QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 30, 2007

Commission file number: 1-11997

SPHERION CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation

or organization) | | 36-3536544

(I.R.S. Employer Identification Number) |

2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309

(Address of principal executive offices) (Zip code)

(954) 308-7600

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | Name of each exchange

|

|---|

Title of each class

COMMON STOCK—$0.01 PAR VALUE | | on which registered

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of the Registrant, computed by reference to the closing price of the Registrant's Common Stock, par value $0.01 per share ("Common Stock"), as of June 29, 2007 on the New York Stock Exchange, was $527,477,409.

Number of shares of Registrant's Common Stock outstanding on February 24, 2008 was 55,869,080.

Documents Incorporated by Reference:

Certain specified portions of the registrant's definitive proxy statement to be filed within 120 days after December 30, 2007, are incorporated herein by reference in response to Part III, Items 11, 13 and 14, inclusive, and to certain portions of Part III, Items 10 and 12.

SPHERION CORPORATION AND SUBSIDIARIES

TABLE OF CONTENTS

| |

| | Page No.

|

|---|

PART I |

|

|

|

|

ITEM 1 |

|

Business |

|

1 |

| ITEM 1A | | Risk Factors | | 10 |

| ITEM 1B | | Unresolved Staff Comments | | 15 |

| ITEM 2 | | Properties | | 15 |

| ITEM 3 | | Legal Proceedings | | 15 |

| ITEM 4 | | Submission of Matters to a Vote of Security Holders | | 15 |

PART II |

|

|

|

|

ITEM 5 |

|

Market for the Registrant's Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities |

|

16 |

| ITEM 6 | | Selected Financial Data | | 19 |

| ITEM 7 | | Management's Discussion and Analysis of Financial Condition and

Results of Operations | | 20 |

| ITEM 7A | | Quantitative and Qualitative Disclosures About Market Risk | | 39 |

| ITEM 8 | | Financial Statements and Supplementary Data | | 40 |

| ITEM 9 | | Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure | | 76 |

| ITEM 9A | | Controls and Procedures | | 76 |

| ITEM 9B | | Other Information | | 76 |

PART III |

|

|

|

|

ITEM 10 |

|

Directors, Executive Officers and Corporate Governance |

|

76 |

| ITEM 11 | | Executive Compensation | | 76 |

| ITEM 12 | | Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters | | 77 |

| ITEM 13 | | Certain Relationships and Related Transactions, and

Director Independence | | 76 |

| ITEM 14 | | Principal Accountant Fees and Services | | 76 |

PART IV |

|

|

|

|

ITEM 15 |

|

Exhibits and Financial Statement Schedules and Reports on Form 8-K |

|

78 |

| | | Exhibit Index | | 78 |

| SIGNATURES | | 83 |

i

PART I

Item 1. BUSINESS

As used in this report, the terms "we," "us," "our," "Spherion" and the "Company" refer to Spherion Corporation and its consolidated subsidiaries, unless otherwise expressly stated or the context otherwise requires.

Company Overview

Spherion Corporation was founded in 1946 and provides temporary staffing services, managed services and permanent placement services. We are headquartered in Fort Lauderdale, Florida, and operate a network of 742 locations within North America. We are incorporated under the laws of the State of Delaware. As of December 30, 2007, we had 582 company-owned offices, 90 franchised locations and 70 area-based franchised locations.

We provide temporary staffing services, managed services and permanent placement services under two operating segments—Staffing Services and Professional Services, within the United States of America and Canada. As of December 30, 2007, our Canadian operations represented approximately 5.2% of the Company's total revenue. Temporary staffing services include personnel in the following skill categories: clerical, light industrial, information technology, finance and accounting, legal, engineering, sales and marketing, human resources and administrative. Managed services include services where we manage certain aspects of a customer function such as: recruiting, administrative services, data center or network operations. Permanent placement is a service where our employees locate talent on behalf of our customers, screen the candidates and assist in the recruitment efforts.

We provide services to a wide variety of customers across most major industries in North America. Our customers range in size from large Fortune 500 companies to small, locally run businesses.

In 2007, we acquired several staffing companies within the United States. During the second quarter of 2007, we acquired Resulté Universal, Ltd. ("Resulté"), a Texas based temporary staffing and recruiting firm specializing in providing information technology ("IT") and accounting and finance personnel. In the third quarter of 2007, Spherion acquired Todays Staffing, Inc. ("Todays"), a temporary staffing and recruiting company focused in the clerical market. In the fourth quarter of 2007, Spherion acquired IntelliMark Holdings, Inc., and its wholly owned subsidiary Technisource, Inc. ("Technisource"), a company that provides IT temporary staffing and recruiting and managed IT services within the United States. In addition, we periodically enter into transactions with our franchise and area-based franchise owners to buy and sell operations in certain markets. See Note 7, "Acquisitions," in the accompanying Consolidated Financial Statements for further discussion.

During the second quarter of 2007, we sold our outplacement consulting business. This business was included within the Staffing Services segment and the operating results for all periods presented have been reclassified as discontinued operations. During 2005, we sold our operations in the call center outsourcing business in the United States of America. The call center outsourcing business was comprised of four call centers, of which three were sold in 2005, and we retained the remaining call center.

For information concerning our financial condition, results of operations and related financial data, you should review the "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the "Financial Statements and Supplementary Data" sections of this document. You also should review and consider the risks relating to our business and industry that we describe under the heading "Risk Factors."

1

Industry Overview

Spherion Corporation is a temporary staffing and recruiting company operating in North America. The North American staffing market revenues were estimated to be approximately $123.0 billion in 2007. This market includes temporary staffing, permanent placement and other services similar to those provided by Spherion. The North American staffing market in 2007 is estimated to have grown by approximately 1% to 4% with the high end of the range attributable to high demand skill sets such as finance, accounting, legal, engineering, and information technology specialists.

About 55% of the staffing industry is estimated to be concentrated in professional skills, including information technology, finance and accounting, legal, administrative and other skills that are consistent with those offered within Spherion's Professional Services operating segment. The balance of the North American staffing market is concentrated on services in the clerical and light industrial skill sets, similar to those offered in Spherion's Staffing Services operating segment.

Business conditions in the staffing industry are economically sensitive. Over the past three years, Spherion and many of its peers benefited from market expansion; although growth slowed in the most recent year consistent with U.S. economic conditions. Companies have continued to experience success in the usage of temporary help, which has facilitated rapid workforce adjustments as economic conditions improve. This practice has increased the demand for temporary help in North America, which as of December 2007 was almost 2.0% of the total workforce, an increase from 1.0% in the early 1990's. Demographics of the labor force continue to indicate that the overall labor pool may shrink slightly over the next 10 years, creating a shortage of qualified job candidates, especially for certain professional workers. We believe the shortage will increase the need for companies to continue to use the services of Spherion and other companies within the staffing industry.

Operations Overview

The Company is organized around two operating segments—Staffing Services and Professional Services. Within our Staffing Services operating segment, we provide three primary services—temporary staffing, managed services, and permanent placement. Within our Professional Services operating segment, we provide temporary staffing and permanent placement services. These services are further described as follows:

- •

- Temporary staffing—This is a service where our employees work at customer locations under the supervision of customer personnel. The duration of the assignment can be from a day or less to a period of several months. The number of our temporary employees at any given time is directly related to our customers' requirements and these employees are generally only paid when on assignment with a customer. We provide temporary employees with clerical, light industrial, information technology, finance and accounting, legal, engineering, marketing and administrative skill sets. We are responsible for all employment related taxes of these temporary employees, workers' compensation and federal and state unemployment (burden costs). Services are generally billed by the hour for the number of hours worked. Bill rates are often determined as a mark-up over pay or a mark-up over pay plus burden and are estimated prior to the commencement of beginning the work. We typically retain the risk of loss if these estimated mark-ups are not high enough to cover actual losses due to higher than anticipated unemployment, workers' compensation or other losses.

- •

- Managed services—This is a service where we manage aspects of the operation and management of a customer function such as recruiting and administrative services, and generally provide that service under long-term contracts. Managed services are provided by our employees who typically manage and staff aspects of the customer function. In certain cases we may only manage the customer function which could be staffed by a combination of Spherion, customer or other third-party employees. We are responsible for the operation of the customer function and generally are

2

required to meet minimum service level agreements and provide customer driven reporting. A growing area of our managed services business is recruitment outsourcing and within this offering we take responsibility for most aspects of a customer's hiring or recruiting function. Fees are determined based on a combination of headcount, service level provided and/or fixed fee per transaction/unit processed. We are responsible for all employment related taxes of our employees, workers' compensation and federal and state unemployment. As with temporary staffing, we typically retain the risk of loss for unemployment, workers' compensation or other losses if our rates are not high enough to recover these costs.

- •

- Permanent placement—This is a service where we identify candidates on behalf of our customers, screen the candidates and assist in the recruitment efforts. If the customer hires the candidate, our billing is generally a percentage of first year compensation for the candidate placed. Billing is contingent upon filling the assigned position and we establish reserves for candidates placed with customers who do not stay through a guarantee period, typically three months.

The following table represents the fiscal year 2007 revenues derived from each of these services within our operating segments (in thousands):

| | Staffing Services

| | Professional Services

| |

|---|

| | Amount

| | % Total

| | Amount

| | % Total

| |

|---|

| Temporary staffing | | $ | 1,259,411 | | 85.5 | % | $ | 489,713 | | 89.9 | % |

| Managed services | | | 189,574 | | 12.9 | % | | — | | — | |

| Permanent placement | | | 23,251 | | 1.6 | % | | 55,165 | | 10.1 | % |

| | |

| |

| |

| |

| |

| | Total | | $ | 1,472,236 | | 100.0 | % | $ | 544,878 | | 100.0 | % |

| | |

| |

| |

| |

| |

Within the services described above, the Staffing Services operating segment concentrates on temporary staffing and placement of individuals with administrative clerical and light industrial skill sets. Managed services are provided within the Staffing Services operating segment. The Professional Services operating segment concentrates on temporary staffing and placement of professional skill sets in the areas of information technology, finance and accounting, legal, engineering, sales and marketing, human resources and administrative. See Note 16, "Segment Information," in the accompanying Consolidated Financial Statements for additional information regarding the revenues, profits and losses and total assets for both our Staffing Services and Professional Services operating segments for 2007, 2006 and 2005.

Location Structure

Our locations are company-owned, franchised or area-based franchised. We believe that we can increase profitability and serve our customer base through a combination of these locations. For 2007, 88.5% of revenues were derived from company-owned locations, with the remaining derived from franchised and area-based franchised locations.

3

The following table details the number of locations:

| | Fiscal Years

|

|---|

| | 2007

| | 2006

| | 2005

|

|---|

| Company-owned locations | | 582 | | 486 | | 478 |

| Franchised locations | | 90 | | 93 | | 94 |

| Area-based franchised locations | | 70 | | 81 | | 87 |

| | |

| |

| |

|

| | Total | | 742 | | 660 | | 659 |

| | |

| |

| |

|

| United States of America | | 702 | | 624 | | 627 |

| Canada | | 40 | | 36 | | 32 |

| | |

| |

| |

|

| | Total | | 742 | | 660 | | 659 |

| | |

| |

| |

|

We operate both company-owned branch and customer on-premise locations. A branch location is designed to serve multiple customers in a geographic market, while a customer on-premise location is established at the customer's location to serve only that customer. Future new or closed locations are driven by sales success creating the need for new company-owned branches and customer on-premise locations. In 2007, the number of our locations increased from 2006 due primarily to the offices we acquired from Technisource and Todays.

| | Fiscal Years

| |

|---|

| | 2007

| | 2006

| | 2005

| |

|---|

| Franchisee revenues (in thousands) | | $ | 223,468 | | $ | 236,195 | | $ | 256,411 | |

| Franchisee commissions as a % of gross profit | | | 74 | % | | 72 | % | | 70 | % |

| Number of franchisee | | | 52 | | | 51 | | | 52 | |

| Number of franchisee locations | | | 90 | | | 93 | | | 94 | |

We grant franchises, which give the franchisee the right to establish a recruitment business utilizing our tradenames, service marks, advertising materials, sales programs, operating procedures, manuals and forms within a designated territory. We typically grant franchisees the exclusive right to establish an office to market and provide light industrial and clerical temporary personnel within a designated geographic area. We provide franchisees with our national, regional and cooperative local advertising. We also assist our franchisees in obtaining business from our national accounts. Franchise agreements are generally for an initial term of 10 years and are renewable for successive 5-year terms at our discretion. Our franchisees operate in the Staffing Services operating segment.

In our franchise arrangements, we act as the principal in customer transactions through direct contractual relationships with the customers, owning related customer receivables and being the legal employer of the temporary employee and the franchisee acts as our agent providing certain sales and recruiting services. Sales by the franchised locations are included in our revenues and the direct costs of services (payroll for the temporary employees and related payroll taxes and employee benefits) are included in our cost of services. We are responsible for paying the wages of the temporary employees and all related payroll taxes, employee benefits and insurance. We share responsibilities in collecting accounts receivable. The franchisee is responsible to reimburse us up to 100% of uncollected accounts receivable, but we bear the loss in cases where the franchisee does not have sufficient financial wherewithal to reimburse uncollectible accounts.

4

The franchisee is responsible for establishing its location and paying its related administrative and operating expenses, such as the rent, utilities and salaries of their sales and service staff. The franchisee receives a commission from us, which averaged 74% of the franchised offices' gross profit for the fiscal year ended December 30, 2007. Our Consolidated Statements of Earnings reflect the franchisee commission as an operating expense, but do not include the rent, utilities and salaries of the franchisee's full-time office employees as these expenses are the responsibility of the franchisee. Our Consolidated Balance Sheets include the accounts receivable, payroll liabilities for temporary employees and related employee benefit liabilities and the franchisee commission payable. The only exception to this financial statement presentation is the circumstance when we are required to consolidate certain franchisees.

From time to time, we may finance a portion of the purchase price of the franchise at market rates of interest or provide working capital loans to franchisees. The outstanding principal balance of such notes receivable was $0.6 million as of December 30, 2007.

| | Fiscal Years

| |

|---|

| | 2007

| | 2006

| | 2005

| |

|---|

| Area-based franchisee royalty revenues (in thousands) | | $ | 8,243 | | $ | 8,554 | | $ | 8,976 | |

| Royalty revenues as a % of area-based franchisee sales | | | 4 | % | | 4 | % | | 4 | % |

| Number of area-based franchisees | | | 14 | | | 17 | | | 23 | |

| Number of area-based franchisee locations | | | 70 | | | 81 | | | 87 | |

We grant area-based franchises, which give the area-based franchisee the right to establish a recruitment business utilizing our tradenames, service marks, advertising materials, sales programs, operating procedures, manuals and forms within a designated territory. We typically grant area-based franchisees the exclusive right to establish an office to market and provide light industrial and clerical temporary personnel within a designated geographic area. We provide area-based franchisees with our national, regional and local advertising. We also assist our area-based franchisees in obtaining business from our national accounts. Most area-based franchise agreements are 10 years in length and renewable every 5 years thereafter. A number of area-based franchisees are second-generation owners and most operate in more than one area-based franchise territory.

Area-based franchisees operate their businesses autonomously within the framework of our policies and standards and recruit, employ and pay their own full-time and temporary employees. Area-based franchisees are responsible for all employment related taxes and workers' compensation costs of their employees. Area-based franchisees do not use our computer systems except to bill activity relating to national accounts. We receive royalty fees from each area-based franchise based upon the area-based franchisee's revenues.

From time to time, we may finance a portion of the purchase price of the area-based franchise at market rates of interest or provide working capital loans to area-based franchisees. The outstanding principal balance of such notes receivable was $0.6 million as of December 30, 2007.

5

Acquisitions

In the fourth quarter of 2007, Spherion acquired Technisource, a company that provides IT temporary staffing and recruiting and managed IT services within the United States. Total consideration was $140.0 million, consisting of $120.0 million in cash from existing available resources and a deferred payment in the amount of $20.0 million. During the third quarter of 2007, Spherion acquired Todays, a temporary staffing and recruiting company focused in the clerical market, for consideration of $39.3 million. During the second quarter of 2007, Spherion acquired Resulté, a Texas based temporary staffing and recruiting firm specializing in providing IT and accounting and finance personnel. The consideration for Resulté was $15.8 million. See Note 7, "Acquisitions," in the accompanying Consolidated Financial Statements for further discussion.

During the third quarter of 2007, we purchased the remaining 15% interest in our Canadian operations from the minority interest stockholder pursuant to an existing put/call agreement. The purchase price was approximately $6.1 million at current exchange rates of which $5.5 million was paid in 2007 and the final payment of $0.6 million is listed under "Other current liabilities" in the attached Consolidated Balance Sheet. In 2007, we recorded expense of $2.3 million, to adjust the liability under the put/call to the agreed purchase price in accordance with SFAS No. 150, "Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity," as well as to reflect foreign currency fluctuations.

We are generally the purchaser of choice when a Spherion franchisee or area-based franchisee decides to sell its business. We have a right of first refusal on any franchise or area-based franchise sale at the same terms and conditions as may be agreed with another purchaser (who ultimately must be approved by us, even if we waive our right of first refusal), and we have a standard end of term purchase option on our franchises and our more recently granted area-based franchises, however we are not obligated in our standard agreements to repurchase either our franchised or area-based franchised locations. In 2007, we acquired area-based franchise operations in Boston, Kansas City, Lexington, Pittsburgh and several smaller franchised operations for consideration of approximately $12.2 million.

Competition

We operate in highly competitive and fragmented markets in our operating segments. Within temporary staffing and permanent placement services, there are low barriers to entry. Within managed services, there can be more significant barriers to entry as capital and systems requirements are higher.

The staffing industry is served by thousands of competitors with most having small, local operations. There are several very large national and international competitors who also directly compete with us. The local competitors are generally characterized as independent operators serving local marketplaces. The ability to fund working capital requirements is one of the key success factors for these competitors. Local competitors may also be more flexible in offering alternatives to their customers in either attracting candidates or in servicing the customer, but generally cannot service national customers due to a lack of systems or geographic coverage. We compete with local competitors in all of our markets generally when the customer is a local or retail customer, and we expect to continue to do so.

Many of the large national and international competitors are characterized by very broad geographic coverage, large and complex information systems that can handle numerous legal and regulatory requirements and substantial financial resources. We compete against these companies for the larger customers where the customer requires broad geographic coverage, competitive national pricing and typically consolidated reporting to assist in controlling costs. Since most national customers use a central procurement department, the industry has moved towards consolidated competitive bidding with pricing as one of the key selection criteria. This has led to intense price competition within the staffing and recruitment industry, particularly within the large account customer segment.

6

We believe that our customers primarily focus on the following key factors in selecting a service provider: location or geographic coverage, price and service delivery. Geographic coverage is important from the customer and candidate standpoint. Customers require that their providers be able to service most, if not all, of their locations. Location is important to the candidate because many candidates are unwilling to travel outside of their particular geographic market for a position. We have 742 locations in North America throughout the United States of America and Canada, and believe that our coverage is adequate in the markets we serve. Our lack of international coverage could put us at a disadvantage compared to our larger competitors in obtaining new business from multinational customers. However, we do not believe our North American focus to be a significant disadvantage in competing for business in our targeted customer segments. Service delivery is understanding the customers' specific job requirements through consultative assessments, the ability to provide the right candidate for the right job and the ability to measure the quality of job performance. Factors in obtaining qualified candidates for employment assignments with customers include the quality of available opportunities, wages, responsiveness to work schedules and the number of available work hours. No single customer accounted for 10 percent or more of our consolidated revenues in 2007.

Within the Staffing Services operating segment, some of our largest competitors are Adecco S.A., Manpower Inc. and Kelly Services, Inc. Within the Professional Services operating segment, we compete with Robert Half International Inc., MPS Group, Inc. and Kforce Inc., among others.

Trademarks

Through our subsidiaries, we maintain a number of trademarks, tradenames and service marks in the United States of America and certain other countries. We believe that many of these marks and tradenames, including SPHERION®, ON-PREMISE®, THE MERGIS GROUP®, TODAYS STAFFING®, and TECHNISOURCE® are important to our business. In addition, we maintain other intangible property rights including a registered trademark on EMERGING WORKFORCE®. Our trademark registrations in the United States of America for SPHERION®, INTERIM®, TODAYS STAFFING®, and TECHNISOURCE® expire October 9, 2011, March 8, 2013, April 6, 2013, August 14, 2011, and October 9, 2017, but are renewable for ten-year successive terms.

Governmental Regulation

Staffing firms are generally subject to one or more of the following types of government regulations: (i) regulation of the employer/employee relationship between a firm and its flexible staff, (ii) registration, licensing, record keeping and reporting requirements and (iii) substantive limitations on its operations. Staffing firms are the legal employers of their temporary workers. Therefore, staffing firms are governed by laws regulating the employer/employee relationship such as wage and hour regulations, tax withholding and reporting, social security or retirement, anti-discrimination and workers' compensation.

We also have operations in Canada, where there are significant national, provincial or local regulations of staffing services. These laws may require that part-time, temporary and contract workers receive benefits similar to full-time workers, such as vacation, welfare plan contributions, notice prior to termination and severance pay. In some cases, hours of work and the duration of assignments are limited and workers may not be assigned to certain industries. We do not anticipate that these legal structures and requirements will have a material effect on our growth or prospects. However, any material change in national, provincial or local regulation of staffing services could have a material adverse effect on us.

Our sale of area-based franchises and franchises is regulated by the Federal Trade Commission and by authorities in approximately 14 states and is subject to statutory requirements in certain Canadian provinces. Under these laws, we must deliver a franchise disclosure document to prospective franchisees. These and other state laws may also apply substantive standards that govern the relationship between franchisors and franchisees. In states where we are selling area-based franchises and franchises, we have

7

filed either the appropriate registration or obtained an exemption from registration. We do not anticipate that these requirements or other state laws will have a material effect on our ability to sell area-based franchises and franchises or operate our business through area-based franchised and franchised offices.

Employees

We estimate that we employed approximately 258,000 people in 2007. On average, approximately 70,000 billable personnel were assigned with our customers at any given time.

Seasonality and Cyclical Nature of Business

Seasonality—Our businesses are seasonal in nature with customer related demand generally at its highest point during the third and fourth quarters and lowest during the first quarter. The third and fourth quarters are normally higher as our customers increase their temporary workforces for the holiday season. We typically experience a decrease in our first quarter revenues compared with fourth quarter revenues. The decrease in first quarter revenues compared with the preceding fourth quarters for 2007, 2006 and 2005 was 7%, 7%, and 12%, respectively. First quarter revenues in 2005 compared with the preceding fourth quarter decreased partially due to first quarter 2005 including thirteen weeks, whereas fourth quarter 2004 included fourteen weeks.

Cyclical Nature of the Business—The staffing industry has historically been considered to be cyclical, often acting as an indicator of both economic downswings and upswings. Staffing customers tend to use temporary staffing to supplement their existing workforces and generally hire permanent workers when long-term demand is expected to increase. As a consequence of this, our revenues tend to increase quickly when the economy begins to grow. Conversely, our revenues also tend to decrease quickly when the economy begins to weaken as our customers reduce temporary workers before terminating their own employees. While we have longer-term managed service contracts which are not as directly dependent upon the economic cycle, these revenues are not significant enough to offset the impact of cyclical economic activity in our larger service offerings.

8

Executive Officers of the Registrant

Our executive officers are:

Name and Age

| | Position

|

|---|

Roy G. Krause, 61 |

|

President and Chief Executive Officer since October 2004; President and Chief Operating Officer from July 2003 to October 2004; Executive Vice President and Chief Financial Officer from October 1995 to July 2003. |

William J. Grubbs, 50 |

|

Executive Vice President and Chief Operating Officer since November 2007; Executive Vice President from February 2007 to November 2007; Senior Vice President and Chief Marketing and Corporate Development Officer from November 2005 to February 2007. From March 2002 to September 2005, Chief Operating Officer, Spring Group plc, a publicly held information technology and professional staffing and recruiting company based in the United Kingdom. |

Mark W. Smith, 45 |

|

Executive Vice President and Chief Financial Officer since November 2007; Senior Vice President and Chief Financial Officer from July 2003 to November 2007; Vice President, Business Services from September 2002 to July 2003; Vice President, Business Services and Controller from August 2001 to September 2002. |

John D. Heins, 48 |

|

Senior Vice President and Chief Human Resources Officer since October 2006. From 1995 to 2006, Vice President—Human Resources and Administrative Services for JM Family Enterprises, a privately held $9 billion diversified automotive company. |

Loretta A. Penn, 58 |

|

Senior Vice President and Chief Service Excellence Officer since November 2007; Vice President and Chief Service Excellence Advocate from March 2006 to October 2007; Vice President, Strategic Accounts from February 2000 to February 2006. Ms. Penn is a member of the Board of Directors of TECO Energy, a leading energy and public utility company, headquartered in Tampa, Florida. |

Availability of Reports and Other Information

Our corporate website ishttp://www.spherion.com. We make available on this website or in print, free of charge, access to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statement on Schedule 14A and amendments to those materials filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 as soon as reasonably practicable after we electronically submit such materials to the Securities and Exchange Commission. Also available on our website, or in print to any stockholder that requests it, are Spherion's Corporate Governance Principles, Code of Business Conduct and Ethics, as well as charters for the Audit Committee, Compensation Committee, Corporate Governance Committee, Executive Committee and Nominating Committee. In addition, the Commission's website ishttp://www.sec.gov. The Commission makes available on its website, free of charge, reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically with the Commission. Information provided on our website or on the Commission's website is not part of this Annual Report on Form 10-K.

9

Item 1A. RISK FACTORS

Our business, financial condition, results of operations, cash flows and prospects, and the prevailing market price and performance of our common stock, may be adversely affected by a number of factors, including the matters discussed below. Certain statements and information set forth in this Annual Report on Form 10-K, as well as other written or oral statements made from time to time by us or by our authorized officers on our behalf, constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. We intend for our forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should note that our forward-looking statements speak only as of the date of this Annual Report on Form 10-K or when made and we undertake no duty or obligation to update or revise our forward-looking statements, whether as a result of new information, future events or otherwise. Although we believe that the expectations, plans, intentions and projections reflected in our forward-looking statements are reasonable, such statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The risks, uncertainties and other factors that our stockholders and prospective investors should consider include the following:

We operate in highly competitive markets with low barriers to entry, and may be unable to compete successfully against existing or new competitors.

We operate in highly competitive and fragmented markets in both of our operating segments. There are low barriers to entry by potential competitors at the local level. We face significant competition in the markets we serve and will continue to face significant competition in any geographic markets or industry sectors that we may enter. The majority of competitors are significantly smaller than we are. However, certain of our competitors are larger, have greater marketing, technical and financial resources, and have stronger brand name recognition than we have. As a result, some of our competitors may be in a better position to capitalize on new technologies and changes in customer requirements, and to devote more resources than we can to the development, promotion and sale of their service offerings. In some cases, our large competitors have lower operating expenses and as a result, we may face increased competitive pricing pressures and may not be able to obtain or retain our new or existing customers. Some of our competitors can provide broader geographic coverage than we can and this could limit our ability to service large customers who wish to consolidate services.

There has been a significant increase in the number of customers consolidating their staffing services purchases with a single provider or with a small number of providers. The trend to consolidate purchases has in some cases made it more difficult for us to obtain or retain customers. We also face the risk that certain of our current and prospective customers may decide to provide similar services internally. Additionally, pricing pressures have intensified as customers have continued to competitively bid new contracts. This trend is expected to continue for the foreseeable future. As a result, we cannot assure you that we will not encounter increased competition in the future.

Any significant economic downturn could result in less demand from customers and lower revenues.

Because demand for personnel services and recruitment services is sensitive to changes in the level of economic activity, our business may suffer during economic downturns. As economic activity slows down, companies tend to reduce their use of temporary employees and recruitment services before undertaking layoffs of their regular employees, resulting in decreased demand for our personnel. Additionally, an economic downturn could result in higher unemployment claims and costs in future periods. Also, as businesses reduce their hiring of permanent employees, revenues from our recruitment services is adversely affected. As a result, any significant economic downturn could have a material adverse effect on our business, financial condition or results of operations.

10

A loss of customers may result in a material impact on the results of our operations.

We may experience a reduction in business from a large customer or a number of customers, or we may lose such customers. We cannot guarantee that we will be able to retain long-term relationships with our larger customers in the future. Our customers may experience a deterioration in their current financial condition or future prospects, or may experience a bankruptcy. We are also at a risk of losses from uncollectible account receivables if our customers' financial positions deteriorate. A significant reduction in demand from our customers may result in an adverse impact on our business and results of operations in future periods.

Our business strategy is based on profitable growth in North America. We have implemented steps to continue increasing our growth rates by concentrating in local markets with small and mid-sized customers through relationship selling, focusing on key large accounts with profitable margins, targeting new accounts by providing integrated services, and continuing to improve operating leverage by reducing corporate and field overhead. We also plan to grow within our Professional Services segment by providing more services to existing Staffing Services segment customers. If we are not successful in achieving these objectives with our customers, our revenues, costs and overall profitability could be negatively affected. If we are unable to execute our business strategy effectively, our productivity and cost competitiveness could be negatively affected.

Our contracts contain termination provisions and pricing risks that could decrease our revenues, profitability and cash flow.

Some of our customer contracts permit termination in the event our performance is not consistent with service levels specified in those contracts. Our customers' ability to terminate contracts, as well as having many short-term contracts, creates uncertain revenue streams. Some of our contracts contain pricing provisions that allow customers to pay a set fee for our services regardless of whether our costs to perform these services exceed the amount of the set fee. Some of our contracts provide for credits to our customers if we fail to achieve specific contract standards. Some of our contracts contain re-pricing provisions that can result in reductions of our fees for performing our services. Many of our contracts provide for a billing at a set mark-up above the temporary employees pay rate. In estimating these mark-ups we use our best estimates of expected costs for federal and state unemployment, workers' compensation or other costs. If actual costs for these items exceed our estimates, we typically cannot recover these retroactively from customers. Additionally, the actual development of workers' compensation claims can take many years after an accident or injury develops; such development, if adverse could negatively impact the Company.

Our failure or inability to perform under customer contracts could result in damage to our reputation and give rise to legal claims against us.

If customers are not satisfied with our level of performance, our reputation in the industry may suffer, which could materially and adversely affect our business, financial condition, results of operations and cash flow. Certain areas of our business require us to assume a greater level of responsibility for developing or maintaining processes on behalf of our customers. Many of these processes are critical to the operation of our customers' businesses. Our failure or inability to complete these engagements satisfactorily could have a material adverse effect on our customers' operations and consequently may give rise to claims against us for actual or consequential damages or otherwise damage our reputation. Any of these claims could have a material adverse effect on our business, financial condition or results of operations.

We made several acquisitions in 2007 and may make additional future acquisitions to expand our service offerings, broaden our customer base or expand our geographic presence. Acquisitions involve a number of additional risks, including the diversion of management's attention from our existing

11

operations, the failure to retain key personnel or customers of an acquired business, the assumption of unknown liabilities of the acquired business for which there are inadequate indemnifications, the potential impairment of acquired intangible assets and the ability to successfully integrate the business. We could experience financial or other setbacks if any of the businesses that we acquired or acquire have liabilities or problems of which we are not aware. Further, we cannot assure you that any past and future acquired businesses will generate anticipated revenues or earnings. As a result, the anticipated benefits from acquisitions may not be achieved.

The disposition of businesses previously sold may create contractual liabilities associated with indemnifications provided.

We have disposed of several business units over the past five years. The disposition of these businesses usually requires that we indemnify the purchaser for liabilities that arose prior to the disposition date. These liabilities are typically related to audits of tax liabilities by local authorities and other pre-existing liabilities such as lease obligations. Additionally, in the contracts we make various representations and warranties and from time to time claims are made against us related to these items. With regard to businesses we have disposed of over the past five years, the time periods for bringing such indemnity and warrant claims have expired in a number of instances. During 2007, we recorded $0.6 million as part of discontinued operations for these matters. The fair value of these indemnifications are recorded at the time of the sale. Subsequently if any liabilities become known and are both probable and reasonably estimable, they are recorded as an expense. For some of the dispositions, we have or may have future claims which are not yet probable and reasonably estimable and have not been recorded as an expense. Future earnings from discontinued operations could be materially adversely affected if we are not successful in defending our positions with the purchasers of these discontinued operations. Additionally, if we are required to make cash payments for any of these liabilities, our financial condition could be materially adversely affected.

We may experience business interruptions that could have an adverse affect on our operations.

We could be negatively affected by natural disasters (many of our processing functions are located in a hurricane-prone area), fire, power loss, telecommunications failures, hardware or software malfunctions and break-downs, computer viruses or similar events. Although we have disaster recovery plans in place, we may not be able to adequately execute these plans in a timely fashion. If our critical information systems fail or are otherwise unavailable, this could temporarily impact our ability to pay employees, bill customers, service customers, maintain billing and payroll records reliably and pay taxes, which could adversely affect our revenues, operating expenses, and financial condition. A prolonged outage could seriously impact our ability to service customers or hire temporary workers and could seriously threaten the organization.

We are dependent upon availability of qualified personnel, and may not be able to attract and retain sufficient numbers of qualified personnel necessary to succeed.

We depend upon our ability to attract qualified personnel who possess the skills and experience necessary to meet the staffing requirements of our customers or to successfully bid for new customer projects. We must continually evaluate and upgrade our base of available qualified personnel to keep pace with changing customer needs and emerging technologies. Competition for individuals with proven professional or technical skills currently exists. We could have difficulty attracting and retaining sufficient numbers of qualified personnel necessary for our business to succeed.

Regulatory challenges to our tax filing positions could result in additional taxes.

We file tax returns with various governmental entities within the United States and Canada. The filings include returns with the Federal government, the states and numerous cities, counties and municipalities. Additionally, we have a limited number of filings with foreign governments related to the final wind down of our international operations. When we prepare these tax filings, we are required to follow numerous and complex legal and technical requirements where interpretation of rules and

12

regulations is required. We believe that we have appropriately filed our tax returns and properly reported taxable transactions, but the final tax amounts are subject to regulatory audit and interpretation. We believe we have established adequate reserves with respect to any tax liabilities that may arise in relation to these transactions should our position be successfully challenged by tax authorities, however, an unfavorable settlement could result in higher payments and additional charges to income above the amounts reserved.

We may lose key personnel, and therefore, our business may suffer.

Our operations are dependent on the continued efforts of our officers and executive management. In addition, we are dependent on the performance and productivity of our local managers and field personnel. Our ability to attract and retain business is significantly affected by local relationships and the quality of service rendered. The loss of those key officers and members of executive management who have acquired significant experience in our industry may cause a significant disruption to our business. Moreover, the loss of our key managers and field personnel may jeopardize existing customer relationships with businesses that continue to use our services based upon past relationships with these local managers and field personnel. The loss of such key personnel could materially adversely affect our operations, because it may result in an inability to establish and maintain customer relationships and otherwise operate our business.

We may be exposed to employment-related claims and costs that could have a material adverse affect on our business, financial condition and results of operations.

We employ and place people in the workplaces of other businesses. Attendant risks of such activity that could increase our cost of doing business include:

- •

- possible claims of discrimination and harassment;

- •

- errors and omissions by the personnel we place, particularly for the acts of temporary professionals (e.g., accountants, attorneys, engineers and information technology consultants);

- •

- misuse or misappropriation of customer funds or proprietary information; and

- •

- payment of workers' compensation and other similar claims.

Although we maintain insurance coverage for general liability, errors and omissions and employee theft, such insurance coverage may not be adequate in scope or amount to cover any such liability. A failure of any of our personnel to observe our policies and guidelines intended to reduce exposure to these risks could have a material effect upon us. We cannot assure that we will not experience such problems in the future.

We retain all or a portion of the risk under our workers' compensation, general liability, professional liability and employment practices liability insurance programs, and health insurance benefits programs. Changes in the estimates of these accruals are charged or credited to earnings in the period determined, and therefore a large fluctuation in any given quarter could materially adversely affect earnings in that period.

We are a defendant in a variety of litigation and other actions from time to time, which may have a material adverse effect on our business, financial condition and results of operations.

We and our subsidiaries are regularly involved in a variety of litigation arising out of our business. Occasionally, this litigation can be material. We cannot assure you that our insurance will cover all claims that may be asserted against us. Should the ultimate judgments or settlements exceed our insurance coverage, they could have a material adverse effect on our results of operations, financial position and cash flows. We also cannot assure you that we will be able to obtain appropriate types or levels of insurance in the future or that adequate replacement policies will be available on acceptable terms, if at all.

13

Government regulation may significantly increase our costs, including payroll-related costs and unemployment taxes.

In conducting our business, we are required to pay a number of payroll and related expenses, including unemployment taxes, workers' compensation and medical insurance for our personnel. Unemployment insurance premiums paid by employers typically increase during periods of increased levels of unemployment. Workers' compensation costs may increase in the future if states have raised benefit levels and liberalized allowable claims. Attempts to increase revenue from light industrial customers may expose us to increased workers' compensation claims and higher costs. Future earnings could be adversely affected if we are not able to increase the fees charged to customers to offset increased costs related to unemployment insurance or workers' compensation benefits.

We are subject to business risks associated with operations in Canada, which could make this operation significantly more costly.

Operation in this market is subject to risks inherent in international business activities, including:

- •

- fluctuations in currency exchange rates;

- •

- varying economic and political conditions;

- •

- overlapping or differing tax structures; and

- •

- multiple regulations concerning pay rates, benefits, vacation, statutory holiday pay, workers' compensation, union membership, termination pay and the termination of employment.

Failure to meet certain covenant requirements under our revolving lines of credit could impact part or all of our availability to borrow under our revolving lines of credit.

Our revolving lines of credit provide for certain affirmative and negative covenants which may limit the total availability under this line of credit based upon our ability to meet these covenants. These covenants include, but are not limited to: a fixed charge coverage ratio; limitations on capital expenditures, additional debt incurred, mergers, consolidations or sales; and transactions with subsidiaries and related parties. Failure to meet compliance with one or more of these covenants in the future could affect the amount of availability we have to borrow against and as a result, our liquidity and financial condition may be adversely affected. We were in compliance with all aspects of our revolving credit facility at December 30, 2007.

The price of our common stock may fluctuate significantly, which may result in losses for our investors.

The market price for our common stock has been and may continue to be volatile. For example, during the fiscal year ended December 30, 2007, the prices of our common stock as reported on the New York Stock Exchange ranged from a high of $10.37 to a low of $6.90. Our stock price can fluctuate as a result of a variety of factors, including factors listed in these "Risk Factors" and others, many of which are beyond our control. These factors include:

- •

- actual or anticipated variations in our quarterly operating results;

- •

- announcement of new services by us or our competitors;

- •

- announcements relating to strategic relationships or acquisitions;

- •

- changes in financial estimates or other statements by securities analysts; and

- •

- changes in general economic conditions.

14

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 2. PROPERTIES

Our corporate headquarters are located at 2050 Spectrum Boulevard, Fort Lauderdale, Florida, in a 125,000 square-foot building owned by us. In addition, we lease approximately 70,000 square feet in Alpharetta, Georgia for operating functions. All other field locations operate in space held primarily under three to five year leases providing fixed monthly rentals. Our corporate headquarters and our field locations are used by both our Staffing Services and our Professional Services operating segments. We believe that our facilities are adequate for our needs.

Item 3. LEGAL PROCEEDINGS

In the ordinary course of our business, we are or may be threatened with or named as a defendant in various lawsuits. We maintain insurance in such amounts and with such coverages and deductibles as we believe are reasonable and prudent. The principal risks that we insure against are workers' compensation, personal injury, bodily injury, property damage, professional malpractice, errors and omissions and fidelity losses. Our management does not expect that the outcome of any pending lawsuits relating to such matters, individually or collectively, will have a material adverse effect on our financial condition, results of operations or cash flows.

On December 13, 2004, and as amended on January 13, 2005 and October 31, 2005, Glidepath Holding B.V. and Jeimon Holdings N.V. filed an action against Spherion Corporation in the U.S. District Court of the Southern District of New York. Glidepath and Jeimon Holdings, investors in the entity that acquired the Cyber Center business of Spherion Technology (UK) Limited, a subsidiary of Spherion Corporation, in 2002, sued Spherion for fraud, negligent misrepresentation, aiding and abetting breach of fiduciary duty and unjust enrichment and seek $32.0 million in damages, and treble for punitive damages, plus attorneys' fees, expert fees and costs. Glidepath and Jeimon Holdings allege that an individual who was an officer of Spherion Technology (UK) fraudulently induced them to invest in a corporation formed to purchase the Cyber Center business, while he remained in the employ of Spherion Technology (UK) and was to be paid an incentive bonus for the sale by Spherion. They allege that he misled them as to his employment status at the time, as to the prospects for the Cyber Center, and as to whether the newly formed corporation was assuming the indebtedness of Spherion Technology (UK) associated with the Cyber Center business. They allege that in doing so, he was acting as Spherion's agent. Spherion intends to vigorously defend this matter. Although this claim is in the preliminary stages, Spherion has a reserve of $0.3 million related to this matter. Spherion does not have insurance coverage for this claim.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year ended December 30, 2007.

15

PART II

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market for the Registrant's Common Equity

Our common stock is traded on The New York Stock Exchange under the symbol "SFN." The following table sets forth, for the periods indicated, the high and low prices per share of the common stock as reported on The New York Stock Exchange:

2007

| | High

| | Low

|

|---|

| First Quarter | | $ | 9.65 | | $ | 7.32 |

| Second Quarter | | | 10.37 | | | 8.40 |

| Third Quarter | | | 9.77 | | | 6.90 |

| Fourth Quarter | | | 9.72 | | | 6.95 |

2006

|

|

High

|

|

Low

|

|---|

| First Quarter | | $ | 11.41 | | $ | 8.94 |

| Second Quarter | | | 10.94 | | | 7.81 |

| Third Quarter | | | 9.13 | | | 6.80 |

| Fourth Quarter | | | 7.90 | | | 6.76 |

On February 24, 2008, there were approximately 2,199 holders of record of our common stock.

We did not pay cash dividends in 2007 and 2006, and do not intend to pay cash dividends in the foreseeable future. Our U.S. revolving line of credit provides for certain covenants which restrict our ability to pay cash dividends in the event of default or under certain circumstances.

The information required by Item 201(d) of Regulation S-K is set forth in Part III, Item 12 of this Annual Report on Form 10-K.

16

Issuer Purchases of Equity Securities

During 2007, Spherion purchased 1.2 million shares for approximately $10.3 million at an average price per share of $8.69. Repurchases during the fourth quarter were as follows:

Period

| | Total

Number of

Shares

Purchased

| | Average

Price Paid

per Share

| | Total Number of

Shares Purchased

as Part of Publicly

Announced Program

| | Maximum Number

of Shares that

May Yet Be

Purchased Under

the Program(1)

|

|---|

| Month 1 | | | | | | | | | |

| | October 1, 2007 through October 28, 2007 | | 312 | (2) | $ | 8.64 | | — | | — |

Month 2 |

|

|

|

|

|

|

|

|

|

| | October 29, 2007 through November 25, 2007 | | 284 | (2) | | 7.93 | | — | | — |

Month 3 |

|

|

|

|

|

|

|

|

|

| | November 26, 2007 through December 30, 2007 | | 100,479 | (2) | | 7.52 | | 100,000 | | — |

| | |

| |

| |

| |

|

Total |

|

101,075 |

|

$ |

7.52 |

|

100,000 |

|

— |

| | |

| |

| |

| |

|

- (1)

- On January 4, 2008, the Board of Directors authorized the repurchase of up to $25.0 million of the Company's common stock. This authorization replaced the previous repurchase plan authorized on February 20, 2007, which allowed the repurchase of a maximum of 50,000 shares of common stock per week to mitigate the dilutive impact of shares issued under our various employee benefit plans.

- (2)

- Number of shares purchased also includes purchases that relate to deferred compensation plan for highly compensated employees. This is a non-publicly announced program.

17

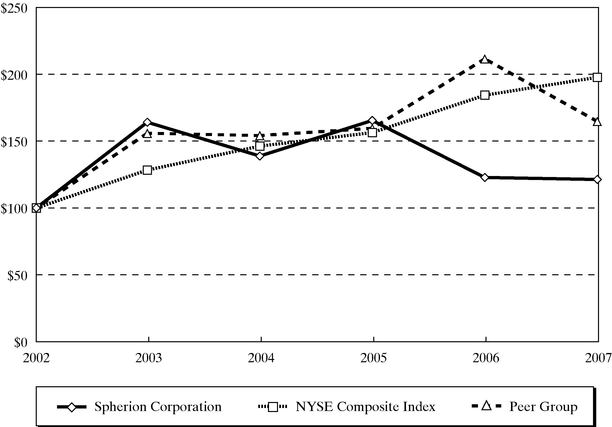

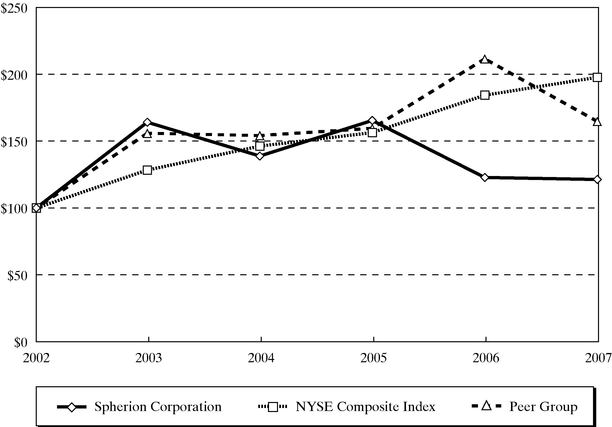

Performance Graph

The following graph sets forth the cumulative total stockholder return on our Common Stock, the cumulative total return of the NYSE composite index and the cumulative total return of our Peer Group Index (the "Peer Group Index"), each for the period beginning December 31, 2003 and ending December 30, 2007. The total cumulative return on investment (change in stock price plus reinvested dividends, if any) for us, the NYSE composite index and the Peer Group Index assumes that a $100 investment was made on December 31, 2002. We have not declared any dividends in the period represented in this performance graph.

The Peer Group Index is comprised of the following publicly traded companies: Adecco S.A.; Kelly Services, Inc.; Manpower Inc.; MPS Group, Inc.; and Robert Half International Inc.

The data for this performance graph was compiled for us by Standard and Poor's. The stock price performance shown on this graph is not necessarily indicative of future price performance of our Common Stock.

Comparison of Cumulative Five Year

Total Return

| | Fiscal Years

|

|---|

| | 2002

| | 2003

| | 2004

| | 2005

| | 2006

| | 2007

|

|---|

| Spherion Corporation | | $ | 100.00 | | $ | 164.13 | | $ | 138.84 | | $ | 165.45 | | $ | 122.81 | | $ | 121.32 |

| NYSE Composite Index | | | 100.00 | | | 128.36 | | | 146.23 | | | 156.39 | | | 184.33 | | | 197.74 |

| Peer Group | | | 100.00 | | | 155.87 | | | 154.19 | | | 159.56 | | | 211.50 | | | 164.74 |

18

Item 6. SELECTED FINANCIAL DATA

The following table summarizes selected financial information for each of the most recent five fiscal years and should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the accompanying Consolidated Financial Statements included in this Annual Report on Form 10-K.

| | Fiscal Years

| |

|---|

| | 2007(1,2)

| | 2006(2)

| | 2005(2)

| | 2004(2,3)

| | 2003(2,4)

| |

|---|

| | (in thousands, except per share data and operating locations)

| |

|---|

| Statement of Operation Data: | | | | | | | | | | | | | | | | |

| Revenues | | $ | 2,017,114 | | $ | 1,922,735 | | $ | 1,966,400 | | $ | 2,009,149 | | $ | 1,716,027 | |

| Gross profit | | | 477,986 | | | 447,079 | | | 426,185 | | | 403,753 | | | 368,923 | |

| Earnings (loss) from continuing operations | | | 29,137 | | | 22,323 | | | 22,575 | | | 12,298 | | | (2,137 | ) |

| Net earnings (loss) | | | 25,266 | | | 54,682 | | | 12,029 | | | 35,829 | | | (13,913 | ) |

| Earnings (loss) per share—Basic: | | | | | | | | | | | | | | | | |

| | Earnings (loss) from continuing operations | | $ | 0.52 | | $ | 0.39 | | $ | 0.37 | | $ | 0.20 | | $ | (0.04 | ) |

| | Net earnings (loss) per share | | | 0.45 | | | 0.96 | | | 0.20 | | | 0.59 | | | (0.23 | ) |

| Earnings (loss) per share—Diluted: | | | | | | | | | | | | | | | | |

| | Earnings (loss) from continuing operations | | $ | 0.51 | | $ | 0.39 | | $ | 0.37 | | $ | 0.20 | | $ | (0.04 | ) |

| | Net earnings (loss) per share | | | 0.44 | | | 0.95 | | | 0.20 | | | 0.57 | | | (0.23 | ) |

Weighted Average Shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Basic | | | 56,234 | | | 57,212 | | | 60,938 | | | 61,036 | | | 59,951 | |

| | Diluted | | | 56,893 | | | 57,784 | | | 61,430 | | | 62,313 | | | 59,951 | |

Additional Data (end of period): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets | | $ | 844,818 | | $ | 693,387 | | $ | 742,644 | | $ | 830,266 | | $ | 864,834 | |

| Long-term debt, net of current portion | | $ | 22,148 | | $ | 2,377 | | $ | 3,735 | | $ | 4,766 | | $ | 98,073 | |

| Working capital | | $ | 124,938 | | $ | 207,269 | | $ | 129,893 | | $ | 119,832 | | $ | 225,489 | |

| Operating locations | | | 742 | | | 660 | | | 659 | | | 716 | | | 811 | |

- (1)

- The results of operations include Todays and Technisource from the dates of acquisition of September 28, 2007 and December 3, 2007, respectively, and various immaterial acquisitions.

- (2)

- The sale of our outplacement consulting business occurred in the second quarter of 2007 and we reclassified operating results for all periods presented as discontinued operations.

- (3)

- The 2004 fiscal year contains 53 weeks. All other years contain 52 weeks. The 2004 results included pre-tax restructuring and other charges of $8.4 million.

- (4)

- The 2003 results include the Canadian results of operations from the date of acquisition (April 4, 2003) and pre-tax restructuring and other charges of $4.2 million.

19

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Organization of Information

Management's Discussion and Analysis provides a narrative on our financial performance and condition that should be read in conjunction with the accompanying Consolidated Financial Statements. It includes the following sections:

- •

- Company Overview

- •

- Executive Summary

- •

- Operating Results

- •

- Liquidity and Capital Resources

- •

- Contractual Obligations and Commitments

- •

- Off-Balance Sheet Arrangements

- •

- Critical Accounting Policies

- •

- New Accounting Pronouncements

- •

- Inflation

- •

- Seasonality and Cyclical Nature of Business

- •

- Forward-Looking Statements-Safe Harbor

Company Overview

Spherion Corporation provides temporary staffing services, managed services and permanent placement services. Founded in 1946, we are headquartered in Fort Lauderdale, Florida, with a network of 742 locations in North America. Our locations are company-owned, franchised or area-based franchised. As of December 30, 2007, we had 582 company-owned locations, 90 franchised locations and 70 area-based franchised locations.

The Company is organized around two operating segments—Staffing Services and Professional Services. The Staffing Services segment provides temporary staffing, managed services and permanent placement of employees with primarily clerical and light industrial skills. The Professional Services segment provides temporary staffing and permanent placement of employees with higher-level skill sets, such as information technology, finance and accounting, legal, engineering, sales and marketing, human resources and administrative. See theOperations Overview section of Part I of this Annual Report on Form 10-K for further description of our operating segments.

In 2007, we acquired several staffing companies within the United States. During the second quarter of 2007, we acquired Resulté Universal, Ltd. ("Resulté"), a Texas based temporary staffing and recruiting firm specializing in providing information technology ("IT") and accounting and finance personnel. In the third quarter of 2007, Spherion acquired Todays Staffing, Inc. ("Todays"), a temporary staffing and recruiting company focused in the clerical market. In the fourth quarter of 2007, Spherion acquired Technisource, Inc. ("Technisource"), a company that provides IT temporary staffing and recruiting and managed IT services within the United States. In addition, we periodically enter into transactions with our franchise and area-based franchise owners to buy and sell operations in certain markets.

20

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS—(Continued)

Executive Summary

The following is a brief summary of our primary 2007 objectives and accomplishments:

- •

- Targeted revenue growth. Our strategy in 2007 was to grow revenue with our targeted small and mid-sized customers and increase the portion of company revenues generated from our Professional Services operating segment. Revenue increased 4.9% in total and 0.4% on an organic basis during 2007 compared with the prior year. Revenue from small to mid-sized accounts (customers that do business with Spherion of $5 million or less, annually) increased to 49.0% of revenue in 2007 from 47.0% in the prior year. Additionally, in 2007 Professional Services revenues increased 10.6% and 0.9% on an organic basis. Including the impact of acquisitions, Professional Services increased to 27.0% of total company revenue, from 25.6% in the prior year.

- •

- Emphasizing higher margin services. During 2007, we continued to focus on providing additional services to existing accounts, particularly for higher value Professional Services and Recruitment Process Outsourcing ("RPO"). In addition to growth in our Professional Services business unit in 2007, much of which came from small to mid-sized customers, our RPO business grew 56.3% year over year. Overall, gross profit margin was 23.7%, an increase of 40 basis points compared with the prior year. The 40 basis point increase in our gross profit margin is primarily due to the change in business mix due to growth of our higher margin RPO and Professional Services as well as expanded gross profit margins for professional temporary staffing services.

- •

- Continuing to improve operating leverage. Improvements in operating leverage required us to balance growth in operating expenses with growth in business volumes and gross profit. Selling, general and administrative expenses were up $16.3 million compared with the prior year with $10.2 million of the increase attributable to the acquisitions. Through effective management of our cost structure, we reduced selling, general and administrative costs as a percentage of gross profit to 90.3% from 92.9% in 2006.

In 2008 we plan to focus on three key operating objectives:

- •

- First, execute our growth strategy among small to mid-sized accounts:

- •

- Continue to concentrate on organic growth;

- •

- Expand services at existing accounts, particularly Professional Services;

- •

- Maintain premium pricing and margin compared with market; and

- •

- Disproportionally grow Professional Services to change our business mix to be more representative of the overall North American recruiting and staffing market.

- •

- Second, reinforce our commitment to grow our higher margin businesses:

- •

- Leverage the addition of Todays and Technisource to expand our margins through business mix change;

- •

- Exploit market-leading RPO services; and

- •

- Increase pricing discipline.

- •

- Third, continue improving operating leverage and maintain financial discipline:

- •

- Effectively integrate our acquisitions to fully realize planned cost synergies;

21

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS—(Continued)

- •

- Limit growth in selling, general and administrative expenses to fifty percent of our growth in gross profit; and

- •

- Maintain Days Sales Outstanding (DSO, a measure of how quickly accounts receivable are collected) at 50 days or better.

Operating Results

Consolidated Operating Results

22

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS—(Continued)

- •

- Our effective tax rate from continuing operations was 37.3% which increased from the prior year rate of 34.2% primarily due to higher state tax expense and certain non-deductable costs associated with the Canadian purchase discussed above.

- •

- Earnings from continuing operations were $0.51 per share for 2007 compared with $0.39 per share in 2006.

- •

- Loss from discontinued operations was $(0.07) per share primarily related to the write-off of goodwill and loss on disposal related to our outplacement consulting business sold in the second quarter of 2007.

- •

- DSO remained stable at 50 days in 2007 compared to 2006.

23

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS—(Continued)

- •

- Restructuring and other charges (credits) were $(0.2) million in 2006 versus $1.8 million in 2005. The charge in 2005 was largely related to staff reductions associated with a contract loss.

- •

- Our effective tax rate from continuing operations was 34.2% in 2006 and 2005.

- •

- Earnings from continuing operations were $0.39 per share for 2006 compared with $0.37 in the prior year. Earnings from continuing operations were impacted by stock option expense for the 2006 period in the amount of $3.2 million, net of tax, or $0.05 per share.

- •

- Discontinued operations had a pre-tax loss of $1.6 million in 2006 as a result of the resolution of certain purchaser claims for previously sold operations in the Asia/Pacific region. Discontinued operations had net earnings of $32.4 million, which includes a tax benefit of $30.8 million related to the resolution of certain international tax matters.

- •

- DSO decreased to 50 days at the end of 2006 compared with 54 days at the end of 2005.

Discontinued Operations

For the fiscal years ended December 30, 2007, December 31, 2006 and January 1, 2006, discontinued operations through the dates of their disposition, as applicable, had pre-tax operating losses of $6.3 million, $1.6 million and $11.3 million, respectively.

See Note 14, "Discontinued Operations," in the accompanying Notes to the Consolidated Financial Statements for further discussion.

Restructuring and Other Charges

The following is a summary of restructuring activities (in thousands):

| | Fiscal Years

| |

|---|

| | 2007

| | 2006

| | 2005

| |

|---|

| Staffing Services | | $ | — | | $ | 363 | | $ | 1,840 | |

| Professional Services | | | — | | | 106 | | | 49 | |

| Corporate | | | — | | | 899 | | | 341 | |

| Reversal of over accrual | | | — | | | (582 | ) | | (175 | ) |

| | |

| |

| |

| |

| Restructuring | | | — | | | 786 | | | 2,055 | |

| Other charges (credits) | | | 700 | | | (963 | ) | | (292 | ) |

| | |

| |

| |

| |

| | Total restructuring and other charges (credits) | | $ | 700 | | $ | (177 | ) | $ | 1,763 | |

| | |

| |

| |

| |

See Note 15, "Restructuring and Other Charges," in the accompanying notes to the Consolidated Financial Statements for further discussion.

24

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF