KeyCorp Second Quarter 2016 Earnings Review July 26, 2016 Beth E. Mooney Chairman and Chief Executive Officer Don Kimble Chief Financial Officer Exhibit 99.2

FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION DISCLOSURE This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s and First Niagara’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in KeyCorp’s and First Niagara’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to meet closing conditions to the merger; delay in closing the merger; difficulties and delays in integrating the First Niagara business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of KeyCorp’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation also includes certain non-GAAP financial measures related to “tangible common equity,” “Common Equity Tier 1,” “pre-provision net revenue,” “cash efficiency ratio,” and certain financial measures excluding merger-related expenses. Management believes these measures may assist investors, analysts and regulators in analyzing Key’s financials. Although Key has procedures in place to ensure that these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the reconciliations to the most comparable GAAP measures, please refer to the appendix of this presentation or page 96 of our Form 10-Q dated March 31, 2016.

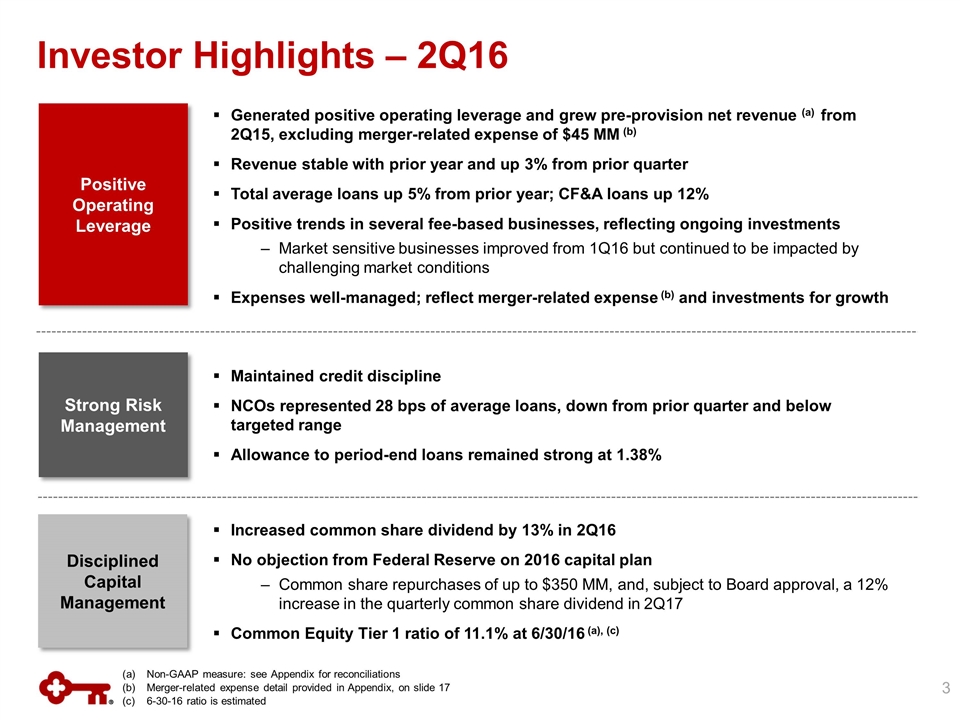

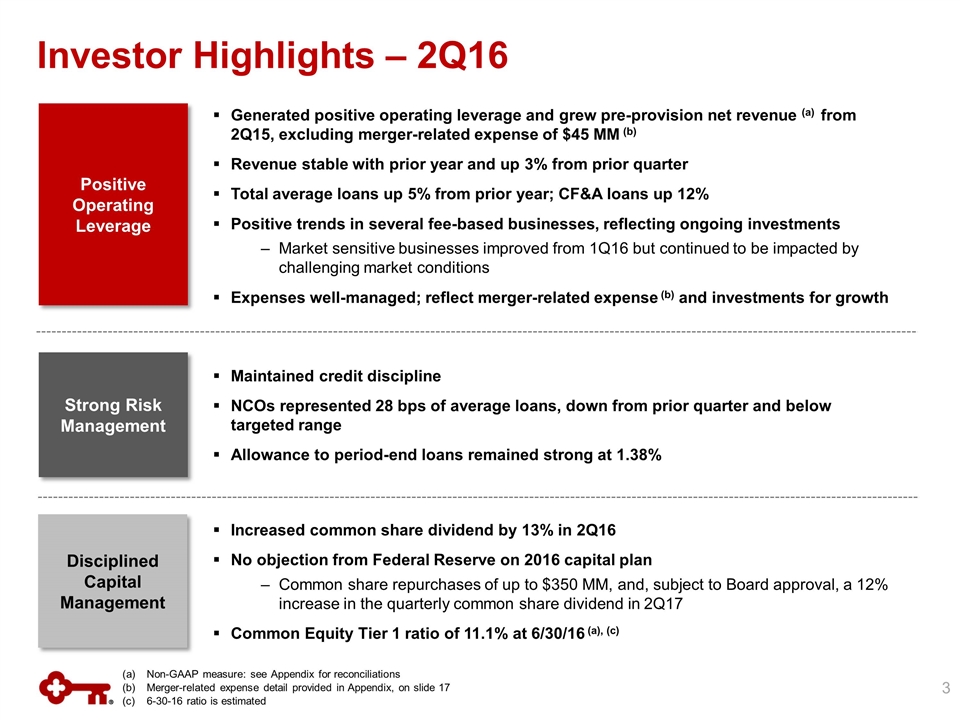

Non-GAAP measure: see Appendix for reconciliations Merger-related expense detail provided in Appendix, on slide 17 6-30-16 ratio is estimated Disciplined Capital Management Generated positive operating leverage and grew pre-provision net revenue (a) from 2Q15, excluding merger-related expense of $45 MM (b) Revenue stable with prior year and up 3% from prior quarter Total average loans up 5% from prior year; CF&A loans up 12% Positive trends in several fee-based businesses, reflecting ongoing investments Market sensitive businesses improved from 1Q16 but continued to be impacted by challenging market conditions Expenses well-managed; reflect merger-related expense (b) and investments for growth Strong Risk Management Investor Highlights – 2Q16 Positive Operating Leverage Maintained credit discipline NCOs represented 28 bps of average loans, down from prior quarter and below targeted range Allowance to period-end loans remained strong at 1.38% Increased common share dividend by 13% in 2Q16 No objection from Federal Reserve on 2016 capital plan Common share repurchases of up to $350 MM, and, subject to Board approval, a 12% increase in the quarterly common share dividend in 2Q17 Common Equity Tier 1 ratio of 11.1% at 6/30/16 (a), (c)

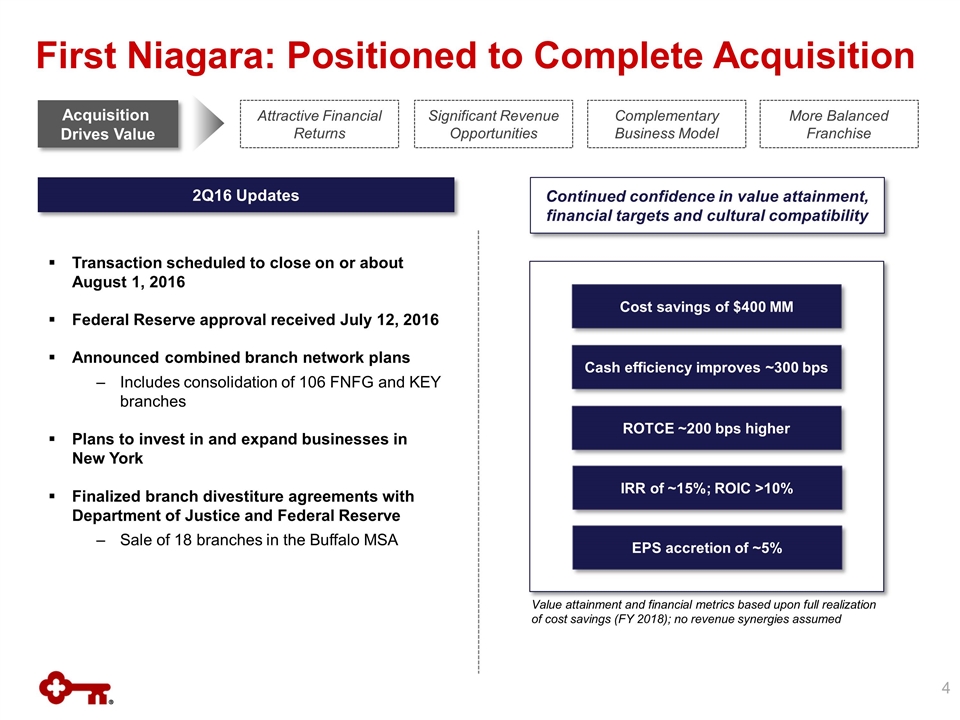

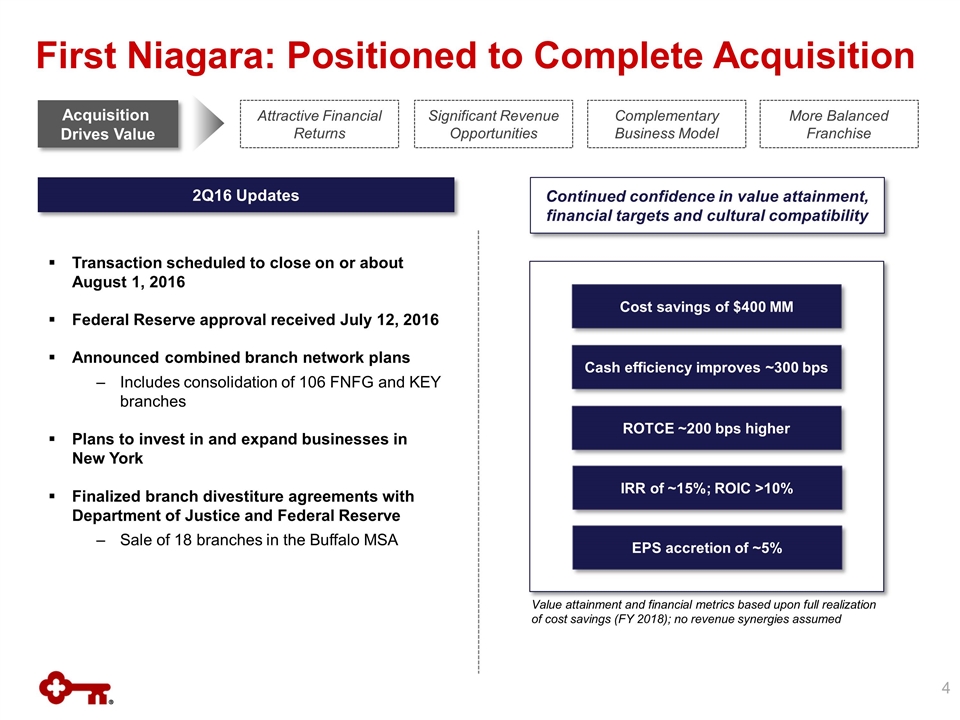

0 First Niagara: Positioned to Complete Acquisition Acquisition Drives Value 2Q16 Updates Transaction scheduled to close on or about August 1, 2016 Federal Reserve approval received July 12, 2016 Announced combined branch network plans Includes consolidation of 106 FNFG and KEY branches Plans to invest in and expand businesses in New York Finalized branch divestiture agreements with Department of Justice and Federal Reserve Sale of 18 branches in the Buffalo MSA Attractive Financial Returns Significant Revenue Opportunities Complementary Business Model More Balanced Franchise Cost savings of $400 MM ROTCE ~200 bps higher Cash efficiency improves ~300 bps EPS accretion of ~5% IRR of ~15%; ROIC >10% Continued confidence in value attainment, financial targets and cultural compatibility Value attainment and financial metrics based upon full realization of cost savings (FY 2018); no revenue synergies assumed

Financial Review

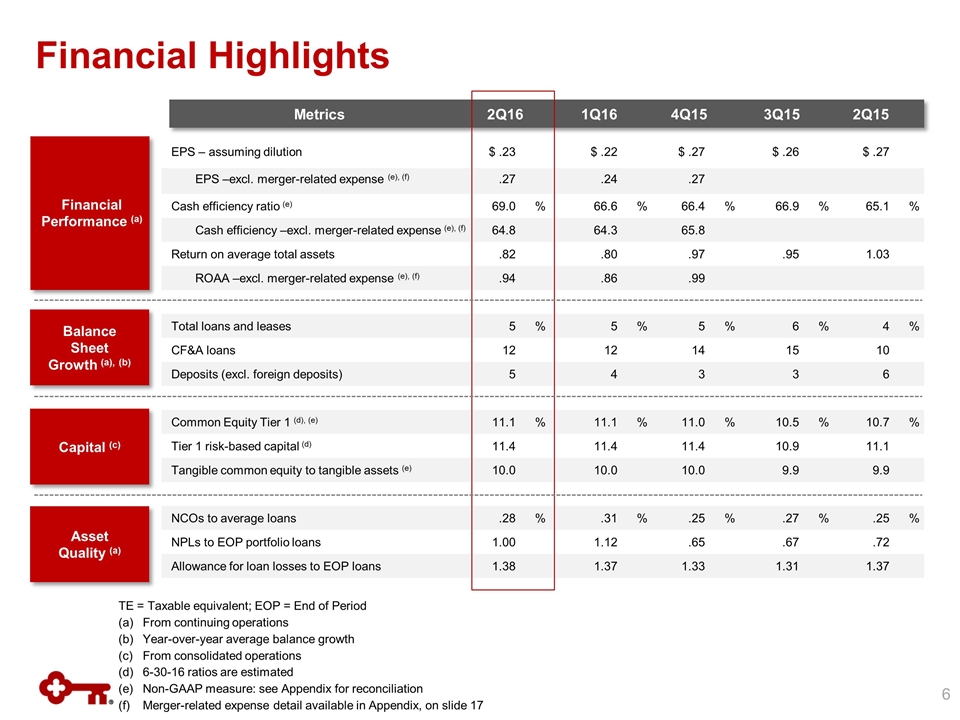

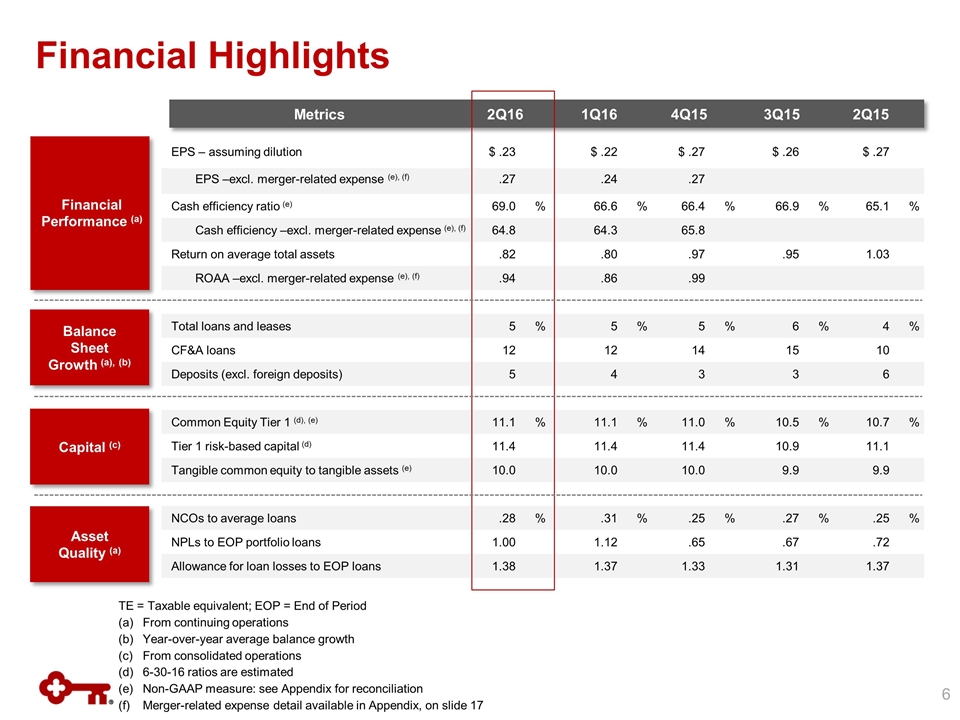

Financial Highlights TE = Taxable equivalent; EOP = End of Period From continuing operations Year-over-year average balance growth (c) From consolidated operations (d) 6-30-16 ratios are estimated Non-GAAP measure: see Appendix for reconciliation Merger-related expense detail available in Appendix, on slide 17 EPS – assuming dilution $ .23 $ .22 $ .27 $ .26 $ .27 EPS –excl. merger-related expense (e), (f) .27 .24 .27 Cash efficiency ratio (e) 69.0 % 66.6 % 66.4 % 66.9 % 65.1 % Cash efficiency –excl. merger-related expense (e), (f) 64.8 64.3 65.8 Return on average total assets .82 .80 .97 .95 1.03 ROAA –excl. merger-related expense (e), (f) .94 .86 .99 Total loans and leases 5 % 5 % 5 % 6 % 4 % CF&A loans 12 12 14 15 10 Deposits (excl. foreign deposits) 5 4 3 3 6 Common Equity Tier 1 (d), (e) 11.1 % 11.1 % 11.0 % 10.5 % 10.7 % Tier 1 risk-based capital (d) 11.4 11.4 11.4 10.9 11.1 Tangible common equity to tangible assets (e) 10.0 10.0 10.0 9.9 9.9 NCOs to average loans .28 % .31 % .25 % .27 % .25 % NPLs to EOP portfolio loans 1.00 1.12 .65 .67 .72 Allowance for loan losses to EOP loans 1.38 1.37 1.33 1.31 1.37 Balance Sheet Growth (a), (b) Capital (c) Asset Quality (a) Financial Performance (a) Metrics 2Q16 1Q16 4Q15 3Q15 2Q15

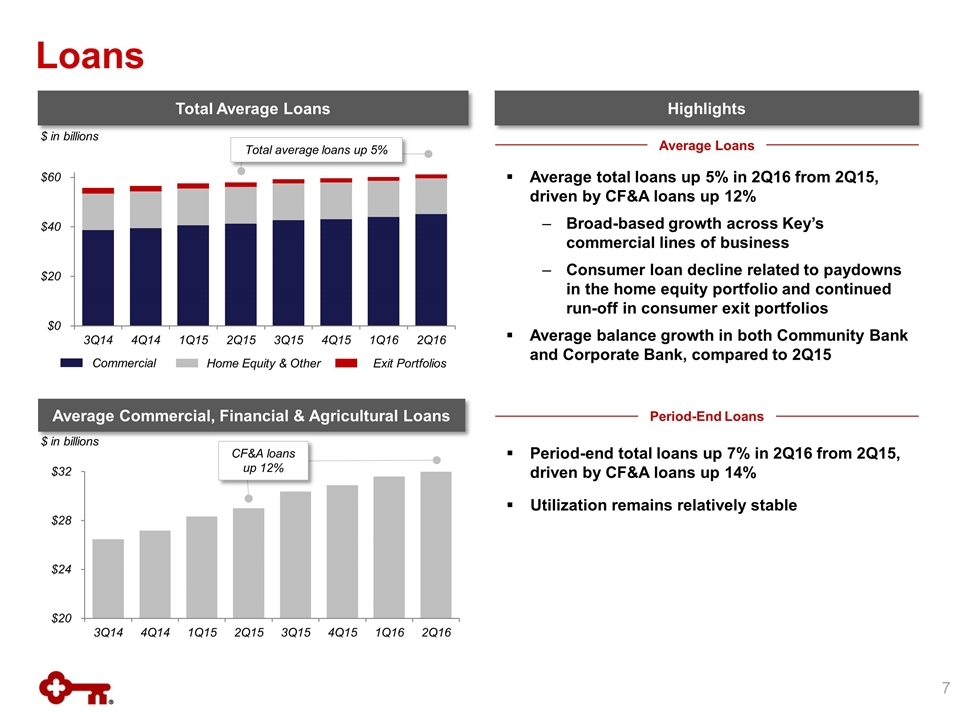

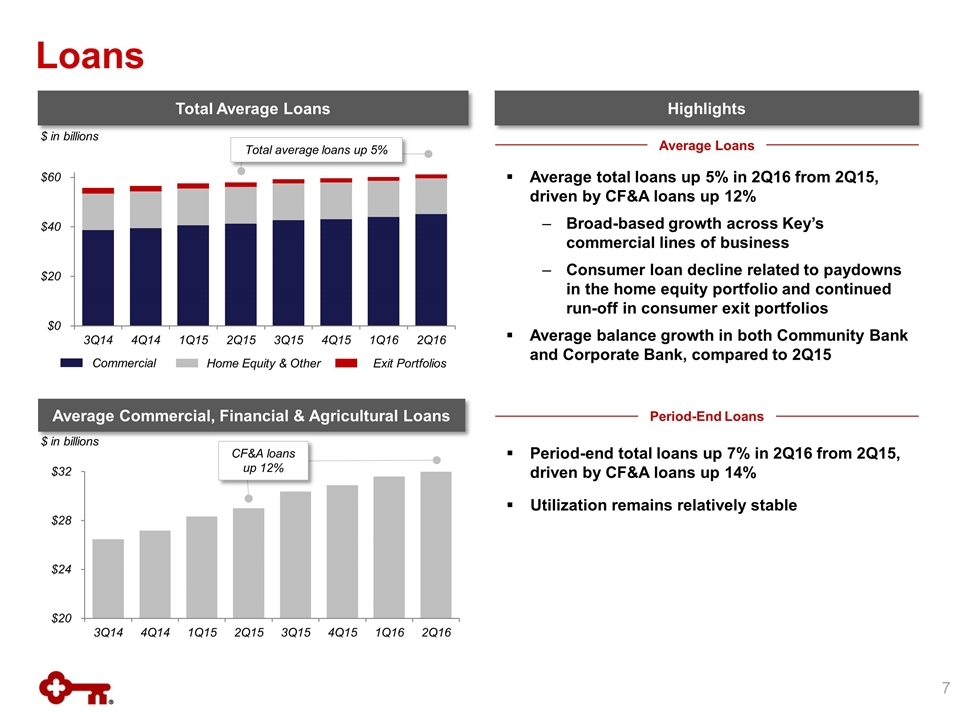

Loans $ in billions Average Commercial, Financial & Agricultural Loans Total Average Loans Exit Portfolios Home Equity & Other Commercial $ in billions Period-end total loans up 7% in 2Q16 from 2Q15, driven by CF&A loans up 14% Utilization remains relatively stable Average Loans CF&A loans up 12% Highlights Total average loans up 5% Average total loans up 5% in 2Q16 from 2Q15, driven by CF&A loans up 12% Broad-based growth across Key’s commercial lines of business Consumer loan decline related to paydowns in the home equity portfolio and continued run-off in consumer exit portfolios Average balance growth in both Community Bank and Corporate Bank, compared to 2Q15 Period-End Loans

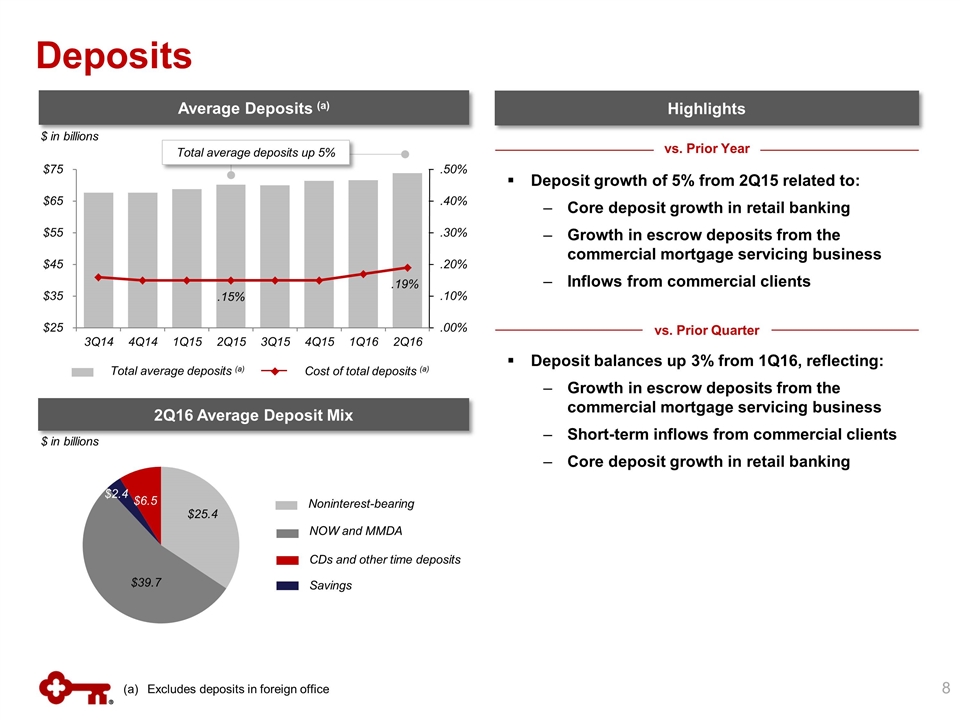

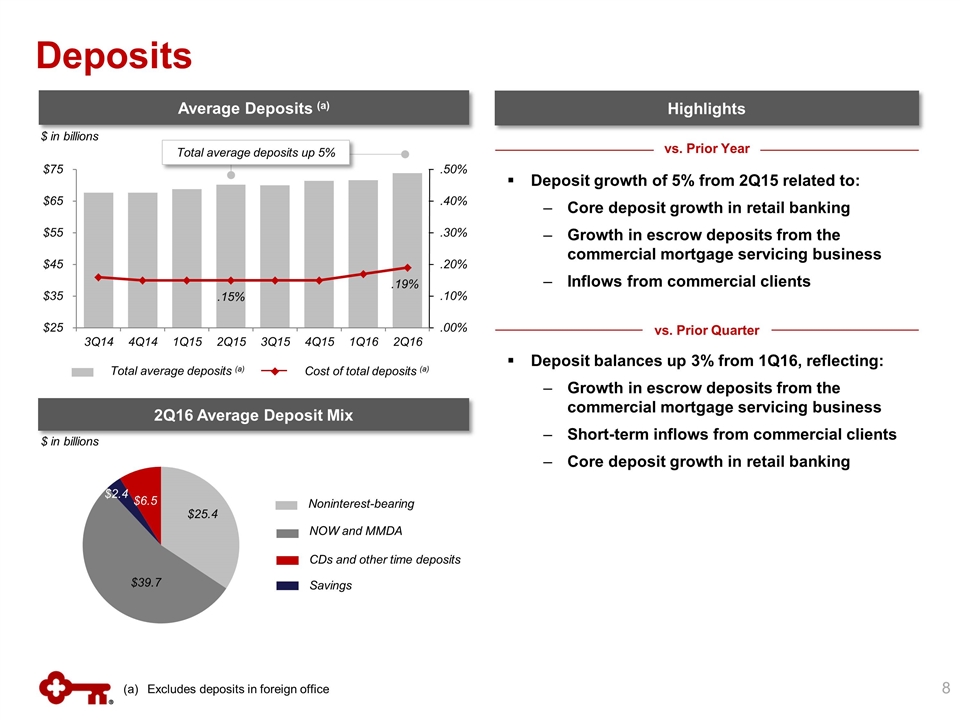

Deposit balances up 3% from 1Q16, reflecting: Growth in escrow deposits from the commercial mortgage servicing business Short-term inflows from commercial clients Core deposit growth in retail banking 2Q16 Average Deposit Mix Deposit growth of 5% from 2Q15 related to: Core deposit growth in retail banking Growth in escrow deposits from the commercial mortgage servicing business Inflows from commercial clients Average Deposits (a) Excludes deposits in foreign office Cost of total deposits (a) CDs and other time deposits Savings Noninterest-bearing NOW and MMDA Total average deposits (a) Highlights Deposits Total average deposits up 5% $ in billions $ in billions vs. Prior Year vs. Prior Quarter

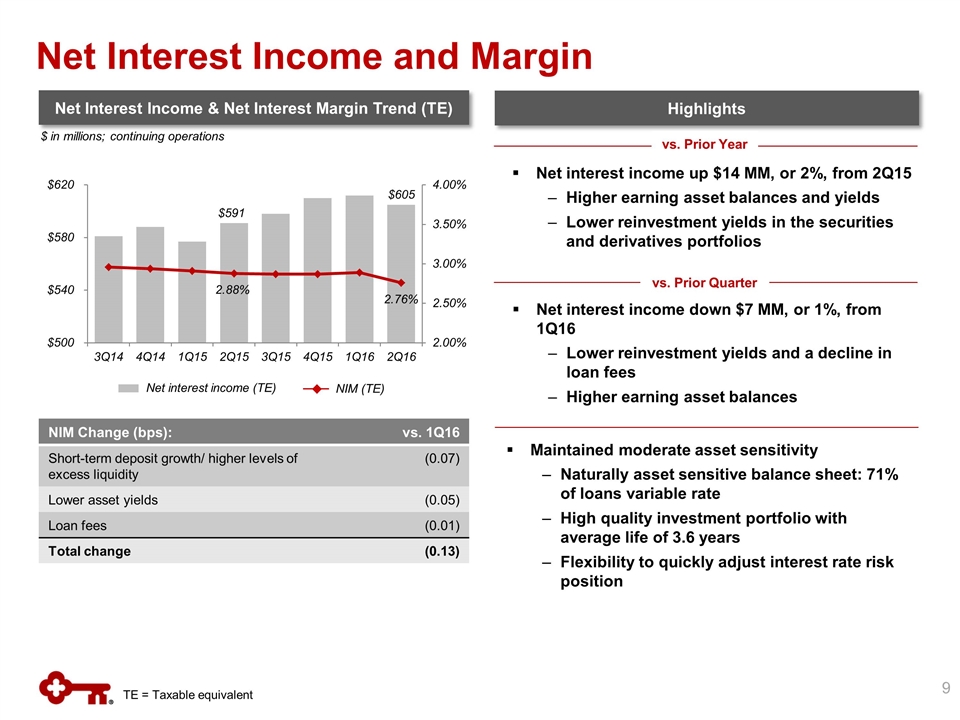

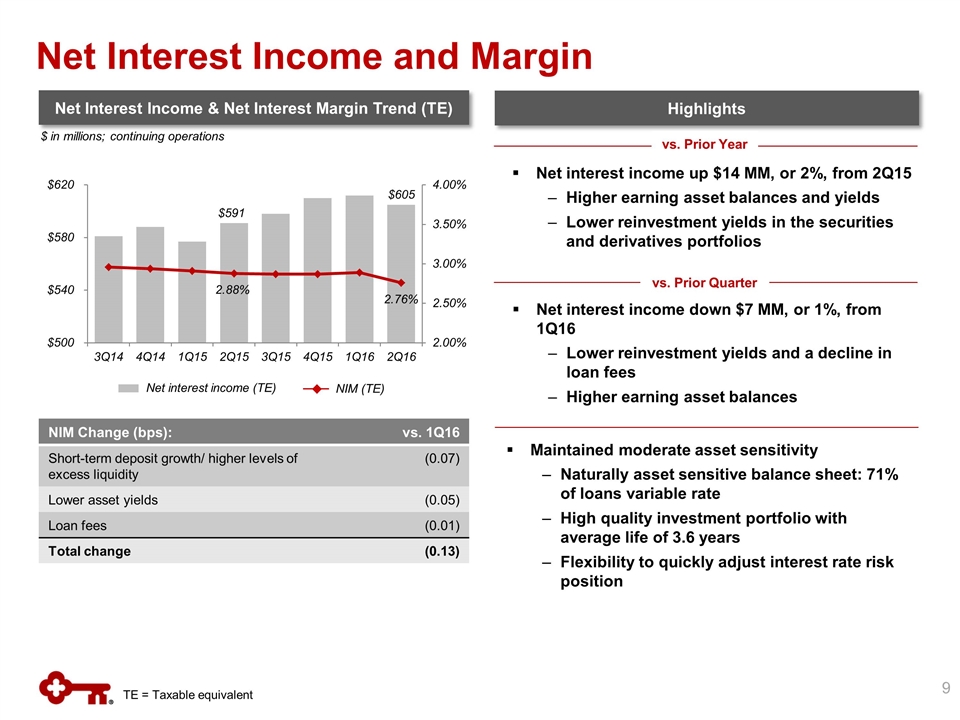

Net interest income down $7 MM, or 1%, from 1Q16 Lower reinvestment yields and a decline in loan fees Higher earning asset balances TE = Taxable equivalent Net interest income (TE) NIM (TE) NIM Change (bps): vs. 1Q16 Short-term deposit growth/ higher levels of excess liquidity (0.07) Lower asset yields (0.05) Loan fees (0.01) Total change (0.13) Maintained moderate asset sensitivity Naturally asset sensitive balance sheet: 71% of loans variable rate High quality investment portfolio with average life of 3.6 years Flexibility to quickly adjust interest rate risk position Net interest income up $14 MM, or 2%, from 2Q15 Higher earning asset balances and yields Lower reinvestment yields in the securities and derivatives portfolios Net Interest Income and Margin Net Interest Income & Net Interest Margin Trend (TE) Highlights $ in millions; continuing operations vs. Prior Year vs. Prior Quarter

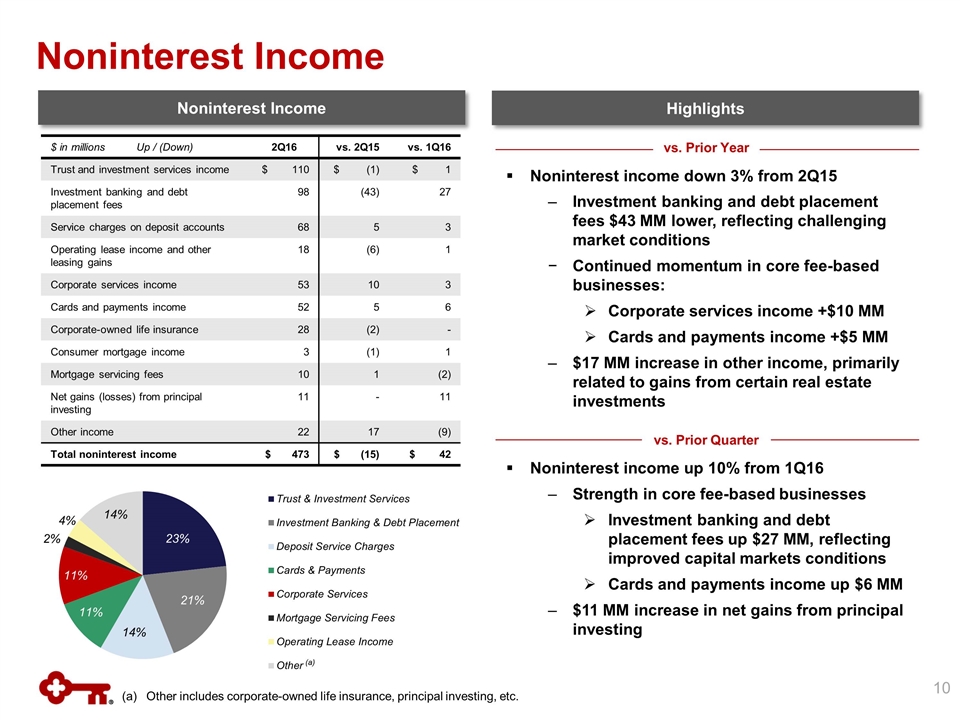

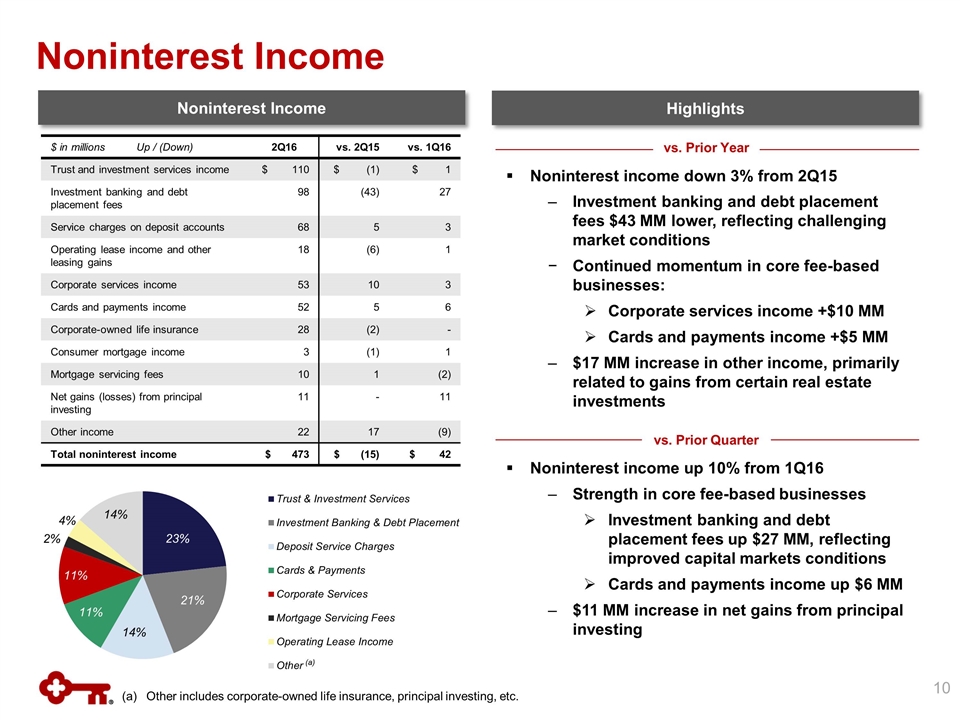

Noninterest Income Noninterest Income $ in millions Up / (Down) 2Q16 vs. 2Q15 vs. 1Q16 Trust and investment services income $ 110 $ (1) $ 1 Investment banking and debt placement fees 98 (43) 27 Service charges on deposit accounts 68 5 3 Operating lease income and other leasing gains 18 (6) 1 Corporate services income 53 10 3 Cards and payments income 52 5 6 Corporate-owned life insurance 28 (2) - Consumer mortgage income 3 (1) 1 Mortgage servicing fees 10 1 (2) Net gains (losses) from principal investing 11 - 11 Other income 22 17 (9) Total noninterest income $ 473 $ (15) $ 42 Highlights Noninterest income down 3% from 2Q15 Investment banking and debt placement fees $43 MM lower, reflecting challenging market conditions Continued momentum in core fee-based businesses: Corporate services income +$10 MM Cards and payments income +$5 MM $17 MM increase in other income, primarily related to gains from certain real estate investments Noninterest income up 10% from 1Q16 Strength in core fee-based businesses Investment banking and debt placement fees up $27 MM, reflecting improved capital markets conditions Cards and payments income up $6 MM $11 MM increase in net gains from principal investing (a) Other includes corporate-owned life insurance, principal investing, etc. vs. Prior Year vs. Prior Quarter

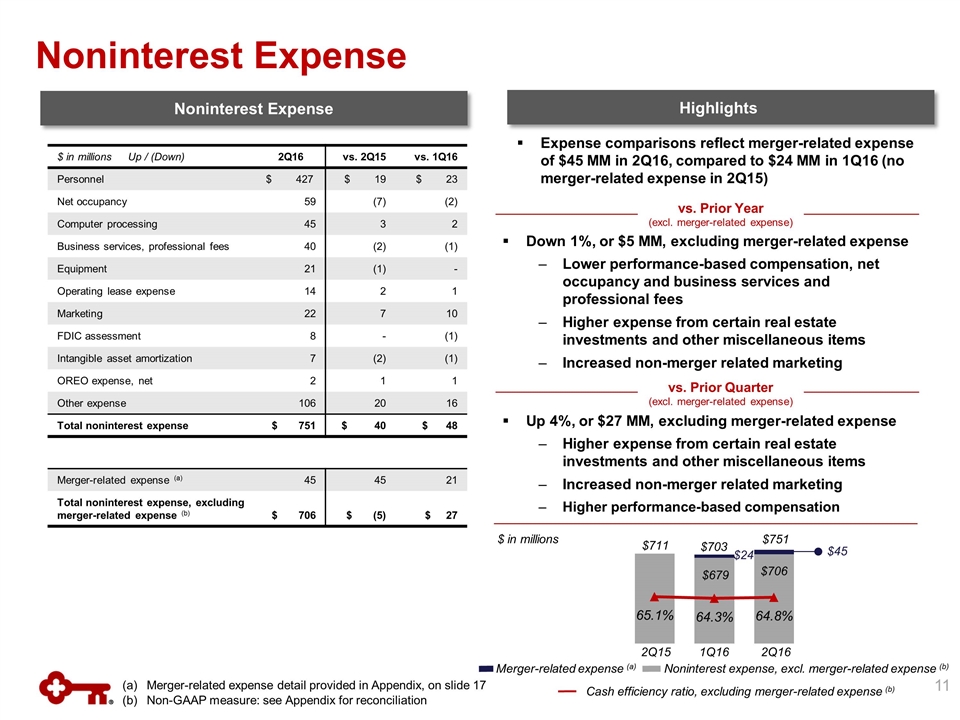

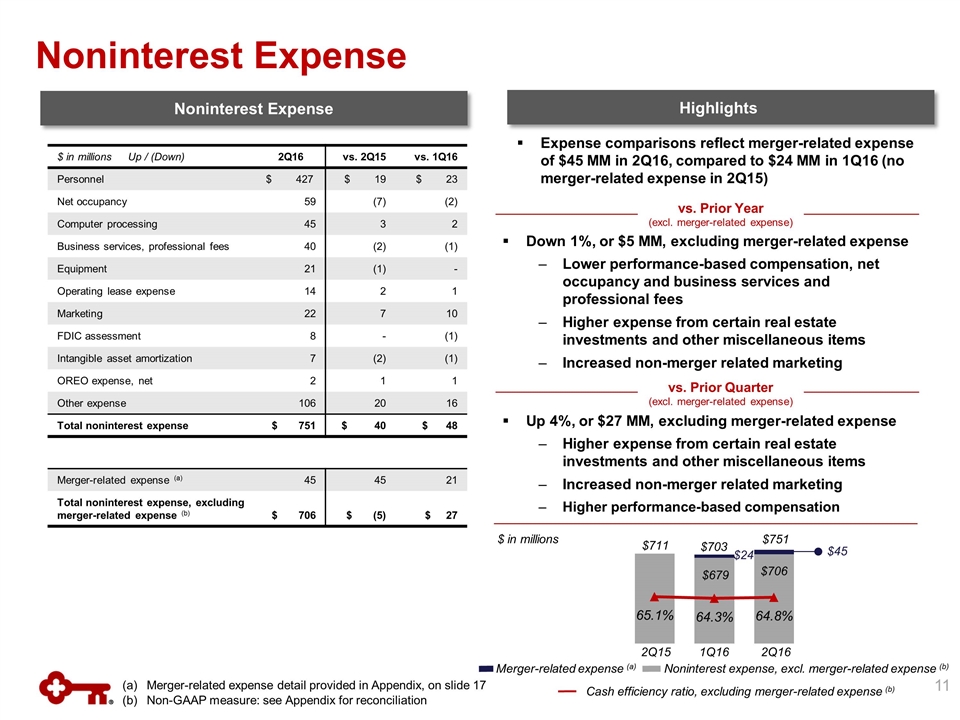

Noninterest expense, excl. merger-related expense (b) $ in millions Up / (Down) 2Q16 vs. 2Q15 vs. 1Q16 Personnel $ 427 $ 19 $ 23 Net occupancy 59 (7) (2) Computer processing 45 3 2 Business services, professional fees 40 (2) (1) Equipment 21 (1) - Operating lease expense 14 2 1 Marketing 22 7 10 FDIC assessment 8 - (1) Intangible asset amortization 7 (2) (1) OREO expense, net 2 1 1 Other expense 106 20 16 Total noninterest expense $ 751 $ 40 $ 48 Merger-related expense (a) 45 45 21 Total noninterest expense, excluding merger-related expense (b) $ 706 $ (5) $ 27 Noninterest Expense Noninterest Expense Merger-related expense detail provided in Appendix, on slide 17 Non-GAAP measure: see Appendix for reconciliation Highlights Cash efficiency ratio, excluding merger-related expense (b) Down 1%, or $5 MM, excluding merger-related expense Lower performance-based compensation, net occupancy and business services and professional fees Higher expense from certain real estate investments and other miscellaneous items Increased non-merger related marketing Merger-related expense (a) vs. Prior Year (excl. merger-related expense) vs. Prior Quarter (excl. merger-related expense) $ in millions $751 $703 $45 $706 $24 $679 $711 1Q16 2Q16 2Q15 Expense comparisons reflect merger-related expense of $45 MM in 2Q16, compared to $24 MM in 1Q16 (no merger-related expense in 2Q15) Up 4%, or $27 MM, excluding merger-related expense Higher expense from certain real estate investments and other miscellaneous items Increased non-merger related marketing Higher performance-based compensation

Nonperforming Assets Net Charge-offs & Provision for Credit Losses NPLs NPLs to period-end loans NCOs Provision for credit losses NCOs to average loans $ in millions NPLs held for sale, OREO & other NPAs Credit Quality Highlights Net loan charge-offs remain below targeted range, at 28 basis points of average loans Nonperforming loans decreased $57 MM from 1Q16 and represented 1.00% of period-end loans Allowance for loan and lease losses represented 1.38% of period-end loans; 138% coverage of nonperforming loans Allowance for Loan and Lease Losses Allowance for loan and lease losses to NPLs Allowance for loan and lease losses $ in millions $440 $637 $ in millions

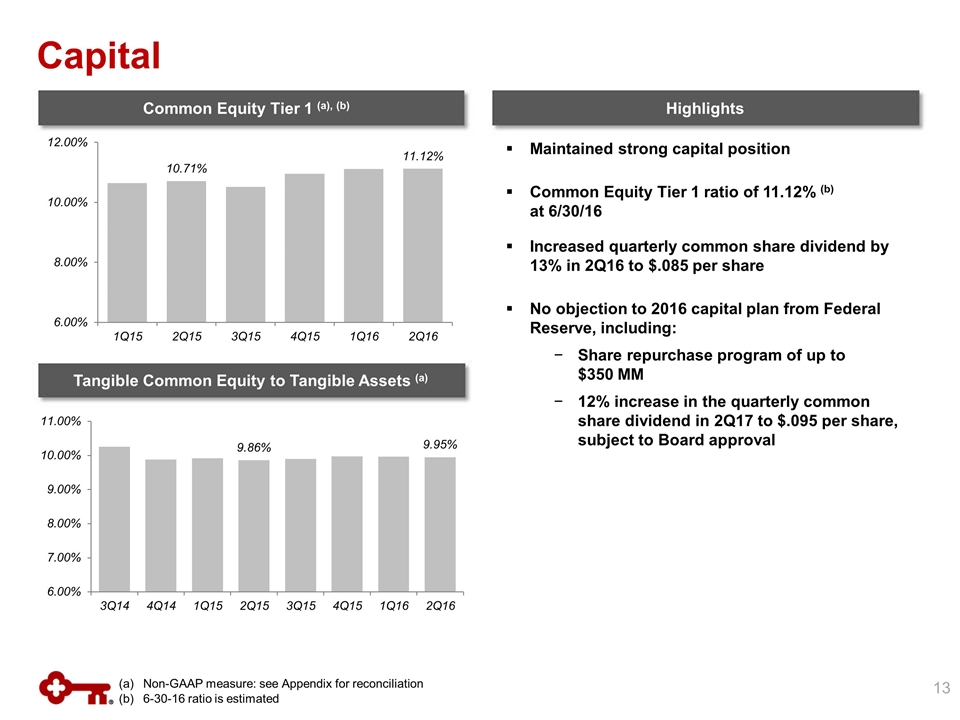

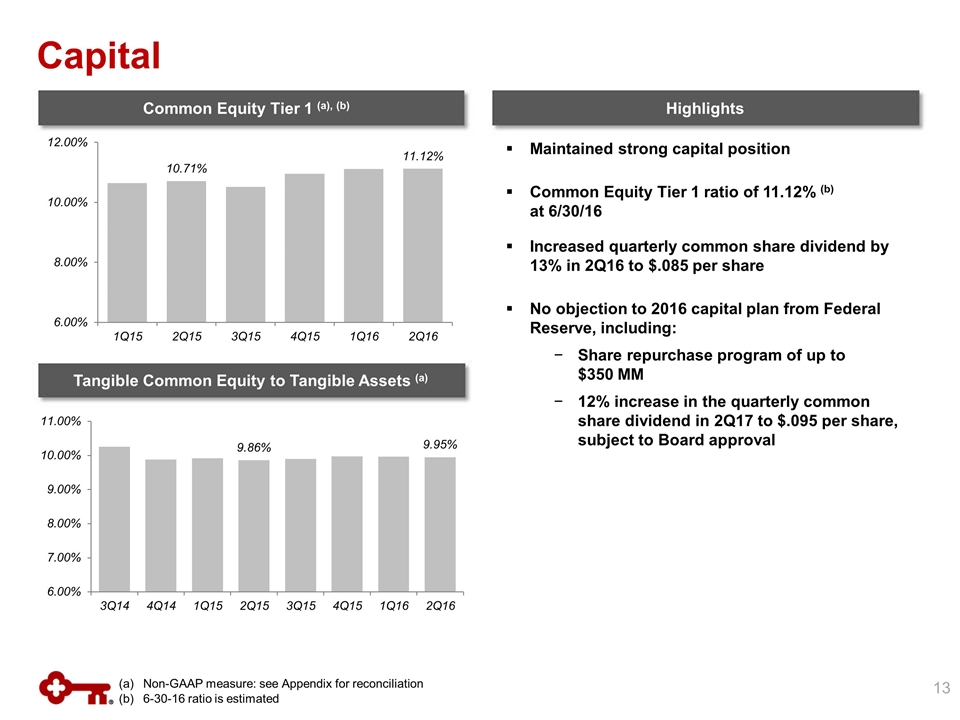

Maintained strong capital position Common Equity Tier 1 ratio of 11.12% (b) at 6/30/16 Increased quarterly common share dividend by 13% in 2Q16 to $.085 per share No objection to 2016 capital plan from Federal Reserve, including: Share repurchase program of up to $350 MM 12% increase in the quarterly common share dividend in 2Q17 to $.095 per share, subject to Board approval Non-GAAP measure: see Appendix for reconciliation 6-30-16 ratio is estimated Capital Common Equity Tier 1 (a), (b) Tangible Common Equity to Tangible Assets (a) Highlights

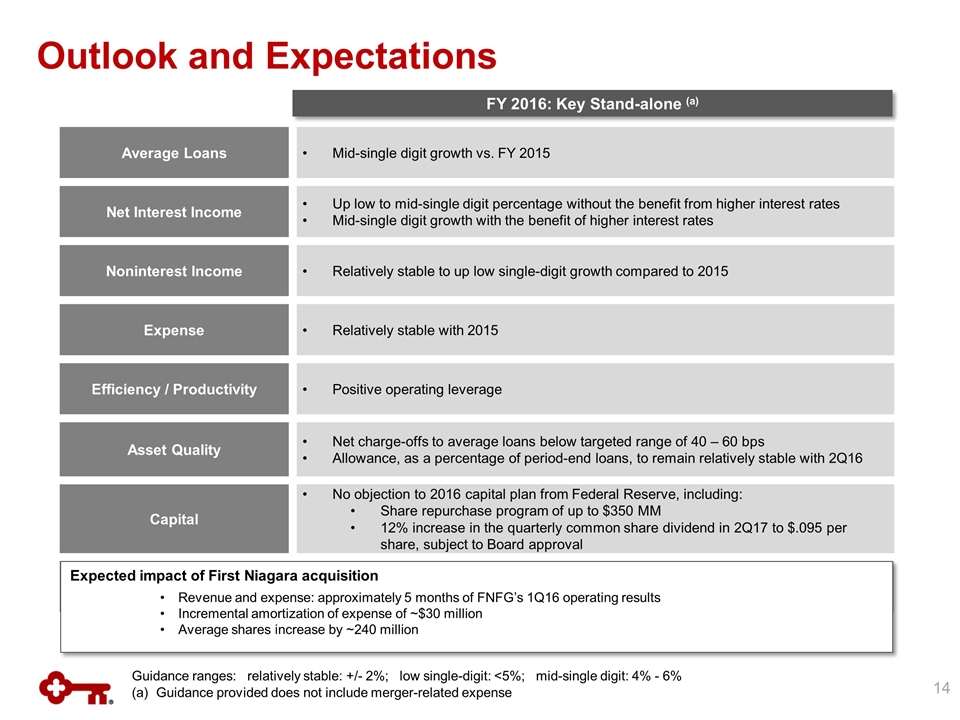

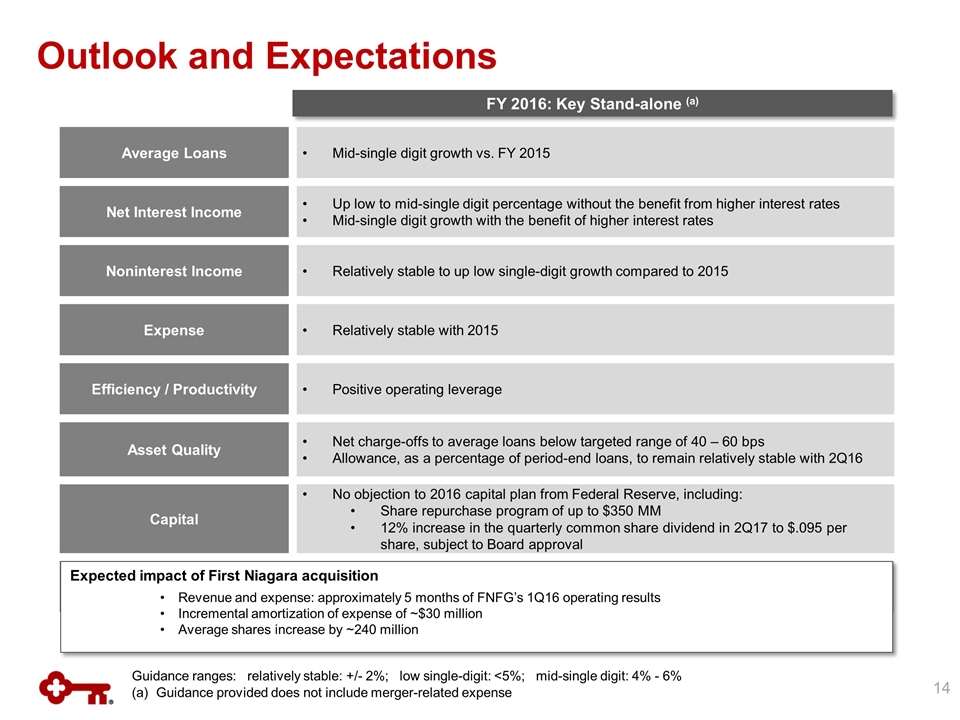

Outlook and Expectations Average Loans Mid-single digit growth vs. FY 2015 Net Interest Income Up low to mid-single digit percentage without the benefit from higher interest rates Mid-single digit growth with the benefit of higher interest rates Noninterest Income Relatively stable to up low single-digit growth compared to 2015 Expense Relatively stable with 2015 Efficiency / Productivity Positive operating leverage Asset Quality Net charge-offs to average loans below targeted range of 40 – 60 bps Allowance, as a percentage of period-end loans, to remain relatively stable with 2Q16 Capital No objection to 2016 capital plan from Federal Reserve, including: Share repurchase program of up to $350 MM 12% increase in the quarterly common share dividend in 2Q17 to $.095 per share, subject to Board approval Guidance ranges: relatively stable: +/- 2%; low single-digit: <5%; mid-single digit: 4% - 6% Guidance provided does not include merger-related expense FY 2016: Key Stand-alone (a) Expected impact of First Niagara acquisition Revenue and expense: approximately 5 months of FNFG’s 1Q16 operating results Incremental amortization of expense of ~$30 million Average shares increase by ~240 million

Appendix

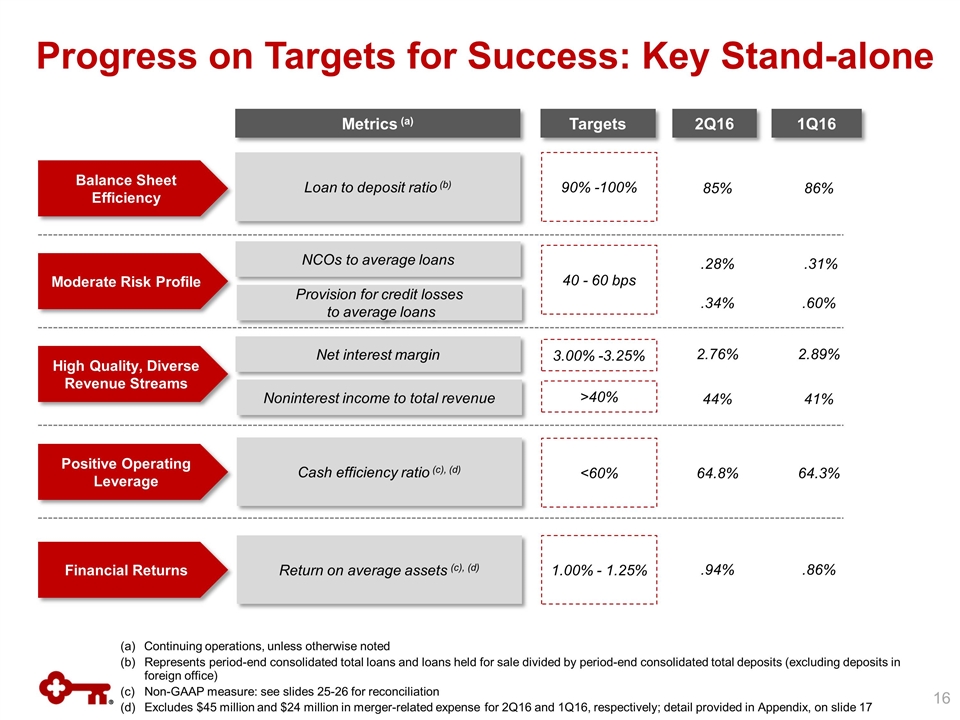

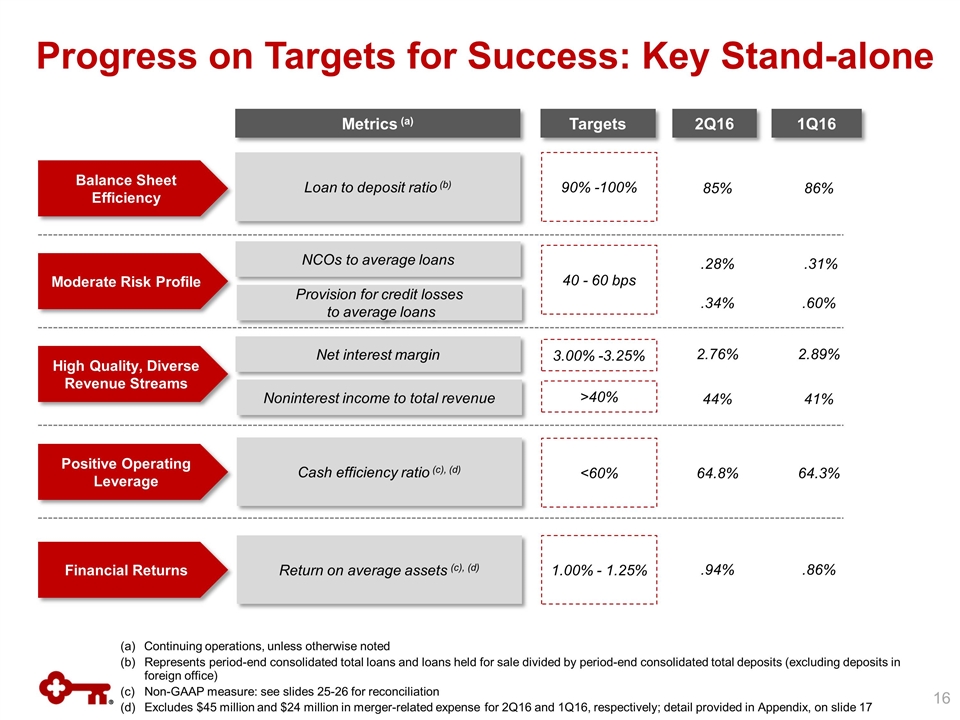

Progress on Targets for Success: Key Stand-alone (a) Continuing operations, unless otherwise noted Represents period-end consolidated total loans and loans held for sale divided by period-end consolidated total deposits (excluding deposits in foreign office) Non-GAAP measure: see slides 25-26 for reconciliation Excludes $45 million and $24 million in merger-related expense for 2Q16 and 1Q16, respectively; detail provided in Appendix, on slide 17 Balance Sheet Efficiency Moderate Risk Profile High Quality, Diverse Revenue Streams Positive Operating Leverage Financial Returns Metrics (a) 1Q16 2Q16 Targets Loan to deposit ratio (b) NCOs to average loans Provision for credit losses to average loans Net interest margin Noninterest income to total revenue Cash efficiency ratio (c), (d) 86% 85% .31% .28% 64.3% 64.8% .60% .34% 2.89% 2.76% 41% 44% 90% -100% 40 - 60 bps 3.00% -3.25% <60% >40% .86% .94% 1.00% - 1.25% Return on average assets (c), (d)

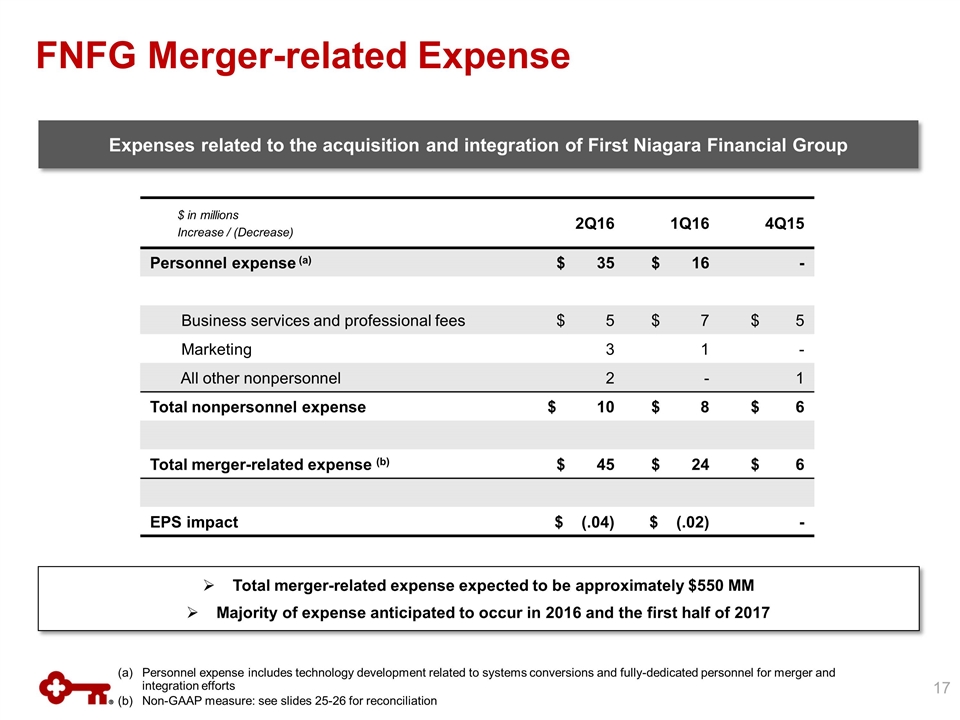

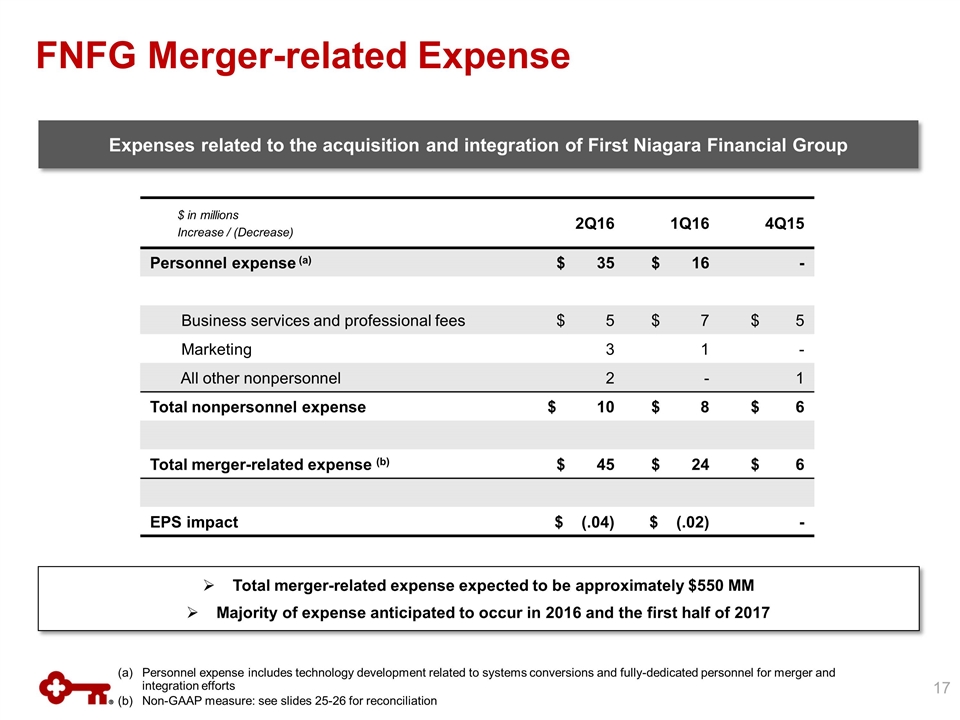

2Q16 1Q16 4Q15 Personnel expense (a) $ 35 $ 16 - Business services and professional fees $ 5 $ 7 $ 5 Marketing 3 1 - All other nonpersonnel 2 - 1 Total nonpersonnel expense $ 10 $ 8 $ 6 Total merger-related expense (b) $ 45 $ 24 $ 6 EPS impact $ (.04) $ (.02) - FNFG Merger-related Expense Expenses related to the acquisition and integration of First Niagara Financial Group Total merger-related expense expected to be approximately $550 MM Majority of expense anticipated to occur in 2016 and the first half of 2017 $ in millions Increase / (Decrease) Personnel expense includes technology development related to systems conversions and fully-dedicated personnel for merger and integration efforts Non-GAAP measure: see slides 25-26 for reconciliation

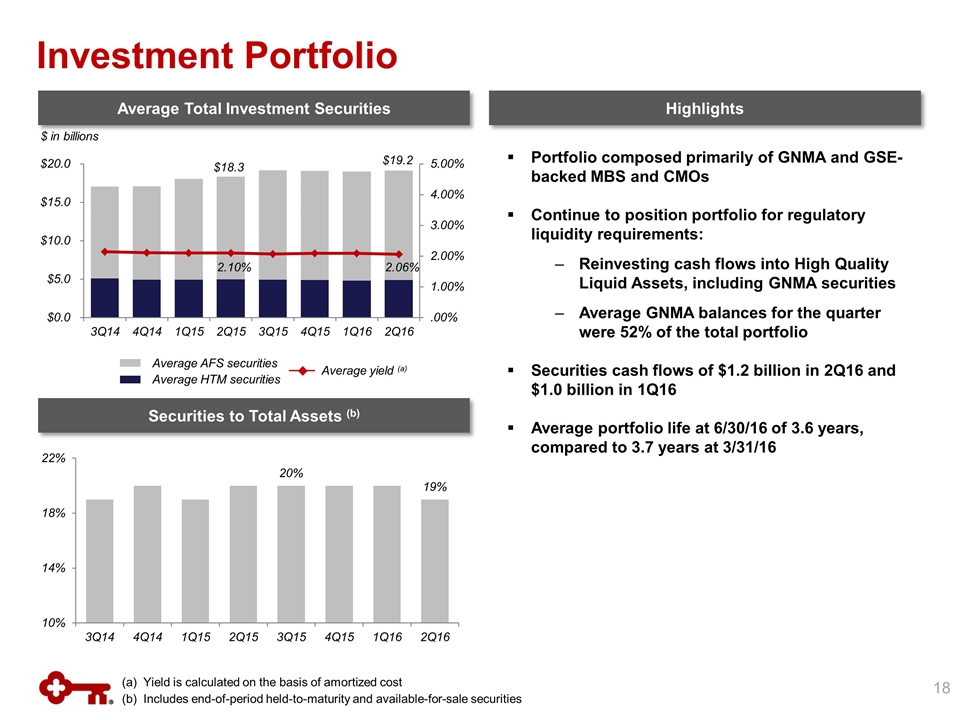

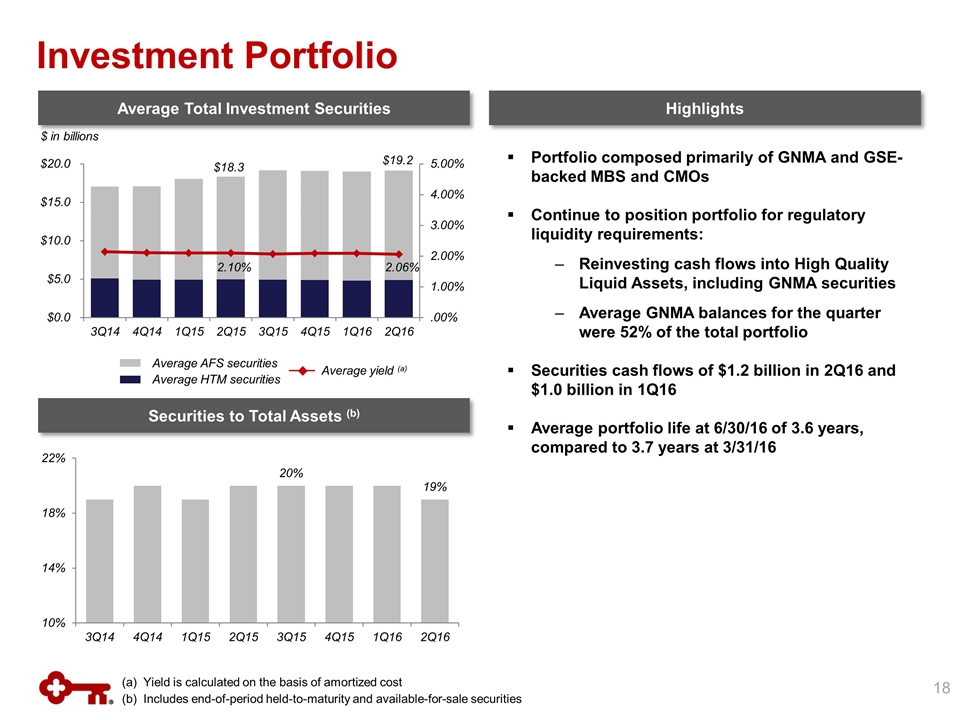

Average Total Investment Securities Highlights Average AFS securities Investment Portfolio Portfolio composed primarily of GNMA and GSE-backed MBS and CMOs Continue to position portfolio for regulatory liquidity requirements: Reinvesting cash flows into High Quality Liquid Assets, including GNMA securities Average GNMA balances for the quarter were 52% of the total portfolio Securities cash flows of $1.2 billion in 2Q16 and $1.0 billion in 1Q16 Average portfolio life at 6/30/16 of 3.6 years, compared to 3.7 years at 3/31/16 Securities to Total Assets (b) (a) Yield is calculated on the basis of amortized cost (b) Includes end-of-period held-to-maturity and available-for-sale securities Average yield (a) Average HTM securities 2.10% $18.3 $19.2 $ in billions 2.06%

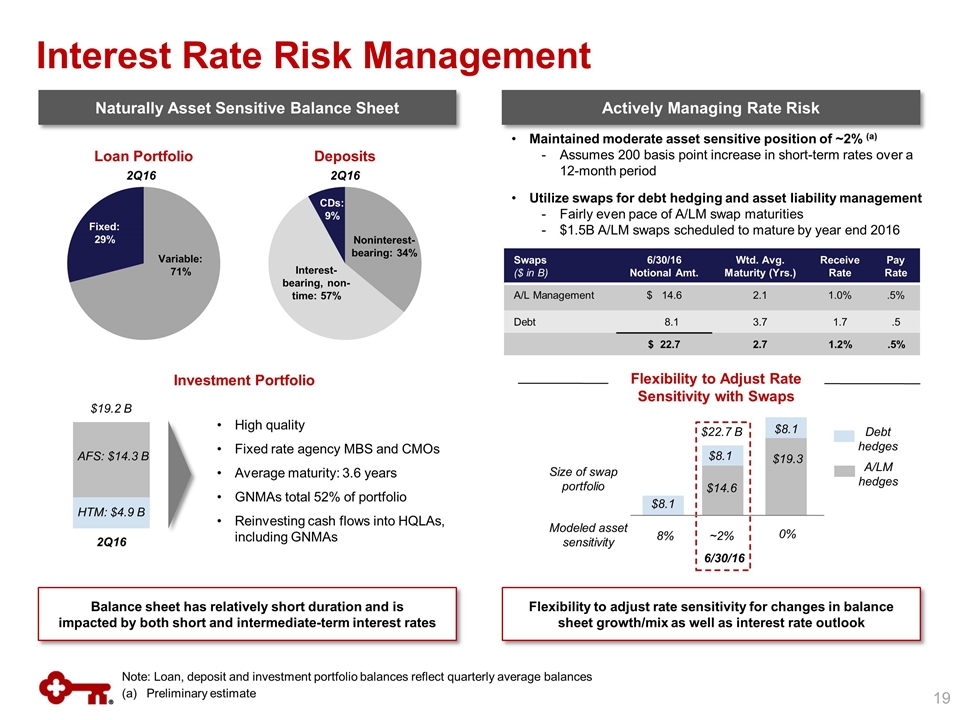

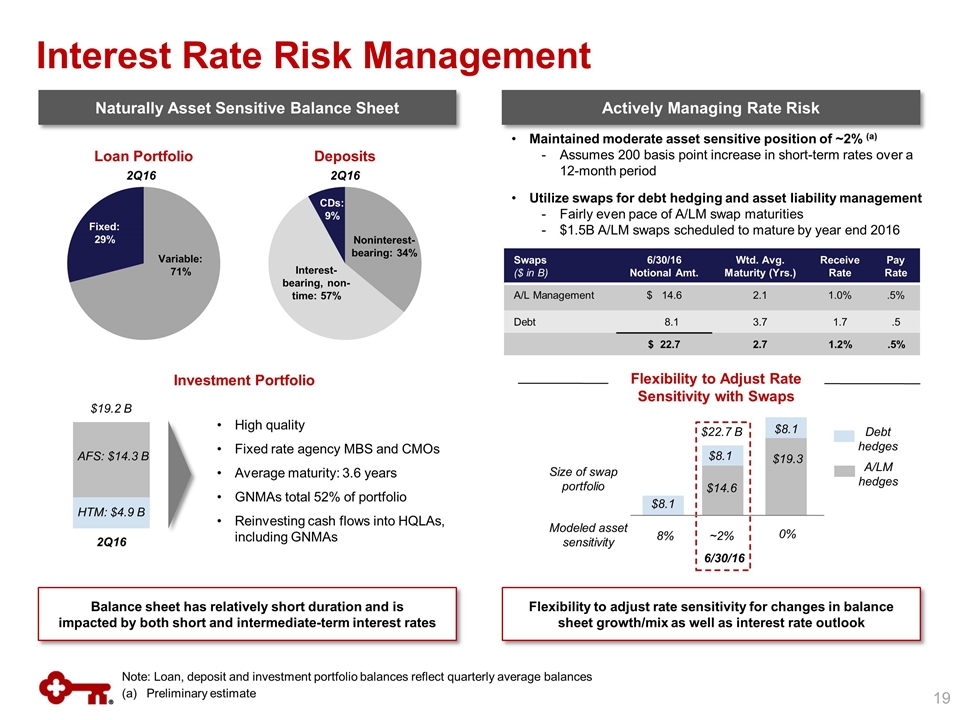

Interest Rate Risk Management Naturally Asset Sensitive Balance Sheet Actively Managing Rate Risk High quality Fixed rate agency MBS and CMOs Average maturity: 3.6 years GNMAs total 52% of portfolio Reinvesting cash flows into HQLAs, including GNMAs $14.6 $19.3 $8.1 $8.1 Size of swap portfolio Modeled asset sensitivity ~2% 0% 8% $8.1 Flexibility to Adjust Rate Sensitivity with Swaps Loan Portfolio Variable: 71% Fixed: 29% Deposits Flexibility to adjust rate sensitivity for changes in balance sheet growth/mix as well as interest rate outlook Debt hedges A/LM hedges Investment Portfolio Noninterest-bearing: 34% Interest-bearing, non-time: 57% CDs: 9% Maintained moderate asset sensitive position of ~2% (a) Assumes 200 basis point increase in short-term rates over a 12-month period Utilize swaps for debt hedging and asset liability management Fairly even pace of A/LM swap maturities $1.5B A/LM swaps scheduled to mature by year end 2016 6/30/16 Swaps ($ in B) 6/30/16 Notional Amt. Wtd. Avg. Maturity (Yrs.) Receive Rate Pay Rate A/L Management $ 14.6 2.1 1.0% .5% Debt 8.1 3.7 1.7 .5 $ 22.7 2.7 1.2% .5% 2Q16 $19.2 B AFS: $14.3 B HTM: $4.9 B Balance sheet has relatively short duration and is impacted by both short and intermediate-term interest rates $22.7 B 2Q16 2Q16 Note: Loan, deposit and investment portfolio balances reflect quarterly average balances (a) Preliminary estimate

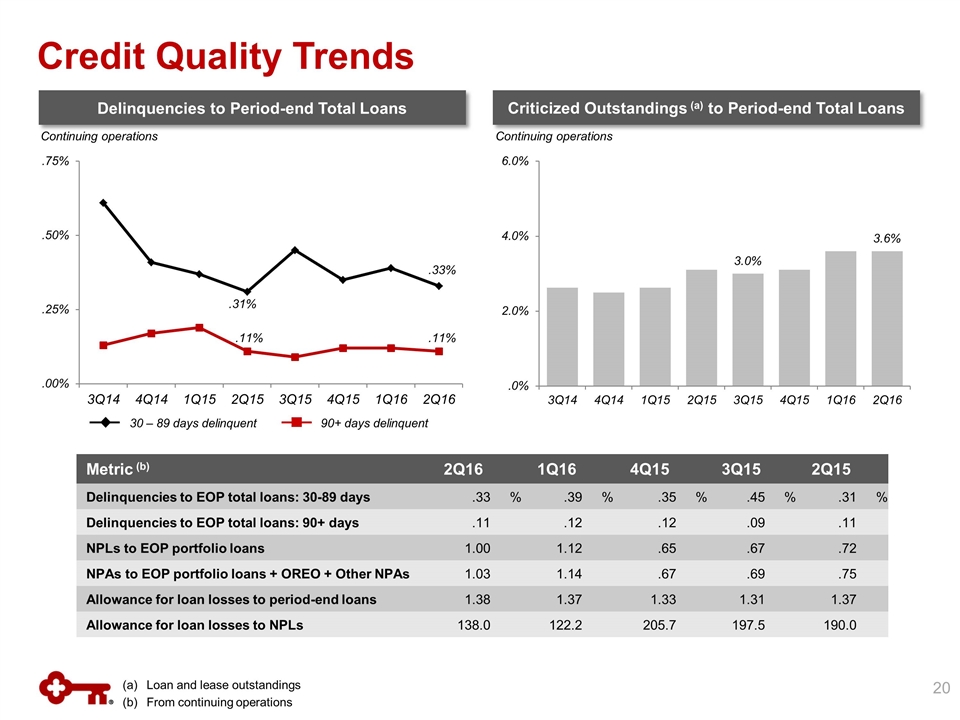

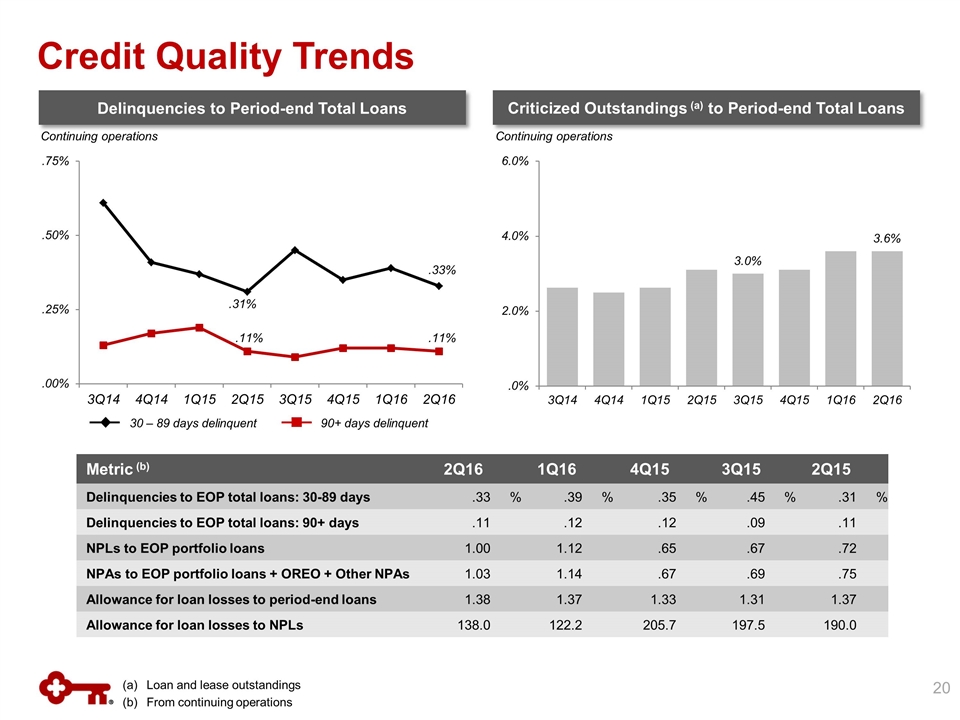

Credit Quality Trends Criticized Outstandings (a) to Period-end Total Loans Delinquencies to Period-end Total Loans Loan and lease outstandings From continuing operations 30 – 89 days delinquent 90+ days delinquent Metric (b) 2Q16 1Q16 4Q15 3Q15 2Q15 Delinquencies to EOP total loans: 30-89 days .33 % .39 % .35 % .45 % .31 % Delinquencies to EOP total loans: 90+ days .11 .12 .12 .09 .11 NPLs to EOP portfolio loans 1.00 1.12 .65 .67 .72 NPAs to EOP portfolio loans + OREO + Other NPAs 1.03 1.14 .67 .69 .75 Allowance for loan losses to period-end loans 1.38 1.37 1.33 1.31 1.37 Allowance for loan losses to NPLs 138.0 122.2 205.7 197.5 190.0 Continuing operations Continuing operations

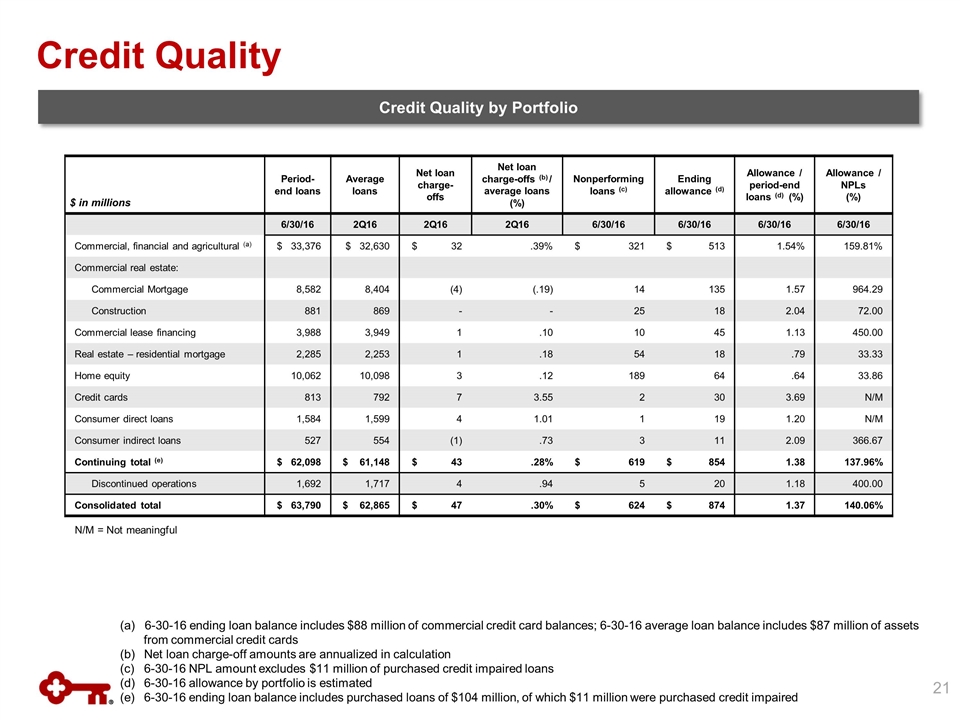

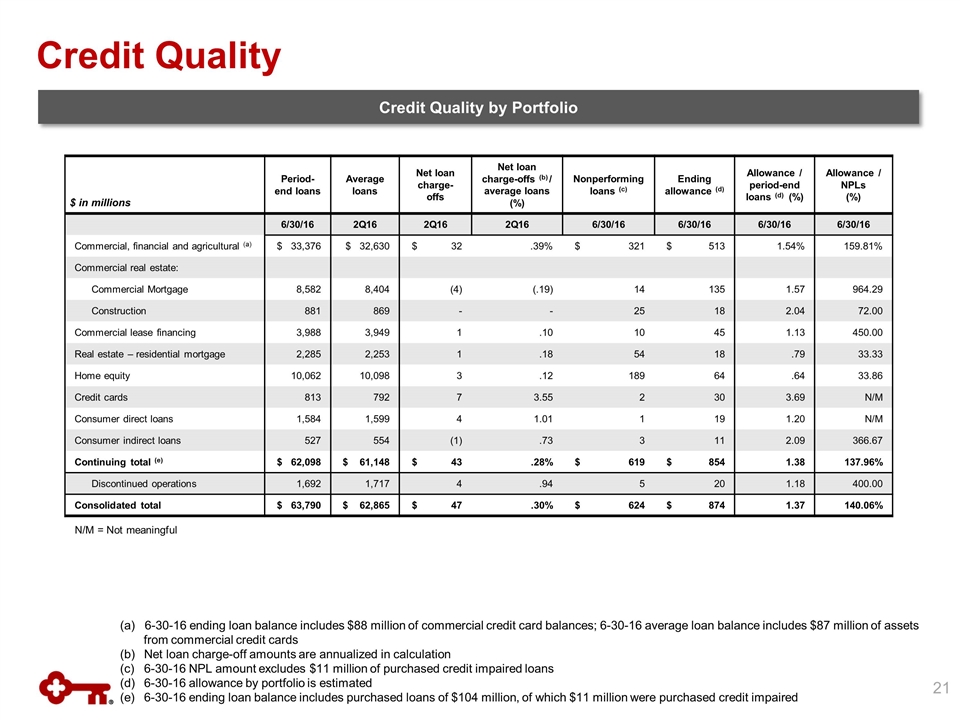

Period-end loans Average loans Net loan charge-offs Net loan charge-offs (b) / average loans (%) Nonperforming loans (c) Ending allowance (d) Allowance / period-end loans (d) (%) Allowance / NPLs (%) 6/30/16 2Q16 2Q16 2Q16 6/30/16 6/30/16 6/30/16 6/30/16 Commercial, financial and agricultural (a) $ 33,376 $ 32,630 $ 32 .39% $ 321 $ 513 1.54% 159.81% Commercial real estate: Commercial Mortgage 8,582 8,404 (4) (.19) 14 135 1.57 964.29 Construction 881 869 - - 25 18 2.04 72.00 Commercial lease financing 3,988 3,949 1 .10 10 45 1.13 450.00 Real estate – residential mortgage 2,285 2,253 1 .18 54 18 .79 33.33 Home equity 10,062 10,098 3 .12 189 64 .64 33.86 Credit cards 813 792 7 3.55 2 30 3.69 N/M Consumer direct loans 1,584 1,599 4 1.01 1 19 1.20 N/M Consumer indirect loans 527 554 (1) .73 3 11 2.09 366.67 Continuing total (e) $ 62,098 $ 61,148 $ 43 .28% $ 619 $ 854 1.38 137.96% Discontinued operations 1,692 1,717 4 .94 5 20 1.18 400.00 Consolidated total $ 63,790 $ 62,865 $ 47 .30% $ 624 $ 874 1.37 140.06% Credit Quality by Portfolio Credit Quality $ in millions (a) 6-30-16 ending loan balance includes $88 million of commercial credit card balances; 6-30-16 average loan balance includes $87 million of assets from commercial credit cards Net loan charge-off amounts are annualized in calculation 6-30-16 NPL amount excludes $11 million of purchased credit impaired loans 6-30-16 allowance by portfolio is estimated 6-30-16 ending loan balance includes purchased loans of $104 million, of which $11 million were purchased credit impaired N/M = Not meaningful

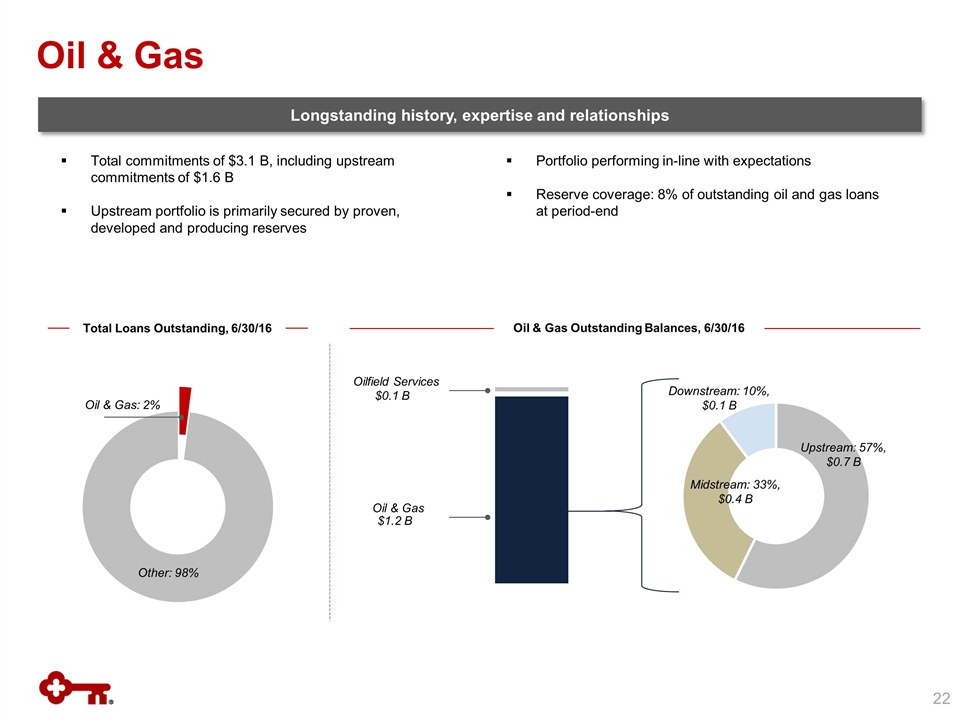

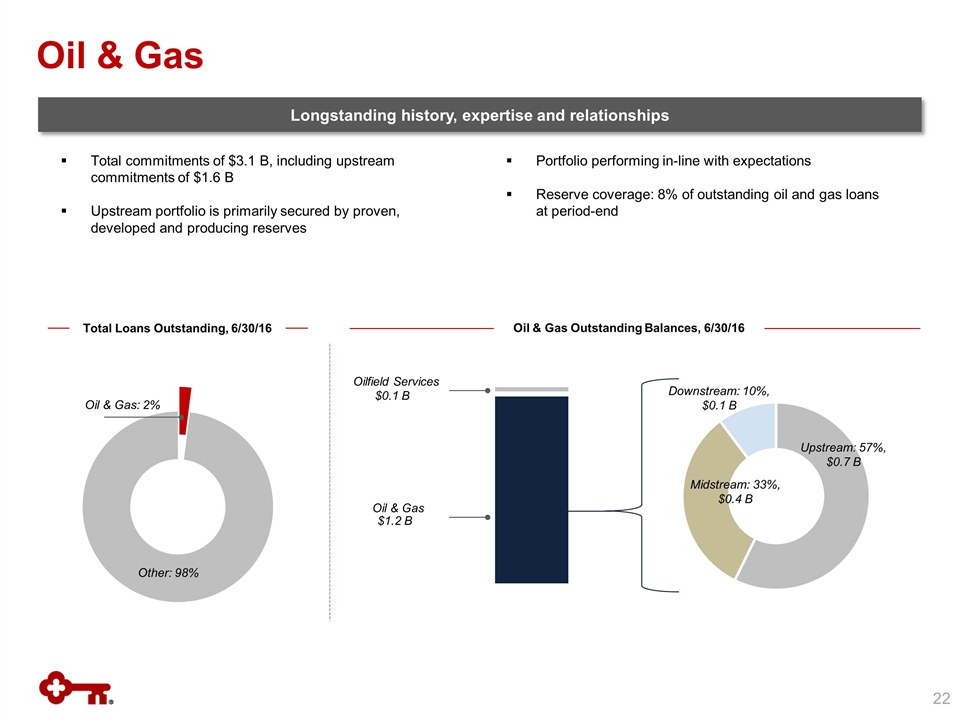

Oil & Gas Longstanding history, expertise and relationships Total commitments of $3.1 B, including upstream commitments of $1.6 B Upstream portfolio is primarily secured by proven, developed and producing reserves Total Loans Outstanding, 6/30/16 Portfolio performing in-line with expectations Reserve coverage: 8% of outstanding oil and gas loans at period-end Oil & Gas: 2% Other: 98% Oil & Gas Outstanding Balances, 6/30/16 Oilfield Services Upstream: 57%, $0.7 B Midstream: 33%, $0.4 B Downstream: 10%, $0.1 B $0.1 B Oil & Gas $1.2 B

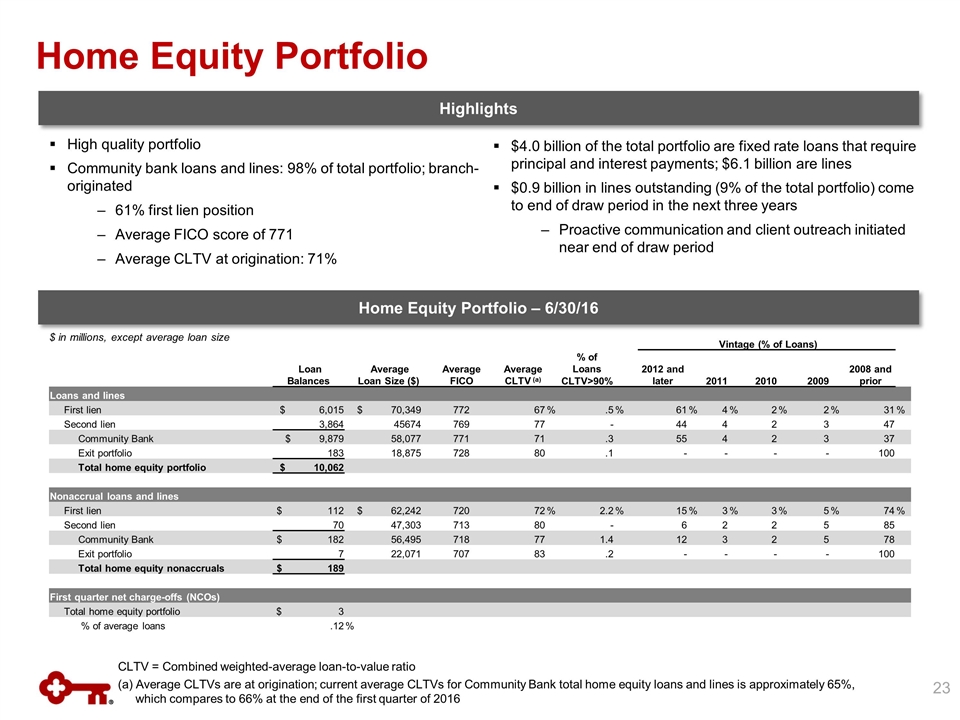

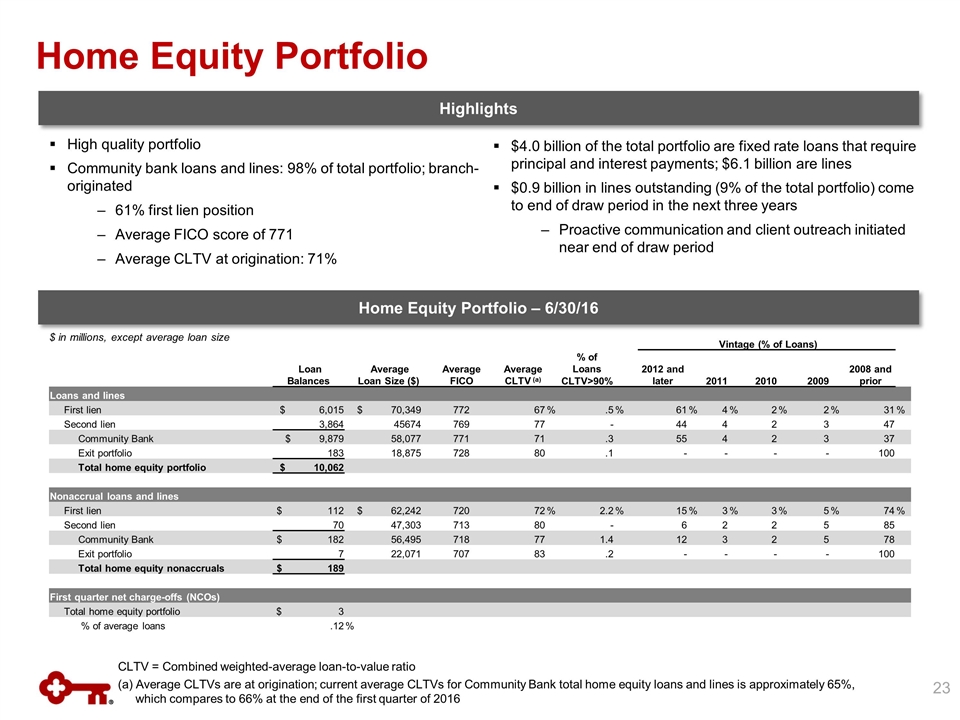

Vintage (% of Loans) Loan Balances Average Loan Size ($) Average FICO Average CLTV (a) % of Loans CLTV>90% 2012 and later 2011 2010 2009 2008 and prior Loans and lines First lien $ 6,015 $ 70,349 772 67 % .5 % 61 % 4 % 2 % 2 % 31 % Second lien 3,864 45674 769 77 - 44 4 2 3 47 Community Bank $ 9,879 58,077 771 71 .3 55 4 2 3 37 Exit portfolio 183 18,875 728 80 .1 - - - - 100 Total home equity portfolio $ 10,062 Nonaccrual loans and lines First lien $ 112 $ 62,242 720 72 % 2.2 % 15 % 3 % 3 % 5 % 74 % Second lien 70 47,303 713 80 - 6 2 2 5 85 Community Bank $ 182 56,495 718 77 1.4 12 3 2 5 78 Exit portfolio 7 22,071 707 83 .2 - - - - 100 Total home equity nonaccruals $ 189 First quarter net charge-offs (NCOs) Total home equity portfolio $ 3 % of average loans .12 % (a) Average CLTVs are at origination; current average CLTVs for Community Bank total home equity loans and lines is approximately 65%, which compares to 66% at the end of the first quarter of 2016 Home Equity Portfolio – 6/30/16 $ in millions, except average loan size Home Equity Portfolio Highlights High quality portfolio Community bank loans and lines: 98% of total portfolio; branch-originated 61% first lien position Average FICO score of 771 Average CLTV at origination: 71% $4.0 billion of the total portfolio are fixed rate loans that require principal and interest payments; $6.1 billion are lines $0.9 billion in lines outstanding (9% of the total portfolio) come to end of draw period in the next three years Proactive communication and client outreach initiated near end of draw period CLTV = Combined weighted-average loan-to-value ratio

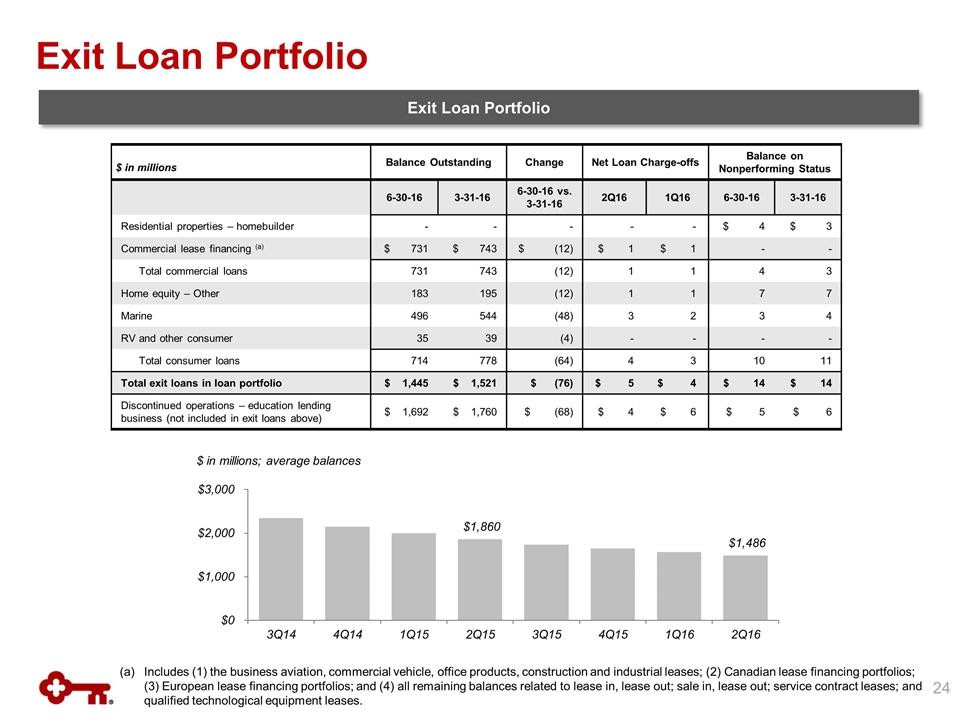

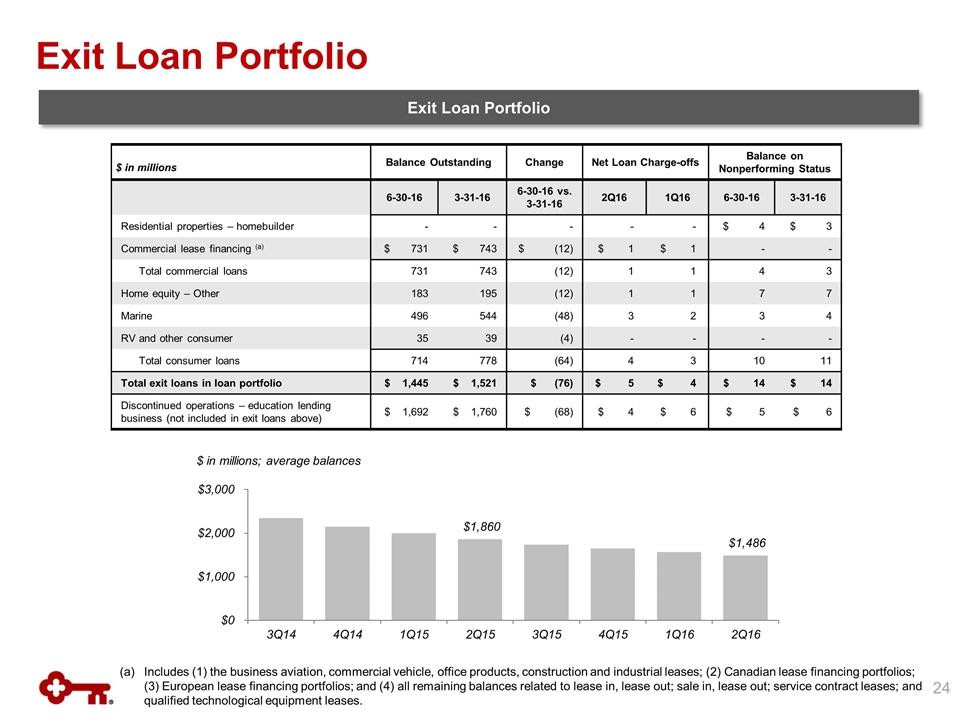

Balance Outstanding Change Net Loan Charge-offs Balance on Nonperforming Status 6-30-16 3-31-16 6-30-16 vs. 3-31-16 2Q16 1Q16 6-30-16 3-31-16 Residential properties – homebuilder - - - - - $ 4 $ 3 Commercial lease financing (a) $ 731 $ 743 $ (12) $ 1 $ 1 - - Total commercial loans 731 743 (12) 1 1 4 3 Home equity – Other 183 195 (12) 1 1 7 7 Marine 496 544 (48) 3 2 3 4 RV and other consumer 35 39 (4) - - - - Total consumer loans 714 778 (64) 4 3 10 11 Total exit loans in loan portfolio $ 1,445 $ 1,521 $ (76) $ 5 $ 4 $ 14 $ 14 Discontinued operations – education lending business (not included in exit loans above) $ 1,692 $ 1,760 $ (68) $ 4 $ 6 $ 5 $ 6 $ in millions; average balances Includes (1) the business aviation, commercial vehicle, office products, construction and industrial leases; (2) Canadian lease financing portfolios; (3) European lease financing portfolios; and (4) all remaining balances related to lease in, lease out; sale in, lease out; service contract leases; and qualified technological equipment leases. $ in millions Exit Loan Portfolio Exit Loan Portfolio

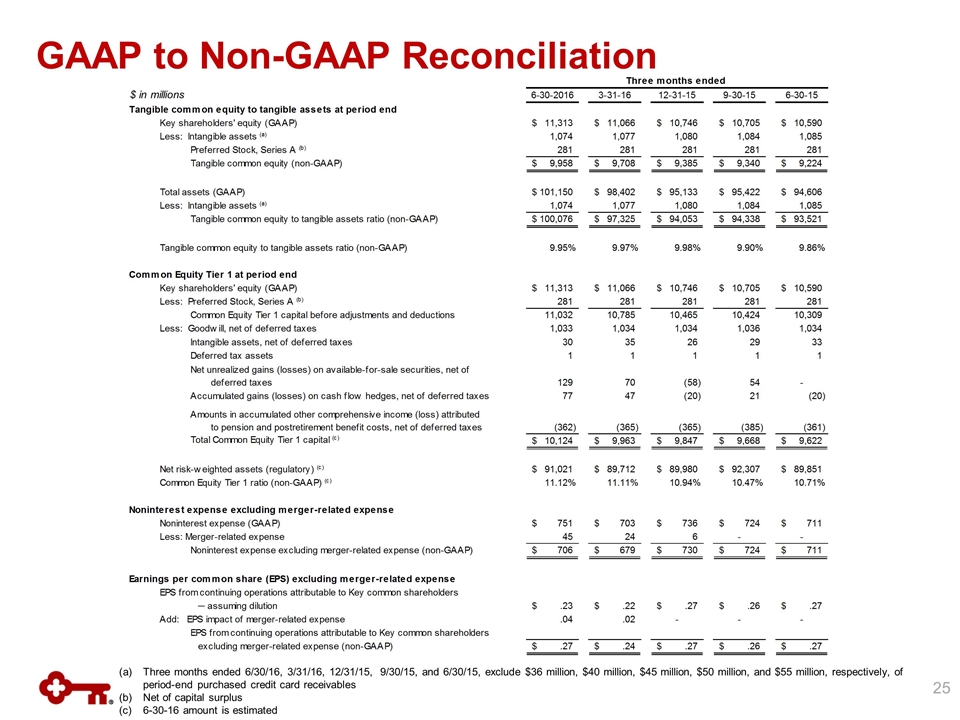

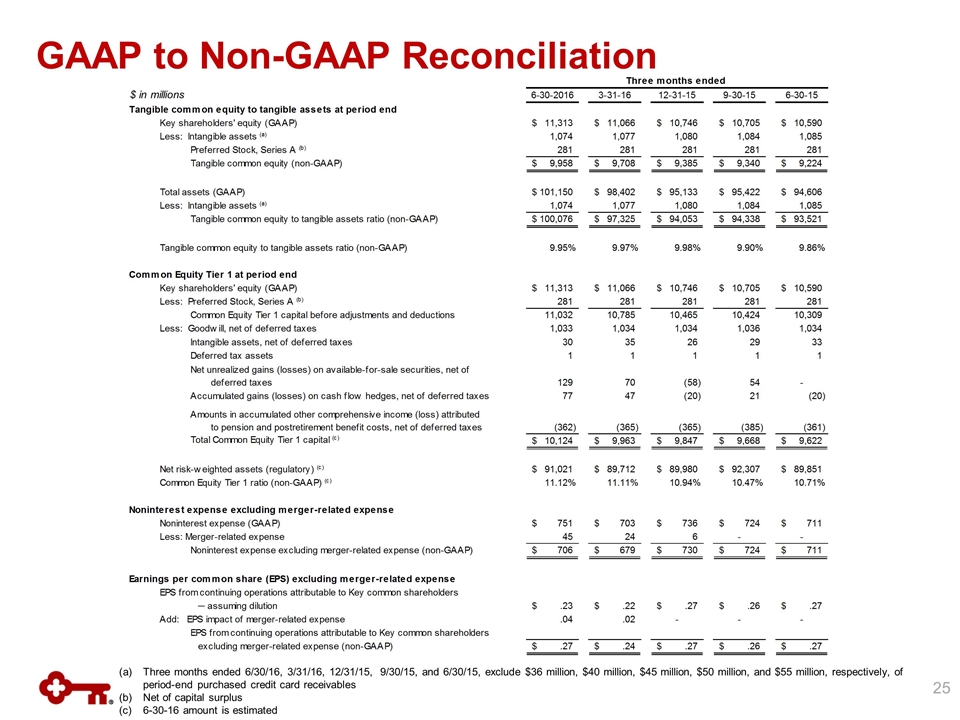

GAAP to Non-GAAP Reconciliation $ in millions Three months ended 6/30/16, 3/31/16, 12/31/15, 9/30/15, and 6/30/15, exclude $36 million, $40 million, $45 million, $50 million, and $55 million, respectively, of period-end purchased credit card receivables Net of capital surplus 6-30-16 amount is estimated Three months ended 6-30-2016 3-31-16 12-31-15 9-30-15 6-30-15 Tangible common equity to tangible assets at period end Key shareholders' equity (GAAP) $11,313 $11,066 $10,746 $10,705 $10,590 Less: Intangible assets (a) 1074 1077 1080 1084 1085 Preferred Stock, Series A (b) 281 281 281 281 281 Tangible common equity (non-GAAP) $9,958 $9,708 $9,385 $9,340 $9,224 Total assets (GAAP) $,101,150 $98,402 $95,133 $95,422 $94,606 Less: Intangible assets (a) 1074 1077 1080 1084 1085 Tangible common equity to tangible assets ratio (non-GAAP) $,100,076 $97,325 $94,053 $94,338 $93,521 Tangible common equity to tangible assets ratio (non-GAAP) 9.9500000000000005E-2 9.9699999999999997E-2 9.98E-2 9.9000000000000005E-2 9.8599999999999993E-2 Common Equity Tier 1 at period end Key shareholders' equity (GAAP) $11,313 $11,066 $10,746 $10,705 $10,590 Less: Preferred Stock, Series A (b) 281 281 281 281 281 Common Equity Tier 1 capital before adjustments and deductions 11032 10785 10465 10424 10309 Less: Goodwill, net of deferred taxes 1033 1034 1034 1036 1034 Intangible assets, net of deferred taxes 30 35 26 29 33 Deferred tax assets 1 1 1 1 1 Net unrealized gains (losses) on available-for-sale securities, net of deferred taxes 129 70 -58 54 - Accumulated gains (losses) on cash flow hedges, net of deferred taxes 77 47 -20 21 -20 Amounts in accumulated other comprehensive income (loss) attributed to pension and postretirement benefit costs, net of deferred taxes -362 -365 -365 -385 -361 Total Common Equity Tier 1 capital (c) $10,124 $9,963 $9,847 $9,668 $9,622 Net risk-weighted assets (regulatory) (c) $91,021 $89,712 $89,980 $92,307 $89,851 Common Equity Tier 1 ratio (non-GAAP) (c) 0.11119999999999999 0.1111 0.1094 0.1047 0.1071 Noninterest expense excluding merger-related expense Noninterest expense (GAAP) $751 $703 $736 $724 $711 Less: Merger-related expense 45 24 6 - - Noninterest expense excluding merger-related expense (non-GAAP) $706 $679 $730 $724 $711 Earnings per common share (EPS) excluding merger-related expense EPS from continuing operations attributable to Key common shareholders ─ assuming dilution $0.23 $0.22 $0.27 $0.26 $0.27 Add: EPS impact of merger-related expense 0.04 0.02 - - - EPS from continuing operations attributable to Key common shareholders excluding merger-related expense (non-GAAP) $0.27 $0.24 $0.27 $0.26 $0.27 Tier 1 common equity at period end Key shareholders' equity (GAPP) - - - - - Qualifying capital securities - - - - - Less: Goodwill - - - - - Accumulated other comprehensive income (loss) (d) - - - - - Other assets (e) - - - - - Total Tier 1 capital (regulatory) - - - - - Less: Qualifying capital securities - - - - - Preferred Stock, Series A (b) - - - - - Total Tier 1 common equity (non-GAAP) - - - - - Net risk-weighted assets (regulatory) - - - - - Tier 1 common equity ratio (non-GAAP) - - - - -

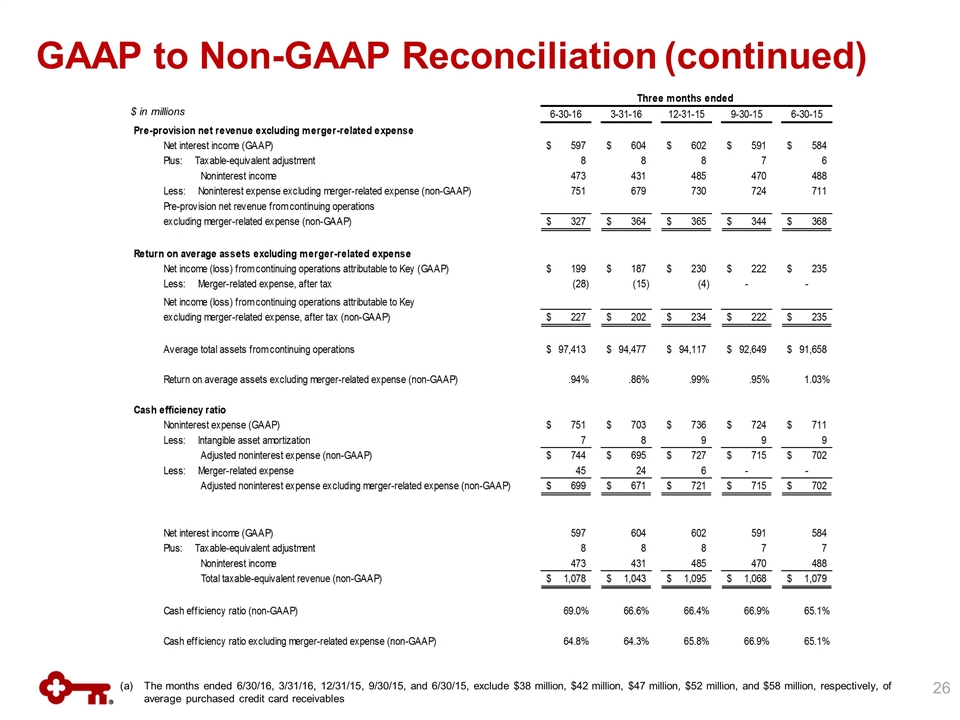

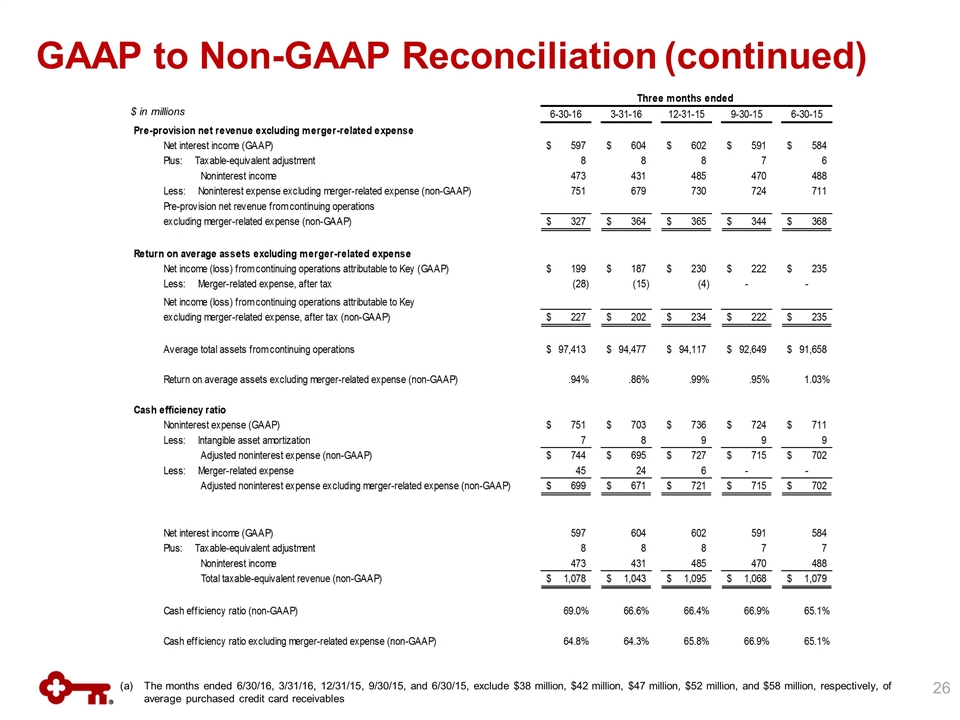

GAAP to Non-GAAP Reconciliation (continued) The months ended 6/30/16, 3/31/16, 12/31/15, 9/30/15, and 6/30/15, exclude $38 million, $42 million, $47 million, $52 million, and $58 million, respectively, of average purchased credit card receivables $ in millions Three months ended 6-30-16 3-31-16 12-31-15 9-30-15 6-30-15 Pre-provision net revenue excluding merger-related expense Net interest income (GAAP) $597 $604 $602 $591 $584 Plus: Taxable-equivalent adjustment 8 8 8 7 6 Noninterest income 473 431 485 470 488 Less: Noninterest expense excluding merger-related expense (non-GAAP) 751 679 730 724 711 Pre-provision net revenue from continuing operations excluding merger-related expense (non-GAAP) $327 $364 $365 $344 $368 Return on average assets excluding merger-related expense Net income (loss) from continuing operations attributable to Key (GAAP) $199 $187 $230 $222 $235 Less: Merger-related expense, after tax -28 -15 -4 - - Net income (loss) from continuing operations attributable to Key excluding merger-related expense, after tax (non-GAAP) $227 $202 $234 $222 $235 Average total assets from continuing operations $97,413 $94,477 $94,117 $92,649 $91,658 Return on average assets excluding merger-related expense (non-GAAP) .94% .86% .99% .95% 1.03E-2 Cash efficiency ratio Noninterest expense (GAAP) $751 $703 $736 $724 $711 Less: Intangible asset amortization 7 8 9 9 9 Adjusted noninterest expense (non-GAAP) $744 $695 $727 $715 $702 Less: Merger-related expense 45 24 6 - - Adjusted noninterest expense excluding merger-related expense (non-GAAP) $699 $671 $721 $715 $702 Net interest income (GAAP) 597 604 602 591 584 Plus: Taxable-equivalent adjustment 8 8 8 7 7 Noninterest income 473 431 485 470 488 Total taxable-equivalent revenue (non-GAAP) $1,078 $1,043 $1,095 $1,068 $1,079 Cash efficiency ratio (non-GAAP) 0.69 0.66600000000000004 0.66400000000000003 0.66900000000000004 0.65100000000000002 Cash efficiency ratio excluding merger-related expense (non-GAAP) 0.64800000000000002 0.64300000000000002 0.65800000000000003 0.66900000000000004 0.65100000000000002

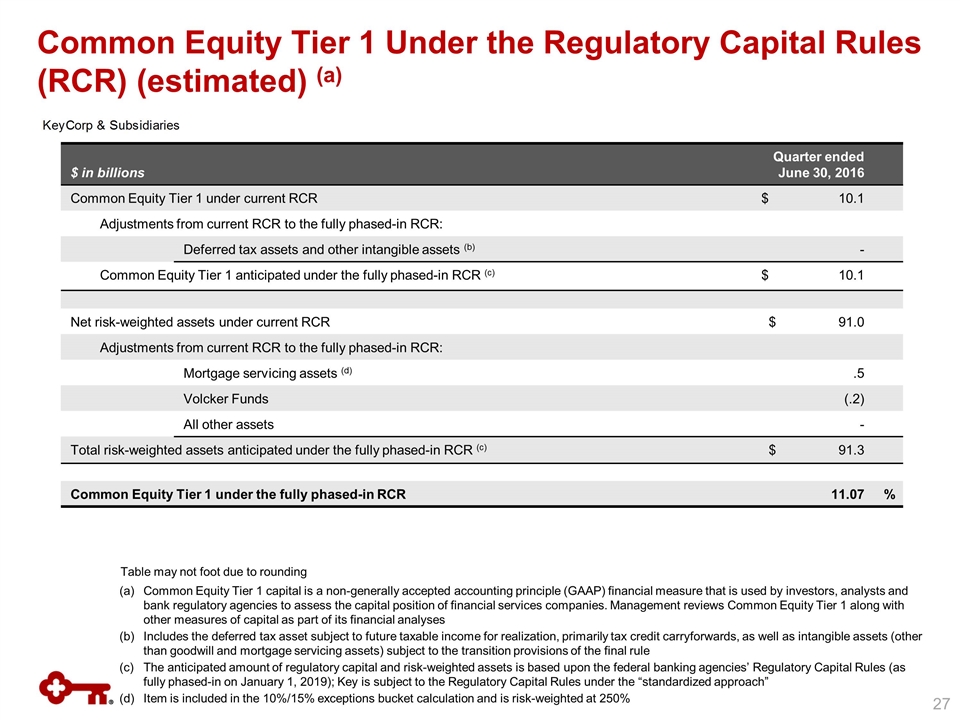

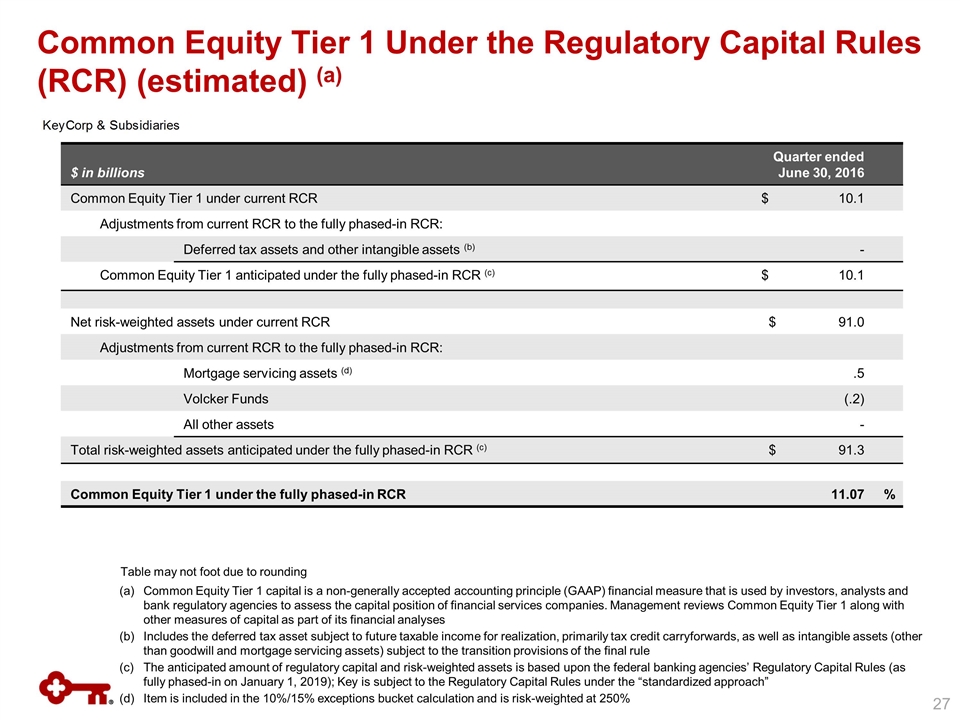

$ in billions Quarter ended June 30, 2016 Common Equity Tier 1 under current RCR $ 10.1 Adjustments from current RCR to the fully phased-in RCR: Deferred tax assets and other intangible assets (b) - Common Equity Tier 1 anticipated under the fully phased-in RCR (c) $ 10.1 Net risk-weighted assets under current RCR $ 91.0 Adjustments from current RCR to the fully phased-in RCR: Mortgage servicing assets (d) .5 Volcker Funds (.2) All other assets - Total risk-weighted assets anticipated under the fully phased-in RCR (c) $ 91.3 Common Equity Tier 1 under the fully phased-in RCR 11.07 % Common Equity Tier 1 capital is a non-generally accepted accounting principle (GAAP) financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews Common Equity Tier 1 along with other measures of capital as part of its financial analyses Includes the deferred tax asset subject to future taxable income for realization, primarily tax credit carryforwards, as well as intangible assets (other than goodwill and mortgage servicing assets) subject to the transition provisions of the final rule The anticipated amount of regulatory capital and risk-weighted assets is based upon the federal banking agencies’ Regulatory Capital Rules (as fully phased-in on January 1, 2019); Key is subject to the Regulatory Capital Rules under the “standardized approach” Item is included in the 10%/15% exceptions bucket calculation and is risk-weighted at 250% Table may not foot due to rounding Common Equity Tier 1 Under the Regulatory Capital Rules (RCR) (estimated) (a)