United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant To Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of April, 2003

GRUPO INDUSTRIAL MASECA, S.A. de C.V.

(MASECA INDUSTRIAL GROUP, INC.)

(Translation of Registrant's name into English)

Calzada del Valle Ote. 407

Col. Del Valle, San Pedro Garza Garcia, N.L. Mexico 66220

(Address of principal office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F ___

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

CONTENTS

* Press Release dated April 23, 2003

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GRUPO INDUSTRIAL MASECA, S.A. de C.V.

By /s/ Raul Cavazos Morales

___________________________

Raul Cavazos Morales

Chief Financial Officer

Date: April 23, 2003

| | Contacts:

Rogelio Sanchez(52 81) 8399-3312

rogelio_sanchez@gruma.com

Lilia Gomez(52 81) 8399-3324

lilia_gomez@gruma.com

Fax:(52 81) 8399-3359

Web site: http://www.gruma.com |

| Monterrey, N.L., Mexico, April 23, 2003 | | New York Stock Exchange: MSK

Bolsa Mexicana de Valores: MASECAB |

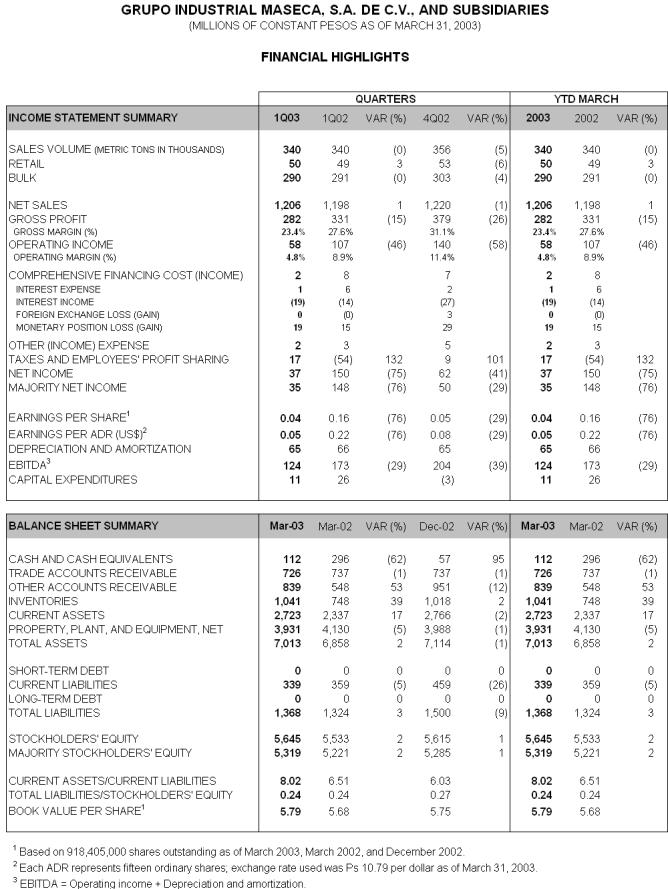

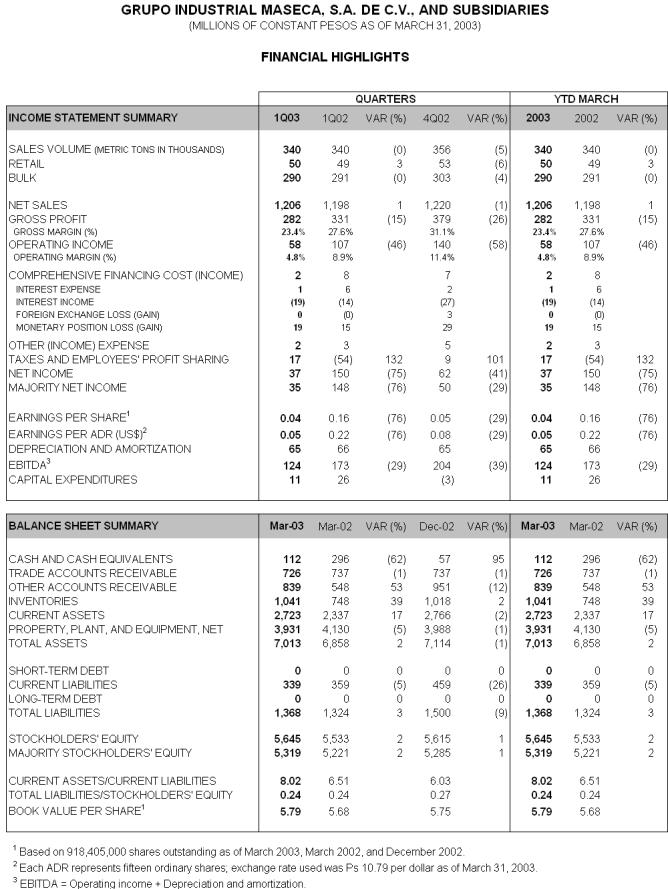

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION FOR FIRST QUARTER 2003

(PESOS AMOUNTS ARE STATED IN MILLIONS IN CONSTANT TERMS AS OF MARCH 31, 2003)

During 1Q03, GIMSA raised corn flour prices, while sales volume remained flat compared to 1Q02. To avoid a negative effect on sales volume, the company raised corn flour prices at the beginning of the year to reflect only partially the rise in corn costs. Toward the end of March, however, GIMSA was able to implement additional price increases without affecting sales volume. This strategy is expected to enable the company to restore its margins in the near future.

By reducing administrative expenses, GIMSA has been able to focus resources on strengthening its commercial strategy and improving customer service without increasing operating expenses.

1Q03 vs. 1Q02

Net Sales

Sales volume was flat as result of

A 3% increase in one-kilogram consumer retail package sales (GIMSA's new commercial structure enables it to negotiate more directly with employees in charge of purchasing at DICONSA, the Mexican government's social welfare and distribution program), offset by

- A 1% decline in bulk corn flour sales resulting from a sharp rise in the price of tortillas throughout the industry, which affected tortilla consumption.

Net sales increased 1%, reflecting higher corn flour prices in connection with higher cost of corn.

Cost of Sales

Cost of sales increased 6% in absolute terms and, as a percentage of net sales, increased to 76.6% from 72.4%. Eighty percent of the increase was driven by higher corn costs and 20% by higher fuel and electricity costs.

Gross profit

Gross profit was 15% lower due to the aforementioned increase in costs. Gross margins declined to 23.4% from 27.6%.

Selling, General, and Administrative Expenses (SG&A)

SG&A was flat in absolute terms and, as a percentage of net sales, decreased to 18.6% from 18.7% because GIMSA raised corn flour prices. GIMSA lowered administrative expenses by 7% as part of its program to redirect resources to strengthen its commercialization and customer service infrastructure. These measures are all part of the company's new commercial strategy to facilitate resumption in volume growth.

Operating Income

Operating income declined 46%, and operating margin dropped to 4.8% from 8.9% due to the higher corn costs mentioned above, which were not fully reflected in the price of corn flour during most of 1Q03.

Net Comprehensive Financing Cost

| Items | 1Q03 | 1Q02 | Change | Comments |

| Ps millions | Ps millions | Ps millions | |

| Interest expense | 1 | 6 | (5) | Lower interest rates and lower debt |

| Interest income | (19) | (14) | (5) | Higher outstanding cash balances |

| Foreign exchange loss (gain) | 0 | 0 | 0 | Peso devaluation in 4Q02 |

| Monetary position loss (gain) | 19 | 15 | 4 | Higher net monetary asset position due mainly to higher cash balances |

| Total | 1 | 7 | (6) | |

Taxes and Employees' Profit Sharing

Provisions for income taxes and employees' profit sharing were Ps 71 million higher, totaling Ps 17 million. In 1Q02, GIMSA recorded extraordinary income of Ps 54 million in connection with lower deferred taxes, which resulted from the changes in the statutory income tax rate from 35% to 32% beginning in 2003 and continuing through 2005. The effective tax rate was 32.0%.

Majority Net Income

Majority net income was 76% lower, resulting primarily from the aforementioned extraordinary tax income in 1Q02 and the increased cost of corn in 1Q03. Majority net income as a percentage of net sales decreased to 2.9% from 12.4%.

March 2003 vs. December 2002

On March 31, 2003, total assets were Ps 7,013 million, 1% lower than on December 31, 2002, due to lower cash balances in connection with reduced trade accounts payable related to corn procurement. In addition, property, plant, and equipment declined because depreciation exceeded capital expenditures.

Total liabilities on March 31, 2003, were Ps 1,368 million, 9% lower, due mostly to lower trade accounts payable in connection with payments related to the build-up of corn inventories made during the winter crop season.

Stockholders' equity on March 31, 2003, was Ps 5,645 million, representing a 1% increase.

Operational Ratios

| 1Q03 | 4Q02 | 1Q02 |

| Accounts receivable outstanding (days to sales) | 54 | 54 | 55 |

| Inventory turnover (days to cost of sales) | 101 | 109 | 78 |

| Net working capital turnover (days to sales) | 131 | 121 | 104 |

| Asset turnover (total assets to sales) | 1.5 | 1.5 | 1.4 |

Profitability Ratios

| 1Q03 % | 4Q02 % | 1Q02 % |

| ROA | 4.0 | 5.6 | 6.7 |

| ROE | 4.9 | 7.0 | 8.4 |

| ROIC | 4.6 | 5.1 | 5.6 |

CONFERENCE CALL

The company will hold a conference call to discuss 1Q03 results on April 24, 2003, at 11:30 a.m. Eastern Time (10:30 a.m. Mexico and CT; 9:30 a.m. MT; 8:30 a.m. PT). From the U.S. or Canada please call (800) 360-9865; international or local callers dial (973) 694-6836. The conference call will also be web-cast live via the GRUMA corporate web site, www.gruma.com. For the conference replay, please call (800) 428-6051 or (973) 709-2089 and enter pass code 290101. Please go to the Investor Relations page of the web site for further details. The audio web-cast will be achieved on the site.

Founded in 1949, GIMSA, S.A. de C.V., is the largest producer of corn flour in Mexico. GIMSA is engaged principally in the production, distribution, and sale of corn flour in Mexico under the MASECA® brand name. GIMSA owns 18 production facilities located throughout the country and has an estimated annual corn flour capacity of 2.3 million metric tons. GIMSA's corn flour is used mainly in the preparation of tortillas and other related products. In 2002, the company's market share was approximately 73% within the corn flour industry.

ACCOUNTING PROCEDURES

All figures have been restated in Mexican pesos of constant purchasing power as of March 31, 2003, and were prepared in accordance with Mexican Generally Accepted Accounting Principles, commonly referred to as ''Mexican GAAP''. The restatement was prepared using factors derived from the Mexican National Consumer Price Index.

This report may contain certain forward-looking statements and information relating to GIMSA, S.A. de C.V., that are based on the beliefs of its management as well as assumptions made by and information then available to GIMSA. Such statements reflect the views of GIMSA with respect to future events and are subject to certain risks, uncertainties, and assumptions. Many factors could cause the actual results, performance, or achievements of GIMSA to be materially different from historical results or any future results, performance, or achievements that may be expressed or implied by such forward-looking statements. Such factors include, among others, changes in economic, political, social, governmental, business, or other factors globally or in Mexico, as well as world and domestic corn prices. If one or more of these risks or uncertainties materializes, or underlying assumptions are proven incorrect, actual results may vary materially from those described herein as anticipated, believed, estim ated, expected, or targeted. GIMSA does not intend, and undertakes no obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.