Putnam Management

100 Federal Street

Boston, MA 02110

August 30, 2022

Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 Attn: David Manion and Timothy Worthington | |

Re: Comments on Registration Statement on Form N-14 (File No. 333-266242), filed with the Securities and Exchange Commission (the “Commission”) on July 20, 2022 (the “Registration Statement”), of Putnam Asset Allocation Funds (the “Registrant”), on behalf of its series, Putnam Multi-Asset Income Fund (the “Surviving Fund”)

Dear Messrs. Manion and Worthington:

This letter responds to the comments that Mr. Manion provided telephonically to Venice Monagan and Janet Smith of Putnam Management and Yana Guss and Elizabeth Madsen of Ropes & Gray LLP (“Ropes & Gray”), counsel to the Funds, on behalf of the staff of the Commission (the “Staff”) on August 1, 2022 and to the comments that Mr. Worthington provided telephonically to Peter Fariel and Venice Monagan of Putnam Management and Elizabeth Madsen of Ropes & Gray on behalf of the Staff on August 17, 2022 regarding the Registration Statement. The Registration Statement relates to the merger of Putnam Multi-Asset Absolute Return Fund (the “Acquired Fund”) with and into the Surviving Fund (the Acquired Fund and the Surviving Fund are collectively referred to as the “Funds”). For convenience of reference, I have summarized each of the Commission Staff’s comments before the Registrant’s response. The Commission Staff’s comments will be addressed in a pre-effective amendment to the Registration Statement to be filed on or around September 6, 2022.

Accounting Comments

| 1. | Comment: Please provide hyperlinks to all documents that are incorporated by reference into this filing. |

Response: The requested change has been made.

| 2. | Comment: Please amend the Registration Statement to include a delaying amendment in accordance with Rule 473 under the Securities Act of 1933, as amended. |

Response: The requested filing was made on August 17, 2022.

| 3. | Comment: Please supplementally provide the analysis for Putnam Management’s determination that the Surviving Fund is the appropriate accounting and performance survivor of the merger. |

Response: Analysis supporting Putnam Management’s determination that the Surviving Fund is the appropriate accounting and performance survivor of the merger was provided to the Staff via email on August 9, 2022 and a supplemental letter was submitted to the Staff via email on August 19, 2022. A copy of the letter provided on August 18, 2022 is attached hereto as Appendix A.

| 4. | Comment: In the “Message from the President and Chair,” please note that Putnam Multi-Asset Income Fund was previously known as Putnam Income Strategies Portfolio. Additionally, when reference is made to prior filings of Putnam Multi-Asset Income Fund, please include a reference to the Fund’s prior name. |

Response: The requested changes have been made.

| 5. | Comment: Under the heading “How do the management fees and other expenses of the funds compare, and what are they estimated to be following the proposed merger?” in the section “Questions and Answers Regarding the Proposed Merger,” the Staff notes a sentence which states “As of May 31, 2022, the total annual fund operating expense ratio after expense reimbursement of Putnam Multi-Asset Absolute Return Fund was 0.73%.” Please add disclosure noting to which class of shares of Putnam Multi-Asset Absolute Return Fund this sentence applies. |

Response: The Registrant has added disclosure clarifying that this sentence applies to class Y shares.

| 6. | Comment: Under the heading “What are the federal income tax consequences of the proposed merger?” in the section “Questions and Answers Regarding the Proposed Merger,” the Staff notes a sentence which mentions Putnam Multi-Asset Income Fund’s “repositioning in July 2022.” Please supplementally describe this repositioning. |

Response: The following changes to Putnam Multi-Asset Income Fund’s name, investment objective, principal investment strategy, fee structure, as well as to the share classes offered by the fund occurred upon the effectiveness of an amendment to the fund’s registration statement on July 12, 2022. Specifically:

| • | The fund’s name changed to “Putnam Multi-Asset Income Fund” (it was previously called Putnam Income Strategies Portfolio). |

| • | The fund’s investment goal was previously “to seek total return consistent with preservation of capital with total return composed of capital appreciation and income.” As revised, the fund’s goal is “to seek total return consistent with conservation of capital. Within the fund’s total return orientation, the fund seeks to provide current income, along with long-term capital appreciation.” |

| • | The fund’s benchmark was previously a custom blended benchmark, the Putnam Income Strategies Blended Benchmark. Previously, the benchmark was 55% the Bloomberg U.S. Aggregate Bond Index, 21% the Russell 3000® Index, 14% the JPMorgan Developed High Yield Index, 6% the ICE BofA U.S. Treasury Bill Index, and 4% the MSCI EAFE Index (ND). The fund’s current benchmark, the Putnam Multi-Asset Income Blended Benchmark, is 55% the Bloomberg U.S. Aggregate Bond Index, 22.5% the Russell 3000® Index, 18% the JPMorgan Developed High Yield Index, and 4.5% the MSCI EAFE Index (ND). |

| • | The fund’s principal investment strategy changed to slightly increase the fund’s strategic allocation to equity and to slightly decrease its strategic allocation to fixed income, as follows: |

| Class | Prior Strategic Allocation | Current Allocation | Prior and Current Strategic Range |

| Equity | 25% | 27% | 5-50% |

| Fixed Income | 75% | 73% | 50-95% |

| • | The class of shares of the fund that had been outstanding was redesignated as Class P shares. |

| • | The fund has registered several additional classes of shares, including Class A, Class C, Class R, Class R5, Class R6, and Class Y shares. |

Additionally, the Registrant has added the following disclosure under the heading “How does the investment performance of the funds compare?” in the section “Questions and Answers Regarding the Proposed Merger”:

Before July 2022, Putnam Multi-Asset Income Fund had a slightly different investment goal and principal investment strategy. In particular, it had a small allocation to cash, which was eliminated in July 2022, resulting in small increases in exposure to equity investments and high yield bonds.

| 7. | Comment: Under the heading “How does the investment performance of the funds compare?” in the section “Questions and Answers Regarding the Proposed Merger,” the Staff notes a sentence which states “As of June 15, 2022, Putnam Management anticipates that Putnam Multi-Asset Absolute Return Fund will dispose of approximately 82% of its portfolio holdings prior to the merger….” Please describe supplementally |

whether this percentage is inclusive of any sale of assets that will be necessary to effect the redemption of Putnam RetirementReady Fund shareholders.

Response: The Registrant confirms that this figure does not include any sale of assets that will be necessary to effect the redemption of the Putnam RetirementReady Fund shareholders.

| 8. | Comment: Please confirm supplementally that current fees and expenses were used to prepare the Shareholder Fees and Annual Fund Operating Expenses tables. |

Response: The Registrant confirms fees and expenses as of February 28, 2022 (Putnam Multi-Asset Absolute Return Fund’s fiscal year end) were used to prepare the Shareholder Fees and Annual Fund Operating Expenses tables on pages 28-31 in Part A of the Registration Statement. Separately, in connection with comments nos. 10 and 18, the Registrant has added Shareholder Fees and Annual Fund Operating Expense tables in Appendix A of Part A of the Registration Statement which are based on the anticipated fees and expenses as of February 3, 2023, following the anticipated redemption of Putnam RetirementReady Funds’ investments in Putnam Multi-Asset Absolute Return Fund.

| 9. | Comment: Given the significant reduction in assets expected following the redemption of the Putnam RetirementReady Funds’ investments in Putnam Multi-Asset Absolute Return Fund, please confirm supplementally whether Putnam Multi-Asset Absolute Return Fund’s prospectus will be stickered in connection with this expected redemption. |

Response: Putnam Management notes that the Registration Statement includes disclosure regarding the Putnam RetirementReady Funds redemption and that Putnam Management has issued press releases announcing the changes to the Putnam RetirementReady Funds, including that the Putnam RetirementReady Funds will be redeeming current investments in underlying funds. Putnam Management has not yet made a determination as to whether it will supplement Putnam Multi-Asset Absolute Return Fund’s prospectus but will consider the facts and circumstances at the time, including whether the merger is approved by shareholders of Putnam Multi-Asset Absolute Return Fund.

| 10. | Comment: Please include an Annual Fund Operating Expenses table which reflects the expected fees and expenses to be in effect following the redemption of the Putnam RetirementReady Funds’ investments in Putnam Multi-Asset Absolute Return Fund but before the closing of the merger. |

Response: The requested change has been made. An Annual Fund Operating Expenses table which reflects the expected fees and expenses to be in effect following the redemption of the Putnam RetirementReady Funds’ investments in Putnam Multi-Asset Absolute Return Fund but before the closing of the merger has been added in Appendix A to Part A of the Registration Statement.

| 11. | Comment: Please add disclosure noting that the pro forma expense reimbursement for the Acquiring Fund reflects a contractual expense limitation on the Acquiring Fund’s total expense ratio of 40 basis points that went into effect in July 2022, replacing a prior contractual expense limitation of 46 basis points. |

Response: The requested change has been made.

| 12. | Comment: With respect to the Expense Example table, please confirm that that the figures provided for the costs over 10 years are correct for the following share classes: class B and class C of the Target Fund, class C and class P of the Acquiring Fund, and class C and P of the pro forma combined fund. |

Response: The Registrant confirms that the figures provided in the Expense Example table are correct.

| 13. | Comment: Under the heading “Performance” in the section “Trustees’ Considerations Relating to the Proposed Merger,” the Staff notes disclosure stating, “…Putnam Multi-Asset Absolute Return Fund has a stronger performance record than Putnam Multi-Asset Income Fund over the one-year and year-to-date periods ended May 31, 2022….” Please provide additional disclosure in support of this statement. For example, how much better was the performance of Putnam Multi-Asset Absolute Return Fund than the performance of Putnam Multi-Asset Income Fund over those periods? Please note supplementally where the performance relating to this sentence is included in the filing. |

Response: The Registrant has added additional performance disclosure in support of this statement. The Registrant notes that a performance table comparing performance as of May 31, 2022 is not included in the Registration Statement but has been provided supplementally below. The Registrant respectfully notes that a comparison of the Funds calendar year total returns and a table of Average Annual Total Returns is included under the heading “How does the investment performance of the funds compare?” in the section “Questions and Answers Regarding the Proposed Merger.”

| FOR THE PERIOD ENDED MAY 31, 2022 | | | | | |

| | | One | Since | 3 Years | 5 Years | 10 years |

| | YTD | Year | 12/31/2019 | Ann | Ann | Ann |

| Putnam Multi-Asset Absolute Return Fund class A | 2.42 | 3.12 | -1.91 | -1.57 | -0.81 | 1.47 |

| Putnam Multi-Asset Income Fund (formerly, Putnam Income Strategies Portfolio) class A | -8.98 | -6.84 | 0.76 | | | |

| 14. | Comment: The Staff notes the discussion of the performance of a CIT under the heading “Performance” in the section “Trustees’ Considerations Relating to the Proposed Merger.” Please discuss supplementally how the performance of the CIT compared to the Target Fund, taking into account any higher fees paid by the Target Fund. |

Response: As reflected in the performance comparison provided below, Putnam RA Income Strategies Trust, the CIT, outperformed the Target Fund for the three-, five- and ten-year and since-inception periods ended May 31, 2022. The performance reflected below has been adjusted to account for the higher fees paid by the Target Fund.

| FOR THE PERIOD ENDED MAY 31, 2022 | | | | | |

| | | One | 3 Years | 5 Years | 10 years | Since |

| | YTD | Year | Ann | Ann | Ann | 12/23/2008 |

| Putnam Multi-Asset Absolute Return Fund class A | 2.42 | 3.12 | -1.57 | -0.81 | 1.47 | 2.84 |

| Putnam RA Income Strategies Trust | -8.42 | -5.41 | 5.33 | 4.95 | 6.39 | 8.37 |

| 15. | Comment: Under the heading “Ongoing fund expenses” in the section “Trustees’ Considerations Relating to the Proposed Merger,” please include additional disclosure relating to the timing of the Putnam RetirementReady Funds repositioning and redemption. |

Response: The requested change has been made.

| 16. | Comment: Under the heading “Other factors” in the section “Trustees’ Considerations Relating to the Proposed Merger,” the Staff notes disclosure stating, “Putnam Multi-Asset Income Fund has fewer net assets than Putnam Multi-Asset Absolute Return Fund.” Please revise this statement to note that Putnam Multi-Asset Income Fund has significantly fewer net assets than Putnam Multi-Asset Absolute Return Fund. |

Response: The Registrant has revised the disclosure to state that “Putnam Multi-Asset Absolute Return Fund is a significantly smaller fund than Putnam Multi-Asset Income Fund.”

| 17. | Comment: Under the heading “Federal Income Tax Consequences” in the section “Information about the Proposed Merger,” please include a discussion of the Target Fund’s pre-merger capital loss carryovers and the application of these amounts in light of the redemptions by the Putnam RetirementReady Funds. Please disclose whether you expect gains or losses to be incurred. |

Response: The Registrant has added disclosure noting that the Target Fund’s pre-merger capital loss carryovers will not be impacted by the Putnam RetirementReady Funds’ redemptions, as the Target Fund has net unrealized losses at 7/31/22, and securities sold to cover the redemptions are expected to generate realized capital losses.

| 18. | Comment: Please include a capitalization table which reflects the expected capitalization of the funds following the redemption of the Putnam RetirementReady Funds’ investments in Putnam Multi-Asset Absolute Return Fund but before the closing of the merger. |

Response: The requested change has been made. A capitalization table which reflects the expected capitalization of the funds following the redemption of the Putnam RetirementReady Funds’ investments in Putnam Multi-Asset Absolute Return Fund but before the closing of the merger has been included in Appendix A to Part A of the N-14.

| 19. | Comment: Please add disclosure to the Share Ownership tables flagging the expected redemptions of investments by the Putnam RetirementReady Funds in the Target Fund. |

Response: The requested change has been made.

| 20. | Comment: Please add a discussion about the expected redemptions of investments by the Putnam RetirementReady Funds in the Target Fund to the Pro Forma Financial Information section. |

Response: The requested change has been made.

| 21. | Comment: Under the heading “Narrative Description of the Pro Forma Effects of the Reorganization” in the section “Pro Forma Financial Information,” the Staff notes the inclusion of the following sentence: “The significant accounting policies, including valuation policies, of Putnam Multi-Asset Income Fund and Putnam Multi-Asset Absolute Return Fund are substantially identical and are not expected to change as a result of the merger.” Please edit this sentence to add a reference to “federal income tax policies” in addition to valuation policies. |

Response: The requested change has been made.

| 22. | Comment: Under the heading “Portfolio Realignment” in the section “Pro Forma Financial Information,” the Staff notes disclosure stating that “Putnam Management estimates that the fund would have paid $1.9 million (0.32% of total fund assets) in brokerage fees” if the merger had occurred on June 15, 2022. Please disclose supplementally whether this estimate includes any amounts necessary to effect redemption of the Putnam RetirementReady Funds’ investments out of the Target Fund. |

Response: The Registrant confirms that this estimate does not include amounts necessary to effect redemption of the Putnam RetirementReady Funds’ investments out of the Target Fund.

Disclosure Comments

| 1. | Comment: Please add disclosure describing the consequences of the Acquired Fund’s shareholders not approving the merger. |

Response: The requested change has been made. The Registrant has added the following disclosure under the heading “How do the management fees and other expenses of the funds compare, and what are they estimated to be following the proposed merger?” in the section “Questions and Answers Regarding the Proposed Merger”:

If shareholders do not approve the merger, Putnam Management expects to request that the Board of Trustees consider other strategic alternatives for the Putnam Multi-Asset Absolute Return Fund, which could include liquidation of the fund.

| 2. | Comment: The Staff notes that disclosure included in the section “Questions and Answers Regarding the Proposed Merger” does not appear to address any negative consequences or counterarguments to the merger. Please ensure all essential information |

about the Registrant and transaction is disclosed in such a way as to allow an informed proxy vote.

Response: The Registrant confirms its belief that all essential information about the Registrant and transaction is disclosed in the Registration Statement. The Registrant respectfully notes the following disclosure, which is included under the heading “How do the management fees and other expenses of the funds compare, and what are they estimated to be following the proposed merger?” in the section “Questions and Answers Regarding the Proposed Merger:”

If the merger with Putnam Multi-Asset Income Fund, which does not have a performance adjustment to its management fee, does not occur, Putnam Multi-Asset Absolute Return Fund’s management fee will continue to be adjusted based on its performance. If the merger does not occur, shareholders of Putnam Multi-Asset Absolute Return Fund will bear lower effective management fee rates if Putnam Multi-Asset Absolute Return Fund underperforms its benchmark index by an amount sufficient to reduce the fund’s effective management fee rate below the rate charged to Putnam Multi-Asset Income Fund. Conversely, shareholders of Putnam Multi-Asset Absolute Return Fund will bear higher management fee rates if Putnam Multi-Asset Absolute Return Fund outperforms its benchmark index or underperforms its benchmark index by an amount insufficient to decrease Putnam Multi-Asset Absolute Return Fund’s effective management fee rate below the rate charged to Putnam Multi-Asset Income Fund. Nevertheless, absent significant over-performance during the next three years against the performance benchmark index, Putnam Multi-Asset Absolute Return Fund, in the absence of the merger, would likely continue to be subject to negative performance adjustments for the next three years due to the inclusion of historical periods of significant underperformance in the performance adjustment calculation.

| 3. | Comment: Please consider providing a more detailed Table of Contents. |

Response: The Registrant respectfully declines to make this change. The Registrant notes that the Table of Contents included on page 3 of the proxy statement provides page numbers for all sections and appendices included in Part A of the Registration Statement.

| 4. | Comment: Under the heading “What is being proposed?” in the section “Questions and Answers Regarding the Proposed Merger,” the Staff notes a sentence which states “Shareholders will receive Merger Shares of the same class as the Putnam Multi-Asset Absolute Return Fund shares they held, except for shareholders of class B shares of Putnam Multi-Asset Absolute Return Fund, who will receive class A shares of Putnam Multi-Asset Income Fund.” Please explain the difference between class A shares and |

class B shares and how those differences would affect a shareholder. If there are no differences, please state as much.

Response: Class A shares have lower annual expenses and higher dividends than class B shares because class A shares have lower 12b-1 fees than class B shares. Shareholders of class B of Putnam Multi-Asset Absolute Return Fund who receive class A shares of Putnam Multi-Asset Income Fund through the merger will experience lower annual expenses and higher dividends than if they had received class B shares.

| 5. | Comment: Under the heading “Why is the merger being proposed?” in the section “Questions and Answers Regarding the Proposed Merger,” the Staff notes a sentence which states “However, if shareholders approve the merger, Putnam Management currently anticipates that the merger will be effected following the repositioning (“RR Funds Repositioning”) of the Putnam RetirementReady Funds (the “RR Funds”) as a suite of ESG-focused exchange-traded funds, which will necessitate a redemption by the RR Funds of their investments in Putnam Multi-Asset Absolute Return Fund and the other underlying mutual funds.” Please consider redrafting this sentence to clarify that the Putnam RetirementReady Funds repositioning is not contingent on the merger. |

Response: The Registrant has deleted the sentence in question and has added the following disclosure under the heading “What are the costs associated with the merger?” in the section “Questions and Answers Regarding the Proposed Merger”:

Putnam Management currently anticipates that the merger, if approved by shareholders, will close on or about February 13, 2023, following the repositioning (“RR Funds Repositioning”) of the Putnam RetirementReady Funds (the “RR Funds”). In the RR Funds Repositioning, which does not require any shareholder approval, the RR Funds will redeem their investments in Putnam Multi-Asset Absolute Return Fund (and all of the other underlying mutual funds in which the RR Funds currently invest) and will become an ESG-focused target date suite of funds that invest in exchange-traded funds that each pursue an ESG-focused principal investment strategy. The RR Funds Repositioning is expected to occur on or about February 3, 2023, a little more than one week before the merger. The RR Funds Repositioning and the merger are entirely independent of one another. The RR Funds Repositioning (and related redemption by the RR Funds of their investments in Putnam Multi-Asset Absolute Return Fund) will occur whether or not shareholders approve the merger, and the merger, if approved by shareholders, will occur whether or not the RR Funds Repositioning occurs.

| 6. | Comment: Under the heading “Why is the merger being proposed?” in the section “Questions and Answers Regarding the Proposed Merger,” please add disclosure noting that the merger will proceed even if the Putnam RetirementReady Funds repositioning does not occur. |

Response: The Registrant has added the requested disclosure under the heading “What are the costs associated with the merger?” in the section “Questions and Answers Regarding the Proposed Merger.” Please see response to comment #5 above.

| 7. | Comment: Under the heading “How do the investment goals, strategies, policies, and restrictions of the two funds compare?” in the section “Questions and Answers Regarding the Proposed Merger,” the Staff notes language which states, “…provided that this limitation does not apply to obligations issued or guaranteed as to interest or principal by the U.S. government or its agencies or instrumentalities or to securities issued by other investment companies (emphasis added).” Please explain supplementally whether this statement implies that the Acquiring Fund may invest to a greater extent in government-backed securities and if so, whether that affects the risk profile of the Acquiring Fund. |

Response: The Registrant notes that the ability of the Acquiring Fund to acquire more than 10% of the voting securities of an obligation issued or guaranteed as to interest or principal by the U.S. government or its agencies or instrumentalities would provide the Acquiring Fund with greater flexibility, as compared with the Acquired Fund. As a practical matter, however, Putnam Management does not believe that the Acquiring Fund will take advantage of this greater flexibility, and thus does not believe that this flexibility alters the risk profile of the Acquiring Fund.

| 8. | Comment: Please consider removing the disclosure following the “Average annual total returns” relating to the trademarks, service marks, and copyrights of Bloomberg Finance L.P., Frank Russell Company and ICE BofA Indexes, as this information is inconsistent with form filing requirements. |

Response: The Registrant notes that, pursuant to a licensing agreement with Bloomberg, the Registrant is required to identify Bloomberg as the source of any return information included in the prospectus in respect of a Bloomberg index (including when included as a component of a blended benchmark) alongside each reference to that index in the registration statement. Accordingly, the Fund respectfully declines to remove the footnote to the “Average annual total return” table that identifies Bloomberg as the source of return information for the Bloomberg U.S. Aggregate Bond Index, a component of the Putnam Multi-Asset Income Blended Benchmark. The Registrant further notes that, pursuant to licensing agreements with Bloomberg, Russell and ICE BofA, any time that return information is included in the prospectus in respect of a Bloomberg, Russell or

ICE BofA index (including when included as a component of a blended benchmark), the Fund is required to include the other disclaimers relating to Bloomberg, Russell or ICE BofA, as the case may be, within the prospectus but not necessarily alongside the return information. Accordingly, and in light of Commission Staff’s request, the Registrant has relocated those disclaimers to another section of the prospectus.

| 9. | Comment: Under the heading “What are the costs associated with the merger?” in the section “Questions and Answers Regarding the Proposed Merger,” the Staff notes a sentence which states “These costs will be borne by Putnam Multi-Asset Absolute Return Fund and are not included in the merger costs described in the paragraph above.” Please describe whether there will be any tax impact to Putnam Multi-Asset Absolute Return Fund resulting from the Putnam RetirementReady Funds’ redemption. Please provide an estimate of the capital gains distribution which could be triggered by such redemption. |

Response: The Registrant does not expect that the redemption by the Putnam RetirementReady Funds of their investment in Putnam Multi-Asset Absolute Return Fund to trigger a realized capital gain distribution in Putnam Multi-Asset Absolute Return Fund.

| 10. | Comment: Do both the Acquired Fund and Acquiring Fund invest in the same type of assets with similar levels of exposure? If not, please add disclosure describing those differences and explaining how those differences could impact the relative risk of investing in the Acquiring Fund. |

Response: The sector and asset class exposures of the Acquired Fund and the Acquiring Fund differ, primarily with respect to their exposure to equity investments. Although the Acquired Fund’s investment strategy contemplates investments in a wide range of asset classes, including equity securities, it does not have a fixed strategic allocation to equity securities and its exposure has varied significantly over time. In contrast, the Acquiring Fund has a strategic allocation to equity securities of 27% (with a permitted range of 5-50%). The Acquired Fund has historically made significant use of derivatives. The Acquiring Fund makes less use of derivatives than the Acquired Fund, but has generally used swaps to gain its target allocation of fixed income and equity exposure. In addition, the Acquired Fund’s exposure to corporate bonds has historically been lower than the exposure of the Acquiring Fund. As of July 31, 2022, the Acquiring Fund had over 28% of its assets invested directly in corporate bonds as well as some additional exposure through swaps on corporate bond ETFs, and over 21% of its assets invested in stocks. As of July 31, 2022, Putnam Multi-Asset Absolute Return Fund had no exposure to corporate bonds and only 3% of its assets were invested in stocks. Despite these differences, in sector and asset class exposure, Putnam Management believes that the

risk/return profiles of the funds are substantially similar. The Registrant proposes to add the following disclosure under the heading “How do the investment goals, strategies, policies, and restrictions of the two funds compare?” in the section “Questions and Answers Regarding the Proposed Merger”:

The risk/return profile of the combined fund following the merger is expected to be substantially similar to the risk/return profile of Putnam Multi-Asset Income Fund. Putnam Multi-Asset Income Fund’s risk/return profile is substantially similar to that of Putnam Multi-Asset Absolute Return Fund but, as discussed in the sub-section What are the principal investment strategies and related risks? below, the funds’ sector and asset class exposures differ, primarily with respect to their exposure to equity investments. Although Putnam Multi-Asset Absolute Return Fund’s investment strategy contemplates investments in a wide range of asset classes, including equity securities, it does not have a fixed strategic allocation to equity securities. In contrast, Putnam Multi-Asset Income Fund has a strategic allocation to equity securities of 27%.

In addition, the Registrant will add the following disclosure under the caption “What are the funds’ principal investment strategies and related risks?”

Putnam Multi-Asset Absolute Return Fund normally has significant exposure to derivatives, while Putnam Multi-Asset Income Fund invests in swaps to gain its target allocation of fixed income and equity exposure. The funds strategies also differ in their exposure to equity investments. Although Putnam Multi-Asset Absolute Return Fund’s investment strategy contemplates investments in a wide range of asset classes, including equity securities, it does not have a fixed strategic allocation to equity securities. In contrast, Putnam Multi-Asset Income Fund has a strategic allocation to equity securities of 27% (with a permitted range of 5-50%) and 73% to fixed income securities (with a permitted range of 50-95%).

| 11. | Comment: In the section “Risk Factors,” the Staff notes a sentence that states “The principal risks of an investment in Putnam Multi-Asset Income Fund, the acquiring fund, are substantially similar to the principal risks of an investment in Putnam Multi-Asset Absolute Return Fund, except that Putnam Multi-Asset Income Fund also invests in convertible securities.” Please consider explaining how Putnam Multi-Asset Income Fund’s investment in convertible securities impacts the risk profile of the fund. |

Response: Although Putnam Multi-Asset Income Fund may invest in convertible securities, Putnam Management does not expect investments in convertible securities to be significant enough to impact the risk profile of the fund.

| 12. | Comment: The sixth bullet point under the heading “What are the principal risks of Putnam Multi-Asset Income Fund, and how do they compare with those of Putnam Multi-Asset Absolute Return Fund?” in the section “Risk Factors” states, “the risk that these effects could negatively impact the fund’s performance and lead to losses on your investment in the fund.” Please clarify what is meant by “these effects.” |

Response: The Registrant has edited the disclosure to clarify that “these effects” refers to negative effects of the coronavirus pandemic and efforts to contain its spread on the value, volatility and liquidity of the securities and other assets in which the fund invests.

| 13. | Comment: The thirteenth bullet point under the heading “What are the principal risks of Putnam Multi-Asset Income Fund, and how do they compare with those of Putnam Multi-Asset Absolute Return Fund?” in the section “Risk Factors” states, “the potential for default risk to be higher for non-qualified mortgages.” Please clarify what default risk is being compared to. |

Response: The Registrant has revised the disclosure to clarify that default risk has the potential to be higher for non-qualified mortgages than for qualified mortgages.

| 14. | Comment: In the section “Risk Factors,” the Staff notes the inclusion of disclosure which states, “The fund expects to engage in frequent trading.” How does the frequency of trading compare between the Acquired Fund and Acquiring Fund? |

Response: As disclosed in the most recent shareholder report for the semi-annual period ended February 28, 2022, the Acquiring Fund’s portfolio turnover for the period then ended was 65% (with portfolio turnover rates of 144% and 54% for the periods ended 8/31/21 and 8/31/20, respectively). With respect to the Acquired Fund, the portfolio turnover rate for the semi-annual period ended April 30, 2022 was 756% (with portfolio turnover rates of 1040% and 416%, respectively, for the periods ended 10/31/21 and 10/31/20).

| 15. | Comment: Under the heading “What are the funds’ principal investment strategies and related risks?” in the section “Risk Factors,” the Staff notes disclosure explaining that the Acquired Fund combines “directional” strategies and “non-directional” strategies. Does the Acquiring Fund also invest in “directional” and “non-directional” strategies? If not, |

please explain how the Acquiring Fund selects investments. If so, please add disclosure clarifying the strategy is shared across both funds.

Response: The Acquiring Fund does not employ express “directional” or “non-directional” strategies as a component of its investment strategy. As disclosed in the Registration Statement, the Acquiring Fund may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell equity investments. The Acquiring Fund may also consider, among other factors, credit, interest rate and prepayment risks, as well as general market conditions, when deciding whether to buy or sell fixed-income investments. In managing the Acquiring Fund, Putnam Management makes asset allocation decisions for the Acquiring Fund with respect to asset classes and security selection relative to its custom benchmark, including whether to underweight or overweight the benchmark. Although this approach has some similarities to the directional strategy of the Acquired Fund that is managed against a cash benchmark, it is not an express directional strategy.

| 16. | Comment: Please ensure that the discussion regarding the risks of investing in derivatives that appears under the heading “What are the funds’ principal investment strategies and related risks?” in the section “Risk Factors” is appropriately tailored for each type of derivatives instrument that the Acquiring Fund is expected to use as part of its principal investment strategies. For additional guidance, please refer to the letter from Mr. Barry Miller, Associate Director of the SEC's Office of Legal Disclosure, to Ms. Karrie McMillan, General Counsel, Investment Company Institute, dated July 30, 2010 (“Barry Miller Letter”). Disclosure for any principal investment related to derivatives should be tailored specifically to how a fund expects to be managed and should address those strategies that the fund expects to be the most important means of achieving its objectives and that it anticipates will have a significant effect on its performance. Disclosure should not be generic risks associated with each derivative type. |

Response: The Registrant has reviewed the disclosure regarding the risks of investing in derivatives that appears under the heading “Risks” in light of the Barry Miller Letter and Item 9(b) of Form N-1A (referenced by Item 5(a) of Form N-14) and believes that the disclosure appropriately summarizes the principal risks associated with the derivatives instruments that the Acquiring Fund is expected to use as part of its principal investment strategies.

| 17. | Comment: To the extent it is applicable, please include disclosure about the Acquiring Fund’s use of derivatives in the description of the Acquiring Fund’s strategy. |

Response: The Registrant has revised the relevant disclosure as follows (new language denoted by underlining and deleted language denoted by strike-through):

Putnam Multi-Asset Income Fund also invests in other types of investments, such as in REITs and convertible securities, and may use derivatives for both hedging and non-hedging purposes but does so to a lesser extent than Putnam Multi-Asset Absolute Return Fund.

| 18. | Comment: Please supplementally confirm that any material adverse factors considered by the Independent Trustees when approving the merger have been disclosed in the Registration Statement. |

Response: The Registrant confirms that all material adverse factors considered by the Independent Trustees when approving the merger have been disclosed in the Registration Statement.

I believe this letter addresses the Staff’s comments. Should you have any further questions, please do not hesitate to call me at (617) 760-2577. Thank you for your assistance.

Very truly yours,

/s/ Venice Monagan

Venice Monagan

Senior Counsel

Putnam Management

cc: James E. Thomas, Esq., Ropes & Gray LLP

Bryan Chegwidden, Esq., Ropes & Gray LLP

Yana Guss, Esq., Ropes & Gray LLP

Peter T. Fariel, Esq., Putnam Management

Appendix A

Putnam Investments

100 Federal Street

Boston, MA 02110

August 19, 2022

Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 Attn: Catalina Jaime, Branch Chief, Division of Investment Management, Disclosure Review and Accounting Office | | |

| Re: | Comments to the Registration Statement on Form N-14 (File Nos. 033-51017 811-07121) (the “Registration Statement”) of Putnam Asset Allocation Funds, on behalf of its Putnam Multi-Asset Income Fund series (“Multi-Asset Income”), filed with the Securities and Exchange Commission (the “Commission”) on July 20, 2022 |

Dear Ms. Jaime:

This letter responds to the comments that you and Michael Republicano of the staff of the Commission (“Commission Staff”) provided to Peter Fariel, Venice Monagan and Janet Smith of Putnam Investment Management, LLC (“Putnam Management”), investment adviser to the Fund, and Yana Guss and Elizabeth Madsen of Ropes & Gray LLP, counsel to the Fund, on August 11, 2022. Putnam Management continues to strongly believe that a majority of the relevant factors under relevant accounting and Commission staff guidance regarding the identification of the survivor for purposes of financial statements and financial reporting support Putnam Management’s conclusion that Multi-Asset Income, the surviving fund under state law in the merger of Multi-Asset Income and Multi-Asset Absolute Return Fund (“MAAR”), should be identified as the survivor for purposes of financial statements and performance reporting. This letter supplements the letter dated August 9, 2022 from Putnam Management to the Commission Staff and provides additional support that each of the following relevant factors favor Multi-Asset Income as the survivor and are not “neutral” factors: Investment Objectives, Policies and Restrictions, Portfolio Composition and Expense Structure.

Separately, and as noted during the August 11th call, Putnam Management and Ropes & Gray will review the disclosure in the N-14 to determine whether there are any appropriate modifications to reflect the information on accounting and financial reporting survivor set forth in the August 9th Letter and below.

Investment Objectives, Policies and Restrictions

Investment Objectives

Although the investment objectives of the Funds are similar in that both objectives refer to total return, there is a significant difference between the two objectives. MAAR’s investment objective is to seek positive total return. In contrast, Multi-Asset Income’s investment objective qualifies its total return objective with a reference to “consistent with conservation of capital.” The objective also includes another critical distinction—stating that “Within the fund’s total return orientation, the fund seeks to provide current income, along with long-term capital appreciation.” There is no reference to an income component in the investment objective of MAAR. The combined fund will have an identical investment objective to Multi-Asset Income. As evidence of the income component of the investment objective, Multi-Asset Income pays a monthly distribution, as will the combined fund (which is a very important selection criterion for financial firms in considering funds on behalf of their clients.)

Investment Policies

The investment strategies of MAAR and Multi-Asset Income have important and material differences:

| · | Volatility Component. MAAR has an investment strategy that expressly states that it is generally intended to produce lower volatility over a reasonable period of time than has been historically associated with traditional asset classes that have earned similar levels of return over long historical periods. Multi-Asset Income has no volatility component in its investment strategy. |

| · | Directional and Non-Directional Components. MAAR employs both “directional” and “non-directional” strategies that are not components of Multi-Asset Income’s strategy. The contribution of MAAR’s non-directional strategy to portfolio risk has been as high as 87% as recently as April 2020. Again, Multi-Asst Income has no “non-directional” strategy as a component. |

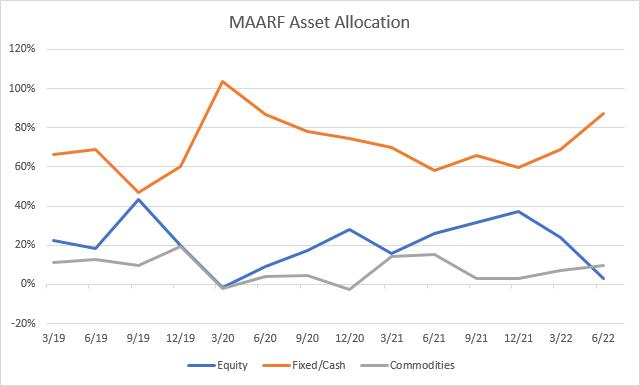

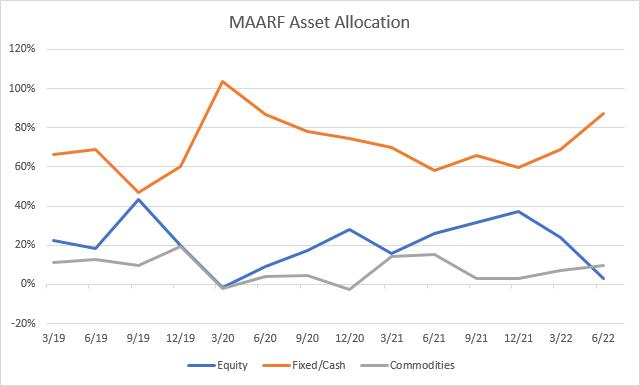

| · | Equity Exposure. Although MAAR’s investment strategy contemplates investments in a wide range of asset classes, including equity securities, it does not have a fixed strategic allocation to equity securities. In fact, as the chart included in the August 9th Letter and provided below illustrates, MAAR’s equity exposure has varied considerably over time, ranging from as low as -2% to as high as 51% since December 31, 2019 (with equity security risk ranging from -1% to 93% of portfolio risk since inception. In contrast, Multi-Asset Income has a strategic allocation of 27% to equity securities. In addition, Multi-Asset Income is subject to a quantitative limit on allocation to equity (5-50%) and fixed income (50-95%), whereas MAAR has not such limit. In practice, Multi-Asset Income’s allocation to equity securities has varied from 19% to 35% since inception as shown in the chart below. |

| · | Use of Derivatives. Although the investment strategy for each fund states that the fund uses derivatives to a significant extent both for hedging and non-hedging purposes, in implementing the investment strategy, MAAR makes far greater use of derivatives relative to Multi-Asset Income. |

o Comparing the disclosure in recent shareholder reports illustrates this difference. The shareholder report for Multi-Asset Income for the period ended February 28, 2022 stated that “The fund used futures contracts to manage exposure to market risk and to equitize cash. The fund employed total return swaps to hedge sector exposure, to gain and manage exposure to specific sectors or industries, and to manage exposure to specific securities. The fund also used total return swaps to gain exposure to both a basket of securities and to specific markets or countries.” In the shareholder report for MAAR for the period ending April 30, 2022, it states that “Futures were used to manage the fund’s exposure to market risk and help equitize cash. Futures and interest-rate swaps were used to gain exposure to interest rates and hedge prepayment and interest-rate risks. Credit default swaps were used to hedge credit and market risks as well as gain exposure to individual names or baskets of securities. Total return swaps were used to hedge sector exposure; manage exposure to specific sectors, securities, and industries; and gain exposure to specific markets, countries, sectors, industries, or baskets of securities.” Note that MAAR’s shareholder report referenced the use of interest rate swaps and credit default swaps in addition to the derivative instruments used by Multi-Asset Income given the absence of any credit default swap positions and nominal exposure to interest rate swaps for Multi-Asset Income.

o This difference is further evidenced in the extent of derivatives exposure measured by number of derivatives positions and notional exposure as discussed under Portfolio Composition below.

The combined fund will continue the investment strategy of Multi-Asset Income, including the components described above. In Putnam Management’s view, the difference in investment strategies is further illustrated by (i) the fact that the funds are in two different Morningstar categories: MAAR in the Macro Trading category and Multi-Asset Income in the “Allocation-15%-30% Equity” category and (ii) as noted in the Registration Statement, as of June 15, 2022, Putnam Management anticipates that MAAR will dispose of approximately 82% of its portfolio holdings prior to the merger.

Investment Restrictions

During the telephone call on August 11, 2022, the Staff observed that the fundamental investment restrictions (with related exceptions) of the funds were similar. It is completely understandable that the funds have many identical fundamental investment restrictions and related exceptions given that the restrictions are largely driven by the substantive provisions of the 1940 Act. The fundamental investment restrictions of any two registered investment companies tend to be similar at a high level. Ultimately, it is the manner in which a fund relies on exceptions to the restrictions in implementing its investment strategy that is relevant to an understanding of a fund’s investment approach. As noted above, there are differences in the investment strategy between the two funds. As an example, both funds have a fundamental investment restriction that the fund will not “purchase or sell commodities or commodity contracts, except as permitted by applicable law.” Yet, as noted above, the funds’ use of derivatives vary significantly.

In addition, as noted in the Registration Statement, there is a material difference in the investment restriction related to investments in the voting securities of an issuer. While MAAR may not and will not, with respect to 75% of its total assets, acquire more than 10% of the outstanding voting securities of any issuer (emphasis added), Multi-Asset Income may not and will not, with respect to 75% of its total assets, acquire more than 10% of the voting securities of any issuer; provided that this limitation does not apply to obligations issued or guaranteed as to interest or principal by the U.S. government or its agencies or instrumentalities or to securities issued by other investment companies (emphasis added). MAAR’s fundamental investment restriction could, under certain circumstances, act as a constraint on the ability to invest in underlying registered investment companies and U.S. government or agency securities although Putnam Management does not expect that this difference will have a material impact on the combined fund’s go-forward investment approach. The combined fund will be subject to the less restrictive fundamental investment restrictions applicable to Multi-Asset Income.

Portfolio Composition

Putnam strongly believes that the portfolio composition factor favors Multi-Asset Income as the surviving fund for accounting and performance purposes. As the chart included in the August 9th Letter illustrates, the combined fund is expected to more closely reflect the portfolio composition of Multi-Asset Income across several key asset classes:

| · | Corporate bonds. As of July 31, 2022, MAAR had no exposure to corporate bonds. In contrast, Multi-Asset Income had over 28% of its assets invested in corporate bonds and the combined fund is expected to have 27% of its assets invested in investment-grade corporates. |

| · | Stocks. As of July 31, 2022, MAAR had only approximately 3% exposure to stocks (which as discussed above varies considerably over time) whereas Multi-Asset Income had over 21% of its assets in stocks. The combined fund is projected to have approximately 22% in stocks. |

| · | Derivatives exposure. As discussed above under “Investment Objectives, Policies and Restrictions”, MAAR employs derivatives more extensively than Multi-Asset Income. This is reflected not only in the types of derivative instruments but also in the volume measured both by number of positions and notional value. |

| | | MAAR | | MAI | |

| | | 4/30/2022(semi) | | 2/28/2022(semi) | |

| Notional or Contract Amount | Derivative Activity* | Open Contracts at 5/31/22 | Average Notional Value* | Open Contracts at 5/31/22 | |

| Purchased equity option contracts | $6,000 | | $0 | | |

| Purchased currency option contracts | $24,800,000 | | $0 | | |

| Purchased swap option contracts | $10,600,000 | 8 | $0 | | |

| Written equity option contracts | $6,000 | | $0 | | |

| Written currency option contracts | $1,900,000 | | $0 | | |

| Futures contracts | $418,447,285 | 2,757 | $2,452,341 | 18 | |

| Forward currency contracts | $433,400,000 | | $0 | | |

| Centrally cleared interest rate swap contracts | $314,900,000 | 43 | $230,000 | 1 | |

| OTC total return swap contracts | $1,420,000,000 | 53 | $11,800,000 | 14 | |

| Centrally cleared total return swap contracts | $77,600,000 | | $880,000 | 2 | |

| OTC credit default contracts | $136,200,000 | 58 | $0 | | |

| Centrally cleared credit default contracts | $67,900,000 | 1 | $81,000 | 1 | |

| | | | | | |

| | *The volume of activity for the reporting period is based on the average holdings at the end of each |

| | fiscal quarter, except for Futures which is the notional amount at 5/31/22 | | |

| | | | | | | | | | | |

Expense Structure

As noted in the August 9th Letter, Putnam believes that the expense structures of MAAR and Multi-Asset Income are significantly different. Most notably, MAAR is subject to a performance fee and Multi-Asset Income and the combined fund are not subject to a performance fee. The performance adjustment for MAAR has had a significant impact on MAAR’s net management fee and total expense ratio over time:

| Year | MAAR Gross Base Management Fee % | Performance Fee Adjustment % | Net Management Fee % | Class A Total Expense Ratio % * |

| 2/28/2022 | 0.713 | 0.31 | 0.403 | 0.94 |

| 2021 | 0.712 | 0.326 | 0.386 | 0.88 |

| 2020 | 0.719 | 0.317 | 0.402 | 0.86 |

| 2019 | 0.722 | 0.286 | 0.436 | 0.89 |

| 2018 | 0.777 | 0.224 | 0.553 | 1.02 |

| 2017 | 0.875 | 0.182 | 0.693 | 1.16 |

| 2016 | 0.876 | 0.156 | 0.72 | 1.19 |

| 2015 | 0.867 | 0.058 | 0.809 | 1.26 |

| 2014 | 0.871 | 0.079 | 0.792 | 1.24 |

| 2013 | 0.88 | 0.078 | 0.802 | 1.25 |

| 2012 | 0.886 | 0.023 | 0.863 | 1.33 |

| *Excludes Acquired Fund Fees | | | |

In addition, the base management fee of MAAR is significantly higher than Multi-Asset Income’s base management fee, which will apply to the combined fund. At July 31, 2022, MAAR has a gross base management fee of 72 bps whereas the management fee of Multi-Asset Income and the combined fund is only 47 bps. The expected expense ratio of the combined fund is .84% which more closely resembles Multi-Asset Income’s expense ratio of .78% than MAAR’s current expense ratio of .94%.

In conclusion, the above analysis provides further support for the position that the majority of factors, specifically Investment Strategies, Portfolio Composition and Expense Structure, support a position that the combined fund will more closely resemble Multi-Asset Income, therefore we have concluded that Multi-Asset Income is the appropriate accounting and performance survivor.