UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08104

Constellation Target Select Fund

(Exact name of registrant as specified in charter)

________

1205 Westlakes Drive Suite 100

Berwyn, PA 19312

(Address of principal executive offices) (Zip code)

Constellation Funds Group

P.O. Box 21920

Kansas City, MO 64105-9520

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-242-5742

Date of fiscal year end: September 30, 2004

Date of reporting period: March 31, 2004

Item 1. Reports to Stockholders.

Trust Investment Adviser Sub-Adviser Distributor Administrator Legal Counsel Independent Auditors

To open an account, receive account information, make inquiries, or request literature: This report was prepared for shareholders of the Constellation Target Select Equity Fund. It may be distributed to others only if preceded or accompanied by a Prospectus, which contains detailed information. |

Semiannual Report

Target Select Equity Fund

| |

Contents

| Page | Section |

| 2 | Total Returns and Fund Investment Objective |

| 5 | Statement of Net Assets |

| 7 | Statement of Operations |

| 8 | Statement of Changes in Net Assets |

| 9 | Financial Highlights |

| 10 | Notes to Financial Statements |

| 14 | Proxy Voting Results |

| 15 | Trustees and Officers of the Trust |

Constellation Funds Group

The Constellation Funds Group (formerly the Alpha Select Funds) offer the Target Select Equity Fund (the “Fund”), a non-diversified mutual fund for individual and institutional investors with three separate classes of shares: Class A, Class C, and Class I. The Class I Shares are the only active class of shares as of March 31, 2004. The minimum initial investment in the Class A and Class C shares is $1,000 ($500 for retirement plans), and the minimum initial investment for Class I Shares is $2,500. The minimum amount for subsequent investments is $50 for Class A, Class C, and Class I Shares. The Fund reserves the right to waive the minimum initial investment, and may do so for financial intermediaries who purchase shares through a brokerage firm or a mutual fund marketplace.

Constellation Investment Management Company, LP (“CIMCO”), located in Berwyn, Pennsylvania, was formed on May 19, 2000, and serves as the Adviser to the Fund.

CIMCO has appointed Turner Investment Partners, Inc. (“Turner”) as sub-adviser to the Target Select Equity Fund.

Turner is based in Berwyn, Pennsylvania. The firm, founded in 1990, invests in equity, fixed-income, and balanced portfolios on behalf of individuals and institutions. As of March 31, 2004, Turner had over $13 billion in assets under management.

Turner employs a quantitative investment model in its management of the Fund. The model builds a portfolio of the best-ranked companies that is sector neutral to the Russell 3000 Index, over-weighting Large/Small companies and Growth/Value companies based on the forecast of Turners’ asset allocation models.

Shareholder Services

The Constellation Funds Group’s shareholders receive annual and semiannual reports and quarterly account statements. Shareholders who have questions about their accounts may call a toll-free telephone number, 1 (866) 242 5742. Or they may write to Constellation Funds Group, P.O. Box 219520, Kansas City, Missouri 64105-9520

Target Select Equity Fund

| Total Returns* | ||||||||||||||

| Through March 31, 2004 | ||||||||||||||

| Six-Month Return | 1 Year Return | 3 Year Return | 5 Year Return | Inception to date** | ||||||||||

| (average annual) | ||||||||||||||

| Target Select Equity Fund | 17.80 | % | 41.99 | % | (8.41 | )% | (2.73 | )% | 3.91 | % | ||||

| Russell 3000 Index | 14.94 | 38.19 | 1.95 | 0.14 | 3.99 | |||||||||

| S&P 500 Index | 14.08 | 35.12 | 0.63 | (1.20 | ) | 3.78 | ||||||||

| Lipper Multi-Cap Growth Funds | ||||||||||||||

| Classification | 3.71 | 39.55 | (1.43 | ) | (1.91 | ) | 3.62 | |||||||

| * Past performance cannot guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares when redeemed, may be worth more or less than their original cost. Fee waivers are in effect; if they had not been in effect, performance would have been lower. | ||||||||||||||

| **The inception date for the Target Select Equity Fund is December 31, 1997. | ||||||||||||||

Fund Investment Objective

The Target Select Equity Fund seeks long-term capital appreciation. It invests primarily (at least 80% of its net assets) in U.S. and foreign common stocks and other equity securities of companies without regard to their market capitalization. This is a non-fundamental investment policy that can be changed by the Fund up to 60 days prior notice to shareholders. The Fund may invest in securities of companies operating in a broad range of industries located in the U.S. and overseas.

The Fund may employ a multi-manager approach to take advantage of the best investment ideas of a number of sub-advisers, each with its own investment approach. Under a multi-manager approach, each sub-adviser manages a portion of the Fund’s assets, under the general supervision of the Fund’s investment adviser (such sub-adviser and investment adviser together, the “Advisers”). Here, each sub-adviser selects a relatively small number of securities, as few as 10, for its portion of the Fund’s assets. Such a focused security-selection process permits each sub-adviser to act on only the investment ideas that it thinks have the greatest return potential.

The Fund’s investment adviser, Constellation Investment Management Company, LP (“CIMCO”) ensures that the sub-advisers comply with the Fund’s investment policies and guidelines. CIMCO will also recommend the appointment of additional or replacement sub-advisers to the Board of Trustees (the “Board”).

Currently CIMCO employs and oversees one sub-adviser, Turner Investment Partners, Inc., which currently manages 100% of the Fund’s total assets.

2

Target Select Equity Fund

During the six month period ended March 31, 2004, the Target Select Equity Fund delivered a total return of 17.80%. This compares with a total return of 14.94% for the Fund’s benchmark, the Russell 3000 Index.

Fund Structure & Management

A team of portfolio managers from Turner manages the Fund. David Kovacs, Senior Portfolio Manager, serves as lead manager of this team. The managers employ a multi-style, all capitalization approach, with the ability to overweight the style or capitalization believed by management to provide the best opportunity for strong performance and price appreciation. The management team uses quantitative modeling to assist with asset allocation and security selection decisions. They also review the fundamentals of each company within the portfolio to ensure that recent events or news relating to the company that cannot be identified by the quantitative model are considered and their potential impact on stock performance is evaluated. This approach has allowed the Fund to retain a well-diversified approach, with portfolio holdings from a variety of distinct segments of the market.

Market Review

During the six month period ended March 31, 2004, the Fund benefited from the strong rally in stocks that began early in 2003 and continued through the fourth quarter. In December, both the Dow Jones Industrial Average and the NASDAQ broke significant psychological barriers, as the Dow surpassed the 10,000-point mark and the NASDAQ closed above 2,000 for the first time in nearly two years. Tax relief, low interest rates, strong economic data and demonstrable growth in corporate profits boosted investor confidence and sustained strong equity performance through the beginning of 2004. However, in February, stocks experienced a correction driven by investor uncertainty about possible fed actions and geopolitical risk and growing concern over employment reports and the sustainability of corporate earnings. Despite the pullback, major market indices ended the first quarter on a positive note and posted gains for the quarter.

Portfolio Review

Contributing the most to performance were our holdings in the healthcare sector. Our exposure to stocks in the medical specialties and managed health care industries, combined with our decision to significantly underweight large pharmaceutical stocks boosted performance. In addition, the Fund’s holdings in financial services stocks performed well during the period. The Fund’s holdings in the autos and transportation sector detracted the most from performance during the period.

3

Target Select Equity Fund

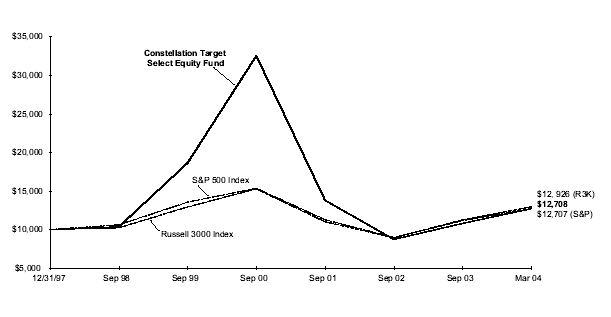

Growth of a $10,000 Investment in the Target Select Equity Fund:

December 31, 1997 - March 31, 2004*

| Annualized Total Returns | |||||||

| Past 6 months | Past 3 Years | Past 5 Years | Since Inception | ||||

| 17.80% | (8.41%) | (2.73%) | 3.91% | ||||

*These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares when redeemed, may be worth more or less than their original cost. The performance graph does not reflect the deduction of taxes that a shareholder will pay on fund distributions or the redemption of fund shares. The inception date for the Target Select Equity Fund is December 31, 1997.

4

| Statement of Net Assets | Constellation Funds |

| March 31, 2004 | (Unaudited) |

| Target Select | Market | ||||

| Equity Fund | Shares | Value | |||

| Common Stock - 104.6% | |||||

| Consumer Discretionary - 11.7% | |||||

| Borders Group | 370 | $ | 8,784 | ||

| BorgWarner | 100 | 8,483 | |||

| Guitar Center* | 300 | 11,142 | |||

| Kellwood | 230 | 9,027 | |||

| Lowe’s | 30 | 1,684 | |||

| PEP Boys | 310 | 8,603 | |||

| Petsmart | 300 | 8,178 | |||

| Standard-Pacific | 160 | 9,600 | |||

| 65,501 | |||||

| Consumer Staples - 10.1% | |||||

| Altria Group | 110 | 5,990 | |||

| Anheuser-Busch | 20 | 1,019 | |||

| NBTY* | 250 | 9,295 | |||

| Rayovac* | 420 | 12,012 | |||

| RJ Reynolds Tobacco Holdings | 180 | 10,890 | |||

| Smithfield Foods* | 280 | 7,594 | |||

| Supervalu | 330 | 10,078 | |||

| 56,878 | |||||

| Energy - 5.4% | |||||

| Cal Dive International* | 490 | 12,657 | |||

| ChevronTexaco | 30 | 2,633 | |||

| ConocoPhillips | 60 | 4,189 | |||

| Exxon Mobil | 60 | 2,495 | |||

| Unit* | 310 | 8,500 | |||

| 30,474 | |||||

| Financials - 24.3% | |||||

| Bank of America | 80 | 6,479 | |||

| Citigroup | 260 | 13,442 | |||

| Conseco* | 330 | 7,643 | |||

| Doral Financial | 280 | 9,856 | |||

| Freddie Mac | 60 | 3,544 | |||

| IndyMac Bancorp | 260 | 9,435 | |||

| JP Morgan Chase | 251 | 10,530 | |||

| Merrill Lynch | 80 | 4,765 | |||

| Odyssey Re Holdings | 300 | 8,100 | |||

| Ohio Casualty* | 460 | 9,195 | |||

| Philadelphia Consolidated Holding* | 180 | 10,440 | |||

| Market | |||||

| Shares | Value | ||||

| Financials (continued) | |||||

| Phoenix | 790 | $ | 10,594 | ||

| ProAssurance* | 240 | 8,400 | |||

| Providian Financial* | 840 | 11,004 | |||

| Sovereign Bancorp | 420 | 8,996 | |||

| Wachovia | 50 | 2,350 | |||

| Washington Mutual | 50 | 2,135 | |||

| 136,908 | |||||

| Health Care - 12.6% | |||||

| Aetna | 120 | 10,767 | |||

| Anthem* | 100 | 9,064 | |||

| Endo Pharmaceuticals Holdings* | 340 | 8,303 | |||

| Johnson & Johnson | 120 | 6,086 | |||

| Kindred Healthcare* | 220 | 11,066 | |||

| Pacificare Health Systems* | 220 | 8,701 | |||

| Pfizer | 60 | 2,103 | |||

| Select Medical | 680 | 11,356 | |||

| UnitedHealth Group | 50 | 3,222 | |||

| 70,668 | |||||

| Industrials - 11.8% | |||||

| Allied Waste Industries* | 780 | 10,382 | |||

| Brink’s | 390 | 10,756 | |||

| General Electric | 100 | 3,052 | |||

| ITT Educational Services* | 310 | 9,672 | |||

| Lockheed Martin | 160 | 7,302 | |||

| Manpower | 170 | 7,905 | |||

| Navistar International* | 120 | 5,502 | |||

| Reliance Steel & Aluminum | 200 | 7,030 | |||

| Rockwell Automation | 140 | 4,854 | |||

| 66,455 | |||||

| Information Technology - 20.2% | |||||

| Amkor Technology* | 500 | 7,315 | |||

| Anixter International* | 190 | 5,367 | |||

| Arrow Electronics* | 240 | 6,110 | |||

| Cadence Design Systems* | 340 | 5,012 | |||

| Cypress Semiconductor* | 270 | 5,527 | |||

| Earthlink* | 1,280 | 11,341 | |||

| First Data | 50 | 2,108 | |||

| Fisher Scientific International* | 170 | 9,357 | |||

5

| Statement of Net Assets | Constellation Funds |

| March 31, 2004 | (Unaudited) |

| Target Select | Market | ||||

| Equity Fund (continued) | Shares | Value | |||

| Information Technology (continued) | |||||

| Hewlett-Packard | 170 | $ | 3,883 | ||

| Intel | 260 | 7,072 | |||

| International Business Machines | 120 | 11,021 | |||

| MEMC Electronic Materials* | 770 | 7,045 | |||

| Mentor Graphics* | 370 | 6,593 | |||

| NII Holdings, Cl B* | 370 | 12,961 | |||

| Siliconix* | 130 | 6,062 | |||

| Tech Data* | 170 | 6,960 | |||

| 113,734 | |||||

| Materials - 3.4% | |||||

| Commercial Metals | 290 | 9,234 | |||

| Dow Chemical | 40 | 1,610 | |||

| Georgia-Pacific | 240 | 8,086 | |||

| 18,930 | |||||

| Utilities - 5.1% | |||||

| Allegheny Energy* | 630 | 8,637 | |||

| Avista | 580 | 10,974 | |||

| UGI | 280 | 9,218 | |||

| 28,829 | |||||

| Total Common Stock | |||||

| (Cost $566,454) | 588,377 | ||||

| Warrants - 0.0% | |||||

| Dime Bancorp* (A) | 300 | 57 | |||

| MicroStrategy, Expires 06/24/07 | 3 | 1 | |||

| Total Warrants | |||||

| (Cost $0) | 58 | ||||

| Total Investments - 104.6% | |||||

| (Cost $566,454) | 588,435 | ||||

| Other Assets and Liabilities—(4.6)% | |||||

| Investment Advisory Fees Receivable | 14,239 | ||||

| Administrator Fees Payable | (92 | ) | |||

| Other Assets and Liabilities, net | (40,245 | ) | |||

| Total Other Assets and Liabilities | (26,098 | ) | |||

| Value | |||

| Net assets: | |||

| Portfolio Capital (unlimited authorization – no par value) | |||

| based on 96,623 outstanding shares of beneficial interest | $ | 2,462,629 | |

| Undistributed net investment income | 181 | ||

| Accumulated net realized loss on Investments | (1,922,502 | ) | |

| Net realized gain on foreign currency transactions | 48 | ||

| Net unrealized appreciation on investments | 21,981 | ||

| Total Net Assets - 100% | $ | 562,337 | |

| Net Asset Value, Offering and Redemption Price Per Share | $ | 5.82 | |

(A) This warrant represents a potential distribution settlement in a legal claim and does not have a strike price or an expiration date.

* Non-income producing security

Cl — Class

The accompanying notes are an integral part of financial statements

6

| Statement of Operations | Constellation Funds |

| For the Six Month Period Ended March 31, 2004 | (Unaudited) |

| Target Select | |||

| Equity Fund | |||

| Investment Income: | |||

| Dividend | $ | 3,656 | |

| Interest | 15 | ||

| Security Lending | 503 | ||

| Total Investment Income | 4,174 | ||

| Expenses: | |||

| Investment Advisory Fees | 2,624 | ||

| Administrator Fees | 392 | ||

| Transfer Agent Fees | 26,302 | ||

| Professional Fees | 22,439 | ||

| Trustees’ Fees | 11,875 | ||

| Registration Fees | 10,332 | ||

| Custodian Fees | 8,991 | ||

| Printing Fees | 7,016 | ||

| Insurance and Other Fees | 667 | ||

| Total Expenses | 90,638 | ||

| Less: Investment Advisory Fee Waiver | (2,624 | ) | |

| Reimbursements by Adviser | (84,908 | ) | |

| Net Expenses | 3,106 | ||

| Net Investment Income | 1,068 | ||

| Net Realized Gain From Securities Sold | 67,285 | ||

| Net Change in Unrealized Appreciation of Investment Securities | 21,913 | ||

| Net Realized and Unrealized Gain on Investments | 89,198 | ||

| Net Increase in Net Assets Resulting From Operations | $ | 90,266 | |

The accompanying notes are an integral part of financial statements

7

| Statement of Changes in Net Assets | Constellation Funds |

| For the Six Month Period Ended March 31, 2004 (unaudited) and for the Year Ended September 30, 2003 | |

| Target Select | ||||||

| Equity Fund | ||||||

| 2004 | 2003 | |||||

| Investment Activities | ||||||

| Net Investment Income | $ | 1,068 | $ | 4,391 | ||

| Net Realized Gain From Securities Sold | 67,285 | 76,763 | ||||

| Net Realized Gain on Foreign Currency Transactions | - | 48 | ||||

| Net Change in Unrealized Appreciation of Investment Securities | 21,913 | 9,346 | ||||

| Net Change in Unrealized Depreciation of Foreign Currency and Translation of Other Assets and Liabilities in Foreign Currency | - | (24 | ) | |||

| Net Increase in Net Assets Resulting from Operations | 90,266 | 90,524 | ||||

| Dividends to Shareholders: | ||||||

| Net Investment Income | (5,216 | ) | - | |||

| Total Dividends | (5,216 | ) | - | |||

| Capital Share Transactions: | ||||||

| Proceeds From Shares Issued | 34,106 | 232,684 | ||||

| Proceeds From Shares Issued in Lieu of Cash Distributions | 5,091 | - | ||||

| Costs of Shares Redeemed | (104,440 | ) | (73,239 | ) | ||

| Increase (Decrease) in Net Assets From Capital Share Transactions | (65,243 | ) | 159,445 | |||

| Total Increase in Net Assets | 19,807 | 249,969 | ||||

| Net Assets: | ||||||

| Beginning of Period | 542,530 | 292,561 | ||||

| End of Period | $ | 562,337 | $ | 542,530 | ||

| Undistributed Net Investment Income | $ | 181 | $ | 4,329 | ||

| Shares Issued and Redeemed: | ||||||

| Issued | 6,182 | 51,360 | ||||

| Issued in Lieu of Cash Distributions | 927 | - | ||||

| Redeemed | (19,144 | ) | (15,282 | ) | ||

| Net Increase (Decrease) in Capital Shares | (12,035 | ) | 36,078 | |||

The accompanying notes are an integral part of financial statements

8

| Financial Highlights | Constellation Funds |

| For a Share Outstanding Throughout Each Period |

| Target Select Equity Fund |

| Net Asset Value Beginning of Period | Net Investment Income (Loss) | Realized and Unrealized Gains (Losses) on Investments | Distributions from Net Investment Income | Distributions from Capital Gains | Net Asset Value End of Period | Total Return† | Net Assets End of Period (000) | Ratio of Net Expenses to Average Net Assets†† | Ratio of Total Expenses to Average Net Assets | Ratio of Net Investment Income (Loss) to Average Net Assets†† | Portfolio Turnover Rate | |||||||||||||||||||||||||||

| 2004 | *(1) | $ | 4.99 | $ | 0.02 | $ | 0.87 | $ | (0.06 | ) | $ | - | $ | 5.82 | 17.80 | % | $ | 562 | 1.11 | % | 32.45 | % | 0.38 | % | 502.42 | % | ||||||||||||

| 2003 | 4.03 | 0.05 | 0.91 | - | - | 4.99 | 23.82 | 543 | 0.49 | (2) | 37.26 | 1.02 | 837.39 | |||||||||||||||||||||||||

| 2002 | 6.37 | (0.09 | ) | (2.25 | ) | - | - | 4.03 | (36.73 | ) | 293 | 1.10 | 26.94 | (0.80 | ) | 984.03 | ||||||||||||||||||||||

| 2001 | (3) | 21.84 | (0.02 | ) | (10.32 | ) | - | (5.13 | ) | 6.37 | (57.64 | ) | 1,759 | 1.23 | (4) | 10.29 | (0.26 | ) | 681.78 | |||||||||||||||||||

| 2000 | 17.17 | (0.06 | ) | 10.74 | - | (6.01 | ) | 21.84 | 74.45 | 4,506 | 1.30 | 6.06 | (0.55 | ) | 1,081.55 | |||||||||||||||||||||||

| 1999 | 10.34 | (0.07 | ) | 7.80 | - | (0.90 | ) | 17.17 | 80.04 | 1,839 | 1.30 | 10.19 | (0.56 | ) | 1,279.40 | |||||||||||||||||||||||

| * | For the six-month period ended March 31, 2004 (Unaudited). All ratios for the period have been annualized. |

| † | Returns are for the period indicated and have not been annualized. |

| †† | Inclusive of waivers and reimbursements. |

| (1) | On March 4, 2004 shareholders of the Fund approved a new investment advisory agreement between Alpha Select Funds, on behalf of the Fund, and Constellation Investment Management Company, LP (“CIMCO”), and a new sub-advisory agreement between CIMCO and Turner Investment Partners, Inc. |

| (2) | Effective May 20, 2003 the maximum expense cap changed from 1.22% to 1.50% |

| (3) | On October 19, 2000 shareholders of the TIP Target Select Equity Fund (the “Fund”) approved a tax-free reorganization under which all assets and liabilities of the Fund were transferred to the Alpha Select Funds Target Select Equity Fund. In connection with the reorganization, shareholders approved a change in the adviser from Turner Investment Partners, Inc. to Concentrated Capital Management, LP. |

| (4) | On November 1, 2000 the maximum expense cap changed from 1.30% to 1.22%. |

Amounts designated as “-” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of financial statements

9

| Notes of Financial Statements | Constellation Funds |

| March 31, 2004 | (Unaudited) |

| 1. Organization: |

Constellation Funds Group (formerly the Alpha Select Funds) (the “Trust”), a Delaware business trust, is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company with one portfolio, the Target Select Equity Fund (the “Fund”). The Fund is registered to offer three separate classes of shares: Class A Shares, Class C Shares and Class I Shares. The Class I Shares are the only active class of shares as of March 31, 2004. The Fund is non-diversified, and may therefore be invested in equity securities of a limited number of issuers. The Fund’s prospectus provides a description of the Fund’s investment objectives, policies, and strategies.

| 2. Significant Accounting Policies: |

The following is a summary of the significant accounting policies followed by the Fund:

Security Valuation- Investments in equity securities which are traded on a national exchange (or reported on the NASDAQ national market system) are stated at the official closing price if readily available for such equity securities on each business day; other equity securities traded in the over-the-counter market and listed equity securities for which no sale was reported on that date are stated at the last quoted bid price. Securities listed on a foreign exchange are valued based on quotations from the primary market in which they are traded. Long-term debt securities are valued by an independent pricing service and such prices are believed to reflect the fair value of such securities. Short-term obligations with maturities of sixty days or less are valued at amortized cost which approximates market value. Subject to the foregoing, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by, or under the direction of, the Fund’s Board of Trustees (the “Board”).

Security Transactions and Related Income- Security transactions are accounted for on the date the security is purchased or sold (trade date). Dividend income is recognized on the ex-dividend date, and interest income is recognized on the accrual basis. Costs used in determining realized gains and losses on the sales of investment securities are those of the specific securities sold during the respective holding period.

Foreign Currency Translation- The books and records of the Fund are maintained in U.S. dollars on the following basis: (I) market value of investment securities, other assets and liabilities at the current rate of exchange; and (II) purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective date of such transaction.

For foreign equity securities, the Fund does not isolate that portion of gains and losses on investment securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities.

10

| Notes of Financial Statements (Continued) | Constellation Funds |

| March 31, 2004 | (Unaudited) |

Repurchase Agreements- Securities pledged as collateral for repurchase agreements are held by the custodian bank until the respective agreements mature. Provisions of the repurchase agreements ensure that the market value of the collateral, including accrued interest thereon, is not less than 102%. In the event of default of the counterparty and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Fund may be delayed or limited.

Distributions to Shareholders- Distributions from net investment income are declared and paid to shareholders annually. Any net realized capital gains on sales of securities are distributed to shareholders at least annually.

| 3. Transactions with Affiliates: |

Certain officers of the Trust are also officers of Constellation Investment Management Company, LP (“CIMCO”) (the Adviser and Administrator), Turner Investment Partners, Inc. (the Sub-Adviser) and SEI Investments Global Funds Services (the Sub-Administrator) and/or SEI Investments Distribution Co. Such officers are paid no fees by the Trust for serving as officers and trustees of the Trust.

The Fund effects trades through Constellation Investment Distribution Company, Inc. (“CIDCO”) for security purchases and sales transactions. Commissions paid through those trades for the Fund for the six-month period ended March 31, 2004 were $114.

| 4. Administration, Shareholder Servicing and Distribution Agreements: |

CIMCO provides administrative services to the Fund under an Administration Agreement with the Trust. For its services, CIMCO receives an annual fee of 0.15% of the aggregate average daily net assets of the Trust up to $2 billion, and 0.12% on such assets in excess of $2 billion (subject to applicable waivers). Prior to March 4, 2004, Turner provided administrative services to the Fund. Under a separate Sub-Administration Agreement between CIMCO and the Sub-Administrator, the Sub-Administrator provides accounting and other administrative services to the Fund. For the six-month period ended March 31, 2004, the Sub-Administrator was paid $173 by CIMCO.

CIDCO, a broker dealer subsidiary of CIMCO, provides distribution services and shareholder servicing to the Fund under separate Distribution and Shareholder Servicing Agreements. Prior to March 4, 2004, Turner provided distribution services and shareholder servicing to the Fund.

DST Systems, Inc. serves as the Transfer Agent and dividend disbursing agent for the Fund under a transfer agency agreement with the Trust. The Fund reimburses CIMCO for amounts paid to third parties that provide sub-transfer agency and other administrative services to the Fund.

| 5. Investment Advisory Agreement: |

The Trust and CIMCO (the “Adviser”) are parties to an Investment Advisory Agreement dated March 4, 2004, under which the Adviser receives an annual fee base equal to 1.0625% of the average daily net assets of the Fund. Prior to March 4, 2004, Concentrated Capital Management, LP served as investment adviser to the Fund. The Fund has one Sub-Adviser, Turner. For its services, the Sub-Adviser is entitled to receive a fee payable by the Adviser.

11

| Notes of Financial Statements (Continued) | Constellation Funds |

| March 31, 2004 | (Unaudited) |

The Adviser has contractually agreed to waive all or a portion of its fees and to reimburse expenses of the Fund in order to limit its total operating expenses (as a percentage of average daily net assets on an annualized basis) to not more than 1.50% and to voluntarily keep the Fund’s “other expenses” (as a percentage of average daily net assets on an annualized basis) from exceeding 0.1575%.

The Advisory fee is comprised of a base fee and a performance adjustment that increases or decreases the total fee depending upon the performance of the Fund relative to the Fund’s performance benchmark. The Fund’s base fee is accrued daily and paid monthly, based on average net assets during the performance period. The performance period consists of the current month plus the previous 11 months.

The performance adjustment is calculated and paid monthly by comparing the Fund’s performance to that of the Fund’s performance benchmark (the Russell 3000 Index) over the 12-month period. The annual performance adjustment is multiplied by the average net assets of the Fund over the entire performance period, which is then multiplied by a fraction, the numerator of which is the number of days in the month and the denominator of which is 365 (366 in leap years). The resulting amount is then added to (in the case of overperformance) or subtracted from (in the case of underperformance) the base fee. The base advisory fee, annual adjustment rate and over/under performance relative to the benchmark threshold is as follows:

| Base Advisory Fee | Annual Adjustment Rate | Over/ Under Performance | ||

| 1.0625% | +/-0.15% | +/-3.00% |

During the six-month period ended March 31, 2004, the Fund’s Advisory Fees were adjusted in accordance with the policy described above as follows:

| Base Adviser Fee | Performance Adjustment | Gross Adviser Fee | ||

| $2,967 | $(344) | $2,624 |

| 6. Investment Transactions: |

The total cost of security purchases and the proceeds from security sales, other than short-term investments, for the six-month period ended March 31, 2004, were as follows:

| Purchases | $ | 2,826,023 |

| Sales | 2,850,506 |

| 7. Federal Income Taxes: |

The Fund is classified as a separate taxable entity for Federal income tax purposes. The Fund intends to continue to qualify as a separate “regulated investment company” under the Internal Revenue Code and make the requisite distributions to shareholders that will be sufficient to relieve it from Federal income tax and Federal excise tax. Therefore, no Federal tax provision is required.

The amounts of distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from those amounts determined under accounting principles generally accepted in the United States of America. These book/tax differences are either temporary or permanent in nature. The character of distributions made during the year from net investment income or net realized gains, and the timing of distributions where the fiscal year in which the amounts are distributed may differ from the year that the income or realized gains (losses) were recorded by the Fund. To the extent these differences are permanent,

12

| Notes of Financial Statements (Concluded) | Constellation Funds |

| March 31, 2004 | (Unaudited) |

adjustments are made to the appropriate equity accounts in the period that the differences arise. As of September 30, 2003, the components of Accumulated Losses on a tax basis for the Fund were as follows:

| Amount | |||

| Capital loss carryforwards | $ | (1,989,788 | ) |

| Undistributed ordinary income | 4,378 | ||

| Unrealized appreciation | 68 | ||

| Total accumulated losses | $ | (1,985,342 | ) |

The Fund had capital loss carryforwards at September 30, 2003 as follows:

| Year Loss Expires | Amount | ||

| 2011 | $ | 218,750 | |

| 2010 | 1,649,644 | ||

| 2009 | 121,394 | ||

For Federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains.

At March 31, 2004, the total cost of securities for Federal income tax purposes and the aggregate gross unrealized appreciation and depreciation for the securities held by the Fund were as follows:

| Federal tax cost | $ | 566,454 | |

| Aggregate gross unrealized appreciation | 23,881 | ||

| Aggregate gross unrealized depreciation | (1,900 | ) | |

| Net unrealized appreciation | $ | 21,981 | |

8. Credit Risks:

The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

9. Loans of Portfolio Securities:

The Fund may lend securities in its portfolio pursuant to a securities lending agreement (“Lending Agreement”) with the Turner Funds (an affiliate) and Goldman Sachs & Co. Unless otherwise agreed, security loans made pursuant to the Lending Agreement are required at all times to be secured by collateral equal to at least 100% of the market value of the securities loaned. Cash collateral received is invested pursuant to the terms approved by the Board. All such investments are made at the risk of the Funds and, as such, the Funds are liable for investment losses. The Fund is receiving an annual fee for its participation in the Lending Agreement which is allocated among participating funds based on estimated lending activity. In the event of bankruptcy of the borrower, realization/retention of the collateral may be subject to legal proceedings.

No securities were on loan as of March 31, 2004.

13

Proxy Voting Results

Proposal 1: The vote of the shareholders on the proposal to approve a new investment advisory agreement between the Trust, on behalf of the Fund, and Constellation Investment Management Company LP (“CIMCO”).

| FOR: | 71,054 | 73% of shares voted | 73% of shares outstanding |

| AGAINST: | 0% of shares voted | 0% of shares outstanding | |

| ABSTAIN: | 0% of shares voted | 0% of shares outstanding |

Proposal 2: The vote to approve a new investment sub-advisory agreement between CIMCO, on behalf of the Fund, and Turner Investment Partners, Inc.

| FOR: | 71,054 | 73% of shares voted | 73% of shares outstanding |

| AGAINST: | 0% of shares voted | 0% of shares outstanding | |

| ABSTAIN: | 0% of shares voted | 0% of shares outstanding |

Proposal 3: The vote to elect John Grady, Ronald Filante, Alfred Salvato and Janet Sansone to the Board of Trustees to hold office until their successor(s) are elected or until their resignation or removal.

| FOR: | 71,054 | 73% of shares voted | 73% of shares outstanding |

| AGAINST: | 0% of shares voted | 0% of shares outstanding | |

| ABSTAIN: | 0% of shares voted | 0% of shares outstanding |

14

Trustees and Officers of the Trust

Interested Trustee

| John H. Grady, Jr. | |

| Address | Constellation Investment Management Company, LP, Berywn, PA 19312 |

| Date of Birth | 6/1/61 |

| Position held | |

| with Fund | Trustee |

| Principal occupation(s) during past 5 years | |

| President and CEO of CIMCO since 2003. Executive Vice President & Secretary from 2001 to 2003 - General Counsel, Chief Legal Officer of Turner from 2001 to 2003. CID President, Chief Operating Officer since September 2001. Partner, Morgan, Lewis & Bockius LLP (law firm) (October 1995 - January 2001). | |

Non-Interested Trustees

| Ronald Filante | |

| Address | 51 Verdum Avenue, New Rochelle, NY 10804 |

| Date of Birth | 11/19/45 |

| Position held | |

| with Fund | Trustee |

| Principal occupation(s) during past 5 years | |

| Associate Professor of Finance, Pace University, since 1987. | |

| Alfred C. Salvato | |

| Address | New Rochelle, NY 10804 |

| Date of Birth | 1/9/58 |

| Position held | |

| with Fund | Trustee |

| Principal occupation(s) during past 5 years | |

| Treasurer, Thomas Jefferson University, since 1995, and Assistant Treasurer, 1988-1995. | |

| Janet F. Sansone | |

| Address | 1023 North Pitt Street, Alexandria, VA 22314-1525 |

| Date of Birth | 8/11/45 |

| Position held | |

| with Fund | Trustee since 2004 |

| Principal occupation(s) during past 5 years | |

| Executive Director, JFS Consulting. Consultant since 1999. Senior Vice President of Human Resources of Frontier Corporation (telecommunications company), (1993-1999). | |

15

Trustees and Officers of the Trust

Executive Officers

| Peter Golden | |

| Address | SEI Investments, Oaks PA, 19456 |

| Date of Birth | 6/27/64 |

| Positions held | |

| with Fund | Controller and Chief Financial Officer since 2001 |

| Principal occupation(s) during past 5 years | |

| Director of Funds Accounting of SEI Investments (investment management company) since June 2001; Previously, Vice President of Fund Administration, J.P. Morgan Chase & Co. (investment bank), March 2000 to April 2001; Vice President, Fund and Pension Accounting, Chase Manhattan Bank (investment bank), June 1997 to March 2000. | |

| Lydia A. Gavalis | |

| Address | SEI Investments, Oaks PA, 19456 |

| Date of Birth | 6/5/64 |

| Positions held | |

| with Fund | Vice President and Assistant Secretary since 1999 |

| Principal occupation(s) during past 5 years | |

| Vice President and Assistant Secretary of SEI Investments (investment management company) since 1998. | |

| William E. Zitelli, JR. | |

| Address | SEI Investments, Oaks PA, 19456 |

| Date of Birth | 6/14/68 |

| Positions held | |

| with Fund | Vice President and Assistant Secretary since 2000 |

| Principal occupation(s) during past 5 years | |

| Vice President and Assistant Secretary of SEI Investments (investment management company) since August 2000. Vice President, Merrill Lynch & Co. Asset Management Group (investment management company) (1998 - 2000). | |

| Timothy D. Barto | |

| Address | SEI Investments, Oaks PA, 19456 |

| Date of Birth | 3/28/68 |

| Positions held | |

| with Fund | Vice President and Assistant Secretary since 2000 |

| Principal occupation(s) during past 5 years | |

| Employed by SEI Investments since October 1999. Vice President and Assistant Secretary of SEI Investments (investment management company) since December 1999. Associate at Dechert Price & Rhoads (law firm) (1997-1999). | |

16

Trustees and Officers of the Trust

| Christine M. McCullough | |

| Address | SEI Investments, Oaks PA, 19456 |

| Date of Birth | 12/2/60 |

| Positions held | |

| with Fund | Vice President and Assistant Secretary since 2000 |

| Principal occupation(s) during past 5 years | |

| Employed by SEI Investments (investment management company) since November 1, 1999. Vice President and Assistant Secretary of SEI Investments since December 1999. Associate at White and Williams LLP (law firm) (1991-1999). | |

| Antoinette C. Robbins | |

| Address | Constellation Investment Management Company, LP, Berwyn, PA 19312 |

| Date of Birth | 3/23/63 |

| Position held | |

| with Fund | Vice President since 2004 |

| Principal occupation(s) during past 5 years | |

| Employed by CIMCO as Vice President and Director of Compliance since 2004. Previously, Vice President and Director of Compliance of Turner Investment Partners, Inc. (investment management company) (2002-2004). Senior Gift Planning Officer, American Civil Liberties Union (2001–2002). Assistant Vice President and Counsel, Equitable Life Assurance Society of the United States (insurance company) (1996-2002). | |

| John J. Canning | |

| Address | Constellation Investment Management Company, LP, Berwyn, PA 19312 |

| Date of Birth | 11/15/70 |

| Positions held | |

| with Fund | Vice President and Assistant Secretary since 2004 |

| Principal occupation(s) during past 5 years | |

| Employed by CIMCO as Vice President and Director of Mutual Fund Administration and Operations since 2004. Previously, Assistant Director of Mutual Fund Administration and Operations, Sub-Advisory Institutional Service Product Manager for Turner Investment Partners, Inc. (investment management company) (2000-2004). Portfolio Implementation Analyst, SEI Investments (investment management company) (1998-2000). | |

17

Trustees and Officers of the Trust

| Rami Livelsberger | |

| Address | Constellation Investment Management Company, LP, Berwyn, PA 19312 |

| Date of Birth | 11/14/74 |

| Positions held | |

| with Fund | Vice President and Assistant Secretary since 2004 |

| Principal occupation(s) during past 5 years | |

| Employed by CIMCO as Vice President, Fund Governance since 2004. Previously, Compliance Officer, Legal Assistant for Turner Investment Partners, Inc. (investment management company) (2001-2004). Legal Assistant, Morgan Lewis & Bockius LLP (law firm) (1999-2001). | |

| Saeed A. Franklin | |

| Address | Constellation Investment Management Company, LP, Berwyn, PA 19312 |

| Date of Birth | 8/1/75 |

| Position held | |

| with Fund | Vice President since 2004 |

| Principal occupation(s) during past 5 years | |

| Employed by CIMCO as Vice President, Fund Administration; previously, Performance Analyst, Turner Investment Partners, Inc. (investment management company) (2003-2004). Performance Analyst, ING Variable Annuities (an insurance company) (2001-2003). Senior Fund Accountant, Bank of New York (investment bank) (1999-2001). Fund Accountant, PFPC Inc. (investment management company) (1997-1999). | |

18

The Board of Trustees of the Trust has delegated responsibility for decisions regarding proxy voting for securities held by each Fund to Constellation Investment Management Company, LP and the underlying sub-adviser (Turner Investment Partners, Inc.). Constellation and the sub-adviser will vote such proxies in accordance with their respective proxy policies and procedures, which are included in Appendix B to the SAI. The Board of Trustees will periodically review each Fund’s proxy voting record.

Beginning in 2004, the Trust will be required to disclose annually each Fund’s complete proxy voting record on new Form N-PX. The first filing of Form N-PX will cover the period from July 1, 2003 through June 30, 2004, and is due no later than August 31, 2004. Once filed, Form N-PX for each Fund will be available via the Funds’ website, www.constellationfundsgroup.com. Each Fund’s Form N-PX will also be available on the SEC’s website at http://www.sec.gov.

Item 2. Code of Ethics.

Not applicable for semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end investment management companies.

Item 6. (Reserved)

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment management companies.

Item 8. Purchasers of Equity Securities by Closed-End Management Company and Affiliated Purchasers.

Not applicable.

Item 9. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 10. Controls and Procedures.

(a) The certifying officers, whose certifications are included herewith, have evaluated the registrant’s disclosure controls and procedures within 90 days of the filing date of this report. In their opinion, based on their evaluation, the registrant’s disclosure controls and procedures are adequately designed, and are operating effectively to ensure, that information required to be disclosed by the registrant in the reports it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

(b) There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s last fiscal half-year that has materially affected, or is reasonably likely to materially affect, the registrants internal control over financial reporting.

Items 11. Exhibits.

(a)(1) Not applicable for semi-annual report.

(a)(2) A separate certification for the principal executive officer and the principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended (17 CFR 270.30a-2(a)), are filed herewith.

(b) Officer certifications as required by Rule 30a-2(b) under the Investment Company Act of 1940, as amended (17 CFR 270.30a-2(b)) also accompany this filing as an Exhibit.

SIGNATURES

Pursuant to the requirements of the securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Constellation Target Select Fund |

| By (Signature and Title)* | /s/ John H. Grady, Jr. |

| John H. Grady, Jr., President & CEO | |

| Date 5/26/04 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ John H. Grady, Jr. |

| John H. Grady, Jr., President & CEO | |

| Date 5/26/04 | |

| By (Signature and Title)* | /s/ Peter J. Golden |

| Peter J. Golden, Controller and CFO | |

| Date 5/26/04 |

* Print the name and title of each signing officer under his or her signature.