UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to

Section 14(a) of the Securities

Exchange Act of 1934(Amendment No.)

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

SFN GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o Fee paid previously with preliminary materials.

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

To our Stockholders:

On behalf of the Board of Directors, it is our pleasure to invite you to attend the annual meeting of stockholders of SFN Group, Inc.

As shown in the notice enclosed, the annual meeting will be held at 9:00 a.m. (Eastern Daylight Time) on Tuesday, May 17, 2011 at our corporate headquarters, 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309. At the annual meeting we will be acting on the matters described in this proxy statement. If you will need directions to the annual meeting, or if you require special assistance at the annual meeting because of a disability, please contact Ms. Dahlton Bennington at (954) 308-8427.

We hope you will be able to attend our annual meeting. However, whether or not you are personally present, it is important that your shares be represented at this meeting to assure the presence of a quorum. Whether or not you plan to attend the annual meeting, you are urged to cast your vote as soon as possible.

Thank you for your support.

| Sincerely,

| | | |

|

| |  | |

| Roy G. Krause

President & Chief Executive Officer | | James J. Forese

Chairman | |

SFN GROUP, INC.

_____________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

_____________

To Be Held

Tuesday, May 17, 2011

9:00 a.m. EDT

To our Stockholders:

NOTICE IS HEREBY GIVEN that the 2011 Annual Meeting of Stockholders (the “Annual Meeting”) of SFN GROUP, INC., a Delaware corporation (the “Company”), will be held at 9:00 a.m. (Eastern Daylight Time) on Tuesday, May 17, 2011 at our corporate headquarters, 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309. At the Annual Meeting, our stockholders will be asked to consider and vote upon the following matters:

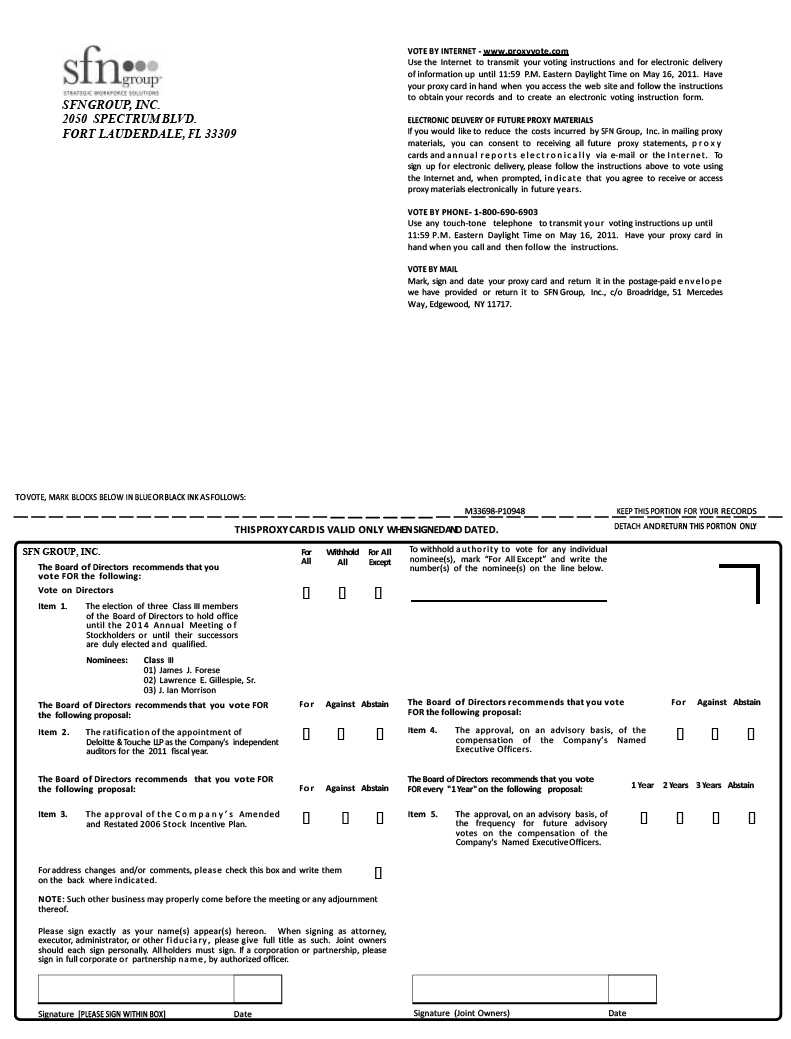

1. The election of three Class III members of the Board of Directors to hold office until the 2014 annual meeting of stockholders or until their successors are duly elected and qualified.

2. The ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the 2011 fiscal year.

3. The approval of the Company’s Amended and Restated 2006 Stock Incentive Plan.

4. The approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers.

5. The approval, on an advisory basis, of the frequency for future advisory votes on the compensation of the Company’s Named Executive Officers.

6. The transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Only stockholders of record at the close of business on March 18, 2011 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

| BY ORDER OF THE BOARD OF DIRECTORS,

|

| Thad S. Florence |

| Secretary |

Fort Lauderdale, Florida

April 7, 2011

—IMPORTANT— WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE CAST YOUR VOTE AS SOON AS POSSIBLE. IF YOU ATTEND THE MEETING AND SO DESIRE, YOU MAY VOTE IN PERSON. THANK YOU FOR VOTING PROMPTLY. |

TABLE OF CONTENTS |

ABOUT THE ANNUAL MEETING …………………………………………………………………………….. | 1 |

Purpose of the Annual Meeting …………………………………………………………………………………… | 1 |

Voting at the Annual Meeting ……………………………………………………………………………………… | 1 |

Voting Rights of the Holders of Our Common Stock ………………………………………………………………... | 1 |

Quorum ……………………………………………………………………………………………………………... | 1 |

Notice Regarding Availability of Proxy Materials ……………………………………………………..................... | 2 |

How to Vote …………………………………………………………………………………………….................... | 2 |

Changing Your Vote ……………………………………………………………………………………….................... | 3 |

The Board’s Recommendations ……………………………………………………………………………………... | 3 |

Required Vote for Approval ……………………………………………………………………………..................... | 3 |

| |

CORPORATE GOVERNANCE AND BOARD MATTERS …………………………………………………... | 4 |

General ……………………………………………………………………………………………………………... | 4 |

Board Committees ………………………………………………………………………………………………….. | 4 |

Director Independence; Board Leadership Structure ………………………………………………………………. | 5 |

Director Selection Process ………………………………………………………………………………………….. | 5 |

Board Compensation ……………………………………………………………………………………………….. | 6 |

Certain Relationships and Related Transactions …………………………………………………………………… | 8 |

Corporate Governance Guidelines, Board Oversight of Enterprise Risk, and Code of Ethics …………………….. | 8 |

Communication with the Board …………………………………………………………………………………….. | 8 |

Stockholder Proposals …………………���……………………………………………………………………….. | 8 |

| |

EXECUTIVE COMPENSATION………………………………………………………………………………... | 9 |

Compensation Committee Governance …………………………………………………………………………….. | 9 |

Compensation Policies and Practices as they Relate to Risk Management ………………………………………... | 9 |

Compensation Committee Interlocks and Insider Participation ……………………………………………………. | 10 |

Compensation Committee Report ………………………………………………………………………………….. | 10 |

Compensation Discussion and Analysis ……………………………………………………………………………. | 11 |

Compensation Philosophy and Objectives …………………………………………………………………………. | 13 |

Oversight of Executive Compensation Programs …………………………………………………………………... | 13 |

Key Compensation Elements ………………………………………………………………………………………. | 15 |

Summary Compensation Table …………………………………………………………………………………….. | 22 |

Grants of Plan-Based Awards ……………………………………………………………………………………… | 23 |

Outstanding Equity Awards at Fiscal Year-End …………………………………………………………………… | 25 |

Options Exercised and Stock Vested During Fiscal 2010 ………………………………………………………….. | 26 |

Nonqualified Deferred Compensation ……………………………………………………………………………… | 27 |

Potential Payments on Account of Retirement, Termination without Cause, Termination on Change | |

in Control, Death/Disability or Resignation ……………………………………………………………... | 28 |

Post-Termination and Change in Control Benefits as of December 26, 2010 ……………………………………... | 29 |

| |

AUDIT-RELATED MATTERS ………………………………………………………………………………….. | 30 |

Audit Committee Report …………………………………………………………………………………………… | 30 |

Audit and Non-Audit Fees ………………………………………………………………………………………….. | 31 |

Pre-Approval Policies and Procedures ……………………………………………………………………………... | 31 |

| |

ITEMS TO BE VOTED ON ……………………………………………………………………………………… | 32 |

Item 1 – Election of three Class III members of the Board of Directors …………………………………………… | 32 |

Item 2 – Ratification of the Appointment of Auditors ……………………………………………………………... | 35 |

Item 3 – Approval of the Amended and Restated 2006 Stock Incentive Plan ……………………………………... | 35 |

Item 4 – Advisory Vote on the Compensation of the Company’s Named Executive Officers …………………….. | 44 |

Item 5 – Advisory Vote on the Frequency for Future Advisory Votes on the Compensation of the Company’s | |

Named Executive Officers ………………………………………………………………………………. | 46 |

Other Matters ……………………………………………………………………………………………………….. | 47 |

OTHER INFORMATION ………………………………………………………………………………………... | 47 |

Security Ownership of Certain Beneficial Owners and Management ……………………………………………… | 47 |

Section 16(a) Beneficial Ownership Reporting Compliance ………………………………………………………. | 50 |

Equity Compensation Plan Information ……………………………………………………………………………. | 50 |

Proxy Solicitation Costs ……………………………………………………………………………………………. | 50 |

Householding; Availability of Materials …………………………………………………………………………… | 50 |

| |

ANNEX A ………………………………………………………………………………………………………….. | A-1 |

| |

ANNEX B ………………………………………………………………………………………………………….. | B-1 |

2011 ANNUAL MEETING OF STOCKHOLDERS

OF

SFN GROUP, INC.

_____________

PROXY STATEMENT

_____________

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation by the Board of Directors (the “Board”) of SFN Group, Inc., a Delaware corporation (“SFN” or the “Company”), of proxies from the holders of our common stock, $0.01 par value per share (the “Common Stock”), for use at our 2011 Annual Meeting of Stockholders to be held pursuant to the enclosed Notice of Annual Meeting, at 9:00 a.m. (Eastern Daylight Time) on Tuesday, May 17, 2011, at our corporate headquarters, 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309, telephone (954) 308-7600, or at any adjournments or postponements thereof (the “Annual Meeting”).

This Proxy Statement and the form of proxy (“Proxy Card”) are first being made available to stockholders on April 7, 2011.

ABOUT THE ANNUAL MEETING

Purpose of the Annual Meeting

At the Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting attached to this Proxy Statement. In addition, management will respond to questions by stockholders.

Voting at the Annual Meeting

Only stockholders of record at the close of business on March 18, 2011, the record date for the Annual Meeting (the “Record Date”), are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the Common Stock that you held on that date at the Annual Meeting, or any postponements or adjournments of the Annual Meeting.

Voting Rights of the Holders of Our Common Stock

Each stockholder is entitled to one vote on each matter properly presented at the Annual Meeting for each share of Common Stock owned by that stockholder at the close of business on the Record Date. Therefore, if you owned 100 shares of Common Stock at the close of business on March 18, 2011, you can cast 100 votes for each matter properly presented at the Annual Meeting. Stockholders do not have a right to cumulate their votes for directors.

Quorum

The presence at the Annual Meeting of a majority of Common Stock issued and outstanding and entitled to vote, the holders of which are present in person or represented by proxy, will constitute a quorum, permitting us to conduct business at the Annual Meeting. As of the Record Date, there were 50,922,242 shares of Common Stock issued and outstanding and entitled to be voted at the Annual Meeting. Thus, the presence of the holders of Common Stock representing at least 25,461,122 shares will be required to establish a quorum. If less than a majority of the shares of Common Stock entitled to vote are represented at the Annual Meeting, the holders of a majority of the shares actually represented may adjourn the Annual Meeting to another date, time and place.

Pursuant to Delaware law, proxies received but marked as abstentions and broker non-votes are counted as present for purposes of determining the presence or absence of a quorum. Abstentions are counted as present and entitled to vote and will be counted as votes cast at the Annual Meeting, but will not be counted as votes cast for or against any given matter. However, a broker non-vote on a matter is considered as not entitled to vote on that matter and thus is not counted as a vote cast in determining whether a matter has been approved.

A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder at our corporate headquarters, 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309, during the Annual Meeting and during the ten day period prior to the Annual Meeting.

NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

Pursuant to the “notice and access” rules adopted by the Securities and Exchange Commission (“SEC”), we have elected to provide access to our proxy materials via the Internet. We believe that the "notice and access" process will expedite the receipt of proxy materials, reduce our printing and mailing expenses and reduce the environmental impact of producing materials required for the Annual Meeting. A Notice Regarding Availability of Proxy Materials (“Notice”) will be mailed to most of our registered stockholders and beneficial owners. The Notice contains instructions on how to access the proxy materials on the Internet, how to vote, and how to request printed copies.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 17, 2011

Our 2010 Annual Report on Form 10-K and this Proxy Statement are available atwww.proxyvote.com. Please have the 12-digit control number on the Notice available to access these documents.

How to Vote

Depending on how you hold your Common Stock, there are several ways in which you may vote:

· Vote by Telephone. You may vote by telephone by following the instructions included with the Notice. The deadline for voting by telephone is 11:59 p.m. (Eastern Daylight Time) on May 16, 2011. For those “street name” stockholders (stockholders whose shares are held through a broker or nominee) who wish to vote by telephone, please check your voting instruction card or contact your broker or nominee to determine whether you will be able to vote by telephone.

· Vote on the Internet. You may vote electronically through the Internet by following the instructions included with the Notice. The deadline for voting electronically using the Internet is 11:59 p.m. (Eastern Daylight Time) on May 16, 2011. For those “street name” stockholders who wish to vote by using the Internet, please check your voting instruction card or contact your broker or nominee to determine whether you will be able to vote using the Internet.

· Vote by Proxy Card. You may vote by Proxy Card if you request proxy materials, which include a Proxy Card, as set forth in the Notice.

· Attend the Annual Meeting in person. Any stockholder may attend the Annual Meeting in person and vote their shares in person; however, if you are a “street name” stockholder and you wish to vote in person at the Annual Meeting, you will need to obtain a proxy form from the institution that holds your shares.

· 401(k) Plan stockholders. If you participate in SFN’s 401(k) plan, you may vote the amount of shares of Common Stock credited to your account as of the Record Date. You may vote by instructing JPMorgan Chase Bank N.A., the trustee of the 401(k) plan, pursuant to the instruction card being delivered with this Proxy Statement to plan participants. The trustee will vote your shares in accordance with your duly executed instructions if received by May 13, 2011. If you do not send timely instructions, the nonvoted whole and fractional shares will be voted by the trustee in the same proportion that it votes the whole and fractional shares for which it did receive timely voting instructions.

No matter what method you ultimately decide to use to vote your Common Stock, we urge you to vote promptly.

Changing Your Vote

You may change your vote at any time before your proxy is exercised by filing with our Corporate Secretary either a notice of revocation or a duly executed proxy bearing a later date; however, no such revocation or subsequent proxy will be effective unless and until written notice of the revocation or subsequent proxy is received by us at or prior to the Annual Meeting.

For 401(k) shares, you may revoke previously given voting instructions on or before May 13, 2011 by filing with the trustee either a written notice of revocation or a properly completed and signed voting instruction card bearing a later date.

The Board’s Recommendations

The Board’s recommendations are set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

· “for” election of the nominated Class III directors (see Item 1);

· “for” ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the 2011 fiscal year (see Item 2);

· “for” approval of the Company’s Amended and Restated 2006 Stock Incentive Plan (see Item 3);

· “for” approval, on an advisory basis, of the compensation of the Company’s Named Executive Officers (see Item 4); and

· “for” a frequency of every “1 year” for future advisory votes on the compensation of the Company’s Named Executive Officers (see Item 5).

Unless you give other instructions, the persons named proxy holders will vote in accordance with the recommendations of the Board. With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

Required Vote for Approval

Election of Directors; Frequency of Stockholder Vote on Named Executive Officer Compensation. The affirmative vote of a plurality of the votes of the stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for the election of directors and the determination of the frequency of the stockholder advisory vote on Named Executive Officer compensation. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Similarly, a properly executed proxy marked “ABSTAIN” with respect to the determination of the frequency of the stockholder advisory vote on Named Executive Officer compensation will not be voted with respect to any of the frequency options.

Other Items. For each other item, the affirmative vote of the holders of a majority of the stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the item will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any such matter will not be voted, although it will be counted as representing a share or shares represented by proxy and entitled to vote at the Annual Meeting. Accordingly, an abstention will have the effect of a negative vote.

“Broker non-votes” occur when shares held by a brokerage firm are not voted with respect to a proposal because the firm has not received voting instructions from the stockholder and the firm does not have the authority to vote the shares in its discretion. Under the rules of the New York Stock Exchange (“NYSE”), brokerage firms may have the authority to vote their customers’ shares on certain routine matters for which they do not receive voting instructions, such as the ratification of the selection of our independent registered public accounting firm. Under recent NYSE rule changes, a broker does not have the discretion to vote on the election of directors and, as a result, any broker that is a member of the NYSE will not have the discretion to vote on the election of directors. Furthermore, a broker does not have the discretion to vote on the Company’s Amended and Restated 2006 StockIncentive Plan, the compensation of the Company’s Named Executive Officers, and the frequency of the vote on the compensation of the Company’s Named Executive Officers. A broker non-vote will have no effect on the proposals.

CORPORATE GOVERNANCE AND BOARD MATTERS

General

There are currently nine members of the Board:

James J. Forese, Chairman

Steven S. Elbaum

William F. Evans

Lawrence E. Gillespie, Sr.

Roy G. Krause

J. Ian Morrison

David R. Parker

Barbara Pellow

Anne Szostak

The Board held five meetings during the fiscal year ended December 26, 2010 (“Fiscal 2010”). All directors who served during the entire Fiscal 2010 attended at least seventy-five percent of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which such director served during Fiscal 2010. Mr. Gillespie also attended at least seventy-five percent of such meetings measured from the time he was elected to the Board on April 2, 2010. We do not have a formal policy regarding attendance by members of the Board at the annual meeting of stockholders, but we encourage directors to attend and historically, most have done so. At our last annual meeting of stockholders, held on May 18, 2010, all of our directors attended.

Board Committees

The standing committees of the Board include: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. The following table sets forth Committee memberships as of the date of this Proxy Statement.

Director | | Audit Committee | | Compensation Committee | | Corporate Governance and Nominating Committee |

James J. Forese | | | | | | ** |

Steven S. Elbaum | | * | | | | * |

William F. Evans | | ** | | | | * |

Lawrence E. Gillespie, Sr. | | * | | | | * |

Roy G. Krause | | | | | | |

J. Ian Morrison | | | | * | | * |

David R. Parker | | * | | | | * |

Barbara Pellow | | | | * | | * |

Anne Szostak | | | | ** | | * |

____________________

The functions of the Audit Committee and its activities during Fiscal 2010 are described below in theAudit Committee Report. The Audit Committee held 12 meetings during Fiscal 2010. All members of the Audit Committee are “independent” within the meaning of the listing standards of the NYSE and meet financial literacy and management expertise requirements. Chairman William F. Evans has been designated by the Board as an “audit committee financial expert” within the meaning of Item 407 of Regulation S-K under the Securities Exchange Act of 1934, as amended. The charter of the Audit Committee is available on our website atwww.sfngroup.com under theCorporate Governance tab found in the Investor Relations section, and a copy may be obtained by written request to our Corporate Secretary at SFN Group, Inc., 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309.

��

All members of the Compensation Committee are “independent” within the meaning of the listing standards of the NYSE. The Compensation Committee grants stock and equity-linked awards, determines and approves, in consultation with the other independent directors, the Chief Executive Officer’s (“CEO”) annual compensation, evaluates the performance and approves the compensation of our Named Executive Officers (as defined on page 11), administers our equity-based plans, and reviews and makes recommendations to the Board concerning compensation for directors and approval of compensation plans requiring stockholder approval. For further information on the Compensation Committee's processes and procedures for consideration and determination of executive compensation, see the Compensation Discussion and Analysis elsewhere in this Proxy Statement. The Compensation Committee held five meetings during Fiscal 2010. The charter of the Compensation Committee is available on our website atwww.sfngroup.com under the Corporate Governance tab found in the Investor Relations section, and a copy may be obtained by written request to our Corporate Secretary at SFN Group, Inc., 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309.

The Corporate Governance and Nominating Committee is comprised of all of the independent, non-employee directors and meets regularly in executive session without the presence of the CEO or other management. These executive sessions are presided over by the Committee’s Chairman who is selected annually by the Board. During Fiscal 2010, James J. Forese, as the Committee's Chairman, presided over the executive sessions. The primary functions of the Corporate Governance and Nominating Committee include (i) developing and recommending to the Board a set of corporate governance guidelines; (ii) reviewing and recommending to the Board roles and compositions of the various Board committees; (iii) evaluating the performance of the Board; (iv) evaluating the performance of senior management; and (v) identifying and recommending nominees for election as directors. The Corporate Governance and Nominating Committee held four meetings during Fiscal 2010. The charter of the Corporate Governance and Nominating Committee is available on our website atwww.sfngroup.com under the Corporate Governance tab found in the Investor Relations section, and a copy may be obtained by written request to the Corporate Secretary at SFN Group, Inc., 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309.

Director Independence; Board Leadership Structure

The provisions of ourGovernance Principles regarding director independence meet the listing standards of the NYSE. A copy of ourGovernance Principles is also available on our website atwww.sfngroup.com under the Corporate Governance tab found in the Investor Relations section, and a copy may be obtained by written request to our Corporate Secretary at SFN Group, Inc., 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309. The Board has determined that all of its current members are “independent” within the meaning of these standards, with the exception of Roy G. Krause, who is also our President and Chief Executive Officer. The Board has determined that each independent director has no material relationship with the Company, other than in their capacity as an independent director and stockholder. The Board has the ability to retain outside advisors as it deems necessary in the performance of its duties.

The positions of Chairman and Chief Executive Officer are separate at SFN, in accordance with ourGovernance Principles adopted by the Board. James J. Forese serves as our Chairman and Roy G. Krause serves as our President and Chief Executive Officer. The Board believes that this segregation avoids conflicts that may arise as the result of combining the roles, and effectively maintains independent oversight of management.

Director Selection Process

The Corporate Governance and Nominating Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and stockholders. The Committee has also retained, from time to time, a third-party executive search firm to identify candidates upon request of the Committee. A stockholder who wishes to recommend a prospective nominee for the Board should notify our Corporate Secretary in writing with whatever supporting material the stockholder considers appropriate. The Corporate Governance and Nominating Committee will consider whether to nominate any person nominated by a stockholder pursuant to the provisions of our Restated By-laws relating to stockholder nominations as described in “Stockholder Proposals” on page 8.

Once the Corporate Governance and Nominating Committee has identified a prospective nominee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the Committee determines, in consultation with the Chairman of the Board and other Board members as appropriate, that additional consideration is warranted, it may request the third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the standards and qualifications set out in the charter of the Corporate Governance and Nominating Committee, including:

· the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties;

· the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board;

· the prospective nominee’s character and integrity;

· the prospective nominee’s ability to be free of any conflict of interest; and

· the prospective nominee’s diversity of experience, background, gender, race and age.

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Committee determines whether to interview the prospective nominee, and if warranted, one or more members of the Committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the Committee.

Board Compensation

Non-employee directors receive an annual retainer. The annual retainer is determined by the Board each year and is effective for a twelve-month period commencing on the date of the Board meeting coinciding with the Company’s annual meeting. For 2010, this twelve-month period commenced on May 18, 2010. The Board may designate the manner in which the annual retainer shall be payable including, but not limited to, in cash, in shares of our Common Stock or in any combination thereof, and may permit up to 100% of the annual retainer to be deferred and paid to the directors in the form of Restricted Stock Units with a voluntary deferral feature (“RSUs”). The annual retainer payable to each non-employee director is currently set at $35,000. The Chairman of the Board receives an additional annual retainer in the amount of $125,000 payable in cash, RSUs or stock options, at the election of the Board. In 2010, the Board elected to pay the Chairman in cash. In addition, the Chairpersons of the Audit and Compensation Committees receive an additional annual retainer in the amount of $20,000, payable in cash.

Additionally, non-employee directors are compensated at the rate of $2,000 per Board meeting attended and between $500 and $1,500 per Committee meeting attended (depending on meeting length), all payable in cash. Directors are reimbursed for expenses incurred by them in connection with our business. In addition, Messrs. Evans and Morrison participate in certain of our health benefit plans for which they pay a premium to the Company.

In 2010, each non-employee director was entitled to receive an annual grant of RSUs in an amount equal to $75,000 based on the value of the underlying Common Stock, vesting on the first anniversary of the date of grant. In 2010, 9,004 RSUs were granted to each non-employee director on May 18, 2010 and will vest on May 18, 2011.

All grants of Common Stock to non-employee directors are subject to a cap of 30,000 shares per non-employee director in any fiscal year, pursuant to our 2006 Stock Incentive Plan.

Non-employee directors are required to meet certain stock ownership guidelines. Prior to February 2011, each director was required to own and hold a minimum of 10,000 shares of our Common Stock. New directors had two years from the date of election to comply with this requirement. In February 2011, the Board adopted new director stock ownership requirements. Under the new requirements, each director is required to own and hold shares having a value of at least three times the annual director retainer ($35,000 x 3 = $105,000). New directors have five years from the time of election to the Board to meet this requirement. Vested Deferred Stock Units (“DSUs”) and vested RSUs count toward this requirement. All of our current directors, except for Mr. Gillespie, have met the stock ownership requirement. Mr. Gillespie should be compliant as of May 18, 2011 when his 2010 annual grant vests.

Prior to July 2006, director retainers payable in shares of our Common Stock, and annual director grants, were in the form of DSUs in accordance with the Deferred Stock Plan (a plan that was terminated upon the approval of the 2006 Stock Incentive Plan).

The table below shows the total cash paid and equity-based compensation awarded to each of our non-employee directors during 2010.

| | Fees Earned or Paid in Cash | | Stock Awards | | Total |

Name | | ($) | | ($) (1) | | ($) |

James J. Forese | | $ | 202,000 | | $ | 75,003 | | $ | 277,003 |

Steven S. Elbaum | | $ | 69,500 | | $ | 75,003 | | $ | 144,503 |

William F. Evans | | $ | 89,000 | | $ | 75,003 | | $ | 164,003 |

Lawrence E. Gillespie, Sr.(2) | | $ | 53,000 | | $ | 75,003 | | $ | 128,003 |

J. Ian Morrison | | $ | 58,500 | | $ | 75,003 | | $ | 133,503 |

David R. Parker | | $ | 66,500 | | $ | 75,003 | | $ | 141,503 |

Barbara Pellow | | $ | 59,500 | | $ | 75,003 | | $ | 134,503 |

Anne Szostak | | $ | 79,500 | | $ | 75,003 | | $ | 154,503 |

A. Michael Victory (3) | | $ | 8,500 | | $ | 0 | | $ | 8,500 |

____________________

(1) | RSUs were granted on May 18, 2010, with an aggregate grant date fair value of $8.33 as calculated in accordance with ASC Topic 718, and vest on May 18, 2011. The aggregate number of DSUs and RSUs held by the non-employee directors at the end of Fiscal 2010 were: James J. Forese, 15,463 DSUs, all of which were vested and deferred, and 42,809 RSUs, of which 33,805 were vested and deferred; Steven S. Elbaum, 77,238 DSUs, all of which were vested and deferred, and 37,259 RSUs, of which 28,255 were vested and deferred; William F. Evans, 20,494 DSUs, all of which were vested and deferred, and 42,809 RSUs, of which 33,805 were vested and deferred; Lawrence E. Gillespie, Sr., 9,004 RSUs, none of which were vested; J. Ian Morrison, 20,494 DSUs, all of which were vested and deferred, and 42,809 RSUs, of which 33,805 were vested and deferred; David R. Parker, 42,809 RSUs, of which 33,805 were vested and deferred; Barbara Pellow, 9,004 RSUs, none of which were vested; Anne Szostak, 7,576 DSUs, all of which were vested and deferred, and 24,575 RSUs, of which 15,571 were vested and deferred; A. Michael Victory, 0 DSUs and 0 RSUs. Although no option awards were granted to directors during Fiscal 2010, the aggregate number of shares covered by option awards held by the non-employee directors at the end of Fiscal 2010 were: 5,000 vested shares for James J. Forese; 74,111 vested shares for Steven S. Elbaum; 31,738 vested shares for William F. Evans; 0 shares for Lawrence E. Gillespie, Sr.; 31,738 vested shares for J. Ian Morrison; 5,000 vested shares for David R. Parker; 0 shares for Barbara Pellow; 0 shares for Anne Szostak; and 31,738 vested shares for A. Michael Victory. |

(2) | Mr. Gillespie was elected to the Board on April 2, 2010, and therefore did not participate in all 2010 Board and applicable Board committee meetings. |

(3) | A. Michael Victory, a director since 1980, passed away on March 27, 2010. Prior to his passing, Mr. Victory attended three committee and two Board meetings. Due to the timing of his passing, Mr. Victory did not receive an annual stock grant in 2010. Further, any unvested DSUs and RSUs held by Mr. Victory were forfeited upon his passing in accordance with the terms of our stock Plans, and such forfeitures are reflected in the totals in footnote one above. |

Certain Relationships and Related Transactions

We did not have any related party transactions, as described in Item 404(a) of Regulation S-K, during Fiscal 2010. Ourpolicy, pursuant to ourGovernance Principlesand ourCode of Business Conduct and Ethics, is to not enter into any transaction that would require disclosure under Item 404(a) of Regulation S-K. If such a transaction were to arise, we would require approval of the full Board, excluding any interested directors.

Corporate Governance Guidelines, Board Oversight of Enterprise Risk, and Code of Ethics

The Board has adopted a set ofGovernance Principles, which provide a framework within which the Board and its Committees direct the affairs of the Company. TheGovernance Principlesaddress the roles of the Board and management, functions of the Board, qualifications for directors, director independence, ethics and conflicts of interest, among other matters. TheGovernance Principlesare available on our website atwww.sfngroup.com under the Corporate Governance tab found in the Investor Relations section, and a copy may be obtained by written request to our Corporate Secretary at SFN Group, Inc., 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309.

The Board has overall responsibility for risk oversight, with a focus on the most significant risks facing the Company. In accordance with ourGovernance Principles, the Board assesses major risks facing the Company, and reviews options for their mitigation. In order to facilitate this assessment and review, management conducts an enterprise risk assessment at the beginning of each year. The risk assessment is enterprise-wide, and has been developed to identify, assess and prioritize the Company’s key risks, including potential magnitude, likelihood and velocity of each risk, as well as to consider mitigation initiatives to manage those risks. Executive management and key functional heads are surveyed to develop this information. Our Director of Internal Audit, who reports directly to the Chairman of the Audit Committee, coordinates this assessment and review. The results of the assessment are reviewed and discussed with the Audit Committee and the full Board, and management and the Board agree upon risk prioritization and mitigation measures for the coming year.

We also have aCode of Business Conduct and Ethics, which is applicable to all of our employees, officers and directors and a separateCode of Ethics for Chief Executive Officer and Senior Financial Officers, which is applicable to the principal executive officer, the principal financial officer and the senior vice president of finance. Both theCode of Business Conduct and Ethics and the Code of Ethics for Chief Executive Officer and Senior Financial Officersare available on our website atwww.sfngroup.com under the Corporate Governance tab found in the Investor Relations section, and a copy may be obtained by written request to our Corporate Secretary at SFN Group, Inc., 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309. We intend to post amendments or waivers, if any, to theCode of Business Conduct and Ethics(to the extent applicable to our principal executive officer, principal financial officer or senior vice president of finance) and waivers to theCode of Ethics for Chief Executive Officer and Senior Financial Officersat this location on our website. There are currently no amendment waivers to either of these codes.

Communication with the Board

Any stockholder or other interested party who wishes to communicate with the Board, a committee of the Board, the non-management directors as a group or any member of the Board (including our non-executive chairman and presiding director), may send correspondence to our Corporate Secretary at SFN Group, Inc., 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309. Our Corporate Secretary will submit all stockholder correspondence relating to material matters affecting the Company to the Board, committee of the Board, the presiding director, non-management directors as a group or individual member, as the case may be.

Stockholder Proposals

As more specifically provided in our Restated By-laws, no business may be brought before an annual meeting unless it is specified in the notice of the meeting or is otherwise brought before the meeting by or at the direction of the Board or by a stockholder entitled to vote who has delivered proper notice to us not less than 50 days nor more than 75 days prior to the scheduled date of the annual meeting. Accordingly, as our Restated By-laws state that our annual meeting be held on the third Tuesday of May each year, unless otherwise determined by the Board, any stockholder proposal to be considered at the 2012 Annual Meeting must be properly submitted to us not earlier than March 1, 2012 nor later than March 26, 2012. Stockholders desiring to suggest qualified nominees for director positions should submit the required information to our Corporate Secretary within the same time period. Detailed information for submitting stockholder proposals or recommendations for director nominees will be providedto you if you make a written request to our Corporate Secretary, 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309. These requirements are separate from the Securities and Exchange Commission’s requirements that a stockholder must meet in order to have a proposal included in our Proxy Statement. For the 2012 Annual Meeting,under the Commission’s requirements, any stockholder proposals and recommendations for director nominees must be received by our Corporate Secretary no later than December 9, 2011 in order to be included in our 2012 Proxy Statement.

EXECUTIVE COMPENSATION

Compensation Committee Governance

Charter. The Compensation Committee’s charter is available on our website atwww.sfngroup.comunder the Corporate Governance tab found in the Investor Relations section.

Scope of authority. In accordance with the Compensation Committee Charter, the Committee is responsible for the following:

· Participating in the development and approval of the compensation philosophy and policies;

· Reviewing and approving corporate goals and objectives with respect to compensation for the Chief Executive Officer and other senior officers, consistent with our business strategy, evaluating the officers’ performance in light of those goals and objectives, and based on those evaluations determining their annual and long-term compensation, including salary, bonus, incentive and equity compensation;

· Administering equity-based plans;

· Approving adoption of compensation plans not requiring stockholder approval and recommending for Board approval compensation plans requiring stockholder approval;

· Recommending to the Board compensation for the Board;

· Reviewing and discussing with management our disclosures under the "Compensation Discussion and Analysis" (the "CD&A"), and based on such review and discussion, making a recommendation to the Board as to whether the CD&A should be included in our Annual Report on Form 10-K and the Company's proxy statement; and

· Preparing and publishing a Committee report on executive compensation in our proxy statement.

Delegation authority. The Compensation Committee may delegate authority to officers or to a subcommittee as it may deem appropriate from time to time. The Committee has delegated to the Chief Executive Officer the ability to award up to an aggregate of 100,000 shares annually under the Company’s 2006 Stock Incentive Plan (the “2006 Plan”) to non-insider new hires, with a maximum of 25,000 shares for any individual.

Compensation Policies and Practices as they Relate to Risk Management

Compensation Risk Assessment. Members of the Company’s executive management team have considered and analyzed the Company’s compensation policies and practices and specifically whether those policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. The Company’s analysis was focused on five categories: pay philosophy and mix, performance measures and payout curves, long-term incentives, executive employment and change-in-control agreements, and compensation-related governance practices and processes. The Compensation Committee requested that management review its analysis with the Committee. Some of the factors considered in analyzing the Company’s compensation policies and practices include:

· Total compensation amount and mix that is appropriately balanced between fixed (base salary) and variable pay (short-term and long-term incentives);

· Short-term incentives and long-term performance-based grants that are appropriately capped, thereby limiting payout potential;

· Short-term and long-term incentives that are based upon different measures, including financial and operational goals, thereby rewarding for performance results achieved across a number of dimensions;

· Reasonable payout curves and thresholds that help create an appropriate balance between performance goals and the resulting rewards;

9

· Several programs and policies that serve to mitigate risk, including officer stock ownership requirements, clawback policies in our incentive programs, anti-hedging requirements and non-compete and non-solicitation agreements to deter unfavorable behavior after employment;

· An independent compensation consultant is utilized by the Compensation Committee;

· Equity-granting practices that are controlled by the Compensation Committee; and

· A Stock Incentive Plan that prohibits option repricing.

Based upon the analysis that was performed, including a review of the above factors, we do not believe our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company.

Compensation Committee Interlocks and Insider Participation

The 2010 Compensation Committee was comprised of Anne Szostak (Chairperson), J. Ian Morrison and Barbara Pellow. A. Michael Victory also served on the Committee until his passing on March 27, 2010. None of these Committee members have ever been an officer or employee of SFN or any of our subsidiaries and none of our executive officers has served on the compensation committee or Board of Directors of any company of which any of our other directors is an executive officer.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the following Compensation Discussion and Analysis, required by Item 402(b) of Regulation S-K, with management and, based on such review and discussions, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K and the Company’s proxy statement.

Date: March 23, 2011

| | BY THE COMPENSATION COMMITTEE, Anne Szostak, Chairperson J. Ian Morrison Barbara Pellow |

Compensation Discussion and Analysis

Overview

This Compensation Discussion and Analysis describes and analyzes the material elements of our compensation policies and decisions with respect to each of our executive officers listed in the “Summary Compensation Table” onpage 22. This discussion focuses on our 2010 programs, but also refers to 2009 and 2011 compensation decisions where we believe that background will enhance our stockholders’ understanding of our programs and compensation philosophy. As reference, our named executive officers for 2010 (“NEOs”) are:

· Roy G. Krause - President and Chief Executive Officer;

· Mark W. Smith - Executive Vice President and Chief Financial Officer;

· William J. Grubbs - Executive Vice President and Chief Operating Officer; and

· John D. Heins - Senior Vice President and Chief Human Resources Officer.

The Compensation Committee (the “Committee”) of the Board of Directors oversees the design and administration of the Company’s compensation programs for the NEOs.

Executive Summary

SFN is a large North American-based company that provides strategic workforce solutions. SFN has two operating segments, Professional Services and Staffing Services which provide staffing, outsourcing and other and permanent placement under several specialty brands. SFN has 559 offices, approximately 170,000 employees, and serves over 8,000 customers. Accordingly, SFN needs executive talent with the competencies and skills necessary to operate successfully in a variety of customer environments and in delivering a wide range of services, from lower level light industrial temporary staffing all the way up to highly complex recruitment outsourcing services to Fortune 100 companies. SFN believes that its ability to attract and retain executives who have the competencies and skills to lead in such a diverse operation helps to create long-term shareholder value.

In making decisions regarding compensation elements, program features and compensation award levels for our executives, SFN is guided by a series of principles that are listed below. Within the framework of these principles, SFN considers the competitive market, financial and operational results, performance against long-term targets and various individual factors. Although certain elements of compensation are tied to objective, predetermined goals, compensation decisions are not strictly formulaic but reflect subjective judgments as well.

As described later in more detail, SFN’s compensation philosophy and objectives focus on these principles:

· Provide competitive total pay opportunities;

· Emphasize “pay for performance”, and thereby link rewards to results achieved;

· Align interests of SFN’s NEOs with those of stockholders; and

· Recognize the importance of retaining NEOs.

As indicated, “pay for performance” is a key element of SFN’s compensation program. The impact of this approach is evident from the compensation results over the last two years and looking forward to 2011.

In 2009, the staffing industry and SFN were impacted significantly by the economic downturn. The decline in demand for our services caused a decline in SFN revenues and profitability for the year. The impact on pay for our executives was felt through base salary reductions, below target bonus payouts, and performance-based RSUs earned at a level well below target.

Demand for our services dramatically improved as 2010 started and, as such, we reported significantly improved results in 2010. According to the Bureau of Labor Statistics, temporary employment in the U.S. increased by 15% in 2010, compared with a 22.4% decline experienced in 2009. As a result, SFN achieved the following:

· 2010 revenues increased by 20% over 2009, including the impact of the acquisition and integration of Tatum, LLC. Excluding the impact of the Tatum, LLC acquisition, revenue grew 15% year over year, consistent with market and peer trends;

· Earnings from continuing operations were $0.28 per diluted share for 2010, compared with a loss of $0.11 per share for 2009;

· Adjusted earnings per share (Adjusted EPS)1from continuing operations in 2010 were $0.31 per share compared with $0.00 in 2009;

· Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA)2margin achieved in 2010 was 3.0%, a 100 basis point improvement over the 2009 level of 2.0%; and

· Total shareholder return results for both the one year and three years ended December 31, 2010 were above the industry median.

Our much improved 2010 financial performance had the following impact on NEO pay:

· NEO salaries were restored to rates in effect prior to the temporary pay reduction imposed in 2009. One NEO also received an increase to more closely align with market;

· The Adjusted EPS component of NEO annual incentives was earned at 151% of target. However, after considering SFN’s comparable performance versus its peers, management recommended, and the Compensation Committee concurred, that the Adjusted EPS portion of the annual incentive should be limited to a 125% payout. On a comparative basis, the Adjusted EPS component was not paid for 2009 due to Adjusted EPS below threshold;

· The Operational Objectives component of NEO annual incentives was earned at 125% of target due to strong performance in customer satisfaction, voluntary turnover and employee satisfaction;

· Performance-based RSU awards granted in 2010 were earned at 100% of target (the maximum payout level) versus 26% of target in 2009, based on the degree to which the Adjusted EBITDA margin target was achieved in those years; and

· In recognition of the solid performance of transforming and operating the Company during the economic downturn in 2009, equity-based grants for the NEOs in 2010 had grant-date fair values that were higher than the 2009 awards and thus more closely aligned with market award levels. The decline in our stock price in 2009 and share management practices contributed to equity-based grants for the NEOs in 2009 that were below our target award values.

1Adjusted earnings per share from continuing operations is a “non-GAAP” financial measure as defined by SEC rules. The calculation excludes certain non-operating charges, such as charges related to restructuring and other intangible impairments. See Annex B for a reconciliation of these measures to the most directly comparable financial measure calculated and presented in accordance with GAAP.

2Adjusted earnings before interest, taxes, depreciation and amortization from continuing operations is a “non-GAAP” financial measure as defined by SEC rules. The calculation excludes certain non-operating charges, such as charges related to restructuring and other intangible impairments. See Annex B for a reconciliation of these measures to the most directly comparable financial measure calculated and presented in accordance with GAAP.

Looking to 2011, there is broad expectation within the markets that SFN serves that there will be continued growth in customer demand, although future growth in revenue and profitability is subject to many risks that the Company cannot control. However, the Company has established targets for its annual and long-term incentives that require continued growth in Adjusted EPS and expansion of Adjusted EBITDA margin in order for the NEOs to be rewarded. The Company’s 2011 long-term incentive awards have been approved by the Board of Directorssubject to stockholder approval of the Amended and Restated 2006 Stock Incentive Plan. This year, for the first time, our program includes performance-based RSUs that provide for rewards in excess of target if the Company achieves Adjusted EBITDA margin in excess of our targets. Finally, base pay levels for our NEOs have been adjusted modestly.

The remainder of this CD&A describes the following aspects of our executive compensation programs in greater detail:

· Compensation philosophy and objectives;

· Oversight of executive compensation programs; and

· Key compensation elements and decisions (including benchmarking).

Compensation Philosophy and Objectives

We operate in a highly competitive industry and business environment. As such, our executive compensation programs are designed to help us attract and retain executive talent with the requisite and unique competencies and skills to operate successfully, and are focused on motivating our executives to increase stockholder value for our investors. We believe that it is important to have solid, yet flexible programs that can adapt as necessary to a changing economic climate.

The fundamental principles of our programs are to:

· Provide competitive total pay opportunities: We believe that having market-competitive programs is critical to ensuring that we can attract a talented team of NEOs who can help us accomplish our business objectives. For this reason, we establish target pay opportunities at approximately the size adjusted market median compared with our industry peers (as described below).

· Emphasize “pay for performance”, and thereby link rewards to results achieved: Both SFN management and the Compensation Committee strongly believe a meaningful portion of NEOs’ pay opportunities should be based on performance, rather than tied to fixed pay such as base salary or benefits. Actual amounts received should be based on challenging Company and individual financial and operational performance targets, and should vary substantially based on the degree to which we achieve these goals. Further, the portion of pay opportunities based on performance should increase as an executive’s overall responsibilities increase.

· Align the interests of SFN’s NEOs with those of our stockholders: We believe that denominating a significant portion of total pay opportunities in the form of equity-based awards motivates our NEOs to enhance stockholder value and that our stock ownership requirements further support the alignment we want to achieve.

· Recognize the importance of retaining our NEOs: As noted above, we operate in a highly-competitive business environment. For this reason, our programs also contemplate that we may make periodic equity based awards designed to enhance our ability to retain those executives with the knowledge and experience necessary to accomplish our business strategy and objectives.

Oversight of Executive Compensation Programs

Committee’s Role

The Compensation Committee of the Board is responsible for approving the compensation programs for NEOs and making specific decisions regarding their pay opportunities and actual amounts awarded. The Committee, which includes only independent directors, recognizes the importance to our investors of having sound processes for developing and administering compensation and benefit programs. The Committee establishes and administers our policies and related programs and procedures for annual and long-term executive and director compensation, reviews and approves additions or changes to employee benefit programs, and assesses our organizational structure and development of executives. As noted elsewhere in this Proxy Statement, additional details about the Committee's duties are outlined in its charter which can be found on our website.

The Compensation Committee determines the compensation for all of our NEOs. The Compensation Committee makes decisions about CEO compensation in consultation with the other independent members of the Board, and after a detailed review of the CEO’s performance.

Independent Compensation Consultant

The Compensation Committee has retained an independent compensation consultant to assist with executive and director compensation matters. Through September 2010, Hewitt Associates (“Hewitt”) provided these services to the Committee. For the rest of the year, Meridian Compensation Partners, LLC (“Meridian”) provided such services. In this capacity, Meridian reports directly to the Committee chair, and as necessary communicates directly with the Committee without management present. Meridian also works with management regarding various proposals, as directed by the Committee. Meridian representatives generally attend all regularly-scheduled meetings of the Committee, and participate in executive sessions as requested.

The scope of executive and director compensation consulting services provided by Hewitt and/or Meridian during 2010 included reviewing all management-prepared Compensation Committee meeting materials, including the proposed amendments to the 2006 Stock Incentive Plan, the competitive benchmarking analyses of NEO compensation programs, design of the annual and long-term incentive programs, “Say on Pay” and “Say on Frequency” benchmarking, the compensation risk assessment, the Compensation Discussion and Analysis, NEO total compensation analyses (i.e., tally sheets, as further discussed below), and evaluations of the CEO and Board stock ownership requirements. Meridian also provided consulting support regarding Board compensation levels. During 2010, Hewitt continued to provide health and welfare benefit administration services to our employees under a multi-year contract entered into with the Company in 2009. The decision to retain Hewitt for such administration services was recommended by SFN management, but required the prior approval of the Compensation Committee to ensure that any potential impact on the independence of Hewitt was fully and carefully considered. During 2010 Hewitt had no other relationship with SFN that would have had any potential impact on Hewitt’s independence.

The aggregate fees paid by SFN to Hewitt in 2010 for executive and director compensation consulting services and benefit administration services were $226,085 and $656,440, respectively.

In November 2010, the Committee ratified the appointment of Meridian as its independent executive compensation consultant for 2011. Any proposed engagements of Meridian by SFN management require prior approval by the Committee chair so that any potential impact on the independence of Meridian can be considered. SFN management did not retain Meridian for services other than those provided in its role as Compensation Committee independent consultant.

Role of Executive Officers

The CEO and other NEOs have no role in recommending or setting their own compensation. The CEO, with input from the Chief Human Resources Officer, makes recommendations for compensation for his direct reports (including base salary, target incentive levels, actual incentive payouts, and long-term incentive grants), and provides input on their performance. He also provides input regarding financial and operating goals and metrics, as well as executive compensation policies and procedures. The Chief Human Resources Officer also provides input to Compensation Committee regarding the anticipated and actual impact of policies and programs on SFN and its executives. The Chief Financial Officer certifies to the Compensation Committee that financial performance goals have, or have not, been met relative to our annual incentive plan and performance-based equity grants. The Committee considers, discusses, modifies as appropriate, and takes action on such proposals as are presented for review.

Key Compensation Elements

Our NEO compensation programs include the following direct elements:

· Base salaries;

· Annual incentive awards paid in cash; and

· Long-term incentive awards settled in equity.

We also provide indirect compensation in the form of health and welfare benefits and deferred compensation.

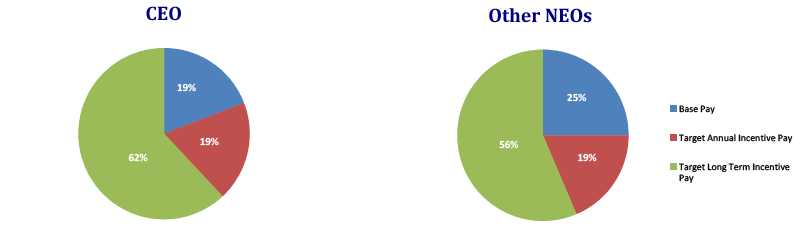

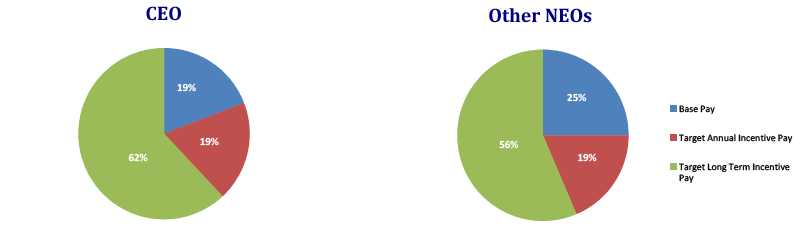

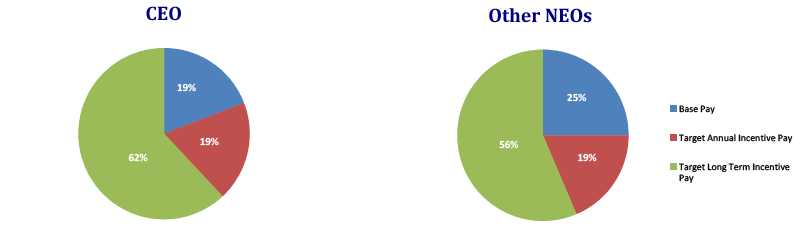

The mix of base pay, target annual incentive pay and target long-term incentives for 2010 emphasized performance-based pay, as illustrated by the following charts:

Benchmarking

To determine 2010 compensation opportunities for our NEOs, the Committee’s consultant benchmarked target and actual pay opportunities for our NEOs against target and actual executive pay as disclosed in the proxy statements of our key competitors in the staffing and recruiting industry. A peer group was developed based on companies in the staffing and recruiting industry of similar size as measured by revenues and that compete with SFN for business and for talent.

The staffing and recruiting comparator group companies viewed by the Compensation Committee as appropriate comparators for benchmarking purposes are listed below.

Adecco S.A.* | Kforce Inc. | Resources Connection, Inc. |

CDI Corp. | Manpower Inc. | Robert Half International Inc. |

Comsys IT Partners, Inc. | MPS Group, Inc. | TrueBlue, Inc. |

Hudson Highland Group, Inc. | On Assignment, Inc. | Volt Information Sciences, Inc. |

Kelly Services, Inc. | | |

*Pay reviewed as an additional reference point

We define the “market” as the size-adjusted 50th percentile of the data, based on total revenues. For the analysis used in early 2010, SFN’s 2008 revenues of $2.2 billion compared to the 2008 average and median revenues of the peer group of $5.5 billion and $1.4 billion, respectively.

The same peer group of companies was used by management in 2010 to update the benchmarking analysis to assist with pay decisions made in early 2011. The only exception to the peer group is that Adecco was removed because pay data for its comparable executives are not publicly available. SFN’s 2009 revenues of approximately $1.7 billion were between the average and median of the peer companies ($2.8 billion and $1.0 billion, respectively).

For 2011 and all future analysis, the peer group will be reviewed and revised as necessary to reflect changes associated with industry consolidation.

We focus on target pay opportunities, rather than actual plan payouts, to establish our pay structure. We target pay opportunities for our NEOs approximately at market median, but this may vary somewhat by individual based on a subjective assessment of factors such as experience, tenure, span of responsibility, performance, expected contribution to future results, historical compensation levels, and retention concerns. In determining the amounts of each compensation component for NEOs, we consider how the various components of pay compare to market as well as how they contribute to total compensation opportunities.

Tally Sheets

During 2010, the Committee reviewed tally sheets prepared by management for each NEO. The tally sheets describe the total dollar value of each NEO’s annual compensation opportunities, including the value of salary, annual and long-term incentive compensation and the costs incurred by SFN to provide various health and insurance benefits to the NEOs. The tally sheets also describe the mix of compensation, the outstanding stock awards and their accumulated realized and unrealized gains, and the amounts the NEOs will receive if they leave SFN under various circumstances (such as retirement, termination without cause, death or disability, change in control, or termination in connection with a change in control).

The tally sheet review ensured that the Committee was able to make informed decisions regarding the impact on NEO compensation of changes it considers. These sheets provide insight into the compensation opportunities available to our NEOs (by component and in total), the motivational and retention aspects of outstanding equity plan awards, and the potential obligations that could become payable under a variety of possible employment termination scenarios.

Base Salaries

SFN believes that offering competitive base salaries is necessary to recruit and compensate senior executives (as well as other employees) for their daily efforts.

Base salary levels also play a critical role in our compensation programs because they impact the value of various other compensation and benefit elements. Specifically, target annual and long-term incentives are established as a percentage of base salary, and various employee benefits and severance benefits also are impacted by salary levels.

In early 2010, the Compensation Committee concluded, based upon the peer benchmarking and the economic environment at the time, that there would be no salary increases for our NEOs, other than Mr. Grubbs whose base pay was adjusted to more closely align his pay with market levels. For this reason, the 2010 salary rates of $660,000 for Mr. Krause, $364,000 for Mr. Smith, and $284,000 for Mr. Heins, are the same as their 2009 (and 2008) salary rates. Mr. Grubbs’ salary was adjusted from $420,000 to $445,000.

Given that base salaries for most NEOs had not been increased since 2008, the Compensation Committee determined that for 2011, increases would be provided to each NEO. Mr. Krause’s annual salary was increased approximately 6% to $700,000. Mr. Smith’s annual salary was increased approximately 7% to $390,000, to address an increase in responsibility. 2011 base pay rates were increased approximately 2% for Mr. Grubbs and Mr. Heins, bringing their 2011 annual salaries to $455,000 and $290,000, respectively.

Annual Incentives

Our annual incentive plan provides rewards that are payable in cash when we achieve specified goals for key financial and operational measures.

The ranges of award opportunities (expressed as dollar amounts) for the NEOs are shown in the Grants of Plan-Based Awards Table onpage 23. Target awards as a percentage of base salary for all NEOs remained at the same levels in 2010 as for 2009 (i.e., 100% for Mr. Krause, 80% for Mr. Smith and Mr. Grubbs, and 60% for Mr. Heins).

Based on our competitive analysis, these target opportunities, when coupled with base salary levels, result in target cash compensation opportunities for our NEOs that are competitive.

The 2010 annual incentive award was conditioned on achievement of the following metrics:

· Adjusted Earnings Per Share – 80% weighting; and

· Operational Objectives – 20% weighting.

Adjusted EPS was selected by the Compensation Committee as the primary performance metric for the annual incentive plan because it is a key indicator of absolute success, and effectively aligns management with our stockholders. Our industry is cyclical, and our results are influenced by economic and labor market cycles that are not always predictable. We believe that it is important to focus plan participants on achieving our earnings goals in all economic conditions, and that this is critical to our goal of creating value for our stockholders.

Specific Adjusted EPS targets and related payouts for 2010 were as follows. Note that payouts were interpolated for performance results between the levels shown.

Performance Level | | Adjusted EPS | | Payout as % of Target Award |

Maximum | | $ | 0.46 | | 200 | % |

Above Target | | $ | 0.23 | | 125 | % |

Target | | $ | 0.14 | | 100 | % |

Threshold | | $ | 0.04 | | 40 | % |

Below Threshold | | $ | <0.04 | | 0 | % |

| |

Actual Results | | $ | 0.31 | | 125 | % |

At Adjusted EPS of $0.31, the NEO annual incentives would have been earned at a 151% of target. However, after considering SFN’s comparable performance versus its peers, management recommended and the Compensation Committee concurred that the Adjusted EPS portion of the annual incentive should be limited to a 125% payout.

The Committee also believes that stockholder value is enhanced by balancing financial measures like Adjusted EPS with other measures that reflect the degree to which SFN management successfully executes on goals associated with service excellence, employee turnover and core values. For this reason, selected Operational Objectives serve as the remaining key element of our annual incentive plan, and collectively are weighted at 20%.

The three key Operational Objectives for 2010, each of which was weighted equally, are described below:

(1) Customer satisfaction as measured by our Candidate, User & Enterprise (CUE) Scorecard system;

(2) Voluntary turnover among key employees; and

(3) Employee satisfaction as measured via our annual culture survey (i.e. core values).

Threshold, target and maximum goals for each measure and the actual overall result achieved are indicated below:

Performance Level | | CUE Scorecard Service Excellence | | Key Employee Voluntary Turnover | | Core Values | | Payout as % of Target |

Maximum | | 4.78 | | 14.00 | % | | 6.00 | | 200 | % |

Target | | 4.35 | | 17.90 | % | | 5.26 | | 100 | % |

Threshold | | 3.97 | | 24.00 | % | | 4.20 | | 50 | % |

Below Threshold | | < 3.97 | | > 24.00 | % | | < 4.20 | | 0 | % |

| | | | | | | Actual Results: | | 125 | % |

2010 results. Payouts for 2010 were based on Adjusted EPS and Operational Objectives results adjusted for the Compensation Committee’s evaluation of overall performance. Although Adjusted EPS results were such that payouts under the formula would have been 151% of target, after considering SFN’s comparable performance versus its peers, management recommended and the Compensation Committee concurred that the Adjusted EPS portion of the annual incentive should be limited to a 125% payout. Based on performance results for the various Operational Objectives goals, the Compensation Committee approved payouts for that component at 125% of target.

2011 performance measures. Our annual incentive plan for 2011 will retain Adjusted EPS as the key financial metric, weighted at 80% of the target award. The remaining 20% of our target awards will be linked to Operational Objectives deemed important to our business success. These goals again reflect the high value SFN places on service excellence, voluntary employee turnover and core values. For 2011, target awards as a percentage of base salary for all NEOs remain at the same levels as for 2010 (i.e. 100% for Mr. Krause, 80% for Mr. Grubbs and Mr. Smith, and 60% for Mr. Heins).

Long-term Incentives

Purpose

As part of our compensation programs,we provide long-term incentives that we believe are competitive and necessary to attract and retain talented executives. These awards are denominated in equity because we believe that doing so aligns our NEOs’ interests with those of our stockholders. Long-term incentive awards also tie a substantial portion of compensation to longer-term performance and foster teamwork.

Program Design

Long-term incentives were awarded in three forms to the NEOs in 2010: (1) stock options, (2) performance-based RSUs based on achieving an Adjusted EBITDA margin goal, and (3) time-based RSUs. We believe that stock options provide an appropriate reward because our executives realize gains from these grants when our stockholders benefit from subsequent stock price increases. We view the performance-based RSUs as an effective way of driving the financial success of SFN because our executives realize value when we achieve our pre-determined performance goals. We include time-based RSUs in our program because we view it as critical to ensure the continuity of our management as we address the numerous business and industry challenges in this economic climate.

Timing of Grants

Stock options and RSUs were granted at the February 15, 2010 Compensation Committee meeting. As is our practice, the stock option strike price was set as the closing price on the day of the grant. While the CEO participated in setting the date of the Board meeting several months in advance, no member of senior management influenced the timing of the grant date and the setting of the meeting was not made so as to time option grants in coordination with the release of material information.

How Award Sizes Were Determined

In 2010, after evaluating various alternatives to long-term incentive grant practices, we determined that a market-based approach using multiples of salary was the most effective way to provide consistent opportunity on a year-to-year basis. The opportunities provided are targeted at size-adjusted median, but actual award sizes may vary based on our assessment of an individual’s performance, potential, impact on the business and retention concerns.

The number of stock options granted was determined using the Black-Scholes-Merton methodology, and the number of both time- and performance-based RSU grants was determined based on the economic value of the Company’s stock. In addition to measuring share usage according to our grant guidelines, we also monitor share usage by periodically assessing our grant practices relative to peers (“burn rate analysis”). Our analyses indicate that our historical burn rate is within competitive norms.

Stock Options

Stock options granted in 2010 have a seven year term and vest on a pro-rata basis over a three year period, in three equal annual installments beginning with the first anniversary of the grant date.

Time-based RSUs

Time-based RSUs granted in 2010 vest on a pro-rata basis over a three-year period, in three equal annual installments beginning with the first anniversary of the grant date.

Performance-based RSUs

Performance-based RSUs granted in 2010 are earned according to the schedule below. We selected Adjusted EBITDA margin as the performance measure for this grant to recognize the importance to our overall success of expanding margins as the economy improves. Amounts earned are capped at the target awards granted (with no upside potential) with payouts interpolated on a straight-line basis for performance between the levels indicated. To further encourage retention, any shares earned based on performance results vest on a pro rata basis over a three year period beginning with the first anniversary of the grant date.

Performance Level | | Adjusted EBITDA Margin | | Payout as % of TargetAward |

Maximum | | > 2.14 | % | | 100 | % |

Target | | 2.14 | % | | 100 | % |

Threshold | | 1.92 | % | | 40 | % |

Below Threshold | | < 1.92 | % | | 0 | % |

|

Actual Results | | 3.00 | % | | 100 | % |

As noted above, our Adjusted EBITDA margin for 2010 was 3.00%, which resulted in the awards earned at 100% of target levels.

2011 Long-term Incentive Program