Exhibit 4.3

KEYCORP

Subordinated Medium-Term Notes, Series T

Officers’ Certificate and Company Order

Pursuant to the Indenture dated as of June 10, 1994, as supplemented by the First Supplemental Indenture, dated as of November 14, 2001, the Second Supplemental Indenture, dated as of November 13, 2013, and the Third Supplemental Indenture, dated as of June 16, 2023, relating to unsecured and subordinated notes (as so amended, and as may be further amended or supplemented from time to time, collectively, the “Indenture”) between KeyCorp, an Ohio corporation (the “Company’), and Deutsche Bank Trust Company Americas, as Trustee (the “Trustee”), and resolutions adopted by the Company’s Board of Directors on May 10, 2023, this Officers’ Certificate and Company Order is being delivered to the Trustee to establish the terms of a series of Securities in accordance with Section 301 of the Indenture, to establish the forms of the Securities of such series in accordance with Section 201 of the Indenture, and to establish the procedures for the authentication and delivery of specific Securities from time to time pursuant to Section 303 of the Indenture. As authorized by the Indenture, this Officers’ Certificate and Company Order has the same effect as, and is being used in lieu of, a supplemental indenture thereto.

All conditions precedent provided for in the Indenture relating to the establishment of (i) a series of Securities, (ii) the forms of such series of Securities, and (iii) the procedures for the authentication and delivery of such series of Securities have been complied with.

The Company has filed a registration statement on Form S-3ASR (No. 333-272573), including a prospectus, and a prospectus supplement pursuant to Rule 424 under the Securities Act (the “Prospectus Supplement”), with the Commission, relating to the Notes (as defined below). In connection with each issuances of Notes, the Company will prepare a pricing supplement to the Prospectus Supplement in substantially the form attached hereto as Exhibit E (each, a “Pricing Supplement”), or in such other form as may be approved by the Chairman of the Board, a Vice Chairman of the Board, the President or a Vice President, the Chief Financial Officer, the Treasurer or an Assistant Treasurer, the Secretary or an Assistant Secretary, of the Company, or any other officer of the Company customarily performing functions similar to those performed by any of the above designated officers (each, an “Authorized Officer”).

Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to them in the Indenture.

A. Establishment of Series pursuant to Section 301 of the Indenture.

There is hereby established pursuant to Section 301 of the Indenture a series of Securities which shall have the following terms (the numbered clauses set forth below correspond to the numbered subsections of Section 301 of the Indenture):

(1) The Securities of such series shall bear the title “Subordinated Medium-Term Notes, Series T” (referred to herein as the “Notes”).

(2) The aggregate principal amount of the Notes of such series to be issued pursuant to this Officers’ Certificate is unlimited.

(3) (a) Each Note within such series shall mature on a date 9 months or more from its date of issue as specified in such Note and in the applicable Pricing Supplement; provided, however, that no Commercial Paper Rate Note (as defined below) shall mature less than 9 months and 1 day from its date of issue. Unless otherwise stated in the applicable Pricing Supplement, no Series T Note will mature less than 5 years from its date of issue. If the Maturity Date of any Note or the Interest Payment Date of any Note (other than a Floating Rate Note (as defined below)) specified in the applicable Pricing Supplement is a day that is not a Business Day, interest, principal and premium, if any, will be paid on the next day that is a Business Day with the same force and effect as if made on such specified Maturity Date or Interest Payment Date, as applicable, and no interest on that payment will accrue for the period from and after such specified Maturity Date or Interest Payment Date, as applicable. With respect to the Notes of this series, unless otherwise defined in the Pricing Supplement, “Business Day” means, unless the applicable Pricing Supplement specifies otherwise, (i) for SOFR Notes, any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association (or any successor thereto) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities; (ii) for Notes denominated in a specified currency other than the euro, any day that is not a Saturday or Sunday and that is not a day that banking institutions in New York City are generally authorized or obligated by law or executive order to close, and is also a day on which commercial banks and foreign exchange markets settle payments in the principal financial center of the country of the relevant specified currency (if other than New York City); (iii) for Notes denominated in the euro, any day that is not a Saturday or Sunday and that is not a day that banking institutions in London are generally authorized or obligated by law or executive order to close, and is also a day on which the Trans-European Automated Real Time Gross Settlement Express Transfer payment system which utilizes a single shared platform and which was launched on November 19, 2007 (or any successor or replacement for that system) is open for settlement of payment in the euro (a “T2 Business Day”); and (iv) in all other instances, any day that is not a Saturday or Sunday and that is not a day that banking institutions in New York City are generally authorized or obligated by law or executive order to close.

Unless otherwise specified in the applicable Pricing Supplement, the principal financial center of any country for the purpose of the foregoing definition is (1) the capital city of the country issuing the specified currency, or (2) the capital city of the country to which the designated currency relates, as applicable, except, in the case of (1) or (2) above, that with respect to United States dollars, Australian dollars, Canadian dollars, euro, New Zealand dollars, South African rand and Swiss francs, the “principal financial center” shall be The City of New York and (solely in the case of the specified currency) Sydney, Toronto, London (solely in the case of the designated currency), Wellington, Johannesburg and Zurich, respectively.

-2-

(b) If specified in the applicable Pricing Supplement that the Notes are “Renewable Notes”, the Renewable Notes will mature on an interest payment date as specified in the applicable Pricing Supplement (the “initial maturity date”), unless the maturity of all or any portion of the principal amount is extended as described below. On the interest payment dates in June and December each year (unless different interest payment dates are specified in the Pricing Supplement), which are “election dates”, the maturity of the Renewable Notes will be extended to the interest payment date occurring 12 months after the election date, unless the holder elects to terminate the automatic extension of the maturity of the Renewable Notes or any portion having a principal amount of $1,000 or any multiple of $1,000 in excess thereof. To terminate, notice has to be delivered to the paying agent not less than nor more than the number of days specified in the applicable Pricing Supplement prior to the related election date. The option may be exercised with respect to less than the entire principal amount of the Renewable Notes so long as the principal amount for which the option is not exercised is at least $1,000 or any larger amount that is an integral multiple of $1,000. The maturity of the Renewable Notes may not be extended beyond the final maturity date that is set forth in the applicable Pricing Supplement. If the holder elects to terminate the automatic extension of the maturity and the election is not revoked, then the portion of the Renewable Note for which election was made will become due and payable on the interest payment date, unless another date is set forth in the Pricing Supplement, falling six months after the election date prior to which the holder made such election. An election to terminate the automatic extension of maturity may be revoked as to any portion of the Renewable Notes having a principal amount of $1,000 or any multiple of $1,000 in excess thereof by delivering a notice to the paying agent on any day following the effective date of the election to terminate the automatic extension and prior to the date 15 days before the date on which the portion would have matured.

(c) If specified in the applicable Pricing Supplement Notes that the Notes are “Extendible Notes”, the Company has the option to extend the stated maturity of such Extendible Notes for an extension period. Such an extension period is one or more periods of one to five whole years, up to but not beyond the final maturity date described in the related Pricing Supplement. The Company may exercise its option to extend the Extendible Note by notifying the applicable trustee (or any duly appointed paying agent) at least 50 but not more than 60 days prior to the then effective maturity date. If the Company elects to extend the Extendible Note, the Trustee (or paying agent) will mail (at least 40 days prior to the maturity date) to the registered holder of the Extendible Note a notice (“Extension Notice”) informing the holder of its election, the new maturity date and any updated terms. Upon the mailing of the Extension Notice, the maturity of such Extendible Note will be extended automatically as set forth in the Extension Notice. However, the Company may, not later than 20 days prior to the maturity date of an Extendible Note (or, if such date is not a Business Day, on the immediately succeeding Business Day), at its option, establish a higher interest rate, in the case of a Fixed Rate Note, or a higher spread and/or spread multiplier, in the case of a Floating Rate Note, for the extension period by mailing or causing the Trustee (or paying agent) to mail notice of such higher interest rate or higher spread and/or spread multiplier to the holder of the Extendible Note. The notice will be irrevocable. If the Company elects to extend the maturity of an Extendible Note, the holder of the note will have the option to instead elect repayment of the note by the Company on the then effective maturity date. In order for an Extendible Note to be so repaid on the maturity date, the Company must receive, at

-3-

least 25 days but not more than 35 days prior to the maturity date: (i) the Extendible Note with the form “Option to Elect Repayment” on the reverse of the Extendible Note duly completed; or (ii) a facsimile transmission, telex or a letter from a member of a national securities exchange or the Financial Industry Regulatory Authority, Inc. (“FINRA”) or a commercial bank or trust company in the United States setting forth the name of the holder of the Extendible Note, the principal amount of the Extendible Note, the principal amount of the Extendible Note to be repaid, the certificate number or a description of the tenor and terms of the Extendible Note, a statement that the option to elect repayment is being exercised thereby and a guarantee that the Extendible Note to be repaid, together with the duly completed form entitled “Option to Elect Repayment” on the reverse of the Extendible Note, will be received by the Trustee (or paying agent) not later than the fifth Business Day after the date of the facsimile transmission, telex or letter; provided, however, that the facsimile transmission, telex or letter will only be effective if the Trustee or paying agent receives the Extendible Note and form duly completed by that fifth business day. A holder of an Extendible Note may exercise this option for less than the aggregate principal amount of the Extendible Note then outstanding if the principal amount of the Extendible Note remaining outstanding after repayment is an authorized denomination.

(4) Each Note within such series that bears interest will bear interest at either (a) a fixed rate (the “Fixed Rate Notes”), (b) a floating rate determined by reference to one or more base rates, which may be adjusted by a Spread and/or Spread Multiplier (each as defined below) (the “Floating Rate Notes”), or (c) an indexed rate (the “Indexed Notes”). Notes within such series may also be issued as “Zero Coupon Notes” which do not provide for any periodic payments of interest. Notes may be issued as Discount Notes at a discount from the principal amount thereof due at the stated maturity as specified in the applicable Pricing Supplement. Any Floating Rate Note may also have either or both of the following as set forth in the applicable Pricing Supplement: (i) a maximum interest rate limitation, or ceiling, on the rate at which interest will accrue during any Interest Reset Period (as defined below); and (ii) a minimum interest rate limitation, or floor, on the rate at which interest will accrue during any Interest Reset Period. The interest rate on a Note will in no event be higher than the maximum rate permitted by New York law as the same may be modified by United States law of general application. Under present New York law, the maximum rate of interest, with certain exceptions, is 16% per annum on a simple interest basis for securities in which less than $250,000 has been invested and 25% per annum on a simple interest basis for securities in which $250,000 or more has been invested. This limit may not apply to Notes in which $2,500,000 or more has been invested. The applicable Pricing Supplement may designate any of the following interest rate bases or formulas (“Base Rates”) as applicable to each Floating Rate Note: (a) the Canadian Overnight Repo Rate Average (“CORRA”), in which case such Note will be a “CORRA Note”; (b) the CMT Rate, in which case such Note will be a “CMT Rate Note”; (c) the Commercial Paper Rate, in which case such Note will be a “Commercial Paper Rate Note”; (d) EURIBOR, in which case such note will be a “EURIBOR Note”; (e) the Federal Funds Rate, in which case such Note will be a “Federal Funds Rate Note”; (f) the Prime Rate, in which case such Note will be a “Prime Rate Note”; (g) SOFR, in which case such Note will be a “SOFR Note”; (h) the Treasury Rate, in which case such Note will be a “Treasury Rate Note”; or (i) one or more other Base Rates.

-4-

The interest rate on each Floating Rate Note for each Interest Period will be determined by reference to the applicable Base Rates specified in the applicable Pricing Supplement for such Interest Period, plus or minus the applicable Spread, if any, or multiplied by the applicable Spread Multiplier, if any. The “Spread” is the number of basis points, each one-hundredth of a percentage point, specified in the applicable Pricing Supplement to be added or subtracted from the Base Rate for a Floating Rate Note. The “Spread Multiplier” is the percentage specified in the applicable Pricing Supplement to be applied to the Base Rate for a Floating Rate Note.

Each Note that bears interest will bear interest from and including its date of issue or from and including the most recent Interest Payment Date to which interest on such Note (or one or more predecessor Notes) has been paid or duly provided for (i) at the fixed rate per annum applicable to the related Interest Period, (ii) at the rate determined pursuant to the applicable index, or (iii) at a rate per annum determined pursuant to the Base Rates applicable to the related Interest Period or Interest Periods, in each case as specified therein and in the applicable Pricing Supplement, until the principal thereof is paid or made available for payment. Interest will be payable on each Interest Payment Date and at maturity or upon redemption. The first payment of interest on any Note originally issued after a Regular Record Date and on or before an Interest Payment Date will be made on the Interest Payment Date following the next succeeding Regular Record Date to the registered holder on such next succeeding Regular Record Date. Interest rates and Base Rates are subject to change by the Company from time to time but no such change will affect any Note theretofore issued or which the Company has agreed to issue. Unless otherwise specified in the applicable Pricing Supplement, the “Interest Payment Dates” and the “Regular Record Dates” for Fixed Rate Notes shall be as described below under “Fixed Rate Notes” and the “Interest Payment Dates” and the “Regular Record Dates” for Floating Rate Notes shall be as described below under “Floating Rate Notes”.

The applicable Pricing Supplement will specify among other things: (i) the issue price, Interest Payment Dates and Regular Record Dates; (ii) with respect to any Fixed Rate Note, the interest rate; (iii) with respect to any Indexed Note, the index; (iv) with respect to any Floating Rate Note, the Initial Interest Rate (as defined below), the method (which may vary from Interest Period to Interest Period) of calculating the interest rate applicable to each Interest Period (including, if applicable, the Spread and/or Spread Multiplier, the Interest Determination Dates (as defined below), the Interest Reset Dates and any minimum or maximum interest rate limitations); (v) whether such Note is a Discount Note; and (vi) any other terms related to interest on the Notes.

Fixed Rate Notes.

Each Fixed Rate Note (except a Zero Coupon Note), whether or not issued as a Discount Note, will bear interest at the annual rate specified therein and in the applicable Pricing Supplement. Unless otherwise specified in the applicable Pricing Supplement, the Interest Payment Dates for the Fixed Rate Notes will be on June 15 and December 15 of each year and at maturity or upon redemption and the Regular Record Dates for the Fixed Rate Notes will be June 1 and December 1, respectively. Unless otherwise specified in the applicable Pricing Supplement, each interest payment on a Fixed Rate Note will include interest accrued from, and including, the issue date or the last Interest Payment Date, as the case may be, to, but excluding, the following Interest Payment Date or the Maturity Date or Redemption Date, as the case may be. Interest on

-5-

Fixed Rate Notes will be computed and paid on the basis of a 360-day year of twelve 30-day months. In the event that the Maturity Date or any Interest Payment Date on a Fixed Rate Note is not a Business Day, principal, premium, if any, and interest will be paid on the next day that is a Business Day, and no additional interest will accrue for the period from and after the Maturity Date or the scheduled Interest Payment Date, as the case may be, as a result of such delayed payment.

A Fixed Rate Note may pay amounts in respect of both interest and principal amortized over the life of the Note (an “Amortizing Note”). Unless otherwise specified in the applicable Pricing Supplement, payments of principal and interest on Amortizing Notes will be made semiannually on each June 15 and December 15, and the Regular Record Date will be June 1 and December 1, respectively. Payments on Amortizing Notes will be applied first to interest due and payable and then to the reduction of unpaid principal amount.

Floating Rate Notes.

Unless otherwise specified in the applicable Pricing Supplement and except as provided below, interest on Floating Rate Notes will be payable on the following Interest Payment Dates: in the case of Floating Rate Notes with interest payable monthly, on the third Wednesday of each month of each year; in the case of Floating Rate Notes with interest payable quarterly, on the third Wednesday of March, June, September and December of each year; in the case of Floating Rate Notes with interest payable semiannually, on the third Wednesday of the two months of each year specified in the applicable Pricing Supplement; and in the case of Floating Rate Notes with interest payable annually, on the third Wednesday of the month of each year specified in the applicable Pricing Supplement. Interest will also be paid at maturity or upon redemption or repurchase. Unless otherwise specified in the applicable Pricing Supplement, the Regular Record Dates for the Floating Rate Notes will be the day (whether or not a Business Day) fifteen calendar days preceding each Interest Payment Date. In the event that any Interest Payment Date (but not the Maturity Date) for any Floating Rate Note is not a Business Day, such Interest Payment Date shall be postponed to the next day that is a Business Day, provided that, for SOFR, CORRA and EURIBOR notes, if such Business Day is in the next succeeding calendar month, such Interest Payment Date shall be the immediately preceding Business Day. If the Maturity Date is not a Business Day, principal, premium, if any, and interest will be paid on the next succeeding Business Day, and no interest will accrue from and after the Maturity Date.

The rate of interest on each Floating Rate Note will be reset daily, weekly, monthly, quarterly, semi-annually, annually or on some other basis (such specified period, an “Interest Reset Period”, and the date on which each such reset occurs, an “Interest Reset Date”), as specified in the applicable Pricing Supplement. Unless otherwise specified in the applicable Pricing Supplement, the Interest Reset Date will be as follows: in the case of Floating Rate Notes which are reset daily, each Business Day; in the case of Floating Rate Notes (other than Treasury Rate Notes) which are reset weekly, the Wednesday of each week; in the case of Floating Rate Notes that are Treasury Rate Notes which are reset weekly, the Tuesday of each week (except if the auction date falls on a Tuesday, then the next Business Day, as provided below); in the case of Floating Rate Notes which are reset monthly, the third Wednesday of each month; in the case of Floating Rate Notes which are reset quarterly, the third Wednesday of March, June, September and December of each year; in the case of Floating Rate Notes which are reset semi-annually, the third Wednesday of the two months of each year which are six months apart, as specified in the applicable Pricing Supplement; and in the case of Floating Rate Notes which are reset annually, the third Wednesday of the month of each year specified in the applicable Pricing Supplement.

-6-

The interest rate in effect from the date of issue to the first Interest Reset Date with respect to a Floating Rate Note (the “Initial Interest Rate”) will be as specified in the applicable Pricing Supplement. If any Interest Reset Date for any Floating Rate Note would otherwise be a day that is not a Business Day, such Interest Reset Date shall be postponed to the next day that is a Business Day, provided that, for SOFR, CORRA and EURIBOR notes, if such Business Day is in the next succeeding calendar month, such Interest Reset Date shall be the immediately preceding Business Day.

Unless otherwise specified in the applicable Pricing Supplement, the interest rate determined with respect to any Interest Determination Date will become effective on and as of the next succeeding Interest Reset Date. As used herein, “Interest Determination Date” means the date as of which the new interest rate is determined for a particular Interest Reset Date, based on the applicable interest rate basis or formula as of that Interest Determination Date and calculated on the related Calculation Date. The “Calculation Date” is the date by which the calculation agent will determine the new interest rate that became effective on a particular Interest Reset Date based on the applicable interest rate basis or formula on the Interest Determination Date. The Interest Determination Date for all Floating Rate Notes (except SOFR Notes, CORRA Notes, EURIBOR Notes and Treasury Rate Notes) will be the second Business Day before the Interest Reset Date. The Interest Determination Date in the case of SOFR Notes will be as set forth below under “—SOFR Notes” or in the applicable Pricing Supplement. For CORRA Notes, the Interest Determination Date will be the applicable Interest Reset Date. For EURIBOR Notes, the Interest Determination Date will be the second T2 Business Day before the applicable Interest Reset Date.

The Interest Determination Date for Treasury Rate Notes will be the day of the week in which the Interest Reset Date falls on which Treasury bills of the same index maturity are normally auctioned. Treasury bills are usually sold at auction on Monday of each week, unless that day is a legal holiday, in which case the auction is usually held on Tuesday. Sometimes, the auction is held on the preceding Friday. If an auction is held on the preceding Friday, that day will be the Interest Determination Date relating to the Interest Reset Date occurring in the next week. If an auction date falls on any interest reset date, then the Interest Reset Date will instead be the first Business Day immediately following the auction date.

Each interest payment on a floating rate note will include interest accrued from, and including, the issue date or the last interest payment date, as the case may be, to, but excluding, the following interest payment date or the Maturity Date or Redemption Date, as the case may be. Accrued interest on a Floating Rate Note will be calculated by multiplying the principal amount of a note by an accrued interest factor (the “Accrued Interest Factor”). The Accrued Interest Factor is the sum of the interest factors calculated for each day in the period for which accrued interest is being calculated. The interest factor for each day is computed by dividing the interest rate in effect on that day by (1) the actual number of days in the year, in the case of Treasury Rate Notes or CMT Rate Notes, (2) 365, in the case of CORRA Notes, or (3) 360, in the case of

-7-

other Floating Rate Notes. All percentages resulting from any calculation are rounded to the nearest one hundred-thousandth of a percentage point, with five one-millionths of a percentage point rounded upward. For example, 9.876545% (or .09876545) will be rounded to 9.87655% (or .0987655). All currency amounts used in or resulting from such calculation will be rounded to the nearest one-hundredth of a unit (with five one-thousandths of a unit being rounded upward).

Unless otherwise specified in the applicable Pricing Supplement, KeyBank National Association will be the “calculation agent”. Unless otherwise specified in the applicable Pricing Supplement, the “calculation date”, if applicable, pertaining to any Interest Determination Date on a Floating Rate Note will be the earlier of (i) the tenth calendar day after such Interest Determination Date, or, if any such day is not a Business Day, the next succeeding Business Day, and (ii) the Business Day immediately preceding the relevant Interest Payment Date, or the Maturity Date, as the case may be.

CORRA Notes. CORRA Notes will bear interest at the interest rates, calculated with reference to the Canadian Overnight Repo Rate Average, commonly referred to as CORRA, and the Spread and/or Spread Multiplier, if any, specified in the CORRA Notes and in the applicable Pricing Supplement. CORRA Notes will be subject to the minimum and the maximum interest rate, if any.

Unless the applicable Pricing Supplement specifies otherwise, the interest rate for each relevant interest period will be determined by the calculation agent on each interest determination date relating to a floating rate note for which the interest rate is determined with reference to CORRA (a “CORRA Interest Determination Date”), at a base rate equal to compounded daily CORRA (“compounded CORRA”), calculated as described below or by any other method of calculation specified in the applicable Pricing Supplement.

The amount of interest accrued and payable on the CORRA Notes for each interest period will be calculated by the calculation agent and will be equal to the product of (i) the outstanding principal amount of the CORRA Notes multiplied by (ii) the product of (a) the base rate adjusted by the applicable spread or spread multiplier for the relevant interest period multiplied by (b) the quotient of the actual number of calendar days in such interest period divided by 365.

The calculation agent will determine compounded CORRA for each applicable interest period in accordance with the formula below, and with respect to the observation period relating to such interest period. Compounded CORRA, the interest rate and accrued interest for each interest period will be determined by the calculation agent in arrears for each applicable interest period as soon as reasonably practicable on or after the last day of the applicable observation period related to such interest period and prior to the relevant interest payment date. The calculation agent will notify the Company of compounded CORRA and such interest rate and accrued interest for each interest period as soon as reasonably practicable after such determination, but in any event by the business day immediately prior to the interest payment date.

-8-

Compounded CORRA Notes with Observation Shift

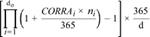

“Compounded CORRA” means, for any observation period, the rate of return of a daily compounded interest investment calculated in accordance with the following formula, with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.00000005 being rounded upwards:

where:

“d” for any observation period, means the number of calendar days in the relevant observation period;

“d0” for any observation period, is the number of Toronto banking days in the relevant observation period;

“i” means a series of whole numbers from one to d0, each representing the relevant Toronto banking day in chronological order from, and including, the first Toronto banking day in the relevant observation period;

“ni” for any Toronto banking day “i” in the relevant observation period, means the number of calendar days from, and including, such Toronto banking day “i” to, but excluding, the following Toronto banking day (which is “i” + 1);

“CORRAi” means, in respect of any Toronto banking day “i” in the relevant observation period, a reference rate equal to the daily Canada Overnight Repo Rate Average for such Toronto banking day, as published by the Bank of Canada, as the administrator of CORRA (or any successor administrator of CORRA), on the website of the Bank of Canada or any successor website, or such other source or page as is specified in the applicable Pricing Supplement or, if the Bank of Canada’s website or such other source or page as is specified in the applicable Pricing Supplement, as applicable, is unavailable, as otherwise published by such authorized distributors (in each case, at approximately 11:00 a.m., Toronto time (or such other time as is specified in the applicable Pricing Supplement)), on the immediately following Toronto banking day, which is Toronto banking day “i”+ 1;

“observation period” means, in respect of each observation period, the period from, and including, the date that is two Toronto banking days (or such other number of Toronto banking days as the Company may specify in the applicable Pricing Supplement) preceding the first date in such interest period to, but excluding, the date that is two Toronto banking days (or such other number of Toronto banking days as the Company may specify in the applicable Pricing Supplement) preceding the interest payment date for such interest period; and

“Toronto banking day” means a day on which Schedule I banks under the Bank Act (Canada) are open for business in the city of Toronto, Canada.

If neither the administrator nor authorized distributors provide or publish CORRA and an Index Cessation Effective Date with respect to CORRA has not occurred, then, in respect of any day for which CORRA is required, references to CORRA will be deemed to be references to the last provided or published CORRA.

-9-

Notwithstanding the foregoing, upon the occurrence of an Index Cessation Event, the terms and provisions set forth under “—Effect of an Index Cessation Event — CORRA” will apply to the CORRA Notes.

Effect of an Index Cessation Event — CORRA

Upon the occurrence of an Index Cessation Event and related Index Cessation Effective Date, the interest rate for a CORRA Interest Determination Date that occurs on or after such Index Cessation Effective Date will be the CAD Recommended Rate determined in accordance with (i) and (ii) below, to which the calculation agent will apply the most recently published spread and make such adjustments as are necessary to account for any difference in the term, structure or tenor of the CAD Recommended Rate in comparison to CORRA, in each case that the Company or its designee (which may be an affiliate of the Company), after consulting with the Company, determines, from time to time, and notifies to the calculation agent, are consistent with accepted market practice or applicable regulatory or legislative action or guidance for the use of such Applicable Fallback Rate for debt obligations comparable to the CORRA Notes in such circumstances:

| (i) | Index Cessation Effective Date with respect to CORRA. If there is a CAD Recommended Rate before the end of the first Toronto banking day following the Index Cessation Effective Date with respect to CORRA but neither the administrator nor authorized distributors provide or publish the CAD Recommended Rate and an Index Cessation Effective Date with respect to the CAD Recommended Rate has not occurred, then, in respect of any day for which the CAD Recommended Rate is required, references to the CAD Recommended Rate will be deemed to be references to the last provided or published CAD Recommended Rate. |

| (ii) | No CAD Recommended Rate or Index Cessation Effective Date with respect to CAD Recommended Rate. If there is no CAD Recommended Rate before the end of the first Toronto banking day following the Index Cessation Effective Date with respect to CORRA, or there is a CAD Recommended Rate and an Index Cessation Effective Date subsequently occurs with respect to such CAD Recommended Rate, then the base rate for a CORRA Interest Determination Date that occurs on or after such applicable Index Cessation Effective Date will be the BOC Target Rate (as defined below). |

Applicable Fallback Rate Conforming Changes. Notwithstanding the foregoing, in connection with the implementation of an Applicable Fallback Rate, the Company or its designee (which may be an affiliate of the Company), after consulting with the Company, may make such adjustments to the Applicable Fallback Rate or the spread thereon, if any, as well as the business day convention, the calendar day count convention, interest determination dates, interest reset dates and related provisions and definitions (including observation dates for reference rates), in each case that are consistent with accepted market practice for the use of the Applicable Fallback Rate for debt obligations such as the CORRA Notes in such circumstances.

-10-

Any determination, decision or election that may be made by the Company or the calculation agent, as applicable, in relation to the Applicable Fallback Rate, including any determination with respect to an adjustment or the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection: (i) will be conclusive and binding, absent manifest error; (ii) if made by the Company, will be made in the Company’s sole discretion, or, as applicable, if made by the calculation agent will be made after consultation with the Company and the calculation agent will not make any such determination, decision or election to which the Company objects and will have no liability for not making any such determination, decision or election; and (iii) shall become effective without consent from the holders of the CORRA Notes or any other party.

Definitions. As used in the foregoing terms and provisions relating to the determination of CORRA:

“Applicable Fallback Rate” means the CAD Recommended Rate, or the BOC Target Rate, as applicable;

“BOC Target Rate” means the Bank of Canada’s Target for the Overnight Rate as set by the Bank of Canada and published on the Bank of Canada’s Website;

“CAD Recommended Rate” means the rate (inclusive of any spreads or adjustments) recommended as the replacement for CORRA by a committee officially endorsed or convened by the Bank of Canada for the purpose of recommending a replacement for CORRA (which rate may be produced by the Bank of Canada or another administrator) and as provided by the administrator of that rate or, if that rate is not provided by the administrator thereof (or a successor administrator), published by an authorized distributor;

“CAD Recommended Rate Index Cessation Effective Date” means, in respect of the CAD Recommended Rate and a CAD Recommended Rate Cessation Event, the first date on which the CAD Recommended Rate would ordinarily have been provided and is no longer provided;

“Index Cessation Effective Date” means, in respect of an Index Cessation Event, the first date on which CORRA or the Applicable Fallback Rate, as applicable, is no longer provided. If CORRA or the Applicable Fallback Rate, as applicable, ceases to be provided on the same day that it is required to determine the base rate for an interest period pursuant to the terms of an applicable series of CORRA Notes but it was provided at the time at which it is to be observed pursuant to the terms and provisions of such series of CORRA Notes (or, if no such time is specified in the terms and provisions of such series, at the time at which it is ordinarily published), then the Index Cessation Effective Date will be the next day on which the rate would ordinarily have been published; and

“Index Cessation Event” means:

| (A) | a public statement or publication of information by or on behalf of the administrator or provider of CORRA or the Applicable Fallback Rate, as applicable, announcing that it has ceased or will cease to provide CORRA or the Applicable Fallback Rate, as applicable, permanently or indefinitely, provided that, at the time of the statement or publication, there is no successor administrator or provider that will continue to provide CORRA or the Applicable Fallback Rate, as applicable; or |

-11-

| (B) | a public statement or publication of information by the regulatory supervisor for the administrator or provider of CORRA or the Applicable Fallback Rate, as applicable, the Bank of Canada, an insolvency official with jurisdiction over the administrator or provider for CORRA or the Applicable Fallback Rate, as applicable, a resolution authority with jurisdiction over the administrator or provider for CORRA or the Applicable Fallback Rate, as applicable, or a court or an entity with similar insolvency or resolution authority over the administrator or provider for CORRA or the Applicable Fallback Rate, as applicable, which states that the administrator or provider of CORRA or the Applicable Fallback Rate, as applicable, has ceased or will cease to provide CORRA or the Applicable Fallback Rate, as applicable, permanently or indefinitely, provided that, at the time of the statement or publication, there is no successor administrator or provider that will continue to provide CORRA or the Applicable Fallback Rate, as applicable. |

Constant Maturity Treasury (CMT) Rate Notes. CMT Rate Notes will bear interest for each Interest Reset Period at the interest rates calculated with reference to the CMT Rate, plus or minus any Spread, and/or multiplied by any Spread Multiplier, if any, as specified in the CMT Rate Notes and in the applicable Pricing Supplement. CMT Rate Notes will be subject to the minimum and the maximum interest rate, if any, as specified in the applicable Pricing Supplement.

Unless otherwise specified in the applicable Pricing Supplement, “CMT Rate” means, with respect to any Interest Determination Date relating to a Floating Rate Note for which the interest rate is determined with reference to the CMT Rate (a “CMT Rate Interest Determination Date”):

(I) If “Reuters Page FRBCMT” is the specified CMT Reuters Page in the applicable Pricing Supplement, the CMT Rate on the CMT Rate Interest Determination Date shall be a percentage equal to the yield for United States Treasury securities at “constant maturity” having the index maturity specified in the applicable Pricing Supplement as set forth in the daily update of H.15 under the caption “Treasury constant maturities,” as such yield is displayed on Reuters (or any successor service) on page FRBCMT (or any other page as may replace such page on such service) (“Reuters Page FRBCMT”) for such CMT Rate Interest Determination Date. The calculation agent will follow the following procedures if the Reuters Page FRBCMT CMT Rate cannot be determined as described in the preceding sentence:

a. If such rate does not appear on Reuters Page FRBCMT, the CMT Rate on such CMT Rate Interest Determination Date shall be a percentage equal to the yield for United States Treasury securities at “constant maturity” having the index maturity specified in the applicable Pricing Supplement and for such CMT Rate Interest Determination Date as set forth in the daily update of H.15 under the caption “Treasury constant maturities.”

b. If such rate does not appear in the daily update of H.15, the CMT Rate on such CMT Rate Interest Determination Date shall be the rate for the period of the index maturity specified in the applicable Pricing Supplement as may then be published by either the Federal Reserve Board or the United States Department of the Treasury that the calculation agent determines to be comparable to the rate that would otherwise have been published in the daily update of H.15.

-12-

c. If the Federal Reserve Board or the United States Department of the Treasury does not publish a yield on United States Treasury securities at “constant maturity” having the index maturity specified in the applicable Pricing Supplement for such CMT Rate Interest Determination Date, the CMT Rate on such CMT Rate Interest Determination Date shall be calculated by the calculation agent and shall be a yield-to-maturity based on the arithmetic mean of the secondary market bid prices at approximately 3:30 p.m., New York City time, on such CMT Rate Interest Determination Date of three leading primary United States government securities dealers in New York City (which may include the agents or their affiliates) (each, a “reference dealer”) selected by the calculation agent from five such reference dealers selected by the calculation agent and eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity equal to the index maturity specified in the applicable Pricing Supplement, a remaining term to maturity no more than one year shorter than such index maturity and in a principal amount that is representative for a single transaction in such securities in such market at such time.

d. If fewer than three prices are provided as requested, the CMT Rate on such CMT Rate Interest Determination Date shall be calculated by the calculation agent and shall be a yield-to-maturity based on the arithmetic mean of the secondary market bid prices as of approximately 3:30 p.m., New York City time, on such CMT Rate Interest Determination Date of three reference dealers selected by the calculation agent from five such reference dealers selected by the calculation agent and eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity greater than the index maturity specified in the applicable Pricing Supplement, a remaining term to maturity closest to such index maturity and in a principal amount that is representative for a single transaction in such securities in such market at such time. If two such United States Treasury securities with an original maturity greater than the index maturity specified in the applicable Pricing Supplement have remaining terms to maturity equally close to such index maturity, the quotes for the treasury security with the shorter original term to maturity will be used. If fewer than five but more than two such prices are provided as requested, the CMT Rate on such CMT Rate Interest Determination Date shall be calculated by the calculation agent and shall be based on the arithmetic mean of the bid prices obtained and neither the highest nor the lowest of such quotations shall be eliminated; provided, however, that if fewer than three such prices are provided as requested, the CMT Rate determined as of such CMT Rate Interest Determination Date shall be the CMT Rate in effect on such CMT Rate Interest Determination Date.

(II) If “Reuters Page FEDCMT” is the specified CMT Reuters Page in the applicable Pricing Supplement, the CMT Rate on the CMT Rate Interest Determination Date shall be a percentage equal to the one-week or one-month, as specified in the applicable Pricing Supplement, average yield for United States Treasury securities at “constant maturity” having the index maturity specified in the applicable Pricing Supplement as set forth in the daily update of H.15 opposite the caption “Treasury Constant Maturities,” as such yield is displayed on Reuters on page FEDCMT (or any other page as may replace such page on such service) (“Reuters Page FEDCMT”) for the week or month, as applicable, ended immediately preceding the week or month, as applicable, in which such CMT Rate Interest Determination Date falls. The calculation agent will follow the following procedures if the Reuters Page FEDCMT CMT Rate cannot be determined as described in the preceding sentence:

-13-

a. If such rate does not appear on Reuters Page FEDCMT, the CMT Rate on such CMT Rate Interest Determination Date shall be a percentage equal to the one-week or one-month, as specified in the applicable Pricing Supplement, average yield for United States Treasury securities at “constant maturity” having the index maturity specified in the applicable Pricing Supplement for the week or month, as applicable, preceding such CMT Rate Interest Determination Date as set forth in the daily update of H.15 opposite the caption “Treasury Constant Maturities.”

b. If such rate does not appear in the daily update of H.15, the CMT Rate on such CMT Rate Interest Determination Date shall be the one-week or one-month, as specified in the applicable Pricing Supplement, average yield for United States Treasury securities at “constant maturity” having the index maturity specified in the applicable Pricing Supplement as otherwise announced by the Federal Reserve Bank of New York for the week or month, as applicable, ended immediately preceding the week or month, as applicable, in which such CMT Rate Interest Determination Date falls.

c. If the Federal Reserve Bank of New York does not publish a one-week or one-month, as specified in the applicable Pricing Supplement, average yield on United States Treasury securities at “constant maturity” having the index maturity specified in the applicable Pricing Supplement for the applicable week or month, the CMT Rate on such CMT Rate Interest Determination Date shall be calculated by the calculation agent and shall be a yield-to-maturity based on the arithmetic mean of the secondary market bid prices at approximately 3:30 p.m., New York City time, on such CMT Rate Interest Determination Date of three reference dealers selected by the calculation agent from five such reference dealers selected by the calculation agent and eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity equal to the index maturity specified in the applicable Pricing Supplement, a remaining term to maturity of no more than one year shorter than such index maturity and in a principal amount that is representative for a single transaction in such securities in such market at such time.

d. If fewer than five but more than two such prices are provided as requested, the CMT Rate on such CMT Rate Interest Determination Date shall be the rate on the CMT Rate Interest Determination Date calculated by the calculation agent based on the arithmetic mean of the bid prices obtained and neither the highest nor the lowest of such quotation shall be eliminated.

-14-

e. If fewer than three prices are provided as requested, the CMT Rate on such CMT Rate Interest Determination Date shall be calculated by the calculation agent and shall be a yield-to-maturity based on the arithmetic mean of the secondary market bid prices as of approximately 3:30 p.m., New York City time, on such CMT Rate interest determination date of three reference dealers selected by the calculation agent from five such reference dealers selected by the calculation agent and eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity longer than the index maturity specified in the applicable Pricing Supplement, a remaining term to maturity closest to such index maturity and in a principal amount that is representative for a single transaction in such securities in such market at such time. If two United States Treasury securities with an original maturity greater than the index maturity specified in the applicable Pricing Supplement have remaining terms to maturity equally close to such index maturity, the quotes for the Treasury security with the shorter original term to maturity will be used. If fewer than five but more than two such prices are provided as requested, the CMT Rate on such CMT Rate Interest Determination Date shall be the rate on the CMT Rate Interest Determination Date calculated by the calculation agent based on the arithmetic mean of the bid prices obtained and neither the highest nor lowest of such quotations shall be eliminated; provided, however, that if fewer than three such prices are provided as requested, the CMT Rate determined as of such CMT Rate determination date shall be the CMT Rate in effect on such CMT Rate Interest Determination Date.

Commercial Paper Rate Notes. Commercial Paper Rate Notes will bear interest for each Interest Reset Period at an interest rate equal to the Commercial Paper Rate, plus or minus any Spread, and/or multiplied by any Spread Multiplier, as specified in such Commercial Paper Rate Note and the applicable Pricing Supplement, and will be subject to the minimum interest rate or the maximum interest rate, if any, as specified in the applicable Pricing Supplement.

Unless otherwise specified in the applicable Pricing Supplement, the “Commercial Paper Rate” for any Interest Determination Date is the money market yield (as defined below) of the rate on that date for commercial paper having the index maturity described in the related Pricing Supplement, as published in the daily update of H.15 under the heading “Commercial Paper — Nonfinancial” prior to 3:00 p.m., New York City time, on the calculation date for that Interest Determination Date.

Unless otherwise specified in the applicable Pricing Supplement, the calculation agent will observe the following procedures if the Commercial Paper Rate cannot be determined as described above:

(I) If the above rate is not published in the daily update of H.15 by 3:00 p.m., New York City time, on the calculation date, the Commercial Paper Rate will be the money market yield of the rate on that Interest Determination Date for commercial paper having the index maturity described in the Pricing Supplement, as published in another recognized electronic source used for the purpose of displaying such rate.

(II) If that rate is not published in the daily update of H.15 or another recognized electronic source by 3:00 p.m., New York City time, on the calculation date, then the calculation agent will determine the Commercial Paper Rate to be the money market yield of the arithmetic mean of the offered rates of three leading dealers of U.S. dollar commercial paper in New York City as of 11:00 a.m., New York City time, on that Interest Determination Date for commercial paper having the index maturity described in the Pricing Supplement placed for an industrial issuer whose bond rating is “AA”, or the equivalent, from a nationally recognized securities rating organization. The calculation agent will select the three dealers referred to above.

-15-

(III) If fewer than three dealers selected by the calculation agent are quoting as mentioned above, the Commercial Paper Rate will remain the Commercial Paper Rate then in effect on that Interest Determination Date.

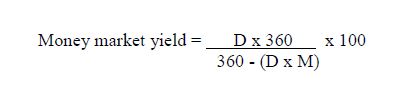

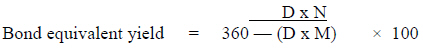

“Money market yield” shall be a yield (expressed as a percentage) calculated in accordance with the following formula:

where “D” refers to the applicable annual rate for commercial paper, quoted on a bank discount basis and expressed as a decimal, and “M” refers to the actual number of days in the interest period for which the interest is being calculated.

EURIBOR Notes. EURIBOR Notes will bear interest for each interest reset period at an interest rate equal to EURIBOR, plus or minus any Spread, and/or multiplied by any Spread Multiplier as specified in such EURIBOR Note and the applicable Pricing Supplement. The EURIBOR Notes will be subject to the minimum interest rate or the maximum interest rate, if any, as specified in the applicable Pricing Supplement.

The calculation agent will determine EURIBOR on each EURIBOR determination date, which is the second T2 Business Day prior to the Interest Reset Date for each Interest Reset Period.

Unless otherwise specified in the applicable Pricing Supplement, EURIBOR means, with respect to any Interest Determination Date relating to a Floating Rate Note for which the interest rate is determined with reference to EURIBOR (a “EURIBOR Interest Determination Date”), a base rate equal to the interest rate for deposits in euro designated as “EURIBOR” as sponsored, calculated and published by EMMI having the index maturity specified in the applicable Pricing Supplement, as that rate appears on Reuters Page EURIBOR01 (or any other page as may replace such page on such service) (“Reuters Page EURIBOR01”) as of 11:00 a.m., Brussels time, on such EURIBOR Interest Determination Date.

Unless the applicable Pricing Supplement specifies otherwise, the following procedures will be followed if EURIBOR cannot be determined as described above:

(I) If the rate described above does not appear on Reuters Page EURIBOR01, EURIBOR will be determined on the basis of the rates, at approximately 11:00 a.m., Brussels time, on such EURIBOR Interest Determination Date, at which deposits of the following kind are offered to prime banks in the euro-zone interbank market by the principal euro-zone office of each of four major banks in that market selected by the calculation agent, after consultation with the Company: euro deposits having such EURIBOR index maturity, beginning on such EURIBOR Interest Reset Date, and in a representative amount. The calculation agent will request that the principal euro-zone office of each of these banks provide a quotation of its rate. If at least two quotations are provided, EURIBOR for such EURIBOR Interest Determination Date will be the arithmetic mean of those quotations.

-16-

(II) If fewer than two quotations are provided as described above, EURIBOR for such EURIBOR Interest Determination Date will be the arithmetic mean of the rates for loans of the following kind to leading euro-zone banks quoted, at approximately 11:00 a.m., Brussels time on that EURIBOR Interest Determination Date, by three major banks in the euro-zone selected by the calculation agent: loans of euro having such EURIBOR index maturity, beginning on such EURIBOR Interest Reset Date, and in an amount that is representative of a single transaction in euro in that market at the time.

(III) If fewer than three banks selected by the calculation agent are quoting as described above, EURIBOR for the new interest period will be EURIBOR in effect for the prior interest period. If the initial Base Rate has been in effect for the prior interest period, however, it will remain in effect for the new interest period.

Notwithstanding, and at any time during the application of, the foregoing procedures, if the Company or its designee determines that a Benchmark Event has occurred in relation to any notes that reference EURIBOR, then, pursuant to the provisions described under “Benchmark Discontinuation—Reference Rate Replacement—EURIBOR,” the Company will use reasonable efforts to appoint an Independent Financial Adviser for the determination (with the Company’s agreement) of, amongst other items, a Successor Rate (as defined below) or, alternatively, if the Company and the Independent Financial Adviser agree that there is no Successor Rate, an Alternative Benchmark Rate (as defined below) and, in each case, an Adjustment Spread (as defined below) and the provisions described under “Benchmark Discontinuation—Reference Rate Replacement—EURIBOR” shall, in such circumstances, apply to the EURIBOR notes.

Benchmark Discontinuation—Reference Rate Replacement—EURIBOR

Notwithstanding the foregoing, if the Company or its designee (which may be an affiliate of the Company), after consulting with the Company, determines that a Benchmark Event (as defined below) has occurred when any interest rate (or the relevant component part thereof) remains to be determined by reference to EURIBOR, then the following provisions shall apply:

| • | the Company will use reasonable efforts to appoint an Independent Financial Adviser (as defined below) for the determination (with the Company’s agreement) of a Successor Rate (as defined below) or, alternatively, if the Company and the Independent Financial Adviser agree that there is no Successor Rate, an alternative rate (the “Alternative Benchmark Rate”) and, in either case, an alternative screen page or source (the “Alternative Relevant Screen Page”) and an Adjustment Spread (as defined below) (if applicable) no later than three business days prior to the relevant interest determination date relating to the next succeeding interest period (the “IA Determination Cut-off Date”) for purposes of determining the interest rate applicable to the notes for all future interest periods; |

-17-

| • | the Alternative Benchmark Rate will be such rate as the Company and the Independent Financial Adviser agree has replaced the relevant reference rate in customary market usage for the purposes of determining the applicable interest rate or, if the Company and the Independent Financial Adviser agree that there is no such rate, such other rate as the Company and the Independent Financial Adviser agree is most comparable to the relevant reference rate, and the Alternative Relevant Screen Page shall be such page of an information service as displays the Alternative Benchmark Rate; |

| • | if the Company is unable to appoint an Independent Financial Adviser, or if the Company and the Independent Financial Adviser cannot agree upon, or cannot select a Successor Rate or an Alternative Benchmark Rate and Alternative Relevant Screen Page prior to the IA Determination Cut-off Date in accordance with the clause immediately above, then the Company may determine which (if any) rate has replaced the relevant reference rate in customary market usage for purposes of determining the applicable interest rate or, if the Company determines that there is no such rate, which (if any) rate is most comparable to the relevant reference rate, and the Alternative Benchmark Rate will be the rate so determined by the Company, and the Alternative Relevant Screen Page will be such page of an information service as displays the Alternative Benchmark Rate; provided, however, that if this clause applies and the Company is unable or unwilling to determine an Alternative Benchmark Rate and Alternative Relevant Screen Page prior to the interest determination date relating to the next succeeding interest period in accordance with this clause, the reference rate applicable to such interest period will be determined pursuant to the interest rate provisions for notes referencing EURIBOR as applicable and as outlined above under the captions “EURIBOR Notes”; |

| • | if a Successor Rate or an Alternative Benchmark Rate and an Alternative Relevant Screen Page is determined in accordance with the preceding provisions, such Successor Rate or such Alternative Benchmark Rate and such Alternative Relevant Screen Page will be the benchmark and the Relevant Screen Page in relation to the notes for all future interest periods; |

| • | if the Company determines, together with the Independent Financial Adviser, that (A) an Adjustment Spread is required to be applied to the Successor Rate or the Alternative Benchmark Rate and (B) the quantum of, or a formula or methodology for determining, such Adjustment Spread, then such Adjustment Spread will be applied to the Successor Rate or the Alternative Benchmark Rate for each subsequent determination of a relevant interest rate and Interest Amount(s) (or a component part thereof) by reference to such Successor Rate or such Alternative Benchmark Rate; |

| • | if a Successor Rate or an Alternative Benchmark Rate and/or Adjustment Spread is determined in accordance with the above provisions, the Company may also specify additional changes applicable to the notes, and the method for determining the fallback rate in relation to the notes, to follow market practice in relation to the Successor Rate or the Alternative Benchmark Rate and/or the Adjustment Spread, which changes shall apply to the notes for all future interest periods; and |

-18-

| • | the Company will promptly, following the determination of any Successor Rate or any Alternative Benchmark Rate and any Alternative Relevant Screen Page and any Adjustment Spread (if any), give notice thereof and of any changes pursuant to the clause immediately above to the calculation agent, the fiscal and paying agent and the holders of the notes. |

“Adjustment Spread” means either a spread (which may be positive or negative) or a formula or methodology for calculating a spread, which the Company determines should be applied to the relevant Successor Rate or the relevant Alternative Benchmark Rate (as applicable), as a result of the replacement of the relevant reference rate with the relevant Successor Rate or the relevant Alternative Benchmark Rate (as applicable), and is the spread, formula or methodology which:

| • | in the case of a Successor Rate, is recommended or formally provided as an option for parties to adopt, in relation to the replacement of the reference rate with the Successor Rate by any Relevant Nominating Body; or |

| • | in the case of a Successor Rate for which no such recommendation has been made, or option provided, or in the case of an Alternative Benchmark Rate, the spread, formula or methodology which the Company determines to be appropriate to reduce or eliminate, to the fullest extent reasonably practicable in the circumstances, any economic prejudice or benefit (as the case may be) to holders as a result of the replacement of the reference rate with the Successor Rate or the Alternative Benchmark Rate (as applicable). |

“Benchmark Event” means:

(a) the relevant reference rate has ceased to be published on the Relevant Screen Page as a result of such benchmark ceasing to be calculated or administered; or

(b) a public statement by the administrator of the relevant reference rate that it will cease publishing such reference rate permanently or indefinitely (in circumstances where no successor administrator has been appointed that will continue publication of such reference rate); or

(c) a public statement by the supervisor of the administrator of the relevant reference rate that such reference rate has been or will be permanently or indefinitely discontinued; or

(d) a public statement by the supervisor of the administrator of the relevant reference rate that means that such reference rate will be prohibited from being used or that its use will be subject to restrictions or adverse consequences; or

(e) a public statement by the supervisor of the administrator of the relevant reference rate that, in the view of such supervisor, such reference rate is no longer representative of an underlying market; or

-19-

(f) it has or will become unlawful for the calculation agent or the Company to calculate any payments due to be made to any holder using the relevant reference rate (including, without limitation, under the Benchmarks Regulation (EU) 2016/1011, if applicable),

provided that the Benchmark Event shall be deemed to occur only (i) in the case of paragraphs (b) and (c) above, on the date of the cessation of the relevant reference rate or the discontinuation of the reference rate, as the case may be, (ii) in the case of paragraph (d) above, on the date of prohibition of use of the reference rate and (iii) in the case of paragraph (e) above, on the date with effect from which the reference rate will no longer be (or will be deemed by the relevant supervisor to no longer be) representative of its relevant underlying market and which is specified in the public statement, and, in each case, not the date of the relevant public statement.

“euro-zone” means, at any time, the region comprised of the member states of the European Economic and Monetary Union that, as of that time, have adopted a single currency in accordance with the Treaty on European Union of February 1992.

“Independent Financial Adviser” means an independent financial institution of international repute or other independent financial adviser experienced in the international debt capital markets, in each case appointed by the Company.

“Relevant Nominating Body” means, in respect of a benchmark or screen rate (as applicable):

| • | the European Union, the central bank, reserve bank, monetary authority or similar institution for the currency to which the benchmark or screen rate (as applicable) relates, or any central bank or other supervisory authority which is responsible for supervising the administrator of the benchmark or screen rate (as applicable); or |

| • | any working group or committee sponsored by, chaired or co-chaired by or constituted at the request of (a) the central bank for the currency to which the benchmark or screen rate (as applicable) relates, (b) any central bank or other supervisory authority which is responsible for supervising the administrator of the benchmark or screen rate (as applicable), (c) a group of the aforementioned central banks or other supervisory authorities or (d) the Financial Stability Board or any part thereof. |

“Successor Rate” means the reference rate (and related alternative screen page or source, if available) that the Independent Financial Adviser (with the Company’s agreement) determines is a successor to or replacement of the relevant reference rate which is formally recommended by any Relevant Nominating Body.

Federal Funds Rate Notes. Federal Funds Rate Notes will bear interest for each Interest Reset Period at an interest rate equal to the Federal Funds Rate, plus or minus any Spread, and/or multiplied by any Spread Multiplier as specified in such Federal Funds Rate Note and the applicable Pricing Supplement. The Federal Funds Rate will be calculated by reference to either the Federal Funds (Effective) Rate, the Federal Funds Open Rate or the Federal Funds Target Rate, as specified in the applicable Pricing Supplement. The Federal Funds Rate will be subject to the minimum interest rate or the maximum interest rate, if any, specified in the applicable Pricing Supplement.

Unless otherwise specified in the applicable Pricing Supplement, “Federal Funds Rate” means the rate determined by the calculation agent, with respect to any Interest Determination Date relating to a Floating Rate Note for which the interest rate is determined with reference to the Federal Funds Rate (a “Federal Funds Rate Interest Determination Date”), in accordance with the following provisions:

-20-

(I) If “Federal Funds (Effective) Rate” is the specified Federal Funds Rate in the applicable Pricing Supplement, the Federal Funds Rate as of the applicable Federal Funds Rate Interest Determination Date shall be the rate with respect to such date for United States dollar federal funds as published in the daily update of H.15 opposite the caption “Federal Funds (effective),” as such rate is displayed on Reuters on page FEDFUNDS1 (or any other page as may replace such page on such service) (“Reuters Page FEDFUNDS1”) under the heading “EFFECT,” or, if such rate is not so published by 3:00 p.m., New York City time, on the Calculation Date, the rate with respect to such Federal Funds Rate Interest Determination Date for United States dollar federal funds as published in another recognized electronic source used for the purpose of displaying such rate, under the caption “Federal funds (effective).” If such rate does not appear on Reuters Page FEDFUNDS1 or is not yet published in the daily update of H.15 or another recognized electronic source by 3:00 p.m., New York City time, on the related Calculation Date, then the Federal Funds Rate with respect to such Federal Funds Rate Interest Determination Date shall be calculated by the calculation agent and will be the arithmetic mean of the rates for the last transaction in overnight United States dollar federal funds arranged by three leading brokers of U.S. dollar federal funds transactions in New York City (which may include the Agents or their affiliates) selected by the calculation agent, prior to 9:00 a.m., New York City time, on the Business Day following such Federal Funds Rate Interest Determination Date; provided, however, that if the brokers so selected by the calculation agent are not quoting as mentioned in this sentence, the Federal Funds Rate determined as of such Federal Funds Rate Interest Determination Date will be the Federal Funds Rate in effect on such Federal Funds Rate Interest Determination Date without giving effect to any resetting of the Federal Funds Rate on such Federal Funds Rate Interest Determination Date.

(II) If “Federal Funds Open Rate” is the specified Federal Funds Rate in the applicable Pricing Supplement, the Federal Funds Rate as of the applicable Federal Funds Rate Interest Determination Date shall be the rate on such date under the heading “Federal Funds” for the relevant index maturity and opposite the caption “Open” as such rate is displayed on Reuters on page 5 (or any other page as may replace such page on such service) (“Reuters Page 5”), or, if such rate does not appear on Reuters Page 5 by 3:00 p.m., New York City time, on the Calculation Date, the Federal Funds Rate for the Federal Funds Rate Interest Determination Date will be the rate for that day displayed on FFPREBON Index page on Bloomberg L.P. (“Bloomberg”), which is the Fed Funds Opening Rate as reported by Prebon Yamane (or a successor) on Bloomberg. If such rate does not appear on Reuters Page 5 or is not displayed on FFPREBON Index page on Bloomberg or another recognized electronic source by 3:00 p.m., New York City time, on the related Calculation Date, then the Federal Funds Rate on such Federal Funds Rate Interest Determination Date shall be calculated by the calculation agent and will be the arithmetic mean of the rates for the last transaction in overnight United States dollar federal funds arranged by three leading brokers of United States dollar federal funds transactions in New York City (which may include the Agents or their affiliates) selected by the calculation agent prior to 9:00 a.m., New York City time, on such Federal Funds Rate Interest Determination Date; provided, however, that if the brokers so selected by the calculation agent are not quoting as mentioned in this sentence, the Federal Funds Rate determined as of such Federal Funds Rate Interest Determination Date will be the Federal Funds Rate in effect on such Federal Funds Rate Interest Determination Date without giving effect to any resetting of the Federal Funds Rate on such Federal Funds Rate Interest Determination Date.

-21-

(III) If “Federal Funds Target Rate” is the specified Federal Funds Rate in the applicable Pricing Supplement, the Federal Funds Rate as of the applicable Federal Funds Rate Interest Determination Date shall be the rate on such date as displayed on the FDTR Index page on Bloomberg. If such rate does not appear on the FDTR Index page on Bloomberg by 3:00 p.m., New York City time, on the Calculation Date, the Federal Funds Rate for such Federal Funds Rate Interest Determination Date will be the rate for that day appearing on Reuters Page USFFTARGET= (or any other page as may replace such page on such service) (“Reuters Page USFFTARGET=”). If such rate does not appear on the FDTR Index page on Bloomberg or is not displayed on Reuters Page USFFTARGET= by 3:00 p.m., New York City time, on the related Calculation Date, then the Federal Funds Rate on such Federal Funds Rate Interest Determination Date shall be calculated by the calculation agent and will be the arithmetic mean of the rates for the last transaction in overnight United States dollar federal funds arranged by three leading brokers of United States dollar federal funds transactions in New York City (which may include the Agents or their affiliates) selected by the calculation agent prior to 9:00 a.m., New York City time, on such federal funds rate interest determination date; provided, however, that if the brokers so selected by the calculation agent are not quoting as mentioned in this sentence, the Federal Funds Rate determined as of such Federal Funds Rate Interest Determination Date will be the Federal Funds Rate in effect on such Federal Funds Rate Interest Determination Date without giving effect to any resetting of the Federal Funds Rate on such Federal Funds Rate Interest Determination Date.

Prime Rate Notes. Prime Rate Notes will bear interest for each Interest Reset Period at a rate equal to the Prime Rate, plus or minus any Spread, and/or multiplied by any Spread Multiplier as specified in the Prime Rate Notes and the applicable Pricing Supplement. Prime Rate Notes will be subject to the minimum interest rate or the maximum interest rate, if any, specified in the applicable Pricing Supplement.

The “Prime Rate” for any Interest Determination Date is the prime rate or base lending rate on that date, as published in the daily update of H.15 by 3:00 p.m., New York City time, on the calculation date for that Interest Determination Date under the heading “Bank Prime Loan” or, if not published by 3:00 p.m., New York City time, on the related calculation date, the rate on such Interest Determination Date as published in another recognized electronic source used for the purpose of displaying such rate, under the caption “Bank Prime Loan.”

The calculation agent will follow the following procedures if the Prime Rate cannot be determined as described above:

(I) If the rate is not published in the daily update of H.15 or another recognized electronic source by 3:00 p.m., New York City time, on the calculation date, then the calculation agent will determine the Prime Rate to be the arithmetic mean of the rates of interest publicly announced by each bank that appears on USPRIME1 as that bank’s prime rate or base lending rate as of 11:00 a.m., New York City time, on that Interest Determination Date.

-22-

(II) If at least one rate but fewer than four rates appear on USPRIME1 on the Interest Determination Date, then the Prime Rate will be the arithmetic mean of the prime rates or base lending rates quoted (on the basis of the actual number of days in the year divided by a 360-day year) as of the close of business on the Interest Determination Date by three major money center banks in the City of New York selected by the calculation agent.

(III) If the banks selected by the calculation agent are not quoting as mentioned above, the Prime Rate will remain the Prime Rate then in effect on the Interest Determination Date.

“USPRIME1” means the display on Reuters (or any successor service) on the “USPRIME1 Page” (or such other page as may replace the USPRIME1 Page on such service) for the purpose of displaying Prime Rates or base lending rates of major U.S. banks.

SOFR Notes. Prior to the occurrence of a Benchmark Transition Event and related Benchmark Replacement Date (each as defined below in this “—SOFR Notes” section), if any notes are designated on the cover of the applicable Pricing Supplement with reference to the Secured Overnight Financing Rate, commonly referred to as SOFR, such notes will bear interest calculated by reference to daily SOFR, a 30-, 90- or 180-day average SOFR, or any other SOFR rate or SOFR index rate, as may be published at such time by the SOFR Administrator (as defined below) or calculable at such time by reference to such published rates, in each case as specified in the applicable Pricing Supplement, and the spread and/or spread multiplier, if any, specified on the face of the SOFR Notes and on the cover of the applicable Pricing Supplement. SOFR Notes will be subject to the minimum and the maximum interest rate, if any, as specified in any applicable Pricing Supplement.

SOFR Notes will be Compounded SOFR Notes or Compounded SOFR Index notes, as described below, unless otherwise specified in the applicable Pricing Supplement.

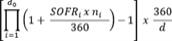

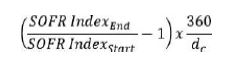

Unless the applicable Pricing Supplement specifies otherwise, the interest rate applicable for each interest period will be the rate determined by the calculation agent, with respect to any interest determination date relating to a floating rate note for which the interest rate is determined with reference to SOFR (a “SOFR Interest Determination Date”) at a base rate equal to compounded daily SOFR (“Compounded SOFR”), calculated as described below or by any other method of calculation specified in the applicable Pricing Supplement.