KeyCorp Third Quarter 2023 Earnings Review October 19, 2023 Chris Gorman Chairman and Chief Executive Officer Clark Khayat Chief Financial Officer

Forward-looking Statements and Additional Information This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “seek,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible,” “potential,” “strategy,” “opportunities,” or “trends,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are based on assumptions that involve risks and uncertainties, which are subject to change based on various important factors (some of which are beyond KeyCorp’s control). Actual results may differ materially from current projections. Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward-looking Statements” and “Risk Factors” in KeyCorp’s Annual Report on Form 10-K for the year ended December 31, 2022, Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, and in other filings of KeyCorp with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any forward- looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding KeyCorp, please refer to our SEC filings available at www.key.com/ir. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation also includes certain non-GAAP financial measures related to “tangible common equity” and “cash efficiency ratio.” Although Key has procedures in place to ensure that these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the reconciliations to the most comparable GAAP measures, please refer to the appendix of this presentation, or page 48 of our Form 10-Q dated June 30, 2023. Certain income or expense items may be expressed on a per common share basis. This is done for analytical and decision-making purposes to better discern underlying trends in total consolidated earnings per share performance excluding the impact of such items. When the impact of certain items is disclosed separately, the after-tax amount is computed using the marginal tax rate, with this then being the amount used to calculate the earnings per share equivalent. GAAP: Generally Accepted Accounting Principles 2

3 ▪ Increased CET1 ratio by 50 bps; above targeted range ‒ Risk-weighted assets declined by $7Bn(1) ▪ Strong core funded balance sheet ‒ Granular, diverse deposit base: average deposits up $2Bn ▪ NII declined from prior quarter and year-ago period ‒ Reflects higher interest rates and balance sheet positioning ▪ Growth in noninterest income ‒ Driven by strong activity in capital markets, payments, and wealth ▪ Well-managed expenses ‒ Expenses up 3% QoQ and stable YoY ▪ Solid credit quality ‒ NCOs to average loans: .24% 3Q23 Highlights ▪ Strengthening and optimizing our balance sheet ‒ Strengthening our balance sheet by continuing to grow core deposits and improve funding and liquidity ‒ Positioning Key to meet new capital requirements under the proposed Basel III Endgame framework ▪ Simplifying and streamlining our focus ‒ Narrowing our focus on high-impact initiatives that improve efficiency and support ongoing investments ‒ Leveraging our relationship-based business model focused on targeted scale to drive future growth and strong performance ▪ Maintaining strong risk management – High-quality portfolio positions Key to continue to deliver sound, profitable growth (1) 9/30/2023 figures are estimated; (2) 9/30/2023 figures are estimated and reflect Key's election to adopt the CECL optional transition provision 3Q23 Financial Results Strategic Highlights & Outlook 9.8% CET1(2) $.29 Earnings per diluted common share $7Bn Reduction in RWAs (1) vs. prior QTR 24 bps NCO to Average Loans

Financial Review

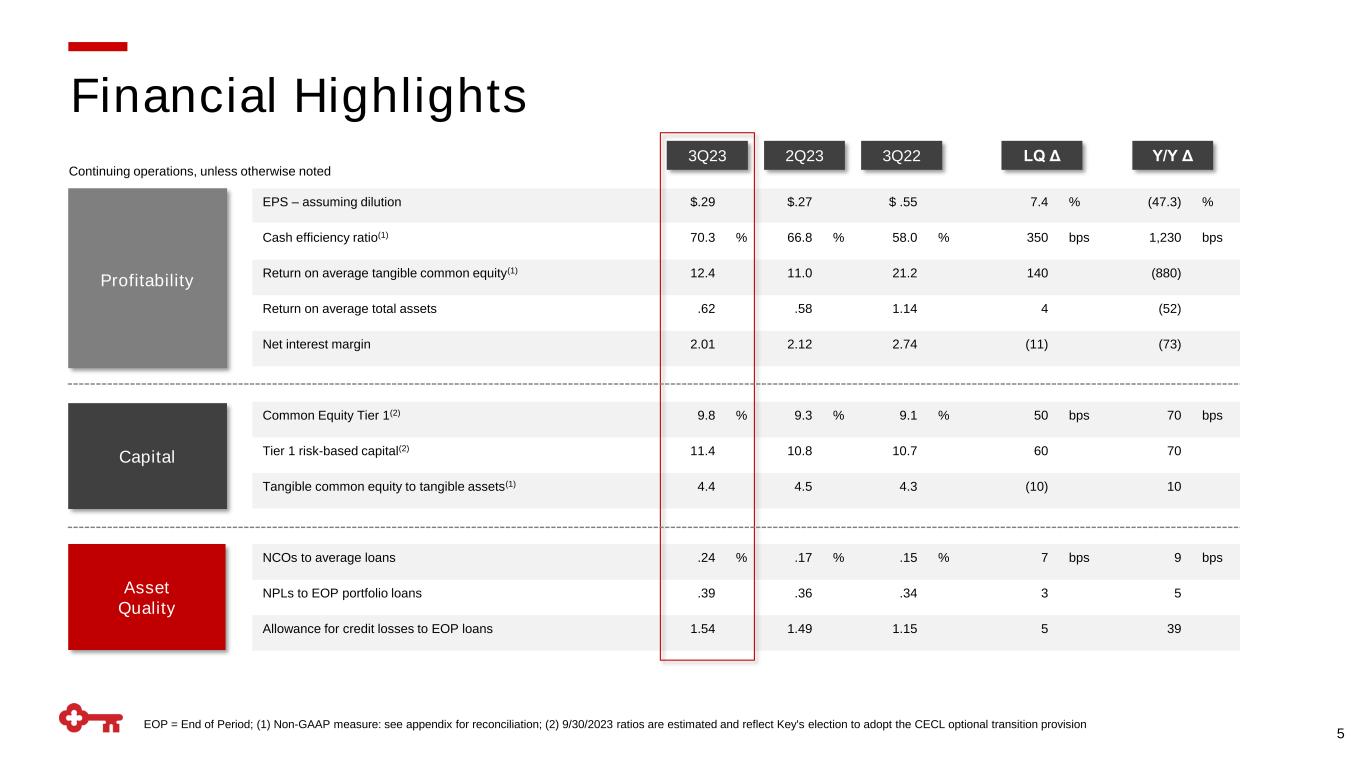

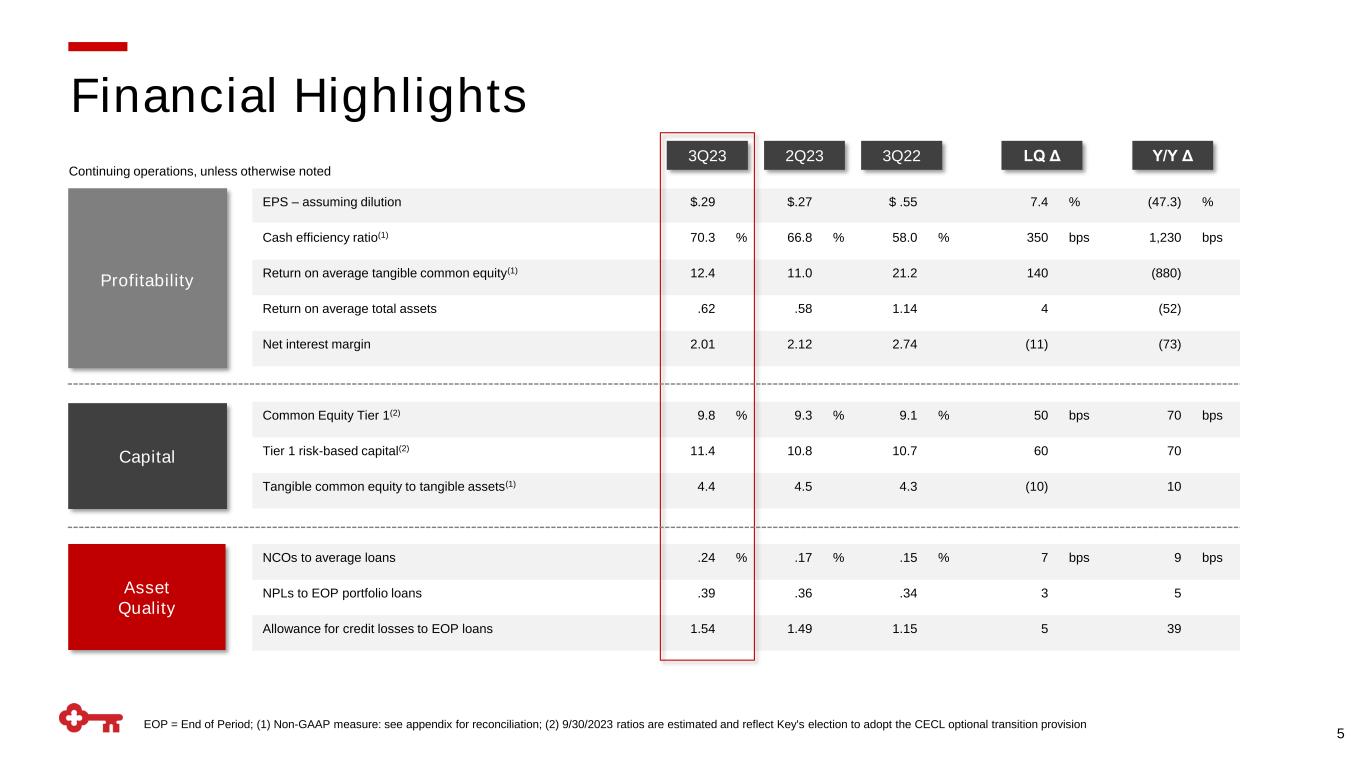

EOP = End of Period; (1) Non-GAAP measure: see appendix for reconciliation; (2) 9/30/2023 ratios are estimated and reflect Key's election to adopt the CECL optional transition provision 5 EPS – assuming dilution $.29 $.27 $ .55 7.4 % (47.3) % Cash efficiency ratio(1) 70.3 % 66.8 % 58.0 % 350 bps 1,230 bps Return on average tangible common equity(1) 12.4 11.0 21.2 140 (880) Return on average total assets .62 .58 1.14 4 (52) Net interest margin 2.01 2.12 2.74 (11) (73) Common Equity Tier 1(2) 9.8 % 9.3 % 9.1 % 50 bps 70 bps Tier 1 risk-based capital(2) 11.4 10.8 10.7 60 70 Tangible common equity to tangible assets(1) 4.4 4.5 4.3 (10) 10 NCOs to average loans .24 % .17 % .15 % 7 bps 9 bps NPLs to EOP portfolio loans .39 .36 .34 3 5 Allowance for credit losses to EOP loans 1.54 1.49 1.15 5 39 Profitability Capital Asset Quality 3Q23 2Q23 3Q22 LQ Δ Y/Y Δ Continuing operations, unless otherwise noted Financial Highlights

6 $78.3 $80.9 $83.0 $84.0 $81.5 $36.1 $36.8 $36.8 $36.6 $36.1 3.97% 4.57% 5.01% 5.26% 5.41% 1.00% 3Q22 4Q22 1Q23 2Q23 3Q23 Average Consumer Average Commercial $ in billions ▪ Average loans up 3% from 3Q22 − Growth in C&I loans driven by relationship clients ▪ Average loans down 3% from 2Q23 − Driven by our balance sheet optimization efforts as we deemphasize non-relationship business − Decline in C&I loans − Decline in consumer mortgage and home equity loans vs. Prior Year vs. Prior Quarter $114.4 $117.7 $119.8 Loans Results reflect our balance sheet optimization efforts as we deemphasize non-relationship business Total Average Loans Highlights $120.7 $117.6 Loan Yield

$90.2 $87.4 $84.6 $82.5 $83.9 $52.3 $54.4 $52.2 $51.4 $54.9 $1.7 $3.9 $6.6 $9.0 $6.1 16 51 99 149 188 3Q22 4Q22 1Q23 2Q23 3Q23 $142.9$144.2 $145.7 $143.4 (1) Other includes brokered deposits and other deposits; (2) Cumulative beta indexed to 4Q21 7 $ in billions Deposits Continue to focus on relationship banking and primacy; average deposits increased compared to the prior quarter and year-ago period ▪ Average deposits up 0.4% from 3Q22 − Increase in wholesale deposits and public sector deposits − Partly offset by a continuation of impacts from changing client behavior reflective of higher interest rates and a normalization of pandemic-related deposits ▪ Average deposits up 1% from 2Q23 − Driven by an increase in consumer and commercial deposit balances − The increase was partly offset by a decline in other time deposits, reflecting lower wholesale deposits ($7Bn of average brokered deposits in 3Q23) vs. Prior Year vs. Prior Quarter ▪ Cumulative total interest-bearing deposit beta: 46%(2) $144.8 Deposits Highlights Average Consumer Average Commercial Average Other (1) Total deposit cost (bp)

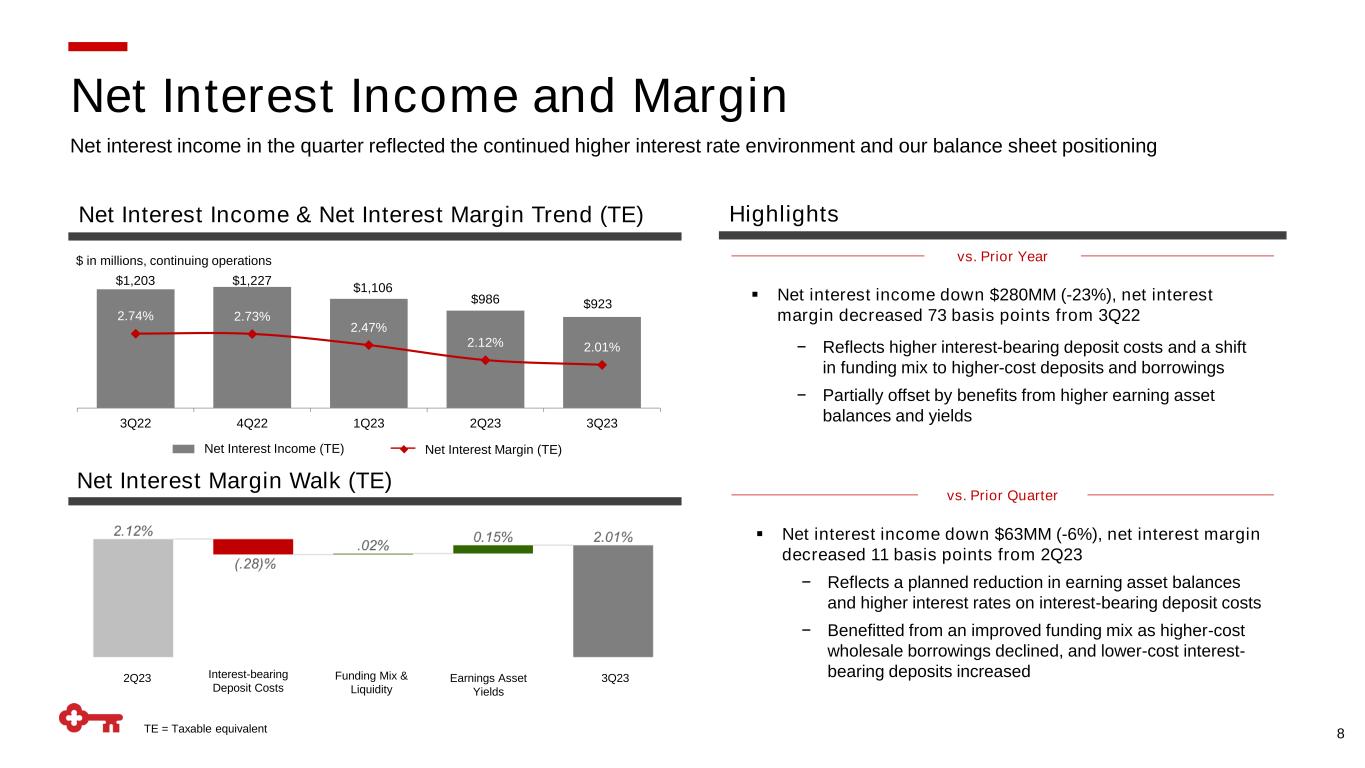

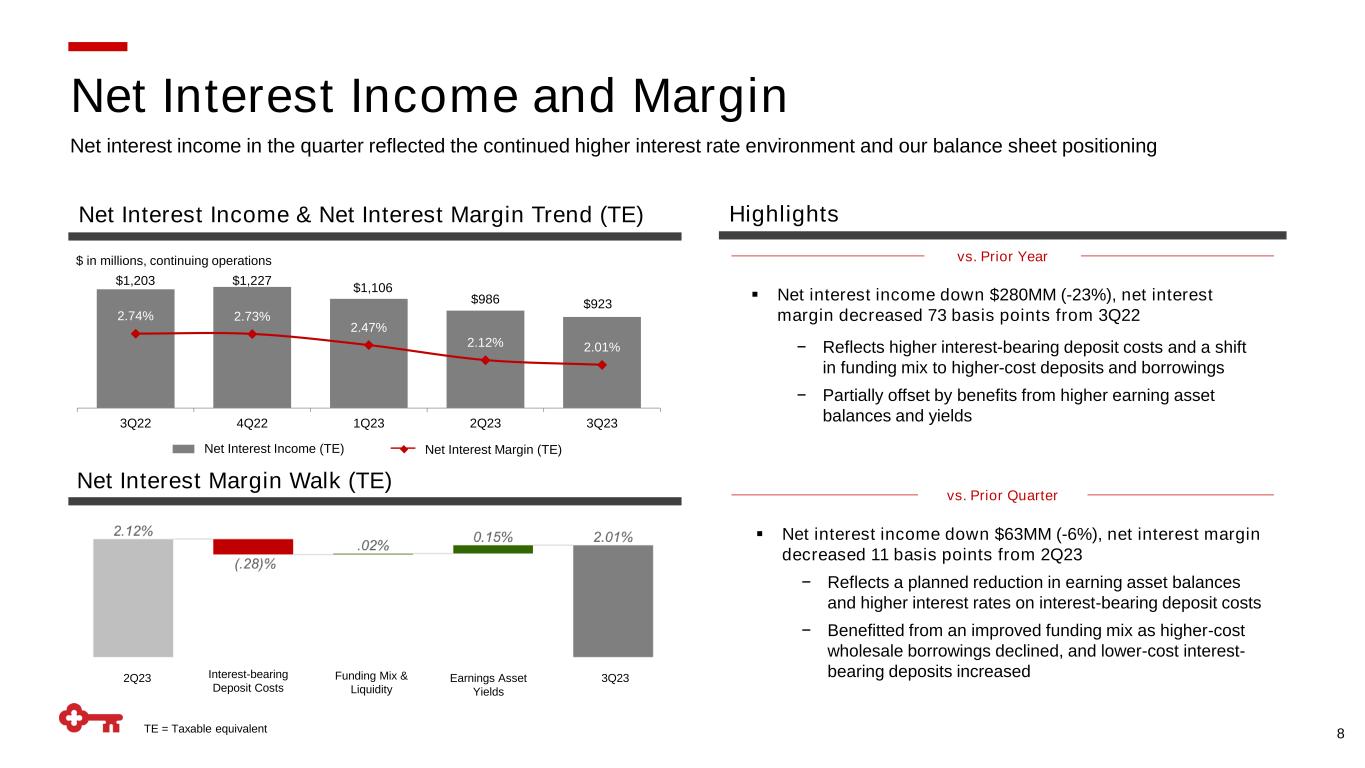

$ in millions, continuing operations vs. Prior Quarter TE = Taxable equivalent $1,203 $1,227 $1,106 $986 $923 2.74% 2.73% 2.47% 2.12% 2.01% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 3Q22 4Q22 1Q23 2Q23 3Q23 ▪ Net interest income down $280MM (-23%), net interest margin decreased 73 basis points from 3Q22 − Reflects higher interest-bearing deposit costs and a shift in funding mix to higher-cost deposits and borrowings − Partially offset by benefits from higher earning asset balances and yields ▪ Net interest income down $63MM (-6%), net interest margin decreased 11 basis points from 2Q23 − Reflects a planned reduction in earning asset balances and higher interest rates on interest-bearing deposit costs − Benefitted from an improved funding mix as higher-cost wholesale borrowings declined, and lower-cost interest- bearing deposits increased 8 vs. Prior Year Net Interest Income (TE) Net Interest Margin (TE) Net interest income in the quarter reflected the continued higher interest rate environment and our balance sheet positioning Net Interest Income and Margin Net Interest Margin Walk (TE) Interest-bearing Deposit Costs Funding Mix & Liquidity Earnings Asset Yields 3Q232Q23 Net Interest Income & Net Interest Margin Trend (TE) Highlights

9 Expecting significant benefit from swap and Treasury maturities Net Interest Income Opportunities Illustrative, $ in millions $39 $67 $97 $112 $131 $150 $7 $13 $22 $41 $71 $102 $46 $80 $119 $152 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 ~$1Bn annualized Net Interest Income benefit by 1Q25 (1) Assumes the forward curve as of 9/30/2023 and maturities to occur on the last day of each quarter Treasuries Swaps Net Interest Income Pickup from Short-dated Maturities(1) $202 $252

10 ▪ Noninterest income down $40MM (-6%) from 3Q22 − Lower service charges on deposit accounts (-$23MM) driven by a reduction in NSF/OD fees and lower account analysis fees related to higher interest rates − Lower corporate services income (-$23MM) driven by lower customer derivatives trading revenue − Lower investment banking and debt placement fees (-$13MM) reflecting lower capital markets activity vs. Prior Quarter ▪ Noninterest income up $34MM (+6%) from 2Q23 − Higher investment banking and debt placement fees (+$21MM) − Higher other income (+$18MM) due to higher trading income and a gain on a loan sale − Lower corporate services income (-$13MM) driven by lower customer derivatives trading revenue vs. Prior Year $ in millions - up / (down) 3Q23 vs. 3Q22 vs. 2Q23 Trust and investment services income $ 130 $ 3 $ 4 Investment banking and debt placement fees 141 (13) 21 Cards and payments income 90 (1) 5 Service charges on deposit accounts 69 (23) - Corporate services income 73 (23) (13) Commercial mortgage servicing fees 46 2 (4) Corporate-owned life insurance 35 2 3 Consumer mortgage income 15 1 1 Operating lease income and other leasing gains 22 3 (1) Other income 22 9 18 Total noninterest income $ 643 $ (40) $ 34 Stronger investment banking and debt placement fees drove the increase in fee income compared to the prior quarter Noninterest Income Noninterest Income Highlights

11 vs. Prior Quarter vs. Prior Year ▪ Noninterest expense up $4MM (+0.4%) from 3Q22 − Higher computer processing expense (+$12MM) related to technology investments and higher personnel expense (+$8MM) and employee benefits costs − Lower business and professional fees (-$9MM) and lower operating lease expense (-$6MM) ▪ Noninterest expense up $34MM (+3%) from 2Q23 − Higher personnel expense (+$41MM) due to higher incentive and stock-based compensation reflecting a higher stock price, production-related incentives, and other incentive funding − Partially offset by a decline in computer processing expense (-$6MM) and broad-based declines among expense categories Continue to simplify and streamline businesses to create expense efficiencies while continuing to make targeted investments for the future Noninterest Expense $ in millions - favorable / (unfavorable) 3Q23 vs. 3Q22 vs. 2Q23 Personnel $ 663 $ (8) $ (41) Net occupancy 67 5 (2) Computer processing 89 (12) 6 Business services and professional fees 38 9 3 Equipment 20 3 2 Operating lease expense 18 6 3 Marketing 28 2 1 Other expense 187 (9) (6) Total noninterest expense $ 1,110 $ (4) $ (34) Noninterest Expense Highlights

$1,338 $1,562 $1,656 $1,771 $1,778 343% 404% 398% 411% 391% 3Q22 4Q22 1Q23 2Q23 3Q23 Allowance for credit losses to NPLsAllowance for credit losses 3Q23 allowance for credit losses to period-end loans of 1.54%$ in millions NCO = Net charge-off NPL = Nonperforming Loans (1) Loan and lease outstandings 12 $43 $41 $45 $52 71 $109 $265 $139 $167 81 0.15% 0.14% 0.15% 0.17% 0.24% 3Q22 4Q22 1Q23 2Q23 3Q23 $ in millions NCOs Provision for credit losses NCOs to avg. loans 2.5% 2.5% 2.8% 3.3% 3.9% 3Q22 4Q22 1Q23 2Q23 3Q23 Continuing Operations Disciplined underwriting with net charge-offs remaining near low levels Credit Quality 0.16% 0.15% 0.14% 0.12% 0.15% 0.04% 0.05% 0.05% 0.06% 0.04% 3Q22 4Q22 1Q23 2Q23 3Q23 30 – 89 days delinquent 90+ days delinquent Net Charge-offs & Provision for Credit Losses Continuing Operations Delinquencies to Period-end Total Loans Criticized Outstandings (1) to Period-end Total Loans Allowance for Credit Losses (ACL)

9.1% 9.1% 9.1% 9.3% 9.8% 3Q22 4Q22 1Q23 2Q23 3Q23 A = Actual; E = Estimated (1) 9/30/23 ratio is estimated and reflects Key's election to adopt the CECL optional transition provision; (2) Assumes market forwards as of September 30, 2023 13 Strong capital position, up 50 basis points from last quarter and well above targeted range Capital Target operating range: 9% - 9.5% ▪ Priorities remain unchanged: focused on supporting relationship clients and dividends ▪ Declared 3Q23 dividend of $.205 per common share Common Equity Tier 1(1) Projected AOCI Impacts(2) 9/30/2023 A 12/31/2023 E 12/31/2024 E 12/31/2025 E Illustrative, $ in billions $(6.6) $(6.2) $(4.8) $(4.1) ~27% AOCI burn down by the end of 2024 ~39% AOCI burn down by the end of 2025 ~$2.5Bn Capital Build Contribution by End of 2025

Average Balance Sheet • Loans: down 1% - 3% • Deposits: relatively stable • Loans: up 6% - 9% • Deposits: flat to down 2% Net Interest Income (TE) • Net interest income: relatively stable (Prior guidance flat to down 2%) • Net interest income: down 12% - 14% Noninterest Income • Noninterest income: up 1% - 3% (Prior guidance up 4% - 6%) • Noninterest income: down 7% - 9% Noninterest Expense • Noninterest expense: relatively stable(1) • Noninterest expense: relatively stable(1) Credit Quality • Net charge-offs to average loans: 25 – 35 bps (4Q23) • Net charge-offs to average loans: 25 – 30 bps (FY2023) Taxes • GAAP tax rate: 18% - 19% (4Q23) • GAAP tax rate: 18% - 19% (FY2023) Long-term Targets Positive operating leverage Moderate risk profile: Net charge-offs to avg. loans targeted range of 40-60 bps ROTCE: 16% - 19% Cash efficiency ratio: 54% - 56% Note: Guidance range: relatively stable: +/- 2% Note: Assumes market forwards as of September 30, 2023 (1) The noninterest expense guidance excludes the proposed FDIC special assessment related to recovering the cost of the closures of Silicon Valley Bank and Signature Bank, efficiency related expenses, and an expected pension settlement charge Outlook 4Q23 (vs. 3Q23) FY2023 (vs. FY2022) 14 Guidance as of 10/19/2023

Appendix

16 $ in billions, as of 9/30/2023 ▪ $8Bn of deposits are from low-cost, stable escrow balances ▪ $13.5Bn of uninsured deposits are collateralized by government-backed securities ▪ 79% of commercial segment deposit balances are from core operating accounts ▪ Loan-to-deposit ratio: 81%(2) 3Q23 Mix by Insurance Coverage 59% 32% 5% Deposits: A Diverse Core Base Key’s deposit base is made up of over three and a half million retail, small business, private banking, and commercial clients, with two-thirds of balances covered by FDIC insurance or collateralized 46% 26% 12% 9% 7% Middle Market Business Banking Retail Large Corporate Public Sector Uninsured and Uncollateralized Insured Collateralized 58% 33% 9% $144.3 67% of balances insured or collateralized 58% of balances from retail and business banking clients Note: All figures are based on 9/30/2023 period-end data unless otherwise noted (1) Includes collateralized state and municipal balances and excludes bank and nonbank subsidiaries; (2) Represents period-end consolidated total loans and loans held for sale divided by period-end consolidated total deposits (1) 3Q23 Mix by Client Highlights $ in billions CDs and other time deposits Savings Noninterest-bearing Demand and MMDA 3Q23 Average Deposit Mix 63% 23% 10%4% $144.8 As of 9/30/2023

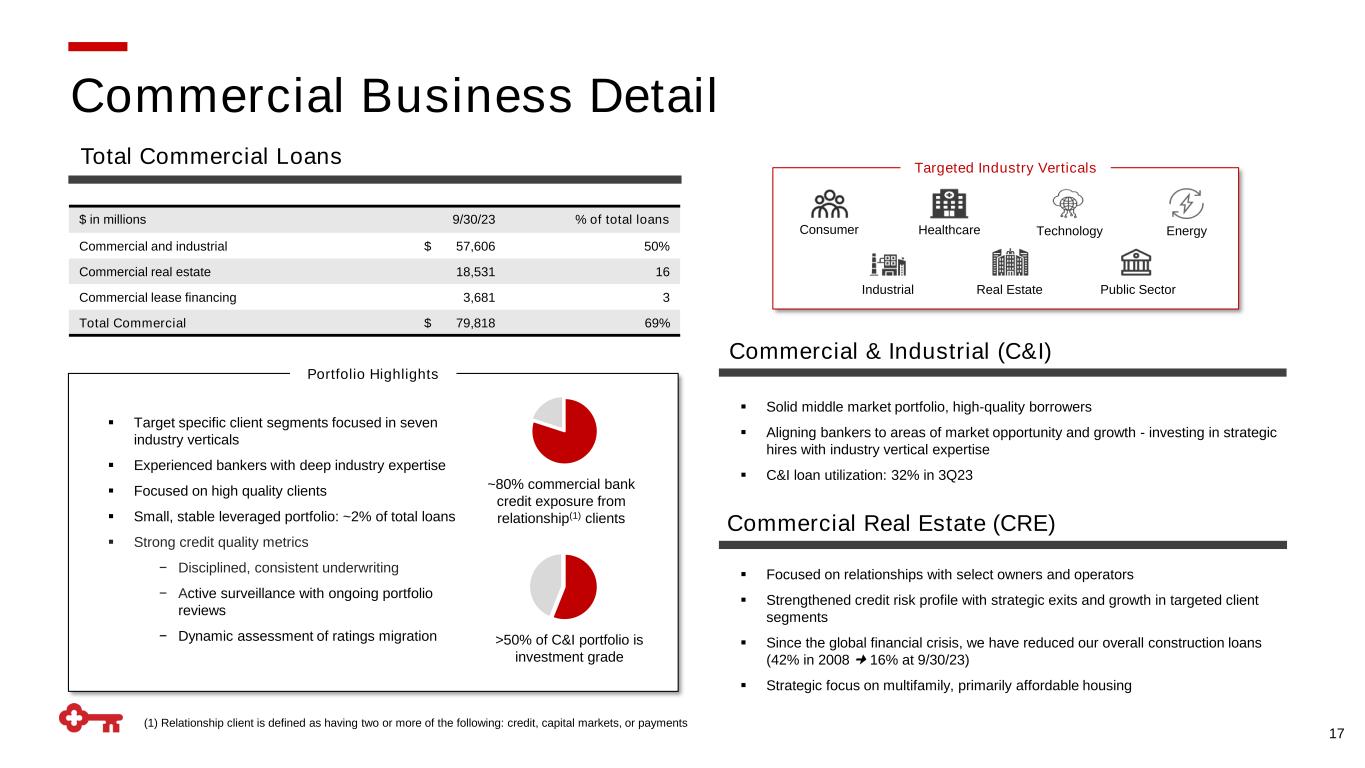

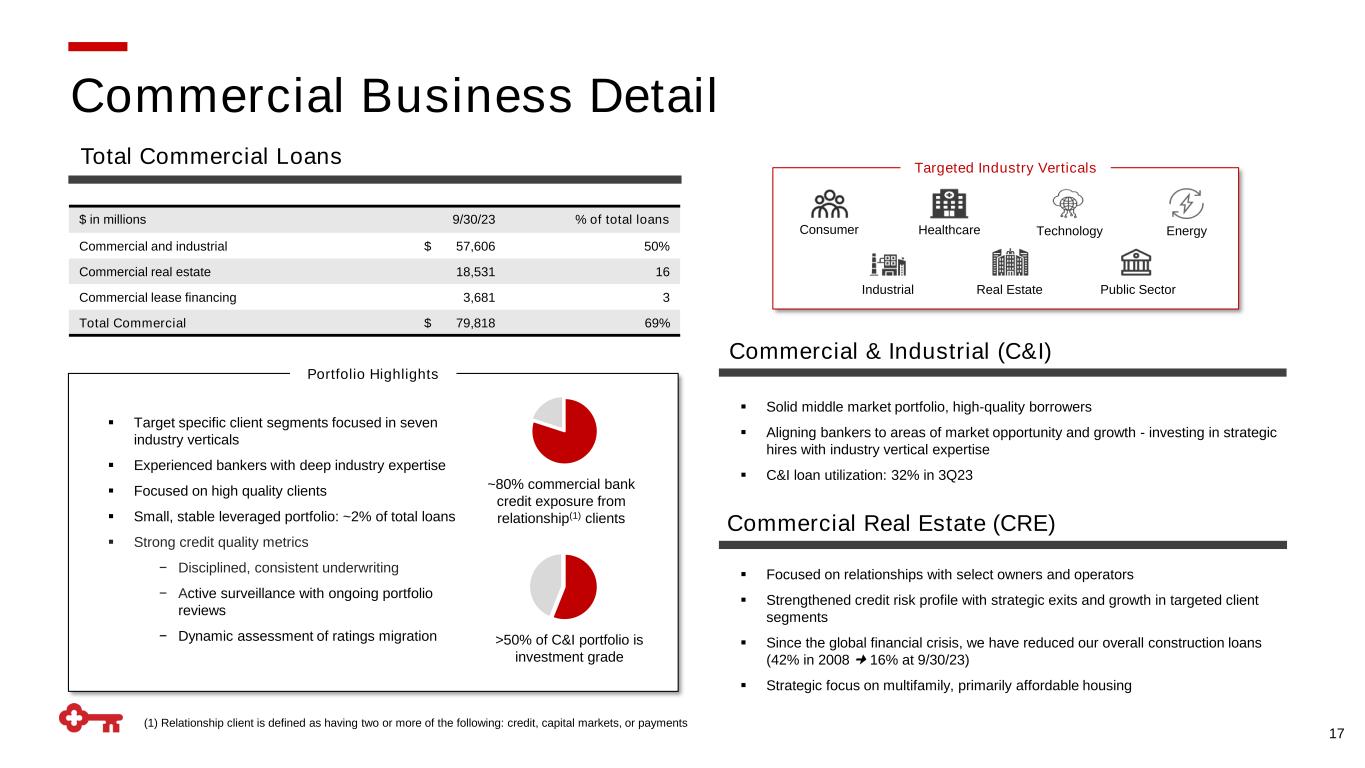

Portfolio Highlights ▪ Target specific client segments focused in seven industry verticals ▪ Experienced bankers with deep industry expertise ▪ Focused on high quality clients ▪ Small, stable leveraged portfolio: ~2% of total loans ▪ Strong credit quality metrics − Disciplined, consistent underwriting − Active surveillance with ongoing portfolio reviews − Dynamic assessment of ratings migration ~80% commercial bank credit exposure from relationship(1) clients Targeted Industry Verticals Consumer Energy Industrial TechnologyHealthcare (1) Relationship client is defined as having two or more of the following: credit, capital markets, or payments ▪ Solid middle market portfolio, high-quality borrowers ▪ Aligning bankers to areas of market opportunity and growth - investing in strategic hires with industry vertical expertise ▪ C&I loan utilization: 32% in 3Q23 ▪ Focused on relationships with select owners and operators ▪ Strengthened credit risk profile with strategic exits and growth in targeted client segments ▪ Since the global financial crisis, we have reduced our overall construction loans (42% in 2008 16% at 9/30/23) ▪ Strategic focus on multifamily, primarily affordable housing Real Estate Public Sector 17 $ in millions 9/30/23 % of total loans Commercial and industrial $ 57,606 50% Commercial real estate 18,531 16 Commercial lease financing 3,681 3 Total Commercial $ 79,818 69% >50% of C&I portfolio is investment grade Total Commercial Loans Commercial & Industrial (C&I) Commercial Real Estate (CRE) Commercial Business Detail

Key has limited exposure to riskier asset classes like office, lodging, and retail 18 $ in millions, non-owner occupied 9/30/23 % of total loans Multifamily $ 9,025 7.8% Industrial 811 <1% Retail 1,161 1% Senior Housing 809 <1% Office 865 <1% B and C Class Office in Central Business Districts 116 N/A Lodging 206 <1% Other 1,888 1.6% Total Non-owner Occupied Commercial Real Estate $ 14,765 13% Office Loans as a Portion of Total Loans (1) Source: 10-Q filing data as of 6/30/2023 – peers include BAC, CFG, JPM, MTB, PNC, TFC, WFC, and ZION, as others do not report data on office balances Portfolio by Asset Class Office Loan Detail Commercial Real Estate Loan Portfolio Detail ▪ 17% to mature in 2023 ($147MM) ▪ $0 non-owner-occupied construction ▪ Nonperforming loans: 2.3% ▪ Delinquencies: ‒ 30 – 89 Day: 0.00% ‒ 90+ day: 0.01% Office Highlights 0.7% 3.1% Key Peer Median (1)

Portfolio Highlights ▪ Prime & super prime client base focused on relationships ▪ Continuing to invest in digital to drive future growth 768 weighted average FICO at origination Note: Table may not foot due to rounding (1) Indirect auto portfolio was sold on 9/10/21 Total Consumer Loans 19 $ in billions 9/30/23 % of total loans WA FICO at origination Consumer mortgage $ 21,309 18% 754 Home equity 7,324 6 807 Consumer direct 6,074 5 759 Credit card 988 1 793 Consumer indirect(1) 31 N/A N/A Total Consumer $ 35,726 31% 768 ▪ Assets under management of $52.5Bn, up $4.5Bn from the year-ago period ▪ Collaborating with businesses across Key, representing strong cross-sell opportunities ▪ Launched Key Private Client in 2023 and have seen compelling traction, adding over 17K households, growing both investments and deposits Wealth Management $ in millions Assets Under Management $47.8 $51.3 $53.7 $54.0 $52.5 3Q22 4Q22 1Q23 2Q23 3Q23 +10% Growth Consumer Business Detail

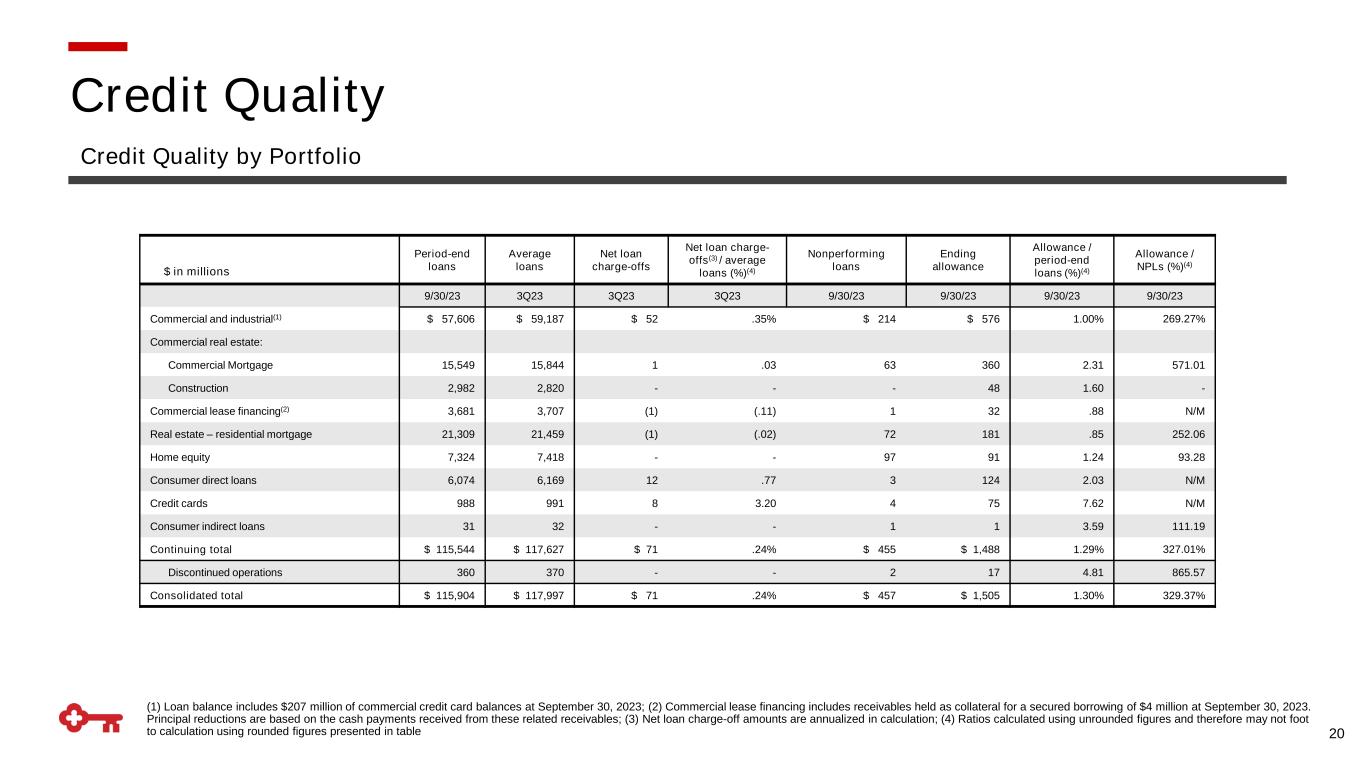

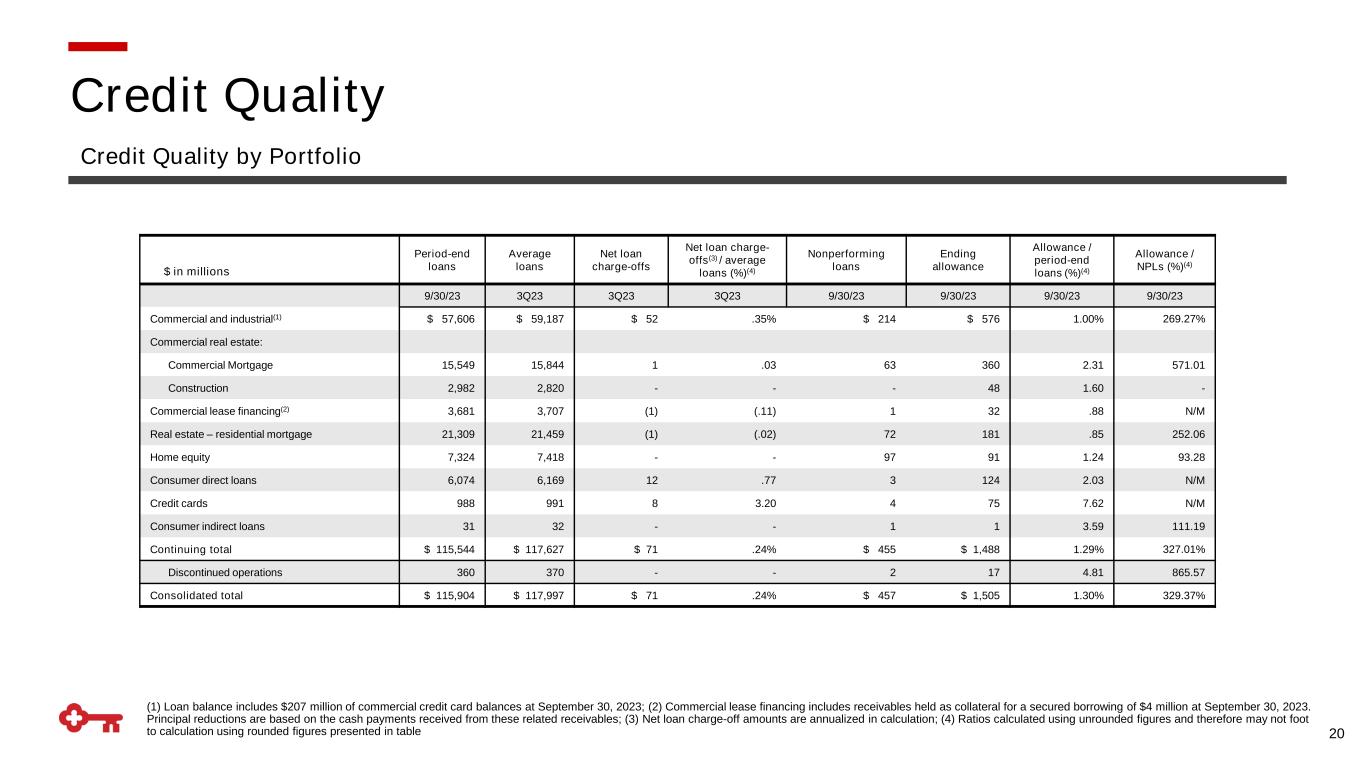

Period-end loans Average loans Net loan charge-offs Net loan charge- offs(3) / average loans (%)(4) Nonperforming loans Ending allowance Allowance / period-end loans (%)(4) Allowance / NPLs (%)(4) 9/30/23 3Q23 3Q23 3Q23 9/30/23 9/30/23 9/30/23 9/30/23 Commercial and industrial(1) $ 57,606 $ 59,187 $ 52 .35% $ 214 $ 576 1.00% 269.27% Commercial real estate: Commercial Mortgage 15,549 15,844 1 .03 63 360 2.31 571.01 Construction 2,982 2,820 - - - 48 1.60 - Commercial lease financing(2) 3,681 3,707 (1) (.11) 1 32 .88 N/M Real estate – residential mortgage 21,309 21,459 (1) (.02) 72 181 .85 252.06 Home equity 7,324 7,418 - - 97 91 1.24 93.28 Consumer direct loans 6,074 6,169 12 .77 3 124 2.03 N/M Credit cards 988 991 8 3.20 4 75 7.62 N/M Consumer indirect loans 31 32 - - 1 1 3.59 111.19 Continuing total $ 115,544 $ 117,627 $ 71 .24% $ 455 $ 1,488 1.29% 327.01% Discontinued operations 360 370 - - 2 17 4.81 865.57 Consolidated total $ 115,904 $ 117,997 $ 71 .24% $ 457 $ 1,505 1.30% 329.37% 20 $ in millions (1) Loan balance includes $207 million of commercial credit card balances at September 30, 2023; (2) Commercial lease financing includes receivables held as collateral for a secured borrowing of $4 million at September 30, 2023. Principal reductions are based on the cash payments received from these related receivables; (3) Net loan charge-off amounts are annualized in calculation; (4) Ratios calculated using unrounded figures and therefore may not foot to calculation using rounded figures presented in table Credit Quality Credit Quality by Portfolio

Prime 8% 1M SOFR 21% 3M SOFR 6% O/N SOFR 25% Fixed 36% Other 4% (1) Loan statistics based on 9/30/2023 ending balances; (2) Deposit statistics based on 9/30/2023 average balances; (3) Yield is calculated on the basis of amortized cost Loan Composition(1) Deposit Mix(2) ▪ Attractive business model with relationship-oriented lending franchise − Distinctive commercial capabilities drive C&I growth and ~64% floating-rate loan mix − Laurel Road and consumer mortgage enhance fixed rate loan volumes with attractive client profile ▪ Investment portfolio positioned to provide liquidity and enhance returns while benefiting from higher reinvestment rates − Objectives include investing in mortgage-backed securities with lower prepayment risks and limited exposure to unamortized premiums ▪ Average balances reflects portfolio runoff in 3Q23 ▪ HTM utilized to reduce OCI volatility beginning in 2Q22 ‒ Current portfolio consists of ~20% HTM (+5% year over year) 21 Noninterest- bearing Interest- bearing 23% $7.9 $8.3 $8.9 $9.4 $9.0 $42.3 $39.2 $39.2 $38.9 $37.3 1.85% 1.91% 1.98% 2.04% 2.06% 3Q22 4Q22 1Q23 2Q23 3Q23 Average AFS securities Average yield(3)Average HTM securities $ in billions Average Total Investment Securities Balance Sheet Management Detail 3Q23 Balance Sheet Highlights Highlights $50.3 $50.2 $47.5 $48.1 $46.3 77%

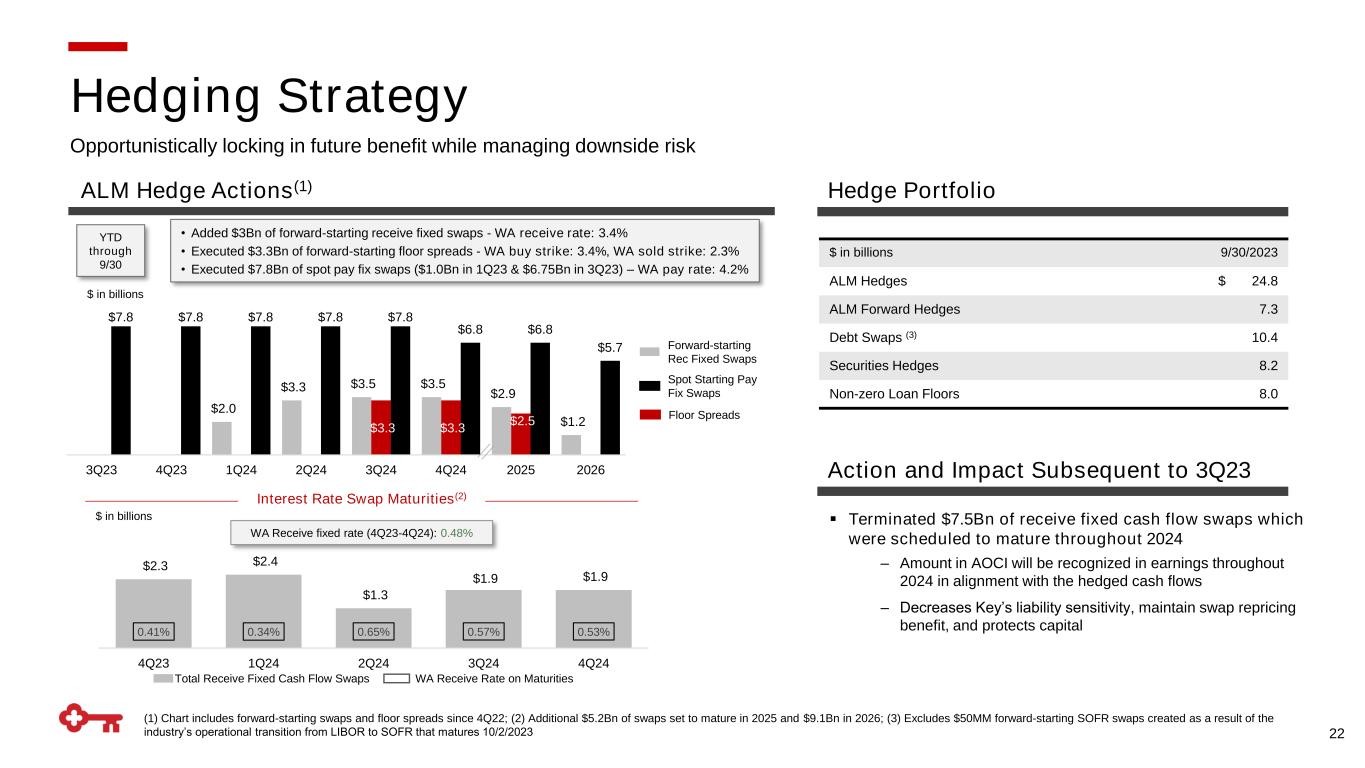

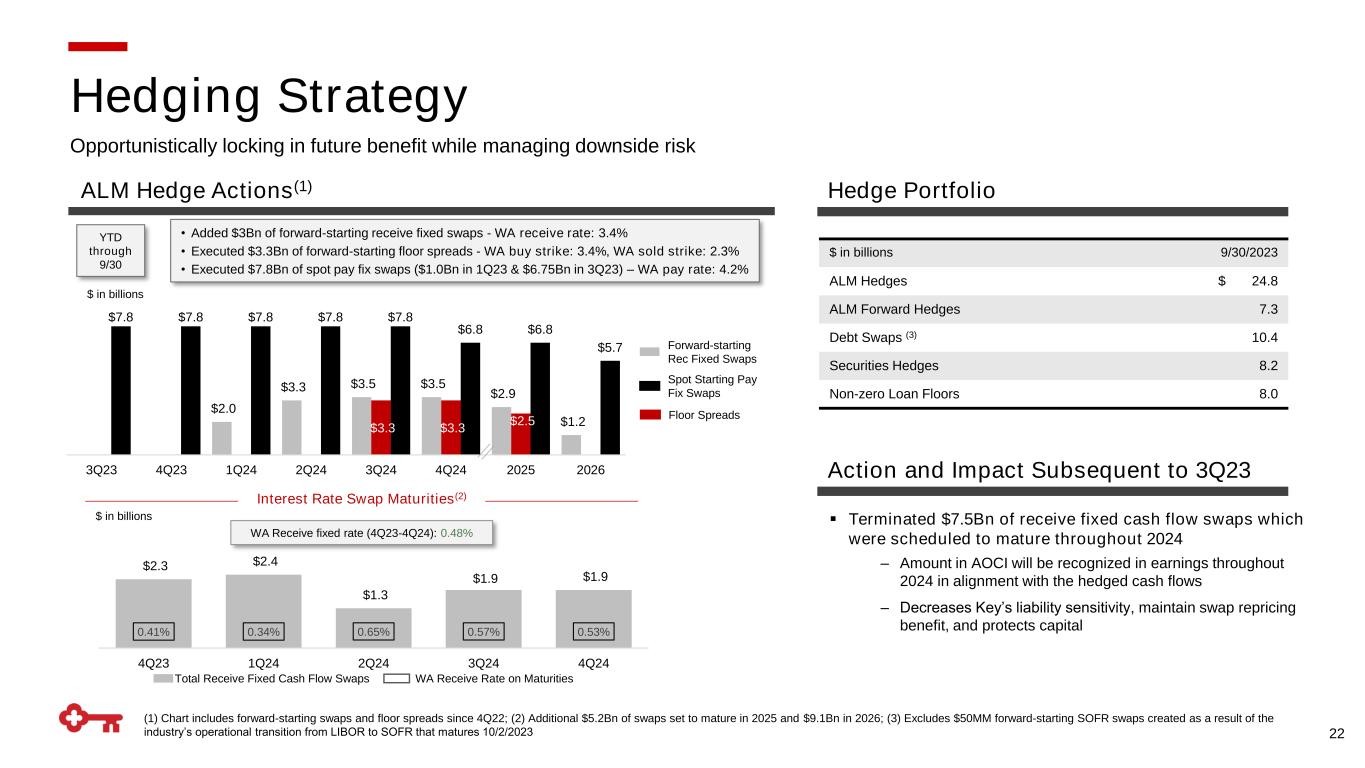

22 Hedging Strategy Opportunistically locking in future benefit while managing downside risk ALM Hedge Actions(1) Hedge Portfolio $ in billions (1) Chart includes forward-starting swaps and floor spreads since 4Q22; (2) Additional $5.2Bn of swaps set to mature in 2025 and $9.1Bn in 2026; (3) Excludes $50MM forward-starting SOFR swaps created as a result of the industry’s operational transition from LIBOR to SOFR that matures 10/2/2023 WA Receive fixed rate (4Q23-4Q24): 0.48% Interest Rate Swap Maturities(2) $2.0 $3.3 $3.5 $3.5 $2.9 $1.2 $3.3 $3.3 $2.5 $7.8 $7.8 $7.8 $7.8 $7.8 $6.8 $6.8 $5.7 $0.0 $2.0 $4.0 $6.0 $8.0 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 2025 2026 • Added $3Bn of forward-starting receive fixed swaps - WA receive rate: 3.4% • Executed $3.3Bn of forward-starting floor spreads - WA buy strike: 3.4%, WA sold strike: 2.3% • Executed $7.8Bn of spot pay fix swaps ($1.0Bn in 1Q23 & $6.75Bn in 3Q23) – WA pay rate: 4.2% $ in billions YTD through 9/30 Forward-starting Rec Fixed Swaps Floor Spreads Spot Starting Pay Fix Swaps Action and Impact Subsequent to 3Q23 ▪ Terminated $7.5Bn of receive fixed cash flow swaps which were scheduled to mature throughout 2024 ‒ Amount in AOCI will be recognized in earnings throughout 2024 in alignment with the hedged cash flows ‒ Decreases Key’s liability sensitivity, maintain swap repricing benefit, and protects capital $2.3 $2.4 $1.3 $1.9 $1.9 0.41% 0.34% 0.65% 0.57% 0.53% $0.0 $1.0 $2.0 $3.0 4Q23 1Q24 2Q24 3Q24 4Q24 Total Receive Fixed Cash Flow Swaps WA Receive Rate on Maturities $ in billions 9/30/2023 ALM Hedges $ 24.8 ALM Forward Hedges 7.3 Debt Swaps (3) 10.4 Securities Hedges 8.2 Non-zero Loan Floors 8.0

23 Projected Cash Flows & Maturities (under implied forward rates) Floating Rate (including hedges) Existing Portfolio Repricing Characteristics Highlights (1) 2023 Projected cashflows does not include realized cashflows from 1Q23, 2Q23 and 3Q23 Investment Portfolio $ in billions $0.4 $0.7 $1.5 $2.6 $2.9 $0.3 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 WA yield on portfolio 0.44% $ in billions .48%.44%.45%.29% .17% Short-term Treasury Maturities WA Maturity Yield Short-term Treasury Maturities .63% ▪ Portfolio used for funding and liquidity management ‒ Portfolio composed primarily of fixed-rate GNMA and GSE-backed MBS and CMOs ‒ Portfolio yield excluding short-term Treasury/Agency securities: 2.4% ▪ Portfolio constructed to enhance current returns on excess liquidity, while preserving the opportunity to capitalize on higher interest rates in the future ‒ Agency MBS/CMO investments constructed to limit extension risk and provide continued cash flows as rates rise (~$1.2Bn per quarter in the near-term) ‒ Short-term Treasury/Agency portfolio consists of a laddered maturity profile has begun running off and will continue to provide yield enhancement opportunity through 1Q25 ▪ Available for sale portfolio duration of 4.9 years at 9/30/2023 (duration including securities hedges) ▪ $6.75Bn of fair value hedges on CMBS and RMBS securities were executed in 3Q23 at a weighted average pay rate of 4.22% $11.5 $21.7 $13.7 2023** 2024 2025 (1)

24 Remaining maturity, as of September 30, 2023 $ in millions Agency Residential Collateralized Mortgage Obligations Agency Residential Mortgage- backed Securities Agency Commercial Mortgage- backed Securities Asset- backed Securities Other Total One year or less $ 12 $ - $ 5 $ 873 $ 5 $ 895 After 1 through 5 years 1,714 114 2,194 2 10 4,034 After 5 through 10 years 2,340 8 276 4 - 2,628 After 10 years 1,214 46 36 - - 1,296 Amortized Cost 5,280 168 2,511 879 15 8,853 Fair Value 4,832 145 2,217 836 14 8,044 Remaining maturity, as of September 30, 2023 $ in millions U.S. Treasury, Agencies, and Corporations Agency Residential Collateralized Mortgage Obligations Agency Residential Mortgage- backed Securities Agency Commercial Mortgage- backed Securities Total One year or less $ 5,224 $ 40 $ 1 $ 18 $ 5,283 After 1 through 5 years 3,596 1,538 2,239 2,106 9,479 After 5 through 10 years 111 8,556 802 5,495 14,964 After 10 years 100 4,526 443 1,044 6,113 Fair Value 9,031 14,660 3,485 8,663 35,839 Available for Sale (AFS) Held-to-Maturity (HTM) Securities Maturity Schedule

25 $ in millions (1) For the three months ended September 30, 2023, June 30, 2023, and September 30, 2022, intangible assets exclude $1 million, $1 million, and $2 million, respectively, of period-end purchased credit card receivables; (2) Net of capital surplus; (3) For the three months ended September 30, 2023, June 30, 2023, and September 30, 2022, average intangible assets exclude $1 million, $1 million, and $2 million, respectively, of average purchased credit card receivables GAAP to Non-GAAP Reconciliation 9/30/2023 6/30/2023 9/30/2022 Tangible common equity to tangible assets at period end Key shareholders' equity (GAAP) 13,356$ 13,844$ 13,290$ Less: Intangible assets (1) 2,816$ 2,826 2,856 Preferred Stock (2) 2,446$ 2,446 2,446 Tangible common equity (non-GAAP) 8,094$ 8,572$ 7,988$ Total assets (GAAP) 187,851$ 195,037$ 190,051$ Less: Intangible assets (1) 2,816$ 2,826 2,856 Tangible assets (non-GAAP) 185,035$ 192,211$ 187,195$ Tangible common equity to tangible assets ratio (non-GAAP) 4.37% 4.46% 4.27% Average tangible common equity Average Key shareholders' equity (GAAP) 13,831$ 14,412$ 14,614$ Less: Intangible assets (average) (3) 2,821$ 2,831 2,863 Preferred Stock (average) 2,500$ 2,500 2,148 Average tangible common equity (non-GAAP) 8,510$ 9,081$ 9,603$ Three months ended

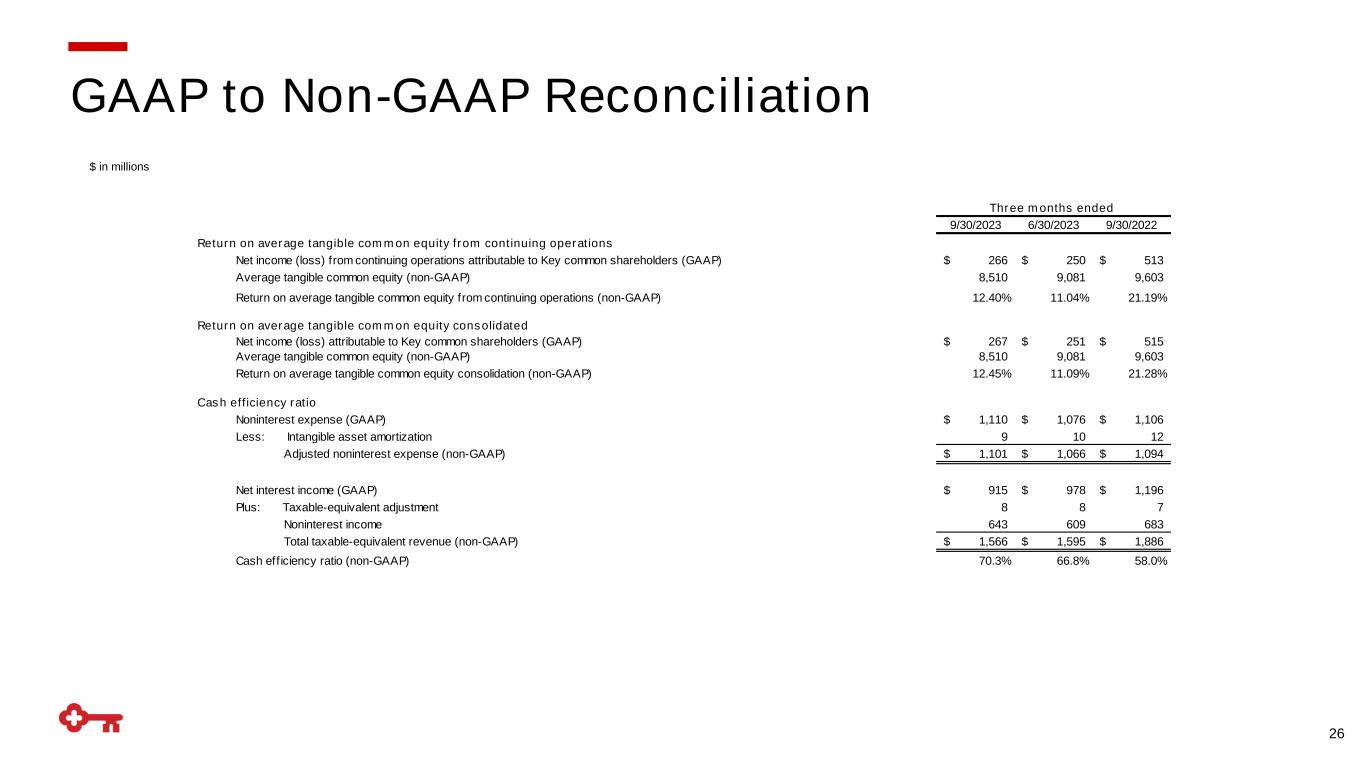

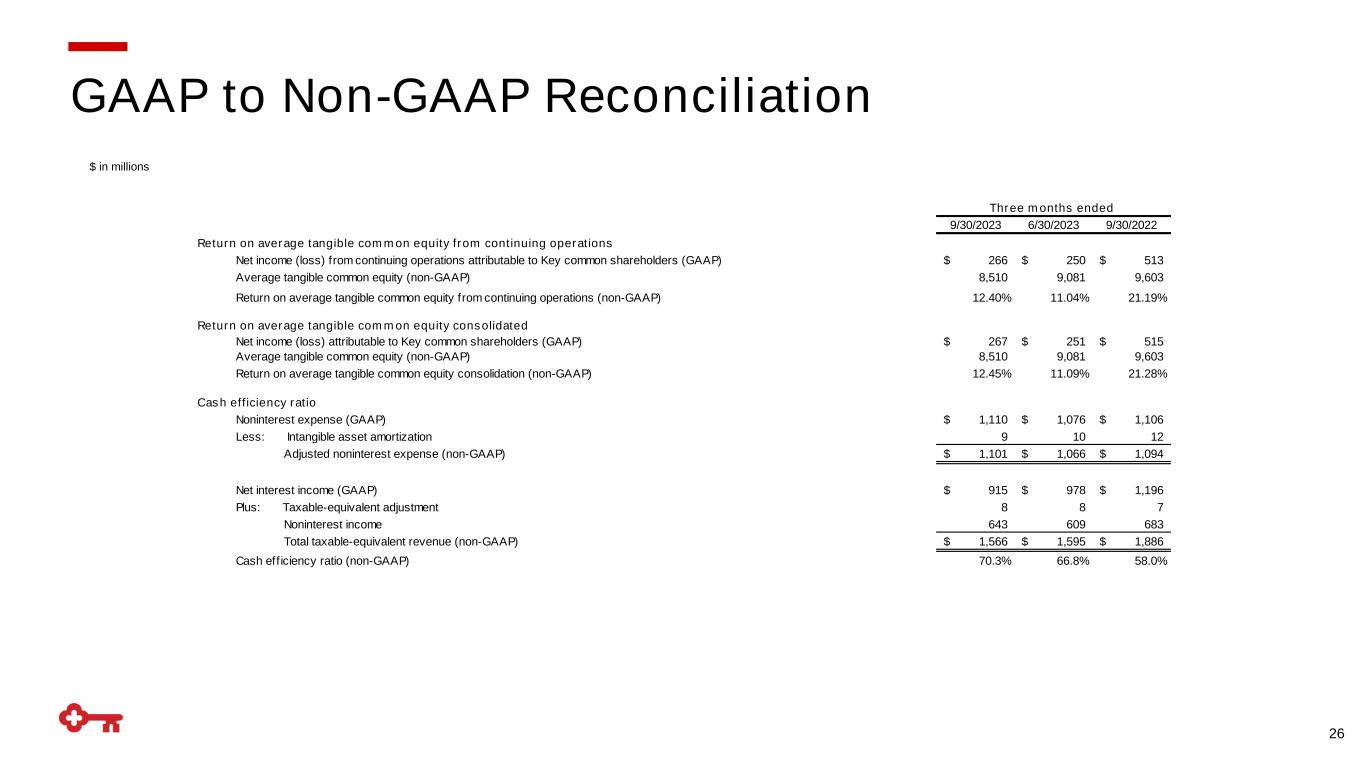

26 $ in millions GAAP to Non-GAAP Reconciliation 9/30/2023 6/30/2023 9/30/2022 Return on average tangible common equity from continuing operations Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) 266$ 250$ 513$ Average tangible common equity (non-GAAP) 8,510 9,081 9,603 Return on average tangible common equity from continuing operations (non-GAAP) 12.40% 11.04% 21.19% Return on average tangible common equity consolidated Net income (loss) attributable to Key common shareholders (GAAP) 267$ 251$ 515$ Average tangible common equity (non-GAAP) 8,510 9,081 9,603 Return on average tangible common equity consolidation (non-GAAP) 12.45% 11.09% 21.28% Cash efficiency ratio Noninterest expense (GAAP) 1,110$ 1,076$ 1,106$ Less: Intangible asset amortization 9 10 12 Adjusted noninterest expense (non-GAAP) 1,101$ 1,066$ 1,094$ Net interest income (GAAP) 915$ 978$ 1,196$ Plus: Taxable-equivalent adjustment 8 8 7 Noninterest income 643 609 683 Total taxable-equivalent revenue (non-GAAP) 1,566$ 1,595$ 1,886$ Cash eff iciency ratio (non-GAAP) 70.3% 66.8% 58.0% Three months ended