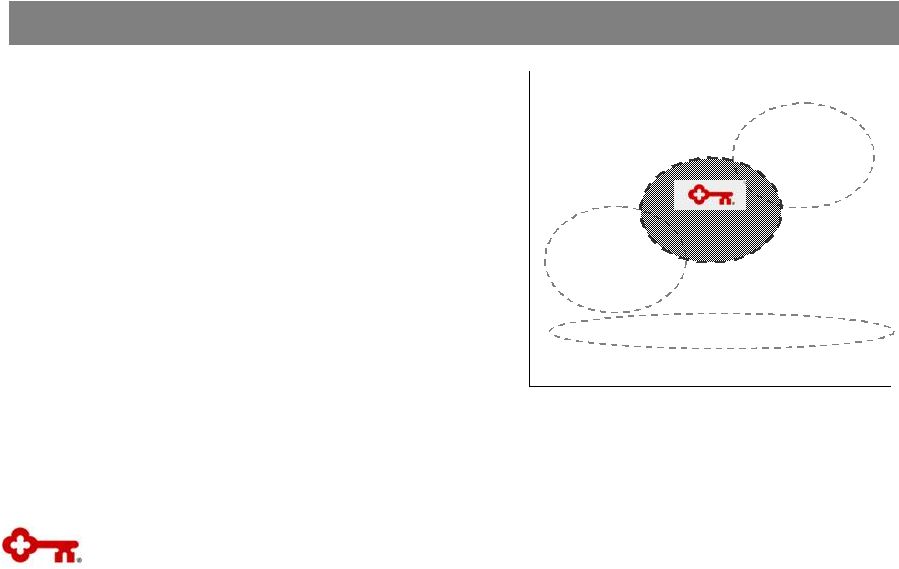

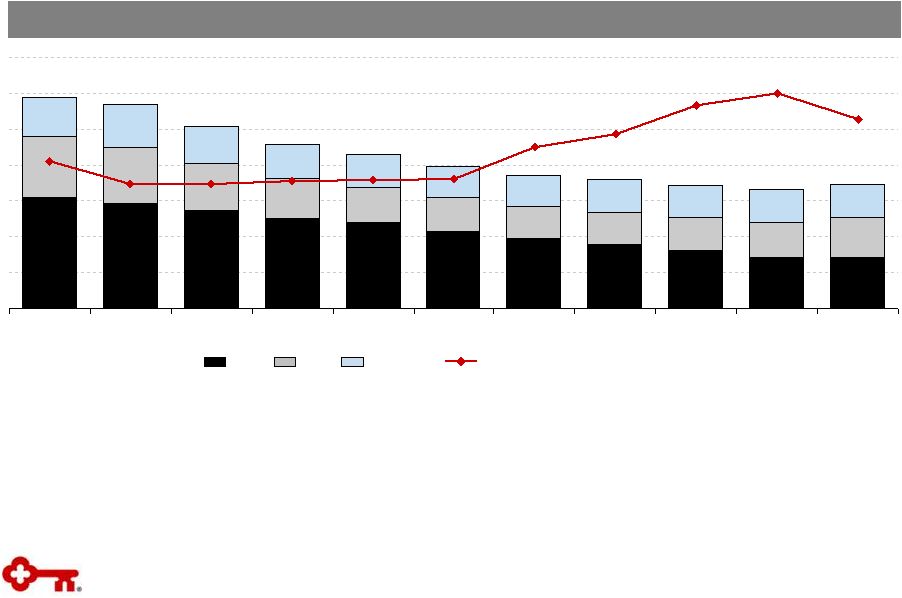

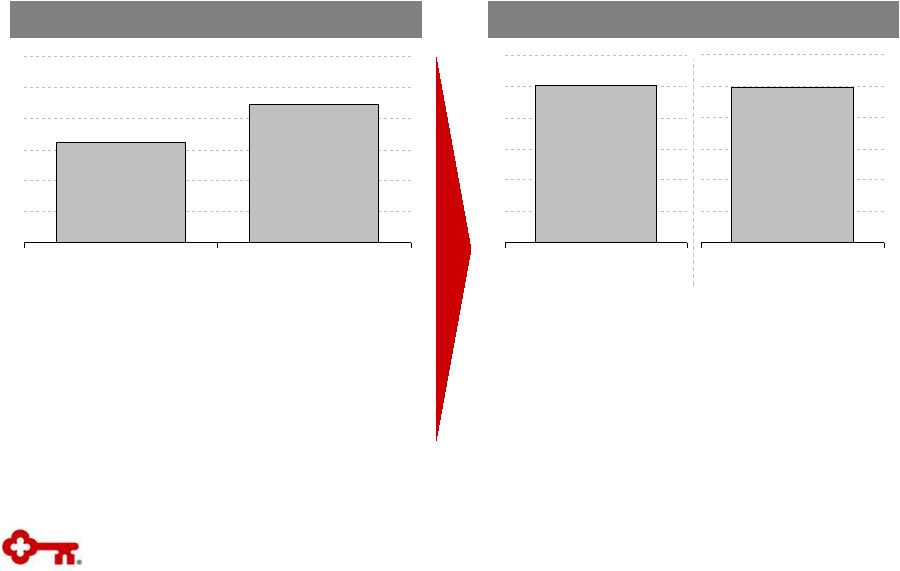

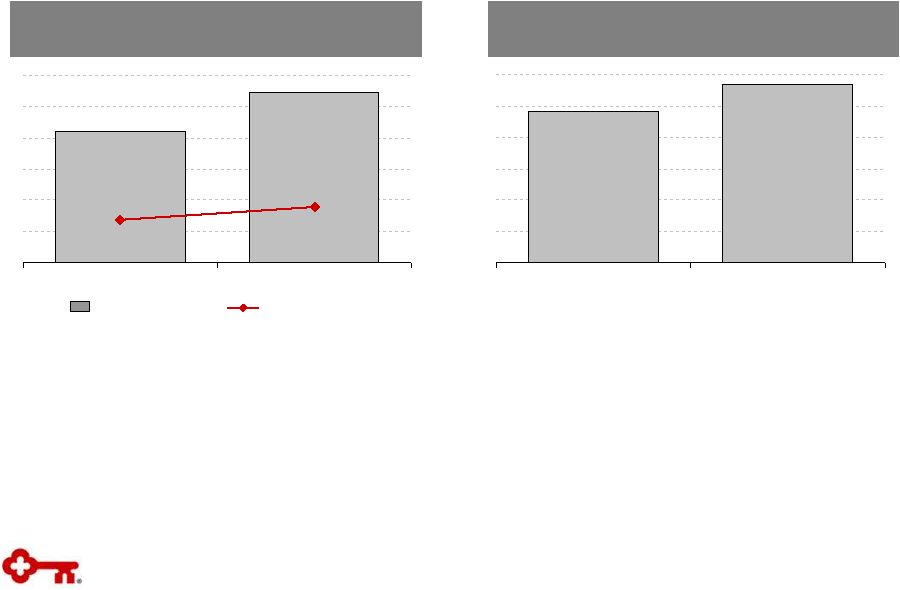

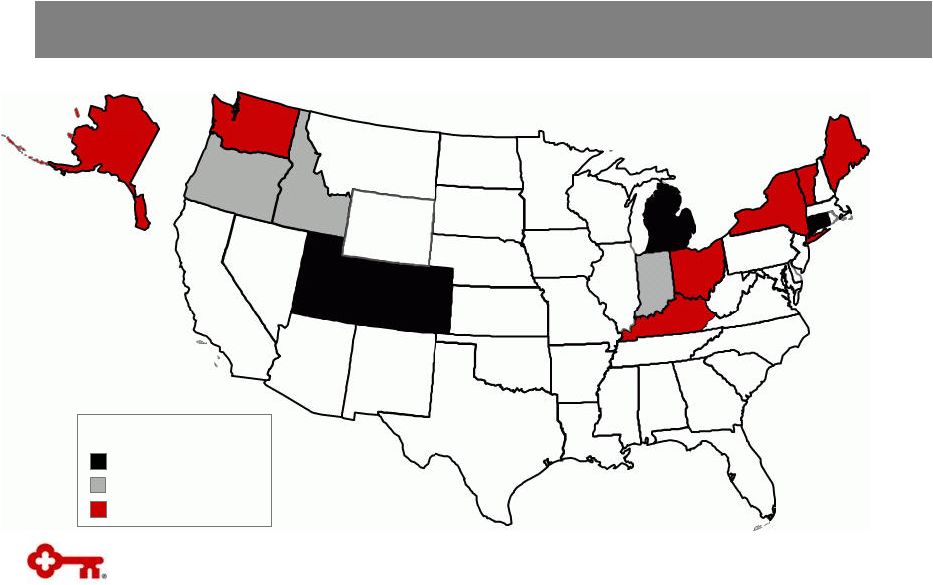

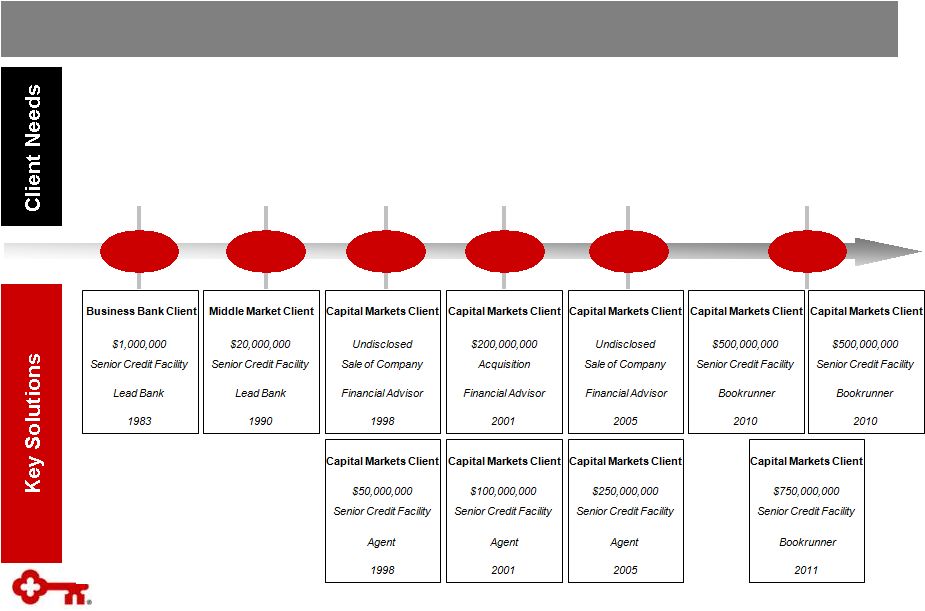

9 Activity • Tight coordination between Real Estate relationship managers and Capital Markets execution bankers Results • $106mm in LTM 3Q11 real estate Investment Banking Income and Debt Placement Fees (1) • #1 among domestic regional banks in equity capital markets fee revenue since 1Q10 Aligned to Serve Our Clients Key’s integrated model is aligned to serve client needs • KEF product specialists are embedded in all districts to deepen relationships with colleagues and clients for tailored solutions • $497mm in Community Bank lease volume LTM 3Q11, up 40% YoY • Commercial Banking-Investment Banking initiative leverages local relationships with industry/product expertise – a differentiator • Industry and capital markets specialists complete 850 client calls with commercial bankers • Regular, two-way referral activity between Key Corporate Bank and Key Community Bank • Treasury Management, foreign exchange and derivatives teams provide solutions to clients across Key’s franchise • Treasury Management services provided to Community Bank clients with more than $8B in deposits • Provide foreign exchange and derivatives solutions to nearly 3,000 Community Bank clients (1) Includes debt and equity capital markets underwriting, loan syndication, M&A advisory, and commercial mortgage banking private placement fees |