| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM N-CSR

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| Investment Company Act file number | | 811- 7123 |

| Advantage Funds, Inc. |

| (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) | | (Zip code) |

| Michael A. Rosenberg, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 10/31 |

| Date of reporting period: | | 10/31/07 |

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which has a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR Form will be filed for this series, as appropriate.

| ADVANTAGE FUNDS, INC. |

| |

| - | | Dreyfus Premier Total Return Advantage Fund |

| - | | Global Alpha Fund |

FORM N-CSR

| Item 1. | | Reports to Stockholders. |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents |

| |

| | | THE FUND |

| |

|

| 2 | | A Letter from the CEO |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 8 | | Understanding Your Fund’s Expenses |

| 8 | | Comparing Your Fund’s Expenses |

| With Those of Other Funds |

| 9 | | Statement of Investments |

| 16 | | Statement of Financial Futures |

| 16 | | Statement of Options Written |

| 17 | | Statement of Assets and Liabilities |

| 18 | | Statement of Operations |

| 19 | | Statement of Changes in Net Assets |

| 21 | | Financial Highlights |

| 24 | | Notes to Financial Statements |

| 35 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 36 | | Important Tax Information |

| 37 | | Board Members Information |

| 40 | | Officers of the Fund |

| |

| FOR MORE INFORMATION |

|

| | | Back Cover |

| Dreyfus Premier |

| Total Return |

| Advantage Fund |

A LETTER FROM THE CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Premier Total Return Advantage Fund, covering the 12-month period from November 1, 2006, through October 31, 2007.

After a prolonged period of relative price stability, volatility has returned to the U.S. financial markets.The third quarter of 2007 provided greater swings in security valuations than we’ve seen in several years, as the economic cycle matured and credit concerns spread from the sub-prime mortgage sector to other credit-sensitive areas of the fixed-income markets. In contrast, U.S. Treasury securities rallied strongly as investors became more averse to credit risks and engaged in a “flight to quality.”

In our view, these developments signaled a shift to a new phase of the credit cycle in which the price of risk has increased to reflect a more borrower-friendly tone in the credit markets. Although the housing downturn and sub-prime turmoil may persist for the next few months or quarters, lower short-term interest rates from the Federal Reserve Board should help keep credit available to borrowers and forestall a more severe economic downturn. In addition, turning points such as this one may be a good time to review your portfolio with your financial advisor, who can help you reposition your fixed-income investments for a changing market environment.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Managers.

Thank you for your continued confidence and support.

2

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2006, through October 31, 2007, as provided by David Kwan and Lowell Bennett, Portfolio Managers

Fund and Market Performance Overview

The U.S. bond market encountered heightened turbulence during the summer of 2007 when a credit crisis originating in the sub-prime mortgage sector sparked a “flight to quality” among fixed-income investors, and prices of higher-yielding securities declined sharply.The fund’s returns were lower than its benchmark, primarily due to its active currency strategy, which emphasized the weakening U.S. dollar.

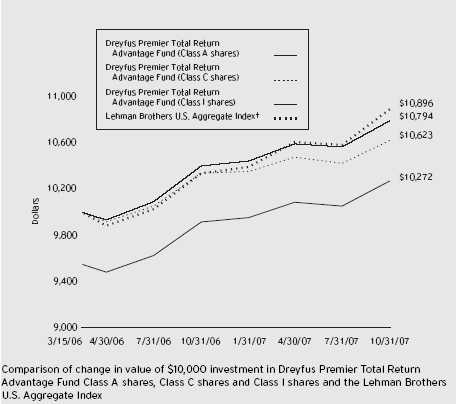

For the 12-month period ended October 31, 2007, Dreyfus Premier Total Return Advantage Fund achieved total returns of 3.57% for Class A shares, 2.73% for Class C shares and 3.75% for Class I shares.1 In comparison, the fund’s benchmark, the Lehman Brothers U.S. Aggregate Index (the “Index”), achieved a total return of 5.38% for the same period.2

The Fund’s Investment Approach

The fund seeks to maximize total return from capital appreciation and income.To pursue its goal, the fund normally invests in securities and other instruments that provide exposure to fixed income and currency markets.

To focus the fund’s investments on the U.S. fixed income market, we employ an active core bond strategy, in which four proprietary quantitative models are run and implemented independently of one another.We overlay the active core bond strategy with a separate global bond strategy, setting the fund’s exposures to the world’s major bond markets according to our view of their relative valuations. Finally, we employ an active currency strategy in which we evaluate and establish exposure to various currencies based on relative valuations as determined by real interest rates and purchasing power parity.

The fund typically will invest in bonds rated investment grade or the unrated equivalent, but we may invest up to 30% of the fund’s assets in securities rated below investment grade at the time of purchase. The average effective maturity of the fund’s portfolio typically will range between three and 10 years.

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

Sub-Prime Deterioration Drove Bond Market Results

The U.S. bond market fared relatively well over the first half of the reporting period in an environment of moderate economic growth, low inflation and stable short-term interest rates. However, investor sentiment deteriorated rapidly in June 2007, when credit concerns spread from sub-prime mortgages to other areas of the financial markets. Heightened credit concerns caused a “flight to quality,” causing prices of corporate and asset-backed securities to fall sharply while U.S.Treasury securities gained value.

The Federal Reserve Board (the “Fed”) acted, along with other central banks, in August to promote greater market liquidity, and the market began to rebound. The Fed took action again in September and October, cutting short-term interest rates by a total of 75 basis points. While these moves helped restore a degree of investor confidence, risk premiums remained high by the end of the reporting period.

Weak U.S. Dollar Detracts from Performance

A relatively short average duration in the fund’s core bond portfolio relative to the benchmark over the first half of the reporting period aided the fund’s performance as U.S. interest rates increased. As rates rose we maintained a more neutral average duration, which positioned the fund well for the fall in interest rates in the wake of the credit crunch. The sub-prime mortgage meltdown had a relatively muted impact on the performance of the fund’s core bond strategy due to our focus on higher-quality securities.

Our global bond strategy produced results that slightly trailed the benchmark. An emphasis on securities in nations with higher interest rates, such as Australia, detracted from performance when rates in those markets rose further. Conversely, the fund’s relatively short exposure to the lower-yielding Japanese bond market also detracted from performance as that market gained modestly.

The fund’s active currency strategy had the greatest impact on the fund’s results over the reporting period.We focused most of our attention on currencies from countries with higher inflation-adjusted interest rates and, when it was significant enough, we focused on currencies that we believed to have become significantly undervalued on a purchasing power parity basis. For example, we found such favorable valuation with the Japanese yen, in which we held an overweight position during the

4

first half of the year. Initially this hurt the strategy as the ongoing carry trade worked against the yen, but as the carry trade unwound in the wake of the credit crunch, the yen appreciated. A similar overweight positioning in the undervalued U.S. dollar, versus an underweight to several of the overvalued commodity currencies (Australian dollar, Canadian dollar, and Norwegian krone) detracted from the fund’s per-formance.We attribute the weakening U.S. dollar to the Fed’s cutting of short-term interest rates in light of the credit crunch and mortgage situation, as well as to the commodity currencies, which have continued to strengthen significantly as commodity prices have climbed.

Finding Opportunities in a Changing Market

We have maintained a generally conservative approach in the core bond portfolio, including a slightly shorter-than-average duration posture and a high-quality bias. In the global bond portfolio, we have continued to emphasize higher-yielding Australian bonds while underweighting the British bond market.The fund’s currency component has continued to focus on the British pound with high inflation-adjusted interest rates, and the U.S. dollar, which appears undervalued to us. In our judgment, these are prudent strategies in a volatile market environment.

November 15, 2007

| | | Foreign bonds are subject to special risks including exposure to currency fluctuations, |

| | | changing political and economic conditions, and potentially less liquidity. |

| | | Investments in foreign currencies are subject to the risk that those currencies will decline in |

| | | value relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will |

| | | decline relative to the currency being hedged. Currency rates in foreign countries may |

| | | fluctuate significantly over short periods of time. A decline in the value of foreign currencies |

| | | relative to the U.S. dollar will reduce the value of securities held by the fund and |

| | | denominated in those currencies. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid and does not take into |

| | | consideration the maximum initial sales charge in the case of Class A shares or the applicable |

| | | contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these |

| | | charges been reflected, returns would have been lower. Past performance is no guarantee of future |

| | | results. Share price and investment return fluctuate such that upon redemption, fund shares may be |

| | | worth more or less than their original cost. Return figures provided reflect the absorption of certain |

| | | fund expenses by The Dreyfus Corporation pursuant to an agreement in effect through October |

| | | 31, 2008, at which time it may be extended, modified or terminated. Had these expenses not |

| | | been absorbed, the fund’s returns would have been lower. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Lehman Brothers U.S.Aggregate Index is a widely accepted, unmanaged total |

| | | return index of corporate, U.S. government and U.S. government agency debt instruments, mortgage- |

| | | backed securities and asset-backed securities with an average maturity of 1-10 years. Index returns |

| | | do not reflect fees and expenses associated with operating a mutual fund. |

The Fund 5

FUND PERFORMANCE

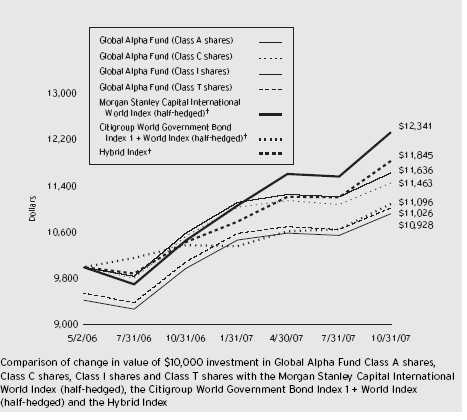

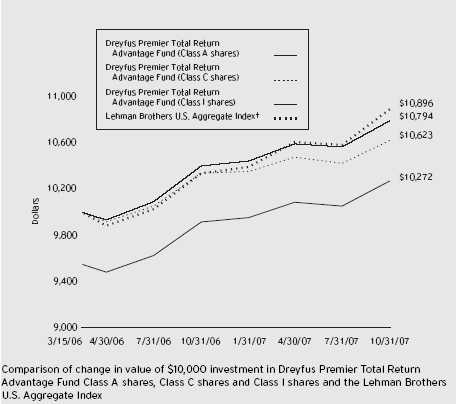

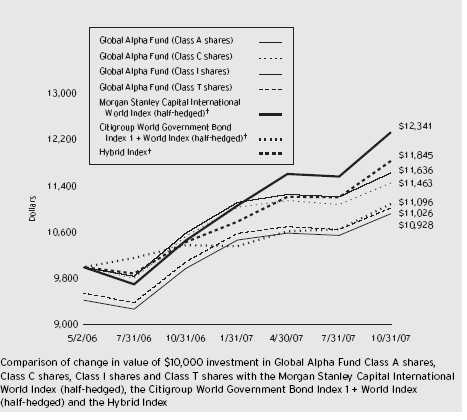

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance. |

| The above graph compares a $10,000 investment made in Class A, Class C and Class I shares of Dreyfus Premier |

| Total Return Advantage Fund on 3/15/06 (inception date) to a $10,000 investment made in the Lehman Brothers |

| U.S. Aggregate Index (the “Index”) on that date. For comparative purposes, the value of the Index on 2/28/06 is used |

| as the beginning value on 3/15/06. All dividends and capital gain distributions are reinvested. |

| The fund invests primarily in fixed-income securities and instruments that provide investment exposure to fixed-income |

| markets.The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A |

| shares and all other applicable fees and expenses on all classes.The Index is a widely accepted, unmanaged total return |

| index of corporate, U.S. government and U.S. government agency debt instruments, mortgage-backed securities and asset- |

| backed securities with an average maturity of 1-10 years.The Index does not take into account charges, fees and other |

| expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained |

| in the Financial Highlights section of the prospectus and elsewhere in this report. |

6

| Average Annual Total Returns as of 10/31/07 | | | | |

| |

| | | Inception | | | | From |

| | | Date | | 1 Year | | Inception |

| |

| |

| |

|

| Class A shares | | | | | | |

| with maximum sales charge (4.5%) | | 3/15/06 | | (1.07)% | | 1.66% |

| without sales charge | | 3/15/06 | | 3.57% | | 4.58% |

| Class C shares | | | | | | |

| with applicable redemption charge † | | 3/15/06 | | 1.75% | | 3.78% |

| without redemption | | 3/15/06 | | 2.73% | | 3.78% |

| Class I shares | | 3/15/06 | | 3.75% | | 4.80% |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on the fund distributions or the redemption of fund shares. |

| † The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| date of purchase. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier Total Return Advantage Fund from May 1, 2007 to October 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | | | |

| assuming actual returns for the six months ended October 31, 2007 | | |

| | | Class A | | Class C | | Class I |

| |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.63 | | $ 8.43 | | $ 3.36 |

| Ending value (after expenses) | | $1,018.20 | | $1,013.80 | | $1,018.80 |

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | | | | |

| assuming a hypothetical 5% annualized return for the six months ended October 31, 2007 |

| | | Class A | | Class C | | Class I |

| |

| |

| |

|

| Expenses paid per $1,000 † | | $ 4.63 | | $ 8.44 | | $ 3.36 |

| Ending value (after expenses) | | $1,020.62 | | $1,016.84 | | $1,021.88 |

† Expenses are equal to the fund’s annualized expense ratio of .91% for Class A, 1.66% for Class C and .66% for Class I, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

8

| STATEMENT OF INVESTMENTS |

| October 31, 2007 |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes—93.3% | | Rate (%) | | Date | | Amount ($) | | Value ( |

| |

| |

| |

| |

|

| Asset-Backed Ctfs./ | | | | | | | | |

| Auto Receivables—6.1% | | | | | | | | |

| Americredit Automobile Receivables | | | | | | |

| Trust, Ser. 2007-CM, Cl. A4A | | 5.55 | | 4/7/14 | | 50,000 | | 50,314 |

| Capital One Auto Finance Trust, | | | | | | | | |

| Ser. 2005-C, Cl. A3 | | 4.61 | | 7/15/10 | | 41,541 | | 41,489 |

| Chase Manhattan Auto Owner Trust, | | | | | | |

| Ser. 2006-B, Cl. A4 | | 5.11 | | 4/15/14 | | 100,000 | | 100,725 |

| Daimler Chrysler Auto Trust, | | | | | | | | |

| Ser. 2004-A, Cl. A4 | | 2.58 | | 4/8/09 | | 25,108 | | 25,094 |

| Harley-Davidson Motorcycle Trust, | | | | | | |

| Ser. 2004-1, Cl. A2 | | 2.53 | | 11/15/11 | | 50,803 | | 49,916 |

| Honda Auto Receivables Owner | | | | | | | | |

| Trust, Ser. 2005-5, Cl. A4 | | 4.69 | | 2/15/11 | | 140,000 | | 139,825 |

| Honda Auto Receivables Owner | | | | | | | | |

| Trust, Ser. 2006-2, Cl. A4 | | 5.28 | | 1/23/12 | | 100,000 | | 100,963 |

| Household Automotive Trust, | | | | | | | | |

| Ser. 2003-2, Cl. A4 | | 3.02 | | 12/17/10 | | 40,393 | | 40,291 |

| Nissan Auto Receivables Owner | | | | | | | | |

| Trust, Ser. 2006-A, Cl. A4 | | 4.77 | | 7/15/11 | | 50,000 | | 49,869 |

| USAA Auto Owner Trust, | | | | | | | | |

| Ser. 2004-3, Cl. A4 | | 3.53 | | 6/15/11 | | 90,331 | | 89,641 |

| WFS Financial Owner Trust, | | | | | | | | |

| Ser. 2004-2, Cl. A4 | | 3.54 | | 11/21/11 | | 52,058 | | 51,752 |

| | | | | | | | | 739,879 |

| Asset-Backed Ctfs./Credit Cards—4.1% | | | | | | |

| Capital One Multi-Asset Execution | | | | | | |

| Trust, Ser. 2005-A2, Cl. A2 | | 4.05 | | 2/15/11 | | 100,000 | | 99,598 |

| Chase Issuance Trust, | | | | | | | | |

| Ser. 2005-A10, Cl. A10 | | 4.65 | | 12/17/12 | | 100,000 | | 99,513 |

| Citibank Credit Card Issuance | | | | | | | | |

| Trust, Ser. 2003-A8, Cl. A8 | | 3.50 | | 8/16/10 | | 100,000 | | 98,788 |

| Citibank Credit Card Master Trust, | | | | | | |

| Ser. 1992-2, Cl. A | | 5.88 | | 3/10/11 | | 100,000 | | 101,441 |

| MBNA Master Credit Card Trust, | | | | | | | | |

| Ser. 2000-L, Cl. A | | 6.50 | | 4/15/10 | | 100,000 | | 100,052 |

| | | | | | | | | 499,392 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Asset-Backed Ctfs./ | | | | | | | | |

| Home Equity Loans—2.4% | | | | | | | | |

| MASTR Asset-Backed Securities | | | | | | | | |

| Trust, Ser. 2005-AB1, Cl. A2 | | 5.05 | | 11/25/35 | | 100,000 a | | 99,084 |

| Renaissance Home Equity Loan | | | | | | | | |

| Trust, Ser. 2005-2, Cl. AF3 | | 4.50 | | 8/25/35 | | 100,000 a | | 99,129 |

| Residential Asset Mortgage | | | | | | | | |

| Products, Ser. 2003-RZ4, Cl. A7 | | 4.79 | | 6/25/33 | | 91,485 a | | 87,611 |

| Specialty Underwriting & | | | | | | | | |

| Residential Finance, | | | | | | | | |

| Ser. 2003-BC4, Cl. A3B | | 4.79 | | 11/25/34 | | 7,426 a | | 6,861 |

| | | | | | | | | 292,685 |

| Asset-Backed Ctfs./Student Loans—.1% | | | | | | |

| College Loan Corporation Trust, | | | | | | | | |

| Stripped Security, Interest | | | | | | | | |

| Only Class, Ser. 2006-1, Cl. AIO | | 10.00 | | 7/25/08 | | 200,000 b | | 14,031 |

| Banks—3.8% | | | | | | | | |

| ABN AMRO Bank, | | | | | | | | |

| Sr. Notes | | 5.26 | | 4/18/08 | | 50,000 a,c | | 50,025 |

| Bank One, | | | | | | | | |

| Sub. Notes | | 7.88 | | 8/1/10 | | 50,000 | | 53,427 |

| Royal Bank of Canada, | | | | | | | | |

| Notes | | 3.88 | | 5/4/09 | | 100,000 | | 99,137 |

| U.S. Bank, | | | | | | | | |

| Sub. Notes | | 6.30 | | 2/4/14 | | 100,000 | | 106,090 |

| Wells Fargo, | | | | | | | | |

| Sr. Unscd., Notes | | 4.20 | | 1/15/10 | | 50,000 | | 49,264 |

| Wells Fargo, | | | | | | | | |

| Notes | | 5.76 | | 3/10/08 | | 100,000 a | | 100,058 |

| | | | | | | | | 458,001 |

| Commercial Mortgage | | | | | | | | |

| Pass-Through Ctfs.—4.6% | | | | | | | | |

| GMAC Commercial Mortgage | | | | | | | | |

| Securities, Ser. 2001-C2, Cl. A1 | | 6.25 | | 4/15/34 | | 53,839 | | 54,387 |

| J.P. Morgan Chase Commercial | | | | | | | | |

| Mortgage Securities, | | | | | | | | |

| Ser. 2005-LDP3, Cl. A4A | | 4.94 | | 8/15/42 | | 102,000 a | | 97,939 |

| J.P. Morgan Chase Commercial | | | | | | | | |

| Mortgage Securities, | | | | | | | | |

| Ser. 2005-LDP3, Cl. A3 | | 4.96 | | 8/15/42 | | 75,000 | | 73,429 |

10

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | |

| J.P. Morgan Chase Commercial | | | | | | | | |

| Mortgage Securities, | | | | | | | | |

| Ser. 2005-LDP5, Cl. ASB | | 5.17 | | 12/15/44 | | 100,000 a | | 99,044 |

| Morgan Stanley Capital I, | | | | | | | | |

| Ser. 2006-HQ8, Cl. AJ | | 5.47 | | 3/12/44 | | 65,000 a | | 63,211 |

| Morgan Stanley Dean Witter Capital | | | | | | |

| I, Ser. 2003-HQ2, Cl. A1 | | 4.18 | | 3/12/35 | | 114,783 | | 111,146 |

| Wachovia Bank Commercial Mortgage | | | | | | |

| Trust, Ser. 2005-C16, Cl. A2 | | 4.38 | | 10/15/41 | | 60,829 | | 59,950 |

| | | | | | | | | 559,106 |

| Diversified Financial Services—14.0% | | | | | | |

| Allstate Life Global Funding | | | | | | | | |

| Trusts, Notes, Ser. 04-1 | | 4.50 | | 5/29/09 | | 200,000 | | 198,885 |

| Bear Stearns Cos., | | | | | | | | |

| Sr. Unscd. Notes | | 5.19 | | 1/31/11 | | 100,000 a | | 96,963 |

| Boeing Capital, | | | | | | | | |

| Unscd. Notes | | 6.50 | | 2/15/12 | | 50,000 | | 52,900 |

| Citigroup, | | | | | | | | |

| Notes | | 5.13 | | 5/5/14 | | 150,000 | | 147,267 |

| Citigroup, | | | | | | | | |

| Notes | | 5.86 | | 6/9/09 | | 50,000 a | | 50,054 |

| Credit Suisse USA, | | | | | | | | |

| Gtd. Notes | | 5.76 | | 8/15/10 | | 100,000 a | | 99,830 |

| Credit Suisse USA, | | | | | | | | |

| Gtd. Notes | | 5.85 | | 12/9/08 | | 50,000 a | | 49,992 |

| General Electric Capital, | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 6.00 | | 6/15/12 | | 200,000 | | 207,676 |

| Goldman Sachs Group, | | | | | | | | |

| Notes | | 5.70 | | 9/1/12 | | 100,000 | | 101,659 |

| Household Finance, | | | | | | | | |

| Sr. Unscd. Notes | | 4.13 | | 11/16/09 | | 100,000 | | 98,240 |

| International Lease Finance, | | | | | | | | |

| Notes | | 5.75 | | 6/15/11 | | 100,000 | | 101,079 |

| JPMorgan Chase & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 1/17/11 | | 100,000 a | | 99,614 |

| Lehman Brothers Holdings, | | | | | | | | |

| Sr. Unscd. Notes | | 5.42 | | 12/23/10 | | 100,000 a | | 98,159 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | |

| Services (continued) | | | | | | | | |

| MBNA, | | | | | | | | |

| Bonds | | 5.00 | | 6/15/15 | | 100,000 | | 96,268 |

| Merrill Lynch & Co., | | | | | | | | |

| Notes | | 5.56 | | 11/1/11 | | 100,000 a | | 97,610 |

| Morgan Stanley, | | | | | | | | |

| Unsub. Bonds | | 6.75 | | 4/15/11 | | 100,000 | | 104,576 |

| | | | | | | | | 1,700,772 |

| Electric Utilities—.8% | | | | | | | | |

| SCANA, | | | | | | | | |

| Notes | | 6.88 | | 5/15/11 | | 50,000 | | 52,197 |

| Wisconsin Energy, | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 12/1/08 | | 50,000 | | 50,204 |

| | | | | | | | | 102,401 |

| Foreign/Governmental—.4% | | | | | | | | |

| United Mexican States, | | | | | | | | |

| Notes | | 6.63 | | 3/3/15 | | 50,000 | | 54,550 |

| Health Care—1.2% | | | | | | | | |

| Abbott Laboratories, | | | | | | | | |

| Notes | | 5.60 | | 5/15/11 | | 50,000 | | 51,125 |

| Merck & Co., | | | | | | | | |

| Notes | | 4.38 | | 2/15/13 | | 100,000 | | 97,100 |

| | | | | | | | | 148,225 |

| Oil & Gas—1.3% | | | | | | | | |

| Conoco Funding, | | | | | | | | |

| Gtd. Bonds | | 6.35 | | 10/15/11 | | 100,000 | | 105,063 |

| KeySpan, | | | | | | | | |

| Sr. Unsub. Notes | | 7.63 | | 11/15/10 | | 50,000 | | 53,523 |

| | | | | | | | | 158,586 |

| Property & Casualty Insurance—3.3% | | | | | | |

| Berkshire Hathaway Finance, | | | | | | | | |

| Gtd. Notes | | 4.63 | | 10/15/13 | | 100,000 | | 97,267 |

| Hartford Life Global Funding | | | | | | | | |

| Trusts, Notes | | 5.20 | | 2/15/11 | | 150,000 | | 150,263 |

| Principal Life Income Funding | | | | | | | | |

| Trusts, Notes | | 5.13 | | 3/1/11 | | 150,000 | | 149,706 |

| | | | | | | | | 397,236 |

12

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Residential Mortgage | | | | | | | | |

| Pass-Through Ctfs.—1.7% | | | | | | | | |

| Credit Suisse Mortgage Capital | | | | | | | | |

| Ctfs., Ser. 2006-C3, Cl. A3 | | 5.83 | | 6/15/38 | | 100,000 a | | 102,024 |

| Merrill Lynch/Countrywide | | | | | | | | |

| Commercial Mortgage, | | | | | | | | |

| Ser. 2006-2, Cl. A4 | | 5.91 | | 6/12/46 | | 100,000 a | | 102,511 |

| | | | | | | | | 204,535 |

| Retail—.9% | | | | | | | | |

| Wal-Mart Stores, | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 8/10/09 | | 100,000 | | 103,626 |

| Technology—.8% | | | | | | | | |

| International Business Machines, | | | | | | | | |

| Unscd. Notes | | 4.25 | | 9/15/09 | | 50,000 | | 49,722 |

| Oracle, | | | | | | | | |

| Unscd. Notes | | 5.00 | | 1/15/11 | | 50,000 | | 50,094 |

| | | | | | | | | 99,816 |

| Telecommunications—2.1% | | | | | | | | |

| BellSouth, | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 10/15/11 | | 100,000 | | 103,042 |

| Cisco Systems, | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 2/22/11 | | 100,000 | | 101,133 |

| Motorola, | | | | | | | | |

| Unscd. Notes | | 7.63 | | 11/15/10 | | 50,000 | | 53,407 |

| | | | | | | | | 257,582 |

| U.S. Government Agencies/ | | | | | | | | |

| Mortgage-Backed—42.4% | | | | | | | | |

| Federal Home Loan Mortgage Corp.: | | | | | | |

| 4.50%, 12/1/19 | | | | | | 798,667 | | 773,598 |

| 5.00%, 11/1/33—7/1/35 | | | | | | 646,904 | | 622,002 |

| 5.50%, 12/1/18—10/1/21 | | | | | | 661,988 | | 664,054 |

| 5.65%, 2/1/37 | | | | | | 47,439 a | | 47,495 |

| 5.72%, 2/1/37 | | | | | | 89,830 a | | 90,906 |

| 5.96%, 1/1/37 | | | | | | 87,708 a | | 88,908 |

| 6.00%, 10/1/19—9/1/34 | | | | | | 252,886 | | 256,970 |

| 6.50%, 8/1/12 | | | | | | 96,704 | | 99,327 |

| 7.00%, 1/1/36 | | | | | | 180,560 | | 188,038 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| | | Principal | | |

| Bonds and Notes (continued) | | Amount ($) | | Value ($) |

| |

| |

|

| U.S. Government Agencies/ | | | | |

| Mortgage-Backed (continued) | | | | |

| Federal National Mortgage Association: | | | | |

| 4.00%, 3/1/21 | | 91,496 | | 86,272 |

| 5.00%, 7/1/19—11/1/34 | | 882,228 | | 865,005 |

| 5.50%, 12/1/16 | | 175,000 d | | 175,191 |

| 5.50%, 7/1/17—8/1/35 | | 583,465 | | 581,848 |

| 5.76%, 4/1/37 | | 94,203 a | | 95,211 |

| 6.00%, 8/1/17 | | 142,573 | | 145,362 |

| 6.50%, 7/1/33 | | 108,271 | | 111,705 |

| 7.00%, 4/1/32 | | 86,735 | | 90,854 |

| Government National Mortgage Association I | | |

| 5.00%, 9/15/33—1/15/34 | | 178,961 | | 173,955 |

| | | | | 5,156,701 |

| U.S. Government Securities—3.3% | | | | |

| U.S. Treasury Bonds | | | | |

| 6.25%, 5/15/30 | | 295,000 | | 354,807 |

| U.S. Treasury Notes | | | | |

| 4.88%, 7/31/11 | | 40,000 | | 41,172 |

| | | | | 395,979 |

| Total Bonds and Notes | | | | |

| (cost $11,288,922) | | | | 11,343,103 |

| |

| |

|

| |

| | | Principal | | |

| Short-Term Investment—.8% | | Amount ($) | | Value ($) |

| |

| |

|

| U.S. Treasury Bill | | | | |

| 4.00%, 12/20/07 | | | | |

| (cost $94,483) | | 95,000 e | | 94,499 |

14

| Other Investment—3.2% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | |

| (cost $384,000) | | 384,000 f | | 384,000 |

| |

| |

|

| Total Investments (cost $11,767,405) | | 97.3% | | 11,821,602 |

| Cash and Receivables (Net) | | 2.7% | | 333,106 |

| Net Assets | | 100.0% | | 12,154,708 |

| a Variable rate security—interest rate subject to periodic change. |

| b Notional face amount shown. |

| c Security exempt from registration under Rule 144A of the Securities Act of 1933.This security may be resold in |

| transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2007, this security |

| amounted to $50,025 or .4% of net assets. |

| d Purchased on a forward commitment basis. |

| e All or partially held by a broker as collateral for open financial futures positions. |

| f Investment in affiliated money market mutual fund. |

| Portfolio Summary (Unaudited) † | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| U.S. Government & Agencies | | 45.7 | | Short-Term/Money Market Investment | | 4.0 |

| Corporate Bonds | | 28.2 | | Foreign/Governmental | | .4 |

| Asset/Mortgage-Backed | | 19.0 | | | | 97.3 |

| † Based on net assets. |

| See notes to financial statements. |

The Fund 15

| STATEMENT OF FINANCIAL FUTURES |

| October 31, 2007 |

| | | | | | | | | Unrealized |

| | | | | Market Value | | | | Appreciation |

| | | | | Covered by | | | | (Depreciation) |

| | | Contracts | | Contracts ($) | | Expiration | | at 10/31/2007 ($) |

| |

| |

| |

| |

|

| Financial Futures Long | | | | | | | | |

| U.S. Treasury 10 year Notes | | 13 | | 1,430,203 | | December 2007 | | 6,971 |

| U.S. Treasury 30 year Bonds | | 9 | | 1,013,344 | | December 2007 | | 7,629 |

| 10 Year Euro-Bond | | 4 | | 655,841 | | December 2007 | | 6,331 |

| Australian 10 Year Bonds | | 8 | | 731,284 | | December 2007 | | (8,320) |

| Financial Futures Short | | | | | | | | |

| U.S. Treasury 2 year Notes | | 1 | | (207,109) | | December 2007 | | 356 |

| U.S. Treasury 5 year Notes | | 1 | | (107,344) | | December 2007 | | 356 |

| Canadian 10 Year Bonds | | 1 | | (118,751) | | December 2007 | | (291) |

| British Long Gilt | | 4 | | (891,599) | | December 2007 | | (1,096) |

| Japanese 10 Year Bond | | 4 | | (472,186) | | December 2007 | | (4,314) |

| | | | | | | | | 7,622 |

See notes to financial statements.

| STATEMENT OF OPTIONS WRITTEN |

| October 31, 2007 |

| | | Face Amount | | |

| | | Covered by | | |

| | | Contracts ($) | | Value ($) |

| |

| |

|

| Call Options | | | | |

| U.S. Treasury 10 Year Notes | | | | |

| November 2007 @ 110 | | 200,000 | | (1,188) |

| Put Options | | | | |

| U.S. Treasury 10 Year Notes | | | | |

| November 2007 @ 109 | | 200,000 | | (437) |

| (Premiums received $2,582) | | | | (1,625) |

| |

| See notes to financial statements. | | | | |

16

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2007 |

| | | | | Cost | | Value |

| |

| |

| |

|

| Assets ($): | | | | | | |

| Investments in securities—See Statement of Investments: | | | | |

| Unaffiliated issuers | | | | 11,383,405 | | 11,437,602 |

| Affiliated issuers | | | | 384,000 | | 384,000 |

| Cash | | | | | | 4,552 |

| Receivable for investment securities sold | | | | 477,993 |

| Receivable for open mortgage-backed dollar rolls—Note 4 | | | | 176,233 |

| Dividends and interest receivable | | | | | | 93,195 |

| Receivable for shares of Common Stock subscribed | | | | 75,500 |

| Unrealized appreciation on forward currency exchange contracts—Note 4 | | 62,354 |

| Prepaid expenses | | | | | | 6,195 |

| | | | | | | 12,717,624 |

| |

| |

| |

|

| Liabilities ($): | | | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | 9,460 |

| Payable for open mortgage-backed dollar rolls—Note 4 | | | | 351,394 |

| Unrealized depreciation on forward currency exchange contracts—Note 4 | | 106,346 |

| Payable for investment securities purchased | | | | 25,203 |

| Payable for futures variation margin—Note 4 | | | | 17,105 |

| Payable for shares of Common Stock redeemed | | | | 6,790 |

| Outstanding options written, at value (premiums received | | | | |

| $2,582)—See Statement of Options Written—Note 4 | | | | 1,625 |

| Accrued expenses | | | | | | 44,993 |

| | | | | | | 562,916 |

| |

| |

| |

|

| Net Assets ($) | | | | | | 12,154,708 |

| |

| |

| |

|

| Composition of Net Assets ($): | | | | | | |

| Paid-in capital | | | | | | 12,056,579 |

| Accumulated undistributed investment income—net | | | | 132,397 |

| Accumulated net realized gain (loss) on investments | | | | (53,052) |

| Accumulated net unrealized appreciation (depreciation) on investments, | | |

| foreign currency transactions and options transactions (including | | |

| $7,622 net unrealized appreciation on financial futures) | | | | 18,784 |

| |

| |

|

| Net Assets ($) | | | | | | 12,154,708 |

| |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | | | |

| | | Class A | | Class C | | Class I |

| |

| |

| |

|

| Net Assets ($) | | 10,512,348 | | 1,043,608 | | 598,752 |

| Shares Outstanding | | 833,228 | | 82,949 | | 47,428 |

| |

| |

| |

|

| Net Asset Value Per Share ($) | | 12.62 | | 12.58 | | 12.62 |

See notes to financial statements.

The Fund 17

| STATEMENT OF OPERATIONS |

| Year Ended October 31, 2007 |

| Investment Income ($): | | |

| Income: | | |

| Interest | | 612,422 |

| Dividends; | | |

| Affiliated issuers | | 24,279 |

| Total Income | | 636,701 |

| Expenses: | | |

| Management fee—Note 3(a) | | 65,546 |

| Registration fees | | 58,770 |

| Auditing fees | | 39,907 |

| Shareholder servicing costs—Note 3(c) | | 29,603 |

| Custodian fees—Note 3(c) | | 11,696 |

| Prospectus and shareholders’ reports | | 9,202 |

| Distribution fees—Note 3(b) | | 8,594 |

| Directors’ fees and expenses—Note 3(d) | | 803 |

| Legal fees | | 172 |

| Loan commitment fees—Note 2 | | 72 |

| Miscellaneous | | 23,183 |

| Total Expenses | | 247,548 |

| Less—expense reimbursement from | | |

| The Dreyfus Corporation due to undertaking—Note 3(a) | | (133,159) |

| Less—reduction in custody fees due to earnings credits—Note 1(c) | | (1,116) |

| Net Expenses | | 113,273 |

| Investment Income—Net | | 523,428 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 33,512 |

| Net realized gain (loss) on financial futures | | 778 |

| Net realized gain (loss) on forward currency exchange contracts | | (75,956) |

| Net Realized Gain (Loss) | | (41,666) |

| Net unrealized appreciation (depreciation) on investments, foreign | | |

| currency transactions and options transactions [including ($10,834) |

| net unrealized (depreciation) on financial futures] | | (74,456) |

| Net Realized and Unrealized Gain (Loss) on Investments | | (116,122) |

| Net Increase in Net Assets Resulting from Operations | | 407,306 |

See notes to financial statements.

18

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended October 31, |

| |

|

| | | 2007 a | | 2006 b |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 523,428 | | 259,642 |

| Net realized gain (loss) on investments | | (41,666) | | 50,972 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (74,456) | | 93,240 |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 407,306 | | 403,854 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | | (419,622) | | (135,349) |

| Class C shares | | (38,774) | | (6,088) |

| Class I shares | | (25,611) | | (8,012) |

| Net realized gain on investments: | | | | |

| Class A shares | | (68,019) | | — |

| Class C shares | | (7,649) | | — |

| Class I shares | | (3,907) | | — |

| Total Dividends | | (563,582) | | (149,449) |

| |

| |

|

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | | 655,488 | | 9,647,803 |

| Class C shares | | 316,237 | | 963,446 |

| Class I shares | | — | | 556,000 |

| Dividends reinvested: | | | | |

| Class A shares | | 484,809 | | 134,854 |

| Class C shares | | 22,864 | | 6,088 |

| Class I shares | | 29,517 | | 8,012 |

| Cost of shares redeemed: | | | | |

| Class A shares | | (500,598) | | (2,513) |

| Class C shares | | (265,428) | | — |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | | 742,889 | | 11,313,690 |

| Total Increase (Decrease) in Net Assets | | 586,613 | | 11,568,095 |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 11,568,095 | | — |

| End of Period | | 12,154,708 | | 11,568,095 |

| Undistributed investment income—net | | 132,397 | | 109,807 |

The Fund 19

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended October 31, |

| |

|

| | | 2007 a | | 2006 b |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class A | | | | |

| Shares sold | | 52,259 | | 771,527 |

| Shares issued for dividends reinvested | | 38,679 | | 10,881 |

| Shares redeemed | | (39,916) | | (202) |

| Net Increase (Decrease) in Shares Outstanding | | 51,022 | | 782,206 |

| |

| |

|

| Class C | | | | |

| Shares sold | | 25,205 | | 76,664 |

| Shares issued for dividends reinvested | | 1,825 | | 492 |

| Shares redeemed | | (21,237) | | — |

| Net Increase (Decrease) in Shares Outstanding | | 5,793 | | 77,156 |

| |

| |

|

| Class I | | | | |

| Shares sold | | — | | 44,426 |

| Shares issued for dividends reinvested | | 2,355 | | 647 |

| Net Increase (Decrease) in Shares Outstanding | | 2,355 | | 45,073 |

| a | | Effective June 1, 2007, the fund redesignated Class R shares to Class I shares. |

| b | | From March 15, 2006 (commencement of operations) to October 31, 2006. |

| See notes to financial statements. |

20

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | Year Ended October 31, |

| |

|

| Class A Shares | | 2007 | | 2006 a |

| |

| |

|

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | | 12.79 | | 12.50 |

| Investment Operations: | | | | |

| Investment income—net b | | .56 | | .32 |

| Net realized and unrealized gain (loss) on investments | | (.11) | | .16 |

| Total from Investment Operations | | .45 | | .48 |

| Distributions: | | | | |

| Dividends from investment income—net | | (.53) | | (.19) |

| Dividends from net realized gain on investments | | (.09) | | — |

| Total Distributions | | (.62) | | (.19) |

| Net asset value, end of period | | 12.62 | | 12.79 |

| |

| |

|

| Total Return (%) c | | 3.57 | | 3.86d |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | | 2.01 | | 3.32e |

| Ratio of net expenses to average net assets | | .89 | | .88e |

| Ratio of net investment income to average net assets | | 4.45 | | 3.99e |

| Portfolio Turnover Rate f | | 75.04 | | 104.30d |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 10,512 | | 10,006 |

| a | | From March 15, 2006 (commencement of operations) to October 31, 2006. |

| b | | Based on average shares outstanding at each month end. |

| c | | Exclusive of sales charge. |

| d | | Not annualized. |

| e | | Annualized. |

| f | | The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended October 31, 2007 and |

| | | October 31, 2006, were 51.54% and 101.24%, respectively. |

| See notes to financial statements. |

The Fund 21

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended October 31, |

| |

|

| Class C Shares | | 2007 | | 2006 a |

| |

| |

|

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | | 12.77 | | 12.50 |

| Investment Operations: | | | | |

| Investment income—net b | | .47 | | .25 |

| Net realized and unrealized gain (loss) on investments | | (.13) | | .17 |

| Total from Investment Operations | | .34 | | .42 |

| Distributions: | | | | |

| Dividends from investment income—net | | (.44) | | (.15) |

| Dividends from net realized gain on investments | | (.09) | | — |

| Total Distributions | | (.53) | | (.15) |

| Net asset value, end of period | | 12.58 | | 12.77 |

| |

| |

|

| Total Return (%) c | | 2.73 | | 3.41d |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | | 2.79 | | 4.12e |

| Ratio of net expenses to average net assets | | 1.64 | | 1.61e |

| Ratio of net investment income to average net assets | | 3.71 | | 3.28e |

| Portfolio Turnover Rate f | | 75.04 | | 104.30d |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 1,044 | | 985 |

| a From March 15, 2006 (commencement of operations) to October 31, 2006. |

| b Based on average shares outstanding at each month end. |

| c Exclusive of sales charge. |

| d Not annualized. |

| e Annualized. |

| f The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended October 31, 2007 and |

| October 31, 2006 were 51.54% and 101.24%, respectively. |

| See notes to financial statements. |

22

| | | Year Ended October 31, |

| |

|

| Class I Shares | | 2007 a | | 2006 b |

| |

| |

|

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | | 12.80 | | 12.50 |

| Investment Operations: | | | | |

| Investment income—net c | | .59 | | .33 |

| Net realized and unrealized gain (loss) on investments | | (.12) | | .17 |

| Total from Investment Operations | | .47 | | .50 |

| Distributions: | | | | |

| Dividends from investment income—net | | (.56) | | (.20) |

| Dividends from net realized gain on investments | | (.09) | | — |

| Total Distributions | | (.65) | | (.20) |

| Net asset value, end of period | | 12.62 | | 12.80 |

| |

| |

|

| Total Return (%) | | 3.75 | | 4.04d |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | | 1.78 | | 3.08e |

| Ratio of net expenses to average net assets | | .64 | | .63e |

| Ratio of net investment income to average net assets | | 4.70 | | 4.25e |

| Portfolio Turnover Rate f | | 75.04 | | 104.30d |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 599 | | 577 |

| a Effective June 1, 2007, the fund redesignated Class R shares to Class I shares. |

| b From March 15, 2006 (commencement of operations) to October 31, 2006. |

| c Based on average shares outstanding at each month end. |

| d Not annualized. |

| e Annualized. |

| f The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended October 31, 2007 and |

| October 31, 2006 were 51.54% and 101.24%, respectively. |

| See notes to financial statements. |

The Fund 23

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier Total Return Advantage Fund (the “fund”) is a separate diversified series of Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering twelve series, including the fund. The fund’s investment objective seeks to maximize total return through capital appreciation and income.The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund’s investment adviser.

On July 1, 2007, Mellon Financial Corporation (‘Mellon Financial”) and The Bank of New York Company, Inc. merged, forming The Bank of New York Mellon Corporation (“BNY Mellon”). As part of this transaction, Dreyfus became a wholly-owned subsidiary of BNY Mellon.

The fund’s Board of Directors approved the redesignation of the fund’s Class R shares as Class I shares, effective June 1, 2007.The description of the eligibility requirements for Class I shares remains the same as it was for Class R shares.

MBSC Securities Corporation (“the Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue 300 million shares of $.001 par value Common Stock.The fund currently offers three classes of shares: Class A (100 million shares authorized), Class C (100 million shares authorized) and Class I (100 million shares authorized). Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

24

As of October 31, 2007, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held 767,131 of Class A, 42,223 of Class C and 42,765 of Class I shares of the fund.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities excluding short-term investments (other than U.S. Treasury Bills), financial futures and forward currency exchange contracts are valued each business day by an independent pricing service (the “Service”) approved by the Board of Directors. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are valued as determined by the Service, based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. Restricted securities, as well as securities or other assets for which recent market quotations are not readily available, that are not valued by a pricing service approved by the Board of Directors, or are determined by the fund not

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

to reflect accurately fair value, are valued at fair value as determined in good faith under the direction of the Board of Directors. The factors that may be considered when fair valuing a security include fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Short-term investments, excluding U.S. Treasury Bills, are carried at amortized cost, which approximates value. Registered open-end investment companies that are not traded on an exchange are valued at their net asset value. Financial futures and options, which are traded on an exchange, are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

The Financial Accounting Standards Board (“FASB”) released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements.The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains

26

or losses realized on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments is recognized on the accrual basis.

The fund has an arrangement with the custodian bank whereby the fund receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

(d) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(e) Dividends to shareholders: It is the policy of the fund to declare and pay dividends from investment income-net, quarterly. Dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

On October 31, 2007, the Board of Directors declared a cash dividend of $.139, $.109 and $.147 per share from undistributed investment income-net for Class A, Class C and Class I, respectively, payable on November 1, 2007 (ex-dividend date), to shareholders of record as of the close of business on October 31, 2007.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

The FASB released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year.Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

At October 31, 2007, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $132,397, accumulated capital losses $59,164 and unrealized appreciation $24,896.

The accumulated capital loss carryover is available to be applied against future net securities profits, if any, realized subsequent to October 31, 2007. If not applied, the carryover expires in fiscal 2015.

The tax characters of distributions paid to shareholders during the fiscal periods ended October 31, 2007 and October 31, 2006 were as follows: ordinary income $507,935 and $149,449 and long-term capital gains $55,647 and $0, respectively.

28

During the period ended October 31, 2007, as a result of permanent book to tax differences, primarily due to the tax treatment for amortization of premiums and paydown gains and losses on mortgage-backed securities, the fund decreased accumulated undistributed investment income-net by $16,831 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowing. During the period ended October 31, 2007, the fund did not borrow under the Facility.

| NOTE 3—Management Fee and Other Transactions With |

| Affiliates: |

(a) Pursuant to a Management Agreement (“Agreement”) with the Manager, the management fee is computed at the annual rate of .55% of the value of the fund’s average daily net assets and is payable monthly. The Manager has undertaken from November 1, 2006, through October 31, 2008, that, if the fund’s aggregate expenses, exclusive of taxes, brokerage fees, Rule 12b-1 distribution plan fees, interest expense, commitment fees, shareholder services plan fees and extraordinary expenses, exceed an annual rate of .65% of the value of the fund’s average daily net assets, the fund may deduct from the payment to be made to the Manager under the Agreement, or the Manager will bear, such excess expense.The expense reimbursement, pursuant to the undertaking, amounted to $133,159 during the period ended October 31, 2007.

During the period ended October 31, 2007, the Distributor retained $72 from commissions earned on sales of the fund’s Class A shares.

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of the average daily net assets of Class C shares. During the period ended October 31, 2007, Class C shares were charged $8,594 pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services.The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2007, Class A and Class C shares were charged $25,466 and $2,865, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended October 31, 2007, the fund was charged $800 pursuant to the transfer agency agreement.

The fund compensates Mellon Bank, N.A., an affiliate of the Manager, under a custody agreement for providing custodial services for the fund. During the period ended October 31, 2007, the fund was charged $11,696 pursuant to the custody agreement.

During the period ended October 31, 2007, the fund was charged $4,660 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $5,268,Rule 12b-1 distribution plan fees $728,shareholder services plan

30

fees $2,454, custodian fees $7,719 chief compliance officer fees $2,812 and transfer agency per account fees $156, which are offset against an expense reimbursement currently in effect in the amount of $9,677.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales (including paydowns) of investment securities, excluding short-term securities, financial futures, options transactions and forward currency exchange contracts during the period ended October 31, 2007, amounted to $9,186,140 and $8,744,303, respectively, of which $2,737,564 in purchases and $2,738,850 in sales were from mortgage dollar roll transactions.

A mortgage dollar roll transaction involves a sale by the fund of mortgage related securities that it holds with an agreement by the fund to repurchase similar securities at an agreed upon price and date. The securities purchased will bear the same interest rate as those sold, but generally will be collateralized by pools of mortgages with different prepayment histories than those securities sold.

The fund may invest in financial futures contracts in order to gain exposure to or protect against changes in the market. The fund is exposed to market risk as a result of changes in the value of the underlying financial instruments. Investments in financial futures require the fund to “mark to market” on a daily basis, which reflects the change in market value of the contracts at the close of each day’s trading. Accordingly, variation margin payments are received or made to reflect daily unrealized gains or losses.When the contracts are closed, the fund recognizes a realized gain or loss.These investments require initial margin deposits with a broker, which consist of cash or cash equivalents. The amount of these deposits is determined by the exchange or Board

The Fund 31

NOTES TO FINANCIAL STATEMENTS (continued)

of Trade on which the contract is traded and is subject to change. Contracts open October 31, 2007, are set forth in the Statement of Financial Futures.

The fund may purchase and write (sell) put and call options in order to gain exposure to or to protect against changes in the market.

As a writer of call options, the fund receives a premium at the outset and then bears the market risk of unfavorable changes in the price of the financial instrument underlying the option. Generally, the fund would incur a gain, to the extent of the premium, if the price of the underlying financial instrument decreases between the date the option is written and the date on which the option is terminated. Generally, the fund would realize a loss, if the price of the financial instrument increases between those dates.

As a writer of put options, the fund receives a premium at the outset and then bears the market risk of unfavorable changes in the price of the financial instrument underlying the option. Generally, the fund would incur a gain, to the extent of the premium, if the price of the underlying financial instrument increases between the date the option is written and the date on which the option is terminated. Generally, the fund would realize a loss, if the price of the financial instrument decreases between those dates.

The following summarizes the fund’s call/put options written for the period ended October 31, 2007:

| | | Face Amount | | |

| | | Covered by | | Premiums |

| Options Written: | | Contracts ($) | | Received ($) |

| |

| |

|

| Contracts outstanding | | | | |

| October 31, 2006 | | — | | — |

| Contracts written | | 4,000 | | 2,582 |

| Contracts outstanding | | | | |

| October 31, 2007 | | 4,000 | | 2,582 |

The fund enters into forward currency exchange contracts to gain exposure to foreign currency, hedge its exposure against changes in

32

exchange rates on its foreign portfolio holdings and to settle foreign currency transactions. When executing forward currency exchange contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future.With respect to sales of forward currency exchange contracts, the fund would incur a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward currency exchange contracts, the fund would incur a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates.The fund is also exposed to credit risk associated with counterparty nonperformance on these forward currency exchange contracts which is typically limited to the unrealized gain on each open contract.The following summarizes open forward currency exchange contracts at October 31, 2007:

| | | Foreign | | | | | | Unrealized |

| Forward Currency | | Currency | | | | | | Appreciation |

| Exchange Contracts | | Amounts | | Cost ($) | | Value ($) (Depreciation) ($) |

| |

| |

| |

|

| Purchases: | | | | | | | | |

| British Pound, | | | | | | | | |

| expiring 12/19/2007 | | 491,000 | | 989,129 | | 1,018,442 | | 29,313 |

| Japanese Yen, expiring | | | | | | | | |

| 12/19/2007 | | 24,002,000 | | 207,695 | | 209,321 | | 1,626 |

| New Zealand Dollar, | | | | | | | | |

| expiring 12/19/2007 | | 399,000 | | 273,992 | | 305,407 | | 31,415 |

| Sales: | | | | Proceeds ($) | | | | |

| Australian Dollar, | | | | | | | | |

| expiring 12/19/2007 | | 484,000 | | 419,311 | | 447,366 | | (28,055) |

| Canadian Dollar, | | | | | | | | |

| expiring 12/19/2007 | | 261,000 | | 248,229 | | 274,855 | | (26,626) |

| Euro, expiring | | | | | | | | |

| 12/19/2007 | | 138,000 | | 193,657 | | 199,780 | | (6,123) |

The Fund 33

NOTES TO FINANCIAL STATEMENTS (continued)

| | | Foreign | | | | | | Unrealized |

| Forward Currency | | Currency | | | | | | Appreciation |

| Exchange Contracts | | Amounts | | Proceeds ($) | | Value ($) (Depreciation) ($) |

| |

| |

| |

|

| Sales (continued): | | | | | | | | |

| Norwegian Krone, | | | | | | | | |

| expiring 12/19/2007 | | 1,987,000 | | 348,600 | | 368,279 | | (19,679) |

| Swedish Krone, | | | | | | | | |

| expiring 12/19/2007 | | 761,000 | | 111,519 | | 119,731 | | (8,212) |

| Swiss Franc, | | | | | | | | |

| expiring 12/19/2007 | | 851,000 | | 718,874 | | 736,525 | | (17,651) |

| Total | | | | | | | | (43,992) |

| At October 31, 2007, the cost of investments for federal income tax |

| purposes was $11,781,356; accordingly, accumulated net unrealized |

| appreciation on investments was $40,246, consisting of $91,455 gross |

| unrealized appreciation and $51,209 gross unrealized depreciation. |

34

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

Shareholders and Board of Directors

Dreyfus Premier Total Return Advantage Fund

We have audited the accompanying statement of assets and liabilities, including the statements of investments, financial futures and securities sold short, of Dreyfus Premier Total Return Advantage Fund (one of the fund’s comprising Advantage Funds, Inc.) as of October 31, 2007, and the related statements of operations for the year then ended and the changes in net assets and financial highlights for the periods indicated. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2007 by correspondence with the custodian and others.We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier Total Return Advantage Fund at October 31, 2007, and the results of its operations for the year then ended and the changes in its net assets and the financial highlights for the indicated periods, in conformity with U.S. generally accepted accounting principles.

| | New York, New York

December 20, 2007

|

The Fund 35

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates 99.69% of ordinary dividends paid during the fiscal year ended October 31, 2007 as qualifying for “interest related dividends. Also, the fund hereby designates $.0600 per share as a long-term capital gain distribution and $.0258 per share as a short-term capital gain distribution paid on December 28, 2006.

36

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (64) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • Century Business Services, Inc., a provider of outsourcing functions for small and medium size |

| companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director |

| No. of Portfolios for which Board Member Serves: 165 |

| Peggy C. Davis (64) |

| Board Member (2006) |

| Principal Occupation During Past 5 Years: |

| • Shad Professor of Law, New York University School of Law (1983-present) |

| • Writer and teacher in the fields of evidence, constitutional theory, family law, social sciences |

| and the law, legal process and professional methodology and training |

| No. of Portfolios for which Board Member Serves: 65 |

| David P. Feldman (67) |

| Board Member (1996) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • BBH Mutual Funds Group (11 funds), Director |

| • The Jeffrey Company, a private investment company, Director |

| No. of Portfolios for which Board Member Serves: 49 |

The Fund 37

BOARD MEMBERS INFORMATION (Unaudited) (continued)

| James F. Henry (76) |

| Board Member (2006) |

| Principal Occupation During Past 5 Years: |

| • President,The International Institute for Conflict Prevention and Resolution, a non-profit |

| organization principally engaged in the development of alternatives to business litigation |

| (Retired 2003) |

| • Advisor to The Elaw Forum, a consultant on managing corporate legal costs |

| • Advisor to John Jay Homestead (the restored home of the first U.S. Chief Justice) |

| • Individual Trustee of several trusts |

| Other Board Memberships and Affiliations: |

| • Director, advisor and mediator involved in several non-profit organizations, primarily engaged |

| in domestic and international dispute resolution, and historic preservation |

| No. of Portfolios for which Board Member Serves: 40 |

| Ehud Houminer (67) |

| Board Member (1993) |

| Principal Occupation During Past 5 Years: |

| • Executive-in-Residence at the Columbia Business School, Columbia University |

| Other Board Memberships and Affiliations: |

| • Avnet Inc., an electronics distributor, Director |

| • International Advisory Board to the MBA Program School of Management, Ben Gurion |

| University, Chairman |

| No. of Portfolios for which Board Member Serves: 67 |

| Gloria Messinger (77) |

| Board Member (1993) |

| Principal Occupation During Past 5 Years: |

| • Arbitrator for American Arbitration Association and National Association of Securities Dealers, Inc. |

| • Consultant in Intellectual Property |

| Other Board Memberships and Affiliations: |

| • Theater for a New Audience, Inc., Director |

| • Brooklyn Philharmonic, Director |

| No. of Portfolios for which Board Member Serves: 40 |

38

| Dr. Martin Peretz (68) |

| Board Member (2006) |

| Principal Occupation During Past 5 Years: |

| • Editor-in-Chief of The New Republic Magazine |

| • Lecturer in Social Studies at Harvard University (1965-2002) |

| • Director of TheStreet.com, a financial information service on the web |

| Other Board Memberships and Affiliations: |

| • American Council of Trustees and Alumni, Director |

| • Pershing Square Capital Management, Adviser |

| • Montefiore Ventures, General Partner |

| • Harvard Center for Blood Research,Trustee |

| • Bard College,Trustee |

| • Board of Overseers of YIVO Institute for Jewish Research, Chairman |

| No. of Portfolios for which Board Member Serves: 40 |

| Anne Wexler (77) |

| Board Member (1996) |

| Principal Occupation During Past 5 Years: |

| • Chairman of the Wexler & Walker Public Policy Associates, consultants specializing in |

| government relations and public affairs from January 1981 to present |

| Other Board Memberships and Affiliations: |

| • Wilshire Mutual Funds (5 funds), Director |

| • The Community Foundation for the National Capital Region, Director |

| • Member of the Council of Foreign Relations |

| • Member of the National Park Foundation |