

For the Year Ended October 31, 2008

INVESTMENT INCOME: | | | |

Interest | | $ 15,200,715 | |

Less: Foreign taxes withheld | | (60,002 | ) |

Total Investment Income | | 15,140,713 | |

EXPENSES: | | | |

Investment management fee (Note 2) | | 1,955,915 | |

Excise tax (Note 1) | | 285,261 | |

Interest expense (Notes 3 and 4) | | 236,260 | |

Shareholder reports | | 144,857 | |

Custody fees | | 119,916 | |

Legal fees | | 110,527 | |

Audit and tax | | 57,535 | |

Directors’ fees | | 30,241 | |

Transfer agent fees | | 28,039 | |

Commitment fees (Note 4) | | 22,341 | |

Stock exchange listing fees | | 19,892 | |

Insurance | | 4,102 | |

Miscellaneous expenses | | 9,424 | |

Total Expenses | | 3,024,310 | |

NET INVESTMENT INCOME | | 12,116,403 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FUTURES CONTRACTS, SWAP | | | |

CONTRACTS AND FOREIGN CURRENCY TRANSACTIONS (NOTES 1 AND 3): | | | |

Net Realized Gain (Loss) From: | | | |

Investment transactions | | 2,695,015 | |

Futures contracts | | (222,462 | ) |

Swap contracts | | 102,239 | |

Foreign currency transactions | | (145,454 | ) |

Net Realized Gain | | 2,429,338 | |

Change in Net Unrealized Appreciation/Depreciation From: | | | |

Investments | | (65,189,821 | ) |

Futures contracts | | (50,394 | ) |

Swap contracts | | (11,875 | ) |

Foreign currencies | | (494,284 | ) |

Change in Net Unrealized Appreciation/Depreciation | | (65,746,374 | ) |

NET LOSS ON INVESTMENTS, FUTURES CONTRACTS, SWAP CONTRACTS AND FOREIGN | | | |

CURRENCY TRANSACTIONS | | (63,317,036 | ) |

DECREASE IN NET ASSETS FROM OPERATIONS | | $ (51,200,633 | ) |

See Notes to Financial Statements.

14 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | |

Statements of changes in net assets

FOR THE YEARS ENDED OCTOBER 31, | | 2008 | | 2007 | |

OPERATIONS: | | | | | |

Net investment income | | $ 12,116,403 | | $ 11,871,742 | |

Net realized gain | | 2,429,338 | | 5,349,459 | |

Change in net unrealized appreciation/depreciation | | (65,746,374 | ) | (1,230,949 | ) |

Increase from payment by affiliate | | — | | 143,005 | |

Increase (Decrease) in Net Assets From Operations | | (51,200,633 | ) | 16,133,257 | |

DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTE 1): | | | | | |

Net investment income | | (10,427,595 | ) | (10,615,010 | ) |

Net realized gains | | (4,539,622 | ) | (7,590,331 | ) |

Decrease in Net Assets From Distributions to Shareholders | | (14,967,217 | ) | (18,205,341 | ) |

DECREASE IN NET ASSETS | | (66,167,850 | ) | (2,072,084 | ) |

NET ASSETS: | | | | | |

Beginning of year | | 197,819,026 | | 199,891,110 | |

End of year* | | $131,651,176 | | $197,819,026 | |

* Includes undistributed net investment income of: | | $4,537,737 | | $2,210,243 | |

See Notes to Financial Statements.

| | Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 15 |

Financial highlights

FOR A SHARE OF CAPITAL STOCK OUTSTANDING THROUGHOUT EACH YEAR ENDED OCTOBER 31:

| | 2008 | | 2007 | | 20061 | | 20051 | | 20041 | |

NET ASSET VALUE, BEGINNING OF YEAR | | $15.20 | | | $15.36 | | | $16.72 | | | $15.53 | | | $15.04 | | |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income | | 0.93 | | | 0.91 | | | 0.85 | | | 1.20 | | | 1.26 | | |

Net realized and unrealized gain (loss) | | (4.86 | ) | | 0.33 | | | 0.57 | | | 1.35 | | | 0.66 | | |

Total income (loss) from operations | | (3.93 | ) | | 1.24 | | | 1.42 | | | 2.55 | | | 1.92 | | |

LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | |

Net investment income | | (0.80 | ) | | (0.82 | ) | | (0.86 | ) | | (1.29 | ) | | (1.39 | ) | |

Net realized gains | | (0.35 | ) | | (0.58 | ) | | (1.92 | ) | | (0.07 | ) | | (0.04 | ) | |

Total distributions | | (1.15 | ) | | (1.40 | ) | | (2.78 | ) | | (1.36 | ) | | (1.43 | ) | |

Increase in Net Asset Value due to shares issued on reinvestment of distributions | | — | | | — | | | 0.00 | 2 | | — | | | — | | |

NET ASSET VALUE, END OF YEAR | | $10.12 | | | $15.20 | | | $15.36 | | | $16.72 | | | $15.53 | | |

MARKET PRICE, END OF YEAR | | $8.55 | | | $13.15 | | | $13.37 | | | $15.02 | | | $16.34 | | |

Total return, based on NAV3,6 | | (27.70 | )% | | 8.51 | %4 | | 9.55 | %5 | | 17.19 | % | | 13.52 | % | |

Total return, based on Market Price6 | | (28.48 | )% | | 8.92 | % | | 6.95 | % | | 0.19 | % | | 12.19 | % | |

NET ASSETS, END OF YEAR (000s) | | $131,651 | | | $197,819 | | | $199,891 | | | $216,894 | | | $201,182 | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | |

Gross expenses | | 1.62 | % | | 1.56 | % | | 1.45 | % | | 2.24 | % | | 2.00 | % | |

Gross expenses, excluding interest expense | | 1.50 | | | 1.30 | | | 1.28 | | | 1.24 | | | 1.24 | | |

Net expenses | | 1.62 | | | 1.55 | 7 | | 1.45 | 7 | | 2.24 | | | 2.00 | | |

Net expenses, excluding interest expense | | 1.50 | | | 1.30 | 7 | | 1.28 | 7 | | 1.24 | | | 1.24 | | |

Net investment income | | 6.50 | | | 6.05 | | | 5.57 | | | 7.41 | | | 8.39 | | |

PORTFOLIO TURNOVER RATE | | 39 | % | | 64 | % | | 72 | % | | 83 | % | | 94 | % | |

SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | |

Loans Outstanding, End of Year (000s) | | — | 8 | | — | 8 | | — | 8 | | $10,000 | | | $60,000 | | |

Asset Coverage for Loan Outstanding | | — | 8 | | — | 8 | | — | 8 | | 2,269.00 | % | | 435.00 | % | |

Weighted Average Loan (000s) | | — | 8 | | — | 8 | | $10,000 | 8 | | $46,027 | | | $60,000 | | |

Weighted Average Interest Rate on Loans | | — | 8 | | — | 8 | | 5.07 | %8 | | 3.79 | % | | 2.34 | % | |

1 | Per share amounts have been calculated using the average shares method. |

2 | Amount represents less than $0.01 per share. |

3 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

4 | The manager fully reimbursed the Fund for losses incurred resulting from the Fund not meeting an investment restriction. Without this reimbursement, total return would have been 8.44%. |

5 | If the Fund had met its investment restriction, the total return may have been different. |

6 | The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. |

7 | Reflects fee waivers and/or expense reimbursements. |

8 | At October 31, 2008, 2007, and 2006, the Fund did not have an outstanding loan. |

See Notes to Financial Statements.

16 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | |

Notes to financial statements

1. Organization and significant accounting policies

Western Asset Worldwide Income Fund Inc. (the “Fund”) was incorporated in Maryland on October 21, 1993 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended, (the “1940 Act”). The Fund’s investment objective is maintain a high level of current income. As a secondary objective, the Fund seeks to maximize total return.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. Debt securities are valued at the mean between the last quoted bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. Equity securities for which market quotations are available are valued at the last reported sale price or official closing price on the primary market or exchange on which they trade. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market, and are valued at the mean between the last quoted bid and asked prices as of the close of business of that market. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these investments at fair value as determined in accordance with the procedures approved by the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

(b) Repurchase agreements. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market to ensure the adequacy of the collateral. If the seller defaults, and the market value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Reverse repurchase agreements. The Fund may enter into a reverse repurchase agreement in which the Fund sells a portfolio security at a specified

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 17 |

Notes to financial statements continued

price with an agreement to purchase the same or substantially the same security from the same counterparty at a fixed or determinable price at a future date. When entering into reverse repurchase agreements, the Fund’s custodian delivers to the counterparty liquid assets, the market value of which, at the inception of the transaction, at least equals the repurchase price (including accrued interest). The Fund pays interest on amounts obtained pursuant to reverse repurchase agreements. Reverse repurchase agreements are considered to be borrowings, which may create leverage risk to the Fund.

(d) Financial futures contracts. The Fund may enter into financial futures contracts typically, but not necessarily, to hedge a portion of the portfolio. Upon entering into a financial futures contract, the Fund is required to deposit cash or securities as initial margin, equal in value to a certain percentage of the contract amount (initial margin deposit). Additional securities are also segregated up to the current market value of the financial futures contracts. Subsequent payments, known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the value of the underlying financial instruments. For foreign currency denominated futures contracts, variation margins are not settled daily. The Fund recognizes an unrealized gain or loss equal to the fluctuation in the value. When the financial futures contracts are closed, a realized gain or loss is recognized equal to the difference between the proceeds from (or cost of) the closing transactions and the Fund’s basis in the contracts.

The risks associated with entering into financial futures contracts include the possibility that a change in the value of the contract may not correlate with the changes in the value of the underlying financial instruments. In addition, investing in financial futures contracts involves the risk that the Fund could lose more than the initial margin deposit and subsequent payments required for a futures transaction. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

(e) Credit default swaps. The Fund may enter into credit default swap (“CDS”) contracts for investment purposes, to manage its credit risk or to add leverage. CDS agreements involve one party making a stream of payments to another party in exchange for the right to receive a specified return in the event of a default by a third party, typically corporate issuers or sovereign issuers of an emerging country, on a specified obligation. The Fund may use a CDS to provide a measure of protection against defaults of the issuers (i.e., to reduce risk where a Fund has exposure to the sovereign issuer) or to take an active long or short position with respect to the likelihood of a particular issuer’s default. As a seller of protection, the Fund generally receives an upfront payment or a fixed rate of income throughout the term of the swap provided that there is no credit event. If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will pay to the buyer of the protection an amount up to the notional value of the swap, and in

18 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

certain instances take delivery of the security. As the seller, the Fund would effectively add leverage to its portfolio because, in addition to its total net assets, the Fund would be subject to investment exposure on the notional amount of the swap. As a buyer of protection, the Fund generally receives an amount up to the notional value of the swap if a credit event occurs.

Payments received or made at the beginning of the measurement period are reflected as such on the Statement of Assets and Liabilities. These upfront payments are recorded as realized gain or loss on the Statement of Operations and are amortized over the life of the swap. A liquidation payment received or made at the termination of the swap is recorded as realized gain or loss on the Statement of Operations. Net periodic payments received or paid by the Fund are recorded as realized gain or loss on the Statement of Operations.

Entering into a CDS agreement involves, to varying degrees, elements of credit, market and documentation risk in excess of the related amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreement may default on its obligation to perform or disagree as to the meaning of the contractual terms in the agreement, and that there will be unfavorable changes in net interest rates.

(f) Forward foreign currency contracts. The Fund may enter into a forward foreign currency contract to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate settlement of a foreign currency denominated portfolio transaction. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set price with delivery and settlement at a future date. The contract is marked-to-market daily and the change in value is recorded by the Fund as an unrealized gain or loss. When a forward foreign currency contract is closed, through either delivery or offset by entering into another forward foreign currency contract, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it was closed.

Forward foreign currency contracts involve elements of market risk in excess of the amounts reflected in the Statement(s) of Assets and Liabilities. The Fund(s) bear(s) the risk of an unfavorable change in the foreign exchange rate underlying the forward foreign currency contract. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

(g) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 19 |

Notes to financial statements continued

based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities, at the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(h) Credit and market risk. The Fund invests in high-yield and emerging market instruments that are subject to certain credit and market risks. The yields of high-yield and emerging market debt obligations reflect, among other things, perceived credit and market risks. The Fund’s investment in securities rated below investment grade typically involves risks not associated with higher rated securities including, among others, greater risk related to timely and ultimate payment of interest and principal, greater market price volatility and less liquid secondary market trading. The consequences of political, social, economic or diplomatic changes may have disruptive effects on the market prices of investments held by the Fund. The Fund’s investment in non-U.S. dollar denominated securities may also result in foreign currency losses caused by devaluations and exchange rate fluctuations.

(i) Other risks. Consistent with its objective to seek high current income, the Fund may invest in instruments whose values and interest rates are linked to foreign currencies, interest rates, indices or some other financial indicator. The value at maturity or interest rates for these instruments will increase or decrease according to the change in the indicator to which they are indexed. These securities are generally more volatile in nature, and the risk of loss of principal is greater.

(j) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis.

20 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

Dividend income is recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

(k) Distributions to shareholders. Distributions from net investment income for the Fund, if any, are declared and paid on a monthly basis. Distributions of net realized gains, if any, are declared at least annually. Pursuant to its Managed Distribution Policy, the Fund intends to make regular monthly distributions to shareholders at a fixed rate per common share, which rate may be adjusted from time to time by the Fund’s Board of Directors. Under the Fund’s Managed Distribution Policy, if, for any monthly distribution, the value of the Fund’s net investment income and net realized capital gain is less than the amount of the distribution, the difference will be distributed from the Fund’s assets (and constitute a “return of capital”). The Board of Directors may terminate or suspend the Managed Distribution Policy at any time, including when certain events would make part of the return of capital taxable to shareholders. Any such termination or suspension could have an adverse effect on the market price for Fund’s shares. Distributions are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(l) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income and net realized gains, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Fund’s financial statements. However, due to the timing of when distributions are made, the Fund may be subject to an excise tax of 4% of the amount by which 98% of the Fund’s annual taxable income exceeds the distributions from such taxable income for the year. The Fund paid $193,867 of the federal excise taxes attributable to calendar year 2007 in March 2008.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years and has concluded that as of October 31, 2008, no provision for income tax would be required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(m) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting.

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 21 |

Notes to financial statements continued

These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | Undistributed net

investment income | | Accumulated net

realized gain | | Paid-in Capital | |

(a) | | $285,261 | | — | | $(285,261) | |

(b) | | 353,425 | | $(353,425) | | — | |

(a) | | Reclassifications are primarily due to a non-deductible excise tax paid by the Fund. |

(b) | | Reclassifications are primarily due to foreign currency transactions treated as ordinary income for tax purposes and book/tax differences in the treatment of swaps. |

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and Western Asset Management Company (“Western Asset”) and Western Asset Management Company Limited (“Western Asset Limited”) are the Fund’s subadvisers. LMPFA, Western Asset and Western Asset Limited are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

LMPFA provides administrative and certain oversight services to the Fund. The Fund pays LMPFA an investment management fee, calculated daily and paid monthly, at an annual rate of 1.050% of the Fund’s average weekly net assets up to $250 million and 1.025% of the Fund’s average weekly net assets in excess of $250 million, for its services. LMPFA has delegated to Western Asset the day-to-day portfolio management of the Fund. For its services, LMPFA pays Western Asset 70% of the net management fee it receives from the Fund. Western Asset Limited provides certain advisory services to the Fund relating to currency transactions and investments in non-U.S. dollar denominated securities. Western Asset Limited does not receive any compensation from the Fund but is paid by Western Asset for its services to the Fund.

Certain officers and one Director of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

3. Investments

During the year ended October 31, 2008, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

Purchases | | $67,942,837 | |

Sales | | 87,939,180 | |

22 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

At October 31, 2008, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

Gross unrealized appreciation | | $ 934,996 | |

Gross unrealized depreciation | | (55,065,598 | ) |

Net unrealized depreciation | | $(54,130,602 | ) |

Transactions in reverse repurchase agreements for the Fund during the year ended October 31, 2008 were as follows:

AVERAGE

DAILY

BALANCE* | | WEIGHTED

AVERAGE

INTEREST RATE* | | MAXIMUM

AMOUNT

OUTSTANDING | |

$9,422,912 | | 2.647% | | $10,930,042 | |

* | Average based on the number of days that the Fund had reverse repurchase agreements outstanding. |

Interest rates on reverse repurchase agreements ranged from 0.350% to 4.750% during the year ended October 31, 2008. Interest expense incurred on reverse repurchase agreements totaled $236,260.

At October 31, 2008, the Fund had the following open forward foreign currency contracts as described below:

FOREIGN

CURRENCY | | | | LOCAL

CURRENCY | | MARKET

VALUE | | SETTLEMENT

DATE | | UNREALIZED

GAIN(LOSS) | |

Contracts to Buy: | | | | | | | | | | | |

Russian Ruble | | | | 17,323,020 | | $615,002 | | 12/8/08 | | $ (57,998 | ) |

Russian Ruble | | | | 13,459,741 | | 477,848 | | 12/8/08 | | (45,246 | ) |

Russian Ruble | | | | 7,421,520 | | 262,644 | | 12/11/08 | | (26,205 | ) |

Russian Ruble | | | | 9,087,390 | | 321,598 | | 12/11/08 | | (29,402 | ) |

| | | | | | | | | | (158,851 | ) |

Contracts to Sell: | | | | | | | | | | | |

Euro | | | | 260,230 | | $330,725 | | 12/8/08 | | $ 38,463 | |

Euro | | | | 199,944 | | 254,108 | | 12/8/08 | | 29,773 | |

Euro | | | | 204,000 | | 259,254 | | 12/11/08 | | 29,595 | |

| | | | | | | | | | 97,831 | |

Net unrealized loss on open forward foreign currency contracts | | | | | | $ (61,020 | ) |

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 23 |

Notes to financial statements continued

At October 31, 2008, the Fund held the following credit default swap contracts:

SWAP COUNTERPARTY

(REFERENCE ENTITY) | | NOTIONAL

AMOUNT | | TERMINATION

DATE | | PERIODIC

PAYMENTS

MADE BY

THE FUND‡ | | PERIODIC

PAYMENTS

RECEIVED BY

THE FUND‡ | | UNREALIZED

DEPRECIATION | |

Credit Default Swaps: | | | | | | | | | | | |

| | | | | | | | | | | |

Credit Suisse First Boston Inc.

(RSHB Capital, 7.175% due 5/16/13) | | $1,430,000 | | 11/20/08 | | (a) | | 8.000% quarterly | | $ (3,235 | ) |

Credit Suisse First Boston Inc.

(Turanalem Finance BV, 8.000% due 3/24/14) | | 1,430,000 | | 11/20/08 | | (a) | | 27.500% quarterly | | (8,640 | ) |

Credit Suisse First Boston Inc.

(Turanalem Finance BV, 8.000% due 3/24/14) | | 1,622,000 | | 11/20/08 | | (a) | | 31.000% quarterly | | 0 | |

Net unrealized depreciation on open swap contracts | | | | | $(11,875 | ) |

‡ | Percentage shown is an annual percentage rate. |

(a) | As a seller of protection, the Fund will pay an amount up to the notional value of the swap, and in certain instances take delivery of the security if a credit event occurs. |

4. Loan

At October 31, 2008, the Fund had a $22,000,000 credit line pursuant to an amended and restated revolving credit and security agreement, dated as of November 20, 2006, among the Fund, CHARTA, LLC (“the Lender”), as successor by assignment to Panterra Funding LLC, and Citibank N.A. (“Citibank”) as a secondary lender, for which Citibank also acts as administrative agent. The loan generally bears interest at a variable rate based on the weighted average interest rates of the underlying commercial paper or LIBOR, plus any applicable margin. In addition, the Fund pays a commitment fee at an annual rate of 0.10% on the total amount of the credit line, whether used or unused. Securities held by the Fund are subject to a lien, granted to the lenders, to the extent of the borrowing outstanding and any additional expenses. For the year ended October 31, 2008, the Fund did not have any borrowings outstanding under this credit agreement.

5. Distributions subsequent to October 31, 2008

On August 14, 2008, the Board of Directors (“Board”) of the Fund declared a distribution in the amount of $0.1000 per share, payable on November 28, 2008 to shareholders of record on November 21, 2008. On November 17, 2008, the Board declared a distribution in the amount of $0.1000 per share, payable on December 26, 2008 to shareholders of record on December 19, 2008. Additionally, the Board declared two distributions in the amount of $0.1000 per share, payable on January 30, 2009 and February 27, 2009 to shareholders of record on January 23, 2009 and February 20, 2009, respectively.

24 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

6. Income tax information and distributions to shareholders

The tax character of distributions paid during the fiscal years ended October 31, were as follows:

| | 2008 | | 2007 | |

Distributions Paid From: | | | | | |

Ordinary income | | $11,313,915 | | $12,265,308 | |

Net long-term capital gains | | 3,653,302 | | 5,940,033 | |

Total taxable distributions | | $14,967,217 | | $18,205,341 | |

As of October 31, 2008, the components of accumulated earnings on a tax basis were as follows:

Undistributed ordinary income — net | | $ 4,520,263 | |

Undistributed long-term capital gains — net | | 712,021 | |

Total undistributed earnings | | 5,232,284 | |

Other book/tax temporary differences(a) | | 17,474 | |

Unrealized appreciation/(depreciation)(b) | | (54,583,366 | ) |

Total accumulated earnings/(losses) — net | | $(49,333,608 | ) |

(a) | Other book/tax temporary differences are attributable primarily to the realization for tax purposes of unrealized losses on foreign currency contracts and book/tax differences in the timing of the deductibility of various expenses. |

(b) | The difference between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax deferral of losses on wash sales and the difference between book and tax amortization methods for premiums on fixed income securities. |

7. Recent accounting pronouncements

On September 20, 2006, the Financial Accounting Standards Board (“FASB”) released Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements. The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management has determined that there is no material impact to the Fund’s valuation policies as a result of adopting FAS 157. The Fund will implement the disclosure requirements beginning with its January 31, 2009 Form N-Q.

* * *

In March 2008, FASB issued the Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“FAS 161”). FAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. FAS 161 requires enhanced disclosures about the Fund’s derivative and hedging activities, including how such activities are accounted for and their effect on the Fund’s financial position, performance and

Western Asset Worldwide Income Fund Inc. 2008 Annual Report | | 25 |

Notes to financial statements continued

cash flows. Management is currently evaluating the impact the adoption of FAS 161 will have on the Fund’s financial statements and related disclosures.

* * *

During September, 2008 FASB Staff Position FAS 133-1 and FASB Interpretation 45-4, Disclosures about Credit Derivatives and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the Effective Date of FASB Statement No. 161 (“Amendment”) was issued and is effective for annual and interim reporting periods ending after November 15, 2008. The Amendment requires enhanced disclosures regarding credit derivatives and hybrid financial instruments containing embedded credit derivatives. Management is currently evaluating the impact the adoption of the Amendment will have on the Fund’s financial statement disclosures.

8. Investment restriction

The Fund’s investment policy states that under normal market conditions, the Fund will invest at least 65% of its total assets in high-yield foreign sovereign debt securities. The Fund also may invest up to 35% of its total assets in high-yield non-U.S. and U.S. corporate debt securities.

As of October 31, 2006, the Fund had approximately 55% in high-yield foreign sovereign debt securities. During the year ended October 31, 2007, the Fund’s investment manager has realigned the Fund’s portfolio to meet the Fund’s investment policy and has reimbursed the Fund for losses and transaction costs incurred by the Fund in the amount of $143,005.

26 | | Western Asset Worldwide Income Fund Inc. 2008 Annual Report |

Report of independent registered public accounting firm

The Board of Directors and Shareholders

Western Asset Worldwide Income Fund Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Western Asset Worldwide Income Fund Inc. as of October 31, 2008, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the four-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the year ended October 31, 2004 were audited by other independent registered public accountants whose report thereon, dated December 21, 2004, expressed an unqualified opinion on those financial highlights.