| | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

| |

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| |

Touchstone Funds Group Trust Touchstone Strategic Trust Touchstone Variable Series Trust |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | |

TOUCHSTONE FUNDS GROUP TRUST

TOUCHSTONE STRATEGIC TRUST

TOUCHSTONE VARIABLE SERIES TRUST

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

July 13, 2021

Dear Shareholder:

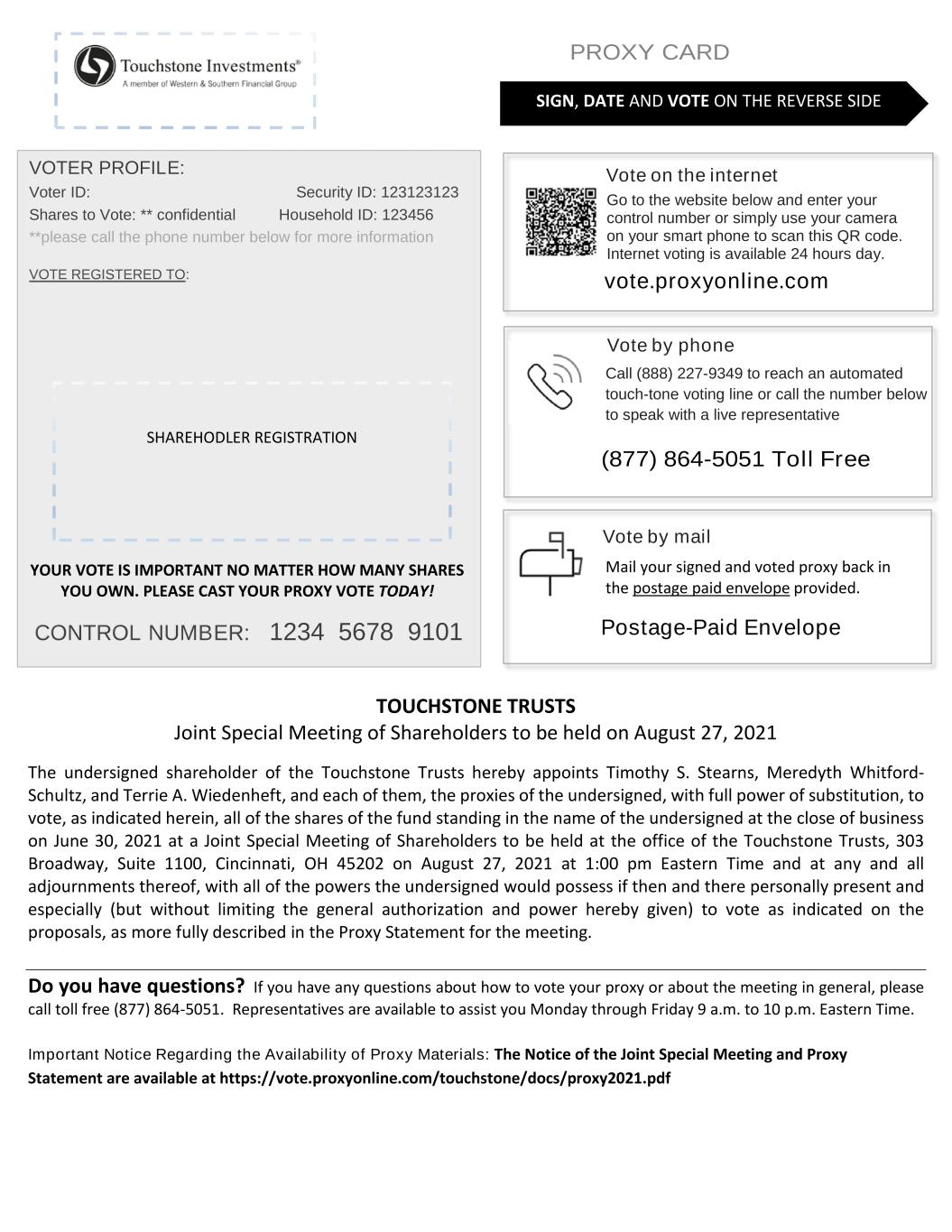

The proxy statement that accompanies this letter describes a proposal to elect four nominees to the Board of Trustees for each of the three Touchstone Trusts: Touchstone Funds Group Trust, Touchstone Strategic Trust, and Touchstone Variable Series Trust, at a joint special meeting of shareholders to be held on August 27, 2021. You are being asked to vote on the proposal. The Board of Trustees has approved the proposal and recommends that you vote FOR the proposal.

The proxy statement contains important details about each of the nominees and the Board of Trustees in general. I urge you to take the time to review it carefully. Your vote is important regardless of how many shares you own. Please read the attached proxy statement carefully and cast your vote promptly using the enclosed card and postage-paid envelope, by phone using the toll-free number, or online at vote.proxyonline.com.

We appreciate your business and the trust you have placed in us. We look forward to serving you for many years to come.

Sincerely,

E. Blake Moore, Jr.

President

Touchstone Trusts

TOUCHSTONE FUNDS GROUP TRUST

TOUCHSTONE STRATEGIC TRUST

TOUCHSTONE VARIABLE SERIES TRUST

(collectively, the “Touchstone Trusts”)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

To Be Held on August 27, 2021

To the Shareholders of the Touchstone Trusts:

NOTICE IS HEREBY GIVEN THAT a Joint Special Meeting of Shareholders will be held at 303 Broadway, Suite 1100, Cincinnati, Ohio, 45202 on August 27, 2021 at 1:00 p.m. Eastern Time (the “Special Meeting”) for the Shareholders of Touchstone Funds Group Trust, a Delaware statutory trust, and the Touchstone Strategic Trust and Touchstone Variable Series Trust, each a Massachusetts business trust (collectively, the “Touchstone Trusts”). The Special Meeting will be held at the offices of the Touchstone Trusts, for the following purposes:

1. To elect four Trustees to the Board of Trustees for each of the Touchstone Trusts.

2. To transact such other business that may properly come before the Special Meeting or any adjournments.

The Board of Trustees has fixed the close of business on June 30, 2021 as the record date for determination of shareholders entitled to notice of and to vote at the Special Meeting.

By order of the Board of Trustees

Meredyth A. Whitford-Schultz

Secretary

Touchstone Trusts

July 13, 2021

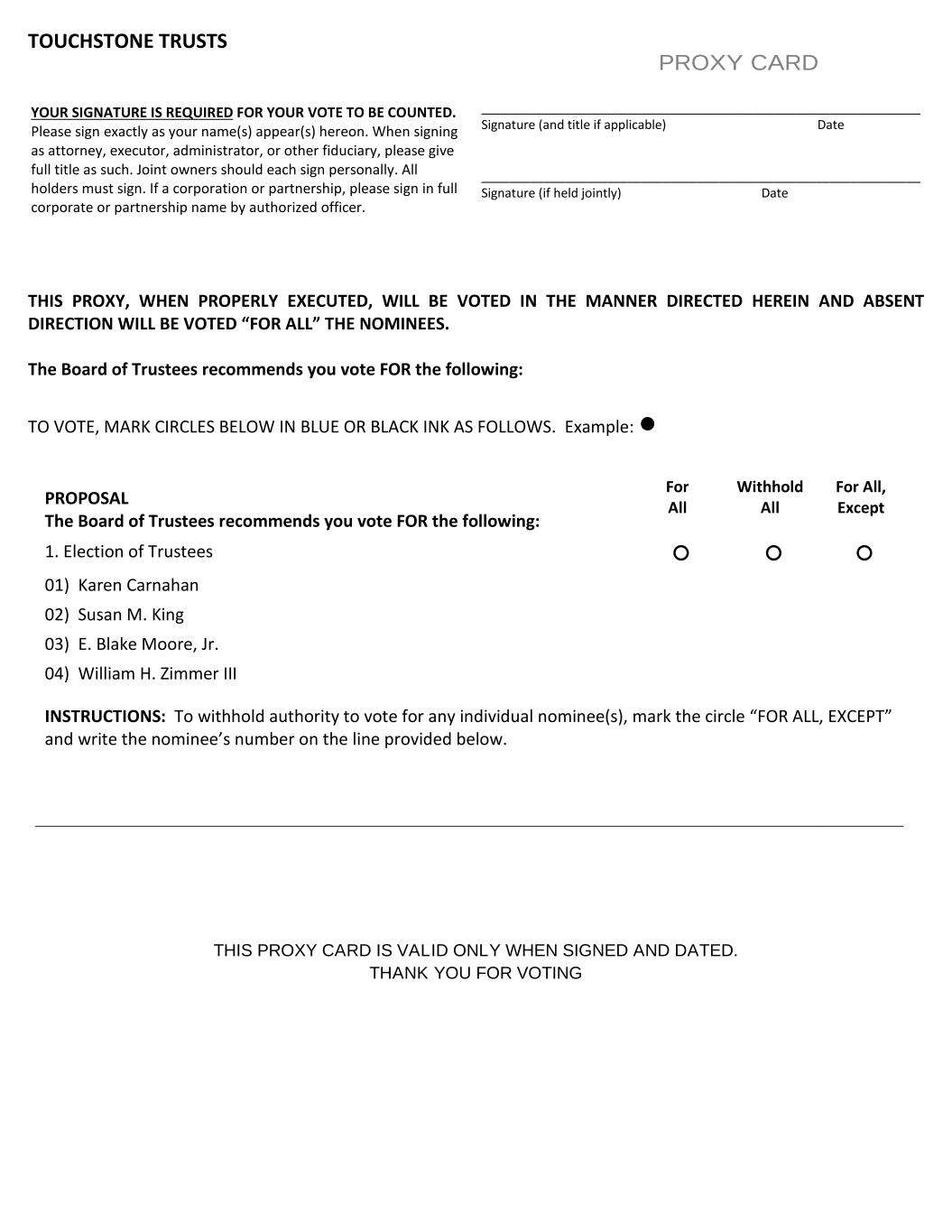

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE SPECIAL MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. SHAREHOLDERS MAY ALSO VOTE BY TELEPHONE OR VOTE THROUGH THE INTERNET. INSTRUCTIONS FOR THE PROPER EXECUTION OF THE PROXY CARD ARE SET FORTH IMMEDIATELY FOLLOWING THE ACCOMPANYING PROXY STATEMENT OR, WITH RESPECT TO TELEPHONE OR INTERNET VOTING, ON THE PROXY CARD. IT IS IMPORTANT THAT YOU VOTE PROMPTLY.

TOUCHSTONE FUNDS GROUP TRUST

TOUCHSTONE STRATEGIC TRUST

TOUCHSTONE VARIABLE SERIES TRUST

(each a “Trust”, and collectively, the “Touchstone Trusts” or “Trusts”)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(800) 543-0407

JOINT SPECIAL MEETING OF SHAREHOLDERS

To be held on August 27, 2021

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of the Touchstone Trusts for use at a joint special meeting of shareholders to be held at 1:00 p.m. Eastern Time on August 27, 2021 and any adjournments (the “Special Meeting”). The Special Meeting will be held at the offices of the Trusts, 303 Broadway, Suite 1100, Cincinnati, Ohio 45202, for the purpose of electing four nominees to the Board of each Trust.

This Proxy Statement, the Notice of Joint Special Meeting of Shareholders and the proxy cards are first being mailed to shareholders on or about July 15, 2021.

This Proxy Statement is furnished to the shareholders of the following Touchstone Trusts and their respective funds (collectively, the “Funds”):

•The Touchstone Funds Group Trust (“TFGT”), which consists of the Touchstone Active Bond Fund, the Touchstone Anti-Benchmark® International Core Equity Fund, the Touchstone Credit Opportunities Fund, the Touchstone Dividend Equity Fund, the Touchstone High Yield Fund, the Touchstone Impact Bond Fund, the Touchstone International ESG Equity Fund, the Touchstone Mid Cap Fund, the Touchstone Mid Cap Value Fund, the Touchstone Sands Capital Select Growth Fund, the Touchstone Small Cap Fund, the Touchstone Small Cap Value Fund, and the Touchstone Ultra Short Duration Fixed Income Fund (each a “TFGT Fund”, and collectively the “TFGT Funds”).

•The Touchstone Strategic Trust (“TST”), which consists of the Touchstone Anti-Benchmark® US Core Equity Fund, the Touchstone Balanced Fund, the Touchstone Dynamic Global Allocation Fund, the Touchstone Flexible Income Fund, the Touchstone Focused Fund, the Touchstone Global ESG Equity Fund, the Touchstone Growth Opportunities Fund, the Touchstone International Equity Fund, the Touchstone International Growth Fund, the Touchstone Large Cap Fund, the Touchstone Large Cap Focused Fund, the Touchstone Large Company Growth Fund, the Touchstone Mid Cap Growth Fund, the Touchstone Ohio Tax-Free Bond Fund, the Touchstone Sands Capital Emerging Markets Growth Fund, the Touchstone Sands Capital International Growth Fund, the Touchstone Small Company Fund, the Touchstone Strategic Income Opportunities Fund, and the Touchstone Value Fund (each a “TST Fund”, and collectively the “TST Funds”).

•The Touchstone Variable Series Trust (“TVST”), which consists of the Touchstone Balanced Fund, the Touchstone Bond Fund, the Touchstone Common Stock Fund, and the Touchstone Small Company Fund (each a “TVST Fund”, and collectively the “TVST Funds”).

It is expected that the solicitation of proxies will be primarily by mail. Supplementary solicitations may be made by mail, telephone, facsimile, internet, or personal contact by representatives of the Touchstone Trusts. AST Fund Solutions LLC has been engaged to assist in the distribution, tabulation, and solicitation of proxies. The anticipated cost of such services is approximately $1.2 million. All costs associated with the preparation, filing, and distribution of this Proxy Statement, the solicitation, and the meeting will be borne by the Funds of each Touchstone Trust, allocated based on the number of shareholder accounts in each Fund.

Any shareholder submitting a proxy has the power to revoke it by attending and voting in person at the Special Meeting, by mailing a notice of revocation to the Secretary at the principal office of the Touchstone Trusts prior to the Special Meeting, or by executing a superseding proxy by telephone or through the internet to the Touchstone Trusts prior to the Special Meeting. All properly executed proxies received before the Special Meeting will be voted as specified on the proxy.

A majority of the outstanding shares of each Trust must be present in person or by proxy to constitute a quorum for the transaction of business for each respective Trust. If the necessary quorum to transact business or the vote required to approve the proposal is not obtained at the Special Meeting, the persons named as proxies on the proxy card may propose one or more adjournments of the Special Meeting, in accordance with applicable law, to permit the further solicitation of proxies. Any such adjournment would require the affirmative vote of a majority of the shares voting on the adjournment. The persons named as proxies will vote those proxies which they are entitled to vote in favor of the proposal in favor of such adjournment, and will vote against any such adjournment those proxies that they have been instructed to vote against the proposal. Abstentions and “broker non-votes” are counted for purposes of determining whether a quorum is present but do not represent votes cast with respect to a proposal. “Broker non-votes” are shares held by a broker or nominee for which an executed proxy is received by the Touchstone Trusts, but are not voted as to one or more proposals because instructions have not been received from beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary power.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting To Be Held on August 27, 2021:

This Proxy Statement is available at www.TouchstoneInvestments.com/Resources. In addition, a copy of each Trust’s annual report and unaudited semi-annual report (for their respective fiscal year and period ends as listed below) is available free of charge on the Touchstone Trusts’ website, www.TouchstoneInvestments.com or by calling 800-543-0407.

Table of Contents

| | | | | |

| Page |

| Summary of the Proposal | 4 |

| Required Vote | 4 |

| Board of Trustees Recommendation | 4 |

| Proposal 1: Election of Trustees | 5 |

| General Information on the Current Trustees, Nominees, and Officers of the Trust | 6 |

| Additional Information About the Current Trustees and Nominees | 11 |

| General Information Regarding the Board of Trustees | 13 |

| Independent Auditors | 17 |

| Additional Information About the Trusts | 19 |

| Investment Advisor and Other Service Providers | 65 |

| Certain Voting Matters for TVST | 66 |

| Other Business | 67 |

| Instructions for Signing Proxy Cards | 68 |

| Appendix A - Governance Committee Charter | A-1 |

SUMMARY OF THE PROPOSAL

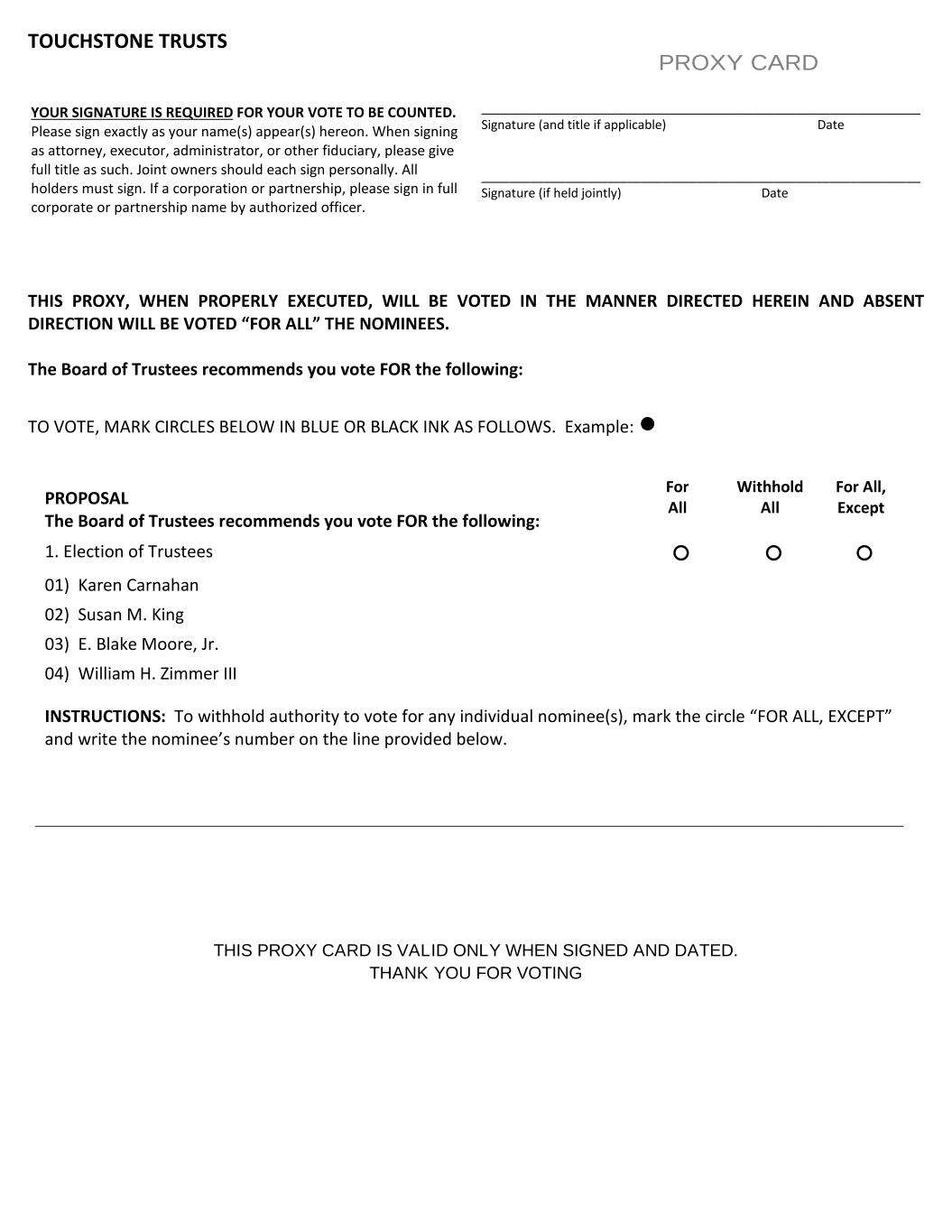

At the Special Meeting, four nominees will be standing for election to the Board of each Trust. As described in greater detail herein, the ballot consists of two current trustees—Ms. Karen Carnahan and Mr. William H. Zimmer III—and two nominees who do not currently serve on the Board—Ms. Susan M. King and Mr. E. Blake Moore, Jr. If elected each nominee shall serve until the age of 75 or until he or she resigns or is removed as a Trustee. Each of the nominees has consented to serve or continue to serve, as the case may be, as a trustee of the Trusts.

Shareholders of record of the Funds within the Touchstone Trusts, except TVST, at the close of business on June 30, 2021 (the “Record Date”) will be entitled to one vote per share of each full share of the Trusts, with proportionate voting for fractional shares.

Shareholders of record of the TVST Funds at the close of business on the Record Date will be entitled to one vote for each dollar of net asset value of such Fund and each fractional dollar amount shall be entitled to a proportionate fractional vote. Please see the section titled "CERTAIN VOTING MATTERS FOR TVST" for additional information related to how TVST shares are voted.

REQUIRED VOTE

APPROVAL OF PROPOSAL 1 REQUIRES THE AFFIRMATIVE VOTE OF A PLURALITY OF THE SHARES OF EACH TRUST VOTING IN PERSON OR BY PROXY AT THE SPECIAL MEETING. SHARES REPRESENTED BY PROXIES THAT REFLECT ABSTENTIONS OR BROKER NON-VOTES WILL BE COUNTED AS SHARES THAT ARE PRESENT AND ENTITLED TO VOTE ON THE MATTER FOR PURPOSES OF DETERMINING THE PRESENCE OF A QUORUM.

BOARD OF TRUSTEES RECOMMENDATION

ON MAY 20, 2021, THE BOARD OF TRUSTEES, INCLUDING A MAJORITY OF THE INDEPENDENT TRUSTEES (AS THAT TERM IS DEFINED BELOW), MET TO REVIEW PERTINENT INFORMATION ON THE NOMINEES FOR ELECTION TO THE BOARD OF TRUSTEES AND UNANIMOUSLY DETERMINED TO NOMINATE KAREN CARNAHAN, SUSAN M. KING, E. BLAKE MOORE, JR. AND WILLIAM H. ZIMMER III (THE “NOMINEES”) TO SERVE OR CONTINUE TO SERVE ON THE BOARD, SUBJECT TO THE REQUIRED SHAREHOLDER APPROVAL. THE BOARD OF TRUSTEES OF THE TOUCHSTONE TRUSTS RECOMMENDS THAT EACH NOMINEE BE ELECTED TO SERVE AS A TRUSTEE UNTIL HE OR SHE CEASES TO BE A TRUSTEE.

PROPOSAL 1: ELECTION OF TRUSTEES

The vote of a plurality of each Trust’s shares represented at the Special Meeting is required for the election of Trustees. As either Massachusetts business trusts or Delaware statutory trusts, the Touchstone Trusts are not required, and do not intend, to hold annual shareholder meetings for the purpose of electing Trustees.

Although the Touchstone Trusts will not normally hold annual meetings of their shareholders, they may hold shareholder meetings on important matters, and shareholders have certain rights to call a meeting to remove a Trustee or to take other action described in each Trust’s Declaration of Trust. Also, if at any time less than a majority of the Trustees holding office have been elected by the shareholders, the Trustees then in office will promptly call a shareholder meeting for the purpose of electing Trustees.

At the Special Meeting, four Nominees will be standing for election to the Board of each Trust. The ballot consists of two current Trustees—Ms. Karen Carnahan and Mr. William H. Zimmer III (together, the “Incumbent Nominees”)—and two nominees who do not currently serve on the Board—Ms. Susan M. King and Mr. E. Blake Moore, Jr. (together, the “New Nominees” and with the Incumbent Nominees, the “Nominees”). If elected, each Nominee shall serve until the age of 75 or until he or she resigns or is removed as a Trustee. Each of the Nominees has consented to serve or continue to serve, as the case may be, as a Trustee of the Trusts.

Mses. Susan Hickenlooper and Jill T. McGruder and Messrs. William Gale and Kevin Robie, who are current Trustees of the Trusts (the “Current Trustees”), are not included on the ballot because they were previously elected by shareholders in August 2013. These Current Trustees are not standing for election at the Special Meeting.

The Board of Trustees of the Touchstone Trusts recommends that each Nominee be elected to serve as a Trustee until he or she ceases to be a Trustee. The Incumbent Nominees are currently Trustees and have served in that capacity for as many years as indicated below. The Governance Committee of each Trust has nominated the New Nominees to serve as Trustees of each Trust. Each of the Current Trustees and Incumbent Nominees currently oversee all of the Funds of each Trust.

Mr. Moore, who is a New Nominee, is an “interested person” of the Trusts within the meaning of Section 2(a)(19) of the Investment Company Act of 1940 (“Interested Trustee”) because he is an officer of both Touchstone Advisors, Inc. (the “Advisor”), the Trusts’ investment adviser, and Touchstone Securities, Inc. (the “Distributor”), the Trusts’ principal underwriter. Ms. McGruder, who is a Current Trustee, is also an Interested Trustee because she is a director of the Advisor and the Distributor, as well as an officer of various affiliates of the Advisor and the Distributor.

Except for Mr. Moore and Ms. McGruder, all of the Current Trustees, the Incumbent Nominees, and the New Nominees are not interested persons under Section 2(a)(19) of the Investment Company Act of 1940 (“Independent Trustees”).

If the Nominees described in this Proxy Statement are elected by shareholders, there will be six Independent Trustees and two Interested Trustees on the Board of the Trusts, all of whom will have been elected by shareholders.

GENERAL INFORMATION ON THE CURRENT TRUSTEES, NOMINEES,

AND OFFICERS OF THE TRUSTS

The following is a list of the Nominees, the length of time served (if applicable), principal occupations for the past five years, and other directorships held during the past five years. Each Nominee, if elected by shareholders, will oversee 36 Funds that comprise the entire Touchstone Fund Complex. All funds managed by the Advisor are part of the “Touchstone Fund Complex.” As of June 30, 2021, the Touchstone Fund Complex consisted of 19 series of TST, 13 series of TFGT, and 4 series of TVST.

Nominees (Standing For Election)

Interested New Nominee:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name

Year of Birth(1) | | Position(s)

Held with

Trusts | | Term of Office and

Length of Time

Served | | Principal

Occupation(s)

During Past 5 Years | | Other

Directorships

Held During Past 5 Years |

E. Blake Moore, Jr.

Year of Birth: 1958 | | President and New Trustee Nominee | | President: Until resignation, removal or disqualification

President since January 2021

Trustee if Approved: Until retirement at age 75 or until he resigns or is removed | | Chief Executive Officer of Touchstone Advisors, Inc. and Touchstone Securities Inc. (since 2020); President, Foresters Investment Management Company, Inc. (2018 to 2020); President, North American Asset Management at Foresters Financial (2018 to 2020); Managing Director, Head of Americas at UBS Asset Management (2015 to 2017); and Executive Vice President, Head of Distribution at Mackenzie Investments (2011 to 2014). | | Trustee, College of Wooster (since 2008); and Director, UBS Funds (2015 to 2017). |

Independent Incumbent Nominees/New Nominee:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name

Year of Birth(1) | | Position

Held with

Trusts | | Term of Office and

Length of Time

Served | | Principal

Occupation(s)

During Past 5 Years | | Other

Directorships

Held During Past 5 Years |

Karen Carnahan

Year of Birth: 1954 | | Trustee | | Until retirement at age 75 or until she resigns or is removed

Trustee since 2019 | | Retired; formerly Chief Operating Officer of Shred-it (a business services company) from 2014 to 2015; formerly President & Chief Operating Officer of the document management division of Cintas Corporation (a business services company) from 2008 to 2014. | | Director, Cintas Corporation since 2019; Director, Boys & Girls Club of West Chester/Liberty since 2016; and Board of Advisors, Best Upon Request since 2020.

|

| | | | | | | | |

Susan M. King

Year of Birth: 1963 | | New Trustee Nominee | | If Approved: Until retirement at age 75 or until she resigns or is removed | | Formerly, Partner of ID Funds LLC (2020 to 2021); formerly, Senior Vice President, Head of Product and Marketing Strategy of Foresters Financial (2018 to 2020); formerly, Managing Director, Head of Sales Strategy and Marketing, Americas of UBS Asset Management (2015 to 2017); formerly, Director, Allianz Funds, Allianz Funds Multi-Strategy Trust and AllianzGI Institutional Multi-Series Trust (2014 to 2015); and formerly, Director, Alliance Capital Cash Management Offshore Funds (2003 to 2005). | | Trustee, Claremont McKenna College (since 2017); Trustee, Israel Cancer Research Fund (since 2019); and Board Member of WHAM! (Women's Health Access Matters) (since 2021). |

| | | | | | | | |

William H. Zimmer III

Year of Birth: 1953 | | Trustee | | Until retirement at age 75 or until he resigns or is removed

Trustee since 2019 | | Independent Treasury Consultant since 2014. | | Director, Deaconess Associations, Inc. (healthcare) since 2001; Trustee, Huntington Funds (mutual funds) from 2006 to 2015; and Director, National Association of Corporate Treasurers from 2011 to 2015. |

Current Trustees (Not Standing For Election)

Following is information about the other Trustees of the Trusts currently serving and who are not standing for election. These Trustees will continue to serve on the Board until retirement, resignation or removal. Each Current Trustee oversees 36 Funds that comprise the entire Touchstone Fund Complex. Each of these Trustees was last elected by shareholders in August 2013.

Interested Trustee:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name

Year of Birth(1) | | Position

Held with

Trusts | | Term of Office and

Length of Time

Served | | Principal

Occupation(s)

During Past 5 Years | | Other

Directorships

Held During Past 5 Years |

Jill T. McGruder

Year of Birth: 1955 | | Trustee | | Until retirement at age 75 or until she resigns or is removed

Trustee since 1999 | | President of Touchstone Funds from 1999 to 2020; President, Director and CEO of IFS Financial Services, Inc. (a holding company) since 1999; and Senior Vice President and Chief Marketing Officer of Western & Southern Financial Group, Inc. (a financial services company) since 2016. | | Director, Integrity Life Insurance Co. and National Integrity Life Insurance Co. since 2005; Director, Touchstone Securities (the Distributor) since 1999; Director, Touchstone Advisors (the Advisor) since 1999; Director, W&S Brokerage Services, Inc. since 1999; Director, W&S Financial Group Distributors, Inc. since 1999; Director, Insurance Profillment Solutions LLC since 2014; Director, Columbus Life Insurance Co. since 2016; Director, The Lafayette Life Insurance Co. since 2016; Director, Gerber Life Insurance Company since 2019; Director, Western & Southern Agency, Inc. since 2018; and Director, LL Global, Inc. (not-for-profit trade organization with operating divisions LIMRA and LOMA) since 2016. |

Independent Trustees:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name

Year of Birth(1) | | Position

Held with

Trusts | | Term of Office and

Length of Time

Served | | Principal

Occupation(s)

During Past 5 Years | | Other

Directorships

Held During Past 5 Years |

William C. Gale

Year of Birth: 1952 | | Trustee | | Until retirement at age 75 or until he resigns or is removed

Trustee since 2013 | | Retired; formerly Senior Vice President and Chief Financial Officer of Cintas Corporation (a business services company) from 1995 to 2015. | | None. |

| | | | | | | | |

Susan J. Hickenlooper, CFA

Year of Birth: 1946 | | Trustee | | Until retirement at age 75 or until she resigns or is removed

Trustee since

2009 | | Retired from investment management. | | Trustee, Episcopal Diocese of Southern Ohio from 2014 to 2018. |

| | | | | | | | |

Kevin A. Robie

Year of Birth: 1956 | | Trustee | | Until retirement at age 75 or until he resigns or is removed

Trustee since 2013 | | Retired; formerly Vice President of Portfolio Management at Soin LLC (private multinational holding company and family office) from 2004 to 2020. | | Director, SaverSystems, Inc. since 2015; Director, Buckeye EcoCare, Inc. from 2013 to 2018; Director, Turner Property Services Group, Inc. since 2017; Trustee, Dayton Region New Market Fund, LLC (private fund) since 2010; and Trustee, Entrepreneurs Center, Inc. (business incubator) since 2006. |

(1)The address for each Trustee and Nominee is c/o Touchstone Advisors, Inc., 303 Broadway, Suite 1100, Cincinnati, Ohio 45202.

Principal Officers

The following is a list of the Officers of the Trusts, the length of time served, and principal occupations for the past five years.

| | | | | | | | | | | | | | | | | | | | |

Name

Address

Year of Birth | | Position(s)

Held with Trust(1) | | Term of Office and Length of

Time Served | | Principal Occupation(s) During

Past 5 Years |

E. Blake Moore, Jr.

Touchstone Advisors, Inc.

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

Year of Birth: 1958 | | President | | Until resignation, removal or disqualification

President since January 2021 | | See biography above. |

| | | | | | |

Timothy D. Paulin

Touchstone Advisors, Inc.

303 Broadway

Suite 1100

Cincinnati, Ohio 45202

Year of Birth: 1963 | | Vice President | | Until resignation, removal or disqualification

Vice President since 2010 | | Senior Vice President of Investment Research and Product Management of Touchstone Advisors, Inc. |

| | | | | | |

Timothy S. Stearns

Touchstone Advisors Inc.

303 Broadway

Suite 1100

Cincinnati, Ohio 45202

Year of Birth: 1963 | | Chief Compliance Officer | | Until resignation, removal or disqualification

Chief Compliance Officer since 2013 | | Chief Compliance Officer of Touchstone Advisors, Inc., Touchstone Securities, Inc., and W&S Brokerage Services, Inc. |

| | | | | | |

Terrie A. Wiedenheft

Touchstone Advisors, Inc.

303 Broadway

Suite 1100

Cincinnati, Ohio 45202

Year of Birth: 1962 | | Controller and Treasurer | | Until resignation, removal or disqualification

Controller and Treasurer since 2006 | | Senior Vice President, Chief Financial Officer and Chief Operations Officer, of IFS Financial Services, Inc. (a holding company); Senior Vice President and Chief Administration Officer within the Office of the Chief Marketing Officer of Western & Southern Financial Group (since 2021). |

| | | | | | |

Meredyth A. Whitford-Schultz

Western & Southern Financial Group

400 Broadway Cincinnati, Ohio 45202

Year of Birth: 1981 | | Secretary | | Until resignation, removal or disqualification

Secretary since 2018 | | Senior Counsel - Securities/Mutual Funds of Western & Southern Financial Group (since 2015); Associate at Morgan Lewis & Bockius LLP (law firm) (2014 to 2015); Associate at Bingham McCutchen LLP (law firm) (2008 to 2014). |

(1) Each officer also holds the same office with TFGT, TST, and TVST.

(1) Each officer also holds the same office with TFGT, TST, and TVST.

ADDITIONAL INFORMATION ABOUT THE CURRENT TRUSTEES AND NOMINEES

Current Trustee and Nominee Ownership in the Touchstone Funds

The following tables set forth information describing the dollar range of shares beneficially owned by each Current Trustee and Nominee in each Trust and in all Trusts in the aggregate in the Touchstone Funds as of June 30, 2021.

| | | | | | | | | | | | | | | | | | | | |

Name of Current

Trustee or Nominee* | | Name of Fund (and Trust) | | Dollar Range of Equity

Securities in the

Fund | | Aggregate Dollar Range of Shares in

the Touchstone

Fund Complex(1) |

| Interested Trustees | | | | | | |

| | | | | | | |

| Jill T. McGruder | | Touchstone Active Bond Fund (TFGT) | | $10,001 - $50,000 | | Over $100,000 |

| | Touchstone Focused Fund (TST) | | Over $100,000 | | |

| | Touchstone Global ESG Equity Fund (TST) | | $10,001 - $50,000 | | |

| | Touchstone Growth Opportunities Fund (TST) | | $50,001 - $100,000 | | |

| | Touchstone High Yield Fund (TFGT) | | Over $100,000 | | |

| | Touchstone International Equity Fund (TST) | | $1 - $10,000 | | |

| | Touchstone Mid Cap Growth Fund (TST) | | Over $100,000 | | |

| | Touchstone Mid Cap Value Fund (TFGT) | | Over $100,000 | | |

| | Touchstone Sands Capital Select Growth Fund (TFGT) | | $50,001 - $100,000 | | |

| | Touchstone Small Company Fund (TST) | | Over $100,000 | | |

| | Touchstone Value Fund (TST) | | $10,001 - $50,000 | | |

| | | | | | | |

| E. Blake Moore, Jr.* | | Touchstone Active Bond Fund (TFGT) | | Over $100,000 | | Over $100,000 |

| | Touchstone Focused Fund (TST) | | Over $100,000 | | |

| | Touchstone Sands Emerging Markets Growth Fund (TST) | | Over $100,000 | | |

| | Touchstone Ultra Short Duration Fixed Income Fund (TFGT) | | Over $100,000 | | |

| | | | | | |

| Independent Trustees | | | | | | |

| | | | | | |

| Karen Carnahan* | | Touchstone Focused Fund (TST) | | $10,001 - $50,000 | | $10,001 -$50,000 |

| | Touchstone Sands Capital Select Growth Fund (TFGT) | | $10,001 - $50,000 | | |

| | | | | | |

| William C. Gale | | None | | N/A | | N/A |

| | | | | | |

| Susan J. Hickenlooper | | Touchstone Focused Fund (TST) | | Over $100,000 | | Over $100,000 |

| | Touchstone International Growth Fund (TST) | | $10,001 - $50,000 | | |

| | Touchstone Large Company Growth Fund (TST) | | Over $100,000 | | |

| | | | | | | | | | | | | | | | | | | | |

Name of Current

Trustee or Nominee* | | Name of Fund (and Trust) | | Dollar Range of Equity

Securities in the

Fund | | Aggregate Dollar Range of Shares in

the Touchstone

Fund Complex(1) |

| | Touchstone Mid Cap Fund (TFGT) | | Over $100,000 | | |

| | Touchstone Mid Cap Value Fund (TFGT) | | $50,001 - $100,000 | | |

| | Touchstone Sands Capital Emerging Markets Growth Fund (TST) | | $50,001 - $100,000 | | |

| | Touchstone Sands Capital Select Growth Fund (TFGT) | | Over $100,000 | | |

| | Touchstone Small Cap Fund (TFGT) | | $50,001 - $100,000 | | |

| | | | | | |

| Susan M. King* | | None | | N/A | | N/A |

| | | | | | |

| Kevin Robie | | Touchstone Sands Capital Emerging Markets Growth Fund (TST) | | $10,001 - $50,000 | | $10,001 -$50,000 |

| | | | | | |

| William H. Zimmer III* | | None | | N/A | | N/A |

*Indicates a Nominee.

(1)As of June 30, 2021, the Touchstone Fund Complex consisted of 13 series of TFGT, 19 series of TST, and 4 variable annuity series of TVST.

Trustee Compensation

The following table shows the compensation paid to the Trustees by the Trusts and the aggregate compensation paid by the Touchstone Fund Complex during the 12-month period ended March 31, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Compensation from TFGT | | Compensation from TST | | Compensation from TVST | | Aggregate Compensation from the Touchstone Fund Complex(1) |

| Interested Trustee | | | | | | | | |

| Jill T. McGruder | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

Independent Trustees(2) | | | | | | | | |

| Karen Carnahan | | $ | 47,741 | | | $ | 69,275 | | | $ | 26,260 | | | $ | 151,000 | |

Phillip R. Cox(3) | | $ | 26,650 | | | $ | 38,950 | | | $ | 14,350 | | | $ | 82,000 | |

| William C. Gale | | $ | 51,664 | | | $ | 74,969 | | | $ | 28,416 | | | $ | 163,000 | |

| Susan J. Hickenlooper | | $ | 49,691 | | | $ | 72,125 | | | $ | 27,310 | | | $ | 157,000 | |

| Kevin A. Robie | | $ | 45,768 | | | $ | 66,431 | | | $ | 25,154 | | | $ | 145,000 | |

| William H. Zimmer III | | $ | 45,768 | | | $ | 66,431 | | | $ | 25,154 | | | $ | 145,000 | |

(1)As of June 30, 2021, the Touchstone Fund Complex consisted of 13 series of TFGT, 19 series of TST, and 4 variable annuity series of TVST.(2)The Independent Trustees are eligible to participate in the Touchstone Trustee Deferred Compensation Plan, which allows them to defer payment of a specific amount of their Trustee compensation, subject to a minimum quarterly reduction of $1,000. The total amount of deferred compensation accrued by the Independent Trustees from the Touchstone Fund Complex during the fiscal year ended December 31, 2020 was $20,000.

(3)Mr. Cox resigned as a Trustee effective at the close of business on August 31, 2020.

The following table shows the Trustee quarterly compensation schedule: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Retainer | | Governance

Committee Meeting Attendance Fees | | Audit

Committee Meeting Attendance Fees | | Board

Meeting

Attendance Fees |

| Retainer and Meeting Attendance Fees | | $ | 21,000 | | | $ | 4,500 | | | $ | 4,500 | | | $ | 5,000 | |

| | | | | | | | |

| Lead Independent Trustee Fees | | $ | 6,000 | | | | | | | |

| | | | | | | | |

| Committee Chair Fees | | $ | 1,000 | | | $ | 2,000 | | | $ | 2,000 | | | |

| | | | | | | | |

Telephonic Meeting Attendance Fee = $1,500

Independent Trustee compensation and Trustee and officer expenses are typically divided equally among the series comprising the Touchstone Fund Complex.

GENERAL INFORMATION REGARDING THE BOARD OF TRUSTEES

Each Trust is governed by a Board of Trustees (collectively, the “Board”), which is responsible for protecting the interests of the shareholders. The Board meets periodically throughout the year to oversee the Trusts’ activities, review performance, and review the actions of the Trusts’ Advisor, which is responsible for the Trusts’ day-to-day operations. Below is the number of meetings for each Trust as of its most recent fiscal year end or 12 month period as set forth below.

•TFGT: There were four regular meetings and no special meetings held during the fiscal year ended September 30, 2020.

•TST: There were four regular meetings and one special meeting held during the 12 months ended March 31, 2021.

•TVST: There were four regular meetings and no special meetings held during the fiscal year ended December 31, 2020.

Each Trustee attended at least 75% of the regularly scheduled board and committee meetings for each Trust during its latest fiscal year. Since Annual Shareholder Meetings are not required by open-end funds, there is no formal policy requiring Trustees attendance, but Trustee attendance is encouraged for all shareholder meetings.

Additional Information About the Current Trustees and Nominees

The Board believes that each Current Trustee’s and Nominee’s experience, qualifications, attributes, or skills on an individual basis and in combination with those of the other Trustees lead to the conclusion that the Trustees possess the requisite experience, qualifications, attributes, and skills to serve on the Board. The Board believes that the Trustees’ ability to review critically, evaluate, question, and discuss information provided to them; to interact effectively with the Advisor, sub-advisors, other service providers, counsel, and independent auditors; and to exercise effective business judgment in the performance of their duties, support this conclusion. The Board has also considered the contributions that each Current Trustee and Nominee can make to the Board and the Trusts.

In its periodic self-assessment of the effectiveness of the Board, the Board considers the complementary individual skills and experience of the individual Trustees primarily in the broader context of the Board’s overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Trusts and their Funds.

In addition, the following specific experience, qualifications, attributes and skills apply as to each Nominee and Current Trustee:

| | | | | |

| Nominees | |

| Karen Carnahan+,** | Ms. Carnahan has experience as a president and chief operating officer of a division of a global company, and treasurer of a global company |

| Susan M. King++, ** | Ms. King has experience in senior executive product, marketing, and sales positions at global asset management firms |

| E. Blake Moore, Jr.*, ++ | Mr. Moore has experience as a president of a global financial services company, as well as executive leadership roles within the Advisor and Distributor |

| William H. Zimmer III+, ** | Mr. Zimmer has experience as a chief executive officer, chief financial officer, and treasurer of various financial services, telecommunications and technology companies |

| |

| Current Trustees (Not Standing for Election) |

| William C. Gale** | Mr. Gale has experience as a chief financial officer, an internal auditor of various global companies, and has accounting experience as a manager at a major accounting firm |

| Susan J. Hickenlooper** | Ms. Hickenlooper has executive and board experience at various businesses, foundations and charitable organizations |

| Jill T. McGruder* | Ms. McGruder has experience as a chief executive officer of a financial services company and director of various other businesses, as well as executive and leadership roles within the Advisor and Distributor |

| Kevin A. Robie** | Mr. Robie has portfolio management experience at a private multinational holding company |

*Indicates an Interested Trustee.

**Indicates an Independent Trustee.

+Indicates an Incumbent Nominee.

++Indicates a New Nominee.

Please note that references to the qualifications, attributes, and skills of the Current Trustees and Nominees are pursuant to requirements of the Securities and Exchange Commission ("SEC"), do not constitute holding out the Board, any Current Trustee, or any Nominee as having any special expertise or experience, and shall not impose any greater responsibility on any such person or on the Board.

Board Structure

If the Nominees are elected, the Board will be composed of six Independent Trustees and two Interested Trustees immediately following the election. Ms. McGruder, an Interested Trustee, is Chairperson of the Board. The full Board has appointed William C. Gale to serve as the Lead Independent Trustee. Ms. McGruder oversees the day-to-day business affairs of the Trusts and communicates with Mr. Gale regularly on various issues affecting the Trusts, as appropriate. Mr. Gale, among other things, chairs meetings of the Independent Trustees, serves as a spokesperson for the Independent Trustees, and serves as a liaison between the Independent Trustees and the Trusts' management between Board meetings. Except for any duties specified, the designation of Lead Independent Trustee does not impose on such Independent Trustee any duties, obligations, or liability that is greater than the duties, obligations, or liability imposed on such person as a member of the Board, generally. The Independent Trustees are advised at these meetings, as well as at other times, by separate, independent legal counsel.

The Board holds four regular meetings each year to consider and address matters involving the Trusts and their Funds. The Board also may hold special meetings to address matters arising between regular meetings. The Independent Trustees also regularly meet outside the presence of management and are advised by independent legal counsel. These meetings may take place in-person, by video conference or by telephone.

The Board has established a committee structure that includes an Audit Committee and a Governance Committee (discussed in more detail below). The Board conducts much of its work through these Committees. Each Committee

is comprised entirely of Independent Trustees, which ensures that the Funds have effective and independent governance and oversight.

The Board reviews its structure regularly and believes that its leadership structure, including having a super-majority of Independent Trustees, coupled with an Interested Chairperson and a Lead Independent Trustee, is appropriate and in the best interests of the Trusts because it allows the Board to exercise informed and independent judgment over matters under its purview, and it allocates areas of responsibility among the Committees and the full Board in a manner that enhances effective oversight. The Board believes that having an Interested Chairperson is appropriate and in the best interests of the Trusts given: (1) the extensive oversight provided by the Trusts' Advisor over the affiliated and unaffiliated sub-advisors that conduct the day-to-day management of the Funds of each Trust; (2) the extent to which the work of the Board is conducted through the standing Committees; (3) the extent to which the Independent Trustees meet regularly, together with independent legal counsel, in the absence of the Interested Chairperson; and (4) the Interested Chairperson’s additional roles as a director of the Advisor and the Distributor and senior executive of IFS Financial Services, Inc., the Advisor’s parent company, and of other affiliates of the Advisor, which enhance the Board’s understanding of the operations of the Advisor and the role of the Trusts and the Advisor within Western & Southern Financial Group, Inc. The Board also believes that the role of the Lead Independent Trustee within the leadership structure is integral to promoting independent oversight of the Funds’ operations and meaningful representation of the shareholders’ interests. In addition, the Board believes its leadership structure facilitates the orderly and efficient flow of information to the Independent Trustees from the Trusts' management.

Standing Committees of the Board

The Board is responsible for overseeing the operations of the Trusts in accordance with the provisions of the 1940 Act and other applicable laws and each Trust’s Declaration of Trust. The Board has established the following Committees to assist in its oversight functions. Each Committee is composed entirely of Independent Trustees.

Each of the Audit Committee and Governance Committee are governed by a charter that was approved by the Board. A copy of the Governance Committee Charter is attached as Appendix A.

Audit Committee. All of the Independent Trustees are members of the Audit Committee. The Audit Committee is responsible for overseeing each Trust’s accounting and financial reporting policies, practices and internal controls. Ms. Carnahan is the Chair of the Audit Committee. Below is the number of Audit Committee meetings for each Trust as of its most recent fiscal year end or 12 month period as set forth below.

•TFGT: There were four Audit Committee meetings held during the fiscal year ended September 30, 2020.

•TST: There were four Audit Committee meetings held during the 12 months ended March 31, 2021.

•TVST: There were four Audit Committee meetings held during the fiscal year ended December 31, 2020.

Governance Committee. All of the Independent Trustees are members of the Governance Committee. The Governance Committee is responsible for overseeing the Trusts' compliance program and compliance issues, procedures for valuing securities and responding to any pricing issues. Ms. Hickenlooper is chair of the Governance Committee.Below is the number of Governance Committee meetings for each Trust as of its most recent fiscal year end or 12 month period as set forth below.

•TFGT: There were four Governance Committee meetings held during the fiscal year ended September 30, 2020.

•TST: There were four Governance Committee meetings held during the 12 months ended March 31, 2021.

•TVST: There were four Governance Committee meetings held during the fiscal year ended December 31, 2020.

In addition, the Governance Committee is responsible for recommending candidates to serve on the Board. The Governance Committee will consider shareholder recommendations for nomination to the Board only in the event

that there is a vacancy on the Board. Shareholders who wish to submit recommendations for nominations to the Board to fill the vacancy must submit their recommendations in writing to Ms. Susan Hickenlooper, Chair of the Governance Committee, c/o Touchstone Funds, 303 Broadway, Suite 1100, Cincinnati, Ohio 45202. Shareholders should include appropriate information on the background and qualifications of any person recommended to the Governance Committee (e.g., a resume), as well as the candidate’s contact information and a written consent from the candidate to serve if nominated and elected. Shareholder recommendations for nominations to the Board will be accepted on an ongoing basis and such recommendations will be kept on file for consideration in the event of a future vacancy on the Board.

When a vacancy on the Board exists or is anticipated, and such vacancy is to be filled by an Independent Trustee, the Governance Committee identifies candidates by obtaining referrals from such sources as it may deem appropriate, which may include current Trustees, management of the Trusts, counsel and other advisors to the Trustees, and shareholders of a Fund who submit recommendations in accordance the procedures set forth above. The Governance Committee gives any candidates recommended by shareholders the same consideration as any other candidate.

A candidate recommended as a nominee for Independent Trustee must not be an “interested person” of any Trust. Otherwise, there are no specific qualifications for Board membership. In evaluating a candidate for a position on the Board, including any candidate recommended by shareholders of a Trust, the Governance Committee may consider a variety of information about the candidate. Among the factors that the Governance Committee generally considers are the following: (i) the candidate’s understanding of the mutual fund industry; (ii) the candidate’s leadership experience or prior board experience; (iii) the candidate’s educational background, business and professional experience, reputation for high ethical standards and professional integrity; (iv) any specific financial, technical or other expertise possessed by the candidate, and the extent to which such expertise would complement the Board’s existing mix of skills, core competencies and qualifications; (v) the candidate’s perceived ability to contribute to the ongoing functions of the Board, including the candidate’s ability and commitment to attend meetings regularly and work collaboratively with other members of the Board; and (vi) such other factors as the Governance Committee determines to be relevant in light of the existing composition of the Board and any anticipated vacancies. Prior to making a final recommendation to the Independent Trustees and the Board, the Governance Committee conducted personal interviews with those candidates it concluded were the most qualified candidates.

The Governance Committee takes the overall diversity of the Board into account when considering and evaluating candidates for Board membership. While the Governance Committee has not adopted a specific policy on diversity or a particular definition of diversity, when considering candidates, the Governance Committee generally considers the manner in which each candidate’s professional experience, education, background, race, gender and national origin are complementary to the existing Trustees’ attributes.

The Governance Committee has approved Mses. Carnahan and King and Messrs. Moore and Zimmer for inclusion on the Trusts’ proxy card. These Nominees were recommended for approval as Independent Trustees (except in the case of Mr. Moore who was recommended for approval as an Interested Trustee) by the current Independent Trustees.

Board Oversight of Risk

Consistent with its responsibilities for oversight of the Trusts and their Funds, the Board, among other things, oversees risk management of each Fund’s investment program and business affairs directly and through the committee structure that it has established. Risks to the Funds include, among others, investment risk, credit risk, liquidity risk, valuation risk and operational risk, as well as the overall business risk relating to the Funds. The Board has adopted, and periodically reviews, policies and procedures designed to address these risks. Under the overall oversight of the Board, the Advisor, sub-advisors, and other key service providers to the Funds, including the administrator, the distributor, the transfer agent, the custodian, and the independent auditors, have also implemented a variety of processes, procedures and controls to address these risks. Different processes, procedures and controls are employed with respect to different types of risks. These processes include those that are embedded in the

conduct of regular business by the Board and in the responsibilities of officers of the Trusts and other service providers.

The Board requires senior officers of the Trusts, including the Chief Compliance Officer (“CCO”), to report to the Board on a variety of matters at regular and special meetings of the Board, including matters relating to risk management. The Board and the Audit Committee receive regular reports from the Trusts' independent auditors on internal control and financial reporting matters. On at least a quarterly basis, the Board meets with the Trusts' CCO, including meetings in executive sessions, to discuss issues related to portfolio compliance and, on at least an annual basis, receives a report from the CCO regarding the effectiveness of the Trusts' compliance program. In addition, the Board also receives reports from the Advisor on the investments and securities trading of the Funds, including their investment performance and asset weightings compared to appropriate benchmarks, as well as reports regarding the valuation of those investments. The Board also receives reports from the Trusts' primary service providers on a periodic or regular basis, including the sub-advisors to the Funds.

Fund shareholders who wish to send communications to the Board may do so by sending an email to TI-contact@touchstoneinvestments.com or by visiting the “Contact Us” section at www.TouchstoneInvestments.com, which will promptly be forwarded to each Board member. The Secretary reserves the right not to forward to the Trustees any abusive, threatening, or otherwise inappropriate materials. Alternatively, you may also contact Mr. Timothy S. Stearns, Vice President and Chief Compliance Officer of the Trusts, at 303 Broadway, Suite 1100, Cincinnati, Ohio 45202.

INDEPENDENT AUDITORS

Based on the Audit Committee’s recommendation, the Board, including a majority of Independent Trustees, selected Ernst & Young LLP (“E&Y”) as auditors to each of the Funds within the Trusts (except for a Fund in each of TST and TFGT) during each Trust’s current fiscal year. The Board also selected Tait, Weller & Baker, LLP ("Tait Weller") as auditors to a Fund within each of TST and TFGT as noted below:

| | | | | | | | |

| Touchstone Funds Group Trust | | Auditor for the fiscal year ending

September 30, 2021 |

| Touchstone Dividend Equity Fund* | | Tait Weller |

| | | | | | | | |

| Touchstone Strategic Trust | | Auditor for the fiscal year ending

March 31, 2022 |

| Touchstone Strategic Income Opportunities Fund* | | Tait Weller |

*These Funds are expected to commence operations on or about July 16, 2021 and, as of the date of this Proxy Statement, have not yet incurred any audit fees, audit-related fees, tax fees and other fees from Tait Weller.

Representatives from E&Y and Tait Weller will not be attending this Special Meeting, but will have the opportunity to make a statement if they desire and will be available by telephone should any matter arise requiring their presence.

Audit Committee Pre-Approval Policies. The Audit Committee’s pre-approval policies describe the types of audit, audit-related, tax, and other services that have the general pre-approval of the Audit Committee. The pre-approval policies provide that annual audit service fees, tax services not specifically granted pre-approval, services exceeding pre-approved cost levels, and other services that have not received general pre-approval will be subject to specific pre-approval by the Audit Committee. The pre-approval policies further provide that the Committee may grant general pre-approval to other audit services (statutory audits and services associated with SEC registration statements, periodic reports, and other documents filed with the SEC or other documents issued in connection with securities offerings), audit-related services (accounting consultations related to accounting, financial reporting or disclosure matters not classified as “audit services”, assistance with understanding and implementing new accounting and financial reporting guidance from rulemaking authorities, agreed-upon or expanded audit procedures related to accounting or billing records required to respond to or comply with financial, accounting or regulatory reporting matters and assistance with internal control reporting requirements under Form N-CSR), tax services that

have historically been provided by the auditor that the Committee believes would not impair the independence of the auditor and are consistent with the SEC’s rules on auditor independence, and permissible non-audit services classified as “all other services” that are routine and recurring services.

Audit Fees, Audit-Related Fees, Tax Fees and Other Fees. During the fiscal years stated below for each Trust, E&Y performed audit services for the Trusts, including the audit of each Trust’s financial statements, review of each Trust’s annual report and registration statement amendments, and reporting matters.

Touchstone Funds Group Trust

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year End | | |

| Fees | 9/30/2019 | 9/30/2020 | | Comments |

| Audit Fees | $ | 252,000 | $ | 259,000 | | These amounts include fees associated with the annual audit and filings of the Trust’s Form N-1A and Form N-CEN. |

| Audit-Related Fees | $ | 22,000 | $ | 16,000 | | Post Audit review procedures of the Trusts Form N-14. |

| Tax Fees | $ | 108,990 | $ | 82,705 | | These amounts consisted of tax compliance services. |

| Other Fees | $ | 17,134 | $ | 11,660 | | These fees relate to the passive foreign investment company ("PFIC") analyzer and Global Withholding Tax Reporter subscriptions. |

The aggregate non-audit fees for TFGT and certain entities*, totaled approximately $731,244 and $913,405 for the fiscal years ended September 30, 2019 and September 30, 2020, respectively.

Touchstone Strategic Trust

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year End | | |

| Fees | 12/31/2019 | 12/31/2020 | | Comments |

| Audit Fees | $ | 55,000 | $ | 55,100 | | These amounts include fees associated with the annual audit and filings of the Trust’s Form N-1A and Form N-CEN. |

| Audit-Related Fees | $ | 6,000 | $ | 8,000 | | Post Audit review procedures of the Trusts Form N-14. |

| Tax Fees | $ | 14,930 | $ | 11,760 | | These amounts consisted of tax compliance services. |

| Other Fees | $ | 2,625 | $ | 1,639 | | These fees relate to the PFIC analyzer and Global Withholding Tax Reporter subscriptions. |

The aggregate non-audit fees for TST and certain entities*, totaled approximately $731,002 and $766,767 for the fiscal years ended December 31, 2019 and December 31, 2020, respectively.

The following series of TST have a December 31 fiscal year end: the Touchstone Anti-Benchmark© US Core Equity Fund, the Touchstone Dynamic Global Allocation Fund, and the Touchstone Sands Capital International Growth Fund.

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year End | | |

| Fees | 3/31/2020 | 3/31/2021 | | Comments |

| Audit Fees | $ | 116,800 | $ | 117,600 | | These amounts include fees associated with the annual audit and filings of the Trust’s Form N-1A and Form N-CEN. |

| Audit-Related Fees | $ | 4,000 | $ | 5,500 | | Post Audit review procedures of the Trusts Form N-14. |

| Tax Fees | $ | 62,045 | $ | 39,555 | | These amounts consisted of tax compliance services. |

| Other Fees | $ | 20,756 | $ | 18,354 | | These fees relate to the PFIC analyzer and Global Withholding Tax Reporter subscriptions. |

The aggregate non-audit fees for TST (March Funds) and certain entities*, totaled approximately $655,460 and $719,238 for the fiscal years ended March 31, 2020 and March 31, 2021, respectively.

The following series of TST have a March 31 fiscal year end: the Touchstone Flexible Income Fund, the Touchstone Focused Fund, the Touchstone Global ESG Equity Fund, the Touchstone Growth Opportunities Fund, the Touchstone Mid Cap Growth Fund, the Touchstone Sands Capital Emerging Markets Growth Fund, and the Touchstone Strategic Income Opportunities Fund.

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year End | | |

| Fees | 6/30/2019 | 6/30/2020 | | Comments |

| Audit Fees | $ | 217,100 | $ | 203,400 | | These amounts include fees associated with the annual audit and filings of the Trust’s Form N-1A and Form N-CEN. |

| Audit-Related Fees | $ | 0 | $ | 8,000 | | Post Audit review procedures of the Trusts Form N-14. |

| Tax Fees | $ | 88,085 | $ | 69,985 | | These amounts consisted of tax compliance services. |

| Other Fees | $ | 28,089 | $ | 40,675 | | These fees relate to the PFIC analyzer and Global Withholding Tax Reporter subscriptions. |

The aggregate non-audit fees for TST (June Funds) and certain entities*, totaled approximately $680,755 and $890,010 for the fiscal years ended June 30, 2019 and June 30, 2020, respectively.

The following series of TST have a June 30 fiscal year end: the Touchstone Balanced Fund, the Touchstone International Equity Fund, the Touchstone International Growth Fund, the Touchstone Large Cap Fund, the Touchstone Large Cap Focused Fund, the Touchstone Large Company Growth Fund, the Touchstone Ohio Tax-Free Bond Fund, the Touchstone Small Company Fund, and the Touchstone Value Fund.

There were no other fees for all other services during the fiscal years presented above.

Touchstone Variable Series Trust

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year End | | |

| Fees | 12/31/2019 | 12/31/2020 | | Comments |

| Audit Fees | $ | 125,800 | $ | 124,900 | | These amounts include fees associated with the annual audit and filings of the Trust’s Form N-1A and Form N-CEN. |

| Audit-Related Fees | $ | 10,000 | $ | 0 | | Post-audit review procedures of the Trust's Form N-14. |

| Tax Fees | $ | 34,180 | $ | 29,910 | | These amounts consisted of tax compliance services. |

| Other Fees | $ | 5,584 | $ | 2,986 | | These fees relate to the PFIC analyzer and Global Withholding Tax Reporter subscriptions. |

The aggregate non-audit fees for TVST and certain entities* totaled approximately $731,002 and $766,767 in 2019 and 2020, respectively.

*Indicates an affiliate of the Funds and/or the Advisor.

ADDITIONAL INFORMATION ABOUT THE TRUSTS

Shares Outstanding

At the close of business on the Record Date, the number of outstanding shares of beneficial interest for each of the Trusts was as follows:

| | | | | | | | | | | |

| Trusts | Touchstone Fund and Share Class | | Share Balance as of

Record Date |

| TOUCHSTONE FUNDS GROUP TRUST: | ACTIVE BOND FUND CLASS A | | 11,195,746.280 | |

| ACTIVE BOND FUND CLASS C | | 425,873.853 | |

| | | | | | | | | | | |

| Trusts | Touchstone Fund and Share Class | | Share Balance as of

Record Date |

| ACTIVE BOND FUND INSTITUTIONAL CLASS | | 11,288,470.689 | |

| ACTIVE BOND FUND CLASS Y | | 8,718,613.870 | |

| ANTI-BENCHMARK INTERNATIONAL CORE EQUITY FUND INSTITUTIONAL CLASS | | 3,332,348.787 | |

| ANTI-BENCHMARK INTERNATIONAL CORE EQUITY FUND CLASS Y | | 23,089.515 | |

| CREDIT OPPORTUNITIES FUND CLASS A | | 5,494,579.640 | |

| CREDIT OPPORTUNITIES FUND CLASS C | | 395,686.757 | |

| CREDIT OPPORTUNITIES FUND INSTITUTIONAL CLASS | | 253,914.960 | |

| CREDIT OPPORTUNITIES FUND CLASS Y | | 7,353,740.958 | |

| HIGH YIELD FUND CLASS A | | 1,778,880.490 | |

| HIGH YIELD FUND CLASS C | | 99,053.874 | |

| HIGH YIELD FUND INSTITUTIONAL CLASS | | 17,355,308.910 | |

| HIGH YIELD FUND CLASS Y | | 3,826,742.563 | |

| IMPACT BOND FUND CLASS A | | 1,801,962.522 | |

| IMPACT BOND FUND CLASS C | | 150,138.247 | |

| IMPACT BOND FUND INSTITUTIONAL CLASS | | 19,723,368.814 | |

| IMPACT BOND FUND CLASS Y | | 17,387,222.177 | |

| INTERNATIONAL ESG EQUITY FUND CLASS A | | 1,138,059.571 | |

| INTERNATIONAL ESG EQUITY FUND CLASS C | | 336,488.769 | |

| INTERNATIONAL ESG EQUITY FUND INSTITUTIONAL CLASS | | 386.392 | |

| INTERNATIONAL ESG EQUITY FUND CLASS Y | | 2,193,451.475 | |

| MID CAP FUND CLASS A | | 2,943,360.079 | |

| MID CAP FUND CLASS C | | 2,182,652.794 | |

| MID CAP FUND INSTITUTIONAL CLASS | | 30,248,168.741 | |

| MID CAP FUND CLASS R6 | | 395,753.681 | |

| MID CAP FUND CLASS Y | | 72,122,960.034 | |

| MID CAP FUND CLASS Z | | 1,258,130.522 | |

| MID CAP VALUE FUND CLASS A | | 584,581.885 | |

| MID CAP VALUE FUND CLASS C | | 214,257.778 | |

| MID CAP VALUE FUND INSTITUTIONAL CLASS | | 18,981,696.912 | |

| MID CAP VALUE FUND CLASS Y | | 17,246,424.807 | |

| SANDS CAPITAL SELECT GROWTH FUND CLASS A | | 10,865,667.644 | |

| SANDS CAPITAL SELECT GROWTH FUND CLASS C | | 1,816,475.533 | |

| SANDS CAPITAL SELECT GROWTH FUND INSTITUTIONAL CLASS | | 119,018,529.405 | |

| SANDS CAPITAL SELECT GROWTH FUND CLASS R6 | | 7,103,936.328 | |

| SANDS CAPITAL SELECT GROWTH FUND CLASS Y | | 88,911,787.092 | |

| SANDS CAPITAL SELECT GROWTH FUND CLASS Z | | 28,602,823.051 | |

| SMALL CAP FUND CLASS A | | 366,993.474 | |

| SMALL CAP FUND CLASS C | | 53,985.885 | |

| SMALL CAP FUND INSTITUTIONAL CLASS | | 2,993,803.075 | |

| SMALL CAP FUND CLASS Y | | 3,346,081.897 | |

| SMALL CAP VALUE FUND CLASS A | | 777,929.999 | |

| SMALL CAP VALUE FUND CLASS C | | 20,440.225 | |

| SMALL CAP VALUE FUND INSTITUTIONAL CLASS | | 285,429.219 | |

| SMALL CAP VALUE FUND CLASS Y | | 1,268,879.693 | |

| ULTRA SHORT DURATION FIXED INCOME FUND CLASS A | | 14,606,450.121 | |

| ULTRA SHORT DURATION FIXED INCOME FUND CLASS C | | 490,342.717 | |

| ULTRA SHORT DURATION FIXED INCOME FUND INSTITUTIONAL CLASS | | 51,700,159.347 | |

| ULTRA SHORT DURATION FIXED INCOME FUND CLASS S | | 6,198,224.549 | |

| | | | | | | | | | | |

| Trusts | Touchstone Fund and Share Class | | Share Balance as of

Record Date |

| ULTRA SHORT DURATION FIXED INCOME FUND CLASS Y | | 34,968,522.993 | |

| ULTRA SHORT DURATION FIXED INCOME FUND CLASS Z | | 8,283,883.262 | |

| | | | | | | | | | | | | | |

| TOUCHSTONE STRATEGIC TRUST: | | ANTI-BENCHMARK US CORE EQUITY FUND CLASS A | | 431,167.718 | |

| | | ANTI-BENCHMARK US CORE EQUITY FUND CLASS C | | 123,397.370 | |

| | | ANTI-BENCHMARK US CORE EQUITY FUND INSTITUTIONAL CLASS | | 1,582,177.921 | |

| | ANTI-BENCHMARK US CORE EQUITY FUND CLASS Y | | 1,172,641.339 | |

| | | BALANCED FUND CLASS A | | 12,621,074.584 | |

| | BALANCED FUND CLASS C | | 2,549,740.418 | |

| | BALANCED FUND CLASS Y | | 7,824,083.382 | |

| | DYNAMIC GLOBAL ALLOCATION FUND CLASS A | | 5,852,916.931 | |

| | DYNAMIC GLOBAL ALLOCATION FUND CLASS C | | 187,718.873 | |

| | DYNAMIC GLOBAL ALLOCATION FUND CLASS Y | | 362,491.557 | |

| | FLEXIBLE INCOME FUND A | | 10,971,532.216 | |

| | FLEXIBLE INCOME FUND C | | 3,853,480.564 | |

| | FLEXIBLE INCOME FUND INSTITUTIONAL CLASS | | 3,784,964.919 | |

| | FLEXIBLE INCOME FUND Y | | 55,288,340.404 | |

| | FOCUSED FUND CLASS A | | 850,900.361 | |

| | FOCUSED FUND CLASS C | | 445,795.723 | |

| | FOCUSED FUND INSTITUTIONAL CLASS | | 458,865.280 | |

| | FOCUSED FUND CLASS Y | | 17,950,997.787 | |

| | GLOBAL ESG EQUITY FUND CLASS A | | 18,736,608.099 | |

| | GLOBAL ESG EQUITY FUND CLASS C | | 328,515.602 | |

| | GLOBAL ESG EQUITY FUND INSTITUTIONAL CLASS | | 449,133.028 | |

| | GLOBAL ESG EQUITY FUND CLASS Y | | 6,233,891.462 | |

| | GROWTH OPPORTUNITIES FUND CLASS A | | 1,366,628.207 | |

| | GROWTH OPPORTUNITIES FUND CLASS C | | 57,322.871 | |

| | GROWTH OPPORTUNITIES FUND INSTITUTIONAL CLASS | | 1,603,840.865 | |

| | GROWTH OPPORTUNITIES FUND CLASS Y | | 680,131.276 | |

| | INTERNATIONAL EQUITY FUND CLASS A | | 4,665,218.360 | |

| | INTERNATIONAL EQUITY FUND CLASS C | | 120,522.288 | |

| | INTERNATIONAL EQUITY FUND INSTITUTIONAL CLASS | | 231,687.394 | |

| | INTERNATIONAL EQUITY FUND CLASS Y | | 1,495,958.161 | |

| | INTERNATIONAL GROWTH FUND CLASS A | | 144,628.172 | |

| | INTERNATIONAL GROWTH FUND CLASS C | | 88,852.282 | |

| | INTERNATIONAL GROWTH FUND INSTITUTIONAL CLASS | | 1,468,568.538 | |

| | INTERNATIONAL GROWTH FUND CLASS Y | | 4,725,258.305 | |

| | LARGE CAP FOCUSED FUND CLASS A | | 26,271,417.076 | |

| | LARGE CAP FOCUSED FUND CLASS C | | 772,573.815 | |

| | LARGE CAP FOCUSED FUND INSTITUTIONAL CLASS | | 3,522,954.519 | |

| | LARGE CAP FOCUSED FUND CLASS Y | | 9,787,664.614 | |

| | LARGE CAP FUND CLASS A | | 239,475.280 | |

| | LARGE CAP FUND CLASS C | | 246,919.823 | |

| | LARGE CAP FUND INSTITUTIONAL CLASS | | 5,041,387.886 | |

| | LARGE CAP FUND CLASS Y | | 15,090,314.298 | |

| | LARGE COMPANY GROWTH FUND CLASS A | | 63,111.420 | |

| | LARGE COMPANY GROWTH FUND CLASS C | | 8,638.819 | |

| | LARGE COMPANY GROWTH FUND INSTITUTIONAL CLASS | | 3,930,085.157 | |

| | LARGE COMPANY GROWTH FUND CLASS Y | | 498,452.890 | |

| | | | | | | | | | | | | | |

| | MID CAP GROWTH FUND CLASS A | | 7,913,263.076 | |

| | MID CAP GROWTH FUND CLASS C | | 853,212.337 | |

| | MID CAP GROWTH FUND INSTITUTIONAL CLASS | | 9,419,534.048 | |

| | MID CAP GROWTH FUND CLASS R6 | | 246,513.285 | |

| | MID CAP GROWTH FUND CLASS Y | | 16,025,196.349 | |

| | OHIO TAX FREE BOND FUND CLASS A | | 2,596,703.842 | |

| | OHIO TAX FREE BOND FUND CLASS C | | 99,056.501 | |

| | OHIO TAX FREE BOND FUND CLASS Y | | 289,835.788 | |

| | OHIO TAX FREE BOND FUND INSTITUTIONAL CLASS | | 1,219,153.165 | |

| | SANDS CAP EMERGING MARKETS GROWTH FUND CLASS A | | 1,231,338.303 | |

| | SANDS CAP EMERGING MARKETS GROWTH FUND CLASS C | | 543,852.907 | |

| | SANDS CAP EMERGING MARKETS GROWTH FUND INSTITUTIONAL CLASS | | 133,089,162.960 | |

| | SANDS CAP EMERGING MARKETS GROWTH FUND CLASS Y | | 73,079,433.710 | |

| | SANDS CAPITAL EMERGING MARKETS GROWTH FUND CLASS R6 | | 7,286,239.514 | |

| | SANDS CAPITAL INTERNATIONAL GROWTH FUND INSTITUTIONAL CLASS | | 250.000 | |

| | SANDS CAPITAL INTERNATIONAL GROWTH FUND CLASS R6 | | 2,500,250.000 | |

| | SANDS CAPITAL INTERNATIONAL GROWTH FUND CLASS Y | | 30,746.611 | |

| | SMALL COMPANY FUND CLASS A | | 91,274,917.086 | |

| | SMALL COMPANY FUND CLASS C | | 8,077,444.652 | |

| | SMALL COMPANY FUND INSTITUTIONAL CLASS | | 2,521,205.657 | |

| | SMALL COMPANY FUND CLASS R6 | | 9,479,564.693 | |

| | SMALL COMPANY FUND CLASS Y | | 37,903,443.114 | |

| | VALUE FUND CLASS A | | 2,895,883.636 | |

| | VALUE FUND CLASS C | | 170,783.672 | |

| | VALUE FUND INSTITUTIONAL CLASS | | 25,281,418.867 | |

| | VALUE FUND CLASS Y | | 8,768,553.064 | |

| | | | | | | | | | | | | | |

| TOUCHSTONE VARIABLE SERIES TRUST: | | TVST BALANCED FUND - Class I | | 1,303,596.013 |

| | TVST BALANCED FUND - SC | | 3,510,806.954 |

| | TVST BOND FUND - Class I | | 3,808,515.448 |

| | TVST BOND FUND - SC | | 6,186,841.206 |

| | TVST COMMON STOCK FUND - Class I | | 12,626,175.640 |

| | TVST COMMON STOCK FUND - SC | | 7,097,290.671 |

| | TVST SMALL COMPANY FUND - Class I | | 4,157,946.218 |

The Touchstone Dividend Equity Fund (TFGT) and Touchstone Strategic Income Opportunities Fund (TST) are expected to commence operations on or about July 16, 2021 and, as of the date of this Proxy Statement, do not have any outstanding shares.

Share Ownership Information

Persons or organizations beneficially owning more than 25% of the outstanding shares of a Fund are presumed to “control” the Fund. As a result, those persons or organizations could have the ability to influence an action taken by a Fund if such action requires a shareholder vote. As of the Record Date, the following chart lists those shareholders who beneficially owned 5% or more of the outstanding shares of the indicated Funds, and also shows the aggregate holdings of persons affiliated with the Funds and the Advisor.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOUCHSTONE FUND | | SHAREHOLDER

NAME AND ADDRESS | | CLASS OF

SHARES | | NUMBER OF

SHARES | | PERCENT

OF CLASS | | |

| ACTIVE BOND FUND CLASS A | | PERSHING LLC

1 PERSHING PLAZA

JERSEY CITY NJ 07399 | | Class A | | 926,334.177 | | 8.27 | % | |

| ACTIVE BOND FUND CLASS C | | PERSHING LLC

1 PERSHING PLAZA

JERSEY CITY NJ 07399 | | Class C | | 72,069.178 | | 16.92 | % | |

| ACTIVE BOND FUND CLASS C | | WELLS FARGO CLEARING SERVICES

2801 MARKET STREET

SAINT LOUIS, MO 63103 | | Class C | | 71,301.110 | | 16.74 | % | |

| ACTIVE BOND FUND CLASS C | | LPL FINANCIAL

4707 EXECUTIVE DRIVE

SAN DIEGO CA 92121-3091 | | Class C | | 64,965.653 | | 15.25 | % | |

| ACTIVE BOND FUND CLASS C | | RAYMOND JAMES

OMNIBUS FOR MUTUAL FUNDS

ATTN COURTNEY WALLER

880 CARILLON PARKWAY

ST PETERSBURG FL 33716 | | Class C | | 43,779.278 | | 10.28 | % | |

| ACTIVE BOND FUND CLASS C | | CHARLES SCHWAB & CO INC

SPECIAL CUSTODY ACCT FBO CUSTOMERS

ATTN MUTUAL FUNDS

211 MAIN STREET

SAN FRANCISCO CA 94105 | | Class C | | 43,134.494 | | 10.13 | % | |

| ACTIVE BOND FUND CLASS C | | MORGAN STANLEY SMITH BARNEY LLC

FOR THE EXCLUSIVE BENEFIT OF ITS

CUSTOMERS

1 NEW YORK PLAZA FL 12

NEW YORK NY 10004-1901 | | Class C | | 30,608.298 | | 7.19 | % | |

| ACTIVE BOND FUND INSTITUTIONAL CLASS | | PERSHING LLC

1 PERSHING PLAZA

JERSEY CITY NJ 07399 | | Institutional Class | | 6,706,053.711 | | 59.41 | % | |

| ACTIVE BOND FUND INSTITUTIONAL CLASS | | NATIONAL LIFE INSURANCE CO

SEPARATE ACCOUNT II

ATTN NANCY LECLERC

INVESTMENT ACCT G DEPT

1 NATIONAL LIFE DRIVE

MONTPELIER VT 05602-3377 | | Institutional Class | | 1,744,110.659 | | 15.45 | % | |

| ACTIVE BOND FUND INSTITUTIONAL CLASS | | BAND & CO C/O US BANK NA

1555 N. RIVERCENTER DRIVE STE. 302

MILWAUKEE WI 53212 | | Institutional Class | | 709,971.912 | | 6.29 | % | |

| ACTIVE BOND FUND CLASS Y | | NATIONAL FINANCIAL SERVICES CORP

(FBO) OUR CUSTOMERS

ATTN MUTUAL FUNDS DEPARTMENT 4TH FL

499 WASHINGTON BLVD

JERSEY CITY NJ 07310-2010 | | Class Y | | 1,342,306.758 | | 15.40 | % | |

| ACTIVE BOND FUND CLASS Y | | BAND & CO C/O US BANK NA

1555 N. RIVERCENTER DRIVE STE. 302

MILWAUKEE WI 53212 | | Class Y | | 1,245,240.013 | | 14.28 | % | |

| ACTIVE BOND FUND CLASS Y | | CHARLES SCHWAB & CO INC

REINVEST ACCOUNT

ATTN MUTUAL FUND DEPARTMENT

101 MONTGOMERY ST

SAN FRANCISCO CA 94104-4151 | | Class Y | | 961,611.819 | | 11.03 | % | |

| ACTIVE BOND FUND CLASS Y | | CHARLES SCHWAB & CO INC

SPECIAL CUSTODY ACCT FBO CUSTOMERS

ATTN MUTUAL FUNDS

211 MAIN STREET

SAN FRANCISCO CA 94105 | | Class Y | | 836,499.793 | | 9.59 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOUCHSTONE FUND | | SHAREHOLDER

NAME AND ADDRESS | | CLASS OF

SHARES | | NUMBER OF

SHARES | | PERCENT

OF CLASS | | |

| ACTIVE BOND FUND CLASS Y | | THE WESTERN & SOUTHERN LIFE

INSURANCE CO DEFERRED COMP PLAN FBO

6 POST 04 DEFERRALS - INSTALLMENT

400 BROADWAY

CINCINNATI OH 45202 | | Class Y | | 801,175.597 | | 9.19 | % | |

| ACTIVE BOND FUND CLASS Y | | UBS WM USA FBO

SPEC CDY A/C EXL BEN CUSTOMERS

OF UBSFSI

1000 HARBOR BLVD

WEEHAWKEN, NJ 07086 | | Class Y | | 743,653.537 | | 8.53 | % | |

| ANTI-BENCHMARK INTERNATIONAL CORE EQUITY FUND INSTITUTIONAL CLASS | | WESTERN SOUTHERN FINANCIAL GROUP

ATTN MS 80- INVESTMENT ACCOUNTING

400 BROADWAY

CINCINNATI OH 45202 | | Institutional Class | | 2,097,994.192 | | 62.96 | % | |

| ANTI-BENCHMARK INTERNATIONAL CORE EQUITY FUND INSTITUTIONAL CLASS | | TOUCHSTONE DYNAMIC GLOBAL

ALLOCATION FUND

303 BROADWAY ST STE 1100

CINCINNATI OH 45202-4220 | | Institutional Class | | 727,242.434 | | 21.82 | % | |

| ANTI-BENCHMARK INTERNATIONAL CORE EQUITY FUND INSTITUTIONAL CLASS | | WESTERN & SOUTHERN LIFE

AND INSURANCE COMPANY

400 BROADWAY MS 80

CINCINNATI OH 45202 | | Institutional Class | | 506,851.676 | | 15.21 | % | |

| ANTI-BENCHMARK INTERNATIONAL CORE EQUITY FUND - Y | | CHARLES SCHWAB & CO INC

101 MONTGOMERY ST

SAN FRANCISCO CA 94104 | | Class Y | | 21,318.347 | | 92.33 | % | |

| ANTI-BENCHMARK INTERNATIONAL CORE EQUITY FUND - Y | | PERSHING LLC

1 PERSHING PLAZA

JERSEY CITY NJ 07399 | | Class Y | | 1,511.158 | | 6.54 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS A | | MLPF & S THE SOLE BENEFIT OF

FOR IT'S CUSTOMERS

ATTN FUND ADMISTRATION

4800 DEER LAKE DR EAST-2ND FLR

JACKSONVILLE FL 32246 | | Class A | | 119,095.024 | | 27.62 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS A | | MORGAN STANLEY SMITH BARNEY LLC

FOR THE EXCLUSIVE BENEFIT OF ITS

CUSTOMERS

1 NEW YORK PLAZA FL 12

NEW YORK NY 10004-1901 | | Class A | | 48,506.312 | | 11.25 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS A | | PERSHING LLC

1 PERSHING PLAZA

JERSEY CITY NJ 07399 | | Class A | | 37,854.321 | | 8.78 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS A | | UBS WM USA FBO

SPEC CDY A/C EXL BEN CUSTOMERS

OF UBSFSI

1000 HARBOR BLVD

WEEHAWKEN, NJ 07086 | | Class A | | 37,290.079 | | 8.65 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS A | | WELLS FARGO CLEARING SERVICES

2801 MARKET STREET

SAINT LOUIS, MO 63103 | | Class A | | 35,728.303 | | 8.29 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS A | | LPL FINANCIAL

4707 EXECUTIVE DRIVE

SAN DIEGO CA 92121-3091 | | Class A | | 33,276.892 | | 7.72 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS C | | LPL FINANCIAL

4707 EXECUTIVE DRIVE

SAN DIEGO CA 92121-3091 | | Class C | | 71,113.834 | | 57.63 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOUCHSTONE FUND | | SHAREHOLDER

NAME AND ADDRESS | | CLASS OF

SHARES | | NUMBER OF

SHARES | | PERCENT

OF CLASS | | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS C | | MORGAN STANLEY SMITH BARNEY LLC

FOR THE EXCLUSIVE BENEFIT OF ITS

CUSTOMERS

1 NEW YORK PLAZA FL 12

NEW YORK NY 10004-1901 | | Class C | | 20,354.524 | | 16.50 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS C | | ROGER D KRUMLAUF TOD

SUBJECT TO STA TOD RULES

4468 CAMBRIDGE DR

PORT HURON MI 48060-7209 | | Class C | | 6,570.602 | | 5.32 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND INSTITUTIONAL CLASS | | WESTERN SOUTHERN FINANCIAL GROUP*

ATTN MS 80- INVESTMENT ACCOUNTING

400 BROADWAY

CINCINNATI OH 45202 | | Institutional Class | | 1,573,783.292 | | 99.47 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS Y | | UBS WM USA FBO

SPEC CDY A/C EXL BEN CUSTOMERS

OF UBSFSI

1000 HARBOR BLVD

WEEHAWKEN, NJ 07086 | | Class Y | | 160,730.216 | | 13.71 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS Y | | CHARLES SCHWAB & CO INC

SPECIAL CUSTODY ACCOUNT

FOR BENEFIT OF CUSTOMERS

ATTN MUTUAL FUNDS

101 MONTGOMERY ST

SAN FRANCISCO CA 94104-4151 | | Class Y | | 91,566.102 | | 7.81 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS Y | | NATIONAL FINANCIAL SERVICES CORP

(FBO) OUR CUSTOMERS

ATTN MUTUAL FUNDS DEPARTMENT 4TH FL

499 WASHINGTON BLVD

JERSEY CITY NJ 07310-2010 | | Class Y | | 72,406.448 | | 6.17 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS Y | | FIRST STATE TRUST COMPANY FBO NBT 3

2 RIGHTER PARKWAY

WILMINGTON DE 19803 | | Class Y | | 71,245.434 | | 6.08 | % | |

| ANTI-BENCHMARK US CORE EQUITY FUND CLASS Y | | LPL FINANCIAL

4707 EXECUTIVE DRIVE

SAN DIEGO CA 92121-3091 | | Class Y | | 61,966.115 | | 5.28 | % | |

| BALANCED FUND CLASS A | | PERSHING LLC

1 PERSHING PLAZA

JERSEY CITY NJ 07399 | | Class A | | 730,775.966 | | 5.79 | % | |

| BALANCED FUND CLASS C | | WELLS FARGO CLEARING SERVICES

2801 MARKET STREET

SAINT LOUIS, MO 63103 | | Class C | | 865,444.792 | | 33.94 | % | |

| BALANCED FUND CLASS C | | RAYMOND JAMES

OMNIBUS FOR MUTUAL FUNDS

ATTN COURTNEY WALLER

880 CARILLON PARKWAY

ST PETERSBURG FL 33716 | | Class C | | 568,167.925 | | 22.28 | % | |

| BALANCED FUND CLASS C | | PERSHING LLC

1 PERSHING PLAZA

JERSEY CITY NJ 07399 | | Class C | | 260,235.483 | | 10.21 | % | |

| BALANCED FUND CLASS C | | LPL FINANCIAL

4707 EXECUTIVE DRIVE

SAN DIEGO CA 92121-3091 | | Class C | | 220,844.168 | | 8.66 | % | |

| BALANCED FUND CLASS C | | AMERICAN ENTERPRISE INVESTMENT SVC