| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-7123 |

| |

| Dreyfus Growth & Value Funds, Inc. |

| (Exact name of Registrant as specified in charter) |

| |

| |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (212) 922-6000 |

| Date of fiscal year end: | | 08/31 |

| Date of reporting period: | | 08/31/2005 |

FORM N-CSR

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 7 | | Understanding Your Fund’s Expenses |

| 7 | | Comparing Your Fund’s Expenses |

| | | With Those of Other Funds |

| 8 | | Statement of Investments |

| 13 | | Statement of Assets and Liabilities |

| 14 | | Statement of Operations |

| 15 | | Statement of Changes in Net Assets |

| 16 | | Financial Highlights |

| 17 | | Notes to Financial Statements |

| 24 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 25 | | Information About the Review and Approval |

| | | of the Fund’s Management Agreement |

| 30 | | Board Members Information |

| 32 | | Officers of the Fund |

| |

| | | FOR MORE INFORMATION |

| |

|

| | | Back Cover |

The Fund

| | Dreyfus

Emerging Leaders Fund

|

LETTER FROM THE CHAIRMAN

This annual report for Dreyfus Emerging Leaders Fund covers the 12-month period from September 1, 2004, through August 31, 2005. Inside, you’ll find valuable information about how the fund was managed during the reporting period, including a discussion with the fund’s portfolio managers, John S. Cone, Oliver Buckley, Langton C. Garvin and Kristin Crawford, each of whom comprise the Smallcap Team of Franklin Portfolio Associates, LLC.

On average, stock prices ended the reporting period higher than where they began. However, most of the market’s gains occurred during the closing months of 2004. So far in 2005, positive factors, including steady economic growth and higher corporate profits, were largely offset by headwinds, such as sharply higher energy prices and rising short-term interest rates. Midcap stocks produced higher returns than small-cap stocks in this environment, and small-cap stocks outperformed large-cap stocks. Also, value-oriented stocks have generally produced better results than their more growth-oriented counterparts during the past 12 months.

Recent shocks to the U.S. economy — including sharply higher gasoline prices and other lingering consequences of Hurricane Katrina — have added a degree of uncertainty to the economic outlook.Nonetheless,our economists currently expect the economy to continue to grow without either entering a recession or triggering a significant acceleration of infla-tion.As always, we encourage you to discuss the potential implications of these and other matters with your financial advisor.

Thank you for your continued confidence and support.

DISCUSSION OF FUND PERFORMANCE

| | John S. Cone, Oliver Buckley, Langton C. Garvin and

Kristin Crawford, Portfolio Managers

|

How did Dreyfus Emerging Leaders Fund perform relative to

its benchmark?

|

For the 12-month period ended August 31, 2005, the fund produced a total return of 23.68% .1 In comparison, the fund’s benchmark, the Russell 2000 Index (the “Index”), achieved a 23.10% total return for the same period.2

We attribute these results to continuing growth in the U.S. economy, which led to better-than-forecasted corporate financial results for many companies. These favorable developments outweighed the negative impact of rising interest rates and energy prices, resulting in a generally positive environment for most stocks. Small- to midcap stocks tended to outperform their large-cap counterparts, as they have for the past six years. The fund participated fully in the small-cap market’s gains, delivering particularly strong returns in the health care, producer durables and technology sectors. Although a few individual holdings detracted from returns, the fund roughly matched or exceeded the benchmark’s performance in most investment sectors.

What is the fund’s investment approach?

The fund seeks capital growth by investing at least 80% of its assets in companies we believe are emerging leaders: companies characterized by new or innovative products, services or processes having the potential to enhance earnings growth. The fund primarily invests in companies with market capitalizations of less than $2 billion at the time of purchase. Because the fund may continue to hold a security as its market capitalization grows, a substantial portion of the fund’s holdings can have market capitalizations in excess of $2 billion at any given time.

For the first 10 months of the reporting period, we employed a blended approach, investing in a combination of growth and value stocks. Using fundamental research and direct management contact, we sought stocks with strong positions in major product lines,

| | DISCUSSION OF FUND PERFORMANCE (continued)

|

sustained achievement records and strong financial conditions. We sought special situations, such as corporate restructurings or management changes that could be a catalyst for stock appreciation.

Since June 30, 2005, we have employed a structured, risk-controlled approach in which principles of fundamental analysis are implemented quantitatively.This disciplined,“bottom-up,” approach seeks to identify undervalued securities through computer models that rank stocks based on fundamental momentum, relative value, long-term growth and additional factors, such as technical factors.We attempt to maintain a neutral exposure to industry groups relative to the Index. Within each sector, we overweight the stocks ranked most attractive and underweight or avoid those ranked least attractive.

What other factors influenced the fund’s performance?

The fund secured its greatest gains in the health care sector, where relative returns were bolstered by good individual stock selections and an emphasis on health care facilities and service providers. Top performers included insurer PacifiCare Health Systems, eldercare and rehabilitation specialist Genesis HealthCare and outpatient dialysis services provider DaVita.The fund’s relatively light exposure to biotech-nology stocks further enhanced its performance relative to the benchmark.

Our stock selection strategy also generated relatively strong gains in other sectors. In the producer durables area, the fund’s returns benefited most significantly from its position in United Defense Industries, which was acquired at a premium by BAE Systems; and heavy machinery producer JLG Industries, which rose on the strength of greater industrial demand for roadwork and construction equipment. Most of the fund’s best technology performers were concentrated in the software and services area, including F5 Networks, a provider of application traffic management products, and Anteon International, a designer of governmental defense and emergency response systems. Gains in these holdings, and in Genesis Microchip, a maker of display image processors, more than made up for disappointing returns from other technology holdings, such as semiconductor maker Skyworks Solutions and Internet services provider InfoSpace. Finally, in the

energy sector, the fund’s investment in Arch Coal generated notably good returns amid rising commodity prices due to rising industrial demand for a limited supply of energy commodities.

The fund experienced only a few significant disappointments during the reporting period. In addition to the technology stocks mentioned above, the fund’s returns were hurt by a dip in shares of acute care facilities operator LifePoint Hospitals, which acquired less profitable competitors in the summer of 2005. In the financial sector, a mild earnings shortfall led to a decline in Signature Bank, a New York-based banking, brokerage and insurance service provider.

What is the fund’s current strategy?

The Smallcap Team of Franklin Portfolio Associates, LLC stepped in as the fund’s portfolio manager on June 30, 2005.While we have maintained the fund’s focus on small-cap stocks, during the final two months of the reporting period we began the gradual process of adjusting the fund’s portfolio composition to reflect our quantitatively driven, sector-neutral investment approach. We anticipate that this process will continue over the next several months.

As of the end of the reporting period, the fund continued to reflect the prior managers’ emphasis on certain sectors, with reduced but still overweighted exposure to technology and energy stocks and, within the health care sector, medical service providers.The fund also held slightly underweighted exposure to the financial and specialty retail areas.

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | fund shares may be worth more or less than their original cost. Return figures provided reflect the |

| | | absorption of fund expenses by The Dreyfus Corporation pursuant to an agreement effective |

| | | March 16, 2005, through March 31, 2006, at which time it may be extended, terminated or |

| | | modified. Had these expenses not been absorbed, the fund’s returns would have been lower. |

| | | Part of the fund’s recent performance is attributable to positive returns from its initial public |

| | | offering (IPO) investments. There can be no guarantee that IPOs will have or continue to |

| | | have a positive effect on the fund’s performance. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Russell 2000 Index is an unmanaged index of small-cap stock performance |

| | | and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000 |

| | | Index is composed of the 3,000 largest U.S. companies based on total market capitalization. |

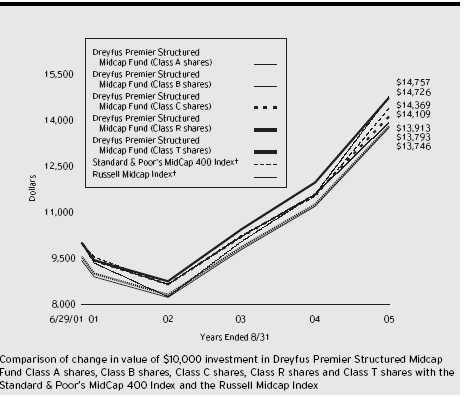

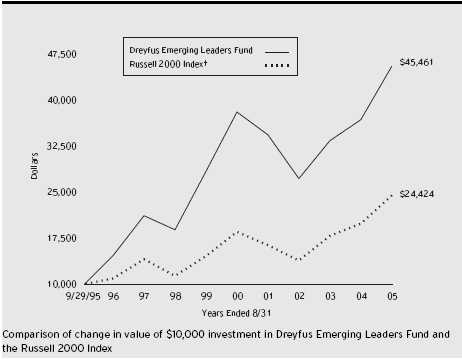

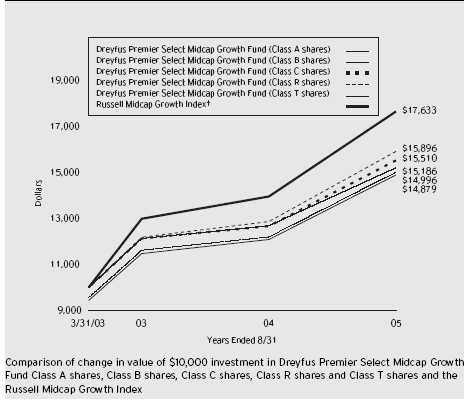

| Average Annual Total Returns | | as of 8/31/05 | | | | |

| | | Inception | | | | | | From |

| | | Date | | 1 Year | | 5 Years | | Inception |

| |

| |

| |

| |

|

| Fund | | 9/29/95 | | 23.68% | | 3.66% | | 16.49% |

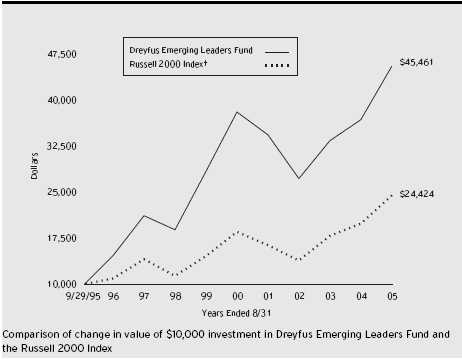

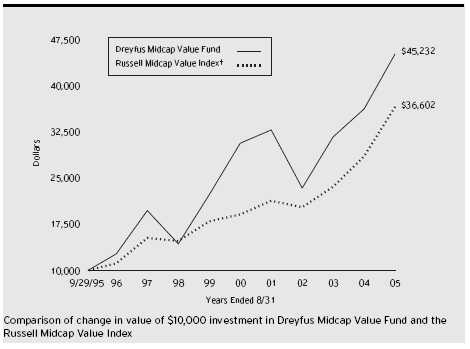

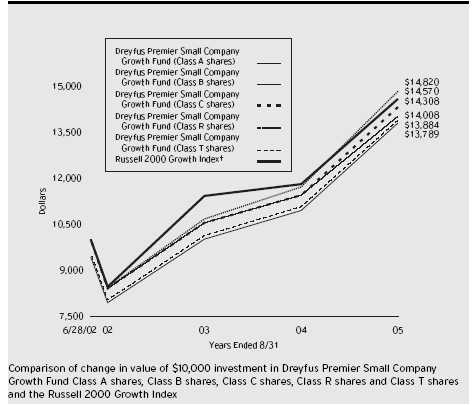

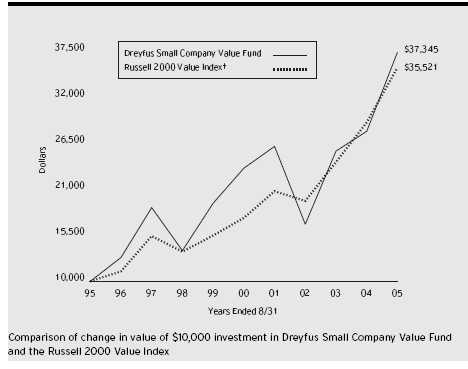

† Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Part of the fund’s recent performance is attributable to positive returns from its initial public offering (IPO) investments. There can be no guarantee that IPOs will have or continue to have a positive effect on fund performance.

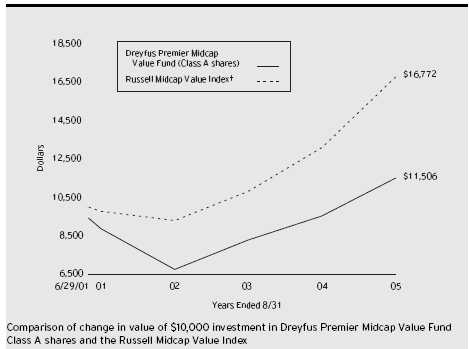

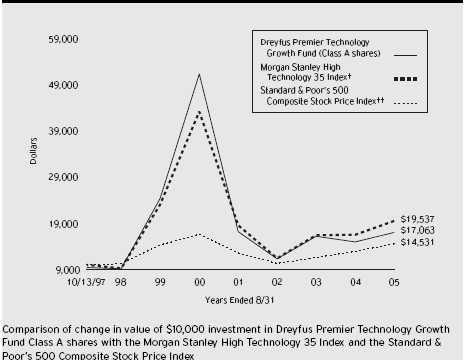

The above graph compares a $10,000 investment made in Dreyfus Emerging Leaders Fund on 9/29/95 (inception date) to a $10,000 investment made in the Russell 2000 Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses.The Russell 2000 Index is an unmanaged index and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000 Index is composed of 3,000 of the largest U.S. companies by market capitalization and does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

U N D E R S TA N D I N G YO U R F U N D ’ S E X P E N S E S ( U n a u d i t e d )

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Emerging Leaders Fund from March 1, 2005 to August 31, 2005. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended August 31, 2005

|

| Expenses paid per $1,000 † | | $ 6.07 |

| Ending value (after expenses) | | $1,058.50 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

|

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended August 31, 2005

|

| Expenses paid per $1,000 † | | $ 5.96 |

| Ending value (after expenses) | | $1,019.31 |

† Expenses are equal to the fund’s annualized expense ratio of 1.17%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | STATEMENT OF INVESTMENTS

August 31, 2005

|

| Common Stocks—100.0% | | Shares | | Value ($) |

| |

| |

|

| Commercial & Professional Services—6.7% | | |

| Bell Microproducts | | 99,600 a | | 1,008,948 |

| Cantel Medical | | 127,800 a | | 2,658,240 |

| Harte-Hanks | | 374,600 | | 9,612,236 |

| Rush Enterprises, Cl. A | | 44,900 a | | 717,951 |

| Spartan Stores | | 47,059 a | | 481,884 |

| United Natural Foods | | 109,000 a | | 3,706,000 |

| Valassis Communications | | 340,000 a | | 13,406,200 |

| Valueclick | | 366,400 a,b | | 5,290,816 |

| WESCO International | | 425,000 a | | 14,747,500 |

| | | | | 51,629,775 |

| Communications—.2% | | | | |

| Golden Telecom | | 35,700 b | | 1,053,150 |

| Talk America Holdings | | 53,400 a,b | | 489,678 |

| | | | | 1,542,828 |

| Consumer Non-Durables—2.2% | | | | |

| Church & Dwight | | 355,000 | | 13,546,800 |

| Mannatech | | 78,600 b | | 977,784 |

| Parlux Fragrances | | 83,800 a,b | | 2,628,806 |

| | | | | 17,153,390 |

| Consumer Services—5.7% | | | | |

| Educate | | 349,800 a | | 5,659,764 |

| Intrawest | | 593,500 | | 15,520,025 |

| Lakes Entertainment | | 60,200 a,b | | 746,480 |

| Lin TV, Cl. A | | 47,500 a | | 717,725 |

| Orient-Express Hotels, Cl. A | | 296,300 | | 9,105,299 |

| Pinnacle Entertainment | | 598,400 a | | 11,932,096 |

| World Wrestling Entertainment | | 34,600 | | 436,998 |

| | | | | 44,118,387 |

| Electronic Technology—11.5% | | | | |

| Advanced Energy Industries | | 337,100 a | | 4,018,232 |

| Cypress Semiconductor | | 700,000 a,b | | 10,941,000 |

| DRS Technologies | | 132,100 | | 6,796,545 |

| Extreme Networks | | 1,650,000 a | | 7,128,000 |

| F5 Networks | | 215,000 a | | 8,877,350 |

| Genesis Microchip | | 648,500 a | | 17,049,065 |

| Hexcel | | 748,400 a | | 14,556,380 |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Electronic Technology (continued) | | | | |

| Integrated Circuit Systems | | 292,700 a | | 6,164,262 |

| Intevac | | 64,600 a | | 844,322 |

| MIPS Technologies | | 361,100 a | | 2,264,097 |

| Omnivision Technologies | | 154,000 a,b | | 2,257,640 |

| Redback Networks | | 63,100 a | | 570,424 |

| Silicon Image | | 361,600 a | | 3,735,328 |

| SpectraLink | | 149,100 | | 1,921,899 |

| TTM Technologies | | 166,500 a | | 1,288,710 |

| X-Rite | | 43,100 | | 542,629 |

| | | | | 88,955,883 |

| Energy Minerals—7.1% | | | | |

| Arch Coal | | 212,300 b | | 13,629,660 |

| Cabot Oil & Gas | | 396,000 | | 17,103,240 |

| Houston Exploration | | 150,000 a | | 8,835,000 |

| Unit | | 290,000 a | | 15,097,400 |

| | | | | 54,665,300 |

| Finance—18.3% | | | | |

| Affiliated Managers Group | | 226,600 a,b | | 16,453,426 |

| Affordable Residential Communities | | 74,400 b | | 879,408 |

| Amegy Bancorp | | 673,600 | | 15,135,792 |

| BFC Financial, Cl. A | | 61,800 a | | 470,916 |

| Bimini Mortgage Management, Cl. A | | 51,400 | | 641,472 |

| Boykin Lodging | | 134,800 a | | 1,773,968 |

| First Midwest Bancorp | | 422,000 | | 16,010,680 |

| Flagstar Bancorp | | 106,900 b | | 1,844,025 |

| Greater Bay Bancorp | | 566,900 | | 14,285,880 |

| Harbor Florida Bancshares | | 354,500 | | 12,910,890 |

| LTC Properties | | 74,800 | | 1,513,204 |

| Luminent Mortgage Capital | | 235,800 | | 2,136,348 |

| Montpelier Re Holdings | | 335,400 | | 10,967,580 |

| Ocwen Financial | | 90,000 a,b | | 618,300 |

| Partners Trust Financial Group | | 72,000 | | 853,200 |

| Presidential Life | | 33,100 | | 582,229 |

| R&G Financial, Cl. B | | 243,300 | | 3,681,129 |

| Reinsurance Group of America | | 256,600 | | 11,010,706 |

| Signature Bank | | 234,700 a | | 7,038,653 |

| | STATEMENT OF INVESTMENTS (continued)

|

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Finance (continued) | | | | |

| Webster Financial | | 262,200 | | 12,040,224 |

| Westamerica Bancorporation | | 200,000 | | 10,442,000 |

| | | | | 141,290,030 |

| Health Technology—3.6% | | | | |

| Andrx | | 582,000 a,b | | 10,551,660 |

| ArQule | | 75,000 a | | 573,000 |

| Candela | | 72,200 a | | 715,502 |

| Cotherix | | 125,200 a,b | | 1,745,288 |

| Enzon Pharmaceuticals | | 248,000 a | | 1,733,520 |

| Eyetech Pharmaceuticals | | 370,800 a,b | | 6,778,224 |

| Genitope | | 171,200 a,b | | 1,374,736 |

| Myogen | | 7,600 a,b | | 157,320 |

| Neurometrix | | 146,700 a | | 4,085,595 |

| | | | | 27,714,845 |

| Industrial Services—5.9% | | | | |

| Superior Energy Services | | 765,000 a | | 16,768,800 |

| Todco, Cl. A | | 580,000 | | 20,137,600 |

| Universal Compression Holdings | | 206,900 a | | 8,524,280 |

| | | | | 45,430,680 |

| Non-Energy Minerals—2.4% | | | | |

| Agnico-Eagle Mines | | 890,000 | | 11,641,200 |

| Olin | | 356,800 | | 6,665,024 |

| | | | | 18,306,224 |

| Process Industries—5.6% | | | | |

| Agrium | | 600,000 | | 12,900,000 |

| Albany International, Cl. A | | 380,000 | | 13,687,600 |

| Cambrex | | 45,100 | | 857,802 |

| Crown Holdings | | 572,400 a | | 9,667,836 |

| Pioneer Cos. | | 40,100 a | | 887,012 |

| Wausau Paper | | 384,800 | | 4,579,120 |

| Wellman | | 51,400 | | 357,230 |

| | | | | 42,936,600 |

| Producer Manufacturing—5.9% | | | | |

| IDEX | | 310,000 | | 13,485,000 |

| JLG Industries | | 541,400 b | | 17,752,506 |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Producer Manufacturing (continued) | | |

| Steel Technologies | | 62,600 | | 1,465,466 |

| Trinity Industries | | 349,700 b | | 13,089,271 |

| | | | | 45,792,243 |

| Retail Trade—5.4% | | | | |

| Bon-Ton Stores | | 33,000 | | 668,910 |

| Genesco | | 399,600 a | | 15,868,116 |

| Pacific Sunwear of California | | 622,000 a | | 14,853,360 |

| PETCO Animal Supplies | | 451,000 a | | 9,976,120 |

| | | | | 41,366,506 |

| Technology Services—13.4% | | | | |

| Anteon International | | 320,000 a | | 14,704,000 |

| Apria Healthcare Group | | 365,000 a | | 12,493,950 |

| Business Objects, ADR | | 349,500 a,b | | 11,652,330 |

| Chemed | | 300,000 b | | 12,138,000 |

| eCollege.com | | 58,500 a,b | | 734,175 |

| Entercom Communications | | 94,500 a | | 3,161,025 |

| Genesis HealthCare | | 330,000 a | | 13,233,000 |

| Global Payments | | 200,000 | | 13,156,000 |

| Hyperion Solutions | | 235,400 a | | 10,209,298 |

| LifePoint Hospitals | | 115,600 a | | 5,257,488 |

| NDCHealth | | 255,000 | | 4,796,550 |

| Online Resources | | 65,500 a | | 628,145 |

| Vignette | | 102,400 a | | 1,555,456 |

| | | | | 103,719,417 |

| Transportation—2.4% | | | | |

| Skywest | | 619,100 | | 14,678,861 |

| World Air Holdings | | 349,100 a | | 3,515,437 |

| | | | | 18,194,298 |

| Utilities—3.7% | | | | |

| ALLETE | | 274,200 | | 12,407,550 |

| Duquesne Light Holdings | | 600,000 b | | 10,890,000 |

| Puget Energy | | 247,900 | | 5,644,683 |

| | | | | 28,942,233 |

| Total Common Stocks | | | | |

| (cost $534,863,906) | | | | 771,758,639 |

| | STATEMENT OF INVESTMENTS (continued)

|

| Other Investment—.7% | | | | Shares | | Value ($) |

| |

| |

| |

|

| Registered Investment Company; | | | | | | |

| Dreyfus Institutional Preferred Plus Money Market Fund | | |

| (cost $5,501,000) | | | | 5,501,000 c | | 5,501,000 |

| |

| |

| |

|

| |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—7.8% | | | | |

| |

| |

|

| Registered Investment Company; | | | | | | |

| Dreyfus Institutional Cash Advantage Fund | | | | |

| (cost $60,286,082) | | | | 60,286,082 c | | 60,286,082 |

| |

| |

| |

|

| |

| Total Investments (cost $600,650,988) | | 108.5% | | 837,545,721 |

| Liabilities, Less Cash and Receivables | | (8.5%) | | (65,535,720) |

| Net Assets | | | | 100.0% | | 772,010,001 |

| |

| ADR—American Depository Receipts. | | | | | | |

| a | | Non-income producing. | | | | | | |

| b | | All or a portion of these securities are on loan. At August 31, 2005, the total market value of the fund’s securities on |

| | | loan is $58,815,708 and the total market value of the collateral held by the fund is $60,286,082. |

| c | | Investments in affiliated money market mutual funds. | | |

| |

| |

|

| |

| |

| |

| |

| Portfolio Summary † | | | | | | |

| | | | | Value (%) | | | | Value (%) |

| |

| |

| |

| |

|

| Finance | | 18.3 | | Industrial Services | | 5.9 |

| Technology Services | | 13.4 | | Consumer Services | | 5.7 |

| Electronic Technology | | 11.5 | | Process Industries | | 5.6 |

| Money Market Investments | | 8.5 | | Retail Trade | | 5.4 |

| Energy Minerals | | 7.1 | | Other | | 14.5 |

| Commercial & Professional Services | | 6.7 | | | | |

| Producer Manufacturing | | 5.9 | | | | 108.5 |

| |

| † | | Based on net assets. | | | | | | |

| See notes to financial statements. | | | | | | |

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2005

|

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities— | | | | |

| See Statement of Investments (including securities | | |

| on loan, valued at $58,815,708)—Note 1(b): | | |

| Unaffiliated issuers | | 534,863,906 | | 771,758,639 |

| Affiliated issuers | | 65,787,082 | | 65,787,082 |

| Cash | | | | 22,127 |

| Dividends and interest receivable | | | | 346,888 |

| Receivable for shares of Common Stock subscribed | | 156,616 |

| Prepaid expenses | | | | 33,450 |

| | | | | 838,104,802 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 785,109 |

| Liability for securities loaned—Note 1(b) | | 60,286,082 |

| Payable for investment securities purchased | | 3,014,912 |

| Payable for shares of Common Stock redeemed | | 1,669,138 |

| Accrued expenses | | | | 339,560 |

| | | | | 66,094,801 |

| |

| |

|

| Net Assets ($) | | | | 772,010,001 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 428,201,599 |

| Accumulated undistributed investment income—net | | 1,910 |

| Accumulated net realized gain (loss) on investments | | 106,911,759 |

| Accumulated net unrealized appreciation | | |

| (depreciation) on investments | | | | 236,894,733 |

| |

| |

|

| Net Assets ($) | | | | 772,010,001 |

| |

| |

|

| Shares Outstanding | | | | |

| (100 million shares of $.001 par value Common Stock authorized) | | 16,552,328 |

| Net Asset Value, offering and redemption price per share—Note 3(e) ($) | | 46.64 |

See notes to financial statements.

|

| | STATEMENT OF OPERATIONS

Year Ended August 31, 2005

|

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $26,682 foreign taxes withheld at source): | | |

| Unaffiliated issuers | | 9,667,233 |

| Affiliated issuers | | 536,335 |

| Income from securities lending | | 242,324 |

| Total Income | | 10,445,892 |

| Expenses: | | |

| Management fee—Note 3(a) | | 8,270,087 |

| Shareholder servicing costs—Note 3(b) | | 3,707,175 |

| Custodian fees—Note 3(b) | | 66,520 |

| Professional fees | | 48,235 |

| Prospectus and shareholders’ reports | | 35,238 |

| Registration fees | | 19,931 |

| Directors’ fees and expenses—Note 3(c) | | 18,483 |

| Interest expense—Note 2 | | 14,158 |

| Loan commitment fees—Note 2 | | 6,015 |

| Miscellaneous | | 24,630 |

| Total Expenses | | 12,210,472 |

| Less—reduction in management fee | | |

| due to undertaking—Note 3(a) | | (620,065) |

| Net Expenses | | 11,590,407 |

| Investment (Loss)—Net | | (1,144,515) |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 174,321,426 |

| Net unrealized appreciation (depreciation) on investments | | 30,084,682 |

| Net Realized and Unrealized Gain (Loss) on Investments | | 204,406,108 |

| Net Increase in Net Assets Resulting from Operations | | 203,261,593 |

| | See notes to financial statements.

|

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended August 31, |

| |

|

| | | 2005 | | 2004 |

| |

| |

|

| Operations ($): | | | | |

| Investment (loss)—net | | (1,144,515) | | (5,932,203) |

| Net realized gain (loss) on investments | | 174,321,426 | | 153,626,269 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | 30,084,682 | | (20,290,024) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 203,261,593 | | 127,404,042 |

| |

| |

|

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold | | 124,224,914 | | 316,518,596 |

| Cost of shares redeemed | | (548,335,097) | | (621,998,115) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | | (424,110,183) | | (305,479,519) |

| Total Increase (Decrease) in Net Assets | | (220,848,590) | | (178,075,477) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 992,858,591 | | 1,170,934,068 |

| End of Period | | 772,010,001 | | 992,858,591 |

| Undistributed investment income—net | | 1,910 | | — |

| |

| |

|

| Capital Share Transactions (Shares): | | | | |

| Shares sold | | 2,919,033 | | 8,304,150 |

| Shares redeemed | | (12,695,747) | | (16,228,851) |

| Net Increase (Decrease) in Shares Outstanding | | (9,776,714) | | (7,924,701) |

See notes to financial statements.

|

The following table describes the performance for the fiscal periods indicated. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | Year Ended August 31, | | |

| |

| |

| |

|

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 37.71 | | 34.18 | | 27.85 | | 36.06 | | 40.61 |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—net a | | (.05) | | (.19) | | (.16) | | (.16) | | (.15) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 8.98 | | 3.72 | | 6.49 | | (7.21) | | (3.81) |

| Total from Investment Operations | | 8.93 | | 3.53 | | 6.33 | | (7.37) | | (3.96) |

| Distributions: | | | | | | | | | | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | (.84) | | (.59) |

| Net asset value, end of period | | 46.64 | | 37.71 | | 34.18 | | 27.85 | | 36.06 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 23.68 | | 10.29 | | 22.77 | | (20.78) | | (9.80) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.33 | | 1.31 | | 1.38 | | 1.34 | | 1.29 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.26 | | 1.31 | | 1.38 | | 1.34 | | 1.29 |

| Ratio of net investment (loss) | | | | | | | | | | |

| to average net assets | | (.12) | | (.50) | | (.56) | | (.49) | | (.39) |

| Portfolio Turnover Rate | | 42.07 | | 47.66 | | 50.27 | | 36.24 | | 77.63 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period | | | | | | | | | | |

| ($ x 1,000) | | 772,010 | | 992,859 | | 1,170,934 | | 1,074,004 | | 1,379,534 |

| | a Based on average shares outstanding at each month end.

See notes to financial statements.

|

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Emerging Leaders Fund (the “fund”) is a separate diversified series of Dreyfus Growth and Value Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company that offers twelve series, including the fund.The fund’s investment objective is capital growth.The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund’s investment adviser.The Manager is a wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”). Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares, which are sold to existing shareholders without a sales charge.The fund is closed to new investors.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked

| | NOTES TO FINANCIAL STATEMENTS (continued)

|

prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Investments in registered investment companies are valued at net assets.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR’s and futures contracts. For other securities that are fair valued by the Board of Directors, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments is recognized on the accrual basis.

The fund has an arrangement with the custodian bank whereby the fund receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits, if any, as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with Mellon Bank, N.A., an affiliate of the Manager, the fund may lend securities to qualified

institutions.At origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan will be maintained at all times. Cash collateral is invested in certain money market mutual funds managed by the Manager. The fund will be entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund would bear the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

(c) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

At August 31, 2005, the components of accumulated earnings on a tax basis were as follows: undistributed capital gains $108,744,881 and unrealized appreciation $235,063,521.

| | NOTES TO FINANCIAL STATEMENTS (continued)

|

During the period ended August 31, 2005, as a result of permanent book to tax differences primarily due to the tax treatment for net operating losses and real estate investment trusts, the fund increased accumulated undistributed investment income-net by $1,146,425 and decreased paid-in capital by the same amount. Net assets were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

|

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowings.

The average daily amount of borrowings outstanding under the Facility during the period ended August 31, 2005 was approximately $481,400, with a related weighted average annualized interest rate of 2.94% .

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of .90% of the value of the fund’s average daily net assets and is payable monthly.The Manager has undertaken from March 16, 2005 through March 31, 2006 that, if the fund’s aggregate expenses, exclusive of taxes, brokerage fees, interest on borrowings, shareholder services plan fees and extraordinary expenses, exceed an annual rate of .90% of the value of the fund’s average daily net assets, the fund may deduct from the payment to be made to the Manager under the Agreement, or the Manager will bear, such excess expenses. The expense reimbursement, pursuant to the undertaking, amounted to $620,065 during the period ended August 31, 2005.

(b) Under the Shareholder Services Plan, the fund pays the Distributor at an annual rate of .25% of the value of the fund’s average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as

answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended August 31, 2005, the fund was charged $2,297,246 pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended August 31, 2005, the fund was charged $183,374 pursuant to the transfer agency agreement.

The fund compensates Mellon Bank, N.A., an affiliate of the Manager under a custody agreement for providing custodial services for the fund. During the period ended August 31, 2005, the fund was charged $66,520 pursuant to the custody agreement.

During the period ended August 31, 2005, the fund was charged $2,520 for services performed by the Chief Compliance Officer.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: management fees $589,030, shareholder services plan fees $163,912, custody fees $14,940, chief compliance officer fees $1,533 and transfer agency per account fees $72,800, which are offset against an expense reimbursement currently in effect in the amount of $57,106.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

(d) Pursuant to an exemptive order from the Securities and Exchange Commission, the fund may invest its available cash balances in affiliated money market mutual funds. Management fees of the underlying money market mutual funds have been waived by the Manager.

| | NOTES TO FINANCIAL STATEMENTS (continued)

|

(e) A 1% redemption fee is charged and retained by the fund on certain shares redeemed within thirty days following the date of issuance, including redemptions made through the use of the fund’s exchange privilege.

NOTE 4—Securities Transactions:

|

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended August 31, 2005, amounted to $375,547,274 and $753,256,342, respectively.

At August 31, 2005, the cost of investments for federal income tax purposes was $602,482,200; accordingly, accumulated net unrealized appreciation on investments was $235,063,521, consisting of $246,699,768 gross unrealized appreciation and $11,636,247 gross unrealized depreciation.

In early 2004, two purported class and derivative actions were filed against Mellon Financial, Mellon Bank, N.A., Dreyfus, Founders Asset Management LLC, and certain directors of the Dreyfus Funds and the Dreyfus Founders Funds (together, the “Funds”) in the United States District Court for the Western District of Pennsylvania. In September 2004, plaintiffs served a Consolidated Amended Complaint (the “Amended Complaint”) on behalf of a purported class of all persons who acquired interests in any of the Funds between January 30, 1999 and November 17, 2003, and derivatively on behalf of the Funds.The Amended Complaint in the newly styled In re Dreyfus Mutual Funds Fee Litigation also named the Distributor, Premier Mutual Fund Services, Inc. and two additional Fund directors as defendants and alleges violations of the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Pennsylvania Unfair Trade Practices and Consumer Protection Law and common-law claims.

Plaintiffs seek to recover allegedly improper and excessive Rule 12b-1 and advisory fees allegedly charged to the Funds for marketing and distribution services. More specifically, plaintiffs claim, among other things, that 12b-1 fees and directed brokerage were improperly used to pay brokers to recommend the Funds over other funds, and that such payments were not disclosed to investors. In addition, plaintiffs assert that economies of scale and soft-dollar benefits were not passed on to the Funds. Plaintiffs further allege that 12b-1 fees were improperly charged to certain of the Funds that were closed to new investors.The Amended Complaint seeks compensatory and punitive damages, rescission of the advisory contracts, and an accounting and restitution of any unlawful fees, as well as an award of attorneys’ fees and litigation expenses. As noted, some of the claims in this litigation are asserted derivatively on behalf of the Funds that have been named as nominal defendants. With respect to such derivative claims, no relief is sought against the Funds. Dreyfus believes the allegations to be totally without merit and intends to defend the action vigorously. In November 2004, all named defendants moved to dismiss the Amended Complaint in whole or substantial part. Briefing was completed in May 2005.

Additional lawsuits arising out of these circumstances and presenting similar allegations and requests for relief may be filed against the defendants in the future. Neither Dreyfus nor the Funds believe that any of the pending actions will have a material adverse effect on the Funds or Dreyfus’ ability to perform its contract with the Funds.

| | REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

|

Shareholders and Board of Directors

Dreyfus Emerging Leaders Fund

|

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Emerging Leaders Fund (one of the funds comprising Dreyfus Growth and Value Funds, Inc.) as of August 31, 2005, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting.Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances,but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting.Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included verification by examination of securities held by the custodian as of August 31, 2005 and confirmation of securities not held by the custodian by correspondence with oth-ers.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Emerging Leaders Fund at August 31, 2005, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U.S. generally accepted accounting principles.

New York, New York

October 14, 2005

|

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE

FUND’S MANAGEMENT AGREEMENT (Unaudited)

|

At a meeting of the Board of Directors held on March 14, 2005, the Board considered the re-approval for an annual period of the Fund’s Management Agreement, pursuant to which the Manager provides the Fund with investment advisory and administrative services. The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940,as amended) of the Fund,were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Manager.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The Board members received a presentation from representatives of the Manager regarding services provided to the Fund and other funds in the Dreyfus fund complex, and discussed the nature, extent and quality of the services provided to the Fund pursuant to its Management Agreement. The presentation included a detailed summary of the services provided to Dreyfus-managed mutual funds by each business unit within the Manager.The Manager’s representatives reviewed the Fund’s distribution of accounts and the relationships the Manager has with various intermediaries and the different needs of each.The Manager’s representatives noted the diversity of distribution of the Fund as well as among the funds in the Dreyfus fund complex, and the Manager’s corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each of the Fund’s distribution channels.The Board also reviewed the number of shareholder accounts in the Fund, as well as the Fund’s asset size.

The Board members also considered the Manager’s research and portfolio management capabilities and that the Manager also provides oversight of day-to-day Fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board members also considered the Manager’s extensive administrative, accounting and compliance infrastructure.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board members reviewed the Fund’s performance, management fee and expense ratios and placed significant emphasis on comparisons to a group of comparable funds and Lipper

| | I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E

F U N D ’S M A N A G E M E N T A G R E E M E N T ( U n a u d i t e d ) ( c o n t i n u e d )

|

category averages, as applicable. The group of comparable funds was previously approved by the Board for this purpose, and was prepared using a Board-approved selection methodology that was based, in part, on selecting non-affiliated funds reported in the same Lipper category as the Fund.The Board members discussed the results of the comparisons for various periods ended January 31, 2005, and noted that the Fund’s performance was lower than the comparison group averages for the 1-year, 3-year and 5-year periods, but was higher than the Lipper category averages for each such period.The Board discussed with representatives of the Manager the reasons for the Fund’s underperfor-mance compared to the comparison group for the 1-, 3-, and 5-year periods, and the Manager’s efforts to improve performance.The Board members also discussed the Fund’s management fee and expense ratio and reviewed the range of management fees and expense ratios for the funds in the comparison group.The Fund’s management fee ranked in the bottom half (i.e., higher than most others) of the comparison group funds.The Board noted that the Fund’s total expense ratio was higher than the comparison group average, but was lower than the Lipper category average. After discussions with the Board, the Manager undertook, effective March 16, 2005, to waive its fees or reimburse certain Fund expenses until March 31, 2006, if total Fund operating expenses exceed .90% of the value of the Fund’s average daily net assets.

Representatives of the Manager reviewed with the Board members the fees paid to the Manager or its affiliates by mutual funds managed by the Manager or its affiliates with similar investment objectives, policies and strategies as the Fund (the “Similar Funds”), and by other accounts managed or sub-advised by the Manager or its affiliates with similar investment objectives, policies and strategies as the Fund (the “Separate Accounts” and, collectively with the Similar Funds, the “Similar Accounts”).The Manager’s representatives explained the nature of the Similar Accounts and the differences, from the Manager’s perspective, in management of the Similar Accounts as compared to managing and providing services to the Fund; it was noted that the Similar Funds were mutual funds included in the “small-cap growth” and “small-cap growth variable insurance products” funds categories by Lipper. The

Manager’s representatives also reviewed the costs associated with distribution through intermediaries. The Board analyzed the differences in fees paid to the Manager and discussed the relationship of the advisory fees paid in light of the Manager’s performance and the services provided; it was noted that the Similar Funds generally had management fees that were the same as or lower than the fee borne by the Fund, with one Similar Fund having a higher management fee. The Board members considered the relevance of the fee information provided for the Similar Accounts managed by the Manager to evaluate the appropriateness and reasonableness of the Fund’s advisory fees. The Board acknowledged that differences in fees paid by the Similar Accounts seemed to be consistent with the services provided.

Analysis of Profitability and Economies of Scale. The Manager’s representatives reviewed the dollar amount of expenses allocated and profit received by the Manager and the method used to determine such expenses and profit.The Board received and considered information prepared by an independent consulting firm regarding the Manager’s approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex.The Manager’s representatives stated that the methodology had also been reviewed by an independent registered public accounting firm which, like the consultant, found the methodology to be reasonable.The consulting firm also analyzed where any economies of scale might emerge in connection with the management of the Fund.The Board members evaluated the analysis in light of the relevant circumstances for the Fund, and the extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect these economies of scale for the benefit of Fund investors. The Board noted that it appeared that the benefits of any economies of scale also would be appropriately shared with shareholders through increased investment in fund management and administration resources. The Board members also considered potential benefits to the Manager from acting as investment adviser and reviewed the soft dollar arrangements with respect to trading the Fund’s portfolio.

| | I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E

F U N D ’S M A N A G E M E N T A G R E E M E N T ( U n a u d i t e d ) ( c o n t i n u e d )

|

It was noted that the Board members should consider the Manager’s profitability with respect to the Fund as part of their evaluation of whether the fee under the Management Agreement bears a reasonable relationship to the mix of services provided by the Manager, including the nature, extent and quality of such services and that a discussion of economies of scale is predicated on increasing assets and that, if a Fund’s assets had been decreasing, the possibility that the Manager may have realized any economies of scale would be less.The Board members also discussed the profitability percentage ranges determined by appropriate court cases to be reasonable given the services rendered to investment companies. It was noted that the profitability percentage for managing the Fund was not unreasonable given the Fund’s overall performance and generally superior service levels provided.

At the conclusion of these discussions, each of the Directors expressed the opinion that he or she had been furnished with sufficient information to make an informed business decision with respect to continuation of the Fund’s Management Agreement. Based on their discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices provided by the Manager are adequate and appropriate.

- The Board expressed concern over the Fund’s performance, but was satisfied with the Manager’s efforts to improve such performance, noting that the Manager has undertaken to limit the Fund’s expenses as described above.

- The Board concluded that the fee paid to the Manager by the Fund was reasonable in light of comparative performance and expense and advisory fee information, including the Manager’s undertaking to waive or reimburse certain fees and expenses of the Fund, costs of the services provided and profits to be realized and benefits derived or to be derived by the Manager from its relationship with the Fund.

- The Board determined that the economies of scale which may accrue to the Manager and its affiliates in connection with the man- agement of the Fund had been adequately considered by the Manager in connection with the management fee rate charged to the Fund, and that, to the extent in the future it were to be deter- mined that material economies of scale had not been shared with the Fund, the Board would seek to have those economies of scale shared with the Fund.

The Board members considered these conclusions and determinations, along with the information received on a routine and regular basis throughout the year, and, without any one factor being dispositive, the Board determined that re-approval of the Fund’s Management Agreement was in the best interests of the Fund and its shareholders.

BOARD MEMBERS INFORMATION (Unaudited)

| | Joseph S. DiMartino (61)

Chairman of the Board (1995)

|

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| | Other Board Memberships and Affiliations:

|

- The Muscular Dystrophy Association, Director

- Levcor International, Inc., an apparel fabric processor, Director

- Century Business Services, Inc., a provider of outsourcing functions for small and medium size companies, Director

- The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director

- Azimuth Trust, an institutional asset management firm, Member of Board of Managers and Advisory Board

- Sunair Electronics, Inc., engages in the design, manufacture and sale of high frequency systems for long-range voice and data communications, as well as providing certain outdoor-related services to homes and businesses, Director

No. of Portfolios for which Board Member Serves: 193

| | David P. Feldman (65)

Board Member (1996)

|

| Principal Occupation During Past 5 Years: |

| • Corporate Director & Trustee |

| | Other Board Memberships and Affiliations:

|

- BBH Mutual Funds Group (11 funds), Director

- The Jeffrey Company, a private investment company, Director

- QMED, a medical device company, Director

No. of Portfolios for which Board Member Serves: 58

| | Ehud Houminer (65)

Board Member (1993)

|

| | Principal Occupation During Past 5 Years:

|

- Executive-in-Residence at the Columbia Business School, Columbia University

- Principal of Lear,Yavitz and Associates, a management consulting firm (1996 to 2001)

| | Other Board Memberships and Affiliations:

|

- Avnet Inc., an electronics distributor, Director

- International Advisory Board to the MBA Program School of Management, Ben Gurion University, Chairman

- Explore Charter School, Brooklyn, NY, Chairman

| | No. of Portfolios for which Board Member Serves: 36

|

| | Gloria Messinger (75)

Board Member (1993)

|

| | Principal Occupation During Past 5 Years:

|

- Arbitrator for American Arbitration Association and National Association of Securities Dealers, Inc.

- Consultant in Intellectual Property

| | Other Board Memberships and Affiliations:

|

- Yale Law School Fund, Director

- Theater for a New Audience, Inc., Director

- Brooklyn Philharmonic, Director

- New York Women’s Agenda Music Performance Trust Fund, Director

| | No. of Portfolios for which Board Member Serves: 25

|

| Principal Occupation During Past 5 Years: |

| • Consultant in Photography |

T. John Szarkowski (79) Board Member (1996)

| Other Board Memberships and Affiliations: |

| • Photography Department at The Museum of Modern Art, Director Emeritus |

| | No. of Portfolios for which Board Member Serves: 25

|

| | Anne Wexler (75)

Board Member (1996)

|

| | Principal Occupation During Past 5 Years:

|

- Chairman of the Wexler & Walker Public Policy Associates, consultants specializing in govern- ment relations and public affairs

| | Other Board Memberships and Affiliations:

|

- Wilshire Mutual Funds (5 funds), Director

- Methanex Corporation, a methanol producing company, Director

- Member of the Council of Foreign Relations

- Member of the National Park Foundation

| | No. of Portfolios for which Board Member Serves: 36

|

Once elected all Board Members serve for an indefinite term.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

John M. Fraser, Jr., Emeritus Board Member

OFFICERS OF THE FUND (Unaudited)

| STEPHEN E. CANTER, President since | | JAMES BITETTO, Vice President and |

| March 2000. | | Assistant Secretary since August 2005. |

| Chairman of the Board, Chief Executive | | Assistant General Counsel and Assistant |

| Officer and Chief Operating Officer of the | | Secretary of the Manager, and an officer of 91 |

| Manager, and an officer of 90 investment | | investment companies (comprised of 200 |

| companies (comprised of 184 portfolios) | | portfolios) managed by the Manager. He is 39 |

| managed by the Manager. Mr. Canter also is a | | years old and has been an employee of the |

| Board member and, where applicable, an | | Manager since December 1996. |

| |

| Executive Committee Member of the other | | JONI LACKS CHARATAN, Vice President |

| investment management subsidiaries of Mellon | | and Assistant Secretary since |

| Financial Corporation, each of which is an | | August 2005. |

| affiliate of the Manager. He is 60 years old and | | |

| has been an employee of the Manager since | | Assistant General Counsel and Assistant |

| May 1995. | | Secretary of the Manager, and an officer of 91 |

| | | investment companies (comprised of 200 |

| STEPHEN R. BYERS, Executive Vice | | portfolios) managed by the Manager. She is 49 |

| President since November 2002. | | years old and has been an employee of the |

| Chief Investment Officer,Vice Chairman and a | | Manager since October 1998. |

| |

| director of the Manager, and an officer of 90 | | JOSEPH M. CHIOFFI, Vice President and |

| investment companies (comprised of 184 | | Assistant Secretary since August 2005. |

| portfolios) managed by the Manager. Mr. Byers | | |

| also is an officer, director or an Executive | | Assistant General Counsel and Assistant |

| Committee Member of certain other | | Secretary of the Manager, and an officer of 91 |

| investment management subsidiaries of Mellon | | investment companies (comprised of 200 |

| Financial Corporation, each of which is an | | portfolios) managed by the Manager. He is 43 |

| affiliate of the Manager. He is 52 years old and | | years old and has been an employee of the |

| has been an employee of the Manager since | | Manager since July 2000. |

| January 2000. | | JANETTE E. FARRAGHER, Vice President |

| MARK N. JACOBS, Vice President since | | and Assistant Secretary since |

| March 2000. | | August 2005. |

| Executive Vice President, Secretary and | | Associate General Counsel of the Manager, |

| General Counsel of the Manager, and an | | and an officer of 91 investment companies |

| officer of 91 investment companies (comprised | | (comprised of 200 portfolios) managed by the |

| of 200 portfolios) managed by the Manager. | | Manager. She is 42 years old and has been an |

| He is 59 years old and has been an employee | | employee of the Manager since February 1984. |

| of the Manager since June 1977. | | JOHN B. HAMMALIAN, Vice President and |

| MICHAEL A. ROSENBERG, Vice President | | Assistant Secretary since August 2005. |

| and Secretary since August 2005. | | Associate General Counsel of the Manager, |

| Associate General Counsel of the Manager, | | and an officer of 91 investment companies |

| and an officer of 91 investment companies | | (comprised of 200 portfolios) managed by the |

| (comprised of 200 portfolios) managed by the | | Manager. He is 42 years old and has been an |

| Manager. He is 45 years old and has been an | | employee of the Manager since February 1991. |

| employee of the Manager since October 1991. | | |

| ROBERT R. MULLERY, Vice President and | | ROBERT SVAGNA, Assistant Treasurer |

| Assistant Secretary since August 2005. | | since December 2002. |

| Associate General Counsel of the Manager, | | Senior Accounting Manager – Equity Funds of |

| and an officer of 91 investment companies | | the Manager, and an officer of 91 investment |

| (comprised of 200 portfolios) managed by the | | companies (comprised of 200 portfolios) |

| Manager. He is 53 years old and has been an | | managed by the Manager. He is 38 years old |

| employee of the Manager since May 1986. | | and has been an employee of the Manager |

| |

| JEFF PRUSNOFSKY, Vice President and | | since November 1990. |

| Assistant Secretary since August 2005. | | KENNETH J. SANDGREN, Assistant |

| Associate General Counsel of the Manager, | | Treasurer since November 2001. |

| and an officer of 91 investment companies | | Mutual Funds Tax Director of the Manager, |

| (comprised of 200 portfolios) managed by the | | and an officer of 91 investment companies |

| Manager. He is 40 years old and has been an | | (comprised of 200 portfolios) managed by the |

| employee of the Manager since October 1990. | | Manager. He is 51 years old and has been an |

| |

| JAMES WINDELS, Treasurer since | | employee of the Manager since June 1993. |

| November 2001. | | JOSEPH W. CONNOLLY, Chief Compliance |

| Director – Mutual Fund Accounting of the | | Officer since October 2004. |

| Manager, and an officer of 91 investment | | Chief Compliance Officer of the Manager and |

| companies (comprised of 200 portfolios) | | The Dreyfus Family of Funds (91 investment |

| managed by the Manager. He is 46 years old | | companies, comprising 200 portfolios). From |

| and has been an employee of the Manager | | November 2001 through March 2004, Mr. |

| since April 1985. | | Connolly was first Vice-President, Mutual |

| |

| GREGORY S. GRUBER, Assistant | | Fund Servicing for Mellon Global Securities |

| Treasurer since August 2005. | | Services. In that capacity, Mr. Connolly was |

| | | responsible for managing Mellon’s Custody, |

| Senior Accounting Manager – Municipal Bond | | Fund Accounting and Fund Administration |

| Funds of the Manager, and an officer of 91 | | services to third-party mutual fund clients. He |

| investment companies (comprised of 200 | | is 48 years old and has served in various |

| portfolios) managed by the Manager. He is 46 | | capacities with the Manager since 1980, |

| years old and has been an employee of the | | including manager of the firm’s Fund |

| Manager since August 1981. | | Accounting Department from 1997 through |

| ERIK D. NAVILOFF, Assistant Treasurer | | October 2001. |

| since August 2005. | | WILLIAM GERMENIS, Anti-Money |

| Senior Accounting Manager – Taxable Fixed | | Laundering Compliance Officer since |

| Income Funds of the Manager, and an officer | | October 2002. |

| of 91 investment companies (comprised of 200 | | Vice President and Anti-Money Laundering |

| portfolios) managed by the Manager. He is 37 | | Compliance Officer of the Distributor, and the |

| years old and has been an employee of the | | Anti-Money Laundering Compliance Officer |

| Manager since November 1992. | | of 88 investment companies (comprised of 197 |

| ROBERT ROBOL, Assistant Treasurer | | portfolios) managed by the Manager. He is 35 |

| since August 2005. | | years old and has been an employee of the |

| | | Distributor since October 1998. |

| Senior Accounting Manager – Money Market | | |

| Funds of the Manager, and an officer of 91 | | |

| investment companies (comprised of 200 | | |

| portfolios) managed by the Manager. He is 41 | | |

| years old and has been an employee of the | | |

| Manager since October 1988. | | |

| For More | | Information |

| |

|

| |

| Dreyfus | | Transfer Agent & |

| Emerging Leaders Fund | | Dividend Disbursing Agent |

| 200 Park Avenue | | Dreyfus Transfer, Inc. |

| New York, NY 10166 | | 200 Park Avenue |

| Manager | | New York, NY 10166 |

| The Dreyfus Corporation | | Distributor |

| 200 Park Avenue | | Dreyfus Service Corporation |

| New York, NY 10166 | | 200 Park Avenue |

| Custodian | | New York, NY 10166 |

| Mellon Bank, N.A. | | |

| One Mellon Bank Center | | |

| Pittsburgh, PA 15258 | | |

| |

|

| |

| |

| Telephone 1-800-645-6561 | | |

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 E-mail Send your request to info@dreyfus.com Internet Information can be viewed online or downloaded at: http://www.dreyfus.com

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the 12-month period ended June 30, 2005, is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 7 | | Understanding Your Fund’s Expenses |

| 7 | | Comparing Your Fund’s Expenses |

| | | With Those of Other Funds |

| 8 | | Statement of Investments |

| 14 | | Statement of Assets and Liabilities |

| 15 | | Statement of Operations |

| 16 | | Statement of Changes in Net Assets |

| 17 | | Financial Highlights |

| 18 | | Notes to Financial Statements |

| 25 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 26 | | Information About the Review and Approval |

| | | of the Fund’s Management Agreement |

| 31 | | Board Members Information |

| 33 | | Officers of the Fund |

| | | FOR MORE INFORMATION |

| |

|

| | | Back Cover |

The Fund

LETTER FROM THE CHAIRMAN

This annual report for Dreyfus Midcap Value Fund covers the 12-month period from September 1, 2004, through August 31, 2005. Inside, you’ll find valuable information about how the fund was managed during the reporting period, including a discussion with the fund’s portfolio manager, David A. Daglio.

On average, stock prices ended the reporting period higher than where they began. However, most of the market’s gains occurred during the closing months of 2004. So far in 2005, positive factors, including steady economic growth and higher corporate profits, were largely offset by headwinds, such as sharply higher energy prices and rising short-term interest rates. Midcap stocks produced higher returns than small-cap stocks in this environment, and small-cap stocks outperformed large-cap stocks. Also, value-oriented stocks have generally produced better results than their more growth-oriented counterparts during the past 12 months.

Recent shocks to the U.S. economy — including sharply higher gasoline prices and other lingering consequences of Hurricane Katrina — have added a degree of uncertainty to the economic outlook.Nonetheless,our economists currently expect the economy to continue to grow without either entering a recession or triggering a significant acceleration of infla-tion.As always, we encourage you to discuss the potential implications of these and other matters with your financial advisor.

Thank you for your continued confidence and support.

DISCUSSION OF FUND PERFORMANCE

David A. Daglio, Portfolio Manager

How did Dreyfus Midcap Value Fund perform relative to its

benchmark?

|

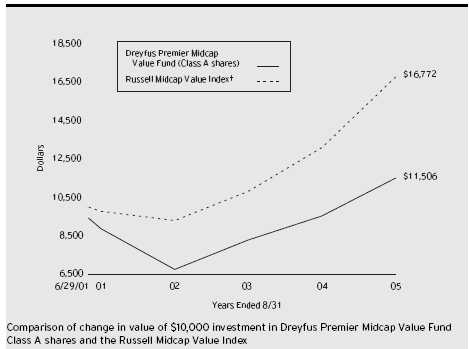

For the 12-month period ended August 31, 2005, Dreyfus Midcap Value Fund produced a 24.70% total return.1 This compares with the 28.06% return provided by the fund’s benchmark, the Russell Midcap Value Index (the “Index”), for the same period.2

An improving U.S. economy and rising corporate earnings more than offset concerns related to rising interest rates and soaring energy prices, fueling gains for midcap stocks during the reporting period. The fund’s return underperformed its benchmark, mainly due to weakness among paper manufacturers and disappointing stock selections in the financials, technology and health care areas.

As of August 17, 2005, David Daglio became the fund’s sole primary portfolio manager.

What is the fund’s investment approach?

The fund’s goal is to surpass the performance of the Index by investing in midcap companies.We consider midcap companies to be companies with market capitalizations between $1 billion and $25 billion at the time of purchase.

We identify potential investments through extensive quantitative and fundamental research. When selecting stocks, the fund will focus on individual stock selection, emphasizing three key factors:

- Value, or how the stock is priced relative to its intrinsic worth based on a variety of traditional measures;

- Sound business fundamentals, as defined by the company’s overall efficiency and profitability; and

- Business momentum, or the presence of a catalyst such as corporate restructuring, change in management or a spin-off that could trigger an increase in the stock’s price in the near term to midterm.

| | DISCUSSION OF FUND PERFORMANCE (continued)

|