- EMN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Eastman Chemical (EMN) DEF 14ADefinitive proxy

Filed: 23 Mar 22, 1:26pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

EASTMAN CHEMICAL COMPANY

(Name of Registrant as Specified in its Charter)

Not applicable.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

LETTER FROM OUR CEO AND BOARD CHAIR

March 17, 2022

| Dear Fellow Eastman Stockholders:

Thank you for your continued investment in Eastman. I, and the rest of the Board of Directors, invite you to attend the 2022 Annual Meeting of Stockholders. Due to the ongoing COVID-19 pandemic our meeting will be held virtually on May 5, 2022, at 11:30 a.m. (EDT) via live webcast, though stockholders may log-in beginning at 11:15 a.m. (EDT). We encourage you to access the Annual Meeting prior to the start time. The business to be considered and voted upon at the meeting is explained in this proxy statement. A copy of Eastman’s 2021 Annual Report to Stockholders is also included with these materials.

It is no understatement to say that 2021 was a challenging year. I am enormously proud of how well the Eastman team served the increased demand, addressed inflation by making appropriate price adjustments, and managed our structural costs so that we can continue to invest in growth. They did this while advancing our innovation programs and transformational initiatives, and so much more. We again demonstrated that we are a world-class team that can take on any challenge and win in any environment.

As we continued to navigate in a COVID-19 environment, we maintained our focus on the health and safety of our people. I am grateful to the Eastman team who continue to adapt to an ever-changing environment and come together as never before to keep each other safe and keep our operations running. As new variants emerged, we continued to quickly and decisively adjust our operations and multiple layers of protection to keep our employees safe and preserve our operational integrity.

|

|  | |

Our Innovation-Driven Growth Model is Succeeding

Our innovation-driven growth model is the heart of who we are and how we win in the marketplace every day. This model has delivered results and we have demonstrated our portfolio can grow above our underlying markets with products that have higher margins and drive strong mix upgrade. | Circular Economy is a New Vector of Significant Growth

The circular economy is emerging as a powerful new vector of growth for Eastman. We have a great opportunity to deliver attractive growth by addressing the plastic waste crisis and reducing our impact on climate at the same time through our molecular recycling technologies. We have made great progress in scaling up our innovation with our two announced projects, the first in the U.S. and the second in France, which we announced earlier this year. | |

Despite the dynamic external environment, over the past year we continued to make significant progress across the five themes described below that create value for Eastman.

Together, we believe these five themes position us for another year of growth and value creation. Innovation and market development are expected to drive organic growth above our underlying end markets consistent with what we do every year. Our portfolio of specialty products is expected to deliver strong top-line and bottom-line growth. We believe we are well positioned to create our own growth and build upon what was a record year in 2021.

Your vote is important for this year’s annual meeting, regardless of the number of shares you own. Signing and returning a proxy card or submitting your proxy by Internet or telephone in advance of the meeting will not prevent you from voting electronically during the meeting if you attend virtually but will assure that your vote is counted if you are unable to attend the meeting online. Whether you choose to vote by proxy card or by telephone or the Internet, I urge you to vote as soon as possible.

Thank you for your support of our Company. We look forward to welcoming you to our annual meeting.

Sincerely,

MARK J. COSTA

CEO and Board Chair

|  |  | ||

Strengthening Execution to Convert Growth to Value

Our aggressive pursuit of productivity is part of the Eastman culture. We continue to make investments in strengthening our execution capability to drive the top line and translate it to the bottom line, including a new integrated business planning system that will enable us to support growth better while keeping inventory levels low. We are also transforming our operations by modernizing and digitizing our capabilities to improve our reliability and cost competitiveness. | Sustainability and ESG are Integrated into How We Win

At Eastman, sustainability is a business imperative. That’s why environmental, social, and governance (“ESG”) is integrated into how we do business at Eastman. We have the responsibility and opportunity to lead, join others to address climate change, mainstream circularity as an economic model, and build a more inclusive and equitable world. You can read more about our ESG initiatives and the progress that we are making in the pages of this proxy statement. | Power of Cash Flow and the Balance Sheet

We have developed a record of strong cash flow in most every environment, achieving a new level of performance. We returned cash to our stockholders and have otherwise put cash to work in a disciplined manner. | ||

March 17, 2022

| Dear Fellow Eastman Stockholders:

This past year has been rewarding yet challenging as disrupted supply chains, soaring inflation, labor shortages, and the ongoing impacts of COVID-19 and its variants created a very dynamic environment. As Lead Director, I can assure you that the Board of Directors remained highly engaged throughout the year, supporting the Company’s efforts to mitigate the impacts of these challenges. We are extremely proud of how well the Eastman team navigated through uncertainty and difficulty to deliver a record year in 2021. They did this while continuing to make significant progress on Eastman’s innovation-driven growth strategy, which the Board is highly committed to.

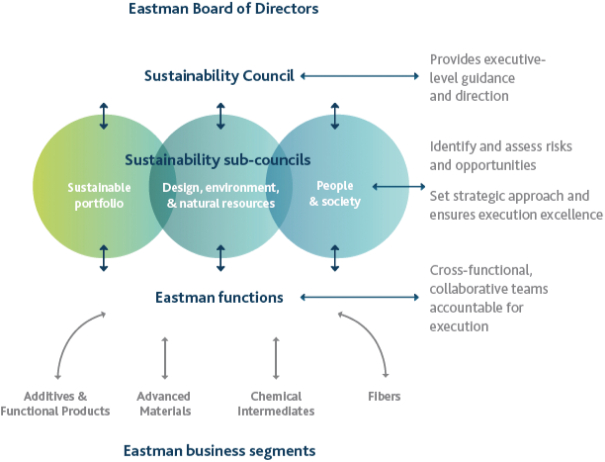

Integrating ESG into Our Strategy

The Board oversees the strategic and operational direction of the Company, as well as risks associated with our business plan. Over the last year, the Board has supported and encouraged management’s actions amid the COVID-19 pandemic, as Eastman remains focused on innovating products and services that enhance the quality of life in a material way.

Integrated into Eastman’s strategy are the Company’s ESG and sustainability initiatives. Over the past year, Eastman has taken significant steps to more clearly define these initiatives and how they link to the growth strategy, including the Company’s intent to become a leader in the circular economy and create a new vector of growth. The Company made great progress on these initiatives in 2021, which has resulted in an increased level and quality of engagement with highly engaged stockholders.

With ESG and sustainability business imperatives for Eastman, the Company outlined our intent to help address climate change, which includes our goals of being carbon neutral by 2050, mainstream circularity as an economic model, and helping to build a more inclusive and equitable world. I encourage you to review Eastman’s sustainability report, A Better Circle, which you can find on www.eastman.com. This report outlines the organization’s ambitious sustainability goals, against which significant progress was made in 2021, notably in the area of circularity. In early 2021, Eastman began construction on a world-scale material-to-material molecular recycling facility in Kingsport, Tennessee. Also, earlier this year, the Company announced plans to build the world’s largest material-to-material molecular recycling facility in France. Using technology with a lower carbon footprint, these facilities will enable the Company to recycle hard-to-recycle plastic waste that is currently being incinerated or sent to landfills. These are bold and ambitious projects that position Eastman as a leader in the circular economy and creates a new vector of growth for the Company.

Additional detail around these and other ESG initiatives can be found within the pages of this proxy statement. |

Our Culture of Inclusivity and Diversity

I would also like to highlight the Company’s efforts to grow and strengthen its culture of inclusivity and diversity. The past few years have brought unprecedented change and disruption to global communities, particularly for historically disadvantaged populations. COVID-19, racial injustice, and economic upheaval have magnified longstanding inequalities and brought our inclusion and diversity (“I&D”) efforts into sharper focus. We have accelerated our efforts to create an environment that fosters a sense of belonging, acceptance, and safety. This is an area of great interest to the Board, with members engaging through regular progress updates, as well as engaging with employees. As we strive to increase diversity throughout the workforce, we aim to do the same at the Board level as well. To increase transparency and accountability in this area, last year, Eastman launched the Company’s first I&D Annual Report, which details the Company’s strategy and progress against the Company’s goals.

We remain committed to maintaining a strong alignment between Company performance and our executive compensation program. The Board is committed to ensuring that our executive compensation programs appropriately incentivize and reward executives when they deliver operating and financial performance, even amid challenging industry conditions. As another measure of accountability, the Board has taken steps to provide greater alignment between the outcomes of the Company’s I&D and ESG efforts and executive compensation.

Improving Transparency

Transparency is important to us, which is why we are enhancing our disclosure practices. We hope you see evidence of this as you review the pages of this proxy statement. You will see our commitment to ESG and how it is integrated into Eastman’s corporate strategy. Through this document, we aim to create a clearer understanding of how our governance and compensation practices drive accountability and performance.

Investor Engagement and Outreach

On behalf of the Board, I want to thank Eastman’s investors for engaging with the Company over the last year and sharing their perspectives on what we are doing well and where we can continue to improve. Feedback the Company receives from stockholders is regularly reported to the Board and its Committees, as appropriate, and is an integral component of the Board’s thoughtful deliberations on the Company’s strategy, operations, governance practices, executive compensation program, and oversight of sustainability initiatives.

Our Commitment to Creating Long-Term Value

Your Board is highly engaged in the Company’s approach to creating long-term value for you, the stockholders. We take our responsibility seriously and understand the trust you place in us to act in your best interest. We are committed to executing our governance responsibilities and providing appropriate oversight of the Company’s operations, long-term strategy, and risk exposure. As Company stewards, we are focused on supporting the strategies and approaches that will deliver strong financial performance and long-term sustainable growth.

On behalf of the Board of Directors, thank you for the trust that you have placed in us. We look forward to serving your interests throughout the upcoming year.

Sincerely,

DAVID W. RAISBECK

Lead Director

2022 Proxy Statement

2022 Proxy Statement

Table of Contents

Note About Forward-Looking Statements

Certain statements made in this proxy statement are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act (Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended), including statements relating to expectations, strategies, and plans for businesses and for the whole of Eastman; capital allocation; environmental matters and opportunities (including potential risks associated with physical impacts of climate change and related voluntary and regulatory carbon requirements); and our environmental, social, and governance objectives and plans, including our I&D efforts. In some cases, you can identify forward-looking statements by terminology such as “anticipates”, “believes”, “estimates”, “expects”, “intends”, “may”, “plans”, “projects”, “forecasts”, “will”, “would”, and similar expressions or expressions of the negative of these terms.

Forward-looking statements are based upon certain underlying assumptions as of the date such statements were made. Such assumptions are based upon internal estimates and other analyses of current market conditions and trends, management expectations, plans, and strategies, economic conditions, and other factors. Forward-looking statements and the assumptions underlying them are necessarily subject to risks and uncertainties inherent in projecting future conditions and results. Actual results could differ materially from expectations expressed in the forward-looking statements if one or more of the underlying assumptions and expectations proves to be inaccurate or is unrealized. The known material factors, risks, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements are identified and discussed in the Risk Factors section of our most recent annual or quarterly report and in other reports we have filed with the U.S. Securities and Exchange Commission (the “SEC”).

The Company cautions you not to place undue reliance on forward-looking statements, which speak only as of the date of this proxy statement. Except as may be required by law, the Company undertakes no obligation to update or alter these forward-looking statements, whether as a result of new information, future events, or otherwise. Investors are advised, however, to consult any further public Company disclosures (such as filings with the SEC, Company press releases, or pre-noticed public investor presentations) on related subjects.

2022 Proxy Statement

|

Eastman Chemical Company

200 South Wilcox Drive

Kingsport, Tennessee 37662

(423) 229-2000

OF STOCKHOLDERS

Meeting Information

| How to Vote by Proxy | |||||||||

DATE: Thursday, May 5, 2022

TIME: 11:30 a.m. (EDT)

| LOCATION: Virtually at https://register.proxypush.com/emn |

Only stockholders of record at the close of business on March 15, 2022 are entitled to notice of, and to vote at, the meeting. It is important that your shares be represented and voted at the meeting. Please vote by proxy in one of these ways:

By Internet at the web address shown on your proxy card, electronic form of proxy, or voting instruction form.

Use the toll-free telephone number shown on your proxy card, electronic form of proxy, or voting instruction form (if you received the proxy materials by mail from a broker or bank).

Mark, sign, date, and promptly return or submit your proxy card, electronic form of proxy, or voting instruction form (in the postage-paid envelope provided if you are returning a paper proxy card).

Signing and returning the proxy card or submitting your proxy electronically by Internet or telephone does not affect your right to vote electronically during the meeting if you attend the meeting virtually. | ||||||||

To Our Stockholders:

The 2022 Annual Meeting of Stockholders of Eastman Chemical Company will be held virtually on May 5, 2022 at 11:30 a.m. (EDT) via live webcast at https://register.proxypush.com/emn.

| ||||||||||

Voting Items | Board Recommendation

| |||||||||

1. ELECT DIRECTORS. To elect ten directors to serve until the 2023 Annual Meeting of Stockholders and their successors are duly elected and qualified. |

FOR each director nominee | |||||||||

2. ADVISORY APPROVAL OF EXECUTIVE COMPENSATION. To approve, on an advisory basis, the compensation of certain of the Company’s executive officers. |

FOR | |||||||||

3. RATIFY APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for 2022. |

FOR | |||||||||

4. ADVISORY VOTE ON STOCKHOLDER PROPOSAL. To vote on a proposal submitted by a stockholder, if properly presented at the meeting, regarding special shareholder meetings. |

AGAINST | |||||||||

Transact Any Other Business. To transact such other business as may properly come before the meeting.

By order of the Board of Directors

CLARK L. JORDAN Corporate Secretary March 17, 2022 | ||||||||||

This Notice and Proxy Statement are first being sent to stockholders on or about March 23, 2022. Our 2021 Annual Report on Form 10-K is being sent with this Notice and Proxy Statement.

Eastman Overview

Eastman Chemical Company (“Eastman” or the “Company”) is a global specialty materials company that produces a broad range of products found in items people use every day. Eastman began business in 1920 for the purpose of producing chemicals for Eastman Kodak Company’s photographic business and became a public company, incorporated in Delaware, on December 31, 1993.

With the purpose of enhancing the quality of life in a material way, Eastman works with customers to deliver innovative products and solutions while maintaining a commitment to safety and sustainability. The Company’s innovation-driven growth model takes advantage of world-class technology platforms, deep customer engagement, and differentiated application development to grow its leading positions in attractive end markets such as transportation, building and construction, and consumables.

In 2021, we were honored to be recognized by Fortune magazine as a “Change the World” company and named by Barron’s as one of the “100 Most Sustainable Companies” in the United States among other awards.

As a globally inclusive and diverse company, Eastman employs approximately 14,000 people around the world and serves customers in more than 100 countries.

Sustainability and ESG are Integrated into How We Win

Sustainability and ESG are integrated into Eastman’s compelling growth strategy. As Eastman grows, so does our positive impact. We have made bold commitments to mitigate climate change (including committing to be carbon neutral by 2050), and our technology platforms and several of our key product lines are linked to sustainable macro trends enabling market-driven solutions. Our corporate strategy is designed to drive organic growth while also driving our positive impact.

We have a compelling and ambitious strategy to leverage our innovation-driven growth model to develop sustainable innovations that address the triple challenge of climate change, plastic waste, and a growing population.

2022 Proxy Statement 1

2022 Proxy Statement 1

About the Company

In addition, our unwavering commitments to I&D extend to the highest levels of our Company. In 2021, we published our first I&D Report, which is available on our website (www.eastman.com), to provide greater transparency in this important area. We believe that to meet today’s most pressing needs, we must inspire innovative ideas by making every team member feel valued and empowered to do their best work.

We remain committed to maintaining our strong corporate governance policies and practices and enhancing transparency. We seek out and welcome engagement with our stockholders.

2 2022 Proxy Statement

About the Company

Enabling a Circular Economy — Creating a new vector of Growth for Eastman

The global waste plastic crisis and climate change are two of the greatest challenges of our time, and the world desperately needs a materials revolution that will help address both.

Brands are facing growing climate and environmental scrutiny from consumers, end users, non-governmental organizations, investors, and other stakeholders, resulting in companies setting aggressive goals to include recycled content in products.

Historically, the world has operated in a linear economy where raw materials and resources are extracted or harvested from the ground to produce products. Those products are then used, some only a couple of times, and when we no longer want them, they are thrown away — creating a take-make-consume-waste process known as a linear economy.

A circular economy focuses on making the most of the world’s resources — minimizing waste and maximizing value by providing end-of-life solutions to reduce, reuse, and recycle products and materials that typically end up in landfills and our waterways. It keeps materials in use and decouples growth from scarce resource consumption, allowing economic development and improvement in quality of life within natural resource limits.

There’s mounting tension between the needs of a growing world population and the limits of our natural resources. Each year, more than 300 million tons of plastic are produced globally and only about 15% are recycled today. Estimates are that roughly 25% is incinerated, about 40% is landfilled, and about 20% leaks into the environment — including our oceans.

Our experts are pioneering the shift to circular materials. That means we are moving from a linear economy (take, make, consume, waste) to a circular economy (make, use, reuse, remake, recycle). We’re committed to revolutionizing our materials to give them a longer life and richer purpose using our two advanced circular recycling technologies — carbon renewal and polyester renewal.

Carbon renewal technology (“CRT”) uses a broad mixture of plastic waste — in some instances items as diverse as mixed plastics, textiles, and carpet — as a material source. CRT takes a wide array of mixed plastic waste and breaks it back down into its molecular building blocks, allowing the molecules to be reassembled to build new products. This allows materials to be recycled over-and-over — unlike mechanical recycling — with no compromise or loss of quality.

2022 Proxy Statement 3

2022 Proxy Statement 3

About the Company

This technology provides a circular solution for materials that currently cannot be recycled today, keeping them in use and out of landfills and incinerators. Better yet, the end products are identical to those produced with virgin content. Based upon a third-party life cycle analysis, the process reduces greenhouse gas emissions by 20%-50% when compared to processes using fossil feedstocks.

Polyester renewal technology (“PRT”) takes polyester plastic wastes, such as soft drink bottles, carpet, or even polyester-based clothing, and unzips the polymer chain back to its monomer links. These monomers are then purified and later sent through a polymerization process to make new polymers that can be used to create new high-quality products avoiding the downgrade to lower-quality product use that often occurs with mechanical recycling.

Based upon a third-party life cycle analysis, this process is expected to reduce greenhouse gas emissions by 20%-30% when compared to processes using fossil feedstocks.

Making the Future of Recycling a Reality Today

Construction is Underway on a Molecular Plastics Recycling Facility in Kingsport, Tennessee

Eastman announced a significant capital investment for a new methanolysis facility to be built at our largest manufacturing site located in Kingsport, Tennessee. This facility is expected to provide intermediates that will enable between 150 and 200 kmt of polymer production, depending on product mix. Given the demand for recycled material, the flexibility of this technology to use a variety of polyester waste plastic as a feedstock, the attractive greenhouse gas footprint relative to deriving the monomers from fossil feedstocks, and importantly, the expected price premium that consumers are willing to pay, we feel the time is right.

The feedstock for this facility will be hard-to-recycle polyester waste plastic. As we add additional capacity over time, we will continue to work with a variety of stakeholders to increase and improve the recycling infrastructure for the sorting and distribution of waste plastic.

We expect the facility to be mechanically complete by year-end 2022 and producing commercial quantities in mid-2023.

Announcement of Plans to Build the World’s Largest Molecular Plastics Recycling Facility in France

On January 17, 2022, French President Emmanuel Macron and Eastman CEO Mark Costa jointly announced Eastman’s plan to invest up to $1 billion in a material-to-material molecular recycling facility in France that would use Eastman’s PRT to recycle up to 160,000 metric tons annually of hard-to-recycle waste plastic that is currently being incinerated. The plant and a recycling innovation center are expected to be operational by 2025.

This project has also garnered support from an impressive roster of global brands that share our commitment to solving the world’s plastic waste problem and view molecular recycling as a pivotal tool for achieving circularity. Many global brands are leading the way by signing letters of intent for multi-year supply agreements from this facility.

How we Innovate

Beyond these innovative recycling technologies, Eastman is pursuing specific opportunities to leverage our innovation-driven growth model for continued greater than end-market growth by both sustaining the Company’s leadership in existing markets and expanding into new markets.

4 2022 Proxy Statement

About the Company

Eastman uses an innovation-driven growth model which consists of leveraging world-class, scalable technology platforms, delivering differentiated application development capabilities, and relentlessly engaging the market.

We are also changing our business and operations to improve our cost structure, increase investment in growth, and strengthen execution capabilities, including specific initiatives to transform operations, work processes and systems, and business structure alignment, scale, and integration.

Executing our Commitment to Strategically Manage our Portfolio of Businesses

On November 1, 2021, we completed the sale of the rubber additives (including Crystex™ insoluble sulfur and Santoflex™ antidegradants) and other product lines and related assets and technology of the global tire additives business of the Company’s Additives & Functional Products segment.

On October 28, 2021, we entered into a definitive agreement to sell the Company’s adhesives resins business, which includes hydrocarbon resins (including Impera™ tire resins), pure monomer resins, polyolefin polymers, rosins and dispersions, and oleochemical and fatty-acid based resins product lines, of the Company’s Additives & Functional Products segment for $1 billion.

For additional information on the sale of rubber additives and the pending sale of adhesives resins businesses, see Note 2, “Divestiture and Business Held for Sale”, to the Company’s consolidated financial statements in Part II, Item 8, Financial Statements and Supplementary Data, of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on February 25, 2022.

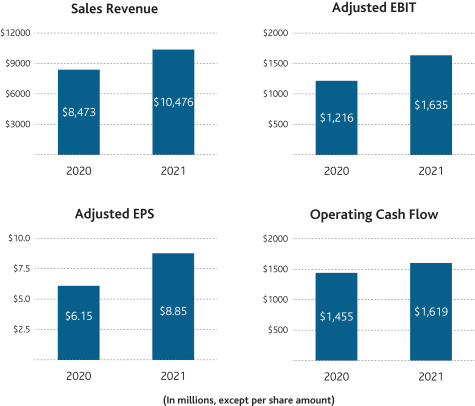

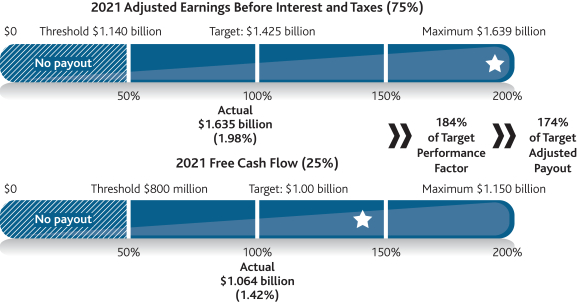

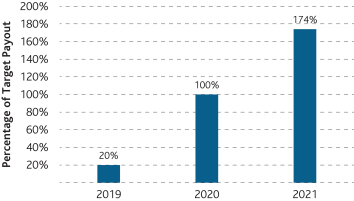

The Company reported 2021 sales revenue of $10.48 billion, earnings before interest and taxes (“EBIT”) of $1.28 billion, and net earnings attributable to Eastman of $857 million. Diluted earnings per share (“EPS”) were $6.25. Net cash provided by operating activities was $1.6 billion and “free cash flow” (cash provided by or used in operating activities less the amount of net capital expenditures) was $1.064 billion. Excluding non-core items, adjusted EBIT was $1.635 billion and adjusted diluted EPS was $8.85. See Annex A of this proxy statement for reconciliation of financial measures under accounting principles generally accepted in the United States (“GAAP”) to non-GAAP financial measures, description of excluded items, and related information.

We delivered record sales revenue and adjusted EPS and laid out exciting plans for the future as a world leading material innovation company.

The global Eastman team did an outstanding job navigating through a very difficult operating environment that included unprecedented logistics and supply chain challenges; rapid, broad-based inflation; and labor shortages. The COVID-19 coronavirus Delta and Omicron variants reminded us that we are not yet free of the ongoing threat of the COVID-19 pandemic and the disruption and uncertainty it causes.

2022 Proxy Statement 5

2022 Proxy Statement 5

2021 Financial Highlights

Even in this dynamic environment, we continued to deliver compelling revenue and earnings growth, advance our innovation programs and transformational initiatives, strengthen our business portfolio, achieve milestones toward our ambitious sustainability goals, and so much more.

Hereare just a few of our financial highlights from the year:

• Generated $1.064 billion of free cash flow, marking our fifth consecutive year of delivering greater than $1 billion in free cash flow and demonstrating resilience in both good and challenging environments with our operating cash flow exceeding $1.6 billion;

• Delivered record, full-year revenue and adjusted EPS;

• Generated approximately $600 million in new business revenue from innovation, driven by strong growth of specialty products across the Company;

• Returned approximately $1.375 billion to our stockholders through dividends, which we increased for the twelfth consecutive year, and share repurchases. We believe these results show that momentum is building across the Company and demonstrate the value we are creating; and

• Total shareholder return (“TSR”): 2021 TSR (change in stock price plus dividends assuming reinvestment of dividends with end date of December 31, 2021), reflecting the transitioning nature of our portfolio, was:

• 1-year: 24%

• 2-year: 63%

• 3-year: 82%

|

6 2022 Proxy Statement

Summary of Items to be Voted on at the Annual Meeting

SUMMARY OF ITEMS TO BE VOTED ON AT THE ANNUAL MEETING

This summary highlights important information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote, including the section “Additional Information About the Annual Meeting” for information on how to attend, submit questions, and vote during the Annual Meeting.

| ITEM 1 ELECTION OF DIRECTORS | ||||||||||

Stockholders are being asked to vote on the election of ten directors to serve until the 2023 Annual Meeting of Stockholders. The terms of office of all ten current directors will expire at the 2022 Annual Meeting, and each of those directors has been nominated for re-election for a one-year term. |

| |||||||||

| “FOR” |

| PAGE 11

| u

| ||||||

Board Nominees

| ||||||||||||||

2022 Proxy Statement 7

2022 Proxy Statement 7

Summary of Items to be Voted on at the Annual Meeting

INDEPENDENCE

All director nominees except our Chief Executive Officer are independent and meet heightened independence standards for our Audit, Compensation and Management Development, and Nominating and Corporate Governance Committees. |

|

|

DIVERSITY OF SKILLS, EXPERIENCE, GENDER AND ETHNICITY, AND THOUGHT

We have a diverse Board representing a range of experience and backgrounds. | |||||||

Independent: 9 Not Independent: 1 |

Our Board is

90% Independent |

Management & strategy experience

Gender or ethnic diversity | 100% 40% | |||||||

TENURE Newer (1-4 years): 3 Medium-tenured (5-10 years): 2 Longer-tenured ( +10 years): 5 |

| 9.6 years average tenure | AGE <60 years: 2 60-69 years: 7 70+ years: 1 |

Our Board age limit is 75 years | ||||||||

| ||||||||||||

ITEM 2 ADVISORY APPROVAL OF EXECUTIVE COMPENSATION | ||||||||

Stockholders have the right to vote to approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed pursuant to the compensation disclosure rules of the SEC. This advisory vote is commonly referred to as the “say-on-pay” vote.

| ||||||||

| “FOR” | PAGE 45 u

| ||||||

Our pay-for-performance executive compensation program is thoughtful, consistent, and balanced and is aligned with the Company’s business strategies.

| ||||||||

• We align pay with Company performance and to support a long-term, high performance business model.

• We link most of the pay for our senior executives to long-term business strategies and key priorities, with substantial stockholding requirements. | • We measure performance against challenging goals established at the start of each performance cycle that are aligned with our key strategy and business priorities.

• We discourage imprudent risk taking by avoiding undue emphasis on any one metric or short-term goal. | |

8 2022 Proxy Statement

Summary of Items to be Voted on at the Annual Meeting

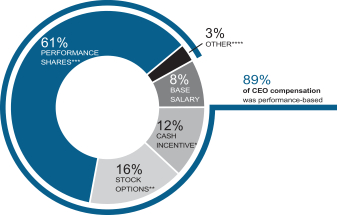

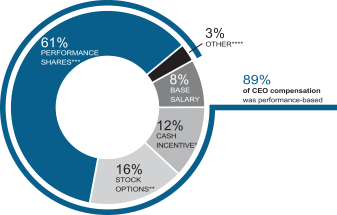

CEO Pay Mix

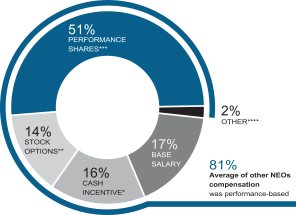

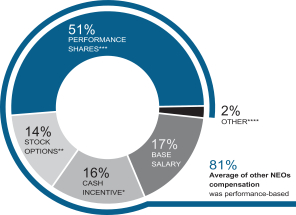

NEO Pay Mix

| * | Target cash payment for 2021 target corporate and individual performance. |

| ** | Grant date fair value of stock options granted in 2021. See Note 1 to the Summary Compensation Table below. |

| *** | Grant date accounting valuation of shares of Eastman common stock underlying performance shares awarded for the 2021-2023 performance period. See Note 1 to the Summary Compensation Table below. |

| **** | For a description of other compensation, see Note 5 to the Summary Compensation Table below. |

Compensation Best Practices

Our compensation program incorporates the following practices and features:

| What We Do | ||||

| Oversight and decisions by a Compensation Committee comprised solely of independent directors with significant executive compensation and management experience who understand drivers of long-term corporate performance. | |||

| Use an independent compensation consultant to the Compensation Committee with no conflicts of interest. | |||

| Annual assessment by the Compensation Committee of potential risks associated with the compensation. | |||

| Benchmark executive pay and overall program design based on data from the Compensation Committee’s independent compensation consultant, and use competitive peer company data in making decisions about all components of pay. | |||

| Significant portion of pay based on corporate and individual performance. | |||

| Robust stock ownership expectations. | |||

| Executive pay recoupment (or “clawback”) policy. | |||

| “Double trigger” change-in-control vesting of outstanding stock-based pay awards. | |||

| Regular dialogue with investors and proxy advisory firms about executive pay program and practices. | |||

| What We Don’t Do | ||||

| Target a specific percentile of competitive peer company pay to set executive pay. | |||

| Reprice or change performance targets for stock options or other long-term stock-based incentive awards after those awards are granted. | |||

| Include value of equity awards in pension benefit calculations. | |||

| Allow pledging or hedging of Company stock by our executive officers. | |||

| “Gross-up” taxes for any imputed income on limited executive perquisites. | |||

| “Gross-up” tax payments, or accelerate equity vesting without termination following change-in-control, under limited change-in-control severance arrangements. | |||

|

| |||

|

| |||

2022 Proxy Statement 9

2022 Proxy Statement 9

Summary of Items to be Voted on at the Annual Meeting

ITEM 3 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||||||

The Audit Committee of the Board of Directors has retained PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2022. Stockholders are being asked to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP.

| ||||||||

| “FOR” | PAGE 87 u

| ||||||

ITEM 4 ADVISORY VOTE ON STOCKHOLDER PROPOSAL REGARDING SPECIAL SHAREHOLDER MEETINGS | ||||||||

Stockholders will vote on this proposal if properly presented by the proponent at the meeting. For the reasons described in the Company’s response, the Board opposes the proposal.

| ||||||||

|

“AGAINST”

| PAGE 88 u

| ||||||

10 2022 Proxy Statement

Item 1 — Election of Directors

Stockholders are being asked to vote on the election of ten directors to serve until the 2023 Annual Meeting of Stockholders and their successors are duly elected and qualified. The terms of office of all ten current directors will expire at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), and each of those directors has been nominated for re-election for a one-year term. If any nominee is unable or unwilling to serve (which we do not anticipate), the persons designated as proxies will vote your shares for the remaining nominees and for another nominee proposed by the Board of Directors (the “Board”) or, as an alternative, the Board could reduce the number of directors to be elected at the Annual Meeting.

Majority Vote Standard for Election of Directors. The Company’s Bylaws provide that directors are elected by a majority of votes cast by stockholders. If a nominee who is serving as a director is not re-elected by a majority of votes cast at a meeting, under Delaware law the director would continue to serve on the Board as a “holdover director.” However, under the director election provision of our Bylaws, any incumbent director who is a holdover director whose successor has not been elected by stockholders would be required to offer to resign from the Board. The Nominating and Corporate Governance Committee would then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. The Board would act on the recommendation and publicly disclose its decision and rationale within 90 days from the date the election results are certified. The director who tenders his or her resignation would not participate in the Board’s decision. Under Delaware law, if a nominee who was not already serving as a director is not elected by a majority of votes cast by stockholders at an annual meeting, such nominee would not become a director.

|

The nominees have been recommended to the Board by the Nominating and Corporate Governance Committee of the Board. The Board recommends that you vote “FOR” the election of each of the ten nominees as described under “Director Nominees.”

|

2022 Proxy Statement 11

2022 Proxy Statement 11

The Board of Directors

The Board is elected by the stockholders to oversee management and to assure that the long-term interests of the stockholders are being served. The primary role of the Board is to maximize stockholder value over the long-term. Eastman’s business is conducted by its employees, managers, and officers, under the direction of the Chief Executive Officer and with the oversight of the Board.

Under the Corporate Governance Guidelines, the desired attributes of individual directors are:

|

The Board recognizes that its success hinges on its ability to meet a broad spectrum of challenges that the Company will encounter over the long-term. Variable challenges demand not only a diverse set of perspectives, backgrounds, and skills, but strong communication and collaboration among the whole Board.

Our Board is committed to ensuring that it is well-equipped to oversee the Company’s business and effectively represent the interests of stockholders. Our Board regularly reviews its composition to ensure it includes directors with the experience, skills, and diversity necessary for effective, independent Board oversight. Our Board has initiated a process to add new directors with capabilities that would be beneficial to the Company and stockholders. Our Board will continue to seek to add new directors to our Board, focusing on skills, experience, and diversity.

12 2022 Proxy Statement

The Board of Directors — Board Overview

Board Overview and Skills and Qualifications Matrix

The non-employee directors together possess a diverse inventory of relevant skills and experience, but all of the non-employee directors have experience in corporate management and strategy as well as international business experience. The Company believes the Board is equipped by its composition and culture to effectively oversee key risks and challenges the Company faces. The Nominating and Corporate Governance Committee and the Board use the following matrix in its review of each director’s skills and qualifications.

Director Since |  Experience and Skills Experience and Skills  | |||||||||||||||||||||

| Board Nominees | Independent | Committee Memberships |  |  |  |  |  |  |  | |||||||||||||

| Humberto P. Alfonso

Age: 64

| 2011 | ∎ | • Audit (C) • Environmental, Safety & Sustainability • Finance | ∎ | CFO | CFO | ∎ | ||||||||||||||

| Brett D. Begemann Age: 61 | 2011 | ∎ | • Compensation & Management Development (C) • Environmental, Safety & Sustainability • Finance • Nominating & Corporate Governance | ∎ | COO | ∎ | ∎ | ||||||||||||||

| Mark J. Costa Age: 56 | 2013 | ∎ | CEO | ∎ | ∎ | ||||||||||||||||

|

Edward L. Doheny II Age: 59 | 2020 | ∎ | • Audit • Environmental, Safety & Sustainability • Finance | ∎ | CEO | ∎ | ∎ | ∎ | |||||||||||||

| Julie F. Holder Age: 69

| 2011 | ∎ | • Compensation & Management Development • Environmental, Safety & Sustainability (C) • Finance • Nominating & Corporate Governance | ∎ | SVP | ∎ | ∎ | ||||||||||||||

| Renée J. Hornbaker Age: 69

|

2003 |

∎ | • Compensation & Management Development • Environmental, Safety & Sustainability • Finance (C) • Nominating & Corporate Governance | ∎ | CFO | ∎ | CFO | ∎ | |||||||||||||

| Kim Ann Mink Age: 62

| 2018 | ∎ | • Audit • Environmental, Safety & Sustainability • Finance | ∎ | CEO | ∎ | ∎ | ∎ | |||||||||||||

| James J. O’Brien Age: 67 | 2016 | ∎ | • Compensation & Management Development • Environmental, Safety & Sustainability • Finance • Nominating & Corporate Governance (C) | ∎ | CEO | ∎ | ∎ | ∎ | |||||||||||||

| David W. Raisbeck Age: 72 |

2000 | ∎ | • Compensation & Management Development • Environmental, Safety & Sustainability • Finance • Nominating & Corporate Governance | ∎ | VICE | ∎ | ∎ | ∎ | |||||||||||||

| Charles K. Stevens III Age: 62 | 2020 | ∎ | • Audit • Environmental, Safety & Sustainability • Finance | ∎ | CFO | CFO | ∎ | ||||||||||||||

(C) = Chair

| International business |  | Chemical industry and specialty materials strategy, technology, innovation, or manufacturing |  | Marketing |  | Information systems and digital technology | |||||||

| Corporate management & strategy |

| Finance & accounting |  | Legal, governmental, environmental policies compliance |  | Diversity |

Board Gender and Ethnic Diversity and Tenure

|  |  |

2022 Proxy Statement 13

2022 Proxy Statement 13

The Board of Directors — Director Nominees

Executive Vice

Director: Since January 2011

Age: 64

Committees:

• Audit (Chair)

• Environmental, Safety and Sustainability

• Finance

Experience and Skills:

|

Humberto P. Alfonso

Background:

Mr. Alfonso has been Executive Vice President and Chief Financial Officer of Information Services Group, a global technology research and advisory firm, since June 2021. Previously, Mr. Alfonso served as Chief Executive Officer, Global, of Yowie Group Ltd., a confectionary company, from June 2016, and as a director from March 2017, until January 2018. Mr. Alfonso was President, International, of The Hershey Company, a chocolate and cocoa products company, from April 2013 until his retirement in June 2015. He was Executive Vice President, Chief Financial Officer, and Chief Administrative Officer of Hershey from November 2011 to April 2013, and Senior Vice President and Chief Financial Officer from July 2007 to November 2011. He joined Hershey in July 2006, initially serving as Vice President, Finance and Planning, U.S. Commercial Group from July 2006 to October 2006, and then serving as Vice President, Finance and Planning, North American Commercial Group from October 2006 to July 2007. Before joining Hershey, Mr. Alfonso held a variety of finance positions at Cadbury Schweppes, a multi-national confectionary company, serving as Executive Vice President Finance and Chief Financial Officer of Cadbury Schweppes Americas Beverages from March 2005 to July 2006 and Vice President Finance, Global Supply Chain from May 2003 to March 2005. Prior to that, Mr. Alfonso held a number of senior financial positions at Pfizer, Inc., a biopharmaceutical company.

Skills and Expertise:

In addition to serving on the Board, Mr. Alfonso is Chair of the Audit Committee and a member of the Environmental, Safety and Sustainability Committee, and the Finance Committee. Mr. Alfonso possesses a strong financial management and accounting background. His experience includes various senior financial positions held during his career, including his service as an executive vice president and chief financial officer, which provide a solid platform for his service on the Audit Committee, especially concerning financial and audit-related matters and, as Chair of the Audit Committee, to lead the Audit Committee’s oversight of the Company’s financial reporting process and its internal and disclosure controls and of the work of the independent registered public accounting firm. In addition, Mr. Alfonso’s substantial senior level management experience, including his previous position as a chief executive officer, brings significant operational insight to the Board. |

14 2022 Proxy Statement

The Board of Directors — Director Nominees

Retired Chief Operating

Director: Since February 2011

Age: 61

Committees:

• Compensation and Management Development

• Environmental, Safety and Sustainability

• Finance

• Nominating and Corporate Governance

Experience and Skills:

|

Brett D.

Background:

Mr. Begemann was the Chief Operating Officer for the Crop Science Division of Bayer AG, a German global life sciences company with core competencies in the areas of health care and agriculture, upon the completion of Bayer’s acquisition of Monsanto Company, a leading global provider of technology-based solutions and agricultural products that improve farm productivity and food quality, from June 2018 until his retirement in June 2021. Previously, Mr. Begemann served as President and Chief Operating Officer of Monsanto, with responsibility for worldwide sales and operations, corporate affairs, and global business organization since October 2013. He joined Monsanto in 1983, initially serving in the company’s sales and marketing organization and later in various senior management and executive positions with increasing responsibility, including Executive Vice President, Global Commercial from October 2007 to October 2009, Executive Vice President and Chief Commercial Officer until August 2012, and President and Chief Commercial Officer from August 2012 to October 2013.

Skills and Expertise:

In addition to serving on the Board, Mr. Begemann serves as Chair of the Compensation and Management Development Committee and as a member of the Environmental, Safety and Sustainability Committee, the Finance Committee, and the Nominating and Corporate Governance Committee. His substantial and varied experience as an executive of an international public company, including working closely with the Board of Directors of Monsanto and the Supervisory Board and the Board of Management of Bayer, brings to the Board a significant depth of knowledge and experience in global biotechnology and chemicals business operations and international and emerging markets growth strategies, and public company management development and compensation. His wide-ranging experience and knowledge contributes to the Board and its Committees significant insight into a number of functional areas critical to Eastman, including as Chair of the Compensation and Management Development Committee. |

2022 Proxy Statement 15

2022 Proxy Statement 15

The Board of Directors — Director Nominees

Chief Executive Officer

Director: Since May 2013

Age: 56

Committees: None

Experience and Skills:

|

Mark J. Costa

Background:

Mr. Costa has been Chief Executive Officer since January 2014 and Board of Directors Chair since July 2014. Since joining Eastman in 2006, he has held a number of executive positions and has been instrumental in developing the strategies, strengthening the capabilities, and building a growth and outcome-oriented culture that have led to the Company’s innovative growth. In 2006, Mr. Costa joined Eastman’s executive team as Chief Marketing Officer and leader of corporate strategy and business development. He was named Executive Vice President and assumed profit and loss responsibilities for the Specialty Plastics and Performance Polymers businesses in addition to his prior responsibilities in 2008. The following year, his role was expanded to lead the specialty products businesses. During this time, he also served as Chief Marketing Officer and had executive responsibility for global integrated supply chain and Eastman’s global innovation and sustainability initiatives. In 2013, Mr. Costa was appointed President of Eastman and served in that position until he became Chief Executive Officer. Before joining Eastman, Mr. Costa was a senior partner with Monitor Group, a global management consulting firm. He played a crucial role in developing Monitor’s techniques in corporate transformations and portfolio management and designing client business and marketing capability building programs.

Skills and Expertise:

Since he joined the Company, Mr. Costa has led a variety of business, marketing, functional, and strategic areas and initiatives, currently serving as Chief Executive Officer, and has senior management, corporate transformation and portfolio management, and business and marketing capability experience and expertise from both his years with the Company and previously as a consultant. As a result, he is appropriately and uniquely able to advise the Board on the opportunities and challenges of managing the Company and its strategy for value creating growth, as well as its day-to-day operations and risks. We believe the perspective of the Chief Executive Officer of the Company is critical for the Board in order for it effectively to oversee the affairs of the Company and its strategy for growth. Through serving in a number of executive positions at Eastman and being instrumental in developing Eastman’s growth strategies for its businesses, Mr. Costa’s unique knowledge of the opportunities and challenges associated with our business and familiarity with the Company, as well as of the chemical industry and various market participants, also make him uniquely qualified to lead and advise the Board as Chair. |

16 2022 Proxy Statement

The Board of Directors — Director Nominees

Director: Since February 2020

Age: 59

Committees: • Audit

• Environmental, Safety and Sustainability

• Finance

Experience and Skills:

|

Edward L.

Background:

Mr. Doheny became the President and Chief Executive Officer of Sealed Air Corporation, a global leader in essential packaging solutions, in January 2018. Mr. Doheny joined Sealed Air as the Chief Operating Officer and CEO Designate and a member of the Board of Directors in September 2017. Previously, Mr. Doheny served as President and Chief Executive Officer and a director of Joy Global Inc., a manufacturer and servicer of industrial mining equipment, from December 2013 until its sale to Komatsu in 2017 and as Executive Vice President and as President and Chief Operating Officer of Joy Global’s Underground Mining Machinery business from 2006 to 2013. Prior to joining Joy Global, Mr. Doheny had a 21-year career with Ingersoll-Rand plc, a diversified global producer of products and industrial solutions, where he held a series of executive and senior management positions of increasing responsibility, including for engineering and marketing. During the last five years, Mr. Doheny was also a member of the Board of Directors of John Bean Technologies Corporation, a global technology solutions provider to the food and beverage industry and provider of equipment and services to air transportation companies.

Skills and Expertise:

In addition to his Board service, Mr. Doheny also serves as a member of the Audit Committee, the Environmental, Safety and Sustainability Committee, and the Finance Committee. Mr. Doheny’s extensive corporate management experience and expertise in manufacturing through his high-level positions at several global industrial and manufacturing companies allow him to offer a valuable perspective on the Company’s strategy for sustainable long-term growth focused on technology, innovation, and operational excellence. |

2022 Proxy Statement 17

2022 Proxy Statement 17

The Board of Directors — Director Nominees

Retired Senior Vice

Director: Since November 2011

Age: 69

Committees:

• Compensation and Management Development

• Environmental, Safety and Sustainability (Chair)

• Finance

• Nominating and Corporate Governance

Experience and Skills:

|

Julie F. Holder

Background:

Ms. Holder has been the Chief Executive Officer of JFH Insights LLC, a consulting firm primarily dedicated to leadership coaching for high potential women executives, since founding the company in 2009. She developed and teaches executive education courses for the Eli Broad College of Management at Michigan State University designed to help women be more successful in their careers and help senior leadership build a more inclusive corporate culture. Previously, Ms. Holder served as Senior Vice President, Chief Marketing, Sales and Reputation Officer, U.S. Area Executive Oversight of The Dow Chemical Company, a diversified, worldwide manufacturer and supplier of products used primarily as raw materials in the manufacture of customer products and services, from 2007 until her retirement in 2009, and before that was Vice President, Human Resources, Public Affairs and Diversity and Inclusion of Dow from 2006 to 2007. Prior to that, Ms. Holder served in various positions with increasing seniority at Dow from 1975 to 2006. Ms. Holder was during the last five years a member of the Board of Directors of W. R. Grace & Co., a leading global supplier of catalysts and engineered materials.

Skills and Expertise:

In addition to serving on the Board, Ms. Holder is Chair of the Environmental, Safety and Sustainability Committee and is a member of the Compensation and Management Development Committee, the Finance Committee, and the Nominating and Corporate Governance Committee. Ms. Holder brings to the Board substantial corporate management experience as well as expertise in international sales and marketing and the chemicals industry through her various senior management positions at Dow. Ms. Holder’s long history at Dow provides her substantial chemical industry experience across a broad range of functional areas and allows her to offer management and operational insight to the Board with an in-depth understanding of the opportunities and challenges associated with our business, including as Chair of the Environmental, Safety and Sustainability Committee. In addition, Ms. Holder’s experience in human resources management adds to the Compensation and Management Development Committee’s oversight of and decisions concerning management development and compensation and her professional background of overseeing increasingly large and diverse business units results in her having the financial sophistication and understanding of a company similar to Eastman, which is of great benefit to the Board and the Finance Committee. |

18 2022 Proxy Statement

The Board of Directors — Director Nominees

Retired Executive Vice

Director: Since September 2003

Age: 69

Committees: • Compensation and Management Development

• Environmental, Safety and Sustainability

• Finance (Chair)

• Nominating and Corporate Governance

Experience and Skills:

|

Renée J.

Background:

Ms. Hornbaker has been Chief Executive Officer of Storey & Gates LLC, a consulting firm providing business advisory services including executive coaching and board governance training for boards, since founding the company in 2018. She served as Executive Vice President and Chief Financial Officer of Stream Energy, a retail energy, wireless, and protective services provider, from 2011 to December 2017, and was a member of the Board of Directors and Board Chair and Compensation Committee Chair from December 2017 until the sale of Stream Energy in July 2019. Ms. Hornbaker served as Chief Financial Officer of Shared Technologies, Inc., a provider of converged voice and data networking solutions, from 2006 to May 2011, and was Consultant to the Chief Executive Officer of CompuCom Systems, Inc., an information technology services provider, from 2005 to 2006. She was Vice President and Chief Financial Officer of Flowserve Corporation, a global provider of industrial flow management products and services, from 1997 until 2004, and served as Vice President of Business Development and Chief Information Officer from 1997 to 1998. In 1977, Ms. Hornbaker joined the accounting firm Deloitte, Haskins & Sells, where she became a senior manager of its audit practice in the firm’s Chicago office. Following that, she served in senior financial positions with several major companies from 1986 until 1996, including five years at Phelps Dodge Corporation, a mining company, where she had financial responsibilities for its international businesses including Columbian Chemicals Corporation. Ms. Hornbaker is also a member of the Board of Directors of Berry Corporation, an upstream energy company.

Skills and Expertise:

Ms. Hornbaker’s expertise in a variety of financial and accounting matters, experience in business development, strategy and technology, and service with large global businesses makes her a valuable member of the Board, and enhances the value of her service as Chair of the Finance Committee and as a member of the Compensation and Management Development Committee, the Environmental, Safety and Sustainability Committee, and the Nominating and Corporate Governance Committee. Ms. Hornbaker’s significant experience in several senior financial positions at various companies, including her previous service as a chief financial officer and as a senior manager at an accounting firm, provides a solid platform for her to advise and consult with the Board on financial and audit-related matters. | |

2022 Proxy Statement 19

2022 Proxy Statement 19

The Board of Directors — Director Nominees

Retired President

Director: Since July 2018

Age: 62

Committees: • Audit

• Environmental, Safety and Sustainability

• Finance

Experience and Skills:

|

Kim Ann Mink

Background:

Dr. Mink was President and Chief Executive Officer of Innophos Holdings, Inc., a leading international producer of performance-critical and nutritional functional ingredients, with applications in food, health, nutrition and industrial specialties markets, from December 2015, a director of Innophos from January 2016, and Chairman of the Board from February 2017, until completion of One Rock Capital Partners’s acquisition of Innophos in February 2020. Dr. Mink previously served as Business President of Elastomers, Electrical and Telecommunications at The Dow Chemical Company from September 2012 to December 2015. Dr. Mink joined Dow in April 2009 as Global General Manager, Performance Materials and President and Chief Executive Officer of ANGUS Chemical Co. (then a subsidiary of Dow). Prior to joining Dow, she had previously served for more than 20 years at the Rohm and Haas Company, a chemical manufacturing company (which was acquired by Dow), where she held roles of increasing responsibility, including corporate vice president and general manager for the Ion Exchange Resins business. Dr. Mink is also a member of the Boards of Directors of Avient Corporation, a plastics material and resin manufacturing company, and of Air Liquide, an industrial gases company.

Skills and Expertise:

Dr. Mink provides valuable guidance to the Board with her extensive background and past experience as an executive in the specialty chemical industry and as a chief executive officer overseeing business and developing growth initiatives. Dr. Mink brings specialty materials experience and technical expertise to the Board. Dr. Mink’s proven leadership and deep understanding of key end markets enhance the Board’s innovation-driven growth strategy. Dr. Mink is a member of the Audit Committee, the Environmental, Safety and Sustainability Committee, and the Finance Committee. |

20 2022 Proxy Statement

The Board of Directors — Director Nominees

Retired Chairman of

Director: Since February 2016

Age: 67

Committees: • Compensation and Management Development

• Environmental, Safety and Sustainability

• Finance

• Nominating and Corporate Governance (Chair)

Experience and Skills:

|

James J. O’Brien Background:

Mr. O’Brien served as Chairman of the Board and Chief Executive Officer of Ashland Inc., a leading global specialty chemical company, from 2002 until his retirement in December 2014, and previously served as President and Chief Operating Officer and Senior Vice President and Group Operating Officer from 2001 to 2002. He joined Ashland (then known as Ashland Chemical Company) in 1976, and after serving in various positions, became President of the Valvoline business in 1995. Mr. O’Brien is also a member of the Boards of Directors of Albemarle Corporation, a chemical manufacturing company, and Humana Inc., a health insurance company, and was during the last five years a member of the Board of Directors of WESCO International, Inc., a multi-national electrical distribution and services company.

Skills and Expertise:

In addition to serving as a member of the Board, Mr. O’Brien serves as Chair of the Nominating and Corporate Governance Committee and on the Compensation and Management Development Committee, the Environmental, Safety and Sustainability Committee, and the Finance Committee. Mr. O’Brien brings to the Board extensive knowledge of the chemical industry and substantial experience as an executive of an international public company that allow him to offer management insight and understanding of industry challenges to the Board. Under his leadership, Ashland was transformed to a global specialty chemical company. His significant experience serving on other public company boards and management experience and knowledge in the areas of finance, accounting, international business operations, risk oversight, and corporate governance provide a solid platform for his service on the Board and as Chair of the Nominating and Corporate Governance Committee and on the Compensation and Management Development Committee, the Environmental, Safety and Sustainability Committee, and the Finance Committee.

|

2022 Proxy Statement 21

2022 Proxy Statement 21

The Board of Directors — Director Nominees

Retired Vice Chairman

Lead Director

Director: Since December 2000

Age: 72

Committees:

• Compensation and Management Development

• Environmental, Safety and Sustainability

• Finance

• Nominating and Corporate Governance

Experience and Skills:

|

David W. Raisbeck

Background:

Mr. Raisbeck was Vice Chairman of Cargill, Incorporated, an agricultural trading and processing company, from 1999 until his retirement in 2008, and was a director of Cargill until September 2009. He joined Cargill in 1971 and held a variety of merchandising and management positions focused primarily in the commodity and financial trading businesses. Mr. Raisbeck was appointed President of Cargill’s Financial Markets Division in 1988 and President of Cargill’s Trading Sector in 1993, was elected a director of Cargill in 1994 and Executive Vice President in 1995. Mr. Raisbeck was a director of CarVal, a distressed asset management company owned by Cargill, and of Black River Asset Management, a hedge fund owned by Cargill, until 2009.

Skills and Expertise:

Mr. Raisbeck’s depth of experience in the areas of trading and risks related to commodities and raw materials, which are significant components of our operations and the manufacturing of our products, is valuable to our Board and its Finance Committee, and in his responsibilities as Lead Director. Given his professional experience managing trading businesses and other risk-based, finance-related transactions, Mr. Raisbeck has unique capabilities and insight with respect to the managing of risk exposure and execution of financing transactions. His substantial experience serving on the boards of directors of other companies and his varied corporate management experience allows us to leverage his experiences with respect to, among other things, appropriate oversight and related actions utilized in the Board environment, including corporate governance matters as Lead Director and as a member of the Compensation and Management Development Committee, the Environmental, Safety and Sustainability Committee, the Finance Committee, and the Nominating and Corporate Governance Committee. |

22 2022 Proxy Statement

The Board of Directors — Director Nominees

Retired Executive Vice

Director: Since February 2020

Age: 62

Committees: • Audit • Environmental, Safety and Sustainability • Finance

Experience and Skills:

|

Charles K.

Background:

Mr. Stevens was Executive Vice President and Chief Financial Officer of General Motors Company, a corporation that designs, manufactures, markets, and distributes vehicles and vehicle parts, and sells financial services, from 2014 until 2018, and retired from General Motors in early 2019. He joined the Buick-Oldsmobile-Cadillac Group in 1978 and served in various positions of increasing responsibility in the financial and operating organizations, including Chief Financial Officer, General Manager ASEAN Operations and Vice President Finance, Thailand from 2002 to 2005, Vice President Finance, Chief Financial Officer, Canada from 2006 to 2007, Executive Director, Finance, Chief Financial Officer, Mexico from 2008 to 2009, Chief Financial Officer, North America and Interim Chief Financial Officer and General Manager, South America from 2010 to 2013. Mr. Stevens is also a member of the Boards of Directors of Flex Ltd., a multi-national electronics contract manufacturer, Masco Corporation, a manufacturer of products for the home improvement and new home construction markets, and Tenneco Inc., an automotive components original equipment manufacturer and an after market ride control and emissions product manufacturer.

Skills and Expertise:

In addition to his Board service, Mr. Stevens also serves on the Audit Committee, the Environmental, Safety and Sustainability Committee, and the Finance Committee. Mr. Stevens brings to the Board and its Audit and Finance Committees significant leadership experience in financial and accounting operations of a large, global publicly held manufacturing and marketing company. His extensive background and expertise provide to our management and Board a valuable understanding of finance, financial operations, international financial matters, public company accounting, mergers and acquisitions, and consumer goods. His past responsibilities also include being a vital contributor to developing and executing business strategies to drive profitable growth, which benefit our Board as it oversees our strategy. Mr. Stevens also serves on the boards of three other public companies which allows him to leverage his experience for the further benefit of the Company.

|

2022 Proxy Statement 23

2022 Proxy Statement 23

The Board of Directors — Director Independence

The Board and its Nominating and Corporate Governance Committee have reviewed the standards of independence for directors established by applicable laws and regulations, including the listing standards of the New York Stock Exchange, and by the Company’s Corporate Governance Guidelines, and have reviewed and evaluated the relationships of directors with the Company and its management. Based upon this review and evaluation, the Board has determined that none of the non-employee members of the Board (that is, all directors but Mr. Costa) has or had a relationship with the Company or its management that would interfere with such director’s exercise of independent judgment, and that each non-employee member of the Board is an independent director. In addition, each non-employee member of the Board meets the heightened independence standards for our Audit, Compensation, and Nominating and Corporate Governance Committees.

In making these determinations, the Nominating and Corporate Governance Committee and the Board reviewed and evaluated all direct and indirect transactions and relationships between the Company and the non-employee directors and their affiliates and immediate family members. Under the New York Stock Exchange listing standards and Eastman’s Corporate Governance Guidelines, an “independent” director is one who has “no direct or indirect material relationship with the Company or its management” and who:

|

24 2022 Proxy Statement

The Board of Directors — Director Nominations

|

The Nominating and Corporate Governance Committee is responsible for reviewing and recommending to the Board potential directors who possess the skills, knowledge, and understanding necessary to be valued members of the Board in order to assist it in successfully performing its role in corporate oversight and governance. The Nominating and Corporate Governance Committee considers not only an individual director’s or possible nominee’s qualities, performance, and professional responsibilities, but also the then-current composition of the Board and the challenges and needs of the Board as a whole in an effort to ensure that the Board is comprised of a diverse group of members who, individually and collectively, best serve the needs of the Company and its stockholders. In general, and in giving due consideration to the composition of the Board, the desired attributes of individual directors, including those of any nominees of stockholders, are as described under “Board Composition”.

The Nominating and Corporate Governance Committee will consider persons nominated by stockholders and recommend to the full Board whether such nominee should be included with the Board’s nominees for election by stockholders. Our Bylaws contain provisions that address the process (including the required information and deadlines) by which a stockholder or group of stockholders may nominate an individual for consideration by the Nominating and Corporate Governance Committee to stand for election at an annual meeting of stockholders. In addition, the proxy access provision in our Bylaws provides that, under certain circumstances, a stockholder, or a group of up to 20 stockholders, owning 3% or more of our outstanding common stock continuously for at least the previous three years may nominate and include director nominees constituting up to 20% of the number of directors then serving on the Board in the Company’s proxy materials, provided that such stockholder(s) and nominee(s) satisfy the disclosure and other requirements set forth in our Bylaws. In order to use this proxy access Bylaw provision, stockholders are required to hold shares until the date of the applicable annual meeting. For additional information on how stockholders may submit nominees for election to the Board, see “Additional Information about the Annual Meeting — What Are the Requirements for Nominations by Stockholders for Election to the Board of Directors and Stockholder Nomination Proxy Access?”.

The Board and the Nominating and Corporate Governance Committee have from time to time utilized the services of director search firms to assist in the identification of qualified potential director nominees.

2022 Proxy Statement 25

2022 Proxy Statement 25

Corporate Governance

Corporate Governance Highlights

Our commitment to good corporate governance is evidenced by the following practices:

| BOARD STRUCTURE AND GOVERNANCE | SUSTAINABILITY | |||||

• Active Board oversight of risk

• Lead Director and strong Committee chair roles with clearly articulated responsibilities

• 9 out of 10 directors are independent

• Mandatory director retirement age

• Annual Board and Committee self-evaluation process, including individual director evaluations

• Executive sessions at each Board meeting led by the Lead Director without the CEO or other management present | • Long-standing commitment to sustainability and other ESG matters

• Board oversight of human capital management and culture, including I&D

• Comprehensive Sustainability Report in alignment with GRI, SASB, and TCFD frameworks

• Established climate strategy and 2030 Commitments, including GHG emissions reduction targets

• I&D Report

• Annual independent third-party assessment of pay equity

| |||||

| ||||||

| STOCKHOLDER RIGHTS AND ENGAGEMENT | STOCK OWNERSHIP | |||||

• Annual election of directors

• Majority voting for directors

• Stockholder proxy access

• Active and responsive stockholder engagement process

• No stockholder rights plan

• No supermajority voting provisions | • Stock ownership guidelines of 5x base salary for CEO

• Stock ownership guidelines of 5x annual retainer fee for non-employee directors

• Stock ownership guidelines of 2.5x base salary for our other executive officers

• No hedging or pledging of Company stock by directors, executive officers, and all employees

• Executive Incentive Pay Clawback Policy

| |||||

26 2022 Proxy Statement

Corporate Governance — Board Leadership Structure

| Mark J. Costa

Board Chair

|

|

| David W. Raisbeck

Lead Director

| ||||

The Chair of the Board provides leadership to the Board and works with the Board to define its structure and activities in the fulfillment of its responsibilities. The Company believes that the members of the Board possess considerable experience and unique knowledge of the challenges and opportunities the Company may face from time to time, and therefore are in the best position to evaluate the needs of the Company and how best to organize the capabilities of our directors and senior executives to meet those needs at any time. As a result, the Company believes that the decision as to who should serve as Chair and as Chief Executive Officer, and whether the offices should be combined or separate, is properly the responsibility of the Board, to be exercised from time to time in appropriate consideration of then-existing facts and circumstances. Our Corporate Governance Guidelines provide the Board the flexibility to determine whether or not the separation or combination of the Chair and Chief Executive Officer offices is in the best interests of the Company.

Chief Executive Officer and director Mark J. Costa has served as Chair since 2014, the Board having determined that this is the most efficient manner to facilitate effective communication between management and the Board and provide strong and consistent leadership as well as a unified voice for the Company. In addition, the Board believes that combining the roles of Chair and Chief Executive Officer helps ensure that the Chief Executive Officer understands and can effectively and efficiently manage the implementation of the recommendations and decisions of the Board. | In order to give a significant voice to our non-management directors and to reinforce effective, independent leadership on the Board, when the same person holds the Chief Executive Officer and Chair positions or if the Chair is not otherwise independent, the Company’s Bylaws and Corporate Governance Guidelines provide that the Company has a Lead Director. The Lead Director’s responsibilities, which are described in more detail in the Company’s Corporate Governance Guidelines, include: