|

| |

Western & Southern Financial Group® | 400 Broadway Cincinnati, OH 45202 Tel: 513-357-6029 Fax: 513-629-1044 meredyth.whitford@wslife.com |

October 19, 2018

Ms. Jaea Hahn

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| |

| Re: | Touchstone Funds Group Trust (the “Trust”) (File Nos. 033-70958 & 811-08104) |

Dear Ms. Hahn:

On behalf of the Trust, attached are responses to oral comments provided by the Staff of the Securities and Exchange Commission (the “Staff”) on September 6, 2018 regarding the post-effective amendment to the Trust’s registration statement on Form N-1A filed on July 18, 2018 (PEA No. 101) pursuant to Rule 485(a) under the Securities Act of 1933, as amended, with respect to the Touchstone Anti-Benchmark® International Core Equity Fund (the "International Fund") and the Touchstone Anti-Benchmark® US Core Equity Fund (each a "Fund" and together, the "Funds").

For your convenience, your comments are set out below in italicized text and each comment is followed by the Trust’s response.

General

1. Please confirm that any blank or bracketed information in the Funds' Prospectus and Statement of Additional Information will be finalized in the 485(b) filing.

Response: The Trust confirms that it will finalize all blank or bracketed information in each Fund's Prospectus and Statement of Additional Information that will be filed with the Securities and Exchange Commission pursuant to Rule 485(b).

2. Where Staff comments affect disclosure that appears in more than one place, please revise the affected disclosure in each area where it appears. Please carry any summary prospectus comments over to the statutory prospectus, to the extent relevant.

Response: The Trust will apply any Staff comments to each location where the disclosure in question appears.

Prospectus - Both Funds

3. Please confirm in footnote 2 that each expense limitation agreement will last no less than one year from the effective date of the Prospectus.

Response: The Trust confirms that each expense limitation agreement will expire not less than one year from the effective date of the Prospectus.

4. In response to Staff comments, please submit another 485(a) filing for the Funds incorporating the comments discussed with Staff.

Response: The Trust will submit another 485(a) filing for the Funds on or about October 19, 2018 that addresses the Prospectus comments discussed herein for the review of the Staff.

5. Do the Funds intend to operate as index funds? If so, how does each Fund intend to the track its respective index? Please revise each Fund's principal investment strategy to describe the index methodologies. Please also provide the Staff with a white paper describing the index methodology.

Response: For the information of the Staff, the Funds do intend to operate as index funds. Each Fund will fully replicate its respective index. The Trust has revised each Fund's principal investment strategy to include additional information with respect to index methodology. Additional information provided by TOBAM relating to the index rules and methodologies is attached hereto as Exhibit A for the Staff's review.

6. Please clarify whether the Funds' sub-advisor, TOBAM S.A.S. ("TOBAM"), is affiliated with Touchstone Advisors, Inc. ("Touchstone"), the Funds' investment advisor. Please clarify whether TOBAM is the sole sub-advisor to the Funds.

Response: For the information of the Staff, Touchstone intends for TOBAM to be the sole sub-advisor to each Fund. TOBAM is not affiliated with Touchstone or its parent company.

7. If the Funds intend to operate as index funds, please provide a license agreement to which the Funds are a party as an exhibit to the re-filed Registration Statement.

Response: There is an index license agreement relating to the Funds' use of the indices, however, the agreement is between Touchstone Advisors, Inc. and TOBAM. The Funds are not a party to the agreement. As a result, the Trust does not believe it is required to file a copy of the index license agreement pursuant to Form N-1A.

8. Supplementally, please describe TOBAM's experience as an index provider.

Response: TOBAM is an asset management firm established in Paris, France in 2006 and has been an SEC-registered investment adviser since 2011. TOBAM has and will continue to create indices based on its research. TOBAM can license these indices to clients. The ground rules of TOBAM's indices are publicly available and include a description of an example calculation method of the indices. TOBAM currently licenses numerous indices, including its Anti-Benchmark® indices and its MAXDIV® [maximum diversification] range of indices -- there are currently 12 indices that comprise TOBAM's MAXDIV® range of indices. TOBAM licenses its indices to mutual funds and other investment funds across the U.S., Canada, and Europe. As an example, Mackenzie Investments currently offers six Canadian index mutual funds that are each based on a TOBAM index. In addition, Nationwide offers three ETFs in the U.S. that are based on TOBAM indices.

9. In each Fund's principal investment strategy section, please explain in plain English how the sub-advisor seeks to maximize diversification.

Response: The Trust has revised the principal investment strategy section to explain in more detail how the sub-advisor seeks to maximize diversification.

10. Please explain what is meant by the term Anti-Benchmark®.

Response: The term Anti-Benchmark® was created by TOBAM to describe its quantitative investment process designed to maximize portfolio efficiency and take full advantage of the benefits of diversification relative to a traditional market capitalization weighted benchmark. TOBAM's Anti-Benchmark equity strategies use a quantitative approach to provide broad equity market exposure, aiming to outperform the most liquid equity market cap-weighted indices over a market cycle, with less risk. The Anti-Benchmark strategies thus use broad market indices as their reference points in building an optimized “Anti-Benchmark” portfolio.

11. Please discuss whether and how often each index will be rebalanced and whether the Funds will follow the rebalacing of the indices or whether the Funds will have discretion to continue holding securities that are no longer a part of the index.

Response: Both indices will be rebalanced monthly. Each Fund intends to fully replicate its respective index, and therefore, each Fund will also be rebalanced monthly. The Trust has added clarifying language to the Prospectus in this regard.

12. Can the Funds use derivatives to gain exposure to the indices?

Response: The Funds do not intend to use derivatives to gain exposure to the indices and are not aware of any publicly traded derivatives on the indices.

13. Each Fund's principal risks include a "Management Risk". Management risk is typically only used as a risk factor in index funds if such fund uses representative sampling. Please consider renaming or reworking this risk factor to avoid confusion.

Response: The Trust will rename this risk factor as suggested.

14. Each Fund's principal risks include a "Sector and Industry Exposure Risk". If this is a principal risk of the Funds, please revise the principal investment strategies to include a reference to sector and industry exposure. If this is not a principal risk, please remove it.

Response: The Trust confirms that this is not a principal investment strategy of the Funds, and as a result, has removed this risk factor.

15. Please add a risk factor for tracking error/correlation risk, indicating that the Funds may not perfectly track their index.

Response: The Trust will add the requested risk factor.

16. In the "Principal Investment Strategies and Risks - How Do the Funds Implement Their Investment Goal?" section of the Prospectus, please add clarification with respect to full index replication vs. representative sampling. Please also add the number range of component securities in each index.

Response: The Trust has made the requested revisions.

17. The Staff notes the inclusion of the "Principal Investment Strategies and Risks - Can a Fund Depart From its Principal Investment Strategies?" section. Please confirm supplementally that all principal investment strategies have been discussed in the Prospectus.

Response: The Trust confirms that all principal investment strategies of the Funds have been included in the Prospectus.

18. Please confirm whether “Acquired Fund Fees and Expenses” should be included in each fee table given the reference to “other investment companies” on page 12 of the Prospectus.

Response: The Trust confirms that “Acquired Fund Fees and Expenses” are expected to be less than 0.01% and therefore are not included in either fee table. In addition, the Trust confirms that the Funds do not expect to invest in other investment companies, and as a result, the "other investment companies" disclosure has been removed.

19. In the introduction language in the "What are the Principal Risks of Investing in the Funds?" sub-section, please clarify that the table doesn't necessarily reflect the risk/return profile of the Funds.

Response: The Trust will add the requested disclosure.

20. In the Class Y shares disclosure on page 15, please identify the intermediaries referenced in accordance with IM Guidance Update No. 2016-06 and describe any scheduled variations in accordance with such guidance.

Response: The Trust notes that Class Y shares are not subject to Rule 12b-1 fees or sales charges, in accordance with the language referenced by the Staff on page 15 under the heading "Choosing a Class of Shares - Class Y Shares". The Trust notes that a list of intermediaries that may receive additional payments is discussed in the Funds' SAI under the heading "Touchstone Securities". The Trust will add a cross-reference to this section of the SAI in the Prospectus.

21. On page 25 in the "Important Tax Considerations" sub-section, there is a discussion of covered shares. Since these are newly offered funds, please revise this disclosure accordingly.

Response: The Trust will revise this section to remove reference to covered shares.

Prospectus - International Fund only

22. In the first paragraph of the Fund's principal investment strategy, please clarify what the Fund considers to be non-U.S. securities. For example, are ADRs considered non-U.S. or is the determination based on principal place of business, etc.? Please also clarify whether the Fund will hold foreign securities directly and disclose the related risks.

Response: The Trust has revised this disclosure to include the requested clarification.

23. Does the Fund intend to hedge to protect against currency inflation? If not, please disclose the Fund may be subject to currency risk.

Response: The Fund does not intend to hedge to protect against currency inflation. Currency risk is mentioned in the Foreign Securities Risk factor in the Fund's summary section; however, the Trust will add additional disclosure regarding currency risk to the statutory prospectus.

24. Please revise the principal investment strategy to describe how the Fund determines whether a country is a developed market. For example, does it use the MSCI definition of developed market?

Response: The Trust has added the requested clarification with respect to developed markets.

25. Please clarify whether the index that the Fund seeks to replicate includes foreign securities traded on US exchanges.

Response: The Trust has added the request clarification.

26. The Fund's foreign security risk factor seems to focus on securities purchased in foreign markets. Please tailor the risk factor or add additional disclosure with respect to depositary receipts.

Response: The foreign securities risk factor as drafted is primarily intended to cover foreign securities purchased directly in the foreign market. The Trust has included a separate depositary receipt risk factor for the Fund. The Fund intends to purchase foreign shares directly, and may purchase a depositary receipt when TOBAM deems it to be more liquid than the corresponding stock. Clarifying language to this regard has been added to the principal investment strategy.

27. In the "Tax Information" section of the Fund's summary section, please clarify whether foreign investments have an impact on a shareholder's taxes.

Response: The Trust respectfully notes that the current disclosure is consistent with the requirements of Item 7 of Form N-1A. The Trust has included a discussion of foreign taxes in the "Distributions and Taxes" section of the Prospectus.

* * *

If you have any further questions or comments, please contact me at (513) 357-6029.

|

| |

| | Sincerely, |

| | |

| | /s/Meredyth A. Whitford-Schultz |

| | Meredyth A. Whitford-Schultz Counsel, Touchstone Funds |

Deborah B. Eades, Esq.

TOBAM Anti-Benchmark® Core Equity Index Series

Ground Rules

TABLE OF CONTENTS

1.0 Introduction

2.0 Index Management

3.0 Eligible Securities

4.0 Qualification Criteria & Periodic Review of Constituents

5.0 Corporate Actions and Events

6.0 Index Series Algorithm and Calculation Method

Appendices

A. TOBAM Country Classification Rules

B. Further Information

Ground Rules for the TOBAM Core Equity Index Series 2

June 2018, Version 1.0

SECTION 1

| |

| 1.1 | This document sets out the Ground Rules for the construction and management of the TOBAM Core Equity Index Series. |

| |

| 1.2 | TOBAM’s Core Equity investment philosophy is to enhance diversification in order to capture the full risk premium of an asset class. |

Our research indicates that the systematic returns available from equity markets are higher than those available from using market capitalisation-weighted benchmarks, and seem to be more stable over time. Using a traditional benchmark as a reference carries heavy, costly, implicit bets that evolve dynamically. On the contrary, TOBAM’s approach is designed to access the full risk premium evenly from all of the independent sources of risk available in the investment universe.

The Maximum Diversification® process is designed to create portfolios that lie closer to the ex-post efficient frontier than the market cap portfolio over a market cycle.

| |

| 1.3 | The TOBAM Core Equity Index Series is calculated on an end of day basis. Price, Net Total Return and Gross Total Return Indices are published at the end of each working day. The Total Return Indices are based on ex-dividend adjustments. |

| |

| 1.4 | The following indices will be calculated in the TOBAM Anti-Benchmark® Core Equity Index Series: |

| |

| 1. | TOBAM Anti-Benchmark® US Core Equity Index (calculated in US Dollar) |

| |

| 2. | TOBAM Anti-Benchmark® International Core Equity Index (calculated in US Dollar) |

Ground Rules for the TOBAM Core Equity Index Series 3

June 2018, Version 1.0

SECTION 2

| |

| 2.1.1 | TOBAM is the benchmark administrator as defined in the IOSCO principles. |

| |

| 2.1.2 | The TOBAM Core Equity Index Series is supervised by the “TOBAM Index Committee”. |

The TOBAM Index Committee is responsible for any aspect of the TOBAM Core Equity Index Series, notably the definition of the Index Series, the methodology, the distribution, the transparency over significant decisions affecting the Index Series and the establishment of a transparent governance procedure.

The TOBAM Index Committee may amend the Ground Rules when necessary.

The TOBAM Indices General Governance procedure is available upon request.

2.2 The Calculating Agent

2.2.1 Solactive AG (the “Calculating Agent”) is the calculation agent and is responsible for the operation of the TOBAM Core Equity Index Series. The Calculating Agent will set up, calculate and maintain the Index Series.

Setting up the Indices includes establishing the parameters such as data, calculation days, calculation term etc., in connection with the Indices, providing, among other things, necessary data files, review files and constituents data as necessitated.

Maintenance of the Indices includes, but is not limited to, adjustment in relation to the treatment of corporate actions. Any adjustment will be dealt with in accordance with the ground rules and as agreed between the Parties.

The Calculating Agent will keep records of the Index constituents, adjustments and valuations.

2.2.2 The calculation methodology and process is further detailed in the relevant section of the Ground Rules.

For more details on the Calculating Agent procedure and methodology please refer to Solactive Documents (http://www.solactive.com/fr/documents/).

| |

| 2.3 | Status of these Ground Rules |

These Ground Rules set out the methodology and provide information about the publication of the TOBAM Core Equity Index Series.

Ground Rules for the TOBAM Core Equity Index Series 4

June 2018, Version 1.0

SECTION 3

This section describes the universe of eligible securities that can be included in the TOBAM Core Equity Index Series (the "TOBAM Universe”). Below are the conditions a listed stock must satisfy in order to be included in the TOBAM Universe.

These conditions help to ensure sufficient availability of data and stock liquidity for the purpose of constructing the Index Series.

3.1 – Type of securities

Equities listed on a regulated exchange from an Eligible Country are eligible for inclusion in the TOBAM Universe. Both common and preferred shares may be included.

The following are not included in the Universe:

| |

| • | Convertibles shares, loan stocks or any stock functioning like a fixed income security (by having a defined recurrent coupon, for example), |

| |

| • | Limited Partnerships, Investment Trusts (except Real Estate Investment Trusts), ETFs, Mutual Funds, or any stock whose business is that of investing into equities and other investments, |

When a Depositary Receipt (“DR”) is more liquid than its corresponding stock, the stock may be replaced by its DR.

3.2 – Eligible Countries

Each equity is assigned to only one country.

If the country of incorporation is the same as the main listing country then the equity is assigned to this country. Where this condition is not met, please refer to the TOBAM Country Classification rules.

3.3 – Free Float Adjusted Market Capitalisation limits for eligible stocks

To enter the TOBAM Universe, an eligible security must exceed a minimum market capitalisation threshold and comply with certain liquidity rules.

These market capitalisation thresholds evolve with the total market capitalisation of the underlying geographic area. They are reviewed quarterly on the first business day of each review month, i.e. using data as of the close of the last Friday of the previous month.

A daily liquidity limit is set at 0.2% of the market capitalisation limit.

As of the 1st of June 2018, the limits are set at the following level:

| |

| o | Free Float Adjusted Market Capitalisation higher than 2 billion USD |

| |

| o | 3 Month Median Traded Volume higher than 4 million USD. |

| |

| • | For Developed Europe/Middle East: |

| |

| o | Free Float Adjusted Market Capitalisation higher than 3 billion USD |

| |

| o | 3 Month Median Traded Volume higher than 6 million USD. |

| |

| o | Free Float Adjusted Market Capitalisation higher than 6.25 billion USD |

| |

| o | 3 Month Median Traded Volume higher than 12.5 million USD. |

| |

| o | Free Float Adjusted Market Capitalisation higher than 1 billion USD |

| |

| o | 3 Month Median Traded Volume higher than 2 million USD. |

| |

| • | For Emerging Europe and Middle East |

| |

| o | Free Float Adjusted Market Capitalisation higher than 1 billion USD |

| |

| o | 3 Month Median Traded Volume higher than 2 million USD. |

| |

| o | Free Float Adjusted Market Capitalisation higher than 1 billion USD |

Ground Rules for the TOBAM Core Equity Index Series 5

June 2018, Version 1.0

| |

| o | 3 Month Median Traded Volume higher than 2 million USD. |

To be deleted from the Universe, a stock’s market capitalisation and traded value need to fall under 80% of the above-mentioned limits.

|

| | | | |

| | Market Capitalization | 3M Median Value Traded |

| | To enter the Universe (B$) | To Exit the Universe (B$) | To enter the Universe (M$) | To Exit the Universe (M$) |

| DM - Asia | 2.00 | 1.60 | 4.00 | 3.20 |

| DM – Europe/ME | 3.00 | 2.40 | 6.00 | 4.80 |

| DM – America | 6.25 | 5.00 | 12.5 | 10.0 |

| EM – Asia | 1.00 | 0.80 | 2.00 | 1.60 |

| EM – EMEA | 1.00 | 0.80 | 2.00 | 1.60 |

| EM – Latam | 1.00 | 0.80 | 2.00 | 1.60 |

Size and liquidity limits as of June 1st, 2018

3 Month Median Traded Volume is computed over the 3 months preceding the Universe Review. For each stock, the calculation incorporates every day that the relevant market was open.

The “Free Float Adjusted Market Capitalisation” refers to the Total Market Capitalisation Number of Shares that are available to the public. This number includes the Foreign Investment Factor for stocks trading on exchanges in countries with limitations on foreign investor ownership.

3.4 – Date of incorporation

All eligible securities must have been trading for at least 3 months.

3.5 – Review Dates, Additions and Deletions

The Universe is reviewed quarterly in March, June, September and December using data as of the close of the last business day of the previous month.

3.6 – Exceptions

A stock that was previously included within the TOBAM Universe but that no longer satisfies the above criteria due to a temporary suspension of trading may still be included in the universe. More specifically, it will remain within the TOBAM Universe if its suspension lasts for less than three months. The inclusion of any stock can only be perpetuated for this reason once.

In case a situation arises that is not currently detailed within this document, a meeting of the Index Governance Committee will be called to decide how best to resolve the situation. The resulting decision will then be communicated and added to the Ground Rules for their next review.

3.7 – Blacklist for Socially Responsible Investment

The TOBAM Core Equity Index Series integrates Socially Responsible Investment (“SRI”) criteria consistent with TOBAM’s sustainable view. The exclusion list of stocks for SRI reasons is available on http://www.tobam.fr/maxdiv-indexes-exclusion/.

Any stock from a company listed in the SRI Exclusion blacklist is excluded from the eligible securities selected in the TOBAM Universe. When an existing constituent enters the SRI Exclusion blacklist, its deletion from the Index Series will occur at the next review.

More details on the TOBAM SRI policy are available on http://www.tobam.fr.

3.8 – Underlying Universe for the Index Series

The TOBAM Core Equity Index Series will invest in the following subset of the TOBAM Universe:

| |

| 1. | TOBAM International Core Equity Index : All eligible stocks from developed countries excluding United States and Canada |

| |

| 2. | TOBAM USA Core Equity Index : All eligible stocks quoted in USD from United States |

Ground Rules for the TOBAM Core Equity Index Series 6

June 2018, Version 1.0

Countries are defined as per the TOBAM Country Classification Rules.

We define as the Parent Benchmark Index the market capitalisation weighted Index computed on the relevant subset of the TOBAM Universe (as defined above). The Parent Benchmark Index allocation is used for the purpose of setting up the optimisation constraints in Section 4.

Ground Rules for the TOBAM Core Equity Index Series 7

June 2018, Version 1.0

SECTION 4

| |

| 4.0 | QUALIFICATION CRITERIA & PERIODIC REVIEW OF CONSTITUENTS |

| |

| 4.1.1 | The TOBAM Core Equity Index Series will be reviewed monthly using data as of the close of business on the first Friday of the month. |

The new models will be computed using the latest version of the TOBAM Universe.

| |

| 4.1.2 | The new model resulting from the monthly review will be implemented after the close of business on the third Friday of each month, i.e. on the following Monday. |

| |

| 4.2 | Any new corporate action or event arising between the computation of the new model and its implementation will be treated using the rules set out in section 5 of the Ground Rules (Corporate Actions and Events). |

The procedure for index construction is composed of three steps:

| |

| 4.3.1 | A variance/covariance matrix is estimated for the investment universe using daily data. |

The matrix estimation applies a statistical treatment when prices are not available (for instance: bank holidays, suspension of trading, etc.).

Each security is required to have actively traded on a certain proportion of the days considered in the variance/covariance matrix estimation period to be eligible for inclusion in the Index Series.

| |

| 4.3.2 | TOBAM’s portfolio construction methodology is used to create the portfolio maximising the Diversification Ratio®. |

Formally, consider a universe of N stocks {S1,...,SN}, with volatilities σ = (σi) and correlation matrix C = (ρi,i), for 1 ≤ I, j ≤ N. A long-only portfolio is defined as a vector with non-negative weights w = (wi), its volatility is denoted by σ(w), and its weighted average volatility by ‹ w|σ › = Σ wi σi.

The Diversification Ratio DR(w) of the portfolio is defined as the ratio of its weighted average volatility and its volatility:

DR(w) = ‹ w|σ ›

σ(w)

The Diversification Ratio is subsequently maximised in order to create the TOBAM Core Equity Index Series, under the following constraints:

| |

| a) | The maximum weight for any given stock is set at 3% for the TOBAM USA Core Equity Index and at 1.5% for the TOBAM International Core Equity Index. |

When relevant, this constraint may be applied at the issuer level (when a company has several share classes included in the TOBAM Universe, for instance).

| |

| b) | The maximum risk contribution of any given stock is set at 3% of the portfolio risk for the TOBAM USA Core Equity Index and at 1.5% of the portfolio risk for the TOBAM International Core Equity Index. |

| |

| c) | The minimum weight for a stock is set at 10 basis points. |

| |

| d) | The optimisation is penalized in order to reduce the turnover. |

Ground Rules for the TOBAM Core Equity Index Series 8

June 2018, Version 1.0

| |

| e) | The carbon emissions of the TOBAM Anti-Benchmark® Core Equity Index Series are constrained at a maximum of 80% of their respective Parent Benchmark Index values. |

| |

| f) | Additionally the TOBAM International Core Equity Index satisfies the following constraints: |

- Geographic area constraint: the weight of a region cannot exceed by more than 10% its weight in the Parent Benchmark Index. Regions are defined as: Developed Europe and Middle East, Developed Asia.

- Country constraint: the weight of a country cannot exceed by more than 10% its weight in the Parent Benchmark Index.

4.3.3 Special Situations:

| |

| • | If the stock is under a merger and acquisition process its weight will be capped at its current weight. It follows that if a stock is not included in the Index as of the Review Date, its maximum weight will be set at 0%. A stock already included within the Index will have its maximum weight set at its current Index weight. |

Unconfirmed deal proposals (rumours, speculations, etc.) are not taken into account.

Deals with negative premium are not taken into account unless they were previously agreed by the companies’ management.

| |

| • | If a stock is not trading, its weight is constrained at its current level. |

In case a situation arises that is not currently detailed within this document, a meeting of the Index Governance Committee will be called to decide how best to resolve the situation. The resulting decision will then be communicated and added to the Ground Rules for their next review.

Ground Rules for the TOBAM Core Equity Index Series 9

June 2018, Version 1.0

SECTION 5

| |

| 5.0 | CORPORATE ACTIONS AND EVENTS |

| |

| 5.1 | A “Corporate Action” is an event arising on a predefined date (“ex-date”) that materially affects the securities issued by a company. The share price will be subject to an adjustment on the ex-date. The index will be adjusted in line with the ex-date. |

These include the following situations:

| |

| • | Splits (sub-division) / Reverse splits (consolidation) |

| |

| • | Rights Issues/Entitlement Offers |

| |

| • | Share Updates and Investable Weight Changes |

| |

| • | Bankruptcy / Insolvency / Liquidation |

A “Corporate Event” is a reaction to company news (event) that may impact the index depending on the index rules. Where an index adjustment is required, the Calculating Agent will provide notice advising of the timing of the change.

| |

| 5.2 | Splits (sub-division) / Reverse splits (consolidation) |

In the case of a share split or reverse split, it is assumed that the prices change in ratio to the number of shares.

The number of shares is modified according to the corporate action ratio. The weight is unchanged.

A scrip issue is the pro rata issuance of new shares at a price of zero in favour of existing shareholders.

Scrip issues are treated as a cash dividend. The amount will be reinvested across the full index through the Index Divisor. The event is effective as of the ex-Date.

Cash distributions are not taken into account in price indices with the exception of special cash dividends.

For total return indices, the cash distributed is reinvested across the index. The reinvestment occurs on the opening of the ex-date.

5.5 Rights Issues

Rights issues are a right to purchase additional shares from the company in proportion to current holdings.

The index is assumed to participate in the offer when the subscription price is below the closing price of the stock prior to the effective date.

5.6 Shares in issue Updates and Free Float Changes

The index will not participate in any new equity offering or share repurchase operation.

On a general basis, unless it is as a direct consequence of a corporate action treatment listed in this section, any update of the Free Float number of Shares will have no impact on the Index.

5.7 Takeovers & Mergers

| |

| 5.7.1 | Mergers / Takeovers between index constituents: The acquired constituent is deleted from the index on the effective date of the acquisition. |

Ground Rules for the TOBAM Core Equity Index Series 10

June 2018, Version 1.0

Stock term: the resulting/surviving company will remain a constituent according to the stock term of the Merger. Consequently, broadly, no action is required.

Cash Term: The proceeds of a cash financed acquisition are allocated across the index. For the purpose of this reallocation, the weight of the target company will be estimated using its last available closing price.

| |

| 5.7.2 | If an existing constituent is acquired by a non-constituent, the existing constituent is deleted from the index and the acquisition is considered to be a cash financed operation. The proceeds of a cash financed acquisition are allocated across the index. The cash amount is estimated using the last closing price of the acquired company. |

| |

| 5.7.3 | The acquisition of a non-constituent by a constituent has no effect on the Index. |

5.8 Spin-offs

If a constituent splits and distributes shares in one or more new entities, the new shares will be added to the index. The spun-off shares will be considered for deletion at the next rebalancing.

5.9 Bankruptcy / Insolvency / Liquidation

If an index constituent is bankrupt, files for bankruptcy, insolvent or is being liquidated, the security will be removed from the index with a notice period of two business days. The weight of the constituent will be distributed on a pro rata basis across the remaining index constituents.

If the security has already been delisted from the corresponding stock exchange and / or no valid price for the security is available, the Calculating Agent will try, to the best of its knowledge, to track prices from alternative liquid markets. The determined price from an official source will then be used for index deletion.

If no appropriate price for the index constituent is available, the security will be removed with a price of 0 from the index.

5.10 Suspension of trading

If an index constituent is not tradable for an extended period of time, it will be considered for deletion after 20 days. The TOBAM Index Committee members will analyse the situation with the Calculating Agent. The analysis will include the expected duration of the trading interruption and potential impact on the index. If the TOBAM Index Committee consensus is that the stock will resume trading, the review period may be extended by successive 10 days periods.

If the TOBAM Index Committee decides to delete the stock from the index’s constituents, this deletion will occur at a price of zero, unless there is an alternative liquid market which can be used to price the security.

If a deleted stock resumes trading, it may be re-considered for inclusion on the next ordinary rebalancing.

Ground Rules for the TOBAM Core Equity Index Series 11

June 2018, Version 1.0

SECTION 6

| |

| 6.0 | INDEX SERIES ALGORITHM AND CALCULATION METHOD |

| |

| 6.1.1 | End of Day Prices: The TOBAM Core Equity Index Series will be valued using the official closing price for each stock according to its respective exchange. When there is no official closing price for an index component on a specific day, the last known official price is used. |

If an exchange doesn’t publish official closing prices, the Calculating Agent is in charge of determining a pricing policy which ensures tradability and representativeness.

The Calculating Agent may decide to use a different price for an index component in exceptional cases (for instance: market disruption, suspended stocks, etc.).

| |

| 6.1.2 | Foreign Exchange Rates: Reuters Foreign Exchange Rates are used. End of day index prices are computed using the London 4PM WM Fixing rates. |

| |

| 6.1.3 | Real Time Prices: The Calculating Agent uses Exchange specific real time prices for the Equities and Reuters real time foreign exchange rates for real-time index calculations. |

The TOBAM Core Equity Index Series is calculated daily after the close of the North American securities markets. Except for the 1st of January, the Index Series is calculated every weekday when one or more of the constituent markets are open. There is no separate calculation to accommodate the Saturday or Sunday opening of any market.

| |

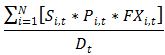

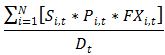

| 6.3.1 | The value of a member of the TOBAM Core Equity Index Series on a given business day t is calculated in accordance with the following formula: |

Indext =

Where:

| |

| • | N is the number of Index components on calculation day t; |

| |

| • | Si,t is the number of index shares of component i on calculation day t; |

| |

| • | Pi,t is the price of index component i on calculation day t; |

| |

| • | FXi,t is the exchange rate to convert the currency of security i into the Index’s base currency on calculation day t; |

| |

| • | Dt is the Index Divisor on calculation day t. |

| |

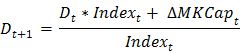

| 6.3.2 | The number of index shares of an index component or the Index Divisor may be modified due to specific events such as corporate actions. In such cases, the index shares are adjusted on the ex-date of the event in such a way that the value of the Index remains unchanged, using the formula: |

Ground Rules for the TOBAM Core Equity Index Series 12

June 2018, Version 1.0

Where:

| |

| • | Dt+1 is the Index Divisor on calculation day t+1; |

| |

| • | Dt is the Index Divisor on calculation day t; |

| |

| • | Indext is the Index level on calculation day t; |

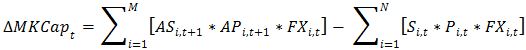

And:

Where:

| |

| • | N is the number of index components on calculation day t; |

| |

| • | M is the number of index components on calculation day t+1; |

| |

| • | Si,t is the number of index shares of component i on calculation day t; |

| |

| • | ASi,t+1 is the adjusted number of Index shares of component i on calculation day t+1; |

| |

| • | Pi,t is the price of index component i on calculation day t; |

| |

| • | APi,t+1 is the adjusted price of index component i on calculation day t+1; |

| |

| • | FXi,t is the exchange rate to convert the currency of security i into the Index’s base currency on calculation day t; |

The adjusted prices and number of shares depend on the event’s type. Further details are available in the Calculating Agent guidelines (please refer to section 2.2.2).

| |

| 6.4 | Recalculations and corrections |

Users of the TOBAM Core Equity Index Series are notified through appropriate media (for instance: ftp, emails, etc.) of the occurrence of recalculations.

6.5 Market Disruption

| |

| The TOBAM Index Committee may decide, in accordance with the Calculating Agent, to undertake special actions or index treatments in case of external events that make it difficult or impossible for TOBAM clients to trade securities on certain markets. Such events include, but are not limited to, the temporary closure of a stock exchange, a government, central bank or monetary authority imposing restrictions on the repatriation of foreign capital and/or on trading, sanctions preventing new investment in a determined country, etc. |

For more information regarding the Index Series algorithm, calculation methodology, corrections and market disruption, please refer to the Calculating Agent policies which are publicly available on its website: https://www.solactive.com/fr/documents/

Ground Rules for the TOBAM Core Equity Index Series 13

June 2018, Version 1.0

APPENDIX A

TOBAM Country Classification Rules

Each stock is assigned to only one country. The TOBAM Country is defined by the following classification rules:

| |

| 1. | If the Incorporation Country and the main listing Country are the same, then this defines the company’s country. This covers most of the securities that satisfy the market cap criteria for inclusion in the TOBAM universe. |

| |

| 2. | If the conditions of Rule 1 are not met, then the TOBAM Index Committee will perform additional analysis and will consider the following criteria |

| |

| • | Secondary listing if any |

| |

| • | Geographic location of the headquarters |

| |

| • | Geographical distribution of revenues |

| |

| • | Geographic location of the shareholders’ base |

| |

| • | Investors’ consideration of the company |

| |

| • | Liquidity (if multiple country listings) |

| |

| • | USA: All common stocks with a primary listing quoted on a US market are considered to be US stocks. |

| |

| • | Europe Developed: The Company is included in the country where its most liquid European stock is listed. |

| |

| • | Russia: We define a security country as Russia if the incorporation country is Russia and the main listing is either in Russia, London or New York. |

| |

| • | China: China Mainland B Shares, Hong Kong P chips, Red chips and H Shares are considered to be Chinese. S Chips, L Chips and N Chips are considered on a case by case basis. |

| |

| • | Any DR is associated to the country of its underlying stock if this latest is listed. This exception prevails on the previous ones. |

| |

| 4. | Change of classification: Any change has to be validated by the TOBAM Index Committee. |

| |

| ◦ | Asia: Australia, Hong Kong, Japan, New Zealand, Singapore |

| |

| ◦ | Europe: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom |

| |

| ◦ | North America: Canada, United States |

| |

| ◦ | Asia: China, India, Indonesia, Malaysia, Philippines, South Korea, Taiwan, Thailand |

| |

| ◦ | Europe and Middle East: Czech Republic, Greece, Hungary, Poland, Russia, South Africa, Turkey |

| |

| ◦ | Latin America: Brazil, Chile, Colombia, Mexico, Peru |

Ground Rules for the TOBAM Core Equity Index Series 14

June 2018, Version 1.0

APPENDIX B

FURTHER INFORMATION

For further information on the TOBAM Core Equity Index Series, please visit TOBAM Website at http://www.tobam.fr.

Or contact TOBAM at: ClientService@tobam.fr

© TOBAM (“TOBAM”) and Solactive AG (“Solactive”) 2018.

TOBAM is a French investment adviser registered with the French Autorité des Marchés Financiers (AMF) and the U.S. Securities and Exchange Commission (SEC) under the U.S. Investment Advisers Act of 1940 and having its registered office located at 49-53 avenue des Champs Elysées, 75008 Paris, France. TOBAM’s Form ADV is available free of charge upon request. In Canada, TOBAM is acting under the assumed name “Tobam SAS Inc.” in Alberta and “TOBAM Société par Actions Simplifiée” in Québec.

All rights in the TOBAM Core Equity Index Series vest in TOBAM. The use of TOBAM Core Equity Index Series to create financial products requires a license granted by TOBAM.

The information shall not be used to verify or correct other data, to create indices, risk models, or analytics, or in connection with issuing, offering, sponsoring, managing or marketing any securities, portfolios, financial products or other investment vehicles without TOBAM’s prior consent.

Past performance and simulations based on back tests are not indicative of future results nor are they reliable indicators of future performance, forecast or prediction. TOBAM does not represent, and indices should not be construed, as a guarantee, promise or assurance of a specific return. Back tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculation of an index may change from time to time based on revisions of the underlying data used in the calculation of the index. TOBAM has continued and will continue its research efforts amending the investment process from time to time accordingly. TOBAM reserves the right of revision or change without notice, of the universe, data, models, strategy and opinions. Back tests performance is not actual performance and do not guaranty the results of an actual index.

The TOBAM Core Equity Index Series are calculated by Solactive or its agent. Solactive is the third-party calculation agent of the TOBAM Core Equity Index Series and receives compensation in that capacity. The financial instrument is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index and/or Index trade mark or the Index Price at any time or in any other respect. The Index is calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the Issuer, Solactive AG has no obligation to point out errors in the Index to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trade mark for the purpose of use in connection with the financial instrument constitutes a recommendation by Solactive AG to invest capital in said financial instrument nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in this financial instrument.

TOBAM does not make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as the results to be obtained from the use of the TOBAM Core Equity Index Series or the suitability of the Index for any particular purpose. Nothing in this communication should be taken as constituting an offer to buy or sell or a recommendation of financial instrument or investment advice. Indices cannot be invested in directly. The information contained herein are provided “as is” and the user of the information assumes the entire risk of any use for itself or any third party. TOBAM and its affiliates do not accept any direct or indirect liability for any errors or omissions in the TOBAM Core Equity Index Series, underlying data or information contained in this publication. All information is provided for information purposes only.

The information contained herein, whether globally or partially, shall not be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of TOBAM or its affiliates.

Copyrights: All text, graphics, interfaces, logos and artwork, including but not limited to design, structure, selection, coordination, expression, "look and feel" and arrangement contained in this presentation, are owned by TOBAM and are protected by copyright and various other intellectual property rights and competition laws.

Trademarks: "TOBAM," "MaxDiv," "Core Equity," "Diversification Ratio,” “Most Diversified Portfolio,” “Most Diversified Portfolios,” “MDP” and "Anti-Benchmark" are registered trademarks. This list is indicative and the absence of a product or service name from this list does not constitute a waiver of TOBAM trademark or other intellectual property rights concerning that name.

Patents: The Anti-Benchmark, MaxDiv and Core Equity strategies, methods and systems for selecting and managing a portfolio of securities, processes and products are patented or patent pending.

Knowledge, processes and strategies: The Anti-Benchmark, MaxDiv and Core Equity strategies, methods and systems for selecting and managing a portfolio of securities, processes and products are protected under competition, passing-off and misappropriation laws.

Ground Rules for the TOBAM Core Equity Index Series 15

June 2018, Version 1.0

Terms of use: TOBAM owns all rights to, title to and interest in TOBAM products and services, marketing and promotional materials, trademarks and patents, including without limitation all associated intellectual property rights. Any use of the intellectual property, knowledge, processes and strategies of TOBAM for any purpose and under any form (known and/or unknown) in direct or indirect relation with financial products including but not limited to certificates, indices, notes, bonds, OTC options, warrants, mutual funds, ETFs and insurance policies (i) is strictly prohibited without TOBAM’s prior written consent and (ii) requires a license.

Ground Rules for the TOBAM Core Equity Index Series 16

June 2018, Version 1.0