Forward Looking Statements This presentation contains comments or information that constitute forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of significant risks and uncertainties, which could cause Southwest Bancorp, Inc. (“OKSB”), First Commercial Bancshares, Inc. (“First Commercial”) or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such forward looking statements. Forward looking statements speak only as of the date they are made and neither OKSB nor First Commercial intend, or undertake any duty to update or revise any forward looking statements contained in this presentation whether as a result of differences in actual results, changes in assumptions, or changes in other factors affecting said factors, except as required by law. These forward-looking statements include, but are not limited to, statements about (i) the expected benefits of the transaction between OKSB and First Commercial, including future financial and operating results, accretion and earn-back, cost savings, enhanced revenues, long term growth, and the expected market position of the combined company that may be realized from the transaction, and (ii) OKSB’s and First Commercial’s plans, objectives, expectations and intentions and all other statements contained in this presentation that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “will,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “positioned,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. Management's determination of the provision and allowance for loan losses, the carrying value of acquired loans, goodwill, and the fair value of investment securities involve judgments that are inherently forward-looking. These statements are based upon the current beliefs and expectations of OKSB’s and First Commercial’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those indicated or implied in the forward-looking statements. There is no assurance that the due diligence process would identify all risks associated with the transaction and no assurance that the conditions to closing will be satisfied. Additional information concerning risks is contained in OKSB’s most recently filed Annual Report on Form 10-K, most recent Quarterly Report on Form 10-Q, recent Current Reports on Form 8-K and other SEC filings.

Forward Looking Statements This presentation contains comments or information that constitute forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of significant risks and uncertainties, which could cause Southwest Bancorp, Inc. (“OKSB”), First Commercial Bancshares, Inc. (“First Commercial”) or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such forward looking statements. Forward looking statements speak only as of the date they are made and neither OKSB nor First Commercial intend, or undertake any duty to update or revise any forward looking statements contained in this presentation whether as a result of differences in actual results, changes in assumptions, or changes in other factors affecting said factors, except as required by law. These forward-looking statements include, but are not limited to, statements about (i) the expected benefits of the transaction between OKSB and First Commercial, including future financial and operating results, accretion and earn-back, cost savings, enhanced revenues, long term growth, and the expected market position of the combined company that may be realized from the transaction, and (ii) OKSB’s and First Commercial’s plans, objectives, expectations and intentions and all other statements contained in this presentation that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “will,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “positioned,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. Management's determination of the provision and allowance for loan losses, the carrying value of acquired loans, goodwill, and the fair value of investment securities involve judgments that are inherently forward-looking. These statements are based upon the current beliefs and expectations of OKSB’s and First Commercial’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those indicated or implied in the forward-looking statements. There is no assurance that the due diligence process would identify all risks associated with the transaction and no assurance that the conditions to closing will be satisfied. Additional information concerning risks is contained in OKSB’s most recently filed Annual Report on Form 10-K, most recent Quarterly Report on Form 10-Q, recent Current Reports on Form 8-K and other SEC filings.

Investor Information Southwest Bancorp, Inc. (“OKSB”) will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that will include a Prospectus of OKSB, Proxy Statement of First Commercial, as well as other relevant documents concerning the proposed transaction. Shareholders are advised to read, when available, the Registration Statement, Proxy Statement, and Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information relating to the proposed transaction. When filed, a free copy of these materials may be obtained on the SEC’s website at http://www.sec.gov. Alternatively, when available, these documents can be obtained free of charge from OKSB’s website at www.oksb.com under the tab “Investors” and then under the tab “SEC Filings”. OKSB, certain of its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of First Commercial in connection with the proposed transaction under the rules of the SEC. Information about these participants is set forth in the proxy statement for OKSB’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on April 22, 2015. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the definitive proxy statement and other relevant materials, when available, to be filed by OKSB with the SEC in conjunction with the proposed transaction. Free copies of this document may be obtained as described in the preceding paragraph.

Investor Information Southwest Bancorp, Inc. (“OKSB”) will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that will include a Prospectus of OKSB, Proxy Statement of First Commercial, as well as other relevant documents concerning the proposed transaction. Shareholders are advised to read, when available, the Registration Statement, Proxy Statement, and Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information relating to the proposed transaction. When filed, a free copy of these materials may be obtained on the SEC’s website at http://www.sec.gov. Alternatively, when available, these documents can be obtained free of charge from OKSB’s website at www.oksb.com under the tab “Investors” and then under the tab “SEC Filings”. OKSB, certain of its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of First Commercial in connection with the proposed transaction under the rules of the SEC. Information about these participants is set forth in the proxy statement for OKSB’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on April 22, 2015. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the definitive proxy statement and other relevant materials, when available, to be filed by OKSB with the SEC in conjunction with the proposed transaction. Free copies of this document may be obtained as described in the preceding paragraph.

Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs

Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs

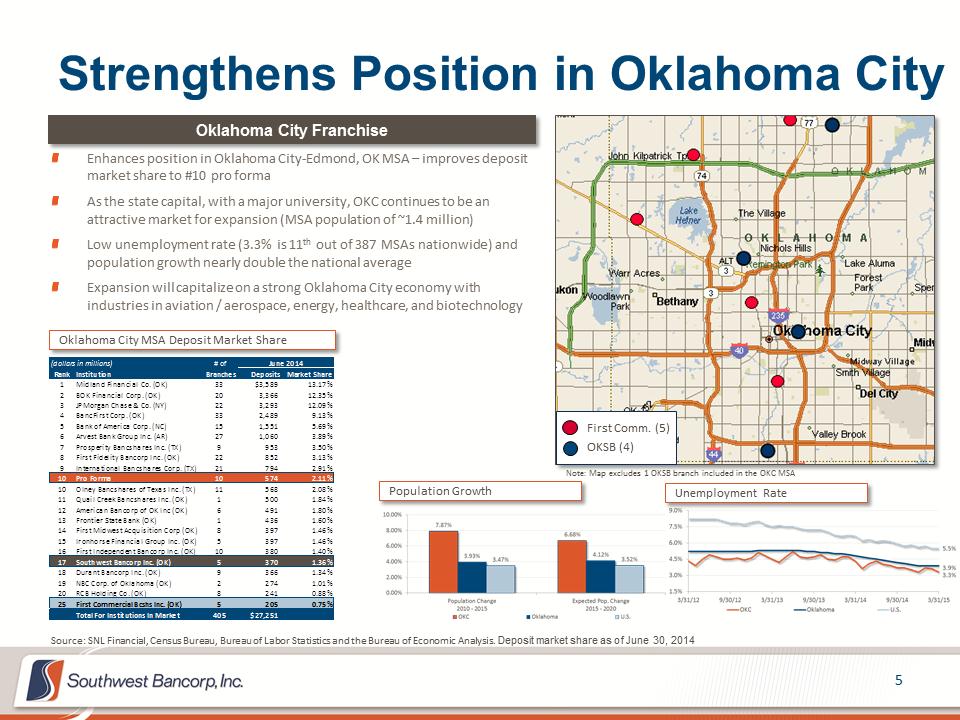

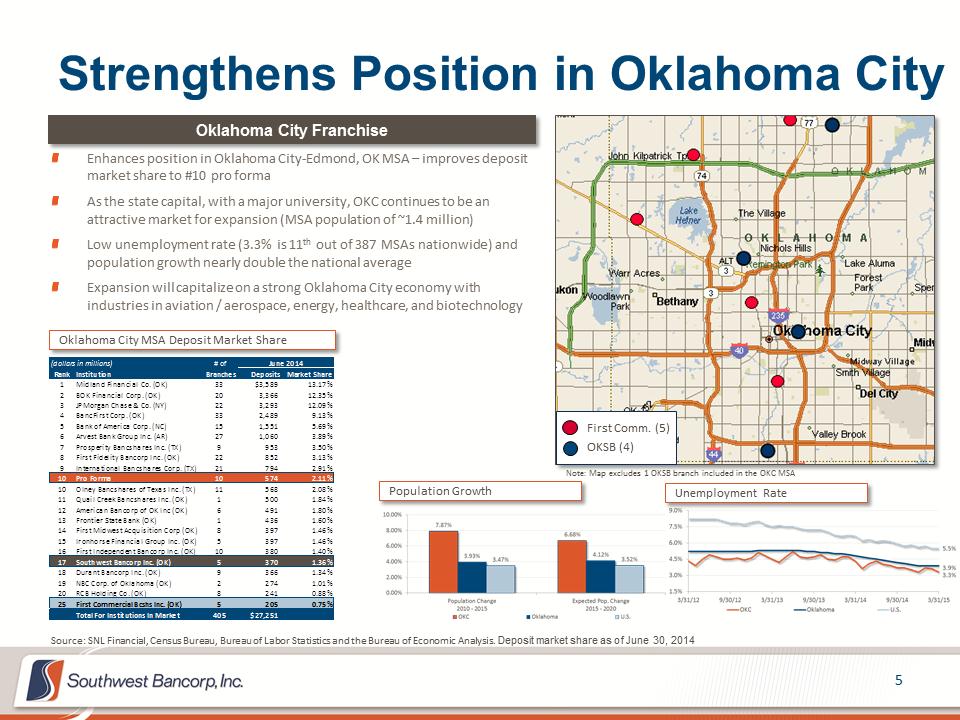

Strengthens Position in Oklahoma City Enhances position in Oklahoma City-Edmond, OK MSA –improves deposit market share to #10 pro forma As the state capital, with a major university, OKC continues to be an attractive market for expansion (MSA population of ~1.4 million) Low unemployment rate (3.3% is 11th out of 387 MSAs nationwide) and population growth nearly double the national average Expansion will capitalize on a strong Oklahoma City economy with industries in aviation / aerospace, energy, healthcare, and biotechnology Oklahoma City Franchise Unemployment Rate Population Growth (dollars in millions)# ofJune 2014RankInstitutionBranches Deposits Market Share1Midland Financial Co. (OK)33$3,58913.17%2BOK Financial Corp. (OK)203,36612.35%3JPMorgan Chase & Co. (NY)223,29312.09%4BancFirst Corp. (OK)332,4899.13%5Bank of America Corp. (NC)151,5515.69%6Arvest Bank Group Inc. (AR)271,0603.89%7Prosperity Bancshares Inc. (TX)99533.50%8First Fidelity Bancorp Inc. (OK)228523.13%9International Bancshares Corp. (TX)217942.91%10Pro Forma105742.11%10Olney Bancshares of Texas Inc. (TX)115682.08%11Quail Creek Bancshares Inc. (OK)15001.84%12American Bancorp of OK Inc (OK)64911.80%13Frontier State Bank (OK)14361.60%14First Midwest Acquisition Corp (OK)83971.46%15Ironhorse Financial Group Inc. (OK)53971.46%16First Independent Bancorp Inc. (OK)103801.40%17Southwest Bancorp Inc. (OK)53701.36%18Durant Bancorp Inc. (OK)93661.34%19NBC Corp. of Oklahoma (OK)22741.01%20RCB Holding Co. (OK)82410.88%25First Commercial Bcshs Inc. (OK)52050.75%Total For Institutions In Market405$27,251First Comm. (5) OKSB (4) Note: Map excludes 1 OKSB branch included in the OKC MSA Oklahoma City MSA Deposit Market Share Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis. Deposit market share as of June 30, 2014 5

Strengthens Position in Oklahoma City Enhances position in Oklahoma City-Edmond, OK MSA –improves deposit market share to #10 pro forma As the state capital, with a major university, OKC continues to be an attractive market for expansion (MSA population of ~1.4 million) Low unemployment rate (3.3% is 11th out of 387 MSAs nationwide) and population growth nearly double the national average Expansion will capitalize on a strong Oklahoma City economy with industries in aviation / aerospace, energy, healthcare, and biotechnology Oklahoma City Franchise Unemployment Rate Population Growth (dollars in millions)# ofJune 2014RankInstitutionBranches Deposits Market Share1Midland Financial Co. (OK)33$3,58913.17%2BOK Financial Corp. (OK)203,36612.35%3JPMorgan Chase & Co. (NY)223,29312.09%4BancFirst Corp. (OK)332,4899.13%5Bank of America Corp. (NC)151,5515.69%6Arvest Bank Group Inc. (AR)271,0603.89%7Prosperity Bancshares Inc. (TX)99533.50%8First Fidelity Bancorp Inc. (OK)228523.13%9International Bancshares Corp. (TX)217942.91%10Pro Forma105742.11%10Olney Bancshares of Texas Inc. (TX)115682.08%11Quail Creek Bancshares Inc. (OK)15001.84%12American Bancorp of OK Inc (OK)64911.80%13Frontier State Bank (OK)14361.60%14First Midwest Acquisition Corp (OK)83971.46%15Ironhorse Financial Group Inc. (OK)53971.46%16First Independent Bancorp Inc. (OK)103801.40%17Southwest Bancorp Inc. (OK)53701.36%18Durant Bancorp Inc. (OK)93661.34%19NBC Corp. of Oklahoma (OK)22741.01%20RCB Holding Co. (OK)82410.88%25First Commercial Bcshs Inc. (OK)52050.75%Total For Institutions In Market405$27,251First Comm. (5) OKSB (4) Note: Map excludes 1 OKSB branch included in the OKC MSA Oklahoma City MSA Deposit Market Share Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis. Deposit market share as of June 30, 2014 5

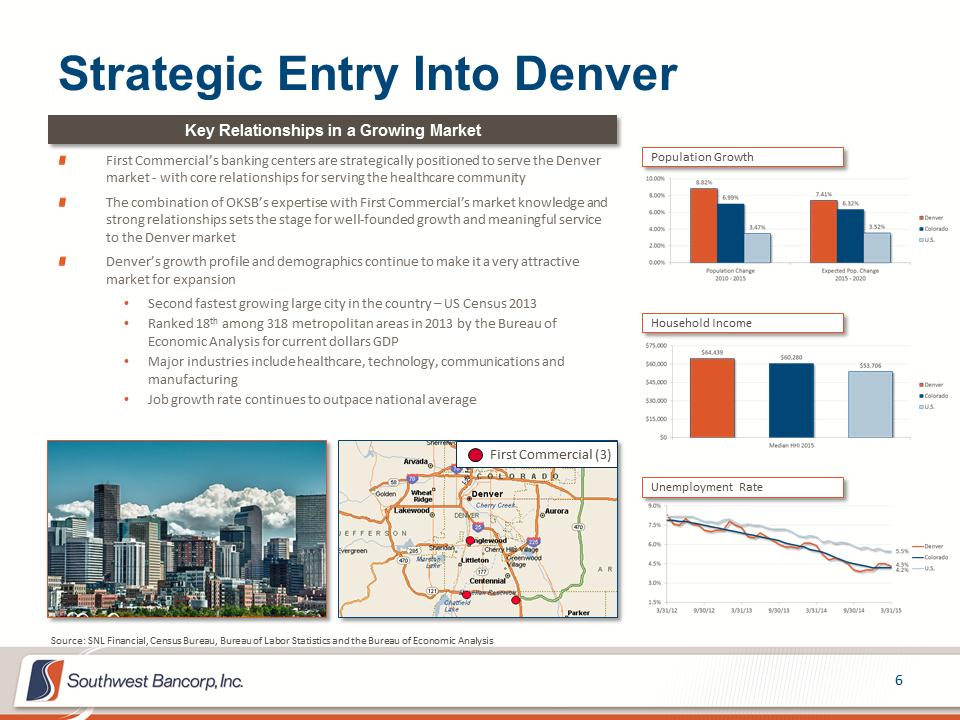

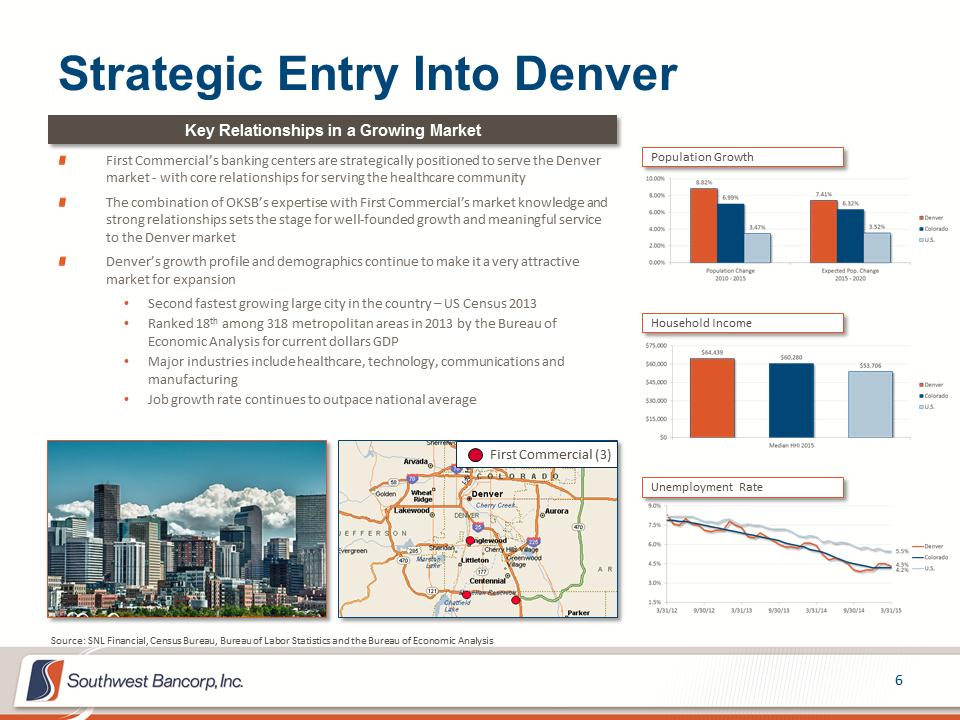

Strategic Entry Into Denver Key Relationships in a Growing Market First Commercial’s banking centers are strategically positioned to serve the Denver market -with core relationships for serving the healthcare community The combination of OKSB’s expertise with First Commercial’s market knowledge and strong relationships sets the stage for well-founded growth and meaningful service to the Denver market Denver’s growth profile and demographics continue to make it a very attractive market for expansion • Second fastest growing large city in the country – US Census 2013 • Ranked 18th among 318 metropolitan areas in 2013 by the Bureau of Economic Analysis for current dollars GDP • Major industries include healthcare, technology, communications and manufacturing • Job growth rate continues to outpace national average First Commercial (3) Population Growth Unemployment Rate Household Income Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis

Strategic Entry Into Denver Key Relationships in a Growing Market First Commercial’s banking centers are strategically positioned to serve the Denver market -with core relationships for serving the healthcare community The combination of OKSB’s expertise with First Commercial’s market knowledge and strong relationships sets the stage for well-founded growth and meaningful service to the Denver market Denver’s growth profile and demographics continue to make it a very attractive market for expansion • Second fastest growing large city in the country – US Census 2013 • Ranked 18th among 318 metropolitan areas in 2013 by the Bureau of Economic Analysis for current dollars GDP • Major industries include healthcare, technology, communications and manufacturing • Job growth rate continues to outpace national average First Commercial (3) Population Growth Unemployment Rate Household Income Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis

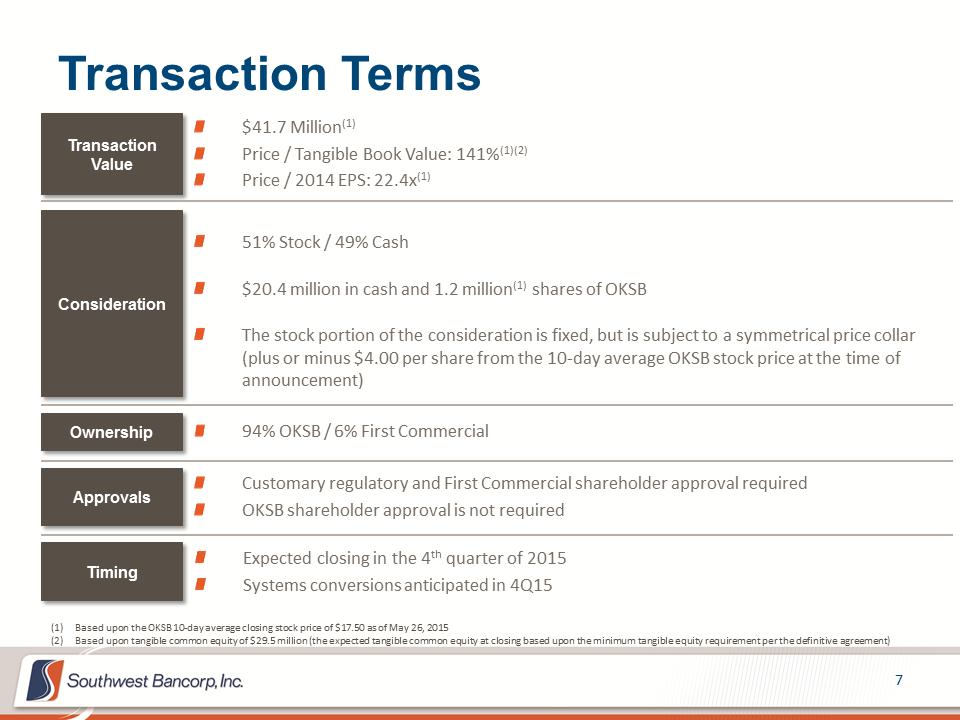

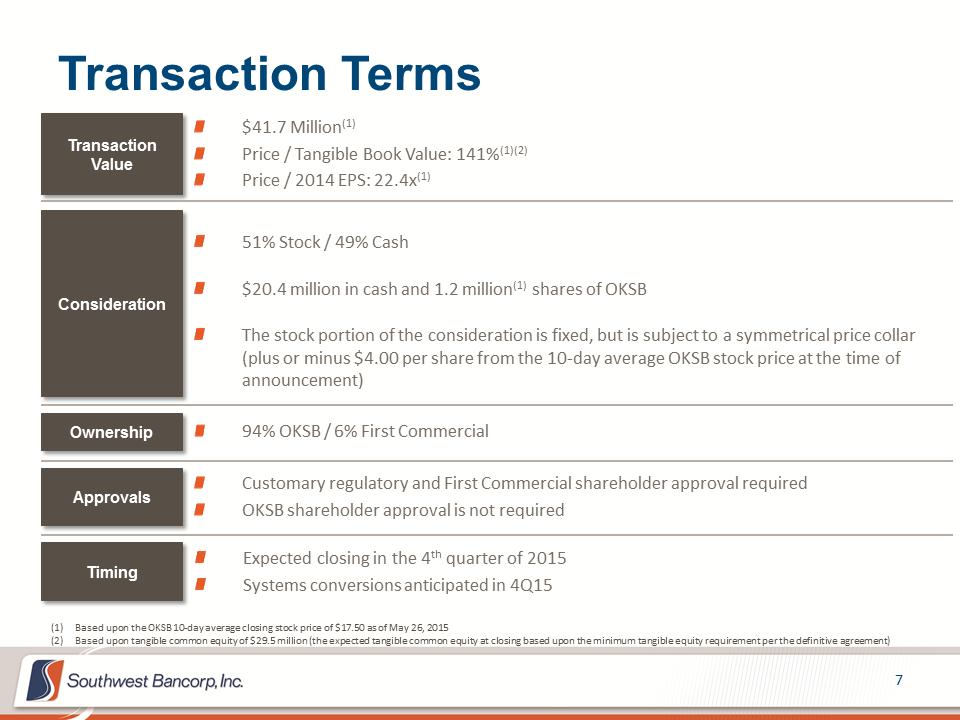

Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement) Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement)

Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement) Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement)

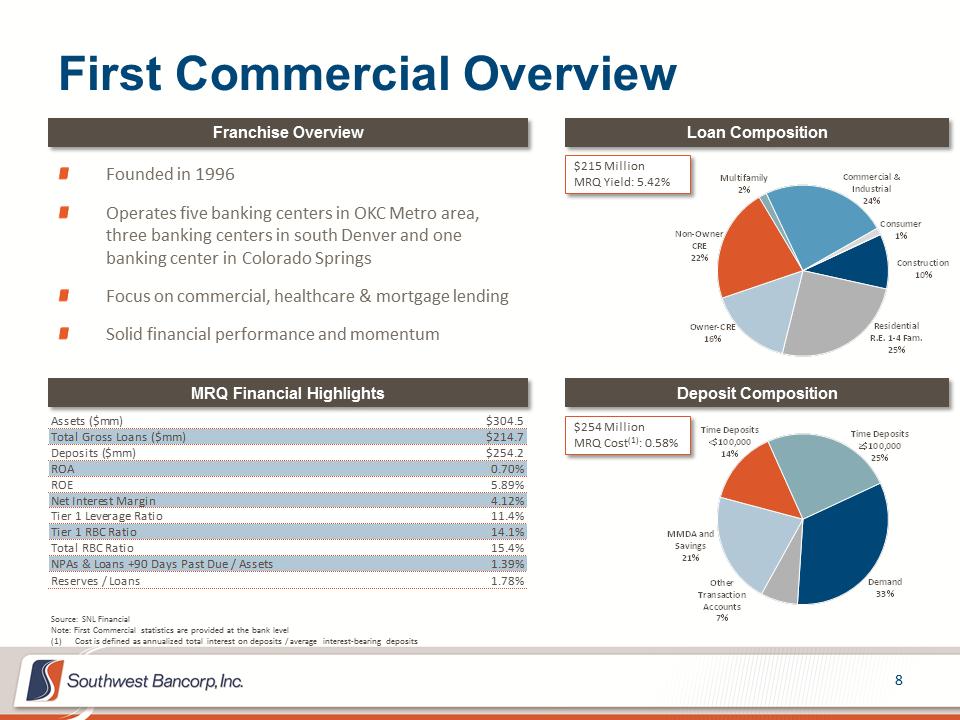

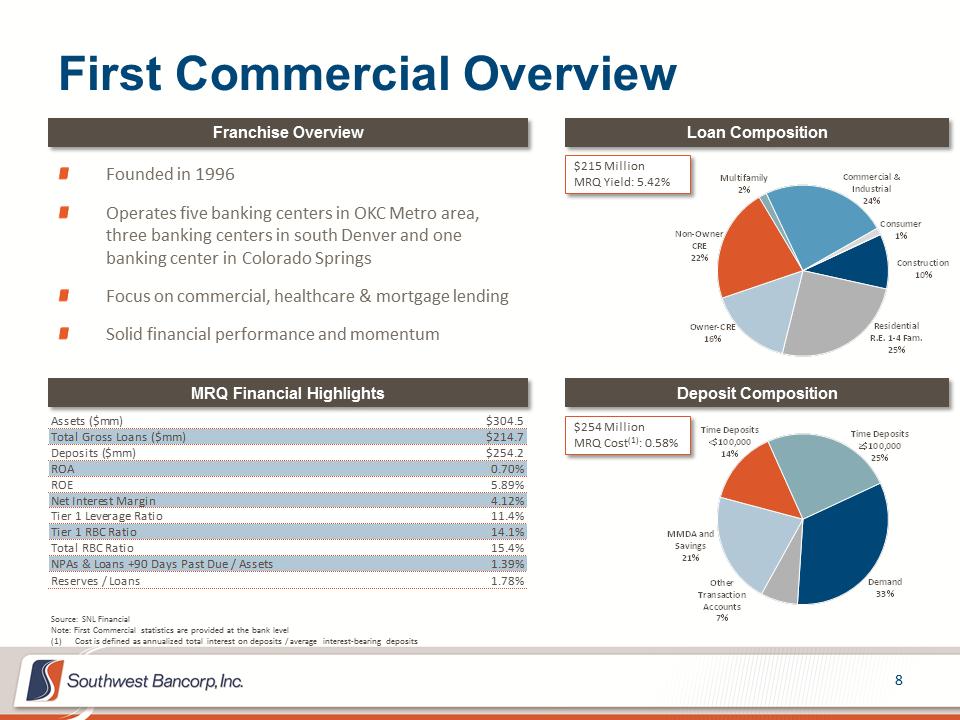

First Commercial Overview Franchise Overview Founded in 1996 Operates five banking centers in OKC Metro area, three banking centers in south Denver and one banking center in Colorado Springs Focus on commercial, healthcare & mortgage lending Solid financial performance and momentum MRQ Financial Highlights Assets ($mm)$304.5Total Gross Loans ($mm)$214.7Deposits ($mm)$254.2ROA0.70%ROE5.89%Net Interest Margin4.12%Tier 1 Leverage Ratio11.4%Tier 1 RBC Ratio14.1%Total RBC Ratio15.4%NPAs & Loans +90 Days Past Due / Assets1.39%Reserves / Loans1.78%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%8 Loan Composition Deposit Composition $215 Million MRQ Yield: 5.42% $254 Million MRQ Cost(1): 0.58% Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Cost is defined as annualized total interest on deposits / average interest-bearing deposits

First Commercial Overview Franchise Overview Founded in 1996 Operates five banking centers in OKC Metro area, three banking centers in south Denver and one banking center in Colorado Springs Focus on commercial, healthcare & mortgage lending Solid financial performance and momentum MRQ Financial Highlights Assets ($mm)$304.5Total Gross Loans ($mm)$214.7Deposits ($mm)$254.2ROA0.70%ROE5.89%Net Interest Margin4.12%Tier 1 Leverage Ratio11.4%Tier 1 RBC Ratio14.1%Total RBC Ratio15.4%NPAs & Loans +90 Days Past Due / Assets1.39%Reserves / Loans1.78%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%8 Loan Composition Deposit Composition $215 Million MRQ Yield: 5.42% $254 Million MRQ Cost(1): 0.58% Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Cost is defined as annualized total interest on deposits / average interest-bearing deposits

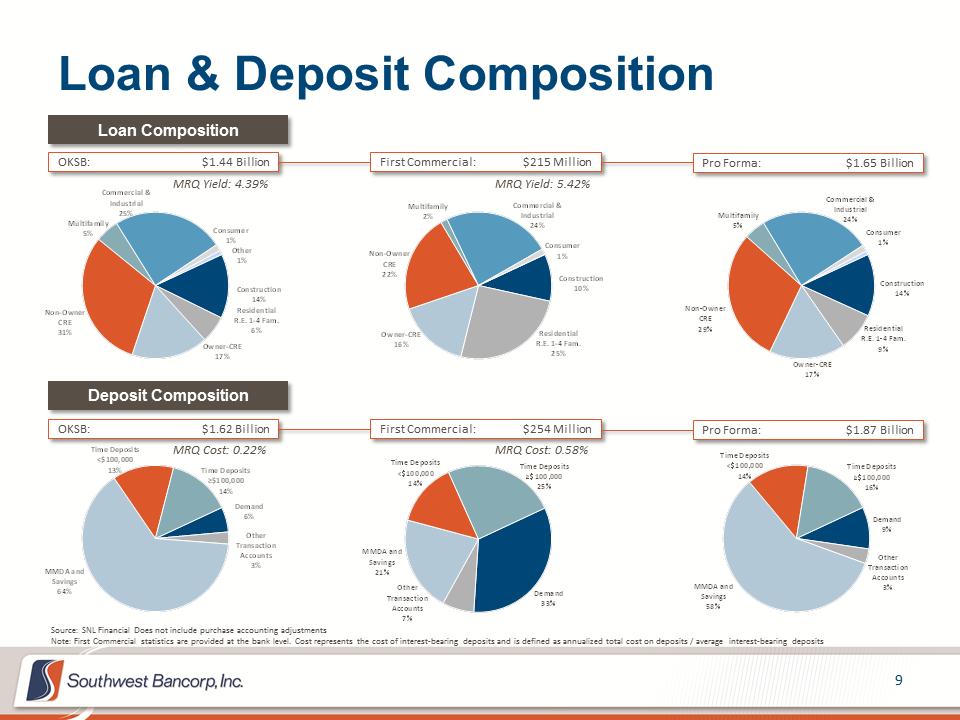

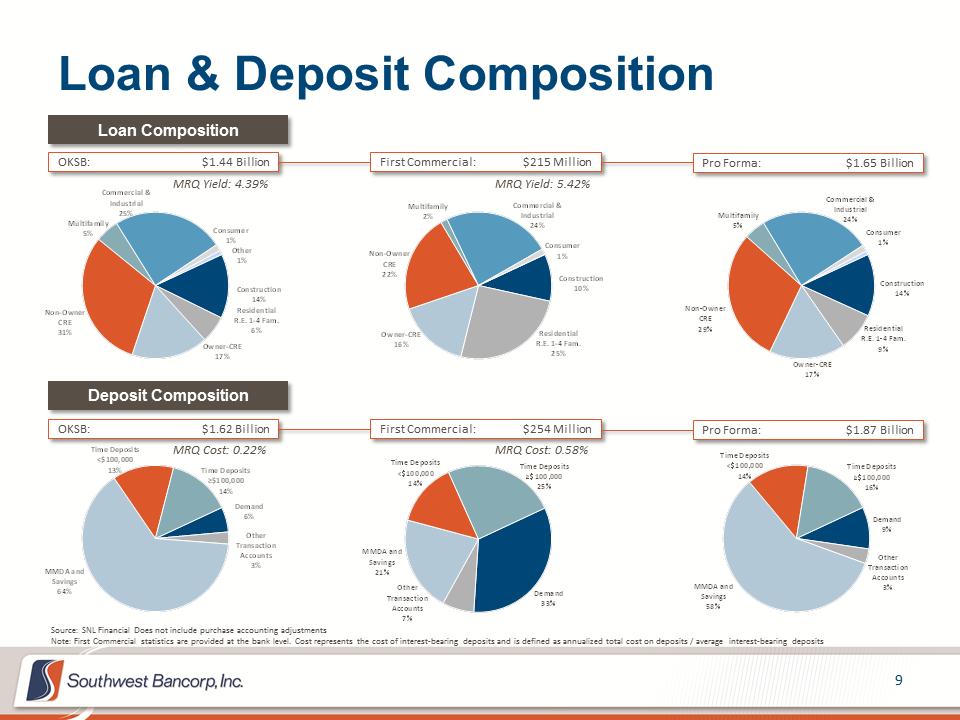

Loan & Deposit Composition Demand9%Other Transaction Accounts3%MMDA and Savings58%Time Deposits <$100,00014%Time Deposits =$100,00016%Construction14%Residential R.E. 1-4 Fam.9%Owner-CRE17%Non-Owner CRE29%Multifamily5%Commercial & Industrial24%Consumer1%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%Demand6%Other Transaction Accounts3%MMDA and Savings64%Time Deposits <$100,00013%Time Deposits =$100,00014%Construction14%Residential R.E. 1-4 Fam.6%Owner-CRE17%Non-Owner CRE31%Multifamily5%Commercial & Industrial25%Consumer1%Other1%9 Loan Composition Deposit Composition Source: SNL Financial Does not include purchase accounting adjustments Note: First Commercial statistics are provided at the bank level. Cost represents the cost of interest-bearing deposits and is defined as annualized total cost on deposits / average interest-bearing deposits OKSB: $1.44 Billion OKSB: $1.62 Billion First Commercial: $254 Million First Commercial: $215 Million Pro Forma: $1.87 Billion Pro Forma: $1.65 Billion MRQ Yield: 4.39% MRQ Yield: 5.42% MRQ Cost: 0.22% MRQ Cost: 0.58%

Loan & Deposit Composition Demand9%Other Transaction Accounts3%MMDA and Savings58%Time Deposits <$100,00014%Time Deposits =$100,00016%Construction14%Residential R.E. 1-4 Fam.9%Owner-CRE17%Non-Owner CRE29%Multifamily5%Commercial & Industrial24%Consumer1%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%Demand6%Other Transaction Accounts3%MMDA and Savings64%Time Deposits <$100,00013%Time Deposits =$100,00014%Construction14%Residential R.E. 1-4 Fam.6%Owner-CRE17%Non-Owner CRE31%Multifamily5%Commercial & Industrial25%Consumer1%Other1%9 Loan Composition Deposit Composition Source: SNL Financial Does not include purchase accounting adjustments Note: First Commercial statistics are provided at the bank level. Cost represents the cost of interest-bearing deposits and is defined as annualized total cost on deposits / average interest-bearing deposits OKSB: $1.44 Billion OKSB: $1.62 Billion First Commercial: $254 Million First Commercial: $215 Million Pro Forma: $1.87 Billion Pro Forma: $1.65 Billion MRQ Yield: 4.39% MRQ Yield: 5.42% MRQ Cost: 0.22% MRQ Cost: 0.58%

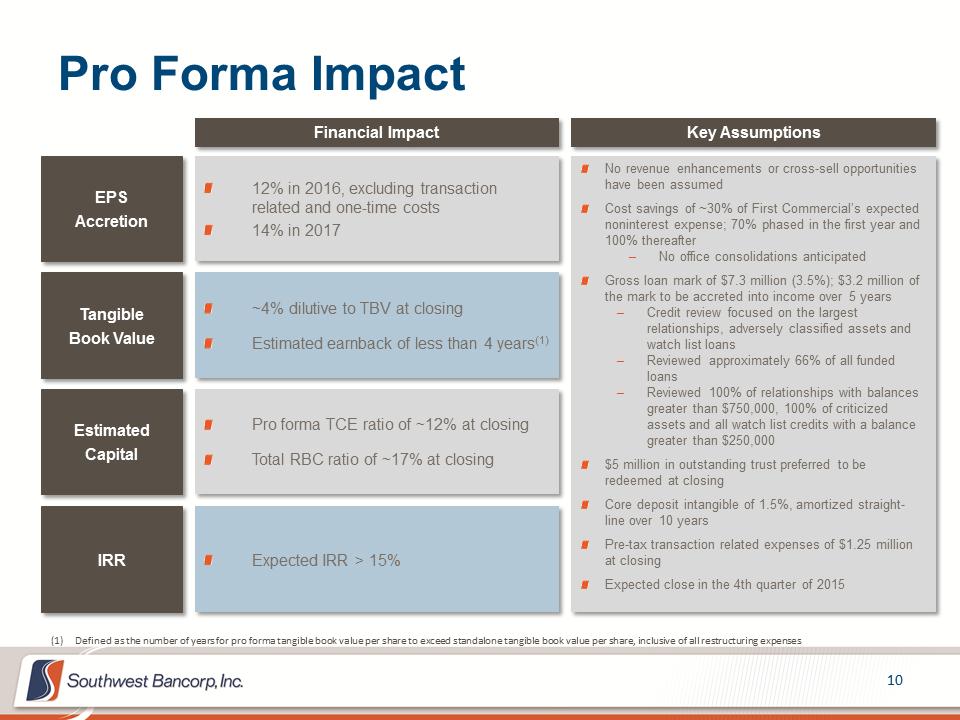

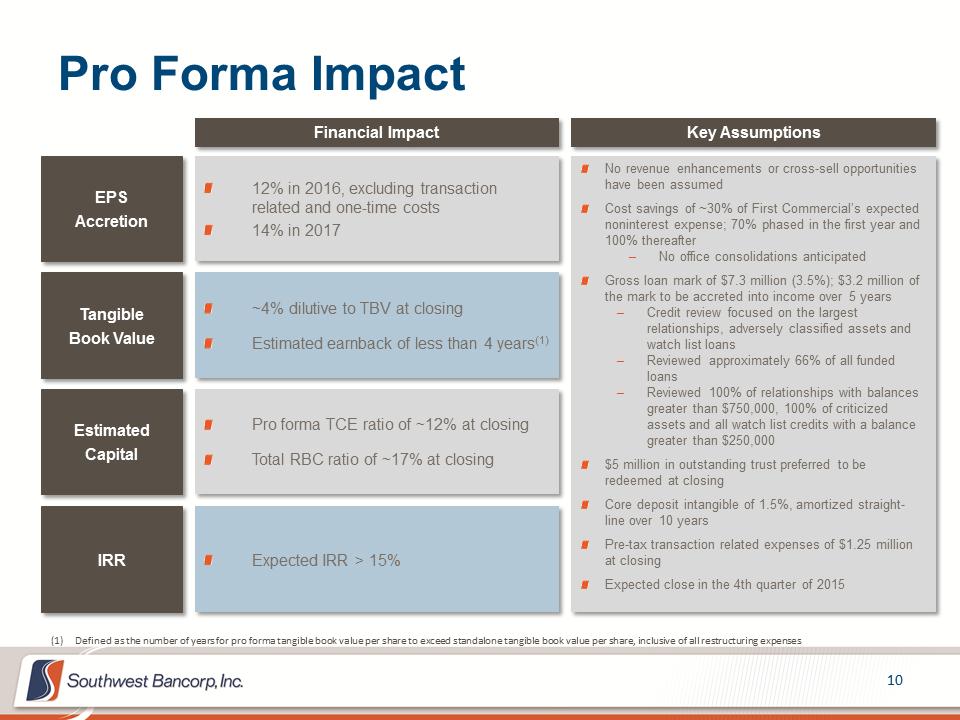

Pro Forma Impact EPS Accretion Tangible Book Value Estimated Capital IRR ~4% dilutive to TBV at closing Estimated earnback of less than 4 years(1) Expected IRR > 15% 10 12% in 2016, excluding transaction related and one-time costs 14% in 2017 Pro forma TCE ratio of ~12% at closing Total RBC ratio of ~17% at closing No revenue enhancements or cross-sell opportunities have been assumed Cost savings of ~30% of First Commercial’s expected noninterest expense; 70% phased in the first year and 100% thereafter – No office consolidations anticipated Gross loan mark of $7.3 million (3.5%); $3.2 million of the mark to be accreted into income over 5 years – Credit review focused on the largest relationships, adversely classified assets and watch list loans – Reviewed approximately 66% of all funded loans – Reviewed 100% of relationships with balances greater than $750,000, 100% of criticized assets and all watch list credits with a balance greater than $250,000 $5 million in outstanding trust preferred to be redeemed at closing Core deposit intangible of 1.5%, amortized straight-line over 10 years Pre-tax transaction related expenses of $1.25 million at closing Expected close in the 4th quarter of 2015 Financial Impact Key Assumptions (1) Defined as the number of years for pro forma tangible book value per share to exceed standalone tangible book value per share, inclusive of all restructuring expenses

Pro Forma Impact EPS Accretion Tangible Book Value Estimated Capital IRR ~4% dilutive to TBV at closing Estimated earnback of less than 4 years(1) Expected IRR > 15% 10 12% in 2016, excluding transaction related and one-time costs 14% in 2017 Pro forma TCE ratio of ~12% at closing Total RBC ratio of ~17% at closing No revenue enhancements or cross-sell opportunities have been assumed Cost savings of ~30% of First Commercial’s expected noninterest expense; 70% phased in the first year and 100% thereafter – No office consolidations anticipated Gross loan mark of $7.3 million (3.5%); $3.2 million of the mark to be accreted into income over 5 years – Credit review focused on the largest relationships, adversely classified assets and watch list loans – Reviewed approximately 66% of all funded loans – Reviewed 100% of relationships with balances greater than $750,000, 100% of criticized assets and all watch list credits with a balance greater than $250,000 $5 million in outstanding trust preferred to be redeemed at closing Core deposit intangible of 1.5%, amortized straight-line over 10 years Pre-tax transaction related expenses of $1.25 million at closing Expected close in the 4th quarter of 2015 Financial Impact Key Assumptions (1) Defined as the number of years for pro forma tangible book value per share to exceed standalone tangible book value per share, inclusive of all restructuring expenses

Conclusion Expands Oklahoma City market and provides attractive entry into the Colorado market Expected to be immediately and significantly accretive to earnings Conservative merger assumptions, identified and achievable future cost savings Leverages strong capital position Primarily in-market transaction with limited execution risk Transaction will enhance OKSB’s near-term and long-term franchise value

Conclusion Expands Oklahoma City market and provides attractive entry into the Colorado market Expected to be immediately and significantly accretive to earnings Conservative merger assumptions, identified and achievable future cost savings Leverages strong capital position Primarily in-market transaction with limited execution risk Transaction will enhance OKSB’s near-term and long-term franchise value

APPENDIX

APPENDIX

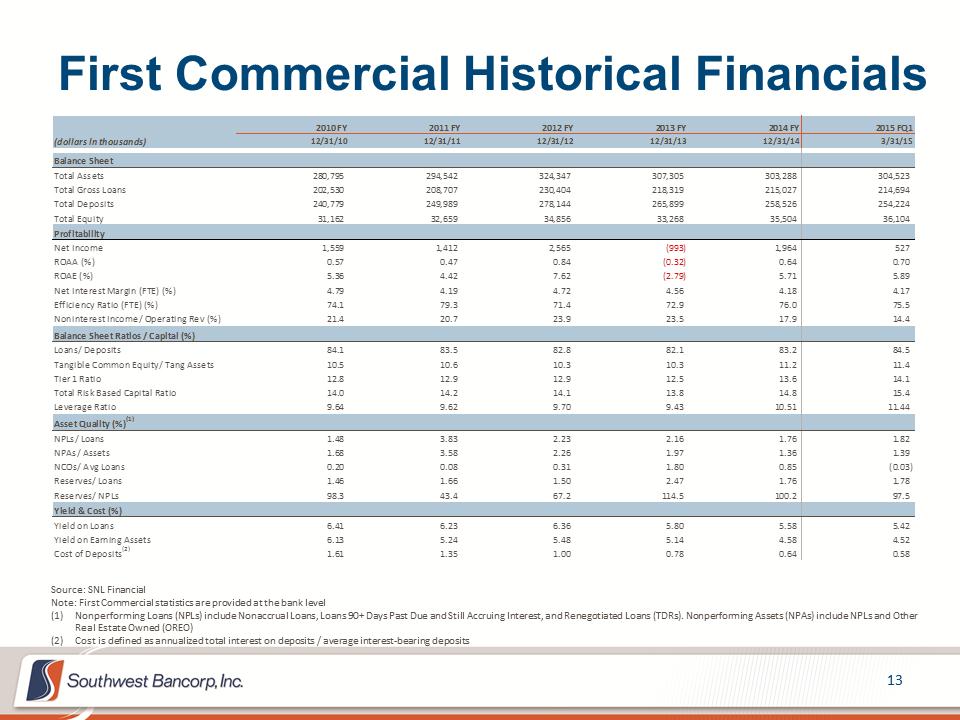

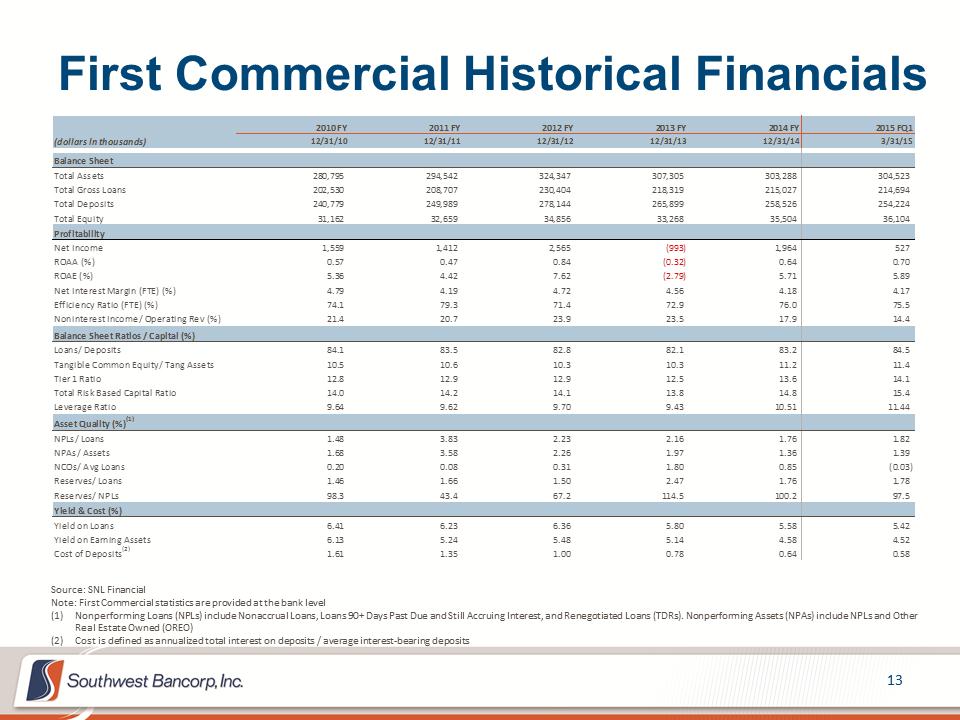

First Commercial Historical Financials 2010 FY2011 FY2012 FY2013 FY2014 dollars in thousands)12/31/1012/31/1112/31/1212/31/1312/SheetTotal Assets280,795294,542324,347307,305303,288304,523Total Gross Loans202,530208,707230,404218,319215,027214,694Total Deposits240,779249,989278,144265,899258,526254,224Total Equity31,16232,65934,85633,26835,50436,104ProfitabilityNet Income1,5591,4122,565(993)(%)0.570.470.84(0.32)(%)5.364.427.62(2.79)Interest Margin (FTE) (%)4.794.194.724.564.184.17Efficiency Ratio (FTE) (%)74.179.371.472.976.075.5Noninterest Income/ Operating Rev (%)21.420.723.923.517.914.4Balance Sheet Ratios / Capital (%)Loans/ Deposits84.183.582.882.183.284.5Tangible Common Equity/ Tang Assets10.510.610.310.311.211.4Tier 1 Ratio12.812.912.912.513.614.1Total Risk Based Capital Ratio14.014.214.113.814.815.4Leverage Ratio9.649.629.709.4310.5111.44Asset Quality (%)(1)NPLs/ Loans1.483.832.232.161.761.82NPAs/ Assets1.683.582.261.971.361.39NCOs/ Avg Loans0.200.080.311.800.85(Reserves/ Loans1.461.661.502.471.761.78Reserves/ NPLs98.343.467.2114.5100.297.5294834653460539537953814Yield & Cost (%)Yield on Loans6.416.236.365.805.585.42Yield on Earning Assets6.135.245.485.144.584.52Cost of Deposits(2)1.611.351.000.780.640.58Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Nonperforming Loans (NPLs) include Nonaccrual Loans, Loans 90+ Days Past Due and Still Accruing Interest, and Renegotiated Loans (TDRs). Nonperforming Assets (NPAs) include NPLs and Other Real Estate Owned (OREO) (2) Cost is defined as annualized total interest on deposits / average interest-bearing deposits

First Commercial Historical Financials 2010 FY2011 FY2012 FY2013 FY2014 dollars in thousands)12/31/1012/31/1112/31/1212/31/1312/SheetTotal Assets280,795294,542324,347307,305303,288304,523Total Gross Loans202,530208,707230,404218,319215,027214,694Total Deposits240,779249,989278,144265,899258,526254,224Total Equity31,16232,65934,85633,26835,50436,104ProfitabilityNet Income1,5591,4122,565(993)(%)0.570.470.84(0.32)(%)5.364.427.62(2.79)Interest Margin (FTE) (%)4.794.194.724.564.184.17Efficiency Ratio (FTE) (%)74.179.371.472.976.075.5Noninterest Income/ Operating Rev (%)21.420.723.923.517.914.4Balance Sheet Ratios / Capital (%)Loans/ Deposits84.183.582.882.183.284.5Tangible Common Equity/ Tang Assets10.510.610.310.311.211.4Tier 1 Ratio12.812.912.912.513.614.1Total Risk Based Capital Ratio14.014.214.113.814.815.4Leverage Ratio9.649.629.709.4310.5111.44Asset Quality (%)(1)NPLs/ Loans1.483.832.232.161.761.82NPAs/ Assets1.683.582.261.971.361.39NCOs/ Avg Loans0.200.080.311.800.85(Reserves/ Loans1.461.661.502.471.761.78Reserves/ NPLs98.343.467.2114.5100.297.5294834653460539537953814Yield & Cost (%)Yield on Loans6.416.236.365.805.585.42Yield on Earning Assets6.135.245.485.144.584.52Cost of Deposits(2)1.611.351.000.780.640.58Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Nonperforming Loans (NPLs) include Nonaccrual Loans, Loans 90+ Days Past Due and Still Accruing Interest, and Renegotiated Loans (TDRs). Nonperforming Assets (NPAs) include NPLs and Other Real Estate Owned (OREO) (2) Cost is defined as annualized total interest on deposits / average interest-bearing deposits

Bank Strong Bank Safe Bank Successfully

Bank Strong Bank Safe Bank Successfully

Forward Looking Statements This presentation contains comments or information that constitute forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of significant risks and uncertainties, which could cause Southwest Bancorp, Inc. (“OKSB”), First Commercial Bancshares, Inc. (“First Commercial”) or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such forward looking statements. Forward looking statements speak only as of the date they are made and neither OKSB nor First Commercial intend, or undertake any duty to update or revise any forward looking statements contained in this presentation whether as a result of differences in actual results, changes in assumptions, or changes in other factors affecting said factors, except as required by law. These forward-looking statements include, but are not limited to, statements about (i) the expected benefits of the transaction between OKSB and First Commercial, including future financial and operating results, accretion and earn-back, cost savings, enhanced revenues, long term growth, and the expected market position of the combined company that may be realized from the transaction, and (ii) OKSB’s and First Commercial’s plans, objectives, expectations and intentions and all other statements contained in this presentation that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “will,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “positioned,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. Management's determination of the provision and allowance for loan losses, the carrying value of acquired loans, goodwill, and the fair value of investment securities involve judgments that are inherently forward-looking. These statements are based upon the current beliefs and expectations of OKSB’s and First Commercial’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those indicated or implied in the forward-looking statements. There is no assurance that the due diligence process would identify all risks associated with the transaction and no assurance that the conditions to closing will be satisfied. Additional information concerning risks is contained in OKSB’s most recently filed Annual Report on Form 10-K, most recent Quarterly Report on Form 10-Q, recent Current Reports on Form 8-K and other SEC filings.

Forward Looking Statements This presentation contains comments or information that constitute forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of significant risks and uncertainties, which could cause Southwest Bancorp, Inc. (“OKSB”), First Commercial Bancshares, Inc. (“First Commercial”) or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such forward looking statements. Forward looking statements speak only as of the date they are made and neither OKSB nor First Commercial intend, or undertake any duty to update or revise any forward looking statements contained in this presentation whether as a result of differences in actual results, changes in assumptions, or changes in other factors affecting said factors, except as required by law. These forward-looking statements include, but are not limited to, statements about (i) the expected benefits of the transaction between OKSB and First Commercial, including future financial and operating results, accretion and earn-back, cost savings, enhanced revenues, long term growth, and the expected market position of the combined company that may be realized from the transaction, and (ii) OKSB’s and First Commercial’s plans, objectives, expectations and intentions and all other statements contained in this presentation that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “will,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “positioned,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. Management's determination of the provision and allowance for loan losses, the carrying value of acquired loans, goodwill, and the fair value of investment securities involve judgments that are inherently forward-looking. These statements are based upon the current beliefs and expectations of OKSB’s and First Commercial’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those indicated or implied in the forward-looking statements. There is no assurance that the due diligence process would identify all risks associated with the transaction and no assurance that the conditions to closing will be satisfied. Additional information concerning risks is contained in OKSB’s most recently filed Annual Report on Form 10-K, most recent Quarterly Report on Form 10-Q, recent Current Reports on Form 8-K and other SEC filings. Investor Information Southwest Bancorp, Inc. (“OKSB”) will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that will include a Prospectus of OKSB, Proxy Statement of First Commercial, as well as other relevant documents concerning the proposed transaction. Shareholders are advised to read, when available, the Registration Statement, Proxy Statement, and Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information relating to the proposed transaction. When filed, a free copy of these materials may be obtained on the SEC’s website at http://www.sec.gov. Alternatively, when available, these documents can be obtained free of charge from OKSB’s website at www.oksb.com under the tab “Investors” and then under the tab “SEC Filings”. OKSB, certain of its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of First Commercial in connection with the proposed transaction under the rules of the SEC. Information about these participants is set forth in the proxy statement for OKSB’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on April 22, 2015. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the definitive proxy statement and other relevant materials, when available, to be filed by OKSB with the SEC in conjunction with the proposed transaction. Free copies of this document may be obtained as described in the preceding paragraph.

Investor Information Southwest Bancorp, Inc. (“OKSB”) will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that will include a Prospectus of OKSB, Proxy Statement of First Commercial, as well as other relevant documents concerning the proposed transaction. Shareholders are advised to read, when available, the Registration Statement, Proxy Statement, and Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information relating to the proposed transaction. When filed, a free copy of these materials may be obtained on the SEC’s website at http://www.sec.gov. Alternatively, when available, these documents can be obtained free of charge from OKSB’s website at www.oksb.com under the tab “Investors” and then under the tab “SEC Filings”. OKSB, certain of its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of First Commercial in connection with the proposed transaction under the rules of the SEC. Information about these participants is set forth in the proxy statement for OKSB’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on April 22, 2015. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the definitive proxy statement and other relevant materials, when available, to be filed by OKSB with the SEC in conjunction with the proposed transaction. Free copies of this document may be obtained as described in the preceding paragraph. Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs

Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs Transaction Overview 4 .Meaningful expansion of Oklahoma City and Edmond coverage –brings over $200 million in deposits and improves market share to #10 .Prudently and accretively deploys our strong capital base .Attractive entry into Colorado with opportunity to grow and expand market .Leverages the OKSB brand, product set and capabilities .Strengthens our focus on Healthcare banking .Substantial EPS accretion: –12% accretive to 2016 EPS(1) –14% accretive to 2017 EPS .Tangible book value dilution of 4% with an expected earnback, including one-time costs, of less than 4 years .Internal rate of return greater than 15% .Strong capital ratios at closing, with an estimated pro forma TCE ratio of 12% and an estimated total risk based capital ratio of 17% .Potential for revenue enhancements and cross-sell opportunities, although none have been assumed in our modeling .Comprehensive due diligence process completed, including extensive credit review .Low levels of credit risk, two identified credits will not be taken in the transaction .Primarily in-market transaction, with an established and complementary customer base and business mix Financially Attractive Strategically Compelling Low Execution Risk (1) Excluding transaction related and one-time costs Strengthens Position in Oklahoma City Enhances position in Oklahoma City-Edmond, OK MSA –improves deposit market share to #10 pro forma As the state capital, with a major university, OKC continues to be an attractive market for expansion (MSA population of ~1.4 million) Low unemployment rate (3.3% is 11th out of 387 MSAs nationwide) and population growth nearly double the national average Expansion will capitalize on a strong Oklahoma City economy with industries in aviation / aerospace, energy, healthcare, and biotechnology Oklahoma City Franchise Unemployment Rate Population Growth (dollars in millions)# ofJune 2014RankInstitutionBranches Deposits Market Share1Midland Financial Co. (OK)33$3,58913.17%2BOK Financial Corp. (OK)203,36612.35%3JPMorgan Chase & Co. (NY)223,29312.09%4BancFirst Corp. (OK)332,4899.13%5Bank of America Corp. (NC)151,5515.69%6Arvest Bank Group Inc. (AR)271,0603.89%7Prosperity Bancshares Inc. (TX)99533.50%8First Fidelity Bancorp Inc. (OK)228523.13%9International Bancshares Corp. (TX)217942.91%10Pro Forma105742.11%10Olney Bancshares of Texas Inc. (TX)115682.08%11Quail Creek Bancshares Inc. (OK)15001.84%12American Bancorp of OK Inc (OK)64911.80%13Frontier State Bank (OK)14361.60%14First Midwest Acquisition Corp (OK)83971.46%15Ironhorse Financial Group Inc. (OK)53971.46%16First Independent Bancorp Inc. (OK)103801.40%17Southwest Bancorp Inc. (OK)53701.36%18Durant Bancorp Inc. (OK)93661.34%19NBC Corp. of Oklahoma (OK)22741.01%20RCB Holding Co. (OK)82410.88%25First Commercial Bcshs Inc. (OK)52050.75%Total For Institutions In Market405$27,251First Comm. (5) OKSB (4) Note: Map excludes 1 OKSB branch included in the OKC MSA Oklahoma City MSA Deposit Market Share Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis. Deposit market share as of June 30, 2014 5

Strengthens Position in Oklahoma City Enhances position in Oklahoma City-Edmond, OK MSA –improves deposit market share to #10 pro forma As the state capital, with a major university, OKC continues to be an attractive market for expansion (MSA population of ~1.4 million) Low unemployment rate (3.3% is 11th out of 387 MSAs nationwide) and population growth nearly double the national average Expansion will capitalize on a strong Oklahoma City economy with industries in aviation / aerospace, energy, healthcare, and biotechnology Oklahoma City Franchise Unemployment Rate Population Growth (dollars in millions)# ofJune 2014RankInstitutionBranches Deposits Market Share1Midland Financial Co. (OK)33$3,58913.17%2BOK Financial Corp. (OK)203,36612.35%3JPMorgan Chase & Co. (NY)223,29312.09%4BancFirst Corp. (OK)332,4899.13%5Bank of America Corp. (NC)151,5515.69%6Arvest Bank Group Inc. (AR)271,0603.89%7Prosperity Bancshares Inc. (TX)99533.50%8First Fidelity Bancorp Inc. (OK)228523.13%9International Bancshares Corp. (TX)217942.91%10Pro Forma105742.11%10Olney Bancshares of Texas Inc. (TX)115682.08%11Quail Creek Bancshares Inc. (OK)15001.84%12American Bancorp of OK Inc (OK)64911.80%13Frontier State Bank (OK)14361.60%14First Midwest Acquisition Corp (OK)83971.46%15Ironhorse Financial Group Inc. (OK)53971.46%16First Independent Bancorp Inc. (OK)103801.40%17Southwest Bancorp Inc. (OK)53701.36%18Durant Bancorp Inc. (OK)93661.34%19NBC Corp. of Oklahoma (OK)22741.01%20RCB Holding Co. (OK)82410.88%25First Commercial Bcshs Inc. (OK)52050.75%Total For Institutions In Market405$27,251First Comm. (5) OKSB (4) Note: Map excludes 1 OKSB branch included in the OKC MSA Oklahoma City MSA Deposit Market Share Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis. Deposit market share as of June 30, 2014 5 Strategic Entry Into Denver Key Relationships in a Growing Market First Commercial’s banking centers are strategically positioned to serve the Denver market -with core relationships for serving the healthcare community The combination of OKSB’s expertise with First Commercial’s market knowledge and strong relationships sets the stage for well-founded growth and meaningful service to the Denver market Denver’s growth profile and demographics continue to make it a very attractive market for expansion • Second fastest growing large city in the country – US Census 2013 • Ranked 18th among 318 metropolitan areas in 2013 by the Bureau of Economic Analysis for current dollars GDP • Major industries include healthcare, technology, communications and manufacturing • Job growth rate continues to outpace national average First Commercial (3) Population Growth Unemployment Rate Household Income Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis

Strategic Entry Into Denver Key Relationships in a Growing Market First Commercial’s banking centers are strategically positioned to serve the Denver market -with core relationships for serving the healthcare community The combination of OKSB’s expertise with First Commercial’s market knowledge and strong relationships sets the stage for well-founded growth and meaningful service to the Denver market Denver’s growth profile and demographics continue to make it a very attractive market for expansion • Second fastest growing large city in the country – US Census 2013 • Ranked 18th among 318 metropolitan areas in 2013 by the Bureau of Economic Analysis for current dollars GDP • Major industries include healthcare, technology, communications and manufacturing • Job growth rate continues to outpace national average First Commercial (3) Population Growth Unemployment Rate Household Income Source: SNL Financial, Census Bureau, Bureau of Labor Statistics and the Bureau of Economic Analysis Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement) Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement)

Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement) Transaction Terms 7 Consideration Transaction Value $41.7 Million(1) Price / Tangible Book Value: 141%(1)(2) Price / 2014 EPS: 22.4x(1) 51% Stock / 49% Cash $20.4 million in cash and 1.2 million(1) shares of OKSB The stock portion of the consideration is fixed, but is subject to a symmetrical price collar (plus or minus $4.00 per share from the 10-day average OKSB stock price at the time of announcement) Ownership 94% OKSB / 6% First Commercial Approvals Customary regulatory and First Commercial shareholder approval required OKSB shareholder approval is not required Timing Expected closing in the 4th quarter of 2015 Systems conversions anticipated in 4Q15 (1) Based upon the OKSB 10-day average closing stock price of $17.50 as of May 26, 2015 (2) Based upon tangible common equity of $29.5 million (the expected tangible common equity at closing based upon the minimum tangible equity requirement per the definitive agreement) First Commercial Overview Franchise Overview Founded in 1996 Operates five banking centers in OKC Metro area, three banking centers in south Denver and one banking center in Colorado Springs Focus on commercial, healthcare & mortgage lending Solid financial performance and momentum MRQ Financial Highlights Assets ($mm)$304.5Total Gross Loans ($mm)$214.7Deposits ($mm)$254.2ROA0.70%ROE5.89%Net Interest Margin4.12%Tier 1 Leverage Ratio11.4%Tier 1 RBC Ratio14.1%Total RBC Ratio15.4%NPAs & Loans +90 Days Past Due / Assets1.39%Reserves / Loans1.78%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%8 Loan Composition Deposit Composition $215 Million MRQ Yield: 5.42% $254 Million MRQ Cost(1): 0.58% Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Cost is defined as annualized total interest on deposits / average interest-bearing deposits

First Commercial Overview Franchise Overview Founded in 1996 Operates five banking centers in OKC Metro area, three banking centers in south Denver and one banking center in Colorado Springs Focus on commercial, healthcare & mortgage lending Solid financial performance and momentum MRQ Financial Highlights Assets ($mm)$304.5Total Gross Loans ($mm)$214.7Deposits ($mm)$254.2ROA0.70%ROE5.89%Net Interest Margin4.12%Tier 1 Leverage Ratio11.4%Tier 1 RBC Ratio14.1%Total RBC Ratio15.4%NPAs & Loans +90 Days Past Due / Assets1.39%Reserves / Loans1.78%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%8 Loan Composition Deposit Composition $215 Million MRQ Yield: 5.42% $254 Million MRQ Cost(1): 0.58% Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Cost is defined as annualized total interest on deposits / average interest-bearing deposits Loan & Deposit Composition Demand9%Other Transaction Accounts3%MMDA and Savings58%Time Deposits <$100,00014%Time Deposits =$100,00016%Construction14%Residential R.E. 1-4 Fam.9%Owner-CRE17%Non-Owner CRE29%Multifamily5%Commercial & Industrial24%Consumer1%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%Demand6%Other Transaction Accounts3%MMDA and Savings64%Time Deposits <$100,00013%Time Deposits =$100,00014%Construction14%Residential R.E. 1-4 Fam.6%Owner-CRE17%Non-Owner CRE31%Multifamily5%Commercial & Industrial25%Consumer1%Other1%9 Loan Composition Deposit Composition Source: SNL Financial Does not include purchase accounting adjustments Note: First Commercial statistics are provided at the bank level. Cost represents the cost of interest-bearing deposits and is defined as annualized total cost on deposits / average interest-bearing deposits OKSB: $1.44 Billion OKSB: $1.62 Billion First Commercial: $254 Million First Commercial: $215 Million Pro Forma: $1.87 Billion Pro Forma: $1.65 Billion MRQ Yield: 4.39% MRQ Yield: 5.42% MRQ Cost: 0.22% MRQ Cost: 0.58%

Loan & Deposit Composition Demand9%Other Transaction Accounts3%MMDA and Savings58%Time Deposits <$100,00014%Time Deposits =$100,00016%Construction14%Residential R.E. 1-4 Fam.9%Owner-CRE17%Non-Owner CRE29%Multifamily5%Commercial & Industrial24%Consumer1%Demand33%Other Transaction Accounts7%MMDA and Savings21%Time Deposits <$100,00014%Time Deposits =$100,00025%Construction10%Residential R.E. 1-4 Fam.25%Owner-CRE16%Non-Owner CRE22%Multifamily2%Commercial & Industrial24%Consumer1%Demand6%Other Transaction Accounts3%MMDA and Savings64%Time Deposits <$100,00013%Time Deposits =$100,00014%Construction14%Residential R.E. 1-4 Fam.6%Owner-CRE17%Non-Owner CRE31%Multifamily5%Commercial & Industrial25%Consumer1%Other1%9 Loan Composition Deposit Composition Source: SNL Financial Does not include purchase accounting adjustments Note: First Commercial statistics are provided at the bank level. Cost represents the cost of interest-bearing deposits and is defined as annualized total cost on deposits / average interest-bearing deposits OKSB: $1.44 Billion OKSB: $1.62 Billion First Commercial: $254 Million First Commercial: $215 Million Pro Forma: $1.87 Billion Pro Forma: $1.65 Billion MRQ Yield: 4.39% MRQ Yield: 5.42% MRQ Cost: 0.22% MRQ Cost: 0.58% Pro Forma Impact EPS Accretion Tangible Book Value Estimated Capital IRR ~4% dilutive to TBV at closing Estimated earnback of less than 4 years(1) Expected IRR > 15% 10 12% in 2016, excluding transaction related and one-time costs 14% in 2017 Pro forma TCE ratio of ~12% at closing Total RBC ratio of ~17% at closing No revenue enhancements or cross-sell opportunities have been assumed Cost savings of ~30% of First Commercial’s expected noninterest expense; 70% phased in the first year and 100% thereafter – No office consolidations anticipated Gross loan mark of $7.3 million (3.5%); $3.2 million of the mark to be accreted into income over 5 years – Credit review focused on the largest relationships, adversely classified assets and watch list loans – Reviewed approximately 66% of all funded loans – Reviewed 100% of relationships with balances greater than $750,000, 100% of criticized assets and all watch list credits with a balance greater than $250,000 $5 million in outstanding trust preferred to be redeemed at closing Core deposit intangible of 1.5%, amortized straight-line over 10 years Pre-tax transaction related expenses of $1.25 million at closing Expected close in the 4th quarter of 2015 Financial Impact Key Assumptions (1) Defined as the number of years for pro forma tangible book value per share to exceed standalone tangible book value per share, inclusive of all restructuring expenses

Pro Forma Impact EPS Accretion Tangible Book Value Estimated Capital IRR ~4% dilutive to TBV at closing Estimated earnback of less than 4 years(1) Expected IRR > 15% 10 12% in 2016, excluding transaction related and one-time costs 14% in 2017 Pro forma TCE ratio of ~12% at closing Total RBC ratio of ~17% at closing No revenue enhancements or cross-sell opportunities have been assumed Cost savings of ~30% of First Commercial’s expected noninterest expense; 70% phased in the first year and 100% thereafter – No office consolidations anticipated Gross loan mark of $7.3 million (3.5%); $3.2 million of the mark to be accreted into income over 5 years – Credit review focused on the largest relationships, adversely classified assets and watch list loans – Reviewed approximately 66% of all funded loans – Reviewed 100% of relationships with balances greater than $750,000, 100% of criticized assets and all watch list credits with a balance greater than $250,000 $5 million in outstanding trust preferred to be redeemed at closing Core deposit intangible of 1.5%, amortized straight-line over 10 years Pre-tax transaction related expenses of $1.25 million at closing Expected close in the 4th quarter of 2015 Financial Impact Key Assumptions (1) Defined as the number of years for pro forma tangible book value per share to exceed standalone tangible book value per share, inclusive of all restructuring expenses Conclusion Expands Oklahoma City market and provides attractive entry into the Colorado market Expected to be immediately and significantly accretive to earnings Conservative merger assumptions, identified and achievable future cost savings Leverages strong capital position Primarily in-market transaction with limited execution risk Transaction will enhance OKSB’s near-term and long-term franchise value

Conclusion Expands Oklahoma City market and provides attractive entry into the Colorado market Expected to be immediately and significantly accretive to earnings Conservative merger assumptions, identified and achievable future cost savings Leverages strong capital position Primarily in-market transaction with limited execution risk Transaction will enhance OKSB’s near-term and long-term franchise value APPENDIX

APPENDIX First Commercial Historical Financials 2010 FY2011 FY2012 FY2013 FY2014 dollars in thousands)12/31/1012/31/1112/31/1212/31/1312/SheetTotal Assets280,795294,542324,347307,305303,288304,523Total Gross Loans202,530208,707230,404218,319215,027214,694Total Deposits240,779249,989278,144265,899258,526254,224Total Equity31,16232,65934,85633,26835,50436,104ProfitabilityNet Income1,5591,4122,565(993)(%)0.570.470.84(0.32)(%)5.364.427.62(2.79)Interest Margin (FTE) (%)4.794.194.724.564.184.17Efficiency Ratio (FTE) (%)74.179.371.472.976.075.5Noninterest Income/ Operating Rev (%)21.420.723.923.517.914.4Balance Sheet Ratios / Capital (%)Loans/ Deposits84.183.582.882.183.284.5Tangible Common Equity/ Tang Assets10.510.610.310.311.211.4Tier 1 Ratio12.812.912.912.513.614.1Total Risk Based Capital Ratio14.014.214.113.814.815.4Leverage Ratio9.649.629.709.4310.5111.44Asset Quality (%)(1)NPLs/ Loans1.483.832.232.161.761.82NPAs/ Assets1.683.582.261.971.361.39NCOs/ Avg Loans0.200.080.311.800.85(Reserves/ Loans1.461.661.502.471.761.78Reserves/ NPLs98.343.467.2114.5100.297.5294834653460539537953814Yield & Cost (%)Yield on Loans6.416.236.365.805.585.42Yield on Earning Assets6.135.245.485.144.584.52Cost of Deposits(2)1.611.351.000.780.640.58Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Nonperforming Loans (NPLs) include Nonaccrual Loans, Loans 90+ Days Past Due and Still Accruing Interest, and Renegotiated Loans (TDRs). Nonperforming Assets (NPAs) include NPLs and Other Real Estate Owned (OREO) (2) Cost is defined as annualized total interest on deposits / average interest-bearing deposits

First Commercial Historical Financials 2010 FY2011 FY2012 FY2013 FY2014 dollars in thousands)12/31/1012/31/1112/31/1212/31/1312/SheetTotal Assets280,795294,542324,347307,305303,288304,523Total Gross Loans202,530208,707230,404218,319215,027214,694Total Deposits240,779249,989278,144265,899258,526254,224Total Equity31,16232,65934,85633,26835,50436,104ProfitabilityNet Income1,5591,4122,565(993)(%)0.570.470.84(0.32)(%)5.364.427.62(2.79)Interest Margin (FTE) (%)4.794.194.724.564.184.17Efficiency Ratio (FTE) (%)74.179.371.472.976.075.5Noninterest Income/ Operating Rev (%)21.420.723.923.517.914.4Balance Sheet Ratios / Capital (%)Loans/ Deposits84.183.582.882.183.284.5Tangible Common Equity/ Tang Assets10.510.610.310.311.211.4Tier 1 Ratio12.812.912.912.513.614.1Total Risk Based Capital Ratio14.014.214.113.814.815.4Leverage Ratio9.649.629.709.4310.5111.44Asset Quality (%)(1)NPLs/ Loans1.483.832.232.161.761.82NPAs/ Assets1.683.582.261.971.361.39NCOs/ Avg Loans0.200.080.311.800.85(Reserves/ Loans1.461.661.502.471.761.78Reserves/ NPLs98.343.467.2114.5100.297.5294834653460539537953814Yield & Cost (%)Yield on Loans6.416.236.365.805.585.42Yield on Earning Assets6.135.245.485.144.584.52Cost of Deposits(2)1.611.351.000.780.640.58Source: SNL Financial Note: First Commercial statistics are provided at the bank level (1) Nonperforming Loans (NPLs) include Nonaccrual Loans, Loans 90+ Days Past Due and Still Accruing Interest, and Renegotiated Loans (TDRs). Nonperforming Assets (NPAs) include NPLs and Other Real Estate Owned (OREO) (2) Cost is defined as annualized total interest on deposits / average interest-bearing deposits Bank Strong Bank Safe Bank Successfully

Bank Strong Bank Safe Bank Successfully