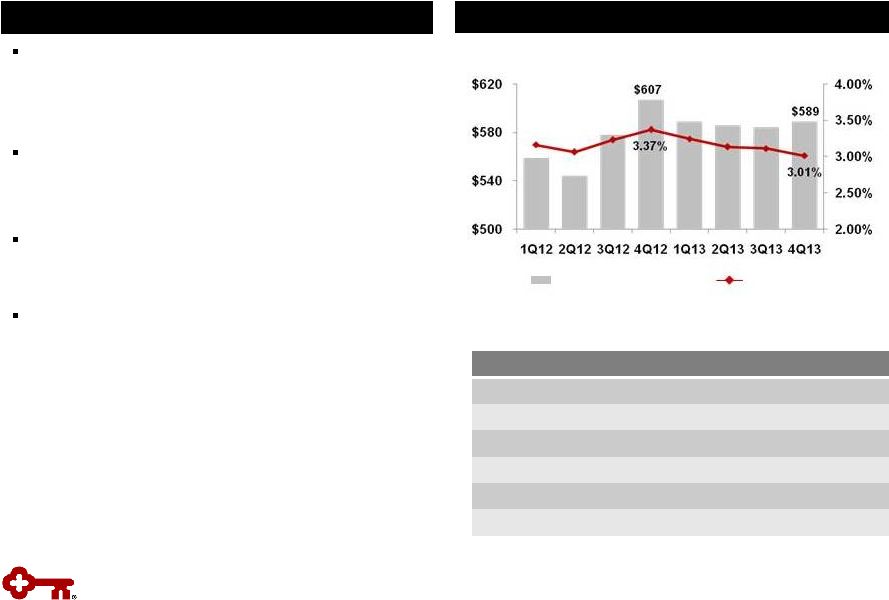

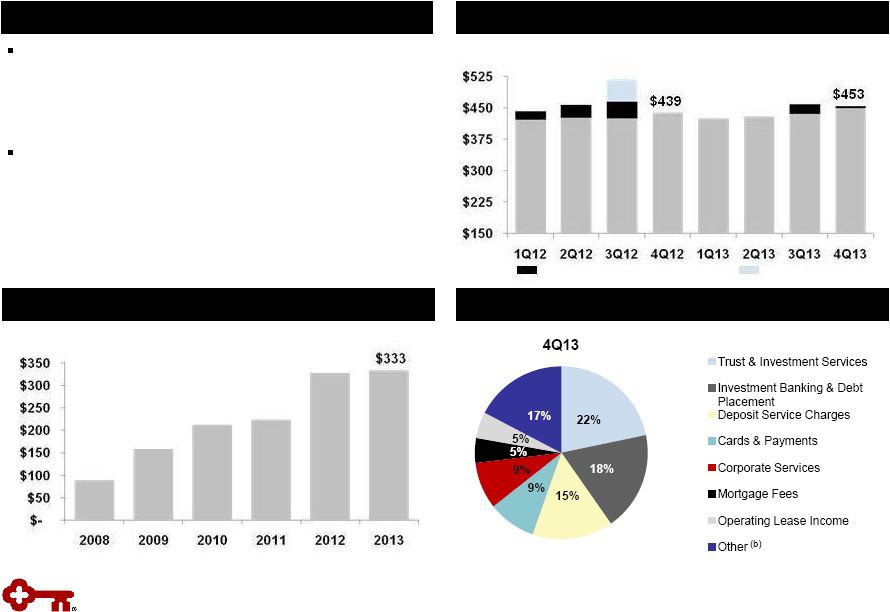

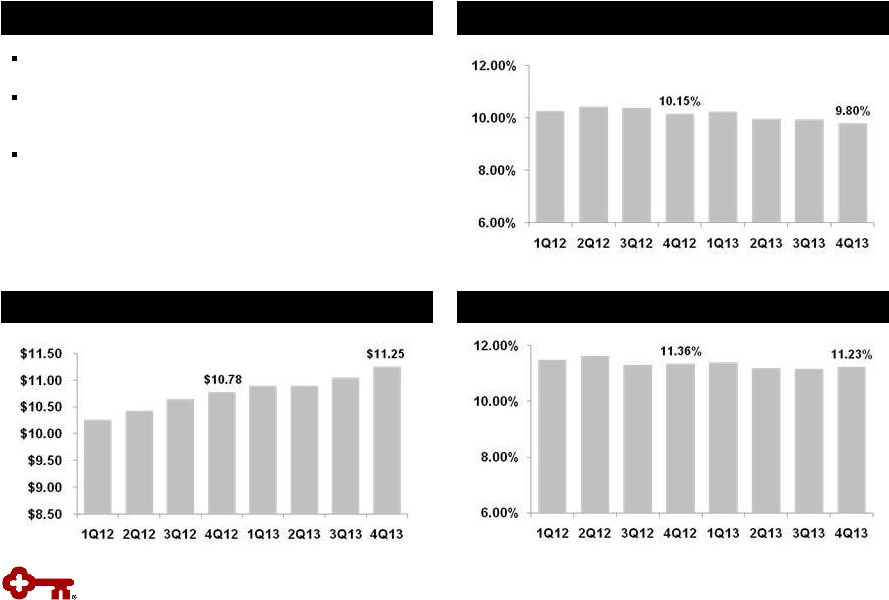

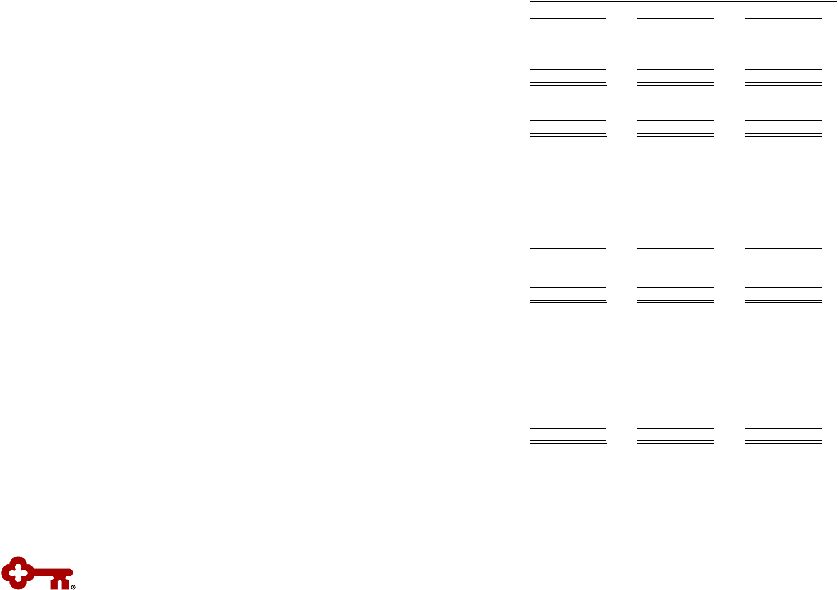

Three months ended 12-31-13 9-30-13 12-31-12 Tangible common equity to tangible assets at period end Key shareholders’ equity (GAAP) $ 10,303 $ 10,206 $ 10,271 Less: Intangible assets (b) 1,014 1,017 1,027 Preferred Stock, Series A (c) 282 282 291 Tangible common equity (non-GAAP) $ 9,007 $ 8,907 $ 8,953 Total assets (GAAP) $ 92,934 $ 90,708 $ 89,236 Less: Intangible assets (b) 1,014 1,017 1,027 Tangible assets (non-GAAP) $ 91,920 $ 89,691 $ 88,209 Tangible common equity to tangible assets ratio (non-GAAP) 9.80 % 9.93 % 10.15 % Tier 1 common equity at period end Key shareholders' equity (GAAP) $ 10,303 $ 10,206 $ 10,271 Qualifying capital securities 339 340 339 Less: Goodwill 979 979 979 Accumulated other comprehensive income (loss) (d) (394) (409) (172) Other assets (e) 91 96 114 Total Tier 1 capital (regulatory) 9,966 9,880 9,689 Less: Qualifying capital securities 339 340 339 Preferred Stock, Series A (c) 282 282 291 Total Tier 1 common equity (non-GAAP) $ 9,345 $ 9,258 $ 9,059 Net risk-weighted assets (regulatory) (e), (f) $ 83,251 $ 82,913 $ 79,734 Tier 1 common equity ratio (non-GAAP) (f) 11.23 % 11.17 % 11.36 % Pre-provision net revenue Net interest income (GAAP) $ 583 $ 578 $ 601 Plus: Taxable-equivalent adjustment 6 6 6 Noninterest income (GAAP) 453 459 439 Less: Noninterest expense (GAAP) 712 716 734 Pre-provision net revenue from continuing operations (non-GAAP) $ 330 $ 327 $ 312 GAAP to Non-GAAP Reconciliation (a) $ in millions (a) 2Q13 and 1Q13 reconciliations available in our 2Q13 earnings press release, available on our website: www.key.com/ir (b) Three months ended December 31, 2013, September 30, 2013, and December 31, 2012 exclude $92 million, $99 million, and $123 million, respectively, of period end purchased credit card receivable intangible assets (c) Net of capital surplus for the three months ended December 31, 2013 and September 30, 2013 (d) Includes net unrealized gains or losses on securities available for sale (except for net unrealized losses on marketable equity securities), net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other postretirement plans (e) Other assets deducted from Tier 1 capital and net risk-weighted assets consist of disallowed intangible assets (excluding goodwill) and deductible portions of nonfinancial equity investments. There were no disallowed deferred tax assets at 12-31-13, 9-30-13, and 12-31-12 (f) 12-31-13 amount is estimated 21 |