As filed with the Securities and Exchange Commission on October 15, 2020

1933 Act File No. [ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

☐ Pre-Effective Amendment No. ☐ Post-Effective Amendment No.

(Check appropriate box or boxes)

Touchstone Funds Group Trust

(Exact Name of Registrant as Specified in Charter)

1-800-543-0407

(Area Code and Telephone Number)

303 Broadway, Suite 1100, Cincinnati, Ohio 45202

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(Name and Address of Agent for Service)

Copies to:

Clair E. Pagnano, Esq.

K&L Gates LLP

One Lincoln Street

Boston, Massachusetts 02111-2950

Ndenisarya M. Bregasi, Esq.

K&L Gates LLP

1601 K Street, NW

Washington, D.C. 20006-1600

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Institutional Class shares of beneficial interest, $0.01 par value, of Touchstone Sands Capital Select Growth Fund, a series of the Registrant, are being registered. No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on November 16, 2020, pursuant to Rule 488 under the Securities Act of 1933.

TOUCHSTONE SANDS CAPITAL INSTITUTIONAL GROWTH FUND

a series of

TOUCHSTONE INSTITUTIONAL FUNDS TRUST

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(800) 543-0407

[ ], 2020

Dear Shareholder:

We have important information concerning your investment in the Touchstone Sands Capital Institutional Growth Fund (the “Target Fund”), a series of Touchstone Institutional Funds Trust (the “Trust”). As a shareholder of the Target Fund, we wish to inform you that the Board of Trustees of the Trust (the “Board”) has approved the reorganization of the Target Fund into the Touchstone Sands Capital Select Growth Fund (the “Acquiring Fund,” and together with the Target Fund, the “Funds”), a series of Touchstone Funds Group Trust (the “Reorganization”).

The Reorganization is intended to eliminate the offering of multiple funds with identical investment goals and substantially identical principal investment strategies; has the potential to provide efficiencies, enhanced marketability and economies of scale for the combined Fund; and the advisory fee schedules, sub-advisory fee schedules, and expense caps for the combined Fund will be lower than those of the Target Fund currently, and the same as the Acquiring Fund currently.

Pursuant to an Agreement and Plan of Reorganization, the Target Fund will transfer all of its assets and liabilities to the Acquiring Fund. As a result of the Reorganization, you will receive Institutional Class shares of the Acquiring Fund that will have a total value equal to the total value of your shares in the Target Fund as of the close of business on the closing date of the Reorganization. The Target Fund will then cease operations and liquidate. The Reorganization is expected to be completed on or about December 11, 2020.

Institutional Class shares of the Acquiring Fund will be issued to the shareholders of the Target Fund, which is a single class fund. The Acquiring Fund also offers Class A, Class C, Class Y, Class Z and Class R6 shares, which are not relevant to the Reorganization.

Shareholder approval is not required to effect the Reorganization. We have enclosed a Prospectus/Information Statement that describes the Reorganization proposal in greater detail, as well as important information about the Acquiring Fund.

Sincerely,

Jill T. McGruder

President

Touchstone Institutional Funds Trust

QUESTIONS & ANSWERS

We recommend that you read the enclosed Prospectus/Information Statement. In addition to the detailed information in the Prospectus/Information Statement, the following questions and answers provide an overview of key features of the Reorganization.

Q. Why are we sending you the Prospectus/Information Statement?

A. On May 21, 2020, the Board of Trustees of Touchstone Institutional Funds Trust (the “Board”) approved the Reorganization of the Target Fund into the Acquiring Fund. The Reorganization does not require approval by shareholders. The Prospectus/Information Statement provides important information regarding the Reorganization and the Acquiring Fund that you should consider carefully.

Q. What will happen to my existing shares?

A. Immediately after the Reorganization, you will own Institutional Class shares of the Acquiring Fund that are equal in total value to the shares of the Target Fund that you hold as of the close of business on the date of the Reorganization (although the number of shares and the net asset value per share may be different).

Q. How do the fees and expenses of the Funds compare?

A. The advisory fee rate of the combined Fund after the Reorganization will be lower than the advisory fee rate for each of the Funds prior to the Reorganization. The shares of the Target Fund and the Institutional Class shares of the Acquiring Fund are not subject to any Rule 12b-1 fees or sales charges.

In addition, each Fund has entered into an expense limitation agreement with Touchstone Advisors, Inc. (“Touchstone Advisors”), each Fund’s investment advisor. Touchstone Advisors has contractually agreed to waive a portion of its fees and reimburse certain Fund expenses in order to limit annual fund operating expenses for each Fund. The expense limitation for Institutional Class shares of the Acquiring Fund is lower than the expense limitation for Institutional Class shares of the Target Fund. The expense limitation agreement is effective through April 30, 2021 for the Target Fund and through November 30, 2021 for the Acquiring Fund. In addition, the net annual fund operating expenses of the Institutional Class of shares of the Acquiring Fund, as a percentage of average net assets, on a pro forma basis, are equal to the annual fund operating expenses of Institutional Class shares the Target Fund.

The section titled “Summary—Reorganization—How do the Funds’ fees and expenses compare?” of the Prospectus/Information Statement compares the fees and expenses of the Funds in detail and the section titled “The Funds’ Management—Expense Limitation Agreement” provides additional information regarding the expense limitation agreements.

Q. How do the Funds’ investment goals and principal investment strategies compare?

A. The Funds have identical investment goals and substantially identical principal investment strategies, and both Funds are managed by the same sub-advisor, Sands Capital Management, LLC (“Sands” or “Sub-Advisor”). The section of the Prospectus/Information Statement titled “Summary—Reorganization—How do the Funds’ investment goals and principal investment strategies compare?” describes the investment goal and principal investment strategies of the Target Fund and the investment goal and principal investment strategies of the Acquiring Fund.

Q. Will I have to pay federal income taxes as a result of the Reorganization?

A. You are not expected to recognize any gain or loss for federal income tax purposes on the exchange of your shares of the Target Fund for shares of the Acquiring Fund. The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. The sections of the Prospectus/Information Statement titled “Summary—Reorganization—What will be the primary federal income tax consequences of the Reorganization?” and “Information About the Reorganization—Material Federal Income Tax

Consequences” provide additional information regarding the federal income tax consequences of the Reorganization.

Prior and subsequent to the Reorganization, none of the securities of the Target Fund are expected to be sold in connection with the Reorganization.

For more information, please see the sections of the Prospectus/Information Statement titled “Summary—Reorganization—What will be the primary federal income tax consequences of the Reorganization?,” and “Information About the Reorganization—Material Federal Income Tax Consequences.”

Q. Who will manage the Acquiring Fund after the Reorganization?

A. Touchstone Advisors serves as the investment advisor to both Funds. Sands serves as the investment sub-advisor to both Funds and Frank M. Sands, CFA, A. Michael Sramek, CFA, Wesley A. Johnston, CFA, and Thomas H. Trentman, CFA, the current portfolio managers of the Funds, will continue to serve as the Acquiring Fund’s portfolio managers. For more information please see the sections of the Prospectus/Information Statement titled “Summary—Reorganization—Who will be the Advisor, Sub-Advisor, and Portfolio Managers of my Fund after the Reorganization?,” “The Funds’ Management—Investment Advisor” and “The Funds’ Management—Sub-Advisor and Portfolio Managers.”

Q. Will I have to pay any sales load, commission, or other similar fee in connection with the Reorganization?

A. No, you will not pay any sales load, commission, or other similar fee in connection with the shares of the Acquiring Fund you will receive in the Reorganization. The shares of the Target Fund and the Institutional Class shares of the Acquiring Fund are not subject to any contingent deferred sales charge (“CDSC”). However, following the Reorganization, additional purchases, exchanges and redemptions of shares of the Acquiring Fund will be subject to any applicable sales loads, commissions, and other similar fees.

Q. Who will pay the costs of the Reorganization?

A. Touchstone Advisors, and not the Funds, will bear 100% of the costs of the Reorganization, which are estimated to be approximately $75,000 or approximately 0.01% of the Target Fund's net assets (as of June 30, 2020), whether or not the Reorganization is completed.

Q. What if I redeem my shares before the Reorganization takes place?

A. If you choose to redeem your shares before the Reorganization takes place, then the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction.

Q. Why is no shareholder action necessary?

A. The declarations of trust of Touchstone Institutional Funds Trust and Touchstone Funds Group Trusts each provide that any series may be reorganized into another series by a vote of a majority of the trustees of the Trust without the approval of shareholders. In addition, the Reorganization of the Target Fund into the Acquiring Fund satisfies the requisite conditions of Rule 17a-8 under the Investment Company Act of 1940, as amended (the “1940 Act”), such that shareholder approval is not required by the 1940 Act.

Q. When will the Reorganization occur?

A. The Reorganization is expected to be completed on or about December 11, 2020.

Q. Who should I contact for more information?

A. You can contact Shareholder Services at (800) 543-0407 for more information.

The information contained in this Prospectus/Information Statement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus/Information Statement is not an offer to sell these securities, and it is not a solicitation of an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

DATED OCTOBER 15, 2020

PROSPECTUS/INFORMATION STATEMENT

[ ], 2020

TOUCHSTONE SANDS CAPITAL INSTITUTIONAL GROWTH FUND

a series of

TOUCHSTONE INSTITUTIONAL FUNDS TRUST

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(800) 543-0407

TOUCHSTONE SANDS CAPITAL SELECT GROWTH FUND

a series of

TOUCHSTONE FUNDS GROUP TRUST

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(800) 543-0407

This Prospectus/Information Statement is being furnished to shareholders of the Touchstone Sands Capital Institutional Growth Fund (the “Target Fund”), a series of Touchstone Institutional Funds Trust (the “Trust”), in connection with an Agreement and Plan of Reorganization (the “Plan”) between the Target Fund and the Touchstone Sands Capital Select Growth Fund (the “Acquiring Fund”), a series of the Touchstone Funds Group Trust, providing for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Institutional Class shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the pro rata (or proportionate) distribution by class of the Acquiring Fund’s shares to the Target Fund’s shareholders in complete liquidation and termination of the Target Fund (the “Reorganization”).

The Board of Trustees of the Trust (the “Board”) has approved the proposed Reorganization. In the Reorganization, you will receive shares of the Acquiring Fund in an amount equal in value to the shares of the Target Fund that you hold as of the close of business on the date of the Reorganization (although the number of shares and the net asset value per share may be different). The Reorganization is expected to be completed on or about December 11, 2020.

This Prospectus/Information Statement is first being sent to shareholders of the Target Fund on or about November [ ], 2020.

Each of the Target Fund and the Acquiring Fund is a series of a registered open-end investment company (mutual fund). The Target Fund and the Acquiring Fund are sometimes referred to in this Prospectus/Information Statement individually as a “Fund” and collectively as the “Funds.”

This Prospectus/Information Statement, which you should read carefully and retain for future reference, concisely presents the information that you should know about the Funds and the Reorganization. This document also serves as a prospectus for the offering and issuance of shares of the Acquiring Fund to be issued in the Reorganization. A Statement of Additional Information (“SAI”) dated [ ], 2020 relating to this Prospectus/Information Statement and the Reorganization has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Prospectus/Information Statement (meaning it is legally a part of this Prospectus/Information Statement).

THIS IS NOT A PROXY STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Additional information concerning the Target Fund and the Acquiring Fund is contained in the documents described below, all of which have been filed with the SEC.

| | | | | | | | |

Information About the Target Fund and the

Acquiring Fund: | | How to Obtain this Information: |

Prospectus 1. Prospectus relating to the Touchstone Sands Capital Institutional Growth Fund dated April 30, 2020, as supplemented through the date of this Prospectus/Information Statement (File No. 033-119865). 2. Prospectus relating to the Touchstone Sands Capital Select Growth Fund Institutional Class Shares and Class R6 Shares dated September 1, 2020, as supplemented through the date of this Prospectus/Information Statement (File No. 333-70958).

Statement of Additional Information 1. SAI relating to the Touchstone Sands Capital Institutional Growth Fund dated April 30, 2020, as supplemented through the date of this Prospectus/Information Statement (File No. 033-119865). 2. SAI relating to the Touchstone Sands Capital Select Growth Fund Institutional Class Shares and Class R6 Shares dated September 1, 2020, as supplemented through the date of this Prospectus/Information Statement (File No. 333-70958).

Annual Report 1. Annual Report relating to the Touchstone Sands Capital Institutional Growth Fund for the fiscal year ended December 31, 2019 (File No. 811-21113). 2. Annual Report relating to the Touchstone Sands Capital Select Growth Fund for the fiscal year ended September 30, 2019 (File No. 811-08104).

Semi-Annual Report 1. Semi-Annual Report relating to the Touchstone Sands Capital Institutional Growth Fund for the six-month period ended June 30, 2020 (File No. 811-21113). 2. Semi-Annual Report relating to the Touchstone Sands Capital Select Growth Fund for the six-month period ended March 31, 2020 (File No. 811-08104).

| | Copies are available upon request and without charge if you:

· Write to Touchstone Institutional Funds Trust or Touchstone Funds Group Trust, P.O. Box 9878, Providence, Rhode Island 02940; or

· Call (800) 543-0407 toll-free; or

· Download a copy from TouchstoneInvestments.com/Resources. |

You can also obtain copies of any of the above-referenced documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov.

This Prospectus/Information Statement sets forth the information shareholders of the Target Fund should know before the Reorganization (in effect, investing in shares of the Acquiring Fund) and constitutes an offering of shares of beneficial interest, $0.01 par value per share, of the Acquiring Fund. Please read this Prospectus/Information Statement carefully and retain it for future reference.

THE SEC HAS NOT DETERMINED THAT THE INFORMATION IN THIS PROSPECTUS/ INFORMATION STATEMENT IS ACCURATE OR ADEQUATE, NOR HAS IT APPROVED OR DISAPPROVED THESE SECURITIES. ANYONE WHO TELLS YOU OTHERWISE IS COMMITTING A CRIMINAL OFFENSE.

An investment in the Acquiring Fund:

•is not a deposit of, or guaranteed by, any bank

•is not insured by the FDIC, the Federal Reserve Board or any other government agency

•is not endorsed by any bank or government agency

•involves investment risk, including possible loss of your original investment

| | | | | |

| Page |

| SUMMARY | 1 |

| Background | 1 |

| Reorganization | 1 |

| Principal Risks | 7 |

| INFORMATION ABOUT THE REORGANIZATION | 8 |

| Reasons for the Reorganization | 8 |

| Agreement and Plan of Reorganization | 9 |

| Description of the Securities to be Issued | 10 |

| Material Federal Income Tax Consequences | 10 |

| Pro Forma Capitalization | 12 |

| THE FUNDS’ MANAGEMENT | 12 |

| Investment Advisor | 12 |

| Sub-Advisor and Portfolio Managers | 13 |

| Advisory and Sub-Advisory Agreement Approval | 14 |

| Expense Limitation Agreement | 14 |

| Other Service Providers | 14 |

| DESCRIPTION OF SHARES | 15 |

| Institutional Class Shares | 15 |

| Buying and Selling Fund Shares | 15 |

| Exchange Privileges of the Funds | 16 |

| DISTRIBUTION AND SHAREHOLDER SERVICING ARRANGEMENTS | 16 |

| INFORMATION ON SHAREHOLDERS’ RIGHTS | 17 |

| FINANCIAL STATEMENTS AND EXPERTS | 18 |

| LEGAL MATTERS | 18 |

| ADDITIONAL INFORMATION | 18 |

| FINANCIAL HIGHLIGHTS | 18 |

| EXHIBIT A: FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| EXHIBIT B: FUNDAMENTAL INVESTMENT LIMITATIONS | B-1 |

| EXHIBIT C: DECLARATIONS OF TRUST | C-1 |

| EXHIBIT D: CONTROL PERSONS AND PRINCIPAL HOLDERS OF SECURITIES | D-1 |

SUMMARY

This section summarizes the primary features of the Reorganization. It may not contain all of the information that is important to you. To understand the Reorganization, you should read this entire Prospectus/Information Statement and the exhibits. This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Information Statement, the SAI, and the Plan, a form of which is attached to this Prospectus/Information Statement as Exhibit A.

Background

The inception date of the Target Fund was January 21, 2005. The inception date of the Acquiring Fund was August 11, 2000. As of June 30, 2020, the Target Fund had total net assets of approximately $2.1 billion. As of June 30, 2020, the Acquiring Fund had total net assets of $2.0 billion.

Reorganization

What are the reasons for the Reorganization?

At a meeting on May 21, 2020, the Board, including those trustees who are not “interested persons,” as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Trustees”), determined that the Reorganization was in the best interests of the Funds and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization. The Board approved the Reorganization.

The Target Fund and the Acquiring Fund currently have identical investment goals and substantially identical principal investment strategies. In addition, the Target Fund and the Acquiring Fund are currently managed by the same sub-advisor and the combined Fund will continue to be managed by the same sub-advisor. The Reorganization is intended to eliminate the offering of multiple funds with identical investment goals and substantially identical principal investment strategies, and has the potential to provide efficiencies, enhanced marketability and economies of scale for the combined Fund. The Board considered the following factors, among others: the investment goals, principal investment strategies, sub-advisor and portfolio managers of the Funds; the historical investment performance record of the Funds; the advice and recommendation of Touchstone Advisors, Inc. (“Touchstone Advisors”), including its opinion that the Reorganization would be in the best interests of the Funds and that the combined Fund would have enhanced marketability and a greater opportunity to achieve economies of scale than either Fund operating individually; and the investment advisory fee and other fees paid by the Funds, the expense ratios of the Funds and the contractual limitations on the Funds’ expenses.

For more information, please see the section titled “Information About the Reorganization—Reasons for the Reorganization.”

What are the key features of the Reorganization?

The Plan sets forth the key features of the Reorganization. The Plan provides for the following:

1.the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Institutional Class shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund;

2.the pro rata (or proportionate) distribution by class of the Acquiring Fund's shares to the Target Fund shareholders in complete liquidation and termination of the Target Fund; and

3.the receipt of an opinion of counsel that the Reorganization qualifies as a tax-free reorganization for federal income tax purposes.

The Reorganization is expected to be completed on or about December 11, 2020.

After the Reorganization, what shares of the Acquiring Fund will I own?

Each Fund is a series of a registered open-end management investment company (i.e., a mutual fund). In the Reorganization, you will receive Institutional Class shares in the Acquiring Fund. The Institutional Class shares of the Acquiring Fund that you receive will have the same total value as your shares of the Target Fund, in each case measured as of the close of business on the date of the Reorganization.

How do the Funds’ fees and expenses compare?

Comparative Fee Tables. The following tables allow you to compare the various fees and expenses that you may pay for buying and holding shares of each Fund. Pro forma expenses project anticipated expenses of the Acquiring Fund following the Reorganization. Actual expenses may be greater or less than those shown. Expense ratios reflect annual fund operating expenses for the twelve months ended June 30, 2020 for the Target Fund and March 31, 2020 for the Acquiring Fund. Pro forma numbers are estimated as if the Reorganization had been completed as of March 31, 2020 and do not include the estimated costs of the Reorganization, which will be borne by Touchstone Advisors and not the Funds.

| | | | | | | | | | | | | | | | | |

| Touchstone Sands Capital Institutional Growth Fund Institutional Class | | Touchstone Sands Capital Select Growth Fund Institutional Class | | Touchstone Sands Capital Select Growth Fund after Reorganization (pro forma combined) Institutional Class |

| Shareholder Fees (fees paid directly from your investment) | | | | | |

| Wire Redemption Fee* | Up to $15 | | Up to $15 | | Up to $15 |

| Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | | | |

| Management Fees | 0.78% | | 0.67% (1) | | 0.61% (1) |

| Distribution and/or Shareholder Service (12b-1) Fees | None | | None | | None |

| Other Expenses | | | | | |

| Liquidity Provider Expenses | 0.02% | | 0.04% (2) | | 0.03% (3) |

| Other Operating Expenses | 0.01% | | 0.12% (2) | | 0.19%(3) |

| Total Other Expenses | 0.03% | | 0.16% | | 0.22% |

| Acquired Fund Fees and Expenses (AFFE) | 0.01% | | 0.01% | | 0.01%(3) |

| Total Annual Fund Operating Expenses | 0.82% | | 0.84% (2) | | 0.84% |

| Fee Waiver and/or Expense Reimbursement | 0.00%(4) | | (0.01)% (5) | | (0.02)%(5) |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.82%(4) | | 0.83% (5) | | 0.82%(5) |

__________________________

*The wire redemption fee is capped at $15. In addition, the wire redemption fee may not exceed two percent (2%) of the amount being redeemed.

(1) Management Fees have been restated to reflect contractual changes to the Acquiring Fund's Investment Advisory Agreement effective June 1, 2020.

(2) Other Expenses are estimated based on fees and expenses incurred by Class Y shares of the Acquiring Fund and expenses of similar Touchstone Funds. Institutional Class shares commenced operations on September 1, 2020. Class Y shares of the Fund are offered in a separate prospectus.

(3) Other Expenses and Acquired Fund Fees and Expenses are estimated based on fees and expenses of the Acquiring and Target Funds assuming the Reorganization had been consummated as of the beginning of the twelve-month period ended March 31, 2020.

(4)Touchstone Advisors, Inc. (the "Advisor" or "Touchstone Advisors") and Touchstone Institutional Funds Trust (“TIFT”) have entered into a contractual expense limitation agreement whereby Touchstone Advisors will waive a portion of its fees or reimburse certain Fund expenses (excluding dividend and interest expenses relating to short sales; interest; taxes; brokerage commissions and other transaction costs; portfolio transaction and investment related expenses, including expenses associated with the Fund's liquidity providers; other expenditures which are capitalized in accordance with U.S. generally accepted accounting principles; the cost of “Acquired Fund Fees and Expenses,” if any; and other extraordinary expenses not incurred in the ordinary course of business) in order to limit annual fund operating expenses to 0.80%. This contractual expense limitation is effective through April 30, 2021, but can be terminated by a vote of the Board of Trustees of TIFT (the “Board”) if it deems the termination to be beneficial to the Target Fund’s shareholders. The terms of the contractual expense limitation agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the Board, such amounts waived or reimbursed for a period of up to three years from the date on which the Advisor reduced its compensation or assumed expenses for the Target Fund. The Target Fund will make repayments to the Advisor only if such repayment does not cause the annual fund operating expenses (after the repayment is taken into account) to exceed both (1) the expense cap in place when such amounts were waived or reimbursed and (2) the Target Fund’s current expense limitation.

(5) Touchstone Advisors and Touchstone Funds Group Trust (“TFGT”) have entered into a contractual expense limitation agreement whereby Touchstone Advisors will waive a portion of its fees or reimburse certain Fund expenses (excluding dividend and interest expenses relating to short sales; interest; taxes; brokerage commissions and other transaction costs;

portfolio transaction and investment related expenses, including expenses associated with the Acquiring Fund's liquidity providers; other expenditures which are capitalized in accordance with U.S. generally accepted accounting principles; the cost of “Acquired Fund Fees and Expenses,” if any; and other extraordinary expenses not incurred in the ordinary course of business) in order to limit annual Fund operating expenses to 0.78% of average daily net assets for Institutional Class shares. This contractual expense limitation is effective through November 30, 2021, but can be terminated by a vote of the Board of Trustees of TFGT (the “Board”) if it deems the termination to be beneficial to the Acquiring Fund’s shareholders. The terms of the contractual expense limitation agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the Board, such amounts waived or reimbursed for a period of up to three years from the date on which the Advisor reduced its compensation or assumed expenses for the Acquiring Fund. The Acquiring Fund will make repayments to the Advisor only if such repayment does not cause the annual fund operating expenses (after the repayment is taken into account) to exceed both (1) the expense cap in place when such amounts were waived or reimbursed and (2) the Acquiring Fund’s current expense limitation.

Expense Example. The example is intended to help you compare the cost of investing in each Fund and the Acquiring Fund (pro forma), assuming the Reorganization takes place. The example assumes that you invest $10,000 for the time periods indicated and redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, that the operating expenses remain as shown above and that the contractual expense limitation agreement for the Acquiring Fund after the Reorganization (pro forma) is in place for the first year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assuming Redemption at End of Period | | | | | | | | | | | |

| Classes | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | |

| Institutional Class | | | | | | | | | | | | |

| Touchstone Sands Capital Institutional Growth Fund* | $ | 84 | | $ | 262 | | $ | 455 | | $ | 1,014 | |

| Touchstone Sands Capital Select Growth Fund | $ | 85 | | $ | 267 | | $ | 465 | | $ | 1,036 | |

Touchstone Sands Capital Select Growth Fund after Reorganization (Pro Forma Combined) | $ | 84 | | $ | 266 | | $ | 464 | | $ | 1,035 | |

* Touchstone Sands Capital Institutional Growth Fund is a single class fund.

Portfolio Turnover. Each Fund pays transaction costs, such as brokerage commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect the Funds’ performance. As of its most recent fiscal year end for each Fund, the portfolio turnover rate for the Target Fund and the Acquiring Fund was 25%.

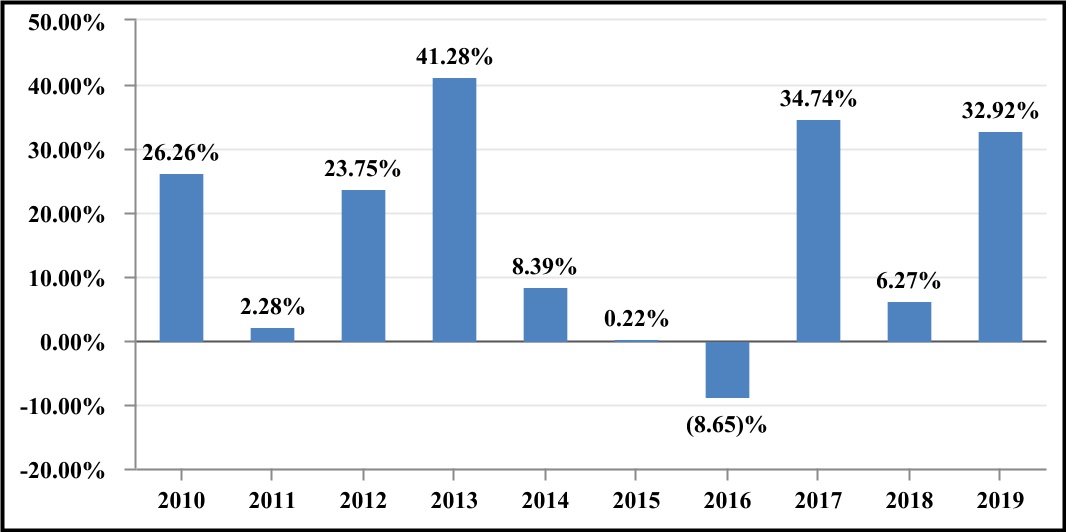

How do the Funds’ performance records compare?

The bar charts and performance tables below illustrate some indication of the risks and volatility of an investment in each Fund by showing changes in each Fund’s performance from calendar year to calendar year and by showing how each of the Target Fund’s and the Acquiring Fund’s average annual total returns for one year, five years, and ten years compare with the Russell 1000® Growth Index (each Fund’s benchmark index). The Funds’ past performance (before and after taxes) does not indicate how the Funds will perform in the future. Updated performance is available at no cost by visiting TouchstoneInvestments.com or by calling (800) 543-0407.

Touchstone Sands Capital Institutional Growth Fund —Total Return as of December 31

| | | | | |

| Best Quarter: First Quarter 2012 24.17% | Worst Quarter: Fourth Quarter 2018 (17.66)% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your after-tax returns may differ from those shown and depend on your tax situation. The after-tax returns do not apply to shares held in an IRA, 401(k), or other tax-advantaged account.

Average Annual Total Returns

For the periods ended December 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Touchstone Sands Capital Institutional Growth Fund* | | | | | | | |

| Return Before Taxes | | 32.92 | % | 11.75 | % | 15.61 | % |

| Return After Taxes on Distributions | | 29.33 | % | 8.97 | % | 13.67 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 21.84 | % | 8.80 | % | 12.78 | % |

Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) | | 36.39 | % | 14.63 | % | 15.22 | % |

* Touchstone Sands Capital Institutional Growth Fund is a single class fund.

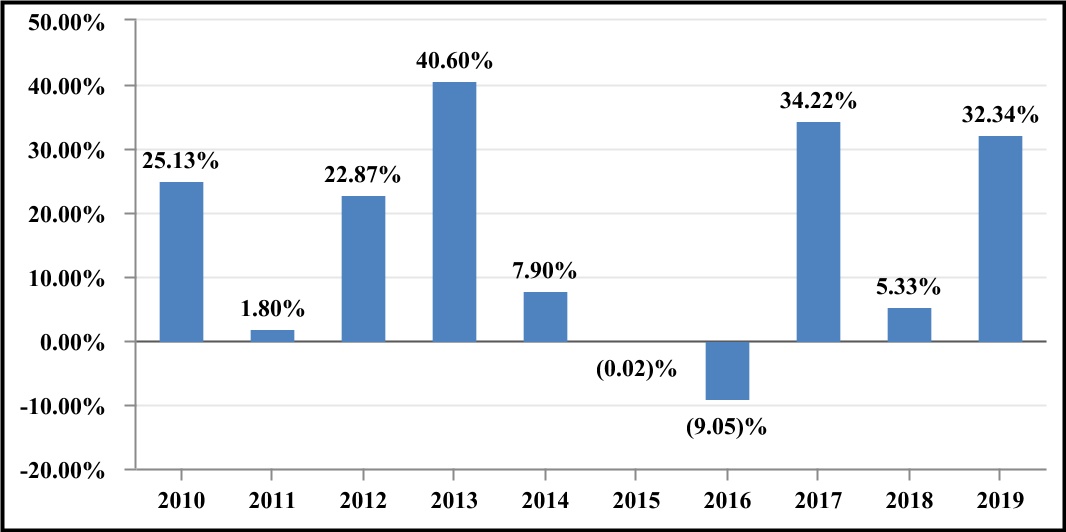

Touchstone Sands Capital Select Growth Fund—Class Z Shares Total Return as of December 31

Institutional Class shares commenced operations on September 1, 2020 and do not have a full calendar year of performance. Class A, Class C, Class Y, Class Z, and Class R6 shares are offered in separate prospectuses. Institutional Class shares would have had substantially similar annual returns to Class A, Class C, Class Y and Class Z shares because the shares are invested in the same portfolio of securities and the annual returns differ only to the extent that the share classes do not have the same shareholder fees and operating expenses. Past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

Touchstone Sands Capital Select Growth Fund — Class Z Total Return as of December 31

| | | | | |

| Best Quarter: First Quarter 2012 23.75% | Worst Quarter: Fourth Quarter 2018 (17.93)% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your after-tax returns may differ from those shown and depend on your tax situation. The after-tax returns do not apply to shares held in an IRA, 401(k), or other tax-advantaged account. The after-tax returns shown in the table are for Class Z shares only. The after-tax returns for Institutional Class shares will differ from the Class Z shares' after-tax returns.

Average Annual Total Returns

For the periods ended December 31, 2019*

| | | | | | | | | | | | | | | | | | | | | | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Touchstone Sands Select Growth Fund—Class Z | | | | | | | |

| Return Before Taxes | | 32.34 | % | 11.21 | % | 14.98 | % |

| Return After Taxes on Distributions | | 26.94 | % | 6.75 | % | 12.50 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | 22.67 | % | 8.04 | % | 12.16 | % |

Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) | | 36.39 | % | 14.63 | % | 15.22 | % |

* Returns are not presented for Institutional Class shares, which commenced operations on September 1, 2020. Performance information for Institutional Class shares will be shown when those shares have a full calendar year of operations.

Will I be able to purchase, redeem, and exchange shares the same way?

Yes, after the Reorganization you will be able to purchase, redeem, and exchange shares of the Acquiring Fund the same way that you purchase, redeem, and exchange shares of the Target Fund. For more information, see the sections titled “Description of Shares—Buying and Selling Fund Shares” and “Description of Shares—Exchange Privileges of the Funds.”

Will I be able to receive distributions the same way?

Like the Target Fund, the Acquiring Fund intends to distribute to its shareholders substantially all of its net investment income and capital gains. Each Fund declares and pays any net investment income dividends annually. After the Reorganization, the Acquiring Fund expects to declare and pay any net investment income dividends annually. Each Fund makes distributions of capital gains, if any, at least annually. After the Reorganization, any income and capital gains will be reinvested in the class of shares of the Acquiring Fund you receive in the Reorganization or, if you have so elected, distributed in cash. Each Fund intends to make distributions that may be taxed as ordinary income or capital gains except when shares are held through a tax-advantaged account, such as a 401(k) plan or an IRA. Withdrawals from a tax-advantaged account, however, may be taxable. For more information, see the section titled “Distribution and Shareholder Servicing Arrangements—Distribution Policy.”

Who will be the Advisor, Sub-Advisor, and Portfolio Managers of my Fund after the Reorganization?

For each Fund, Touchstone Advisors serves as the investment advisor.

Sands Capital Management, LLC (“Sands” or “Sub-Advisor”) serves as sub-advisor to each Fund, with Frank M. Sands, CFA, A. Michael Sramek, CFA, Wesley A. Johnston, CFA, and Thomas H. Trentman, CFA serving as portfolio managers.

After the Reorganization, Touchstone Advisors will continue to serve as investment advisor to the Acquiring Fund, with Sands and Messrs. Sands, Sramek, Johnston, and Trentman continuing in their capacity as sub-advisor and portfolio managers, respectively.

For additional information regarding Touchstone Advisors, the sub-advisor, and the portfolio managers, please see the section titled “The Funds’ Management—Investment Advisor” and “The Funds’ Management—Sub-Advisor and Portfolio Managers.”

What will be the primary federal income tax consequences of the Reorganization?

The Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes. If the Reorganization so qualifies, then generally no gain or loss will be recognized for federal income tax purposes by the Funds or their respective shareholders as a direct result of the Reorganization. As a condition to the closing of the Reorganization, the Funds will each receive an opinion from the law firm of K&L Gates LLP that the Reorganization qualifies as a tax-free reorganization within the meaning of Section 368(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”). The opinion, however, is not binding on the Internal Revenue Service (the “IRS”) or any court and thus does not preclude the IRS or a court from taking a contrary position. See “Information About the Reorganization—Material Federal Income Tax Consequences” for more information on the material federal income tax consequences of the Reorganization.

Prior and subsequent to the Reorganization, none of the securities of the Target Fund are expected to be sold in connection with the Reorganization.

How do the Funds’ investment goals and principal investment strategies compare?

The Funds have identical investment goals and substantially identical investment strategies. The Target Fund’s and the Acquiring Fund’s investment goal is to seek long-term capital appreciation.

Each Fund also has substantially identical fundamental investment limitations, which are set forth in Exhibit B.

The following tables describe the investment goals and principal investment strategies of the Target Fund and the Acquiring Fund.

| | | | | | | | |

| Target Fund | Acquiring Fund |

| Investment Goal | The Fund seeks long-term capital appreciation. | The Fund seeks long-term capital appreciation. |

| Principal Investment Strategy | The Fund invests, under normal market conditions, at least 80% of its assets in common stocks of U.S. companies that the subadvisor, Sands Capital Management, LLC (“Sands Capital”), believes have above-average potential for revenue and earnings growth. This is a non-fundamental investment policy that the Fund can change upon 60 days’ prior notice to shareholders. The Fund emphasizes investments in large capitalization growth companies. The weighted-average market capitalization of these companies is generally in excess of $25 billion, and the Fund generally does not invest in companies that have a market capitalization of less than $2 billion. The Fund will typically own between 25 and 35 companies. | The Fund invests, under normal market conditions, at least 80% of its assets in common stocks of U.S. companies that the subadvisor, Sands Capital Management, LLC, believes have above-average potential for revenue or earnings growth. This is a non-fundamental investment policy that the Fund can change upon 60 days’ prior notice to shareholders. The Fund emphasizes investments in large capitalization growth companies. The weighted-average market capitalization of these companies is generally in excess of $25 billion, and the Fund generally does not invest in companies that have a market capitalization of less than $2 billion. The Fund will typically own between 25 and 35 companies.

|

| The Fund is non-diversified and may invest a significant percentage of its assets in the securities of a single company. The Fund may invest a high percentage of its assets in specific sectors of the market in order to achieve a potentially greater investment return. | The Fund is non-diversified and invests a significant percentage of its assets in the securities of a single company or in the securities of a smaller number of companies than a diversified fund. The Fund may invest a high percentage of its assets in specific sectors of the market in order to achieve a potentially greater investment return. |

| Sands Capital generally seeks to invest in stocks with sustainable above average earnings growth, and with capital appreciation potential. Sands Capital generally considers selling a security when it no longer meets its investment criteria, when the issues causing such problems are not solvable within an acceptable time frame, or when other opportunities appear more attractive. | |

Principal Risks

Each Fund’s share price will fluctuate. You could lose money on your investment in each Fund, and each Fund could return less than other investments. Investments in a Fund are not bank guaranteed, are not deposits and are not insured by the FDIC or any other federal government agency. As with any mutual fund, there is no guarantee that either Fund will achieve its investment goal.

The principal risks of investing in the Funds are similar, as their investment goals are identical and their principal investment strategies are substantially identical. The principal risks of the Funds are set forth below, and such risks apply to both Funds unless otherwise noted. Both Funds are also subject to Economic and Market Events Risk, but the Acquiring Fund does not list this as a principal risk.

The following table compares the principal investment risks of the Target Fund to the principal investment risks of the Acquiring Fund. The principal risks of the Funds are set forth below.

| | | | | | | | | | | | | | | | | |

| | Target Fund | | Acquiring Fund | |

| Economic and Market Events Risk | | X | | | |

| Equity Securities Risk | | X | | X | |

| Large-Cap Risk | | X | | X | |

| Growth-Investing Risk | | X | | X | |

| Non-Diversification Risk | | X | | X | |

| Sector Focus Risk | | X | | X | |

Equity Securities Risk: The Fund is subject to the risk that stock prices will fall over short or extended periods of time. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by these companies may decline in response to such developments, which could result in a decline in the value of the Fund’s shares.

•Large-Cap Risk: Large-cap companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

Growth-Investing Risk: Growth-oriented funds may underperform when value investing is in favor, and growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions of the issuing company’s growth of earnings potential.

Management Risk: In managing the Fund’s portfolio, the Advisor engages one or more sub-advisors to make investment decisions for a portion of or the entire portfolio. There is a risk that the Advisor may be unable to identify and retain sub-advisors who achieve superior investment returns relative to other similar sub-advisors.

Economic and Market Events Risk (Target Fund only): Events in the U.S. and global financial markets, including actions taken by the U.S. Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times, and for varying periods of time, result in unusually high market volatility, which could negatively impact the Fund’s performance and cause the Fund to experience illiquidity, shareholder redemptions, or other potentially adverse effects. Reduced liquidity in credit and fixed-income markets could negatively affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates rise or economic conditions deteriorate.

Non-Diversification Risk: The Fund is non-diversified, which means that it may invest a greater percentage of its assets than a diversified mutual fund in the securities of a limited number of issuers. The use of a non-diversified investment strategy may increase the volatility of the Fund’s investment performance, as the Fund may be more susceptible to risks associated with a single economic, political or regulatory event.

Sector Focus Risk: A fund that focuses its investments in the securities of a particular market sector is subject to the risk that adverse circumstances will have a greater impact on the fund than a fund that does not focus its investments in a particular sector.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

The Reorganization is intended to eliminate the offering of multiple funds with similar investment goals and similar principal investment strategies. The Reorganization has the potential to provide efficiencies, enhanced marketability and economies of scale for the combined Fund. At a meeting held on May 21, 2020, the Board of Trustees (the “Board” or the “Trustees”) of Touchstone Institutional Funds Trust (the “Target Trust”) and Touchstone Funds Group Trust (the “Acquiring Trust”), including the Independent Trustees of the Board, determined that the Reorganization was in the best interests of the Funds and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization. The Board approved the Reorganization.

Additionally, at the same Board meeting, Touchstone Advisors recommended, and the Board approved, launching Institutional Class shares of the Acquiring Fund and reducing the fees and expenses of the Acquiring Fund (including eliminating the performance fee component of the Acquiring Fund’s advisory fee). Institutional Class shares of the Acquiring Fund became

effective on September 1, 2020 and the changes to the fees and expenses of the Acquiring Fund became effective on June 1, 2020.

In evaluating the Reorganization, the Board requested and reviewed, with the assistance of independent legal counsel to the Independent Trustees, materials furnished by Touchstone Advisors, the investment advisor to the Funds. These materials included information regarding the operations and financial condition of the Funds and the principal terms and conditions of the Reorganization, including that the Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes. The Board’s evaluation of the Reorganization took into consideration the changes to the Acquiring Fund that became effective prior to the Reorganization. The Board considered the following factors, among others:

•the investment advisory fee and other fees paid by the Funds, the expense ratios of the Funds and the contractual limitations on the Funds’ expenses and the fee and expense changes with respect to the Acquiring Fund that became effective on June 1, 2020;

•the anticipated benefits to the Funds, including operating efficiencies, that may be achieved from the Reorganization;

•that the expenses of the Reorganization would not be borne by the Funds’ shareholders;

•the terms and conditions of the Reorganization, including the Acquiring Fund’s assumption of all of the liabilities of the Target Fund;

•that the Reorganization is intended to be a tax-free reorganization for federal income tax purposes; and

•alternatives available to shareholders of the Target Fund, including the ability to redeem or exchange their shares.

During their assessment of the Reorganization, the Independent Trustees of the Board met with independent legal counsel outside the presence of representatives of management regarding the legal issues involved. After consideration of the factors noted above, together with other factors and information considered to be relevant, and recognizing that there can be no assurance that any potential operating efficiencies or other benefits will in fact be realized, the Board, including the Independent Trustees concluded that the Reorganization would be in the best interests of each Fund and the interests of existing shareholders of the Funds would not be diluted as a result of the Reorganization.

Agreement and Plan of Reorganization

A form of the Plan is set forth in Exhibit A. The Plan provides that all of the assets of the Target Fund will be transferred to the Acquiring Fund solely in exchange for shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund on or about December 11, 2020 or such other date as may be agreed upon by the parties (the “Closing Date”). You will receive Institutional Class shares of the Acquiring Fund.

Prior to the close of business on the Closing Date, the Target Fund will endeavor to discharge all of its known liabilities and obligations. In addition, prior to the close of business on the Closing Date, for tax reasons, the Target Fund will distribute to its shareholders all of the Target Fund’s investment company taxable income for all taxable periods ending on or before the Closing Date, all of the Target Fund’s net tax-exempt income for all taxable periods ending on or before the Closing Date, and all of its net capital gains realized in all taxable periods ending on or before the Closing Date (after reduction for any available capital loss carryforwards and excluding any net capital gain on which the Target Fund paid federal income tax).

The Bank of New York Mellon, the sub-administrator for the Funds, will compute the value of the Target Fund’s portfolio of securities. The method of valuation employed will be consistent with the valuation procedures described in the Touchstone Institutional Funds Trust declaration of trust and the Target Fund’s prospectus and statement of additional information or such other valuation procedures as shall be mutually agreed upon by the Funds.

As soon after the closing as practicable, the Target Fund will distribute pro rata (or proportionate) to its shareholders of record as of the time of such distribution the full and fractional shares of the Acquiring Fund received by the Target Fund. The liquidation and distribution will be accomplished by the establishment of accounts in the names of the Target Fund’s shareholders on the Acquiring Fund’s share records of its transfer agent. Each account will receive the respective pro rata number of full and fractional shares of Institutional Class shares of the Acquiring Fund due a Target Fund shareholder. All issued and outstanding shares of the Target Fund will be cancelled. After these distributions and the winding up of its affairs, the Target Fund will be terminated.

The Reorganization is subject to the satisfaction or waiver of the conditions set forth in the Plan. The Plan may be terminated (1) by the mutual agreement of the Target Fund and the Acquiring Fund; or (2) at or prior to the closing by either party (a) because of a breach by the other of any representation, warranty, or agreement contained in the Plan to be performed at or prior to the closing, if not cured within 30 days, or (b) because a condition in the Plan expressed to be precedent to the obligations of the terminating party has not been met and it reasonably appears that it will not or cannot be met.

Touchstone Advisors, and not the Funds, will bear 100% of the costs of the Reorganization, which are estimated to be approximately $75,000 or approximately 0.01% of the Target Fund's net assets (as of June 30, 2020), whether or not the Reorganization is completed.

Description of the Securities to be Issued

Shareholders of the Target Fund as of the closing will receive full and fractional shares of the Acquiring Fund in accordance with the terms of the Plan. The shares of the Acquiring Fund to be issued in connection with the Reorganization will be duly and validly issued and outstanding, fully paid and non-assessable by the Acquiring Fund. Shares of the Acquiring Fund to be issued in the Reorganization will have no preemptive or conversion rights and no share certificates will be issued.

Material Federal Income Tax Consequences

The following discussion summarizes the material U.S. federal income tax consequences of the Reorganization that are applicable to you as a Target Fund shareholder. It is based on the Code, applicable U.S. Treasury regulations, judicial authority, and administrative rulings and practice, all as of the date of this Prospectus/Information Statement and all of which are subject to change, including changes with retroactive effect. The discussion below does not address any state, local, or foreign tax consequences of the Reorganization. Your tax treatment may vary depending upon your particular situation. You also may be subject to special rules not discussed below if you are a certain kind of Target Fund shareholder, including, but not limited to: an insurance company; a tax-exempt organization; a financial institution or broker-dealer; a person who is neither a citizen nor resident of the United States or an entity that is not organized under the laws of the United States or a political subdivision thereof; a holder of Target Fund shares as part of a hedge, straddle, conversion or other integrated transaction; a person with “applicable financial statements” within the meaning of Section 451(b) of the Code; a person who does not hold Target Fund shares as a capital asset at the time of the Reorganization; or an entity taxable as a partnership for U.S. federal income tax purposes.

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Code. As a non-waivable condition to the closing of the Reorganization, the Target Fund and the Acquiring Fund will receive an opinion from the law firm of K&L Gates LLP substantially to the effect that, on the basis of the existing provisions of the Code, U.S. Treasury regulations issued thereunder, current administrative rules, pronouncements and court decisions, and certain representations, qualifications, and assumptions with respect to the Reorganization, for federal income tax purposes:

(i) The transfer by the Target Fund of all its assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, immediately followed by the pro rata, by class, distribution of all the Acquiring Fund shares so received by the Target Fund to the Target Fund’s shareholders of record in complete liquidation of the Target Fund and the termination of the Target Fund promptly thereafter, will constitute a “reorganization” within the meaning of Section 368(a)(1) of the Code, and the Acquiring Fund and the Target Fund will each be “a party to a reorganization,” within the meaning of Section 368(b) of the Code, with respect to the Reorganization.

(ii) No gain or loss will be recognized by the Acquiring Fund upon the receipt of all the assets of the Target Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund.

(iii) No gain or loss will be recognized by the Target Fund upon the transfer of all its assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund or upon the distribution (whether actual or constructive) of the Acquiring Fund shares so received to the Target Fund’s shareholders solely in exchange for such shareholders’ shares of the Target Fund in complete liquidation of the Target Fund.

(iv) No gain or loss will be recognized by the Target Fund’s shareholders upon the exchange, pursuant to the Plan, of all their shares of the Target Fund solely for Acquiring Fund shares.

(v) The aggregate basis of the Acquiring Fund shares received by each Target Fund shareholder pursuant to the Plan will be the same as the aggregate basis of the Target Fund shares exchanged therefor by such shareholder.

(vi) The holding period of the Acquiring Fund shares received by each Target Fund shareholder in the Reorganization will include the period during which the shares of the Target Fund exchanged therefor were held by such shareholder, provided such Target Fund shares were held as capital assets at the effective time of the Reorganization.

(vii) The basis of the assets of the Target Fund received by the Acquiring Fund will be the same as the basis of such assets in the hands of the Target Fund immediately before the effective time of the Reorganization.

(viii) The holding period of the assets of the Target Fund received by the Acquiring Fund will include the period during which such assets were held by the Target Fund.

No opinion will be expressed as to (1) the effect of the Reorganization on the Target Fund, the Acquiring Fund or any Target Fund shareholder with respect to any asset (including without limitation any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code) as to which any unrealized gain or loss is required to be recognized under federal income tax principles (i) at the end of a taxable year or on the termination thereof, or (ii) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code or (2) any other federal tax issues (except those set forth above) and any state, local or foreign tax issues of any kind.

No private ruling will be sought from the IRS with respect to the federal income tax consequences of the Reorganization. Opinions of counsel are not binding upon the IRS or the courts, are not guarantees of the tax results, and do not preclude the IRS from adopting or taking a contrary position, which may be sustained by a court. If the Reorganization is consummated but the IRS or the courts determine that the Reorganization does not qualify as a tax-free reorganization under the Code and, thus, is taxable, the Target Fund would recognize gain or loss on the transfer of its assets to the Acquiring Fund and each shareholder of the Target Fund would recognize a taxable gain or loss equal to the difference between its tax basis in its Target Fund shares and the fair market value of the shares of the Acquiring Fund it receives.

Prior to the Reorganization, the Target Fund will declare and pay a distribution to its shareholders, which together with all previous distributions, will have the effect of distributing to its shareholders all of the Target Fund’s investment company taxable income (computed without regard to the deduction for dividends paid), net tax exempt income and realized net capital gain (after reduction for available capital loss carryforwards and excluding certain capital gain on which the Target Fund paid tax), if any, for all periods through the Closing Date. Such distributions will be taxable to shareholders for federal income tax purposes and may include net capital gain from the sale of portfolio assets as discussed below. Even if reinvested in additional shares of the Target Fund, which would be exchanged for shares of the Acquiring Fund in the Reorganization, such distributions will be taxable for federal income tax purposes.

If portfolio assets of the Target Fund are sold prior to the Reorganization, the tax impact of such sales will depend on the holding periods of such assets and the difference between the price at which such portfolio assets are sold and the Target Fund’s basis in such assets. Any capital gains recognized in these sales on a net basis (after taking into account any available capital loss carryforwards) will be distributed to the Target Fund’s shareholders as capital gains (to the extent of net long-term capital gain over any net short-term capital loss) or ordinary dividends (to the extent of net short-term capital gain over any net long-term capital loss) during or with respect to the year of sale, and such distributions will be taxable to shareholders.

The Reorganization will cause the tax year of the Target Fund to close. After the Reorganization, the Acquiring Fund’s ability to use the Target Fund’s or the Acquiring Fund’s realized and unrealized pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. Therefore, in certain circumstances, shareholders may pay federal income tax sooner, or may pay more federal income taxes, than they would have had the Reorganization not occurred. The effect of these potential limitations will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of the Reorganization and the amount of unrealized capital gains in the Funds at the time of the Reorganization.

As of December 31, 2019, for U.S. federal income tax purposes, the Target Fund had no capital loss carryforwards. As of June 30, 2020, for U.S. federal income tax purposes, the Target Fund had net unrealized gains of $1,021,982,197. As of September 30, 2019, for U.S. federal income tax purposes, the Acquiring Fund had no capital loss carryforwards. As of March 31, 2020, for U.S. federal income tax purposes, the Acquiring Fund had net unrealized gains of $556,912,517.

In addition, shareholders of the Target Fund will receive a proportionate share of any taxable income and gains realized by the Acquiring Fund and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the Acquiring Fund. Furthermore, any gain the Acquiring Fund realizes after the Reorganization, including any built-in gain in the portfolio investments of the Target Fund or the Acquiring Fund that was unrealized at the time of the Reorganization, may result in taxable distributions to shareholders holding shares of the Acquiring Fund (including former shareholders of the Target Fund who hold shares of the Acquiring Fund following the Reorganization). After the Reorganization, the Acquiring Fund is not expecting to sell the Target Fund’s investment portfolio received in the Reorganization.

Tracking Your Basis and Holding Period; State and Local Taxes. After the Reorganization, you will continue to be responsible for tracking the adjusted tax basis and holding period of your shares for federal income tax purposes. However, mutual funds must report cost basis information to you and the IRS when a shareholder sells or exchanges shares acquired on or after

January 1, 2012 that are not in a retirement account (“covered shares”). Cost basis reporting by a mutual fund is not required if the shares were acquired in a reorganization and the basis of the acquired shares is determined from the basis of shares that were not covered shares.

This discussion does not address any state, local or foreign tax issues and is limited to material federal income tax issues. You are urged and advised to consult your own tax advisors as to the federal, state, local, foreign, and other tax consequences of the Reorganization in light of your individual circumstances, including the applicability and effect of possible changes in any applicable tax laws.

Pro Forma Capitalization

The following table sets forth the net assets, number of shares outstanding, and net asset value (“NAV”) per share, assuming the Reorganization had been completed as of March 31, 2020. This information is generally referred to as the “capitalization” of a Fund. The term “pro forma capitalization” means the expected capitalization of the Acquiring Fund after giving effect to the Reorganization and assuming the Reorganization had been completed as of March 31, 2020. These numbers may differ as of the Closing Date of the Reorganization.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Touchstone Sands Capital Institutional Growth Fund (1) | | Touchstone Sands Capital Select Growth Fund Institutional Class | | Pro Forma Adjustments(2) | | | Pro Forma Touchstone Sands Capital Select Growth Fund After Reorganization | |

| Net Assets (all classes) | | $1,478,435,319 | | $1,456,382,691 | | | | | $2,934,818,010 | |

| Institutional Class Shares | | | | | | | | | | |

| Net assets | | $1,478,435,319 | | $0 | | | | | $1,478,435,319 | |

| Shares outstanding | | 73,101,090 | | | 0 | | 51,241,662 | | (3) | | 124,342,752 | | |

| Net asset value per share | | $20.22 | | $11.89 | (4) | | | | $11.89 | |

(1) Touchstone Sands Capital Institutional Growth Fund is a single class fund.

(2) Touchstone Advisors, and not the Funds, will bear 100% of the Reorganization expenses.

(3) Pro forma shares outstanding have been adjusted for the accumulated change in the number of the Target Fund’s shareholder accounts based on the relative value of each Fund’s net asset value per share as of March 31, 2020.

(4) The net asset value per share is based on Class Y shares as of March 31, 2020. The inception date of Institutional Class shares is September 1, 2020.

THE FUNDS’ MANAGEMENT

The Funds have the same investment advisor.

Investment Advisor

Touchstone Advisors, Inc.

303 Broadway, Suite 1100, Cincinnati, Ohio 45202

Touchstone Advisors has been a SEC-registered investment advisor since 1994. As of September 30, 2020, it had approximately $22.1 billion in assets under management.

Touchstone Advisors is responsible for selecting each Fund’s sub-advisor(s), subject to approval by the applicable Board. Touchstone Advisors selects a sub-advisor that has shown good investment performance in its areas of expertise. Touchstone Advisors considers various factors in evaluating a sub-advisor, including:

• level of knowledge and skill;

• performance as compared to its peers or benchmark;

• consistency of performance over 5 years or more;

• level of compliance with investment rules and strategies;

• employees;

• facilities and financial strength; and

• quality of service.

Touchstone Advisors will also continually monitor each sub-advisor’s performance through various analyses and through in-person, telephone, and written consultations with a sub-advisor. Touchstone Advisors discusses its expectations for performance with each sub-advisor and provides evaluations and recommendations to the applicable Board, including whether or not a sub-advisor’s contract should be renewed, modified, or terminated.

The SEC has granted an exemptive order that permits the Trusts or Touchstone Advisors, under certain conditions, to select or change unaffiliated sub-advisors, enter into new sub-advisory agreements or amend existing sub-advisory agreements without first obtaining shareholder approval. A Fund must still obtain shareholder approval of any sub-advisory agreement with a sub-advisor affiliated with the Trust of which it is a series or Touchstone Advisors other than by reason of serving as a sub-advisor to one or more Funds. Shareholders of a Fund will be notified of any material changes in the Fund’s sub-advisory arrangements. After the Reorganization, Touchstone Advisors and the Trusts will continue to rely on this exemptive order.

Two or more sub-advisors may manage a Fund, with each managing a portion of the Fund’s assets. If a Fund has more than one sub-advisor, Touchstone Advisors allocates how much of a Fund’s assets are managed by each sub-advisor. Touchstone Advisors may change these allocations from time to time, often based upon the results of its evaluations of the sub-advisors.

Touchstone Advisors is also responsible for running all of the operations of the Funds, except those that are subcontracted to a sub-advisor, custodian, transfer agent, sub-administrative agent, or other parties. For its services, Touchstone Advisors is entitled to receive an investment advisory fee from each Fund at an annualized rate based on the average daily net assets of the Fund. The annual fee rate below is the fee paid to Touchstone Advisors by each Fund for each Fund’s most recent fiscal year end and is net of advisory fees waived by Touchstone Advisors, if any. Touchstone Advisors, and not the Funds, pays from its advisory fee sub-advisory fees to the Funds’ sub-advisors.

Prior to June 1, 2020, the Acquiring Fund paid an advisory fee at an annual rate of 0.85% on the first $1 billion of average daily net assets; 0.80% on the next $500 million; 0.75% on the next $500 million; 0.70% on the assets above $2 billion. In addition, there was a performance fee adjustment to the Acquiring Fund's advisory fee prior to June 1, 2020.

At the May 21, 2020 Board meeting, the Board approved an amendment to the Acquiring Fund’s investment management agreement to reduce the Fund’s advisory fee. Effective June 1, 2020, the Acquiring Fund will pay an advisory fee at an annual rate of 0.70% on the first $1 billion of average daily net assets, 0.65% on the next $500 million, 0.60% on the next $500 million, and 0.55% on assets over $2 billion (the “New Fee Schedule”). The Board also approved eliminating the performance fee component of the Acquiring Fund.

The Target Fund pays a unified management fee from the Fund at an annualized rate, based on the average daily net assets of the Fund.

The annual fee rate below is the fee paid to Touchstone Advisors by the Target Fund and the Acquiring Fund for each Fund’s fiscal year end, as noted below, net of any fee waivers and/or expense reimbursements, which are discussed in more detail below. Touchstone Advisors, and not the Funds, pays sub-advisory fees to Sands from its advisory fee.

1.Target Fund 0.78% (fiscal year ended December 31, 2019)

2.Acquiring Fund 0.88% (fiscal year ended September 30, 2019)

Had the New Fee Schedule been in effect and had the performance fee been eliminated for the twelve-month period ended September 30, 2019, the Acquiring Fund would have paid an effective advisory fee of 0.67%.

Sub-Advisor and Portfolio Managers

Sands Capital Management, LLC, located at 1000 Wilson Boulevard, Suite 3000, Arlington, Virginia 22209, serves as the sub-advisor to the Funds. As sub-advisor, Sands makes investment decisions for the Funds and also ensures compliance with the Funds’ investment policies and guidelines. As of September 30, 2020, Sands had approximately $59.6 billion in assets under management.

The following individuals are jointly and primarily responsible for the management of the Funds’ portfolios.

Frank M. Sands, CFA, Chief Investment Officer and Chief Executive Officer. Mr. Sands joined Sands Capital in June 2000. Prior to 2008, Mr. Sands was President, Director of Research and Sr. Portfolio Manager. He has investment experience dating back to 1994.

A. Michael Sramek, CFA, Senior Portfolio Manager, Research Analyst, and Managing Director. Mr. Sramek joined Sands Capital in April 2001. He has investment experience dating back to 1997.

Wesley A. Johnston, CFA, Portfolio Manager and Senior Research Analyst. Mr. Johnston joined Sands Capital in 2004. He has investment experience dating back to 2004.

Thomas H. Trentman, CFA, Portfolio Manager and Research Analyst. Mr. Trentman joined Sands Capital in 2005. He has investment experience dating back to 2005.

Advisory and Sub-Advisory Agreement Approval

A discussion of the basis for the Board’s approval of the Acquiring Fund’s advisory and sub-advisory agreements can be found in the Acquiring Trust’s March 31, 2020 semi-annual report.

Expense Limitation Agreement

Touchstone Advisors has contractually agreed to waive fees and reimburse expenses to the extent necessary to ensure that each Fund’s total annual operating expenses (excluding dividend and interest expenses relating to short sales; interest; taxes; brokerage commissions and other transaction costs; portfolio transaction and investment related expenses, including expenses associated with the Fund's liquidity providers; other expenditures which are capitalized in accordance with U.S. generally accepted accounting principles; the cost of “Acquired Fund Fees and Expenses,” if any; and other extraordinary expenses not incurred in the ordinary course of business) do not exceed the contractual expense limits set forth below. The contractual expense limits set forth in the table below have been adjusted for each class of each Fund to include the effect of Rule 12b-1 fees, shareholder servicing fees, and other anticipated class specific expenses, if applicable. Fee waivers and expense reimbursements are calculated and applied monthly, based on each Fund’s average net assets during such month. The terms of the contractual expense limitation agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the applicable Fund’s Board, such amounts waived or reimbursed for a period of up to three years from the date on which Touchstone Advisors reduced its compensation or assumed expenses for the Fund. The Fund will make repayments to Touchstone Advisors only if such repayment does not cause the annual fund operating expenses (after the repayment is taken into account) to exceed both (1) the expense cap in place when such amounts were waived or reimbursed and (2) the Fund’s current expense limitation. Fees waived and expenses reimbursed by Touchstone Advisors with respect to the Target Fund prior to the closing of the Reorganization may not be recouped by Touchstone Advisors following the closing of the Reorganization.

| | | | | | | | | | | | | | | | | |

| Fund | | Expense Limit | | Effective Through | |

| Touchstone Sands Capital Institutional Growth Fund* | | 0.80% | | April 30, 2021 | |

| | | | | |

| Touchstone Sands Capital Select Growth Fund - Institutional Class | | 0.78% | | November 30, 2021 | |

*The Fund is a single class fund.

Other Service Providers

The Funds currently have the same service providers. Upon completion of the Reorganization, the Acquiring Fund will continue to engage its existing service providers, as set forth in the chart below.

| | | | | | | | | | | |

| | Service Providers | |

| Principal Underwriter | | Touchstone Securities, Inc. | |

| Administrator | | Touchstone Advisors, Inc. | |

| Sub-Administrative Agent | | The Bank of New York Mellon | |

| Transfer Agent | | BNY Mellon Investment Servicing (US) Inc. | |

| Custodian | | Brown Brothers Harriman & Co. | |

| Independent Registered Public Accounting Firm | | Ernst & Young LLP | |

DESCRIPTION OF SHARES

Share Class Offerings. The Acquiring Fund is offering Institutional Class of shares pursuant to this Prospectus/Information Statement and the SAI. You will not pay any sales load, commission, or other similar fee in connection with the shares you will receive in the Reorganization. However, additional purchases, exchanges and redemptions of shares of a Fund will be subject to any sales loads, commissions, and other similar fees applicable to the Fund. For additional information regarding sales charges, sales charge reductions and waivers, and distribution fees applicable to Fund shares not offered in this Prospectus/Information Statement and the SAI, see the sections titled “Description of Shares” and “Investing with Touchstone” in the Acquiring Fund’s prospectus.

Institutional Class Shares

Institutional Class shares of the Fund are sold at NAV without an initial sales charge so that the full amount of your purchase payment may be immediately invested in the Fund. Institutional Class shares are not subject to a Rule 12b-1 fee or contingent deferred sales charge ("CDSC").

Buying and Selling Fund Shares

Institutional Class shares of the Acquiring Fund have the below minimum investment requirements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | |

| Minimum Investment Requirements | Initial Investment | | | | Additional Investment | | | | |

| Regular Account | | $ | 500,000 | | | $ | 50 | | |