UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2016

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to __________________.

Commission File No.: 0-25244

TRANS WORLD CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| | |

Nevada

(State or Other Jurisdiction of

Incorporation or Organization) | | 13-3738518

(I.R.S. Employer

Identification No.) |

| | |

545 Fifth Avenue, Suite 940

New York, NY

(Address of Principal Executive Offices) | | 10017

(Zip Code) |

Registrant’s telephone number, including area code: (212) 983-3355

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☐ | | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The number of outstanding shares of the registrant’s Common Stock, par value $0.001 per share, as of May 9, 2016 was 8,829,011.

TRANS WORLD CORPORATION AND SUBSIDIARIES

FORM 10-Q

FOR THE QUARTER ENDED MARCH 31, 2016

INDEX

PART I — FINANCIAL INFORMATION

ITEM 1.FINANCIAL STATEMENTS

TRANS WORLD CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

March 31, 2016 and December 31, 2015

(in thousands, except for share data)

| | | | | | | |

| | March 31, 2016 | | December 31, 2015 | |

| | (Unaudited) | | | | |

ASSETS | | | | | | | |

CURRENT ASSETS: | | | | | | | |

Cash and cash equivalents | | $ | 12,286 | | $ | 10,674 | |

Prepaid expenses | | | 570 | | | 409 | |

Other current assets | | | 668 | | | 509 | |

| | | | | | | |

Total current assets | | | 13,524 | | | 11,592 | |

| | | | | | | |

PROPERTY AND EQUIPMENT, net | | | 38,744 | | | 37,122 | |

| | | | | | | |

OTHER ASSETS: | | | | | | | |

Goodwill | | | 5,241 | | | 5,016 | |

Deposits and other assets | | | 1,576 | | | 1,509 | |

| | | | | | | |

Total other assets | | | 6,817 | | | 6,525 | |

| | | | | | | |

TOTAL ASSETS | | $ | 59,085 | | $ | 55,239 | |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

| | | | | | | |

CURRENT LIABILITIES: | | | | | | | |

Long-term debt, current maturities | | $ | 571 | | $ | 542 | |

Capital lease, current portion | | | 16 | | | 22 | |

Accounts payable | | | 609 | | | 753 | |

Czech gaming tax accrual | | | 2,950 | | | 2,219 | |

Foreign income tax accrual | | | 921 | | | 957 | |

Accrued expenses and other current liabilities | | | 2,763 | | | 3,052 | |

| | | | | | | |

Total current liabilities | | | 7,830 | | | 7,545 | |

| | | | | | | |

LONG-TERM LIABILITIES: | | | | | | | |

Long-term debt, less current maturities | | | 7,694 | | | 7,493 | |

Deferred foreign tax liability | | | 33 | | | 32 | |

| | | | | | | |

Total long-term liabilities | | | 7,727 | | | 7,525 | |

| | | | | | | |

COMMITMENTS AND CONTINGENCIES | | | | | | | |

| | | | | | | |

STOCKHOLDERS’ EQUITY: | | | | | | | |

Preferred stock, $.001 par value, 4,000,000 shares authorized, none issued | | | | | | | |

Common stock, $.001 par value, 20,000,000 shares authorized, 8,829,011 shares in 2016 and 2015, issued and outstanding | | | 9 | | | 9 | |

Additional paid-in capital | | | 53,878 | | | 53,387 | |

Accumulated other comprehensive loss | | | (1,420) | | | (3,282) | |

Accumulated deficit | | | (8,939) | | | (9,945) | |

| | | | | | | |

Total stockholders’ equity | | | 43,528 | | | 40,169 | |

| | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 59,085 | | $ | 55,239 | |

See accompanying notes to consolidated interim financial statements.

TRANS WORLD CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

AND COMPREHENSIVE INCOME (LOSS)

Three Months Ended March 31, 2016 and 2015

(in thousands, except for share data and per share data)

| | | | | | | |

| | Three Months Ended March 31, | |

| | 2016 | | 2015 | |

| | (Unaudited) | | (Unaudited) | |

| | | | | | | |

REVENUES | | $ | 12,233 | | $ | 9,502 | |

| | | | | | | |

COSTS AND EXPENSES: | | | | | | | |

| | | | | | | |

Cost of revenues | | | 6,700 | | | 4,932 | |

Depreciation and amortization | | | 500 | | | 395 | |

Selling, general and administrative | | | 3,494 | | | 3,339 | |

| | | 10,694 | | | 8,666 | |

INCOME FROM OPERATIONS, before other expenses and foreign income taxes | | | 1,539 | | | 836 | |

| | | | | | | |

OTHER EXPENSES: | | | | | | | |

| | | | | | | |

Interest expense | | | (62) | | | (31) | |

| | | | | | | |

INCOME BEFORE FOREIGN INCOME TAXES | | | 1,477 | | | 805 | |

| | | | | | | |

FOREIGN INCOME TAXES | | | (471) | | | (282) | |

| | | | | | | |

NET INCOME | | | 1,006 | | | 523 | |

| | | | | | | |

Other comprehensive income (loss), foreign currency translation adjustments, net of tax of $0 | | | 1,862 | | | (4,397) | |

| | | | | | | |

COMPREHENSIVE INCOME (LOSS) | | $ | 2,868 | | $ | (3,874) | |

| | | | | | | |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | | | | | | | |

Basic | | | 8,829,011 | | | 8,821,205 | |

Diluted | | | 9,438,871 | | | 9,244,883 | |

| | | | | | | |

EARNINGS PER COMMON SHARE: | | | | | | | |

| | | | | | | |

Basic | | $ | 0.11 | | $ | 0.06 | |

Diluted | | $ | 0.11 | | $ | 0.06 | |

See accompanying notes to consolidated interim financial statements.

TRANS WORLD CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Three Months Ended March 31, 2016 and 2015

(in thousands)

| | | | | | | |

| | Three Months Ended March 31, | |

| | 2016 | | 2015 | |

| | (Unaudited) | | (Unaudited) | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | |

Net income | | $ | 1,006 | | $ | 523 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

Loss (gain) from sale of assets | | | 125 | | | (2) | |

Depreciation and amortization | | | 500 | | | 395 | |

Stock option expense | | | 41 | | | 15 | |

Deferred board fees | | | 25 | | | 16 | |

Changes in operating assets and liabilities: | | | | | | | |

Prepaid expenses | | | (148) | | | (123) | |

Other current assets | | | (130) | | | (124) | |

Deposits and other assets | | | (1) | | | (14) | |

Accounts payable | | | (178) | | | (334) | |

Czech gaming tax accrual | | | 611 | | | 40 | |

Foreign income tax accrual | | | (76) | | | 17 | |

Accrued expenses and other current liabilities | | | 31 | | | 256 | |

NET CASH PROVIDED BY OPERATING ACTIVITIES | | | 1,806 | | | 665 | |

| | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

Purchases of property and equipment | | | (581) | | | (193) | |

Proceeds from sale of assets | | | | | | 7 | |

NET CASH USED IN INVESTING ACTIVITIES | | | (581) | | | (186) | |

| | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | |

Principal payments on Sparkasse Loans | | | (135) | | | (61) | |

NET CASH USED IN FINANCING ACTIVITIES | | | (135) | | | (61) | |

| | | | | | | |

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | | | 522 | | | (686) | |

| | | | | | | |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | 1,612 | | | (268) | |

| | | | | | | |

CASH AND CASH EQUIVALENTS: | | | | | | | |

Beginning of period | | | 10,674 | | | 6,589 | |

| | | | | | | |

End of period | | $ | 12,286 | | $ | 6,321 | |

| | | | | | | |

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | | | |

Cash paid during the period for interest | | $ | 62 | | $ | 31 | |

Cash paid during the period for foreign income taxes | | $ | 274 | | $ | 201 | |

| | | | | | | |

SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING ACTIVITIES: | | | | | | | |

Deferred compensation to be paid in common stock | | $ | 425 | | $ | 349 | |

See accompanying notes to consolidated interim financial statements.

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

1.Basis of Presentation and Consolidation.

The accompanying unaudited consolidated interim financial statements of Trans World Corporation and Subsidiaries (collectively, the “Company,” “TWC,” “we,” “our” or “us”) as of March 31, 2016 and December 31, 2015 and for the three months ended March 31, 2016 and 2015 are presented in conformity with accounting principles generally accepted in the United States of America (“US GAAP” or “GAAP”), and pursuant to the accounting and disclosure rules and regulations of the Securities and Exchange Commission (the “SEC”) and Regulation S-X. Pursuant to these instructions, certain financial information and footnote disclosures normally included in such consolidated financial statements have been condensed or omitted. In presenting the consolidated interim financial statements, management makes estimates and assumptions that affect the amounts reported and related disclosures. Estimates by their nature are based on judgment and available information. Accordingly, actual results could differ from those estimates. All intercompany balances and transactions have been eliminated in consolidation.

These unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto, together with management’s discussion and analysis, contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015. The results of operations for the three months ended March 31, 2016 are not necessarily indicative of the results that may occur for the year ending December 31, 2016.

The consolidated balance sheet as of December 31, 2015 was derived from the Company’s audited consolidated financial statements but does not include all disclosures required by US GAAP.

The functional currency of the Company’s Czech subsidiaries is the local Czech koruna (“CZK” or “Kč”) and the local currency of the German subsidiary is the euro currency (“EUR” or “€”). However, as our primary reporting wholly-owned subsidiary, Trans World Hotels & Entertainment a.s. (“TWH&E”), is a Czech entity, all revenues and expenses, regardless of sources of origin, are recognized in CZK. In the case of the two German hotels, which are owned by TWH&E through its wholly-owned German subsidiary, Trans World Hotels Germany GmbH (“TWHG”), all EUR revenues and expenses are translated into the Czech currency, then all amounts are finally translated to United States dollars (“USD” or “$”) for reporting purposes.

All monetary amounts set forth in these financial statements are in USD unless otherwise stated herein.

2.Nature of Business.

Trans World Corporation, a Nevada corporation, and Subsidiaries are primarily engaged in the gambling business in the Czech Republic (“Czechia”) and in the hospitality business in Germany (“DE”).

The Company owns and operates three casinos in Czechia, all under the registered brand American Chance Casinos (“ACC”). The Ceska casino (“Ceska”), located in the town of Ceska Kubice, in the western part of Czechia, close to the German border, currently has 15 gaming tables and 100 slot machines. The Route 55 casino (“Route 55”), located in Dolni Dvoriste, in the southern part of Czechia, close to the Austrian border, currently has 21 gaming tables and 138 slot machines. The Route 59 casino (“Route 59”) is located in Hate, near Znojmo, also in the southern part of Czechia, close to the Austrian border, and currently has 23 gaming tables and 176 slot machines.

In addition to the above gaming operations, TWC also owns and operates a 77-room, four-star deluxe hotel, the Hotel Savannah, which is physically connected to its Route 59 casino, and owns a full-service spa, the “Spa at Savannah” (the “Spa”), which is operated by an independent contractor and is attached to the hotel. The hotel features eight banquet halls for meetings and special events as well as a full-service restaurant and bar. Hotel Savannah and the three aforementioned casinos are part of the Company’s casino segment. (See Note 5 below).

TWC also owns and operates two German hotels, which comprise the Company’s hotel segment. The Hotel Columbus, a four-star 117-room hotel (the “Hotel Columbus”) is located in Seligenstadt, near Frankfurt, Germany. The Hotel Columbus features five meeting rooms, a restaurant and separate breakfast room, each with its own kitchen, two bars, a 32-space parking garage and 43 surface lot parking places, including a satellite parking area located across the street from the Hotel. The second hotel, Hotel Freizeit Auefeld, is a 93-room four-star hotel with extensive meeting

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

space and recreational amenities located in Hannoversch Münden (“Hann. Münden”), Germany. The hotel features three food and beverage outlets, ten meeting rooms, an adjoining 13,000 square foot event hall, and an adjoining tennis complex with four indoor courts; several additional recreation areas; an independent townhouse comprised of one four-room and one six-room apartment.

3.Summary of Selected Significant Accounting Policies.

(a)Cash and Cash Equivalents - Cash and cash equivalents are comprised of cash on hand; current balances with banks and similar institutions; and term deposits of three months or less with banks and similar institutions. The carrying amounts of cash at banks and on hand and term bank deposits approximate their fair values.

(b)Revenue Recognition - Casino revenue is defined as the net win from gaming activities, which is the difference between gaming wagers and the amount paid out to wagering patrons, and is recognized on the day it is earned. Revenues generated from ancillary services, which includes room rentals, sales of food, beverage, cigarettes, spa services, and casino logo merchandise, are recognized at the time the related services are performed or goods sold. Room revenue from the hotel and casino segments represented 6.4% and 5.9% of consolidated total revenue for the three months ended March 31, 2016 and 2015, respectively. Food and beverage (“F&B”) revenues from the hotel and casino segments represented approximately 5.2% and 4.4% of consolidated total revenue for the three months ended March 31, 2016 and 2015, respectively.

(c)Business Acquisitions Assets acquired and liabilities assumed in business combinations are recorded on the Company’s consolidated balance sheets as of the respective acquisition dates based upon their estimated fair values at such dates. The results of operations of businesses acquired by the Company have been included in the consolidated statements of income since their respective dates of acquisition. In certain circumstances, the purchase price allocations may be based upon preliminary estimates and assumptions. Accordingly, the allocations are subject to revision until the Company receives final information and other analyses during the measurement period which ends a year after the date of acquisition.

(d)Segment Reporting – Pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 280, Segment Reporting, the Company has two reportable segments, a casino segment and a hotel segment. ASC 280 designates the internal reporting that is used by management for making operating decisions and assessing performance as the source of the Company’s reportable segments. The Company is including this segment reporting under Note 5 below.

(e)Earnings per Share - The Company complies with accounting and disclosure requirements

regarding earnings per share. Basic earnings per common share are computed by dividing net income by the weighted average number of common shares outstanding during the period. Diluted earnings per common share incorporate the dilutive effect of Common Stock equivalents on an average basis during the period. The Company’s Common Stock equivalents currently include stock options, restricted stock, and deferred compensation stock. As of March 31, 2016, the Company’s Common Stock equivalents include 635,000 unexercised stock options, 75,000 shares of restricted stock, and 609,298 shares issuable under the Company’s Deferred Compensation Plan. As of March 31, 2015, the Common Stock equivalents included 585,100 unexercised stock options, 75,000 shares of restricted stock, and 423,664 deferred compensation shares. These shares for the respective years were included in the computation of diluted earnings per common share, if such unexercised stock options, restricted stock, and deferred compensation stock were vested and “in-the-money.”

The Company has not paid dividends on its Common Stock since inception and has no current plans to do so.

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

A table illustrating the impact of dilution on earnings per share, based on the treasury stock method, is presented below:

| | | | | | | |

| | | | | | | |

| | For the Three Months Ended | |

| | March 31, | |

| | 2016 | | 2015 | |

| | (Unaudited) | | (Unaudited) | |

Basic earnings per share: | | | | | | | |

Net income | | $ | 1,006 | | $ | 523 | |

| | | | | | | |

Weighted average common shares | | | 8,829,011 | | | 8,821,205 | |

| | | | | | | |

Basic earnings per share | | $ | 0.11 | | $ | 0.06 | |

| | | | | | | |

Diluted earnings per share: | | | | | | | |

Net income | | $ | 1,006 | | $ | 523 | |

| | | | | | | |

Weighted average common shares | | | 8,829,011 | | | 8,821,205 | |

| | | | | | | |

Addition due to the effect of dilutive securities using the treasury stock method: | | | | | | | |

Stock options and restricted stock | | | 562 | | | 14 | |

Stock issuable under the Deferred Compensation Plan | | | 609,298 | | | 423,664 | |

| | | | | | | |

Dilutive potential common shares | | | 9,438,871 | | | 9,244,883 | |

| | | | | | | |

Diluted earnings per share | | $ | 0.11 | | $ | 0.06 | |

(f)Goodwill - Goodwill represents the excess of the cost of the Company’s subsidiaries over the fair value of their net assets at the date of acquisition. In Czechia, this consisted of the Ceska casino and a parcel of land in Hate (upon a portion of which the Route 59 Casino and Hotel Savannah are situated). In Germany, it consists of the newly acquired Hotel Freizeit Auefeld. Goodwill is subject to at least an annual assessment for impairment, applying a fair-value based test. Goodwill impairment tests require the Company to first assess qualitative factors, which include macroeconomic conditions, financial performance, and industry and market considerations, to determine whether it is necessary to perform a two-step quantitative goodwill impairment test. TWC assesses the potential impairment of goodwill annually (as of September 30th) and on an interim basis whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Upon completion of such review, if impairment is found to have occurred, a corresponding charge to earnings will be recorded. TWC allocates its Czech goodwill over two geographical reporting units, which are components of the casino segment, and are classified as the “Pilsen reporting unit” (“PRU”), which consists of the Ceska casino, and the “South Moravia reporting unit” (“SMRU”), which consists of the land in Hate. The German goodwill is derived from the Hotel Freizeit Auefeld, and is represented by the “Lower Saxony reporting unit” (“LSRU”). There were no indicators of impairment present during the first quarter of 2016 for the Czech reporting units, nor for the Hotel Freizeit Auefeld; therefore, TWC determined that there was no impairment of goodwill at March 31, 2016.

Changes to goodwill during the periods presented are strictly related to the fluctuation in foreign currency exchange rates. See Note 3(i) below.

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

(g)Property and Equipment - Property and equipment is stated at cost less accumulated depreciation and amortization. TWC capitalizes the cost of improvements that extend the life of the asset and expenses maintenance and repair costs as incurred. The Company provides for depreciation and amortization using the straight-line method over the following estimated useful lives:

| | | |

Asset | | Estimated Useful Life | |

| | | |

Buildings | | 30-50 years | |

Furniture, fixtures and equipment | | 4-10 years | |

Leasehold improvements | | 5-20 years | |

At March 31, 2016 and December 31, 2015, property and equipment consisted of the following:

| | | | | | | |

| | As of | | As of | |

| | March 31, 2016 | | December 31, 2015 | |

| | (Unaudited) | | | | |

| | | | | | | |

Land | | $ | 3,004 | | $ | 2,874 | |

Building and improvements | | | 36,575 | | | 34,950 | |

Furniture, fixtures and other equipment | | | 13,185 | | | 12,253 | |

| | | | | | | |

| | | 52,764 | | | 50,077 | |

Less accumulated depreciation and amortization | | | (14,020) | | | (12,955) | |

| | | | | | | |

| | $ | 38,744 | | $ | 37,122 | |

(h)Impairment of Long-lived Assets - The Company periodically evaluates whether current facts or circumstances indicate that the carrying value of its depreciable assets to be held and used may be recoverable. If such circumstances are determined to exist, an estimate of undiscounted future cash flows produced by the long-lived assets, or the appropriate grouping of assets, is compared to the carrying value to determine whether an impairment exists. If an asset is determined to be impaired, the loss is measured based on the difference between the asset’s fair value and its carrying value. An estimate of the asset’s fair value is based on quoted market prices in active markets, if available. If quoted market prices are not available, the estimate of fair value is based on various valuation techniques, including a discounted value of estimated future cash flows. The Company reports an asset to be disposed of at the lower of its carrying value or its estimated net realizable market value. There were no indicators of impairment for long-lived assets for the three months ending March 31, 2016 and 2015.

(i)Foreign Currency Translation - The Company complies with requirements for reporting foreign currency translation, which require that for foreign subsidiaries whose functional currency is the local foreign currency, balance sheet accounts are translated at exchange rates in effect at the end of the period and resulting translation adjustments are included in “accumulated other comprehensive income (loss).” Statement of income accounts are translated by applying monthly averages of daily exchange rates on the respective monthly local statement of operations accounts for the period.

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

The impact of foreign currency translation on goodwill is presented below:

| | | | | | | | | | | | | |

| | Goodwill | | | | |

(Unaudited) | | Casino Segment | | Hotel Segment | | Total | |

| | Pilsen | | South-Moravia | | Lower Saxony | | | | |

As of March 31, 2016 (in thousands, except FX) | | reporting unit | | reporting unit | | reporting unit | | | | |

| | | | | | | | | | | | | |

Balance in USD ($) | | $ | 3,042 | (1) | $ | 537 | (1) | $ | 131 | | $ | 3,710 | |

Balance in EUR (€) | | | | | | | | € | 119 | | € | 119 | |

Foreign Exchange Rate ("FX") | | | 33.8830 | | | 33.8830 | | | 27.2450 | | | | |

Balance in CZK (Kč) | | Kč | 103,072 | (2) | Kč | 18,195 | (2) | Kč | 3,242 | (3) | Kč | 124,509 | |

Applicable FX(4) | | | 23.7570 | | | 23.7570 | | | 23.7570 | | | | |

Balance at March 31, 2016 | | $ | 4,339 | | $ | 766 | | $ | 136 | | $ | 5,241 | |

Net cumulative change to goodwill due to foreign currency translation | | $ | 1,297 | | $ | 229 | | $ | 5 | | $ | 1,531 | |

| (1) | | Goodwill was amortized over 15 years until the Company started to comply with revised GAAP requirements, as of January 1, 2002. This balance represents the remaining, unamortized goodwill, after an impairment charge was taken prior to January 1, 2003. |

| (2) | | USD residual balance translated to CZK at June 30, 1998, the date of acquisition of such assets, with the date of acquisition CZK to USD FX rate of 33.8830. |

| (3) | | EUR balance translated to CZK at June 1, 2015, the date of acquisition of the Hotel Freizeit, with the date of acquisition CZK to EUR FX rate of 27.2450. |

| (4) | | FX central bank foreign exchange rates taken from www.CNB.CZ. |

(j)Stock-based Compensation - The Company accounts for stock options using the modified prospective method in accordance with accounting and disclosure requirements for stock compensation. Under this method, compensation costs include the estimated grant date fair value of the awards amortized over the options’ vesting period. The Company currently utilizes the Black-Scholes option pricing model to measure the fair value of stock options granted to certain key management employees (“KME”s). Stock-based compensation was approximately $41 and $15 for the three months ended March 31, 2016 and 2015, respectively, and is included in selling, general and administrative expenses in the consolidated statements of income.

(k)Comprehensive Income (Loss) – The Company complies with requirements for reporting comprehensive income (loss). Those requirements establish rules for reporting and display of comprehensive income and loss and their components. Except for the Company’s change in the foreign currency translation adjustments to be included in other comprehensive income (loss), there were no other components of the Company’s comprehensive income (loss) in three months ended March 31, 2016 and 2015.

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

(l)Czech Gaming Taxes - The gaming taxes are summarized in the following table:

| | | |

| | 2012 Gaming Tax Law | |

| | (Effective from January 1, 2012 to December 31, 2015) | |

Live Games | | 20% gaming tax from revenue earned from live games (70% of tax paid to the federal government; 30% paid to the local municipality). | |

| | | |

Slots | | 20% gaming tax from revenue earned from slot games (20% of tax paid to the federal government; 80% paid to the local municipality); | |

| | CZK 55 (or approximately $2.22) gaming tax per slot machine, per day (paid to the federal government). | |

| | | |

| | 2016 Gaming Tax Amendment | |

| | (Effective from January 1, 2016) | |

Live Games | | 23% gaming tax from revenue earned from live games (70% of tax paid to the federal government; 30% paid to the local municipality). | |

| | | |

Slots | | 28% gaming tax from revenue earned from slot games (20% of tax paid to the federal government; 80% paid to the local municipality); | |

| | CZK 80 (or approximately $3.37) gaming tax per slot machine, per day (paid to the federal government). | |

| | | |

Gaming taxes are to be paid quarterly, by the 25th day following the end of a quarter. TWC was current on all of its Czech gaming tax payments at March 31, 2016 and through the date of this report.

TWC’s gaming-related taxes and fees, which are recognized in the cost of revenues, for the three months ended March 31, 2016 and 2015 are summarized in the following table:

| | | | | | |

| | | | | | |

| For the Three Months Ended | |

| 2016 | | 2015 | |

| | (Unaudited) | | | (Unaudited) | |

Gaming revenues (excluding ancillary revenues) | $ | 10,351 | | $ | 8,199 | |

| | | | | | |

Gaming taxes | | 2,855 | | | 1,709 | |

Gaming taxes as % of gaming revenues (above) | | 27.6 | % | | 20.8 | % |

In conformity with the European Union (“EU”) taxation legislation, Czechia’s VAT has gradually increased from 5%, when that country joined the EU in 2004, to 21%, the effective rate since 2013. Unlike in other industries, VATs are not recoverable for gaming operations. The recoverable VAT under the Hotel Savannah, Hotel Columbus and Hotel Freizeit Auefeld was not material for the three months ended March 31, 2016 and 2015, respectively.

(m)Income Taxes — The Company complies with accounting and reporting requirements with respect to accounting for U.S. federal, state, local and foreign income taxes, which require an asset and liability approach to financial accounting and reporting for income taxes. Deferred income tax assets and liabilities are computed for differences between the financial statement and the tax bases of assets and liabilities that will result in future taxable or deductible amounts, based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred income tax assets to the amount expected to be realized. In accordance with GAAP, the Company is required to determine whether a tax position of the Company is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The tax benefit to be recognized is measured as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. De-recognition of a tax benefit previously recognized could result in the Company recording a tax liability that would reduce net assets. This guidance also provides directions on thresholds, measurement, de-recognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition that is intended to provide better financial statement comparability among different entities. However, management’s conclusions regarding this guidance may be subject to review and adjustment at a later date based on factors including,

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

but not limited to, on-going analyses of and changes to tax laws, regulations and interpretations thereof. The Company recognizes interest and penalties related to unrecognized tax benefits in interest expense and other expenses, respectively. No interest expense or penalties have been recognized as of and for the three months ended March 31, 2016 and 2015, respectively. The Company is subject to income tax examinations by major taxing authorities for all tax years since 2011.

The Company incurred an estimated foreign income tax expense of $471 and $282 for the three months ended March 31, 2016 and 2015, respectively. There were no income tax liabilities from the hotel segment, due to a net loss. Czechia has an applicable corporate income tax of 19%, while Germany has an applicable corporate income tax rate of 30%. Estimated Czech corporate income tax payments are required to be paid quarterly. TWC was current on all of its tax reporting and payments at March 31, 2016 and through the date of this report.

(n)Recent Accounting Pronouncements In May 2014, the FASB issued guidance on recognizing revenue from contracts with customers. The guidance clarifies the principles for recognizing revenue and establishes a common revenue standard for US GAAP and International Financial Reporting Standards. Early adoption is permitted, but not before the original effective date for public companies with annual reporting periods beginning after December 15, 2016. This guidance was deferred to after December 15, 2017 for public companies. Retrospective application is required. The Company is currently evaluating the impact of adopting this standard and does not expect the standard to have any material impact on its consolidated financial statements.

In June 2014, the FASB issued guidance on stock compensation that requires that a performance target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. As such, the performance target should not be reflected in estimating the grant-date fair value of the award. The guidance is effective for reporting periods beginning after December 15, 2015, with early adoption permitted. The adoption of this guidance did not have a material impact on the Company’s existing stock-based compensation plans or its consolidated financial statements.

In August 2014, the FASB issued guidance on the presentation of financial statements for a going concern. This provides guidance on management’s responsibility to evaluate whether there is substantial doubt about a company’s ability to continue as a going concern and to provide related footnote disclosures. This guidance is effective for fiscal years ending after December 15, 2016, and annual and interim periods thereafter. The Company is reviewing the new standard for adoption and does not expect this standard to have a material impact on the Company’s consolidated financial statements.

In January 2015, the FASB issued an update on the treatment of extraordinary and unusual items. This update eliminates the concept of extraordinary items and the related income statement presentation of such items. The provisions of this guidance are effective for reporting periods beginning after December 15, 2015. The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements.

In April 2015, the FASB issued an update on its guidance on the presentation of debt issuance costs. This update requires debt issuance costs to be presented as a direct deduction from the carrying amount of the related debt liability. The standard is effective for reporting periods beginning after December 15, 2015. Early adoption is permitted for financial statements that have not been previously issued. The update requires application of the updated guidance on a retrospective basis, wherein the balance sheet of each individual period presented should be adjusted to reflect the period-specific effects of applying the new guidance. The debt issuance costs of the Company were not material as of March 31, 2016. The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements.

In September 2015, the FASB issued updated guidance on business combinations. GAAP requires that during the measurement period, the acquirer retrospectively adjust the provisional amounts recognized at the acquisition date with a corresponding adjustment to goodwill. Those adjustments are required when new information is obtained about facts and circumstances that existed as of the acquisition date that, if known, would have affected the measurement of the amounts initially recognized or would have resulted in the recognition of additional assets or liabilities. The acquirer also must revise comparative information for prior periods presented in financial statements as needed, including revising depreciation, amortization, or other income effects as a result of changes made to provisional amounts. To simplify the accounting for adjustments made to provisional amounts recognized in a business combination, this update eliminates

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

the requirement to retrospectively account for those adjustments. For public companies, the updated guidance is effective for financial statements issued for fiscal years beginning after December 15, 2015. The adoption of this guidance did not have a material impact on its consolidated financial statements.

In November 2015, the FASB issued updated guidance on income taxes. Current GAAP requires an entity to separate deferred income tax liabilities and assets into current and noncurrent amounts in a classified statement of financial position. To simplify the presentation of deferred income taxes, this update requires that deferred tax liabilities and assets be classified as noncurrent in a classified statement of financial position. The current requirement that deferred tax liabilities and assets of a taxpaying component of an entity be offset and presented as a single amount is not affected by this update. For public companies, the updated guidance is effective for financial statements issued for annual periods beginning after December 15, 2016. The Company is currently evaluating the impact of adopting this guidance and does not expect the standard to have any material impact on its consolidated financial statements.

In February 2016, the FASB issued updated guidance to increase transparency and comparability among entities by reporting substantially all leased assets and related lease liabilities on the balance sheet and expanding disclosure of information about leasing arrangements. For public companies, the updated guidance is effective for financial statements issued for fiscal years beginning after December 15, 2018 (including interim periods within those fiscal years). Early adoption is permitted. The Company has not adopted this guidance for 2016 and is currently evaluating the impact of adopting it.

4.Commitments and Contingencies.

Lease Obligations - The Company is obligated under one operating lease, averaging approximately $9 per month, with a 2.0% annual rent escalation, for its U.S. corporate office space, expiring in March 2020. Additionally, TWC is also obligated to pay a remaining 68-year ground lease in connection with the newly acquired Hotel Freizeit Auefeld, that has an annual lease payment of €26, or approximately $30. Future aggregate minimum annual rental payments under these leases for the next five years are as follows:

| | | | |

Twelve Months Ending March 31, | | | (Unaudited) | |

2017 | | $ | 128 | |

2018 | | $ | 130 | |

2019 | | $ | 132 | |

2020 | | $ | 134 | |

2021 | | $ | 30 | |

The Company is also obligated under a number of five-year, video slot machine equipment operating leases, the projected costs of which are not included in the table above due to fluctuating inventory, expiring over staggered years, which provide for a monthly fixed rental fee per slot machine, and an option for replacement with different/newer machines during the term of the lease. In the first quarter of 2016, the Company’s slot machine equipment lease expense was $588 versus $576 in the comparable quarter in 2015. All slot leases can be terminated at any time, subject to an early-termination penalty equal to three-month lease payments for each terminated slot machine lease.

Employment Agreements - The Company’s employment agreement with its Chief Executive Officer (“CEO”), Mr. Rami S. Ramadan, absent the intervention of either party by September 30th of each year, will renew automatically for another calendar year, currently ending December 31, 2016. In addition to a perpetually renewable employment term of one year absent the intervention of either party, the agreement provides for annual compensation, plus participation in the Company’s benefits programs and equity incentive plans. As of March 31, 2016, the Company is contractually obligated to pay an aggregate of approximately $338, which represents the annual base salary for the remaining nine months of 2016.

2014 Equity Incentive Plan - In April 2014, the Board unanimously adopted the 2014 Equity Incentive Plan (“2014 Equity Plan”), which was subsequently approved by the shareholders of the Company at its Annual Meeting held in June 2014. The 2014 Equity Plan supercedes the 2004 Equity Incentive Plan, which expired in May 2014.

The 2014 Equity Plan provides that certain awards made under the plan may be eligible for designation as “qualified performance-based compensation” which may be exempt from the $1,000 deduction limit imposed on publicly-

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

held corporations by Section 162(m) of the Internal Revenue Code. The type of awards that may be granted, under the 2014 Equity Plan, by the Compensation Committee of the Board, in its discretion from time to time, include stock options, stock appreciation rights, restricted stock and restricted stock units, other stock-based awards and performance awards.

The 2014 Equity Plan provides the Committee with the discretion to grant to any participant annually any awards not to exceed 200,000 shares of Common Stock and/or any restricted stock or restricted stock units that are not subject to the achievement of a performance target or targets covering more than an aggregate of 150,000 shares. The plan stipulates the authorized number of shares available with respect to which awards may be granted under the plan shall be 660,750, of which 335,750 remained available for issuance as of March 31, 2016. See also Mr. Ramadan’s option grant on November 11, 2014 in Note 11 “Stock Options and Warrants,” above.

Additionally, option awards will be available for grants to the executive officers and non-employee directors as well as other key employees, except that non-employee directors are eligible to receive only awards of non-qualified stock options.

The 2014 Equity Plan also contains the following provisions: (i) no stock option repricings (without the approval of the Company’s shareholders); (ii) limitations on shares other than for stock options; (iii) no discounts on stock options; (iv) minimum three year vesting periods for restricted stock and other stock-based awards; (v) no “evergreen” provisions; and (vi) conformity to Section 409A of the Internal Revenue Code.

On January 29, 2016, the Compensation Committee recommended and the Board approved a bonus of $168,750 to Mr. Ramadan, our chief executive officer, pursuant to his achievement of certain pre-set operational and financial targets. In addition, he was also granted, pursuant to the Company’s 2014 Equity Plan, five-year options to purchase 75,000 shares of Common Stock that vest in four equal parts, with the options to acquire 18,750 shares vesting immediately upon the date of grant and options to acquire 18,750 shares vesting subsequently upon each anniversary of the grant date. The exercise price of all these options was initially set at $2.59 per share, the closing stock price on the date of grant, and will escalate by 4.0% annually on each anniversary date. The fair value of the grant was approximately $78,000, or $1.04 per option.

401(k) Plan - The Company maintains a contributory 401(k) plan. This plan is for the benefit of all U.S.-based, eligible corporate employees, who may have a portion of their salary withheld, not to exceed the maximum federally allowed amount. The Company makes an employer-matching contribution of 60 cents for each employee dollar contributed.

2016 Profit Sharing Plan The 2016 Profit Sharing Plan (the “PSP”) was recommended by the Compensation Committee of the Board and approved by the Board of Directors on February 26, 2016. The 2016 Profit Sharing Plan permits eligible KMEs to share in the pre-tax profits of the Company. The profit sharing plan provides for an incentive payout, the pool amount of which is based on 15.0% of the Company’s earned consolidated annual income before taxes. This pool is to be distributed according to the percentage of each KME’s annual salary as a ratio to the total of all salaries of participating KMEs. TWC accrued $250 and $130 for the quarters ended March 31, 2016 and 2015, respectively, toward the PSP pool. Each KME is required, pursuant to the PSP, to defer 50% of his or her annual profit sharing award, if attained, into the Deferred Compensation Plan.

2016 Individual Performance Plan The 2016 Individual Performance Plan (the “2016 IPP”) was recommended by the Compensation Committee of the Board and approved by the Board of Directors on February 26, 2016. The 2016 IPP provides for incentive payout, based on each KME’s personal performance throughout the operating year, relative to pre-set performance criteria. The 2016 IPP bonuses will be incurred and paid in 2017.

Deferred Compensation Plan On May 17, 2006, the Compensation Committee of the Board unanimously recommended, and the Board approved and adopted, TWC’s Deferred Compensation Plan (the “Deferred Plan”), which provides certain key employees, selected at the discretion of the Board, and all non-employee directors the opportunity to defer receipt of specified portions of their compensation and to have such deferred amounts treated as if invested in the Common Stock of the Company.

The Company adopted the Deferred Plan with the intention that it shall at all times be characterized as a “top hat” plan of deferred compensation maintained for a select group of management, as described under the Employee Retirement Income Security Act of 1974 (“ERISA”) Sections 201(2), 301(a)(3) and 401(a)(1). The Deferred Plan is

TRANS WORLD CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

(All monetary figures in thousands, except for exchange rate and share data)

required at all times to satisfy Section 409A of the Internal Revenue Code. Pursuant to a participant’s election, the unfunded Deferred Plan obligations are payable in the form of Common Stock (and cash for fractional shares) upon the earlier of: (i) a designated, in-service distribution date which must be a minimum of three years from the year of the first deferral; (ii) separation from service; (iii) disability; (iv) change in control of the Company; or (v) death. A participant’s election form must specify whether the payments will be made by lump sum or by installments, and the number of annual installments (with a minimum of two and a maximum of five installments).

Taxing Jurisdiction - Czechia and Germany currently have a number of laws related to various taxes imposed by governmental authorities. Applicable taxes include corporate income tax, value-added tax (“VAT”), and payroll (social) taxes, and, in the case of Czechia, gaming taxes. Tax declarations, together with other legal compliance areas (e.g. customs and currency control matters) are subject to review and investigation by a number of governmental authorities in each country in which TWC operates, which are enabled by law to impose fines, penalties and interest charges, and create tax risks in such countries. Management believes that it has adequately provided for all of its Czech and German tax liabilities. (See also Note 3(l) “Czech Gaming Taxes” and Note 3(m) “Income Taxes” above).

Legal Proceedings - The Company is sometimes subject to various contingencies, the resolutions of which, its management believes, will not have a material adverse effect on the Company’s consolidated financial position or results of operations. TWC was not involved in any material litigation as of March 31, 2016, or through the date of this filing.

5.Segment Information.

The Company recognizes two reporting segments (a casino segment and a hotel segment) and corporate (which, for accounting purposes, is not considered to be a separate “segment”). The casino segment is entirely in Czechia, while the hotel segment is comprised of two hotels in Germany. There are no internal transactions between our reporting segments. The Hotel Columbus and Hotel Freizeit Auefeld are reported under the hotel segment and the Hotel Savannah and Spa, as part of the Route 59 Complex, is reported under the casino segment.

Below is a presentation of the reporting segments:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2016 | | Three Months Ended March 31, 2015 | |

Operations by Segment (Unaudited) | | Casino | | Hotel | | Corporate | | Consolidated | | Casino | | Hotel | | Corporate | | Consolidated | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 11,189 | | $ | 1,044 | | $ | — | | $ | 12,233 | | $ | 8,871 | | $ | 631 | | $ | — | | $ | 9,502 | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenues | | | (6,097) | | | (603) | | | | | | (6,700) | | | (4,654) | | | (278) | | | | | | (4,932) | |

Depreciation and amortization | | | (320) | | | (177) | | | (3) | | | (500) | | | (336) | | | (57) | | | (2) | | | (395) | |

Selling, general and administrative | | | (1,805) | | | (419) | | | (1,270) | | | (3,494) | | | (2,029) | | | (184) | | | (1,126) | | | (3,339) | |

Interest expense | | | (1) | | | (61) | | | | | | (62) | | | (1) | | | (30) | | | | | | (31) | |

Total costs and expenses | | | (8,223) | | | (1,260) | | | (1,273) | | | (10,756) | | | (7,020) | | | (549) | | | (1,128) | | | (8,697) | |

Income (loss) before foreign income taxes | | | 2,966 | | | (216) | | | (1,273) | | | 1,477 | | | 1,851 | | | 82 | | | (1,128) | | | 805 | |

Foreign income taxes | | | (471) | | | | | | | | | (471) | | | (261) | | | (21) | | | | | | (282) | |

Net income (loss) | | $ | 2,495 | | $ | (216) | | $ | (1,273) | | $ | 1,006 | | $ | 1,590 | | $ | 61 | | $ | (1,128) | | $ | 523 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Selected Balance Sheet | | At March 31, 2016 | | At December 31, 2015 | |

Data by Segment (Unaudited) | | Casino | | Hotel | | Corporate | | Consolidated | | Casino | | Hotel | | Corporate | | Consolidated | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Property and equipment, net | | $ | 26,181 | | $ | 11,749 | | $ | 814 | | $ | 38,744 | | $ | 24,513 | | $ | 11,829 | | $ | 780 | | $ | 37,122 | |

Goodwill (allocated) | | | 5,105 | | | 136 | | | | | | 5,241 | | | 4,885 | | | 131 | | | | | | 5,016 | |

Other assets, excluding property and equipment and goodwill | | | 13,573 | | | 1,184 | | | 343 | | | 15,100 | | | 11,117 | | | 1,245 | | | 739 | | | 13,101 | |

Total assets | | $ | 44,859 | | $ | 13,069 | | $ | 1,157 | | $ | 59,085 | | $ | 40,515 | | $ | 13,205 | | $ | 1,519 | | $ | 55,239 | |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Note on Forward-Looking Information

This Form 10-Q contains certain statements that may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by the use in those statements of terminology such as “may,” “will,” “could,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” or “continue,” or the negative of such terms or other comparable terminology. The forward-looking statements included in this Form 10-Q address activities, events or developments that we expect or anticipate will or may occur in the future.

Although we believe the expectations expressed in the forward-looking statements included in this Form 10-Q are based on reasonable assumptions within the bounds of our knowledge of our business at the time the statements are made, a number of factors outside of our control could cause actual results to differ materially from those expressed in any of the forward-looking statements included in this Form 10-Q. Any one or a combination of these factors could materially affect our financial performance, business strategy, business operations, plans, goals and objectives. These factors include but are not limited to:

| · | | the market’s acceptance of our gaming and hotel offerings; |

| · | | the effect of competition in our markets; |

| · | | the political, legislative, and regulatory climates and changes upon our business; |

| · | | the impact of fluctuations of currencies on revenue we receive or expenses we incur; |

| · | | the weather conditions in the markets that we serve; and |

| · | | other factors described in our Form 10-K for the year ended December 31, 2015 under the headings “Risk Factors” and “Quantitative and Qualitative Disclosures About Market Risk.” |

Forward-looking statements that we make or that are made by others on our behalf are based on a knowledge of our business and the environment in which we operate, but because of the factors noted above, actual results may differ significantly from those in forward-looking statements. Consequently, these cautionary statements qualify all of the forward-looking statements we make herein. The results or developments we anticipate may not be realized. Even if substantially realized, those results or developments may not result in the expected consequences for us or affect us, our business or our operations in the ways we expect. We caution readers not to place undue reliance on any of these forward-looking statements in this Form 10-Q, which speak only as of their dates. We assume no obligation to update any of the forward-looking statements.

Nature of Business and Competition

We are engaged in the acquisition, development and management of niche casino operations in Europe, which feature gaming tables and mechanized gaming devices, such as video slot machines, as well as the acquisition, development and the management of midsize hotels, which may include casino facilities. Our expansion into the hotel industry was founded on management’s belief that hotels in the midsize class are complementary to our casino brand; that opportunities in one of these two industries often lead to, or are tied to, opportunities in the other industry; and that a more diversified portfolio of assets will give us greater stability and make us more attractive to potential investors. Further, several of our top management executives have extensive experience in the hotel industry.

Currently, we own and operate three casinos and a hotel in the Czech Republic (“Czechia”). Our Ceska casino, located at Ceska Kubice, in the western part of Czechia close to the border of Germany, currently has six competitors. Our other two Czech casinos are located in the southern part of Czechia, close to the Austrian border. The larger of these two, “Route 55,” located in Dolni Dvoriste, has two competitors, and our other casino, “Route 59,” is located in Hate, near Znojmo, and currently has three competitors. Our four-star deluxe Hotel Savannah features 77 rooms, eight banquet

halls for meetings and special events as well as a full-service restaurant and bar, and is connected to our Route 59 casino with the joint facility’s main restaurant linking the two buildings. Along with the hotel operation, we also launched a full-service spa operation, the Spa at Hotel Savannah (the “Spa”), the operation of which is sub-contracted to a local operator who pays TWC a percentage of its gross revenues. The Spa, which is attached to Hotel Savannah, offers Ayurvedic massage therapies and an indoor pool. Hotel Savannah and the Spa have eight regional competitors, five of which are located in Austria.

In Germany, TWC owns and operates two hotels. The Hotel Columbus, a four-star 117-room hotel is located in Seligenstadt, Germany, near Frankfurt. The Hotel Columbus has six hotel competitors in the Seligenstadt area and surrounding region that it serves, four of which are privately-owned and two of which are part of German hotel chains. The second hotel, Hotel Freizeit Auefeld, is a four-star 93-room hotel, with extensive meeting space and recreational amenities located in Hannoversch Münden (“Hann. Münden”), Germany. The Hotel Freizeit Auefeld is the largest hotel in Hann. Münden and no hotel chains are represented in our market. However, Hotel Freizeit Auefeld does compete with eight smaller, privately-owned hotels in the Hann. Münden area.

Exchange Rates

Due to the fact that the Company’s operations are located in Europe and principally in Czechia and Germany, TWC’s financial results are subject to the influence of fluctuations in foreign currency exchange rates. For our Czech operations, the revenue generated is generally denominated in euros (“EUR” or “€”) and the expenses incurred by these facilities are generally denominated in korunas (“CZK” or “Kč” ). For our German hotel operation, the revenue generated and expenses incurred are primarily denominated in EUR. As our primary reporting subsidiary, Trans World Hotels & Entertainment a.s. (“TWH&E”), is a Czech entity, all revenues and expenses, regardless of sources of origin (including that of Hotel Columbus and Hotel Freizeit Auefeld, which are owned by TWH&E through its wholly-owned German subsidiary, Trans World Hotels Germany GmbH (“TWHG”), are recognized in the Czech currency and translated to U.S. dollars (“USD” or “$”) for reporting purposes. A substantial change in the value of either of these currencies in relation to the value of the USD would have an impact on the results from our operations when translated into USD. We do not hedge our foreign currency holdings or transactions.

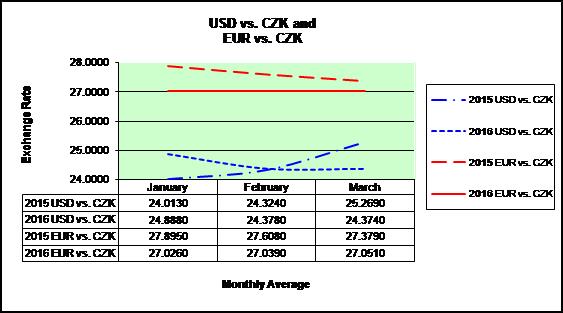

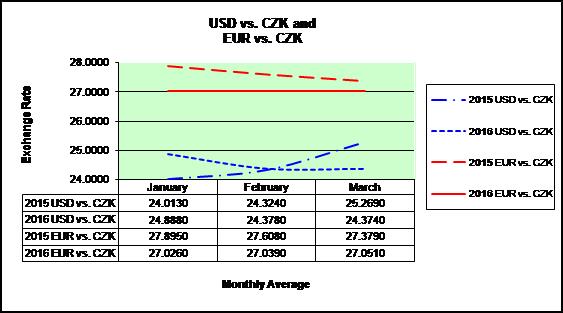

In our financial statements, the actual 2016 and 2015 operating results for the Czech operations and for the two German hotels were first converted to CZK, then were converted to USD using the monthly average of the daily exchange rates of each monthly reporting periods. The monthly average of daily exchange rates for the CZK versus the USD and EUR, respectively, are presented in the following graphical chart.

The consolidated balance sheet totals of the Company’s foreign subsidiaries at March 31, 2016 and December 31, 2015 were converted to USDs using the Czech central bank exchange rates, as reported at www.cnb.cz,

and for information only, the USD to EUR interbank exchange rates, as reported at www.oanda.com, both of which are depicted in the following table:

| | | | | | | |

As Of | | USD | | CZK | | EUR | |

March 31, 2016 | | 1.00 | | 23.757 | | 0.8839 | |

December 31, 2015 | | 1.00 | | 24.824 | | 0.9168 | |

The appreciation of the EUR currency versus the USD through the first three months of 2016 and a corresponding increase in value of the CZK to the USD has postively affected the Company’s operating results, as reported in USD. The appreciation of the daily exchange rate of the CZK from December 31, 2015 of 24.824 to March 31, 2016’s daily rate of 23.757 was 4.3% and enhanced our consolidated balance sheet at March 31, 2016, as presented in USD.

Critical Accounting Policies

The discussion and analysis of our consolidated financial condition and results of operations are based upon our consolidated financial statements. These consolidated financial statements have been prepared following US GAAP and Article 10 of Regulation S-X for interim periods and require us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to potential impairment of goodwill and share-based compensation expense. The reader should also review expanded information about our critical accounting policies and estimates provided in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included in our Form 10-K for the year ended December 31, 2015. There have been no material changes to our critical accounting policies and estimates from the information provided in our Form 10-K for the year ended December 31, 2015.

RESULTS OF OPERATIONS

Performance Measures and Indicators

In discussing the consolidated results of operations, we may use or refer to performance measures and indicators that are common to the gaming industry, such as: (i) total live game drop, the dollar value of gaming chips purchased in a given period; (ii) live game drop per head (“DpH”), the per guest average dollar value of gaming chips purchased for cash; (iii) daily income per slot machine; (iv) net win, the difference between gaming wagers and the amount paid out to wagering patrons; (v) win percentage (“WP”), the ratio of net win over total drop; (vi) occupancy rate, the number of rooms sold divided by the number of rooms available; (vii) average daily rate (“ADR”), the average of room rental rates paid per day; and (viii) revenue per available room for rent (“RevPAR”), revenue generated per available room. These measures are “non-GAAP financial measures.”

Review of the Consolidated Interim Results of the Company:

Three Months Ended March 31, 2016 and 2015:

| | | | | | | | | | | | |

| | Three Months Ended March 31, | | | | | | |

(in thousands) | | 2016 | | 2015 | | Variance $ | | Variance % | |

| | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | |

Revenues, by reporting segment: | | | | | | | | | | | | |

Casino | | $ | 11,189 | | $ | 8,871 | | $ | 2,318 | | 26.1 | % |

Hotel | | | 1,044 | | | 631 | | | 413 | | 65.5 | % |

Total revenue | | | 12,233 | | | 9,502 | | | 2,731 | | 28.7 | % |

| | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | |

Casino | | | 6,097 | | | 4,654 | | | 1,443 | | 31.0 | % |

Hotel | | | 603 | | | 278 | | | 325 | | 116.9 | % |

General and administrative | | | 2,224 | | | 2,213 | | | 11 | | 0.5 | % |

Corporate expenses | | | 1,270 | | | 1,126 | | | 144 | | 12.8 | % |

Depreciation and amortization | | | 500 | | | 395 | | | 105 | | 26.6 | % |

Total operating expenses | | | 10,694 | | | 8,666 | | | 2,028 | | 23.4 | % |

| | | | | | | | | | | | |

Operating income | | | 1,539 | | | 836 | | | 703 | | 84.1 | % |

| | | | | | | | | | | | |

Interest expense | | | (62) | | | (31) | | | (31) | | 100.0 | % |

| | | | | | | | | | | | |

Income before foreign income tax | | | 1,477 | | | 805 | | | 672 | | 83.5 | % |

| | | | | | | | | | | | |

Foreign income taxes | | | (471) | | | (282) | | | (189) | | 67.0 | % |

| | | | | | | | | | | | |

Net income | | $ | 1,006 | | $ | 523 | | $ | 483 | | 92.4 | % |

For the quarter ended March 31, 2016, we generated total revenue of $12.2 million, a 28.7% increase, or $2.7 million, from the $9.5 million from for the same quarter a year ago, resulting largely from the strong revenue achieved at our casinos, coupled with the additional revenue from our hotel segment. The casino revenue was supported by double-digit increases in consolidated attendance and slot revenues, when compared to the prior year’s first quarter. This business improvement was in part due to the continued high level of customer service provided to our patrons and effective player’s loyalty program, continuing the strong momentum of the prior year.

For the first quarter of 2016, our hotel segment, comprised of Hotel Columbus and Hotel Freizeit Auefeld, generated a combined total revenue of $1.0 million, of which approximately 39.5% was from food and beverage (“F&B”) operations. The hotel segment achieved a consolidated occupancy of 43.8% with an ADR of $77.10. The prior year’s quarter did not include the Hotel Freizeit Auefeld, which was acquired on June 10, 2015.

Casino operating expenses were up by $1.4 million, or 31.0%, largely due to volume-based expenses and higher gaming tax rates that became effective on January 1, 2016. (See Note 3(l) – “Czech Gaming Taxes” of the Notes to the Consolidated Financial Statements). Hotel operating expenses in the prior year’s quarter did not include the Hotel Freizeit, as noted above.

General and administrative expenses were relatively flat, due notably to an exceptional charge of approximately $125,000, related to the disposal of assets in connection with the rooms renovation at Hotel Freizeit Auefeld, which was completed in mid-March 2016, but was partly offset by the combination of lower payroll expenses, due to the un-filled position of the managing director of operations in our foreign operations and to lower marketing expenditures.

Corporate expenses were up by $144,000, or 12.8%, when compared with the same quarter last year, mainly resulting from higher accrual for the Company’s annual profit sharing plan at this stage this year, precipitated by the stronger results achieved, and to higher option vesting expenses.

Depreciation and amortization expense increased by $105,000, or 26.6%, resulting largely from the addition of assets, with the acquisition of the Hotel Freizeit Auefeld, which did not not exist in the prior year’s comparable quarter.

Operating income rose by $703,000, or 84.1%, largely due strong revenue generated by our casinos.

The interest expense of $62,000 for the first quarter of 2016 was from three loans: i) bank loan from Bank Sparkasse Seligenstadt for the acquisition of Hotel Columbus; ii) bank loan from Bank Sparkasse Hann. Münden for the acquisition of Hotel Freizeit Auefeld; and iii) a seller-financed loan to secure the acquisition of Hotel Freizeit Auefeld. The interest expense in 2015 did not include the two loans related to the acquisition of Hotel Freizeit Auefeld, which was acquired in June 10, 2015.

Our effective income tax rate for the period ended March 31, 2016 was approximately 31.9%, or a foreign income tax provision of $471,000, versus 35.0%, or $282,000 for the comparable period last year. There was no income tax liability for the hotel segment, in either year, because of net losses, contributed by one-time acquisition-related costs.

Thus, we achieved net income of $1.0 million, a significant improvement of $483,000, or 92.4%, from the same quarter a year ago.

Unlike in U.S.-based casinos, visitors to our casinos are required, by Czech law, to “check in” at the entrance reception desk, by presenting acceptable forms of picture identification, which effectively permits the Company to track the frequency of their visits and, to a limited extent, the duration of each visit. As an incentive to gaming activity, we provide complimentary drinks and a free food buffet to all of our playing guests. In addition to these general amenities, we also issue different classes of “loyalty” cards to customers who spend relatively longer periods of time playing. These cards entitle the holder and a set number of the holder’s guests, depending on the card type, to various complimentary benefits. We also grant certain other privileges to our VIP players, at each local casino management’s discretion, such as opening a private gaming table, or extending the casino’s operating hours, and/or providing free room/hotel accommodations. These loyalty cards are granted based on the frequency of the players’ visits and the aggregate total drop for a pre-determined number of visits. The complimentary F&B, hotel accommodations and other player-related costs were included in the casino operating expenses, which totaled approximately $672,000 for the three months ended March 31, 2016, versus $598,000 for the comparable period in 2015. General gifts and giveaways, which were also recognized in the casino operating expenses, excluding VIP personal gifts, represented $206,000 for the same three months in 2016, compared with $182,000 for the comparable period in 2015, the increase of which was due to higher attendance.

The VIP personal gifts, which consist primarily of granted player loyalty points, were booked as special promotion expenses in the selling, general and administrative costs, and totaled approximately $23,000 for the first quarter in 2016, versus $18,000 for the same quarter a year ago.

Our Operating Facilities:

Our free-standing casinos each offer free parking, a restaurant, lounge areas and multiple bars.

Casino Segment:

Ceska

Our Ceska Casino, which has a Frank Lloyd-Wright-inspired organic modern theme, had, as of March 31, 2016, 15 gaming tables, including seven card tables, seven roulette tables, and a 10-position, Slingshot, multi-win roulette table. The casino also features 100 video slot machines. In addition to the games, Ceska also offers five luxurious hotel-like guest rooms, which, when not used as courtesy accommodations for our valuable players and guests, can be rented to paying overnight guests. The address of our Ceska casino is Ceska Kubice 64, Ceska Kubice 345 32, in the Pilsen region of Czechia.

Route 59

As of March 31, 2016, our Route 59 Casino, which has a New Orleans in the 1920’s theme, operated 23 gaming tables, consisting of twelve card tables, ten roulette tables, and a 16-position, Slingshot multi-win roulette table, as well as 176 video slot machines, 32 of which were added on February 22, 2016. Route 59 Casino is connected to the Hotel

Savannah via a wide public-area corridor and restaurant, to permit easier access between the two operations. Route 59 is located at 199 American Way, Hate-Chvalovice, Znojmo 669 02, in the South Moravia region of Czechia.

Route 55

Our Route 55 Casino features a Miami Beach “Streamline Moderne” style, reminiscent of Miami Beach in the early 1950’s. As of March 31, 2016, the two-story casino offered 21 tables, including 12 card tables, 8 roulette tables, a 16-position, Slingshot multi-win roulette table, as well as 138 video slot machines. On the mezzanine level, the casino offers an Italian restaurant, an open buffet area, a VIP lounge, and three luxurious hotel-like guest rooms, similar to the five guest rooms at Ceska. Route 55 is located at Grenzubergang Wullowitz, Dolni Dvoriste 382 72, in the South Bohemia region of Czechia.

Hotel Savannah and the Spa at Hotel Savannah

As a complement to our gaming operations, we opened Hotel Savannah, a 77-room, European four-star deluxe hotel, the first Company-constructed hotel. We also launched a full-service spa, the “Spa at Hotel Savannah” (the “Spa”), which is attached to the hotel. The operation of the Spa, which features a large indoor pool and Ayurvedic massage therapy, is sub-contracted to a local operator. Hotel Savannah, which offers eight banquet halls for meetings and conventions, is connected to our Route 59 casino by the hotel restaurant that links the two buildings. The combined operation of the hotel and Spa has proven to benefit Route 59 by attracting additional business to the casino.

Hotel Segment:

Hotel Columbus

Our four-star 117-room hotel, Hotel Columbus, is located in the suburbs of Seligenstadt, Germany, about a 20-minute, equidistant drive from Frankfurt city center and the Frankfurt International Airport. Hotel Columbus was constructed in 2001 and was being operated profitably, at the time of our purchase, by a private family, primarily as a hotel for business travelers. Hotel Columbus currently has 99 single rooms and 18 double rooms. It also features five meeting rooms, a spacious restaurant and separate breakfast room, each with its own kitchen, two bars, a 32-place parking garage and 43 surface lot parking places. Hotel Columbus is located at Am Reitpfad 4, 63500 Seligenstadt, in the State of Hesse, Germany.

Hotel Freizeit Auefeld

Our Hotel Freizeit Auefeld is a four-star 93-room hotel, located in Hann. Münden, Germany. Hotel Freizeit Auefeld, which was built in 1991 and expanded with new facilities in 2001, was selected for acquisition by the Company because of its location, approximately two hours driving time from our Hotel Columbus, allowing TWC to employ one hotel director to manage both properties. The Hotel is the only full-service lodging property in the local area, and therefore has a broad target market, as it caters to both business and leisure travelers to the region. The hotel features three F&B outlets, ten meeting rooms, an adjoining 13,000 square foot event hall, an adjoining tennis complex with four indoor courts, several additional recreation areas, and an independent townhouse comprised of one four-room unit and one six-room unit. The ground lease rights, upon which all of the hotel’s assets stand, currently expires on March 1, 2084. The lease agreement includes both a right of first refusal buyout and renewal options in favor of TWC. TWC believes that the addition of this hotel will further contribute the Company’s profitability and diversification goals. Hotel Freizeit Auefeld is located at Hallenbadstrasse 33, 34346 Hann. Münden, in the State of Lower Saxony, Germany.

Sales and Marketing

We utilize a wide range of media marketing and promotional programs in an effort to secure and enhance our competitive position in the respective markets being served and to differentiate our product and services from our competitors. With respect to our Czech casinos, we maintained and enhanced our marketing and promotional programs for our casinos, focusing primarily on internal and customer-oriented loyalty reward programs and greater use of social media and digital communication methods. In the first quarter of 2016, we strove to offer higher-value amenities and more giveaways and also to provide live entertainment, in an ongoing effort to secure and enhance our competitive position in the markets that we serve. The casinos’ event calendars concentrated on key, player-tested, popular events and holidays, while simultaneously focusing on higher player-incentive games designed to reward existing players with

redeemable points via our Player’s Loyalty Program, and thereby promote customer loyalty. Furthermore, we aggressively target key cities in our media campaigns, most notably Vienna and Linz in Austria, and Regensburg in Germany as well as the areas surrounding these cities, all of which are within driving distance of our casinos. In Germany, in addition to completing the product improvements that are currently underway, we recently implemented a dynamic sales strategy that includes the use of an outside company that provides lead sourcing and sales support as a complement to our in-house team, which we expect to help fuel occupancy growth in our two hotels in Germany.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2016, we had a working capital surplus of approximately $5.7 million, an increase of $1.7 million, from the working capital surplus of $4.0 million at December 31, 2015. Net cash provided by operating activities for the three months ended March 31, 2016 was $1.8 million versus $665,000 for the same prior year period. The increase in cash provided by operating activities was due in part to stronger net income earned, the increase in gaming tax accruals, and higher depreciation expense, that, in aggregate, were partially offset by reductions in accounts payable, prepaid expenses, and a reduction in foreign income tax accrual. Net cash used in investing activities of $581,000 consisted largely of the renovation costs to the rooms, kitchen facilities and public areas at the Hotel Freizeit Auefeld, and other minor capital improvements at our casino properties. Net cash used in financing activities of $135,000 consisted of the principal payments on the Hotel Columbus’s Bank Sparkasse Seligenstadt loan, on the bank loan from Bank Sparkasse Hann. Münden and the Hotel Freizeit Auefeld’s seller loan for the acquisition of Hotel Freizeit Auefeld.

We are obligated under various contractual commitments over the next five years. We have no off-balance sheet arrangements. The following is a five-year summary of our commitments as of March 31, 2016:

| | | | | | | | | | | | | | | | |

(in thousands) | | | | | Within | | | Years | | | Years | | | | |

Contractual Obligations (Unaudited) | | Total | | 1 Year | | 2 - 3 | | 4 - 5 | | Thereafter | |

| | | | | | | | | | | | | | | | |

Long-term, secured debt, foreign (1) | | $ | 8,265 | | $ | 571 | | $ | 1,210 | | $ | 1,286 | | $ | 5,198 | |

Slot machine leases (2) | | | 9,840 | | | 1,968 | | | 3,936 | | | 3,936 | | | | |

Operating and other capital leases (3) | | | 419 | | | 114 | | | 201 | | | 104 | | | | |

Ground lease (4) | | | 2,019 | | | 30 | | | 59 | | | 59 | | | 1,871 | |

Employment agreements (5) | | | 565 | | | 565 | | | | | | | | | | |