PROVIDENT BANKSHARES

C O R P O R A T I O N

Acquisition of:

Expanding in High Growth Markets

November 3, 2003

Southern Financial Bank

Filed by Provident Bankshares Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Southern Financial Bancorp, Inc.

Commission File No. 0-22836

The following is a conference call presentation, hosted on November 3, 2003, in connection with Provident Bankshares Corporation’s proposed merger with Southern Financial Bancorp, Inc., a Virginia corporation:

Provident Bankshares Corporation and Southern Financial Bancorp, Inc. will be filing a joint proxy statement/prospectus and other relevant documents concerning the merger with the United States Securities and

Exchange Commission (the "SEC").

WE URGE INVESTORS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, BECAUSE THEY CONTAIN IMPORTANT

INFORMATION.

Investors will be able to obtain these documents free of charge at the SEC's web site (www.sec.gov). In addition, documents filed with the SEC by Provident Bankshares Corporation will be available free of charge

from the Investor Relations Department at Provident Bankshares Corporation, 114 East Lexington Street, Baltimore, Maryland 21202. Documents filed with the SEC by Southern Financial Bancorp, Inc. will be

available free of charge from the Investor Relations Department at Southern Financial Bancorp, Inc., 37 East Main Street, Warrenton, Virginia 20186.

The directors, executive officers, and certain other members of management of Provident Bankshares Corporation and Southern Financial Bancorp, Inc. may be soliciting proxies in favor of the merger from the

companies' respective shareholders. For information about these directors, executive officers, and members of management, shareholders are asked to refer to the most recent proxy statements issued by the

respective companies, which are available on their web sites and at the addresses provided in the preceding paragraph.

FORWARD-LOOKING STATEMENTS AND ASSOCIATED RISK FACTORS

This release, and the associated conference call, web cast, other written materials, and statements management may make, may contain certain forward-looking statements regarding the

Company's prospective performance and strategies within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995, and is including this statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of the Company, are generally identified by use of the words

"plan," "believe," "expect," "intend," "anticipate," "estimate," "project," or other similar expressions. The Company's ability to predict results or the actual effects of its plans and strategies

is inherently uncertain. Accordingly, actual results may differ materially from anticipated results.

The following factors, among others, could cause the actual results of the merger to differ materially from the expectations stated in this release and the associated conference call and web

cast: the ability of the companies to obtain the required shareholder or regulatory approvals of the merger; the ability of the companies to consummate the merger; the ability of Southern

Financial to timely complete its acquisition of Essex Bancorp, Inc.; the ability to successfully integrate the companies following the merger; a materially adverse change in the financial

condition of either company; the ability to fully realize the expected cost savings and revenues; and the ability to realize the expected cost savings and revenues on a timely basis.

Other factors that could cause the actual results of the merger to differ materially from current expectations include a change in economic conditions; changes in interest rates, deposit

flows, loan demand, real estate values, and competition; changes in accounting principles, policies, or guidelines; changes in legislation and regulation; and other economic, competitive,

governmental, regulatory, geopolitical, and technological factors affecting the companies' operations, pricing, and services.

The Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

###

TRANSACTION HIGHLIGHTS

Transaction continues Provident’s expansion of

market share in the affluent, high growth markets of

Northern Virginia

Extends presence into attractive markets of

Charlottesville and Richmond

Combines retail strength of Provident with business

banking expertise of Southern Financial

Accretive to GAAP and Cash EPS in the first full year of combined operations

Identified, achievable cost savings

TABLE OF CONTENTS

Transaction Summary

Strategic Benefits

Overview of Southern Financial Bancorp

Pro Forma Financial Impact

TRANSACTION SUMMARY

SUMMARY OF SIGNIFICANT TERMS

(1) Based upon 7,416,329 diluted shares outstanding via the treasury stock method of accounting for options.

(2) Based on PBKS average share closing price during the month of October of $30.68

Value per Southern Financial Bancorp Share:

$44.50

Transaction Value:(1)

$330 million

Structure:

75% stock / 25% cash

Consideration:(2)

1.0875 shares of Provident common stock and $11.125

Estimated Cost Savings:

$ 7 million pre-tax (24.6% of pro forma non-interest expense)

Due Diligence:

Completed

Board Representation:

Georgia S. Derrico

R. Roderick Porter

Required Approvals:

Provident Shareholders

Southern Financial Shareholders

Customary Regulatory Approvals

Expected Closing:

Second Quarter of 2004

SUMMARY OF SIGNIFICANT TERMS

TRANSACTION PRICING AND

COMPARABLES

Source: SNL Financial, Company Filings, Press Releases & KBW

Comparable Transactions include bank transactions greater than $50 million since 1/1/2002

(1) Includes selling companies headquartered in MD, NC, NJ, PA, SC or VA

(2) Southern Financial Bancorp, Inc. is pro forma for the pending acquisition of Essex Bancorp

Mid-Atlantic Comparable Transactions

(1)

PBKS/ SFFB

(2)

High

Median

Low

Premium to Market:

19.4%

68.5%

37.3%

11.0%

Price / LTM Reported EPS:

22.9x

40.7x

20.4x

17.1x

Price / Estimated EPS:

19.0x

19.3x

19.0x

16.7x

Price / Book Value:

2.72x

3.80x

2.88x

1.92x

Price / Tangible Book Value:

3.40x

3.91x

3.04x

2.18x

STRATEGIC BENEFITS

PROVIDENT KEY STRATEGIES

Grow commercial banking market share in the Baltimore-Washington corridor

Build market share and expand branch network in the Washington suburbs

Grow core banking business

Improve financial fundamentals

STRATEGIC BENEFITS

Transaction continues Provident’s expansion of market share in the affluent, high growth

markets of Northern Virginia

Extends presence into attractive markets of Charlottesville and Richmond

Adds significant competitive advantage for business banking companies with a powerful

integrated suite of online banking services

Shared philosophy of customer-oriented, community focus and excellent credit quality

Unique opportunity to achieve cost savings

Traditional cost centers (non-customer interface/operational redundancies)

Allows Provident to scale back its de novo branch expansion

The total is greater then the sum-of-the-parts

Consumer strength of Provident plus the commercial strength of Southern Financial

VIRGINIA: ONE OF THE NATION’S BEST

BANKING MARKETS

Population:

7.4 million (12th largest state)

Projected Population Growth (‘03 – ‘08):

6.5% (14th highest growth rate in the nation)

Median Household Income:

$51,923 (13th highest in the nation and

10% above the national average)

Median Household Income Growth (’03 – ’08):

14.4% (11th highest growth rate in the nation)

Source: SNL Financial and Claritas

PRO FORMA FRANCHISE

Southern Financial’s branches are located in Virginia's best markets

County Demographics

Source: SNL Financial and Claritas

* Southern Financial Bancorp, Inc. is pro forma for the pending acquisition of Essex Bancorp

PBKS Branches

SFFB Branches*

4

-

8% Projected Growth

+8% Projected Growth

PBKS Branches

SFFB Branches*

4

-

8% Projected Growth

+8% Projected Growth

STRATEGIC BENEFITS

Strengthen positions in the highly affluent and fast growing markets of Loudoun, Prince William, and Fairfax

counties

Entries into the following counties: Fauquier, Henrico, Hanover, Emporia, Suffolk, Spotsylvania, Winchester,

Manassas, Frederick, Fredericksburg, Richmond City, Charlottesville, Norfolk, and Albemarle

79% of Southern Financial’s markets are projected to grow at a faster pace than the US average

Source: SNL Financial and Claritas

Deposit data as of 6/30/2002

Median

Pro Forma w/ SFFB

5 yr.

HH Income

5 yr.

Deposits

Population

Projected

2003

Projected

County

Branches

($000)

2003

Growth

($)

Growth

Fairfax (City), VA

3

64,385

21,879

3.2%

75,544

13.6%

Fairfax, VA

15

181,344

1,012,763

7.3%

90,409

12.6%

Fredericksburg, VA

2

7,405

19,956

4.8%

39,208

13.1%

Loudoun, VA

5

47,137

206,849

28.2%

92,979

17.5%

Prince William, VA

4

13,512

307,628

13.9%

72,211

11.9%

BALANCED LOAN PORTFOLIO

* Southern Financial Bancorp, Inc. is pro forma for the pending acquisition of Essex Bancorp

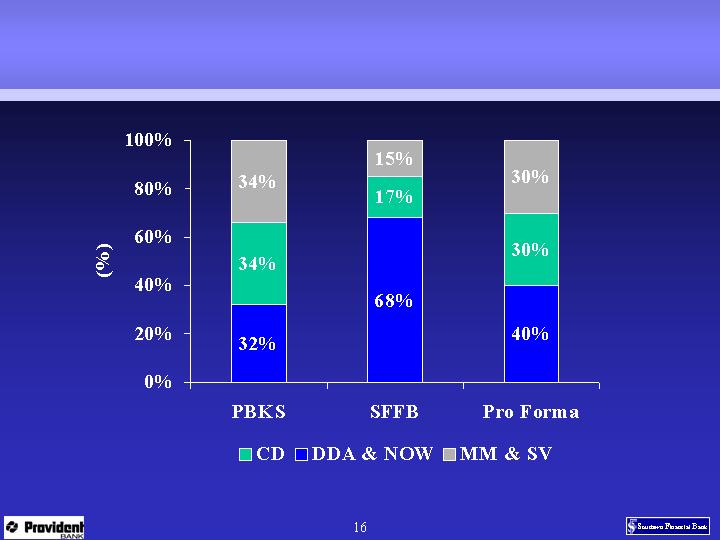

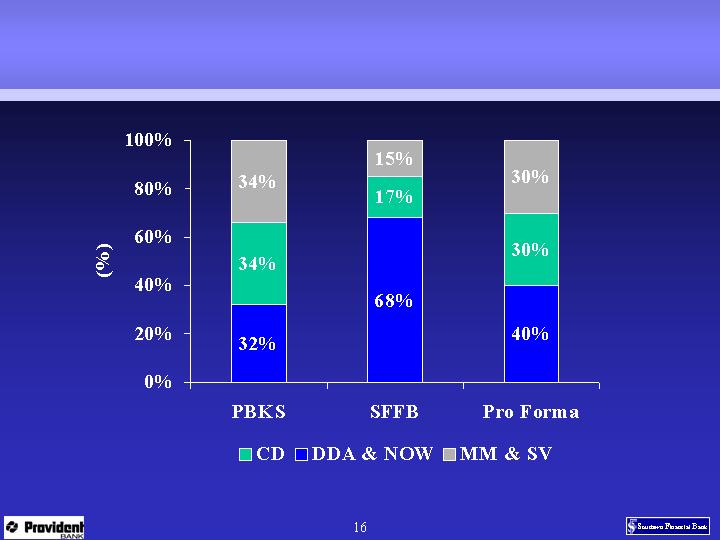

PRO FORMA DEPOSIT MIX

Note: Data as of 6/30/2003 and is not pro forma for the pending acquisition of Essex Bancorp, Inc.

OVERVIEW OF SOUTHERN FINANCIAL BANCORP

OVERVIEW OF SOUTHERN

FINANCIAL BANCORP

Largest Virginia bank operating in the Commonwealth’s most attractive markets

Middle market and small business focus

Leading SBA lender

Franchise Summary

(1) Southern Financial Bancorp, Inc. is pro forma for the pending

acquisition of Essex Bancorp

(2) 12/31/2000 to 9/30/2003, excluding acquisitions

I 76

($ in Thousands)

Headquarters:

Warrenton, VA

Assets:

(1)

$1,487,375

Loans:

(1)

871,696

Deposits:

(1)

1,100,245

Equity:

(1)

115,451

ROAE LTM:

1.21%

ROAA LTM:

14.61%

Net Interest Margin:

3.91%

Branches:

(1)

33

Loan CAGR

(2)

:

22.0%

OVERVIEW OF SOUTHERN

FINANCIAL BANCORP

Southern Financial’s existing platform of services for small businesses include:

SBA Lending

Small Business cash flow and operating tools such as:

ARTS (Accounts Receivable Tracking System)

WebLockBox – payment processing service

Receivables financing

Checking and Sweep Accounts

ACH Client – allows users to initiate transactions such as direct deposit, consumer debits

and credits, vendor payments and Federal and State tax payments

Services

Total Loans: $625M

Total Deposits: $852M

Balance Sheet Composition and Asset Quality

Note: Data as of 6/30/2003 and is not pro forma for the pending acquisition of Essex Bancorp, Inc.

OVERVIEW OF SOUTHERN

FINANCIAL BANCORP

Nonperforming Assets / (Loans + OREO)

0.48%

Reserves / Loans

1.73%

Reserves / Nonperforming Assets

360.44%

PRO FORMA FINANCIAL IMPACT

COST SAVINGS ASSUMPTIONS

($ in Thousands)

Corporate Expenses

Salaries and Benefits:

$4,000

Insurance, Taxes, Fees:

800

Operations:

900

Branch Level:

900

Other:

400

Total

$7,000

GAAP & CASH EPS IMPACT

(1) Based on First Call consensus estimates of $2.23 per share and grown at 8% for 2005

(2) Based on First Call consensus estimates of $2.34 per share and grown at 10% for 2005

(3) 2004 reflects only 6 months of earnings as a result of purchase accounting

(4) Based on pre-tax cost savings of $7 million and grown at 5% per year, includes elimination of SFFB's estimated CDI amortization

(5) Includes opportunity cost of cash of deal charge and financing cost related to the cash portion of the transaction

(6) Assumes 4.0% core deposit intangible, 10 year straight-line amortization

Projected for

2004

2005

Provident Earnings

(1)

$56.2

$60.7

Southern Financial Earnings

(2)

8.5

(3)

18.8

Anticipated After-tax cost savings

(4)

2.1

(3)

5.7

After-tax Financing Cost

(5)

(1.5)

(3)

(3.1)

After-tax Core Deposit Amortization Expense

(6)

(0.6)

(3)

(1.2)

Pro Forma Net Income

$64.8

$80.9

Pro Forma GAAP EPS

$2.21

$2.43

GAAP Impact to Provident ($)

($0.02)

$0.02

GAAP Impact to Provident (%)

(0.67)

%

1.02

%

Pro Forma Cash Net Income

$65.6

$82.3

Pro Forma Cash EPS

$2.24

$2.47

Cash Impact to Provident ($)

$0.00

$0.06

Cash Impact to Provident (%)

0.15

%

2.36

%

PRO FORMA FINANCIAL IMPACT

Capital Ratios

(1) Assumes no asset growth and a dividend payout ratio of 45%.

Pro Forma

(1)

09/30/2003

06/30/2004

12/31/2005

Tangible Equity / Tangible Assets

6.18%

5.19%

6.23%

Leverage Ratio

7.61

7.34

8.39

Tier 1 Ratio

11.99

11.17

12.76

Total Capital Ratio

13.11

12.29

13.89

TRANSACTION INTEGRATION

EXPERIENCE

Three prior acquisitions

At the time of acquisition, First Citizens Financial represented 25% of our assets; Southern Financial Bancorp

represents 29% of our assets today

Provident has more than sufficient systems capacity to accommodate Southern Financial’s customers

We anticipate the Southern Financial Bancorp acquisition and integration will be as successful as Citizens

Financial

(1) Southern Financial Bancorp, Inc. is pro forma for the pending acquisition of Essex Bancorp

Retail

Company

Employees

Accounts

First Citizens Financial

188

56,400

Southern Financial Bancorp

216

47,414

(1)

TRANSACTION STRENGTHS

Strategic Fit

Cultural Compatibility

Financial Opportunity

PROVIDENT BANKSHARES

CORPORATION

(www.provbank.com)

Contact:

PBKS:

Media: Lillian Kilroy: (410) 277-2833

Investment Community: Josie Porterfield: (410) 277-2889

SFFB:

Media & Investment Community: Patricia Ferrick (540)349-3900

S

outhern

F

inancial

B

ank