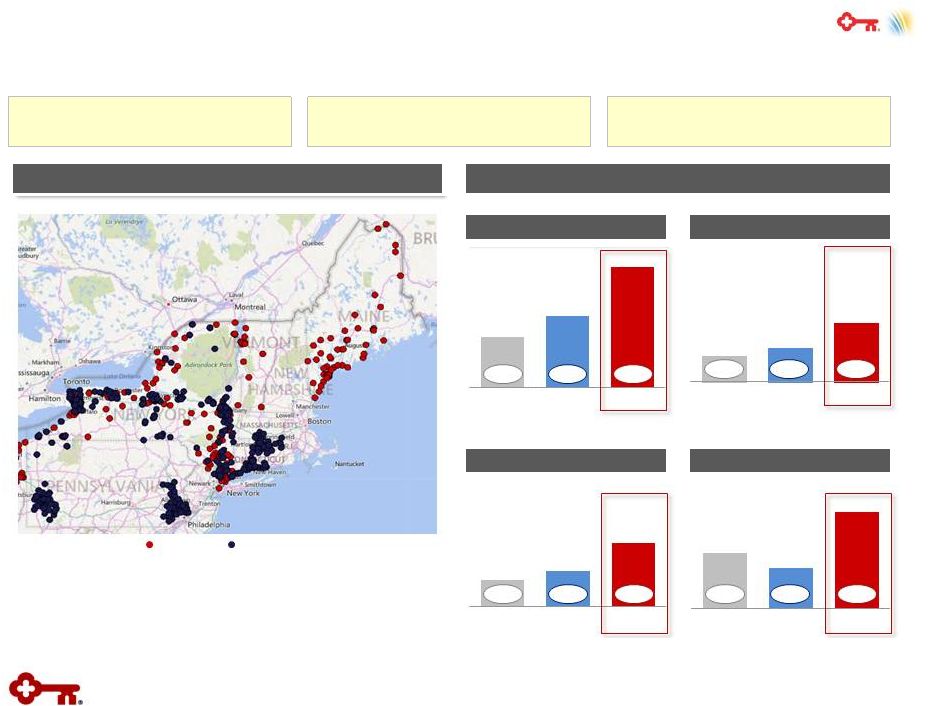

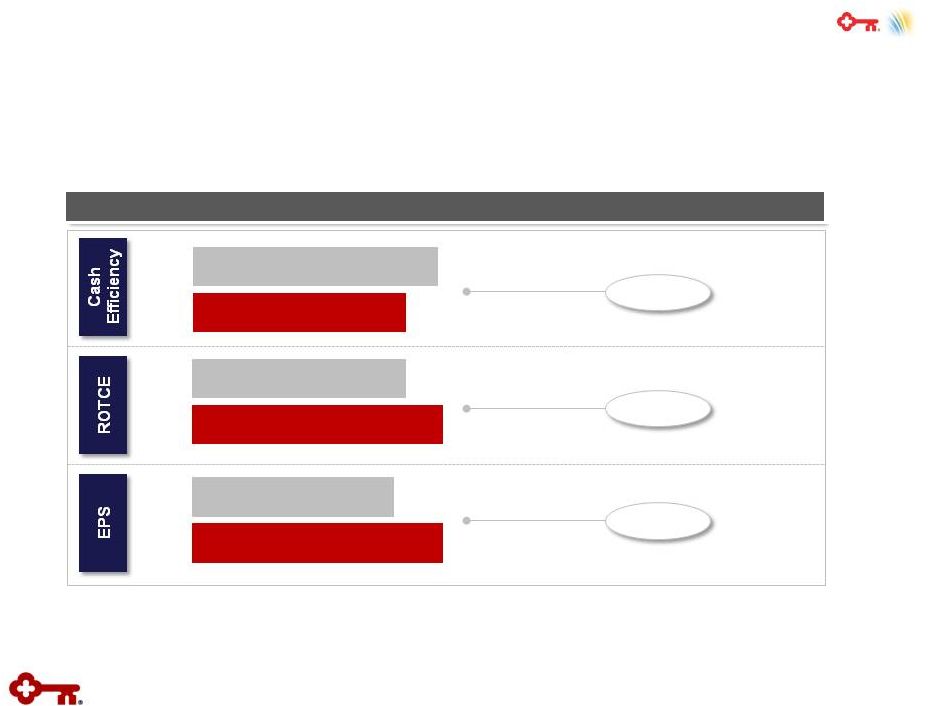

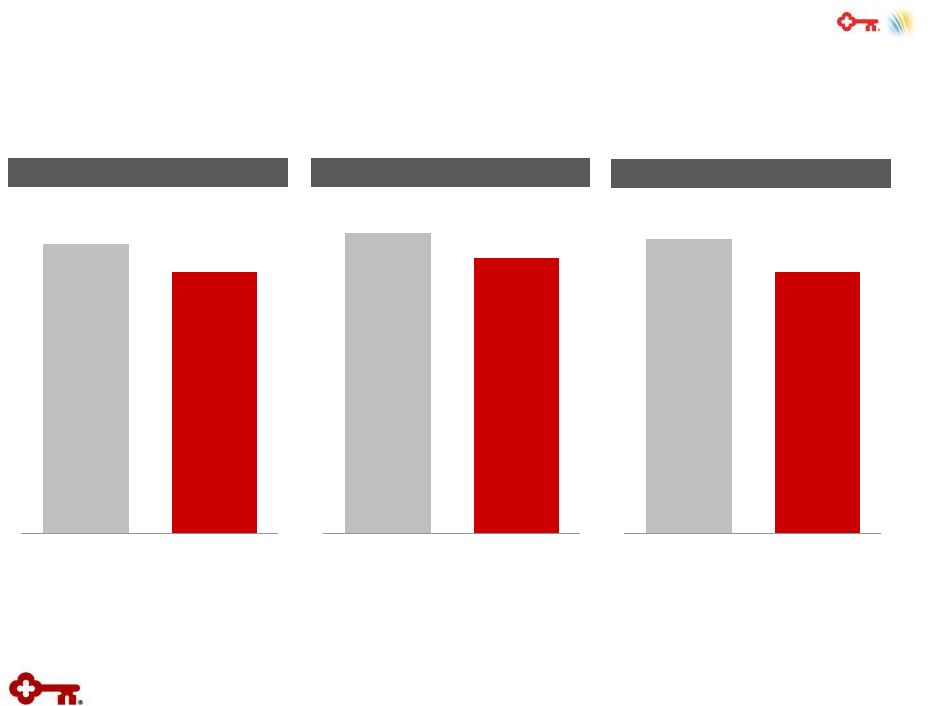

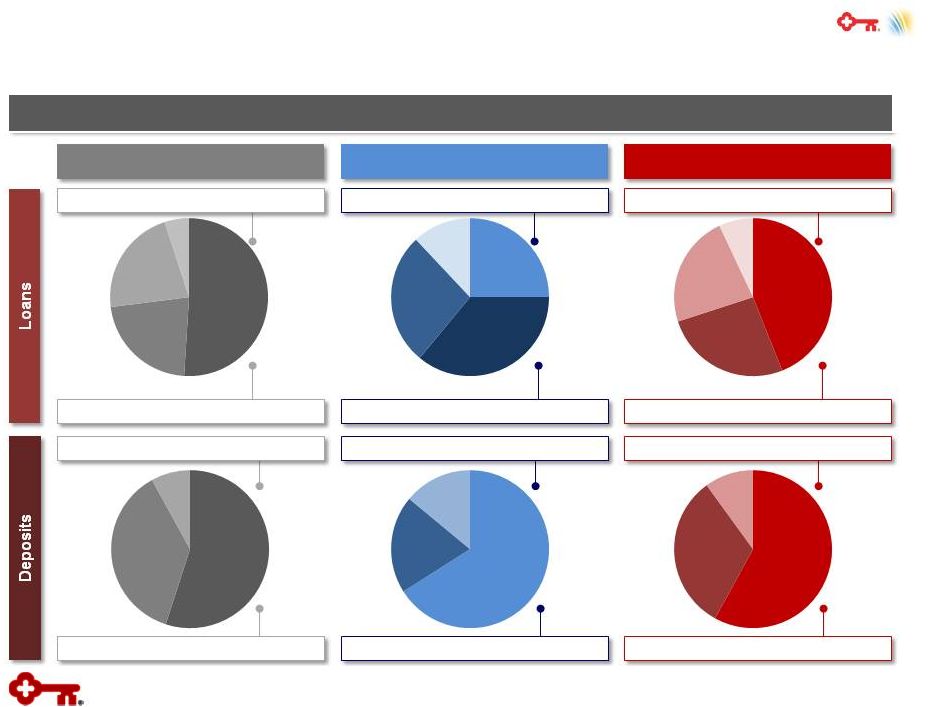

5 Attractive Transaction Economics Better Together • $4.1 billion in aggregate consideration – First Niagara shareholders receive 0.68 Key shares and $2.30 in cash for each FNFG common share – Implied value of $11.40 per FNFG common share, based on Key’s closing share price as of October 29 • Transaction metrics in-line with precedent transactions – P / TBV: 1.7x Core deposit premium: 6.7% P / 2016E EPS: 18.7x P / 2016E EPS (with synergies): 8.5x Key Transaction Terms Key Transaction Terms Financial Impact Financial Impact • Generates compelling financial metrics – Increases ROTCE by ~200 bps – Cash efficiency ratio improves by ~300 bps, driven by $400 million in annual cost savings – EPS accretion of 5% – IRR approximates 15% and ROIC exceeds 10% – Tangible book value dilution of ~12% • Drives revenue synergies by deploying stronger combined product set to existing clients • Efficient use of capital – capital ratios remain strong • Increases scale of Key by ~40% in loans; deposits; total assets (a) Upon full realization of cost savings (FY2018); no revenue synergies assumed Financial Assumptions Financial Assumptions • Cost savings of $400 million pre-tax, or ~40% of FNFG’s current noninterest expense • Meaningful revenue synergies identified, but not included in financial analysis • Merger and integration costs of approximately $550 million pre-tax • Purchase accounting adjustments include ~3% loan mark and ~1.5% core deposit intangible • Key’s existing share repurchase program suspended until closing of transaction; no change to Key’s dividend plans, including anticipated increase to $0.085 per share in 2Q16 – Key anticipates requesting resumption of share repurchase activity in our 2016 CCAR submission • Expected closing in 3Q16, subject to shareholder approval from Key and First Niagara and customary regulatory approvals (a) |