KeyCorp Third Quarter 2024 Earnings Review October 17, 2024 Chris Gorman Chairman and Chief Executive Officer Clark Khayat Chief Financial Officer

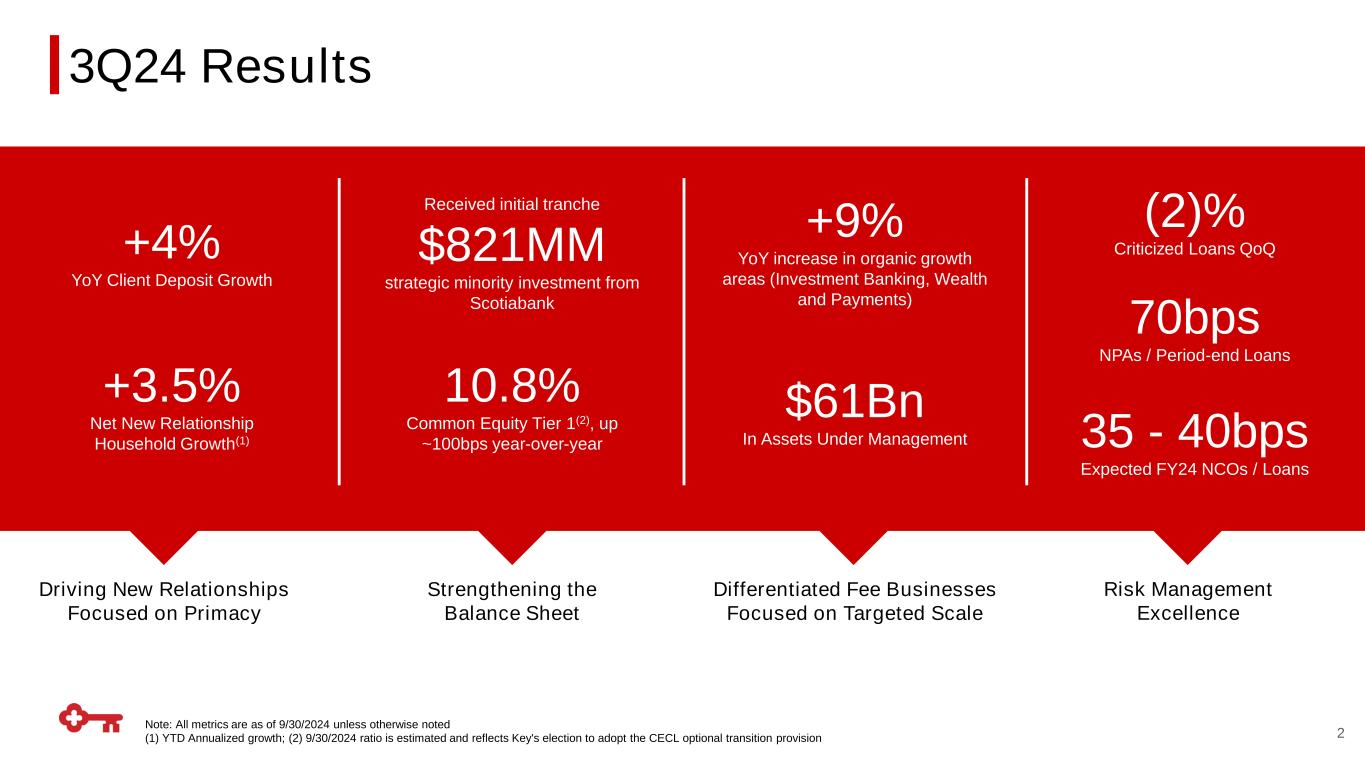

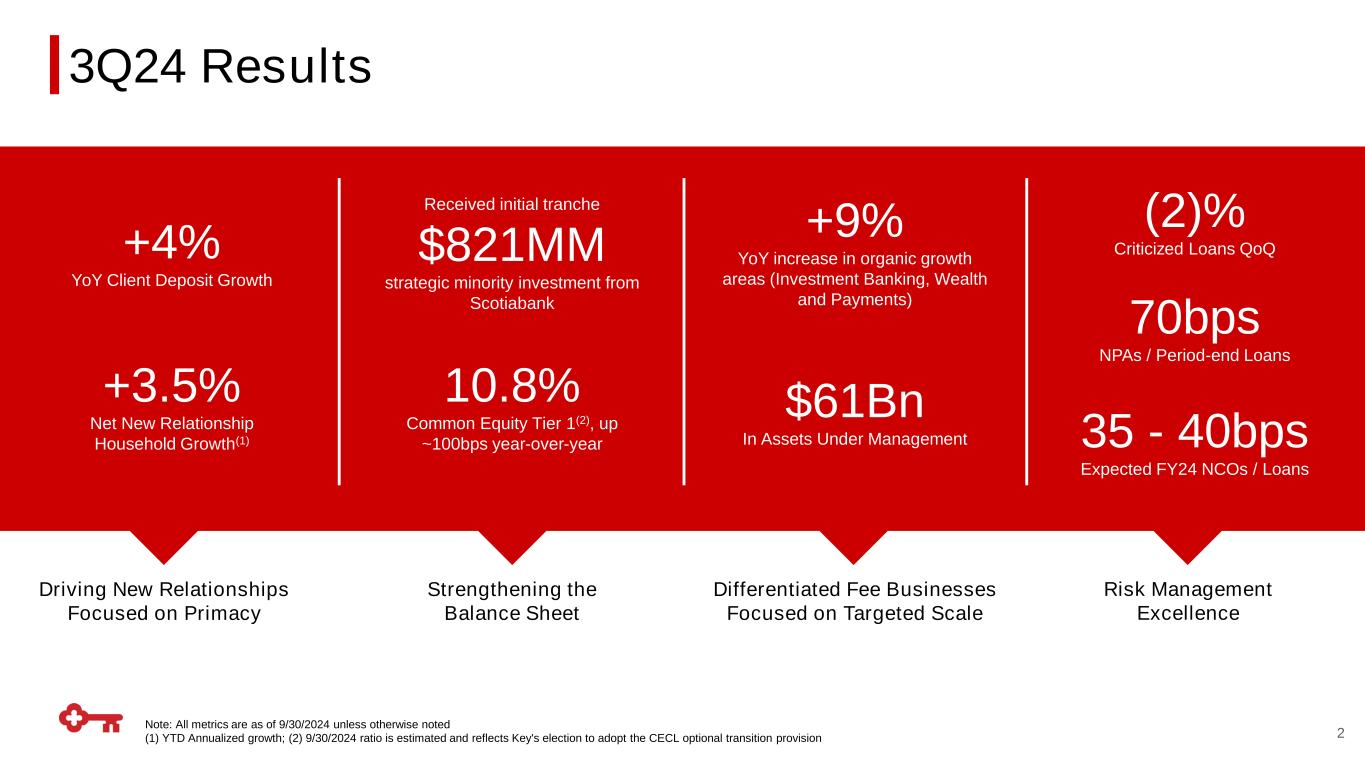

Note: All metrics are as of 9/30/2024 unless otherwise noted (1) YTD Annualized growth; (2) 9/30/2024 ratio is estimated and reflects Key's election to adopt the CECL optional transition provision 3Q24 Results +4% YoY Client Deposit Growth +3.5% Net New Relationship Household Growth(1) Driving New Relationships Focused on Primacy Differentiated Fee Businesses Focused on Targeted Scale 10.8% Common Equity Tier 1(2), up ~100bps year-over-year Strengthening the Balance Sheet 70bps NPAs / Period-end Loans Risk Management Excellence 2 Received initial tranche $821MM strategic minority investment from Scotiabank (2)% Criticized Loans QoQ +9% YoY increase in organic growth areas (Investment Banking, Wealth and Payments) 35 - 40bps Expected FY24 NCOs / Loans $61Bn In Assets Under Management

Financial Review

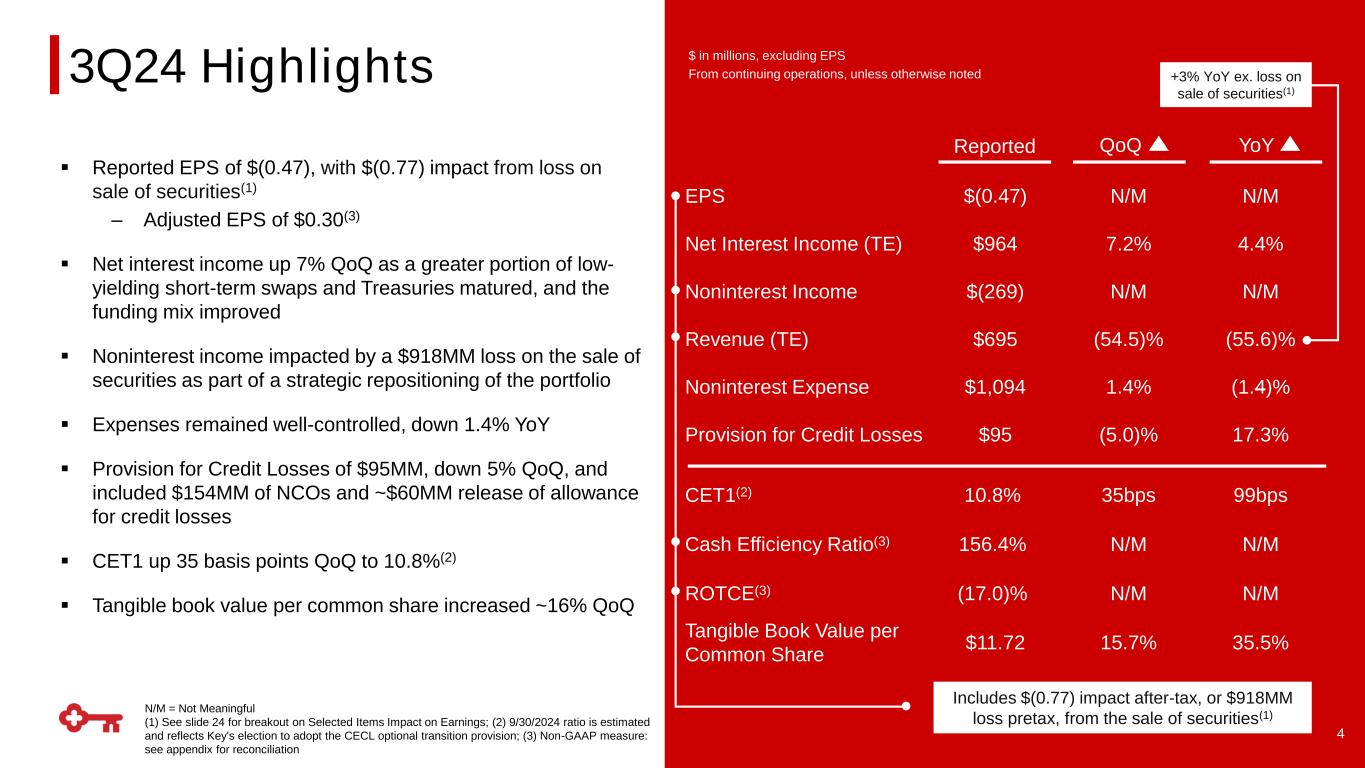

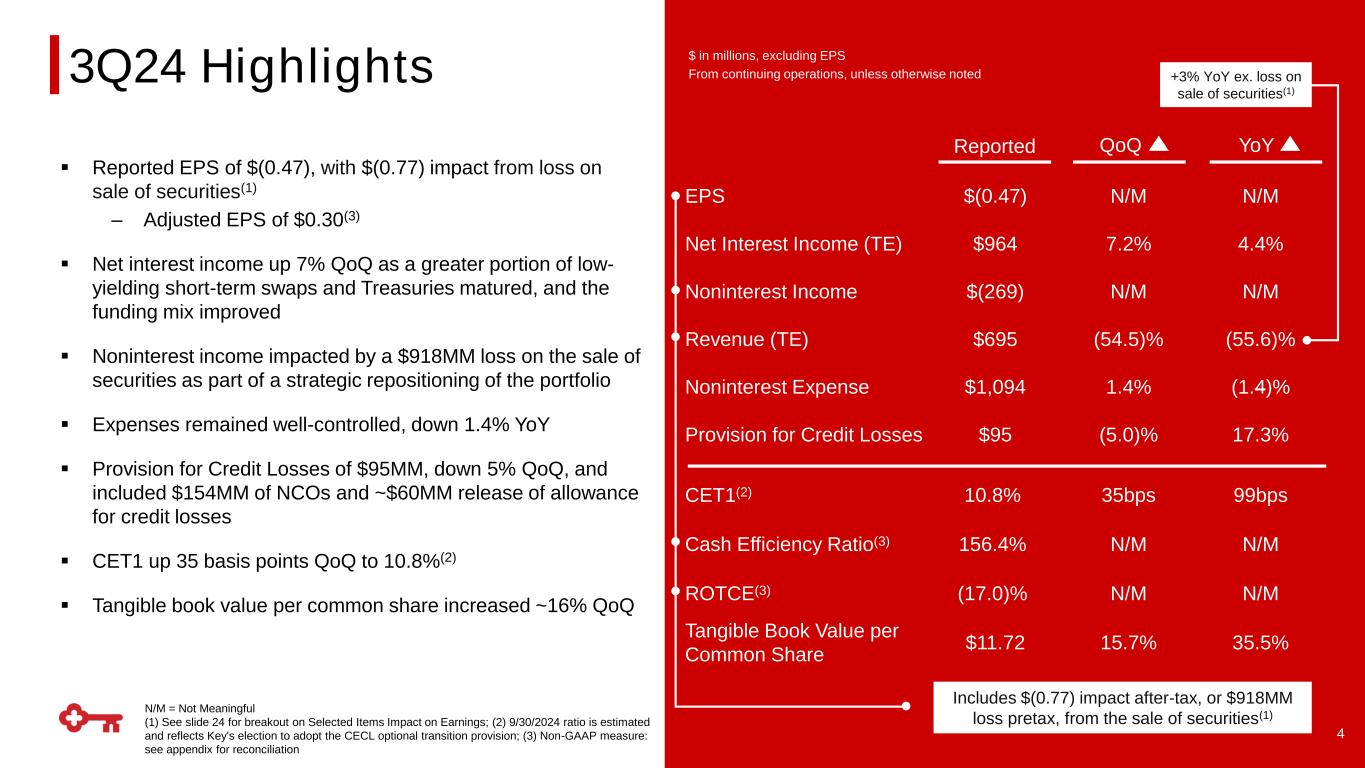

4 Reported QoQ ▪ Reported EPS of $(0.47), with $(0.77) impact from loss on sale of securities(1) ‒ Adjusted EPS of $0.30(3) ▪ Net interest income up 7% QoQ as a greater portion of low- yielding short-term swaps and Treasuries matured, and the funding mix improved ▪ Noninterest income impacted by a $918MM loss on the sale of securities as part of a strategic repositioning of the portfolio ▪ Expenses remained well-controlled, down 1.4% YoY ▪ Provision for Credit Losses of $95MM, down 5% QoQ, and included $154MM of NCOs and ~$60MM release of allowance for credit losses ▪ CET1 up 35 basis points QoQ to 10.8%(2) ▪ Tangible book value per common share increased ~16% QoQ YoY $ in millions, excluding EPS From continuing operations, unless otherwise noted N/M = Not Meaningful (1) See slide 24 for breakout on Selected Items Impact on Earnings; (2) 9/30/2024 ratio is estimated and reflects Key's election to adopt the CECL optional transition provision; (3) Non-GAAP measure: see appendix for reconciliation 3Q24 Highlights EPS $(0.47) N/M N/M Net Interest Income (TE) $964 7.2% 4.4% Noninterest Income $(269) N/M N/M Revenue (TE) $695 (54.5)% (55.6)% Noninterest Expense $1,094 1.4% (1.4)% Provision for Credit Losses $95 (5.0)% 17.3% CET1(2) 10.8% 35bps 99bps Cash Efficiency Ratio(3) 156.4% N/M N/M ROTCE(3) (17.0)% N/M N/M Tangible Book Value per Common Share $11.72 15.7% 35.5% Includes $(0.77) impact after-tax, or $918MM loss pretax, from the sale of securities(1) +3% YoY ex. loss on sale of securities(1)

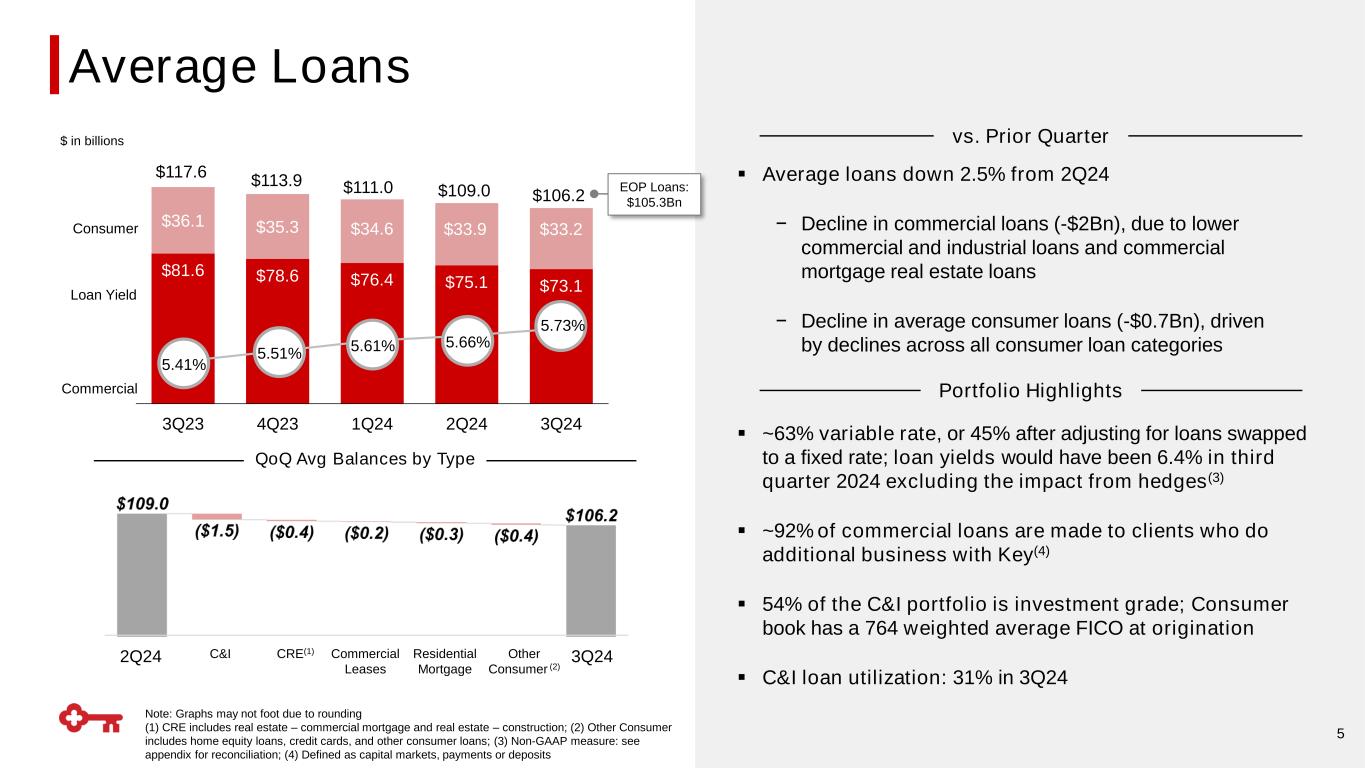

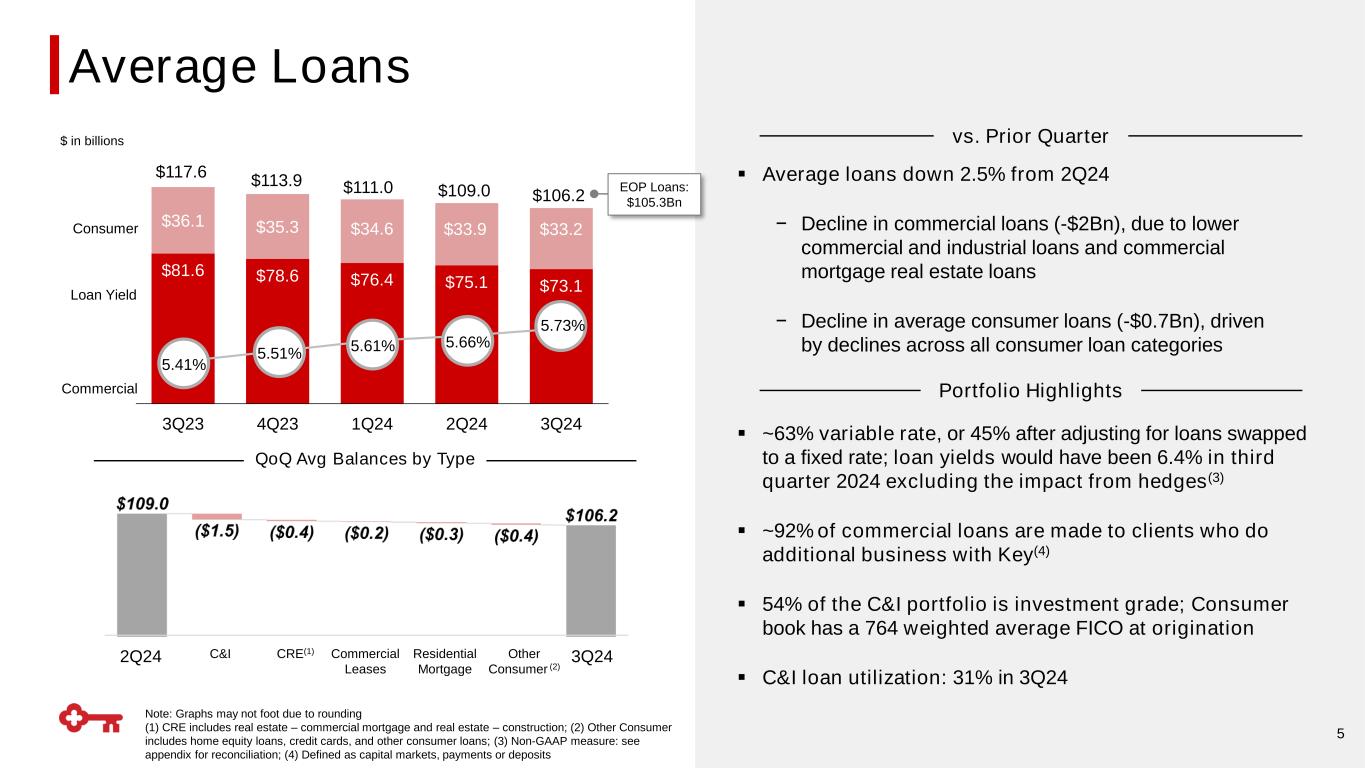

$81.6 $78.6 $76.4 $75.1 $73.1 $36.1 $35.3 $34.6 $33.9 $33.2 3Q23 4Q23 1Q24 2Q24 3Q24 $106.2 5 ▪ Average loans down 2.5% from 2Q24 − Decline in commercial loans (-$2Bn), due to lower commercial and industrial loans and commercial mortgage real estate loans − Decline in average consumer loans (-$0.7Bn), driven by declines across all consumer loan categories vs. Prior Quarter Portfolio Highlights ▪ ~63% variable rate, or 45% after adjusting for loans swapped to a fixed rate; loan yields would have been 6.4% in third quarter 2024 excluding the impact from hedges(3) ▪ ~92% of commercial loans are made to clients who do additional business with Key(4) ▪ 54% of the C&I portfolio is investment grade; Consumer book has a 764 weighted average FICO at origination ▪ C&I loan utilization: 31% in 3Q24 QoQ Avg Balances by Type C&I Commercial Leases 2Q24 3Q24Other Consumer (2) CRE(1) Residential Mortgage Note: Graphs may not foot due to rounding (1) CRE includes real estate – commercial mortgage and real estate – construction; (2) Other Consumer includes home equity loans, credit cards, and other consumer loans; (3) Non-GAAP measure: see appendix for reconciliation; (4) Defined as capital markets, payments or deposits Average Loans Consumer Commercial Loan Yield $117.6 $113.9 $111.0 $109.0 $ in billions 5.41% 5.51% 5.61% 5.66% 5.73% EOP Loans: $105.3Bn

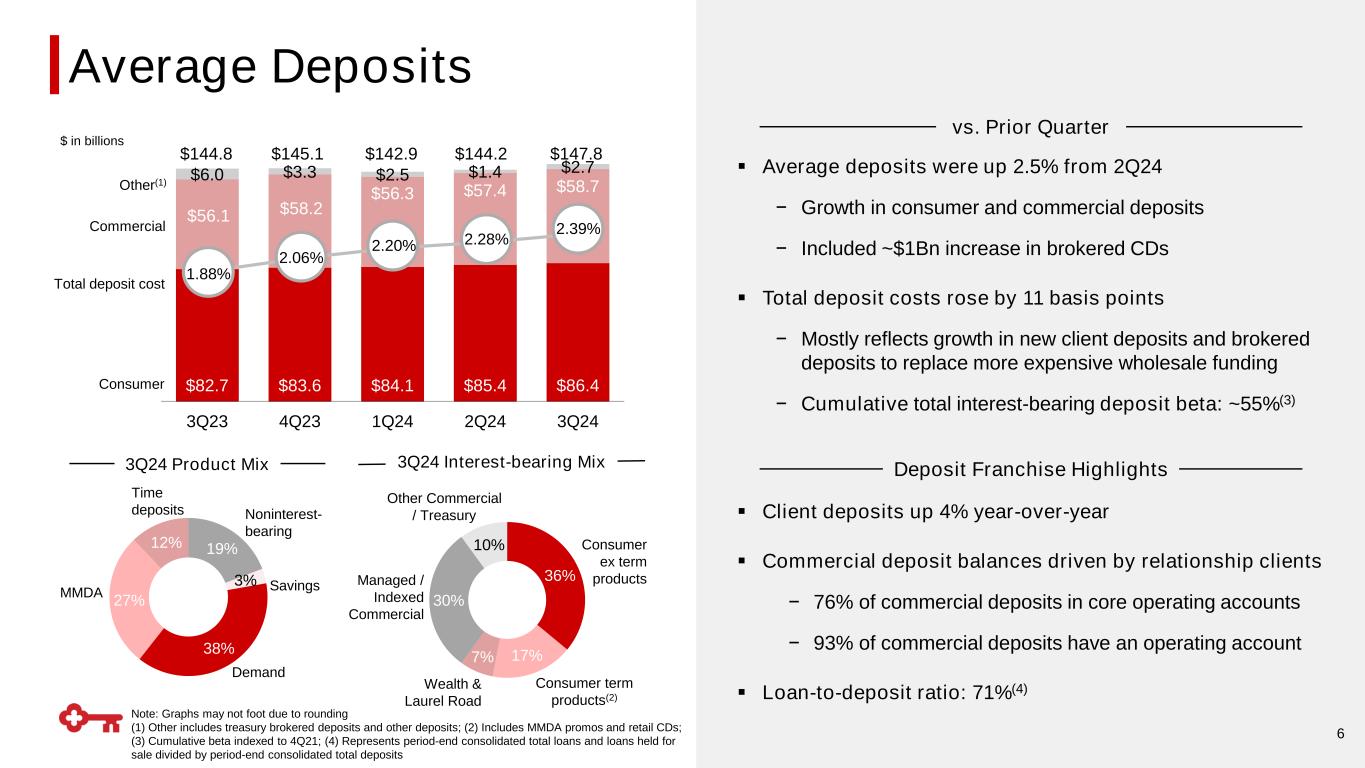

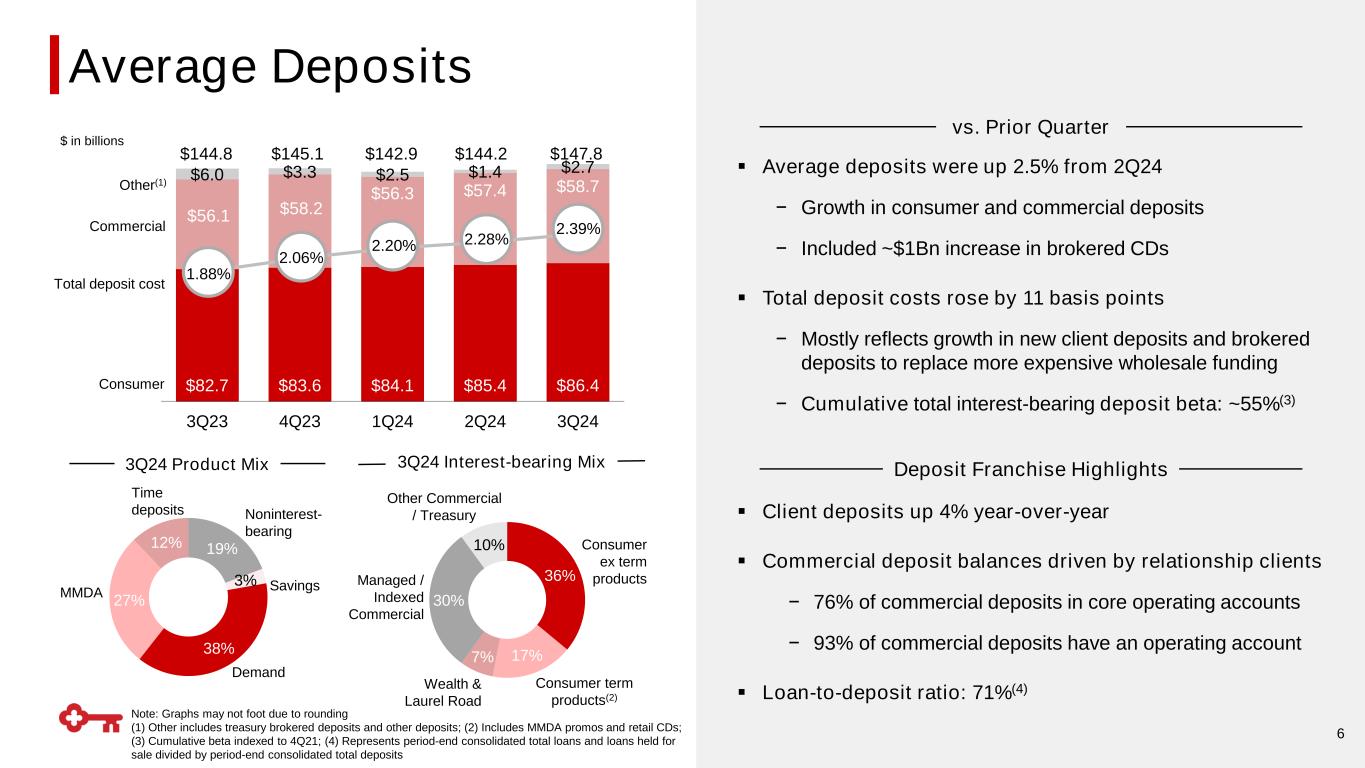

36% 17%7% 30% 10%19% 3% 38% 27% 12% vs. Prior Quarter Deposit Franchise Highlights 6 ▪ Average deposits were up 2.5% from 2Q24 − Growth in consumer and commercial deposits − Included ~$1Bn increase in brokered CDs ▪ Total deposit costs rose by 11 basis points − Mostly reflects growth in new client deposits and brokered deposits to replace more expensive wholesale funding − Cumulative total interest-bearing deposit beta: ~55%(3) ▪ Client deposits up 4% year-over-year ▪ Commercial deposit balances driven by relationship clients − 76% of commercial deposits in core operating accounts − 93% of commercial deposits have an operating account ▪ Loan-to-deposit ratio: 71%(4) 3Q24 Product Mix Time deposits Savings Noninterest- bearing Demand 3Q24 Interest-bearing Mix Consumer ex term products 21% MMDA Other Commercial / Treasury Managed / Indexed Commercial Wealth & Laurel Road Note: Graphs may not foot due to rounding (1) Other includes treasury brokered deposits and other deposits; (2) Includes MMDA promos and retail CDs; (3) Cumulative beta indexed to 4Q21; (4) Represents period-end consolidated total loans and loans held for sale divided by period-end consolidated total deposits Average Deposits Consumer Other(1) Commercial $82.7 $83.6 $84.1 $85.4 $86.4 $56.1 $58.2 $56.3 $57.4 $58.7 $6.0 $3.3 $2.5 $1.4 $2.7 3Q23 4Q23 1Q24 2Q24 3Q24 $145.1$144.8 $142.9 $144.2 Total deposit cost $ in billions 1.88% 2.06% 2.20% 2.28% 2.39% $147.8 Consumer term products(2)

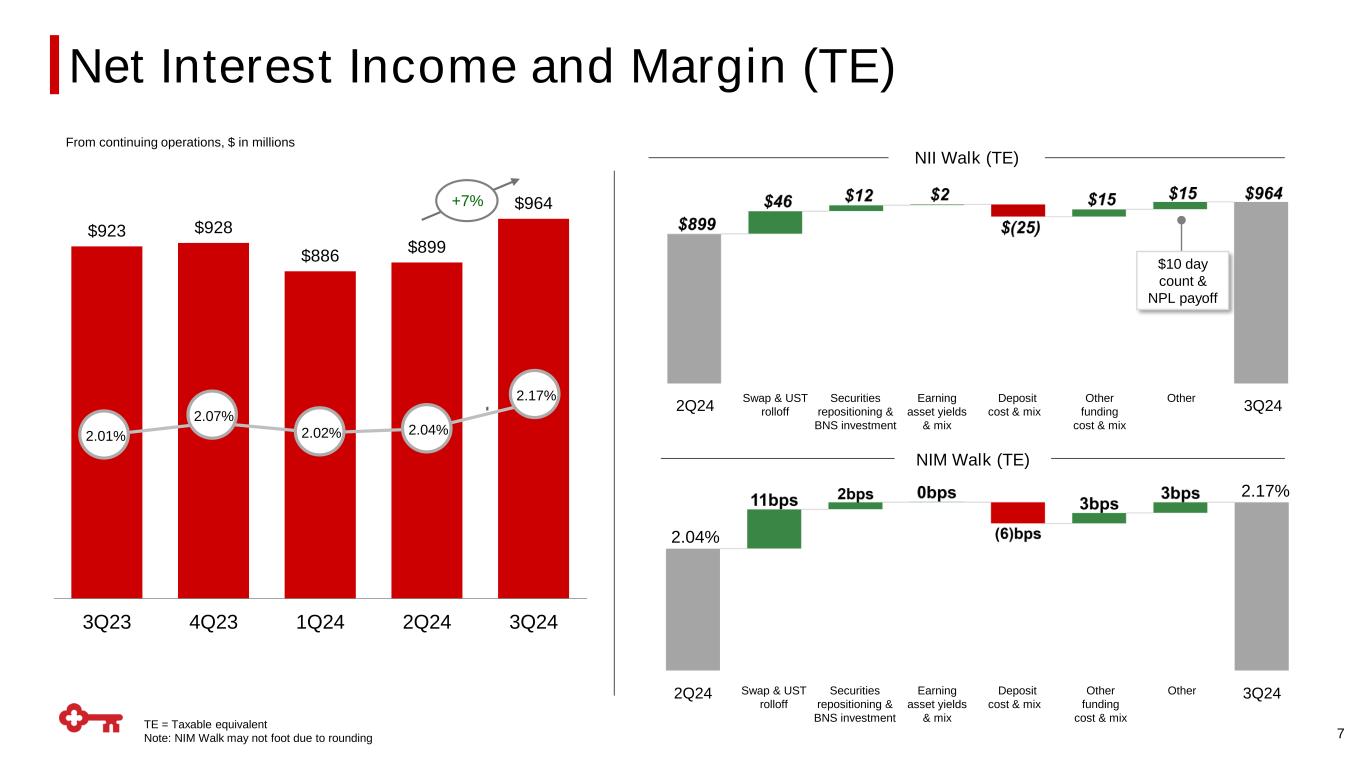

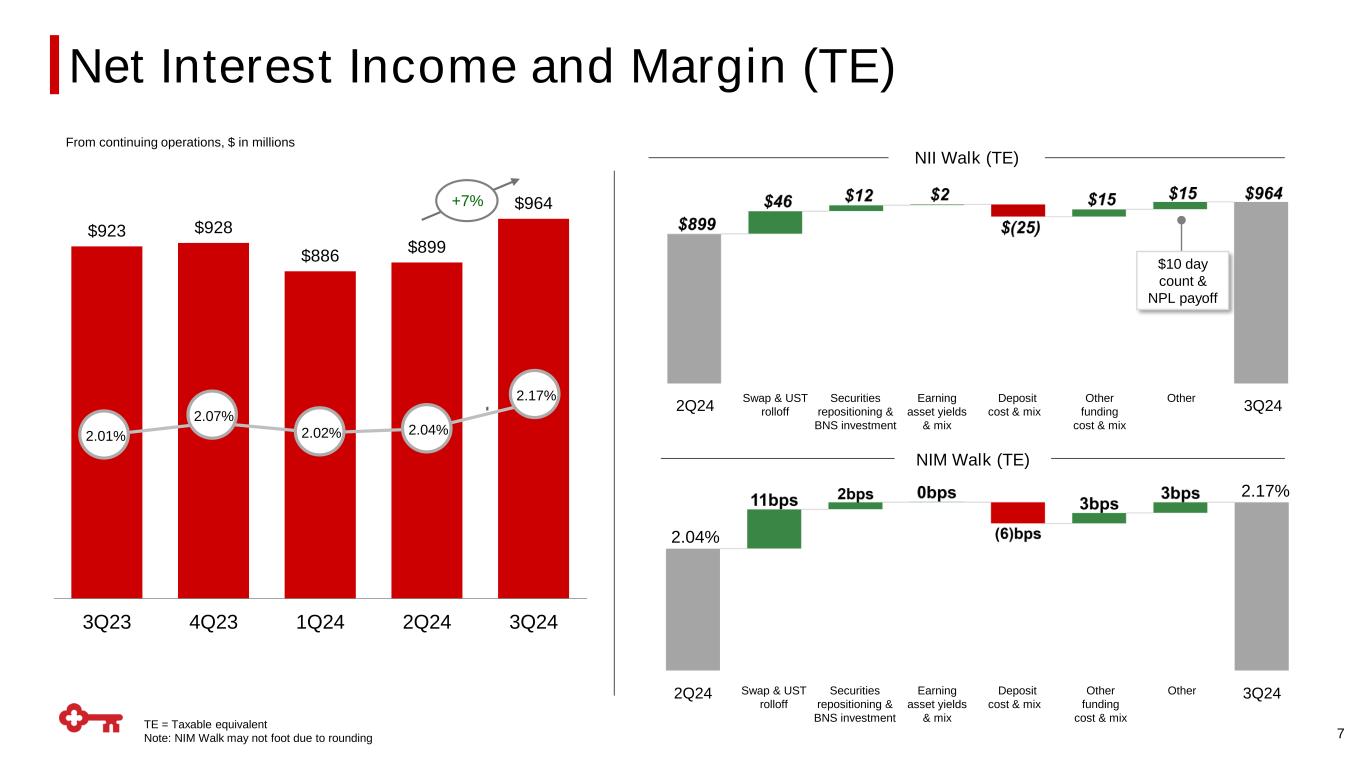

$923 $928 $886 $899 $964 3Q23 4Q23 1Q24 2Q24 3Q24 TE = Taxable equivalent Note: NIM Walk may not foot due to rounding 7 NII Walk (TE) NIM Walk (TE) 2.01% 2.07% 2.02% 2.04% Net Interest Income and Margin (TE) From continuing operations, $ in millions 2.17% +7% Swap & UST rolloff Earning asset yields & mix Deposit cost & mix Other 2Q24 3Q24 Securities repositioning & BNS investment Other funding cost & mix 2.04% 2.17% Swap & UST rolloff Earning asset yields & mix Deposit cost & mix Other2Q24 3Q24Other funding cost & mix Securities repositioning & BNS investment $10 day count & NPL payoff

$236 $216 $181 $141 $126 $171 $130 $139 $140 $90 $85 $84 $46 $61 $73 3Q23 2Q24 3Q24 N/M (1)% +36% +20% +1% (16)% N/M QoQ 8 % change YoY +21% +59% (7)% +8% (23)% vs. Prior Year $ in millions; Illustrative, not drawn to scale ▪ Noninterest income included a $918MM pre- tax loss from the sale of securities(2) − Excluding the loss on the sale of securities(2), fees were up 1% − Investment Banking & Debt Placement growth (+$30MM), due to higher syndications, debt, and equity underwriting fees − Commercial Mortgage Servicing fees (+$27MM), reflects higher active special servicing balances and growth in the overall portfolio − Trust & Investment Services growth (+$10MM) driven by AUM growth and continued strong momentum in Key Private Client (1) Other includes Corporate-Owned Life Insurance Income, Consumer Mortgage Income, Operating Lease Income and Other Leasing Gains, Corporate Services, Service Charges and Other Income; (2) See slide 24 for breakout on Selected Items Impact on Earnings Noninterest Income $643 $627 $(269)Total Noninterest Income Investment Banking & Debt Placement Trust & Investment Services Cards & Payments Commercial Mortgage Servicing Other(1) Pretax loss on sale of securities(2)$(918) Includes $918MM loss on sale of securities(2)

9 $663 $636 $670 $447 $438 $430 $5 3Q23 2Q24 3Q24 Personnel Non-personnel(1) vs. Prior Year % change YoY QoQ (4)% 1% (2)% 5% (1.4)% 1.4% ▪ Noninterest expense down $16MM (-1.4%) − A reduction in an estimated FDIC special assessment (-$6MM), and lower marketing expenses (-$7MM) − Partly offset by an increase in personnel expense (+$7MM) and computer processing costs (+$15MM) ▪ Noninterest expense up $15MM (+1.4%) − Personnel expense (+$34MM) driven by higher incentive compensation, reflective of stronger capital markets activity − Partly offset by a decline in other expense (-$23MM), related to a reduction of the estimated FDIC special assessment charge recognized in the prior quarter(2) $ in millions (1) 2Q24 excludes FDIC special assessments and 3Q24 includes a reduction of the estimated FDIC special assessment charge; (2) FDIC Special Assessment, please see slide 24 for breakout on Selected Items Impact on Earnings Noninterest Expense $1,094$1,079$1,110 Total Noninterest Expense (2) vs. Prior Quarter $(6) (2)

0.15% 0.20% 0.22% 0.26% 0.17% 0.04% 0.09% 0.11% 0.13% 0.16% 3Q23 4Q23 1Q24 2Q24 3Q24 NCO = Net charge-off (1) Loan and lease outstandings 10 $ in millions $4,475 $4,984 $6,588 $6,973 $6,841 3Q23 4Q23 1Q24 2Q24 3Q24 30 – 89 days delinquent 90+ days delinquent Net Charge-offs & Provision for Credit Losses Delinquencies to Period-end Total Loans Criticized Outstandings(1) to Period-end Total Loans $ in millions; Continuing Operations Criticized Outstandings to Period-end Total LoansCriticized Outstandings 3.9% 4.4% 6.0% 6.5% $71 $76 $81 $91 $154 $81 $102 $101 $100 $95 3Q23 4Q23 1Q24 2Q24 3Q24 NCOs Provision for credit losses NCOs to avg. loans 0.24% 0.26% 0.29% 0.34% $455 $574 $658 $710 $728 3Q23 4Q23 1Q24 2Q24 3Q24 Nonperforming Loans to Period-end Total Loans $ in millions Nonperforming Loans to Period-end Total LoansNonperforming Loans 0.39% 0.51% 0.60% 0.66% Credit Quality Continuing Operations 0.69% 0.58% 6.5% +2.5% (2)%

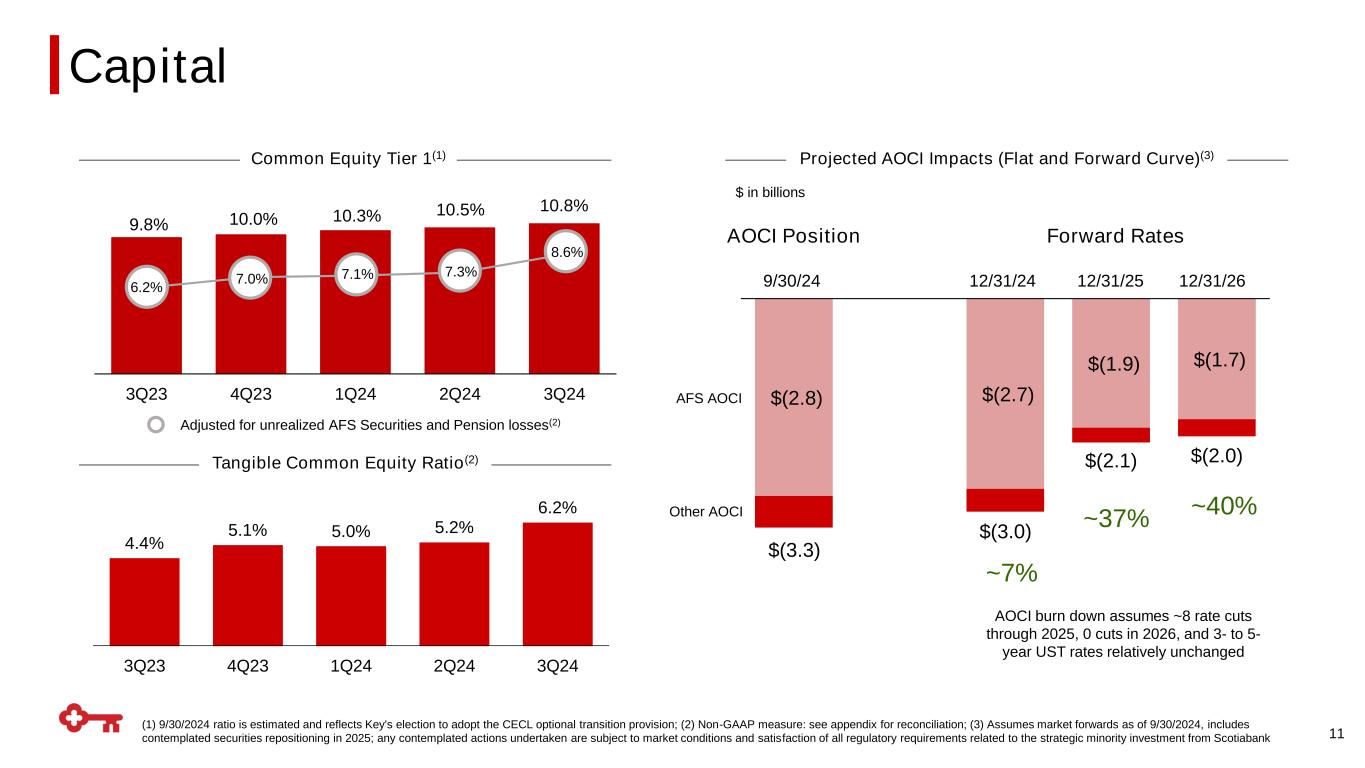

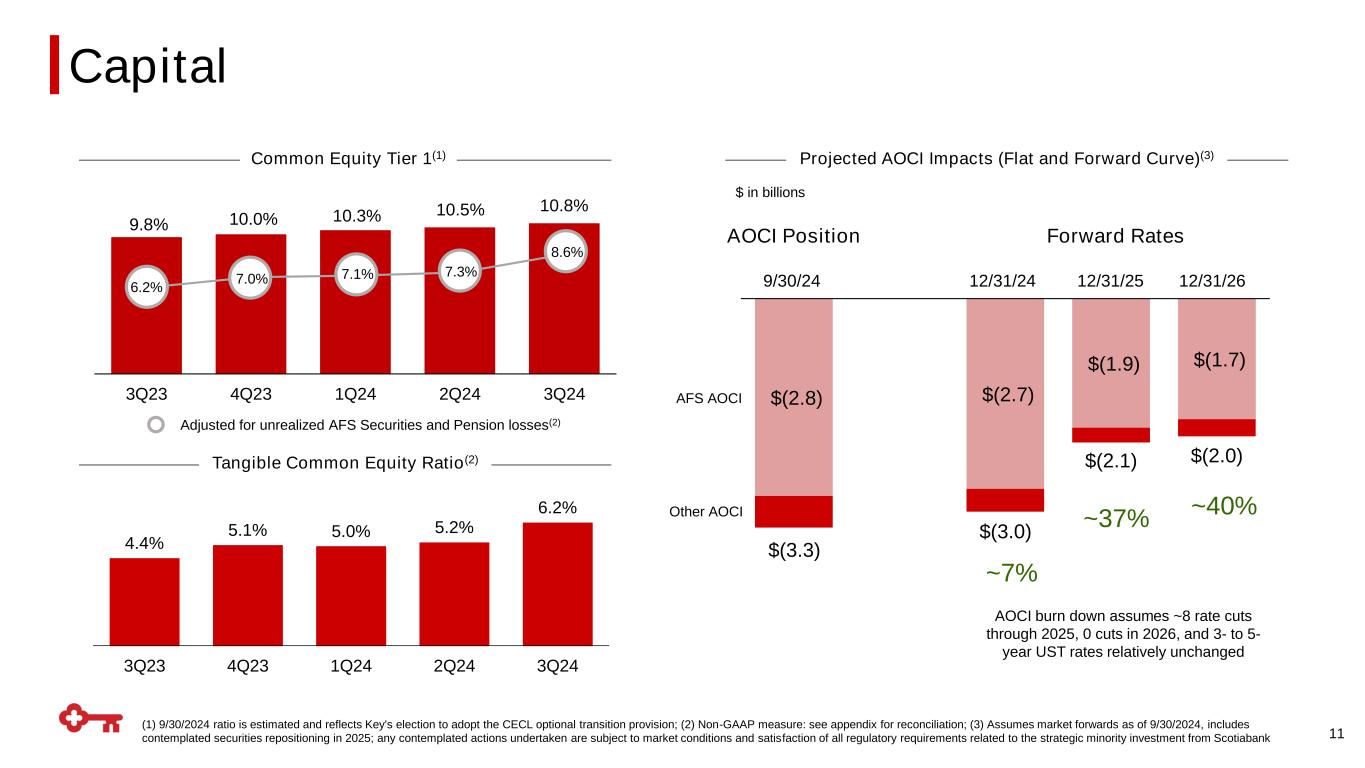

$(2.8) $(2.7) $(1.9) $(1.7) 3Q23 4Q23 1Q24 2Q24 3Q24 11 $ in billions Tangible Common Equity Ratio(2) Common Equity Tier 1(1) Projected AOCI Impacts (Flat and Forward Curve)(3) 4.4% 5.1% 5.0% 5.2% 6.2% 3Q23 4Q23 1Q24 2Q24 3Q24 9.8% 10.0% 10.3% 10.5% Adjusted for unrealized AFS Securities and Pension losses(2) 6.2% 7.0% 7.1% 7.3% (1) 9/30/2024 ratio is estimated and reflects Key's election to adopt the CECL optional transition provision; (2) Non-GAAP measure: see appendix for reconciliation; (3) Assumes market forwards as of 9/30/2024, includes contemplated securities repositioning in 2025; any contemplated actions undertaken are subject to market conditions and satisfaction of all regulatory requirements related to the strategic minority investment from Scotiabank Capital 10.8% 8.6% $(3.3) $(3.0) ~40% $(2.1) Forward Rates 12/31/24 AOCI Position 9/30/24 AOCI burn down assumes ~8 rate cuts through 2025, 0 cuts in 2026, and 3- to 5- year UST rates relatively unchanged ~37% ~7% $(2.0) 12/31/25 12/31/26 AFS AOCI Other AOCI

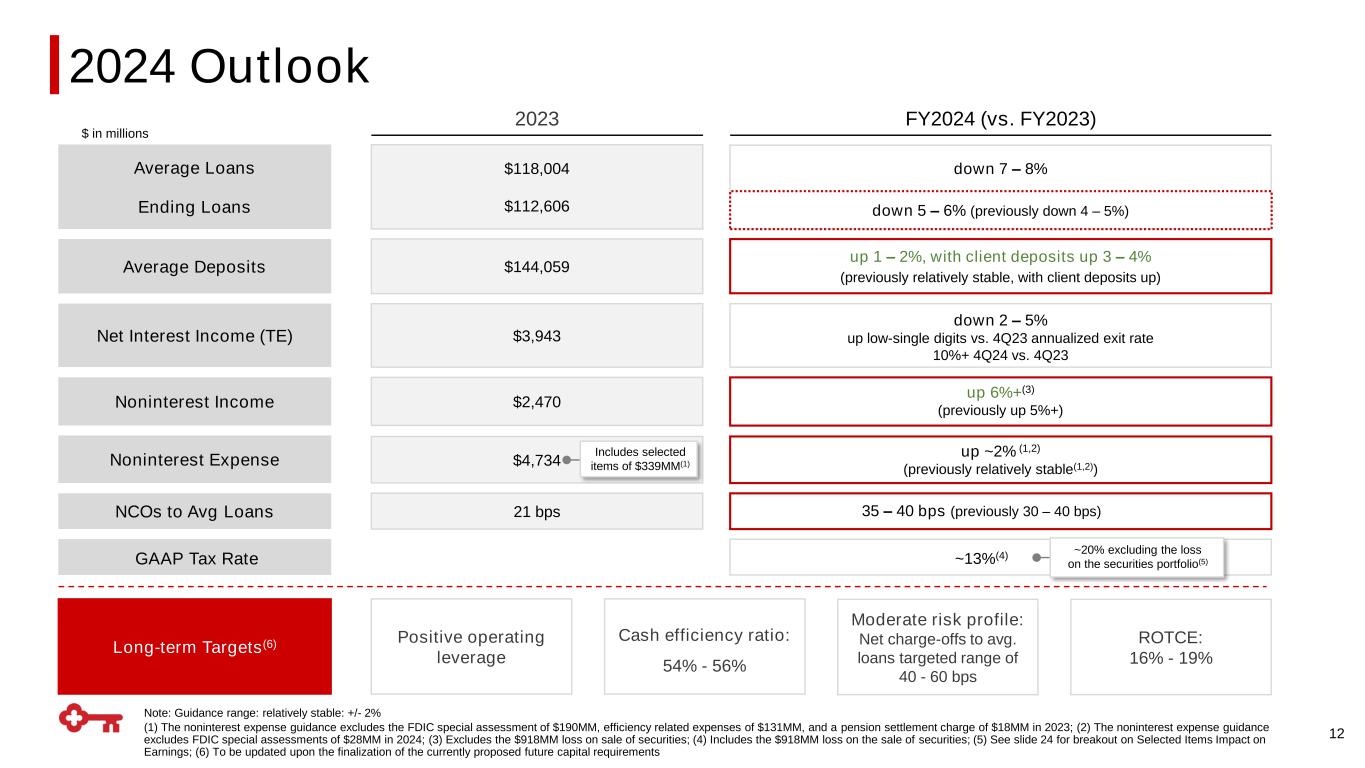

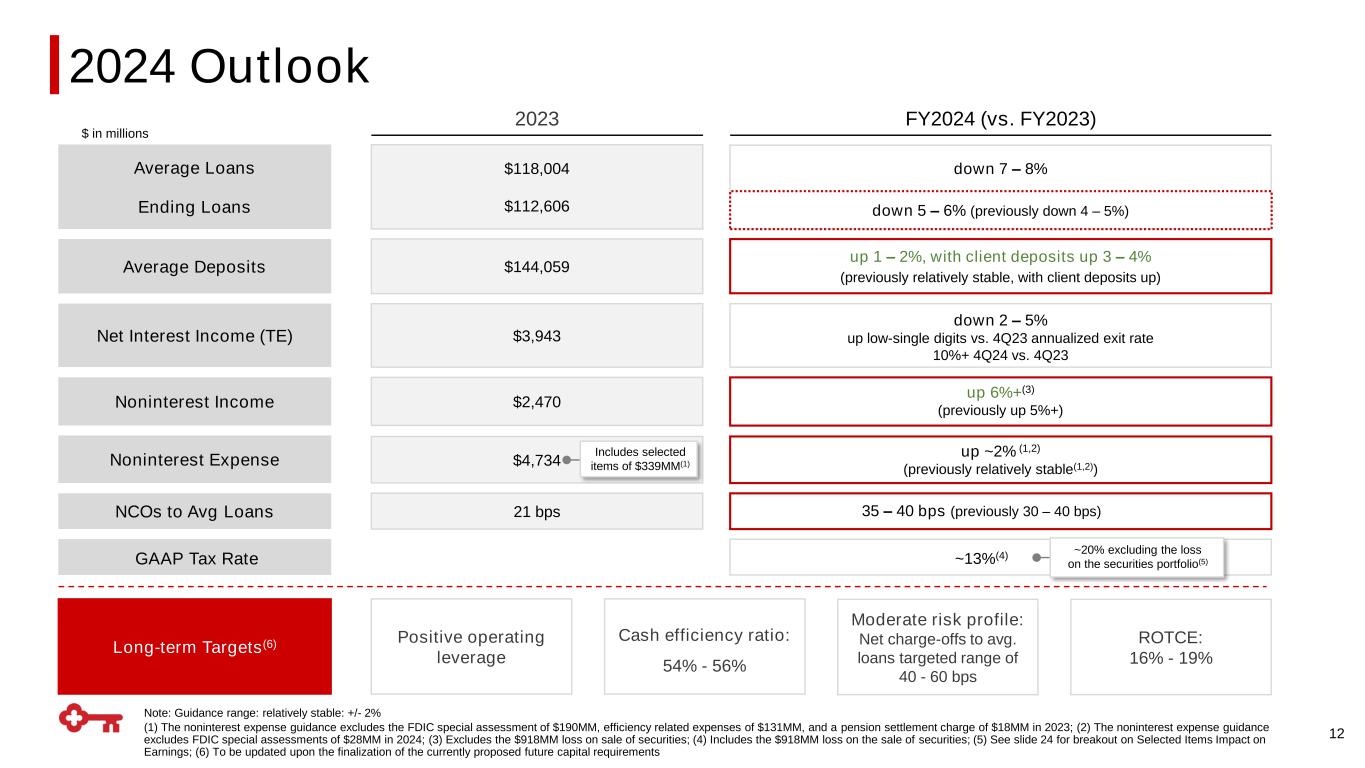

Average Deposits up 1 – 2%, with client deposits up 3 – 4% (previously relatively stable, with client deposits up) FY2024 (vs. FY2023)2023 12 Note: Guidance range: relatively stable: +/- 2% (1) The noninterest expense guidance excludes the FDIC special assessment of $190MM, efficiency related expenses of $131MM, and a pension settlement charge of $18MM in 2023; (2) The noninterest expense guidance excludes FDIC special assessments of $28MM in 2024; (3) Excludes the $918MM loss on sale of securities; (4) Includes the $918MM loss on the sale of securities; (5) See slide 24 for breakout on Selected Items Impact on Earnings; (6) To be updated upon the finalization of the currently proposed future capital requirements $118,004 $112,606 Average Loans Ending Loans Noninterest Income Noninterest Expense NCOs to Avg Loans GAAP Tax Rate down 7 – 8% down 5 – 6% (previously down 4 – 5%) Long-term Targets(6) $144,059 $3,943 Positive operating leverage Cash efficiency ratio: 54% - 56% Moderate risk profile: Net charge-offs to avg. loans targeted range of 40 - 60 bps ROTCE: 16% - 19% down 2 – 5% up low-single digits vs. 4Q23 annualized exit rate 10%+ 4Q24 vs. 4Q23 up 6%+(3) (previously up 5%+) up ~2% (1,2) (previously relatively stable(1,2)) 35 – 40 bps (previously 30 – 40 bps) $2,470 $4,734 21 bps ~13%(4) $ in millions 2024 Outlook Net Interest Income (TE) Includes selected items of $339MM(1) ~20% excluding the loss on the securities portfolio(5)

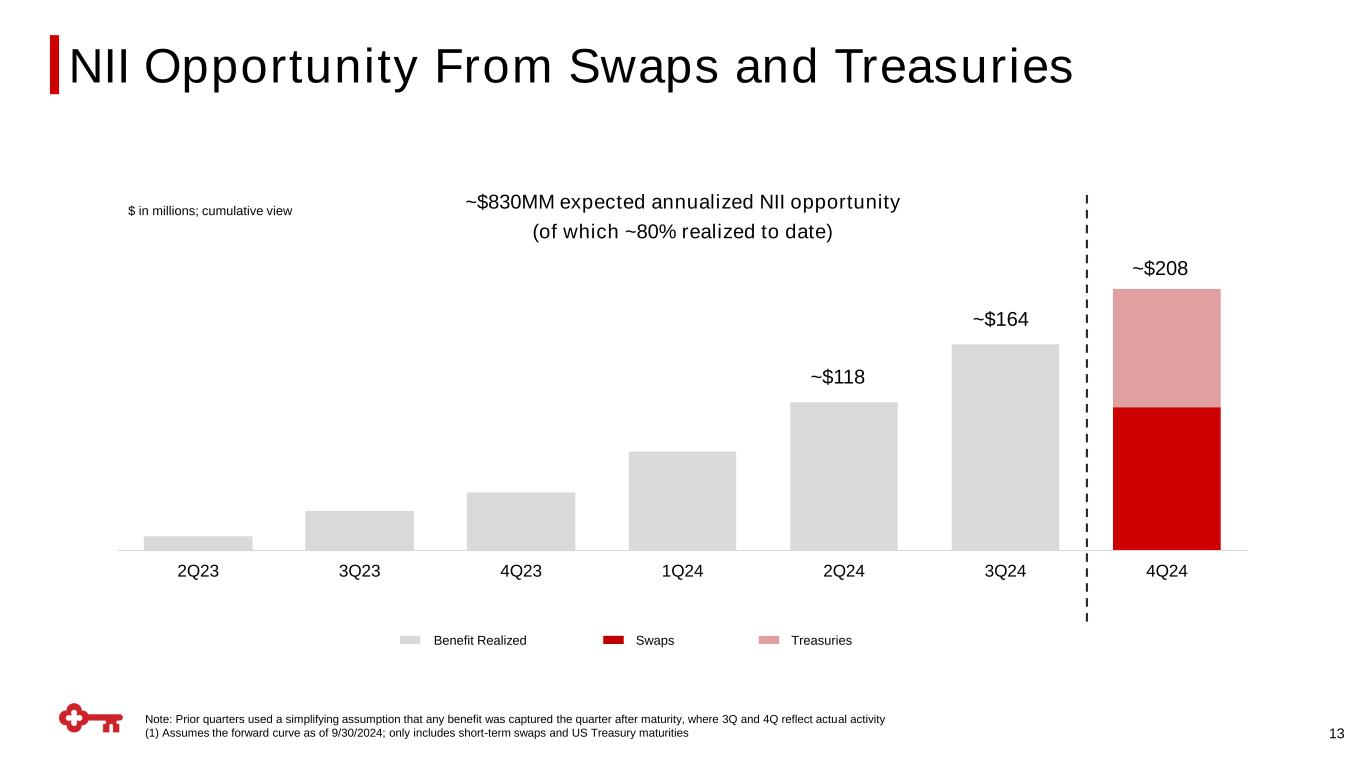

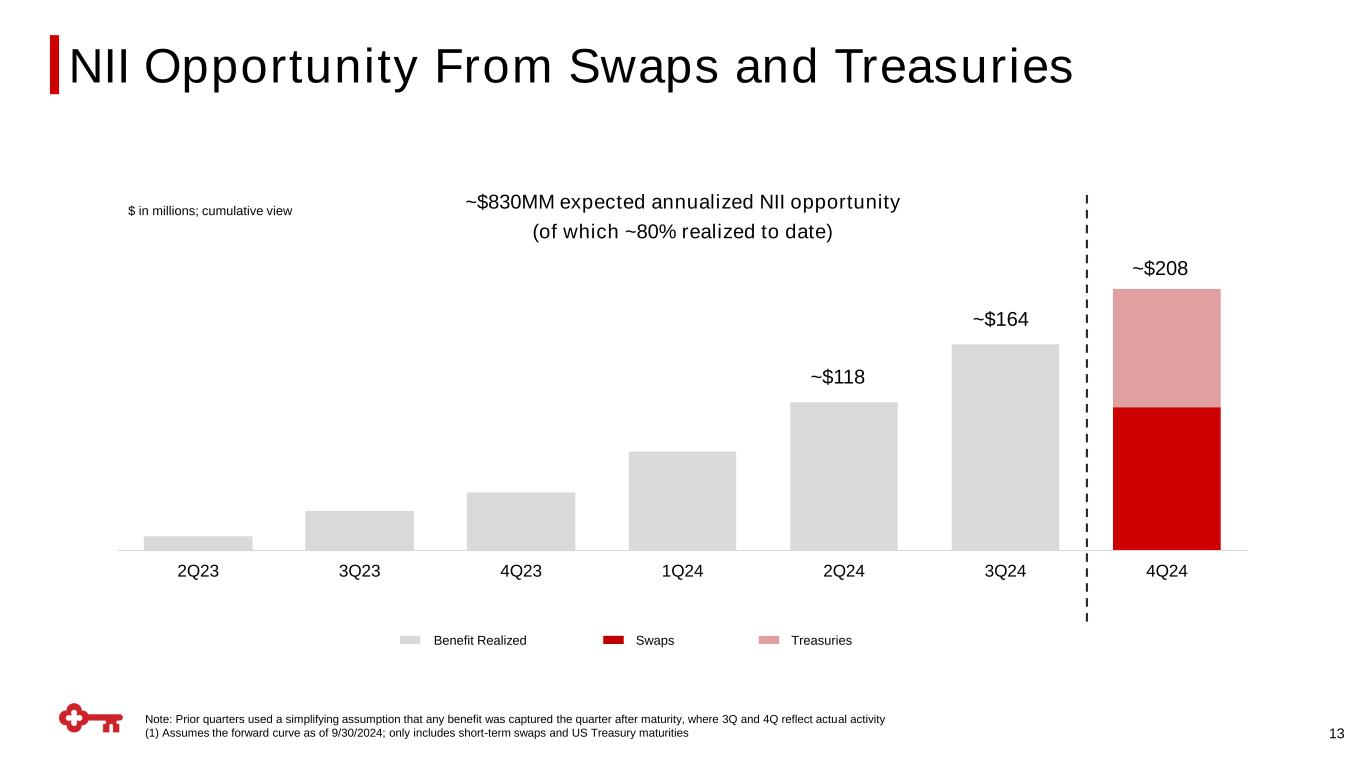

Note: Prior quarters used a simplifying assumption that any benefit was captured the quarter after maturity, where 3Q and 4Q reflect actual activity (1) Assumes the forward curve as of 9/30/2024; only includes short-term swaps and US Treasury maturities 13 NII Opportunity From Swaps and Treasuries 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Treasuries SwapsBenefit Realized $ in millions; cumulative view ~$830MM expected annualized NII opportunity (of which ~80% realized to date) ~$118 ~$164 ~$208

14 ▪ Loan Balances − Commercial loans up ~$1Bn off 3Q average (includes held for investment and held for sale) − Consumer loans decline ~$800MM ▪ Deposit Balances and Mix − Avg deposits flat to up 1% − Some migration from NIB to IB deposits ▪ Other − ~$1.3Bn of securities cash flows roll-off at ~2.4% − ~$0.8Bn of consumer loans roll off at ~4.0% − Variable-rate loans reprice to changes in benchmark SOFR monthly − $12Bn investment securities swapped to floating − $4.75Bn of FHLB debt maturing in 4Q at an expected weighted-average rate of ~5.4% Net Interest Income Opportunity Achieving 4Q24 Exit Rate NII Target Change to NII ($ in millions); Illustrative, not drawn to scale Securities Repositioning & Scotiabank Investment ST USTs & Swaps Opportunity Near-term Impact of Fed Rate Cuts 3Q24 Commercial Loan Growth (HFI + HFS) $1,020+ 4Q24Other (including funding optimization) Other Key Inputs & Assumptions Nets to a slightly negative impact ~2.40% NIM $38 Other Fixed Asset Repricing

Appendix

Other 1% 1M SOFR 20% 3M SOFR 8% Prime 8% O/N SOFR 26% Fixed 37% Loan Composition(1) 61%20% 4% 13% 2% Total Loans AFS Securities Other(3) $9.0 $8.7 $8.4 $8.1 $7.8 $37.3 $35.6 $37.1 $36.8 $36.7 3Q23 4Q23 1Q24 2Q24 3Q24 Average AFS Securities Average Yield(4)Average HTM Securities $ in billions Average Total Investment Securities $46.3 $45.5 $44.9 Fixed-rate Asset Repricing Tailwinds – 4Q24 to 2026 16 2.06% 2.26% 2.40% Balance Sheet Management Detail 2.61% $44.5$44.3 ST Investments HTM Securities2.98% (1) Loan statistics based on 9/30/2024 period-end balances; (2) Based on 9/30/2024 period-end balances; chart may not foot due to rounding; (3) Other includes loans HFS and trading account assets; (4) Yield is calculated on the basis of amortized cost; (5) 2H24 receive-fixed swaps were terminated in September 2023 and realized P&L from the terminated swaps that mature in 2H24 will be recognized throughout 2H24; (6) Excludes short-term Treasury maturities shown in the bottom right graph $ in billions 4Q24 2025 2026 Projected receive-fixed swaps(5) maturities 0.0 $5.2 $9.1 Weighted-average rate received (%) n/a 1.80% 2.78% Projected fixed rate loans cash flows / maturities $4.7 $13.1 $13.6 Weighted-average rate received (%) 3.82% 3.98% 4.22% Projected fixed rate investment securities cash flows / maturities(6) $1.3 $5.9 $6.5 Weighted-average rate received (%) 2.44% 3.14% 3.59% Earning Asset Mix(2)

$18.8 $18.8 $18.1 $23.3 $14.5 $5.8 3Q24 4Q24 1Q25 FY25 FY26 FY27 Hedging Strategy Summary 17 (1) Portfolio as of 9/30/2024 and includes already executed forward-starting swaps; (2) AFS securities swapped to floating rate ~2.3% ~2.3% ~2.6% ~3.1% ~3.3% ~3.8% 4Q24 1Q25 FY25 FY26 FY27 $0 $2.2 $5.2 $9.1 $8.7 n/a 1.4% 1.8% 2.8% 2.9% W.A. Active Receive Rate as of 9/30/24 Note: Maturing Swaps ($Bn) W.A. Receive-fixed Rate Active Receive- fixed Asset Swaps(1) $ in billions; ending balances Other Hedge Positions ($ in billions) 9/30/2024 Debt Hedges $10.8 Securities Hedges(2) $12.4 Floor Spreads $3.3 3Q24 ALM Hedge Actions 2Q24 ALM Hedge Actions ▪ Executed $3.7Bn of forward-starting receive-fixed swaps – WA receive rate: 3.55% (May 2025 start date) ▪ Executed $2.7Bn of spot-starting pay-fixed swaps to hedge securities – WA pay rate: 4.23% ▪ Terminated $1.0Bn of accruing pay-fixed swaps to hedge securities – WA pay rate: 3.84% ▪ Executed $5.75Bn of forward-starting receive-fixed swaps – WA receive rate: 4.06% (March 2025 start date) ▪ Executed $1.35Bn of spot pay-fixed swaps to hedge securities – WA pay rate: 4.48% 1Q24 ALM Hedge Actions ▪ Executed $250MM of forward-starting receive-fixed swaps – WA receive rate: 3.85% (January 2025 start date) ▪ Executed $950MM of forward-starting debt hedges – WA receive rate: 3.77% (March 2025 start date) ▪ Executed $750MM of spot pay-fixed swaps to hedge securities – WA pay rate: 4.1%

1% Office 3% 4% 5% < Nonowner-occupied CRE Loan Portfolio Composition Category III banks KEY Regional bank peers All banks >$10Bn assets 13% Note: NOORE = Nonowner-occupied real estate (Commercial Real Estate); KEY data as of 9/30/2024 (1) Data as of 6/30/2024; Sourced from ffiec.gov ‘peer group average reports’; (2) Data as of 6/30/2024; Includes: CFG, CMA, FCNCA, FITB, HBAN, MTB, RF and ZION; (3) Data as of 6/30/2024; Includes: COF, PNC, TFC and USB; (4) Other NOORE includes Diversified, Industrial, Land & Residential, Retail, Senior Housing, Student Housing, Lodging, Medical Office, Self Storage, Skilled Nursing, and Other 18 Category III banks(3) KEY Regional bank peers(2) All banks >$10Bn assets(1) As a % Total Loans All other loans As a % Total Loans • $0 nonowner-occupied construction • Nonperforming loans: 5.1% • Reserves to loans: ~5% • B&C Class properties in CBDs <0.1% of total loans • Nonperforming loans: 1.22% • Reserves to loans: ~3% • No core-based statistical area >4.2% of total nonowner-occupied CRE Office Highlights Nonowner-occupied CRE Highlights Affordable Housing Other NOORE(4) Traditional Multifamily High-quality CRE portfolio has relatively limited exposure and is diversified by property type and geography 30% 17% 10% Commercial Real Estate

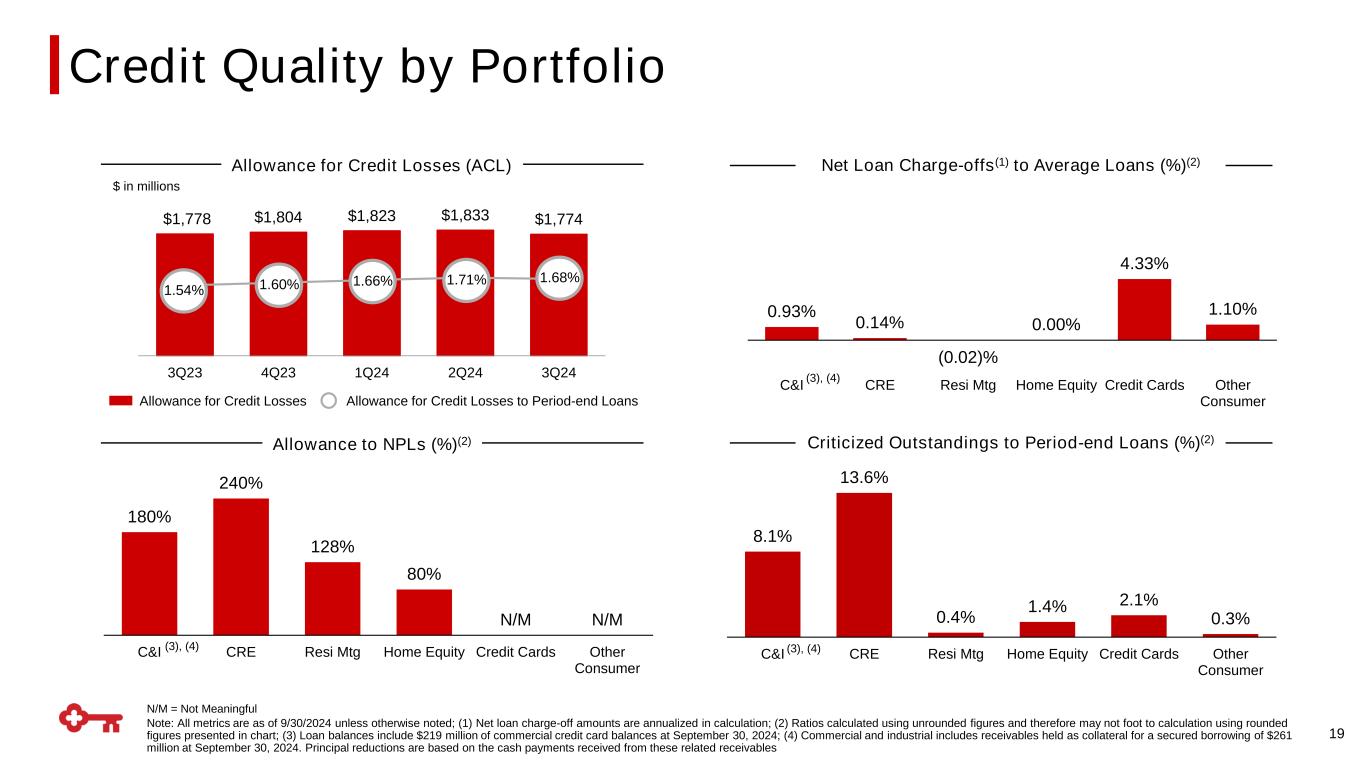

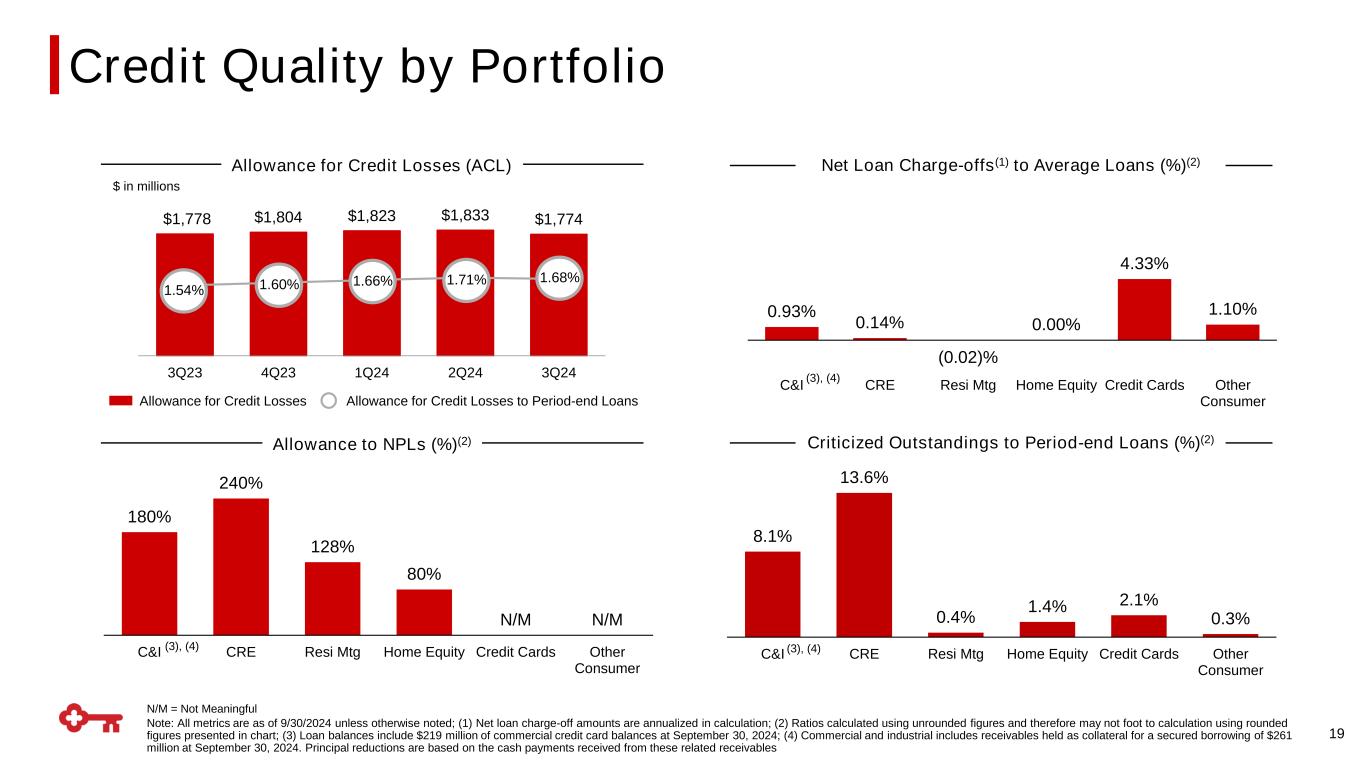

0.93% 0.14% (0.02)% 0.00% 4.33% 1.10% C&I CRE Resi Mtg Home Equity Credit Cards Other Consumer 19 Allowance to NPLs (%)(2) Criticized Outstandings to Period-end Loans (%)(2) 180% 240% 128% 80% N/M N/M C&I CRE Resi Mtg Home Equity Credit Cards Other Consumer 8.1% 13.6% 0.4% 1.4% 2.1% 0.3% C&I CRE Resi Mtg Home Equity Credit Cards Other Consumer Credit Quality by Portfolio (3), (4) (3), (4) (3), (4) N/M = Not Meaningful Note: All metrics are as of 9/30/2024 unless otherwise noted; (1) Net loan charge-off amounts are annualized in calculation; (2) Ratios calculated using unrounded figures and therefore may not foot to calculation using rounded figures presented in chart; (3) Loan balances include $219 million of commercial credit card balances at September 30, 2024; (4) Commercial and industrial includes receivables held as collateral for a secured borrowing of $261 million at September 30, 2024. Principal reductions are based on the cash payments received from these related receivables Allowance for Credit Losses (ACL) $ in millions $1,778 $1,804 $1,823 $1,833 $1,774 3Q23 4Q23 1Q24 2Q24 3Q24 Allowance for Credit Losses to Period-end LoansAllowance for Credit Losses 1.54% 1.60% 1.66% 1.71% 1.68% Net Loan Charge-offs(1) to Average Loans (%)(2)

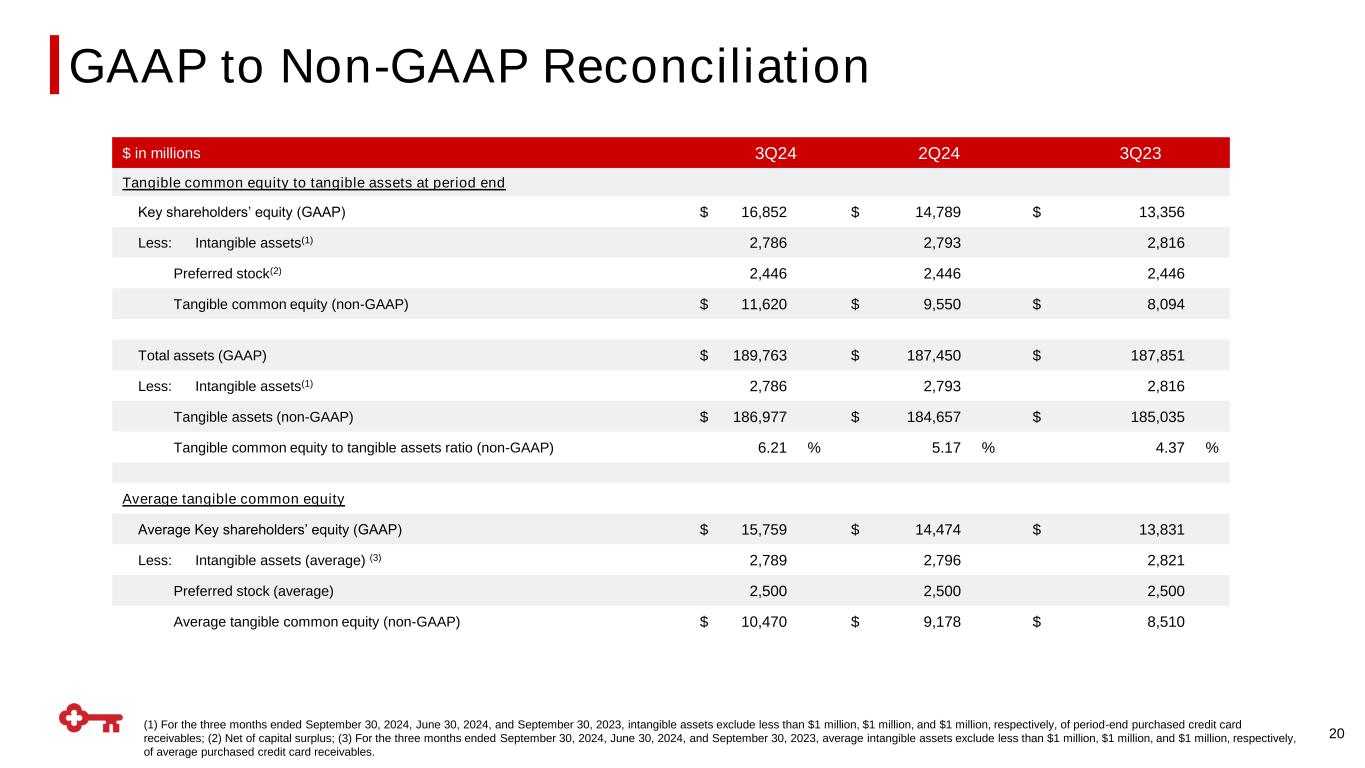

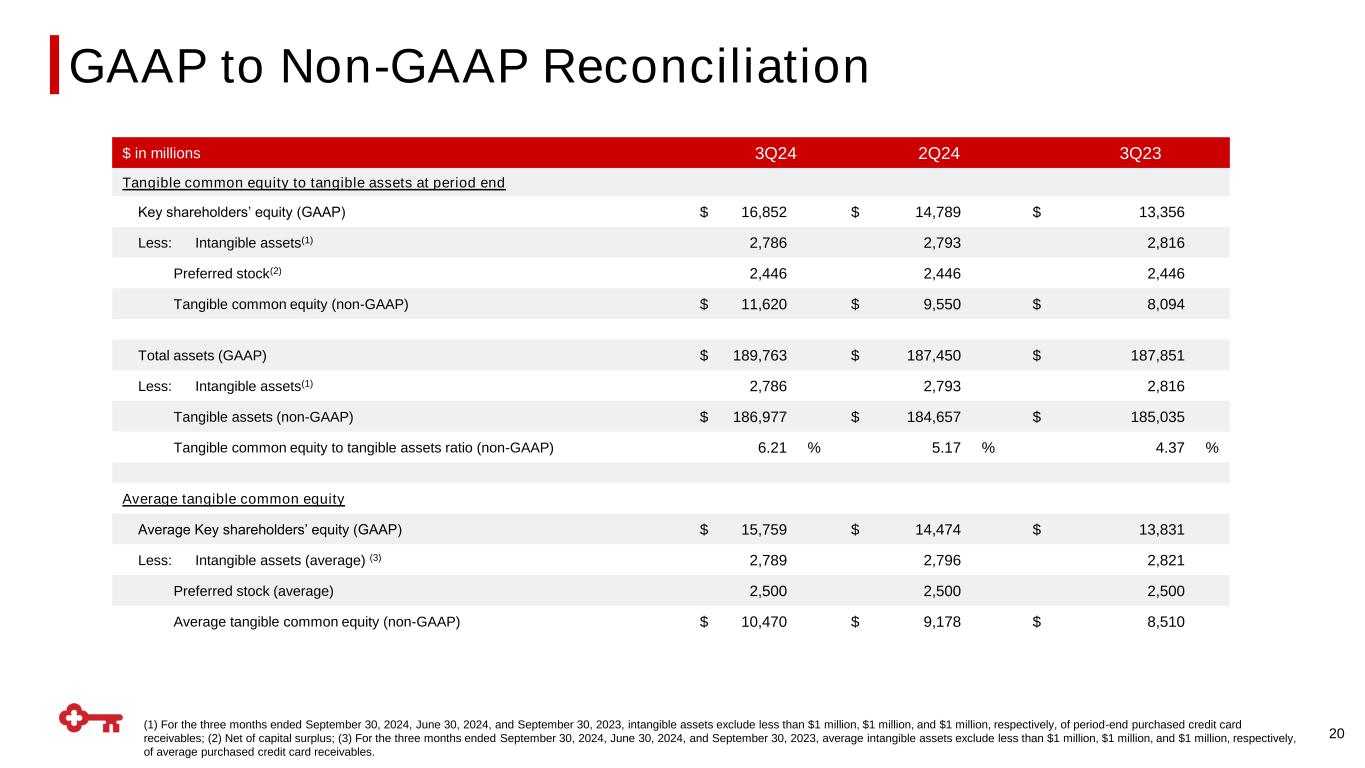

GAAP to Non-GAAP Reconciliation (1) For the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, intangible assets exclude less than $1 million, $1 million, and $1 million, respectively, of period-end purchased credit card receivables; (2) Net of capital surplus; (3) For the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, average intangible assets exclude less than $1 million, $1 million, and $1 million, respectively, of average purchased credit card receivables. 20 $ in millions 3Q24 2Q24 3Q23 Tangible common equity to tangible assets at period end Key shareholders’ equity (GAAP) $ 16,852 $ 14,789 $ 13,356 Less: Intangible assets(1) 2,786 2,793 2,816 Preferred stock(2) 2,446 2,446 2,446 Tangible common equity (non-GAAP) $ 11,620 $ 9,550 $ 8,094 Total assets (GAAP) $ 189,763 $ 187,450 $ 187,851 Less: Intangible assets(1) 2,786 2,793 2,816 Tangible assets (non-GAAP) $ 186,977 $ 184,657 $ 185,035 Tangible common equity to tangible assets ratio (non-GAAP) 6.21 % 5.17 % 4.37 % Average tangible common equity Average Key shareholders’ equity (GAAP) $ 15,759 $ 14,474 $ 13,831 Less: Intangible assets (average) (3) 2,789 2,796 2,821 Preferred stock (average) 2,500 2,500 2,500 Average tangible common equity (non-GAAP) $ 10,470 $ 9,178 $ 8,510

GAAP to Non-GAAP Reconciliation 21 $ in millions 3Q24 2Q24 3Q23 Return on average tangible common equity from continuing operations Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) $ (447) $ 237 $ 266 Average tangible common equity (non-GAAP) 10,470 9,178 8,510 Return on average tangible common equity from continuing operations (non-GAAP) (16.98) % 10.39 % 12.40 % Return on average tangible common equity consolidated Net income (loss) attributable to Key common shareholders (GAAP) $ (446) $ 238 $ 267 Average tangible common equity (non-GAAP) 10,470 9,178 8,510 Return on average tangible common equity consolidation (non-GAAP) (16.95) % 10.43 % 12.45 % Cash efficiency ratio Noninterest expense (GAAP) $ 1,094 $ 1,079 $ 1,110 Less: Intangible asset amortization 7 7 9 Adjusted noninterest expense (non-GAAP) $ 1,087 $ 1,072 $ 1,101 Net interest income (GAAP) $ 952 $ 887 $ 915 Plus: Taxable-equivalent adjustment 12 12 8 Net interest income TE (non-GAAP) 964 899 923 Noninterest income (GAAP) (269) 627 643 Total taxable-equivalent revenue (non-GAAP) $ 695 $ 1,526 $ 1,566 Cash efficiency ratio (non-GAAP) 156.4 % 70.2 % 70.3 %

GAAP to Non-GAAP Reconciliation 22 $ in millions 3Q24 2Q24 3Q23 Adjusted income (loss) available from continuing operations attributable to Key common shareholders Income (loss) from continuing operations attributable to Key common shareholders (GAAP) $ (447) $ 237 $ 266 Plus: Loss on sale of securities (net of tax) 737 - - Adjusted income (loss) available from continuing operations attributable to Key common shareholders (non-GAAP) $ 290 $ 237 $ 266 Diluted earnings per common share (EPS) - adjusted Diluted EPS from continuing operations attributable to Key common shareholders (GAAP) $ (.47) $ .25 $ .29 Plus: EPS impact of loss on sale of securities .77 $ - $ - Diluted EPS from continuing operations attributable to Key common shareholders - adjusted (non-GAAP) $ .30 $ .25 $ .29

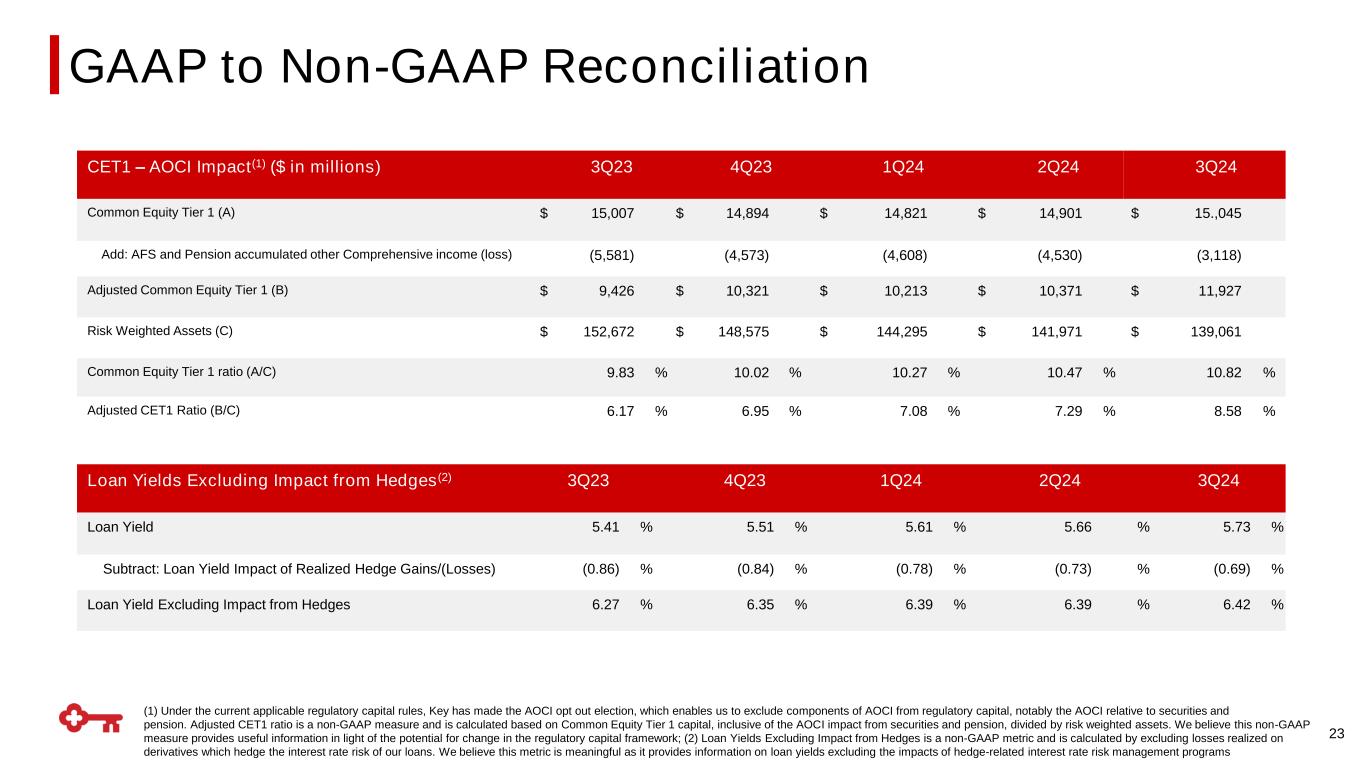

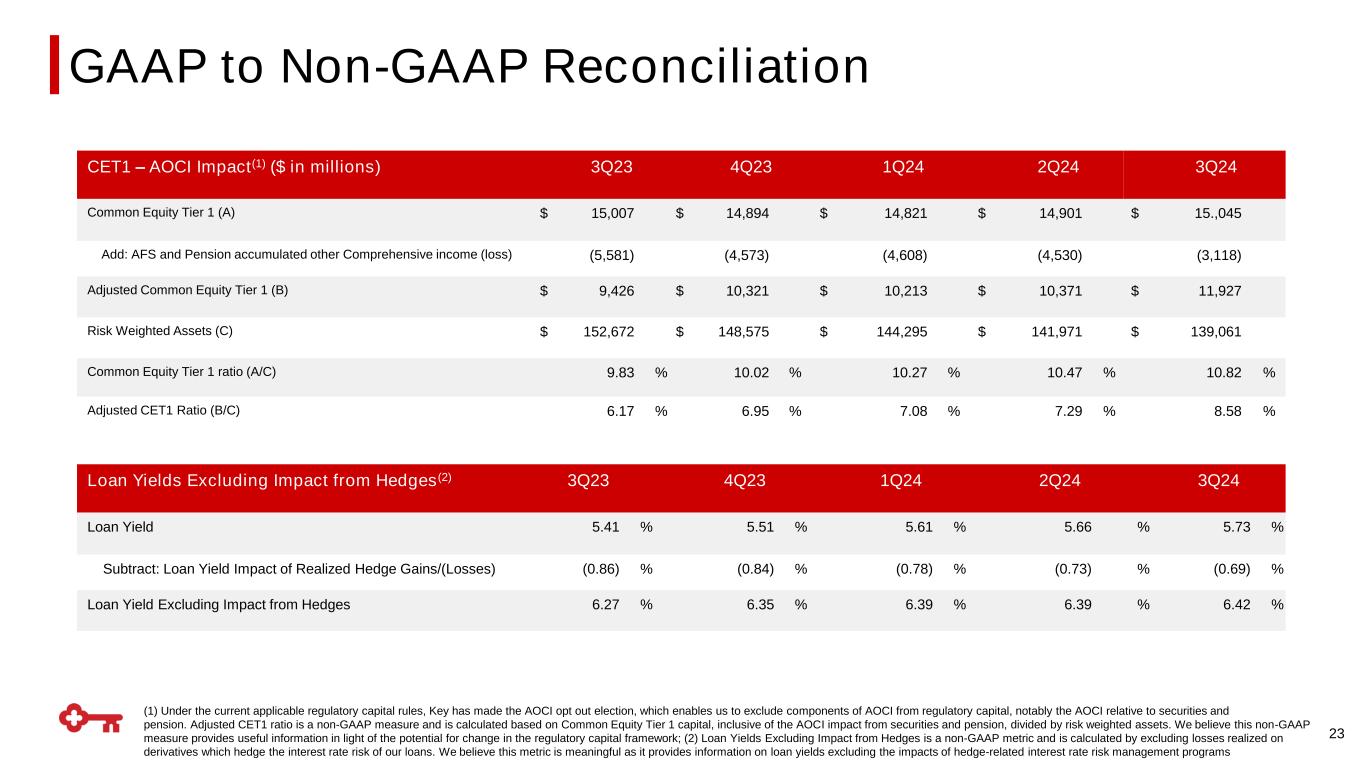

GAAP to Non-GAAP Reconciliation 23 CET1 – AOCI Impact(1) ($ in millions) 3Q23 4Q23 1Q24 2Q24 3Q24 Common Equity Tier 1 (A) $ 15,007 $ 14,894 $ 14,821 $ 14,901 $ 15.,045 Add: AFS and Pension accumulated other Comprehensive income (loss) (5,581) (4,573) (4,608) (4,530) (3,118) Adjusted Common Equity Tier 1 (B) $ 9,426 $ 10,321 $ 10,213 $ 10,371 $ 11,927 Risk Weighted Assets (C) $ 152,672 $ 148,575 $ 144,295 $ 141,971 $ 139,061 Common Equity Tier 1 ratio (A/C) 9.83 % 10.02 % 10.27 % 10.47 % 10.82 % Adjusted CET1 Ratio (B/C) 6.17 % 6.95 % 7.08 % 7.29 % 8.58 % (1) Under the current applicable regulatory capital rules, Key has made the AOCI opt out election, which enables us to exclude components of AOCI from regulatory capital, notably the AOCI relative to securities and pension. Adjusted CET1 ratio is a non-GAAP measure and is calculated based on Common Equity Tier 1 capital, inclusive of the AOCI impact from securities and pension, divided by risk weighted assets. We believe this non-GAAP measure provides useful information in light of the potential for change in the regulatory capital framework; (2) Loan Yields Excluding Impact from Hedges is a non-GAAP metric and is calculated by excluding losses realized on derivatives which hedge the interest rate risk of our loans. We believe this metric is meaningful as it provides information on loan yields excluding the impacts of hedge-related interest rate risk management programs Loan Yields Excluding Impact from Hedges(2) 3Q23 4Q23 1Q24 2Q24 3Q24 Loan Yield 5.41 % 5.51 % 5.61 % 5.66 % 5.73 % Subtract: Loan Yield Impact of Realized Hedge Gains/(Losses) (0.86) % (0.84) % (0.78) % (0.73) % (0.69) % Loan Yield Excluding Impact from Hedges 6.27 % 6.35 % 6.39 % 6.39 % 6.42 %

24 (1) Includes items impacting results or trends during the period but are not considered non-GAAP adjustments; (2) Favorable (unfavorable) impact. (3) After-tax loss on sale of securities adjusted to reflect impact of GAAP accounting for income taxes in interim periods, with related adjustments to be required in the fourth quarter of 2024; (4) Impact to EPS reflected on a fully diluted basis; (5) In November 2023, the FDIC issued a final rule implementing a special assessment on insured depository institutions to recover the loss to the FDIC’s deposit insurance fund (DIF) associated with protecting uninsured depositors following the 2023 closures of Silicon Valley Bank and Signature Bank. KeyCorp recorded the initial loss estimate related to the special assessment during the fourth quarter of 2023. In late February 2024, the FDIC provided updated estimates on the uninsured deposit losses and recoverable assets related to the 2023 closures of Silicon Valley Bank and Signature Bank. KeyCorp recorded the additional expense related to the revised special assessment during the first quarter of 2024. Amounts reflected for both the three-months ended June 30, 2024, and September 30, 2024, represent adjustments from initial estimates based on quarterly invoices received by the FDIC; (6) Efficiency related expenses for the three-months ended December 31, 2023, consist primarily of $39 million of severance recorded in personnel expense and $24 million of corporate real estate related rationalization and other contract termination or renegotiation costs recorded in other expense. Selected Items Impact on Earnings Selected Items Impact on Earnings(1) $ in millions, except per share amounts Pretax(2) After-tax at marginal rate(2)(3) Quarter to date results Amount Net Income EPS(4) Three months ended September 30, 2024 Loss on sale of securities (other income) $ (918) $ (737) $ (0.77) FDIC special assessment (other expense)(4) 6 5 - Three months ended June 30, 2024 FDIC special assessment (other expense)(5) (5) (4) - Three months ended March 31, 2024 FDIC special assessment (other expense)(5) (29) (22) (0.02) Three months ended December 31, 2023 Efficiency related expenses(6) (67) (51) (0.05) Pension settlement (other expense) (18) (14) (0.02) FDIC special assessment (other expense)(5) (190) (144) (0.15) Three months ended September 30, 2023 No items

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “seek,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible,” “potential,” “strategy,” “opportunities,” or “trends,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are based on assumptions that involve risks and uncertainties, which are subject to change based on various important factors (some of which are beyond KeyCorp’s control). Actual results may differ materially from current projections. Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward-looking Statements” and “Risk Factors” in KeyCorp’s Annual Report on Form 10-K for the year ended December 31, 2023, and in subsequent filings of KeyCorp with the Securities and Exchange Commission (the “SEC”). Such forward- looking statements speak only as of the date they are made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding KeyCorp, please refer to our SEC filings available at www.key.com/ir. This document contains GAAP financial measures and non-GAAP financial measures where management believes it to be helpful in understanding Key’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the appendix to this presentation, the financial supplement, or the press release related to this presentation, all of which can be found on Key’s website (www.key.com/ir). Certain returns, yields, performance ratios, or quarterly growth rates are presented on an “annualized” basis. This is done for analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or year-over-year amounts. Income from tax-exempt earning assets is increased by an amount equivalent to the taxes that would have been paid if this income had been taxable at the federal statutory rate. This adjustment puts all earning assets, most notably tax-exempt municipal securities, and certain lease assets, on a common basis that facilitates comparison of results to results of peers. Certain income or expense items may be expressed on a per common share basis. This is done for analytical and decision-making purposes to better discern underlying trends in total consolidated earnings per share performance excluding the impact of such items. When the impact of certain income or expense items is disclosed separately, the after-tax amount is computed using the marginal tax rate, unless otherwise specified, with this then being the amount used to calculate the earnings per share equivalent. GAAP: Generally Accepted Accounting Principles 25 Forward-looking Statements and Additional Information