UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08134 |

|

Eaton Vance Municipals Trust II |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Alan R Dynner The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | January 31 | |

|

Date of reporting period: | January 31, 2007 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Annual Report January 31, 2007

EATON VANCE

HIGH YIELD

MUNICIPALS

FUND

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS, AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance High Yield Municipals Fund as of January 31, 2007

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Portfolio Managers:

Cynthia J. Clemson

Thomas M. Metzold, CFA

Performance for the Year Ended January 31, 2007

· The Fund’s Class A shares had a total return of 9.76% during the year ended January 31, 2007.(1) This return was the result of an increase in net asset value (NAV) to $10.73 per share on January 31, 2007, from $10.24 on January 31, 2006, and the reinvestment of $0.490 in dividends.(2)

· The Fund’s Class B shares had a total return of 8.97% during the same period.(1) This return was the result of an increase in NAV to $10.70 per share on January 31, 2007, from $10.21 on January 31, 2006, and the reinvestment of $0.411 in dividends.(2)

· The Fund’s Class C shares had a total return of 9.03% during the same period.(1) This return was the result of an increase in NAV to $9.93 per share on January 31, 2007, from $9.47 on January 31, 2006, and the reinvestment of $0.382 in dividends.(2)

Economic and Market Conditions

Fourth quarter economic growth rose to 2.2%, according to preliminary data, following the 2.0% growth rate achieved in the third quarter. With higher mortgage rates in the market, led largely by the persistent Federal Reserve (the “Fed”) tightening, the housing market continued to soften, with building permits and existing home sales leading the way. However, energy prices declined significantly in the quarter, somewhat offsetting the impact of a weakening housing market. The economy continued to create jobs over the period, with the unemployment rate standing at 4.6% as of January 31, 2007.

Inflation expectations moderated with the lower energy prices, although the core Consumer Price Index – measured on a year-over-year basis – has demonstrated a slow but steady rise. The Fed, which raised short-term rates 17 times since June 2004, is currently in a pausing mode, awaiting further economic inputs to determine the future direction of interest rate moves. At January 31, 2007, the Federal Funds rate stood at 5.25%.

Municipal market supply during the year ended January 31, 2007 was lower than it had been in the previous year. As a result, municipals have generally outperformed Treasury bonds for the year ended January 31, 2007, as demand has remained strong. At January 31, 2007, long-term AAA-rated, insured municipal bonds yielded 92% of U.S. Treasury bonds with similar maturities.†

For the year ended January 31, 2007, the Lehman Brothers Municipal Bond Index(3) (the “Index”), an unmanaged index of municipal bonds, posted a gain of 4.29%. For more information about the Fund’s performance and that of funds in the same Lipper Classification,(3) see the Performance Information and Portfolio Composition page that follows.

Management Discussion

The Fund invests primarily in bonds with stated maturities of 10 years or longer, as longer-maturity bonds historically have provided greater tax-exempt income for investors than shorter-maturity bonds. Given the flattening of the yield curve for other fixed-income securities over the past 18 months — with shorter-maturity yields rising more than longer-maturity yields — management felt that the long end of the municipal curve was a relatively attractive place to be positioned.

Because of the mixed economic backdrop of contained inflation expectations, a weakened housing market and sustained growth in the labor market, Fund management continued to maintain a somewhat cautious outlook on interest rates. In this environment, Fund management continued to focus on finding relative value within the marketplace – in issuer names, coupons, maturities, sectors and jurisdictions. Relative value trading, which seeks to capitalize on undervalued securities, has enhanced the Fund’s returns during the period.

Quality spreads remained very tight in the high-yield municipal market. Accordingly, management focused on the higher-quality segment within the high-yield universe. In addition, management insisted on sound structure and covenants for new non-rated bonds as a safeguard against a possible credit deterioration in an economic slowdown.

High Yield Municipals Fund Class A was ranked #3 (of 78 funds in the Lipper High Yield Municipal Debt Funds Classification) for the year ended January 31, 2007, #10 (of 73 funds) for 3 years, #7 (of 66 funds) for 5 years and #4 (of 38 funds) for 10 years. Rankings are based on percentage change in net asset value with all distributions reinvested and do not take sales charges into consideration. Source: Lipper, Inc.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal income and/or alternative minimum tax; income may be subject to state and local tax. (3) It is not possible to invest directly in an Index or a Lipper Classification. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. †Source: Bloomberg L.P. Yields are a compilation of a representative variety of general obligations and are not necessarily representative of the Fund’s yield.

1

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

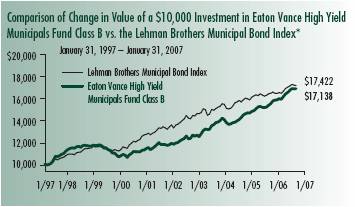

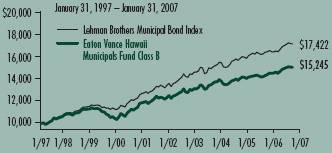

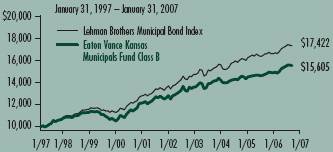

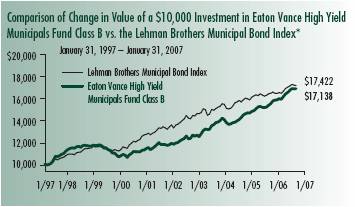

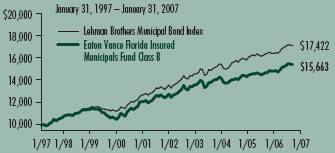

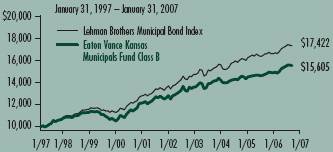

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and the Lehman Brothers Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance(1) | | Class A | | Class B | | Class C | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 9.76 | % | 8.97 | % | 9.03 | % |

Five Years | | 8.33 | | 7.56 | | 7.54 | |

Ten Years | | 6.31 | | 5.54 | | N.A. | |

Life of Fund† | | 6.97 | | 6.15 | | 5.31 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | | | |

One Year | | 4.55 | % | 3.97 | % | 8.03 | % |

Five Years | | 7.28 | | 7.26 | | 7.54 | |

Ten Years | | 5.79 | | 5.54 | | N.A. | |

Life of Fund† | | 6.52 | | 6.15 | | 5.31 | |

†Inception dates: Class A: 8/7/95; Class B: 8/7/95; Class C: 6/18/97

Distribution rates/Yields | | Class A | | Class B | | Class C | |

Distribution Rate(2) | | 4.52 | % | 3.79 | % | 3.80 | % |

Taxable-Equivalent Distribution Rate (2),(3) | | 6.95 | | 5.83 | | 5.85 | |

SEC 30-day Yield (4) | | 3.83 | | 3.27 | | 3.26 | |

Taxable-Equivalent SEC 30-day Yield (3),(4) | | 5.89 | | 5.03 | | 5.02 | |

Index Performance(5) | | | |

Lehman Brothers Municipal Bond Index – Average Annual Total Returns | | | |

One Year | | 4.29 | % |

Five Years | | 5.11 | |

Ten Years | | 5.71 | |

Lipper Averages(6) | | | |

Lipper High Yield Municipal Debt Funds Classification - Average Annual Total Returns | | | |

One Year | | 6.79 | % |

Five Years | | 6.33 | |

Ten Years | | 5.28 | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www. eatonvance.com

*Sources: Thomson Financial; Lipper, Inc. Class B of the Fund commenced operations on 8/7/95.

A $10,000 hypothetical investment at net asset value in Class A shares on 1/31/97 and Class C shares on 6/18/97 (commencement of operations) would have been valued at $18,433 and $16,447, respectively, on 1/31/07. A $10,000 hypothetical investment in Class A shares at the maximum offering price would have been valued at $17,560. It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

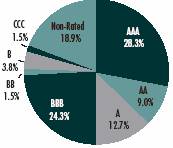

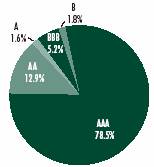

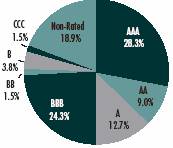

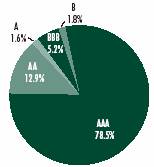

Rating Distribution**(7)

By total investments

** The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1B to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2007 is as follows:

AAA | | 22.3 | % | BBB | | 27.4 | % | CCC | | 1.7 | % |

AA | | 6.6 | % | BB | | 1.6 | % | Non-Rated | | 21.8 | % |

A | | 14.4 | % | B | | 4.2 | % | | | | |

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charge (CDSC) for Class B and Class C shares. If sales charges were included, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B shares reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC returns for Class C shares reflect a 1% CDSC for the first year. (2) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (3) Taxable-equivalent figures assume a maximum 35.0% federal income tax rate. A lower tax rate would result in lower tax-equivalent figures. (4) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result. (5) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only. (6) The Lipper Averages are the average annual total returns, at net asset value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper High Yield Municipal Debt Funds Classification contained 78, 66, and 38 funds for the 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only. (7) As of 1/31/07. Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund. Portfolio holdings information includes securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1B to the Fund’s financial statements. Portfolio information may not be representative of the Fund’s current or future investments and may change due to active management.

2

Eaton Vance High Yield Municipals Fund as of January 31, 2007

FUND EXPENSES

Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2006 – January 31, 2007).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance High Yield Municipals Fund

| | | Beginning Account Value

(8/1/06) | | Ending Account Value

(1/31/07) | | Expenses Paid During Period*

(8/1/06 – 1/31/07) | |

| Actual | |

| Class A | | $ | 1,000.00 | | | $ | 1,048.40 | | | $ | 7.13 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,044.70 | | | $ | 10.98 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,044.60 | | | $ | 10.93 | | |

| Hypothetical | |

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.90 | | | $ | 7.02 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,017.10 | | | $ | 10.82 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,017.10 | | | $ | 10.76 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.38% for Class A shares, 2.13% for Class B shares and 2.12% for Class C shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2006.

3

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PORTFOLIO OF INVESTMENTS

| Tax-Exempt Investments — 112.0% | | | |

Principal Amount

(000's omitted) | | Security | | Value | |

| Cogeneration — 1.3% | | | |

| $ | 7,000 | | | Maryland Energy Cogeneration, (AES Warrior Run), (AMT),

7.40%, 9/1/19 | | $ | 7,038,290 | | |

| | 1,910 | | | Ohio Water Development Authority, Solid Waste Disposal,

(Bay Shore Power), (AMT), 5.875%, 9/1/20 | | | 1,938,593 | | |

| | 4,620 | | | Ohio Water Development Authority, Solid Waste Disposal,

(Bay Shore Power), (AMT), 6.625%, 9/1/20 | | | 4,783,086 | | |

| | 2,050 | | | Pennsylvania Economic Development Financing Authority,

(Colver), (AMT), 5.125%, 12/1/15 | | | 2,076,732 | | |

| | 1,140 | | | Western Generation Agency, OR, (Wauna Cogeneration),

5.00%, 1/1/21 | | | 1,141,653 | | |

| | | | | | | $ | 16,978,354 | | |

| Education — 1.1% | | | |

| $ | 12,000 | | | California Educational Facilities Authority,

(Stanford University), 5.25%, 12/1/32(1) | | $ | 12,664,802 | | |

| | 800 | | | Maryland Health and Higher Educational Facilities Authority,

(Washington Christian Academy), 5.50%, 7/1/38 | | | 818,064 | | |

| | | | | | | $ | 13,482,866 | | |

| Electric Utilities — 6.6% | | | |

| $ | 18,000 | | | Brazos River Authority, TX, PCR (Texas Energy Co.),

(AMT), 5.00%, 3/1/41 | | $ | 18,056,520 | | |

| | 4,920 | | | Brazos River Authority, TX, PCR (Texas Energy Co.),

(AMT), 5.40%, 5/1/29 | | | 5,094,709 | | |

| | 3,000 | | | Brazos River Authority, TX, PCR (Texas Energy Co.),

(AMT), 6.75%, 4/1/38 | | | 3,326,190 | | |

| | 4,500 | | | Chula Vista, CA, (San Diego Gas), (AMT),

5.00%, 12/1/27 | | | 4,736,385 | | |

| | 16,000 | | | Farmington, NM, Pollution Control Revenue,

4.875%, 4/1/33 | | | 16,425,120 | | |

| | 22,100 | | | Massachusetts Development Finance Agency, (Dominion

Energy Brayton Point), (AMT), 5.00%, 2/1/36 | | | 22,851,621 | | |

| | 4,000 | | | Matagorda County, TX, Navigation District No.1, (Reliant

Energy), 8.00%, 5/1/29 | | | 4,223,440 | | |

| | 3,965 | | | Matagorda County, TX, Navigation District No.1, (Reliant

Energy), (AMT), 5.95%, 5/1/30 | | | 4,079,945 | | |

| | 1,500 | | | Mississippi Business Finance Corp., (System Energy

Resources, Inc.), 5.90%, 5/1/22 | | | 1,515,870 | | |

| | 3,000 | | | Puerto Rico Electric Power Authority, 5.25%, 7/1/31 | | | 3,162,540 | | |

| | | | | | | $ | 83,472,340 | | |

| Escrowed / Prerefunded — 5.1% | | | |

| $ | 25,000 | | | Bakersfield, CA, (Bakersfield Assisted Living Center),

Escrowed to Maturity, 0.00%, 4/15/21 | | $ | 13,472,000 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Escrowed / Prerefunded (continued) | | | |

| $ | 4,300 | | | Capital Trust Agency, FL, (Seminole Tribe Convention),

Prerefunded to 10/1/12, 8.95%, 10/1/33(2) | | $ | 5,262,899 | | |

| | 9,500 | | | Dawson Ridge, CO, Metropolitan District #1, Escrowed to

Maturity, 0.00%, 10/1/22 | | | 4,789,235 | | |

| | 3,500 | | | Dawson Ridge, CO, Metropolitan District #1, Escrowed to

Maturity, 0.00%, 10/1/22 | | | 1,764,455 | | |

| | 3,685 | | | Forsyth County, GA, Hospital Authority, (Georgia Baptist

Health Care System), Escrowed to Maturity,

6.25%, 10/1/18(3) | | | 4,158,486 | | |

| | 1,830 | | | Grove City, PA, Area Hospital Authority, (Grove Manor),

Prerefunded to 8/15/08, 6.625%, 8/15/29 | | | 1,913,173 | | |

| | 754 | | | New York, NY, Prerefunded to 6/1/13,

5.25%, 6/1/28(1) | | | 817,657 | | |

| | 5,250 | | | Northwest Arkansas Regional Airport Authority, (AMT),

Prerefunded to 2/1/08, 7.625%, 2/1/27 | | | 5,544,997 | | |

| | 7,050 | | | Tobacco Settlement Financing Corp., NJ, Prerefunded to

6/1/13, 6.75%, 6/1/39(1) | | | 8,178,176 | | |

| | 13,345 | | | Tobacco Settlement Financing Corp., NJ, Prerefunded to

6/1/13, 6.75%, 6/1/39 | | | 15,480,600 | | |

| | 3,620 | | | Wisconsin Health and Educational Facilities Authority,

(Wisconsin Illinois Senior Housing), Prerefunded to

8/1/09, 7.00%, 8/1/29 | | | 3,894,143 | | |

| | | | | | | $ | 65,275,821 | | |

| General Obligations — 7.4% | | | |

| $ | 10,000 | | | California, 4.50%, 9/1/36 | | $ | 9,900,000 | | |

| | 16,500 | | | California, 4.75%, 9/1/35 | | | 16,748,820 | | |

| | 1,195 | | | California, 5.00%, 2/1/32 | | | 1,239,466 | | |

| | 2,200 | | | California, 5.25%, 2/1/30 | | | 2,303,708 | | |

| | 2,000 | | | California, 5.25%, 2/1/33 | | | 2,109,820 | | |

| | 15,420 | | | California, 5.25%, 4/1/34 | | | 16,407,188 | | |

| | 11,230 | | | New York, NY, 4.25%, 1/1/28 | | | 10,814,827 | | |

| | 8,246 | | | New York, NY, 5.25%, 6/1/11(1) | | | 8,734,193 | | |

| | 15,000 | | | Puerto Rico, 5.00%, 7/1/35 | | | 15,669,600 | | |

| | 10,000 | | | Puerto Rico Public Buildings Authority, Government Facilities,

5.00%, 7/1/36 | | | 10,366,200 | | |

| | | | | | | $ | 94,293,822 | | |

| Health Care-Miscellaneous — 1.6% | | | |

| $ | 2,845 | | | Illinois Development Finance Authority, (Community

Rehabilitation Providers), 5.60%, 7/1/19 | | $ | 2,929,155 | | |

| | 789 | | | Osceola County, FL, Industrial Development Authority,

Community Provider Pooled Loan-93, 7.75%, 7/1/17 | | | 789,813 | | |

| | 1,740 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 6.75%, 12/1/36 | | | 1,791,000 | | |

See notes to financial statements

4

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Health Care-Miscellaneous (continued) | | | |

| $ | 897 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 7.00%, 12/1/36 | | $ | 924,442 | | |

| | 742 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 7.00%, 12/1/36 | | | 764,576 | | |

| | 1,621 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 7.75%, 12/1/36 | | | 1,760,185 | | |

| | 1,361 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 7.90%, 12/1/36 | | | 1,481,984 | | |

| | 268 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 8.25%, 12/1/36 | | | 283,865 | | |

| | 608 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 8.375%, 12/1/36 | | | 628,164 | | |

| | 1,684 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 8.50%, 12/1/36 | | | 1,687,498 | | |

| | 674 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 8.70%, 12/1/36 | | | 697,970 | | |

| | 1,349 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 8.81%, 9/1/36 | | | 1,392,351 | | |

| | 424 | | | Tax Revenue Exempt Securities Trust, Community Health

Provider, (Pooled Loan Program Various States Trust

Certificates), 8.875%, 12/1/36 | | | 438,966 | | |

| | 4,460 | | | Yavapai County, AZ, Industrial Development Revenue,

(West Yavapai Guidance Clinic), 6.25%, 12/1/36 | | | 4,440,376 | | |

| | | | | | | $ | 20,010,345 | | |

| Hospital — 16.8% | | | |

| $ | 4,000 | | | Brevard County, FL, Health Facilities Authority,

(Health First, Inc.), 5.00%, 4/1/36 | | $ | 4,107,760 | | |

| | 7,650 | | | California Health Facilities Financing Authority,

(Cedars-Sinai Medical Center), 5.00%, 11/15/34 | | | 7,899,390 | | |

| | 5,000 | | | California Health Facilities Financing Authority,

(Kaiser Foundation Health Plan), 5.00%, 4/1/37 | | | 5,168,700 | | |

| | 7,955 | | | California Statewide Communities Development

Authority, (Kaiser Permanente), 5.00%, 3/1/41 | | | 8,203,673 | | |

| | 19,600 | | | California Statewide Communities Development Authority,

(Kaiser Permanente), 5.25%, 3/1/45 | | | 20,648,012 | | |

| | 2,000 | | | Camden County, NJ, Improvement Authority,

(Cooper Health System), 5.00%, 2/15/25 | | | 2,048,480 | | |

| | 6,900 | | | Camden County, NJ, Improvement Authority,

(Cooper Health System), 5.00%, 2/15/35 | | | 6,993,288 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Hospital (continued) | | | |

| $ | 3,900 | | | Camden County, NJ, Improvement Authority,

(Cooper Health System), 5.25%, 2/15/27 | | $ | 4,064,697 | | |

| | 2,190 | | | Chautauqua County, NY, Industrial Development Agency,

(Women's Christian Association), 6.40%, 11/15/29 | | | 2,294,156 | | |

| | 24,510 | | | Colorado Health Facilities Authority, (Catholic Health

Initiatives), 4.625%, 9/1/39 | | | 24,455,833 | | |

| | 600 | | | Gaylord, MI, Hospital Finance Authority, (Otsego Memorial

Hospital Association), 6.20%, 1/1/25 | | | 626,394 | | |

| | 875 | | | Gaylord, MI, Hospital Finance Authority, (Otsego Memorial

Hospital Association), 6.50%, 1/1/37 | | | 915,539 | | |

| | 1,000 | | | Henderson, NV, Health Care Facility, (Catholic

Healthcare West), 5.625%, 7/1/24 | | | 1,075,130 | | |

| | 10,000 | | | Highlands County, FL, Health Facilities Authority,

(Adventist Health System), 5.00%, 11/15/35 | | | 10,260,400 | | |

| | 1,855 | | | Hillsborough County, FL, Industrial Development Authority,

(Tampa General Hospital), 5.25%, 10/1/28 | | | 1,934,784 | | |

| | 1,780 | | | Indiana Health and Educational Facilities Authority,

(Clarian Health Partners), 4.75%, 2/15/34 | | | 1,779,163 | | |

| | 16,795 | | | Indiana Health and Educational Facilities Authority,

(Clarian Health Partners), 5.00%, 2/15/36 | | | 17,230,662 | | |

| | 12,870 | | | Knox County, TN, Health, Educational & Housing Facilities,

(Covenant Health), 0.00%, 1/1/40 | | | 2,398,196 | | |

| | 9,195 | | | Macomb County, MI, Hospital Finance Authority,

(Mount Clemens General Hospital), 5.875%, 11/15/34 | | | 9,744,769 | | |

| | 7,000 | | | Maricopa County, AZ, Industrial Development Authority,

(Catholic Healthcare), 5.375%, 7/1/23 | | | 7,375,550 | | |

| | 2,000 | | | Maricopa County, AZ, Industrial Development Authority,

(Catholic Healthcare), 5.50%, 7/1/26 | | | 2,133,300 | | |

| | 6,500 | | | Maryland Health and Higher Educational Facilities

Authority, (Peninsula Regional Medical Center),

5.00%, 7/1/36 | | | 6,785,025 | | |

| | 4,890 | | | Montgomery County, PA, Higher Education and Health

Authority, (Catholic Health East), 5.375%, 11/15/34 | | | 5,181,346 | | |

| | 2,500 | | | Montgomery, AL, Medical Clinic Board,

(Jackson Hospital & Clinic), 4.75%, 3/1/31 | | | 2,455,900 | | |

| | 2,500 | | | Montgomery, AL, Medical Clinic Board,

(Jackson Hospital & Clinic), 5.25%, 3/1/36 | | | 2,592,175 | | |

| | 2,000 | | | New Hampshire Health and Educational Facilities Authority,

(Littleton Hospital), 6.00%, 5/1/28 | | | 2,052,500 | | |

| | 2,000 | | | New Jersey Health Care Facilities Financing Authority,

(South Jersey Hospital), 5.00%, 7/1/36 | | | 2,069,000 | | |

| | 12,200 | | | New Jersey Health Care Facilities Financing Authority,

(South Jersey Hospital), 5.00%, 7/1/46 | | | 12,496,948 | | |

| | 2,000 | | | New Jersey Health Care Facilities Financing Authority,

(Trinitas Hospital), 7.50%, 7/1/30 | | | 2,206,800 | | |

| | 2,560 | | | Oneida County, NY, Industrial Development Agency,

(Elizabeth Medical Center), 6.00%, 12/1/29 | | | 2,627,123 | | |

| | 875 | | | Prince George's County, MD, (Greater Southeast

Healthcare System), 6.375%, 1/1/13(4) | | | 25,725 | | |

See notes to financial statements

5

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Hospital (continued) | | | |

| $ | 5,900 | | | Prince George's County, MD, (Greater Southeast

Healthcare System), 6.375%, 1/1/23(4) | | $ | 173,460 | | |

| | 4,890 | | | St. Mary Hospital Authority, PA, (Catholic Health East),

5.375%, 11/15/34 | | | 5,206,187 | | |

| | 10,000 | | | Sullivan County, TN, Health, Educational and Facility

Board, (Wellmont Health System), 5.25%, 9/1/36 | | | 10,435,700 | | |

| | 10,000 | | | Vermont Educational and Health Buildings Financing

Agency, (Fletcher Allen Healthcare), 4.75%, 12/1/36 | | | 9,951,900 | | |

| | 3,410 | | | Washington County, AR, Hospital Revenue, (Regional

Medical Center), 5.00%, 2/1/35 | | | 3,473,017 | | |

| | 1,400 | | | Wisconsin Health and Educational Facilities Authority,

(Vernon Memorial Healthcare, Inc.), 5.10%, 3/1/25 | | | 1,425,830 | | |

| | 2,800 | | | Wisconsin Health and Educational Facilities Authority,

(Vernon Memorial Healthcare, Inc.), 5.25%, 3/1/35 | | | 2,858,072 | | |

| | | | | | | $ | 213,374,584 | | |

| Housing — 3.3% | | | |

| $ | 4,865 | | | Capital Trust Agency, FL, (Atlantic Housing Foundation),

5.30%, 7/1/35 | | $ | 4,951,986 | | |

| | 4,000 | | | Charter Mac Equity Trust, TN, 6.00%, 4/30/19(2) | | | 4,428,880 | | |

| | 2,500 | | | Florida Capital Projects Finance Authority, Student

Housing Revenue, (Florida University), Prerefunded to

8/15/10, 7.75%, 8/15/20 | | | 2,817,400 | | |

| | 1,740 | | | Jefferson County, MO, Industrial Development Authority,

Multifamily, (Riverview Bend Apartments), (AMT),

6.75%, 11/1/29 | | | 1,825,730 | | |

| | 460 | | | Jefferson County, MO, Industrial Development Authority,

Multifamily, (Riverview Bend Apartments), (AMT),

7.125%, 11/1/29 | | | 481,238 | | |

| | 4,000 | | | Muni Mae Tax-Exempt Bond, LLC, (AMT),

5.90%, 11/29/49(2) | | | 4,241,480 | | |

| | 5,000 | | | Muni Mae Tax-Exempt Bond, LLC, (AMT),

6.875%, 6/30/49(2) | | | 5,268,950 | | |

| | 3,060 | | | Oregon Health Authority, (Trillium Affordable Housing),

(AMT), 6.75%, 2/15/29 | | | 3,235,001 | | |

| | 1,370 | | | Oregon Health Authority, (Trillium Affordable Housing),

(AMT), 6.75%, 2/15/29 | | | 1,422,663 | | |

| | 860 | | | Texas Student Housing Corp., (University of North Texas),

9.375%, 7/1/07(4) | | | 835,748 | | |

| | 2,000 | | | Texas Student Housing Corp., (University of North Texas),

11.00%, 7/1/31(4) | | | 2,140,580 | | |

| | 9,600 | | | Wisconsin Housing and Economic Development Authority,

WI, (AMT), 4.875%, 3/1/36 | | | 9,672,288 | | |

| | | | | | | $ | 41,321,944 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Industrial Development Revenue — 15.3% | | | |

| $ | 2,170 | | | ABIA Development Corp., TX, (Austin Cargoport

Development), (AMT), 6.50%, 10/1/24 | | $ | 2,228,184 | | |

| | 3,065 | | | ABIA Development Corp., TX, (Austin Cargoport

Development), (AMT), 9.25%, 10/1/21 | | | 3,530,513 | | |

| | 12,160 | | | Alliance Airport Authority, TX, (American Airlines, Inc.),

(AMT), 7.50%, 12/1/29 | | | 12,405,632 | | |

| | 2,150 | | | Butler, AL, Industrial Development Board, (Georgia-Pacific

Corp.), (AMT), 5.75%, 9/1/28 | | | 2,213,317 | | |

| | 3,900 | | | Carbon County, UT, (Laidlaw Environmental Services, Inc.),

(AMT), 7.45%, 7/1/17 | | | 4,019,535 | | |

| | 5,000 | | | Courtland, AL, Industrial Development Board,

(Solid Waste Disposal), (International Paper Co.), (AMT),

5.20%, 6/1/25 | | | 5,119,500 | | |

| | 23,860 | | | Denver, CO, City and County Special Facilities,

(United Airlines), (AMT), 6.875%, 10/1/32 | | | 24,707,030 | | |

| | 8,085 | | | Effingham County, GA, (Solid Waste Disposal),

(Fort James), (AMT), 5.625%, 7/1/18 | | | 8,201,020 | | |

| | 450 | | | Florence County, SC, (Stone Container), 7.375%, 2/1/07 | | | 450,000 | | |

| | 2,700 | | | Hancock County, KY, (Southwire Co.), (AMT),

7.75%, 7/1/25 | | | 2,744,955 | | |

| | 3,785 | | | Hardeman County, TN, (Correctional Facilities Corp.),

7.75%, 8/1/17 | | | 3,889,617 | | |

| | 5,325 | | | Houston, TX, Airport System, (Continental Airlines), (AMT),

6.75%, 7/1/29 | | | 5,784,494 | | |

| | 2,500 | | | Illinois Finance Authority, Solid Waste Disposal,

(Waste Management, Inc.), (AMT), 5.05%, 8/1/29 | | | 2,554,175 | | |

| | 5,215 | | | Liberty, NY, Development Corp., (Goldman Sachs

Group, Inc.), 5.25%, 10/1/35 | | | 5,984,108 | | |

| | 21,000 | | | Liberty, NY, Development Corp., (Goldman Sachs

Group, Inc.), 5.25%, 10/1/35(1) | | | 24,097,080 | | |

| | 2,730 | | | Maryland Economic Development Authority, (AFCO Cargo),

(AMT), 6.50%, 7/1/24 | | | 2,801,035 | | |

| | 590 | | | Maryland Economic Development Authority, (AFCO Cargo),

(AMT), 7.34%, 7/1/24 | | | 649,324 | | |

| | 1,300 | | | Michigan Strategic Fund, (S.D. Warren), (AMT),

7.375%, 1/15/22 | | | 1,327,456 | | |

| | 5,500 | | | Middlesex County, NJ, Pollution Control Authority,

(Amerada Hess), 5.75%, 9/15/32 | | | 5,831,430 | | |

| | 19,500 | | | Mississippi Business Finance Corp., (Northrop Grumman

Ship System), 4.55%, 12/1/28 | | | 19,453,395 | | |

| | 3,400 | | | Morgantown, KY, Solid Waste Revenue, (IMCO Recycling,

Inc.), (AMT), 7.45%, 5/1/22 | | | 3,477,520 | | |

| | 13,000 | | | New Jersey Economic Development Authority,

(Continental Airlines), (AMT), 6.25%, 9/15/29 | | | 13,561,730 | | |

| | 3,000 | | | New Jersey Economic Development Authority,

(Continental Airlines), (AMT), 6.40%, 9/15/23 | | | 3,145,890 | | |

| | 4,000 | | | New York City, NY, Industrial Development Agency,

(American Airlines, Inc.-JFK International Airport),

8.00%, 8/1/28 | | | 5,005,080 | | |

See notes to financial statements

6

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Industrial Development Revenue (continued) | | | |

| $ | 7,000 | | | New York City, NY, Industrial Development Agency,

(American Airlines, Inc.-JFK International Airport), (AMT),

7.625%, 8/1/25 | | $ | 8,560,160 | | |

| | 5,995 | | | New York City, NY, Industrial Development Agency,

(JFK International Airport), (AMT), 8.50%, 8/1/28 | | | 7,116,724 | | |

| | 2,500 | | | New York City, NY, Industrial Development Agency,

(Liberty-IAC/Interactive Corp.), 5.00%, 9/1/35 | | | 2,591,875 | | |

| | 8,200 | | | Phoenix, AZ, Industrial Development Agency,

(America West Airlines, Inc.), (AMT), 6.25%, 6/1/19 | | | 8,418,366 | | |

| | 825 | | | Puerto Rico Port Authority, (American Airlines), (AMT),

6.30%, 6/1/23 | | | 825,627 | | |

| | 3,000 | | | Rumford, ME, Solid Waste Disposal, (Boise Cascade Corp.),

(AMT), 6.875%, 10/1/26 | | | 3,265,950 | | |

| | | | | | | $ | 193,960,722 | | |

| Insured-Education — 1.2% | | | |

| $ | 10,000 | | | Broward County, FL, Educational Facilities Authority,

(Nova Southeastern University), (AGC),

5.00%, 4/1/26(1) | | $ | 10,513,755 | | |

| | 5,000 | | | University of California, (FSA), 4.50%, 5/15/28 | | | 5,005,350 | | |

| | | | | | | $ | 15,519,105 | | |

| Insured-Electric Utilities — 0.4% | | | |

| $ | 1,500 | | | Puerto Rico Electric Power Authority, (FSA),

Variable Rate, 6.953%, 7/1/29(2)(5) | | $ | 1,723,005 | | |

| | 3,825 | | | Puerto Rico Electric Power Authority, (MBIA),

4.75%, 7/1/33(1) | | | 3,923,749 | | |

| | | | | | | $ | 5,646,754 | | |

| Insured-Escrowed / Prerefunded — 1.2% | | | |

| $ | 2,299 | | | California, (AMBAC), Prerefunded to 10/1/10,

5.50%, 10/1/30(1) | | $ | 2,447,283 | | |

| | 528 | | | California, (AMBAC), Prerefunded to 10/1/10,

5.50%, 10/1/30(1) | | | 562,801 | | |

| | 5,000 | | | New Jersey Transportation Trust Fund Authority, (XLCA),

Prerefunded to 6/15/07, Variable Rate,

6.14%, 6/15/17(2)(6) | | | 5,247,000 | | |

| | 6,000 | | | New Jersey Turnpike Authority, (MBIA),

Prerefunded to 1/1/10, 5.50%, 7/1/23(1) | | | 6,293,260 | | |

| | | | | | | $ | 14,550,344 | | |

| Insured-General Obligations — 5.7% | | | |

| $ | 4,555 | | | California, (AMBAC), 5.00%, 2/1/28(1) | | $ | 5,091,362 | | |

| | 173 | | | California, (AMBAC), Prerefunded to 10/1/10,

5.50%, 10/1/30(1) | | | 184,096 | | |

| | 9,855 | | | Clark County, NV, (AMBAC), 2.50%, 11/1/36 | | | 6,494,445 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Insured-General Obligations (continued) | | | |

| $ | 15,000 | | | Connecticut, (AMBAC), 5.25%, 6/1/19(1) | | $ | 16,880,700 | | |

| | 2,850 | | | Geary County, KS, (XLCA), 3.50%, 9/1/30 | | | 2,414,349 | | |

| | 1,545 | | | Geary County, KS, (XLCA), 3.50%, 9/1/31 | | | 1,299,299 | | |

| | 4,740 | | | Mississippi, (FSA), 5.25%, 11/1/21(1) | | | 5,352,629 | | |

| | 5,380 | | | North Las Vegas, NV, Wastewater Reclamation

System, (MBIA), 4.50%, 10/1/36 | | | 5,323,187 | | |

| | 9,990 | | | Puerto Rico, (AGC), 5.50%, 7/1/29(1) | | | 11,791,230 | | |

| | 4,900 | | | Puerto Rico, (FSA), Variable Rate, 5.92%, 7/1/27(2)(5) | | | 5,679,247 | | |

| | 6,000 | | | Texas Transportation Commission, (FGIC), 4.50%, 4/1/30 | | | 5,978,280 | | |

| | 5,400 | | | Texas Transportation Commission, (FGIC), 4.50%, 4/1/35 | | | 5,344,380 | | |

| | | | | | | $ | 71,833,204 | | |

| Insured-Hospital — 1.3% | | | |

| $ | 7,245 | | | California Statewide Communities Development Authority,

(Sutter Health), (FSA), 5.75%, 8/15/27(1) | | $ | 7,629,734 | | |

| | 8,960 | | | Harrisonburg, VA, Industrial Development Authority,

(Rockingham Memorial Hospital), (AMBAC),

4.50%, 8/15/41 | | | 8,756,966 | | |

| | | | | | | $ | 16,386,700 | | |

| Insured-Housing — 0.3% | | | |

| $ | 3,945 | | | Virginia Housing Development Authority, (MBIA),

5.375%, 7/1/36(1) | | $ | 4,140,481 | | |

| | 13 | | | Virginia Housing Development Authority, (MBIA),

Variable Rate, 7.305%, 7/1/36(2)(5) | | | 15,230 | | |

| | | | | | | $ | 4,155,711 | | |

Insured-Lease Revenue / Certificates of

Participation — 0.8% | | | |

| $ | 9,590 | | | Hudson Yards Infrastructure Corp., (MBIA),

4.50%, 2/15/47 | | $ | 9,482,688 | | |

| | | | | | | $ | 9,482,688 | | |

| Insured-Miscellaneous — 0.6% | | | |

| $ | 10,510 | | | Harris County-Houston, TX, Sports Authority, (MBIA),

0.00%, 11/15/26 | | $ | 4,314,670 | | |

| | 10,000 | | | Harris County-Houston, TX, Sports Authority, (MBIA),

0.00%, 11/15/28 | | | 3,712,300 | | |

| | | | | | | $ | 8,026,970 | | |

| Insured-Special Tax Revenue — 1.5% | | | |

| $ | 10,390 | | | Louisiana Gas and Fuels Tax, (FSA), 4.75%, 5/1/39 | | $ | 10,603,826 | | |

| | 8,300 | | | New York Convention Center Development Corp.,

(AMBAC), 4.75%, 11/15/45 | | | 8,437,282 | | |

| | | | | | | $ | 19,041,108 | | |

See notes to financial statements

7

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Insured-Transportation — 8.3% | | | |

| $ | 2,250 | | | Central, TX, Regional Mobility Authority, (FGIC),

5.00%, 1/1/45 | | $ | 2,324,903 | | |

| | 4,995 | | | Dallas-Fort Worth, TX, International Airport Facility

Improvements Corp., (FSA), 5.50%, 11/1/18(1) | | | 5,392,685 | | |

| | 10,000 | | | E-470 Public Highway Authority, CO, (MBIA),

0.00%, 9/1/37 | | | 2,272,800 | | |

| | 15,000 | | | E-470 Public Highway Authority, CO, (MBIA),

0.00%, 9/1/33 | | | 3,833,700 | | |

| | 20,000 | | | E-470 Public Highway Authority, CO, (MBIA),

0.00%, 9/1/34 | | | 4,825,000 | | |

| | 7,170 | | | Harris County, TX, Toll Road, Senior Lien, (MBIA),

4.50%, 8/15/36 | | | 7,094,715 | | |

| | 6,600 | | | Indianapolis, IN, Local Public Improvement Bond Bank,

(AMBAC), (AMT), 5.00%, 1/1/36 | | | 6,886,836 | | |

| | 14,400 | | | Indianapolis, IN, Local Public Improvement Bond Bank,

(AMBAC), (AMT), 5.00%, 1/1/36(1) | | | 15,025,896 | | |

| | 7,230 | | | Metropolitan Transportation Authority, NY, (FSA),

4.50%, 11/15/36 | | | 7,223,638 | | |

| | 5,966 | | | Monroe County, NY, Airport Authority, (MBIA), (AMT),

5.875%, 1/1/18(1) | | | 6,775,771 | | |

| | 10,935 | | | Port Authority of New York and New Jersey, (CIFG),

(AMT), 4.50%, 9/1/35 | | | 10,813,184 | | |

| | 6,650 | | | Port Authority of New York and New Jersey, (FSA),

4.25%, 12/1/32 | | | 6,196,204 | | |

| | 10,500 | | | Puerto Rico Highway and Transportation Authority, (AGC),

5.00%, 7/1/40 | | | 10,995,180 | | |

| | 770 | | | Puerto Rico Highway and Transportation Authority, (AGC),

5.00%, 7/1/45 | | | 805,759 | | |

| | 1,000 | | | Puerto Rico Highway and Transportation Authority, (AGC),

Variable Rate, 7.355%, 7/1/32(2)(5) | | | 1,123,209 | | |

| | 6,000 | | | Puerto Rico Highway and Transportation Authority, (FSA),

5.00%, 7/1/32(1) | | | 6,246,421 | | |

| | 20,000 | | | Texas State Turnpike Authority, (AMBAC), 0.00%, 8/15/30 | | | 6,936,000 | | |

| | | | | | | $ | 104,771,901 | | |

| Insured-Water and Sewer — 2.8% | | | |

| $ | 10,200 | | | Connecticut Development Authority (Aquarion Water),

(XLCA), (AMT), 5.00%, 7/1/38(1) | | $ | 10,274,409 | | |

| | 7,310 | | | East Baton Rouge, LA, Sewer Commission, (FSA),

4.50%, 2/1/36 | | | 7,164,897 | | |

| | 2,795 | | | Fort Lauderdale, FL, Water and Sewer, (MBIA),

4.25%, 9/1/33 | | | 2,672,579 | | |

| | 7,510 | | | Marysville, OH, Wastewater Treatment System, (XLCA),

4.75%, 12/1/46 | | | 7,615,666 | | |

| | 10,000 | | | Rahway Valley, NJ, Sewerage Authority, (MBIA),

0.00%, 9/1/29 | | | 3,676,700 | | |

| | 4,000 | | | South Central, CT, Regional Water Authority, (XLCA),

4.25%, 8/1/37 | | | 3,849,760 | | |

| | | | | | | $ | 35,254,011 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Lease Revenue / Certificates of Participation — 1.7% | | | |

| $ | 21,000 | | | Greenville County, SC, School District,

5.00%, 12/1/24(1) | | $ | 22,107,260 | | |

| | | | | | | $ | 22,107,260 | | |

| Nursing Home — 1.8% | | | |

| $ | 2,735 | | | Clovis, NM, Industrial Development Revenue,

(Retirement Ranches, Inc.), 7.75%, 4/1/19 | | $ | 2,847,026 | | |

| | 2,300 | | | Colorado Health Facilities Authority,

(Volunteers of America), 5.75%, 7/1/20 | | | 2,355,269 | | |

| | 3,600 | | | Colorado Health Facilities Authority,

(Volunteers of America), 5.875%, 7/1/28 | | | 3,694,788 | | |

| | 1,100 | | | Colorado Health Facilities Authority,

(Volunteers of America), 6.00%, 7/1/29 | | | 1,133,825 | | |

| | 6,100 | | | Maryland Health and Higher Educational Facilities

Authority, (King Farm Presbyterian Community),

5.00%, 1/1/17 | | | 6,114,091 | | |

| | 2,445 | | | Massachusetts Industrial Finance Agency,

(Age Institute of Massachusetts), 8.05%, 11/1/25 | | | 2,487,030 | | |

| | 1,160 | | | Mississippi Business Finance Corp., (Magnolia Healthcare),

7.99%, 7/1/25 | | | 987,241 | | |

| | 2,975 | | | Westmoreland, PA, (Highland Health Systems, Inc.),

9.25%, 6/1/22 | | | 2,982,408 | | |

| | | | | | | $ | 22,601,678 | | |

| Other Revenue — 10.5% | | | |

| $ | 8,000 | | | California County, CA, Tobacco Securitization Agency,

0.00%, 6/1/46 | | $ | 822,480 | | |

| | 5,715 | | | California Statewide Communities Development Authority,

(East Valley Tourist Development Authority),

8.25%, 10/1/14(2) | | | 6,132,424 | | |

| | 1,000 | | | California Statewide Communities Development Authority,

(East Valley Tourist Development Authority),

9.25%, 10/1/20(2) | | | 1,096,640 | | |

| | 6,355 | | | Central Falls, RI, Detention Facility Revenue,

7.25%, 7/15/35 | | | 7,133,805 | | |

| | 45,000 | | | Children's Trust Fund, PR, Tobacco Settlement,

0.00%, 5/15/50 | | | 3,091,050 | | |

| | 38,300 | | | Children's Trust Fund, PR, Tobacco Settlement,

0.00%, 5/15/55 | | | 1,383,013 | | |

| | 6,000 | | | Cow Creek Band Umpqua Tribe of Indians, OR,

5.625%, 10/1/26(2) | | | 6,108,300 | | |

| | 18,250 | | | Golden State Tobacco Securitization Corp., CA,

5.50%, 6/1/33(1) | | | 19,978,640 | | |

| | 6,600 | | | Golden State Tobacco Securitization Corp., CA,

5.625%, 6/1/31(1) | | | 7,271,187 | | |

| | 2,295 | | | Golden State Tobacco Securitization Corp., CA,

6.625%, 6/1/40 | | | 2,605,743 | | |

See notes to financial statements

8

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Other Revenue (continued) | | | |

| $ | 4,940 | | | Mohegan Tribe Indians, CT, Gaming Authority,

6.25%, 1/1/31(2) | | $ | 5,255,617 | | |

| | 14,000 | | | Non-Profit Preferred Funding Trust I,

5.17%, 9/15/37 | | | 13,792,660 | | |

| | 5,900 | | | Northern Tobacco Securitization Corp., AK,

0.00%, 6/1/46 | | | 564,925 | | |

| | 25,715 | | | Northern Tobacco Securitization Corp., AK,

5.00%, 6/1/46 | | | 25,846,404 | | |

| | 1,984 | | | Pueblo of Santa Ana, NM, 15.00%, 4/1/24(2) | | | 2,015,573 | | |

| | 6,000 | | | Puerto Rico Infrastructure Financing Authority,

5.50%, 10/1/32(1) | | | 6,399,060 | | |

| | 2,086 | | | Santa Fe, NM, (1st Interstate Plaza),

8.00%, 7/1/13 | | | 2,168,890 | | |

| | 28,440 | | | Tobacco Settlement Financing Corp., NJ,

0.00%, 6/1/41 | | | 4,200,872 | | |

| | 8,000 | | | Tobacco Settlement Financing Corp., NJ,

4.75%, 6/1/34 | | | 7,674,400 | | |

| | 8,000 | | | Tobacco Settlement Financing Corp., NJ,

5.00%, 6/1/29 | | | 8,028,960 | | |

| | 1,500 | | | Willacy County, TX, Local Government Corp.,

6.00%, 3/1/09 | | | 1,519,635 | | |

| | | | | | | $ | 133,090,278 | | |

| Senior Living / Life Care — 5.8% | | | |

| $ | 7,475 | | | Albuquerque, NM, Retirement Facilities, (La Vida

Liena Retirement Center), 6.60%, 12/15/28 | | $ | 7,784,316 | | |

| | 2,500 | | | Arizona Health Facilities Authority,

(Care Institute, Inc. - Mesa), 7.625%, 1/1/26(7) | | | 2,269,625 | | |

| | 1,575 | | | California Statewide Communities Development Authority,

(Senior Living-Presbyterian Homes), 4.75%, 11/15/26 | | | 1,582,245 | | |

| | 6,000 | | | California Statewide Communities Development Authority,

(Senior Living-Presbyterian Homes), 4.875%, 11/15/36 | | | 6,041,400 | | |

| | 3,000 | | | Cliff House Trust, PA, (AMT), 6.625%, 6/1/27(8) | | | 2,133,540 | | |

| | 8,300 | | | Colorado Health Facilities Authority, (Covenant

Retirement Communities, Inc.), 5.00%, 12/1/35 | | | 8,402,920 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 1/1/13 | | | 465,380 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 7/1/13 | | | 442,190 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 1/1/14 | | | 420,160 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 7/1/14 | | | 399,360 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 1/1/15 | | | 379,640 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 7/1/15 | | | 360,810 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 1/1/16 | | | 343,050 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Senior Living / Life Care (continued) | | | |

| $ | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 7/1/16 | | $ | 326,150 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 1/1/17 | | | 310,030 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 7/1/17 | | | 294,760 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 1/1/18 | | | 280,330 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 7/1/18 | | | 266,530 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 1/1/19 | | | 253,370 | | |

| | 1,000 | | | Glen Cove, NY, Industrial Development Agency,

(The Regency at Glen Cove), 0.00%, 7/1/19 | | | 240,990 | | |

| | 7,500 | | | Kansas City, MO, Industrial Development Authority,

(Kingswood United Methodist Manor),

5.875%, 11/15/29 | | | 7,525,725 | | |

| | 2,600 | | | Maryland Health and Higher Educational Facilities Authority,

(Edenwald), 5.40%, 1/1/37 | | | 2,691,650 | | |

| | 5,040 | | | Massachusetts Industrial Finance Agency, (Forge Hill),

(AMT), 6.75%, 4/1/30 | | | 5,192,309 | | |

| | 6,470 | | | Minneapolis, MN, (Walker Methodist Senior Services),

6.00%, 11/15/28 | | | 6,569,832 | | |

| | 500 | | | North Carolina Medical Care Commission Retirement

(United Methodist), 5.25%, 10/1/24 | | | 514,660 | | |

| | 1,600 | | | North Carolina Medical Care Commission Retirement

(United Methodist), 5.50%, 10/1/32 | | | 1,657,520 | | |

| | 7,315 | | | North Miami, FL, Health Care Facilities, (Imperial Club),

0.00%, 7/1/41 | | | 3,488,743 | | |

| | 3,500 | | | North Miami, FL, Health Care Facilities, (Imperial Club),

7.00%, 1/1/42 | | | 3,490,620 | | |

| | 530 | | | St. Joseph County, IN, Holy Cross Village, 5.70%, 5/15/28 | | | 539,514 | | |

| | 1,225 | | | St. Joseph County, IN, Holy Cross Village,

6.00%, 5/15/26 | | | 1,303,792 | | |

| | 5,460 | | | St. Joseph County, IN, Holy Cross Village,

6.00%, 5/15/38 | | | 5,773,950 | | |

| | 2,000 | | | Suffolk County, NY, Industrial Development Agency,

(Jeffersons Ferry Project), 5.00%, 11/1/28 | | | 2,034,600 | | |

| | | | | | | $ | 73,779,711 | | |

| Special Tax Revenue — 6.6% | | | |

| $ | 1,330 | | | Avelar Creek Community Development District, FL,

(Capital Improvements), 5.375%, 5/1/36 | | $ | 1,329,880 | | |

| | 2,240 | | | Bell Mountain Ranch, CO, Metropolitan District,

6.625%, 11/15/25 | | | 2,378,768 | | |

| | 3,160 | | | Bell Mountain Ranch, CO, Metropolitan District,

7.375%, 11/15/19 | | | 3,417,730 | | |

| | 500 | | | Bridgeville, DE, (Heritage Shores Special

Development District), 5.125%, 7/1/35 | | | 504,400 | | |

| | 6,250 | | | Bridgeville, DE, (Heritage Shores Special

Development District), 5.45%, 7/1/35 | | | 6,293,688 | | |

See notes to financial statements

9

Eaton Vance High Yield Municipals Fund as of January 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Special Tax Revenue (continued) | | | |

| $ | 560 | | | Cascades Groveland Community Development District, FL,

(Capital Improvements), 5.30%, 5/1/36 | | $ | 562,184 | | |

| | 2,285 | | | Concorde Estates Community Development, FL,

5.85%, 5/1/35 | | | 2,399,821 | | |

| | 3,625 | | | Dupree Lakes, FL, Community Development District,

5.375%, 5/1/37 | | | 3,636,673 | | |

| | 19,980 | | | Massachusetts Bay Transportation Authority, Sales Tax

Revenue, 5.25%, 7/1/32(1) | | | 23,220,490 | | |

| | 2,325 | | | New Jersey Economic Development Authority,

(Cigarette Tax), 5.50%, 6/15/24 | | | 2,439,018 | | |

| | 2,500 | | | New Jersey Economic Development Authority,

(Cigarette Tax), 5.50%, 6/15/31 | | | 2,634,075 | | |

| | 2,250 | | | New Jersey Economic Development Authority,

(Cigarette Tax), 5.75%, 6/15/29 | | | 2,419,988 | | |

| | 3,980 | | | New River, FL, Community Development District,

5.00%, 5/1/13 | | | 3,951,702 | | |

| | 10,000 | | | Puerto Rico Infrastructure Financing Authority,

5.00%, 7/1/46 | | | 10,415,100 | | |

| | 6,450 | | | River Hall Community Development District, FL,

(Capital Improvements), 5.45%, 5/1/36 | | | 6,512,823 | | |

| | 2,470 | | | Southern Hills Plantation I Community

Development District, FL, 5.80%, 5/1/35 | | | 2,548,670 | | |

| | 3,755 | | | Sterling Hill, FL, Community Development District,

5.50%, 5/1/37 | | | 3,813,090 | | |

| | 5,000 | | | Tisons Landing, FL, Community Development District,

(Capital Improvements), 5.00%, 11/1/11 | | | 5,023,750 | | |

| | | | | | | $ | 83,501,850 | | |

| Transportation — 1.7% | | | |

| $ | 750 | | | Augusta, GA, Airport Revenue, 5.15%, 1/1/35 | | $ | 772,920 | | |

| | 910 | | | Eagle County, CO, (Eagle County Airport Terminal), (AMT),

7.00%, 5/1/21 | | | 975,256 | | |

| | 1,180 | | | Eagle County, CO, (Eagle County Airport Terminal), (AMT),

7.125%, 5/1/31 | | | 1,277,739 | | |

| | 17,970 | | | Puerto Rico Highway and Transportation Authority,

5.125%, 7/1/39 | | | 18,745,765 | | |

| | | | | | | $ | 21,771,680 | | |

| Water and Sewer — 1.3% | | | |

| $ | 7,680 | | | Massachusetts Water Resources Authority,

4.00%, 8/1/46 | | $ | 6,773,606 | | |

| | 10,000 | | | New York City, NY, Municipal Water Finance Authority,

(Water and Sewer System), 4.75%, 6/15/33(1) | | | 10,238,960 | | |

| | | | | | | $ | 17,012,566 | | |

Total Tax-Exempt Investments

(identified cost $1,354,569,596) | | $ | 1,420,704,317 | | |

| Short-Term Investments — 0.5% | |

Principal Amount

(000's omitted) | | Security | | Value | |

| $ | 5,800 | | | Detroit, MI, Water Supply System, (FGIC),

Variable Rate, 3.58%, 7/1/35 | | $ | 5,800,000 | | |

Total Short-Term Investments

(at amortized cost, $5,800,000) | | $ | 5,800,000 | | |

Total Investments — 112.5%

(identified cost $1,360,369,596) | | $ | 1,426,504,317 | | |

| Other Assets, Less Liabilities — (12.5)% | | $ | (158,006,660 | ) | |

| Net Assets — 100.0% | | $ | 1,268,497,657 | | |

AGC - Assured Guaranty Corp.

AMBAC - AMBAC Financial Group, Inc.

AMT - Interest earned from these securities may be considered a tax preference item for purposes of the Federal Alternative Minimum Tax.

CIFG - CDC IXIS Financial Guaranty North America, Inc.

FGIC - Financial Guaranty Insurance Company

FSA - Financial Security Assurance, Inc.

MBIA - Municipal Bond Insurance Association

XLCA - XL Capital Assurance, Inc.

At January 31, 2007, the concentration of the Fund's investments in the various states, determined as a percentage of net assets, is

as follows:

| California | | | 14.8 | % | |

| New Jersey | | | 10.2 | % | |

| New York | | | 10.6 | % | |

| Others, representing less than 10% individually | | | 76.9 | % | |

The Fund invests primarily in debt securities issued by municipalities. The ability of the issuers of the debt securities to meet their obligations may be affected by economic developments in a specific industry or municipality. In order to reduce the risk associated with such economic developments, at January 31, 2007, 21.8% of total investments are backed by bond insurance of various financial institutions and financial guaranty assurance agencies. The aggregate percentage insured by an individual financial institution ranged from 0.8% to 5.5% of total investments.

(1) Security represents the underlying municipal obligation of an inverse floating rate obligation held by the Fund.

(2) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At January 31, 2007, the aggregate value of the securities is $53,598,454 or 4.2% of the net assets.

(3) Security (or a portion thereof) has been segregated to cover margin requirements on open financial futures contracts.

(4) Defaulted bond.

(5) Security has been issued as a leveraged inverse floater bond. The stated interest rate represents the rate in effect at January 31, 2007.

(6) Security has been issued as an inverse floater bond. The stated interest rate represents the rate in effect at January 31, 2007.

(7) Security is in default and making only partial interest payments.

(8) Security is in default with respect to interest payments.

See notes to financial statements

10

Eaton Vance High Yield Municipals Fund as of January 31, 2007

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of January 31, 2007

| Assets | |

| Investments, at value (identified cost, $1,360,369,596) | | $ | 1,426,504,317 | | |

| Cash | | | 5,935 | | |

| Receivable for investments sold | | | 8,823,908 | | |

| Receivable for Fund shares sold | | | 6,951,755 | | |

| Interest receivable | | | 17,102,024 | | |

| Receivable for open interest rate swap contracts | | | 603,751 | | |

| Total assets | | $ | 1,459,991,690 | | |

| Liabilities | |

| Payable for floating rate notes issued | | $ | 159,374,656 | | |

| Payable for investments purchased | | | 17,131,273 | | |

| Demand note payable | | | 6,300,000 | | |

| Dividends payable | | | 2,455,029 | | |

| Payable for Fund shares redeemed | | | 2,166,421 | | |

| Payable for daily variation margin on open financial futures contracts | | | 1,635,000 | | |

| Interest expense and fees payable | | | 1,136,689 | | |

| Payable to affiliate for investment advisory fees | | | 523,300 | | |

| Payable to affiliate for distribution and service fees | | | 510,533 | | |

| Accrued expenses | | | 261,132 | | |

| Total liabilities | | $ | 191,494,033 | | |

| Net Assets | | $ | 1,268,497,657 | | |

| Sources of Net Assets | |

| Paid-in capital | | $ | 1,238,104,843 | | |

| Accumulated net realized loss (computed on the basis of identified cost) | | | (46,485,809 | ) | |

| Accumulated undistributed net investment income | | | 253,744 | | |

| Net unrealized appreciation (computed on the basis of identified cost) | | | 76,624,879 | | |

| Total | | $ | 1,268,497,657 | | |

| Class A Shares | |

| Net Assets | | $ | 876,579,099 | | |

| Shares Outstanding | | | 81,674,746 | | |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 10.73 | | |

Maximum Offering Price Per Share

(100 ÷ 95.25 of $10.73) | | $ | 11.27 | | |

| Class B Shares | |

| Net Assets | | $ | 126,916,436 | | |

| Shares Outstanding | | | 11,864,028 | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 10.70 | | |

| Class C Shares | |

| Net Assets | | $ | 265,002,122 | | |

| Shares Outstanding | | | 26,686,468 | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 9.93 | | |

| On sales of $25,000 or more, the offering price of Class A shares is reduced. | | | | | |

Statement of Operations

For the Year Ended

January 31, 2007

| Investment Income | |

| Interest | | $ | 66,054,856 | | |

| Total investment income | | $ | 66,054,856 | | |

| Expenses | |

| Investment adviser fee | | $ | 5,486,411 | | |

| Trustees' fees and expenses | | | 24,730 | | |

Distribution and service fees

Class A | | | 1,746,195 | | |

| Class B | | | 1,369,379 | | |

| Class C | | | 2,168,852 | | |

| Transfer and dividend disbursing agent fees | | | 370,059 | | |

| Custodian fee | | | 322,175 | | |

| Registration fees | | | 177,007 | | |

| Legal and accounting services | | | 84,225 | | |

| Printing and postage | | | 66,075 | | |

| Interest expense and fees | | | 5,429,057 | | |

| Miscellaneous | | | 177,581 | | |

| Total expenses | | $ | 17,421,746 | | |

Deduct —

Reduction of custodian fee | | $ | 173,992 | | |

| Total expense reductions | | $ | 173,992 | | |

| Net expenses | | $ | 17,247,754 | | |

| Net investment income | | $ | 48,807,102 | | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) —

Investment transactions (identified cost basis) | | $ | 6,632,901 | | |

| Financial futures contracts | | | (3,212,422 | ) | |

| Net realized gain | | $ | 3,420,479 | | |

Change in unrealized appreciation (depreciation) —

Investments (identified cost basis) | | $ | 30,322,133 | | |

| Financial futures contracts | | | 10,421,382 | | |

| Interest rate swap contracts | | | 603,751 | | |

| Net change in unrealized appreciation (depreciation) | | $ | 41,347,266 | | |

| Net realized and unrealized gain | | $ | 44,767,745 | | |

| Net increase in net assets from operations | | $ | 93,574,847 | | |

See notes to financial statements

11

Eaton Vance High Yield Municipals Fund as of January 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | |

Year Ended

January 31, 2007 | | Year Ended

January 31, 2006

(As Restated, See Note 12) | |

| From operations — | | | | | | | | | |

| Net investment income | | $ | 48,807,102 | | | $ | 35,114,350 | | |

Net realized gain (loss) from

investment transactions, financial

futures contracts and interest rate

swap contracts | | | 3,420,479 | | | | (6,101,880 | ) | |

Net change in unrealized appreciation

(depreciation) from investments,

financial futures contracts and

interest rate swap contracts | | | 41,347,266 | | | | 16,894,451 | | |

| Net increase in net assets from operations | | $ | 93,574,847 | | | $ | 45,906,921 | | |

Distributions to shareholders —

From net investment income

Class A | | $ | (32,292,219 | ) | | $ | (22,596,709 | ) | |

| Class B | | | (5,373,794 | ) | | | (7,250,518 | ) | |

| Class C | | | (8,443,589 | ) | | | (6,237,390 | ) | |

| Total distributions to shareholders | | $ | (46,109,602 | ) | | $ | (36,084,617 | ) | |

Transactions in shares of beneficial interest —

Proceeds from sale of shares

Class A | | $ | 445,747,682 | | | $ | 214,135,660 | | |

| Class B | | | 14,202,362 | | | | 18,088,953 | | |

| Class C | | | 114,324,772 | | | | 79,607,633 | | |

Net asset value of shares issued to

shareholders in payment of

distributions declared

Class A | | | 14,239,883 | | | | 8,805,692 | | |

| Class B | | | 2,063,207 | | | | 2,651,216 | | |

| Class C | | | 3,485,339 | | | | 2,424,849 | | |

Cost of shares redeemed

Class A | | | (136,830,261 | ) | | | (96,636,885 | ) | |

| Class B | | | (22,910,375 | ) | | | (26,392,330 | ) | |

| Class C | | | (30,577,657 | ) | | | (19,755,799 | ) | |

Net asset value of shares exchanged

Class A | | | 16,754,145 | | | | 18,492,431 | | |

| Class B | | | (16,754,145 | ) | | | (18,492,431 | ) | |

Net increase in net assets from

Fund share transactions | | $ | 403,744,952 | | | $ | 182,928,989 | | |

| Net increase in net assets | | $ | 451,210,197 | | | $ | 192,751,293 | | |

| Net Assets | |

| At beginning of year | | $ | 817,287,460 | | | $ | 624,536,167 | | |

| At end of year | | $ | 1,268,497,657 | | | $ | 817,287,460 | | |

Accumulated undistributed

(distributions in excess of)

net investment income

included in net assets | |

| At end of year | | $ | 253,744 | | | $ | (1,975,921 | ) | |

Statement of Cash Flows

| | | For the Year Ended

January 31, 2007 | |

| Cash Flows From Operating Activities — | |

| Net increase in net assets from operations | | $ | 93,574,847 | | |

Adjustments to reconcile net increase in net assets resulting from

operations to net cash used for operating activities:

Investments purchased | | | (979,958,228 | ) | |

| Investments sold | | | 515,567,808 | | |

| Net amortization of premium/(discount) | | | (2,837,383 | ) | |

| Interest receivable | | | (3,014,771 | ) | |

| Payable for daily variation margin on open financial futures contracts | | | 1,222,500 | | |

| Receivable for open interest rate swap contracts | | | (603,751 | ) | |

| Receivable from custodian | | | 200,000 | | |

| Payable to affiliate for investment advisory fees | | | 165,097 | | |

| Payable to affiliate for distribution and service fees | | | 143,916 | | |

| Interest expense and fees payable | | | 448,246 | | |

| Accrued expenses | | | 88,241 | | |

| Net change in realized and unrealized (gain)/loss on investments | | | (36,955,034 | ) | |

| Net cash used in operating activities | | $ | (411,958,512 | ) | |

Cash Flows Provided by Financing Activities —

Demand note payable | | $ | (5,200,000 | ) | |

| Proceeds from shares sold | | | 576,444,853 | | |

| Shares redeemed | | | (192,670,969 | ) | |

| Cash distributions paid net of reinvestments | | | (25,842,065 | ) | |

| Proceeds from secured borrowings | | | 117,819,998 | | |

| Repayment of secured borrowings | | | (58,620,000 | ) | |

| Net cash provided by financing activities | | $ | 411,931,817 | | |

| Net increase in cash | | $ | (26,695 | ) | |

| Cash at beginning of period | | $ | 32,630 | | |

| Cash at end of period | | $ | 5,935 | | |

Supplemental disclosure of

cash flow information | |

Noncash financing activities not included herein consists of reinvestment of

dividends and distributions of: | | $ | 19,788,429 | | |

See notes to financial statements

12

Eaton Vance High Yield Municipals Fund as of January 31, 2007

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class A | |

| | | Year Ended January 31, | |

| | | 2007(1) | | 2006(1)(6) | | 2005(1)(6) | | 2004(1)(6) | | 2003(1)(6) | |

| Net asset value — Beginning of year | | $ | 10.240 | | | $ | 10.090 | | | $ | 10.230 | | | $ | 9.730 | | | $ | 9.660 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.515 | | | $ | 0.535 | | | $ | 0.614 | | | $ | 0.668 | | | $ | 0.682 | | |

| Net realized and unrealized gain (loss) | | | 0.465 | | | | 0.167 | | | | (0.125 | ) | | | 0.486 | | | | 0.031 | | |

| Total income from operations | | $ | 0.980 | | | $ | 0.702 | | | $ | 0.489 | | | $ | 1.154 | | | $ | 0.713 | | |

| Less distributions | |

| From net investment income | | $ | (0.490 | ) | | $ | (0.552 | ) | | $ | (0.629 | ) | | $ | (0.654 | ) | | $ | (0.643 | ) | |

| Total distributions | | $ | (0.490 | ) | | $ | (0.552 | ) | | $ | (0.629 | ) | | $ | (0.654 | ) | | $ | (0.643 | ) | |

| Net asset value — End of year | | $ | 10.730 | | | $ | 10.240 | | | $ | 10.090 | | | $ | 10.230 | | | $ | 9.730 | | |

| Total Return(2) | | | 9.76 | % | | | 7.14 | % | | | 5.05 | % | | | 12.25 | % | | | 7.59 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of year (000's omitted) | | $ | 876,579 | | | $ | 505,474 | | | $ | 354,881 | | | $ | 238,169 | | | $ | 147,004 | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses excluding interest and fees | | | 0.89 | % | | | 0.94 | % | | | 0.99 | %(4) | | | 1.02 | %(4) | | | 1.05 | %(4) | |

| Interest and fees expense(3) | | | 0.52 | % | | | 0.39 | % | | | 0.26 | %(4) | | | 0.21 | %(4) | | | 0.21 | %(4) | |

| Total expenses | | | 1.41 | % | | | 1.33 | % | | | 1.25 | %(4) | | | 1.23 | %(4) | | | 1.26 | %(4) | |

| Expenses after custodian fee reduction excluding interest and fees | | | 0.87 | % | | | 0.93 | % | | | 0.98 | %(4) | | | 1.02 | %(4) | | | 1.05 | %(4) | |

| Net investment income | | | 4.88 | % | | | 5.26 | % | | | 6.17 | % | | | 6.70 | % | | | 7.01 | % | |

| Portfolio Turnover of the Portfolio(5) | | | — | | | | — | | | | 30 | % | | | 16 | % | | | 12 | % | |

| Portfolio Turnover of the Fund | | | 44 | % | | | 27 | % | | | 8 | % | | | — | | | | — | | |

(1) Net investment income per share was computed using average shares outstanding.

(2) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(3) Interest and fees expense relates to the liability for floating rate notes issued in conjunction with inverse floater securities transactions (see Note 1B).

(4) Includes the Fund's share of the Portfolio's allocated expenses while the Fund was making investments directly into the Portfolio.

(5) Portfolio turnover represents the rate of portfolio activity for the period while the Fund was making investments directly into the Portfolio.

(6) As restated — see Note 12.

See notes to financial statements

13

Eaton Vance High Yield Municipals Fund as of January 31, 2007

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class B | |

| | | Year Ended January 31, | |

| | | 2007(1) | | 2006(1)(7) | | 2005(1)(7) | | 2004(1)(7) | | 2003(1)(7) | |

| Net asset value — Beginning of year | | $ | 10.210 | | | $ | 10.060 | | | $ | 10.200 | | | $ | 9.700 | | | $ | 9.640 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.438 | | | $ | 0.463 | | | $ | 0.542 | | | $ | 0.600 | | | $ | 0.606 | | |

| Net realized and unrealized gain (loss) | | | 0.463 | | | | 0.162 | | | | (0.129 | ) | | | 0.479 | | | | 0.022 | | |

| Total income from operations | | $ | 0.901 | | | $ | 0.625 | | | $ | 0.413 | | | $ | 1.079 | | | $ | 0.628 | | |

| Less distributions | |

| From net investment income | | $ | (0.411 | ) | | $ | (0.475 | ) | | $ | (0.553 | ) | | $ | (0.579 | ) | | $ | (0.568 | ) | |

| Total distributions | | $ | (0.411 | ) | | $ | (0.475 | ) | | $ | (0.553 | ) | | $ | (0.579 | ) | | $ | (0.568 | ) | |

| Net asset value — End of year | | $ | 10.700 | | | $ | 10.210 | | | $ | 10.060 | | | $ | 10.200 | | | $ | 9.700 | | |

| Total Return(2) | | | 8.97 | % | | | 6.34 | % | | | 4.52 | %(3) | | | 11.44 | % | | | 6.66 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of year (000's omitted) | | $ | 126,916 | | | $ | 143,784 | | | $ | 165,787 | | | $ | 212,391 | | | $ | 188,959 | | |

| Ratios (As a percentage of average daily net assets): | |