Cincinnati, Ohio 45202-4203

Item 1: Reports to Shareholders.

(a) The Report to Shareholders is attached herewith.

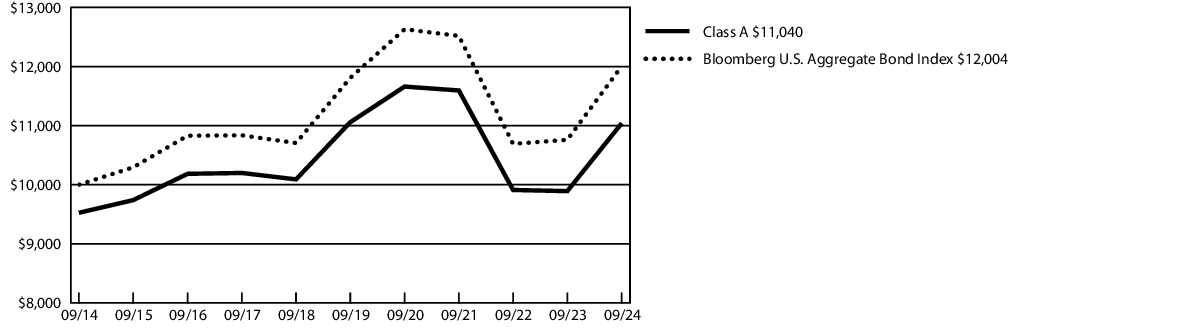

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ 88 | 0.83 % |

| Factor | Performance Impact | Observations |

| Interest Rate Management | Positive | Interest rates have been extremely volatile but have declined materially over the past 12 months. This contributed to both absolute and relative performance, through tactical interest rate management, and positioning for a steeper yield curve. |

| Sector Allocation | Positive | Over the past 12 months the Fund had overweight allocations to Investment Grade Corporate Credit and Emerging Markets debt, which both outperformed and contributed to relative performance. |

| Security Selection | Positive | Security selection within Investment Grade Corporates and securitized debt contributed to relative outperformance. |

| High Yield Credit Protection | Negative | The Fund maintained credit risk protection on high yield credit which underperformed as spreads tightened over the year. |

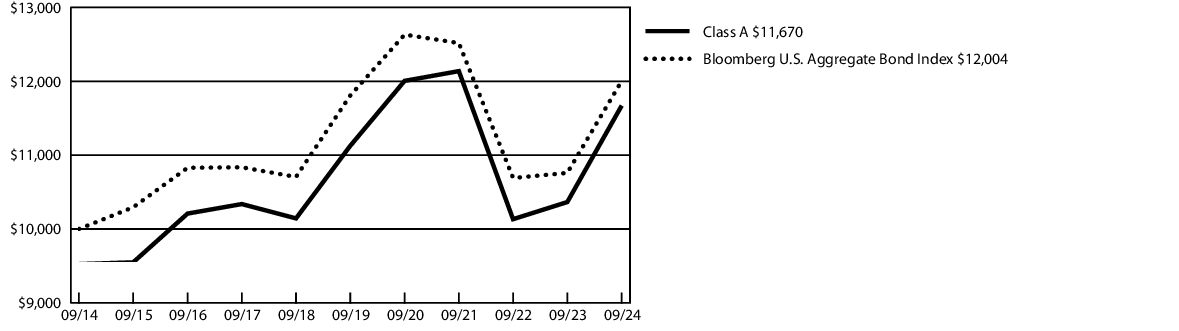

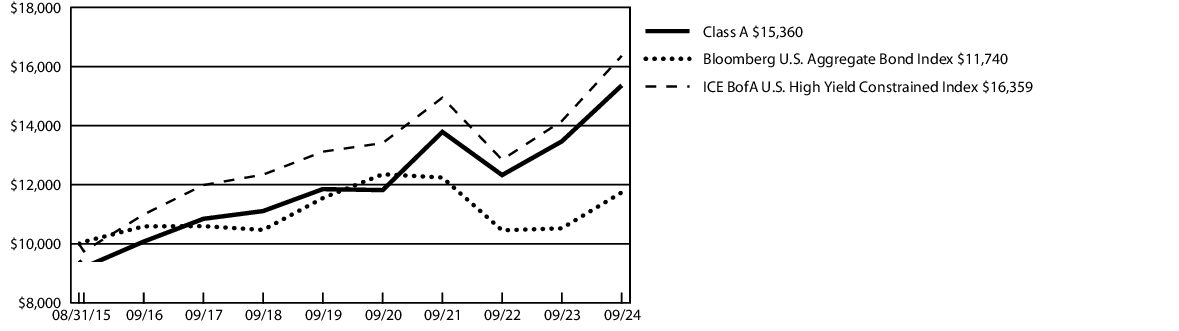

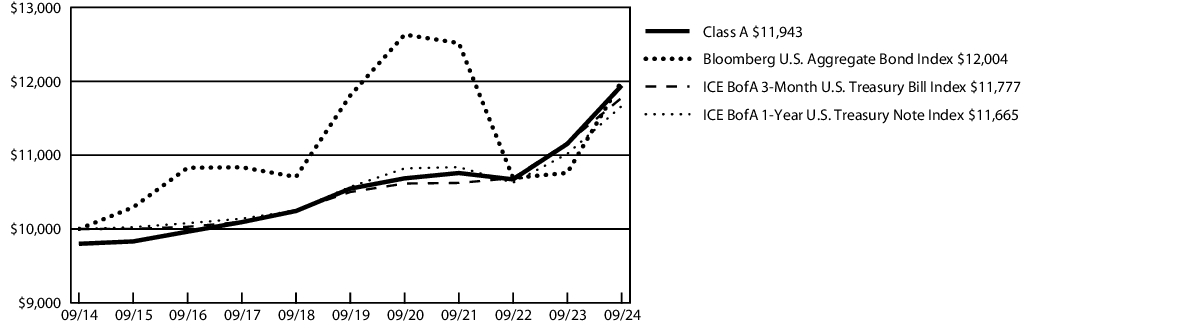

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 8.92 % | 0.55 % | 1.56 % |

| Class A - excluding sales load | 12.60 % | 0.96 % | 2.05 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 263,555,634 |

| Total number of portfolio holdings | 319 |

| Total advisory fees paid | $ 914,151 |

| Portfolio turnover rate | 172 % |

| Corporate Bonds | 39.1 % |

| U.S. Treasury Obligations | 21.2 % |

| Non-Agency Collateralized Mortgage Obligations | 8.6 % |

| U.S. Government Mortgage-Backed Obligations | 7.4 % |

| Agency Collateralized Mortgage Obligations | 6.6 % |

| Commercial Mortgage-Backed Securities | 6.5 % |

| Asset-Backed Securities | 5.3 % |

| Sovereign Government Obligations | 1.1 % |

| Short-Term Investment Fund | 3.6 % |

| Other Assets/Liabilities (Net) | 0.6 % |

| Total | 100.0 % |

| AAA/Aaa | 43.7 % |

| AA/Aa | 7.3 % |

| A/A | 14.1 % |

| BBB/Baa | 26.7 % |

| BB/Ba | 0.6 % |

| B/B | 0.5 % |

| CC | 0.1 % |

| Not Rated | 7.0 % |

| Total | 100.0 % |

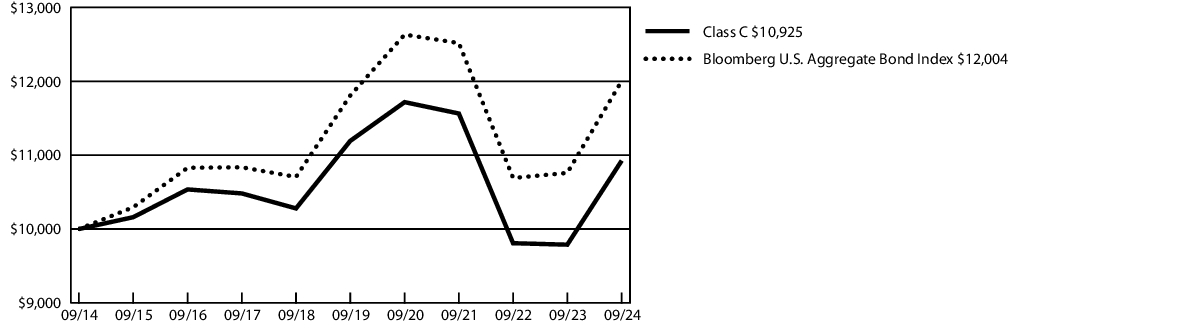

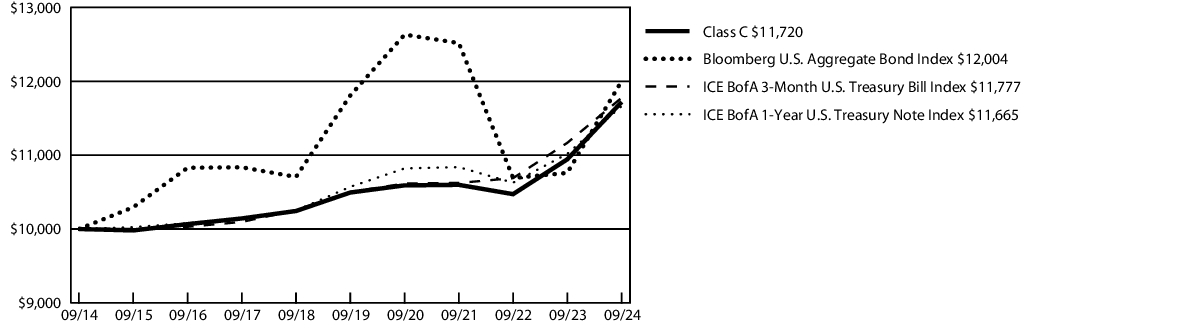

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 165 | 1.56 % |

| Factor | Performance Impact | Observations |

| Interest Rate Management | Positive | Interest rates have been extremely volatile but have declined materially over the past 12 months. This contributed to both absolute and relative performance, through tactical interest rate management, and positioning for a steeper yield curve. |

| Sector Allocation | Positive | Over the past 12 months the Fund had overweight allocations to Investment Grade Corporate Credit and Emerging Markets debt, which both outperformed and contributed to relative performance. |

| Security Selection | Positive | Security selection within Investment Grade Corporates and securitized debt contributed to relative outperformance. |

| High Yield Credit Protection | Negative | The Fund maintained credit risk protection on high yield credit which underperformed as spreads tightened over the year. |

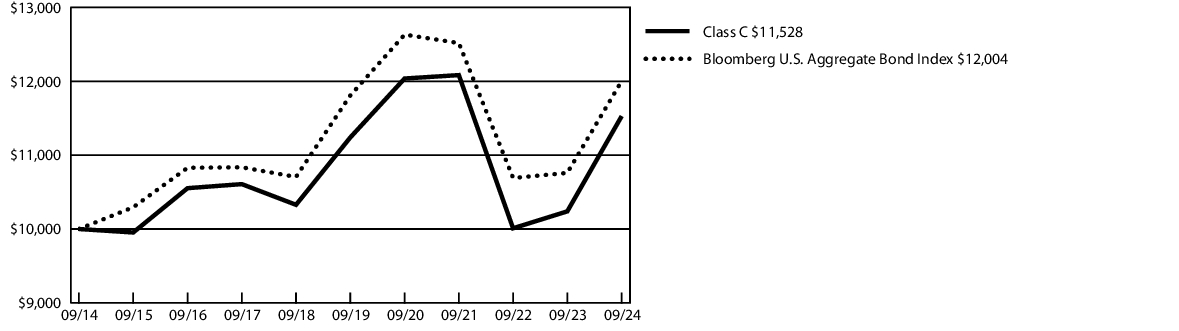

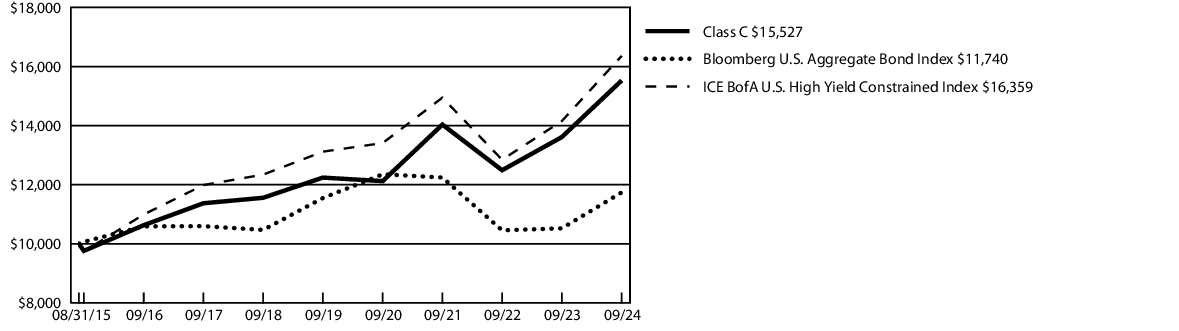

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 10.69 % | 0.22 % | 1.43 % |

| Class C - excluding sales load | 11.69 % | 0.22 % | 1.43 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 263,555,634 |

| Total number of portfolio holdings | 319 |

| Total advisory fees paid | $ 914,151 |

| Portfolio turnover rate | 172 % |

| Corporate Bonds | 39.1 % |

| U.S. Treasury Obligations | 21.2 % |

| Non-Agency Collateralized Mortgage Obligations | 8.6 % |

| U.S. Government Mortgage-Backed Obligations | 7.4 % |

| Agency Collateralized Mortgage Obligations | 6.6 % |

| Commercial Mortgage-Backed Securities | 6.5 % |

| Asset-Backed Securities | 5.3 % |

| Sovereign Government Obligations | 1.1 % |

| Short-Term Investment Fund | 3.6 % |

| Other Assets/Liabilities (Net) | 0.6 % |

| Total | 100.0 % |

| AAA/Aaa | 43.7 % |

| AA/Aa | 7.3 % |

| A/A | 14.1 % |

| BBB/Baa | 26.7 % |

| BB/Ba | 0.6 % |

| B/B | 0.5 % |

| CC | 0.1 % |

| Not Rated | 7.0 % |

| Total | 100.0 % |

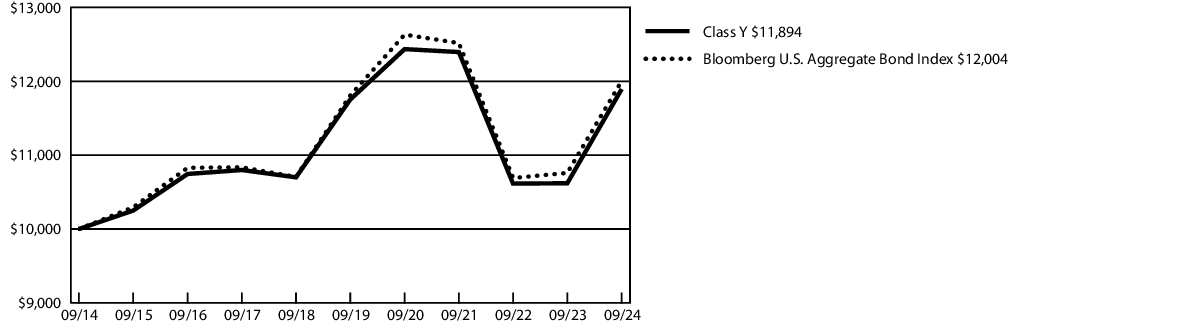

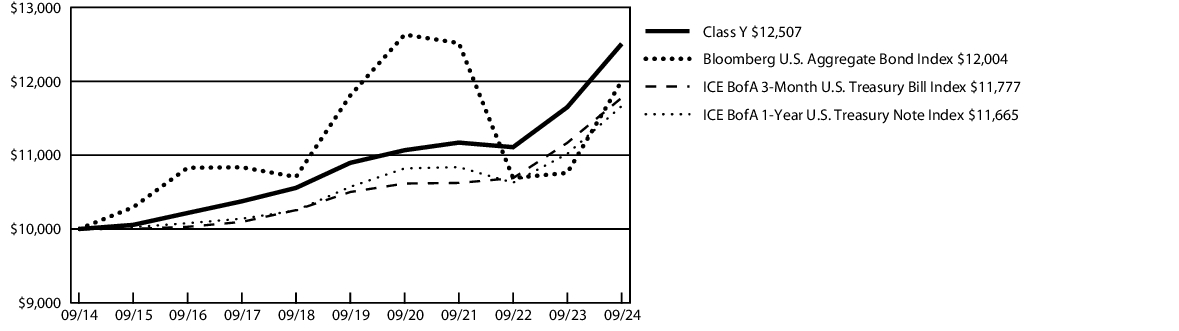

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 62 | 0.58 % |

| Factor | Performance Impact | Observations |

| Interest Rate Management | Positive | Interest rates have been extremely volatile but have declined materially over the past 12 months. This contributed to both absolute and relative performance, through tactical interest rate management, and positioning for a steeper yield curve. |

| Sector Allocation | Positive | Over the past 12 months the Fund had overweight allocations to Investment Grade Corporate Credit and Emerging Markets debt, which both outperformed and contributed to relative performance. |

| Security Selection | Positive | Security selection within Investment Grade Corporates and securitized debt contributed to relative outperformance. |

| High Yield Credit Protection | Negative | The Fund maintained credit risk protection on high yield credit which underperformed as spreads tightened over the year. |

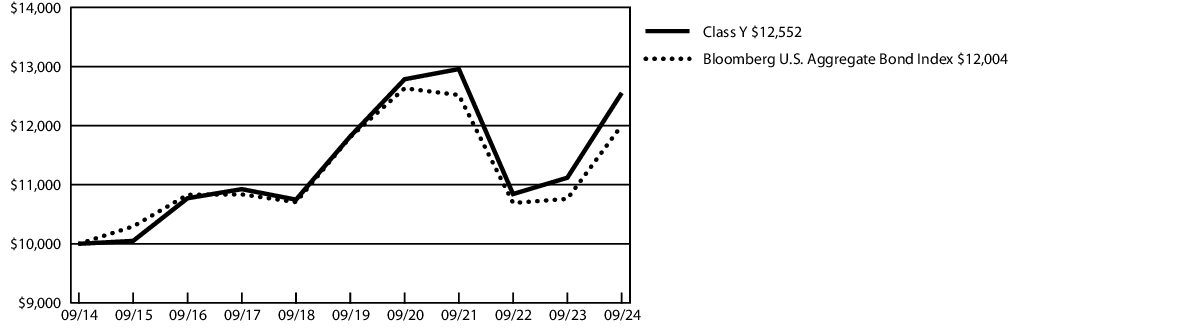

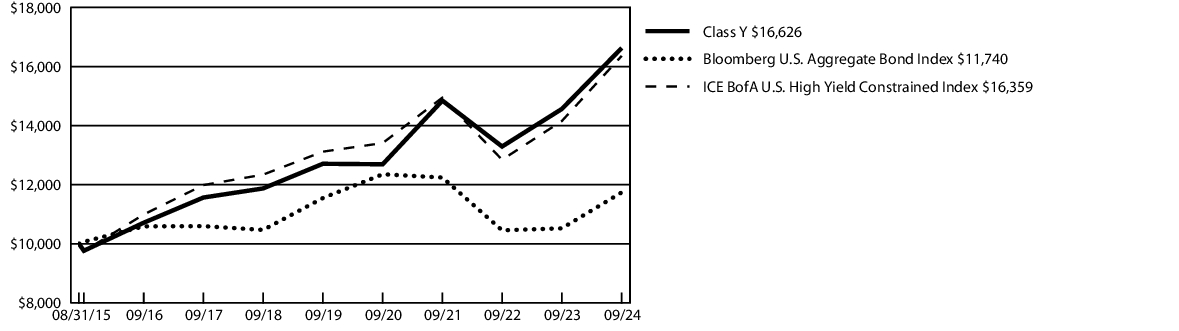

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 12.89 % | 1.21 % | 2.30 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 263,555,634 |

| Total number of portfolio holdings | 319 |

| Total advisory fees paid | $ 914,151 |

| Portfolio turnover rate | 172 % |

| Corporate Bonds | 39.1 % |

| U.S. Treasury Obligations | 21.2 % |

| Non-Agency Collateralized Mortgage Obligations | 8.6 % |

| U.S. Government Mortgage-Backed Obligations | 7.4 % |

| Agency Collateralized Mortgage Obligations | 6.6 % |

| Commercial Mortgage-Backed Securities | 6.5 % |

| Asset-Backed Securities | 5.3 % |

| Sovereign Government Obligations | 1.1 % |

| Short-Term Investment Fund | 3.6 % |

| Other Assets/Liabilities (Net) | 0.6 % |

| Total | 100.0 % |

| AAA/Aaa | 43.7 % |

| AA/Aa | 7.3 % |

| A/A | 14.1 % |

| BBB/Baa | 26.7 % |

| BB/Ba | 0.6 % |

| B/B | 0.5 % |

| CC | 0.1 % |

| Not Rated | 7.0 % |

| Total | 100.0 % |

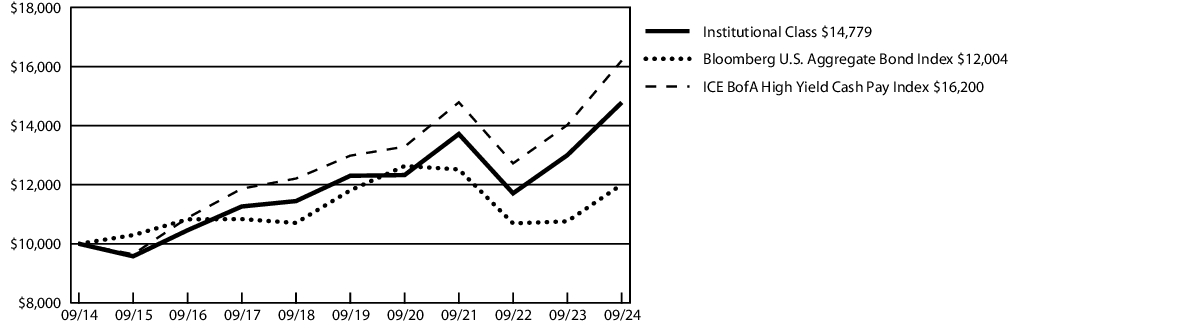

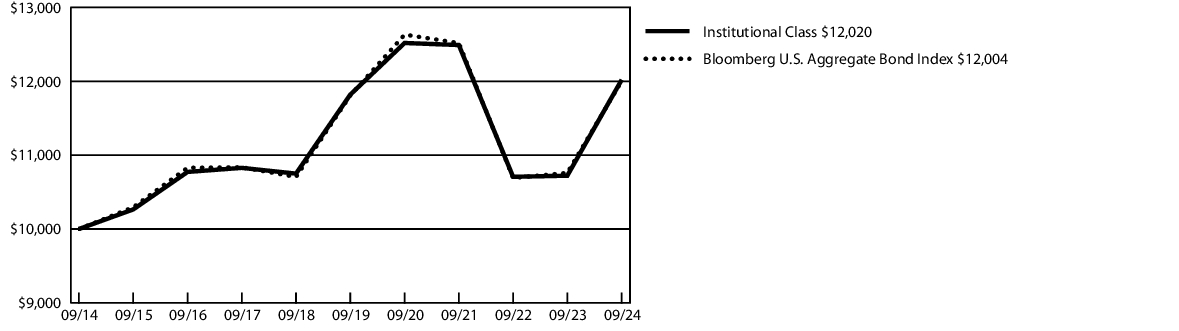

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 53 | 0.50 % |

| Factor | Performance Impact | Observations |

| Interest Rate Management | Positive | Interest rates have been extremely volatile but have declined materially over the past 12 months. This contributed to both absolute and relative performance, through tactical interest rate management, and positioning for a steeper yield curve. |

| Sector Allocation | Positive | Over the past 12 months the Fund had overweight allocations to Investment Grade Corporate Credit and Emerging Markets debt, which both outperformed and contributed to relative performance. |

| Security Selection | Positive | Security selection within Investment Grade Corporates and securitized debt contributed to relative outperformance. |

| High Yield Credit Protection | Negative | The Fund maintained credit risk protection on high yield credit which underperformed as spreads tightened over the year. |

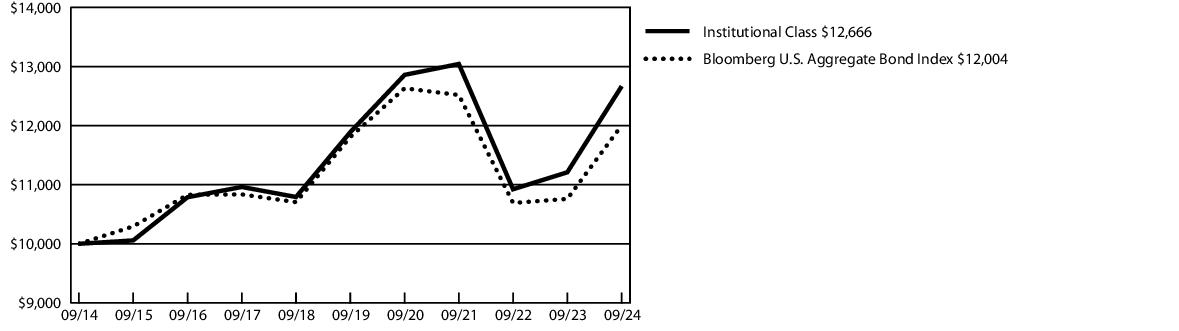

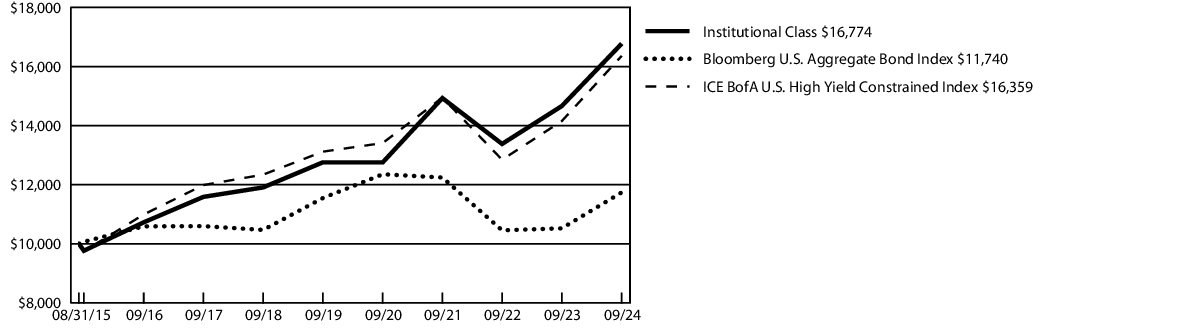

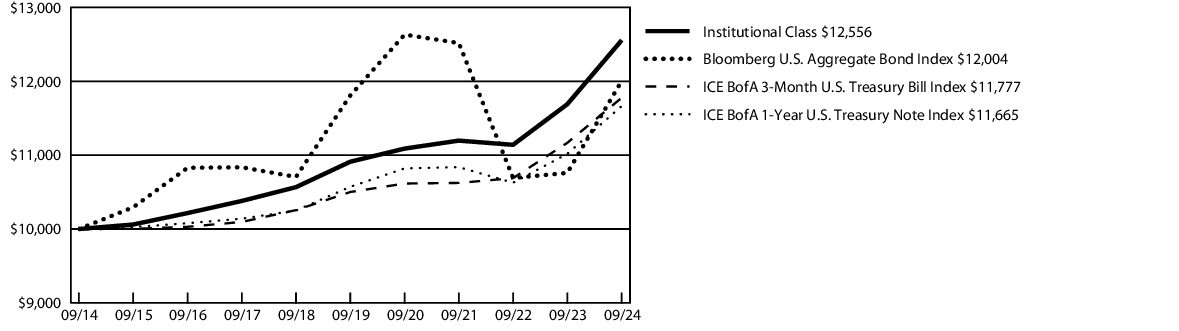

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Institutional Class | 12.98 % | 1.27 % | 2.39 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 263,555,634 |

| Total number of portfolio holdings | 319 |

| Total advisory fees paid | $ 914,151 |

| Portfolio turnover rate | 172 % |

| Corporate Bonds | 39.1 % |

| U.S. Treasury Obligations | 21.2 % |

| Non-Agency Collateralized Mortgage Obligations | 8.6 % |

| U.S. Government Mortgage-Backed Obligations | 7.4 % |

| Agency Collateralized Mortgage Obligations | 6.6 % |

| Commercial Mortgage-Backed Securities | 6.5 % |

| Asset-Backed Securities | 5.3 % |

| Sovereign Government Obligations | 1.1 % |

| Short-Term Investment Fund | 3.6 % |

| Other Assets/Liabilities (Net) | 0.6 % |

| Total | 100.0 % |

| AAA/Aaa | 43.7 % |

| AA/Aa | 7.3 % |

| A/A | 14.1 % |

| BBB/Baa | 26.7 % |

| BB/Ba | 0.6 % |

| B/B | 0.5 % |

| CC | 0.1 % |

| Not Rated | 7.0 % |

| Total | 100.0 % |

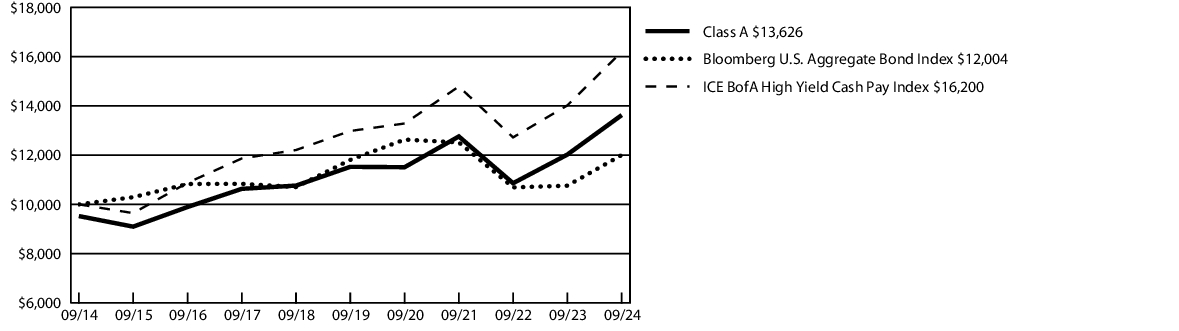

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ 111 | 1.04 % |

| Factor | Performance Impact | Observations |

| Sector Allocation | Positive | Allocations to off-benchmark sectors such as Collateralized Loan Obligation securities and post-reorganization equities were a source of high current income and price appreciation. |

| Trading | Positive | Benefitted from discounted secondary market prices. |

| Bank Loans | Negative | The allocation to bank loans was a headwind to relative performance as the asset class underperformed high yield bonds. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since Inception 1 |

| Class A | 10.41 % | 4.24 % | 4.84 % |

| Class A - excluding sales load | 14.07 % | 5.32 % | 5.52 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.78 % |

| ICE BofA U.S. High Yield Constrained Index | 15.67 % | 4.53 % | 5.58 % |

1 | The inception date of the Fund was August 31, 2015. The returns of the indexes listed above are based on the inception date of the Fund. |

| Fund net assets | $ 623,356,953 |

| Total number of portfolio holdings | 374 |

| Total advisory fees paid | $ 2,769,725 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 79.4 % |

| Bank Loans | 11.9 % |

| Asset-Backed Securities | 3.9 % |

| Common Stocks | 0.6 % |

| Warrants | 0.1 % |

| Trade Claim | 0.0 % |

| Purchased Options | 0.0 % |

| Short-Term Investment Funds | 6.0 % |

| Other Assets/Liabilities (Net) | (1.9 ) % |

| Total | 100.0 % |

| BBB/Baa | 9.7 % |

| BB/Ba | 40.5 % |

| B/B | 36.4 % |

| CCC | 9.0 % |

| CC | 0.1 % |

| Not Rated | 4.3 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 154 | 1.44 % |

| Factor | Performance Impact | Observations |

| Sector Allocation | Positive | Allocations to off-benchmark sectors such as Collateralized Loan Obligation securities and post-reorganization equities were a source of high current income and price appreciation. |

| Trading | Positive | Benefitted from discounted secondary market prices. |

| Bank Loans | Negative | The allocation to bank loans was a headwind to relative performance as the asset class underperformed high yield bonds. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since Inception 1 |

| Class C | 12.57 % | 4.77 % | 4.96 % |

| Class C - excluding sales load | 13.57 % | 4.77 % | 4.96 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.78 % |

| ICE BofA U.S. High Yield Constrained Index | 15.67 % | 4.53 % | 5.58 % |

1 | The inception date of the Fund was August 31, 2015. The returns of the indexes listed above are based on the inception date of the Fund. |

| Fund net assets | $ 623,356,953 |

| Total number of portfolio holdings | 374 |

| Total advisory fees paid | $ 2,769,725 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 79.4 % |

| Bank Loans | 11.9 % |

| Asset-Backed Securities | 3.9 % |

| Common Stocks | 0.6 % |

| Warrants | 0.1 % |

| Trade Claim | 0.0 % |

| Purchased Options | 0.0 % |

| Short-Term Investment Funds | 6.0 % |

| Other Assets/Liabilities (Net) | (1.9 ) % |

| Total | 100.0 % |

| BBB/Baa | 9.7 % |

| BB/Ba | 40.5 % |

| B/B | 36.4 % |

| CCC | 9.0 % |

| CC | 0.1 % |

| Not Rated | 4.3 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 90 | 0.84 % |

| Factor | Performance Impact | Observations |

| Sector Allocation | Positive | Allocations to off-benchmark sectors such as Collateralized Loan Obligation securities and post-reorganization equities were a source of high current income and price appreciation. |

| Trading | Positive | Benefitted from discounted secondary market prices. |

| Bank Loans | Negative | The allocation to bank loans was a headwind to relative performance as the asset class underperformed high yield bonds. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since Inception 1 |

| Class Y | 14.16 % | 5.52 % | 5.76 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.78 % |

| ICE BofA U.S. High Yield Constrained Index | 15.67 % | 4.53 % | 5.58 % |

1 | The inception date of the Fund was August 31, 2015. The returns of the indexes listed above are based on the inception date of the Fund. |

| Fund net assets | $ 623,356,953 |

| Total number of portfolio holdings | 374 |

| Total advisory fees paid | $ 2,769,725 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 79.4 % |

| Bank Loans | 11.9 % |

| Asset-Backed Securities | 3.9 % |

| Common Stocks | 0.6 % |

| Warrants | 0.1 % |

| Trade Claim | 0.0 % |

| Purchased Options | 0.0 % |

| Short-Term Investment Funds | 6.0 % |

| Other Assets/Liabilities (Net) | (1.9 ) % |

| Total | 100.0 % |

| BBB/Baa | 9.7 % |

| BB/Ba | 40.5 % |

| B/B | 36.4 % |

| CCC | 9.0 % |

| CC | 0.1 % |

| Not Rated | 4.3 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentageof a $10,000 investment |

| Institutional Class | $ 79 | 0.74 % |

| Factor | Performance Impact | Observations |

| Sector Allocation | Positive | Allocations to off-benchmark sectors such as Collateralized Loan Obligation securities and post-reorganization equities were a source of high current income and price appreciation. |

| Trading | Positive | Benefitted from discounted secondary market prices. |

| Bank Loans | Negative | The allocation to bank loans was a headwind to relative performance as the asset class underperformed high yield bonds. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since Inception 1 |

| Institutional Class | 14.40 % | 5.63 % | 5.86 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.78 % |

| ICE BofA U.S. High Yield Constrained Index | 15.67 % | 4.53 % | 5.58 % |

1 | The inception date of the Fund was August 31, 2015. The returns of the indexes listed above are based on the inception date of the Fund. |

| Fund net assets | $ 623,356,953 |

| Total number of portfolio holdings | 374 |

| Total advisory fees paid | $ 2,769,725 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 79.4 % |

| Bank Loans | 11.9 % |

| Asset-Backed Securities | 3.9 % |

| Common Stocks | 0.6 % |

| Warrants | 0.1 % |

| Trade Claim | 0.0 % |

| Purchased Options | 0.0 % |

| Short-Term Investment Funds | 6.0 % |

| Other Assets/Liabilities (Net) | (1.9 ) % |

| Total | 100.0 % |

| BBB/Baa | 9.7 % |

| BB/Ba | 40.5 % |

| B/B | 36.4 % |

| CCC | 9.0 % |

| CC | 0.1 % |

| Not Rated | 4.3 % |

| Total | 100.0 % |

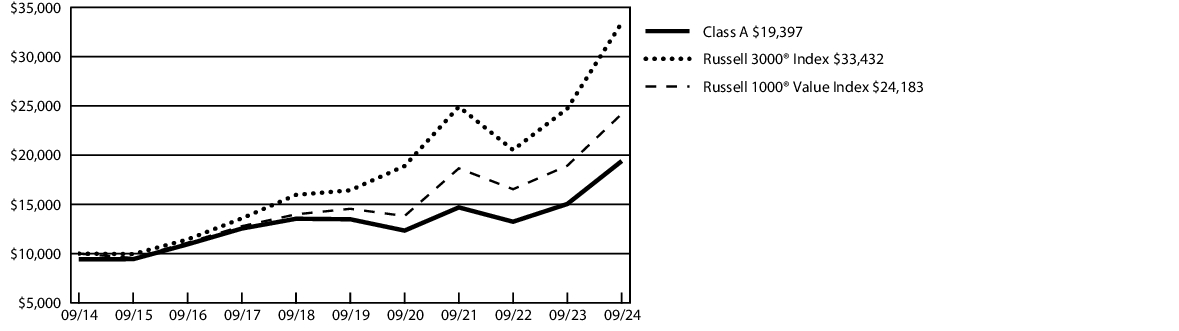

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

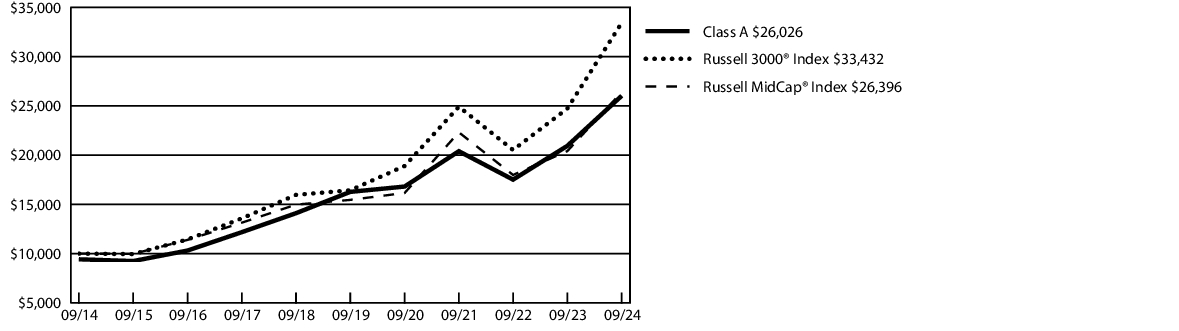

| Class A | $ 113 | 0.99 % |

| Factor | Performance Impact | Observations |

| Security Selection | Positive | Stock selection, primarily within Information Technology, was the main driver of relative outperformance. |

| Sector Allocation | Negative | Underweight exposure to Financials and Industrials detracted from relative performance as the sectors outperformed. |

| Dividend Style | Negative | High dividend paying stocks underperformed low dividend yielding stocks. |

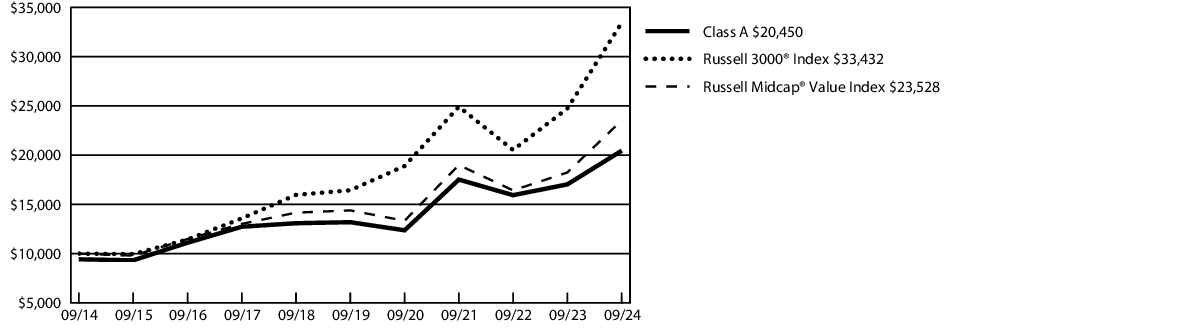

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 22.55 % | 6.27 % | 6.85 % |

| Class A - excluding sales load | 28.97 % | 7.53 % | 7.49 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell 1000 ® Value Index | 27.76 % | 10.69 % | 9.23 % |

| Fund net assets | $ 2,526,043,646 |

| Total number of portfolio holdings | 87 |

| Total advisory fees paid | $ 12,787,406 |

| Portfolio turnover rate | 10 % |

| Information Technology | 21.3 % |

| Financials | 14.8 % |

| Health Care | 13.9 % |

| Industrials | 10.3 % |

| Consumer Discretionary | 8.5 % |

| Communication Services | 8.0 % |

| Consumer Staples | 6.8 % |

| Energy | 4.5 % |

| Utilities | 4.3 % |

| Materials | 3.5 % |

| Real Estate | 3.3 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | (0.1 ) % |

| Total | 100.0 % |

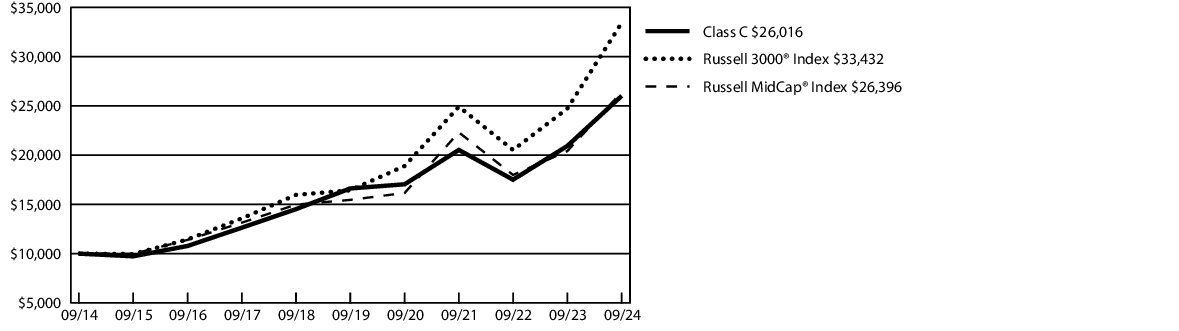

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

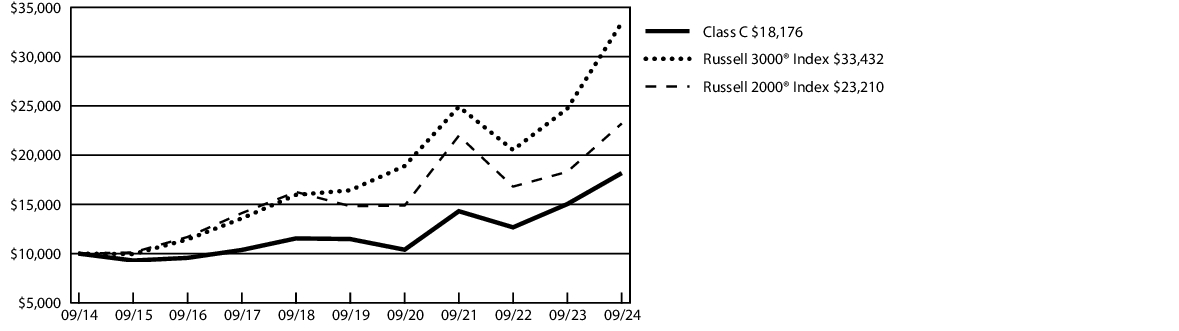

| Class C | $ 193 | 1.69 % |

| Factor | Performance Impact | Observations |

| Security Selection | Positive | Stock selection, primarily within Information Technology, was the main driver of relative outperformance. |

| Sector Allocation | Negative | Underweight exposure to Financials and Industrials detracted from relative performance as the sectors outperformed. |

| Dividend Style | Negative | High dividend paying stocks underperformed low dividend yielding stocks. |

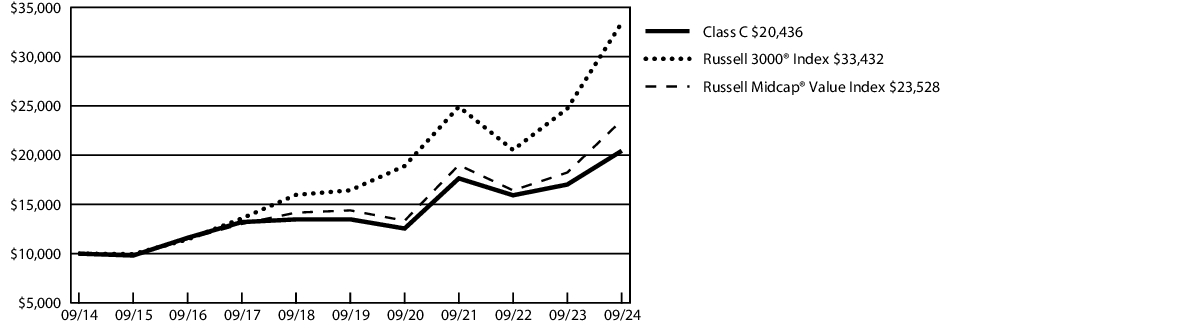

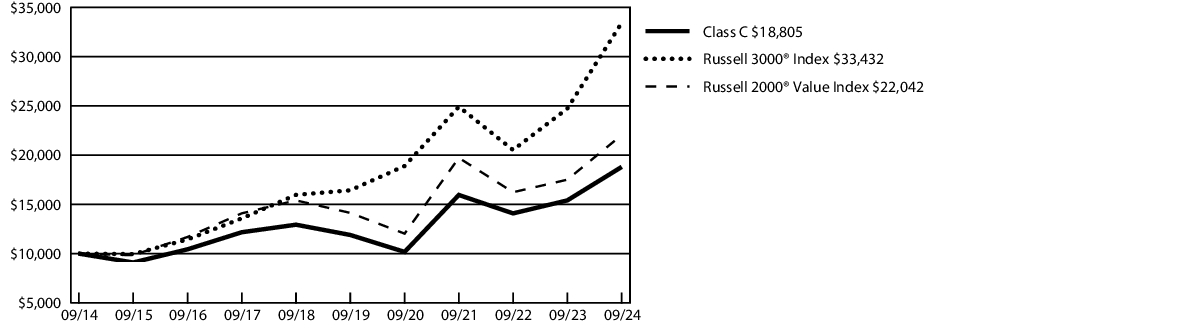

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 27.08 % | 6.80 % | 6.77 % |

| Class C - excluding sales load | 28.08 % | 6.80 % | 6.77 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell 1000 ® Value Index | 27.76 % | 10.69 % | 9.23 % |

| Fund net assets | $ 2,526,043,646 |

| Total number of portfolio holdings | 87 |

| Total advisory fees paid | $ 12,787,406 |

| Portfolio turnover rate | 10 % |

| Information Technology | 21.3 % |

| Financials | 14.8 % |

| Health Care | 13.9 % |

| Industrials | 10.3 % |

| Consumer Discretionary | 8.5 % |

| Communication Services | 8.0 % |

| Consumer Staples | 6.8 % |

| Energy | 4.5 % |

| Utilities | 4.3 % |

| Materials | 3.5 % |

| Real Estate | 3.3 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | (0.1 ) % |

| Total | 100.0 % |

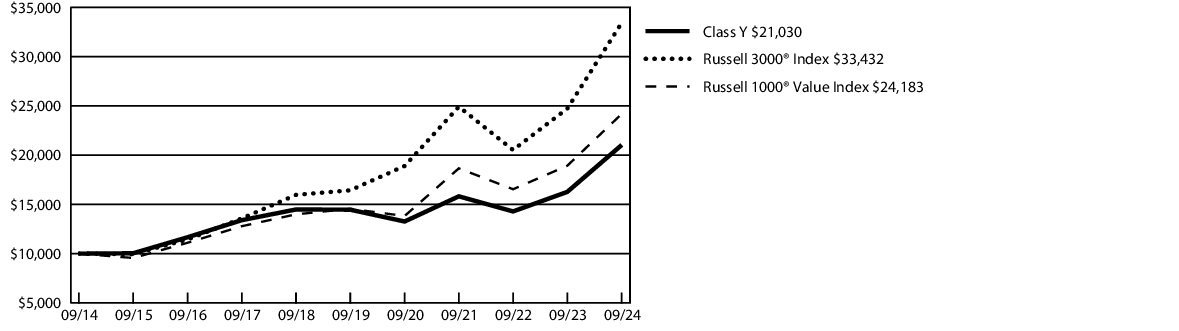

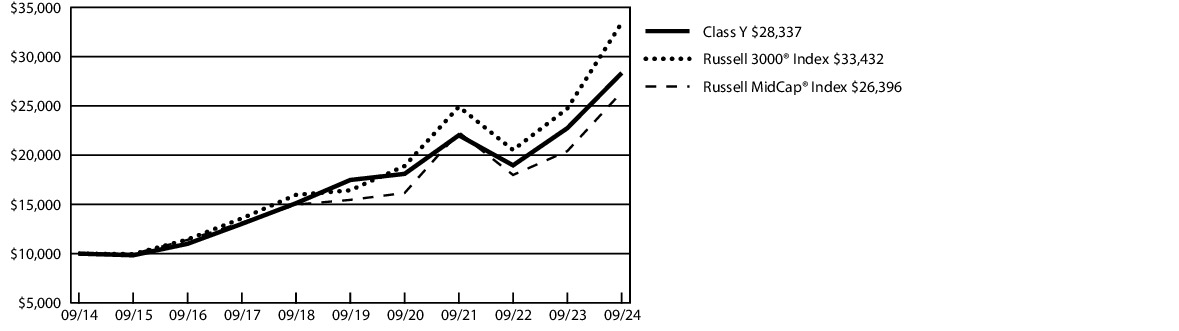

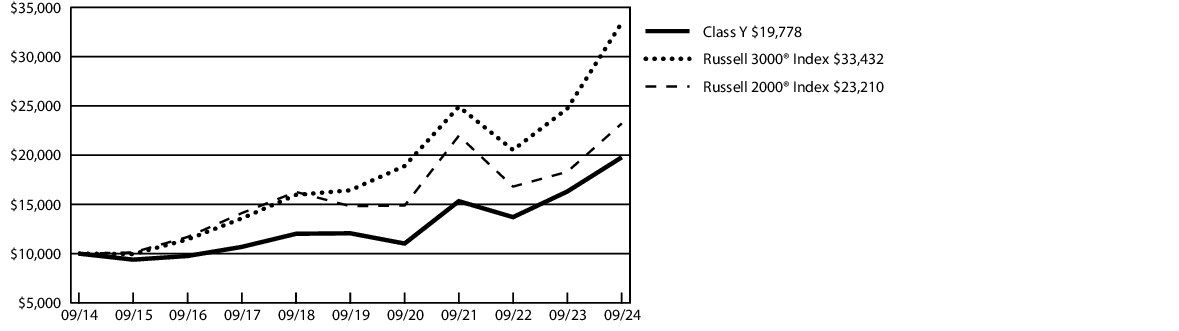

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 87 | 0.76 % |

| Factor | Performance Impact | Observations |

| Security Selection | Positive | Stock selection, primarily within Information Technology, was the main driver of relative outperformance. |

| Sector Allocation | Negative | Underweight exposure to Financials and Industrials detracted from relative performance as the sectors outperformed. |

| Dividend Style | Negative | High dividend paying stocks underperformed low dividend yielding stocks. |

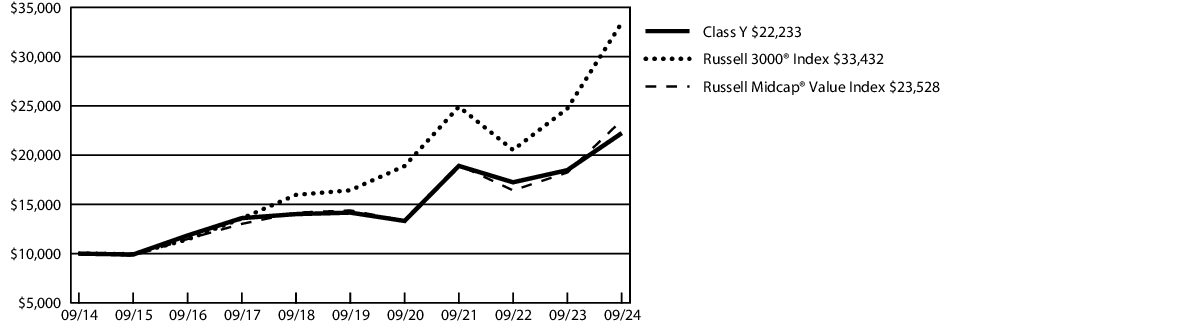

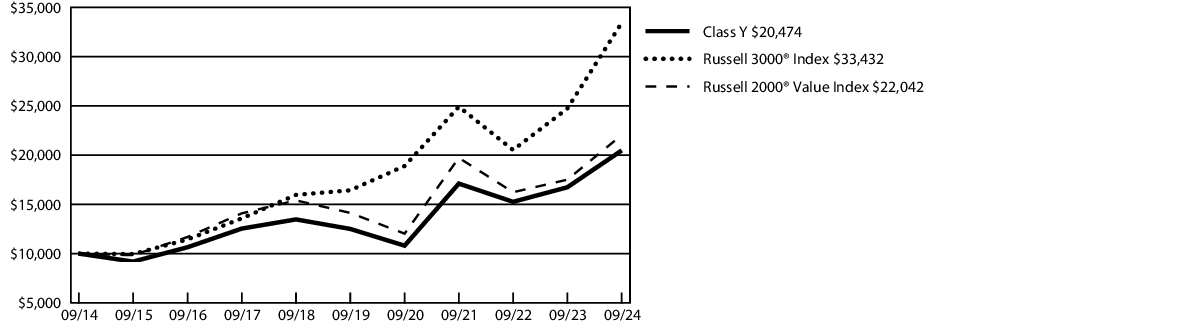

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 29.25 % | 7.77 % | 7.72 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell 1000 ® Value Index | 27.76 % | 10.69 % | 9.23 % |

| Fund net assets | $ 2,526,043,646 |

| Total number of portfolio holdings | 87 |

| Total advisory fees paid | $ 12,787,406 |

| Portfolio turnover rate | 10 % |

| Information Technology | 21.3 % |

| Financials | 14.8 % |

| Health Care | 13.9 % |

| Industrials | 10.3 % |

| Consumer Discretionary | 8.5 % |

| Communication Services | 8.0 % |

| Consumer Staples | 6.8 % |

| Energy | 4.5 % |

| Utilities | 4.3 % |

| Materials | 3.5 % |

| Real Estate | 3.3 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | (0.1 ) % |

| Total | 100.0 % |

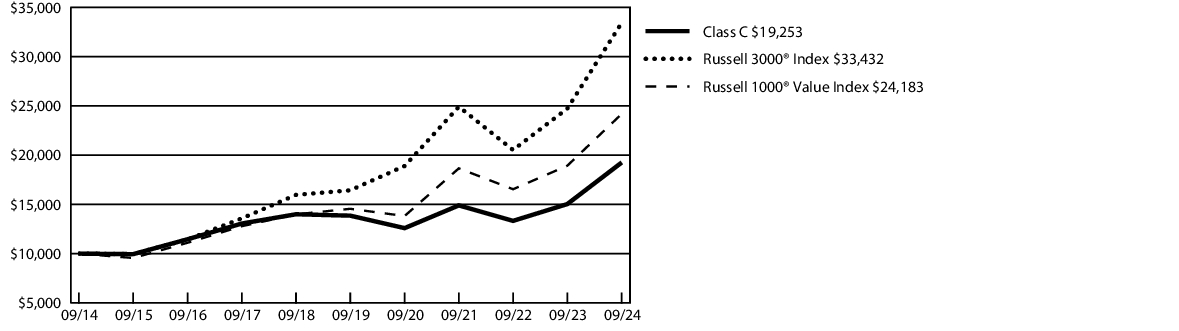

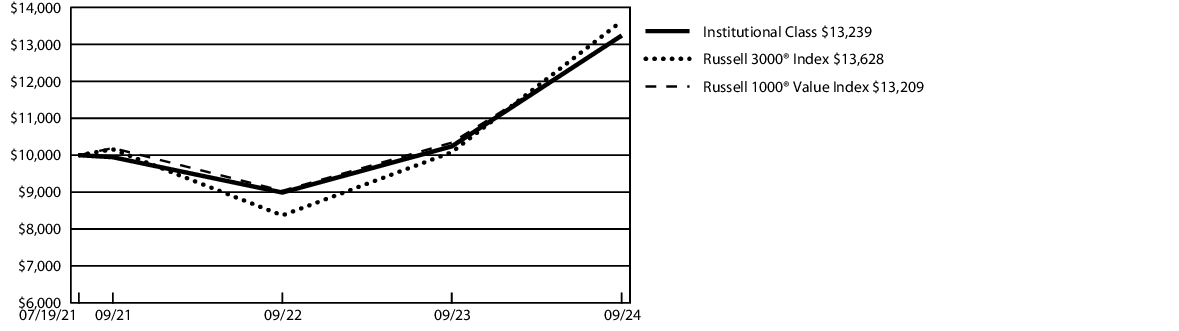

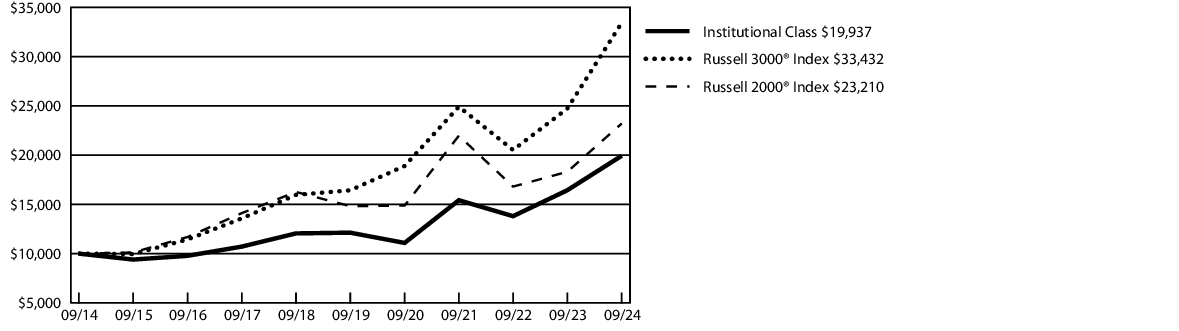

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 77 | 0.67 % |

| Factor | Performance Impact | Observations |

| Security Selection | Positive | Stock selection, primarily within Information Technology, was the main driver of relative outperformance. |

| Sector Allocation | Negative | Underweight exposure to Financials and Industrials detracted from relative performance as the sectors outperformed. |

| Dividend Style | Negative | High dividend paying stocks underperformed low dividend yielding stocks. |

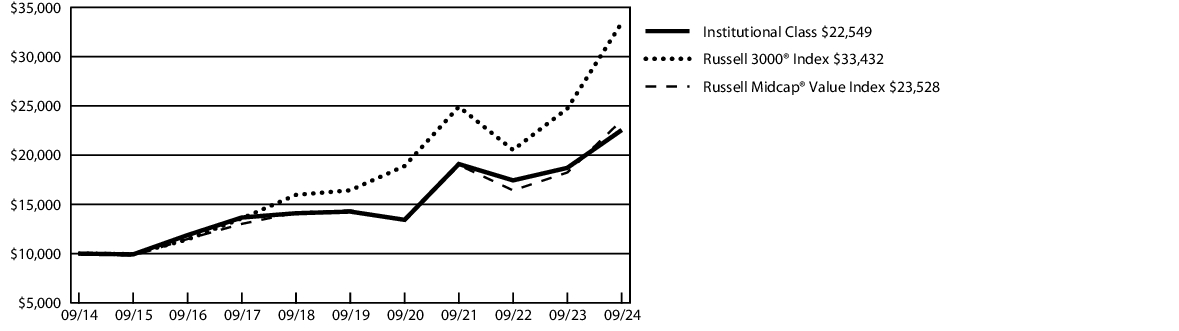

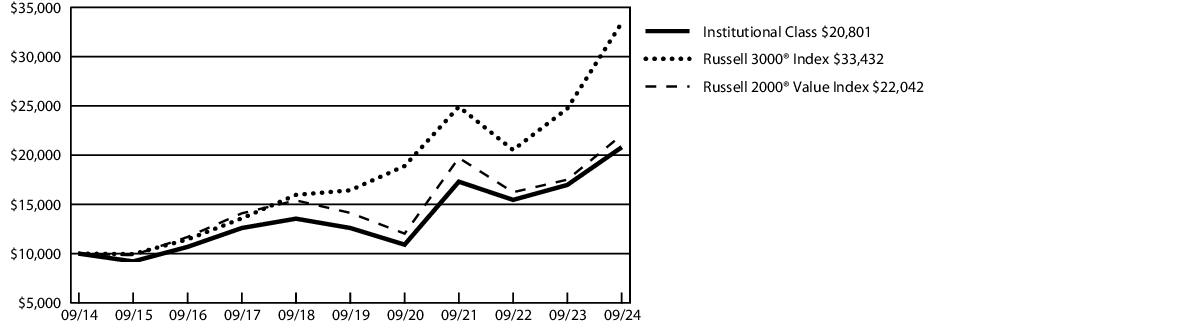

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | Since Inception 1 |

| Institutional Class | 29.31 % | 9.17 % |

| Russell 3000 ® Index | 35.19 % | 10.15 % |

| Russell 1000 ® Value Index | 27.76 % | 9.09 % |

1 | The inception date was July 19, 2021. The returns of the indexes listed above are based on the inception date of the Class. |

| Fund net assets | $ 2,526,043,646 |

| Total number of portfolio holdings | 87 |

| Total advisory fees paid | $ 12,787,406 |

| Portfolio turnover rate | 10 % |

| Information Technology | 21.3 % |

| Financials | 14.8 % |

| Health Care | 13.9 % |

| Industrials | 10.3 % |

| Consumer Discretionary | 8.5 % |

| Communication Services | 8.0 % |

| Consumer Staples | 6.8 % |

| Energy | 4.5 % |

| Utilities | 4.3 % |

| Materials | 3.5 % |

| Real Estate | 3.3 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | (0.1 ) % |

| Total | 100.0 % |

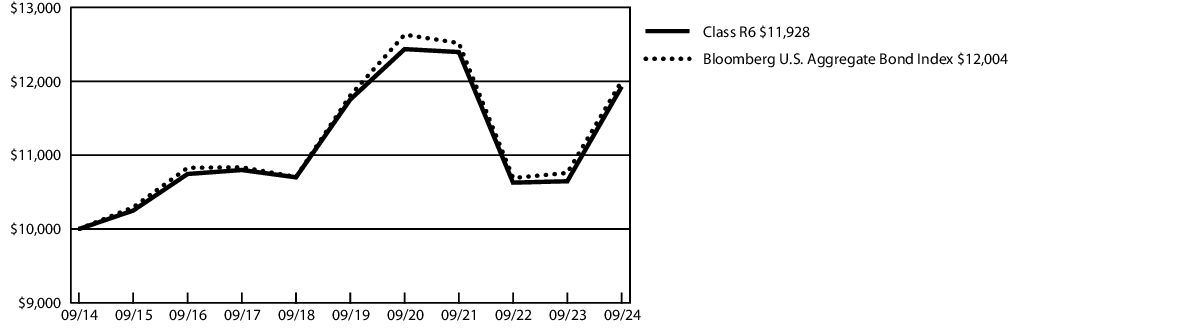

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

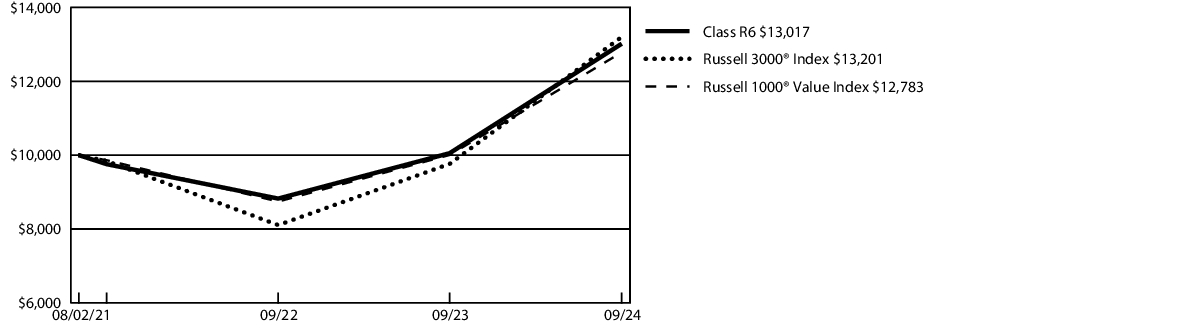

| Class R6 | $ 75 | 0.65 % |

| Factor | Performance Impact | Observations |

| Security Selection | Positive | Stock selection, primarily within Information Technology, was the main driver of relative outperformance. |

| Sector Allocation | Negative | Underweight exposure to Financials and Industrials detracted from relative performance as the sectors outperformed. |

| Dividend Style | Negative | High dividend paying stocks underperformed low dividend yielding stocks. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | Since Inception 1 |

| Class R6 | 29.47 % | 8.70 % |

| Russell 3000 ® Index | 35.19 % | 9.18 % |

| Russell 1000 ® Value Index | 27.76 % | 8.08 % |

1 | The inception date was August 2, 2021. The returns of the indexes listed above are based on the inception date of the Class. |

| Fund net assets | $ 2,526,043,646 |

| Total number of portfolio holdings | 87 |

| Total advisory fees paid | $ 12,787,406 |

| Portfolio turnover rate | 10 % |

| Information Technology | 21.3 % |

| Financials | 14.8 % |

| Health Care | 13.9 % |

| Industrials | 10.3 % |

| Consumer Discretionary | 8.5 % |

| Communication Services | 8.0 % |

| Consumer Staples | 6.8 % |

| Energy | 4.5 % |

| Utilities | 4.3 % |

| Materials | 3.5 % |

| Real Estate | 3.3 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | (0.1 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ 112 | 1.05 % |

| Factor | Performance Impact | Observations |

| Overweight to Media Entertainment Industry | Positive | Strong credit selection among multiple credits led to high sector specific performance. |

| Overweight to QVC Inc. issue | Positive | A significant overweight to the retailer was positive as it recovered from previous lows by reducing debt and extending its maturities. |

| Underweight to CCCs | Negative | The Fund was underweight risk relative to the market in anticipation of financial stress in the lower quality segments of the high yield market due to higher interest rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 9.62 % | 2.98 % | 3.14 % |

| Class A - excluding sales load | 13.34 % | 3.40 % | 3.64 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| ICE BofA High Yield Cash Pay Index | 15.55 % | 4.53 % | 4.94 % |

| Fund net assets | $ 106,625,654 |

| Total number of portfolio holdings | 152 |

| Total advisory fees paid | $ 572,741 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 97.7 % |

| Short-Term Investment Funds | 4.6 % |

| Other Assets/Liabilities (Net) | (2.3 ) % |

| Total | 100.0 % |

| A/A | 0.7 % |

| BBB/Baa | 10.3 % |

| BB/Ba | 58.8 % |

| B/B | 25.4 % |

| CCC | 4.1 % |

| Not Rated | 0.7 % |

| Total | 100.0 % |

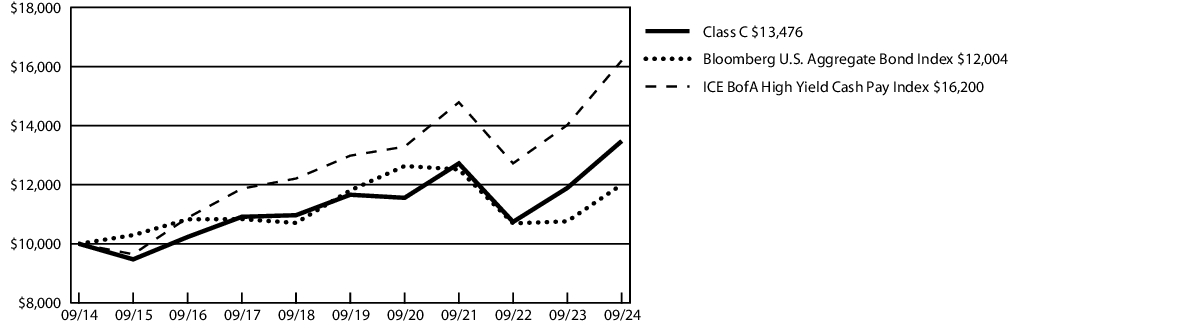

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 191 | 1.80 % |

| Factor | Performance Impact | Observations |

| Overweight to Media Entertainment Industry | Positive | Strong credit selection among multiple credits led to high sector specific performance. |

| Overweight to QVC Inc. issue | Positive | A significant overweight to the retailer was positive as it recovered from previous lows by reducing debt and extending its maturities. |

| Underweight to CCCs | Negative | The Fund was underweight risk relative to the market in anticipation of financial stress in the lower quality segments of the high yield market due to higher interest rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 11.55 % | 2.62 % | 3.03 % |

| Class C - excluding sales load | 12.55 % | 2.62 % | 3.03 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| ICE BofA High Yield Cash Pay Index | 15.55 % | 4.53 % | 4.94 % |

| Fund net assets | $ 106,625,654 |

| Total number of portfolio holdings | 152 |

| Total advisory fees paid | $ 572,741 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 97.7 % |

| Short-Term Investment Funds | 4.6 % |

| Other Assets/Liabilities (Net) | (2.3 ) % |

| Total | 100.0 % |

| A/A | 0.7 % |

| BBB/Baa | 10.3 % |

| BB/Ba | 58.8 % |

| B/B | 25.4 % |

| CCC | 4.1 % |

| Not Rated | 0.7 % |

| Total | 100.0 % |

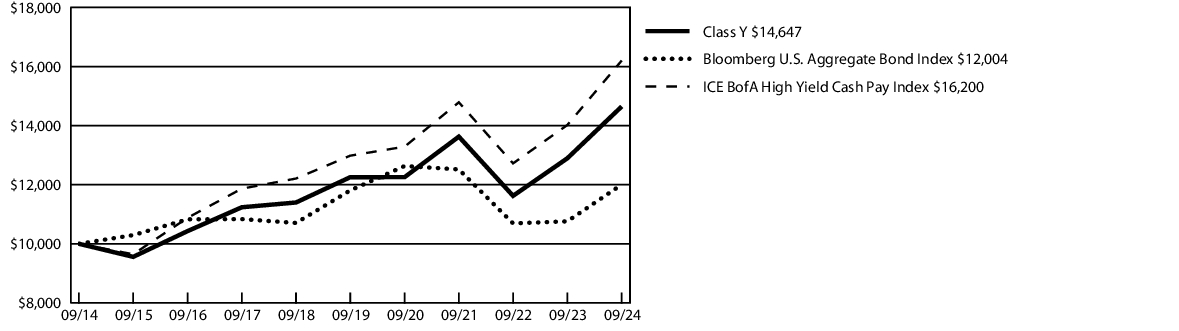

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 85 | 0.80 % |

| Factor | Performance Impact | Observations |

| Overweight to Media Entertainment Industry | Positive | Strong credit selection among multiple credits led to high sector specific performance. |

| Overweight to QVC Inc. issue | Positive | A significant overweight to the retailer was positive as it recovered from previous lows by reducing debt and extending its maturities. |

| Underweight to CCCs | Negative | The Fund was underweight risk relative to the market in anticipation of financial stress in the lower quality segments of the high yield market due to higher interest rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 13.60 % | 3.63 % | 3.89 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| ICE BofA High Yield Cash Pay Index | 15.55 % | 4.53 % | 4.94 % |

| Fund net assets | $ 106,625,654 |

| Total number of portfolio holdings | 152 |

| Total advisory fees paid | $ 572,741 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 97.7 % |

| Short-Term Investment Funds | 4.6 % |

| Other Assets/Liabilities (Net) | (2.3 ) % |

| Total | 100.0 % |

| A/A | 0.7 % |

| BBB/Baa | 10.3 % |

| BB/Ba | 58.8 % |

| B/B | 25.4 % |

| CCC | 4.1 % |

| Not Rated | 0.7 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 77 | 0.72 % |

| Factor | Performance Impact | Observations |

| Overweight to Media Entertainment Industry | Positive | Strong credit selection among multiple credits led to high sector specific performance. |

| Overweight to QVC Inc. issue | Positive | A significant overweight to the retailer was positive as it recovered from previous lows by reducing debt and extending its maturities. |

| Underweight to CCCs | Negative | The Fund was underweight risk relative to the market in anticipation of financial stress in the lower quality segments of the high yield market due to higher interest rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Institutional Class | 13.70 % | 3.74 % | 3.98 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| ICE BofA High Yield Cash Pay Index | 15.55 % | 4.53 % | 4.94 % |

| Fund net assets | $ 106,625,654 |

| Total number of portfolio holdings | 152 |

| Total advisory fees paid | $ 572,741 |

| Portfolio turnover rate | 49 % |

| Corporate Bonds | 97.7 % |

| Short-Term Investment Funds | 4.6 % |

| Other Assets/Liabilities (Net) | (2.3 ) % |

| Total | 100.0 % |

| A/A | 0.7 % |

| BBB/Baa | 10.3 % |

| BB/Ba | 58.8 % |

| B/B | 25.4 % |

| CCC | 4.1 % |

| Not Rated | 0.7 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ 80 | 0.76 % |

| Factor | Performance Impact | Observations |

| Sector | Positive | Overweight to spread sectors (offset by an underweight to Treasuries) added carry and price performance as spreads tightened. |

| Quality | Negative | An underweight to BBB rated bonds weighed on performance as investors drove spreads relatively tighter in lower rated bonds. |

| Security Selection | Positive | Security selection in Mortgage Pass Thru securities and U.S. Agencies benefitted the Fund. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 7.96 % | -0.43 % | 0.99 % |

| Class A - excluding sales load | 11.61 % | -0.03 % | 1.49 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 601,104,958 |

| Total number of portfolio holdings | 271 |

| Total advisory fees paid | $ 1,409,356 |

| Portfolio turnover rate | 20 % |

| Corporate Bonds | 28.6 % |

| U.S. Government Agency Obligations | 20.9 % |

| U.S. Government Mortgage-Backed Obligations | 16.9 % |

| Agency Collateralized Mortgage Obligations | 8.4 % |

| U.S. Treasury Obligations | 7.0 % |

| Asset-Backed Securities | 6.7 % |

| Municipal Bonds | 6.2 % |

| Commercial Mortgage-Backed Securities | 3.8 % |

| Non-Agency Collateralized Mortgage Obligations | 0.1 % |

| Short-Term Investment Fund | 0.7 % |

| Other Assets/Liabilities (Net) | 0.7 % |

| Total | 100.0 % |

| AAA/Aaa | 69.7 % |

| AA/Aa | 11.7 % |

| A/A | 11.4 % |

| BBB/Baa | 7.0 % |

| BB/Ba | 0.2 % |

| Total | 100.0 % |

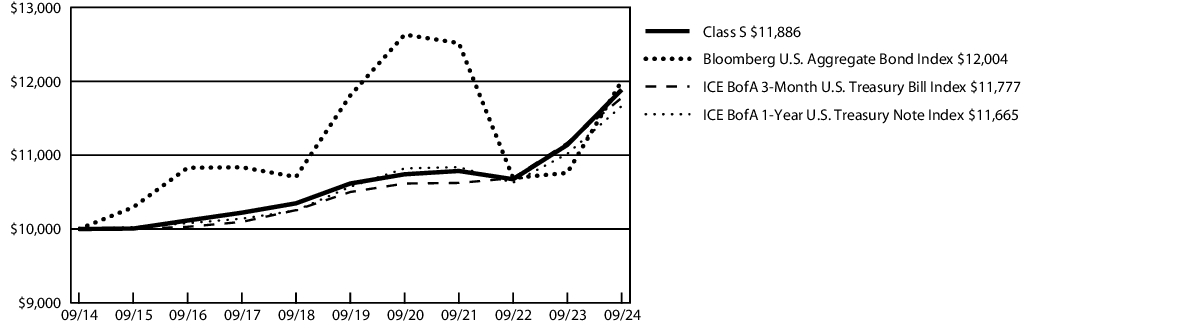

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 159 | 1.51 % |

| Factor | Performance Impact | Observations |

| Sector | Positive | Overweight to spread sectors (offset by an underweight to Treasuries) added carry and price performance as spreads tightened. |

| Quality | Negative | An underweight to BBB rated bonds weighed on performance as investors drove spreads relatively tighter in lower rated bonds. |

| Security Selection | Positive | Security selection in Mortgage Pass Thru securities and U.S. Agencies benefitted the Fund. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 9.77 % | -0.77 % | 0.89 % |

| Class C - excluding sales load | 10.77 % | -0.77 % | 0.89 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 601,104,958 |

| Total number of portfolio holdings | 271 |

| Total advisory fees paid | $ 1,409,356 |

| Portfolio turnover rate | 20 % |

| Corporate Bonds | 28.6 % |

| U.S. Government Agency Obligations | 20.9 % |

| U.S. Government Mortgage-Backed Obligations | 16.9 % |

| Agency Collateralized Mortgage Obligations | 8.4 % |

| U.S. Treasury Obligations | 7.0 % |

| Asset-Backed Securities | 6.7 % |

| Municipal Bonds | 6.2 % |

| Commercial Mortgage-Backed Securities | 3.8 % |

| Non-Agency Collateralized Mortgage Obligations | 0.1 % |

| Short-Term Investment Fund | 0.7 % |

| Other Assets/Liabilities (Net) | 0.7 % |

| Total | 100.0 % |

| AAA/Aaa | 69.7 % |

| AA/Aa | 11.7 % |

| A/A | 11.4 % |

| BBB/Baa | 7.0 % |

| BB/Ba | 0.2 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 54 | 0.51 % |

| Factor | Performance Impact | Observations |

| Sector | Positive | Overweight to spread sectors (offset by an underweight to Treasuries) added carry and price performance as spreads tightened. |

| Quality | Negative | An underweight to BBB rated bonds weighed on performance as investors drove spreads relatively tighter in lower rated bonds. |

| Security Selection | Positive | Security selection in Mortgage Pass Thru securities and U.S. Agencies benefitted the Fund. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 12.00 % | 0.24 % | 1.75 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 601,104,958 |

| Total number of portfolio holdings | 271 |

| Total advisory fees paid | $ 1,409,356 |

| Portfolio turnover rate | 20 % |

| Corporate Bonds | 28.6 % |

| U.S. Government Agency Obligations | 20.9 % |

| U.S. Government Mortgage-Backed Obligations | 16.9 % |

| Agency Collateralized Mortgage Obligations | 8.4 % |

| U.S. Treasury Obligations | 7.0 % |

| Asset-Backed Securities | 6.7 % |

| Municipal Bonds | 6.2 % |

| Commercial Mortgage-Backed Securities | 3.8 % |

| Non-Agency Collateralized Mortgage Obligations | 0.1 % |

| Short-Term Investment Fund | 0.7 % |

| Other Assets/Liabilities (Net) | 0.7 % |

| Total | 100.0 % |

| AAA/Aaa | 69.7 % |

| AA/Aa | 11.7 % |

| A/A | 11.4 % |

| BBB/Baa | 7.0 % |

| BB/Ba | 0.2 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 43 | 0.41 % |

| Factor | Performance Impact | Observations |

| Sector | Positive | Overweight to spread sectors (offset by an underweight to Treasuries) added carry and price performance as spreads tightened. |

| Quality | Negative | An underweight to BBB rated bonds weighed on performance as investors drove spreads relatively tighter in lower rated bonds. |

| Security Selection | Positive | Security selection in Mortgage Pass Thru securities and U.S. Agencies benefitted the Fund. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Institutional Class | 12.10 % | 0.34 % | 1.86 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

| Fund net assets | $ 601,104,958 |

| Total number of portfolio holdings | 271 |

| Total advisory fees paid | $ 1,409,356 |

| Portfolio turnover rate | 20 % |

| Corporate Bonds | 28.6 % |

| U.S. Government Agency Obligations | 20.9 % |

| U.S. Government Mortgage-Backed Obligations | 16.9 % |

| Agency Collateralized Mortgage Obligations | 8.4 % |

| U.S. Treasury Obligations | 7.0 % |

| Asset-Backed Securities | 6.7 % |

| Municipal Bonds | 6.2 % |

| Commercial Mortgage-Backed Securities | 3.8 % |

| Non-Agency Collateralized Mortgage Obligations | 0.1 % |

| Short-Term Investment Fund | 0.7 % |

| Other Assets/Liabilities (Net) | 0.7 % |

| Total | 100.0 % |

| AAA/Aaa | 69.7 % |

| AA/Aa | 11.7 % |

| A/A | 11.4 % |

| BBB/Baa | 7.0 % |

| BB/Ba | 0.2 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R6 | $ 39 | 0.37 % |

| Factor | Performance Impact | Observations |

| Sector | Positive | Overweight to spread sectors (offset by an underweight to Treasuries) added carry and price performance as spreads tightened. |

| Quality | Negative | An underweight to BBB rated bonds weighed on performance as investors drove spreads relatively tighter in lower rated bonds. |

| Security Selection | Positive | Security selection in Mortgage Pass Thru securities and U.S. Agencies benefitted the Fund. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class R6 1 | 12.02 % | 0.29 % | 1.78 % |

| Bloomberg U.S. Aggregate Bond Index | 11.57 % | 0.33 % | 1.84 % |

1 | The inception date was November 22, 2021. Performance information was calculated using the historical performance of Class Y shares for the periods prior to November 22, 2021. |

| Fund net assets | $ 601,104,958 |

| Total number of portfolio holdings | 271 |

| Total advisory fees paid | $ 1,409,356 |

| Portfolio turnover rate | 20 % |

| Corporate Bonds | 28.6 % |

| U.S. Government Agency Obligations | 20.9 % |

| U.S. Government Mortgage-Backed Obligations | 16.9 % |

| Agency Collateralized Mortgage Obligations | 8.4 % |

| U.S. Treasury Obligations | 7.0 % |

| Asset-Backed Securities | 6.7 % |

| Municipal Bonds | 6.2 % |

| Commercial Mortgage-Backed Securities | 3.8 % |

| Non-Agency Collateralized Mortgage Obligations | 0.1 % |

| Short-Term Investment Fund | 0.7 % |

| Other Assets/Liabilities (Net) | 0.7 % |

| Total | 100.0 % |

| AAA/Aaa | 69.7 % |

| AA/Aa | 11.7 % |

| A/A | 11.4 % |

| BBB/Baa | 7.0 % |

| BB/Ba | 0.2 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ 131 | 1.17 % |

| Factor | Performance Impact | Observations |

| Consumer Staples and Utilities Sectors | Negative | We were overweight Consumer Staples and underweight Utilities which detracted from relative performance. |

| Energy and Industrials Sectors | Positive | While sector allocation overall was negative, our underweight position in Energy and our overweight position in Industrials added to relative performance. |

| Materials and Industrials Stocks | Positive | Strong performance from Materials and Industrials sector stocks in the portfolio was a positive contributor to performance. |

| Consumer Discretionary and Consumer Staples Stocks | Negative | Weak performance from Consumer Discretionary and Consumer Staples sector stocks in the portfolio was the main driver of relative underperformance. |

| Quality, Yield and Growth exposures | Negative | We were generally overweight Quality and Yield (shareholder yield) factors and underweight Growth factors which detracted from relative performance. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 18.07 % | 8.73 % | 10.04 % |

| Class A - excluding sales load | 24.28 % | 9.85 % | 10.69 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Index | 29.33 % | 11.30 % | 10.19 % |

| Fund net assets | $ 6,085,137,125 |

| Total number of portfolio holdings | 35 |

| Total advisory fees paid | $ 34,583,103 |

| Portfolio turnover rate | 13 % |

| Industrials | 26.4 % |

| Information Technology | 12.9 % |

| Financials | 12.6 % |

| Consumer Discretionary | 12.0 % |

| Materials | 10.1 % |

| Consumer Staples | 9.8 % |

| Health Care | 8.0 % |

| Real Estate | 6.5 % |

| Short-Term Investment Fund | 1.7 % |

| Other Assets/Liabilities (Net) | (0.0 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 213 | 1.91 % |

| Factor | Performance Impact | Observations |

| Consumer Staples and Utilities Sectors | Negative | We were overweight Consumer Staples and underweight Utilities which detracted from relative performance. |

| Energy and Industrials Sectors | Positive | While sector allocation overall was negative, our underweight position in Energy and our overweight position in Industrials added to relative performance. |

| Materials and Industrials Stocks | Positive | Strong performance from Materials and Industrials sector stocks in the portfolio was a positive contributor to performance. |

| Consumer Discretionary and Consumer Staples Stocks | Negative | Weak performance from Consumer Discretionary and Consumer Staples sector stocks in the portfolio was the main driver of relative underperformance. |

| Quality, Yield and Growth exposures | Negative | We were generally overweight Quality and Yield (shareholder yield) factors and underweight Growth factors which detracted from relative performance. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 22.38 % | 9.06 % | 10.03 % |

| Class C - excluding sales load | 23.38 % | 9.06 % | 10.03 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Index | 29.33 % | 11.30 % | 10.19 % |

| Fund net assets | $ 6,085,137,125 |

| Total number of portfolio holdings | 35 |

| Total advisory fees paid | $ 34,583,103 |

| Portfolio turnover rate | 13 % |

| Industrials | 26.4 % |

| Information Technology | 12.9 % |

| Financials | 12.6 % |

| Consumer Discretionary | 12.0 % |

| Materials | 10.1 % |

| Consumer Staples | 9.8 % |

| Health Care | 8.0 % |

| Real Estate | 6.5 % |

| Short-Term Investment Fund | 1.7 % |

| Other Assets/Liabilities (Net) | (0.0 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 101 | 0.90 % |

| Factor | Performance Impact | Observations |

| Consumer Staples and Utilities Sectors | Negative | We were overweight Consumer Staples and underweight Utilities which detracted from relative performance. |

| Energy and Industrials Sectors | Positive | While sector allocation overall was negative, our underweight position in Energy and our overweight position in Industrials added to relative performance. |

| Materials and Industrials Stocks | Positive | Strong performance from Materials and Industrials sector stocks in the portfolio was a positive contributor to performance. |

| Consumer Discretionary and Consumer Staples Stocks | Negative | Weak performance from Consumer Discretionary and Consumer Staples sector stocks in the portfolio was the main driver of relative underperformance. |

| Quality, Yield and Growth exposures | Negative | We were generally overweight Quality and Yield (shareholder yield) factors and underweight Growth factors which detracted from relative performance. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 24.61 % | 10.15 % | 10.98 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Index | 29.33 % | 11.30 % | 10.19 % |

| Fund net assets | $ 6,085,137,125 |

| Total number of portfolio holdings | 35 |

| Total advisory fees paid | $ 34,583,103 |

| Portfolio turnover rate | 13 % |

| Industrials | 26.4 % |

| Information Technology | 12.9 % |

| Financials | 12.6 % |

| Consumer Discretionary | 12.0 % |

| Materials | 10.1 % |

| Consumer Staples | 9.8 % |

| Health Care | 8.0 % |

| Real Estate | 6.5 % |

| Short-Term Investment Fund | 1.7 % |

| Other Assets/Liabilities (Net) | (0.0 ) % |

| Total | 100.0 % |

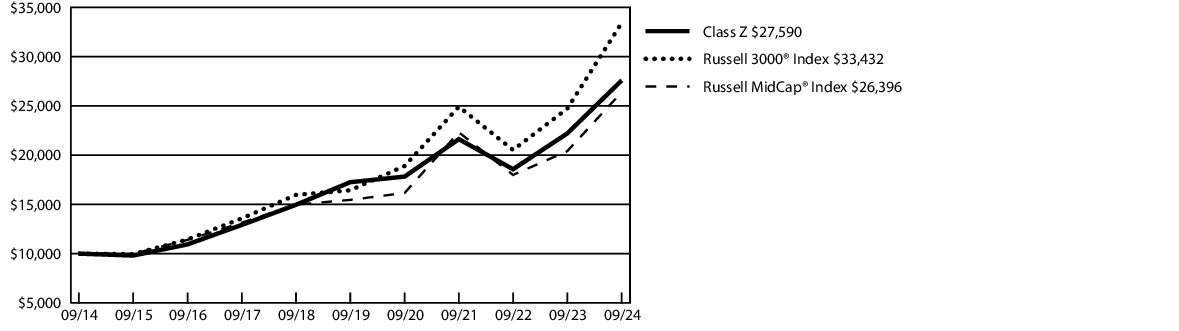

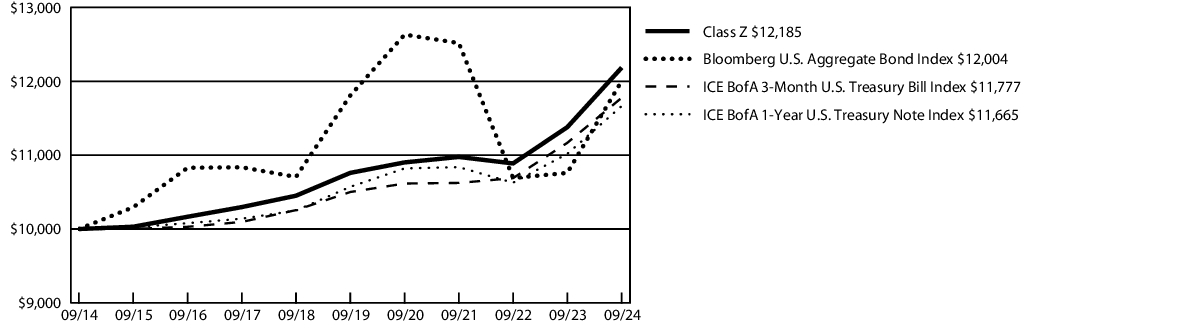

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Z | $ 136 | 1.21 % |

| Factor | Performance Impact | Observations |

| Consumer Staples and Utilities Sectors | Negative | We were overweight Consumer Staples and underweight Utilities which detracted from relative performance. |

| Energy and Industrials Sectors | Positive | While sector allocation overall was negative, our underweight position in Energy and our overweight position in Industrials added to relative performance. |

| Materials and Industrials Stocks | Positive | Strong performance from Materials and Industrials sector stocks in the portfolio was a positive contributor to performance. |

| Consumer Discretionary and Consumer Staples Stocks | Negative | Weak performance from Consumer Discretionary and Consumer Staples sector stocks in the portfolio was the main driver of relative underperformance. |

| Quality, Yield and Growth exposures | Negative | We were generally overweight Quality and Yield (shareholder yield) factors and underweight Growth factors which detracted from relative performance. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Z | 24.24 % | 9.84 % | 10.68 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Index | 29.33 % | 11.30 % | 10.19 % |

| Fund net assets | $ 6,085,137,125 |

| Total number of portfolio holdings | 35 |

| Total advisory fees paid | $ 34,583,103 |

| Portfolio turnover rate | 13 % |

| Industrials | 26.4 % |

| Information Technology | 12.9 % |

| Financials | 12.6 % |

| Consumer Discretionary | 12.0 % |

| Materials | 10.1 % |

| Consumer Staples | 9.8 % |

| Health Care | 8.0 % |

| Real Estate | 6.5 % |

| Short-Term Investment Fund | 1.7 % |

| Other Assets/Liabilities (Net) | (0.0 ) % |

| Total | 100.0 % |

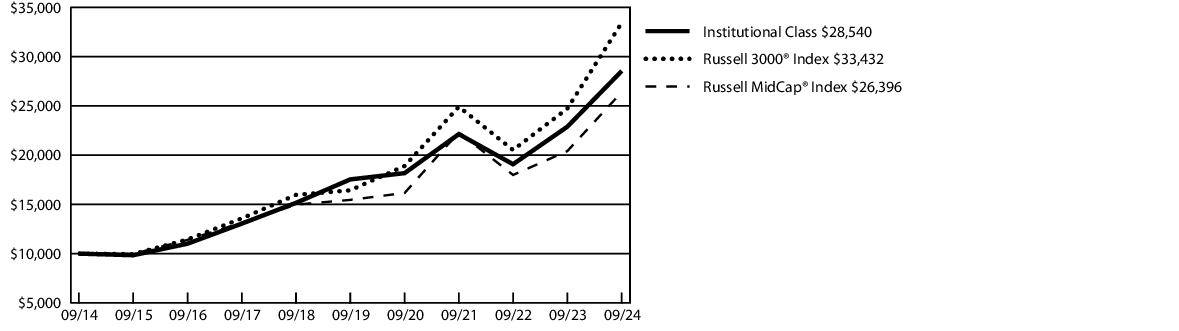

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 95 | 0.85 % |

| Factor | Performance Impact | Observations |

| Consumer Staples and Utilities Sectors | Negative | We were overweight Consumer Staples and underweight Utilities which detracted from relative performance. |

| Energy and Industrials Sectors | Positive | While sector allocation overall was negative, our underweight position in Energy and our overweight position in Industrials added to relative performance. |

| Materials and Industrials Stocks | Positive | Strong performance from Materials and Industrials sector stocks in the portfolio was a positive contributor to performance. |

| Consumer Discretionary and Consumer Staples Stocks | Negative | Weak performance from Consumer Discretionary and Consumer Staples sector stocks in the portfolio was the main driver of relative underperformance. |

| Quality, Yield and Growth exposures | Negative | We were generally overweight Quality and Yield (shareholder yield) factors and underweight Growth factors which detracted from relative performance. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Institutional Class | 24.70 % | 10.23 % | 11.06 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Index | 29.33 % | 11.30 % | 10.19 % |

| Fund net assets | $ 6,085,137,125 |

| Total number of portfolio holdings | 35 |

| Total advisory fees paid | $ 34,583,103 |

| Portfolio turnover rate | 13 % |

| Industrials | 26.4 % |

| Information Technology | 12.9 % |

| Financials | 12.6 % |

| Consumer Discretionary | 12.0 % |

| Materials | 10.1 % |

| Consumer Staples | 9.8 % |

| Health Care | 8.0 % |

| Real Estate | 6.5 % |

| Short-Term Investment Fund | 1.7 % |

| Other Assets/Liabilities (Net) | (0.0 ) % |

| Total | 100.0 % |

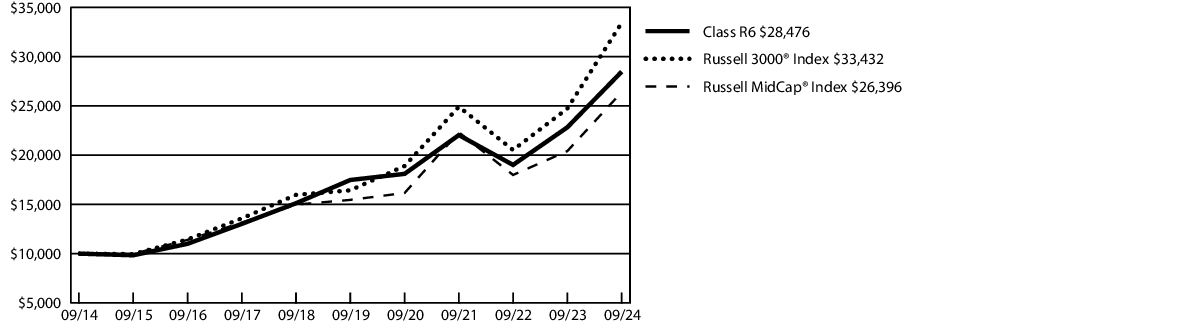

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R6 | $ 89 | 0.79 % |

| Factor | Performance Impact | Observations |

| Consumer Staples and Utilities Sectors | Negative | We were overweight Consumer Staples and underweight Utilities which detracted from relative performance. |

| Energy and Industrials Sectors | Positive | While sector allocation overall was negative, our underweight position in Energy and our overweight position in Industrials added to relative performance. |

| Materials and Industrials Stocks | Positive | Strong performance from Materials and Industrials sector stocks in the portfolio was a positive contributor to performance. |

| Consumer Discretionary and Consumer Staples Stocks | Negative | Weak performance from Consumer Discretionary and Consumer Staples sector stocks in the portfolio was the main driver of relative underperformance. |

| Quality, Yield and Growth exposures | Negative | We were generally overweight Quality and Yield (shareholder yield) factors and underweight Growth factors which detracted from relative performance. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class R6 1 | 24.76 % | 10.25 % | 11.03 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Index | 29.33 % | 11.30 % | 10.19 % |

1 | The inception date was February 22, 2021. Performance information was calculated using the historical performance of Class Y shares for the periods prior to February 22, 2021. |

| Fund net assets | $ 6,085,137,125 |

| Total number of portfolio holdings | 35 |

| Total advisory fees paid | $ 34,583,103 |

| Portfolio turnover rate | 13 % |

| Industrials | 26.4 % |

| Information Technology | 12.9 % |

| Financials | 12.6 % |

| Consumer Discretionary | 12.0 % |

| Materials | 10.1 % |

| Consumer Staples | 9.8 % |

| Health Care | 8.0 % |

| Real Estate | 6.5 % |

| Short-Term Investment Fund | 1.7 % |

| Other Assets/Liabilities (Net) | (0.0 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

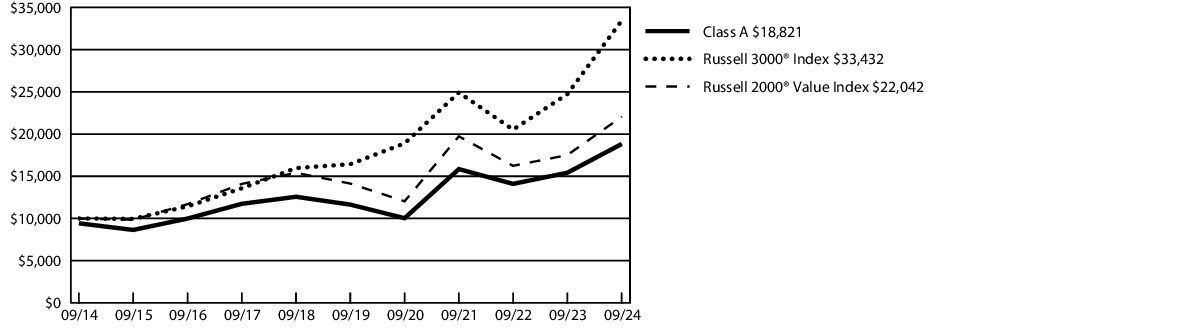

| Class A | $ 136 | 1.24 % |

| Factor | Performance Impact | Observations |

| Communication Services sector | Positive | No exposure to the sector, which underperformed the benchmark. |

| Insurance Industry | Positive | The Allstate Corporation, The Progressive Corporation, and Reinsurance Group of America, Incorporated (“RGA”) all outperformed on margin expansion driven by cost controls and positive pricing. Allstate’s sale of its voluntary benefits business simplified the asset mix while providing capital for growth and buybacks. RGA traded higher as its new CEO raised return targets for the business from prior management’s expectations. |

| Consumer Discretionary sector | Negative | Weakness in LKQ Corp, which experienced several transitory issues during the period, including a worker strike, tax law changes, and dilution from an acquisition. Later in the period, the company underperformed as consumers elected to delay repair work on their vehicles. |

| Consumer Staples sector | Negative | Darling Ingredients Inc., a global rendering company, declined to provide guidance on a 2024 earnings report as volatility in fat prices clouded the near-term outlook. French fry producer Lamb Weston Holdings Inc. continued to suffer from the impacts of a botched enterprise resource planning implementation in 2024. The company lost market share due to its inability to meet customer demand in the face of a volume slowdown at its quick service customers, resulting in excess capacity and low utilization rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 14.06 % | 8.05 % | 7.42 % |

| Class A - excluding sales load | 20.08 % | 9.16 % | 8.05 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Value Index | 29.01 % | 10.33 % | 8.93 % |

| Fund net assets | $ 612,944,224 |

| Total number of portfolio holdings | 73 |

| Total advisory fees paid | $ 5,465,195 |

| Portfolio turnover rate | 29 % |

| Industrials | 20.5 % |

| Financials | 16.3 % |

| Health Care | 10.6 % |

| Consumer Staples | 9.5 % |

| Utilities | 9.1 % |

| Consumer Discretionary | 8.2 % |

| Information Technology | 8.1 % |

| Materials | 6.0 % |

| Real Estate | 5.8 % |

| Energy | 5.0 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | 0.0 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 218 | 1.99 % |

| Factor | Performance Impact | Observations |

| Communication Services sector | Positive | No exposure to the sector, which underperformed the benchmark. |

| Insurance Industry | Positive | The Allstate Corporation, The Progressive Corporation, and Reinsurance Group of America, Incorporated (“RGA”) all outperformed on margin expansion driven by cost controls and positive pricing. Allstate’s sale of its voluntary benefits business simplified the asset mix while providing capital for growth and buybacks. RGA traded higher as its new CEO raised return targets for the business from prior management’s expectations. |

| Consumer Discretionary sector | Negative | Weakness in LKQ Corp, which experienced several transitory issues during the period, including a worker strike, tax law changes, and dilution from an acquisition. Later in the period, the company underperformed as consumers elected to delay repair work on their vehicles. |

| Consumer Staples sector | Negative | Darling Ingredients Inc., a global rendering company, declined to provide guidance on a 2024 earnings report as volatility in fat prices clouded the near-term outlook. French fry producer Lamb Weston Holdings Inc. continued to suffer from the impacts of a botched enterprise resource planning implementation in 2024. The company lost market share due to its inability to meet customer demand in the face of a volume slowdown at its quick service customers, resulting in excess capacity and low utilization rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 18.16 % | 8.35 % | 7.41 % |

| Class C - excluding sales load | 19.16 % | 8.35 % | 7.41 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Value Index | 29.01 % | 10.33 % | 8.93 % |

| Fund net assets | $ 612,944,224 |

| Total number of portfolio holdings | 73 |

| Total advisory fees paid | $ 5,465,195 |

| Portfolio turnover rate | 29 % |

| Industrials | 20.5 % |

| Financials | 16.3 % |

| Health Care | 10.6 % |

| Consumer Staples | 9.5 % |

| Utilities | 9.1 % |

| Consumer Discretionary | 8.2 % |

| Information Technology | 8.1 % |

| Materials | 6.0 % |

| Real Estate | 5.8 % |

| Energy | 5.0 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | 0.0 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 109 | 0.99 % |

| Factor | Performance Impact | Observations |

| Communication Services sector | Positive | No exposure to the sector, which underperformed the benchmark. |

| Insurance Industry | Positive | The Allstate Corporation, The Progressive Corporation, and Reinsurance Group of America, Incorporated (“RGA”) all outperformed on margin expansion driven by cost controls and positive pricing. Allstate’s sale of its voluntary benefits business simplified the asset mix while providing capital for growth and buybacks. RGA traded higher as its new CEO raised return targets for the business from prior management’s expectations. |

| Consumer Discretionary sector | Negative | Weakness in LKQ Corp, which experienced several transitory issues during the period, including a worker strike, tax law changes, and dilution from an acquisition. Later in the period, the company underperformed as consumers elected to delay repair work on their vehicles. |

| Consumer Staples sector | Negative | Darling Ingredients Inc., a global rendering company, declined to provide guidance on a 2024 earnings report as volatility in fat prices clouded the near-term outlook. French fry producer Lamb Weston Holdings Inc. continued to suffer from the impacts of a botched enterprise resource planning implementation in 2024. The company lost market share due to its inability to meet customer demand in the face of a volume slowdown at its quick service customers, resulting in excess capacity and low utilization rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 20.33 % | 9.43 % | 8.32 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Value Index | 29.01 % | 10.33 % | 8.93 % |

| Fund net assets | $ 612,944,224 |

| Total number of portfolio holdings | 73 |

| Total advisory fees paid | $ 5,465,195 |

| Portfolio turnover rate | 29 % |

| Industrials | 20.5 % |

| Financials | 16.3 % |

| Health Care | 10.6 % |

| Consumer Staples | 9.5 % |

| Utilities | 9.1 % |

| Consumer Discretionary | 8.2 % |

| Information Technology | 8.1 % |

| Materials | 6.0 % |

| Real Estate | 5.8 % |

| Energy | 5.0 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | 0.0 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 95 | 0.86 % |

| Factor | Performance Impact | Observations |

| Communication Services sector | Positive | No exposure to the sector, which underperformed the benchmark. |

| Insurance Industry | Positive | The Allstate Corporation, The Progressive Corporation, and Reinsurance Group of America, Incorporated (“RGA”) all outperformed on margin expansion driven by cost controls and positive pricing. Allstate’s sale of its voluntary benefits business simplified the asset mix while providing capital for growth and buybacks. RGA traded higher as its new CEO raised return targets for the business from prior management’s expectations. |

| Consumer Discretionary sector | Negative | Weakness in LKQ Corp, which experienced several transitory issues during the period, including a worker strike, tax law changes, and dilution from an acquisition. Later in the period, the company underperformed as consumers elected to delay repair work on their vehicles. |

| Consumer Staples sector | Negative | Darling Ingredients Inc., a global rendering company, declined to provide guidance on a 2024 earnings report as volatility in fat prices clouded the near-term outlook. French fry producer Lamb Weston Holdings Inc. continued to suffer from the impacts of a botched enterprise resource planning implementation in 2024. The company lost market share due to its inability to meet customer demand in the face of a volume slowdown at its quick service customers, resulting in excess capacity and low utilization rates. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Institutional Class | 20.51 % | 9.58 % | 8.47 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell Midcap ® Value Index | 29.01 % | 10.33 % | 8.93 % |

| Fund net assets | $ 612,944,224 |

| Total number of portfolio holdings | 73 |

| Total advisory fees paid | $ 5,465,195 |

| Portfolio turnover rate | 29 % |

| Industrials | 20.5 % |

| Financials | 16.3 % |

| Health Care | 10.6 % |

| Consumer Staples | 9.5 % |

| Utilities | 9.1 % |

| Consumer Discretionary | 8.2 % |

| Information Technology | 8.1 % |

| Materials | 6.0 % |

| Real Estate | 5.8 % |

| Energy | 5.0 % |

| Short-Term Investment Fund | 0.9 % |

| Other Assets/Liabilities (Net) | 0.0 % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

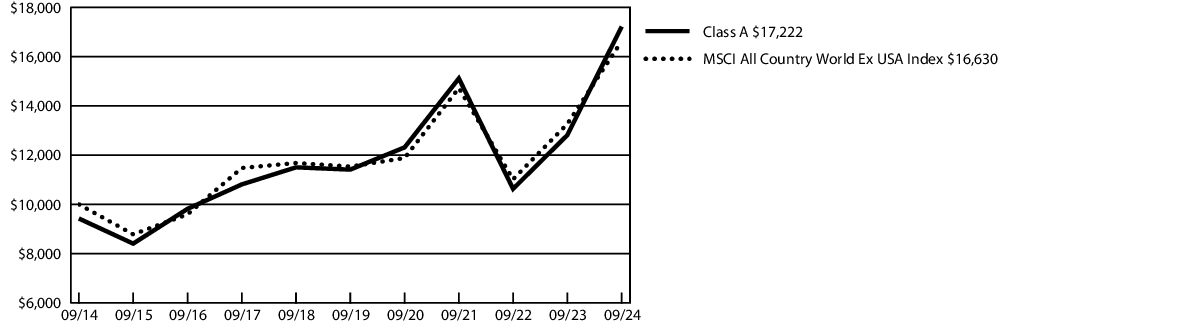

| Class A | $ 138 | 1.18 % |

| Factor | Performance Impact | Observations |

| Western Europe | Positive | European equities performed strongly during the period. Stock selection for the Fund within the region was particularly driven by Adyen N.V. and CTS Eventim AG & Co. |

| Information Technology | Positive | Increased demand for semiconductors for artificial intelligence, in addition to other end-markets. |

| Growth | Positive | Growth equities rallied as central banks globally cut rates. Through September, 2024 was already the third largest year for policy rate cuts ever. |

| Health Care | Negative | The industry continues to face an unprecedented overlapping of headwinds including rapid demand declines for COVID-19 vaccines, lower levels of biotech funding, and a volatile Chinese macroeconomic environment. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 27.71 % | 7.46 % | 5.59 % |

| Class A - excluding sales load | 34.43 % | 8.58 % | 6.22 % |

| MSCI All Country World Ex USA Index | 25.35 % | 7.59 % | 5.22 % |

| Fund net assets | $ 109,051,618 |

| Total number of portfolio holdings | 32 |

| Total advisory fees paid | $ 378,368 |

| Portfolio turnover rate | 117 % |

| Information Technology | 24.1 % |

| Consumer Discretionary | 20.3 % |

| Industrials | 19.0 % |

| Communication Services | 10.9 % |

| Financials | 9.4 % |

| Health Care | 6.1 % |

| Consumer Staples | 4.2 % |

| Materials | 3.5 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Common Stocks | |

| Japan | 12.6 % |

| Netherlands | 11.9 % |

| Switzerland | 9.3 % |

| Brazil | 9.2 % |

| Canada | 8.8 % |

| India | 7.5 % |

| Germany | 6.6 % |

| Sweden | 6.6 % |

| Italy | 5.0 % |

| Taiwan | 4.7 % |

| Singapore | 4.1 % |

| Denmark | 3.6 % |

| United Kingdom | 3.0 % |

| Other Countries | 4.6 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

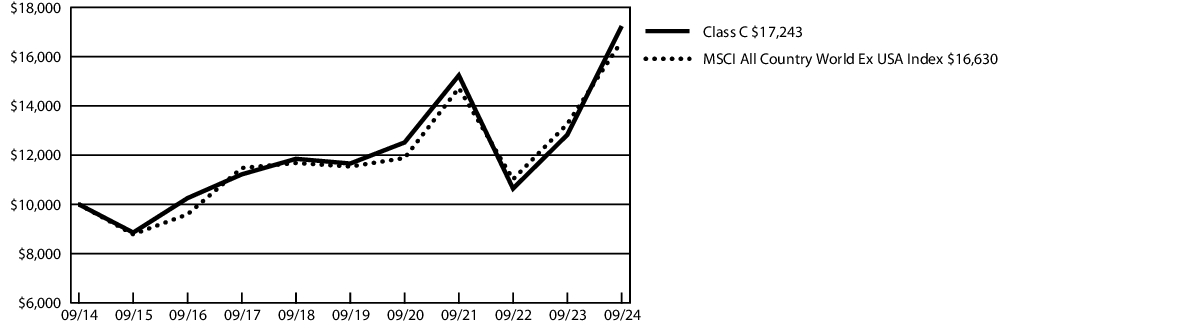

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 229 | 1.96 % |

| Factor | Performance Impact | Observations |

| Western Europe | Positive | European equities performed strongly during the period. Stock selection for the Fund within the region was particularly driven by Adyen N.V. and CTS Eventim AG & Co. |

| Information Technology | Positive | Increased demand for semiconductors for artificial intelligence, in addition to other end-markets. |

| Growth | Positive | Growth equities rallied as central banks globally cut rates. Through September, 2024 was already the third largest year for policy rate cuts ever. |

| Health Care | Negative | The industry continues to face an unprecedented overlapping of headwinds including rapid demand declines for COVID-19 vaccines, lower levels of biotech funding, and a volatile Chinese macroeconomic environment. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 32.48 % | 7.80 % | 5.60 % |

| Class C - excluding sales load | 33.48 % | 7.80 % | 5.60 % |

| MSCI All Country World Ex USA Index | 25.35 % | 7.59 % | 5.22 % |

| Fund net assets | $ 109,051,618 |

| Total number of portfolio holdings | 32 |

| Total advisory fees paid | $ 378,368 |

| Portfolio turnover rate | 117 % |

| Information Technology | 24.1 % |

| Consumer Discretionary | 20.3 % |

| Industrials | 19.0 % |

| Communication Services | 10.9 % |

| Financials | 9.4 % |

| Health Care | 6.1 % |

| Consumer Staples | 4.2 % |

| Materials | 3.5 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Common Stocks | |

| Japan | 12.6 % |

| Netherlands | 11.9 % |

| Switzerland | 9.3 % |

| Brazil | 9.2 % |

| Canada | 8.8 % |

| India | 7.5 % |

| Germany | 6.6 % |

| Sweden | 6.6 % |

| Italy | 5.0 % |

| Taiwan | 4.7 % |

| Singapore | 4.1 % |

| Denmark | 3.6 % |

| United Kingdom | 3.0 % |

| Other Countries | 4.6 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

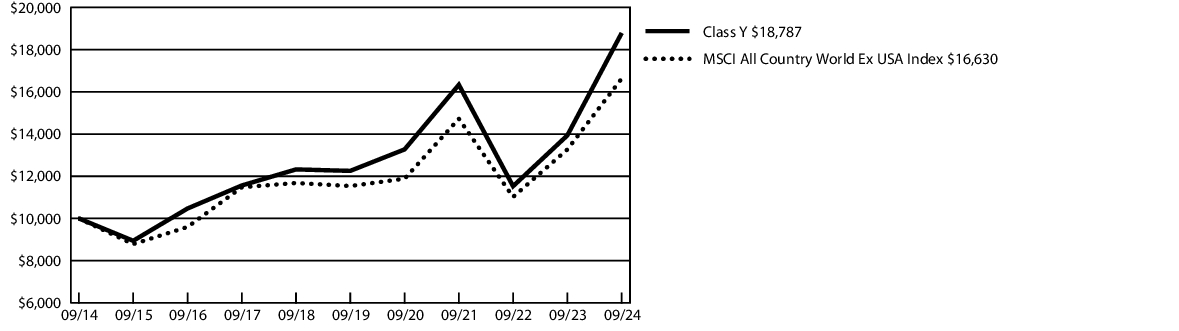

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 107 | 0.91 % |

| Factor | Performance Impact | Observations |

| Western Europe | Positive | European equities performed strongly during the period. Stock selection for the Fund within the region was particularly driven by Adyen N.V. and CTS Eventim AG & Co. |

| Information Technology | Positive | Increased demand for semiconductors for artificial intelligence, in addition to other end-markets. |

| Growth | Positive | Growth equities rallied as central banks globally cut rates. Through September, 2024 was already the third largest year for policy rate cuts ever. |

| Health Care | Negative | The industry continues to face an unprecedented overlapping of headwinds including rapid demand declines for COVID-19 vaccines, lower levels of biotech funding, and a volatile Chinese macroeconomic environment. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 34.82 % | 8.92 % | 6.51 % |

| MSCI All Country World Ex USA Index | 25.35 % | 7.59 % | 5.22 % |

| Fund net assets | $ 109,051,618 |

| Total number of portfolio holdings | 32 |

| Total advisory fees paid | $ 378,368 |

| Portfolio turnover rate | 117 % |

| Information Technology | 24.1 % |

| Consumer Discretionary | 20.3 % |

| Industrials | 19.0 % |

| Communication Services | 10.9 % |

| Financials | 9.4 % |

| Health Care | 6.1 % |

| Consumer Staples | 4.2 % |

| Materials | 3.5 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Common Stocks | |

| Japan | 12.6 % |

| Netherlands | 11.9 % |

| Switzerland | 9.3 % |

| Brazil | 9.2 % |

| Canada | 8.8 % |

| India | 7.5 % |

| Germany | 6.6 % |

| Sweden | 6.6 % |

| Italy | 5.0 % |

| Taiwan | 4.7 % |

| Singapore | 4.1 % |

| Denmark | 3.6 % |

| United Kingdom | 3.0 % |

| Other Countries | 4.6 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

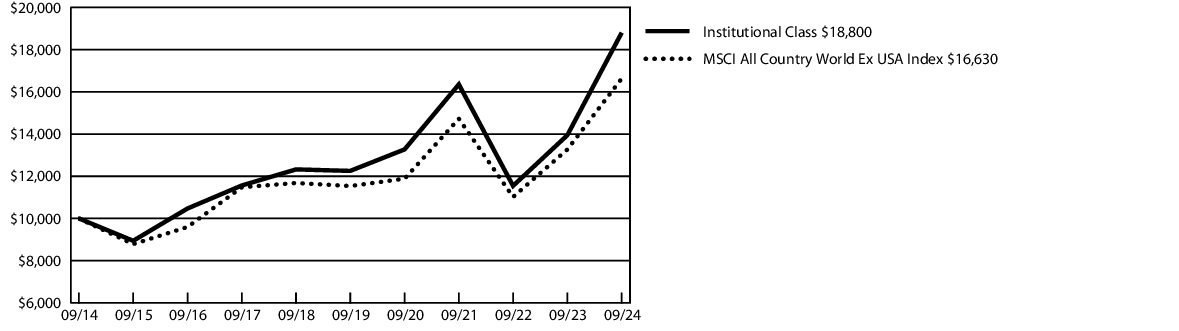

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $ 102 | 0.87 % |

| Factor | Performance Impact | Observations |

| Western Europe | Positive | European equities performed strongly during the period. Stock selection for the Fund within the region was particularly driven by Adyen N.V. and CTS Eventim AG & Co. |

| Information Technology | Positive | Increased demand for semiconductors for artificial intelligence, in addition to other end-markets. |

| Growth | Positive | Growth equities rallied as central banks globally cut rates. Through September, 2024 was already the third largest year for policy rate cuts ever. |

| Health Care | Negative | The industry continues to face an unprecedented overlapping of headwinds including rapid demand declines for COVID-19 vaccines, lower levels of biotech funding, and a volatile Chinese macroeconomic environment. |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Institutional Class 1 | 34.81 % | 8.94 % | 6.52 % |

| MSCI All Country World Ex USA Index | 25.35 % | 7.59 % | 5.22 % |

1 | The inception date was August 23, 2019. Performance information was calculated using the historical performance of Class Y shares for the periods prior to August 23, 2019. |

| Fund net assets | $ 109,051,618 |

| Total number of portfolio holdings | 32 |

| Total advisory fees paid | $ 378,368 |

| Portfolio turnover rate | 117 % |

| Information Technology | 24.1 % |

| Consumer Discretionary | 20.3 % |

| Industrials | 19.0 % |

| Communication Services | 10.9 % |

| Financials | 9.4 % |

| Health Care | 6.1 % |

| Consumer Staples | 4.2 % |

| Materials | 3.5 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Common Stocks | |

| Japan | 12.6 % |

| Netherlands | 11.9 % |

| Switzerland | 9.3 % |

| Brazil | 9.2 % |

| Canada | 8.8 % |

| India | 7.5 % |

| Germany | 6.6 % |

| Sweden | 6.6 % |

| Italy | 5.0 % |

| Taiwan | 4.7 % |

| Singapore | 4.1 % |

| Denmark | 3.6 % |

| United Kingdom | 3.0 % |

| Other Countries | 4.6 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R6 | $ 96 | 0.82 % |

| Factor | Performance Impact | Observations |

| Western Europe | Positive | European equities performed strongly during the period. Stock selection for the Fund within the region was particularly driven by Adyen N.V. and CTS Eventim AG & Co. |

| Information Technology | Positive | Increased demand for semiconductors for artificial intelligence, in addition to other end-markets. |

| Growth | Positive | Growth equities rallied as central banks globally cut rates. Through September, 2024 was already the third largest year for policy rate cuts ever. |

| Health Care | Negative | The industry continues to face an unprecedented overlapping of headwinds including rapid demand declines for COVID-19 vaccines, lower levels of biotech funding, and a volatile Chinese macroeconomic environment. |

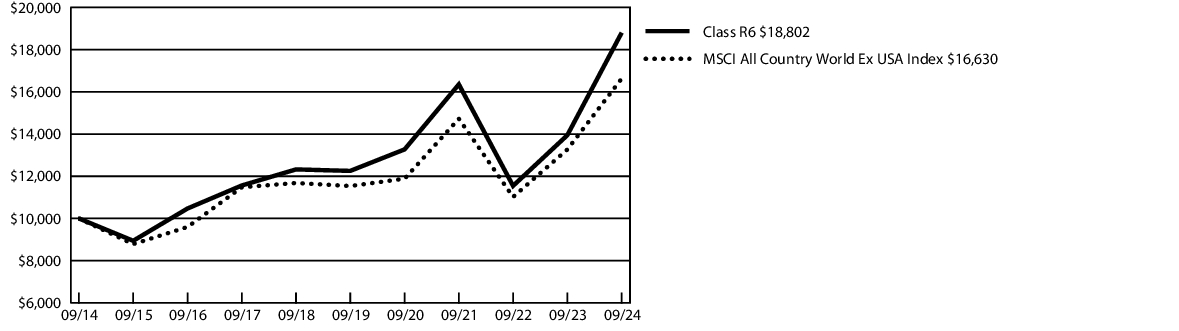

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class R6 1 | 34.83 % | 8.94 % | 6.52 % |

| MSCI All Country World Ex USA Index | 25.35 % | 7.59 % | 5.22 % |

1 | The inception date was August 31, 2023 . Performance information was calculated using the historical performance of Institutional Class shares for the periods prior to August 31, 2023. |

| Fund net assets | $ 109,051,618 |

| Total number of portfolio holdings | 32 |

| Total advisory fees paid | $ 378,368 |

| Portfolio turnover rate | 117 % |

| Information Technology | 24.1 % |

| Consumer Discretionary | 20.3 % |

| Industrials | 19.0 % |

| Communication Services | 10.9 % |

| Financials | 9.4 % |

| Health Care | 6.1 % |

| Consumer Staples | 4.2 % |

| Materials | 3.5 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Common Stocks | |

| Japan | 12.6 % |

| Netherlands | 11.9 % |

| Switzerland | 9.3 % |

| Brazil | 9.2 % |

| Canada | 8.8 % |

| India | 7.5 % |

| Germany | 6.6 % |

| Sweden | 6.6 % |

| Italy | 5.0 % |

| Taiwan | 4.7 % |

| Singapore | 4.1 % |

| Denmark | 3.6 % |

| United Kingdom | 3.0 % |

| Other Countries | 4.6 % |

| Short-Term Investment Fund | 2.8 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

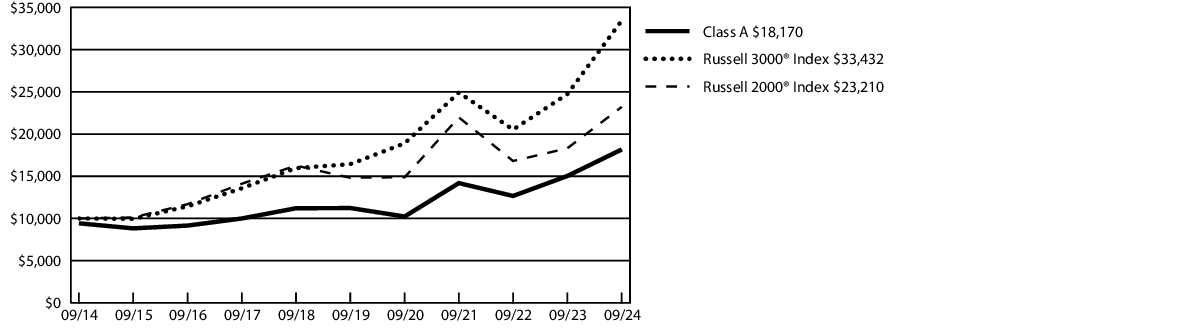

| Class A | $ 139 | 1.16 % |

| Factor | Performance Impact | Observations |

| Information Technology stock performance | Negative | The Fund’s positions in stocks in the Information Technology sector underperformed. |

| Health Care stock performance | Negative | The Fund’s positions in stocks in the Health Care sector underperformed. |

| Style Factor exposure | Negative | The strategy benefitted from its overweight to Growth, Momentum, and residual Volatility; however, this was offset by the portfolio’s underweight to the Quality, Size and Dividend Yield factors. |

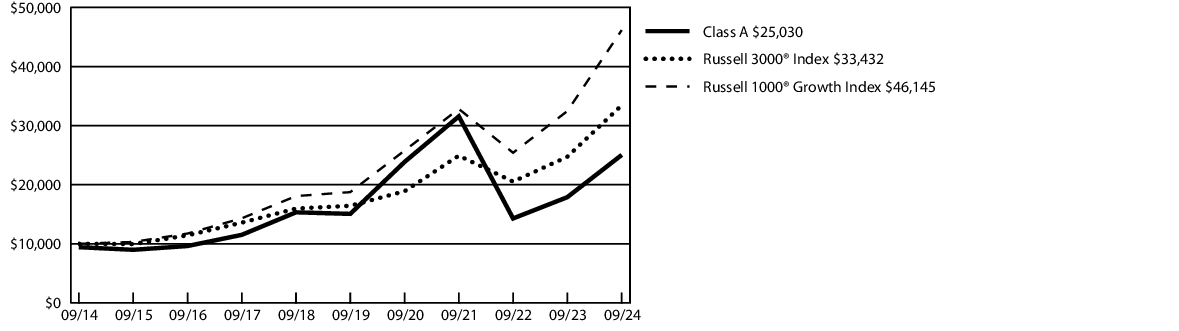

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class A | 32.91 % | 9.57 % | 9.61 % |

| Class A - excluding sales load | 39.94 % | 10.70 % | 10.26 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell 1000 ® Growth Index | 42.19 % | 19.74 % | 16.52 % |

| Fund net assets | $ 2,458,129,714 |

| Total number of portfolio holdings | 31 |

| Total advisory fees paid | $ 16,349,661 |

| Portfolio turnover rate | 37 % |

| Information Technology | 53.4 % |

| Communication Services | 15.6 % |

| Consumer Discretionary | 12.4 % |

| Financials | 10.1 % |

| Health Care | 6.2 % |

| Industrials | 1.6 % |

| Short-Term Investment Fund | 1.0 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ 212 | 1.77 % |

| Factor | Performance Impact | Observations |

| Information Technology stock performance | Negative | The Fund’s positions in stocks in the Information Technology sector underperformed. |

| Health Care stock performance | Negative | The Fund’s positions in stocks in the Health Care sector underperformed. |

| Style Factor exposure | Negative | The strategy benefitted from its overweight to Growth, Momentum, and residual Volatility; however, this was offset by the portfolio’s underweight to the Quality, Size and Dividend Yield factors. |

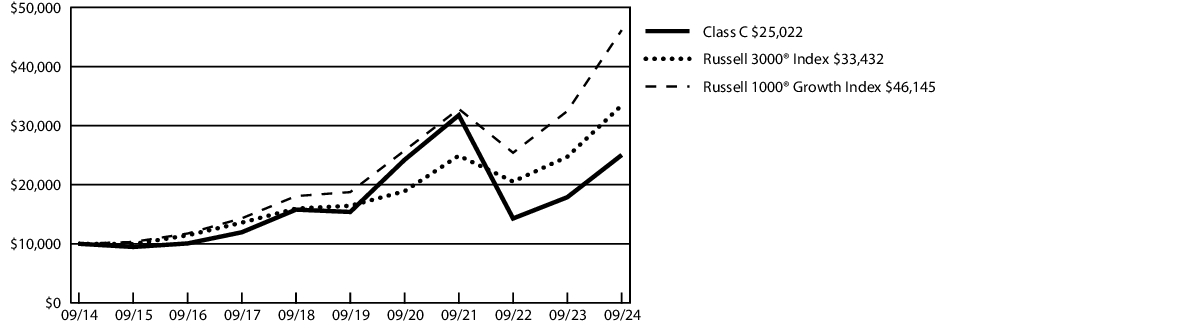

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class C | 38.15 % | 9.97 % | 9.61 % |

| Class C - excluding sales load | 39.15 % | 9.97 % | 9.61 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell 1000 ® Growth Index | 42.19 % | 19.74 % | 16.52 % |

| Fund net assets | $ 2,458,129,714 |

| Total number of portfolio holdings | 31 |

| Total advisory fees paid | $ 16,349,661 |

| Portfolio turnover rate | 37 % |

| Information Technology | 53.4 % |

| Communication Services | 15.6 % |

| Consumer Discretionary | 12.4 % |

| Financials | 10.1 % |

| Health Care | 6.2 % |

| Industrials | 1.6 % |

| Short-Term Investment Fund | 1.0 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $ 108 | 0.90 % |

| Factor | Performance Impact | Observations |

| Information Technology stock performance | Negative | The Fund’s positions in stocks in the Information Technology sector underperformed. |

| Health Care stock performance | Negative | The Fund’s positions in stocks in the Health Care sector underperformed. |

| Style Factor exposure | Negative | The strategy benefitted from its overweight to Growth, Momentum, and residual Volatility; however, this was offset by the portfolio’s underweight to the Quality, Size and Dividend Yield factors. |

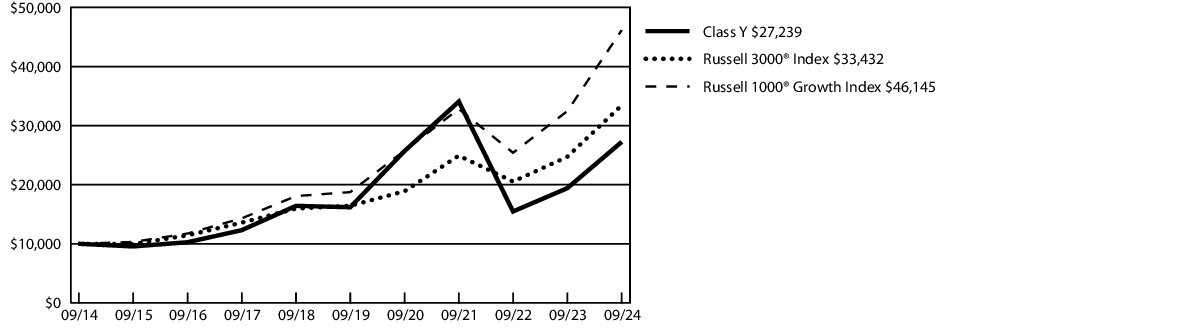

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Y | 40.32 % | 10.98 % | 10.54 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell 1000 ® Growth Index | 42.19 % | 19.74 % | 16.52 % |

| Fund net assets | $ 2,458,129,714 |

| Total number of portfolio holdings | 31 |

| Total advisory fees paid | $ 16,349,661 |

| Portfolio turnover rate | 37 % |

| Information Technology | 53.4 % |

| Communication Services | 15.6 % |

| Consumer Discretionary | 12.4 % |

| Financials | 10.1 % |

| Health Care | 6.2 % |

| Industrials | 1.6 % |

| Short-Term Investment Fund | 1.0 % |

| Other Assets/Liabilities (Net) | (0.3 ) % |

| Total | 100.0 % |

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

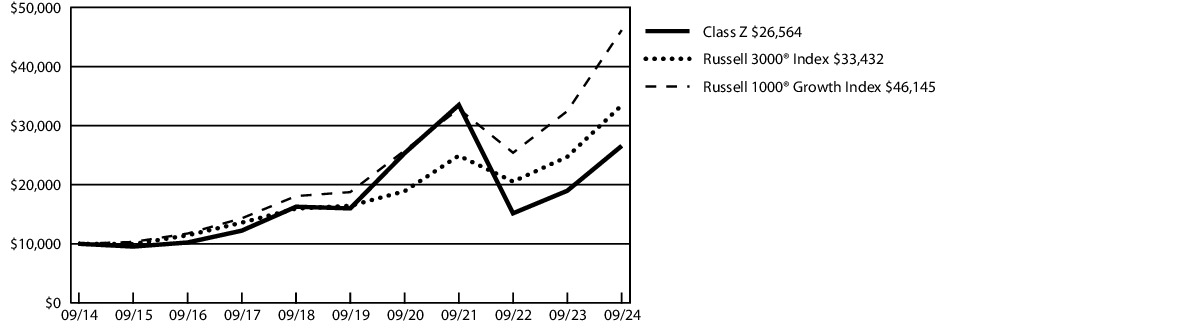

| Class Z | $ 140 | 1.17 % |

| Factor | Performance Impact | Observations |

| Information Technology stock performance | Negative | The Fund’s positions in stocks in the Information Technology sector underperformed. |

| Health Care stock performance | Negative | The Fund’s positions in stocks in the Health Care sector underperformed. |

| Style Factor exposure | Negative | The strategy benefitted from its overweight to Growth, Momentum, and residual Volatility; however, this was offset by the portfolio’s underweight to the Quality, Size and Dividend Yield factors. |

AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class Z | 40.00 % | 10.68 % | 10.26 % |

| Russell 3000 ® Index | 35.19 % | 15.26 % | 12.83 % |

| Russell 1000 ® Growth Index | 42.19 % | 19.74 % | 16.52 % |

| Fund net assets | $ 2,458,129,714 |

| Total number of portfolio holdings | 31 |

| Total advisory fees paid | $ 16,349,661 |

| Portfolio turnover rate | 37 % |

| Information Technology | 53.4 % |

| Communication Services | 15.6 % |

| Consumer Discretionary | 12.4 % |

| Financials | 10.1 % |

| Health Care | 6.2 % |

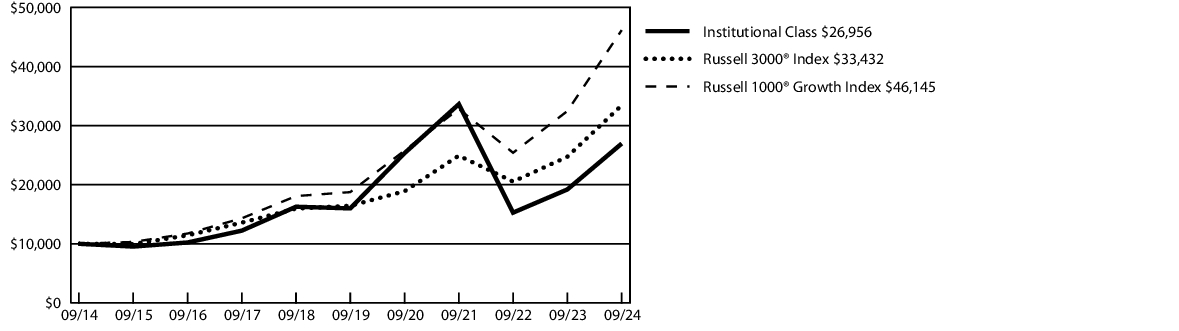

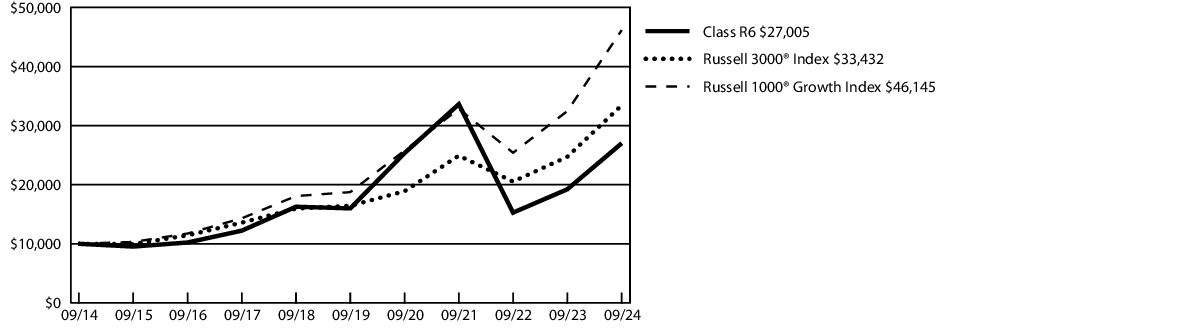

| Industrials | 1.6 % |